Home Depot Taps GE and Tesla for Rooftop Solar Expansion

Home Depot boasts almost 2,300 stores across North America. All those locations combine to provide plenty of square footage for rooftop solar. To that end, the retailer recently announced that it would install solar panels atop at least 50 of its stores in an effort to increase the amount of renewables the company can generate nationwide.

The company says each of the stores chosen to host a solar installation will be able to reduce the amount of electricity needed from the grid by an average of 30 to 35 percent.

This project will supplement Home Depot’s step-by-step adoption of clean energy technologies to power its stores. In previous years, the company was more amenable to fuel cells than other clean technologies: as of last year, the company had installed Bloom Energy’s fuel cells at 140 store locations. The company’s CFO, Carol Tome, told CNBC that stores using the technology were able to reduce their electricity costs by 15 to 20 percent.

Home Depot’s renewables portfolio also includes solar power purchasing agreements (PPAs) in Delaware and Massachusetts; 170 fuel cells operating at stores and distribution centers; and wind farms in Texas and Mexico.

The investment in solar power will boost the company's clean energy footprint to over 130 megawatts (MW) as it aims to generate 135 MW from renewable power technologies by 2020.

According to the company, each of the stores that will score a solar installation will have approximately 1,000 panels on its roof. The typical Home Depot store roof has 104,000 square feet of space. As a result, amount of power generated at each store is equivalent to electrifying 2,300 averaged-sized U.S. homes for a year.

Most of the stores gaining a new solar roof are concentrated in California, Connecticut, Maryland New Jersey and New York. Current by GE will work with Home Depot at 28 east coast stores. Tesla Powerpacks will be installed at six California and New York locations so that each store can store energy and generate additional clean power when needed.

Home Depot’s solar experiment follows up on its retail line of solar products sold at many of its stores. The company partners with local contractors to install residential solar power systems, and also offers options to finance these installations as well. Now the company is showing that it can actually benefit from these products.

Granted, this jump into solar only affects 2 percent of Home Depot’s stores. Nevertheless, the company has shown in recent years it is willing to take additional steps to become a more responsible and sustainable retailer. For example, the company stopped selling pesticides linked to the sharp decline in bee populations in 2014. And as the world’s largest seller of light bulbs, the company supported the phasing out of incandescent light bulbs and even traced where sales of efficient bulbs were highest. Meanwhile, Home Depot has taken several steps to develop a more sustainable supply chain in order to decrease truck deliveries, reduce waste from pallets and slash emissions, and has done so while saving tens of millions of dollars in operational costs.

Image credit: Mike Mozart/Flickr

Support Grows for Republican Carbon Tax Plan

Shortly after President Trump was inaugurated, Republican elders including George Shultz and James Baker presented the White House with a revenue neutral carbon tax proposal. In a nutshell, the idea is to eliminate redundant CO2 regulations, including the Clean Power Plan, enacted during the Obama Administration. Instead, carbon would be taxed, starting at $40 a ton at energy-intensive locations such as ports, mines and refiners. That money in turn would be redistributed amongst U.S. citizens and some businesses – a family of four, for example, would receive about $2,000 annually under such a plan.

The proposal did not go too far, as the White House was distracted with a bevy of other policy agendas on which it preferred to focus. Plus, any proposal linked to taxes or climate change has long been anathema to GOP orthodoxy. But the concept refuses to go away. Vermont is mulling ideas for a statewide carbon tax; the “father of climate change,” former NASA scientist James Hansen, also has expressed support for the GOP proposal.

Furthermore, with the Republicans unable to pass meaningful legislation this year despite controlling both the White House and Congress – not to mention the GOP’s cratering popularity with voters as the midterm elections lurk on the calendar - the idea of a carbon tax is slowly but surely gaining more support across the political spectrum. In addition to energy companies such as ExxonMobil, Shell and Chevron, companies such as Johnson & Johnson, General Motors (GM), PepsiCo and Unilever support the idea. And those companies have allies in NGOs, including the World Resources Institute and The Nature Conservancy.

As Charles Komanoff of the Carbon Tax Center recently explained, the GOP’s rigid stance on climate change is untenable as more Americans describe climate change as an issue highly important to them personally. To that end, change is underway as some of former President Obama’s environmental legacy cannot be entirely dismantled, no matter how fast the Trump White House moves. After all, the country generates power much more differently than it did a decade ago. Despite the howls of protest over the Trump Administration’s decision to neuter the Clean Power Plan, about 80 percent of its goals have been achieved as natural gas and renewables displaced coal as the means to electrify homes and businesses across the country.

A carbon tax could also benefit from the horse trading that is certain to unfold this fall as Congress seeks to show it can get things done with a tax reform bill. Progress on simplifying the onerous federal tax code, while lowering the corporate tax rate, will be difficult for both houses of Congress to attain. One reason is that any plan to develop a border adjustment tax (BAT) on imports has fallen by the wayside. That tax could have generated a trillion dollars over the next 10 years by some estimates, but enough lawmakers were in no mood to promote anything smacking of protectionist legislation.

Joe Kennedy, a former economist at the U.S. Department of Commerce, has suggested a carbon tax could fill in the gap left by the elimination of any BAT. Leveraging a carbon tax to allow for a decrease in the corporate tax rate means such a levy would no longer be revenue-neutral, but if the Congressional Budget Office verifies that such a fee would reduce emissions, this plan could still muster support.

Any carbon tax would obviously require bipartisanship, which nowadays has become an endangered species on Capitol Hill and Pennsylvania Avenue. Two Democratic senators recently floated a revenue-neutral carbon tax that would levy $49 per ton of carbon. So far not one GOP lawmaker has taken the bait; some Republican representatives have filed a non-binding resolution calling for “market-based” climate change solutions, but they otherwise have failed to move the needle.

Unfortunately, Republicans who personally believe something could be done about climate change, but feel hamstrung by their party, have plenty of reasons to be spooked. In California, for example, the extension of the state’s cap-and-trade program recently passed with some GOP support. But many GOP leaders, along with the rank-and-file, have pilloried Assembly Minority Leader Chad Mayes for supporting and celebrating that legislation. Mayes is already facing an opponent in next year’s primary due to his support of what opponents of cap-and-trade describe as a “tax scheme.”

Image credit: U.S. Army Corps of Engineers/Flickr

Trump Order Puts Nation's Infrastructure at Risk for Climate Impacts

President Trump announced a solution to the nation's infrastructure problem last week. However, the solution and the problem don't really match up. On Tuesday he signed a new executive order purportedly aimed at speeding up infrastructure improvements, but the end result could be to expose taxpayers, businesses and entire communities to new risks from climate change and other environmental hazards.

The new infrastructure executive order

The new executive order focuses on speeding up the federal review process, but based on an analysis by Bloomberg it really boils down to a classic case of misdirection.The order strips down the existing federal review process. However, federal agencies are generally not the driving force behind excessive delays on infrastructure projects:

Some experts have said that while existing procedures can be streamlined and made more efficient, most delays are caused by the need for state and local approvals and other factors including available funding...

For some insight into that problem, it's helpful to take a quick look at the Obama administration's efforts to speed up the pace of rooftop solar installations. Studies indicate that "soft costs," including local zoning and permitting regulations, accounted for a major portion of the final cost of rooftop solar. Accordingly, the Obama administration focused on helping local governments speed up their permitting processes.

In contrast, the Trump executive order focuses on federal agencies, not local processes. In fact, Trump's new executive order provides local governments with the option of adopting more stringent standards.

Interestingly, the Trump administration has been leaning on an Obama initiative called FAST-41 to develop more efficient permitting processes at the federal level.

Bloomberg notes that critics of the new order have urged the Trump administration to focus on implementing FAST-41 as the most efficient pathway for comprehensive reform of federal infrastructure review, rather than eliminating regulations willy-nilly.

Taxpayers on the hook for flooding, climate change risks

That brings us to another major problem with the new executive order.

Bloomberg -- and many others -- have pointed out that the new order rolls back a previous order signed by President Obama, which aimed to protect U.S. taxpayers from investing federal dollars in projects at risk for flooding and other climate change impacts:

Among other things, the president’s order will rescind a previous decree signed by former President Barack Obama that required federal agencies to account for flood risk and climate change when paying for roads, bridges or other structures.

The Obama order also protected taxpayers from investing in federally backed mortgages for homes at risk for future flooding.

Where's the beef?

Circling back around to the misdirection issue, Trump's new order also fails to address another major culprit behind infrastructure delays: money.

In that regard, it's instructive to look at the Gateway rail transit project for New York and New Jersey.

Gateway was formulated in recent years, after New Jersey Governor Chris Christie rejected plans for a previous iteration called ARC (Access to the Region's Core). Among other benefits ARC would have improved the area's strained commuter railways by doubling the number of trains in and out of New York.

Christie cited lack of funding as the reason for pulling the plug on the project.

Christie halted ARC in 2010, putting an end to an elaborate planning process that began in 1995 -- more than 20 years ago.

The Gateway project was formulated as a next-best solution and funding was pledged under the Obama administration.

However, the new Trump budget puts Gateway on shaky ground, too.

Trump rolled out a splashy $200 billion, 10-year infrastructure funding plan last May, but analysts at the non-partisan University of Pennsylvania Wharton Budget Model shook out the numbers. According their analysis, the new Trump budget would slash $255 billion in existing infrastructure spending.

The new executive order does not provide a clear pathway for replacing the missing $5 billion, let alone increasing federal spending on infrastructure. The idea, apparently, is to shift more of the funding responsibility onto state and local governments, which is precisely the problem that Governor Christie used to justify killing the ARC project.

If you're interested in more details about the relative impact of funding and regulations on infrastructure project, The Center for American Progress provides a detailed assessment. Here's one snippet:

...the principal restraint facing state and local governments contemplating megaprojects is money, not environmental review. In fact, state and local governments often begin environmental review with the hope that this will help build the political momentum necessary to secure the funding for construction.

Like Bloomberg, CAP cites the Gateway project as an example, while underscoring the role of political will in securing funding for infrastructure projects:

...The preliminary estimated total cost is more than $23 billion. The political challenges of securing this much money are daunting. Environmental review is not the obstacle preventing completion.

What happened to the climate advisors?

Due to transparency issues, it's difficult to sort out who, or which groups, shaped the policy underlying Trump's new executive order.

Trump signed the order last Tuesday, apparently without formal input from his Advisory Council on Infrastructure.

Trumped established the council in July, but he failed to recruit or name any members, at least not formally. He then disbanded the council last Thursday, after his Manufacturing and "Strategic and Policy" councils let word slip that they were disbanding in protest of the Charlottesville debacle.

Had it been active, the Council on Infrastructure had a broad mission to guide infrastructure policy. According to the broadcast trade publication B&C News, the members were to have represented a broad range of sectors including but not limited to "real estate, finance, construction, communications and technology, transportation and logistics, labor, environmental policy, regional and local economic development."

The members would have been charged with this mission:

"...study the scope and effectiveness of, and make findings and recommendations to the President regarding, Federal Government funding, support, and delivery of infrastructure projects in several sectors, including surface transportation, aviation, ports and waterways, water resources, renewable energy generation, electricity transmission, broadband, pipelines, and other such sectors as determined by the Council."

That's all well and good, but apparently Trump has been receiving guidance on an informal basis, with a focus on the real estate sector.

The New York Times reports:

Days before his inauguration, the president announced that he was naming the real estate developers Richard LeFrak and Steven Roth to lead the infrastructure group. He has since added two people from the world of private equity: Joshua Harris, a founder of Apollo Global Management, and William E. Ford, the chief executive of General Atlantic.

According to the Times, Trump has "solicited policy advice" from the group, prior to and after signing July's executive order.

At least one environmental group, Food & Water Watch, has filed a lawsuit challenging the legality of the ad hoc advisory group, claiming that Trump is "outsourcing policy making to private individuals who are unfettered by conflict-of-interest rules and other public accountability standards."

And, what happened to the Climate Advisory Council?

The transparency issue comes into focus when 'you consider what the executive order could have looked like, had Trump sought guidance from infrastructure and climate change experts including those in his own Department of Energy.

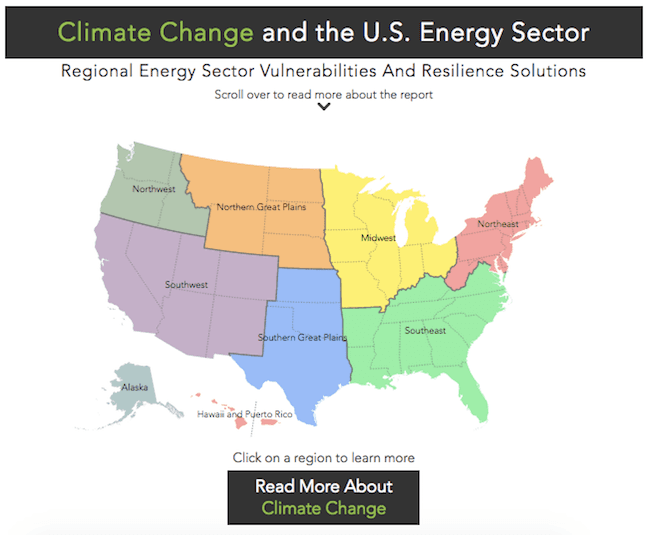

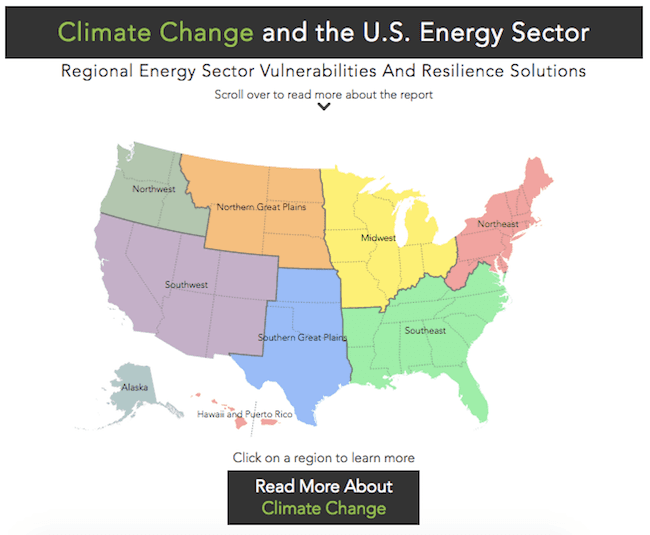

Despite Trump's rhetoric on climate change, the Energy Department still provides a robust online information hub for climate change impacts in the U.S.

That includes an interactive map detailing climate change impacts on the nation's energy resources and energy infrastructure.

According to the Energy Department, we need to do something -- and fast!

We live in a rapidly changing world. The effects of climate change -- such as heat waves, rising sea levels and more severe storms -- are already being felt across the United States. Our energy infrastructure is especially vulnerable to climate-related impacts, which can pose a serious threat to America’s prosperity, national security, energy security and quality of life.

For that matter, over the weekend The Washington Post reported that the President has disbanded an advisory group on climate change, basically by allowing its charter to expire on its Sunday deadline:

The Trump administration has decided to disband the federal advisory panel for the National Climate Assessment, a group aimed at helping policymakers and private-sector officials incorporate the government’s climate analysis into long-term planning.

We'll likely never know who, or which groups, took the upper hand on shaping Trump's new infrastructure policy, but it sure doesn't look like anybody who really knows anything was involved.

Shocker.

Image (screenshot): via US Department of Energy.

GMO Crop Yields Uncertain in Warming Climates According to New Research

Scientists have been arguing for decades over how to best fill the world's food basket.Transgenic food producers maintain that the world needs today's technology to protect -- and increase -- its food production. Genetic modification has in some cases extended the life of perishable foods like tomatoes and made it easier to safeguard crops from blight and disease.

Advocates that lobby for more "natural" processes like some forms of organic farming tout their own accomplishments as well, claiming that while the long-term safety of ingesting GM crops is still relatively unknown, sustainable agriculture has proven results and can perform just as well if not better in mass food production than monoculture crops.

A new peer-reviewed paper by a researcher at Macalester College, Minn. in fact, is the latest to add weight to the claim that sustainable farming is the planet's best tool for meeting the demands of a growing global population. Scientists warn that with the world's increasing growth, food demands are due to outstrip our current rate of production by 2050. Improving and accelerating food production is a must if we are to ensure enough food for the world's population.

Prof. William G. Moseley, whose area of expertise is geography, maintains that while GM technology provides new tools to combating food shortages, its strategies actually increase -- not decrease -- the cost of food production in developing countries. That's because it relies on standardization of food production methods in environments that don't always allow for such predictable measures.

"[GM] solutions are often aimed at maximizing production under ideal conditions, as opposed to minimizing risk in highly variable meteorological environments," wrote Mosley. Places where that often works best is "semiarid tropics" and climates where rainfall may be reduced due to climate change. "As such, investing in GMO-seed technology represents a significant financial risk for many small famers in variable rainfall environments.” He added that market conditions in developing countries often make investing in GM crops a much riskier business for the small landholder.

Moseley isn't the only expert to question the viability of GM technology as a means for boosting the world's food production. In 2014, researchers in the Department of Environmental Science, Policy and Management at the University of California found that the yield gap between transgenic food production and sustainable farming methods was shrinking.

The reason? "Improved" strategies in sustainable farming was able to increase food production, just as GM technology had first proven to do when it was unveiled. Smart farming methods like taking advantage of "intercrop combinations, crop rotation sequences, composting, biological control, etc. ... could be altered in different cropping systems to mitigate yield gaps between organic and conventional production," Lauren C. Ponisio et al, said.

"Our meta-analyses found relatively small, and potentially overestimated, differences in yield between organic and conventional agriculture," leading to the conclusion that sustainable farming methods actually do have the potential to meet the world's mandatory thresholds for food production, if given the chance.

Other experts insist that the strategies used in sustainable food production have long-term benefits that go far beyond the season's food yield, especially when it comes to combating the effects of this century's greatest challenge: climate change.

"Unlike genetically-engineered crops (GMOs) that attempt to build resilience into the genomes of specific cultivars one trait at a time, agroecology strengthens the resilience of the entire agroecosystem," said Eric Holt-Gimenez, an agroecologist, political economist and the Executive Director of Food First. Agroecology is the application of ecological systems to agriculture. Biodiversity and careful, well-managed agroecological farming methods have actually been shown to boost the endurance of crops against global warming, drought, flooding and plummeting temperatures.

He also points out that not all organic farms necessarily fit the profile of agroecology. Some are "vast industrial monocultures," said Holt-Gimenez,

What these new studies indicate "is that agroecology — not organic agriculture per se — is the key to yield and sustainability."

Images: Flickr/Global Justice Now; Flickr/Northwest College Agriculture

Why Investors are Still Missing the Mark on ESG Integration

By Chat Reynders

The notion that environmental, social, and governance (ESG) analysis is a complement to – not a substitute for – fundamental security analysis is nothing new. However, ESG has now become a buzzword and a check-box across much of the investment industry. More investment products and managers are touting the fact that ESG and other sustainability criteria are considered in the investment process to attract the growing pool of investors interested in making an impact.

ESG analysis should not be easy. It is a discipline rooted in the fact that making an investment decision is about more than analyzing numbers – it is about understanding how non-financial factors hinder or complement company performance. But today, the vast majority of ESG’s application comes in the form of applying quantitative ratings and rankings to screen out prospective investments that do not meet predetermined criteria.

Isolating ESG metrics and relying on their ratings and rankings alone may be risky. Not only is it a dramatic oversimplification, but it also fails in terms of how ESG analysis can be used effectively to identify companies that deliver on both sustainable earnings growth and positive social and environmental impact.

Importantly, the check-box approach jeopardizes the momentum that socially responsible investing (SRI) has achieved over the past decade. Exclusionary screening is not an investment discipline; it is a simple way for investors to respond to social and environmental concerns and is the primary reason that traditional SRI failed to gain traction. In an effort to avoid association with exclusionary screening, some managers are claiming to only invest in “best in class” ESG performers. Those that follow this approach still fall short when it comes to uncovering climate change and other sustainability-related information needed to determine risk and opportunity in stock evaluation. Here is why:

1. The data is imperfect:

Currently, there is no regulation concerning the disclosure of ESG issues. Although organizations such as the Sustainability Accounting Standards Board (SASB) are working to address standardization and materiality, inconsistencies across ESG data providers and researchers remain. For example, a CSRHub analysis found a wide discrepancy between the sustainability ratings provided by MSCI and Sustainalytics, two leading ESG research firms (Reuters).

2. Data looks backward, not forward:

ESG data, ratings, and rankings are creating unjustified confidence primarily based on what a company has done in the past. As investors, however, we want to know how a company views ESG factors now and how consideration of these factors will impact the company and its financial performance in the future.

3. Materiality is lacking:

As corporate social responsibility (CSR) has become commonplace, companies are getting more savvy about what to report. Publishing information that sheds a company in the best light possible in relation to ESG criteria neglects other information – both positive and negative – and fails to address issues that may be more material to a company and its business.

What is the solution? At Reynders, McVeigh, ESG data and analysis is a starting point, not an endpoint. It gives us an idea of where we need to focus our research, do more digging, and, most importantly, develop the right questions for both good and bad performers. We are more interested in where a company is going than where it is coming from.

The most daunting concern is that ESG is strictly being used as a quantitative tool. If investors are not investigating the qualitative questions behind the data, they simply are not doing a good job when it comes to ESG. The right questions help investors understand how a company’s financial statements align with its ESG activities. For example, if a company promotes its purpose as creating innovative technologies to mitigate greenhouse gas emissions, but has only allocated 2% to research and development – it does not add up. Similarly, a small or mid-cap company that is doing great things may receive poor ESG scores because it does not have the resources to report, or has not yet determined the best way to report compared to larger companies.

Asking the right qualitative questions is hard, but it is paramount for building a relationship with management to understand the DNA of a company and its plans moving forward. Questions differ across industries, companies, and material issues, but primarily address:

- How is the company setting goals?

- Is management and the company long-term oriented – looking for solutions and business practices that will lead to better outcomes for all stakeholders?

- Is there a true understanding that treating employees well leads to bottom line success?

The answers lead to deeper trust between investors and companies, and that is what we believe good investing is all about: building a better understanding of how the company is making money, how investor returns are compounding, and how it is improving the world.

While ESG information is improving, the data is only useful in the context of a thoughtful investment discipline. As is true with any productive research process, investors need to understand that ESG information is merely the starting point for forming the kind of critical questions that can lead to valuable insights.

Chat Reynders, Chairman and Chief Executive Officer of Reynders, McVeigh Capital Management LLC., has more than 25 years of experience in investment management and social venture investing. He has structured and funded public/private partnerships that have brought more than $150 million in revenues to leading cultural institutions. He has for decades produced socially oriented IMAX films, including the Oscar-nominated Dolphins and Coral Reef Adventure. Chat's focus on climate change also led him to his current role as a Director on the Board of the MacGillivray Freeman Educational Foundation (MFEF), an organization committed to increasing awareness of the delicate state of our oceans and environment. He also serves on the board of directors of the Westminster Kennel Club, and the Brookwood School.

New app increases access to investing in green energy

Toyota's Hydrogen Dream Could Help 7-Eleven Grow -- Sustainably

The emerging hydrogen economy is creating new opportunities for businesses to collaborate on energy solutions that benefit the bottom line while reducing greenhouse gas emissions. The latest to test the waters is 7-Eleven. The company has just paired up with Toyota to study how zero emission hydrogen can help reduce emissions along its distribution system and at its growing number of stores.

That "growing number" is what makes the new collaboration especially interesting. If the plan works out, it could enable 7-Eleven to continue growing in size without growing its carbon footprint, too.

Toyota And 7-Eleven collaborate on hydrogen

The primary source of hydrogen today is fossil natural gas, and if that remains the case then hydrogen is not a sustainable solution over the long run.

However, the advent of low cost renewable energy is beginning to change hydrogen for the better. Hydrogen is actually abundant in our ecosystem, but since the element is unstable on its own, it is most often found paired in a chemical bond with oxygen in good old H2O. It takes energy to split water into its base elements, and if that energy is from a dirty source, the resulting hydrogen is not a clean fuel. However as the costs of renewable energy continue to decrease, clean hydrogen becomes more feasible.

If the new collaboration between Toyota and 7-Eleven relies on fossil-sourced hydrogen initially, there are indications that sustainable hydrogen could be the ultimate goal.

The partnership, announced on August 9, recruits 7-Eleven stores in Japan to help engineer the "low-carbon and hydrogen-based society in the future." Toyota already has a demonstration project under way in Japan for powering economic activity with water-sourced hydrogen using offshore wind turbines, and it has just launched a major hydrogen research initiative with a broad sustainability mission.

The agreement between Toyota and 7-Eleven covers the distribution angle through fuel cell trucks, which will use hydrogen for motive power and also for operating refrigeration units.

To reduce emissions related to store operations, the agreement leverages existing solar generators in Japan, where the company made waves back in 2011 by opening 100 solar powered stores.

7-Eleven has been dipping its toes into next-generation energy management, and that is also reflected in the new collaboration.

In tandem with the existing solar generators, 7-Eleven stores will examine integrating hydrogen generators, based on units used in fuel cell electric vehicles like those in Toyota's Mirai fuel cell EV. 7-Eleven will also install battery systems that can be used for EV charging. The battery arrays can also fill in as a power supply for the store in case of emergency.

7-Eleven and the hydrogen economy of the future

So, here's where it gets interesting. Between its stores and its transportation network, 7-Eleven has a pretty hefty carbon footprint to manage already.

That footprint is likely to sprawl even farther as 7-Eleven adds more stores, but the increased number of stores is only part of the challenge.

7-Eleven is joining supermarkets and other convenience chains in the march to sell ready-to-eat meals to grab-and-go customers. That means more refrigeration is needed in stores and on trucks, and consequently more energy.

Last April the Dallas News took an in depth look at 7-Eleven's plans for expansion in the U.S., and it's a real eye opener. The gist is that the company is buying (or now, has bought) more than 1100 existing convenience stores from Sunoco, located mainly along the East Coast and in Texas.

On top of that, 7-Eleven is getting into the burgeoning taco business, by purchasing the trademarks of Laredo Taco Company and Stripes:

7-Eleven, which has been building its fresh food offerings in recent years, is gaining a whole new menu of breakfast and lunch tacos with Laredo Taco Company and Stripes. A new Stripes store in Corpus Christie has a dining area with 28 seats and an outdoor patio for 20 more, which is different from the traditional 2,500-square-foot 7-Eleven.

According to the Dallas News, 7-Eleven currently has more than 9800 stores in the U.S. and Canada. If the Stripes Corpus Christie model of indoor seating prove profitable, it becomes an additional area growth for 7-Eleven, and for its carbon footprint -- especially considering the high demand for air conditioning in the southern U.S.

That's where 7-Eleven's hydrogen and solar collaboration with Toyota in Japan comes in. The two companies will have the opportunity to measure before-and-after carbon emissions in real life, rather than simply modeling and estimating.

If it all works out, solar power with a hydrogen boost -- sustainable hydrogen, that is -- could enable 7-Eleven to do something that would have been all but impossible just a few years ago: continue growing, while stabilizing and perhaps even shrinking its carbon footprint.

Image: via Toyota Motor Company.

Big Oil Faces More Calls for Stranded Asset Disclosure

By Elisabeth Jeffries

Had ExxonMobil reported its reserves differently in 2016, investors might have taken another view of the company’s future. It reported its Kearl oil sands as reserves, effectively as cash in the ground. In 2016 it was ordered to take these assets of its books by the Securities and Exchange Commission. A major shift in its disclosures ensued in March 2017, with proved reserves cut by 3.3 billion oil-equivalent barrels. If it costs too much to get that oil out of the ground, it doesn't count as an asset.

According to Tarek Soliman, senior analyst at the CDP, if climate-related risk were considered systematically, there would have been a different disclosure in the first place. “If the company were to integrate climate risk into its assessments, it would highlight that these assets show a high propensity to become impaired. They would have been downgraded to a resource rather than a reserve, and this problem would have been foreseen,” notes Soliman. Valuations across the whole hydrocarbons sector could be impacted.

A redirection of energy pathway, not just for ExxonMobil but for all its competitors, might follow if they acted this way, as recommended in the final report of the Task Force on Climate-Related Financial Disclosures (TCFD) presented to the G20. Reporting financial activity using the lens of climate-related risk would, according to the TCFD, help more appropriately price risks and allocate capital in the context of climate change. The initiative is voluntary, would help speed the transition to a low-carbon economy, and would shift the corporate perspective beyond immediate concerns.

Most industries are not reporting on this values-based assumption. Oil and gas companies are understandably among the least likely to report through a channel that undermines their very raison d’etre. Their disclosure of historic greenhouse gas emissions (usually in corporate responsibility statements) has certainly improved since the last decade. But now the pressure, as expressed by the TCFD, is to disclose for the first time in financial filings and to look much further into the future.

This is not about innovative accounting but more in-depth information. “It would change what the directors are telling us in the strategic report but wouldn’t change [the structure of] the balance sheet and profit and loss account,” explains Russell Picot, special advisor to the TCFD and former chief accounting officer at HSBC. For hydrocarbons, categories such as reserves and resources in strategic reports would be the numbers most likely to change.

Leaders have already emerged, and the picture is mixed. In its 2016 study, In the Pipeline CDP finds Norwegian company Statoil the best hydrocarbons performer on carbon disclosure for the longer-term horizon, with Canadian company Suncor listed as the poorest, and ExxonMobil second to last. “Statoil is the only company that quantifies what a world with a 2 degree Celsius [°C] temperature increase would do to its worth,” says Soliman. Indeed, in its 2016 annual report, Statoil states that the International Energy Agency’s ‘450 ppm scenario,’ compatible with that temperature increase, “could have a positive impact of approximately 6 percent on Statoil’s net present value compared to Statoil’s internal planning assumptions as of December 2016.”

While most companies employ conventional economic metrics to justify decisions in financial filings, CDP finds they also increasingly publish carbon pricing. This can be perceived as another way to express the risk of regulation on carbon emissions and to test the company’s resilience in that light. Eight out of the 11 companies studied use an internal carbon price, ranging from USD 22/tonne to USD 57/tonne. Three (Chevron, Occidental and Petrobras) are silent on the matter. Some apply a carbon price to projects under assessment, but there is no evidence they screen out projects on this basis. “I have not seen a case where the company has said: The project makes sense but we are going to veto it because the carbon price is too high,” says Soliman.

The TCFD report thus comes at a time of transition. Some oil and gas majors are talking about climate risk, others are not. Some are acting accordingly, others paying lip service. An obvious example of directional shift is Italian company Eni, which is increasing the share of gas in its portfolio. In its 2015 annual report, it states: “Companies operating in energy business have to face with challenges…such as climate change and a gradual decarbonization process. In this context, natural gas represents an opportunity for a strategic repositioning, thanks to gas low carbon intensity.”

But the task force wants more. If the corporate community systematically adopted its recommendations, balance sheet, income statements and strategic reports would need modifications, as Picot points out: “including climate risk would sharpen disclosures on the impairment of cash flows arising from assets.”

Investors would be able to access a set of comparable sector scenario analysis relating at least to a 2°C scenario as well as, for instance, scenarios related to Nationally Determined Contributions and business-as-usual (greater than 2°C) scenarios. But the actual frameworks have yet to be shaped. “We need to see a period of experimentation. Three or four years down the road we could potentially be assessing what is useful in the voluntary disclosures, and see it codified by institutions through, for example, stock exchange guidelines,” says Picot.

However, he suggested the most significant progression would be found in strategic discussions in financial statements. “This is not going to result in a huge data drop by companies but rather a thoughtful narrative description from board directors. It will hopefully be used as an engagement tool as well as a divestment tool,” he says. A move towards less carbon-intensive business models could result. However, says Picot: “we’re not saying they should alter their business model but that the information needs to get out there so that the market can decide.”

Disclosures on climate-related risk have been improving, but as the Statoil case demonstrates, the view of risk is always subjective. “The company had the previous year assessed a 5% loss in NPV, so the 6% improvement estimated in 2016 was an interesting flip,” points out Soliman. Arguably, the risks to financial performance are considerable if a company moves away from its traditional business model or abandons its store of expertise.

This piece originally appeared on Ethical Performance and is republished here with permission

This Furniture Maker Has an Idea for California’s 102 Million Dead Trees

California is slowly recovering from a painful drought due to several months of plentiful rain and snow, and has reversed most of the statewide water restrictions. Nevertheless, the state’s landscape will long suffer from this painful legacy: over 102 million dead trees, most of which are in the Sierra Nevada mountains and surrounding foothills, are scattered across California’s forests. Trees that died off during the drought were joined by others that became weakened and succumbed to pests such as beetles.

No easy answers exist for coping with all these dead trees. If you happen to be camping at a state park or national forest in the Sierras, there is plenty of fuel for pit fires. Some conservationists have suggested clearing that wood and using it for biomass energy. Most of these dead trees standing or lying around, waiting for nature’s cycle to take its course. But none of those options is ideal, as one way or another, they allow for more emissions to enter the atmosphere.

A pair of furniture makers have another idea: transform that wood into functional objects that are also climate-friendly.

Sam Schabacker and Sandra Lupien founded SapphirePine, a product line of contemporary furniture that showcases this wood’s nature beauty. The company salvages dead native conifers, which include ponderosa, coulter and foxtail pines. That wood, in addition to being lightweight yet sturdy, also offers aesthetic appeal due the streaks of blue and grey often interspersed within the grain.

SapphirePine is currently taking custom orders for dining tables, benches and coffee tables. The company also has launched a Kickstarter campaign in order to raise funds for a van and tools its co-founders say are needed to increase both quality and production.

Image credit: SapphirePine

Michigan Accuses Flint of 'Endangering the Public' Over Lack of Water System

New pipes are going in. The old lead pipes are on the way out. But according to a list of violations issued to the city of Flint last week by Michigan's Department of Environmental Quality (DEQ), the city still has a very long way to go before it will be say it has tackled its contaminated water problems.

"Significant deficiencies" still need to be tackled by the city council, the biggest of which is settling on just where it wants to get its water. And according to DEQ, that ambivalence is holding up a long list of other initiatives, "including infrastructure improvements, establishing water rates, securing outside funding for critical projects, ensuring reliable delivery of drinking water, and recruiting/hiring water department staff."

The issue at hand isn't that there aren't available water sources says the state, but that the council can't agree on how it should provide water to residents.

In June, after the city council failed to approve a long-term contract with its old water provider, Great Lakes Water Authority (where it currently gets its water on a temporary basis), the state sued the city for allegedly endangering the public. The state had initially offered to forgive infrastructure loans if the city will agree to sign a 30-year contract with GLWA, a step that some council members oppose because it would effectively quash local efforts to establish a city-owned water plant and increase water rates to residents.

But temporarily extending the GLWA contract may not solve Flint's fiscal problems either, since it will cost the city an added surcharge, ballooning water rates to $600,000 a month.

Nor will it necessarily lessen problems for residents, some of which faced the threat of tax liens earlier this year for not paying off their delinquent water bills. In May the city threatened to impose liens against some 8,000 homeowners for unpaid water bills that were incurred during the water crisis that halted the use of city tap water. The city council eventually bowed to pressure to put the action on hold, acknowledging that imposing liens could result in thousands losing their homes. The American Civil Liberties Union and the NAACP Legal Defense Fund pointed out that it was the city's own water management system that provided the contaminated water at the source of the legal debate.

If there is any positive news to come out of Flint, it is that the Environmental Protection Agency (EPA) has agreed to write off $21 million in loans it advanced to Flint Mich. to upgrade its water system between 1999 and 2003. The four loans were issued to the city with the state's support under the agency's Drinking Water State Revolving Fund.

“Rebuilding our nation's infrastructure is one of the President's top priorities, and EPA is especially focused on those communities, like Flint, that need it the most,” EPA Administrator Scott Pruitt said. The Drinking Water loan program is a federal-state program in which the state chips in 20 percent of the approved loan. Gov. Rick Snyder acknowledged the federal government's decision, noting that the write-off would help Michigan and "allow for state funding to be spent on high priority infrastructure needs that maintain recent water quality improvements and address public health concerns."

And even though residents only have a few more years before they can count on using their spanking new water infrastructure, experts figure the Flint water crisis is due to be a topic of discussion in council chambers and court rooms for a very long time. A federal appeals court recently ruled that Flint residents do have the power to sue the state government over the impact of the water crisis. The ruling overturns an earlier district court decision that stated that federal water law prevented residents from suing the state, which had appointed emergency water managers to run the Flint water system. Experts have blamed the lack of proper water treatment and the water quality of the Flint water source as the reason for 12 deaths from Legionnaire's Disease and more than lead poisoning of thousands of Flint residents, including approximately 8,000 children.