In Madagascar, A Waterless Toilet May Provide a Global Solution

If there is one technology that symbolizes the global water sector’s future struggles, it would be the toilet. While there have been plenty of advances in farming irrigation and water purification, toilets are still stuck in a Victorian-era time warp. Granted, sanitation is improving across the world. In 1990, only 54 percent of the world’s citizens had access to flush toilets or covered latrines; the World Health Organization says that as of 2015, that metric has improved to 68 percent.

But the fact that toilet technology has not changed much in over 150 years poses several challenges as more countries cope with scarcity of clean water for drinking -- never mind flushing. “The business opportunity of the decade,” is how one TriplePundit contributing writer described the need for scalable and sustainable toilet technology two years ago. That opportunity may very well be alive and well in Madagascar right now.

Loowatt is a startup based in the United Kingdom that has been selling its waterless toilets in Madagascar since 2012. At first glance, Loowatt’s contraption looks like the familiar western toilet. But upon flushing, instead of water, the toilet emits a biodegradable film that envelopes the human waste and then stores it within a large cartridge underneath the unit. The company says its technology eliminates any odors or mess commonly associated with the unsightly and smelly pit latrines. Owners of the toilets can arrange to have the storage cartridges emptied weekly, or more often depending on the frequency of use, and they can also request service via text message. Currently 100 families in the country’s capital, Antananarivo, subscribe to Loowatt’s system.

After all that poo is collected, it is then transported to Loowatt’s biodigester, which processes the waste into liquid fertilizer, compost and even some electricity – well, at least enough power to recharge some cell phones. According to Lina Zeldovich of Quartz, the waste deposited by the approximate 800 people each month creates six tons of fertilizer. The alternative, explained Zeldovich, is for that human waste to end up in a local lake.

Water shortages are not necessarily an issue in Antananarivo, which receives anywhere from seven to 20 days of rainfall a month, depending on the season. The challenge is that across much of the island country, the country has a high water table – in fact, that groundwater allows many of the country’s citizens to grow rice on their property. The problem with flush toilets, therefore, is the constant risk of contamination. And the commonplace pit latrine toilets, while a definite step up from open defecation, are not the best solution for Madagascar, either, as their maintenance is often expensive and fraught with health risks.

Could Loowatt’s technology succeed elsewhere? Civic leaders across the U.S. have touted low-flow toilets as the solution to tackle current and future water woes. The problem with those toilets, however, is that most plumbing relies on the “oomph” of a large flush to shove all that waste through municipal water treatment systems. Add a few “flushable” baby wipes into the mix, and the results are creaky water systems all over the U.S. – discharging water at a rate that ends up negating the water savings from the snazzy new water-efficient toilets.

Whether these Loowatt toilets are used in the parched U.S. Southwest or coastal areas threatened by sea-level rise, they could offer a solution to the wasteful and ineffective toilet. The big question mark, however, is scalability. Zeldovich noted that the Loowatt service in Madagascar costs residents about $4 a month – that price would be exponentially higher in the U.S. and other advanced economies, and then there awaits other challenges such as local regulations and consumers’ queasiness.

But within an industry that poses countless questions but offers few answers, Loowatt is far ahead of the pack. In addition to many accolades and awards, Loowatt has received a $1 million grant from the Gates Foundation, which has conducted a global “Toilet Challenge” since 2011.

Image credit: Loowatt/Facebook

Health Impacts of Climate Change Happening Now

By: Kate Harveston

The pollution that causes global warming also causes several health problems, and climate change’s impacts can have a damaging effect, too. As policy makers, scientists, environmental activists and others work to convey the importance of climate change, some are beginning to focus less on saving the polar bears and more on global warming’s effect on human health.

Doing this may enable organizations to garner more public support for their environmental initiatives.

Climate change and health

Climate change’s negative impact on human health isn’t something that only a few environmental activists have claimed. Several respected medical associations recently teamed up to form the Medical Society Consortium on Climate Change and Health. Their mission is to spread awareness of the impact of global warming on public health.

The health effects of climate change occur due to pollution and risks associated with high heat and extreme weather.

Most Americans live in a county with an unhealthy amount of contamination in the air, according to a list put together by the American Lung Association. These threats are serious. The World Health Organization (WHO) estimates that pollution could be linked to 7 million premature deaths in just one year and can lead to increased instances of heart disease, stroke, COPD, lung cancer and asthma.

Not only can the same pollution that causes global warming result in health problems, but the higher temperatures that occur as a result can also lead to increased levels of smog, creating a vicious cycle.

As global temperatures continue to increase, heat-related health risks will also continue to rise. Heat waves are already occurring more often and are leading to hospitalizations, heat strokes, wildfires and in some cases, death.

Public health and public support

The impacts of climate change on human health are certainly real, and focusing on them more when talking about environmental initiatives can make the need for that program feel more real to some people, too. The latest research suggests focusing on public health rather than environmental concerns is more useful for garnering public support.

This may be because talking about how the state of the environment impacts an individual makes the issue hit much closer to home. It’s easier to think about it in relation to your everyday health and the health of those you know and care about than in terms of the more abstract idea of the environment or planet. It encourages people to think about climate change’s impacts on where they live as opposed to a polar bear thousands of miles away.

For example, an activist working in manufacturing — might be interested in getting his management team on board with cleaner, safer standards of operation. In an attempt to convince the boss that it’s necessary, the activist may focus on the hazards that chemical waste causes to human health, as opposed to, say highlighting all the fish that die when a toxic spill is dumped into the ocean.

It may seem dark, but many businesses simply aren’t worried about the environment and being eco-friendly. Health impacts are more immediate than changes in the climate. Environmental changes take a long time to occur, and the people talking about climate change will not live to see most of the impacts they discuss.

Health risks are relevant today, so they feel more urgent and real. An incentive related to people all of a sudden becomes a company-wide healthy living initiative. It’s good for morale and shows that the company is concerned for the well-being of its employees.

How to talk about the environment and health

Whatever the reason, it’s clear that talking about impacts on the environment is not as effective as it needs to be, at least with some sects of the populations. Talking about environmental initiatives in a way that emphasizes specific and immediate impacts can change the way people respond.

When communicating about a new environmental initiative, tailor it as much as you can to the people you’re speaking to. Mention local health issues, landmarks, industries or ways of life that may be impacted because of global warming.

While you should keep it personal, be careful not to place blame on the people you’re speaking to, attempt to shame them into action or scare them with tales of doom and gloom. This will probably turn them off from what you’re trying to accomplish.

Instead, stay realistic, grounded and let people know how helping the environment can help them, too. This isn’t to say you should ignore the science, just make the issue as relatable as you can while sticking to the facts. If you do this, you might find you’ll get a much stronger response to your environmental initiatives, or as you could fittingly choose to call them, public health plans.

Kate Harveston is a political blogger and activist. She takes a special interest in anything related to the environment and policy reform. If you like her writing, you can follow her on Twitter or subscribe to her blog, Only Slightly Biased.

Image credit: Jayel Aheram, Flickr

Air cleaning technology to be trialed at London bus stops, courtesy of The Body Shop and Airlabs

Record green energy levels not an existential threat to UK utilities

Deloitte Survey: Employees Need to Know Volunteerism Matters

This post was sponsored by Deloitte as a part of a larger editorial package. It went through our normal editorial review process.

An increasing number of businesses are discovering that volunteerism is an important part of their corporate social responsibility program. It's not only good for the local community and improves the corporate brand, but it's a powerful tool for increasing engagement in the workplace.

Yet a surprising number of employees in today's marketplace don't realize that their volunteer activities can lead to career opportunities and valuable on-the-job training. In a recent survey conducted by Deloitte Services, only 18 percent of respondents said they considered volunteerism to be a career-maker. Barely twice that amount saw volunteer activities as a way to gain valuable job skills.

Among corporate leaders, "there is a very strong belief, not only in Deloitte, but across corporate America, that [including] volunteerism on your resume... improves hireability," said Doug Marshall, managing director of Deloitte's Corporate Citizenship According to last year's survey, more than 90 percent of hiring influencers said they felt volunteerism can build skills. More than 80 percent said they would definitely hire candidates with volunteer experience.

Yet according to last year's survey of employees, only about 30 percent of job and advancement seekers make that volunteer work a part of their resume or curriculum vitae.

"So there is a disconnect between what employers think about the effectiveness of volunteering for the individual and how the individual sees it," said Marshall, who suggested that corporations may be sitting on a gold mine of opportunities to develop and enhance corporate citizenship opportunities within their workplaces.

"I think there is an opportunity for companies ... to do a better job of helping to educate our employees about the benefits of volunteering to them and making it more attractive and making it more accessible to them." He pointed out that research shows doing so helps tailor the very skills that are needed in a growing workplace.

While employee engagement wasn't a specific part of this year's survey, Marshall said that previous surveys, both by Deloitte and by other firms, have confirmed that employees feel volunteer programs help engage in the workplace, the teams they work with and the company's personal values and brand.

But the real indicator to companies that corporate citizenship programs speak to a brand's reputation is what applicants say motivated them to put in their employment application in the first place.

Eighty-nine percent of respondents in this year's survey said they believed companies that organize and support volunteer opportunities offer a better working environment than those who don't. Seventy percent said that volunteer initiatives are more likely to boost employee morale than other activities like company-organized happy hours.

What's more, volunteerism, said 74 percent of respondents, enhances the employee's sense of purpose.

The millennial message

It's an acknowledged fact that millennials in today's workforce have been a driving force in corporate social responsibility programs. Our grandparents' or great-grandparents' workplace, where employees went to work exclusively for the sake of the job and the paycheck is a thing of the past. Today, millennials don't just look for, they expect corporate responsibility engagement in their communities. And they expect that they will be able to be a part of it.

"Seventy-five percent of millennials [say] they would volunteer more if they understood the value" their contributions had on others, Marshall said.

At Deloitte, millennials comprise 57 percent of the workforce, and many are now in leadership positions. Marshall said the corporation hires thousands of workers a year, and that segment of the workforce helps shape the company's -- and the marketplace's -- understanding of what is intrinsically important to potential candidates.

Deloitte Impact Day

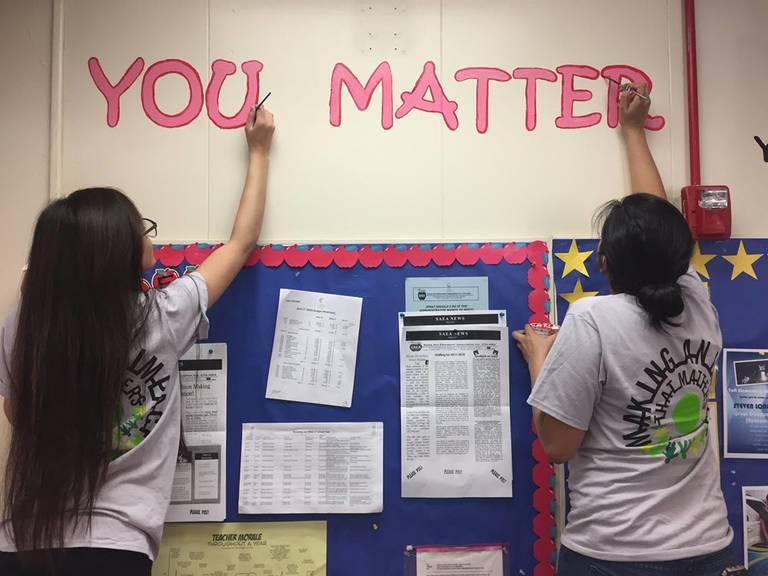

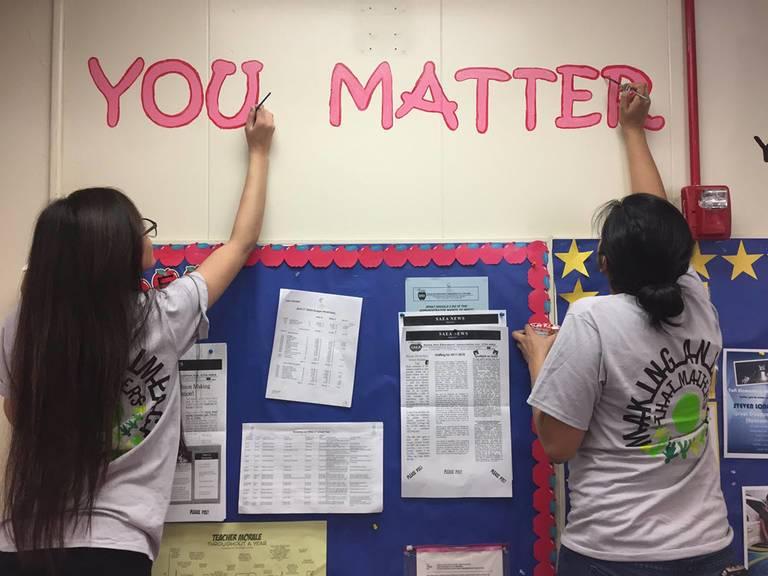

Deloitte's own commitment to corporate social responsibility goes back almost two decades, when it established its Impact Day program. Each year, the corporation sponsors as many as 1,000 volunteer events across the country, staffed by employees from its 80+ offices. And the program truly lives up to its name, said Marshall: This year's Impact Day, which took place June 9th and marked the program's 18th year of service, saw roughly 25,000 professionals participating in their respective communities.

Education and college readiness are key topics in Deloitte's Impact Day events, but volunteers have also participated in a broad selection of other initiatives that directly impact the needs and resiliency of their respective communities. Marshall said the topics are organized by volunteers, and anyone can suggest programs they feel would benefit from volunteerism.

"[The programs] are typically led by volunteers for volunteers in their local community, and that way people have a lot of leeway to find things that they are passionate about and that they can get other people passionate about to go do."

Marshall said the true takeaway from this year's survey results is underlying message that millennials are delivering when they say they don't volunteer as much as they would like. Sixty-nine percent of the respondents this year said that they don't have enough time to volunteer during the day; 75 percent confirmed would likely volunteer more if they understood the true person-to-person impact their philanthropy makes in their community.

"There are things that companies can do to help employees see that value," said Marshall and in so doing, shape the impact they have in the communities that value their brand and their success.

Images: Courtesy of Deloitte Services

Coal-Killing Renewables Take Aim at Nuclear Energy

The clean energy organization The Sun Day Campaign has picked apart the latest data from the U.S. Energy Information Agency, and the news is ominous for nuclear energy. For the first time since nuclear power plants began operating in this country 60 years ago, hydropower, wind, solar and other renewables accounted for more electricity generation than the nuclear fleet.

The Sun Day Campaign released its analysis on Monday and the timing is significant. This week is "Energy Week" according to the Trump Administration. In contrast to his vociferous support for coal jobs and the fossil industry, President Trump has been relatively silent on nuclear energy. The latest figures from EIA provide little in the way of motivation to start talking up nuclear -- especially not when you factor in rooftop solar for residential and commercial properties.

Renewables, rooftop solar and business stepping up

Before we get to the Sun Day analysis, consider that the story of renewables has been consistent for the past ten years, especially for new wind and solar technologies.

The story is simple: costs are dropping rapidly, with a consequent rapid increase in installation and generating capacity.

So far low cost natural gas has been the primary driver of coal power plant closings, but renewables are beginning to play a larger role.

Another aspect to the story is the rise in distributed, small solar. Small scale wind is also edging in, but the big news is the explosive growth of rooftop solar for residential and commercial properties.

The rise of rooftop solar makes an enormous difference in terms of the need to replace aging nuclear units and build new ones.

The U.S. Department of Energy presents a case for increasing nuclear power capacity based on a projected increase in domestic electricity demand of an average 1 percent annually.

However, in 2016 the Energy Information Agency updated its 2010-2040 electricity sales projection to an average increase of 0.7 percent annually, with this key observation:

Residential and commercial electricity sales would be 5.0% and 1.7% higher, respectively, in 2040 without the electricity generated by rooftop PV systems.

EIA also foresaw that energy efficiency would come into play, a factor that is especially evident in the commercial sector:

...Commercial sector electricity intensity (electricity sales per square foot of floorspace) is projected to decline 0.3% per year as total commercial sector floorspace increases 1.1% per year. Federal energy efficiency standards, as well as technological improvements in lighting, refrigeration, space heating, and space cooling, contribute to the decline in electricity intensity.

Now for the bad news...and the good news

Unfortunately, the 2016 EIA outlook was based on adoption of the Clean Power Plan. That Obama Administration initiative was hung up in court and has not yet gone into force. Last March President Trump took steps to ensure that it will never go into effect, and earlier this month he announced that the U.S. was withdrawing from the Paris Agreement on climate change.

For the present, that means renewables will have to leverage economic and social responsibility advantages to continue making inroads on fossil fuels.

In other words, the business community will have to step up its game if the trendline for renewables is to continue.

The good news is that bottom line considerations can play a powerful role. Businesses are already taking advantage of power purchase agreements to access low cost renewables, provide for greater resiliency and save money on their electricity bills. A similar no-money-up-front financing arrangement is also emerging for energy efficiency upgrades.

In addition, on the heels of Trump's Paris announcement, more than 1,200 businesses, mayors and academic institutions have joined with several state governors and other stakeholders to join Michael Bloomberg's We Are Still In campaign in support of the Agreement.

As for competing with nuclear, the economic case for renewables is clear from an economic perspective. However, the picture is complicated because, despite its risks and costs, nuclear energy is promoted as a zero emission force, and it has some heavy hitters in its corner including Microsoft's Bill Gates.

The Sun Day Campaign runs the numbers

With all this in mind, let's take a look at the Sun Day analysis. Going by the EIA data, beginning of this year left nuclear struggling to keep a leading role:

For the first third of this year, renewables and nuclear power have been running neck-in-neck with renewables providing 20.20% of U.S. net electrical generation during the four-month period (January - April) compared to 20.75% for nuclear power.

Then the hammer came down:

But in March and April, renewables surpassed nuclear power and have taken a growing lead: 21.60% (renewables) vs. 20.34% (nuclear) in March, and 22.98% (renewables) vs. 19.19% (nuclear) in April.

Sun Day notes that the year-to-year figures also look bad for nuclear, as the latest indicator in a four-year downward spiral for nuclear capacity:

Electrical output by renewables during the first third of 2017 compared to the same period in 2016 has increased by 12.1% whereas nuclear output has dropped by 2.9%.

Even if several nuclear construction projects under way are completed, that additional capacity will be more than wiped out by a rash of planned retirements, resulting in an overall drop.

Energy Week!

The issue of nuclear waste disposal throws another monkey wrench into the nuclear mix. Last week during a Congressional budget hearing Energy Secretary Rick Perry struggled to explain how his agency would finally come through with a permanent nuclear waste repository (he also struggled to explain climate change, but that's a whole 'nother can of worms).

With all this in mind, the Energy Department's @ENERGY Twitter account includes some interesting hints about the direction that the Trump nuclear policy will go in.

The Energy Department's Twitter is very active as a matter of routine, and for the past week it has been heavily promoting a new podcast about the history of the famous nuclear weapon initiative, The Manhattan Project. In contrast, the agency's promotion of its nuclear power programs is negligible.

Survey the agency's tweets over the past week and along with a tweet or two about nuclear power you'll see a decent amount of focus on renewables and job creation in renewable energy fields, including at least two recent tweets linking the occasion of Energy Week to a state-by-state energy job report that highlights renewable energy and energy efficiency jobs.

Even the lesser known field of wave and tidal energy gets a mention.

Overall, @ENERGY has been heavily emphasizing the Energy Department's science mission, with numerous tweets spotlighting its foundational research work through the national laboratory network.

At a White House press conference on Tuesday, Perry made a forceful case in favor of ramping up the nation's commitment to nuclear energy. It will be interesting to see how he tackles the topic during his address at the annual US EIA conference.

Putting a Price Tag on the Great Barrier Reef

It's never a good sign when economists have to put a dollar sign on an ecological landmark to determine its importance.

But that's just what happened when Deloitte Access Economics was asked to take hard look at the Great Barrier Reef value in dollars, cents and irreplaceable industries.

What it came up with pretty much confirmed the government of Australia's assertion that the reef, was, well, irreplaceable: A dollar value that sounds more like that of a nation's yearly gross domestic product.

In fact, at $56 billion the value of the Great Barrier Reef tops the projected GDP (for 2017) of the world's smallest 112 countries, with Belarus, Libya and Lebanon coming in just under its value.

Tourism and what was creatively called "indirect or non-use" value,(meaning the economic value of it purely existing as a brand to people who know of it but haven't visited) made up the bulk of its assigned value. Things like scuba-diving tourism and the economic significance to the Australian economy, were a smaller, though significant part of the tally.

Of course, what wasn't built into the estimate was the ecological contributions to the earth's heath: the benefits that the ocean derives from the largest coral reef system in the world. Providing habitat for fish and marine species, regulating carbon dioxide and nitrogen in the ocean and helping to maintain marine biodiversity are still benefits that researchers have yet to estimate for our environment.

So, is putting a financial value on our most precious ecological resources along the lines of tourism, day trips and national economies going to keep them safe?

Will it ensure that the last third of the Barrier Reef that hasn't been bleached from warming water currents off the coast of Queensland will be protected?

Any time we attach a dollar figure to irreplaceable ecology we run the risk of overlooking the obvious: that tourism, agribusiness, supply chains or national economies can eventually become the gauge for how well we protect them. There's no better example of that thinking these days than the Amazon, where battles continue to be fought over the commercial way nations ensure their economic resilience and the rest of the planet wrestles with the loss of the trees and species we need to fight climate change.

Still, the study was fairly exhaustive. The six-month-long research was paid for by the Great Barrier Reef Foundation and included surveys of 1,500 people in 10 countries. Some 60 percent of those surveyed said they would gladly pay to keep the reef healthy and alive. The survey didn't determine how that would be done, or how scientists, who have already been struggling to find ways to rehabilitate coral habitats affected by global warming, would do so.

So yes, in some cases there may be actually be benefit to framing our most irreplaceable ecological infrastructures in economic terms. People understand size, and they understand loss.

"At $56 billion, the reef is valued at more than 12 Sydney Opera Houses," explained the Foundation's director, Steve Sargent when he tried to sum up what the World Heritage site meant to "Brand Australia."

It's a value that the rest of the world may not quite get when they try to understand how $56 billion becomes the sum-total value of the world's greatest "rainforests of the sea."

Instead, they may find former vice president and environmentalist Al Gore's summation more helpful:

"Any failure to protect this indispensable natural resource would have profound impacts not only to Australia but around the world."

Succinctly said.

Flickr images: Kyle Taylor; Jorge Lascar

Economic Development, Sustainability Go Hand-in-Hand for Gonzales, Calif.

By Irwin Speizer

Taylor Farms and the City of Gonzales have proved to be a winning combination when it comes to sustainable economic development. The company’s produce processing plant in Gonzales is the city’s largest economic development project to date, employing about 1,000, and it exemplifies the city’s quest for companies that adopt innovative and sustainable practices.

In April, Taylor debuted its newest addition to the plant, a cogeneration facility that uses cleaner natural gas to produce power for the facility while running waste heat through a heat exchanger to help chill produce. The cogeneration operation joins a wind turbine and solar panels to provide 90 percent of the plant’s energy needs.

Taylor’s sustainability efforts don’t stop with energy usage. Taylor recently launched an aggressive recycling and reuse program that aims to significantly reduce the amount of landfill waste sent out from the plant, with an ultimate target of zero waste. Taylor has also deployed a water recycling process that allows it to reuse water three times in the washing process. Before finally pumping used water out, it is run through cooling towers to help reduce the temperature of incoming fresh water.

Taylor’s level of dedication to sustainability and to lowering its carbon footprint is still rather rare in the food processing industry. The company hopes to use what it learns in Gonzales throughout its network, which includes 22 facilities around the country and one in Mexico.

“As far as we are aware, there is no one else doing anything remotely close to this,” says Nicole Flewell, Taylor’s Director of Sustainability.

The fact that all this sustainability activity is taking place in Gonzales is no accident. Rather, it is a testament to the city’s focus on sustainability in its economic development efforts. The city partnered with Taylor in building the wind turbine and has worked to provide swift and efficient project approvals (Gonzales prides itself on running a streamlined and business-friendly development review process that at the same time promotes sustainability). A number of other companies that moved to Gonzales also employ sustainable practices.

Gonzales has undertaken several green city projects and efforts under a program called G3 (Gonzales Grows Green).

The initiative seeks partnerships with businesses to advance green and sustainable practices while also striving to improve community environmental awareness. A city sustainability team aids companies on green projects, including guidance on obtaining incentives, rebates, and tax credits.

The sustainability emphasis certainly hasn’t hurt local economic development. Gonzales has posted Monterey County’s fastest growing tax base for the past several years.

“As job creators continue to choose Gonzales for establishing their small and large entrepreneurial dreams, they will be welcomed into a community that asks them to dream a little bigger and do what they do with sustainability and innovation at the core of their business models,” says Gonzales City Manager Rene Mendez. “They will find peer mentors and willing partners in the City of Gonzales.”

Taylor says working with the city has been a rewarding experience.

“We are very appreciative of the partnership Taylor Farms has developed over the years with the City of Gonzales,” says Sam Chaidez, Taylor’s Director of Operations. “The city has a strong commitment to promoting a successful business environment and has become a leader in establishing a culture of prosperity, innovation, and sustainable growth which are all values that align very well with Taylor Farms.”

The green advances in Gonzales haven’t gone unnoticed elsewhere. Mandy Brooks, Resource Recovery Manager for Salinas Valley Recycles, which operates the nearby Salinas Valley landfill and related waste collection, recycling and reuse programs, says what’s happening at Taylor specifically and in Gonzales generally can serve as a model for other communities and companies.

“Taylor is kind of unique in that they have a dedicated sustainability coordinator,” Brooks says. “Gonzales is unique too, with its G3 program.”

Using clean and renewable energy is particularly important in vegetable processing, which requires power-hungry refrigeration to chill fresh produce. The Taylor cogeneration project produces 2.25 megawatts of power, which, on average, is enough to supply 64 percent of the plant’s power needs with onsite natural gas that is 21 percent cleaner than energy from the power grid. The wind turbine offsets 16 percent of the plant’s power needs with renewable energy. Solar panels kick in another 10 percent of the plant’s power needs with renewable energy. Total offset: 90 percent of the plant’s needs. On some days, those three sources provide all the energy the plant requires.

Those kinds of numbers resonate at Gonzales City Hall, where advances in sustainability that also help the community grow are cherished.

“Taylor Farms continues to establish itself as a regional force when it comes to implementing innovative programs aimed at energy independence through the use of renewable and clean energy technologies,” Mendez says. “Taylor Farms stands out as an example of a can-do attitude that exemplifies our community motto, ‘The Gonzales Way.’

Irwin Speizer is a freelance writer and communications consultant based in Monterey, Ca.

Image credit: Taylor Farms

UPS Boosts Long-Term Commitment to Sustainable Fuel, Power and Transport

The worldwide delivery service UPS today revealed what it says are aggressive greenhouse gas emissions reduction targets and future additions of more alternative fuel and advanced technology vehicles to its global fleet. The company discusses the goals in its latest corporate sustainability report, which also outlines the logistics giant’s efforts to generate 25 percent of its electricity from renewables. The company has also embarked on an initiative to reduce emissions from its worldwide ground operations 12 percent by 2025. UPS says these goals were developed using methodologies developed by organizations partnering on the Science Based Targets global initiative.

Those are quite ambitious initiatives for UPS, which says as of last year, clean energy accounts for only 0.2 percent of its electricity consumption. The company’s quest to incorporate vehicles not fueled by gasoline or diesel within its fleet may be an easier goal to attain. The company claims that 19.6 percent of its ground fuel will be derived from sources other than fossil fuels, and seeks to boost that ratio to 40 percent by 2025. When it comes to UPS’s fleet, the $60 billion company hopes to boost the total number of new vehicles running on alternative fuels to 25 percent, which would be a healthy increase from its current estimate of 16 percent.

UPS’s recent investments indicate that the company is on track to meet these goals. Earlier this year, UPS revealed that it would boost its onsite solar power generation capacity five-fold across eight of its U.S. facilities at the cost of $18 million. As of its latest sustainability report, UPS has yet to share how the company could leapfrog from generating less than 1 percent of its power requirements to one-quarter of its electricity needs in eight years.

But it is the potential transformation of its global delivery fleet where UPS generates the most excitement. Two years ago, the company announced it would aim to drive a collective one billion miles via advanced technology vehicles and renewable sources of fuels by sometime this year; the company’s “rolling laboratory” of 7,200 alternative fuel vehicles attained that goal last summer. The company’s constant experimentation with various fuels most recently included the testing of a hydrogen fuel cell-powered truck.

As is the case with many companies, UPS future fuel and emissions savings may come from innovations that did not seem possible only a few years ago. Emissions generated by its air fleet represent a stubborn hurdle for many transportation companies, but UPS says it is investing in software and updated aircraft that will help the company chip away at its carbon footprint. UPS, as is the case with airlines, has little choice but to pin its hopes on more efficient airplanes, as the promise of biofuels shows little promise in scaling up across the global aviation sector.

Another challenge for the transportation and logistics sectors is that “last mile” of delivery, when goods finally are delivered to end consumers. In its most recent sustainability report, UPS floated the idea of using a person’s exact GPS location, rather than a physical street address, to hand over that package. Could you soon receive that coveted package when you’re at the local Starbucks while “Brown” is dropping off goods at adjacent stores? That may seem farfetched, but the point is that UPS appears to be open about finding new ways to boost overall efficiency by going beyond the conventional fossil fuels vs. renewables debate.

Watch for UPS to surprise us in the next few years. The company has a long history of not only announcing, but delivering, on its sustainability goals, and is spending aggressively on that front. To date, the company says it has invested more than $750 million on alternative fuels and advanced technologies infrastructure since 2009.

Image credit: kenjonbro/Flickr

Did Amazon Acquire Conscious Capitalism Along with Whole Foods?

Two weeks after Amazon announced its acquisition of Whole Foods for almost $14 billion, the assessments of what this deal means for retail and food industries are still rolling in. Some predictions have been rather dystopian, with visions of robots replacing cashiers a popular scenario – one that may be true, though Bloomberg sees this as occurring within warehouses, not at the checkout stand. Or perhaps Amazon’s founder and CEO, Jeff Bezos, wants to “take control of the physical world as well as the digital one” as he merges online and brick-and-mortar retail.

On the lighter side, one needs to roll into an older location in Los Angeles or New York, see what a mess some of these more cramped locations have become, and assume Amazon’s technology can help Whole Foods wake up out of its recent doldrums. In the view of Forbes, we can put our MBA hats and see how Whole Foods’ locations can become testing laboratories for Amazon’s new business ideas – while the grocery chain can help the Seattle tech giant crack the one nut it has not conquered, online supermarket shopping.

But according to the co-CEOs of the organization Conscious Capitalism, the Amazon-Whole Foods marriage is a huge step forward for purpose-driven business. If Bezos will step back and let Whole Foods’ co-founder and CEO John Mackey (who has penned a book outlining his vision of capitalism) continue to nurture the grocers’ culture, this new entity can actually help capitalism become a force for good:

“Whether through acquisition, partnerships or emulation, we envision a future in which the more businesses practice Conscious Capitalism the more opportunities the philosophy will have to influence and impact otherwise less conscious businesses. And with more conscious businesses in the world, the more capitalism will be viewed as the force for good we know it has the potential to be when practiced consciously.” - Alexander McCobin & Doug Rauch, co-CEOs of Conscious Capitalism.

Critics of both Amazon and Whole Foods may pause at the ebullience with which McCobin and Rauch view these companies’ merger. In the past, Amazon has been targeted over accusations that it has dismissed its carbon footprint, sold dodgy products and sabotage of decent jobs while replacing them with poorly-paying warehouse positions. But when it comes to responsible business, the company has also taken a stand on recent immigration controversies while attempting to mitigate its massive carbon footprint with its investment in clean energy technologies.

A similar batch of mixed messages also holds true for Whole Foods. Once largely applauded for making organic foods and personal care products mainstream, in recent years the company has been jeered for being a hipster “Whole Paycheck” cliché from its asparagus water and pre-peeled oranges embarrassment to its description as “America’s Temple of Pseudoscience” as mocked by the Daily Beast. And when it comes to more substantial matters, Mackey has been painted as anti-labor and anti-union; others questioned Whole Foods’ commitment to social responsibility with allegations of prison labor within the company's supply chain.

Overall, however, McCobin and Rauch are forgiving of Mackey, insisting that he now has the opportunity to cajole Bezos and Amazon’s top executives to adopt some of the grocers’ conscious capitalism business practices.

So could Amazon join a roster of top brands, which includes REI, Starbucks, Costco, and Southwest Airlines, which McCobin and Rauch herald as examples of companies that have made public commitments to become more “conscious” corporate leaders? When announcing the Amazon acquisition to Whole Foods employees, Mackey lavished praise on Amazon for its eschewing of short-term Wall Street expectations in favor of long term strategic thinking. That approach, which once confounded many analysts, has certainly paid off for Amazon, which a few weeks ago witnessed its stock price surpass $1,000 a share.

The question is whether Amazon will either pick Whole Foods apart until it is unrecognizable – the fear many of the supermarket chain’s fans share - or build upon the grocer’s successful 20-year track record. Odds are that Bezos and Amazon will tilt towards the latter. One just needs to look at Bezos’ four-year-old acquisition of the Washington Post: once a proud newspaper that fell into rapid decline, the Post has enjoyed a resurgence and is one of the best U.S.-based print and digital news sites.

Whole Foods could benefit from an analogous makeover, as Amazon’s technology gurus find ways to improve its overall performance. Whole Foods' locations, meanwhile, could become laboratories for Amazon's new services and ideas. If the results include more rewarding job opportunities, more healthful food options at an even more competitive price and most importantly, if Amazon embeds some of Whole Foods’ more admirable values within its operations, this deal could be a big win for more responsible capitalism after all. As of now, however, those if’s are quite big as a skeptical public still tries to adapt to retail’s new reality.

Image credit: Ines Hegedus-Garcia/Flickr