Newly Merged DanoneWave Now the Largest U.S. Public Benefit Corporation

Plant-based foods and beverages, as well as organic dairy products, are surging in popularity due to their perceived nutrition, environmental benefits or a combination of both.

Last summer, French multinational food company Danone acquired WhiteWave Foods, which owns brands such as Silk, Horizon Organics, Wallaby and Earthbound Farms, for $10 billion. The sale proved that foods once relegated to the local health food store are now mainstream, and can generate copious profits as they are sold in big-box chains such as Target and Costco.

But these health and ecological benefits could also transcend to local communities as well, if we are to believe a press release widely disseminated by the new DanoneWave company.

The newly combined entity, which generates over $6 billion in revenues annually and now employs 6,000 people, says it has become the largest public benefit corporation within the U.S. This announcement comes less than two weeks after Danone completed its acquisition of WhiteWave at $56.25 per share – providing investors a 350 percent return if they held their stock in the company since WhiteWave first went public in 2013. The new company combines WhiteWave with Danone's dairy business and operates as a subsidiary of Danone.

DanoneWave has accomplished a business model that at first glance seems impossible: creating a company that sells both dairy-based and nut-based milks. But as Fortune reported, the newly created company is riding the wave of enthusiasm for natural and organic foods. Overall sales of milk have been on the decline this decade, but organic milk saw a boost of well over 20 percent. So the business case is there; then what’s the social benefit?

DanoneWave says the point of becoming a public benefit corporation is to launch an “alimentation revolution,” which will strengthen individuals, their communities and, at a higher level, the world.

To keep that promise, this new entity is taking a long-term view that would have not been possible if WhiteWave were still publicly traded and subjected to Wall Street’s onerous quarterly forecasts. For the moment, the company is taking two approaches.

First, the company is articulating this mission within its articles of incorporation. DanoneWave will encourage dietary habits that toe the line with its parent company’s mission, which is to “bring health through food to as many people as possible.” In addition – and this is where DanoneWave is breaking new ground – the company has pledged to follow a model of sustainable development, which will generate “economic and social value” for employees, suppliers, customers and the environment.

Next, in order to charter through these new waters, DanoneWave CEO Lorna Davis announced an advisory committee that will be central to the newly created company’s corporate governance.

The chair of this committee is Rose Marcario, Patagonia’s CEO. Other committee members include doctors, the head of B Corporation’s European unit and a partner at Greenmount Capital Partners, which has long invested in companies that make socially responsible consumer products. That group will advise DanoneWave’s executive team on a wide range of issues, including diversity, animal welfare, water conservation and environmental stewardship.

It’s a bold new experiment for DanoneWave, which is now among the 15 largest food and beverage companies in the U.S. Its structure will allow the company’s executives to balance profit with the creation of social benefit, a concept that butts heads with over a century of conventional American business practices. For now, the company is eschewing any certification, although Fortune reported that DanoneWave aims to become a certified B Corporation by 2020.

If DanoneWave proves it can revolutionize the food industry while keeping its multinational parent happy with respect to financial performance, look for other companies to consider a similar shift. Younger consumers have made it clear they not only want more healthful products, but they also want to buy from companies with a clear social mission. Businesses could find that they will lose market share to DanoneWave and other upstarts if they cannot win the hearts -- followed by the wallets -- of this new generation of customers.

Image credit: Mike Mozart/Flickr

$4.5 Trillion in Global Assets Still Exposed to Climate Change Risks

A recent survey reveals that the world’s largest investment funds and managers are taking the long-term risks of climate change far more seriously than they were a few years ago, a trend that has especially become true in Europe.

But according to London-based Asset Owners Disclosure Project (AOPD), far too many companies in the financial sector within the U.S. and China are not taking any action to account for the the risks (and potential opportunities) climate change could exact on their portfolios. As a result, the 114 American companies that are taking no action are putting their firms’ long-term financial viability, as well as those of their customers, in jeopardy.

AOPD estimates that the assets at risk total about $4.5 trillion. Laggards include the Thrift Service Plan, which boasts 4.8 million participants in its retirement funds tailored for federal employees and military personnel. Fidelity Investments, which claims over $2 trillion in assets under its belt, also does not include climate change as a factor while assessing its portfolios’ long-term risks.

AOPD’s researchers cite encouraging development on the climate change front over the past two years, but they insist asset owners still have plenty of room to improve.

Overall, at least 60 percent of the asset owners AOPD surveyed in its most recent report say they are at a minimum taking some action when it comes to climate change. But 40 percent are still doing nothing.

And somewhere between the leaders and laggards are what AOPD calls the “bystanders,” which the group says have much to accomplish before they can truly say they are doing what they can to shield their customers from future climate-related risks. Nevertheless, the report takes an optimistic tone, as the vast majority of asset managers realize the opportunities in joining the world’s transition to a low-carbon economy -- yet foreboding risks at simply maintaining business as usual.

When it comes to the world’s largest asset owners, the funds that received the AOPD’s X rating -- in other words, doing absolutely nothing to track, disclose or mitigate climate risks -- are mostly sovereign wealth funds.

Many of them are in the Middle East’s Gulf region, a worrisome prospect considering countries such as Qatar, Kuwait and Saudi Arabia are already struggling with the three-year trend of low oil prices. And as renewables continue to scale and become far more cost competitive, they will continue to nudge fossil fuels toward irrelevance.

In addition, large Japanese insurance companies -- such as Mitsui and Zenkyroren, which alone have almost a combined $1 trillion in assets -- are also reportedly giving a blind eye to climate change risks.

Meanwhile, AAA-rated funds, those AOPD determined are doing most to prepare their customers for future financial challenges related to climate change, have increased by 17 percent when compared to the organization’s previous report. They include some of the Netherlands’ largest pension funds, the CalPERS fund for California state employees and the $7 billion Australia Local Government Super pension fund -- which AOPD ranks as the global leader when it comes to overall disclosure, strategy and risk management.

AOPD’s evaluation of asset managers reveals a similar demographic split. The highest-rated fund manager, APG Asset Management, is based in the Netherlands. Other globally recognized investment advisors based in Europe, such as Aviva, Allainz and HSBC, are also rated relatively high. But a lack of transparency on climate change policy, combined with the lack of action at the corporate level, are putting far too many investors at risk in AOPD’s assessment.

Along with Fidelity, U.S. firms Affiliated Managers Group and New York Life Investment Management are perched at the bottom of the organization’s rankings. Other American investment firms, such as Legg Mason, Vanguard, Capital Group and Wells Capital Management, do not fare much better.

For those investors who factor climate change risks in the structure of their portfolios, which countries are the safest bets? AOPD lauds France for its recent mandatory climate change disclosure rules, though Scandinavian countries rank higher overall, with Sweden topping the list. The U.S., however, is relegated toward the bottom, with only Switzerland and Japan earning lower overall scores. The Gulf states in the Middle East and Singapore present an even larger risk from AOPD’s point of view. As far as who should manage these funds, the breakdown is similar: The Netherlands is judged as the safest, followed by Germany and the United Kingdom.

Overall, AOPD is confident that both the world’s largest funds, as well as its leading asset managers, will soon start taking climate change more seriously.

The evidence suggests that global investments in the low-carbon economy are already on the rise. And as more companies adopt climate change strategies and become more transparent about them, the pressure will mount on other funds and managers who are resistant to these market shifts.

After all, the only alternative to restructuring portfolios for a 21st-century economy is to see those portfolios dwindle as investors begin to stash their funds elsewhere.

Image credit: Michael Duxbury/Flickr

Will Sea-Level Rise Kill Coastal Florida’s Housing Market?

The sub-prime and foreclosure crises of 2008 have been long forgotten by many, especially in Florida. The Sunshine State’s population has surged over 20 million since then. And for those who have spent most of their lives in a Northern climate, the reasons are obvious: year-round sun, gorgeous beaches and a reasonable cost of living.

With those new arrivals came a renewed surge in both housing prices and construction. A bullish stock market, an awareness that interest rates are inching up, and the growth of personal income in Florida have combined to boost housing values in markets such as Tampa and Orlando.

But the rush to build in Florida, especially along the coasts, ignores a stubborn fact: Sea-level rise threatens the long-term viability of the state’s cities. Last summer, the online real estate database company Zillow estimated that 1 in 8 Florida houses could be under water by the end of this century, which could wipe out at least $400 billion in property values statewide.

Furthermore, a recent Bloomberg profile of Florida’s real estate market suggests that property values could crater sooner than believed, even before sea-level rise affects a single home.

As reporter Christopher Flavelle pointed out, homes in affluent towns such as Coral Gables are coveted because of ample space to moor docks along canals and marinas. But if sea-level rise continues along Florida’s shores – and data suggests it is already up four inches since 1992, the year Hurricane Andrew savaged South Florida – homeowners will increasingly start looking to sell while mortgage lenders become more hesitant to underwrite loans.

Tidal flooding has already become a regular occurrence across much of South Florida, and the results include ruined cars, threats to local drinking supplies, mosquito infestations and more expensive infrastructure. But all the water pumps and elevated roadways cannot stop the fact that flooding will wreak havoc more frequently and with more intensity.

The pull to live near the beach is a strong one, but climate change risks are already testing the real estate, construction and insurance industries.

Last year, Sean Becketti, an economist with Freddie Mac, said that any trigger could cause a run on coastal properties: More banks could decline to underwrite mortgages; insurers could avoid these housing markets; or a bad spell of flooding could suddenly cause a burst of housing sales, which in turn would spook the markets.

Furthermore, the highest seawalls and most elevated roadways cannot confront the stubborn truth about South Florida’s geology: The coast sits atop a layer of porous limestone that behaves like a sponge, which is great for storing water. The problem is that sea-level rise and storm surges will further contaminate the region’s fresh water supplies, making less habitable -- even if a huge influx of infrastructure keeps both the classic art deco hotels and modern high-rise condos of Miami Beach intact.

Do not expect the real estate industry, long a sector resistant to transparency and consumer protection, to take action any time soon. Real estate companies and their agents rely on a cycle of cashing in during housing booms, and they are accustomed to waiting out the storm during times of bust.

But in an era of increased flooding, the dominoes could start falling at any moment. Florida has no law that requires home sellers to disclose potential flooding risks to buyers, with the Pew Charitable Trust being one organization arguing that such disclosures must become standard practice. Just as it has become routine to disclose asbestos or lead-based paint, there should be a national standard mandating the disclosure of a property’s potential flood risk. Such a move could protect more families – and taxpayers – from potential ruin.

Image credit: Wyn Van Devanter/Flickr

Business and Innovation in Food Waste

Food that is thrown away winds up in landfills where it gives off methane, a greenhouse gas with a warming potential 23 times that of carbon dioxide. Food waste is a huge problem in the U.S. where 63 million tons of food are tossed every year at a cost of $218 billion. That wasted food uses 20 percent of America's fresh water, fertilizer, cropland and landfill space.

The nonprofit organization ReFED released two new tools to help prove food waste reduction creates business opportunities and jobs, and to demonstrate the potential to simplify food date labeling.

ReFED's Innovator Database focuses on startups founded around food waste innovation. It tracks over 400 commercial and nonprofit organizations that combat food waste while creating over 2,000 jobs, more than 200 of which have been founded in the last five years.

The database allows users to look at the food waste innovation sector and presents solutions by type and geography. It also helps connect innovators to the private sector, government, foundations, and investors for collaboration and fundraising. The majority of innovators in the database are for-profit (70 percent) with 55 percent offering services nationally.

Consumer education is an important component in reducing food waste, and it is one of the categories in the database. About 25 percent of produce is wasted before it even hits supermarkets because it does not look aesthetically perfect. That equals 20 billion pounds. Two campaigns on the database are trying to put an end to that wasted produce by educating consumers.

The Ugly Fruit and Veg campaign, founded in 2014 and based in Castro Valley, California, posts daily social media pictures of fruits and vegetables that are not as perfect looking as we are used to seeing in supermarkets. The campaign has over 100,000 followers in more than 180 countries on Twitter, Instagram, Facebook and We Heart It.

The Ugly Produce is Beautiful campaign is based in New York City. Founded in 2016 by food expert and entrepreneur Sarah Phillips, the campaign is a global movement of producers, retailers, restaurants and consumers who are creating awareness about the nutritional value of “ugly” produce. The campaign helps people take action to increase their consumption of ugly produce through recipes and tips on a companion website called CraftyBaking.com.

ReFED’s Policy Finder focuses on government and identifies opportunities to simplify state and federal food labeling regulations, which save consumers and businesses over $29 billion a year.

The ReFED Policy Finder, developed in partnership with Harvard Law School’s Food Law and Policy Clinic, features an interactive map of federal and state laws and policies. Almost half of all states have enacted food donation liability protections above the federal baseline that encourage businesses to donate foods that would otherwise be thrown away. Of the 10 states that generate the most food waste, California is the only one that offers state-level incentives to promote food donation and has an organics waste recycling law on the books, according to ReFED.

None of the 50 states regulate every category of date labeling, ReFED says. Georgia regulates all aspects but perishable foods. Washington, D.C., on the other hand, regulates every category which includes perishable foods, potentially hazardous foods, milk dairy, meat/poultry, shellfish and eggs.

“These tools reveal that food waste reduction is both a source of viable, scalable business enterprise and a potentially significant job generator,” said Chris Cochran, executive director of ReFED, in a statement.Last year, ReFED released a report which laid out ways to reduce food waste by 20 percent. Doing so would create 15,000 new jobs, double recovered food donations to nonprofit organizations, reduce up to 1.5 percent of fresh water use, and avoid almost 18 million tons of greenhouse gas emissions a year, according to the organization.

In other words, food waste reduction is a win-win for Americans and the environment. And it's simply good business.

Image credit: Flickr/Nick Saltmarsh

A Federal Incentive for Social Entrepreneurs to Expand Their Businesses

By Leah B. Thibault

Various federal and state financial incentives can further the growth and expansion of businesses committed to making a positive social impact through their daily operations, particularly if that means creating jobs in low-income communities with high unemployment.

Rural counties from New England to the American South to Hawaii are attracting socially responsible businesses by providing economic development packages and financing for new equipment purchases, new factory construction and facilities renovation.

Rural industries can avail themselves of an enthusiastic workforce, access to natural resources and several programs designed to encourage investment in these economically-underserved communities. Financing tools like the New Market Tax Credit Program or the USDA’s Rural Development grants, guarantees, and loans can make the choice to locate in rural areas a smart one -- both fiscally and socially.

Take Ehrmann Commonwealth Dairy. The Commonwealth in its name is a reference to early plans to locate in Massachusetts; but this Vermont-based producer of the Green Mountain Creamery brand of Greek yogurt has made sharing its prosperity with the community a key part of its DNA, bringing a whole new emphasis to the name.

The decision to site the yogurt processing plant in Vermont was driven in large part by the financing incentives offered by the federal New Markets Tax Credit program and state of Vermont economic development programs, encouraging the growth of a new market for area dairy farmers.

Ehrmann Commonwealth Dairy has been a purpose-driven business since its establishment. Leadership committed to return 5 percent of net profits to the small family farmers who produce the milk for the facility. Commonwealth Dairy provides those funds to the Farm and Forest Viability Program of the Vermont Housing and Conservation Board -- which, in turn, distributes them as grants to eligible farms. As of July 2016, Commonwealth Dairy awarded $769,631 in funds and leveraged an additional $3.4 million from other sources. These funds went to 30 different farms, 90 percent of which have herds smaller than 500.

The fund has been used to reinvest throughout the value chain -- for barn construction, milking equipment, and milking parlor renovations, among other uses.

For Karie Atherton of Aires-Hill Farm, it meant adding grooved cement floors in her barn and milking parlor, preventing further loss of cows due to injuries. Not only is animal well-being improved, but the project has also made a big difference in her business.

“It just goes to show you, little things can really improve your cash flow because you’re not losing cows,” Atherton said. “I wish I would have done the project sooner. I knew there would be a difference, but I didn’t realize it would be so dramatic.”

And Atherton isn’t alone. The 15 completed projects have resulted in an average increase in gross income of $18,351 per farm.

Similarly, the Axio Green project brings new meaning to the term community solar in the former mill town of Greenfield, Massachusetts.

Its forward-thinking leadership led to the installation of a privately-run solar farm on a capped landfill on the outskirts of town. The 2-megawatt facility not only supplies nearly half of the electricity for city buildings and saves the city approximately $175,000 in annual electricity costs, but the outcomes have also rippled back to the community through reduced property taxes.

The movement toward a cleaner energy future didn’t stop at the installation of a single solar farm. As part of the financing package with CEI Capital Management, the project sponsors worked with local community development institution, Common Capital, to donate $100,000 to Greenfield Community College to develop a worker training program in the solar energy sector. The project also generated an additional $100,000 from electricity sale profits to the college.

“The Greenfield Solar Farm is a low-profile but highly impactful project,” says Common Capital CEO Christopher Sikes. “It is hidden away at the old town dump. It’s quiet and doesn’t pollute and because the sun did indeed shine, it has produced the electricity for the town. Plus, Greenfield Community College got its worker training in solar energy classes started. Sometimes the most successful projects are invisible in plain sight.”

Right now, the U.S. Congress is beginning to debate tax reform. As part of the discussion, the New Markets Tax Credit program is likely to become one in a mix of many that will be considered for termination or continuation. The program has delivered significant benefits across the country with many examples in both rural and urban areas. It is an investment in job growth and sustainability. It deserves congressional support over the long term.

If you agree, please tell your representative and/or senator to support the program as he or she does the important work of determining how to provide support to both our businesses and our communities.

Image credit: Pixabay

Leah B. Thibault is Director of Executive Administration and Special Projects for CEI Capital Management. The company creates and preserves jobs and improves quality of life in rural, low-income communities by providing access to project capital through New Markets Tax Credits. Over 12 years, CEI Capital Management has placed over $924 million in 90 different projects across the U.S. In addition to fiscal soundness, CEI Capital Management evaluates each project according to its benefit to the local community, economic gain and positive impact on the environment. It is a wholly owned subsidiary of Coastal Enterprises, Inc. (CEI), the Maine-based nonprofit community development financial institution that was among the founders of this important federal economic development program.

100% Renewable Energy: If L'Oreal Can Do It, So Can You

Despite the sharp political divide between renewable energy and fossil fuel advocates, so-called "red" states are emerging as wind and solar leaders in the U.S. That's a significant development because it provides more flexibility for companies that are looking for opportunities to decarbonize. They can search right-leaning states as well as left-leaning ones for clean energy investments while taking advantage of workforce, logistics, supply chain and other other bottom line areas.

L'Oreal USA is a case in point. Last week the company issued its 2016 Progress Report, announcing that it has achieved 100 percent renewable electricity for its manufacturing plants in the U.S. The feat was accomplished primarily through renewable energy projects in three states that are not generally associated with a favorable political environment for action on climate change.

L'Oreal invests in green energy, reaps greenbacks

The report chronicles steps that the company has taken toward meeting the goals outlined in its "Sharing Beauty With All" sustainability strategy. Inside, the cosmetics giant pushes back against the notion that decarbonization is an economic depressant.

Globally, the report charts a 67 percent decrease in L'Oreal's overall carbon emissions compared to a 2005 baseline. Rather than shrinking its output, the company grew production by 29 percent over the same time period.

The achievement is all the more notable because the company's initial global target was a 60 percent reduction in carbon emissions by 2020.

Harvesting clean energy from red states

The new report underscores L'Oreal's determination to position itself as a global sustainability leader. Here's the money quote from Alexandra Palt, the company's Chief Sustainability Officer:

"...All sustainability program reflects the innovative spirit that is hard at work at L’Oréal, especially in the United States. We remain committed to being a sustainability leader here and around the world, and look forward to exceeding our goals in the future.”

To underscore the point, L'Oreal went big for its 100 percent renewable electricity achievement.

The company's largest manufacturing site globally (measured by tons of output) and its largest U.S. site is in Florence, Kentucky. That facility has now become the home of Kentucky's largest commercial solar array.

L'Oreal can also lay claim to the fourth largest solar array in Arkansas (and the third largest commercial one), at its Little Rock site. In operation for 40 years, the facility illustrates how older businesses -- and conservative states -- can transition to more sustainable technology.

Wind also gets a shout-out from L'Oreal, with a 12-turbine installation at its distribution center in Texas, where the wind energy industry has been nurtured along with the help of a major wind transmission line.

Covering all the bases

L'Oreal's path to 100 percent renewable electricity illustrates how companies can leverage high profile projects for good publicity. The achievement also demonstrates that companies can reach the 100 percent goal by taking advantage of other opportunities that are not as eye-catching from a public relations angle.

To reach the 100 percent mark, L'Oreal also purchased renewable energy credits. The company also has 14 existing renewable energy installations in the U.S., making a total of 17 with the three most recent additions.

In terms of the company's overall sustainability efforts, there is still much to be done. However, the U.S. clean energy buys helped L'Oreal reach -- and beat -- its initial goal of a 60 percent reduction in total carbon emissions by 2020, four years ahead of schedule.

Other highlights of the report include a 48 percent drop in water use globally, and a 35 percent reduction in waste (per finished product) since 2005.

The company is also transitioning to recycled packaging, for example in its Biolage R.A.W. and Garnier Fructis lines.

A 100-day message for U.S. President Donald Trump

Coincidentally or not, L'Oreal and many other major companies (Salesforce is another good example) have been communicating strong, positive messages about climate action during the first 100 days of the Trump Administration.

Political observers have noted that the Trump Administration is having trouble coming up with an impressive list of achievements during his first 100 days, but the solution is at hand: simply repackage existing clean energy programs and stamp them with the Trump brand.

He wouldn't be the first. After all, former U.S. President Barack Obama is widely credited with progress on renewables and energy efficiency, and his programs evolved from the nation's existing national laboratories and research programs.

L'Oreal doesn't straight up advise President Trump to start taking credit for existing programs, but the company's press release for the new progress report includes a strong pitch for the EPA Energy Star efficiency program, which began back in 1996, and the EPA Green Power Partnership, which launched in 2001.

The company also notes that it is on board with at least one initiative for which President Obama can claim complete credit, the American Business Act on Climate Change. The initiative attracted scores of leading U.S. companies when it launched in 2015, in the lead up to the Paris climate talks.

Interestingly, it appears that President Trump may be moving in the direction of clean energy re-branding.

His Department of Energy is facing the budget axe, but meanwhile it has been pouring forth a flood of news about its clean energy programs and activities.

Hopefully initiatives like this one from L'Oreal will continue to make the business case for sustainable action.

Image: via L'Oreal.

Forced Labor Still Looms in IT, Food and Beverages

When it comes to the use of slavery and other forms of forced labor in the garment industry, consumers aren’t afraid to voice their objections.

And according to a new report by KnowTheChain, that advocacy has been instrumental in reducing the use of forced labor in the industry. Companies like HP and Adidas have heard the condemnations loud and clear and have worked hard to stop the use of slavery in the supply chains they utilize.

But when it comes to the use of forced labor in other industry sectors, like food and beverage, reducing forced labor hasn’t been as successful.

“This is reflective of the level of media attention and civil society pressure companies in each of the sectors have received,” the website reported, which in this case, has been much lower when it comes to how seafood is harvested or the cacao for our chocolate bars is grown.

KnowTheChain’s 2017 report on forced labor in the global economy is the organization’s second annual report. Established in 2013 by Humanity United in partnership with Business & Human Rights Resource Centre, Sustainalytics and Verité, it aims to shine a spotlight on a topic that until recently, hasn’t garnered quite enough attention in the media – and consequently, in the minds of many of North America’s budget-conscious consumers.

The report looks at seven key categories across three main industry sectors and rates the level of success that each sector has shown in eradicating forced labor from its supply chain. The researchers found that of the three sectors, food and beverage and information and communications technology faced the greatest challenges in ensuring that slavery and forced labor weren’t used in the procurement and production of materials and products.

This isn’t exactly a new finding when it comes to the tech industry. TriplePundit has reported a number of times on how forced labor has shaped the industry, and the efforts that a select number of companies are making to wipe abusive labor tactics from their supply chains.

But what is new about KnowTheChain’s investigations, is its ability to pinpoint just where the abuse is most virulent in each sector.

Information and communications, for example, gained moderately high marks for commitment and governance, and moderate scores for the kinds of monitoring the industry receives. It also received a moderate score for its success in eradicating forced labor from the procurement process. But tech companies scored low marks when it came to workers’ rights: guaranteeing that workers’ had the ability to organize, submit grievances and express opinions about how they are treated.

HP scored the highest marks in that sector, but it still received moderately low marks when it came to recruitment and workers’ right to voice.

Food and beverage companies scored even worse when it came to recruitment, largely due to the lack of oversight when it comes to migrant workers and seasonal laborers both in the US and abroad. It also scored poorly when it came to ensuring workers’ rights were observed when it came to its procurement chain.

That’s not to say that all companies scored the same in these problem areas. In the food and beverage sector, Unilever scored the highest, showcasing efforts that we have talked about before: its commitment to eradicating forced labor from the industry, integration of that commitment into the supply chain, risk assessments and coming up with corrective action plans to provide remedy in its efforts.

In fact, coming up with remedies seemed to be a hallmark for those companies that could demonstrate their commitment to eradicating the use of slavery and abuse from the industry. Adidas, H&M, Unilever and HP all had corrective action plans in place and were working on remedy programs.

KnowTheChain also made some astute observations in its report. One of them we’ve heard before: Companies are often more proactive in monitoring and addressing forced labor issues in first-tier suppliers than those further down the chain. That’s a problem when it comes to stopping slavery and abuse in the tech supply chain, because materials can often pass through many hands before they get to the final manufacturer.

But there’s some bright spots, as well, says the organizations.

While many companies are still taking steps that are far too small to make an appreciable difference in their supply chains, say the writers, “it is encouraging that a number of companies across sectors have joined the Leadership Group for Responsible Recruitment (thus committing to the ‘Employer Pays’ Principle) and that some industry associations are starting to take action.”

And that’s important because it means that KnowTheChain’s message isn’t just being heard by its consumer and investor readership, but the companies that hold the most power in eradicating forced labor from their supply chains.

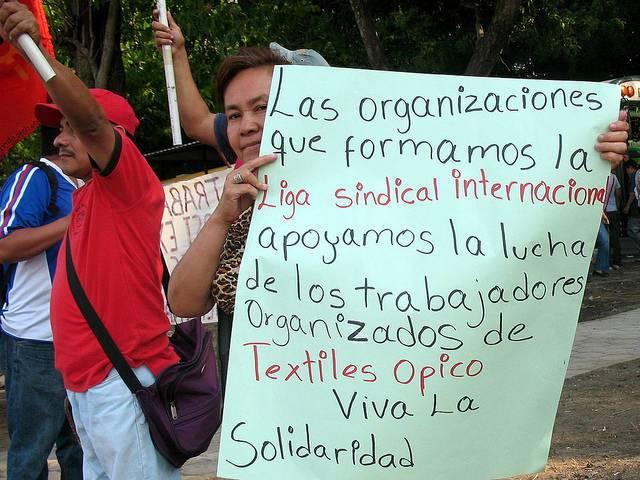

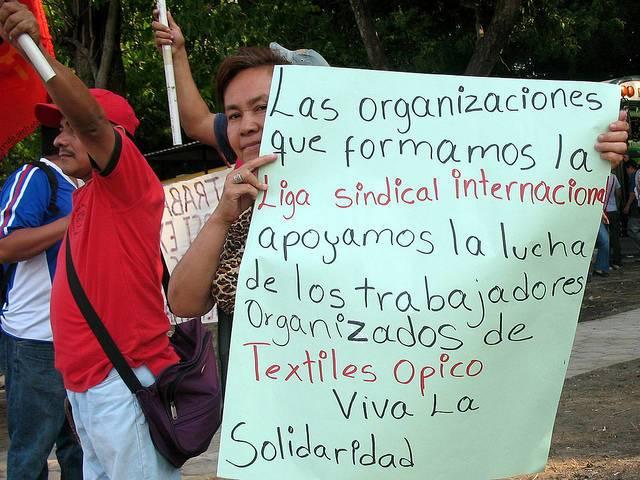

Flickr images: Seven Xu; NoBorder Network; International Union League

Proposed Bill in Congress Would Silence Activist Investors

A new bill proposed in the U.S. House of Representatives could eliminate one of the favorite tactics of shareholders who want companies to change how they conduct business.

Supporters of the Financial Choice Act 2.0, including Jeb Hensarling, Chair of the House Financial Services Committee, claim that this legislation will hold Wall Street accountable by empowering ordinary Americans instead of Washington, D.C. bureaucrats.

But critics of this legislation, which promises to overhaul the Dodd-Frank Act, say that if this bill becomes law, it will do more than end the “too big to fail era” and end the banking bailouts, which in part fueled the rise of the Tea Party earlier this decade. They argue that the legislation throws the baby out with the bathwater, as it would phase out the mechanism by which activist shareholders have been able to nudge companies to become more environmentally and socially responsible.

Current U.S. Securities and Exchange Commission (SEC) rules require investors to own either 1 percent or $2,000 worth of a publicly-traded companies stock for a continuous year in order to allow them to file shareholder resolutions to be voted on at a company’s annual shareholders meeting. The rule has allowed non-profits such as PETA, the Humane Society and Philadelphia-based Sisters of St. Francis to attempt to influence corporate policies by forcing shareholders to vote on a wide variety of issues on annual proxy statements. While these shareholder proposals were generally non-binding, and have overall been voted down by an overwhelming margin over the years, the public relations fallout has often convinced companies to enact such changes eventually. The Humane Society, for example, has taken credit for companies such as Tysons and Smithfield to push their suppliers to improve their animal welfare standards due to their wielding of shareholder proposals.

But this proposed legislation would end the $2,000 minimum threshold and keep the one percent mandate intact, and prohibit the filing of shareholder proposals on the behalf of other investors. Walmart's market cap currently is over $227 billion; one only has to imagine the hurdles imposed on shareholders who want to pursue change at a company of even one-tenth of Walmart's size. The effect would serve to muzzle the vast majority of shareholders, who in the past have pushed for reforms related to executive compensation, lobbying activities, climate change and campaign finance.

Earlier this year, investors urged the Trump Administration to keep rule 14a-8, the SEC directive that allows such proposals to come to a vote at annual shareholder meetings. While the sheer number of these resolutions have increased in recent years, as a percentage, this is still a rare tactic; the 172 resolutions that made ballots during last year’s proxy season affected less than 5 percent of the publicly traded firms selling shares within the U.S. Market.

As the New York Times pointed out yesterday, this legislation would create sweeping changes that go beyond proxy ballots. Instead of allowing the SEC to continue file administrative cases before its own internal judges, those cases would be tried in front of a federal district court, which in recent years have ruled more favorably to companies. In addition, the SEC would no longer be able to bar someone guilty of violating federal securities laws from serving as an executive or director of a publicly owned company. And while the SEC could still impose multi-million dollar fines for securities violations, the agency would also have to determine whether such penalties would harm shareholders, which in the end would discourage such punishment in the first place.

“Change is certainly in the air for the S.E.C,” wrote Peter J. Henning in the Times. “The question is whether it will be hamstrung by the Financial Choice Act 2.0 if it is adopted in its current form, and how effective it will be in policing corporate America.”

Considering that the White House prefers a neutered SEC that will ditch enforcement for unfettered business expansion, watch for yet another reform from the previous decade to disappear in the coming months.

Image credit: Daniel Foster/Flickr

Like Trump, Tom Brady’s Charity Funded by Others

Tom Brady did not go to the White House for last week’s Super Bowl victory celebration with Donald Trump, which fueled all kinds of speculation after the president’s non-mention of him during the ceremony. Nevertheless, the two reported friends definitely have one thing in common: Brady and Trump have both been accused of launching charities that boast their names, but not their funds.

According to the Boston Globe, Brady’s foundation, the Change the World Foundation Trust, dates back to 2005. It was initially funded with almost a half-million dollars, with all but $10,000 of it paid for personally by Brady. But since then, records made publicly available show that Brady has paid nothing into the foundation, which distributes grants to other non-profits aligned with Brady’s personal interests. Foundations affiliated with Brady’s alma maters, children’s private schools, or charities launched by Brady’s friends have been recipients of the trust’s funds year after year. But those donations were largely paid for by Best Buddies, a non-profit founded by Anthony Shriver, son of Sargent Shriver, the 1972 Democratic vice presidential nominee and nephew of John F. Kennedy, the 35th president.

Best Buddies says it is part of a world volunteer movement to increase opportunities for citizens with intellectual and developmental disabilities. Year after year, Best Buddies has donated about $500,000 annually to Brady’s trust since 2011. The NGO credits Brady with helping the organization raise $46.5 million for the organization over the last 15 years.

No one is disputing the good work that Best Buddies does in communities here and the U.S. worldwide. And Brady has the right to donate as much money as he wants to the organizations of his choosing.

The problem, however, is that Brady appears to be making these donations with other people’s money. And as Nonprofit Quarterly has pointed out, the annual checks that Best Buddies pays to Brady’s Foundation come across as a quid pro quo for Brady’s involvement with Shriver’s organization. The gray area, according to some analysts, is that Best Buddies has not made it clear that the funds paid to Brady’s trust are a form compensation or honorarium, despite Shriver’s comments in recent years. And considering that Brady and his wife, Gisele Bundchen, are together reportedly worth over $540 million, any descriptions of them as “philanthropists” is a stretch if neither of them are the ones actually writing out the checks.

Another foundation of Brady’s, the TB12 Foundation, also raises questions as its mission is to “To enhance the health, well-being and athletic potential of promising young American amateur athletes by providing access to the TB12 Method of athletic training.” That pledge is similar to the mission of TB 12, a company with ties to Brady that sells athletic apparel, operates a fitness center and advises athletes on how to maintain peak athletic performance.

Brady may be a hero to many for his long football career and heroics in the most recent Super Bowl; New England Patriots fans adore him for his role in transforming a once-lethargic sports franchise into the most successful NFL team in recent years. But using charities to either boost your own company’s bottom line, or to pay for pet causes with someone else's money - even if legal - crosses into a very grey area on the ethics front. At a time when many non-profits struggle to do good work without the benefits of headlines, Brady and his wife should reconsider what is best described as their self-serving approach to philanthropy.

Image credit: Keith Allison/Flickr

The Surprisingly Large Corporate Investments in Donald Trump's Inauguration Party Fund

According to The Hill, the amount raised for U.S. President Donald Trump’s inauguration ceremonies in January generated a record $107 million, more than doubling the amount raised for former President Barack Obama’s celebrations when he took the oath of office in 2009.

The data released last week by the Federal Election Commission (FEC) suggests wealthy individuals and companies that refused to donate to the current president during his campaign, or avoided last summer’s Republican convention in Cleveland, were eager to show that they were on board with the new administration – and are now are seeing the benefits of their support.

According to The Center for Public Integrity, Trump’s inauguration committee promised generous perks in exchange for large donations that came in the amount of six- or seven-figures. Donors who shelled out more than $1 million were promised tickets to an exclusive “leadership luncheon” that included presidential cabinet appointees along with leaders from Congress. Those same donors were also offered invitations to a “ladies luncheon” at which Trump family members were scheduled to join, along with a dinner hosted by Vice President Mike Pence and his wife.

The goal was to raise as much as $75 million, a ceiling easily surpassed; and if you do not remember Trump crowing about this number, keep in mind that when Obama was inaugurated eight years ago, individual donations were capped at $50,000 and checks were not accepted from corporations, lobbyists or political action committees.

Now, as the current president approaches his much hyped first 100 days of his administration, evidence suggests that corporate donors are benefiting from a favorable political and regulatory climate.

Take the second largest donor to the inauguration committee, AT&T, which paid just over $2 million to the fund. The company has long opposed net neutrality rules, which were designed to treat internet access akin to a public utility. AT&T long opposed the stance the Federal Communication Commission (FCC) had taken on net neutrality. But in February, AT&T got its wish when the FCC’s new leadership announced that it would stop the agency’s investigation of “zero-rating” offers, which allow companies to provide certain streaming services to customers without having the data count against any monthly cap.

Energy companies were also amongst the million-dollar donors. Christopher Cline, who sold his holdings in Foresight Energy before the coal industry’s collapse but still owns assets that would benefit from the sector’s resurgence, was one donor who is banking on coal becoming great again. But Green Plains Renewable Energy, a major player in the ethanol industry, was also a large donor; Trump made it clear shortly after his inauguration that he supports federal ethanol production mandates. John Hess, CEO of the oil company Hess Corporation, also was a seven-figure donor.

Then there is the largest overall donor to Trump’s inauguration committee, hotel and casino magnate Sheldon Adelson. The casino industry has long noted Adelson’s opposition to online gambling, and although Trump has still not taken a firm stance on the issue, the sector has pushed for a national ban on the practice. In addition to Adelson’s $25 million donation to the Trump campaign as the election drew closer, he also donated $5 million to the inauguration fund, and later was on the president’s transition team.

But this donors’ list also shows that such close ties to the Trump Administration can become a slippery slope for companies and those who run them. The blog The Intercept, followed by the newspaper The Oregonian, recently revealed that Portland hotelier Gordon Sondland donated $1 million to the president’s inauguration committee, but did not use his name; instead those funds were paid in the name of four Oregon- and Washington-based companies linked to him. Sondland had planned to host a “yuge” fundraiser for Trump back in September. But he later claimed a change in heart after Trump launched a tirade against Khizr and Ghazala Khan, the parents of a slain Muslim soldier killed during the war in Iraq, and who made international headlines after their appearance on the Democratic National Convention stage. The lack of transparency has earned Sondland plenty of scorn. Others could be in the crosshairs soon, as Huffington Post reporter Christina Wilkie has succeeded with her call for help in deciphering those FEC filings.

As more connections come to light, inauguration donations could be tough for companies to explain to stakeholders. And that long list includes companies as diverse as Allied Wallet, Bank of America, Boeing, Dow and Qualcomm.

Image credit: Michael Vadon/Flickr