As New Opportunities Emerge, the U.S. Offshore Wind Industry is Ready for Takeoff

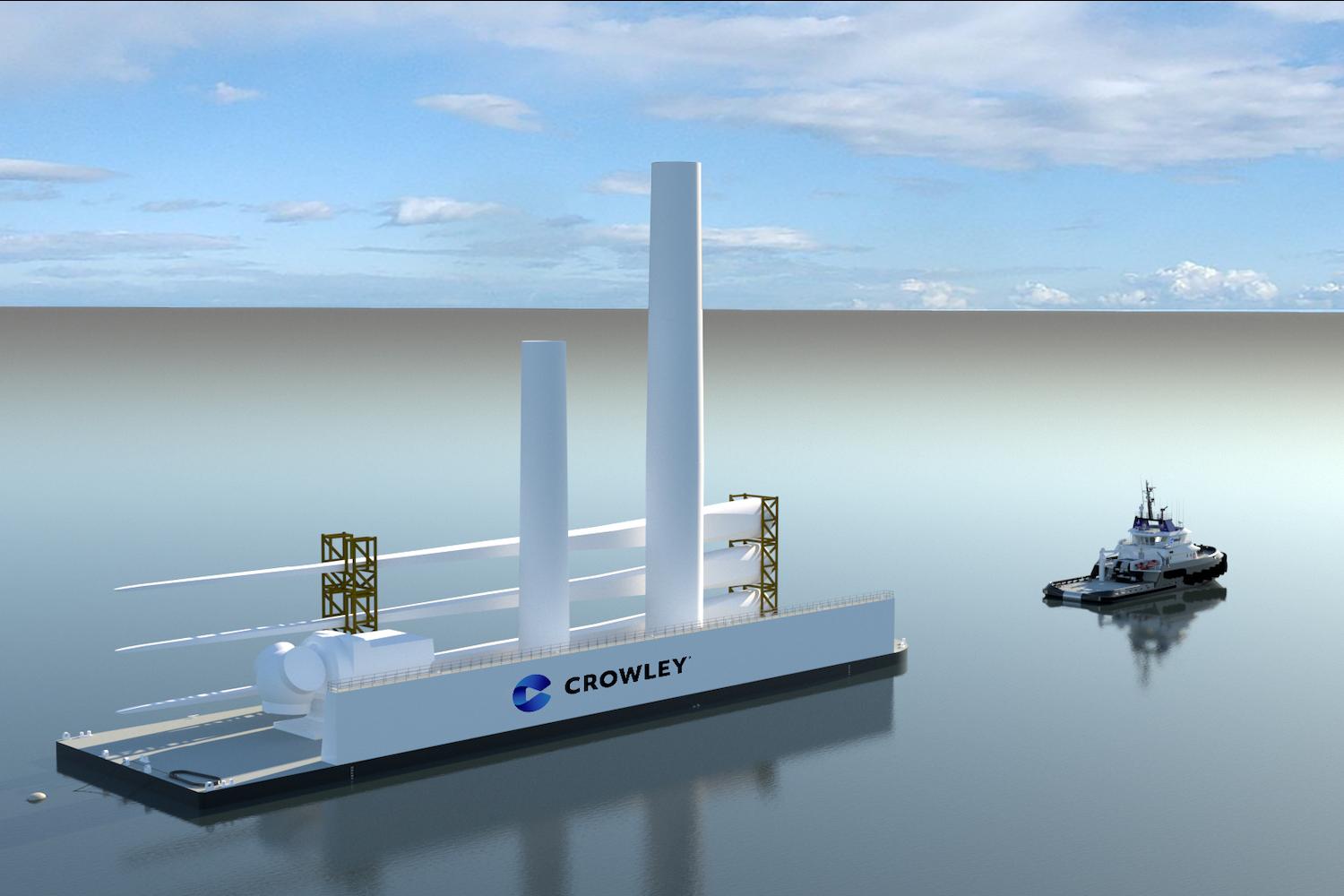

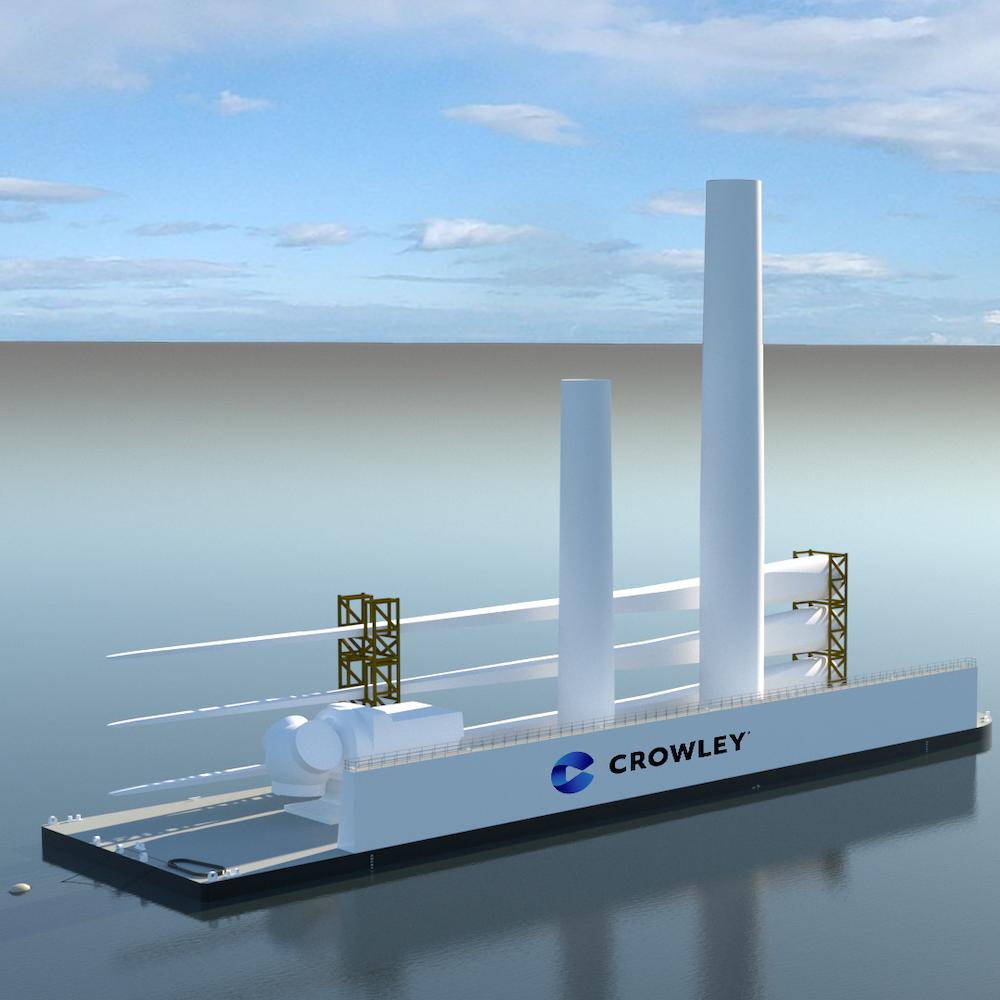

Crowley’s 400-foot long, 105-foot wide, heavy lift deck barges have 25-foot side shells to support offshore exploration and development activity.

Offshore wind energy is relatively new to the U.S., with the first offshore turbines coming online less than 10 years ago. As with any new industry, its impact on the national economy has yet to take shape, but signs of activity are already beginning to stir.

A look at the current landscape indicates offshore wind will exercise a strong and sustainable influence over business growth and job creation in the U.S. in the years to come, while also helping to shepherd the global economy into a more sustainable energy profile.

Vast opportunities in the U.S. offshore wind industry

Compared to land-based wind farms, it may seem difficult, cumbersome and expensive at first glance to send wind turbines out to sea. However, there are several significant advantages. Wind speeds are stronger and more efficient on the open ocean, larger areas are available for development, and offshore wind farms can serve high-population coastal cities where land for renewable energy development is scarce. In addition, the massive wind turbines of today can be shipped from a port-side manufacturing facility to the offshore site without encountering tunnels, bridges and other onshore obstacles.

The coastal waters of the contiguous U.S. are rich in offshore wind opportunities. According to an assessment by the U.S. Department of Energy, 1.5 terawatts – 1,500 gigawatts -- of offshore wind energy are technically available for development with conventional, fixed-bottom wind turbines. New floating turbine technology has opened up an additional 2.8 terawatts in waters that are too deep for conventional turbines.

The U.S. offshore wind industry is gearing up

In other parts of the world, the offshore wind industry is already well underway — and accelerating. In Europe, for example, Denmark installed the first offshore turbines in 1991. It took 30 years for Europe’s total offshore capacity to reach 14.6 gigawatts in 2021. The EU is targeting another 45 gigawatts of offshore capacity in less than 10 years and 300 gigawatts by 2050.

In the U.S., the nation’s first commercially operating offshore wind farm is the Block Island wind farm off the coast of Rhode Island. It came online in 2016 with just five turbines and a total capacity of 30 megawatts.

Seven years later, Block Island still remains the nation’s only commercially operating wind farm, but not for long.

A new, streamlined offshore wind area leasing process and more vigorous support from public policymakers has finally opened up the U.S. market and set the stage for a new burst of economic activity.

Helping to accelerate the U.S. offshore wind industry are legacy maritime firms like Crowley, which have the experience and knowledge base to take a new maritime industry under their wing by leveraging supply chain capabilities and the nation’s substantial port-side infrastructure opportunities.

Massachusetts, for example, has set a goal of 5.6 gigawatts in offshore wind capacity by 2030. The state enlisted Crowley to provide terminal operations and other support for the new Salem Offshore Wind Terminal, which is nearing the construction phase.

In an interesting twist on the decarbonization story, the terminal site once housed a 750-megawatt coal and oil power plant. The plant was shut down in 2014, and part of the site now houses a gas power plant.

Crowley is tasked with designing, constructing and providing operational logistics services for wind developers serving projects for Massachusetts and other New England states. That includes vessels, onsite logistics and broader supply chain management, as well as maintenance support once the turbines are operational.

Along with supplying clean energy, the New England states’ push toward offshore wind is set to create an infusion of new jobs in wind, maritime and related industry.

“We see the need for mariners, stevedores, logisticians and technicians — roles and careers that will add value to the supply chain and wind industries and also benefit the communities’ economies,” said Bob Karl, senior vice president and general manager of Crowley Wind Services. “In addition, the project will support workforce in the construction phase beginning late 2023-2024.”

In support of wind industry employment, Crowley also partnered with the Massachusetts Maritime Academy in a first-of-its-kind training and workforce development program tailored to the New England offshore wind energy industry.

Meeting the floating offshore wind challenge

The waters of the Atlantic coast are relatively shallow, making them ideal for fixed-bottom wind turbines. The Pacific coast is deeper, requiring new floating wind technology. Crowley is also pursuing opportunities there, as California works toward a statewide goal of at least 5 gigawatts in offshore wind energy by 2030.

Planners anticipate the waters off Humboldt Bay in Northern California can provide 1.6 gigawatts of that amount. Crowley’s Wind Services business unit is developing a new marine terminal there to service the region’s floating offshore wind sector.

“Services there will support tenants in the manufacturing, installation and operation of offshore wind floating platforms, use of large heavy cargo vessels, and providing crewing and marshaling services in the Pacific waters,” according to the company.

Floating wind technology is relatively nascent, but there is a strong overlap with traditional maritime services. The key functions are heavy lift capabilities and other supportive operations that are well within its skill set, Karl said.

“Crowley has decades of experience supporting the energy industry, and the assets and services we have operated in the past — tugs and barges, terminals, marine engineering — can help develop, build and sustain wind installations on the U.S. East, West and Gulf Coasts,” he told us.

“Crowley has been supporting large assets and equipment installations, as well as providing supply chain services that has helped the energy sector in the past, and these capabilities are applicable now,” he continued. "The use of our supply chain management experience, asset support for offshore projects and history of operating terminals is a natural fit for supporting renewable energy in offshore wind.”

Economic development and decarbonization, too

Crowley includes itself in the trend toward decarbonization, with an eye on its full value chain as well as its own operations. The company aims to achieve net zero greenhouse gas emissions across the value chain by 2050 and published its second annual sustainability report detailing its decarbonization efforts this summer.

The reports highlighted Crowley’s first-of-its-kind electric tugboat, the use of liquified natural gas instead of conventional maritime fuel, and the recent endowment of the Crowley Center for Transportation and Logistics as an innovation hub at the University of Florida’s Coggin College of Business in Jacksonville.

Crowley added to its innovation roster last year in a joint venture with the shipbuilding firm ESVAGT, which has pioneered the use of purpose-built, specialized service operations vessels (SOVs) for offshore wind construction personnel. The venture is building a new SOV for coastal Virginia wind installations.

Follow the money to a new Industrial Revolution

Crowley expects construction at the Salem facility to begin later this year., and the company has established an office in California to oversee the terminal development at Humboldt Bay. In Louisiana, the company has the right of first refusal to develop and operate a wind terminal at Port Fourchon.

“We are also building out more engineering, procurement and construction capabilities for project management so energy companies can leverage end-to-end, turnkey services as the nascent wind industry in the U.S. takes off,” Karl said.

Despite opposition by some fossil energy interests and other stakeholders, the U.S. offshore wind industry has the potential to lead a 21st-century Industrial Revolution. Progress will continue to accelerate if public policy in support of decarbonization continues to gather force.

“Crowley is committed to reaching net-zero emissions across all our scopes, not just our operations but our full value chain including our suppliers and partners,” Karl said. “Not only is clean, renewable energy from wind consistent with Crowley’s commitment to reaching net-zero, it helps our communities, and the people there enjoy a more sustainable future.”

This article series is sponsored by Crowley and produced by the TriplePundit editorial team.

Images courtesy of Crowley

Can Kelp Save the Fashion Industry?

Kelp may bring up images of underwater forests and frolicking sea otters, but there’s more to this seaweed than meets the eye. These ecosystems are powerhouses of marine diversity, and kelp is found in products from food to soil conditioners. Now you can wear it, too, as innovators find success in turning this giant seaweed into fiber.

The startup Keel Labs says its yarn made from kelp comes with a significantly lower environmental footprint than other common fibers. In addition, kelp is like the teenager of the crop world, sprouting up to 18 inches per day. Could the ocean hold the key to eco-friendly fashion?

Launching a kelp-based fiber

After witnessing the unsustainable practices in the fashion industry, Aleks Gosiewski and Tessa Callaghan founded Keel Labs in 2017. With a mission built on ocean-based materials, the startup recently launched its flagship product, Kelsun yarn.

Produced from biopolymers — large molecules obtained from living things — extracted from kelp, it’s mixed with cotton to produce a surprisingly soft yarn. Obviously, it's aimed at the fashion industry, but it's also applicable to home furnishings, interiors and motor vehicles.

While not the first kelp-based fiber out there, Kelsun yarn is unique for having a high content from seaweed, said Chris Mekeel, the company’s vice president of research and development.

“Across the board, you can find novel companies that are solving old problems in new ways, and they're pulling from recent advances in biotech and biomaterials,” Mekeel said. “Look at the polymer that we're working with: If we wanted to engineer and design that polymer, we couldn't do as good of a job as nature's done through evolution over millions of years.”

Keel Labs’ biopolymer technology also has the potential to replace petroleum-based and plastic products, Mekeel said, though the company's current focus is fibers and textiles.

The high cost of fashionable fiber

Kelp’s potential makes sense. It’s hardly news that the fashion industry has sustainability issues, starting with its roots: fiber.

For starters, many synthetic fibers, like polyester and acrylic, are produced from petroleum, a nonrenewable resource. They also shed a lot of microfibers into waterways when they’re washed. Globally, they contribute around 35 percent of the microplastics in oceans — making them the largest source, according to a report from the International Union for Conservation of Nature. Polyester production also comes with a sizable carbon footprint — up to 4 percent of the world’s carbon emissions.

On the other hand, natural fibers have their own set of problems. For example, 2,700 liters of water is used to make one cotton shirt, according to the World Resources Institute. That’s what you’d drink in over two years. This hefty use can be linked to dwindling water supplies in some parts of the world.

Cotton is also called the world’s dirtiest crop for a reason. Its cultivation accounts for nearly 5 percent of global pesticide sales and 10 percent of insecticide sales, according to the Better Cotton Initiative. Pesticide use seriously damages the environment and harms farmers, potentially poisoning millions each year.

Despite this, there is a push for more sustainable and organic cotton. For instance, the Better Cotton Initiative supports practices like reducing pesticide use, using water sustainably, providing decent working conditions, and preserving soil health and biodiversity. While they’ve made great strides, sustainability programs like Better Cotton only cover around 20 percent of global cotton production.

With all of this in mind, hemp holds promise as a more productive, environmentally-friendly alternative, but its current production in the U.S. remains just a silver compared to broad swathes of cotton fields in the Southwest and Southeast.

Kelp’s light footprint

Perhaps the solution was growing just offshore. Currently, Keel Labs uses naturally harvested kelp, although it plans to look toward farmed kelp as it scales up. Thankfully, wherever it is found, kelp provides a number of benefits.

“It has much lower carbon dioxide emissions by comparison to essentially any fiber that's on the market currently,” Mekeel said. “It also represents a significant reduction in water usage.”

Kelp farms have a low environmental footprint since they don’t need pesticides, fertilizers or freshwater. Kelp also sequesters carbon in the ocean, helping combat ocean acidification caused by climate change. This, in turn, benefits shellfish and marine food webs including fish, seabirds and whales.

Kelp also cleans up nutrient runoff in coastal waters. For instance, around New York City, environmental organizations are experimenting with kelp farms to remediate polluted waters. And kelp forests provide habitats for numerous plants and animals. However, kelp farms do not appear to support the same levels of biodiversity as these natural areas.

The future for marine fibers

The future for alternative fibers looks bright. The market for sustainable fabrics — worth nearly $26 billion in 2022 — is predicted to grow to almost $75 billion in 10 years. While organic cotton is likely to drive much of that growth, there’s ample room for more creative types of textiles.

Kelp may be a solid choice. Around 30 species of kelp are found in temperate and arctic coastal waters worldwide. And the global seaweed market is expected to grow to nearly $12 billion in 2030.

“We’re at this intersection right now in industrial history where there is this demand for greener production processes across the board in every industry,” Mekeel said. “It’s coming from environmental regulations and the need to replace, in a lot of cases, petroleum-based products, which have a finite amount available to us. And that coincides with an end-user consumer sentiment that we can do better.”

As products with sustainable attributes become increasingly mainstream, consumers should have more sustainable choices across the world of fiber, fabric and fashion. And if this comes from a beneficial source like kelp, all the better.

Featured image: Oleksandr Sushko/Unsplash

Busting Myths About ESG and Sustainable Investing

"Anti-ESG" rhetoric on political campaign trails and cable news breeds misinformation and creates misunderstanding about the use of environmental, social and governance factors in business. This week we're breaking down some of the most common myths we see out there about ESG and what it means for businesses and investors, with insight from Andrew Behar, CEO of the shareholder advocacy organization As You Sow.

Myth: ESG is just a big greenwash. Companies aren't really improving.

Back in 2019, the CEO-led Business Roundtable — which represents executives at some of the largest U.S. companies — issued a statement revising the “purpose of a corporation.” After decades of saying companies should make all of their decisions based on maximizing short-term shareholder profit, the executive group proclaimed the private sector has a duty to all of its stakeholders, including employees, customers and communities. That means considering things like environmental sustainability and social equity alongside profit — in other words, adopting ESG principles.

Those are big words from a lobbyist group that includes executives from major financial companies like BlackRock and JPMorgan Chase, and many onlookers weren't convinced. Environmental and social advocates said businesses weren't living up to what they put on paper, and — particularly as the anti-ESG narrative took hold — politicians, pundits and social media warriors took aim at companies for the mere mention of considerations beyond the bottom line. The result? Companies got quieter about their work in ESG, a trend known in sustainability circles as "greenhushing."

"Five years ago, companies were doing nothing and taking a victory lap," Behar said. "Right now we have companies doing stuff — and I can tell you, it's with greater intensity, with greater depth — but they do not want to take the victory lap. It’s a better situation, because they're actually changing their policies and practices, but it's the greenhushing. They want to be quiet, because there are too many trolls out there."

Behind the scenes, companies are spending more on new programming tied to sustainability and social impact. They've also agreed to gather more information about things like diversity, equity and inclusion (DEI) in their workforces and the ways climate change impacts their supply chains — and disclose that information to investors and shareholder groups like As You Sow.

"When the declarations were made in 2019 about the new purpose of a corporation, that was really the moment where all of the companies said, 'Okay, if we want to outperform, if we want to succeed, we're going to be shifting our fundamental philosophy,'" Behar told us.

In this sense, anti-ESG critics are about four years "late to the party," he said. "There's no question in my mind that we are well along this implementation phase of a new purpose of a corporation and this transformation to a regenerative economy based on justice and sustainability. The extractive economy is winding down. And it's just a question of how fast and how much pain they're going to cause everybody else in the process."

Myth: ESG and sustainable investing are anti-business.

Many far-right critics characterize ESG as something brand new, a symptom of the "wokeness" and "cancel culture" they say grip modern society. But ESG isn't new. The term was coined back in 2005. And even before the Business Roundtable's 2019 statement, thousands of professionals were working as "ESG analysts" across the mainstream financial sector.

For investors, ESG is primarily a risk management and long-term growth mechanism. By understanding how companies manage their supply chains, source their ingredients and treat their workers, investors can better understand which companies are prepared for the future. Likewise, companies leverage ESG principles to manage and mitigate the risks they face.

"Overall, what we're seeing here is just basic good business practices being demonized for political ends and people spending a lot of money to do it. And a lot of that is trying to stop what we see as market forces that have already happened — this is way over," Behar said. "The companies that have adopted justice and sustainability are the ones that people want to put their money in, because they know those companies are going to succeed over the next five, 10, 20 years."

Myth: If companies embrace ESG, goods and services will become more expensive.

Many individual products that are marketed as "sustainable" do come at higher prices. Critics often use this point to argue that the more companies consider ESG principles, the more expensive goods and services will become across the board.

But this misses critical context around the state of modern global supply chains. Social inequality and environmental crises already make it more difficult — and more expensive — to do business. ESG principles offer a way to manage and reduce that risk, which stabilizes prices over the long term.

Take climate change as an example and what Behar refers to as "climate inflation." His team at As You Sow aggregates news articles that cover increasing commodity prices tied to climate change. They've noted a clear upward pattern over recent years, with the spring heatwaves in Europe that all but decimated Spain's olive industry among recent examples.

"They had no olives, so olives are more expensive," Behar explained. "Coffee's more expensive, chocolate's more expensive, cotton's more expensive. Cereal's more expensive. The boiling of the planet is really having some impacts on global commodity prices."

Myth: You can't invest sustainably unless you're rich.

Indeed, institutional investors like asset managers, endowments and foundations increasingly use ESG factors to decide where to invest their money. ESG-focused institutional investment is projected to increase by 84 percent by 2026, making up around a fifth of all assets under management.

But you don't have to be rich to invest sustainably, or to leverage your voting power as a shareholder in support of ESG. Last month, we outlined some simple ways for any and everyone to get involved with sustainable investing if they have the interest — from voting their proxies on individual stocks, to voicing their support for ESG in their 401(k) plans.

"We know we've got this vast majority of folks who actually want to vote to get corporations to provide a livable planet," Behar said. "It's a matter now of just getting people to talk about it."

Image credit: Patrick Tomasso/Unsplash

New Zealand is Reducing Agricultural Emissions By Building Efficiency

New Zealand’s government has an ambitious plan for its agricultural sector to be “the world’s most sustainable provider of high-value food and fiber products.” The roadmap for the sector includes targets such as adding $44 billion to food and fiber exports by 2030 while slashing sector emissions by 10 percent.

Looking for a sustainable red meat? Try New Zealand grass-fed beef or lamb.

Raising cattle and other livestock creates greenhouse gas emissions and uses more water than vegetable, grain and legume production. However, cattle and sheep farmers in New Zealand are cutting emissions and growing livestock in areas otherwise unsuitable for vegetable and grain production.

“The way we farm our beef in New Zealand is different from what a lot of the world does,” said Kate Acland, farmer and chair of the farmer-owned industry organization Beef + Lamb New Zealand. “The carbon footprint of New Zealand lamb and beef is among the lowest in the world.”

Acland farms with her husband and three children on a 10,000-acre plot called Mount Somers Station on New Zealand’s southern island. They raise sheep, deer, bees, and both beef and dairy cattle in a temperate climate, between 1,600 and 2,600 feet above sea level.

“Our beef [cattle] run on hills where we can’t grow crops,” Acland said. “They are outside all year round and not under irrigation. Our water use is rain."

Because New Zealand is an island nation with limited space, farmers are often more focused on creating efficiencies rather than scaling up, and greater farming efficiencies leads to greater sustainability gains.

“Since 1990, we have reduced our carbon footprint by 30 percent, but we are still producing the same kilograms of product,” Acland explained. “We continue to chase and pursue efficiency for the health of our planet and the health of our balance sheet.”

For example, the number of lambs that each ewe gives birth to has been steadily increasing over the last 10 years. When one ewe can give birth to two or more lambs, the lamb production has a smaller carbon footprint. When farmers can finish their grass-fed livestock to heavier weights in a shorter amount of time, the carbon emissions per product also decreases.

Livestock farmers like Acland also leverage practices that help the surrounding ecosystem, such as running animals as a large group in different fields on a rotating basis, known as rotational grazing. More time between grazing allows the grasslands to recover and roots to grow deeper.

When it comes to practices that promote biodiversity, “people do it because it’s the right thing to do,” Acland said. New Zealand’s livestock farming sector has pledged to be carbon neutral by 2050, and all major farming sectors in the country have signed an industry-wide pledge to measure, report and reduce their greenhouse gas emissions.

New Zealand’s approach to wine

Acland spends most of her time as a sheep and cattle farmer, but her background is in wine grapes, and she maintains a vineyard in addition to Mount Somers Station. She grows her wine grapes using regenerative methods such as intercropping, the practice of growing cover crops between rows of cash crops, and composting, using the spent grape skins from the winery to mulch the vines.

“We maintain diverse grasses underneath the vineyard, such as rye grass, clover and chicory,” Acland said. “We have about 16 different species that are under the vineyards. We let them go to flower. When we mow, we mow with a side throw so it goes underneath the vines and adds to organic matter. Our soil is sandy, and our soil [organic matter] is depleted. We are trying to build it up.”

Wine grapes are New Zealand’s largest horticultural crop by area. And almost all wine in New Zealand comes from farms that participate in Sustainable Winegrowing New Zealand, an industry-wide certification program that has been in place since 1995, Acland said. The program covers all aspects of sustainability, from climate to chemical use to labor rights for workers.

“There is a strong consumer demand for sustainably certified wines,” said Edwin Massey, general manager sustainability for New Zealand Winegrowers, the national organization for the country's grape and wine sector. “This demand is growing through demographic change: Younger people are drinking less alcohol overall, but when they choose to drink, they are more often choosing premium products that connect with their ethics and values. Having a robust sustainability certification process helps assure these consumers that New Zealand wine is the right choice for them.”

The New Zealand wine sector has set sustainability goals that are critical to the future success of the industry. New Zealand wine is differentiated by the country’s cool climate and water supply, meaning that working to mitigate climate change is in the best interest of vintners and other industry stakeholders. Research is currently underway to identify vines resilient to disease and pest pressure and that are more drought tolerant, Massey said.

Meanwhile, consumer demand for New Zealand wine is strong. “Demand for New Zealand wine continues to outstrip supply and is the key reason why New Zealand proudly occupies some of the highest price points in any market we export to,” said Charlotte Read, general manager of marketing for New Zealand Winegrowers. "New Zealand wine exports have surged to new record levels with their largest ever one-year growth, lifting 25 percent in value to NZD$2.4 billion [about US$1.5 billion].”

Although New Zealand produces less than 2 percent of global supply, the country is now the sixth largest exporter of wine by value, Read said.

Kiwifruit is king

While wine grapes are New Zealand’s biggest horticultural crop by area, kiwifruit are its biggest horticultural crop by economic value. Kiwifruit is a $2.6 billion sector in New Zealand, with most of the farms found in the Bay of Plenty. Zespri is the marketer for the country’s kiwifruit industry and handles exportation, marketing, and distribution of New Zealand kiwis to over 50 countries worldwide, including the U.S.

New Zealand kiwifruit production increased by close to 70 percent between 2010 and 2019, and at the same time, the industry improved efficiencies on-farm and in packing and shipping that accounted for a 24 percent drop in greenhouse gas emissions.

“We’re starting from a strong base in terms of already treading fairly lightly on the land, but as an industry, we’re making steady progress on improving environmental practices both on-orchard and throughout the supply chain,” said Rachel Depree, executive officer for sustainability at Zespri.

On orchard, Zespri has developed research and development partnerships to better grow and promote regenerative and sustainable farming practices in the kiwifruit and apple sectors. “Over the next five years, we’re looking to test the regenerative concept in three kiwifruit and three apple orchards, using a specific combination of soil, water and biodiversity management practices, comprehensive monitoring of critical ecosystem services, and undertaking an economic analysis of the results,” Depree explained.

Zespri is also working in partnership with key leaders in New Zealand’s primary sectors to prepare for the impacts of climate change and manage biodiversity risks. It also set long-term sustainability goals that account for the priorities of customers, growers and other stakeholders, in packaging, water, climate change, health and wellbeing and community investment.

Telling the New Zealand story to the world

While sustainability claims can help a farmer market their products, Acland emphasized that New Zealand farmers also implement more regenerative practices as a labor of love. “I don’t know a single farmer who is driven solely by money,” she said. “We do it because we love the lifestyle, and we love everything about it.”

For example, the country's largest red meat producer encourages its farmer-suppliers to keep swaths of their land wild in order to promote carbon sequestration — allowing them to formulaically offset the emissions from the beef they produce through this practice.

“It’s a cool story. It’s not purchased carbon credits, but it’s happening within each individual farming system.” Acland said. “Because New Zealand is so good, especially in the greenhouse gas space, the challenge for our export businesses is to go to the world and try to claim a premium and sell their story.”

At the same time, Acland acknowledges that as consumers move increasingly toward eating local, selling the world agricultural products from New Zealand could seem counterintuitive. However, she noted that transport plays a small role in the overall emissions from New Zealand agricultural sectors like beef and lamb. “People are wanting to eat local, but 90 to 95 percent of emissions are made on farms, so that’s where the gains can be made,” she said.

New Zealand’s sustainability commitments also provided the basis for a robust free trade agreement with the European Union that aims to improve the sustainability of both New Zealand and EU food systems.

The deal was signed on July 9 of this year and includes standards for climate impact, labor and gender equity, as well as subsidy provisions for sustainable fisheries. Trade between the EU and New Zealand is projected to grow by 30 percent as a result of the agreement, according to the European Commission.

For her part, Acland is confident in the future of regenerative agriculture across New Zealand farms. “We are regenerative by the very nature of how we farm: grass fed and pasture raised,” she said. “We have huge pride in what we do and our environmental stewardship.”

This article series is sponsored by Beef + Lamb New Zealand and produced by the TriplePundit editorial team.

Image courtesy of Beef + Lamb New Zealand

Follow the Science-Based Targets, And the Offsets May Come

Groups including the Science-Based Targets initiative encourage their corporate members to look toward eliminating emissions from their supply chains and purchasing renewable energy, rather than relying on carbon offsets for their climate action plans.

Companies that rely mainly on carbon offsets to build their sustainability profiles may be facing trouble ahead. The Science-Based Targets initiative is making the case for direct action on carbon management, and more business leaders are joining the movement. Those left behind may find themselves at risk of reputational damage unless they do their homework and approach carbon offsets with caution.

Science-Based Targets: Follow the money

The Science-Based Targets initiative launched in 2015 as a means to steer the massive resources of private capital toward effective climate solutions that are based on science. SBTi provides companies with the tools to set net-zero carbon emission goals for their own operations and take effective steps toward reaching those goals.

“Science-based targets show companies and financial institutions how much and how quickly they need to reduce their greenhouse gas (GHG) emissions to prevent the worst effects of climate change,” SBTi explains.

The organization’s ability to muster financial firepower has been growing. It launched in partnership with business and environmental organizations including the United Nations Global Compact, CDP (formerly the Carbon Disclosure Project), WRI (World Resources Institute) and WWF (the World Wide Fund for Nature). The We Mean Business Coalition also signed its members on to the initiative. And in 2021, SBTi closed out its net-zero Business Ambition for 1.5°C campaign after recruiting 1,000 companies.

Members of the campaign now represent more than $23 trillion in market capitalization, topping the entire GDP of the United States, according to SBTi.

By the end of last year, membership climbed to more than 4,000 companies accounting for more than 33 percent of the market capitalization of the entire global economy. The number includes those committed to setting targets as well as those that have already started the process.

What a difference the U.S. makes

Another indication of the growing influence of the Science-Based Targets initiative came on August 3 when the U.S. branch of the global organization Ad Net Zero updated its recruiting numbers.

The Ad Net Zero parent organization formed in the U.K in 2020 with the goal of shifting consumer behavior, as well as helping the advertising industry reduce its carbon footprint. Last June, the organization announced that its members are required to commit to net-zero targets through the SBTi or a comparable alternative, such as the U.N. Race to Zero or The Climate Pledge.

The U.S. branch launched in February 2023 under a partnership with 18 leading industry organizations, including the American Association of Advertising Agencies (4A’s), the Association of National Advertisers and Interactive Advertising Bureau.

The addition of a branch in the U.S. had a significant impact on the global reach of Ad Net Zero. As described by the U.S. branch, the global organization now covers a market that accounts for 45 percent of all advertising expenditures, with the U.S. market alone accounting for 40 percent.

In its latest update, Ad Net Zero U.S. listed brands and advertisers including Molson Coors, Uber, 51toCarbonZero, Acceptable Ads Committee, Brand Safety Institute, BSV Digital Displays, GMR, Integral Ad Science, LoopMe, woman- and LGBT-owned The Mixx, Murphy Cobb and Scope3 among its most recent members. The firm ThanksToYou also recently joined as its first member focusing on the Latin America market.

The power of collaboration

Of course, it is easy for companies to sign on to various pledges and letters of support to advocate for climate action. Following up with actual action steps is the hard part. But collaboration can help companies pool their resources and share best practices.

The companies that sign on to the Ad Net Zero organization are leveraging collaboration to maximize their effectiveness. In addition to insisting on concrete action steps consistent with science-based targets, Ad Net Zero draws on the diverse resources of its members and partners to provide industry-specific training and guidance.

The U.S. branch, for example, reports that its 70-strong membership includes global-level supporters and agency holding company subsidiaries. Together, the 70 members represent “a spectrum of companies across the advertising ecosystem, from brands and agencies to production, advertising technology and media.”

To the extent that the U.S. advertising industry of the 20th century steered consumer behavior toward carbon intensity, perhaps the 21st-century advertising model will become equally effective in the opposite direction.

The signs are pointing in the right direction. The global Ad Net Zero organization has partnered on education, measurement and training initiatives with other organizations including the World Advertising Federation’s Global Alliance for Responsible Media and the U.K. nonprofit carbon calculator AdGreen. In addition, experienced members like Meta and Accenture are combining their expertise and communications resources.

Ad Net Zero also notes that eight of the 10 biggest advertising agencies in the world are members, along with three of the biggest brand advertisers. The top three companies in the ad tech sector are also represented. In 2021, these three companies alone serviced 74 percent of online ad spending, as well as 47 percent of all advertising dollars.

“All for None” and the potential power of carbon offsets

As befits the creative resources at its disposal, the global Ad Net Zero organization adopted the clever slogan, "All for None.” By evoking the capability of each individual to make a difference in collaborative action toward net zero, that message can resonate with individual consumers as well as business leaders.

The consumer angle could offer a way forward for carbon offsets, which have increasingly come under fire for promising more than they can deliver.

In January, for example, The Guardian reported on an investigation into the leading voluntary carbon offset standard Verra, in which the news organization concluded: “Forest carbon offsets approved by the world’s leading certifier and used by Disney, Shell, Gucci and other big corporations are largely worthless and could make global heating worse.”

In May, CNBC reported on an analysis of almost 300 global carbon offset projects, accounting for 11 percent of all carbon credits sold to date. The analysis was undertaken by researchers at the Berkeley Carbon Trading Project. “Major registries in the carbon offset market are systematically over-crediting projects and delivering dubious carbon offsets, allowing some companies to claim more climate benefits than deserved,” wrote Emma Newburger of CNBC in summary.

Still, global groups like the World Economic Forum continue to support carbon offsets, and the availability of new data could improve transparency and reliability. However, WEF also cautions that carbon accounting is “fiendishly complex.”

Companies seeking to reduce their carbon footprints are best advised to join the Science-Based Targets initiative or a comparable organization. SBTi, for example, requires companies to take direct action within their own operations and value chains, without relying on offsets.

On the other hand, SBTi does not entirely exclude carbon offsets. “Offsets are only considered to be an option for companies wanting to finance additional emission reductions beyond their science-based targets (SBT) or net-zero targets,” the organization explains.

That leaves the door open for consumer engagement. Deloitte is among the analysts expecting more companies to use point-of-purchase offsets to promote their brands, with the help of apps and other user-friendly technologies.

“Several categories of consumer spending, including food, transportation and entertainment, could easily incorporate an option to purchase carbon offsets,” Deloitte noted in a July report.

In that regard, the creative talent of the advertising industry could provide a loud, meaningful counterbalance to the torrent of Republican-led attacks on ESG (environmental, social and governance) business principles.

Red flags about carbon offsets abound, but with sufficient transparency, reliability and user-friendliness, they could become an important way to stimulate individual action on climate change and help motivate consumers to adjust their purchasing habits to prioritize sustainability and circularity.

Image credits: Markus Spiske/Unsplash

This New Marketplace Aims to Encourage Farmers to Adopt Sustainable Practices

Traceability is increasingly important across agricultural sectors — and not just because of government regulations. Many consumers want to know that their food and other products have been ethically and sustainably sourced. Not all crops have kept up with the trend toward sustainable farming and labeling, however. In the U.S. grain sector, for example, few growers practice sustainable agricultural techniques, and transparency to the field level remains a challenge.

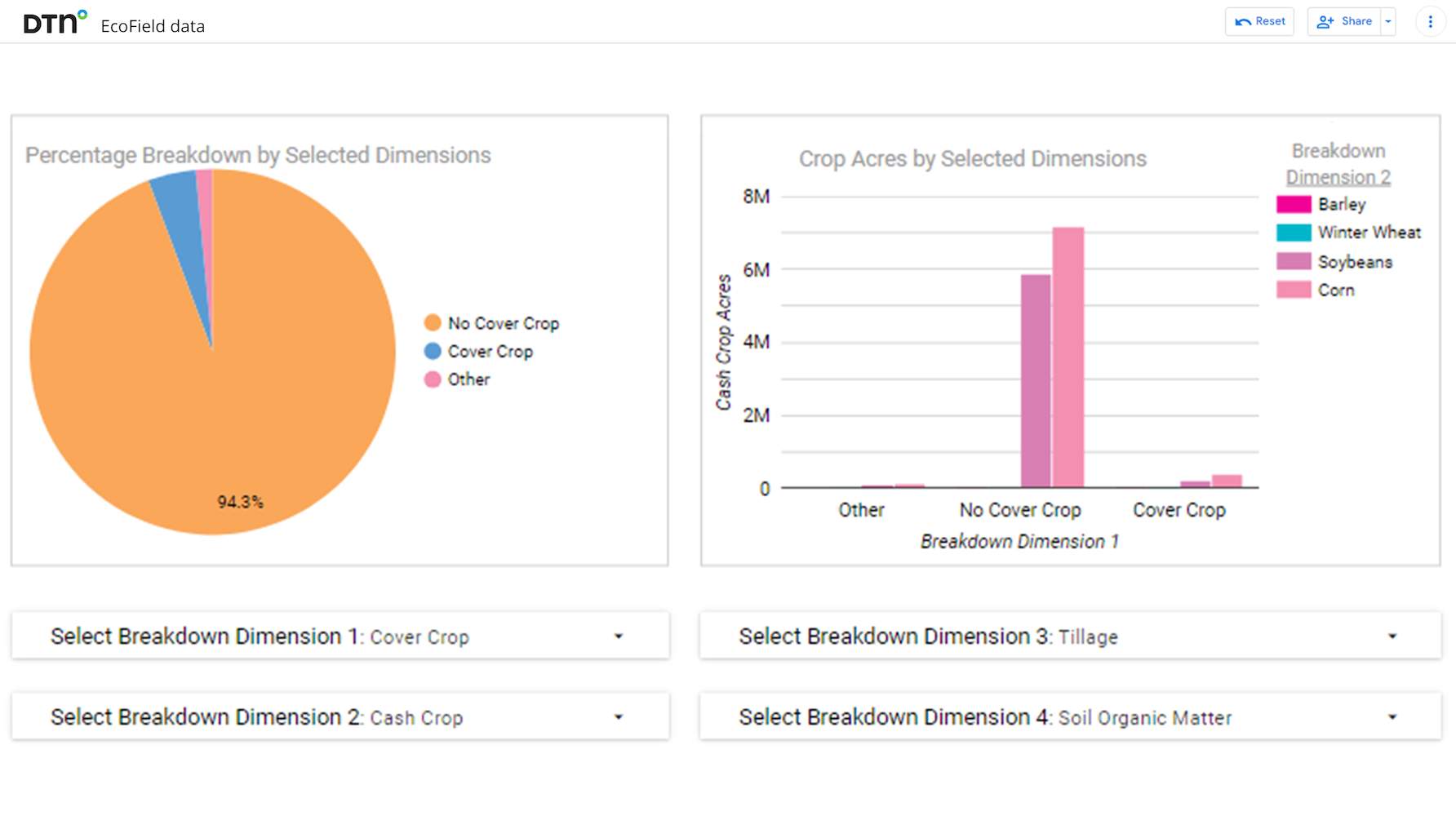

DTN, which specializes in technology, data and analytics, is among the businesses looking to change that. The company is collecting data on 19 major grain, oil seed and legume crops across 35 states in preparation for launching a sustainable marketplace in partnership with the U.S. Department of Agriculture. Using the marketplace powered by machine learning, grain buyers will be able to make their purchases based on agronomic practices like cover cropping, tillage and irrigation.

“Consumer demand is a huge one in this in the near term. Brands want to say things along the lines of 'this [is the footprint]' and be able to substantiate a claim such as 'this is a net zero product,'” Grey Montgomery, senior vice president and head of ag products and operations at DTN, told TriplePundit. He referred to the increasing number of consumer packaged goods companies that provide information about the practices behind their products through scannable codes. “That kind of degree of traceability seems to be an inevitability in consumer demand, and so we're trying to do our part to meet that.”

The marketplace DTN is developing will also be useful in regards to the U.S. Securities and Exchange Commission’s Scope 3 emissions reporting requirements. Although the SEC’s climate rules have yet to be finalized, businesses need to be prepared for when they are — which makes elective environmental, social and governance (ESG) reporting a wise move.

“A number of companies like to be able to note what their Scope 3 footprint is … and how close they are to net zero in their in their public reports,” Montgomery said. While DTN is not creating a carbon credit marketplace, the compiled data on carbon sequestration can be used as an awareness tool for potential carbon credits, he said.

DTN collects data on approximately 50 measures of sustainability, with cover crops being of the highest priority for the USDA. The practice refers to planting secondary crops after harvest in order to maintain topsoil health and prevent erosion, among other benefits. “We’re literally helping the USDA identify cover crops and make [farmers] aware of USDA funding that helps pay for the cost of conversion," Montgomery explained.

On that aspect, there’s definitely a lot of room for improvement. DTN’s data shows that the vast majority of grain farmers are not using cover crops, with many reluctant due to higher costs and potentially smaller yields, as demonstrated by NASA research.

Researchers Claire E. LaCanne, of the Natural Resource Management Department at South Dakota State University, and Jonathan G. Lundgren, of the Ecdysis Foundation, also found lower yields in a 2018 study of the effects of regenerative farming on corn crops —29 percent lower to be precise. However, profit actually increased under the sustainable model by a whopping 78 percent. “Profit was positively correlated with the particulate organic matter of the soil, not yield,” they wrote.

While the partnership between DTN and the USDA isn’t going so far as to require all-organic production, Montgomery is confident the sustainably grown grains, seed oils and legumes will fetch a higher price. And that will entice more farmers to convert to sustainable practices.

“The gist of it is that what we're trying to create is a marketplace whereby any number of entities that seek to buy grain would be able to buy grain based on the ... sustainability traits [and] practices of farmers,” he said. “Because of those differences in traits, the goal ultimately [is that] farmers get rewarded with a premium non-commodity price for their practices.”

Image credit: Raphael Rychetsky/Unsplash