3p Weekend: United Can Learn From These Airlines About Customer Service

With a busy week behind you and the weekend within reach, there’s no shame in taking things a bit easy on Friday afternoon. With this in mind, every Friday TriplePundit will give you a fun, easy read on a topic you care about. So, take a break from those endless email threads, and spend five minutes catching up on the latest trends in sustainability and business.

United Airlines is still dealing with a massive public-relations nightmare after a video of security staff violently removing a senior citizen from a flight at Chicago’s O’Hare international airport went viral.

David Dao, a 69-year-old physician from Kentucky, sustained a concussion and broken front teeth during the ordeal and plans to sue the airline. United is also facing boycotts from Chinese passengers who object to the mistreatment of the Chinese-American grandfather.

Frequent travelers routinely complain of airline-related indignities -- from bloated baggage fees, to abrupt cancellations, to odd security measures such as confiscated breast milk. But the horrific experience Dao endured goes above and beyond. And after United came under fire again later this week for removing a couple bound for a destination wedding from a flight over a seat dispute, it's clear the airline hasn't learned its lesson.

For a few pointers on how to treat customers well (beyond, you know, not physically assaulting them), United can look to some of its peers in the North American airline sector.

To find the stand-outs, we looked at the 2016 customer satisfaction rankings from J.D. Power and Associates and the American Customer Satisfaction Index, which rank only North American carriers. We also incorporated lists from Skytrax and TripAdvisor, which rank North American airlines alongside their international competitors. The winners are also long-running favorites among the TriplePundit crew.

So, what makes them so great? Let's take a closer look.

1. JetBlue Airways

Despite being a budget carrier, JetBlue consistently dominates customer service rankings. It topped the American Customer Satisfaction (ACS) Index yet again in 2016, beating out all of the full-price carriers.

Although J.D. Power ranks budget and traditional carriers separately, JetBlue's score beat out the highest-ranking traditional carrier (Alaska Airlines) by 40 points out of a possible 1,000. And on a 2017 list generated by TripAdvisor, JetBlue ranked No. 4 out of both domestic and international carriers. Not bad for an airline best known for its rock-bottom deals.

Both the ACS and J.D. Power lists poll customers on categories such as cost and fees, in-flight services, flight crew friendliness, and ease of check-in.

JetBlue obviously blows it away in the cost category -- at least from its hub cites. But its in-flight services are what put it over the top: The carrier offers flights to more than 90 destinations with free in-flight entertainment and Wi-Fi, spacious leg room and, yes, a small bag of snacks served with a smile. It's also no slouch when it comes to sustainability.

2. Alaska Airlines

Alaska Airlines ranked highest on J.D. Power's list of traditional carriers, earning a 751 out of 1,000. It also ranked No. 3 on the ACS list and No. 9 on the domestic-international TripAdvisor ranking. And it's not hard to see why.

Alaska is known for its friendly staff and sleek aircraft. Even coach passengers can enjoy a respectable amount of legroom and power outlets at their seat on most flights. Alaska Beyond Entertainment offers free shows streaming on your own device, as well as access to the latest pay-per-view shows and movies.

On international flights (or any flight if you're riding in premium class), passengers enjoy surprisingly tasty meals concocted by three-time James Beard award winner Tom Douglas of Seattle. Even if you're purchasing a meal on a domestic flight, the prices are surprisingly reasonable: between $7 and $8 for a hot plate of food, which is about what you'd pay for a bag of Chex Mix on most airlines.

Oh, and if you're a sustainability fan, Alaska is testing out biofuels, too.

3. Southwest Airlines

Southwest came in second on both the J.D. Power and ACS rankings -- and it's improving year over year.

The airline is known for its good deals, but it's also steadily improving both customer service and sustainability. After upcycling a staggering 43 acres of airline interiors into consumer products, Southwest announced its new Evolve interior cabin -- which emphasizes cost efficiency, comfort and sustainability.

The airline's flight crews also rank consistently for top-notch customer service. And passengers can also snag competitively-priced Wi-Fi ($8 for the day, compared to $15 or more for most carriers) and, yep, that free bag of peanuts.

4. Delta Airlines

Delta Airlines came in second place in the J.D. Power rankings and ranked a respectable sixth on the ACS list.

While some travelers complain of delays associated with Delta, they're rare occurrences when traveling in and out of its hub cities. And once you're on board, it's easy to see why the airline still beats out its peers.

The flight crew is happy to offer any passenger a pillow and blanket on all flights. (This really shouldn't be something to brag about, but try asking for it on most American carriers.) Passengers can also kick back with Delta Studio in-flight entertainment on their seat backs or their own device, and snag a pair of complementary headphones if theirs were left behind (again).

On most flights, Delta offers a small bag of snacks in coach class. But earlier this year, it opted to start serving free meals in the main cabin on some of its longest domestic flights. These include popular transcontinental routes between New York and San Francisco or Los Angeles.

5. Hawaiian Airlines

Hawaiian Airlines wasn't ranked by J.D. Power or ACS. But it's a perennial favorite of 3p Editor in Chief Jen Boynton, whose mother lived in Hawaii for years. And it was honored for best airline staff in North America in the 2016 Skytrax World Airline Awards, held annually at the famed Farnborough Airshow.

That cheery customer service reputation aligns with Boynton's personal experiences. "The flight attendants all embody the aloha spirit," she said simply.

Hawaiian also offers complimentary meals and cocktails in the main cabin. And kiss that grey chicken and two-dollar wine goodbye. Meals are prepared in consultation with renowned Hawaiian chef Chai Chaowasaree. And Hawaii's first master sommelier, Chuck Furuya, selects its Hawaii-made spirits and wines.

If passengers are bored on the flight, they can relax with an in-flight entertainment tablet -- provided by the airline -- or browse the duty-free shops from their seat.

Image courtesy of JetBlue (press use only)

The Nitty-Gritty Podcast: United By Blue

The following post is done in partnership with the Nitty Gritty podcast, a production of Bond Street.

It's a misconception that in order to be successful in business, that success—as measured by monetary gain—must come at the expense of something else, like workers rights or the health of the environment. Pillaging as the easiest path to profit. Which is probably why those seeking the path of least resistance continue to operate with only the bottom line in mind. All too often, nefarious companies make headlines for destroying local waterways, recalling toxic products. Entrepreneur and staunch environmentalist Brian Linton set out to not be one of those companies—not just on Earth Day, but all year round. As the founder of United By Blue, Linton provides buyers with an alternative: conscientious consumption for the avid outdoorsman (and woman).

A practice-what-you-preach kind of ethos guides the brand. As Linton sees it, if you’re selling gear meant to help you soak in the beauty of the great outdoors, you should doing your best to preserve some of that greatness for generations to come. This belief touches everything United By Blue does. Their textile lineup includes recycled, organic, and biodegradable fabrics. Their packaging runs the anti-plastic gamut, using everything from banana-fiber paper to hang tags made from elephant dung. One pound of trash gets removed from the ocean with every product United By Blue sells, and the company is on the verge of breaking its one million-pound mark of collected debris. They’re committed to the planet, even if that means having to make decisions less concerned companies might just glaze over. In the latest edition of The Nitty-Gritty—brought to you by Bond Street and Triple Pundit—Linton talks to us about learning sales going door-to-door along the Eastern Seaboard, how a company’s responsibility extends far beyond cash, and the future of United By Blue. Enjoy the full episode below:

https://soundcloud.com/bond-street-186109457/united-by-blue

Terranea Resort Shows Earth Day Spirt All Year Long

Everyone and their sister is tweeting about Earth Day today. And I can't tell you the number of press releases I've received from hotels and resorts touting their eco-conscious pledges and packages. I love the sentiment behind Earth Day, but sometimes I wish it hadn't become a way for brands to inject themselves into the news cycle.

It made me think back to an experience I had a couple of weeks ago. I was parked in a kayak with a net and a camera, keeping one eye on the horizon for grey whales and the other for trash caught in the kelp forest in the channel between Southern California's Palos Verdes peninsula and Catalina island.

“Oh! A potato chip bag. No, it's Terra Chips!” I heard someone shout out with disproportionate excitement to their bounty. I squinted into the distance, convinced I could see a whale spout.

I was kayaking as part of the adventure program at Terranea, the beachfront resort that perches on the edge of the soaring cliffs that once held Marineland.

Keeping the waterway safe and clean makes one of the better spots in Los Angeles to get out on the water and spot the whale mamas and their calves as they migrate north to Alaska. It's also a fun activity for hotel guests that looks stellar on Instagram. For that reason I think of it as a sustainability measure that also boosts the bottom line. Happy guests are return guests and everyone is doing something good for the Earth.

Later that afternoon I found myself on the resort’s lawn with Joe Roy, a falconer and a half blind hawk, one of a menagerie of birds of prey used at Terranea to ward off seagulls and other unwanted pests in a nonlethal, eco-friendly, poison-free way.

"When the seagulls come en masse it can become a sanitary problem and we would prefer the birds eat a natural diet out of the ocean rather than trash and human food not meant for them," Roy explained as he removed a petite leather hood from the hawk's head and readied her for flight.

"Birds of prey are very recognized by other animals so when they occupy this air space we're advertising this territory is occupied by predators if you come in here seeking a free meal."

The ancillary benefit of this eco-friendly solution to pest control is that the tourists love to watch Roy interact with his employees.

"I’m stopped constantly," he said out the side of his mouth as a little boy approached to tell Roy he is "really into hawks, right now."

And finally, right before heading to dinner at the resort's famed Mar'Sel restaurant, I was shown around the property's sea salt conservatory, constructed entirely by Executive Chef Bernard Ibarra who personally cultivates the sea salt from the water around the resort for use in the resort's many restaurants. He lugs buckets of sea water from the ocean each week.

"We have this wonderful resource," Ibarra said, pointing towards the sea. "Why wouldn't I use it?"

This give and take with the natural environment is ingrained in the culture of the Terranea resort and it’s one of the reasons they can comfortably call themselves a sustainable property - a claim I don't accept lightly. Plenty of hotels, particularly in Southern California, ask you to wash your towels and linens less and then load you up with free bottled water and tiny shampoo bottles yet still call themselves "sustainable." These days, eco and green are resort selling points on par with luxurious and chic—often to the point of egregious overuse. That’s why we like to celebrate a property when they show a real commitment to something tangible and effective.

Terranea has also successfully expanded its commitment to sustainability and green practices by including food waste recycling, using a bio-digester that breaks down organic waste and turns it into gray water to go down the sanitary drain. They employ a natural irrigation and water treatment through a series of wet ponds and vegetated wetland channels called Bioswales to enhance water quality and serve as a habitat for native avian species.

They've even adapted a sustainable growing philosophy, incorporating seasonal dining menus that feature local ingredients and organic, freshly picked produce and herbs, as well as harvested honey from Chef Ibarra's on-site garden and the nearby Catalina View Gardens filled with everything from kale to olive trees.

It's a special place, where the Earth is considered every single day, not just as a trending topic.

Editors note: Accommodations at Terranea were covered by the hotel.

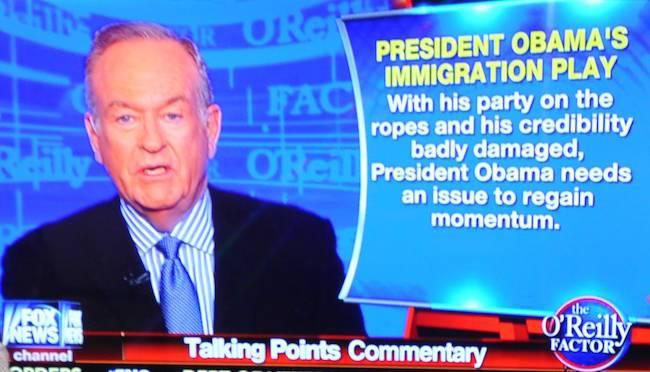

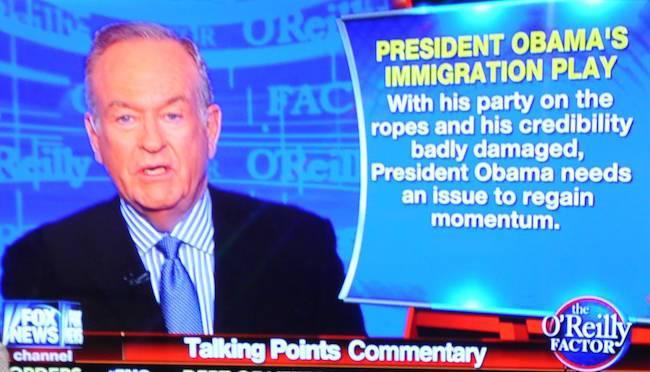

When Boycotts Work: Famed Boycotter Bill O'Reilly Loses Fox Platform

TriplePundit has been exploring why and how some boycotts work while others fail, and the case of popular Fox News television personality Bill O'Reilly is a tailor-made example.

O'Reilly built his career at Fox News partly by promoting boycotts. None of those efforts appeared to have any long-term effect. But O'Reilly himself was booted off the air less than two weeks after dozens of advertisers pulled out of his show, "The O'Reilly Factor."

So, how did advertisers succeed where O'Reilly failed?

When is a boycott not a boycott?

One thing we've been learning is that consumer boycotts are notoriously fickle and often fail.

Boycotts can also be promoted without using the word 'boycott' or related terms.

Still, even ineffective boycotts can be useful. For example, they can draw media attention to a cause, helping organizations to draw followers and raise funds.

That same factor can be at work in media coverage of boycotts. One good example is Breitbart, an online news organization associated with white nationalism. Breitbart frequently promotes boycotts of top companies. Recent targets include Kellogg, Levi-Strauss and Starbucks. None achieved any measurable success, but they do serve to attract readers and reinforce audience loyalty.

O'Reilly also targeted top companies for boycott as part of his ongoing, highly publicized "War on Christmas" series, with his most recent "naughty" and "nice" list published on the Fox News website in December.

Again, there were no measurable effects, but the series served to engage his audience.

In an article published earlier this week, Simon Maloy of Salon points out that O'Reilly also built his earlier career on a long-running boycott series after the U.S. invaded Iraq in 2004.

Do read the full article for all the details. The gist of it is that O'Reilly promoted a boycott of France:

“France wants to embarrass the United States even as it is protecting a killer like Saddam,” O’Reilly said in March 2003, adding: “I don’t call for economic sanctions against France easily, but at this point, it looks like the only way we can send a message to that country which is hurting us.”

O'Reilly's campaign had no measurable effect on the economy of France. But the series did cement his position as a popular cable television pundit.

In sum, O'Reilly's boycotts were effective -- but only insofar as they promoted his own career.

O'Reilly out at Fox News

Another thing we've learned is that boycotts can work under certain circumstances, and the circumstances surrounding the advertiser boycott against O'Reilly formed a perfect storm.

According to one study, companies (or, by extension, brands or even people) are most vulnerable to boycott when they have a good reputation, but are showing signs of slippage.

That description certainly applies to O'Reilly. He is still popular with his core audience, but his identification with the career of Donald Trump became a weak spot for some after he took office as president took office and began floundering in the polls.

O'Reilly's vulnerability is exacerbated because the main point of identification between himself and Trump is not tax policy or a supposed war on Christmas. It's especially fraught: harassing and predatory sexual behavior directed at women.

The result is that former fans among the punditry have begun to desert him. That kind of negative publicity may not have resonated with O'Reilly's viewers, but it certainly did with advertisers and the Fox brand.

Media reporter David Zurawik of the Baltimore Sun is one such former fan. In a detailed piece published on April 8, he links O'Reilly, Trump and former Fox chief Roger Ailes into a missile aimed straight at the Fox brand.

Here's a snip from the beginning...

"Now when I come across him on screen, the only thing that comes to mind is the sick, sexist and predatory culture that is eating like a cancer at Fox News."

...and here is his conclusion:

"I believe O'Reilly has been diminished by the allegations and the news of his multiple settlements, even if he says he paid his accusers only to protect his children from public airings of their charges."But, on the other hand, I may be whistling in the dark to say that — in a culture where someone can boast of sexual assault and still be elected president with 63 million votes. And that president goes out of his way to proclaim his support for O'Reilly."

That's pretty much a textbook case of the vulnerability issue.

When boycotts work

Regardless of O'Reilly's vulnerability, there would be no massive advertiser boycott without two important, long-term trends coming into play.

One is the willingness of individual women to speak out against their harassers, regardless of how it costs them personally.

Last fall, when Trump tried to dismiss his "pussy grabbing" comments as harmless locker room talk, several women went public to describe their experiences with his predatory behavior.

Similarly, Fox attempted to hide O'Reilly's behavior behind a wall of expensive legal settlements. O'Reilly himself claimed the settlements were intended to protect his family.

However, after news of the settlements broke in the New York Times, other women have stepped forward to describe harassing behavior by O'Reilly.

Not too long ago, victims of sexual harassment would have been dismissed out of hand, but legal norms and social support have evolved to generate a more receptive environment.

When brands become activists

That brings us to the second trend: corporate social responsibility.

Advertisers began to flee "The O'Reilly Factor" almost immediately after the Times story broke.

They did not wait around to get calls from irate customers threatening a boycott. Instead, they leveraged their own CSR messaging to explain why they could not have their brands continue an association with the O'Reilly name.

In many cases, the advertisers were global companies with an international reputation to protect, a factor that outweighed O'Reilly's appeal to U.S. audiences.

After the exodus Fox News itself did not suffer a significant loss of revenue, since for the most part ad buys were simply shifted to other slots in the lineup.

However, Fox did not wait around for the other shoe to drop. Like its advertisers, Fox has a brand to protect.

Regardless of O'Reilly's popularity with viewers, Fox decided the risk of a continued association with the O'Reilly brand was not worth the potential for fallout on its own business.

Lesson learned: Consumer boycotts often fail to get traction, but when top corporations flex their buying power, action can be swift and decisive.

Photo (cropped): by Carl Lender via flickr.com, creative commons license.

At Ford, Every Last Scrap of Aluminum Recycling Counts

Automakers, especially the American Big Three, are longtime recycling leaders. After all, those large sheets of metal, particularly the steel that comprises a car’s body, are easy pickings.

General Motors, for example, has said in the past that it generates $1 billion in revenues annually from recycling. In recent months, the company partnered with its peers, as well as NGOs, to boost its waste diversion efforts.

Nevertheless, there is always room for improvement on waste diversion. As automobile designers and engineers consider approaches to creating cars that are lighter and more fuel-efficient, new materials find their way into newer models of cars. This is particularly true of aluminum, more of which is finding its way in cars for both its durability and reduced weight.

In the case of Ford Motor Co., the recent adoption of more aluminum in those F-150 pickups reduced their weight by as much as 700 pounds. But the flip side is that new materials throw a wrench into companies’ sustainability and waste management plans. The effort is worth it, however, as using recycling aluminum is 95 percent more energy efficient than refining raw aluminum from bauxite.

Three Ford plants benefit from closed-loop recycling systems, allowing the company to recycle and additional 5 million pounds of aluminum a week. Not only have these factories witnessed a significant decrease in waste, but they benefit from increased energy savings as well.

The result is the accumulation of high-strength and military-grade aluminum alloy each month that can be repurposed to build the equivalent of 51 commercial jets, or over 37,000 of Ford’s F-series truck bodies – a huge spike in aluminum recycling over previous years, the company said this week.

Chip Conrad, a Ford stamping engineer, led the design of these updated recycling systems. Now operating at Ford’s Dearborn Stamping, Kentucky Truck in Louisville and its Buffalo, New York Stamping factories, the systems present a dizzying tangle of vacuum motors and tubes. After various parts are cut into shape, the scraps, which are about the size of a dollar bill, are vacuumed into the pipes, which stretch for miles across these factories.

These pipes are necessary as different sections of a car -- such as fenders, doors or smaller parts -- require various grades of aluminum. Therefore, in addition to these long and winding tubes, computer controls directs different grades of alloys to four separate semi-trucks, which then haul the scrap aluminum to a reprocessing plant so it can be smelted and the aluminum stamping and fabrication process can launch all over again.

Ford’s sustainability team says the system is crucial for the company to meet its long-term sustainability and greenhouse gas emissions reduction targets.

Prior to the new systems Conrad and his team implemented at these three plants, Ford previously reported it was able to conserve enough aluminum to make new bodies for 30,000 F-150 trucks. The redesign of these three factories’ systems alone account for a 23 percent increase in the company’s total aluminum recycling.

While such improvements in recycling allows such companies as Ford to show stakeholders their sustainability chops, the conservation of materials such as aluminum is largely driven by cold hard numbers. In previous years, Ford said that for every F-150 that had rolled off its assembly lines, approximately $300 worth of aluminum scrap were left behind on the shop floor. Considering the company’s claims that its F-Series has been the highest selling truck in America for four decades, that is a lot of energy, metal and cash that Ford had been leaving behind before this latest recycling innovation.

Image credit: Ford Motor Co.

Oil and Gas Giants Flee Canada's Tar Sands

A growing number of American oil and gas giants are divesting themselves of their Canadian tar sands holdings.

In the latest move, Chevron is reportedly looking to sell its 20 percent stake in the Athabasca Oil Sands project, located in Alberta. The company has been in talks with investment banks about the sale, which could net Chevron $2.5 billion,a source told Reuters. Chevron is the second biggest oil producer in the U.S.

The month of March saw three companies -- two of them American -- divest some of their tar sands assets.

ConocoPhillips signed a deal worth $13.3 billion in March to divest a good part of its Canadian assets. The Houston-based oil and gas giant agreed to sell its interests in Foster Creek Christina Lake oil sands partnership in northeast Alberta and the majority of its gas assets in the Western Canada deep basin in Alberta to Cenovus, a Canadian company. The company will retain its interests in two other Alberta tar sands projects.

Divesting itself of part of its tar sands assets “improves our underlying financial and portfolio metrics, which will drive free cash flow generation and returns,” Ryan Lance, ConocoPhillips chairman and CEO, said of the deal during a press conference.

Marathon Oil is another American oil and gas giant to sell its interests in Canada’s tar sands. In early March, the company signed an agreement to sell its Canadian subsidiary, which includes its 20 percent interest in the Athabasca Oil Sands project, for $2.5 billion. At the same time, the company announced an agreement to acquire about 70,000 net surface acres in the Permian basin, located in Texas and New Mexico, for $1.1 billion.

Divesting of its tar sands assets while acquiring holdings in the Permian basin “are transformative milestones that will further align our portfolio with our strategy,” said Marathon Oil President and CEO Lee Tillman.

Shell also sold some of its tar sands assets in March, including reducing its interests in AOSP from 60 percent to 10 percent. The British–Dutch multinational sold part of its interests in the Athabasca project to a subsidiary of Canadian Natural Resources Ltd. for $8.5 billion.

Shell CEO Ben van Beurden characterized the announcement as “significant step in re-shaping Shell’s portfolio in line with our long-term strategy.”

ExxonMobil also wrote off one of its investments in a tar sands project this year. In a February statement, the company said that “as a result of very low prices during 2016, certain quantities of liquids and natural gas no longer qualified as proved reserves under SEC guidelines.” Exxon is the largest publicly-traded oil and gas company in the world. In its annual 10-K filing to the SEC, the company said it reduced its proven reserves by 3.3 billion oil-equivalent barrels last year compared to 2015.

As a result of the divestments American and European oil and gas giants have announced this year, Canadian-headquartered companies will own about 80 percent of tar sands assets, according to JWN Energy.

Tar sands oil are some of the dirtiest fossil fuels

Alberta is home to a boreal forest that provides 1.3 billion acres of habitat for a wide swath of species that include grizzly bears and wolves. That is an area the size of Florida. The trees and bogs capture carbon dioxide, and the wetlands act as a filter for millions of gallons of water. First Nation communities, indigenous Canadians, rely on the boreal forest for hunting, fishing and trapping.The boreal forest is also part of the Canadian tar sands region. If you're not familiar with it, the Natural Resources Defense Council (NRDC) describes tar sands as “a sludgy deposit of sand, clay, water and sticky, black bitumen used to make synthetic oil.”

The process to turn tar sands into oil is very energy-intensive and causes environmental damage to the boreal forest, where trees are clear-cut to make way for tar sands development. The cycle represents the fastest growing source of Canada’s greenhouse gas emissions, according to Greenpeace.

Despite the divestment from tar sands assets by foreign oil and gas giants, the tar sands will continue to be developed by Canadian companies, to the detriment of the boreal forest.

As Dan Woynillowicz, senior policy analyst with the Pembina Institute, based in Calgary, Alberta, wrote for World Watch, North America is “a critical juncture in its transportation fuel future.” Indeed it is, and the time is now to transition to clean and renewable fuels.

Image credit: Flickr/Howl Arts Collective

ExxonMobil Seeks Waiver to Drill in Russian Waters

ExxonMobil is seeking a waiver from the Treasury Department to lift sanctions restricting drilling exploration in the Black Sea. The waiver application first debuted during the Barack Obama administration, but now sits before the Donald Trump administration in a testy time for Russian-American relations.

If the waiver is granted, ExxonMobil will be able to drill (and benefit financially) in tandem with Russian state oil company Rosneft.

Update: the waiver was denied.

Relations were tense during the Obama years, but a spotlight has turned on the relationship in the wake of Russia’s alleged attempts to influence the United States presidential election.

The waiver request, reported Wednesday by the Wall Street Journal, would lift sanctions handed to Russia in March 2014 after its annexation of Crimea from neighboring Ukraine. Sanctions were escalated and tightened in July when Russia was linked to shooting down Malaysia Airlines Flight 17 in eastern Ukraine, killing all 298 passengers and crew on board the plane traveling from Amsterdam to Kuala Lumpur.

Even still, ExxonMobil pushed for leniency and pressed for deeper exploration in Russia’s Arctic. The waiver application was first made in 2015, Alan Jeffers, an ExxonMobil spokesman, told the New York Times. And the company hasn't let up. Exxon argues that if it does not start drilling by the end of 2017, it could lose its contractual exploration. And European oil and gas companies, like Italy’s Eni, would be free to take over the work.

“We are going to drill with Eni next year. That is our plan. On the Black Sea,” Zeljko Runje, vice president of Rosneft’s offshore projects, told Russian news media last summer.

European sanctions were also issued as a response to Russia’s invasion of Crimea, but the United States drew a much harder line. ExxonMobil, however, has received minor exemptions to the Russian sanctions, reported Clifford Krauss of the New York Times. The oil giant was given the green light to finish a $700 million project it started in the Kara Sea in the fall of 2014, claiming it wouldn’t be safe to up and leave the project unfinished.

Secretary of State Rex Tillerson’s previous leadership role in ExxonMobil could raise a few red flags if the Trump administration decides to lift the sanctions in the Black Sea. Tillerson, who served as ExxonMobil’s chief executive from 2006 to 2017, has strong business ties with Russian president Vladimir Putin.

In 2011, the two clinched a drilling deal worth $3.2 billion in exploration of the Black Sea and Arctic Ocean. Two years later, the Russian leader tapped Tillerson to join Putin’s Order of Friendship although some, such as David Filipov of the Washington Post, view the invite as relatively trivial.

In 2014, long before Tillerson even envisioned himself as leader of the State Department, the ExxonMobil CEO said he did not support the sanctions, and understandably so. The then-businessman said he doesn't "find them to be effective unless they are very well implemented comprehensively, and that’s a very hard thing to do.”

Tillerson has, however, been quick to criticize Putin’s policies at times -- particularly Russia’s role in supporting the Syrian government. He has pledged to stay out of any decisions relating to Exxon.

On the heels of the 2014 sanctions, Russia vowed to turn inward and continue to drill, with or without help from European and American oil giants.

“Nobody will just sit and wait,” Ildar Davletshin, a Russian oil analyst, told the New York Times in 2014.

Sen. John McCain (R-Ariz.) and Michael McFaul, former U.S. ambassador to Russia under the Obama administration, both took to Twitter to discuss their discontent with the idea of lifting the Russian drilling sanctions for Exxon. McFaul suggested that if the administration accepted the waiver, then “all that tough talk last week about Russia was just that -- talk.”

MSNBC host Rachel Maddow, who has been one of Trump’s stiffest and most outspoken opponents, also tweeted about the waiver.

Ka-ching! Payout time.https://t.co/fovQGP09AQ

— Rachel Maddow MSNBC (@maddow) April 19, 2017

She may be insinuating that Tillerson stands to benefit financially from sanctions being eased against Russia, or perhaps that Russia will benefit financially and will get this favor in return for influencing the election in Trump's favor. It's hard to tell. An analysis conducted by the Intercept found that Maddow dedicated more than half of her show to Russia over a six-week period.

Image credit: Flickr/Bureau of Safety and Environmental Enforcement BSEE

Empower Volunteer Ambassadors to Fuel Your Community’s Sustainability Outreach

By Kim Lundgren

We’re in the thick of Earth Month, a time when many local communities plan big community sustainability events to tap into a heightened (and sometimes fleeting) desire to “go green.” The warmer weather also kicks off a season of community events -- from 5K runs and neighborhood association block parties to ethnic festivals and farmers markets -- that stretches through the fall (when, advanced planners might note, Energy Action Month can be a good hook).

The local governments I’ve worked with over the years often struggle with the following:

- How can limited staff hit all these events, especially when the majority of these events fall outside the standard Monday-Friday, 9-5 work week?

- For those events you can cover, what’s the best way to really engage the folks there?

- And how do you become part of the everyday conversations that your community members have?

One place to look is Washington, D.C. -- the local government part, not the federal.

I recently spoke with Dan Guilbeault, chief of the sustainability and equity branchof Washington, D.C.’s Department of Energy and Environment, about the District's innovative and effective Sustainable D.C. Ambassadors volunteer program.

Take a listen to our SAS Talk with Kim podcast of that discussion, as Guilbeault dives into the nuts and bolts of the program, now in its fifth year.

Building a foundation for engagement

The District has a pretty robust catalog of sustainability initiatives from its Sustainable D.C. Plan that it wants to spread the word about -- from a bike share program to solar energy to getting healthy food in schools. And it’s a progressive city with support from elected leaders, local government staff (Guilbeault estimates that due to the District government’s unique function as city, county, and state government, between 60 and 80 people working in D.C. government touch sustainability either directly or indirectly) and residents.

Even in such fertile ground, D.C. knew better than to take a “build it and they will come” approach. So during the development of the Sustainable D.C. plan from 2011 to 2014, Guilbeault said community participation was a “foundational element.” More than 700 people were involved during the plan’s creation, with volunteers meeting every other week to draft a vision and recommendations. It was a dedicated group, but the participants didn’t necessarily reflect the city’s diversity in terms of age, race, income or ward (D.C .has eight wards, with which many residents strongly associate). Nor could the District count on that level of engagement during the implementation phase.

One way that the District has tried to crack the community engagement nut was to create a group of credible, natural advocates with the Sustainable D.C. Ambassadors program. At its core, the program admits what we all know: it’s better to have residents talking with other residents about our sustainability work than to have government workers talking at them.

So what have been some of the keys for the District? I’ve summarized the top takeaways from my conversation with Dan Guilbeault:

Make it empowering

Guilbeault was very clear that the District was “not looking to create disciples.” These are not paid District employees, and they are not given specific scripts. Guilbeault’s team trains them with basic knowledge about sustainability options so they feel empowered to answer questions, communicate why this matters to the community and point people in the right direction.

This ranges from working a table at a community event to talking with friends and family in more run-of-the-mill conversations. These ambassadors -- even once they completed the program -- take what they’ve learned into their personal and work lives. They can answer a neighbor’s question about energy efficiency, or post a response on a neighborhood listserv about recycling or offer advice on how to make their workplace greener.

There is also an application process, and the District has to turn people away each year. (Guilbeault says they usually get around 80 applicants and select a cohort of about 40 to 50. They count on about 30 of those being the most active, and about seven to 10 carry over to the next year with the opportunity to become mentors to the newbies.) That means those who were chosen know they are part of a select group, which in turns helps them keep their commitment.

Make it easy

What is that commitment? The quickest way to lose volunteer steam is to make it burdensome, but you also need people to feel invested. Any behavioral scientist will tell you that having someone make a specific pledge or commitment boosts the chance of action.

Ambassadors commit to attending one community event a month (typically a two- to three-hour shift), helping the District’s goal of Ambassadors participating in at least one event every weekend. (This recruitment flyer gives you some of the program basics and value propositions.)

It’s hard to pull that off on the backs of District staff alone, especially when you might have competing events that request your presence. The idea is to take make it easy for the volunteers to just show up at events and be on autopilot. District staff deal with the logistics of scheduling and stocking up on materials, etc, so that the Ambassador’s time and energy can be focused on the task at hand: talking to the community.

Guilbeault is quick to note that making it easy on the volunteers can be a “heavy lift” for staff, so give careful consideration to your staff time and resources before charging forward with a similar approach. As the program has evolved, the District has responded to feedback to make the application and training process less burdensome and more accessible.

Make it representative

It’s a work in progress, but true to the “equity” part of his department’s mission Guilbeault talks about their efforts from the very beginning to go beyond the usual suspects.

The pilot year intentionally included at least several ambassadors from each of the District’s nine wards. But they know that to get a diverse pool of candidates, it’s critical to build partnerships with a broad range of organizations that can act as trusted voices to the community.

Hearing about a volunteer opportunity from an organization a resident knows and trusts can be far more appealing than receiving the same opportunity from government.

Make it fun

As those of us working in the environmental and sustainability fields know all too well, there is a tendency for our work to convey a bit of “doom and gloom” -- not to mention it can be complicated and confusing. The District is using the Ambassadors program to emphasize that “sustainability is fun” and to have average residents talk in a more relaxed, less wonky tone.

And for the volunteers to communicate “fun,” it has to be fun for them. The District’s ambassadors get a free T-shirt. They meet people from all walks of life and make new connections. They visit different parts of the city and are exposed to cool events. They get a training that provides skills useful at work and in life. And judging from the photos, they totally have fun.

One unexpected benefit Guilbeault calls out is the advice they’ve received on messaging and materials. Given their different backgrounds and approaches, the ambassadors have identified what messages and tactics work best to draw people in. The result, as you can see from some of these examples, is a shift from text-heavy brochures to something more fun, simple, engaging and -- most importantly -- effective.

The city expects the program to keep growing. Their evaluation surveys have shown that the triggers for someone joining the Ambassadors program include:

- Being new to the area and wanting to get involved in the community

- Interest in learning new skills or enhancing their resume

- Truly caring about the issues -- whether it’s clean energy, cleaning up area waterways, or local food access.

Guilbeault sums it up as “people looking for a positive way to make a change in their community and their world.” That’s especially true these days, in D.C. and throughout the country.

If you're struggling to build that foundational go-to volunteer program, the Sustainable D.C. Ambassador model might worth considering.

Kim Lundgren is CEO of Kim Lundgren Associates, Inc. (KLA), a benefits corporation that delivers customized solutions for local governments to create the sustainable community they want. Kim was an early municipal sustainability pioneer and has dedicated the last 16 years to spurring local action and long-lasting behavior change to realize tangible improvements to the economic, environmental, and social aspects of our communities ultimately resulting in a more sustainable future. You can listen to her SAS Talk with Kim podcast with D.C.'s Dan Guilbeault and other local sustainability leaders.

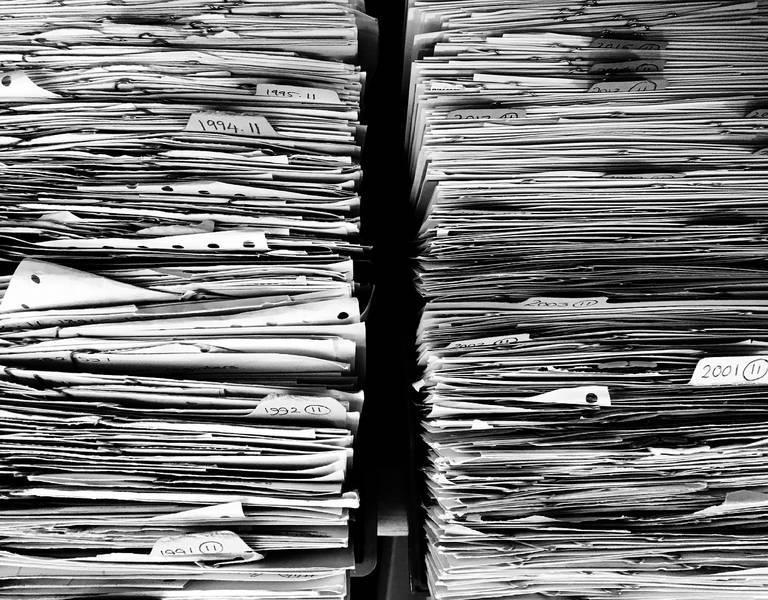

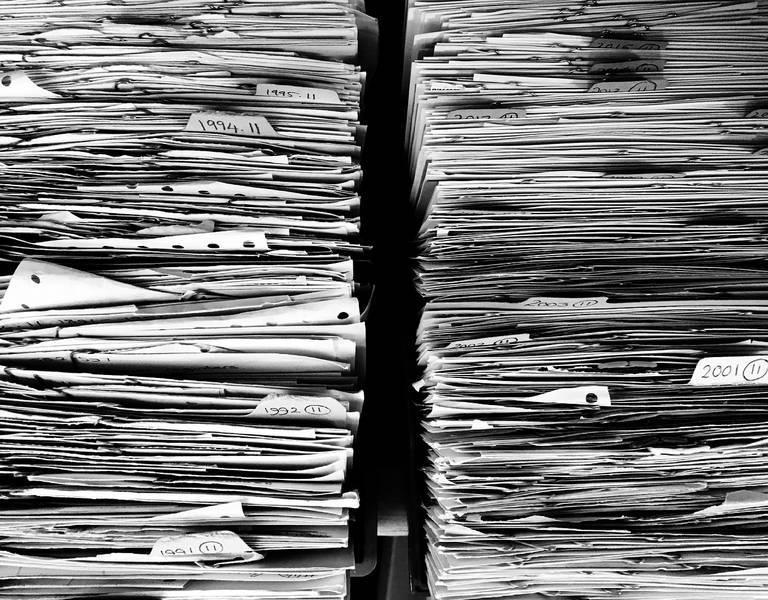

Customers Want to Go Paperless: It’s Up to You

By Jenna Cyprus

In the pursuit of paperless communication, customers were typically seen as a deterrent more than an aid. For years, businesses fought to get customers to opt out of paper statements and go online. But things have finally changed. It’s now the customers who are demanding paperless options.

The 'why' behind going paperless

The idea of the paperless office has been tossed around for decades, but it’s always discussed with hesitancy. For one, most businesses owners aren’t sure it’ll ever be possible to go totally paperless. Secondly, those who believe they can go paperless don’t necessarily want to. But the good news is that paperless is finally becoming a realistic option, and your customers are likely already on board (whether you realize it or not).

Many business owners assume that the primary reason for going paperless is to show customers that the organization prioritizes sustainability. And while this may be true to an extent, there are much more practical benefits involved. Sometimes customers just want to enjoy the surface level benefits.

“Imagine yourself as a customer,” document workflow expert Dave Quint suggests. “What if, instead of filling out paperwork in the waiting room of your doctor’s office, you were able to fill it out from the comfort of your own home at your convenience before the appointment? Or if your doctor could pull up all of your health records from a tablet or computer right in the exam room? How about if your real estate agent could access all the details on the home you were standing in from a tablet? Would you feel satisfied as a customer?”

See, today’s customers are looking for convenience. First and foremost, going paperless appeals to this desire. The fact that paperless operations allow your organization to be sustainable is just icing on the cake.

Practical action steps for your business

There really aren’t downsides to going paperless. It’ll require some time and energy up front, but the benefits are far greater than you can imagine.

Here are a few practical steps that will allow you to satisfy the call for paperless communication.

1. Ditch the mass mailers: Few things are more expensive or inefficient than mass mailers. Not only do mass mailers provide little return, but they’re also a waste of paper. You’re better off burning down a couple of trees and using the heat to warm your office. At least then you’d get some practical value.

What’s the alternative, you’re probably asking? Many companies are turning to voice broadcasting systems that are quicker, cheaper and more efficient.

2. Require electronic billing: A lot of businesses offer electronic billing, but few are adamant about it. Customers still sign up for paper-based billing, not because they want to, but because there’s no incentive to do otherwise.

If you want to get serious about paperless billing, incentivize your customers. Offer them a discount to go paperless. You may even try the reverse by adding a surcharge for paper billing.

3: Create accessible online content: If you’re going to cut ties with paper, you have to make sure that your communication doesn’t suffer as a result. In fact, your communication with customers should improve when you make the move to paperless.

Depending on the type of business you run, you may need to create online functionality that lets customers log in to see information specific to their account. Or it may be as simple as launching a blog and being intentional about keeping people abreast of changes and developments.

4. Feel free to brag: You’ve been taught your entire life that humility is a characteristic worth fostering. And while that’s true, the same can’t always be said in the business world. If your company is doing something that’s considered good practice, you should shout if from the rooftops.

Once you go paperless, make this one of your calling cards. Feel free to brag about it and let customers and prospective customers know that you prioritize sustainability and listen to the needs of the marketplace.

Being outspoken about paperless customer communications will help you gain more visibility and enjoy a higher return on your investment.

Recognize the true value of paperless

Sustainability is obviously at the heart of the paperless office, but don’t assume that this is all about reducing your company’s environmental footprint. There’s also an extremely practical reason for ditching the paper and pursuing digital forms of data storage and communication. Put simply, customers want you to ditch paper.

Conveniently, going paperless is more practical than it’s ever been. There are still some logistical issues you’ll have to sort through, but don’t let these small problems prevent you from pursuing the larger objective.

Going paperless is possible – so give your customers what they want.

Image credit: Pixabay

Jenna is a freelance writer from Renton, WA who is particularly interested in travel, nature, and parenting. Follow her on Twitter.

Aetna Foundation Leverages Philanthropic Investment to Build Healthier Communities

Take a drive through a neighborhood you haven’t visited recently, and you may notice something odd.

Maybe it’s a semi-rural area that hugs an industrial center where your neighbor works: the area with declining property values that seems to be frozen in time, with storefronts that have been shuttered for years and pockets of houses with broken sidewalks.

Or maybe it’s that pretty, winding hillside of older houses that you pass by each morning on the way to the gym, the one framed by green spaces and fast-paced traffic corridors speeding toward the city center.

Park your car and take a stroll through any of these neighborhoods, and you may find something missing – something most Americans assume is a part of everyday life in the 21st century: easily accessible stores.

Yes, there’s likely a corner store at the main intersection that features canned food and deli slices. Or there may be a full-service grocery store a few miles away, which amounts to a 30-minute round trip or more by bus.

But for some 23 million Americans, getting to a store for fruits, vegetables and other fresh foods can be a problem if they don’t have a vehicle. Researchers commonly refer to such neighborhoods as “food deserts.” These areas aren’t necessarily economically depressed, either.

Although nearly half of those 23 million residents live below the poverty line, a lack of access to nearby stores that have adequate nutritional foods exists at every strata of the population -- and in just about every city, from the economically struggling downtown quarter to the semi-affluent suburbs. And not surprisingly, food deserts dominate rural areas that are stitched together by small towns, country farms and few stores in between.

Changing Americans’ access to healthy nutrition and replacing those food deserts with well-stocked stores starts at the local level, says Dr. Garth Graham, president of the nonprofit Aetna Foundation, which each year provides funding to local stakeholders that can find new ways to improve health equity in their neighborhoods.

That funding comes in many forms -- from nationwide competitions to incentivize cities and counties to start grassroots initiatives, to providing grants, guidance and technology information to help small businesses with big ideas succeed.

Or it may involve funding technological and medical research that has the potential to revolutionize how we age and how we heal.

Aetna Foundation: Healthy cities, sustainable businesses

One of the Foundation’s more popular initiatives is its Healthiest Cities and Counties Challenge, which dares cities, counties, and Native American tribes to find new and unexpected ways to combat issues like obesity, declining life expectancy and other challenges in their communities.

Entrants must not only demonstrate ways their community can benefit from the initiative, but also offer “replicable strategies” with measurable and demonstrable results.

The top 50 finalists receive seed funding of $10,000, adding up to $1.5 million in prize money over the next several years. Winners are challenged to combine the cash with other community funding sources to accomplish their goals.

The 50 finalists include communities like Perris, California, which sees community gardens, healthy eating and education as important links to creating “health equity” in the city. Hillsborough County, Florida, near Tampa Bay, sees small community gardens as the key to increase both residential access to fresh food and healthy walking and biking for able-bodied residents.

Other contestant cities like Miami see improving healthcare access for low-income residents and individuals struggling with substance abuse as the way to increase health equity in its Little Havana neighborhood.

The Healthiest Cities and Counties Challenge is intended to "recognize and incentivize cities and counties that are doing innovative things on the ground to address social determinants of health,” Dr. Graham told 3p. “Our goal is to work with those locations that are most committed to improving not just the physical health but the social problems throughout the city.”

The Foundation emphasizes the use of evidence-based models, Dr. Graham told us, because its experts believe the path to improving healthy living is ensuring successful local initiatives can be duplicated in other communities.

“And to do that, it has to be based in evidenced-based infrastructure that is both effective and replicable,” he explained.

Startups and technology

The same is true for the small businesses the Aetna Foundation works with in its Innovation in Underserved Communities Funding program. The Foundation has been known to grant funding to small businesses that can demonstrate constructive ways to weaken the impact of America’s food deserts. Concepts like the EatFresh website, developed by Leah’s Pantry, work to not only address food inequity issues, but also language obstacles in growing cities.

Incentivizing change “is really about lowering the barriers of entry so people who are existing locally can enter the marketplace,” Dr. Graham told us. That includes taking into account the local, and sometimes hidden, language and cultural barriers that can keep a business and its potential consumers from connecting.

“There are a lot of people who have the ability to make these things on a personal or a macro basis but have challenges commercializing it, even locally,” explained Graham. “We work with a number of grantees that use innovative technologies like cell phone technology to allow them to accept not only credit cards but food stamps. ... Those are the kinds of things we believe are important.”

Another area where technology plays into the organization’s impact funding is in health care. The ARMstrokes app, funded with the help of the Aetna Foundation, provides recovery support and guidance for individuals who are working to regain movement or abilities that were impaired by a stroke.

“[We] are focusing on helping and training folks in both stroke recovery and in identifying key aspects, both clinical and non-clinical, that lead to better outcomes,” Dr. Graham told 3p.

Asked what the common denominator is when deciding what type of community initiative or business would benefit the best from its investment, he said the foundation “aligns our dollars more with our mission and impact.” When it comes to impact investing and philanthropy, it's all about deciding what you are ultimately trying to accomplish and staying true to both the goal and the desired impact, he explained.

“Many times with investing, you can go an inch deep and very wide. We prefer to go very deep within geographic areas and [not just] in terms of location but topic areas,” Dr. Graham said, adding that the Foundation looks to not only what is relevant to the company, but to its employee base as well. "We have found that impact investing and investing where we can measure our [effect] appropriately has been the most beneficial.”

Employee enthusiasm is a valuable asset

And taking into consideration what the local employee base feels is particularly important, Dr. Graham explained, especially when trying to inspire engagement in the values and interests the organization is attempting to bring to the community.

“What we have found is employees have a natural passion in their work lives. So tapping into the things that really matter to the company or foundation’s workers means increased desire to be a part of the organization and its accomplishments."

When it's all said and done, acting locally “but thinking globally” is what has allowed Aetna Foundation to provide its best support in communities in need, Dr. Graham said. And the grants it affords to underserved neighborhoods will likely impact these communities for years to come, as they forge their own paths to success and share best practices with their neighbors to ensure healthier communities for all.

Image credit: Pixabay