'Abortion-Hushing' Can Restore Some Rights, But More Trouble Looms

Protestors rally in support of reproductive rights in Reno, Nevada.

The term “greenhushing” has become familiar shorthand for the ability of corporations to make progress on environmental issues, without running afoul of partisan political objections to ESG (environmental, social, governance) principles, by not talking much about the work they're doing. U.S. business leaders could apply a similar tactic to advocate for reproductive rights on a state-by-state basis, but progress in that area can only be guaranteed by strong federal protections for abortion and contraceptive access.

Abortion-hushing in Texas

One recent example of “abortion-hushing” occurred in Texas, a state that gained a particularly strong reputation for restricting abortion access with the passage of Senate Bill 8 in 2021.

Republican Gov. Greg Abbott is front and center among the state officials supporting the ban. However, as noted by reporter Selena Simmons-Duffin of National Public Radio, earlier this month he quietly signed a bill into law that undercuts the “fetal heartbeat” provisions of Senate Bill 8.

“Abbott signed a law giving doctors leeway to provide abortions in Texas when a patient's water breaks too early and for ectopic pregnancies,” Simmons-Duffin reported. “The new law, which goes into effect Sept. 1, is the work of a Houston Democratic lawmaker who built bipartisan support."

Simmons-Duffin, who reports on health policy for NPR, attributed the legislative achievement to the absence of the word “abortion” in the bill. The lawmaker behind the bill, Democratic state Rep. Ann Johnson, adopted that strategy after hearing from doctors in her constituency. She realized there was a sharp disconnect between what doctors know about abortion and what Republican lawmakers in Texas believe about abortion.

For doctors, abortion is a broad term that covers fatal or life-threatening medical conditions. In contrast, Johnson portrays the political opposition as rooted in a belief that abortion always consists of an “elective procedure on a completely healthy fetus," she told Simmons-Duffin.

Half measures are not enough

That view of the political opposition does not fully capture the full range of anti-woman, anti-pregnancy sentiment expressed in abortion bans. The Johnson bill also focuses narrowly on two instances where the pregnancy will clearly not result in a live birth, without including a range of other complications.

Still, the Johnson bill does represent some progress. It helps to shield some medically necessary abortions from the false portrayal of abortion as a self-centered act of cavalier individualism. The emphasis on medical necessity provides an opening for business leaders in other abortion-restricting states to advocate for at least a partial relaxation of the law.

However, a piecemeal, state-by-state approach is not enough. Republican office holders are already setting the wheels in motion for a national abortion ban that could supersede any state-based attempts to preserve the rights of pregnant people.

Elections have consequences, but judicial appointments are for life

A national ban on abortion may seem like a remote possibility, though that depends on the outcome of the 2024 election cycle. Of more immediate concern is the peppering of the U.S. judiciary with ultra-conservative judges, capped by the presence of a 6-3 Republican-appointed supermajority on the United States Supreme Court, including three justices appointed by former President Donald Trump.

Regardless of which party prevails on legislative policy, the lifetime appointments to the Supreme Court will continue to impact abortion rights for the foreseeable future.

That impact has already proved devastating. Despite pledges of support for precedent during nomination hearings, the Republican-appointed Supreme Court supermajority upended 40 years’ worth of precedent on abortion rights when it overturned the 1974 Roe v. Wade decision last summer.

Extremist judges elsewhere in the federal system have also had a powerful impact on abortion access. In particular, U.S. District Court Judge Matthew Kacsmaryk of Amarillo, Texas, set off a firestorm of protest on April 7 when he issued a ruling that overturned the Food and Drug Administration’s approval of the widely used abortion drug mifepristone. That approval was first rendered 23 years ago, in the year 2000, and it has been expanded since then.

Countdown to catastrophe

Mifepristone is still available for the time being. However, its future status is in doubt. The U.S. Department of Justice challenged the Kacsmaryk ruling, and the case was sent to the U.S. Court of Appeals for the 5th Circuit. A three-judge panel of the court issued its ruling last Wednesday, August 16.

“Access to the abortion pill mifepristone must be restricted, a U.S. appeals court ruled on Wednesday, ordering a ban on telemedicine prescriptions and shipments of the drug by mail,” Reuters reported.

It could have been worse. A two-judge majority on the panel narrowly applied the ruling to COVID-related expansions on access. Nevertheless, the ruling was not a surprise. “All three judges on the panel are staunchly conservative, with a history of opposing abortion rights,” observed Reuters reporter Brendan Pierson.

“One of them, Circuit Judge James Ho, said he would have gone further and pulled mifepristone off the market, but the other two judges said the lawsuit came too late to challenge the original 2000 approval,” Pierson added.

The panel did put a hold on the ruling, pending the results of an appeal to the U.S. Supreme Court by the Justice Department. The clock is ticking. If the Supreme Court decides to let the ruling stand, or if it throws further roadblocks against access to mifepristone, abortion access will be impacted in all 50 states, not just the states that restrict access.

The spillover of abortion patients from restrictive states to non-restrictive states has already resulted in backlogs and needless delays. Limiting telemedicine and mail-order shipments will push more patients into doctors’ offices, further straining medical systems.

The full implications for corporate DEI (diversity, equity and inclusion) programs are yet to be seen. However, signs of an impact on economic opportunity have already emerged, and the loss of obstetrics and gynecology services in some communities sounds an ominous note for employee recruitment and retention.

Business leaders have long ignored the warning signs of anti-abortion extremism by continuing to lend financial support to Republican candidates who oppose abortion rights. The 2024 election cycle provides one final opportunity to undo some of the damage done, if they choose to take it.

Image credit: Manny Becerra/Unsplash

Singapore Leads Green Finance and Helps Other Countries Follow Suit

The skyline around the Gardens by the Bay nature park in the Central Region of Singapore.

As the United Nations COP28 climate talks approach, wealth and resource inequality remains a glaring blindspot in international climate action strategies. To meet global climate goals, the developing and emerging economies most vulnerable to climate change will need to see massive increases in clean energy investment, according to the International Energy Agency (IEA).

"Annual clean energy investments in emerging and developing economies will need to more than triple from $770 billion in 2022 to as much as $2.8 trillion by the early 2030s to meet rising energy needs and align with the climate goals set out in the Paris Agreement," the IEA found in a June report.

Public investment cannot bridge this gap alone. Meeting international benchmarks also requires massive mobilization of private capital.

Singapore’s government and financial institutions recognize this need. The country leverages green finance plans — including public-private partnerships and carbon trading — to help not only itself but also the rest of Southeast Asia meet their climate change contributions.

Becoming a leader in green finance

Singapore launched its Green Plan 2030 in 2021, which lays out a roadmap for commitment to the U.N.'s 2030 Sustainable Development Agenda as well as the Paris Agreement on climate change. A collaboration between the Ministries of Education, National Development, Sustainability and the Environment, Trade and Industry, and Transport, the plan establishes concrete targets across these sectors through as far as 2040.

Targets for 2030 include Singapore becoming an Asian carbon services hub and “a leading center for green finance and services to facilitate Asia’s transition to a low-carbon and sustainable future,” the plan reads.

This past spring, Singapore’s central bank — the Monetary Authority of Singapore — assembled an outline for government efforts to drive green finance through the Finance for Net Zero Action Plan, which is an expansion of its 2019 plan.

The bank’s approach focuses on “promoting consistent, comparable, reliable climate data disclosure; engaging financial institutions to support risk management; science-based transition plans; and more,” said Bo Bai, chairman and co-founder of the Singapore-based financial technology company MVGX Holdings.

In green finance public-private partnerships, for example, the government sets policy guidelines. Then, financial regulators offer financial institutions and other organizations support and advice on cooperating with those guidelines.

On the private side, companies can then begin the process of measuring carbon emissions across different operating scopes, mitigating emissions, offsetting emissions often through carbon credits, certifying emissions reductions to ensure they meet international standards, and financing the new scope, Bai said.

Leveraging international partnerships responsibly

In 2022, Singapore signed memorandums of understanding to collaborate with Vietnam, a fellow Association of Southeast Asian Nations (ASEAN) member state, on energy and carbon credits. The memorandums underscore the nations’ commitment to shared progress toward climate resilience and Southeast Asia’s overall decarbonization through efforts including financing renewable energy, increased cross-border electricity trade, and carbon credit pilot programs.

Leveraging international partnerships is an important opportunity for global decarbonization, for which each nation under the Paris Agreement commits to support through its Nationally Determined Contribution. Cross-border carbon trading opens up a host of important accountability questions, which regional partnerships like those in Singapore and Southeast Asia must navigate responsibly.

“For example, if you have a Thailand carbon project's generated corporate credit, when the owner of a source of carbon credit sells these to a buyer, say, in Singapore: Is this going to be counted as Thailand’s carbon emission reduction when they report to the United Nations, or is it going to be counted as Singapore's?” Bai said, citing Article 6 of the Paris Agreement.

Questions like these usher in possibilities for new infrastructure that demands accountability within green finance. Climate registries and auditing systems help regulate carbon markets by providing transparent accounting and issuing offsets, helping prevent the double-counting of carbon credits and offsets.

Not all countries, however, have national registries. And existing registries — whether national, private or international — did not effectively share their respective information efficiently. At the Asia-Pacific Petroleum Conference last September, the World Bank and the International Emissions Trading Association selected Singapore to anchor a decentralized metadata platform that consolidates existing climate registries representing 11 national governments and 30 organizations called the Climate Action Data Trust.

And Singapore continues to explore data and environment, social and governance (ESG) disclosure information through other international initiatives like the China-Singapore Green Finance Taskforce established in April.

Singapore's leadership in green finance not only sets a strong example of bilateral and regional climate partnerships but also, hopefully, marks a long-overdue flow of capital and expertise to emerging economies.

Image credit: Timo Volz/Pexels

HP Puts a Big Bet On Sustainable Impact As a Competitive Edge

HP's focus on ESG principles doesn't hamper innovation. The HP Metal Jet S100, launched in 2022 to enable mass production of 3D-printed metal parts, is a case in point. (Image courtesy of HP)

Big tech companies are looking for ways to differentiate in a hyper-competitive landscape amid economic headwinds that caused tech giants to lose a combined market value of around $2.5 trillion in 2022.

Rather than seeing that as an excuse to cut programs that might seem ancillary to the bottom line, like those related to sustainability and environmental, social and governance (ESG) issues, many tech leaders see ESG as critical as ever to their business in 2023. In fact, aligning the core business and value creation to ESG performance is how a number of tech firms are seeking to stand out from the crowd.

Among them is global tech leader HP, for which ESG has long been a defining aspect of doing business. HP has reported on its Sustainable Impact goals and progress for more than two decades and was among the first companies globally to publish its complete carbon footprint over 10 years ago. The company is aiming to halve greenhouse gas emissions by 2030 and reach net-zero emissions by 2040.

Linking business success and ESG investments

HP publicly shares how its ESG investments influence business success. The company reported that $3.5 billion in net sales were influenced by its Sustainable Impact efforts in 2021 — a threefold increase from a year earlier. In 2021, HP also tracked more than $7 billion in new sales that meet customer requirements for eco-labels, like Energy Star and EPEAT. This is a sign that HP is being rewarded amidst growing consumer pressure for more sustainable products and services.

“We are seeing increasing interest in sustainability and social impact from our customers, investors, and employees,” James McCall, HP’s chief sustainability officer, told TriplePundit. “We know that it’s a factor in attracting and retaining talent, and we’re seeing a rise in employee engagement, including employee volunteering. With our customers, sustainability is increasingly a purchase consideration.”

Circularity takes center stage

HP and other tech firms are largely dependent on the finite resources that provide the materials for their products, from hard-to-recycle plastics to critical minerals. As such, they face a tough balancing act in meeting their environmental and social ambitions. It is not surprising, then, that HP’s sustainability strategy includes a key focus on circularity, or systems where materials are reused and recycled in perpetuity and nothing becomes waste.

The company is leading the way when it comes to using recycled materials. Acknowledging there is no universally accepted definition of what it means for a company to be “circular,” HP created its circularity goal by focusing on the materials and products it places on the market, committing that 75 percent of HP’s products and packaging will come from circular sources by 2030.

Toward robust measurement and disclosure

Ambitious goals mean that HP must be robust in its data-gathering so it can be accurate in its measurement and confident in its disclosure. Companies with the right systems in place for data collection will be better prepared to meet upcoming ESG regulations, like the anticipated climate risk disclosure requirements from the U.S. Securities and Exchange Commission (SEC) and the EU’s Corporate Sustainability Reporting Directive (CSRD), for example

HP aims to halve its absolute value chain emissions by 2030. And it says it’s always pursuing areas for improvement, such as using a new life cycle assessment (LCA) tool to calculate emissions associated with its personal systems products. LCAs like these evaluate environmental impacts at every stage of a product’s life, from raw materials sourcing to production, distribution, use and, ultimately, reuse or disposal. "It's an ongoing collaborative process that involves continuous information and knowledge sharing from across multiple organizations," McCall said.

Data collection remains a complex challenge

HP was one of the first in the tech industry to provide information connecting sustainability with sales wins, first publishing this data in its 2019 Sustainable Impact Report.

“Not only is tracking and sharing this data important for our own leadership, we also heard from customers and peers that this type of information helps them reinforce their own business case toward investing in sustainability initiatives,” McCall said.

Still, collecting data on ESG programming and impact all over the world is a tall order for any company. “Historically, measurement and metrics has been complex,” McCall noted. “We collect data from more than 100 sites globally, and that process has varied by issue, business unit, function and geography. In 2021, HP set its aggressive and comprehensive 2030 agenda, taking that complexity into account.”

Another sign of a company committed to strong governance for sustainability is third-party verification of its data. HP has voluntarily reported on its sustainability work for more than 20 years. For the past 10 years, EY has performed an independent review of selected key performance indicators in HP’s reports. With its 2021 Sustainable Impact Report, EY reviewed 10 metrics spanning Scope 1, 2 and 3 greenhouse gas emissions.

“We are also implementing even more robust reviews for HP’s disclosures, leaning in on our company’s approach to financial reporting,” McCall said. “All of this helps reinforce our long-standing commitment to authenticity.”

Tying executive compensation to ESG performance

HP is among a growing number of companies that has added ESG-related incentives to its compensation strategy. “All members of our executive leadership team have responsibility for Sustainable Impact targets — and performance against these targets and other business objectives is tied to their total compensation, ” McCall said.

HP is not alone in this move to link compensation to ESG performance. According to recent Harvard Law School research, the vast majority of S&P 500 companies are now tying executive compensation to some form of ESG performance: 66 percent of S&P companies did so in 2020, a figure that increased to 73 percent by 2021. Most significant was the rise in use of diversity, equity and inclusion (DEI) goals, from 35 percent of S&P companies in 2020 to 51 percent in 2021. But also the share of firms tying carbon footprint and emissions reduction goals to executive pay also grew considerably, from 10 percent in 2020 to 19 percent in 2021.

Why are firms making this part of their governance strategies? According to Harvard Law, to signal ESG is a priority, to respond to investor expectations and to achieve the ESG commitments the company has made.

“Now is a time for bold moves”

For HP, integrating ESG and business strategy ladders up to its aspiration“to become the world’s most sustainable and just technology company.” As he announced the company’s 2030 sustainable impact goals, HP President and CEO, Enrique Lores made the case for business transformation based on ESG factors.

“Climate change is a defining challenge of our generation that demands immediate action and investment,” Lores said. “Now is a time for bold moves and ambitious goals that will protect our planet and create new sources of innovation and growth across the global economy.”

This article series is sponsored by Workiva and produced by the TriplePundit editorial team.

Making it Easy for Enterprises to Engage with a Low-Carbon Agenda

This article is sponsored by Alibaba

Undoubtedly, technology has made our lives easier and cloud computing has emerged as a crucial tool adopted by many companies across various industries, unlocking vast potential and benefits. However, that's the beginning. With artificial intelligence, big-data capabilities and more cutting-edge technologies, cloud-based solutions can serve as a pivotal technological platform to support an innovative agenda, including with respect to sustainability.

We believe that the future of sustainable development lies in a low-carbon circular economy driven by innovative technologies and alternative energy sources. Particularly, digitization has become indispensable in tackling sustainability challenges. In the future, sustainability will become a vital standard for evaluating companies, necessitating urgent action by businesses big and small to reduce their carbon footprint and environmental impact while achieving their sustainability goals. Embracing digital technology within a business organization will also encourage sustainable innovations. Therefore, selecting the right strategies for investing in sustainable solutions is crucial to achieving the United Nations’ Sustainable Development Goals, mainly the SDG12 (responsible consumption and production) and SDG13 (climate action) goals.

The use of sustainable technology has been identified by Gartner as one of the Top 10 Strategic Technology Trends for 2023, highlighting it as a powerful tool for shaping the innovations of the future. When carefully and thoughtfully implemented, this technology can provide a valuable resource for helping to manage and lower the emissions of companies.

In addition, an analysis by Accenture shows that businesses can reduce their carbon footprint by 84 percent on average when migrating to cloud services. According to Gartner, more than 85 percent of companies will adopt a cloud-first principle by 2025, which can be a critical measure for carbon reduction and efficiency enhancement for both businesses and the economy.

Though migrating to the cloud can also generate carbon emissions, it’s imperative to provide cloud users with information on the carbon footprint of the cloud products and services they use. This is where AI-powered software-as-a-service (SaaS) solutions, such as Alibaba Cloud’s Energy Expert, can play a significant role. For example, a carbon management platform built upon a proven cloud infrastructure can enable users to make informed decisions about their energy consumption before taking steps to reduce their carbon emissions.

More importantly, organizations can benefit from a solution that is designed to help them monitor, analyze and optimize their carbon emission and make informed actions to fulfill their sustainability goals. A streamlined solution should be able to help enterprises to automate the carbon accounting and reporting process and obtain real-time sustainability impact statistics for them to make informed decisions.

An efficient sustainability solution enables enterprises to identify the sources of carbon emissions from their daily business activities as well as the full life cycle of their products, based on the PAS 2060 and ISO 14064 standards on carbon neutrality. Organizations can quantify their carbon footprint through pre-built calculation models and our datasets. It provides real-time visibility into carbon emission patterns and sustainability performance through visualizations on dashboards and online reports.

SaaS-sustainability: A case study

During the recent Olympic Esports Week (OEW) in June this year, Alibaba Cloud’s Energy Expert was deployed to measure and analyze carbon emissions from the event’s temporary construction, generating data-driven insights on the choice of materials and equipment.

Leveraging the latest tech-driven sustainability solution, the event organizers were able to identify the sources of carbon emissions from venue construction and operation, quantify the carbon footprint generated by a venue, and visualize a venue’s sustainability performance via an integrated dashboard and online reports.

In addition, Malaysia’s leading asset management and infrastructure solutions company, UEM Edgenta Bhd’s digital ecosystem platform, Edgenta NXT, has also adopted Energy Expert. The company is using the platform to count and measure emissions and carbon footprint to assist on their Scope 1, Scope 2 and Scope 3 emissions roadmap calculations. The sustainability SaaS solution has helped them to simplify the process, reduce errors, and prepare for a compliance exercise that they will be undertaking. The solution has been instrumental in helping them implement their ESG strategy.

It is remarkable to see that in recent years, numerous companies have pledged to achieve a net-zero emission target. In less than a year, the number of companies with net-zero pledges doubled, from 500 in 2019 to more than 1,000 in 2020. Malaysia, with its favorable business environment, advanced digital infrastructure and strategic location, is well positioned to become a leading hub for the digital economy in the region.

Considering Malaysia's goal of achieving a national agenda of net zero by 2050, we anticipate a growing demand from various industries to integrate sustainability into their business operations and minimize their environmental impact. This allows local companies to adapt more quickly to the digital era and run their business in a more sustainable manner, all while remaining agile and competitive in a fast-changing market.

This article is sponsored by Alibaba

Image credit: Matt Artz/Unsplash

Move Over Microplastic-Making Detergent Pods, a Plastic-Free Version is Here

There’s no denying the convenience of laundry and dishwasher pods made with water-soluble plastic. But the price of that convenience adds to the microplastic pollution accumulating in the environment and in our bodies. However, a solution to this part of the growing global plastic problem could be at hand.

Notpla, a startup based in the United Kingdom that makes plastic-free packaging from seaweed and plants, is partnering with Mack, a U.K.-based environmentally-friendly cleaning brand, to create sustainable detergent sachets for washing laundry and dishware — similar to the plastic pods we’re used to seeing on store shelves.

Detergent pods have a plastic problem

“This is our first commercial partnership with Mack to introduce this groundbreaking water-soluble film for the home and laundry care market, revolutionizing traditional packaging methods,” Cécile Roques, films product manager for Notpla, told TriplePundit in an email. “The collaboration represents a significant step toward sustainable alternatives to PVA and PVOH.”

Laundry and dishwasher pods are typically made of polyvinyl alcohol, a synthetic plastic material also known as PVA or PVOH. In the United States alone, 75 percent of the 17,200 metric tons of PVA used for these pods each year ends up in the environment as plastic pollution, according to a recent study.

“It’s easy not to think about PVOH as a plastic. Unlike much of the plastic we consume, it dissolves during use and leaves no visible residue,” Roques said. “We have often been told that these are plastic-free solutions. However, this is not true. PVOH is made from fossil fuels, and many studies have shown that they leave microplastics or plastics residue in the environment after dissolution.”

Seaweed is the secret ingredient

Notpla Film, the product used for the plastic-free sachets, is made from seaweed, plant and mineral extracts. It degrades naturally in four to six weeks without the need for industrial composting or special conditions, leaving no trace behind, Roques said.

“Our product does not disguise plastics,” she said. “Notpla packaging is made from natural materials and will dissolve or break down back to a natural state without human intervention, a key stepping stone to protecting our planet.”

And seaweed, one of the planet’s most abundant sources of biomass, has the potential to not only help reduce microplastic pollution but also capture carbon dioxide, one of the leading causes of climate change, said Pierre Paslier, co-founder of Notpla.

“In the fight against climate change, seaweed could be a surprising — but vital — weapon,” Paslier told the Carbon Herald. “Giant kelp’s biomass, for instance, increases by 20 percent per day, its production does not compete with food crops, and requires no fertilizer or fresh water to produce.”

Making the plastic-free swap easy

Notpla has developed various materials from plant-based ingredients since 2016. Its team has grown since then, and the bulk of its investment has been in research and development and manufacturing.

“At this stage, our team is full of expert knowledge in the field of regenerative materials, so our ability to foresee and troubleshoot hurdles has grown a lot,” Roque said. “We have elaborated the films from scratch, so we know the material extremely well and are aware of the material properties and barriers.”

Notpla wants its products to fit existing packaging machinery so manufacturers can avoid new capital expenditures when adopting its packaging solutions and easily scale to the size of the market.

“In the case of films, we need to meet the demands of huge markets and are working with brands who are selling direct-to-consumer,” Roque said. “Adapting natural materials to fit plastic production lines is not easy, and it took us tens of iterations to solve the many technical challenges we faced.”

Notpla is one of three companies that use seaweed to design sustainable, biologically degradable alternatives to thin-film plastic that received the 2023 Tom Ford Plastic Innovation Prize after a rigorous nine-month testing phase. The film was tested in soil, seawater and even a simulated whale gut, Roque said. “They aimed to look at the biological degradation at end-of-life and product performance of the films."

Plastic-free products that use Notpla Film will soon be available on Mack’s website for consumers to buy directly. “Within the year we will be launching Notpla Film with more consumer brands in the homecare and laundry market, which will be available through various retailers,” Roque said. “Toward the end of the year, we will begin to launch in different markets and applications as well, including dry food, such as herbs and spices, and cosmetics and personal care.”

While products using Notpla Film are currently only available in the U.K., the company is working with a number of U.S. partners to launch in the near future, she said. The rest of Notpla’s product range, such as its coated boxes, are widely available in the U.K., Ireland, Germany, Austria, the Netherlands, Poland, Spain and France through the food delivery platform Just Eat.

“Notpla’s primary goal is to replace as much single-use plastic as possible. We encourage companies to invest in finding the most planet-friendly formulations possible, but their current formulations can work with our films,” Roque said. “Any business wanting to make improvements on their current practices and showing real action is a business we want to work with.”

Images courtesy of Notpla

As New Opportunities Emerge, the U.S. Offshore Wind Industry is Ready for Takeoff

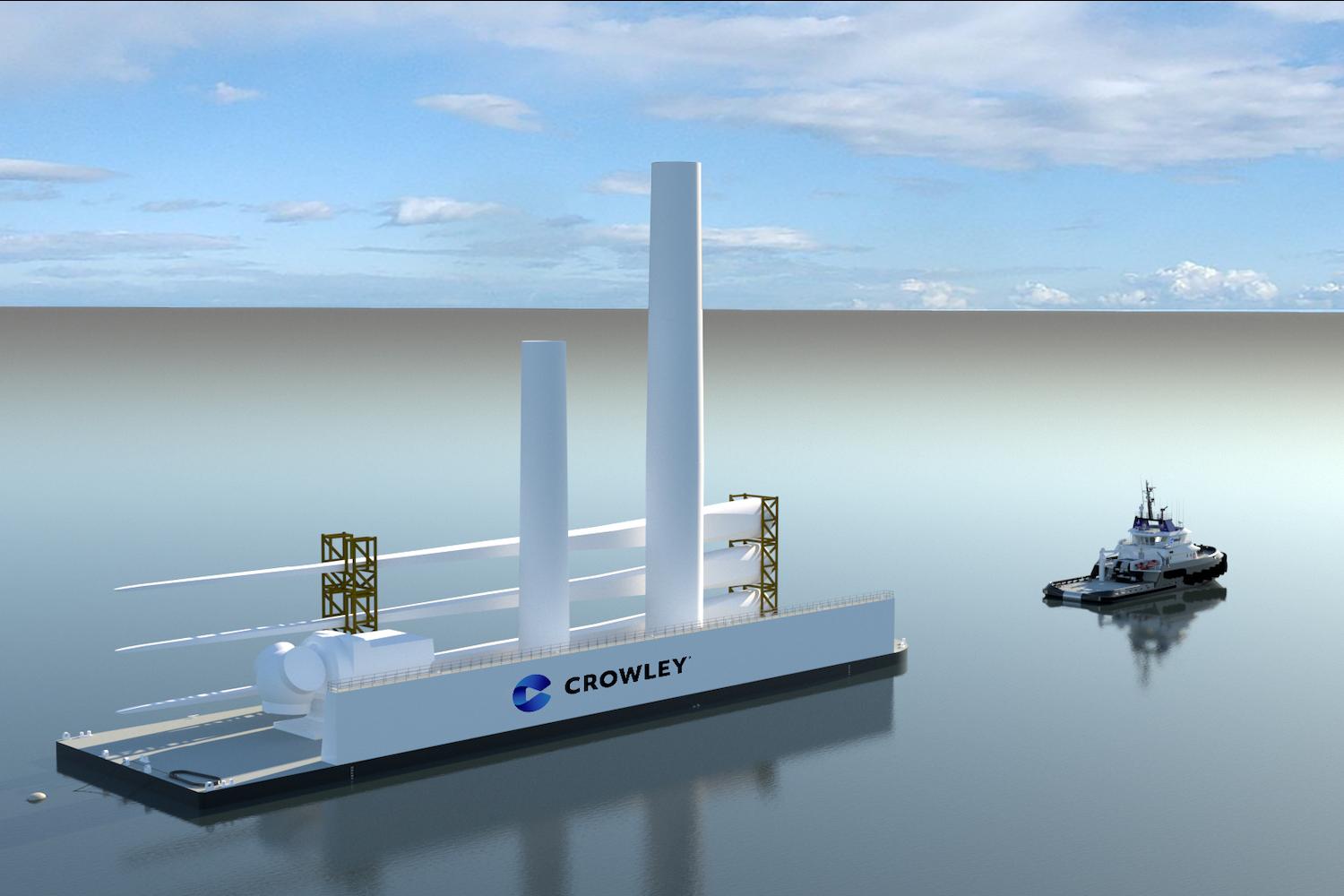

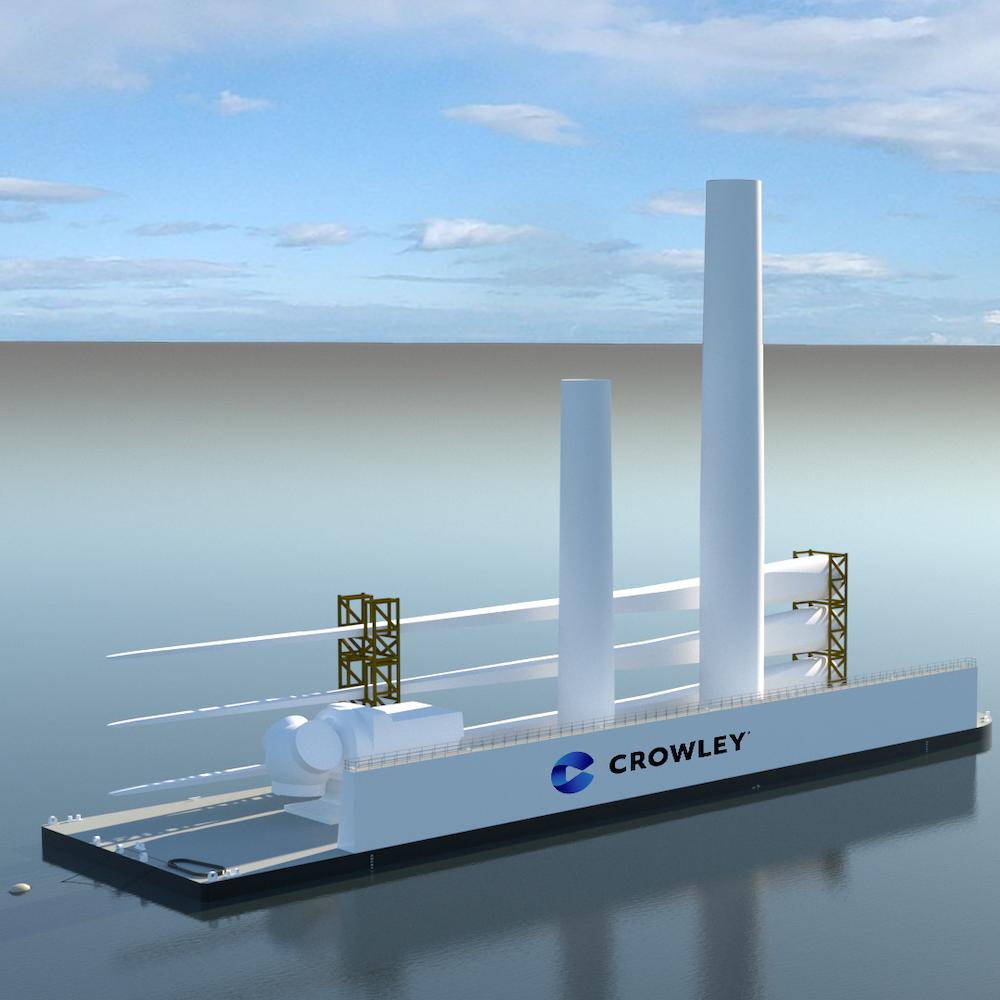

Crowley’s 400-foot long, 105-foot wide, heavy lift deck barges have 25-foot side shells to support offshore exploration and development activity.

Offshore wind energy is relatively new to the U.S., with the first offshore turbines coming online less than 10 years ago. As with any new industry, its impact on the national economy has yet to take shape, but signs of activity are already beginning to stir.

A look at the current landscape indicates offshore wind will exercise a strong and sustainable influence over business growth and job creation in the U.S. in the years to come, while also helping to shepherd the global economy into a more sustainable energy profile.

Vast opportunities in the U.S. offshore wind industry

Compared to land-based wind farms, it may seem difficult, cumbersome and expensive at first glance to send wind turbines out to sea. However, there are several significant advantages. Wind speeds are stronger and more efficient on the open ocean, larger areas are available for development, and offshore wind farms can serve high-population coastal cities where land for renewable energy development is scarce. In addition, the massive wind turbines of today can be shipped from a port-side manufacturing facility to the offshore site without encountering tunnels, bridges and other onshore obstacles.

The coastal waters of the contiguous U.S. are rich in offshore wind opportunities. According to an assessment by the U.S. Department of Energy, 1.5 terawatts – 1,500 gigawatts -- of offshore wind energy are technically available for development with conventional, fixed-bottom wind turbines. New floating turbine technology has opened up an additional 2.8 terawatts in waters that are too deep for conventional turbines.

The U.S. offshore wind industry is gearing up

In other parts of the world, the offshore wind industry is already well underway — and accelerating. In Europe, for example, Denmark installed the first offshore turbines in 1991. It took 30 years for Europe’s total offshore capacity to reach 14.6 gigawatts in 2021. The EU is targeting another 45 gigawatts of offshore capacity in less than 10 years and 300 gigawatts by 2050.

In the U.S., the nation’s first commercially operating offshore wind farm is the Block Island wind farm off the coast of Rhode Island. It came online in 2016 with just five turbines and a total capacity of 30 megawatts.

Seven years later, Block Island still remains the nation’s only commercially operating wind farm, but not for long.

A new, streamlined offshore wind area leasing process and more vigorous support from public policymakers has finally opened up the U.S. market and set the stage for a new burst of economic activity.

Helping to accelerate the U.S. offshore wind industry are legacy maritime firms like Crowley, which have the experience and knowledge base to take a new maritime industry under their wing by leveraging supply chain capabilities and the nation’s substantial port-side infrastructure opportunities.

Massachusetts, for example, has set a goal of 5.6 gigawatts in offshore wind capacity by 2030. The state enlisted Crowley to provide terminal operations and other support for the new Salem Offshore Wind Terminal, which is nearing the construction phase.

In an interesting twist on the decarbonization story, the terminal site once housed a 750-megawatt coal and oil power plant. The plant was shut down in 2014, and part of the site now houses a gas power plant.

Crowley is tasked with designing, constructing and providing operational logistics services for wind developers serving projects for Massachusetts and other New England states. That includes vessels, onsite logistics and broader supply chain management, as well as maintenance support once the turbines are operational.

Along with supplying clean energy, the New England states’ push toward offshore wind is set to create an infusion of new jobs in wind, maritime and related industry.

“We see the need for mariners, stevedores, logisticians and technicians — roles and careers that will add value to the supply chain and wind industries and also benefit the communities’ economies,” said Bob Karl, senior vice president and general manager of Crowley Wind Services. “In addition, the project will support workforce in the construction phase beginning late 2023-2024.”

In support of wind industry employment, Crowley also partnered with the Massachusetts Maritime Academy in a first-of-its-kind training and workforce development program tailored to the New England offshore wind energy industry.

Meeting the floating offshore wind challenge

The waters of the Atlantic coast are relatively shallow, making them ideal for fixed-bottom wind turbines. The Pacific coast is deeper, requiring new floating wind technology. Crowley is also pursuing opportunities there, as California works toward a statewide goal of at least 5 gigawatts in offshore wind energy by 2030.

Planners anticipate the waters off Humboldt Bay in Northern California can provide 1.6 gigawatts of that amount. Crowley’s Wind Services business unit is developing a new marine terminal there to service the region’s floating offshore wind sector.

“Services there will support tenants in the manufacturing, installation and operation of offshore wind floating platforms, use of large heavy cargo vessels, and providing crewing and marshaling services in the Pacific waters,” according to the company.

Floating wind technology is relatively nascent, but there is a strong overlap with traditional maritime services. The key functions are heavy lift capabilities and other supportive operations that are well within its skill set, Karl said.

“Crowley has decades of experience supporting the energy industry, and the assets and services we have operated in the past — tugs and barges, terminals, marine engineering — can help develop, build and sustain wind installations on the U.S. East, West and Gulf Coasts,” he told us.

“Crowley has been supporting large assets and equipment installations, as well as providing supply chain services that has helped the energy sector in the past, and these capabilities are applicable now,” he continued. "The use of our supply chain management experience, asset support for offshore projects and history of operating terminals is a natural fit for supporting renewable energy in offshore wind.”

Economic development and decarbonization, too

Crowley includes itself in the trend toward decarbonization, with an eye on its full value chain as well as its own operations. The company aims to achieve net zero greenhouse gas emissions across the value chain by 2050 and published its second annual sustainability report detailing its decarbonization efforts this summer.

The reports highlighted Crowley’s first-of-its-kind electric tugboat, the use of liquified natural gas instead of conventional maritime fuel, and the recent endowment of the Crowley Center for Transportation and Logistics as an innovation hub at the University of Florida’s Coggin College of Business in Jacksonville.

Crowley added to its innovation roster last year in a joint venture with the shipbuilding firm ESVAGT, which has pioneered the use of purpose-built, specialized service operations vessels (SOVs) for offshore wind construction personnel. The venture is building a new SOV for coastal Virginia wind installations.

Follow the money to a new Industrial Revolution

Crowley expects construction at the Salem facility to begin later this year., and the company has established an office in California to oversee the terminal development at Humboldt Bay. In Louisiana, the company has the right of first refusal to develop and operate a wind terminal at Port Fourchon.

“We are also building out more engineering, procurement and construction capabilities for project management so energy companies can leverage end-to-end, turnkey services as the nascent wind industry in the U.S. takes off,” Karl said.

Despite opposition by some fossil energy interests and other stakeholders, the U.S. offshore wind industry has the potential to lead a 21st-century Industrial Revolution. Progress will continue to accelerate if public policy in support of decarbonization continues to gather force.

“Crowley is committed to reaching net-zero emissions across all our scopes, not just our operations but our full value chain including our suppliers and partners,” Karl said. “Not only is clean, renewable energy from wind consistent with Crowley’s commitment to reaching net-zero, it helps our communities, and the people there enjoy a more sustainable future.”

This article series is sponsored by Crowley and produced by the TriplePundit editorial team.

Images courtesy of Crowley