The Well-Deserved Backlash Against the Automated Bodega for the 1 Percent

What do a cold-packed baby food delivery service and a next-gen vending machine startup have in common? Both claim they are solving a problem, but exclude much of the population from their purported benefits - while giving people more ammunition to resent Silicon Valley and the clueless 1 percent.

In the case of Once Upon a Farm, the idea is to ship foil packets of baby food at a price more than twice of what they would cost at a grocery store, with vague promises to drive “social change.”

But the startup Bodega is on a mission far more nefarious, say its critics. The goal of two ex-Google employees is to make sundry products such as deodorants, tampons and protein bars readily available via a smartphone app. Each of these pallid automated glass boxes would change its 100 or so various products over time based on what was being purchased. As ex-Googler Paul McDonald told Fast Company:

“Each community tends to have relatively homogenous tastes, given that they live or work in the same place. By studying their buying behavior, we’re hoping to eventually figure out how the needs of people in one apartment building differ from those in another. We could customize the items in one dorm versus the next.”

While McDonald and his business partner, Ashwath Rajan, did not exactly say they wanted to make the iconic corner bodegas of New York City “obsolete,” the article’s title and unflattering photo of the two lads posing next to their glass box clearly struck a nerve across social media. (You can track the backlash on Twitter with #BodegaGate.) From the onset, the interview with reporter Elizabeth Segran came across as tone-deaf and even arrogant. Most laughable was their insistence that so-called “surveys” in the Latino community found 97 percent of respondents agreeing that appropriating the term “bodega” was not a problem.

Bodegas have long been part of life in New York for their hangover-curing breakfast creations, chopped cheese sandwiches, empanadas and last-minute sales of toothpaste and toilet paper. Even more importantly, they are neighborhood gathering places. In addition to serving smiles, and questions about one’s family or day, bodegas have also been economic and cultural steppingstones for immigrant families making a new life in the U.S.

While associated with New York and to a lesser degree, Los Angeles, “bodega culture” has long been part of the American experience – only in different forms across the country. Cambodians started out in California by often running donut shops after fleeing the Khmer Rouge. Vietnamese refugees thrived in nail salons as they offered steady jobs while learning English and acclimating to a new life. Joe Biden was derided for his unartful comments about Indian-Americans and convenience stores a decade ago. The truth, however, is that many ethnicities anchored themselves in America with the corner store, including my Armenian grandparents, who ran a small grocery store in a dusty San Joaquin Valley town seven days a week for twenty years after moving to California.

But in the city that never sleeps and where walking is often that “last mile” from finally getting from the office to home, the corner bodega has a special hold on New York's psyche. Many have been passed on to younger generations. Nowadays, many challenges lie ahead; for example, rising rents across New York City are forcing many to close.

Nevertheless, bodegas are still a powerful force. Earlier this year, many closed in protest of the Trump Administration’s immigration ban. So from the point of view of many bodega owners, a smartphone-operated box cannot compete with the customer service and quick meals-on-the-go they offer. Others, however, not only see this startup as a threat to their livelihoods, but also as an insult. As repeated in many news stories, the head of the New York State Coalition of Hispanic Chamber of Commerce quickly slammed the idea.

After all, the trademarked name alone is bad enough; but the logo's use of a cat, long a symbol of bodegas' neighborliness, was also a slap in the face to many bodega owners. “It’s either the worst-named startup of the year, or one of the greatest Silicon Valley heel gimmicks of all time,” said The Verge.

McDonald has quickly apologized, but his mea culpa is worse than the company’s initial kickoff. “While we were hoping for a big response, the reaction that we got this morning certainly wasn’t what we expected,” wrote McDonald, which makes one wonder if he or the market research firm advising him bothered to visit a New York street corner other than, say, 5th Avenue and 64th or 65th.

“We want to make sure our name — among other decisions we make — reflects those values. We’re here to learn and improve and hopefully bring a useful, new retail experience to places where commerce currently doesn’t exist,” continued McDonald.

The absurdity of that comment is that he and Rajan are talking about offices, gyms, apartment lobbies and dormitories. Despite McDonald’s protests, this business is, in fact, about selling more stuff to the “stereotypical Whole Foods set.” Hence Vice was unleashed in their assessment of this concept: “The last thing the upper-middle class needs is another gadget that makes life marginally easier and more isolated from the outside world.”

McDonald is clearly an outlier in the millennial world, one that increasingly demands that the companies for which they work have a social purpose. And therein lies the link to Once Upon a Farm. What is this social mission? Commerce is often non-existent in “food deserts,” remote rural towns and low-income neighborhoods. The business plan outlining the need for a “new retail experience” for the tech worker who forgot to bring the calendula-scented deodorant for his post-office workout should earn a C- in a business school marketing module at best.

Hence the sad tale of a marketing campaign that ranks with other poorly executed promotions such as those for the Ford Edsel, New Coke and Trump Steaks. No wonder why Mashable was so mocking in its tone. “These box things were designed to replace bodegas, and nobody wants them,” summed up Colin Daileda.

Image credit: Bodega.ai

MSCI Supports NZ Super Fund's Low Carbon Strategy

Green Building Helps the Environment While Saving Money

Photo: Whirlpool Corporation

Green building is a trend that is on the upswing. The number of global builders that have at least 60 percent of their projects certified green will double from 2015 to 2018, predicts the World Green Building Trends. By 2023, commercial building owners and managers will have invested an estimated $960 billion globally on making their existing built infrastructure green. The global building sector continues to double every three years, according to the Dodge Data & Analytics World Green Building Trends 2016 SmartMarket Report.

Buildings in the US account for nearly 40 percent of national carbon emissions, 39 percent of total energy use, 30 percent of landfill waste, and 12 percent of total water use. LEED certified buildings use 25 percent less energy and 11 percent less water. They also reduce operational costs by 19 percent, and have 34 percent less carbon emissions. LEED-certified buildings in the US between 2015 and 2018 will have an estimated $1.2 billion in energy savings, $149.5 million in water savings, $715.2 million in maintenance savings and $54.2 million in waste savings.

Whirlpool Corporation is a company that understands the importance of green building. The company, known for its kitchen appliances, was recently awarded LEED certification for two of its recent building projects in Benton Harbor, Michigan. They are the 14th and 15th LEED-certified projects for the company since 2009. In both projects, water saving restroom fixtures were installed, including ultra low flow valves and toilets. Those fixtures will reduce water use by 40 percent for both facilities, with about 1,071 thousand gallons saved at the Riverview Campus, and about 697 thousand gallons at the Global Headquarters.

Both Whirlpool building projects also save energy. The Riverview Campus features a central plant heating and cooling system with a building management system, and has high-efficiency interior and exterior lighting. Both buildings make good use of open space, which reduces heat island effect and increases stormwater infiltration. The Global Headquarters has almost 284,000 square feet of vegetated green space outside.

General Motors is another company that gets the importance of green building. In 2013, the car company joined the Department of Energy’s Better Buildings partnership, a group of over 900 organizations with the goal of becoming 20 percent more energy efficient over the next decade. Companies participating in the partnership are committed to cumulatively reduce carbon emissions by 3.47 million metric tons and save $3.1 billion. GM’s participation has resulted in significant water savings; it surpassed its Better Buildings challenge of reducing water intensity by 20 percent by 2020 by reducing it by 28 percent.

GM’s Flint Assembly plant will soon use reverse osmosis (RO) machines during the purification process. The RO machines will create a stream of highly concentrated waste water that the plant will use to help filter air in the paint booth instead of sending the waste water to industrial waste. The process will save the plant 7.5 million gallons of water and $100,000 a year. There are other GM facilities that use RO reject water in a similar manner.

Green buildings save water, energy, reduce carbon and bring cost savings. Whirlpool and GM show how business can lead the way in caring for the environment through greening their buildings.

Photo: Whirlpool Corporation

Sources

https://www.usgbc.org/articles/business-case-green-building

https://www.usgbc.org/articles/green-building-facts

http://www.wncgbc.org/about/importance-of-green-building

http://3blmedia.com/News/Better-Buildings-Conserve-Water-and-Cash

Coal-Fired Power Plants Cost U.S. Consumers $10B a Year

According to the London-based think tank Carbon Tracker, the shuttering of unprofitable and uncompetitive coal-fired power plants across the U.S. could save consumers as much as $10 billion a year by 2021 while increasing the country’s competitiveness.

Carbon Tracker’s analysts claimed they used deeply conservative assumptions in reaching this conclusion. They did not include any costs associated with the Clean Power Plan, nor did they figure any potential carbon taxes or prices into their analyses. The sole environmental regulation they incorporated into their framework is the Clean Air Act, which dates back to 1970 and the Nixon Administration.

The organization’s modeling was based on revenue requirements approved by regulators, while costs associated with coal plants were valued based on their costs relative to the turbines typically used in natural gas-powered plants. The authors found that, at a macroeconomic level, consumers are paying too much for an energy source that has become too expensive and inefficient. Most of the higher costs are attributed to the fact that approximately two-thirds of the nation’s coal plants are “regulated,” and in effect, they receive government-approved prices that cover their costs. Those costs for supporting these uneconomic coal plants, in turn, are passed onto consumers, not shareholders.

“Uncompetitive coal power is being subsidized by an out of date regulatory framework,” they wrote.

Hence, Carbon Tracker concluded that by the mid-2020s, it would be cheaper for utilities to build new combined cycle gas turbines (CCGT) than continue operating 78 percent of existing coal power plants. Meanwhile, the increased efficiency and decreased cost of onshore wind and utility-scale solar power installations are will offer additional competitive alternatives to coal.

“It would be much cheaper to build a new gas power plant than continue running coal power plants,” explained a Carbon Tracker spokesperson to TriplePundit via email. “Consumers end up paying the extra cost through their bills, and by 2021 this will reach $10 billion a year.”

One overarching goal of this study, which Carbon Tracker publicly released this week, is to arm investors with another tool in their kit as they advocate for an accelerated transition away from coal and in order to ensure that their portfolios are aligned with the Paris Accords to keep global temperatures rising no more than 2°C this century. Yet, Carbon Tracker insists there are other benefits from turning towards natural gas and renewables.

After all, the rapid decline in the cost of clean energy technologies has occurred while the natural gas boom has kept prices at record lows, giving these newer power plants a remarkable economic advantage over coal-fired power plants. Meanwhile, the efficiency gains have resulted in reduced demand for load growth, as competition between power generation technologies has intensified. This evolution suggests that the national grid is also ready to make a huge structural change.

Nevertheless, energy markets have long been highly politicized, especially during this current presidential administration. Advances in technology and disruptive changes in business models are often undermined by the regulatory environment in which power generators and suppliers function, says this report. Therefore, from Carbon Tracker’s point of view, a commitment to reducing global temperature rise below 2°C by mid-century would save American utility customers money while streaming the U.S. economy and allowing it to become more competitive. Such a scenario, however, will only unfold if regulation can catch up with the rapid structural changes that have occurred over the past several years. Carbon Tracker is cognizant that it would not be realistic set an arbitrary deadline and make sure all coal disappears – but the report’s authors insist that this transition needs to start as soon as possible.

“Regulated utilities have long been considered safe assets,” concluded the report. “This can no longer be taken for granted, as investor-owned utilities keep high-cost units operating by using regulation to push additional costs on to consumers.”

Image credit: Roy Luck/Flickr

Philip Morris Intl. Comes a Long Way, Shifts to Smoke-Free Products

“You’ve come a long way baby,” was the slogan long used by the Philip Morris brand Virginia Slims when it started marketing cigarettes to women in the late 1960s. Since then the company has morphed several times, with Altria focusing on the U.S. market while Philip Morris International (PMI) markets its products in roughly 180 countries.

Now PMI says it has come a long way as it seeks to transform its business into one that will mostly market and sell smoke-free products. The Switzerland-based conglomerate announced its long-term plan in its most recent sustainability report, the second one the company has issued following the guidelines set by the United Nations Global Compact.

PMI’s pivot comes as tobacco companies are becoming even more harshly criticized for their aggressive tactics in countering anti-smoking campaigns in developed and developing countries alike. The company found itself in the eye of this storm earlier this decade with its lawsuit against Uruguay’s government over its anti-smoking regulations; the global outcry finally stopped when an international court ruled against PMI last year.

The company does not mention the Uruguay snafu at all in this report, but it is clear PMI is facing political and market realities. To that end, PMI insists its work is strongly aligned with the UN’s Sustainable Development Goals (SDGs), summed up in this assessment that would have been unthinkable for a tobacco company to utter only a few years ago: “Smoking cigarettes causes serious disease.”

Hence PMI’s focus is on five SDGs: health, zero-hunger, economic opportunity, responsible consumption and fighting corruption.

So what is a company that in 2016 made 800 billion cigarettes and sold them to 150 million customers going to do?

PMI says is has so far invested $3 billion dollars in research to understand adult smokers’ behavior. And that work has translated into an aggressive program to develop and sell smoke-free products. In a campaign that offers an eerie resemblance to Apple, the company is pinning much of its future on the iQOS vaporizer. The product is currently available in 25 countries and is used by 3 million consumers; PMI claims 8,000 smokers are making the switch daily.

PMI acknowledges that these vaporizers contain nicotine and can be addictive. But from the company’s point of view, this business transformation balances the needs of the company to remain viable while proving that it can be supportive (or at least stay out of the way) of countries’ public health initiatives. Over the next decade, PMI seeks ambitious growth in this iQOS product line:

“It is our ambition that at least 30 percent of our consumers who would otherwise continue smoking switch to our smoke-free products by 2025. We project that by 2025, at least 40 million PMI cigarette smokers will have switched to smoke-free products.”

The company also concedes that quitting any use of tobacco products is the best interest of one’s long-term health. Nevertheless, do not expect PMI’s marketing efforts to reflect that sentiment:

“Our goal is to switch every adult smoker who would otherwise keep smoking to smoke-free products such as IQOS. We are committed to supporting adult smokers in their switching journey through education and guidance.”

The rest of PMI’s sustainability agenda is formulaic and largely attuned to ensuring that the company stays compliant in the markets in which it does business. For example, the company has promised an aggressive program monitoring agricultural labor conditions within its supply chain. “Science-based targets” are behind the company’s long-term goals to reduce emissions 40 percent by 2030. And PMI claims it has a rounded kit in place to guarantee that employees stay motivated and engaged.

Critics of the tobacco industry will find plenty in PMI’s sustainability report that at the very least, will elicit an eye roll or two. But give the company credit for striving to be part of this global conversation on sustainability and responsibility.

Image credit: Unsplash

From Gas Stations to Grid, Will Florida Rebuild After Irma -- Or Reinvent?

The full impact of Hurricane Harvey has barely settled into the nation's consciousness, and it has already been overshadowed by Hurricane Irma. That's partly because Irma has impacted the fuel and electricity infrastructure over a much broader area than Harvey, engulfing practically the entire state of Florida with winds of damaging force and multiple areas of flooding.

Large swaths of the energy infrastructure in Florida will have to be reconstructed, practically from scratch. The question now is whether or not state policymakers will seize the opportunity to adopt 21st century technology, or simply rebuild along the same conventional models that have served the nation relatively well for the past 100 years or so.

After Irma: gasoline shortages and the electric vehicle question

To be clear, electric vehicles would not have alleviated the massive traffic jams that prevented many from fleeing out of Irma's path when evacuations were ordered.

In the context of today's central power generation model, electric vehicles would also succumb to the fueling problem wherever power lines are damaged and power plants are incapacitated.

Laura Bliss of CityLab (an Atlantic Monthly publication) has a detailed rundown of the gasoline situation in Florida, and she also notes that electric cars are not necessarily a better alternative when mass evacuations are ordered. Bliss suggests that buses may be the most effective evacuation solution.

As for recovery in the aftermath of Irma, a distributed power generation model would give electric vehicles an edge, but that would depend on the extent of damage to individual solar or wind installations, and the pace of repair work. Rooftop solar, for example, would not be of much help in the aftermath of a storm that destroys an entire house.

With that in mind, let's look at the availability of conventional gasoline fuel in the aftermath of Hurricane Irma:

Bliss sets the table:

In Gainesville, some 45 percent of gas stations are running dry as of Wednesday. In West Palm Beach, it’s 50 percent. And the price of gas has jumped nearly 30 cents on average—and that’s without the widespread price gouging that plagued Florida this past weekend.These are the tough realities Floridians who evacuated in the face of Hurricane Irma last week even as they begin to return home. An unprecedented six million fled from the Category 5 storm, the largest evacuation in U.S. history.

Bliss explores the question of why Florida's gasoline infrastructure was stretched so thin before, during and after Irma.

The chief factor was time. Much of Florida's gasoline is shipped from Texas refineries, and many of those were impacted by Harvey. In addition, at least one Florida supplier cited by Bliss was diverting supplies from storage over to Texas, to help alleviate fuel shortages there in the aftermath of Harvey.

In advance of Irma, Florida officials scrambled with fuel industry stakeholders to build up supplies, with fuel coming from as far away as Europe. However, the evacuation orders motivated a surge in demand that overwhelmed capacity.

Bliss also notes that even without illegal price gouging, the retail price of gasoline tends to shoot up in shortage situations in tandem with increases in wholesale prices.

In sum, mass ownership of electric vehicles may not prevent traffic jams in a large scale evacuation, but distributed power generation -- combined with energy storage -- could provide EV owners with more opportunities to fuel up in the aftermath of a storm and get recovery under way more quickly.

The vulnerability of central power plants

With the EV question in mind, the availability of electricity in the aftermath of a storm takes on increased urgency.

Jeff St. John of GreenTech Media provides a rundown of Irma's destructive path, citing more than 6.1 million utility customers still without power in Florida, Georgia and South Carolina as of earlier this week.

Though more than 50,000 utility workers were brought in to help out local crews, access to power lines has been hampered by downed trees, flooding and storm surges.

Parts of the grid were damaged so severely that industry officials foresee that the restoration process that could take weeks if not months in some areas.

As described by St. John, Irma also exposed shortcomings in the grid hardening plans that utilities have been developing over the past several years. Florida Power & Light is one example:

FPL, a subsidiary of NextEra Energy, has been preparing for future storms as part of its $3 billion grid infrastructure investment program, which included more concrete poles to replace wooden ones, flood monitoring for low-lying substations, and smart meters that can, among other things, report outages. But...Hurricane Irma brought winds that could “snap a concrete pole” and overwhelm flood protections for underground distribution systems.

CEO Eric Silagy as much as admitted that the conventional grid model is outdated, regardless of how hardened it is:

“We have the strongest, most highly engineered, smartest grid in the U.S., but there is no way to engineer against a storm of this kind of magnitude," he said.

Trump Administration touts the solar solution -- no, really

More likely than not, Florida utilities will carry out their existing grid-hardening plans, perhaps with some modifications, in the interests of restoring power to millions of people as soon as possible.

In the long run, though, both Irma and Harvey will motivate utilities and their customers to take a closer look at renewable energy, distributed power generation and energy storage options that could be up and running quickly in the aftermath of a hurricane or other severe event.

Energy storage in the form of hydrogen for fuel cells could also play an increased role in the sustainable grid of the future.

Interestingly, this week the Energy Department dropped a not-so-subtle hint about the direction in which the Trump Administration would like to see utilities go in Florida and elsewhere.

In a splashy announcement timed with the Solar Power International converence in Las Vegas, the Energy Department released word that President Obama's 2020 "SunShot" goal for reducing the cost of utility-scale solar has been achieved three years ahead of schedule -- and that the agency will now focus more attention on grid resiliency and renewable energy integration.

Trump appointee Daniel Simmons, who is the Acting Assistant Secretary for Energy Efficiency and Renewable Energy, made the announcement. Simmons came to the Energy Department from the fossil fuel industry but he seems to have adjusted his thinking:

“With the impressive decline in solar prices, it is time to address additional emerging challenges...As we look to the future, DOE will focus new solar R&D on the Secretary’s priorities, which include strengthening the reliability and resilience of the electric grid while integrating solar energy.”

Considering Trump's history of unfamiliarity with the details of his own policies, it's not clear that the president is actually aware that his administration has just made a full on commitment to integrating more renewables into the nation's grid. However, that is in fact the policy that the Energy Department has been pursuing ever since Trump tapped noted wind energy fan and former Texas governor Rick Perry to head up the Energy Department.

Though emergency repairs in Florida and elsewhere may follow conventional lines in the short term, it's a safe bet that Perry will leverage Irma and Harvey to push grid reconstruction in a more sustainable direction over the long run.*

Image (cropped): NASA via US Department of Energy.

*Readers please note: Perry has been a steadfast champion of renewables as Energy Secretary despite Trump's pro-coal rhetoric, but his legacy of anti-women policymaking continues to take a toll on women's health in Texas.

Planetary Boundaries: What Are They and How Do They Relate to Business Education?

By Keary Shandler

To stay out of ‘damage-control’ mode, today's business needs to be tuned into a nexus of complex global systems integrating economic, societal and environmental relationships. If business needs to operate differently, then we need to teach business differently, taking up the opportunity to foster interconnectivity of knowledge and critical thinking between disciplines.

Educating business leaders on science is vital.

The impact of climate change is not happening ‘over there’ to someone else. It’s happening in our own backyard, today. For the first six months of 2017, the United States alone experienced losses in excess of $1 billion as a result of nine weather and climate disaster events. With the recent devastation of hurricanes Harvey and Irma, record-breaking statistics achieved in 2016 have now been surpassed. These threatening events not only affect local, regional and national markets, but reach far beyond to global economic scales. Whether your belief that extreme weather events are a result of increased global temperatures or not, as an industry or a business, it’s practical to consider the long-term economic impact. Given enough of these occurrences, businesses and entire industries, may reach points beyond recovery. That translates to no longer being able to afford a simple mitigation approach in business. Global sustainability needs to be a consideration in order for business sustainability to even be entertained - without our natural capital, what other capital do we need to worry about?

In CSR-world, we often cite the “people, planet, profit” tag line. From a hierarchal perspective, most businesses still have the priority of “profit, people, planet” You can play the shell game with these words all you want but if you don’t have “planet” first in the lineup, you can forget having to worry about anything beyond that. Simply put, if we continue to trespass beyond the operating limits of these boundaries, conducting business is the least of our worries.

Over the past two years, a group of passionate business school educators (in Dubai, Perth, Singapore and Munich), have daringly introduced MBA students to the nine Planetary Boundaries concept, "within which humanity can continue to develop and thrive for generations to come."

Traditionally, business students analyse case studies and translate knowledge into academic essays. These types of assessments have value in connecting ideas and theories in a largely abstract context. If we are serious about promoting a fundamental change in behaviour, we need to immerse students in the reality of the issues beyond hypothetical scenarios. This is where we have strived to push the boundaries with an arts-based assessment within our MBA programmes, utilising creativity to generate increased knowledge.

Our assessments asked students to form groups and create a 10-minute video using their smartphone, connecting one or two of the planetary boundaries with industry. This film-making process became an extremely powerful tool in understanding the complex relationship between business, ecological and social environments. Importantly, it helped students realise that all three systems should be collectively considered in business decision making.

By venturing off campus and physically getting their hands dirty, students were literally able to ‘reframe problems through a new lens’. This is an appropriate metaphor as this new perspective on scale (time and place) became an undeniable reality to them. Through the experience, the hard truth sunk in - this ‘climate change thing’ wasn’t such a distant notion. The mental link was made on how extreme weather patterns were more frequently disrupting supply chains, erratically influencing profit margins and challenging operations. Further pennies dropped with the realisations that clean water comes at a tangible cost and that chemical run-off from excessive use of fertilisers, negatively impacts coral reefs and native marine life hundreds (if not thousands) of miles away, in turn impacting food prices, tourism revenue and employment figures. The interconnectivity of these witnessed relationships was seen, heard, smelt, touched and emotionally experienced. This is a level of learning that cannot be achieved through writing a business report.

We are seeing heartening evidence as to how this assessment type is making an impact on the thinking of future business leaders (this is the goal by the way). Some students are already in strategic roles and making changes, creating initiatives and having those educational conversations. The conversations are important steps to help shift corporate behaviour from short-term reactionary thinking to adaptive and transformative mechanisms of resilience.

As business school educators, our understanding of the complexities is often imperfect. However, it remains our responsibility to learn how we can create effective communication of science. Evidence needs to be understood by business (which doesn’t mean dumbing down the science) and that requires working together with scientific communities.

We recently took a bold step in this direction and presented our film-making results at Resilience 2017 – an event that brought together scientists, policy makers, practitioners and academic-types in Stockholm, to discuss challenges and opportunities for global sustainability. It’s clear that business education has a responsibility to explore diversified learning methods and to help create a new social contract with the very systems that have enabled us to prosper. We will continue to use the planetary boundaries to bridge the gap between business and science, aiming to produce responsible business school graduates and global Earth stewards.

Keary Shandler is an affiliate lecturer at Murdoch University Dubai.

Black Girls Code and General Motors Partner for STEM Opportunities in Detroit

It says something when a not-for-profit organization directed at shaking up diversity numbers in the tech industry can choose its donors. This week, Black Girls Code Founder Kimberly Bryant released a statement acknowledging that the six-year-old organization had made its decision: It would accept a $255,000 grant from General Motors. The organization also acknowledge in a separate announcement that it had turned down a $125,000 grant from Uber.

According to Bryant GM's funding will help a strategic goal for Black Girls Code: It will “lay a foundation to fully engage girls of color in Detroit.”

For GM, it's an opportunity to "help build the next generation of STEM leaders," said GM CEO Mary Barra, an effort that GM sees as part and parcel with an "emphasis on expanding opportunities to women and other underrepresented groups."

Only about 9 percent of the automotive manufacturing labor force comprised women of color in 2014, according to a 2015 Deloitte study. The research also found that the automotive industry has one of the worst records when it comes to hiring and retention of women in tech positions.

GM recognizes that the automotive industry's future will include innovations like the self-driving car and electric vehicles, both which will need new, young talent to meet the competitive edge of developing technologies. GM's donation to Black Girls Code and its partnership in developing opportunities for women of color is part of its broader commitment to STEM education, according to TechCrunch, which puts GM's donations to date at about $10 million.

In the coming months, Black Girls Code will be busy in Detroit. In November it will be offering a robot expo to engage school-age girls in the opportunities in STEM, setting the groundwork for a new shakeup of diversity numbers in the old but ever-changing automotive industry.

Image: Flickr/ITU Pictures

How to Conceal with Flair: NRA Hosts First-Ever 'Fashion Show'

Americans have a rich but peculiar relationship with guns. Their mystique became the stuff of wild westerns and spurious tales of gutsy gangsters, while in real, more modern life, communities often find themselves wrestling with the darker, tragic ramifications of romancing gun ownership.

Accidental (unintended) shootings kill as many as 1,300 children a year, according to a study conducted by researchers at the Centers of Disease Control and University of Texas. The statistic, which doesn't include the number of adults that are killed or injured by accidental misuse of a gun (or the number of kids treated and released -- 5,700/year), underscores the odd contrast between American's concept of guns and the true impact of their use.

That dichotomy in thinking came home to rest this last week in South Florida when police were forced to issue an alert to residents not to "shoot at Irma." What started as a Facebook posting urging like-minded Floridians to "show Irma we shoot first" quickly became a social media blitz. The poster said he was only joking and never imagined some 5,600 gun-toting people might actually agree to turn up at the social function. But it forced the Pasco County Sheriff's office to publish a graphic, detailed drawing of just what happens when you shoot live ammunition toward the eye of a hurricane: it is projected back out in fury.

To clarify, DO NOT shoot weapons @ #Irma. You won't make it turn around & it will have very dangerous side effectshttps://t.co/CV4Y9OJknv

— Pasco Sheriff (@PascoSheriff) September 10, 2017

While there is no evidence that anyone was injured by stray bullets, the idea that unhappy residents could demonstrate their resolve by shooting live ammunition into a wind tunnel as it moved across homes will likely leave even more fodder for sociologists who want to understand why guns are such an important symbol of American identity.

And so will last month's remarkable runway fashion show, hosted by none other than the National Rife Association (NRA). On August 25, attendees were treated to an unusual pageant. This time it wasn't the dress that was sparking the attention but the convenience of accessory.

The NRA Carry Guard Expo, held in Wisconsin, sported guns and holsters alike, promoting the idea that as Quartz Magazine quoted, "you can always be fashionably packing."

"This event will equip novices and experts alike with the products, skills, knowledge and mindset necessary to be prepared and respond when a threat arises," announced the NRA on its blog. More than 50 different products from gun and concealed holster manufacturers were on display, promoting the idea that gun-toting fits just about anywhere and any kind of American fashion.

An increasing number of state laws have endorsed that thinking as well. Florida is among the states that regulate concealed weapon permits, but has a "no discretion" clause, which means an agency can't deny an individual's right to conceal a weapon if he/she meets certain criteria. Another 12 states don't require individuals to obtain a permit in order to conceal a weapon.

One writer from ConcealedCarry.com noted astutely that all of the models carried dummy guns and wondered why, if the NRA was promoting a fashion show that encouraged the idea that it was safe to concealed weapons, all of the the models were forced to carry "a blue hunk of plastic" rather than the real thing.

"The guns in the showroom have all been checked and tagged as safe and inert. Not sure why those can't be on the runway of the fashion show," he pondered.

At the end of the catwalk demonstration, guests had the opportunity to vote on the top three concealed weapon items. The NRA hasn't released the results (or, as far as I could find, how many people actually attended the event), but this week's blog does have a new product to entice gun lovers: a shot glass sporting its very own .308 caliber bullet wedged in its side.

"The NRA Point-Of-Impact Shot Glass is the perfect item for any firearm enthusiast," boasts the NRA.

Gun enthusiasts can now hide the gun and sport the bullet as they toast the technology that affords both.

Image: Flickr/Ibro Palic/aliengearholsters.com

After Trump's Paris Debacle, Leading Companies Go Full Steam Ahead on Renewables

SED-Post-Paris-Infographic-FINAL

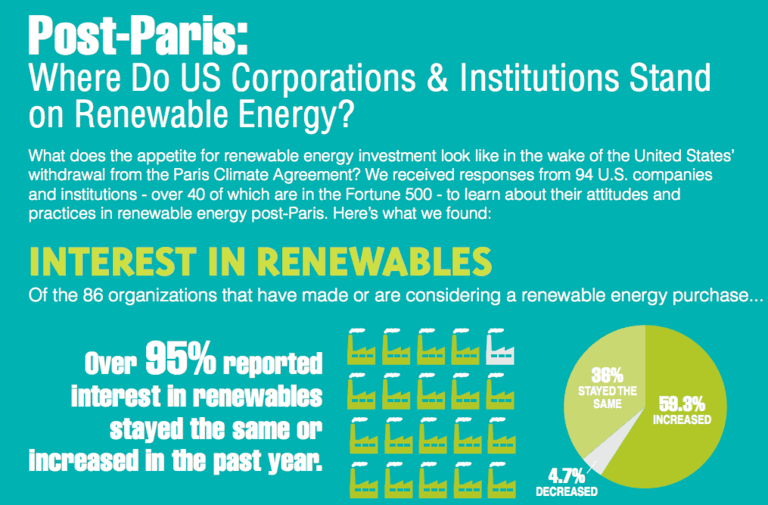

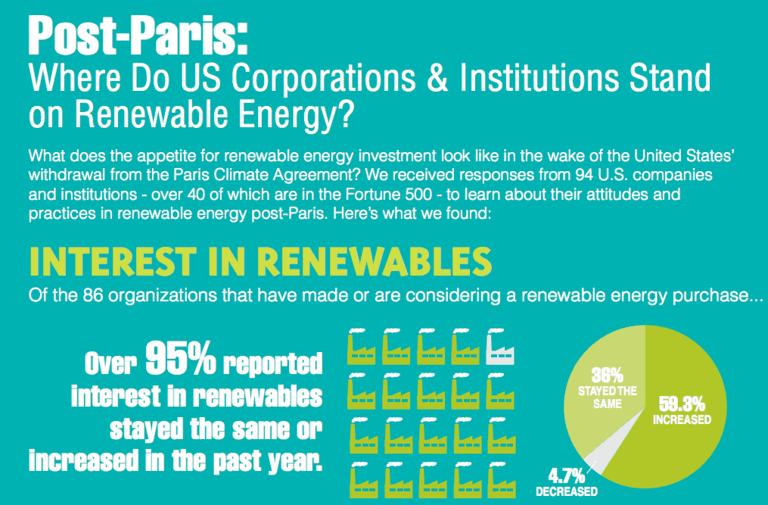

President Donald Trump announced that the U.S. would renege on its commitment to the Paris Agreement on Climate Change last June, and back then the conventional wisdom was that the world would simply move along without him. Since then there have been many indications that the conventional wisdom was actually right. In the latest development, a new survey of 94 major corporations and institutions demonstrates a strong commitment to renewables -- including a "leapfrog" effect that bodes well for future progress.

The survey was conducted by the information and research platform Smart Energy Decisions. The firm specializes in commercial and industrial power users and the respondents were primarily based in the US and Canada.

Nope, it's not the green branding

Green branding is often cited as an important factor in renewable energy investment by businesses, but that factor was more motivating several years ago, when the cost of renewables was generally higher than the cost of fossil fuels.Now that renewables are competing on costs, companies are more interested in the bottom line benefits.

That development is clearly reflected in the findings of Smart Energy Decisions.

The firm garnered survey responses from 94 corporations and institutions shortly after Trump's announcement of the Paris withdrawal, which occurred on June 1. A good 40 of the respondents are included in the Fortune 500 list.

Here's the rundown from Smart Energy Decisions:

Energy cost reduction was the single most important factor for 29.1 percent of organizations that already purchased or are interested in purchasing renewable energy, followed by meeting GHG reduction targets (25.6 percent) and meeting renewable energy targets (16.3 percent).

Green branding does not disappear entirely off the map. A decent proportion of survey respondents -- 8.1 percent -- selected brand image as "the most important factor" influencing their renewable energy buys.

Consumer demand also continues to play a role, though a relatively small one. Almost 6 percent of survey respondents cited consumer demand as the most important factor driving their interest in renewables.

Leapfrogging to renewables

Another finding with good implications for future progress is that companies dipping their toes into renewables for the first time are not taking a leap into the dark. They are taking to heart lessons learned from the early adopters:

Buyers new to renewable energy are “leapfrogging” straight into methods that used to only be prevalent among more mature buyers. For respondents considering a first purchase, the two most-favored methods were onsite power purchase agreements (61.1 percent) and offsite power purchase agreements (44.4 percent). This is in contrast to lower figures for methods that used to be more common among first-time buyers, including onsite, self-owned assets (38.9 percent) and renewable energy certificates (16.7 percent).

The leapfrog effect also seems to be nudging the industrial sector toward renewables. According to Smart Energy Decisions, commercial companies dominated the field of early adopters, but the survey responses indicate that the industrial sector is "gearing up to enter the market."

Smart Energy Decisions has been hearing "chatter" about industry moving toward renewables, and the survey backs that up. Of the industrial companies surveyed, 22.2 percent were considering their first renewable energy buy.

That's especially significant in light of the high electricity load borne by industrial operations compared to the typical commercial firm:

...we have seen a number of large, energy-intensive corporations such as Corning, General Motors, and Toyota announce ambitious renewable energy and/or carbon reduction goals. The potential impact of a broader number of industrial companies turning to renewable energy for their electric supply is significant, as their electric loads far outweighs those of the commercial sector.

Leading companies consider the leap to renewables

Yet another interesting feature of the new survey is that it included respondents that have not yet made renewable energy purchases.

Though by far the lion's share of respondents already have renewables in their pocket, a fairly large proportion -- 19.4 percent -- reported that they have not yet made a renewable energy purchase.

And now for the good news: All of those respondents reported that they are "currently considering" renewables.

As for companies that are already invested in renewables, it looks like the Trump effect caused barely a ripple. Recall that the survey was literally taken within days after Trump announced that the U.S. would withdraw from the Paris Agreement:

Among organizations that already purchased or are interested in purchasing renewable energy, over 95 percent reported interest in renewable energy, stayed the same (36 percent) or increased (59.3 percent) in the past year.

What about climate change?

The new survey also demonstrates the power of goal-setting.

Thousands of companies have already committed to reducing greenhouse gas emissions, and the survey indicates that bottom line considerations are closely entwined with climate change awareness on a corporate level.

Among the group of companies currently invested in renewables, a significant proportion of almost 71 percent had already established a target for reducing greenhouse gases, or they already had a target for transitioning to renewables.

Underscoring the point, a healthy minority of respondents -- 32.6 percent -- had already established targets for both.

In addition, the survey indicates that leading companies are committed to progress, with more than 47 percent of respondents committed to an ultimate goal of 100 percent renewables.

The survey is embargoed as of this writing, but here's a taste indicating that the pace of renewable energy investment is bound to accelerate:

...while leading edge corporate buyers have received much of the attention related to their renewable energy sourcing, the market is broadening and a critical mass of corporate buyers are beginning to enter the market. The survey results show that a signicant number of responding companies were considering their first deal...

In another positive finding, the survey indicates that smaller companies, which previously were relatively hesitant to enter the renewable energy market, are ready to jump on the bandwagon:

...while leading edge corporate buyers have received much of the attention related to their renewable energy sourcing, the market is broadening and a critical mass of corporate buyers are beginning to enter the market...a significant number of responding companies were considering their first deal, including those with smaller relative energy spending (early movers were typically large companies with large energy budgets)...

That development could be attributed to any number of factors. Aside from falling costs, renewable energy technology has matured, energy storage has smoothed out sourcing spikes and dips, and financial arrangements have also become standardized.

The takeaway: When an unstoppable force meets an immovable object, sometimes the unstoppable force just wins.

Image (screenshot): via Smart Energy Decisions.