Can Medicare Still Support the Health Care Needs of U.S. Seniors?

According to the National Committee to Preserve Social Security and Medicare, at least 45 million senior citizens are enrolled in the Medicare. The 50-year-old health care program designed for citizens 65 and older is one reason why seniors, the poorest age group before the New Deal era, who continued to struggle financially through the 1960s, are generally now the country’s most financially comfortable demographic. While there are often complaints about bureaucracy and gaps in coverage, the reality for seniors before the mid-1960s is that they often confronted the highest risk of illness, yet often did not have the means to afford decent medical insurance and care.

But based on senior citizens’ overall quality life now compared to the mid-20th century, the evidence suggests Medicare is working well at a macroeconomic level. The program provides free health screenings that would otherwise be expensive; its costs are rising at a much slower rate than those of private insurance companies; the program’s overhead is much lower than privately run health plans; and now, prescription drugs are more affordable.

Critics often say the program needs long term adjustments in order to remain financially viable as the U.S. population continues to age. Some analysts say Medicare is paying medical coverage for more affluent seniors who could otherwise afford it. Finding decent coverage and even medical professionals who accept Medicare patients can be difficult in less populated and more rural counties. Privacy, of course, will always be an issue, as demonstrated in the recent lawsuit AARP filed to stall the growth of wellness programs, which the organization says risks making private health information publicly available. And there is always the risk that at any moment, costs can spike dramatically.

So is the coverage that seniors receive from Medicare sufficient and affordable enough? What can be done to improve coverage? And is this important program financially resilient enough so that it can continue to provide vital health care insurance for the elderly in the long run?

On those points, TriplePundit interviewed Lina Walker, Vice President of Health Security of the AARP Public Policy Institute, to learn about what this organization believes is needed to bolster seniors’ access to affordable and quality health care.

“Medicare beneficiaries should take the time to educate themselves about what the program covers and plan accordingly," said Dr. Walker. “Their health can suffer if they delay or avoid necessary health care, as well as lead to higher health care costs down the road. “

It is important to remember that, contrary to popular belief, Medicare does not cover all health care services, including most dental care, eye examinations and hearing aids. The program also does not pay expenses for long-term care options such as assisted living or skilled nursing facilities. Medicare coverage can also be limited in certain circumstances. For example, beneficiaries could end up paying for what would have otherwise been a free colonoscopy if their doctor discovers, and then removes, a polyp during the procedure.

But according to Dr. Walker, feedback from AARP members indicates that most Medicare recipients have adequate access to physician sources. The organization has also cited survey data revealing 82 percent of Medicare patients who needed to see a doctor due to an acute illness or injury said they never had to wait longer than they felt was fair; 72 percent said they felt the same about times when they needed routine care, which in reality is on par with younger citizens who need medical services.

Nevertheless, such research has also demonstrated that among Medicare patients who were looking for a new primary care provider, about 14 percent reported that they had a difficult time finding one. A sampling of the 9 million Medicare beneficiaries who are also eligible for Medicaid (the federal health insurance program for low-income American citizens) report that they had more challenges accessing services than other Medicare beneficiaries. In addition, AARP has heard reports of access problems in certain geographic areas, which in fairness, could reflect overall provider shortages in those regions. In some other cases, beneficiaries have to travel long distances for certain types of specialized health care.

Then there is the one coverage gap that is a huge concern to senior citizens, the “doughnut hole” that frequently occurs due to how the Medicare Part D prescription drug benefit is structured. This gap, which can often pose a financial burden, comprise the out-of-pocket expenses between the point at which when a Medicare recipient exhausts their initial drug coverage benefits and the level at which catastrophic coverage begins. This will change, but not for the next four years. “Fortunately, the coverage gap is slowly closing as part of the Affordable Care Act,” explained Dr. Walker. Unfortunately, the Affordable Care Act's future is no longer certain due to political leadership that would prefer to repeal it entirely. Time will tell how these cut-backs effect seniors.

The shoring up of the prescription drug benefit program, however, will not be complete until 2020, so in the meantime, citizens enrolled in Medicare should be aware that their prescription drug costs will most likely increase while they are in the doughnut hole. While Congress and the president-elect consider how much to cut, AARP nonetheless is keeping the pressure on Washington, D.C., as health care expenses can easily surpass 20 percent of a senior citizen’s income. “Congress should help ensure that people on Medicare do not face burdensome out-of-pocket health care costs,” insisted Dr. Walker, “and that all eligible low-income beneficiaries receive help with their Medicare premiums and cost sharing through the Medicare Savings Programs.”

So for seniors concerned about rising health costs, along with younger Americans wondering if the program will still exist for them upon their reaching of retirement age – not to mention the budget hawks who fret about entitlement spending - how can this valuable program be sustained for the next several decades?

In Dr. Walker’s view, the Centers for Medicare & Medicaid Services (CMS), which administers Medicare programs, should regularly, rigorously and in a timely manner monitor and evaluate Medicare beneficiaries’ access to quality care, including physician services and other Part B-covered services, in all Medicare settings, both regionally and nationally. CMS should pay also pay closer attention to access problems of special populations, including beneficiaries who live in rural areas, U.S. territories and commonwealths; people with disabilities; low-income individuals; and finally, minorities and other demographic subgroups.

Furthermore, technology promises to guarantee Medicare’s affordability and solvency while continuing to deliver quality care. “Services provided by Telehealth have great potential to help consumers more easily connect with various health care clinicians, maintain their quality of life, and remain in their communities longer,” said Dr. Walker.

Other technologies, such as smartphone apps or even something simple like email reminders, offer opportunities for people to manage their care by scheduling, and remembering, health-related appointments, prescriptions refills, and reminders to take medications. The use of technology can also serve as a vital link to healthcare providers when time, distance or local access present barriers. In addition, Telehealth can also help provide support to families and caregivers as they become more involved with the care of their loved ones.

“This is an important hour for the Nation, for those of our citizens who have completed their tour of duty and have moved to the sidelines,” said the 33rd U.S. President, Harry Truman, about senior citizens when he made remarks during the July 1965 ceremony at which President Lyndon B. Johnson signed the Medicare bill into law. “These are the days that we are trying to celebrate for them. These people are our prideful responsibility and they are entitled, among other benefits, to the best medical protection available.”

Today, many seniors, thanks to advances in medical technology and better health care, hardly feel as if they are on the “sidelines” of society. But it is largely because of Medicare that they are able to enjoy a much more vibrant life now than they had in generations past. It is up to American society – and taxpayers - to find that balance between shouldering Medicare’s cost and the benefits our countries gain by having an elderly population healthy enough to contribute and enrich our way of life.

Image credit: U.S. National Archives/Flickr

Walt Disney World's Trashcan GPS Alerts Cause Employee Angst

No guest wants to encounter overflowing garbage cans at any venue, whether they are at place such as a large shopping complex or resort. Dirty restrooms are also a no-no, and those charts you see on the inside of doors that track cleaning times are not necessarily enough to keep such a place in order. Technology, therefore, is the perfect solution for any large business to keep the facilities clean and spotless and prevent those trash cans from spilling over. All a company has to do is to place sensors on garbage cans, send automated reminders to custodial workers' smartphones so that they will check and clean those powder rooms - and the closest employee can attend to that task right away.

Well, a pilot program to that effect is currently underway at Walt Disney World Resort outside of Orlando, Florida. And custodial employees are not having it, pitting an unusual fight between labor and management.

The futuristic system, called “Custodial of Tomorrow,” launched last week in, of all places, the theme park’s Tomorrowland. As they clock into work, custodians are handed an iPhone that tracks their location during their shifts. As trash cans need new liners, bathrooms need cleaning or a random mess in Disney World’s public areas need attention, messages will be automatically sent to the closest employee so that such tasks can be completed.

But according to Unite Here Local 362, these employee’s union, the use of such technology opens a can of worms. In an interview with the Orlando Sentinel, custodial workers said they were worried that they could lose seniority when it comes time to select their preferred assignments. Employees were also concerned about repercussions if the iPhones are lost or damaged. In addition, Local 362 complained that the system was rolled out by Disney World’s management without any discussion. Then, of course, there are the ominous fears of “big brother technology” tracking an employee’s every single move.

The dispute at Disney World is yet another example what companies encounter as they balance the benefits of using GPS technology with potential privacy risks. As the Washington Post reported last year, more companies are using smartphone apps to track employees during their working hours. That may make sense for companies with a large disbursed workforce, especially for sales teams that often work out in the field. The ethics become more murky, however, when employees find out that they could also be monitored when they are off the clock – as in the case of a Central California sales executive who was fired after she deleted such an app from her phone after realizing that she was being monitored 24 hours a day, seven days a week.

Some may see the use of this technology as not a big deal at all, especially those who are apt to check in or geolocate on Facebook or Instagram. For some industries, smartphone tracking is now a fact of life. GPS is used by many trucking companies to ensure that their drivers are taking rest breaks as mandated by law. More hotels are using GPS systems to follow towels and linens on their property to not only ensure steady supplies of these items, but also to track towels stolen by guests.

For Disney World’s custodial employees, however, the overall concern is the loss of job autonomy, as their union’s contract with Disney allows them to focus on the type of work they prefer the most. Disney counters that more guests in recent years had complained about cleanliness; hence this tracking system is designed to complete custodial tasks quickly and seamlessly. The program, which includes 40 employees, is scheduled to run until January 19.

Image credit: Jason Mrachina/Flickr

On the Eve of EV Chevy Bolt Rollout, GM Announces Layoffs

GM has enjoyed a resurgence since the 2008-2009 global financial crisis and auto bailout, but sluggish sales last month suggests the largest automaker in the U.S. is in for some belt tightening ahead. According to MarketWatch, the company will lay off 2,000 workers at various assembly plants in Ohio and Michigan during the first quarter of 2017.

GM has also announced that early next year, it will eliminate a third shift at factories in Lordstown, Ohio and Lansing Grand River, Michigan. As more consumers have responded to the low price of gasoline by buying crossover cars and trucks instead of smaller cars, GM said such a move was necessary as it had to match production output with expected demand next year.

Such moves indicate that GM is nervous about how consumers respond to its all-electric Chevrolet Bolt, which the company recently launched into production at a plant north of Detroit. GM has promised the car will be ready for delivery by the end of this year.

The Bolt has scored plenty of attention as it is the first mass-produced electric vehicle that offers a range of over 200 miles with a price less than $40,000. At a cost of $37,495, which falls to $30,000 with a federal tax credit, the all-electric vehicle boasts a range of 238 miles. That range is about half of the average driving range of a gasoline-fueled car with a full tank of gas. A longer driving distance between recharges should provide more comfort to consumers and reduce “range anxiety,” as most drivers are comfortable driving if they about half a tank of gas in their cars.

But as Tom Krisher of PhysOrg has pointed out, GM will be cautious as it starts a limited rollout of the Bolt during 2017. The data research firm IHS Markit estimates that the company will sell at a maximum 300,000 Bolts next year. Early adopters and EV enthusiasts will have plenty of enthusiasm for the Bolt, but in an era where gasoline is $2.00 a gallon or less across much of the country, scoring mainstream consumer interest will be a challenge for what is still a very small market niche. GM is also planning a soft launch of the Bolt with the introduction of its cars to Lyft drivers in a few Illinois and Chicago markets.

Contrast those expectations with the far more bullish Tesla Motors. According to the blog Green Car Reports, the Palo Alto EV juggernaut expects to manufacture 100,000 Model 3 cars in 2017 once production begins mid-year. That number will surge to 300,000 in 2018, as Tesla is determined to plow through its Model 3 waiting list – which the company says has over 370,000 names on it. The Model 3 will be priced at a competitive $35,000 but early Elon Musk has hinted that options will bring the price of most sales closer to $42,000. News sites such as Reuters have cast skepticism that Tesla can line up suppliers fast enough in order to churn out such a high volume of EVs. Nevertheless, despite oil prices, the company’s co-founder and CEO Elon Musk is confident buyers will flock to this mid-priced EV once they see its benefits.

Overall, the outlook for electric cars is bright. Sales of these vehicles in the U.S. were up 26 percent in October, an impressive figure considering many drivers are holding out in anticipation of the Bolt and Model 3. But GM has been disappointed with how the market responded to its EV Spark and the plug-in hybrid Volt in the past. Meanwhile, sales of boat-sized Cadillac cars have increased by 20 percent for the fourth consecutive month. It is understandable that GM is being cautious; but its production capacity can also pull through in the event Bolt sales surge. After all, although oil prices have been low for over two years, the only thing we can really predict about long-term fuel prices is that they are inherently unpredictable.

Image credit: Chevrolet

Yet Another Sustainable Hydrogen Breakthrough By U.S. Researchers

The pace of progress on renewable hydrogen may slow down after president-elect Donald Trump takes office next year, but for now things have really been heating up. In the latest development, a team of researchers based at the Energy Department's Lawrence Berkeley National Laboratory is on the trail of a new solar cell that mimics the natural process of photosynthesis. The goal is to produce hydrogen and other fuels from nothing more than sunlight, water and carbon dioxide.

If the new Berkeley Lab research continues to receive funding, the result will be an efficient, durable "water-splitting" solar cell that could have a productive lifespan of 20 years or more. That's a huge leap forward from the state of today's technology.

Hydrogen from artificial photosynthesis

Hydrogen is the most abundant element on Earth -- no, make that in the entire universe. That makes it attractive as a fuel, for generating electricity in a fuel cell.

Hydrogen fuel cells produce no emissions other than water, so that takes care of the sustainability angle -- or not, as the case may be.

The problem is that hydrogen does not exist naturally on Earth as a standalone element. It has to be extracted from other compounds.

Currently the compound of choice is natural gas. That's two big strikes against hydrogen: extracting hydrogen from natural gas is an energy-intensive process, and the natural gas lifecycle contributes methane to the global warming mix.

Extracting hydrogen from water is one sustainable alternative. One method, electrolysis, involves applying an electrical current to water. That current is source-neutral, which means that solar power and other renewables can be deployed instead of fossil fuels.

The Berkeley team has been exploring a second angle, which is to wrench hydrogen from water through a photochemical reaction. Basically, that involves immersing a specialized solar cell in water and exposing it to sunlight.

The goal is to create an "artificial leaf" that mimics the natural process of photosynthesis.

The artificial leaf approach has the potential to be scalable and cost-effective, but there is one important holdup.

Like natural photosynthesis, the artificial variety requires a catalyst to push the process forward. The catalyst requires an "active" chemical environment, but that's exactly the kind of environment that damages the semiconductors that harvest solar energy in a solar cell.

Leaping the hydrogen hurdle

Berkeley Lab staff scientist Ian Sharp elaborates on the problem from the catalyst side:

“The most efficient catalysts tend to be permeable and easily transform from one phase to another. These types of materials would usually be considered poor choices for protecting electronic components.”

...and here's how it looks from the protective side:

“Good protection layers are dense and chemically inactive. That is completely at odds with the characteristics of an efficient catalyst, which helps to split water to store the energy of light in chemical bonds.”

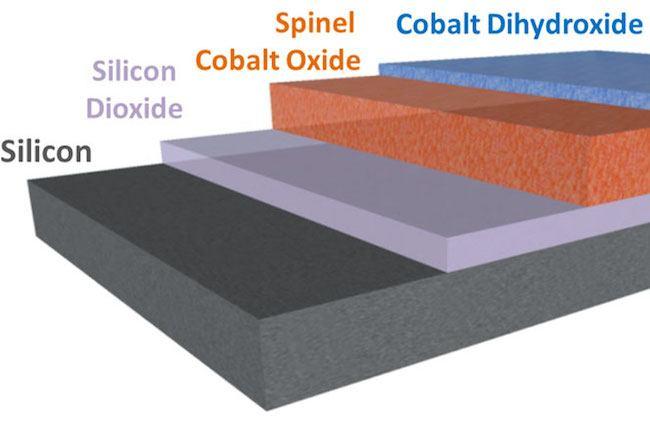

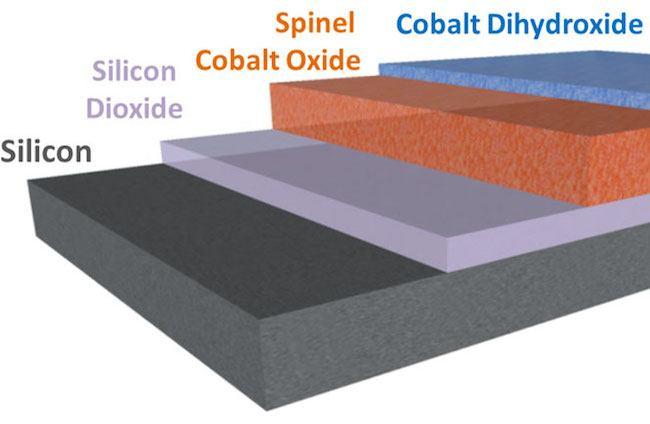

The new Berkeley Lab study details how the team solved both problems. You can find it in the journal Nature under the title, "A multifunctional biphasic water splitting catalyst tailored for integration with high-performance semiconductor photoanodes."

That's a mouthful, right? Basically it means that the researchers developed a new catalyst that also serves as a protective coating for the solar cell's semiconductors.

They weren't just shooting in the dark. They relied on previous studies on water-splitting reactions, which enabled them to focus their efforts on the most promising materials.

The new catalyst is an ultra-thin film consisting of a cobalt dihydroxide materials layered over a form of cobalt oxide.

By ultra-thin, we do mean ultra-thin as in atomic level. The thin films were created practically atom by atom, borrowing a technique from the semiconductor industry called plasma-enhanced atomic layer deposition.

So far the researchers have demonstrated that their new catalyst can run for three days, and potentially longer. That doesn't sound like much of a big deal at first glance, but it's on a much higher plane than any other similar system. According to Berkeley Lab, such systems usually fall apart after just a few seconds.

The next steps -- of which there are many -- include assembling a more thorough understanding of the factors that make water-splitting solar cells degrade.

About that funding stream...

This could be the last step for a promising line of research if the Trump Administration decides to cut the Energy Department's hydrogen budget,

That's not the only such program that could fall under the axe. The Energy Department has a whole raft of research programs for sustainable hydrogen and other fuels that can be generated from sunlight, water and carbon dioxide.

Many of those programs are linked under the umbrella of the Energy Department's Joint Center for Artificial Photosynthesis. Established in 2010 as part of the new national "Energy Hub" network established by President Obama, it currently enrolls a roster of more than 100 researchers drawn from the California Institute of Technology, UC-Irvine and UC-San Diego as well as Berkeley Lab.

The National Accelerator Laboratory at Stanford is also part of the JCAP mission, which is dedicated to finding "new and effective ways to produce fuels using only sunlight, water, and carbon dioxide."

The Obama Administration also just established the new "HydroGEN" initiative to accelerate the development of water-splitting technology, but that's contingent on the availability of funding.

Even if President-elect Trump decides to eliminate the entire Energy Department, that will not stop the hydrogen economy.

Advanced water-splitting research is going on in other countries all around the globe, and that will continue regardless of what happens to the Energy Department.

Hopefully the U.S. will not be left behind. Fingers crossed!

Image (cropped): "Schematic of the multi-functional water splitting catalyst layer engineered using atomic layer deposition for integration with a high-efficiency silicon cell" by Ian Sharp/Berkeley Lab.

Volcom’s Sustainability Initiative Turns Fishing Nets into Bikinis

For decades now, the tragedy of lost fishing nets has been known to environmentalists, scientists and fishers. These nets have the ability to continue fishing long after they have been lost, killing not only fish, but marine mammals, sea turtles and other types of marine life that become entangled in their webs.

Now Volcom is contributing a solution by sourcing a new yarn made from these fishing nets and other types of nylon. Called Econyl, this upcycled product will be used in the company’s Simply Solid Swim collection.

The introduction of Econyl is part of Volcom’s commitment to Strong Oceans, Stable Climate and Smart Society, a component of the firm’s sustainability initiatives. Volcom has developed a New Future roadmap to guide the firm in reaching sustainability targets, identifying where the company causes impacts and how to address them.

“Econyl fiber allowed us to create a collection with deeper meaning and purpose,” said Lindsey Roach, Head of Women’s Business in a statement. “We wanted this collection to be more than beautiful patterns and functional pieces, so the fact that it is made with recovered fishing nets creates a natural connection to surf culture, which fully understands the value of keeping the ocean clean.”

" ,,, when our oceans are weak, we do not thrive as a species. Plus, we like surfing!" - Volcom website

While the garments made from Econyl fiber will contain 78 percent of the material, the fiber itself is made from 100 percent regenerated nylon waste. Econyl is created by Aquafil, a firm with headquarters in Trento, Italy, and facilities around the world. The fiber is created by diverting waste from landfills and oceans through the recovery of abandoned fishing nets and other discarded nylon waste materials. Aquafil says its cutting-edge regeneration system is a pioneering example of the circular economy in action – offering the same quality and performance as traditional nylon, but with the ability to be regenerated an infinite number of times without any loss in quality.

Upcycling nets helps achieve sustainability goals

Upcycling the fishing nets and other nylons will help Volcom reach a key sustainability goal to “increase both the amount of recycled material in our polyester and nylon as well as the usage of organic, recycled and/or better* cotton in its products.” The firm says better cotton “might consist of organic, recycled, or other cotton sources with an improved environmental and social impact.”

Volcom claims Econyl fibers are durable, lightweight, breathable and environmentally friendly, making them ideal for the Simply Solid swimwear collection. The products in the collection will include board shorts, rash guards, halter tops, a tankini (a two-piece resembling a one-piece swimsuit), and a variety of mix-and-match bikini tops and bottoms.

Other elements of Volcom’s sustainability initiatives include:

- Integrating a New Future sustainability program across all facets of Volcom’s consumer marketing.

- Creating an internal Volcom employee and leadership New Future sustainability certification program with at least 90 percent of employees completing certification.

- Developing a program that resembles the firm’s “Give Jeans a Chance” program so that used Volcom products can be collected, processed and either donated or kept for closed loop manufacturing in the future.

The business benefits of sustainability are not lost on Volcom. The firm believes meeting its 2020 targets will help to lower its environmental profit and loss (E P&L) by focusing on raw material sourcing and processing. Volcom’s analysis concludes that 75 percent of the firm’s environmental impacts lie “deep within our supply chain.”

Sustainability has been a key part of the organization’s mission since 2012. Some of the accomplishments since then include:

- Eliminating polyvinyl chloride (PVC) from all Volcom products.

- Sourcing paper and packaging material from recycled sources and/or responsibly managed forests.

- Increasing the amount of sustainable material and processes in Volcom’s product mix.

- Certifying Volcom’s major surf events as “Deep Blue” activities that offset carbon emissions through verified programs such as Wildlife Works REDD+.

Time will tell if these swimsuits are a hit with consumers, but Volcom is on the right path to ensuring oceans remain a renewable resource.

Image courtesy Volcom

Refreshing the business contract with society

Is Food Waste the Next Frontier for the Circular Economy?

As much as half of all food produced in the United States each year is wasted. That quantity has increased 50 percent since 1974 – all while some two billion people go hungry or malnourished each year.

Clearly, we have a problem, and it is only getting worse. The UN predicts that the global population will top nine billion by 2050. As the world looks to feed all those extra mouths, the enormous quantity of food that goes wasted — and what to do about it — will become an increasingly urgent problem.

Fortunately, governments, corporations and individuals are already taking steps to move our food system from a inefficient, linear model to a more closed-loop system that is "restorative and regenerative by design."

Last year, the U.S. government — taking a cue from the Sustainable Development Goals (SDGs) — pledged to cut retail and consumer food waste in half by 2030.

Meanwhile, the governments of France and Italy went a step further — mandating that supermarkets donate unsold produce to charity or otherwise make use of surplus inventory.

At the corporate level, the U.S. Environmental Protection Agency has suggested a five-tired framework by which companies can reduce their food-waste footprint. A number of companies have already answered the call — achieving economic, as well as environmental, benefits along the way.

Quicken Loans attacks waste at the source Sometimes, the simplest way to reduce food waste is by using less food in the first place.

That was the insight behind Quicken Loans food scrap recovery program, begun at Cleveland's Quicken Loans Arena in 2011. By tracking their kitchen waste daily, the company managed to cut the amount of food composted by more than half — from 3.5 tons down to an average of 1.5 tons.

Besides the environmental benefits, this strategy has the added value of reducing costs.

Kroger takes a bite out of hunger

Roughly 37 million tons of food were thrown away in the U.S. in 2013. Meanwhile, about 14 percent of American households were food insecure. By redirecting food waste to hungry people, companies can reduce their environmental impact, improve communities' wellbeing, and reap economic benefits in the form of tax deductions.

Kroger is leading the charge against food waste and hunger through its Perishable Donations Partnership program. Through this initiative, Kroger donated 56 million pounds of fresh food to local food banks in 2015 alone.

Purdue University goes whole hog against food waste Livestock production accounts for roughly three-quarters of agricultural land use globally — much of it devoted to raising corn and soybeans for animal feed. Corporate initiatives that transform waste into feed substitutes could have a dramatic impact on these figures.

A recent study by researchers at the University of Cambridge suggests that turning food waste into pig feed could free up some 4.4 million acres of agricultural land — much of it in environmentally sensitive areas of South America — and cut costs by as much as 50 percent.

One company is already ahead of the curve. Since 2007, MGM Resorts has been diverting much of the pre-consumer waste from their Las Vegas Strip properties to a local pig farm.

MGM requires that restaurants, buffets, and employee dining rooms separate food waste inside their kitchens. The company also employs a 24-hour recycling staff to sort food scraps and mixed recyclables.

The initiative has been successful, with volume of waste recycled increasing from 3,350 to 14,000 tons in a four-year period.

Purdue University turns waste into wattage Even when food waste can't be fed to the hungry or converted to feed, there is often residual value that can be captured and diverted to industrial uses.

Through anaerobic digestion, food waste can be converted into valuable biofuel and soil amendments — reducing the environmental footprint of our food system while increasing alternative energy use.

Purdue University is an early mover in this space — partnering with the city of West Lafayette, Louisiana, to convert food waste into a renewable energy source.

The college sends one to two tons of food scraps to the local wastewater treatment plant each day, where it is processed by microbes into a biogas and a solid residual that can be used as fertilizer. The program has reduced natural gas usage at the plant by 40 percent, in addition to diverting tons of waste from landfills.

New Seasons Markets sow what they reap Despite our best efforts, we'll never be able to make use of every bit of food we grow. However, much of this waste can be composted to fortify soils, improve water quality, and grow the next generation of crops.

New Seasons Markets, a small grocery chain in the Pacific Northwest, has more than doubled its waste diversion program since 2006— saving more than $25,000 in waste expenses during one two-year period alone.

For more food waste reduction strategies, check out the USDA's Food Recovery Challenge. To join the conversation about how a circular economy can transform our food system, take part in the Disruptive Innovation Festival, organized this month by the Ellen Macarthur Foundation.

Image credit: Colin Delaney, Flickr

On a Bleak Night for Progressives, Minimum Wage Hikes a Big Winner

Donald Trump’s upset victory over Hillary Clinton – in the Electoral College, where it counts – capped off a night that largely repudiated progressive values. The Senate and House remain under Republican control, and the GOP scored a higher percentage of governorships across the country. Trump’s victory was largely fueled by disaffected white working class workers who feel forgotten by the 21st century economy.

But both blue and red workers in four very different states will benefit economically after Tuesday night’s returns: voters approved initiatives that will raise their states’ minimum wage over the next few years. And in reliably red South Dakota, over 70 percent of voters shot down a proposal to reduce the “training wage” for workers under 18 to $7.50 an hour.

In Arizona, Colorado and Maine, the minimum wage will reach $12 an hour by 2020. Arizona, long a red state that narrowly favored Trump as of press time, witnessed Proposition 206 passing easily with almost 59 percent of the vote. The state’s minimum wage will rise incrementally annually through 2020; beginning in 2021, that wage will then be adjusted based on increases in cost of living. Workers relying on tips for income can earn a minimum wage that is $3 an hour less, but only if the employer can prove that gratuities pushed their earnings at or above that lowest rate.

(On an issue totally unrelated to the minimum wage, Phoenix-area voters gave progressives another gift: controversial Maricopa County Sheriff and Trump surrogate Joe Arpaio lost his bid for reelection.)

Swayed by proponents who insisted Colorado’s cost of living has made its current $8.31 minimum wage untenable, the Centennial State’s voters passed Amendment 70 with 54 percent of the vote. Several business groups opposed the measure, including the Colorado Restaurant Association, which claimed the eventual wage increase to $12 an hour would disproportionately harm the food service sector. Supporters, however, said a higher wage would reduce dependence on public assistance, an argument the Denver Post said ended up swaying many voters.

Maine also jumped on the minimum wage bandwagon, passing Question 4 by 55 percent and giving workers a raise to $12 an hour. The argument for fairness and a more equitable economy led voters to pass the measure; political action groups supporting the increase outspent their opponents by over a five-to-one ratio.

At face value, Washington hourly workers look to be the big winner, though the cost of living in the Seattle area will still make it a tough place to survive as a minimum wage earner. I-1433 will increase the Washington’s minimum wage to $13.50 an hour. The initiative passed easily, with 59 percent of the vote. This corner of the Pacific Northwest has long been a trendsetter on hourly wages; in 1998 voters approved a measure that linked minimum wage increases to inflation.

Opponents of a higher minimum wage, or any minimum wage at all, describe such measures as job-killers. But as John T. Harvey explained on Forbes, the evidence supporting such outcomes are scant at best. Proponents have long pressed the issue of fairness, but as the voting results in these four states reveal, arguments suggesting that higher wages can reduce reliance on public assistance swayed citizens in both liberal and conservative states.

Supporters of Trump voted for him in part because they wish to return to the halcyon days of when someone could just graduate out of high school and get a job in manufacturing. This is especially true in Michigan, where today’s scarce employment in auto factories nudged Trump to a narrow victory in that state. Indeed, the industry’s shift to right-to-work employment and overseas factories have led to a decline of manufacturing jobs in this sector. But the fact is that for decades, automation has long been the driving factor in job loss.

The U.S. is still a manufacturing powerhouse; but this country is only making high-end, sophisticated goods, and the growth in automation results in far fewer workers employed than in decades past. Hence the shift to the service economy, a long transition that has been a painful one for many American workers. Minimum wage increases are one tool that this country’s leaders can use to ensure that this 21st century economy is one that provides economic security to the people who need it the most.

Image credit: Fibonacci Blue/Flickr

What’s the Impact of the U.S. Presidential Election on Climate?

Donald Trump’s upset victory over Hillary Clinton in Tuesday’s elections portends many changes, and plenty of uncertainty, once he becomes the nation’s 45th President on January 20. One issue that Trump and his allies will surely take on is the progress that the U.S. has made on climate change, especially after last year’s historic Paris agreement. Trump has been on record for describing climate change as a “hoax” invented by the Chinese, a claim he later described as a “joke.”

Joke or no joke, the evidence suggests Trump will pursue environmental policies in a starkly different manner from his predecessor. So will President Trump be able to reverse the progress made over the past eight years, including pulling out of the global climate pact? After all, he is on the record with Reuters saying that along with other treaties, he would at a minimum “renegotiate” the climate deal agreed upon by almost 200 countries.

Yes, Trump could pull the U.S. out of the Paris climate agreement, though many analysts say that is highly unlikely. He could be less confrontational, but still kneecap U.S. commitments, by taking steps such as abolishing the Environmental Protection Agency (EPA) or slashing its funding – both promises he had made during the campaign season. But the reality, as discussed on the Guardian, is that pulling out of a treaty does not necessarily mean a total reversal in policy. The risk, however, is that he can throw global cooperation on climate change into chaos.

Such thoughts have sent shudders throughout the global environmental community. Climate Action Network, for example, has assembled a collection of quotes from leaders that have expressed horror at the thought of what Trump may or may not do while admonishing him that the U.S. has already committed to these climate obligations. “Leaving this important international agreement will damage our credibility with important overseas partners and would be a major setback in the fight against climate change,” said Kelly Stone, a policy analyst with the environmental justice group ActionAid.

Market forces, however, may very well help push the U.S. forward on its climate change commitments, with or without an agreement. Energy is one promise Trump has made that could trip him up during his presidency – just as his fanciful promises of “extreme vetting” of Muslims, building that wall on the border, imposing tariffs, bombing the “s—t out of ISIS” and renegotiating global deals will prove to be tough to enact once he takes office.

Take coal, which Trump has promised to make central to U.S. energy policy. His promises to resuscitate the coal industry won him large margins in Appalachia. But the stubborn fact is that natural gas has become the preferred fuel for power plants across the U.S. Indeed, clean air regulations are part of the switch; but the natural gas boom has made this imperfect but cleaner fuel just as cheap, or even less expensive, than coal.

Meanwhile, renewables have become cost-competitive as well, and sources such as solar and wind power have become far more scalable and efficient over the past few years. Much of this shift has been due to large companies, who view clean energy as a hedge protecting them against volatile fuel prices. Even if a Trump Administration puts the kibosh on many, even all, of the environmental and clean energy programs, that will not stop states, local governments and the private sector from investing in renewables. And these curbs on Trump’s influence come even before the backlash that would likely result if he makes too radical a change in U.S. energy and environmental policies.

Those of us who have been deeply vested in the sustainability movement need to resist the urge to join the collective freak-out and put this week’s election in perspective. Take a page from the book of Joel Makower, founder of GreenBiz:

“We’ll survive this one, too. It won’t be easy or quick, and much is uncertain. One of the hardest things we’ll face is to remain optimistic and empowered and committed. We’ll lose precious time on some pressing issues, but we, too, will find our footing and move forward.”

Our vision of a more sustainable world now has a powerful ally: economics. The market is too powerful a force to succumb to a man seen by many as a hell-bent saboteur of the progress that has been made since the Great Recession. Business now sees the benefits of cleaner energy and sustainable development more than ever, so while there will be setbacks, Tuesday’s outcome does not have to become a complete disaster – unless we idly stand by and allow such events to happen.

Image credit: United Nations/Flickr

Sustainable Business Will Drive the New Economy, Not Trump

Like most of you, I'm still trying to get my head around Donald Trump's victory. While his rise may have been predictable and should have been foreseeable after years of economic and cultural stagnation in the heartland, it doesn't sting any less. And now we all have to live with it.

But you already know that.

As critical optimists, it's imperative that we find the opportunities and lessons hidden inside of any disaster. TriplePundit strongly believes there are many ways to move forward in the wake of this election. The good news is that no one is more poised to to drive forward a sustainability agenda than the business community. Business, with almost no help from the government, has already begun to take proactive action on climate change, drive a clean energy transition, stand up for the need for a diverse workforce and to take action on many other issues we all care about – not just because it’s the right thing to do but because it’s the profitable thing to do.

One of the main reasons TriplePundit exists is to make the business case for action on sustainability. We make this case on moral grounds and practical grounds, but we also make it based on good old fashioned capitalism. Doing good is good business. Take a look at what we and our corporate partners have accomplished over the past year or so:

- We’ve covered the economic benefits coming from the COP21 agreement, something that will likely continue regardless of any presidential meddling.

- We’ve made the business case for women’s leadership.

- We’ve showed why a diverse work force is a more profitable workforce and that discussing the #BlackLivesMatter movement should not be taboo at the water cooler and in the boardroom.

- We’ve covered the rise of B-Corps – a fast growing new business model based on transparency and sustainability.

- We’ve shown that combating food waste can feed people profitably.

- We’ve demonstrated the business case for skills-based volunteering that goes way beyond picking up trash at the beach.

- We’ve shown how a company can take short term expenses for long term gains that benefit the health of their customers as well as the bottom line.

- We’ve shown why mitigating climate risk in a supply chain is a smart and profitable move.

- We’ve even partnered on all new conference next month called Companies vs Climate Change, the roster of which already features a who’s who of the Fortune 500.

To top off your cup of optimism, don’t forget that Hillary Clinton won the popular vote. The majority of Americans support the kinds of positive changes she stood for, regardless of her faults. For that matter, the majority of Trump voters are not racist misogynists who think the earth is flat. They’re mostly people irritated by a government that ignored them. At their core they want a prosperous and meaningful life and a bright future for their children. Business need to be prepared to answer their needs. We need to be prepared to answer their needs.

To sum it up, we still have a lot of work cut out for us, and as regular TriplePundit contributor Henk Campher is fond of saying, "there are still a lot of companies out there selling snake oil." Call them the Trumps of the business world. As we mentioned in our newsletter this morning, NRG’s Bruno Sarda shared the following with his team:

Now our work is all the more important. If government won’t lead, and will possibly [impede our efforts at] a sustainable future, business will need to lead the way even more than it has to date. This is our time. It won’t be easy, but we can’t shy away from the importance of our work. We need to make an unavoidable case for the imperative of sustainable business and a sustainable energy future.

I also talked to Aman Singh, well known journalist and sustainability communications advisor and my co-chair at the upcoming Companies vs. Climate Change conference who told me the following:

As a professional, I feel lucky that I work in the corporate sector. As someone famously said at COP21, many of us have realized that we can have more scalable impact by driving more systemic business decisions. Business can be disruptive. Business can be proactive. Business can search for morality when forced to. And business can drive change because business feeds our stomachs. And that is what I hope business leaders will continue to focus on despite a leadership change in American politics. That we can continue to push uphill for what we know is right and necessary to promise our future generations resilient economies and societies without regulatory support if that’s what it takes. Because together we have another right to vote – as business professionals.”

Sadly, Donald Trump is not a real businessman. He’s a simple con artist, likely as bewildered at his recent success as he is emboldened. The con-job will soon become obvious and Trump’s influence will begin to whither, hopefully with minimal collateral damage. Or maybe he’ll evolve. We have no choice but to heed Hillary Cilnton’s request to greet him with an open mind, but we will be doing so with a very critical eye.

One thing we have a lot more faith in is the ability of the motivated and forward-thinking people in business to continue pushing for positive change in the world. We aim to spend the coming years helping that happen.

(image: PixaBay)