ESG Investing Will Have A Good Year In 2024, Despite Turmoil In The U.S.

(Image credit: Aditya Vyas/Unsplash)

Critics have raised plenty of fire and brimstone in their opposition to investments made through the lens of environmental, social and governance (ESG) principles, but most of that energy has gone to waste. The ESG movement continues to gain momentum globally, and research shows that anti-ESG laws passed in the U.S. had a limited impact. In fact, the only clear losers appear to be the very people that anti-ESG legislation ostensibly aims to protect.

ESG investing gains global momentum while facing headwinds in the U.S. in 2023

The firm Russell Investment has surveyed how the investment management industry integrates ESG principles for the past nine years. Its 2023 survey, released in October, observed “the United States remains mired in a contentious debate” over ESG. That presents a sharp contrast with global jurisdictions that have strengthened their ESG reporting mandates, most notably Canada, Europe and Australia.

The contrast is also reflected in the adoption of the Net-Zero Investment Framework, a set of guidelines to help investors align their holdings with the global push to cap temperature rise at 1.5 degrees Celsius this century. Russell found that 80 percent of the managers surveyed in Europe had already signed on, with the U.S. lagging far behind at just 20 percent.

Others including the sustainable investing asset manager Robeco also noted a growing "ESG backlash in the U.S." in 2023.

The big question is how financial firms are handling the oppositional environment in the U.S. Some have simply decided not to use the acronym “ESG," without actually changing how they use ESG principles. Those taking this approach include the world's largest asset manger, BlackRock, CEO Larry Fink said at the Aspen Ideas Festival in June.

Marjella Lecourt-Alma, CEO and co-founder of the ESG and risk management platform Datamaran, has noticed a similar shift in the way clients talk about ESG. “Some of them say we watch our words a little bit. They are bringing back things like 'corporate sustainability,'” she told TriplePundit in December.

Kris Tomasovic Nelson, senior director and head of ESG investment management for Russell Investments, agreed. “ESG factors are increasingly driving investment decisions,” he told Pensions & Investments reporter Hazel Bradford earlier this month, but “the door is open to using different terminology.”

He hastened to note that strategies at many U.S. financial firms still include ESG principles, even if companies are more careful in talking about them, and said he doesn't see the U.S. situation impacting the global landscape. "Outside of the U.S., I don't see any slowing of momentum," he added.

Taking the anti-ESG bull by the horns heading into 2024

As of last year, 22 U.S. states adopted some form of "anti-ESG" legislation that seeks to limit how ESG principles can be used in investment decision-making or minimize investment in specific funds and firms, according to the law firm K&L Gates. Republican legislators in 12 different states enacted such legislation in 2023 alone, according to an S&P Global analysis. Many were “revised and weakened as they moved through the legislative process,” S&P reported, though they still have had a “chilling effect.”

In another strategy for navigating this complex landscape, some U.S. investors are taking advantage of vague language in these laws to forge ahead.

Earlier this week, for example, Financial Times reporter Will Schmitt highlighted the case of the Texas Permanent School Fund, which deployed an opening in the state’s strict anti-ESG law to put $300 million into an energy transition fund under the Macquarie Green Investment Group. The investment occurred in 2022, shortly after the Texas state comptroller published a “blacklist” of forbidden firms that included Macquarie's energy transition solutions fund.

“The investment highlights how fiduciaries are finding ways to navigate gaps in rules designed by conservative officials to keep environmental, social and governance considerations out of public investment portfolios,” Schmitt observed.

In other states, fiduciaries are taking matters even further into their own hands. The Oklahoma Public Employees Retirement System, for example, avoided a potential loss of $10 million when its board voted to retain BlackRock and State Street as investment advisors, even though the two firms were on an anti-ESG blacklist compiled by the state treasurer, S&P reporter Karin Rives observed in an analysis published last week.

"If we thought that we could have abided by the law without hurting the pension fund, we would have done that in a heartbeat. But we have a fiduciary responsibility," Oklahoma's insurance commissioner, Glen Mulready, told Rives.

Some U.S. firms have also lobbied their representatives in state government for changes to proposed legislation, in hopes of preventing the worst damage.

U.S. public funds face outsized risk under anti-ESG legislation, new analyses show

Despite these workarounds, anti-ESG legislation is impacting public funds, and not in a good way. The supporters of anti-ESG legislation claim the laws are needed to protect the financial interests of pensioners and other members of the general public. However, they neglect to mention that financial firms can simply pack up and take their business out of state.

One such example occurred in Texas, where legislators passed an anti-ESG law in 2021. The new law immediately reduced competition in the municipal bond market, costing the small city of Anna an estimated $277,334 on its bond sale.

That’s just the tip of the iceberg. Texas cities could pay up to $532 million in additional interest on their bonds in less than a year under the legislation, according to an analysis from the University of Pennsylvania and the Federal Reserve Bank of Chicago.

“In Indiana, a bill to limit ESG investing could cut state pension returns by $6.7 billion over the next 10 years,” former Maryland Attorney General Brian Frosh and former Maryland State Treasurer Nancy Kopp wrote in Bloomberg last year, while the Arkansas Public Employees Retirement System risks losing $30 million to $40 million annually.

Karin Rives of S&P Global also cited an analysis by Econsult Solutions Inc., which estimates that six U.S. states could be hit with $708 million in higher borrowing costs due to anti-ESG laws impacting municipal bonds.

In the face of these swift and damaging results, it is fair to ask how legislators and other public servants could miscalculate the impact of anti-ESG laws so badly, especially when they were warned of the risk. They're poised to lose more ground in 2024, as analysts including Thompson Reuters predict ESG will have a transformational impact on business models as more companies focus on reducing their Scope 3 supply chain emissions.

And investors will follow the money, as they always have.

The Software That's Making Mining Better for the Environment

(Image: Tom Fisk/Pexels)

Mining, the process of extracting useful materials from the earth, cannot be done without producing a negative environmental impact. While the increasing use of renewable energy means there may be a reduction in mining for coal and other fossil fuels, this does not signal the end of humankind’s extractive industries. Instead, at best, it will merely lead to a shift in focus.

The electrification of transportation, for example, means valuable minerals such as lithium, manganese and cobalt are in high demand — not just for our cars, but for our phones and other electronic devices, too.

Mining is not going away, but that doesn’t mean it cannot advance to be better and safer while reducing the environmental impact.

“The biggest problem with mining today is the social license to operate,” said Thomas Krom, environment segment director at the infrastructure software company Seequent.

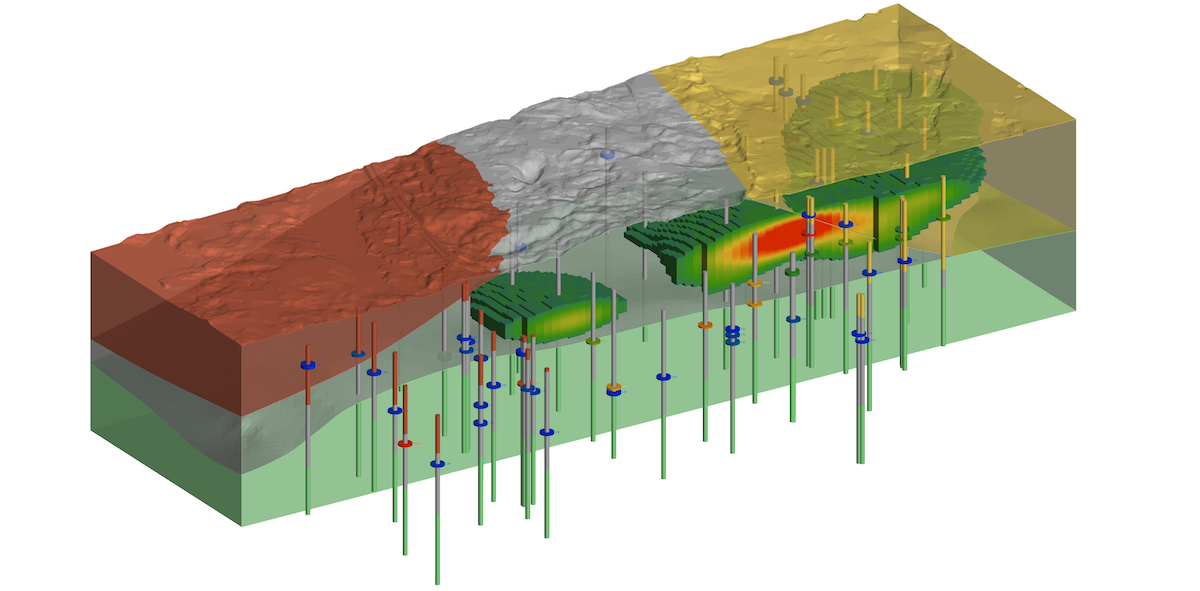

Seequent develops subsurface modeling technology that shows what is below the earth’s surface in a specific location. TriplePundit spoke to Krom, a hydrogeologist with a background in engineering, about the company’s software tools that are deployed in the mining industry.

The brute force of digging things out of the ground — a practice that goes back to the dawn of the Industrial Revolution — may seem like an unusual pairing with the high-tech, virtual world of software technology. But utilizing Seequent’s software makes the process of identifying resources to mine more efficient, Krom said.

This precision prevents random drilling and reduces environmental damage. For Seequent’s customers, it reduces the time needed to set up mining operations by providing highly accurate resource locations.

Without this software, locating a site for mining typically goes something like this: You start with a geological map that indicates that a certain resource is available to mine or look in areas where resources were found historically. Then, you sample and survey the land before any new mining operations begin to determine the likely location and viability of a mining project.

Traditionally, the survey would entail drilling holes in the ground. These days it's possible to survey land with electromagnetic remote sensing techniques, which involve gathering data about the earth by scanning it from above using a helicopter. This method allows greater areas of land to be surveyed more rapidly than older methods.

The important point to understand is the information these modern remote sensing techniques provide was impossible to get before — namely, measurements of resources up to thousands of feet beneath the surface. That’s game-changing compared with traditional surveying methods.

These electromagnetic surveys collect massive amounts of data, Krom said. That’s where Seequent comes in to make sense of all the information collected. Its software processes and filters the data and turns it into useful information. Then, it uses the data to create an accurate three-dimensional picture of the location of the different types of resources underground (see above).

The information can be continually updated, too. Even when drilling begins, new data can be fed back to update it. “The tool lets you always have the best possible understanding of what is around you, and if it’s a resource or not a resource,” Krom said.

Accurately understanding what is beneath the surface also leads to safer mining operations by, for example, knowing the structure and stability of the land around a proposed mining location. And by more accurately targeting resources, mining operations can also reduce waste streams and water usage.

The tools Seequent provides are not just valuable for mining minerals. The company's software is also used in collaboration with nongovernmental organizations to locate underground water resources and has even identified locations for safely burying nuclear waste, Krom said.

The software is deployed widely in lithium mining across the globe and can locate any mineral that is commercially mined today, Krom said. It allows these mining operations to be more targeted, efficient and less environmentally harmful.

While mining inevitably negatively impacts the environment and no tool in itself is able to prevent the poor policymaking that leads to a negative social or environmental impact, this software can certainly help to avoid negative impacts when it’s in responsible hands.

5 High-Tech Climate Solutions Worth Watching in 2024

(Image: Chris Leipelt/Unsplash)

Humanity must adapt to deal with the impacts of climate change as we work to reduce emissions and hold global temperature rise to 1.5 degrees Celsius. Despite its drawbacks, artificial intelligence (AI) has an important role to play in both climate solutions and climate change adaptation, alongside other technologies like cloud computing.

When programmed and used correctly, AI’s ability to synthesize and interpret data to find patterns and predict outcomes makes it a valuable tool with significant potential for positive change. It’s no surprise that technology-driven solutions were prevalent in 2023 or that they continue to be a big deal as 2024 begins. Here are five climate solutions that hit our radar in 2023 that we will continue to watch this year.

Reducing carbon emissions from aviation

Limiting carbon emissions isn’t just about the biggest sources of pollution. Reducing emissions from smaller sources can add up to significant gains or losses in the long run. That’s the idea behind EMMA (Environmental and Movement Monitoring for Airports), a cloud-based AI management platform that cuts unnecessary taxiing time at airports around the world.

The average taxi time for departing flights is over 16 minutes, according to the U.S. Federal Aviation Administration. The average is nearly nine minutes for arrivals. While that might not sound like much, the wasted fuel and unnecessary emissions add up in the end. By better predicting how delays and disruptions will impact arrivals and departures, EMMA helps air traffic controllers improve their decision-making and efficiency. This dynamic enables reduced taxiing time and lowers unnecessary carbon emissions.

Founders Mohammad Hourani and Wisam Costandi spoke with 3p last year about the implementation of EMMA and their plans for its future. They estimate that cutting even a minute off the average taxi time could save a significant amount of emissions.

Read more about EMMA and reduced taxiing time here.

Limiting peak power use

Logical Buildings has been around for a decade. Through its GridRewards app and SmartKit AI software, users can plan their energy consumption to avoid peak use times — leading to fewer carbon emissions from peaker power plants. These plants are brought online to help meet demand during peak hours. They are fossil fuel intensive and emit substantially more carbon than base load plants. Logical Buildings’ software allows residential customers and building operators to plan to use the most energy when renewable energy is readily available. Recently, the company stepped up its game to include not just multi-family housing and larger building operators but individual users, as well.

“That's really one of the key prerequisites to empower people to combat climate change — to know what to do and when,” Jeff Hendler, the company’s CEO, told 3p. “Certain times of day, there's more carbon being generated by the grid. And if you were to know that, you had that visibility, that access to information as an end user, that will change your decisions and how you behave.”

Read more about Logical Building’s tech here.

Assisting the grid transition

Transitioning from fossil fuels to renewables is a core strategy that world leaders are relying on to slow increasing global temperatures, but the energy transition comes with tough challenges. Electrical grids were originally developed around fossil fuels, a supply of which is delivered from power plants 24/7 and can be increased by peaker plants when demand is high. Renewables don’t deliver energy in the same way. Their energy supply fluctuates based on things like sunlight and wind.

That lack of a steady flow can destabilize the grid and, in the worst case, cause issues like blackouts. While it’s not feasible to build a new grid from scratch, technology-driven climate solutions can hep.

This is where the cloud computing power of Reactive Technologies comes in, measuring stored energy and system strength. “Using this system, operators can accurately map any deviations in levels of voltage and electrical frequency, allowing an almost instantaneous response to keep the grid in balance,” Frederico Rauter, chief revenue officer at Reactive Technologies, told 3p. “With GridMetrix in place, operators around the world can reduce the risk of grid instability and bring more renewables online, safely and cost-effectively.”

Read more about how Reactive Technologies is aiding the energy transition here.

Predicting flash floods

Highly sensitive, accurate forecasting and robust early warning systems are even more vital as natural disasters increase in both frequency and destructive force. As far as sounding the alarm on extreme weather events goes, flash floods present a particularly difficult challenge — currently, only very short notice is possible. A partnership between IBM and the University of Illinois strives to change this using an AI model capable of anticipating heavy rainfall and flash floods, starting in the Appalachian Mountains.

“It's very important for local populations, because in mountainous regions … the small towns, the villages, schools, infrastructure, they're all located at the lower elevations for the most part because that's where access is easy,” Ana Barros, professor and engineering department head at the University of Illinois, told 3p. “If one of these flash floods comes through, it tends to kill many people and destroy infrastructure. It's really the complete disaster in terms of all of its social and economic implications.”

If the team is successful, the hope is that the same AI model could be calibrated to work in other mountainous regions around the world. By integrating this enhanced forecasting with early warning systems, significant loss of life could be prevented.

While it’s too early to know how this will play out, the ability to better predict disasters like flash floods could tie in with the U.N.’s Early Warnings for All initiative. The effort aims to make extreme weather notifications available for everyone on Earth by the end of 2027, regardless of where they live or the types of storms involved. Of course, it remains to be seen how far ahead the AI will be able to predict flash floods and what stakeholders will do with that information.

Read more about IBM and the University of Illinois’ work to predict flash floods here.

Using technology to measure the success of climate solutions like reforestation

IBM recently partnered with NASA to develop new AI models capable of interpreting satellite data from a specific geographic location, learning from it, and applying patterns and predictions to real-world circumstances to help communities combat and adapt to climate change.

In the case of Kenya’s natural water towers — mountainous, forested regions that collect and filter the rain and snow that eventually fills rivers, lakes, springs and the groundwater supply — this partnership seeks to measure outcomes from the government’s conservation and reforestation efforts in mountain rainforests. By determining which tactics are working, the AI model informs decision-makers on how to best focus their efforts.

Although IBM’s role in Kenyan sustainability efforts is relatively new, it shows that climate solutions can be measurable. The technology can motivate individuals, businesses and governments to support projects by providing evidence of tangible payoffs. The AI models developed by IBM also demonstrate the potential for such technology to be used anywhere that satellite images can give before and after pictures of sustainability efforts. By utilizing AI in this manner, we can avoid spinning our wheels on ineffective methods and more accurately focus our actions on what’s proven to work.

While the model is already yielding some results, IBM intends to tune it further with higher-resolution photos, Juan Bernabe-Moreno, the director of IBM Research Europe in Ireland and the U.K., told TriplePundit. Higher resolution will improve the accuracy of the model’s interpretations.

Read more about how IBM and NASA are helping the Kenyan government achieve its sustainability objectives here.

Moving forward with AI and technology-driven climate solutions

AI faces substantial criticism for promoting its programmers’ biases, threatening jobs and more. But it can also be used to do a lot of good, especially in the realm of climate solutions. It behooves humankind to make the most of it — and other technology options like cloud computing — in ways that can benefit the planet. We’re excited to see how these technologies develop in 2024, as well as what new climate solutions the year may have in store.

Unleashing the Power of AI: University of Illinois and IBM Join Forces to Anticipate Flash Floods

(Image: Chris Gallagher/Unsplash)

Extreme weather is becoming more common, making the ability to better predict major weather events an increasingly important part of climate adaptation. Better forecasting already saves lives, as providing advanced notice of the need to evacuate or take shelter can prevent the significant loss of life a disaster may have otherwise caused, and artificial intelligence (AI) could prove to be a game-changer in this regard. AI’s ability to use data to make predictions from the patterns it finds suggests that its forecasting ability could drastically improve with further development.

The tech company IBM is among those bringing AI into the sphere of mitigating the impact of weather-related disasters, and together with NASA, it's hard at work on revolutionary foundational models. These models learn from a broad dataset to make using them for many different tasks quicker and easier, as opposed to task-specific models that are trained with data designed to teach them to do one job. This way, a dataset doesn’t need to be painstakingly created for each new task, because the AI can apply the information it’s learned from other situations to teach itself.

Among the projects its working on, IBM partnered with the University of Illinois to develop a foundational model capable of anticipating heavy rainfall and flash floods in the Appalachian Mountains.

The problem of predicting flash floods

Rain doesn’t fall the same way everywhere. The result depends on geography. The same storm that may drench flat land with few negative consequences becomes much more intense in mountainous regions, said Ana Barros, professor and engineering department head at the University of Illinois. The terrain in the southern Appalachian Mountains essentially captures the storm, causing an extreme amount of rain to fall at once.

“That's what the flash flood is about,” she said. “You are having a very strong storm system and having a very heavy precipitation storm that comes through and stays in place for a little bit — for 15 minutes or so.”

Precipitation is one of the most difficult types of weather to predict, Barros said. It becomes even more complex to precisely predict the location, time, and amount of rainfall in mountainous regions because of the way storms interact with the terrain.

Existing weather prediction models can be improved by training them on the wealth of data that is now available to allow for more advanced warnings. This is where the AI model that IBM and the University of Illinois are developing comes in.

At present, warnings are only available about six hours before a flash flood is expected, Barros said. Even then, it’s hard to quantify just how bad a flood may be. She’s hopeful that the improved model will predict flash flood risk 18 to 24 hours ahead of time. Increasing the warning time empowers people, authorities, and emergency managers to plan accordingly and avoid dangerous situations.

“We will not be able to actually stop the [storm],” Barros said. “But what we can make sure of is that people are not there.”

AI model in progress

The new foundational AI model is still in its infancy. The University of Illinois team, led by Barros, is part of the IBM Sustainability Accelerator — a social impact program that supports projects using tech to help vulnerable populations address environmental threats.

“We kick off every project with what we call the IBM garage, which is a process for unpacking these needs, hearing from the community, doing early design work for the technical solution that would come up with the project, and writing a technical roadmap for its implementation,” said Michael Jacobs, sustainability and social innovation leader for corporate social responsibility at IBM.

It’s not just about improving the AI model’s capabilities, either. Once that process is completed, the technology will be scaled up so its insights can be shared with the affected community, Jacobs said. From there, community members will be taught to interpret those insights.

“There are human limitations to all of this,” he said. “Even if we build the perfectly trained or tuned model for this specific use case, the question ... needs to be answered: How are the insights actually implemented or leveraged to help people?”

It’s one thing to know a flood is coming, but another to know what to do about it, Jacobs said. That’s why engaging locals and teaching them to use the tool is important.

Improved outcomes are on the horizon

“Last year we had almost 100 deaths in the southern Appalachians,” Barros said. That’s what the team is aiming to prevent in the future. While the Appalachian Mountains are the starting point for the AI model, there’s potential to expand what is learned there to other regions.

Though this AI-enabled advanced warning is focused on flash floods, “There's another level of forecasting that can be done, which has to do with landslides, because they often happen together,” she said. “There's a lot of hazard predictability and hazard response planning that this kind of work can help.”

Improved flash flood warning and response are proven to save lives. By increasing the amount of time people have to prepare and leave the area, foundational AI models are integral to climate change adaptation.

5 Wind Power Trends to Watch in 2024

(Image credit: Imagevixen/Adobe Stock)

Wind power accounts for about 10 percent of the electricity in the U.S., representing a remarkable growth spurt in recent years. Still, with the climate crisis looming overhead, the wind energy industry needs to grow even further, and faster, than ever before. Competition for land can pose hurdles, but wind industry innovators are coming up with solutions that open up new pathways for rapid growth.

TriplePundit last rounded up five wind energy trends to watch back in 2020. Much has happened over the past four years, and here are the trends we’re watching now.

1. Repowering old wind farms

Wind turbines typically have a lifespan of about 20 years. Assuming the land remains permitted for wind energy, the turbines can be replaced with new, more powerful models as they age out.

These existing sites are already procured, zoned and prepared for wind development. That includes transmission infrastructure and road access, helping to speed up the timeline for a repowering project.

The repowering industry is already scaling up. GE Renewable Energy's RePower program, for example, has upgraded 2,500 wind turbines over 40 different wind farms in the U.S., since launching in 2017. “On average, wind turbines repowered by GE have seen a 20 percent increase in annual energy production,” according to the company.

Some repowering projects are designed to reduce the number of turbines on the site. In Illinois, for example, the firm Leeward Renewable Energy is completing an upgrade of its 80-megawatt GSG Wind farm. The wind farm’s 40 turbines and their towers will be replaced with just 26 new, more powerful models. In addition to producing more energy from the same site, Leeward expects to reduce operational costs, too.

Other repowering projects keep the supportive tower structures and only replace the turbines and the blades, potentially helping to shorten the construction timeline.

The Clean Energy branch of AES is anticipating a 20 percent increase in output from the 100.5-megawatt Clinton wind park in upstate New York after it completes the replacement of old 1.5-megawatt turbines with more powerful 1.62-megawatt models. New, longer turbine blades will contribute to the improved output.

Replacing the blades alone can also make a big difference. AES is expecting a 20 percent increase in output from its Ellenburg site in New York after it refurbishes the existing 54 turbines and installs new, longer blades.

2. Floating offshore wind turbines

Offshore wind presents another opportunity to accelerate the wind energy industry. That’s easier said than done in the U.S, where offshore wind energy projects have already encountered opposition. In addition, two-thirds of the U.S. coastline is too deep for conventional offshore wind turbines.

New floating turbines can help resolve both obstacles. Instead of sitting on monopiles fixed into the seabed, floating turbines rest on platforms tethered to the ocean floor with slim cables. They can be placed farther offshore than conventional turbines, alleviating the aesthetic concerns raised by coastal communities.

One early leader in the floating wind field is the U.S. startup Principle Power. The company has been scaling up commercial production with plans to deliver 300 floating wind turbines by 2030.

Under Joe Biden and Kamala Harris, the U.S. federal government has also set a goal of 15 gigawatts in floating offshore wind by 2035. In December, the nation took a big step toward that goal when five floating wind companies won federal leases along the California coast, totaling a potential capacity of more than 4.6 gigawatts.

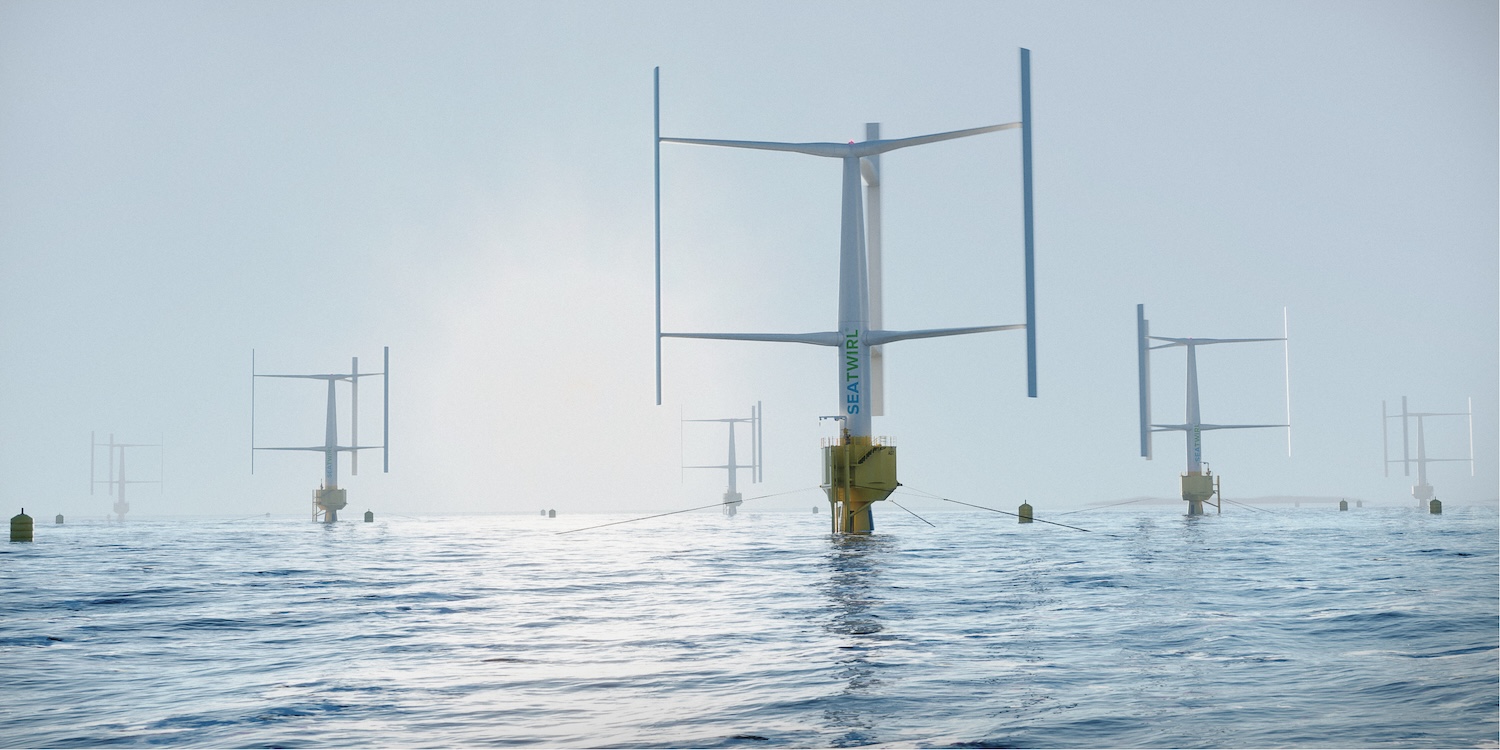

3. Vertical axis wind turbines at sea

Vertical axis wind turbines represent another way to open up new opportunities for wind energy in the U.S. In contrast to the familiar long, tall, three-blade configuration of horizontal axis turbines, vertical axis turbines have a more compact, complicated shape.

Vertical axis turbines were once thought to be best suited for urban areas where space is at a premium. As it turns out, the compact footprint of vertical axis wind turbines also makes them a good fit for floating wind farms. Because they are inherently stable, they reduce, or practically eliminate, the bulky, expensive platforms needed for conventional floating turbines.

The Swedish company SeaTwirl, for example, has developed a turbine in which three vertical blades circle around a central axis. The turbine sits on a single, vertical floater that is stabilized by a satellite of small buoys.

The Norwegian company World Wide Wind has also come up with a platform-free design. Instead of buoys, the turbine is self-stabilized by two sets of vertical axis blades that rotate in opposite directions.

Here in the U.S., the Energy Department is funding floating turbine innovations that cut costs. Sandia National Laboratories for example, has introduced a new, teardrop-shaped turbine with a vertical axis. It replaces the turbine tower with tension cables, in addition to eliminating the platform.

4. New territory for small wind energy turbines

Small-sized wind turbines represent another untapped resource. Today, they are mainly used in rural and suburban areas, where land is available for the turbine towers at homes as well as farms and businesses.

For urban areas, one solution would be to place the turbine on a rooftop instead of a tower. In the past, that posed a number of technology hurdles, as well as competition for roof space from the solar industry.

Those obstacles are beginning to fall. Among the new solutions to emerge are hybrid designs that pair wind turbines with solar installations. Last September, the World Economic Forum took note of a hybrid vertical axis wind and solar rooftop system developed by a French startup called Unéole. Instead of competing for space on the existing roof, the turbines are placed under a new solar roof for even more renewable power generation.

A U.S. startup called Accelerate Wind has developed another type of solution. Its small horizontal-axis turbine is designed to sit on the edge of a roof, leaving plenty of space for other uses in the middle.

Yet another approach involves compact, standalone hybrid systems comprised of both solar panels and wind turbines. One example is a leaf-like turbine designed by the U.S. firm New World Wind. It can be arranged in tree-like clusters, with or without solar panels, to double as a form of urban sculpture.

5. Harvesting slower wind speeds

Regardless of their size or shape, wind turbines are rare in areas of U.S. where wind energy is uneconomical due to low wind speeds. That includes the Southeast, the Gulf Coast and parts of the East Coast.

New technology can boost the economic case for low-speed wind turbines in these areas. The question is whether or not they will be commercially available any time soon.

But, according to the National Renewable Energy Laboratory, this technology is on the horizon. In September, the lab reviewed up-and-coming innovations likely to reach the market before 2030. With these in hand, NREL estimates that the contiguous U.S. could economically tap into 80 percent more wind potential than it does now.

Among the elements identified by NREL are new turbines specially designed for low-speed winds. New cost-cutting manufacturing systems also play a role, including spiral welding and 3D printing. NREL also took note of new “climbing” cranes that reduce the cost of taller wind turbine towers, along with new strategies for reducing the cost of transporting longer turbine blades.

Another new technology to emerge involves control systems that tilt or turn individual turbines in a wind farm to avoid blocking the wind from one turbine to another, NREL observed.

Technology is only part of the solution to grow the wind energy sector

Against this backdrop of activity, opposition to wind development continues. A new study published in September notes that opposition can be especially intense when large wind farms are involved. Race and wealth are also factors in the opposition to large wind projects.

“This suggests an environmental justice challenge we term ‘energy privilege, wherein the delay and cancellation of clean energy in wealthier, Whiter communities leads to continued pollution in poorer communities, and communities of color,” the researchers from the University of California and University of Michigan explained.

The nature of the opposition indicates that a more vigorous effort to remedy environmental equity and justice issues could help accelerate wind development in the U.S., but that is a job for policymakers to tackle.

A Chilling Legal Landscape Has Racial Equity Efforts Under Attack

A colorized image of the 1963 civil rights March on Washington, where an estimated 250,000 people gathered to demand equal access to jobs, housing and education — and hear Martin Luther King Jr.'s now famous "I Have a Dream" speech. (Credit: U.S. Library of Congress. Colorized version made available via Unseen Histories on Unsplash.)

"The inseparable twin of racial injustice [is] economic injustice," Rev. Martin Luther King Jr. wrote in a 1958 essay titled "My Pilgrimage to Nonviolence." When it comes to racial equity in the United States today, "the statement is still real," said Lenwood V. Long Sr., CEO of the African American Alliance of CDFI CEOs, a coalition of Black-led community development financial institutions, credit unions and venture capital firms.

Indeed, the income gap between white and Black workers in the United States has actually increased since the 1970s, and districts serving predominantly students of color receive substantially less funding on average than those serving mostly white students. Black applicants are also nearly twice as likely as white applicants to be denied mortgage loans to purchase a home, one of the most powerful vehicles for building generational wealth. Black Americans who do own homes are more likely to have them appraised for lower than their true market value. These factors and more add up to Black families having an average 24 cents in wealth for every dollar owned by white families.

Efforts to push racial equity forward hinge on interventions to address these very problems. Pointing to a chilling legal environment, Long and other advocates see these efforts as under attack.

The U.S. Supreme Court effectively outlawed affirmative action at colleges and universities in a pair of cases decided in June of last year. And 2023 lawsuits led by conservative groups targeted funds aimed at investing in business leaders of color — including a suit against the Fearless Fund, which invests in women entrepreneurs of color, and the LiftFund supporting women and minority entrepreneurs.

Both affirmative action and investments in business leaders of color target longstanding areas of discrimination. Affirmative action dates back the Civil Rights Movement as a means to address racial discrimination in education and hiring, while funds like Fearless and Lift aim to correct imbalances in venture capital that result in Black entrepreneurs receiving less than 2 percent of all VC funding.

"What they're trying to do is go at the vital organs of the Black community — education and economic development — and say, 'Look here, you're trying to close the racial wealth gap. We’re going to stop you.’ And I think it's shameful,” Long said. "As vital as your heart is, as your lungs are, as the blood pumping in your veins, what is more vital to a just economy than education and economic development?"

In the lawsuits against investment funds in particular, the complainants argue that, by targeting specific entrepreneur communities, the funds discriminate against other entrepreneurs based on race. But narratives like these don't tell the whole story of where that money really goes, Long said.

In a murky legal landscape, racial equity programming can be labeled discrimination

The African American Alliance of CDFI CEOs represents 76 Black-led community development financial institutions (CDFIs) and credit unions serving customers across all 50 U.S. states. Like all financial institutions, CDFIs and credit unions take in deposits from customers and use the money to make loans and investments to grow their bottom lines. But unlike big banks, which tend to seek out the largest and most lucrative investments possible, CDFIs and credit unions invest their money locally in the form of loans to entrepreneurs and for local development projects.

Along with providing capacity-building support, the Alliance runs the Black Renaissance Fund to provide its members with grants and loans. "Our fund is designed to go to Black-led CDFIs only, and they lend to their members," Long said. "They lend to entrepreneurs. They provide housing. They provide capital. If you follow the money flow: We're Black, they're Black, but the outflow, the output, is to not only Black and Brown organizations and entrepreneurs, but they're white as well. So, the final product of that, where the money goes, is to everybody."

Still, in the current legal environment, the simple fact that the Alliance is a group for Black-run institutions in particular, and that it invests in those institutions through the Black Renaissance Fund, could potentially put the organization in the crosshairs.

"We could be very vulnerable to somebody knocking on our door saying, 'You can't do this because you are lending to only Black-led CDFIs,' without looking at the output or the outcome of the dollars invested," Long said. "But, you know, let 'em come. We're not retreating. We're not changing anything. And we'll do whatever we need to do to fight back, to push back, to claw back, because enough is enough. We need conscious people to begin to look at what's happening and realize … what it is: It's a racist attempt to cripple and stop the progress of Black America in education and economic development. That's what it comes to."

Returning to the roots of the Civil Rights Movement to push racial equity forward today

Like targeted funds such as the Fearless Fund and LiftFund, the Alliance's work aims to counter longstanding racial imbalances: White-led CDFIs own more than six times the assets of Black-led CDFIs in the U.S., according to 2020 research from the Hope Policy Institute.

Once the only way for Black Americans to access financial services, the number of Black-led CDFIs and credit unions is now dwindling. "The Black credit union used to be the norm — it was the only resource that Black folks could use to get a loan, to get a car, to get a house," Long said. "We created them, and then we left them suffering. And many of them are now closed. For example, in North Carolina, at one time there were 18 Black-led CDFIs or Black credit unions. There’s not one that’s Black-led today. All of them are under some other institution."

The Alliance has been supporting Black-led CDFIs since 2018, but it's not enough on its own to keep these organizations growing. Long called on Americans, and particularly Black Americans, to consider banking with these institutions to provide them with the capital they need to keep making loans and investments in their communities. "We are making white banks richer and starving our Black banks," he said.

If you look back at King's words, he felt the same way. "We've got to strengthen Black institutions," King said in his last speech before he was assassinated, delivered in support of striking sanitation workers in Memphis, Tennessee. "I call upon you to take your money out of the banks downtown and deposit your money in Tri-State Bank," he continued, referring to the Black-led bank founded in Memphis in the 1940s. "We want a 'bank-in' movement in Memphis."

While most know him as a civil rights visionary, King was also a fierce proponent of economic equity as essential to a truly racially just society. He led the charge for fair housing through the Chicago Freedom Movement and spearheaded the Poor People's Campaign to bring together "poor people of all colors and backgrounds to assert and win their right to a decent life and respect for their culture and dignity," to name just two examples.

Many, including his oldest son Martin Luther King III, speculate it was this work on poverty that got King killed, but there's much all of us can do to honor his legacy and continue his fight today.

Beyond the general public giving a second thought to where they bank, Long called on companies and financial institutions to take a closer look at the investments they make in support of community development projects — and where that money really goes. The Alliance offers a tool to help with this, called the African American Equity Impact Score Card. He also challenged individuals to put more of their retirement investments in Black-run institutions and for organizations like Black churches — already among the largest investors in Black-run financial institutions — to earmark a certain percentage of their donations to hold in Black-led CDFIs and credit unions.

"We need to go back and not forget, and again to make investment — not just penny investment, we need dollar investments in Black-run institutions that are doing the work in Black communities, run by people who spend their lifetimes building up housing or giving loans to Black entrepreneurs," Long said. "We have economic attitude changes that we have to make, and we have to look at how we invest in our communities that we care about."

In upcoming coverage on TriplePundit, we'll take a closer look at how organizations can analyze their investments and their balance sheets through the lens of racial equity, and what leaders at financial institutions learned when they did.

How the Circular Economy Can Transform Buildings Into 'Material Banks'

(Image: Scott Blake/Unsplash)

Demolishing a building with a carefully planned implosion is a spectacular sight, but the debris typically goes to waste in landfills. A new approach takes all that careful planning and puts it to work in a circular economy model that cuts carbon emissions, conserves resources, and provides for bottom-line benefits, too.

Recycling is a good start…

Recycling and reuse is one pillar of the circular economy that can be applied when a building is renovated or demolished. One early, ambitious example of that strategy is an energy-efficiency makeover for the iconic Empire State Building in New York City that included replacement of all 6,154 windows. Instead of demolishing the old windows as scrap, the contractor upcycled them. Each window was retrofitted in a workshop on site, which reused 97 percent of the materials.

The renovation was completed in 2010, but savings from the overall 38 percent cut in energy use continue to this day. In addition, the window upcycling project saved $15.5 million compared to the cost of new windows.

…but much more needs to be done.

While energy-efficiency upgrades and the repurposing of building materials are now fairly commonplace, much more needs to be done in the coming years to accelerate the construction sector's shift toward a circular economy.

Buildings already contribute about 40 percent of global greenhouse gas emissions, a figure set to grow amidst population growth and urbanization. The United Nations Environmental Program is among those warning that growth in the buildings sector will outpace the efforts of recycling and other carbon-reducing measures.

“Raw resource use is predicted to double by 2060 — with steel, concrete and cement already major contributors to greenhouse gas emissions,” the U.N. Environmental Program warns, referring to an expected doubling of floor space globally by 2060.

One solution is to scale recycling up into a mainstream practice in the buildings industry. In 2019, for example, the World Green Building Council introduced a suite of recycling transparency and accountability recommendations under the title, “Bringing embodied carbon up front.”

To draw more attention to recycling, the World Economic Forum will give out a new “Circularity Lighthouse in the Built Environment” award at its annual meeting in Davos, Switzerland, in partnership with McKinsey & Co.

The Swiss green building firm Holcim is the first to receive the Circularity Lighthouse award for its EcoCycle recycling system. The process enables up to 100 percent recycled material to be used in concrete, cement and aggregates, with no loss of performance.

The company claims its EcoCycle technology "can recycle up to 100 percent of construction demolition materials across a broad range of applications, from decarbonized raw materials in low-carbon cement formulation, to recycled aggregates in circular concrete.”

The Circularity Lighthouse award recognizes impact as well as innovation, and Holcim fits the bill. The company recycled almost 7 million tons of construction demolition materials in 2022 through its global network of 100 EcoCycle facilities. It plans to expand with another 50 facilities by 2030.

Beyond recycling: The concept of a "material bank" for a more circular economy in the construction sector

Although the expected doubling of global floor space by 2060 presents a significant challenge, it also presents new opportunities for rethinking the way that buildings are planned from the ground up.

The Ellen MacArthur Foundation is among those advocating for a new approach in which buildings are treated as repositories for materials that can reused.

The “material bank” approach is already suggested by the many historic sites and working neighborhoods around the world, where the original building materials have been in continual use for hundreds of years.

“The materials that are used for construction have the potential to be very long lasting, evidenced by the countless historic buildings that make up our cultural landscape,” said Nick Jeffries, an expert who works with the Foundation’s insights and analysis team.

The problem is that modern buildings are designed to be demolished, not disassembled. The material bank concept represents a new approach for a more circular economy. It incorporates design and construction strategies that enable more materials to be recovered intact and reused.

Jeffries provides the example of a community in the Netherlands that constructed a new “Lego-like” town hall. The building may not be needed in about 20 years, in which case it can be dismantled and the components can be reused.

“To achieve this ambitious reuse rate, irreversible concrete was avoided, favoring instead high-quality prefabricated timber elements, with design tweaks introduced by the supplier, allowing for maximization of future reuse,” Jeffries noted.

Jeffries also described a variation on that theme in Boston, where planners at a conference center anticipated that mass transit would eventually reduce the need for on-site parking. In the meantime, their solution was to build a parking garage with removable ramps and other design elements that can facilitate a relatively quick, economical transition to office space or other uses.

Digital technology and the construction material passport of the future

One major obstacle to mainstreaming the material bank concept is the lack of consistent, accessible information on building materials across all construction industry stakeholders. A solution is emerging in that area as well, in the form of material passports.

Digital product passports for textiles are already planned for the European Union by 2030 to help stem the tide of waste in the textile industry. Likely in the form of a QR code or other scannable tag, the passport will pull together a range of information — from the product’s origins and composition to its sustainability, recyclability and more.

Establishing a similar system for the construction industry will be more complex, but work is already underway. In November, for example, the London-based environmental and engineering consultancy firm Waterman Group launched what it calls the “first standardized approach to materials passports,” in alignment with the EU’s Digital Product Passport initiative.

The digitized, software-enabled effort emphasizes disassembly over demolition in pursuit of a more circular economy. It also includes an online marketplace for reselling materials.

“Materials passports play a pioneering role in advancing sustainability within the construction industry,” Waterman explained. “The data they contain will facilitate informed decision-making on efficient material reuse while resolving the ambiguity around specification, performance and warranties of used materials.”

It remains to be seen if Waterman’s solution becomes the industry standard as the firm envisions. An initial trial is already underway at a 12-story office building set to be constructed in London.

In the meantime, the case for incorporating more circularity into the building industry is growing. A new McKinsey report, for example, outlines the carbon abatement and economic benefits of scaling up the re-circulation of cement, concrete, steel, aluminum, plastics, glass and gypsum.

“Circularity in cement has the potential to create the highest value pool across materials, with an estimated net value gain of $10 billion in 2030 and $122 billion in 2050,” McKinsey notes.

Both McKinsey and the Ellen MacArthur Foundation also advocate for the construction industry to promote “lighthouse” projects that best exemplify a more sustainable, circular approach to building design and recycling.

A lighthouse is a rather bleak, isolated image to deploy, but if support from legislators and other policymakers can help accelerate the circular economy in the construction sector, entire communities will become lighthouses for a more sustainable future.

24 New Plant-Based Foods Coming to Market in 2024

The global demand for plant-based foods is still on the rise, with the plant-based protein and non-dairy milk market set to increase by nearly 18 percent over the next three years. This is great news from an environmental standpoint. While research indicates more people around the world are going vegan, simply eating less meat — sometimes referred to as flexitarianism — is an evidence-based way to address climate change. If half of the global population ate a more plant-rich diet, we'd eliminate nearly a sixth of the emissions necessary to avoid the worst impacts of global warming.

Fortunately, new plant-based brands, partnerships and products are released almost every day, to the delight of vegans and curious omnivores alike, making it easier for everyone to mix up their plates more often. Here are some of the new plant-based foods coming to restaurants and grocery stores near you in 2024.

Chefs, food bloggers and influencers share their top plant-based foods recipes for Veganuary

Market research shows the fresh vegetable market is on the upswing, and vegan food blog VegNews predicts processed foods are out and whole foods are back in (did they ever really leave?). While trying out plant-based swaps for comfort food classics can help to satisfy a craving or perhaps change someone's mindset about what meat-free eating can be, of course no one can live on vegan protein alone.

If you're interested in eating more plant-based foods this year and want to try cooking more yourself at home, you'll find no shortage of inspiration at your fingertips. Millions of posts with the hashtag #Veganuary have hit social media platforms like Instagram, TikTok and Pinterest already this month, many featuring simple and inspiring recipes you can make in 30 minutes or less at home.

Dave’s Hot Chicken rolls out "Not Chicken" choices made from cauliflower

Fast-casual chain Dave's Hot Chicken must have heard about the veg-forward trend. The eatery's first new core menu item since it got its start as a pop-up in a parking lot seven years ago isn't made from chicken or even a plant-based chicken analog, but rather from cauliflower. Customers at Dave's locations across 30 U.S. states and Washington, D.C. will find new cauliflower sliders and bites on the menu that come with the same crunch and spice as the chain's original hot chicken, available for a limited time.

Taco Bell introduces new value menu option for vegetarian choices

Fast-food chain Taco Bell is well known for offering plant-based foods and has been certified by the American Vegetarian Association since 2015. The latest is the new Veggie Build-Your-Own-Cravings-Box, which customers can customize with vegetarian items from the chain's value menu for $5.99. Choices include the black bean crunchwrap supreme, black bean chalupa and spicy potato soft taco. The chain says the new box offering will remain a permanent choice on the menu, meaning vegetarians and flexitarians can save some money on the road for all of 2024 and beyond.

After dropping vegan mac and cheese, the Kraft Heinz 'Not Company' promises new plant-based foods for 2024

Consumer goods giant Kraft Heinz linked up with food tech startup TheNotCompany back in 2022 to bring plant-based versions of beloved grocery brands to market. The resulting joint venture, the Kraft Heinz Not Company, built up a portfolio of plant-based milks, cheeses, mayo and meat alternatives before arguably its biggest launch to date in November of last year.

Kraft's boxed macaroni and cheese is a childhood memory and guilty pleasure for many — the company says a million boxes fly off the shelves every day — so the plant-based "NotMac&Cheese" drop understandably generated a ton of buzz. As the vegan mac rolls out to more U.S. stores, NotCo. says it plans to release new plant-based foods across "several more categories" in 2024.

The world's first yogurt made from fungi is coming to Whole Foods

Backed by Bill Gates, the upstart brand Nature’s Fynd is all about using a proprietary fungi blend to create plant-based alternatives to popular grocery items like cream cheese and breakfast patties. Its latest offering, a vegan yogurt made from fungi protein, may not sound all that appetizing at first, but the brand is looking to change hearts and minds with a flavor and texture it says come closer to dairy while carrying less environmental impact than other plant-based alternatives. The new dairy-free Fy Yogurt will roll out to Whole Foods stores across the U.S. in 2024.

Kellogg's new cereal-only spinoff goes vegan

In October, the consumer goods giant Kellogg's spun off its cereal business into a new subsidiary called WK Kellogg Co., and one of the new company's first big launches just happens to be vegan. Set to hit store shelves this year, the new "Eat Your Mouth Off" line is entirely plant-based and features fruity and chocolate flavors to mirror childhood classics. Both flavors also contain 22 grams of protein and zero grams of sugar per serving, Food Dive reports.

A vegan version of The Laughing Cow cheese is coming to U.S. stores

French cheese giant Bel Group released plant-based cheese alternatives under its cult labels Boursin and Babybel to much fanfare, and The Laughing Cow is the latest of the company's brands to go vegan. Made with almond milk, The Laughing Cow's spreadable vegan cheese is available in two flavors and will roll out to Whole Foods and Kroger grocers across the U.S. this year.

New seasonal oat milk drinks are coming to The Coffee Bean and Tea Leaf

Oat milk is having a serious moment, with the market growing over 10 percent last year alone to more than $3 billion. The Coffee Bean and Tea Leaf started serving oat milk back in 2019, and its seasonal lineup for winter includes two new drinks featuring the non-dairy favorite. The new vanilla spiced oat latte and vanilla spiced oat cold brew hit store shelves last week, along with the return of its popular white and dark chocolate infusions.

Just Salad partners with Michelin-starred chef Amanda Cohen for Veganuary

Amanda Cohen's restaurant Dirt Candy is one of only two vegetarian restaurants in New York City to receive a coveted Michelin star. It also holds a Michelin Green star in recognition of outstanding sustainability initiatives. The restaurant's website reads, "We aren’t saying 'no' to meat, but saying 'yes' to vegetables," and the menu offers a colorful and creative take.

For Veganuary this year, Cohen teamed up with Just Salad to bring a new veg-forward offering to the fast-casual chain's winter menu. The fittingly named Dirt Candy Salad features cucumber, broccoli, spiced pumpkin seeds, pepperoncini, and Castelvetrano olives with tofu on a bed of romaine and arugula. "I'm excited to offer their customers a new vegan recipe that incorporates some of my favorite flavors and ingredients," Cohen said in a statement. The salad will be on the Just Salad menu until the end of January.

Blue Diamond drops almond-oat milk blend

Blue Diamond represents a cooperative of more than 3,000 almond growers in the Central California valley. Along with its tasty flavored almond snacks, the brand is perhaps best known as an early seller of almond milk under the Almond Breeze label.

While many enjoy the flavor and texture of almond milk — and choose it as a more sustainable alternative to real dairy — almonds actually require a lot of water, a major drawback from a sustainability standpoint. Almond Breeze's latest offering blends oat and almond milks together for the best of both worlds. Along with mitigating the water impacts, the brand says it delivers on the flavor of almond milk with the creamy texture of oat milk, while containing more calcium than dairy and less sugar than other oat milks on the market.

Plant-based cheese brand Armored Fresh plans nationwide tour to woo the food sector

With the global vegan cheese market set to reach $4.7 billion by 2026, brands are vying to stake their claim. South Korean startup Armored Fresh is one of the newest entrants to the U.S. market. After making its debut at more than 100 New York City corner grocers in 2022, the brand is eyeing national expansion.

To help it get there, Armored Fresh kicked off a coast-to-coast tour for foodservice professionals this month. The tour will show off the brand's new oat milk American cheese slices to chefs, restauranteurs and retail grocery buyers, along with "additional innovations yet to be released," the brand said in an announcement this month. Its existing lineup includes non-dairy cheddar, provolone, mozzarella and pepper jack cheeses made from oat milk, along with spreads and almond-based sweet and savory cheese cubes. The tour kicked off in New York City on January 2 and will stop in major cities across the U.S. before ending in California.

Starbucks adds an oat milk twist to shaken espresso

Not to be outdone by competitors, the world's most popular coffee chain dropped its own seasonal oat milk drink at the start of the month. The latest entrant to its popular "shaken espresso" line is made with oat milk and a touch of hazelnut for the season. After Starbucks moves on from the New Year's drink list, the new hazelnut oat milk shaken espresso will stay on the menu year-round, VegNews reports. Frankly we're not sure what a shaken espresso is, but if you were waiting for a dairy-free version, wait no longer.

Trader Joe's drops a new version of its discontinued plant-based sausage patties, and this time they're vegan

Trader Joe's introduced its Meatless Breakfast Sausage Patties in the mid 2010s before ultimately discontinuing them. But they're back as of last month with a new fully vegan recipe thanks to the omission of egg whites compared to the prior version. Along with being vegan, version 2.0 touts a better texture and richer flavor from added spices.

The (non-vegan) writer behind Club Trader Joe's, a popular blog among the retailer's cult following, pulled up his 2014 review of the last recipe and confirmed the new one "tastes much better" than the old. "I would say they are 90 percent of the way there to what the pork ones taste like," he wrote. Find them on Trader Joe's shelves across the U.S.

Impossible Foods teases a plant-based take on ballpark favorite franks

Impossible Foods is among those competing for the top spot on the plant-based meat scene. TriplePundit's editorial team first tasted its analog burgers at a side event during the COP21 climate talks back in 2016, and it broke onto the market a year later to much fanfare. The company has since worked with major restaurants, from David Chang’s Fuku and Marcus Samuelsson’s Red Rooster to Burger King and Starbucks, and is now available at major retailers across the U.S.

Adding to its lineup of plant-based burgers, ground beef, pork, sausage and chicken, the food technologists at Impossible are preparing to launch a beef-free ballpark hot dog in time for summer 2024. The company took over a popular New York City hot dog stand last month to give fans a sneak peek at the new offering, which is set to debut at restaurants and retailers this year.

Mellow Mushroom revives an old favorite

With locations across 17 U.S. states, fast-casual pizza chain Mellow Mushroom is known for offering plant-based foods and first rolled out vegan cheese as an option for all pizzas back in 2010. To mark Veganuary this year, the chain is bringing back the fan favorite Miss Mushroom vegan pizza, which features vegan mozzarella and feta cheese from veteran plant-based brand Follow Your Heart, along with spinach, portobello mushrooms and caramelized onions atop a classic red sauce.

U.K. pie maker Pukka adds a new vegan offering

Our friends across the pond love a good pie — and we don't mean the kind made with apples or cherries, but rather savory varieties made with meats and spices inside a buttery pastry shell. Whether you're a native Brit or not, if you're a plant-based eater and a fan of pies, the latest launch from iconic label Pukka is right up your alley. The "No Steak Pie" features a plant-based steak alternative alongside vegan gravy and diced onion inside a puff pastry, adding to the brand's vegan offerings including a plant-based chicken pie launched last year. U.K. shoppers will find the new variety starting this month at retailers including Sainsbury’s, Asda and Tesco, Plant-Based News reports.

South Korean brand Unlimeat launches online plant-based foods shop for the U.S. market while innovating at home

South Korean food tech startup Unlimeat hit the U.S. market back in 2019, and it's catching on in a big way. After selling out products on platforms like Amazon and launching in mainstream grocers, the company launched an e-commerce shop geared toward the U.S. market at the end of last year. Customers can expect "limited editions, collaborative products and items popular in Korea" to hit the shop in 2024.

In a clever nod to the recent global boom in Korean beauty products under the shorthand K-Beauty, the company uses language like "K-vegan" to promote its take on plant-based foods made from agricultural ingredients that are often discarded due to shape or size. Offerings include vegan versions of pulled pork, tuna, jerky and Korean barbecue. The brand also rolled out a delivery service for a vegan version of the popular Kimbap snack in Korea, featuring the U.S. plant-based brand Just Egg.

Vegan honey is coming to the U.K. thanks to a unique cross-border partnership

Slovenia-based Narayan Food has big plans. It's already among the largest organic food producers and top sellers of coconut oil in Europe. And, per the company's LinkedIn page, it aims to build "the largest future food tech hub, enabling startups and scale-ups to come to market faster by providing industrial and commercial scaling."

The new plant-based label Better Foodie, developed in partnership with California-based startup MeliBio, is one of the first moves toward that end. The label's first product, a vegan honey alternative made from plant extracts with no added fruits or sugars, is set to be released in the U.K. later this year — rolling out to 200 independent stores from November, the U.K. publication Food and Drink Network reports.

Dutch brand Redefine Meat rolls out to more restaurants across Europe

Redefine Meat launched in the Netherlands, U.K. and Germany in 2021, becoming the first company to commercialize plant-based whole cuts including tenderloins and flanks made from ingredients like soy, potatoes and barley.

It now sells a variety of plant-based foods for home cooks in stores and online across Europe, and it leans into foodservice partnerships to show off the whole cut offerings. That includes plans to expand to 650 more European restaurants in 2024, Business Green reports, adding to existing partnerships with eateries like Ristorante Mamma Orso in Paris and Rifugio Romano in Rome.

Papa John's and Pizza Hut launch dueling vegan pizzas in the U.K.

Fast-casual pizza chain Papa John's has slowly shifted to offering more plant-based foods at restaurants in the U.K. A new vegan barbecue chicken pie featuring plant-based cheese, mushrooms and onions is the latest offering to hit the menu, and the vegan chicken option is available for all Papa John's pizzas at U.K. stores this month. The company is also offering 60 percent off pies for the month of January to inspire more people to try its plant-based choices, VegNews reports.

Not to be outdone, Pizza Hut partnered with Impossible Foods rival Beyond Meat for the new Beyond Pepperoni offering that hit the menu across the U.K. this month. This comes after fellow fast pizza chain Domino's rolled out vegan pizza at all U.K. restaurants in 2022, including another plant-based pepperoni made by Unilever brand The Vegetarian Butcher.

Hard Rock Cafe introduces vegan and vegetarian menu globally for Veganuary

Theme restaurant chain Hard Rock Cafe rolled out vegan and vegetarian choices for Veganuary this year, with new items on offer at locations from Chicago and Sacramento, California, to Manchester, U.K., and the Maldives. New selections include cauliflower wings, a barbecue plant burger and a veg-heavy quinoa salad.

Salt & Straw rolls out "Dairy-Free Decadence" series with five new flavors

Artisanal ice cream label Salt & Straw has brick and mortar stores in five U.S. states and ships its small-batch ice creams nationwide via an e-commerce shop and monthly subscription. A new series of five dairy-free flavors — oat milk and cookies, red velvet cake, bananas foster, death by chocolate, and marionberry oatmeal cobbler — will be available in store and for delivery beginning in January. "We're leaning into 2024 resolved to give your most tempting perennial treats a totally decadent, dairy-free spin," the company says on its website.

In a tasty blend of cultures, Ireland's favorite fast-casual Mexican chain rolls out vegan carne asada

Boojum, a successful Mexican restaurant chain with locations across Ireland, linked up with the plant-based foods purveyor Mock on a vegan carne asada offering for Veganuary. Made from mushroom, soy and spices, the Mock carne asada can be added to all of Boojum's popular menu items like burritos, tacos, quesadillas and bowls, and it's served with a guajillo chili sauce for a pop of flavor the chain promises is far from bland.

Upstart brand scales up tasty vegan chocolate inspired by Cadbury eggs

Fans of the iconic Cadbury creme egg were aflutter back in 2021 when a 79-year-old U.K. activist burst onto the scene with her vegan chocolate brand Mummy Meagz. The brand's vegan creme eggs were clearly inspired by the confectionary classic, and this year it rolled out a take on mini eggs that are perfect for sharing and snacking. The brand is available at brick and mortar stores in the U.K., and global shoppers can also find it on Amazon.

Emirates is among the airlines promising new plant-based foods for 2024

Based in the United Arab Emirates, the Emirates airline is no stranger to plant-based foods. In a January update, the company referenced a "vegan vault" of more than 300 recipes it has on rotation. Customers can expect "an array of new vegan dishes onboard and in lounges later this year," according to the company. It joins a host of other airlines adding new plant-based foods to the menu in response to customer demand — including U.S.-based United Airlines, European carrier Lufthansa and Japanese carrier All Nippon Airways.

With Harmonized Sustainability Reporting Requirements On the Horizon, Companies Must Prepare Now or Be Left Scrambling

(Image: Vasyl/Adobe Stock)

Global sustainability reporting is finally on the brink of unifying around a set of disclosure requirements for climate and other environmental, social and governance (ESG) issues. This is great news for business leaders who are choking on the alphabet soup of sustainability reporting standards. Yet being prepared to meet the harmonized reporting standards around the corner remains a challenge. Companies are well served to start preparing now rather than later.

More than 600 ESG reporting frameworks and standards are used around the world today. Among the most widely known and adopted are those from the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD).

The proliferation of standards has led to confusion as well as a significant amount of time, effort, and resources to gather the information and data that is shared in annual sustainability and financial reports. On top of that, individual investors often send out their own ESG data questionnaires to companies.

Preparing for regulatory disclosures

To add to the pressure, ESG reporting that has been largely voluntary will now be mandatory in many jurisdictions. The U.S., Canada, the European Union, Australia, Brazil, India, and others have either passed or indicated they will soon enact ESG-specific disclosure requirements for companies.

That includes the European Union’s Corporate Sustainability Reporting Directive (CSRD) which entered into force in January 2023 and requires all large companies and listed companies to disclose information on risks and opportunities arising from ESG issues. The final rules from the U.S. Securities and Exchange Commission (SEC) requiring companies to include certain climate-related disclosures in their reporting are now expected in spring of 2024.

Confusion and reporting for reporting’s sake

“The biggest downside of this situation has been the confusion,” Ted Dhillon, co-founder of the ESG reporting platform FigBytes, told TriplePundit. “The second biggest downside is: How do you standardize your reporting when you have so many different reporting requirements?”

Critically, time spent collecting data for reporting is time not spent on making actual progress toward sustainability goals. The reporting burden has become so overwhelming that the usually small sustainability teams at organizations spend most of their time gathering data, Dhillon said.

“I call sustainability officers ‘nag, bag and drag officers,’ because that's essentially what I've seen them do over the years: Pick up the phone and try to get the data, and that takes up most of the year,” he said. “It is becoming a reporting exercise for reporting's sake and not for making true improvements. In the larger scheme of things, this makes us lose focus on the bigger challenge: We have to get to net zero.”

A welcome move toward harmonized sustainability reporting

Against this backdrop, many welcomed the finalized disclosure standards released by the International Sustainability Standards Board last year, a major step toward a standardized global framework for sustainability reporting. The ISSB Standards, effective from January 1, 2024, provide a comprehensive global baseline of sustainability disclosures that can be mandated and combined with other legislative requirements. The ISSB is part of the IFRS Foundation, which is responsible for writing global financial accounting rules.

Notably, the ISSB supports both regulatory and voluntary adoption, and it has ensured that there will be interoperability between SASB, GRI and the European CSRD. The ISSB Standards have also incorporated the recommendations of the TCFD, and the ISSB will take over monitoring the progress on companies’ climate-related disclosures from the TCFD from 2024.

This harmonization is welcome and needed, Dhillon said. “I think it's critical to have consistency and comparability. Otherwise, organizations will report on what suits them best and hide information that shows them in a negative light. While too many competing frameworks lead to confusion, I think standards and disclosure requirements are absolutely critical for setting a global baseline of sustainability performance.”

From this vantage point, Dhillon applauded the ISSB’s effort to align the various standards and reduce complexity. “The ISSB was clearly the way to go in setting a uniform level playing field for reporting. But I think it will probably take another iteration or two before the ISSB Standards clearly get set as the overarching global standard.”

Preparation is the best prescription

Now, with reporting season upon them, many organizations are trying to understand the implications of the different sustainability reporting developments. They need to figure out if their current reporting strategy is sufficient or whether additional steps are needed to comply with regulatory standards and to meet the expectations of investors and other stakeholders.

Dhillon said the first step should be to consult guidance provided by the standard-setting organizations themselves. The ISSB website offers a wealth of information including answers to frequently asked questions. It is the same for the websites of the other frameworks that companies may be using.

“Companies who have been using other standards like GRI or SASB, or following the recommendations of the TCFD, won’t have such a heavy lift. They will have already started tracking their emissions across the different scopes of 1, 2 and 3 [categories of direct and indirect greenhouse gas emissions],” Dhillon said. “But in light of the new reporting developments, they will need to take a step back and say, ‘Do we do another materiality exercise or at least a scoping exercise to figure out what we missed?’”

You have to start somewhere

For companies that have not yet made much progress on sustainability reporting, Dhillon advised that the global disclosure system CDP is a good place to start, as well as the Greenhouse Gas (GHG) Protocol which offers tools that help with systematic collection of data.

Over time, legislative and mandatory ESG requirements will likely take center stage and “voluntary reporting will just fade away,” Dhillon predicted. “I think the future will be companies reporting probably once, or maybe twice in Europe,” he said. “When organizations file a report to meet the CSRD requirements, for example, they won’t need to report again to any other framework. There will no longer be a need for multiple reports, and I think that’s the ideal situation for any company globally. Once you’ve filed to meet the CSRD or SEC requirements, you’re done and you can focus on your sustainability work.”

This should be welcomed by most companies, and Dhillon believes it will be — “aside from some organizations that don’t want to put their information out there, but they are outliers.”

Taking the alphabet soup of competing frameworks off the menu means companies can focus on the main course: making improvements to their ESG performance overall, he added. And he advised companies not to show up late for that meal.

“The time is now to learn as much as you can, put the systems in place and get started. There's never going to be a perfect situation,” Dhillon said. “Even if it’s just a scoping exercise at the bare minimum, you’ll be in a far better position. At the end of the day, you want to create a mindset shift, because this is a change management issue for organizations. If organizations get started today understanding where their gaps are, they will be ready to meet whatever comes.”

This article series is sponsored by FigBytes and produced by the TriplePundit editorial team.

Mobile Home Owners Form Co-Ops for Housing Security and Climate Resilience

(Image: philipus/Adobe Stock)

This story was originally published by Grist and supported by the Economic Hardship Reporting Project. Sign up for Grist's weekly newsletter here.

As mobile home owners fight rising housing costs, some of them have hit upon a solution that also helps in the fight against climate change: banding together and buying the land underneath their homes.