Business Wants More Renewable Energy: Let's Help Them Get It

Renewable energy is on the verge of massive acceleration. The technology is proven. Investors are eager. Money is available. The problem is getting all three to work together as efficiently -- and quickly -- as possible in order to avert catastrophic climate change. Some nations are racing ahead, while others are lagging far behind.

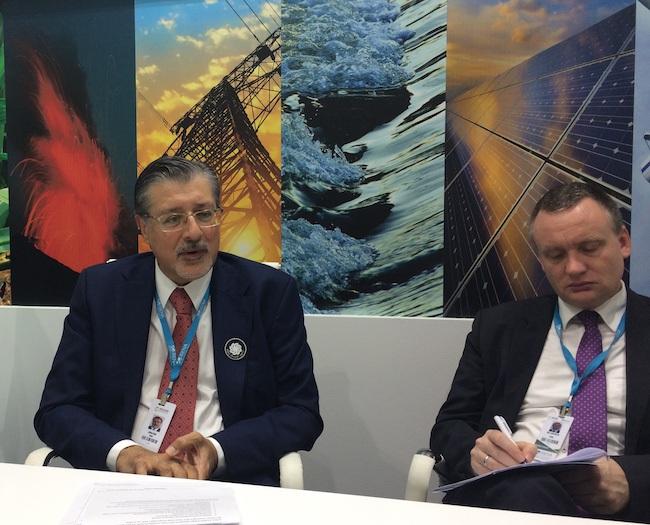

Understanding the forces that determine the pace of the clean-energy revolution in different parts of the world is the somewhat daunting task undertaken by IRENA, the International Renewable Energy Agency. TriplePundit spoke with IRENA Director General Adnan Amin on Tuesday in Abu Dhabi, during the World Future Energy Summit, to get the inside scoop.

The business case for decarbonization grows stronger...

Mr. Amin sat down with Triple Pundit and a small group of journalists just two days after the 7th IRENA Assembly, which was held over the weekend. The Assembly focused on how to accelerate the clean-energy revolution, and the scale of the event demonstrated how eager global leaders are to take action (well, with at least one notable exception).

The event drew scores of high-level ministers and heads of state from IRENA's 158 member countries. It was an "unprecedented" gathering of decision-makers for a discussion of energy policy, Mr. Amin told us. He offered this takeaway:

"There is a strong global perception that the transition [to renewable energy] is happening, and we can make the business case for decarbonization."

Due to technology improvements and other factors, the cost of renewable energy has fallen so quickly -- and so steeply -- that it is already lower than fossil fuels in some markets.

Renewable energy offers beneficial add-ons, too: It is reliable, scalable, immune to fluctuations in fuel prices and, of course, clean.

Mr. Amin said he is confident in the potential to reach the global goal of 36 percent renewable energy by 2030. The global energy mix already stands at 18 percent:

"We are not too far off from doubling renewables by 2030," he told us. "There is an extraordinary level of ambition, and it's increasing every year.

Mr. Amin noted that investments in energy efficiency also have the potential to propel the world on an accelerated track to decarbonization.

So, what's the problem?

...but it could be stronger

IRENA launched in 2009 with the mission of providing information and guidance to nations seeking to transition to renewable energy. Much of the discussion is now pivoting around one central point: Government funding is not nearly enough to accomplish the transition.Private-sector investment is vitally important. But as Mr. Amin described, a serious bottleneck exists in some markets:

"Government needs to understand that most of the money [for renewables] must come from the private sector. That requires rigorous, robust policy. Investors have to be assured of stable policy.To accelerate change, a lot of money is around. But the 'risk premium' is still higher for renewables than fossil fuels."

That's pretty much the opposite of the 'free market' rhetoric popular among a certain set of U.S. politicians (you know who you are), but there you have it. Risk mitigation through public policy was a consistent theme during the 7th Assembly and the World Future Energy Summit.

At the 7th Assembly, for example, a representative from the global renewable energy company Enel had this to say about deciding which markets to enter:

"... You prefer countries that have regulations, to come in a comfortable way ... When you have rules, certainly, people are keen to invest their money there."

In other words: The technology has done its job, and investors are ready to do their job. Now it's up to policymakers to get cracking on creating a secure, predictable regulatory environment.

Not an easy task

No, policymaking is not an easy task (just ask the folks who pledged to replace the Affordable Care Act). TriplePundit sat in on several side conferences at the World Future Energy Summit to get a taste of the complexities involved.

Here's just one tasty example: quality control. That's as key a risk issue in the solar field as it is in any other. If you see someone invest in equipment that was supposed to perform for 20 years and it only lasts 10, you'll take your money elsewhere.

Aside from the impact on investors, solar module under-performance and module failure can have outsized consequences in terms of other public policy issues, particularly waste management. According to IRENA, the rule of thumb is that a 1-megawatt solar array will eventually generate 100 [metric] tons of waste.

So, take a country like Germany, with 40 gigawatts of installed solar capacity. Even just a 1 percent failure rate translates into 40,000 tons of avoidable waste.

In addition to quality issues with the modules themselves, IRENA has also been studying system failures that for wiring mistakes and other mishaps related to installation.

Technology standards are just the beginning. Those standards need to be "operationalized," or put into action. That means testing, inspecting, training and accrediting installers, calibrating equipment, and everything else that goes into establishing a risk-reduced environment for investors.

"We need to promote the whole quality infrastructure in order to get the full benefit" an IRENA expert explained.

If all this sounds like the expense is not worth the effort, IRENA is studying that, too. The answer is: Yes, you can make a sound business case for investing in a precision-tuned regulatory infrastructure.

In Germany, for example, solar systems with post-installation performance tests written into their contracts actually outdid expectations by an average of 3 percent. That might not sound like much, but for larger systems it adds up to big bucks.

In contrast, systems that had no such post-installation tests in their contracts predictably under-performed, coming in at around 3 percent less than expectations.

"A democratic form of energy"

Rural electrification and economic development have also come up regularly during the week's events. When the conversation with Mr. Amin turned to questions-and-answers, TriplePundit jumped at the chance to ask about the nexus between mobile phone technology and the growing market for small-scale, distributed solar energy.

Mr Amin compared solar energy to the transformation that mobile phones have brought about in Africa. He recalled that when he was growing up, rural communities depended on land lines that didn't work most of the time.

Mobile phones brought a level of reliability and efficiency that has been life-changing for many rural households in Africa. Distributed solar energy could have an even more transformative effect, especially in the lives of female farmers who sell their produce in local markets.

Mr. Amin brought up the example of women who could use mobile technology to check prices and conditions at several different markets, rather than bringing their wares to one and hoping for the best. The problem, he explained, is that -- without a far-reaching, reliable and affordable electricity grid -- women often have to travel long distances and wait in line to charge their phones at a local charging concession.

Solar mini-grids provide a quantum leap in convenience, efficiency and dependability.

In addition, by bringing electricity directly into households and communities, solar mini-grids provide the opportunity for quality of life improvements including light that can be used for work or study at night.

"It's a democratic form of energy," Mr. Amin told us.

Mobile phones were transformative because they eliminate the accidents of geography that can limit an individual's access to communication, information and commercial activity.

Renewable energy has the same level of potential by enabling reliable, affordable access to electricity practically anywhere on the globe.

All it takes some good, sound policy.

Sometimes it's an uphill battle -- just ask the American Sustainable Business Council -- but it makes good bottom-line sense.

Image credit Tina Casey

Will Equity Crowdfunding Accelerate Impact Investing in 2017?

By Jamie Garuti

This past May, a new world of possibilities opened up for social entrepreneurs around the country. The Securities & Exchange Commission (SEC) approved Title III, the final part of the 2012 JOBS Act. The new regulation allows for equity crowdfunding, a mechanism that ordinary people can use to become stakeholders of startups.

Prior to Title III, entrepreneurs have used platforms like Kickstarter and Indiegogo to crowdfund seed capital, launching campaigns with business plans, product demos and videos. They then invite family, friends and others in their network to contribute in return for early access to products.

Although successful, the single-product focus didn’t work for many startups launching businesses with broader missions. What’s unique about Title III is that, instead of receiving perks, supporters get a real stake in a company through stock, options or interest repaid on loans. Should they succeed, investors stand to benefit from growth which to date has only been available to angel investors and VCs.

It’s a pretty simple idea that allows entrepreneurs to raise needed money in a fraction of the time traditional methods take. Yet people have been slow to jump on the equity crowdfunding train.

Since the approval of Title III, only 186 companies have launched campaigns. Seventy-nine of them succeeded in hitting their minimum target – the minimum amount in financial commitments a company must reach in order to receive the pledged money.

All in all, the companies that did reach the target threshold received a total of $17.9 million from investors since May. This cash gave companies huge boosts, allowing many to scale up operations and hire new employees. The benefiting companies plan to create about 175 new jobs over the next 90 days, averaging out to 2.2 jobs each.

Already, equity crowdfunding is proving to be an effective tool to spur the economy and create jobs. It’s an open question whether this will also accelerate the efforts of social entrepreneurs seeking to connect with impact investors.

The tactic grabbed the attention of Climate Action Business Association (CABA), a Boston-based organization that helps local businesses take targeted action on climate change.

“We work with small businesses across Massachusetts, many of them consisting of one or two people just starting out, whose business could be transformed by equity crowdfunding," said CABA Executive Director Michael Green. The group hopes to get the word out to its members about equity crowdfunding.

ClimateStore, a CABA member, is among the small number of social impact companies that have launched an equity crowdfunding campaign. The company seeks to build a retail brand for consumers looking to take personal action on climate. They curate products based on carbon impact and integrate climate education with steps for low-carbon living. A much-needed channel for sustainable product manufacturers, ClimateStore has strong plans to expand.

The company was launched in 2014 by Steve Bushnell. A scientist by training, he was frustrated by the lack of integrated information on climate-friendly living. Leveraging the potential of digital marketing, ClimateStore has been steadily adding products and growing its online community.

When Bushnell heard about equity crowdfunding, he saw it as an opportunity to connect with people who could become both investors and advocates. He explained: “We’re excited about Title III because it will not only accelerate our offerings, it will also allow us to connect with people who are passionate about the climate and that can help the brand grow.”

From the 21 fundraising platforms now registered with the SEC for equity crowdfunding use, ClimateStore chose WeFunder. To date, Wefunder has the largest number of Title III companies and allows campaign-level filtering based on social impact and even climate change. Similar to other companies, the ClimateStore campaign page displays a compelling video, states the company's overarching mission, and lists the deliverables it will provide with investor funding.

With tools like this, impact investors can find and support early-stage companies in just a few clicks. The campaign began with a soft launch in December and is ramping up as the company works toward its goal. Although it's looking to raise a minimum of $100,000, ClimateStore can raise up to a maximum of $1 million over 12 months.

With clear benefits of this fundraising model, it is surprising that so few companies have taken advantage of this potentially game-changing tool. This may largely be due to lack of awareness and the need for education with both startups and investors. Even when it does come onto people’s radar, many are skeptical. This is especially true in the case of new investors, who may receive fundraising requests but incorrectly dismiss them as scams.

As the early adopters of equity crowdfunding demonstrate the legitimacy of this fundraising tool, it could be the case that it catches on in 2017. And although it comes with more risk, equity crowdfunding allows investors far more than early access to products. Whether it will accelerates social impact or not has yet to be seen.

Image credit: http://401kcalculator.org

Jamie Garuti is the Communications Manager at Climate Action Business Association. She graduated from Tulane University with a degree in Environmental Studies. Previously, she led a fossil fuel divestment campaign, worked with the leadership development program Climate Summer, and organized in local movements and campaigns for climate justice.

Unilever Wants To Keep Plastic Packaging Out Of Landfills

Something big happened in the consumer packed goods industry over the weekend, though few may have noticed: On Saturday, Unilever said it would make all of its plastic packaging completely recyclable, reusable or compostable by 2025. For a company that buys over 2 million tons of packaging a year, that is a big goal.

In an announcement that received little media coverage, the CPG giant specifically committed to several steps, including renewing its membership in the Ellen MacArthur Foundation -- known for its support of the circular economy -- for another three years and endorsing and supporting its New Plastics Initiative.

As part of its pledge, Unilever plans to publish all of the plastic materials used in its packaging by 2020 to help create a plastics protocol for the industry. The company says it will also invest in a technical solution to recycle multi-layered plastic packaging, with the specific intention of sharing its findings with the CPG industry.

“Our plastic packaging plays a critical role in making our products appealing, safe and enjoyable for our consumers,” Unilever CEO Paul Polman said in a statement.“Yet it is clear that if we want to continue to reap the benefits of this versatile material, we need to do much more as an industry to help ensure it is managed responsibly and efficiently post consumer-use.”

Unilever is seriously committed to reducing waste

Unilever has already made hefty commitments toward waste reduction as part of its Sustainable Living Plan. That includes reducing packaging weight by a third in three years, and increasing the use of plastic content in packaging to at least 25 percent by 2025.Reducing waste is part of Unilever’s goal to halve the environmental footprint of the making and use of its products as its grows its business.

The company achieved its goal of sending zero non-hazardous waste to landfill across its manufacturing operations in 2015. The waste associated with the disposal of Unilever products was by 29 percent since 2010, and the total waste sent for disposal was reduced by 97 percent per ton of production since 2008. Over 600 Unilever sites globally, including almost 400 non-manufacturing sites, have achieved zero non-hazardous waste to landfill.

No company can succeed alone

Nothing less than the involvement of the entire plastic packaging value chain is needed in order for recycling and reuse to become the norm.“We cannot succeed alone,” Unilever declared it its Sustainable Living Plan, first launched in 2010.

In other words, even this CPG behemoth needs industry-wide action in order to meet its commitment. Many elements remain beyond the control of one company, such as a lack of waste-management infrastructure and limited investment in the waste industry.

Although it has been over 40 years since the launch of the first universal recycling symbol, only 14 percent of plastic packaging is collected for recycling around the world, according to a report by the Ellen MacArthur Foundation.

The lack of recycling is costly. An estimated $80 billion to $120 billion worth of plastic packaging material is lost to the economy every year, according to the Foundation.

And, of course, such staggering waste also costs the environment. The Foundation projects that, if we keep going as we are, the oceans may contain more plastics than fish by weight in less than 35 years.

One thing is for certain: Redesign and innovation are sorely needed in the CPG sector. Without it, a significant portion of plastic packaging will never be recycled or reused, according to the Ellen MacArthur Foundation report. To be exact: About 30 percent of plastic packaging is destined for landfill, incineration or energy recovery by its very design, as these items are “often likely to leak into the environment after a short single use."

This said, Unilever's commitment to reduce its plastic packaging waste cannot be ignored by the big players in its industry. Organizations like Ellen MacArthur that are keen to promote the circular-economic solutions can only hope its commitment will spur industry-wide action.

Image credit: Flickr/Kevin Dooley

2017: The Year of the Chicken

By Kenny Torrella

According to the Chinese Zodiac calendar, 2017 is the Year of the Chicken. It’s fitting, since 2017 is shaping up to be the year of reforming the chicken industry.

Despite evidence they may be just as smart as dolphins, most chickens are packed into factory farms that bear no resemblance to the Old MacDonald’s farm we envisioned as children. But all things considered, 2016 was a good year for lessening their suffering.

In November, Massachusetts voters ushered in the nation’s strongest farm animal protection law, which includes a ban on the extreme confinement of egg-laying chickens in cages so small they can’t even extend their wings. Organizations like the Humane Society of the United States and others worked with more than 100 companies to commit to phase out cages for hens.

But the vast majority of chickens on factory farms are bred specifically for their meat, so-called “broiler” chickens. Their lives are rife with severe welfare concerns: cruel genetic manipulation, barren living quarters and painful slaughter.

Thanks to the advancements made in 2016, conscientious consumers and animal advocates are poised to bring much-needed relief this new year to the more than 8 billion meat chickens languishing in today’s factory farms.

If you live in the United States, you probably eat about 25 chickens per year. If you were alive at the turn of the 20th century, you would’ve eaten just a few. What happened? The proliferation of U.S. chicken consumption can be traced back 95 years to a simple mistake, a fluke in the history books of agriculture.

In 1923, Celia Steele of Ocean View, Delaware, ordered 50 chicks in the mail for her small hobby farm, but received 500. She decided to keep them indoors over the winter and, to her surprise, they survived. In the next three years, she expanded her operation to 10,000 chickens. Nine years later, her flock grew to 250,000. Thus was the birth of the American poultry industry, which now makes more than $28.7 billion by raising and slaughtering a staggering 8.8 billion chickens each year.

While some family farmers raise heritage-breed birds on pasture, the vast majority of broiler chickens are kept in windowless warehouses. They’ve been genetically manipulated to rapidly put on weight, leaving their legs unable to keep up with their bloated bodies. Some chickens become completely immobilized, suffering from leg deformities and lameness, and are unable to reach water or food.

Those who make it to slaughter age, a mere six to seven weeks old, are stuffed into crowded transport crates and trucked long distances. Many will die on the trip from a ruptured lung or liver, or asphyxia.

After reaching the slaughterhouse, they’re hung up by the legs and forced into shackles, then lowered into electrified water; most become immobilized but may still be conscious, heading for the slaughter blade still fully able to feel pain. Their throats are then slit, but according to the USDA, millions will miss the blade and then drown in a tank of scalding water used to remove the birds’ feathers.

Due to rising consumer demand for less cruelty to farm animals, and the hard work of animal protection organizations and family farm advocacy groups, the foodservice and restaurant industries are starting to take action and mandating their suppliers to improve this grisly supply chain.

On Dec. 30, 2016, just two days before the new year, Starbucks announced a sweeping policy to improve the lives of the chickens used in its supply chain. By 2024, the company will source chicken meat from breeds of birds that were not genetically selected to grow at such an unhealthy clip. The chickens it sources will also come from facilities that give more space to each bird. Additionally, these suppliers must provide enrichment (such as perches and hay bales) and use a less painful slaughter method, like controlled atmosphere stunning, in which birds will be rendered unconscious with a gas while still in transport crates.

In the weeks prior to Starbucks’ announcement, Panera Bread and Pret a Manger, as well as the top five food service providers — Compass Group, Sodexo, Aramark, Centerplate and Delaware North -- announced similar policies. In 2017, we’ll likely see every major food company hitch their wagons to reducing the suffering of the billions of chickens in the American poultry industry.

While the market is moving toward higher welfare for chickens, it’s also providing more plant-based foods.

Tyson Foods made headlines when it recently launched a $150 million venture capital fund to invest in companies that boast “breakthrough” technologies in the “alternative protein” space. One of those is Beyond Meat, a plant-based company with products available in hundreds of grocery stores nationwide.

Celebrities are on board, too. Arnold Schwarzenegger is calling on everyone to terminate at least half of their meat consumption as a way to reduce greenhouse gas emissions. Paul McCartney has praised the upcoming book "MeatLess" by Kristie Middleton about how eating less meat can help people reach their health goals.

We can all do our part by practicing the Three Rs: reducing or replacing consumption of animal products, and refining our diets by switching to products from farms with higher animal welfare standards.

While some Americans are welcoming the new year and our new political climate with fervent excitement, and some with cautious fear, we can all take solace in the humane sensibilities that underpin this nation. Last November, the Massachusetts voters who overwhelmingly supported higher welfare for chickens represented all political stripes. Companies with diverse workforces and operations coast to coast are tackling cruel practices in the poultry industry head-on. And national surveys continually show that -- whatever race, religion or age you may be -- you likely want to see farm animals treated better.

The creators of the Chinese Zodiac calendar, working some 2,000 odd years ago, couldn’t have predicted the forces converging to reform the chicken industry in 2017. But when we ring in 2018, I think it’s safe to predict that we’ll have created a better world for perhaps the most abused animal on the planet: the chicken.

Image credit: David Paul Morris/HSUS

Kenny Torrella is public policy outreach manager of farm animal protection at The Humane Society of the United States. Follow him on Twitter.

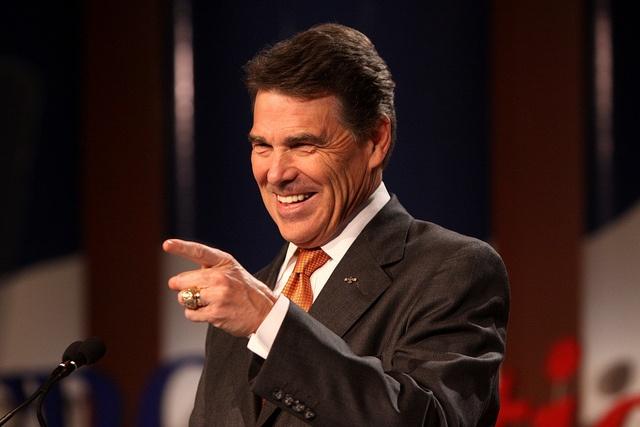

Could a Rick Perry DOE Threaten Jobs, Increase Energy Bills?

Editor's Note: A version of this post originally appeared on the Natural Resources Defense Council's Expert Blog.

By Elizabeth Noll

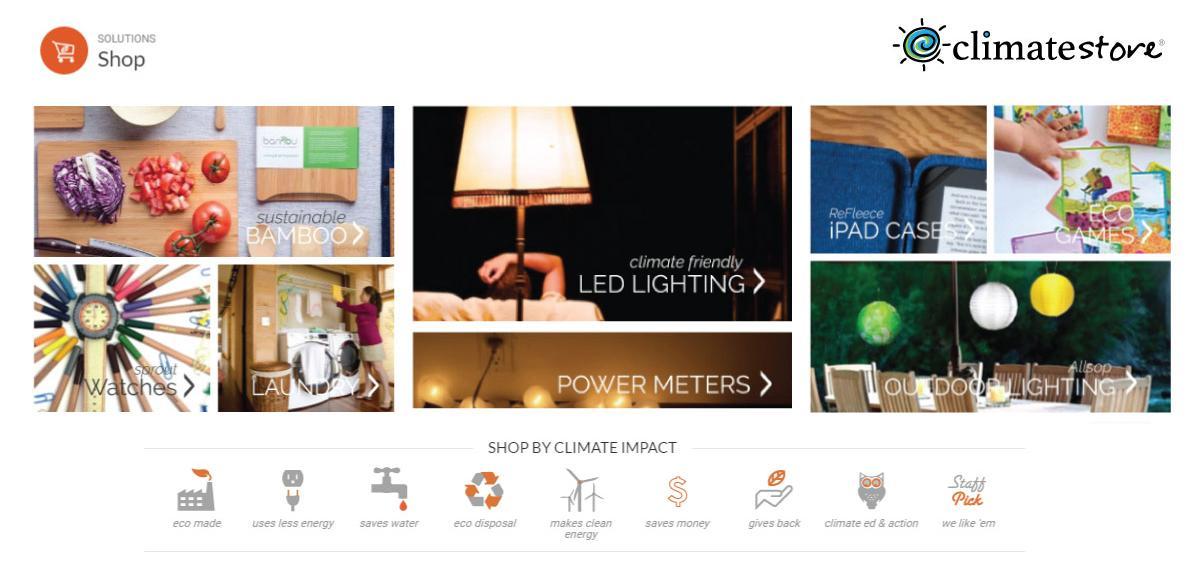

When Rick Perry faces his Senate confirmation hearing on Thursday, the former Texas governor’s goal will be to convince all of us that he’s up to the task of running the U.S. Department of Energy (DOE).

America has enjoyed years of incredible clean-energy progress, and its senators need to make sure this climate denier won’t hamper our nation’s clean-economy momentum, costing jobs and raising our energy bills.

Moving backward on clean-energy progress is not an option. Wind and solar power are cost-competitive with fossil fuels in some states. And 2.5 million Americans are employed in the clean-energy sector in all 50 states.

In fact, as NRDC’s recently released Fourth Annual Energy Report shows, a clean-energy revolution is underway, decarbonizing the electric grid through carbon-reduction targets, energy-efficiency gains, and renewable-energy additions.

We’re in a period where a clean-energy future costs less than a dirty one. DOE programs and initiatives have contributed to that success, and the next energy secretary will be responsible for continuing to push this trajectory.

The United States is at a key turning point for climate and clean-energy leadership, both domestically and globally. And the next secretary of energy must tackle these challenges head on. The members of the Senate Energy and Natural Resources Committee should ask hard questions today to determine whether Perry is capable of championing our nation’s continued clean-energy progress.

Considering that first and foremost the Department of Energy is a nuclear agency tasked with protecting the nation’s nuclear security (60 percent of the DOE budget goes toward nuclear energy, security, weapons, and cleanup), the Committee also needs to question Perry about these critical responsibilities.

But it’s imperative that the senators recognize that fulfilling the DOE mission “to ensure America’s security and prosperity by addressing its energy, environmental and nuclear challenges through transformative science and technology solutions,” has led the U.S. to catapult past clean-energy milestones as prices have plummeted across the board for pollution-free energy resources.

The secretary of energy should be tasked with continuing that progress while overseeing our nation’s weighty nuclear issues. Unfortunately, NRDC has serious concerns about Rick Perry’s interest and ability to pass that test.

Progress made

Perry has been nominated to lead the DOE at a time when we are accelerating our move into a clean-energy future.

Wind energy has made remarkable progress, for example. Land-based wind accounted for 41 percent of all new electric generation capacity installed in 2015. At the close of 2016, our nation’s first offshore wind project came online, a 30-megawatt project off the coast of Rhode Island.

Last year also saw the millionth solar system installed. And thanks to DOE programs like the SunShot Initiative, the cost of these systems has declined 54 percent since 2008. Utility-scale solar has seen even greater declines of 64 percent over the same period.

The DOE’s EV Everywhere program helped drive nearly half a million EVs onto U.S. streets, making America one of the largest EV markets in the world.

And as a direct result of government and industry supported R&D, the cost of a highly-efficient LED lightbulb has dropped by 94 percent since 2008.

What's at stake

Our nation’s clean-energy progress affects Americans quite directly, bringing quality jobs and cleaner air.

The clean-energy economy has created or sustained quality jobs in the energy sector nationwide — 2.5 million jobs to be exact, energy-efficiency being the largest segment with 1.9 million workers and growing. Putting electricians and plumbers to work retrofitting homes to make them more efficient helps build our economy.

Speaking of making our homes more efficient, the Obama administration has issued about 50 minimum efficiency standards that are helping the average American household save $500 on their utility bills annually. That is more than any previous administration and will help reduce carbon emissions by nearly 2.5 million metric tons by 2030.

The standards set last year, alone — ranging from battery chargers to pool pumps — will save consumers nearly $75 billion on their utility bills and avoid the need to generate 1.4 trillion kilowatt-hours of electricity over the next 30 years of shipments. That’s progress worth protecting.

Further, basic research and technological innovation is core to U.S. competitiveness as well as the DOE’s mission. Opportunities like tapping into U.S. offshore wind power potential will be influenced by our next secretary of Energy. Decisions.

Image credit: Flickr/Gage Skidmore

Elizabeth Noll is the legislative director of the energy and transportation for the Natural Resources Defense Council (NRDC). In this role, she works to improve energy efficiency in buildings and the appliances and electronics that operate within them. She also tracks and influences federal policies that help reduce dangerous pollution from power plants. Prior to joining NRDC in 2014, Noll worked on similar issues in the private sector as well as nonprofits, collaborating with utilities and bringing stakeholders together to share energy-saving ideas and technologies.

Why Innovation is Integral to Nonprofit Management

By Daphne Stanford

Successful nonprofit organizations are run by great leaders. So, what does it take to show excellent, innovative leadership in the public-sector and nonprofit worlds?

These two realms often intersect since they share similar interests: the public good, social justice, socioeconomic mobility, ending hunger and homelessness, and so on.

According to Ohio University, one of the most important characteristics of a strong organization is a good mission statement. A strong, clearly-worded mission statement is highly motivating to not only the community, but also the organization’s employees, who are more likely to feel engaged if they feel inspired and are clear on how they are making a difference to society.

Other important characteristics of a strong not-for-profit organization include finding the best people possible for open positions and spending a good amount of quality one-on-one time with employees once the right people have been hired, so the lines of communication remain open. Highly inspired and engaged employees will be more likely to successfully engage their community members, giving their organization the chance to make a societal impact in the first place.

Lastly, it’s crucial that nonprofit coordinators seek to both “under-promise” and “over-deliver,” when seeking funds — even though the temptation to over-promise is often difficult to resist. That way, nobody walks away unhappy, and fundraising goals are met without a lot of failed expectations.

One organization known for its innovation, Teach for America, teamed up with Arizona State University — itself a leader in educational innovation, due in no small part to its groundbreaking number of online offerings.

Teach for America believes in innovation so strongly that it formed the Social Entrepreneurship & Innovation (SEI) team, whose mission is “to end educational inequity in our lifetime.” The team provides one-on-one and group-based professional development and coaching opportunities to both current corps members and alumni of Teach for America. Although not every nonprofit may be large and well-organized enough to put together such a supportive team, the idea is a good one.

Teach for America built a movement around putting young graduates in public classrooms, which was innovative for its time. Many colleges and universities are also exhibiting innovative thinking by offering programs and classes online. Furthermore, there are a number of graduate programs in education available to those interested in a higher pay scale than the salary offered to those with only a Bachelor’s degree.

Having an advanced degree can also encourage teachers to assume a leadership position among their peers. Moreover, teachers mentoring teachers is good for retention: “According to EdWeek, 86 percent of teachers who had a mentor in the first year of their employment remained in their teaching posts.”

One word that gets tossed around in many discussions about innovation is disruption. In her blog, nonprofit governance expert Debra Beck asks what it would take to truly disrupt what happens in the nonprofit boardroom and transform the outcomes. She asks, “What if fun and fulfillment were the norms for the ways nonprofit boards work?”

Perhaps one key to allowing this kind of disruption lies in what the nonprofit consultancy Rad Campaign calls “changing our internal mindset about how we do business, and changing the external perception that what we do isn’t really business.”

Could it be true that many not-for-profit organizations have a sort of inferiority complex? If so, one thing that could help, the Boston Consulting Group found, is to set a shared definition and purpose. If a purpose is defined, there is suddenly an objective that everyone can work toward. It’s difficult to have a purpose, after all, without a clear plan or ultimate goal.

In addition, a viable organizational structure and result-tracking process will help further progress toward said goal. “Organizations need to adopt a mindset that not only tolerates, but celebrates risk and failure. They need to adopt a beginner’s mindset where all ideas are open to vetting and reconsideration," said Stephanie Cosner Berzin, co-director of the Center for Social Innovation at Boston College School of Social Work

This “beginner’s mind” has long been recognized as key to being a good teacher, since it allows room for mistakes and simple explanations of concepts. Simplicity is sometimes undervalued, but it is important to the process of understanding the world again, as if for the first time.

This is what is necessary to innovative in both the for-profit and nonprofit worlds: the ability to empathize with beginners in order to be able to relate to those with much less experience and knowledge than us, to explain ideas thoroughly and to the best of our ability.

Image credit: Flickr/Dennis Skley

Daphne Stanford hosts "The Poetry Show!" on KRBX, her local community radio station, every Sunday at 5 p.m. A writer of poetry, nonfiction, and lyric essays, her favorite pastimes include hiking, bicycling, and good conversation with friends and family. Follow her on Twitter @TPS_on_KRBX.

Corporate sustainability helps improve employee engagement

20 brands protest detention of garment industry trade union leaders in Bangladesh

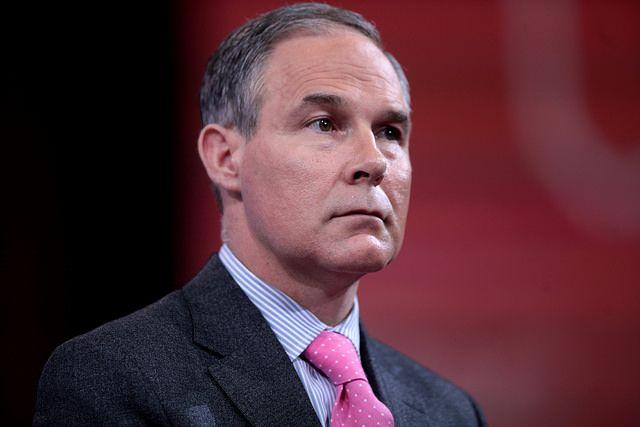

The EPA Under Scott Pruitt: What Will it be Like?

Today, two days before Donald Trump ascends to the presidency, Scott Pruitt will face his Senate confirmation hearing to head the Environmental Protection Agency.

Mr. Pruitt is now halfway through his second term as Attorney General for the state of Oklahoma. TriplePundit spoke with Johnson Bridgewater, president of the Oklahoma chapter of the Sierra Club, about a potential EPA under Pruitt. Bridgewater has been up close and personal with Pruitt's blatant anti-environmental agenda.

"As soon as Pruitt came into office, he disbanded what was established as the Environmental Protection Unit," Bridgewater says. Established by Pruitt's predecessor, the unit was "tasked with working on environmental issues in the state of Oklahoma." The unit investigated issues such as illegal dumping, water contamination and oil refining.

"Since he has been in office, we are unaware of any major environmental issues he has taken on," Bridgewater says.

At first blush, it may seem odd that a man with a clear record of disinterest in environmental issues should be chosen to steer the EPA. But 'disinterest' is likely not the right word. As Bridgewater illustrates, Pruitt took an active interest in overturning environmental protections already in the works.

Chicken parts

When Pruitt took office, a years-long, hard-fought lawsuit brought by the state of Oklahoma against the state of Arkansas and the poultry industry was well underway. The suit alleged that Arkansas-based poultry operations had dumped poultry waste into the Illinois River Basin, as much as 345,000 tons of the stuff annually for years. Arkansas poultry farms were "basically polluting the entire watershed of eastern Oklahoma."

"Mr. Pruitt took that lawsuit out of action," Bridgewater recalls, instead "requesting a study."

Not only that, many of Pruitt's biggest donors for 2010 campaign for Attorney General came from the same poultry interests named in the original lawsuit.

The single largest environmental pollution case in the state, potentially impacting the water for thousands of Oklahoma residents, was thus shelved. No environmental oversight needed. But just in case, we'll study the issue, Pruitt concluded. If the study does amount to anything, any restriction on poultry waste dumping will be voluntary.

What I say, not what I do

Pruitt claimed that he did not support "regulation through litigation." And yet as Attorney General in Oklahoma, he sued the federal government and the EPA 14 times, in an apparent attempt to litigate regulation, Bridgewater explains.

"That someone who has sued the federal government 14 times to claim regulation by litigation isn't appropriate is absolutely laughable," Bridgewater says.

Feel the Earth move

Harold Hamm is president of Oklahoma-based Continental Resources, the self-avowed "America's oil champion." Hamm is perhaps best known as a pioneer of fracking as we know it today. "He is credited," Bridgewater says, "[with] inventing and spreading modern horizontal fracking across both Oklahoma and the United States."

With the fracking boom came a rumble -- specifically, the rumble of earthquakes. "The 21,000 earthquakes that we have had in the last six years [are] very clearly linked to the process of fracking and the oil and gas production that has resulted from it," Bridgewater says.

In response to the growing crisis, the Oklahoma Office of the Attorney General has been "completely silent."

The connection

Harold Hamm served as an advisor for the Trump campaign and was considered Trump's top choice for Energy Secretary. (Hamm turned it down.)

What is less well known about Hamm is his role as the manager of Scott Pruitt's re-election campaign in 2014. Led by Hamm's Continental Resources, the oil and gas industry in Oklahoma funded as much as a third of Pruitt's campaign war chest.

For Bridgewater, this speaks to Pruitt's willingness to "bend over backward" in remuneration for his close financial ties to oil and gas interests.

"It's that blatant,"says Bridegwater. "... There is a very clear series of relationships that exist."

It is a straight line, therefore, from Trump to Hamm to Pruitt. And considering the rhetoric from Trump on energy and climate throughout his campaign, what better choice could there be?

Got science?

Pruitt is on record claiming that the "science behind climate change is not settled," and poses no significant risk. Despite all the connections, campaigns donations and lax, if any, environmental regulation, this is the "fundamental problem" for Bridgewater.

"We are most concerned over the simple fact that Scott Pruitt doesn't see climate change as a problem."

"We see climate change as the greatest environmental catastrophe that is currently underway," Bridgewater says, "and we see the EPA as the most likely way for the United States to make headway on climate change."

Putting someone who does not believe in climate change in charge of the very agency best equipped to deal with what is, in fact, accepted science is the core argument against Pruitt's nomination to head the EPA.

To drive the point home, Bridgewater emphasizes that Pruitt would be the first non-scientist EPA administrator.

The EPA under Pruitt

To understand how the EPA will function under Scott Pruitt's leadership is simply a matter of looking at his record.

"A model for how we would expect the EPA to work is basically to stand aside and let any and all energy extraction processes to move forward regardless of what appear to be the negative consequences," Bridgewater says.

It is a sad irony that Pruitt may well run the EPA.

"If you just look at the facts alone, it is very clear that he backs industry over environmental issues."

Bridgewater hopes senators understand the critical role the EPA plays in protecting our nation's environmental resources (as the agency's name implies). He calls on Congress to consider also the responsibility the agency has safeguarding the health of Americans and promoting the nation's leadership in the new energy economy.

And Pruitt, Bridgewater insists, is not the man for the job.

Image credit: Gage Skidmore, courtesy Flickr

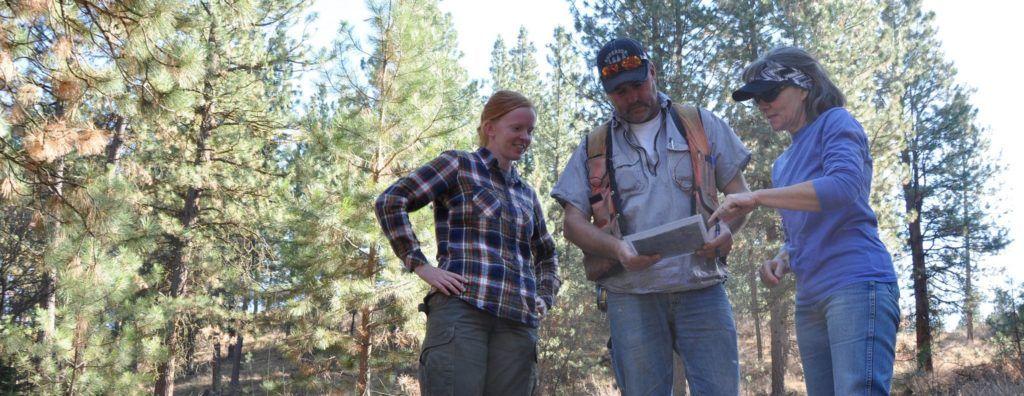

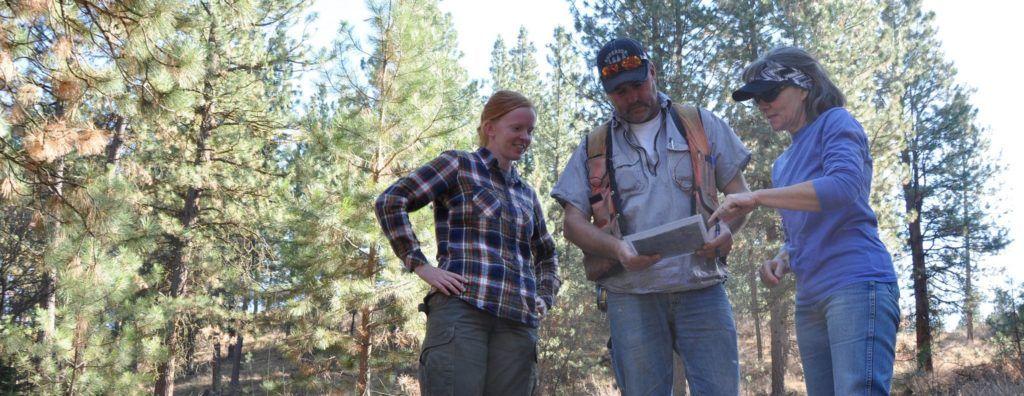

How to Move Sustainable Investing Into the Spotlight

By Kristen Kleiman

I am new to the world of sustainable investments. For the last 25 years, before joining the Climate Trust, my career was centered almost exclusively on timberland investing. The corollaries between sustainable and timberland investing may not be apparent at first, but U.S. timberland investing is based almost entirely on sustainable forestry. In fact, most U.S. timberland companies manage their assets under either the Sustainable Forestry Initiative (SFI) or Forest Stewardship Council (FSC) criteria.

Surprisingly, sustainability isn’t timberland investing’s greatest selling point. Instead, the industry does an excellent job of touting timberland’s positive role in a diversified portfolio. Timberland investment management organizations (TIMOs, as they are now called) rarely call out the environmental benefits of the asset class. Instead, they focus on investment fundamentals that portfolio managers focus on: preservation of capital, inflation hedging, and non-correlation with other asset classes.

There are lessons to be learned here: TIMOs grew from $1 billion to over $50 billion of assets under management from their beginnings in the 1980s to 2010, according to Timberland Investment Resource.

Labels matter...

Agreement on what our industry calls itself may seem inconsequential, but investors appreciate clear naming conventions for ease of performing asset allocation. Back in the late 1990s when I was marketing timberland, this was a real challenge. I had prospective investors ask me: Where does timber belong in my portfolio -- real estate, private equity, alternatives? Some even tried to lump timber in with oil and gas! Twenty years later, it is pretty easy to find timber as its own separate asset allocation (which was the industry’s ultimate goal).

Why does this matter? Like the old adage, “you can’t manage what you don’t measure,” one could argue, “you can’t market what you don’t label.” Sustainable investing (and I use that term tentatively) can’t seem to agree what it should be called: impact investing, socially responsible investing, conservation investing, green investing? And if the industry can’t even agree on its name, a message is sent that we are still too disorganized to warrant serious attention from institutional investors.

Like the TIMOs of the 1990s, the goal should be to convince institutional investors that sustainable investments belong in their portfolios — leading to the allocation of a small percentage to the asset class.

If the industry can achieve that, the numbers become big very quickly.

As of 2015, 96 American university endowments managed assets ranging from $35 billion to $1 billion each, according to the National Association of College and University Business Officers. And, according to the actuarial consultancy Milman, the top 100 U.S. pension funds had $3.4 trillion in assets in 2015. Even a small percentage of these institutional investors is a huge number. For example, a $25 billion pension fund allocation of 1 percent to sustainable investing would be $250 million.

So the industry has a label problem, which means it could have an asset allocation problem. To address this situation, we have to figure out what to call this new asset class.

The sector spans a wide range of issues, including climate change mitigation, poverty alleviation, renewable energy, access to finance, land and species conservation, and affordable housing. Perhaps we need to split them along different lines — lumping environmental-related investing into the broad 'sustainable investing' category, and poverty, education, and affordable housing into 'social finance.' Any way you slice it, this nagging problem requires a solution before we are able to progress.

... and so does risk

Portfolio managers have increasingly focused on risk management and mitigation since the Great Recession. TIMOs understood this early.

Timberland was initially marketed with 8 to 12 percent nominal projected returns (including inflation), with little track record to call on. Those projections were about the same return as a long-term investment in the S&P 500. Not terribly compelling.

But instead of trying to compete with heady projections of private equity and venture capital, TIMOs set themselves apart by showing that timberland investments reduce portfolio risk without reducing overall portfolio returns. Portfolio managers were convinced and started investing. And the icing on the cake was that many TIMOs beat those projected returns by a long shot during that first 20-year period.

Our industry should convince portfolio managers that investing in the sustainable asset class is less risky to their portfolio than not investing — but we have to prove it first.

Does sustainable investing actually de-risk a diversified portfolio of traditional assets? It certainly would seem so, given the work done by corporations to track their sustainability. But by focusing on the portfolio, and not just individual companies in the portfolio, sustainable investing could be seen as essential to portfolio risk management.

Use the right language

Timberland investing wisely uses traditional investment language to describe the asset class. This follows logically from addressing risk. Concepts like efficient frontier analysis, correlations between sustainable investing and traditional asset classes, and inflation hedging, need to be explored and explained.

Another component of right language is to keep the message positive and avoid speaking out against the competition. In the early years of timberland investing, there seemed to be an unwritten rule that you talk up the asset class -- and don’t talk down the competition.

All parties focused on educating investors about the benefits of timberland to their portfolios — it didn’t make any sense to belittle other timberland managers. As a whole, we wanted to build the asset class first and foremost. Competition heated up as the industry matured, but in the early days we were all in it together.

As Climate Trust Capital (an independent firm of the Climate Trust) launches its own funds, educating potential investors on these issues will take on a particular urgency. The required funding needed to support the low-carbon transition -- and arrest temperature changes -- is estimated to be $4.8 trillion according to the 2015 report Banks and Climate Change Impact. Our global wellbeing demands this maturing of sustainable investments — and given the particularly dire climate news of late, it must happen rapidly.

The lessons learned in bringing an asset class from infancy to maturity are many. But if 25 years have taught me anything, it’s that positioning is everything. We need to talk the right talk to move sustainable investments from the fringe to the forefront — where they belong.

Image credit: Flickr/NRCS Oregon

Kristen Kleiman is the Director of Investments for The Climate Trust.