Proposed Wyoming Bill Aims to Outlaw Renewable Power

Earlier this month, Wyoming legislators introduced a bill that would effectively outlaw clean energy by preventing state utilities from selling it. The proposed bill applies to all power generated by large-scale solar or wind projects. If passed, violating utilities would be fined $10 per megawatt hour.

The bill has nine sponsors, two in the state senate and seven in the house, all of whom come from coal-producing counties. While the bill is considered unlikely to pass, despite large Republican majorities in both houses, its intent certainly flies in the face of global efforts to combat climate change.

While most states have renewable portfolio standards, Wyoming is one of the few that does not. And what this bill proposes "is essentially a reverse renewable energy standard," says Shannon Anderson, director of the Powder River Basin Resource Council.

One of the bill’s sponsors, Rep. Scott Clem of Campbell County, has openly questioned the science behind human-caused climate change. He wrote on his website: “The fact of the matter is that man-made climate change is not settled science. Instead, it is hotly disputed by reputable and educated men and women ... "

That is simply not the case. Only a handful of people dispute the overwhelming scientific consensus, most of whom are on fossil fuel company payrolls.

That said, it is not unusual for representatives of state or federal governments to make proposals designed specifically to serve the interests of their constituents. And for many legislators, it makes sense to promote fossil fuels in Wyoming: The state is America's No. 1 coal producer and is also home to vast oil and natural gas reserves.

But while this particular proposal could at best delay layoffs for some Wyoming workers, it threatens to stamp out the clean-energy innovation that could free those workers from relying on a single industry for their livelihoods. The transition to a low-carbon economy seems more inevitable each year, and refusing to jump on board with clean power may mean Wyoming workers are left behind.

"Despite the new president’s campaign promises and whatever actions he might take to ease regulations, coal jobs aren’t coming back," says James Van Nostrand, director of the Center for Energy and Sustainable Development at West Virginia University College of Law.

Even the CEO of the nation’s largest private coal company, Robert Murray of Murray Energy, told CNNMoney that coal employment "can't be brought back to where it was before the election of Barack Obama."

That’s because competition from natural gas -- far more than from renewables -- is shutting coal mines down. If Mr. Clem and his companions really wanted to help the miners in Wyoming, they should have outlawed natural gas-fired power plants, too.

Dave Eskelsen, a spokesman for Rocky Mountain Power, one of the utilities that would be impacted by the law if it were to pass, said wind and natural gas are the cheapest energy sources for the company, more so than coal.

That undermines what Rep. David Miller from Fremont County, another of the bill’s sponsors, claimed when he said: "Wyoming is a great wind state, and we produce a lot of wind energy. We also produce a lot of conventional energy, many times our needs. The electricity generated by coal is amongst the least expensive in the country. We want Wyoming residences to benefit from this inexpensive electrical generation."

Meanwhile, coal miners across the country are fearful of losing black lung disease benefits that were included with the Affordable Care Act that President Donald Trump says he intends to repeal.

Image credit: www.CGPGrey.com via Flickr

Corporations: Unlikely Heroes in America's Quest for Climate Action

By Marty Spitzer

Major U.S. companies have been supporting climate action and investing in renewable energy for decades. IBM set a greenhouse gas emission reduction goal in 1998. Johnson & Johnson set one in 2000 and invested in its first solar project a year later. But a lot has changed since those early days. What began as a vocal minority is now a loud and steady chorus.

Today, companies realize there is real money to be saved by embracing energy efficiency and reducing emissions. By investing in renewable energy, corporations can lock in cheaper energy prices and reduce the risk of market volatility.

These economic benefits of investing in renewables and greening their operations and supply chains have made companies active leaders in the U.S. climate movement. Regardless of the incoming administration’s position on climate change, American corporations’ significant renewable energy and efficiency goals are essential in America’s ability to meet and beat our domestic climate pledges.

Nearly half of America’s Fortune 500 companies have set climate or renewable energy goals. And now we’re seeing the scale of their corporate targets become more aggressive. Thirty-five U.S. companies, including P&G, Walmart, PepsiCo and Hewlett Packard Enterprise have either set or committed to set science-based renewable energy and emissions targets aligned with the path recommended at the international climate talks. And more and more companies are pledging to power their operations with 100 percent renewable energy.

There’s another growing trend afoot: U.S. companies are more willing to exert their considerable influence to demand policy change to safeguard prosperity. Two weeks ago, over 700 companies reaffirmed their support for a low-carbon United States and for the historic Paris Climate Agreement.

The diversity of companies that signed the statement, in addition to those making ambitious science-based targets and renewable energy commitments, shows businesses backing climate action isn’t just a trend among Silicon Valley tech companies and consumer-facing brands. Some of America’s biggest-name manufacturers and retailers are pushing the envelope.

But, with all these companies moving to meet ambitious climate targets, corporate buyers will need greater access to renewable energy from the grid and greater choice in offerings from utility providers.

It’s why corporate buyers outlined their priorities for utilities, utility regulators and the renewable energy marketplace in an open statement. Sixty-five companies now support the Corporate Renewable Energy Buyers’ Principles, including PepsiCo and TD Bank that came on board this week. Collectively, these 65 companies are seeking enough renewable energy equivalent to powering 4.4 million American homes.

Business investments in a clean-energy future may be driven by the bottom line, but they comprise a critical piece of a larger shift in the world. Sharply declining prices of wind and solar energy have converged with a global scientific consensus on the perils of a warming planet. This convergence is pushing climate action forward with irreversible momentum.

Now it’s up to all of us – from corporations to states, cities and civil society – to help accelerate this transformation by demonstrating our vocal and visible support for action and illuminating a clear business case for developing an American economy focused on a low-carbon future: one that is powered by clean and renewable energy sources.

If we can do that, we will provide Americans with new jobs and homegrown industries, more secure and healthier communities, and a more stable climate.

Image credit: Pixabay

Marty Spitzer is World Wildlife Fund's senior director of climate and renewable energy.

3 Tips to Help Entrepreneurs Make the Right Sacrifices

By Gene Ku

I was born and raised by entrepreneurs who, in my opinion, epitomize the American dream. My parents emigrated from South Korea with just the clothes on their backs before building a successful assisted-living business from scratch.

They knew — and impressed upon me — that nothing in life is free. Entrepreneurship, in particular, has steep costs. But they also knew that, in return for their sacrifices, they could achieve a level of success, fulfillment and freedom unattainable by working for someone else.

To me, their sacrifices were always just part of life. That meant some lonely soccer games and long days at daycare, but I didn't resent my parents. From a young age, I saw the long hours they put in, and I understood that their business thrived because of it. They modeled the discipline that I'd eventually need to run my own company.

For entrepreneurs, the company is a second spouse. Like any partner, giving it the attention it deserves isn't easy. Sometimes, it means late nights at work and missed weekend excursions; other times, it means choosing to delay parenthood or other life goals.

Nobody wants to have to make those choices. But if you want to succeed in business, then you first need to know where your priorities lie — and, more to the point, what you're willing to sacrifice in order to achieve them.

The meaning of sacrifice

When I started my company — my professional family — in my early 20s, I knew it would be tough. For years, I practically worked in my sleep. I put aside two things that define young adulthood for many people: socializing with friends and starting a family.

Today, I am 40 years old and engaged. While that might seem late, I saw my 20s and 30s as my entrepreneurial peak. As rewarding as relationships can be, they're also big distractions. It wasn't easy, but I chose to delay that gratification until I'd made my mark in business. I knew that if I chased two rabbits, I'd catch neither.

Unlike delaying starting a family, sacrificing social time wasn't one big decision; it was a series of small ones. I rarely attended happy hours. I skipped after-dinner get-togethers and Sunday afternoon football. There were ups and downs, but I knew that I'd never enjoy the fruits of my labor if I didn't actually put in that labor.

Every success story — not just mine or my parents — contains behind-the-scenes sacrifices. Yes, Tiger Woods has natural talent, but he'd never be a star without spending thousands of hours perfecting his game. The 10,000-hour rule of mastery may be a cliché, but as American writer and educator George Leonard knew, excellence does not come without practice.

Like Woods, entrepreneurs must practice their craft until it becomes an extension of the self. The most successful ones, at some point or another, learn to hone that part of themselves without neglecting the others.

Sacrifice to succeed

Making sacrifices is not an option of entrepreneurship; it's the foundation. If you can accept that, then you're ready to be an entrepreneur. That isn't to say, however, that every moment should be a grind. The following tips can help you live a more balanced life without sacrificing your business, health, or sanity:

1. Get off your ass. I get it. Life is hard, and it's easy to say, "I don't have enough time for that." But if you don't care for your body, then you can't care for yourself and, by extension, your company.

If you think you're too busy for fitness, just consider Strauss Zelnick. At 59, he's a father, a husband and a media executive, and he still finds time to hit the weights. Between running the private equity firm Zelnick Media Capital and Take-Two Interactive — the firm behind video games like "Grand Theft Auto" and "Max Payne" — he leads #TheProgram, a four-day-per-week morning fitness club.

So drop the excuses, and put your health first. Lift weights, go jogging, take a hike or head out on the bicycle. If Zelnick can do it, you can, too.

2. Find your entrepreneurial family. Most of the world doesn't know what you're going through. They're happy to come home after work, pop on Netflix and forget about work until tomorrow morning. And when you work harder than everyone around you, it's easy to throw in the towel.

The solution, though, isn't to quit: It's to meet and associate with people like you. Join entrepreneurial peer groups like Entrepreneurs' Organization, SCORE Association or YPO. Embrace those who are traveling the same path, helping you and cheering you on. There's nothing more uplifting and encouraging than sharing entrepreneurship's struggles and rewards.

3. Realize school never stops. Remember when you walked across that stage, diploma in hand, convinced your education was over? In reality, your entrepreneurial education was just beginning. In business, if you're not constantly learning, then you'll be left behind.

Become a self-guided learner. Read at least one book per month — something that's interesting to you and practical. For a few bucks, you could become a better leader, learn a new skill or even pick up a new language.

For auditory learners, podcasts can yield similar results. My favorites are "The Tim Feriss Show" and "How I Built This," which always help me put my challenges in perspective. Don't have time to listen? Pop on a podcast during your workout or commute.

Ultimately, being successful means being decisive. Don’t half-sacrifice one thing for something else, or you'll fail to achieve either. If you're rewarding your team with a happy hour or eating dinner with family, then put the phone away. You can't bond with people while working. And with all the distractions, you probably won't get much done anyway.

Success doesn't come without sacrifice. It requires you to be purposeful, spend time strategically, delay gratification, and care for your body and mind. If you do those things, then you'll achieve what you set out to accomplish.

Image credit: Frontline Creative via Unsplash

Gene Ku is the founder and chairman of Mobovida, a vertically integrated online retailer and fashion-forward, direct-to-consumer mobile accessory brand. Since 2002, Gene has bootstrapped Mobovida and CellularOutfitter, the largest pure-play online retailer of mobile accessories. Using agile product development and a sophisticated digital marketing model, Gene has propelled Mobovida to a remarkable 14-year compounded annual growth rate with nine consecutive years and counting on the Inc. 5000 list. Gene is also a venture partner at K5 Ventures in Orange County, Calif., and serves as mentor and advisor.

8 Social Impact Metrics you Need to Know About

By Gaurav Bhattacharya

Corporate social responsibility is something that almost every business is concerned about these days. Perhaps your company too does its fair share of work for the betterment of the society. But how do you know whether your efforts are making an impact at all?

It’s true that there are no set standards to measure the effectiveness of any social work, but certain indicators can help you get some perspective.

Take a look at these eight metrics that will help measure the social impact you are able to make as a brand:

1. Volunteer hours

The more you can encourage your employees to come forward and do charity work voluntarily, the bigger the impact you are able to make. And one surefire way to check whether or not your CSR efforts are reaping any results is to keep tabs on the number of volunteer hours.

2. Business impact metrics

There’s a lot more to employee giving and volunteering programs than meets the eye. Of course, you receive monetary benefits in the form of tax breaks, etc. But the benefits go way deeper.

People want to work for socially responsible companies, and investors want to sign deals with them. Therefore, some traditional business metrics – such as an increase in new leads, direct sales and an improvement in business relationships -- can often serve to measure the social impact of your company.

3. Net promoter score

This score is meant to find out how many loyal customers a company has. You can start off by conducting a campaign asking detailed questions to gauge into customers’ psychology, and find out how they feel about your social contributions. The NPS score also happens to be a leading indicator of growth and the quality of perception people have about a brand.

4. Social media activities

Social media has to be the easiest way to find out just how fruitful your social campaigns are turning out to be -- and where you stand in terms of your social responsibilities.

There are countless ways in which companies can leverage the power of social media and use it as a metric to assess their social impact. Ask people questions as to how they feel about your company’s contributions. Ask them whether they feel the company is living up to its responsibilities or not. Use platforms like Twitter and Instagram to target hashtags based on how often you are mentioned in a particular discussion, related to corporate social responsibilities.

5. Reduction in employee turnover

Employees love to be a part of a corporation that believes in the act of giving and making social contributions. And if you are able to conduct successful social campaigns, your efforts are sure to reflect on your employee turnover ratio. If people feel proud to be associated with your brand, they are much more likely to stick with you.

6. Quality of feedback

The only way to find out how people feel about a company being socially responsible is to ask for employee feedback. You can use your company website, social media or other ways to request for feedback. The responses you will receive would be a direct reflection of your social campaigns’ effectiveness and overall impact.

7. Increase in overall sales

Like we discussed, there are many implications to being a socially responsible brand -- part of which is about creating a sustainable society, offering green products, and building a healthier tomorrow. But eventually the company stands to benefit financially too as a result of being a socially responsible entity.

Companies can often observe the social impact of their CSR activities if they sense an increase in overall sales, the business bottom-line or customer retention.

8. Donations

Asking for donations to give to a charitable cause that a company believes in is one way to boost philanthropic profile. The more you can encourage employees and customers to donate for a good cause, the stronger outreach your initiatives will have. A good inflow of donations is a good indicator that you are making a strong positive social impact.

The bottom line

That pretty much sums up a few good metrics businesses can use to measure the impact of their social activities.

What are your thoughts on corporate social responsibilities, and how do you think companies can become more socially responsible? If you feel we missed out on some important CSR metrics, feel free to share them with us.

Image credit: Pexels

Gaurav is the CEO and co-founder of Involve which is a software as a service platform to help companies and its employees give back to their favorite causes by creating personalized giving and volunteering opportunities. He actively participates in the LA tech innovation ecosystem through panel discussions and mentoring. Gaurav started his career by starting a medical software business while still in high school and is an accomplished technology leader with 6 years of team and program leadership with PwC, Montgomery County & Cymer. When he’s not working with the tech community, Gaurav enjoys volunteering for local events with his team. You can follow Involve on Facebook, Twitter and LinkedIn.

Student Loan Company Navient Sued for Illegal Practices

For years economists have debated whether the growth and size of the nation’s student loan debt is really a cause for concern.

Some argue that the numbers tell all: Americans owe $1.3 trillion in student debt. It’s second to the country's mortgage debt in size, which looms at $8.3 trillion. Just a basic bachelor’s degree is enough to leave a student with years of debt long after he or she leaves university, points out MarketWatch reporter Jillian Berman, who has been following the student loan debate for more than a year.

"Research indicates that the [$1.3 trillion (2017)] in student loan debt may be preventing Americans from making the kinds of big purchases that drive economic growth," Berman says.

Others will counter that it’s a matter of perspective: A good quarter of the debt is owned by people who can afford it, says Justin Draeger, president and CEO of the National Association of Student Financial Aid Administrators. “Those in the lowest income brackets hold only 11percent of all outstanding loan debt,” he explained in an op/ed on Forbes.

The real issue, Draeger argued, is how the debt is managed by debtors, parents, and institutions before and while it is being accrued. Students, he said, are often "so confused by the mind-boggling number of loan repayment plans” that they fall hopelessly behind and end up defaulting on their first major financial transaction.

Last week the Consumer Financial Protection Bureau added one more element to the debate when it sued loan servicer Navient and two subsidiaries for what it says are misleading and illegal lending practices.

Navient, charges the CFPB, “created obstacles to repayment by providing bad information, processing payments incorrectly, and failing to act when borrowers complained.”

And when it came to those who needed the help the most, alleges the CFPB, the company “illegally cheated many struggling borrowers out of their rights to lower repayments, which caused them to pay much more than they had to for their loans."

The country’s consumer watchdog isn’t alone in this fight. Illinois and Washington are also suing, alleging violations in state laws.

Washington has been tracking its student loan debt problem for some time. Its attorney general asserts that Navient's system of loan approval not only deceived borrowers, but also roped in family members through a deceptive "co-signer release" that "put up arbitrary barriers and failed to disclose that very few borrowers ever achieve co-signer release."

But what makes this story even more troubling is how Navient gained its footing in the loan servicing business in the first place.

Navient was originally part of Sallie Mae, what was more formally known as the Student Loan Marketing Association. After Congress took a number of steps in 2010 that redesigned how student loans were originated (effectively placing more control in the hands of the Department of Education and less under Sallie Mae), the company announced restructuring plans. In 2014, Sallie Mae and Navient became separate publicly-traded companies -- with distinct, though similar, focuses on student loans.

For their part, Washington and Illinois are also suing Sallie Mae, which Illinois Attorney General Lisa Madigan asserts "put student borrowers into expensive subprime loans that it knew were going to fail." Madigan says Navient's actions led to "billions of dollars of debt" that unnecessarily inflated the burden being carried by student borrowers.

Some analysts are quick to point out that the country's student loan problems have overtones similar to what happened during the mortgage crisis.

As early as November 2015, the crisis was already beginning resembling the subprime mortgage fiasco that sent the country into recession in 2008, reports Shahien Nasiripour, chief financial regulatory correspondent for the Huffington Post.

New regulations under the Department of Education that made it much harder for borrowers to get relief was just one of several escalating factors to the crisis.The other, maintains the CFPB and the state AGs, was Navient's failure to ensure that those who did qualify for having their payments lowered were actually given that option.

Instead, say those investigating Navient, borrowers were shepherded into programs that benefited the loan company financially, not the borrowers.

The question that may still need to be asked, however, is why the federal agency with the power to oversee student loan management didn't catch these problems earlier.

If the Department of Education was charged with originating the loans when the Obama administration took steps to offset ballooning debt, why were Navient and its subsidiaries given what would appear to be unchecked oversight on how rules were applied? Why did it take four years -- the entire length of the company's infancy -- for regulators to discover there were problems inflating the nation's tally of student debt?

With the new pro-business Trump administration setting its sights on revamping the way business is done in both the public and private sectors, it's unclear what the outcome will be of this suit.

Trump has made it clear he wants less government involvement in managing education and public resources, hinting that he would like to see a return to the days when banks issued federally-backed loans.

For the 12 million Navient customers representing some $300 billion in loans, however, those changes offer no real relief. Nor do they spell out how government watchdogs, in the post-subprime mortgage crisis, will quell the public's sense of uncertainty about private loan companies that fall below the radar of government regulators.

Image credit: Flickr/Kazuhisa OTSUBO

Finding Common Ground Through Climate Change Conflict

By Sean Penrith

I read the California Environmental Justice Movement’s Declaration in Support of Carbon Pricing Reform in California last week. In particular, this point resonated with me: “The best available science indicates that the planet is warming more rapidly than we understood when the Kyoto Accord was ratified and that reductions in greenhouse gases must be undertaken more quickly and with greater urgency than previously recognized.” Amen to that!

They go on to make their position abundantly clear. The California environmental justice community intends to “fight at every turn all efforts to extend the cap and trade system in California beyond 2020.” The Declaration spells out that it supports a carbon tax in conjunction with direct emission reductions in place of the cap and trade mechanism.

Reading this prompted me to recall a recent workshop my team attended facilitated by Happy Brain Science. Scott Crabtree, the founder of HBS, enthused that conflict was fantastic because when added to healthy doses of communication, the resulting powerful cocktail was a high degree of collaboration toward a common goal. His nifty formula splashed out on the overhead screen: Conflict + Communication = Collaboration.

Clearly there exists a level of conflict between the environmental justice community and the advocates and practitioners in the cap-and-trade market implemented in California under AB 32. Furthermore, I would warrant that the same level of passion for addressing a warming planet immediately, exhibited in the Declaration, is deeply embedded in many of the project developers who work hard to deliver real, verifiable, and permanent emission reductions that count as carbon instruments in California’s cap-and-trade mechanism. We know this firsthand, given that we offer early-stage carbon financing to help many of these projects get off the ground.

The concerns of the EJ community are certainly not without validity. In a 2016 research brief titled Preliminary Environmental Equity Assessment of California’s Cap-and-Trade Program, they rightly point out that large carbon polluters are more likely to be located in poor communities and communities of color. Such neighborhoods have a 21 percent higher proportion on average of residents living in poverty within 2.5 miles of facilities emitting localized greenhouse gases. The EJ proponents have a point.

At a California Air Resources Board (ARB) workshop I attended late last year, members of the Environmental Justice Advisory Committee (EJAC) addressed ARB board members and the attending stakeholders with four credible requests with regard to the 2030 Target Scoping Plan. They asked that the EJ community be considered as real partners, pressed for economic opportunity, encouraged vertical and lateral integration of policies, and advocated for long-term meaningful results.

It made a whole lot of sense to me. At the signing of AB 197, Assemblyman Eduardo Garcia (D-Coachella) commented that climate change polices were beginning to focus on people. EJAC’s request wholly reflected that same sentiment. They wanted to be engaged and become relevant contributors to policy frameworks that ultimately affected people, particularly those people living in lower-income communities that often bore the brunt.

AB 197 requires ARB to “prioritize … emission reduction rules and regulations that result in direct emission reductions” and protect economically disadvantaged communities when designing climate change regulations, with a keen eye specifically to evaluate the social costs of measures it considers. Meeting the incredibly ambitious greenhouse gas goals now required by law in California in the cheapest manner possible is therefore a central equity issue.

The World Bank's 2016 Carbon Pricing State and Trends Report pointed to the fact that greater cooperation through international carbon trading could reduce the cost of climate change mitigation 32 percent by 2030 and 50 percent by 2050. This cost factor is a significant aspect to consider when challengers to the cap-and-trade system propose alternative mechanisms. The task upon all of us is relating, integrating and involving these policies that seek to address a global pollutant with the people who are arguably the most affected.

It’s useful to turn to other programs now underway that have addressed emissions while balancing localized air quality issues. A research report out this month shared the findings on health impacts of the Regional Greenhouse Gas Initiative (RGGI) cap-and-trade program.

RGGI was the first regional cap-and-trade program with nine participating Northeast states that tackled emissions from the power sector. Historical data for the 2009 to 2014 period tracked air pollution and corresponding health impacts under the RGGI program.

Their analysis found positive health impacts -- estimating the avoidance of 300 to 830 adult deaths, 8,200 to 9,900 asthmas exacerbations, around 14,500 respiratory illnesses, and 35 to 390 heart attacks. This tallied up to a health savings for the RGGI states of $5.7 billion and avoided approximately 44,000 lost workdays.

A brand new report from the Center for Law, Energy and the Environment (CLEE) at UC Berkeley School of Law examined the economic impacts of California’s major climate programs on the San Joaquin Valley, made up of eight counties representing 11 percent of California’s population.

The researchers point out that air quality suffers more in this area than in any other place in the state. And they found that the impacts of the cap-and-trade mechanism, the RPS, and energy-efficiency programs netted an overall economic gain of $13.4 billion for the Valley. The findings underscore that fears of negative economic outcomes from greenhouse gas reduction programs are unfounded.

That same Equity Assessment brief mentioned earlier states that, “as regulated entities adapt to a tightening cap, it will see more localized greenhouse gas and co-pollutant reductions.” I would agree. The cap-and-trade program is working as ARB designed it to.

Returning to the Declaration, Recital 11 states, “Excessive use of offsets denies environmental justice communities the benefits of on-site reductions.” Both sides of the argument frame their position without the benefit of the conflict + communication formula. If only we could get into a room together and simply talk this through.

I raised this point with an environmental justice advocate during a call just this month, sharing my take that renouncing and taking on offsets was the wrong approach to the problem. I explained that over the 2013-2015 period, of all the instruments used for compliance under the cap-and-trade system, allowances totaled 372 million and offsets totaled just 20 million. Furthermore, even if offsets were struck from the menu, I have heard it argued that complying facilities would simply use more allowances.

By removing the utility of offsets, a vital cost containment mechanism is removed -- and that may not be positive for the disadvantaged communities who would bear the higher compliance costs. However, it appears that the offset market is a soft target for the EJ community.

It is important to bear in mind that an allowance represents a permit to emit a ton of emissions while an offset represents the verifiable reduction of one ton of emissions.

Derek Six of ClimeCo may have said it best: Offsets should be considered “an opportunity for innovation and practice changes,” a mechanism for engaging people in non-capped sectors, while also providing significant local co-benefits. Projects from approved protocols, such as dairy digesters, are typically located in rural communities that welcome the positive stimulus of offset revenue and jobs. The forestry sector offers the U.S. a significant resource as a carbon sink -- absorbing and storing the equivalent of around 16 percent of our country’s fossil fuel emissions. Engaging in quality emission reduction projects of this kind benefit people across all socioeconomic divides.

Culling figures from an ad-hoc group of stakeholders working in the offset market, a total of 15.6 million tons, representing close to 30 percent of the total issued offsets, have been reduced in California by virtue of an emissions reduction project in the state. The total offset volume of 54.6 million tons came from 46 projects serving 20 separate disadvantaged communities in California and 26 disadvantaged communities outside of the state.

One such community is the Yurok tribe in Northern California. Their sustainable forestry project was the first to be registered under the cap-and-trade forestry protocol. They have been able to earn millions of dollars due to the existence of the offset credit mechanism.

The tribe is using the income to “reacquire ancestral territory and manage it for community benefit, watershed and salmon fishery health, and the wider climate," Brian Shillinglaw of New Forests explained. "The tribe has a significant number of members below the federal poverty line, and thus falls within the definition of a disadvantaged community. The offsets program has made a real difference in meeting their economic and environmental goals.”

As in any conflict, there are two perspectives that compete. Some of the data I pointed to reflects one such position. A recent article shares compelling details of the EJ community's perspective by way of an up-close-and-personal “toxic tour” highlighting the negative impacts on local neighborhoods.

Adding vigorous communication to the conflict between these disparate groups — groups with, let's admit it, much commonality in their goals — may be the first step to achieving real collaboration. I truly hope so.

Image credit: Flickr/Prayitno

Sean Penrith is the Executive Director for The Climate Trust

What the Tourism Industry Should Take Away From COP22

By Emma Owens

I attended the COP22 climate talks in Marrakech, Morocco, in November of last year on behalf of Positive Impact and the event industry as a whole.

Positive Impact was invited to contribute to a “consultation of recommended key environmental indicators (KEIs) for the tourism private sector." And we were introduced to the ever-growing economic impact of tourism.

As an industry, tourism represents 9.8 percent of GDP and is responsible for 1 in 11 jobs (WTTC). At first glance, this session and its content sounds like something only airlines, tour operators and tourism experts should hear. So, why was Positive Impact -- an events company -- invited to attend? After all, there were only 25 or so experts in the room.

Tourism is more than just leisure. A significant part of tourism is generated by the MICE industry (meetings, incentive, conferences and exhibitions/events).

An example is myself traveling to Morocco to attend COP22. While in Morocco I visited sights, I ate in local restaurants, stayed in a hotel and travelled via plane to get there. My visit to COP22 contributes to tourism as did the other 20,000+ attendees who made their way across the world for the sole purpose of the COP22 event. This is why Positive Impact, a leader in sustainable events, was invited to take part in the consultation and why Positive Impact is collaborating with the United Nations to tell the story of events during the U.N.’s 2017 International Year of Sustainable Tourism for Development.

Others delegates in the room ranged from the founder of the International Ecotourism Society, who is now the director of the International Sustainable Tourism Initiative at Harvard University, to the Research Director from the World Travel and Tourism Council. So, I was in good company.

For me personally, it felt there was pressure on this year’s COP. It seemed like a year to show action as it is a culmination of three previous major milestones:

- The Addis Ababa Action Agenda (AAAA): Governments agreed on a framework for financing sustainable development.

- The 2030 Agenda for Sustainable Development: This agenda defined 17 Sustainable Development Goals to be implemented in the next 15 years by 2030. The goals apply on a global basis and cover aims from ending poverty to combatting climate change.

- The Paris Agreement: A legally binding agreement signed by 197 countries to instigate action on reducing the impacts of climate change in order to cap the global temperature rise at 2 degrees celsius and even limit the temperature increase to a further 1.5 degrees celsius.

With this in mind, we were the second meeting of experts (one took place a month earlier, where these KEIs were elected) and we had the task of absorbing and discussing these KEIs and deciding whether they were feasible, the most essential, and if there were any which had not already been considered, that should be.

These indicators need to be reported on by the tourism value chain, not just hotels, which means that the event industry is going to have a direct impact on these KEIs and should take equal responsibility in monitoring and measuring these indicators. Here are some of the findings.

The key indicator areas:

- Water

- Energy

- Biodiversity/land

- Materials (resources and waste)

- Climate Change (greenhouse gas emissions)

Key feedback on indicators specified in the above topics and how the event industry is impacted:

1. There is the need for a harmonious reporting method that allows for the tourism sector value chain to benchmark against each other and provide context to the results of monitoring and measuring.

This certainly applies to events, and our industry cannot disregard the responsibility it has in contributing to the SDGs and these key environmental indicators. This is an opportunity to show leadership and protect the future of the event industry.

With the Global Reporting Initiative's Event Organizers Sector Supplement at the event industry’s disposal, what is preventing people from monitoring and measuring right now? There is also the opportunity to use an online tool specifically designed by the event industry for the event industry called EventSustainability, which fulfills requirements of ISO 20121 and allows users to report in line with GRI EOSS. For more information on this tool, please get in touch: [email protected].

2. Hotels and other suppliers need to be able to provide clients with measurements on request. For example, a great indicator to report on is the ratio of use of renewable energy sources versus primary energy sources on an annual basis. This indicator is important as it could demonstrate progress and allow us to monitor the shift from non-renewable energy sources to renewable energy resources.

3. It's time to get serious about water use. Again, in our industry the event planner would need to be supplied with measurements from suppliers. Feedback from the consultation in relation to water within the tourism sector was that water is often a local issue and dependent on geographical location, different challenges could arise. It was said that there is no one-size-fits all when it comes to the topic of water. It would be great to hear the event industry’s experience on this topic.

The event industry should consider the five categories highlighted by the October meeting as areas to consider when holding events and reporting on the impact of those events: energy, water, biodiversity, materials (waste and resources) and climate change.

These are representative of the environmental indicators but it is essential that the social and economic impacts are also considered. By considering the three pillars of sustainability and leveraging the campaign which Positive Impact helped develop with the U.N., during the 2017 International Year of Sustainable Tourism, we are in a fantastic position to show the power our industry has in creating positive and sustainable change, not only for the planet but also for the mindsets of participants attending events.

Images courtesy of the author

Emma Owens is a Partnerships Manager at Positive Impact.

The Potential of Green Code for Business

By Anna Johnson

It may seem strange to think about the potential of “green code” – what’s environmentally unsustainable about a bunch of letters and numbers? But when we consider the strain that cluttered code puts on our collective computer systems and the energy expenditures slowdowns can cause, the problem becomes clear: Green code has a lot of potential, and businesses are taking notice.

The growing impact of computing

How could something you do on the computer – such as send a tweet or develop a software program – have anything to do with the environment? After all, aren’t we talking about two distinct areas of reality – one virtual and one physical? Yes, but the correlation exists.

More than half of the world’s population uses the Internet on a daily basis. By 2020, experts project anywhere from 20 billion to 50 billion devices will be connected to the Internet – each performing unique functions, processing code, sharing data and clogging up servers.

Over the last two years, we as a society have created 90 percent of all the data that’s ever existed. That will only increase moving forward and is exactly why many believe the Internet will ultimately become the largest source of carbon emissions on the planet.

While we aren’t experiencing any sort of computing crisis, we have to begin looking ahead. What will it be like in five, 10 or 15 years? We don’t want to look back and lament over the fact that we didn’t take the growing impact of computing seriously.

Understanding green computing

A new niche known as green computing has emerged in order to combat the growth of the Internet and the scaling demands of social media, devices and the Internet of Things. And while there are many different aspects to green computing, the most interesting and promising focus is that of green code (also known as clean code).

Green code essentially refers to code that is written with the intent of diminishing the relative energy consumption demanded by a particular algorithm. It’s a way of writing code that looks at the energy output and attempts to diminish the demand it puts on physical servers and systems.

Green code can be used to increase battery life for mobile devices, save watts, maximize power, lower energy consumption, or combine resources for a more efficient approach to solving a task. And while green code is a huge topic of conversation in research fields, there’s still a long way to go in terms of practical application.

“Despite its increasing popularity as a research topic, little is known about practitioners’ perspectives on green software engineering,” Motherboard editor Michael Byrne noted last year. “Even basic questions such as 'What types of software commonly have requirements about energy usage?', 'How does the importance of reducing energy usage compare to other requirements?', and 'How do developers find and correct energy usage issues?' do not have clear answers.”

What this indicates is that we’re still in the beginning stages of understanding green code and its possible uses. There’s a massive amount of potential, and businesses would do well to search for effective uses.

Businesses would also do well to turn their attention toward the types of tools, software, and digital systems they use and the underlying code that goes into creating and maintaining these tools. Take building a website, for example. Businesses should spend more time vetting website platforms on the front end. Is WordPress, Drupal or Joomla the most efficient solution? What are the environmental implications of one particular content management platform over another?

While we may still be a few years away from seeing green code become mainstream, sustainability expert Tim Frick of Mightybytes sees some distinct ways that forward-thinking businesses can make their digital products more eco-friendly right now. In a 2016 op/ed on TriplePundit, he suggested:

- It all starts with better user experience. Whether it’s your website or mobile application, the more intuitive a resource is, the less time a user has to spend searching for information. Less time means more energy savings.

- Websites, software, apps and tools should all be optimized for the specific devices using them. This prevents the need for sending unnecessary files and ensures the appropriate amount of processing power is used.

- Certain website hosts are greener than others. If you can find one that runs on renewable energy, this is a good thing.

These are just a few ideas, but they show how every little decision matters in the grand scheme of making your digital presence less obtrusive.

What does the future hold?

Nobody knows what the future of green computing holds, but it appears that green code will play an integral role in offsetting the growing burden of data moving forward. The more individual businesses are able to reduce their own digital footprint now, the easier the transition will be in the years to come.

Image credit: Pixabay

Anna is a freelance writer, researcher, and business consultant from Olympia, WA. A columnist for Entrepreneur.com, HuffingtonPost.com and more, Anna specializes in entrepreneurship, technology, and social media trends. Follow her on Twitter and LinkedIn.

California's New Climate Program Steams Ahead Despite Likely Legal Challenges

Less than an hour after Donald J. Trump was sworn into office on Friday, the state of California announced its latest plans to fight climate change.

While the California Air Resources Board (CARB) insisted that the timing of the announcement was coincidental, it was clear the agency has no plans to wait out the Trump administration’s decision on whether to address the effects of global warming.

The proposed plan, which is expected to be finalized by April, includes reducing California’s greenhouse gas emissions to 30 percent below 1990 levels by 2030. It’s the most ambitious GHG target yet set in North America, topping Canada’s aim of 30 percent below 2005 levels by 2030.

The state’s multi-pronged approach includes extending its cap-and-trade program another 13 years and requiring oil refineries to cut their emissions by 20 percent. It also calls for an 18 percent cut in carbon-intense transportation fuels and pushes for more zero-emission vehicles on California’s highways.

“The analysis in the plan finds that cap-and-trade is the lowest cost, most efficient policy approach and provides certainty that the state will meet the 2030 goals even if other measures fall short,” CARB stated. “To date, a total of $3.4 billion in cap-and-trade funds have been appropriated for the California Climate Investments program.”

CARB’s plan dovetails with the California Global Warming Solutions Act of 2006 and Gov. Jerry Brown’s 2016 executive order calling for a 40 percent cut in GHGs by 2030. But it also calls for a more comprehensive approach when it comes to ensuring that the state addresses climate adaptation.

The executive order requires the adaptation plans be updated regularly and sets methods for measuring how well the state is actually succeeding in its adaptation goals, such as infrastructure planning by regional and local governments.

California climate policies vs. Trump administration goals

What California’s new attack on climate change doesn’t yet outline is how it will address the incoming federal administration’s claim that it can overrule the state’s plan to set more stringent emission requirements than the feds.

On Wednesday, Scott Pruitt, who Trump has nominated to head the Environmental Protection Agency, declined to say that California would be permitted a federal waiver to set such limits.

“Administrators in the past have not granted the waiver and have granted the waiver. That is a review process that will be conducted,” Pruitt said in his Senate confirmation hearing.

Nor does the plan spell out how California will address another challenge that some critics say could be more threatening to its innovative cap-and-trade program: legal challenges by the California Chamber of Commerce and private businesses that question the program's financial structure.

In 2013, the chamber sued CARB in Sacramento County Court -- questioning the Air Resources Board's right to auction off a portion of the allowances. The chamber argued there was a lack of statutory authority to implement the cap-and-trade program in this manner.

The court upheld CARB's authority. The National Association of Manufacturers intervened a year later, and the chamber appealed the court's ruling. They argued that the structure was generating revenue "over and above the regulatory fees separately authorized to implement and enforce the law," and that doing so was outside of the agency's stated responsibility.

The state is expected to argue its case this week, with an appeals decision set to arrive later this year. The chamber stated that its issue isn't with the implementation of a cap-and-trade program, but with the manner in which the revenue is being handled.

Nevertheless, losing the case could be devastating to the state's effort to fund its comprehensive climate change battle.

“If that happens, we could lose an entire stream of revenue to make our communities more sustainable,” said California Sen. Kevin de Leon, a Democrat representing District 24 in Los Angeles.

But some analysts say the possibility of losing the case isn't the only thing California has to worry about when it comes to the future of this program.

Cap-and-trade credit sales are actually down, leaving supporters concerned that the uncertainty of the ruling and the anti-clean energy mood in Washington could make the program a poor investment.

And that could be why the state has stepped up to the plate now with details of a plan that clearly benefits from a robust and successful cap-and-trade structure.

With comment period now open to the public, the state is staying true to Gov. Brown's vow to fight against climate change, as well as to ensure that the progress that has been made on other scientific fronts won't be lost to haggling in Washington -- or to court battles in Sacramento.

Image credit: Flickr/Wonderlane

New FDA Rules on Antibiotics Attempt to Squash 'Superbugs'

The death of a Nevada woman has focused renewed attention on the problem of antibiotic-resistant bacteria. The woman, who died in September after returning from a trip to India, contracted a bacterial infection that successfully resisted every FDA-approved treatment.

The incident was reported by the U.S. Centers for Disease Control and Prevention last week, only a few days after the U.S. Food and Drug Administration announced a set of new rules aimed at fighting these so-called "superbugs" on their home-turf: the farm.

Under those regulations, which went into effect Jan. 1, meat producers will no longer be allowed to use antibiotics to help livestock gain weight. And they will be required to obtain veterinary approval before using the drugs for other purposes.

The change — decades in the making — was lauded by many as an important step forward, while others decried it as too little, too late.

The Natural Resources Defense Council, which previously sued the FDA over the issue, equated the agency's actions with "putting lipstick on a pig."

"For decades, FDA has been allowing antibiotics to be used en masse at low doses for both growth promotion and so-called 'disease prevention' in the unsanitary living conditions on many industrial farms," NRDC Senior Attorney Avinash Kar said in a prepared statement.

"Today’s announcement eliminates language on antibiotics labels that says they can be used for one of those purposes — growth promotion. But, and this is a huge BUT, it leaves behind a massive loophole in not addressing the other misuse — 'disease prevention.'”

The end result, Kar said, would be the same: the continued proliferation of drug-resistant bacteria.

Antibiotic resistance is a threat to public health

The use of antibiotics in the meat industry has been widely blamed for the spread of antibiotic-resistant bacteria in recent decades.

Sustained contact with low doses of the drugs accelerates the microbes' evolution — killing off those strains that are vulnerable to the drugs while allowing drug-resistant genes to survive and multiply. The resulting superbugs can then be transmitted to humans through contact with infected meat or feces.

The problem is an urgent one. The U.S. Centers for Disease Control and Prevention (CDC) have classified antibiotic-resistant bacteria as one of the top seven threats to public health for 2017. Such bacteria already claim an estimated 700,000 lives worldwide each year. The U.K. government has warned this number could increase to 10 million by 2050 if current trends continue.

But the problem is not new. In fact, scientists have known about it for decades. All the way back in 1977, the FDA attempted to curtail the use of antibiotics on the farm — an effort that was derailed by Congress.

While lawmakers ignored the problem, the threat only grew more urgent. Last year, scientists were alarmed to find a person infected with a strain of bacteria resistant to colistin, the so-called "drug of last resort." It was the first such case to be documented in the United States and led researchers to predict the emergence of a "pan-drug resistant bacteria." Now, it would seem, those doomsday predictions could be coming true.

The private sector can lead the way

In the absence of government action, some private businesses have stepped in to fill the gap — refusing to purchase meat from suppliers that use antibiotics in their operations.

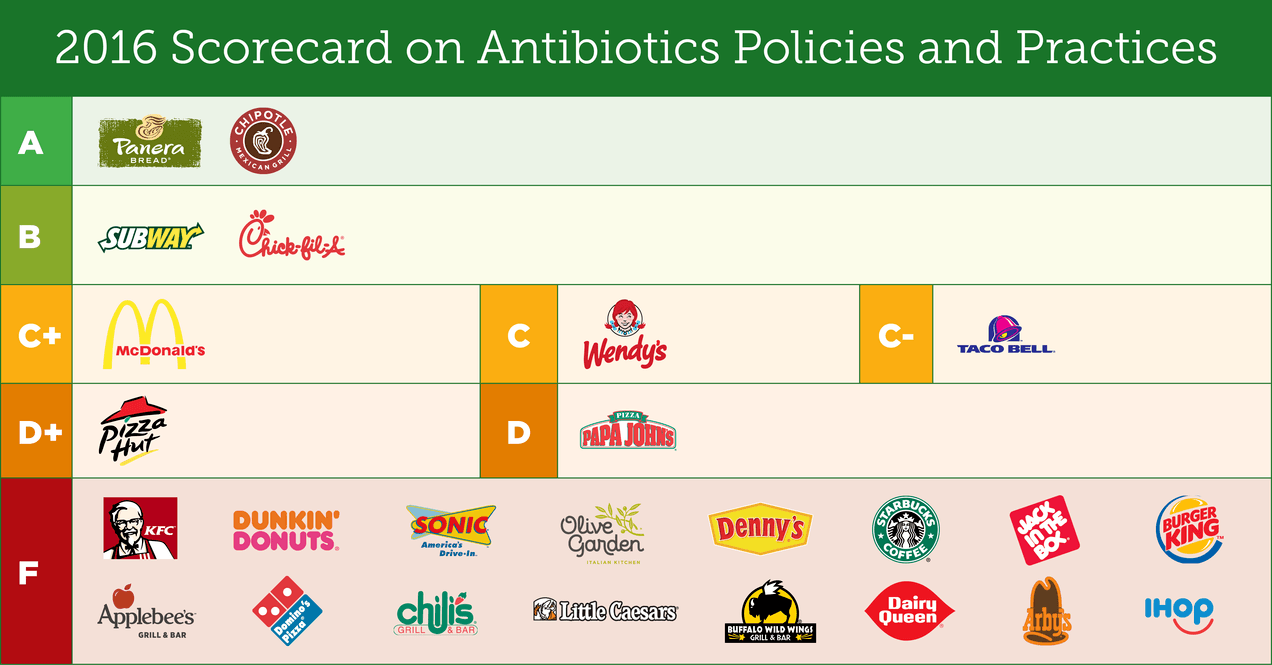

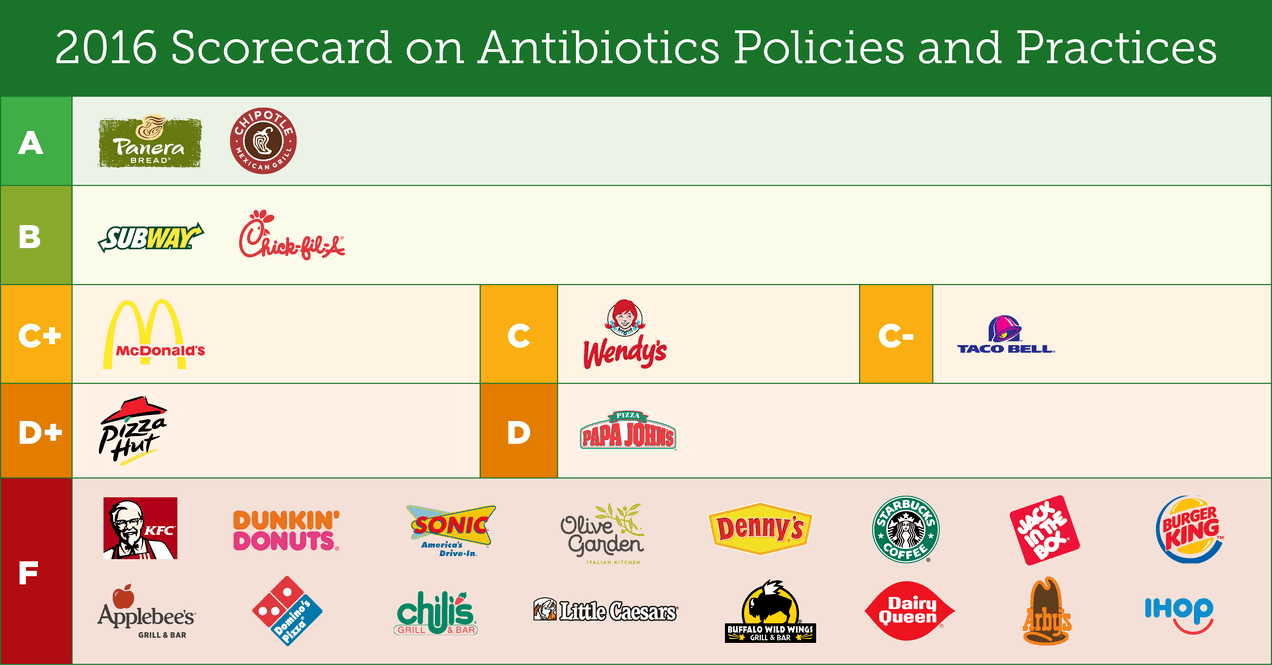

Last year, a consortium of environmental and consumer-advocacy groups released a report rating the top 25 restaurant chains on their commitment to limiting antibiotic use.

Of those surveyed, nine received a passing grade. That number might seem small, but it is twice as many as the prior year. Among these, Panera Bread and Chipotle were the only chains to receive solid “A” grades — meaning they had implemented comprehensive policies that restricted antibiotics use across their supply chains. Burger King and Kentucky Fried Chicken were among those that received a failing grade.

“This year’s progress is encouraging," Cameron Harsh of the Center for Food Safety said in a press release announcing the report. "But companies and consumers can only move the dial so far — it is time for the U.S. government to step up and mandate reductions in antibiotic use for the industry writ large.

"Without strong, enforceable regulations for antibiotic use in place, there is undue burden on the public to hold companies to their commitments and to pressure the laggards in the industry to stop dragging their feet."

Image credits: 1) and 2) U.S. Centers for Disease Control and Prevention; 3) Natural Resources Defense Council