New Fund Aims to Scale Packaging Reuse and Refill Systems Around the World

Attendees at the Subsonic Music Festival in Sydney, Australia, purchase drinks in reusable cups. Reuse and refill systems like these can cut plastic waste dramatically over the next 20 years, according to the U.N. (Image: Turn Systems/Unsplash)

This story is part of a solutions journalism series focused on reuse and refill systems, how they're used around the world, and what's holding them back from scaling further. Follow along with the series here.

As the world chokes on plastic waste, the statistics are so dizzying that many of us have grown numb to them. At least 14 million tons of plastic are washed into the world's oceans every year. That's equivalent to more than 280 billion beverage bottles. These plastics break down into smaller and smaller pieces when exposed to the sun, and the resulting microplastics have been found from the top of Mount Everest to the ocean floor — not to mention in human blood, and more recently within clogged arteries.

If that's not bad enough, it's projected to get worse, with global plastic consumption set to double by 2040 as convenient but wasteful single-use systems expand to the growing global middle class, according to a 2023 analysis from the U.N. Environment Program.

Ready for some good news? We already know how to solve the problem — we just need to put it into action — and a newly announced prototype fund can help.

Reuse and refill systems could cut plastic waste by nearly half

The U.N. Environment Program ran scenarios for halving global plastic waste while reducing plastic litter in oceans and the environment by 80 percent. Most of the plastic reduction needed to reach that target could be achieved by reuse, refill and new delivery models, according to the research.

Before the explosion of single-use plastic in the 1970s, most people purchased their household staples and met their daily needs without packaging. We already know how to send bottles back with the milkman or restock our pantry from the bulk bins at our local corner store. But as it became easier to purchase everything in neat, individual packages, the reuse and refill systems we once depended on fell by the wayside.

As the chickens of our single-use plastic habit come home to roost, the global community is challenged to rebuild those forgotten systems and rethink them for the modern age.

Dozens if not hundreds of startups around the world are taking up the task, with refill systems for groceries, beverages, restaurant takeout, personal care products and more. But it takes significant upfront investment to build the infrastructure necessary to process containers for refill, not to mention the cultural momentum needed to woo people away from single-use, so these ventures often struggle to get out of the starting gate.

The plastic action group Repurpose Global is looking to help more early-stage reuse and refill ventures reach the next level. The Reuse Outcomes Fund, announced last month, will support promising startups in the U.S., Canada and India, leveraging lessons the nonprofit learned from scaling waste management infrastructure across the Global South.

The Reuse Outcomes Fund channels lessons from waste management to help reuse and refill scale up

"Billions of people don't have access to basic municipal waste management and collection services," said Peter Wang Hjemdahl, chief innovation officer and co-founder of Repurpose Global. "If there's no waste collection, there's no recycling, and there is no circular economy at the end of the day."

Repurpose Global uses a model called outcomes-based financing to fund projects that expand waste management systems and capture plastic waste before it can reach the environment. Rather than seeking a financial return, these investments aim to achieve a specific, verifiable environmental or social outcome — in this case, waste that is collected and processed for recycling rather than becoming litter.

The model helped Repurpose Global bring waste management services to more than 600,000 people over the past six years, while recovering over 50 million pounds of plastic waste across the U.S., India, Indonesia, Kenya, Ghana, Colombia and the Dominican Republic.

Like waste management services in underserved areas, fledgling reuse and refill systems face challenges with high upfront cost, limited financing options, and a dearth of best practices that can guide replication of these systems from one place to another. These similarities came to light as Repurpose Global's team connected with more startups as a co-convener of the Innovation Alliance for a Global Plastics Treaty, which pushes for refill companies and other plastic economy innovators to have a more prominent voice in global plastics policy.

"A lot of the issues we saw in waste management in the Global South are applicable in the very early, nascent stages of trying to scale reuse and refill solutions," Hjemdahl said. "We see the same challenges, and we are confident about our track record. We felt that now is the right time to make a concrete commitment."

A three-year investment that could come with big payoff

The Reuse Outcomes Fund will operate over the next three years — first securing partnerships with promising reuse and refill startups, then helping them build capacity and launch new pilot projects, and finally scaling those projects and creating a framework to replicate them elsewhere.

Set to be announced at the end of this year, the first cohort of startups will collectively receive $1 million in funding from Repurpose Global, as well as technical training and capacity-building from the Repurpose team. As part of the outcomes-based financing model, the nonprofit will also build systems that allow for the verification of plastic waste avoided by implementing reuse and refill, as well as a knowledge repository that documents best practices to aid the replication of successful systems.

"Ultimately, we have to define what a 'reuse outcome' is and what a 'refill outcome' is," Hjemdahl said. "It sort of makes logical sense, right? We can avoid a tonnage of plastic waste that would've otherwise not been avoided without the presence of the financing. But the devil is in the details, so we have to work with the sector — not just by ourselves, but work with nonprofits and other leaders in order to actually define these things."

The fund will focus on startups working in three priority areas: refill stations for water bottles and other beverages, reverse logistics models for food and grocery delivery, and returnable packaging systems for e-commerce and physical retailers. These systems are the closest to consumers' daily lives and as such have the potential to eliminate high volumes of plastic waste.

"It's really important that basic amenities like food, water and groceries can reach people in a way that does not require packaging," said Svetlana Dcosta, senior manager of strategic partnerships for Repurpose Global, who developed the Reuse Outcomes Fund alongside Hjemdahl. "For groceries, food deliveries, even your personal care products, oftentimes consumers feel guilty that they come in so much plastic packaging. Enabling and financing these systems allow them to go to a store and refill or call in for a refill when they run out of their staples."

While a $1 million fund may sound like a drop in the bucket compared to the scale of the world's plastic waste problem, effectively expanding reuse and refill holds promise for outsized impact. For example, every 10 percent increase in refillable bottle use across coastal countries could yield a 22 percent reduction in plastic bottle pollution in the world's oceans, according to the nonprofit Oceana.

The fund's focus on documenting best practices for the purpose of replication could also help systems proven through the pilot phase to reach new markets faster and begin to eliminate waste.

"Our thinking here is: Let's come in with an anchor commitment. Let's come in with our expertise, and let's hope to use this fund — which is meant to be a prototype fund — to garner more interest and more work around this," Hjemdahl said. "The initiative here is really a continuation of our mission from day one, which is to bring different folks across the entire ecosystem together to create change against plastic pollution."

Clean Technology Investment Continues to Set Records, Despite Some Blips

(Image: Nicholas Doherty/Unsplash)

The clean technology investment picture seemed mixed last fall in the United States. High-profile setbacks in the U.S. wind industry and lower-than-expected electric vehicle sales both colored the headlines. Partisan political efforts to obstruct clean tech investments also dampened the mood. But after the dust settled, it's clear these were minor hitches in an otherwise strong year for clean tech investment.

Another record-setting year for clean tech investment

The 2022 Inflation Reduction Act is widely credited with spurring clean technology investment in the U.S., including renewable energy and electric vehicles, as well as heat pumps and other retail products.

In the clean energy space alone, the economic and environmental advocacy organization E2 tracked at least 292 major projects in 41 states and Puerto Rico since the Inflation Reduction Act passed in August of 2022, totaling almost $118 billion in capital investment.

Last month, the independent research firm Rhodium Group reported similar signs of growth in its 2023 Clean Investment Monitor. The tracking platform shows a strong, record-setting performance compared to 2022.

“Clean energy and transportation investment in the U.S. set another record in Q4 of 2023, reaching $67 billion — a 40 percent increase from the same period in 2022,” according to Rhodium.

The Q4 results represented a strong finish for 2023, beating the average among all four quarters compared to the previous year. “Looking at the full year of 2023, clean investment came in at $239 billion, up 38 percent from 2022,” Rhodium added.

Electric vehicle sales were not so bad after all in 2023

As for the bad years, 2023 did seem to end on a low note for electric vehicle (EV) sales after Ford and GM announced they were cutting back their production schedules. The gloomy outlook trickled into media reports this year.

“There are signs that demand for EVs appears to be slowing and may not be quite as intense as either automakers or the Biden administration had expected,” PBS reported in January. Though the outlet also noted that 2023 was “a record for electric vehicles in the U.S., with more than 1.2 million sold. That was 50 percent higher than in 2022.”

Fifty percent growth does not seem like a slowdown of any sort. Some industry observers suggest that Ford and GM simply overshot their demand estimates. In other words, the “slowdown” is more a matter of internal book-keeping than an actual measurement of the pace of consumer interest in electric vehicles.

The slowdown, such as it was, could also reflect broader trends in auto sales. A more accurate measurement of consumer interest in EVs would be a comparison of EV sales growth with other vehicles. For example, last fall Cox Automotive assessed that overall new vehicle sales were projected to grow by only about 10 percent in 2023 compared to 2022.

In that context, EV sales are not slowing down at all. “EV sales are increasing faster than any other segment in the industry,” Michelle Krebs, a Cox Automotive executive auto analyst, told Inside Climate News last month.

To the extent that cost impacts sales, it’s also worth noting that the EV market is weighted in favor of SUVs and other larger, more expensive vehicles. In the coming years, automakers will offer a wider range of models and price points, potentially boosting sales with more affordable choices.

Wind power is making a comeback

The wind industry also suffered through some negative media attention in 2023, though in terms of clean energy investment, there was an actual downturn.

In fact, compared to the overall record of clean investment in 2023, the U.S. wind industry sticks out like a sore thumb. Wind investment declined 37 percent in 2023 compared to 2022, landing down at just $9 billion last year, according to Rhodium.

Onshore wind installations totaled only 7 gigawatts in 2023, according to the research organization BloombergNEF. That was a significant drop from the peak year of 2020 when installations totaled 17 gigawatts.

Nevertheless, signs of a better 2024 emerged in the form of “repowering” projects that replace aging wind turbines with new, more efficient models. With an assist from new tax credits, repowering provides the wind industry with an opportunity to grow despite the rising opposition to new wind farms.

Repowering projects alone will add an estimated 6.5 to 7.5 gigawatts to the grid in 2024, Scott Wilmot, vice president of power and renewables intelligence for Enverus Intelligence Research, told Utility Dive. New wind farms will likely add about the same amount.

As for offshore wind, 2023 was a disappointing year marked by a weak showing for new lease offerings in the Gulf of Mexico and the cancellation of two offshore wind farms in New Jersey.

Still, Bloomberg is among those spotting signs that offshore wind developers are beginning to sort through the same challenges that impeded onshore growth last year, including “supply-chain kinks,” inflation and higher borrowing costs.

“Prospects are improving thanks to new tax credits and stronger demand,” Bloomberg reporters Josh Saul and Priscila Azevedo Rocha wrote.

Solving the heat pump problem

Wind power was not the only underperforming area of clean tech investment in 2023. Retail heat pump investments declined 16 percent in 2023 compared to 2022, according to Rhodium.

This is troubling news, considering that electric heat pumps were identified as a key pathway for decarbonizing heating, ventilation and cooling (HVAC) systems that otherwise run on gas, propane or heating oil.

On a brighter note, Rhodium also points out that heat pumps gained market share in the residential construction market in 2023. That could help stimulate investor interest in the future.

One obstacle to faster investment growth in the heat pump field is the cost of installation. In February, the U.S. Department of Energy’s National Renewable Energy Laboratory issued a report indicating that tax credits and rebates in the Inflation Reduction Act will help resolve the cost issue for many households, but not for others.

“Millions of U.S. households would benefit from heat pumps, but the cost of installing the technology needs to come down to make their use a more attractive proposition,” according to the report.

The report also suggests that installation costs are high in part because inexperienced installers are offsetting additional expenses related to working with unfamiliar equipment and processes. To address that obstacle, the Energy Department began funding heat pump installation training programs. Efforts to diversify the clean tech workforce could also help accelerate the pace of installer know-how.

The last word on clean tech investment

All in all, the 2023 results demonstrate that the clean tech field is a wide-ranging and diverse one. If obstacles arise in some areas, investors have many opportunities in others. In fact, the conventional clean tech investments of today — wind, solar, EVs and heat pumps — are beginning to be overshadowed by new opportunities.

There was a significant increase in emerging clean tech fields drawing investment in 2023, including clean hydrogen, sustainable aviation fuels and carbon capture, according to Rhodium.

“The fastest investment growth last year occurred in the deployment of emerging climate technologies — up ten-fold from $0.9 billion in 2022 to $9.1 billion in 2023 — and in the manufacturing of clean technology, up 153 percent from $19 billion in 2022 to $49 billion in 2023,” according to Rhodium.

Partisan public officials in about two dozen states spent considerable time and energy attempting to obstruct clean energy investment. Despite their attempts to leverage their legislative and legal authority, the numbers don’t lie. Clean investment has nowhere to go but up.

How 1,200 Refugees in Ethiopia Are Becoming Business Owners

Three entrepreneurs who are a part of the Delivering Resilient Enterprises and Market Systems program in Uganda. (Image: Jjumba Martin for Mercy Corps)

After helping thousands of refugees in Uganda start businesses through microfinancing and entrepreneurship training, the Delivering Resilient Enterprises and Market Systems (DREAMS) program is expanding to Ethiopia, the country with the second-largest refugee population in Africa.

The DREAMS program is expected to provide $500 in seed funding and business training to an initial group of 1,200 people in Ethiopia, many of whom fled the civil war in Somalia. It’s a collaboration between the nonprofit Village Enterprise and the non-governmental humanitarian aid organization Mercy Corps.

“With refugee numbers at record levels, as well as increases in food prices and decreases in aid budgets, it’s more important than ever that we are providing sustainable solutions and equipping refugees with the training, resources, and markets to become self-reliant,” Dianne Calvi, CEO and president of Village Enterprise, said in a statement about the program's expansion.

Participants in the program take workshops and training sessions facilitated by Village Enterprise to acquire skills in initiating, promoting and growing a business. Then, Mercy Corps identifies lucrative prospects and enables connections with local markets to help the new entrepreneurs optimize their operations and scale their enterprises.

Village Enterprise recently completed a multi-year study of entrepreneurs who participated the organization's programs in Uganda and Kenya. Those entrepreneurs experienced an 83 percent increase in income and more than a 900 percent increase in savings on average after starting the program, Calvi told TriplePundit. Five years later, more than two-thirds of the businesses are still running.

The training is organized into two groups, Winnie Auma, chief program officer for Village Enterprise, told 3p. The first is dedicated to business skills training on topics like how to manage money, use business records to make decisions, and develop, diversify and expand a business. The second focuses on technical skills training provided by private-sector volunteers that is specific to the different value chains established in Uganda and Ethiopia.

“Something very important about our training is that the content was built with behavioral science practices around it,” Auma said. “Goal-setting is a critical part of what gets covered as part of our training and mentoring curriculum. For example, we would use videos from previous Village Enterprise entrepreneurs to inspire model behavior around these communities.”

Another key element to the program’s success is that the business mentors are refugees themselves, Calvi said. They come from the same countries, share the same cultures, and speak the same languages as the participants.

“When they’re delivering the program, they understand the challenges,” Calvi said. “They understand the cultural background of the people they're working with. That ensures high-quality training, but it also ensures that we are moving people along in terms of their well-being as well as increasing their income, savings and assets.”

The program doesn’t just benefit the entrepreneurs. It engages with local leaders and the whole community, Auma said.

“We actually encourage all of the household members to participate in our training whenever possible,” Auma said. “We do community dialogues. We actually seek the consent of the households to make sure that they’re in agreement in terms of who gets to participate in this program.”

Salome Chandra was one of the first participants in the DREAMS program for refugees. Chandra is a mother who arrived in Uganda with six children after escaping the conflict in South Sudan in 2016. When she arrived, all she had were the clothes on her back, a bag of rice, a bottle of oil, and a small jug of water, Calvi said.

“She introduced herself to me as a mother of seven and explained that one had already passed away,” Calvi said. “When I asked her about her husband, she said that she didn’t know where he was or if he was even still alive. She was forced to flee her home in Juba, South Sudan, when war broke out and had to walk for two months with her six children, ages 1 through 12, carrying her youngest on her back.”

Chandra had just completed the DREAMS program training when Calvi met her. “She was excited to be starting her retail business selling meat,” Calvi said. “She spoke enthusiastically about all that she had learned in the training and how no one could take that away from her.”

Now, Chandra is a successful businesswoman and a leader in the refugee camp. Her kids are all attending school. And despite the fact that she hasn’t been able to return home, she feels hopeful for her future, Calvi said.

“[She] was the victim of a broken system,” Calvi said. “Five years later, she owns two acres of land. She is a successful businesswoman running both a retail and agriculture business. She provides not only for her six children, but also five other children who have lost their parents.”

Editor's note: This story was updated on March 12 to clarify that Village Enterprise's multi-year outcomes study includes program participants in both Uganda and Kenya.

Living a Sustainable Life Doesn’t Have to be Expensive

(Image: Pavel Danilyuk/Pexels)

A sustainable lifestyle is often lamented as too expensive, and thus unrealistic, for the average person. In truth, sustainable living can be more affordable than established norms. But it requires changing our mindset and doing more with less.

Though consumers say they are highly concerned about climate change and want to live more sustainably, the increasing cost of living has led 41 percent of global consumers to say higher prices are the top barrier to purchasing more sustainable products, according to the consumer insight company Euromonitor International.

Still, rising prices inadvertently made the general public more sustainable as people consumed less. Not only are more consumers seeking out secondhand clothing and repairing items, they’re also using less water and energy, and wasting less food, according to Euromonitor. All of these are more sustainable and affordable choices.

Items marketed as "sustainable" often do come with higher prices. Instead of buying a bunch of sustainable-labeled stuff, we can center our attention on using what we have for as long as possible, choosing quality over quantity, and eliminating waste to the best of our ability. This is true for clothing, food, transportation, and everywhere else that we use resources and contribute to carbon emissions. While some products are more sustainable than others, sustainability itself is a lot more than green-labeled, feel-good products.

Make a difference with what you wear

The fashion industry and seasonal trends play a huge role in increased waste, carbon emissions and overconsumption. The advent of fast fashion has an undeniable impact, with 60 percent more garments purchased per capita now versus 15 years ago. While fast fashion brands have exacerbated the problem by producing an excess of trendy clothing that’s often only worn once, the underlying issue can be traced back to stuffed closets and styles that expire after a couple of seasons, which were part of the fashion industry since long before the word fast was attached.

It’s indisputable that humans owned fewer garments and wore them longer when we had to make our own. While no one is saying that you have to learn to sew, an old-fashioned approach to clothing is a legitimate path to sustainability. Instead of a new outfit for every day of the month, focus on quality pieces that can be mixed and matched and worn or traded until the end of their (much longer) lifespan.

Instead of cheap synthetics that shed microfibers into water and food systems, look for high-quality clothing made from sustainable fabrics like organic cotton, bamboo and hemp, for example. Bamboo and hemp in particular require very little water to grow, and they fix carbon into the soil. Additionally, new, innovative materials are appearing on the market like mushroom leathers and biodegradable wood pulp-based fabric.

While clothing made from natural fibers will cost more, by focusing on quality over quantity, you will save money with a sustainable wardrobe in the end. Doing so does require a change in mindset, especially when we feel pressured to stay on top of every trend and never wear the same outfit twice. Perhaps it’s time to use that peer pressure to the planet’s advantage and fawn over repeat pieces as they reappear in the office instead.

Achieve sustainability by eliminating food waste

Food waste is a huge barrier to sustainability, both on a societal level and for individual households. Anywhere from 30 to 40 percent of all food in the U.S. ends up in landfills or as compost. While much of this can be attributed to pre-consumer waste, the average American household wastes roughly three pounds of food every week — resulting in substantial carbon emissions and water waste, as well as the unnecessary use of fertilizers and pesticides. At a cost of roughly $1,500 per year, the average household could save a good amount of money and live more sustainably just by eliminating food waste.

These recuperated funds could also be used to purchase sustainably labeled foods, but labels aren’t everything. Eating local, seasonal produce is more sustainable than buying something organic that was shipped halfway across the world. Additionally, eating less meat and consuming fewer processed products goes a long way toward sustainability.

Better ways to get there

Electric vehicles (EVs) are the wave of the future, but are they always the sustainable choice? Producing any new vehicle, whether it is gas-powered or electric, creates an enormous amount of carbon. And the less you drive, the less sustainable it is to purchase a new EV, or any new car for that matter. We rarely give proper credence to more sustainable ways of getting around: taking public transportation, carpooling, bikes, mopeds, motorcycles, or using our own two feet, all of which are cheaper.

Of course, depending on where you live and work, these may not be realistic options. Unfortunately, most U.S. cities are designed in a way that almost forces the use of personal cars and trucks. But if living sustainably is your goal, it’s worth looking for solutions where you can and accepting mild inconveniences for the greater good when possible.

If you have to commute long distances or have other needs that require a lot of driving, it may make sense to buy an EV and ensure it lasts as long as possible. However, upgrading every few years is not a sustainable choice, regardless of what type of vehicle it is. This will not only save on carbon emissions, but it’ll save a lot of money.

Make sustainable living the norm

By using and wasting fewer resources in every aspect of our lives, we can make sustainability the norm while saving money — eventually leading to the whole becoming more than the sum of its parts. It won’t look the same for everyone, but doing so requires a commitment to giving up consumerism in favor of minimalism and making what we have last. Eventually, these choices will impact the larger system and force change at scale.

Can you live 100 percent sustainably? Probably not. Doing so would likely require opting out of modern society and living off-grid. One way or another, we have to produce and consume — through the work we do, the food we eat, the commutes we make, the leisure we take, the places we live and so much more. But that’s precisely why we should focus our efforts on the areas where we can make the biggest difference.

This story is part of Money Month in TriplePundit's 2024 Sustainable Living Challenge. Learn more and take the challenge here.

The SEC Climate Disclosure Rule is Public: Here’s What Companies Need To Do Now

(Image: Tim van der Kuip/Unsplash)

The U.S. Securities and Exchange Commission (SEC) has finalized its long-awaited ruling that will require thousands of companies to disclose climate risks and data. Some stakeholders see the SEC ruling as going too far, while others say it has not gone far enough to address pressing climate issues. Whatever your view, now is the time to solidify plans for compliance. Here are five steps you can take to prepare now.

1. Refine climate governance

With climate disclosure now the purview of the SEC, companies should review current governance approaches and identify opportunities to strengthen them. This may include increasing corporate board oversight as well as board competency in climate-related matters.

It also could be helpful to review the role and composition of the committees tasked with climate governance, ideally ensuring C-suite representation and active subject matter experts who can provide practical insights into corporate targets, progress and potential exposure.

Companies will also benefit from engaging with external experts who can share best practices and provide a candid third-party perspective on how corporate commitments, plans, timelines and actions may be perceived externally.

2. Build agility in tracking, reporting and assurance for greenhouse gas data

It’s all about the data! Companies should take steps to minimize potential unknowns, gaps, and vulnerabilities around their tracking and reporting. Review what you are tracking and how you are tracking it. Consider questions such as: Who is on point for ensuring data quality? Do they have the experience to deliver against rising expectations for data quality and integrity? What is the basis for our company’s climate-related calculations?

Coming requirements for enhanced levels of third-party data assurance — shifting from limited to reasonable assurance — means companies should plan now for the additional time and budget involved with data compilation and management. It’s also a good time to explore what it would take to implement use of a climate disclosure framework, such as the Task Force on Climate-related Financial Disclosures (TCFD), or how to level up initial efforts to align to external standards. Doing so can strengthen your overall reporting efforts and reliability of disclosures.

3. Review your emissions reduction plans

Tracking and reporting are at the heart of the SEC requirements, and stakeholders will invariably measure and compare climate performance among corporations. To prepare for likely peer comparisons by external stakeholders, companies need to proactively conduct (or refresh) peer benchmarking of this fast-moving space.

An audit of the climate-related questions or expectations in requests for proposals and competitive tenders is a relatively basic first step. Along with other information, this audit can provide context to help the corporate climate governance committee re-evaluate current goals and progress. Progress reviews will likely become a regular practice, as climate considerations are increasingly incorporated into standard business planning and budgeting processes.

To minimize potential accusations of greenwashing, consider submitting corporate emissions goals for approval by the Science Based Targets initiative. Whichever emissions reduction goals and targets you set for your company, provide transparency in the efforts to achieve the goals, as well as provide timely, accurate updates on progress and barriers to achievement.

4. Evolve your approach to risk

With this ruling, the SEC is confirming what some prominent investors have been saying for years: climate risk is business risk. While climate risk management and disclosure are akin to longstanding financial disclosure requirements, in many ways, climate action is more challenging and subject to interpretation.

Companies familiar with preparing TCFD-aligned reporting have already begun to see how the business community is expected to address climate-related issues as both material and ongoing business concerns and investment concerns. By now, companies need to be working to integrate climate risk assessment and mitigation efforts into their overall enterprise risk management process. Participating in relevant industry, corporate, and/or location-based groups can also help to provide perspective and illuminate emerging risk issues.

5. Look ahead

Looking ahead, companies need to see this SEC ruling as the beginning — not the end — of climate-related disclosure fueled by regulation. Now is the time to re-evaluate potential implications of additional frameworks and requirements such as the European Union's Corporate Sustainability Reporting Directive (CSRD), the California Climate Corporate Data Accountability Act, and the United Kingdom's Climate-related Financial Disclosure (CFD) regulations, to name a few.

A unified approach to alignment with multiple regulations can reduce risks and compliance costs. More strategically, companies must look ahead at their business — including their customer expectations, growth strategy, geographic footprint, value chain, production model and vulnerabilities, investments, supply chain, and other factors that need to be considered with the SEC ruling.

The SEC ruling affirms that business strategy and climate strategy engage similar stakeholders — including shareholders and the broader investment community, regulators, top management, current and prospective employees and customers, and the media, among others. Those audiences are watching closely.

Today, effective climate management and disclosure must be a part of overall corporate strategy. Companies need to continue to evolve governance and disclosure of climate-related risks and performance not only to prepare for SEC requirements, but also to find new sources of competitive advantage and to realize opportunities while meeting evolving stakeholder expectations in a rapidly changing world.

The Investment Tech Helping Financial Institutions on the Front Lines of Economic Justice

(Image: micheile henderson/Unsplash)

“You are on the front lines of economic justice every day. How do we drive more opportunity to you?” That's the question Catherine Berman and Yuliya Tarasava asked community finance professionals after decades of experience working in mainstream finance.

In 2016, they founded CNote, an investment technology platform that seamlessly connects community development financial institutions (CDFIs) with investors. CDFIs are private, often hyper-local and mission-driven institutions that provide financial services to underserved communities.

In the third quarter of 2023, the top 10 percent of earners held almost 67 percent of total wealth in the United States. As the U.S. income inequality gap widens, communities of color, women, and minority groups continue to face systemic barriers to credit, affordable housing, and business ownership and growth. CDFIs — which include banks, credit unions, loan funds (most of which are nonprofit), and venture capital funds — exist to support local economies and combat these disparities with creative solutions.

Impact-driven banks and credit unions represent almost $700 billion in assets in the U.S. By lending primarily to underserved communities, they enable homeownership, small business ownership, green financing, natural disaster lending, and access to affordable banking services.

The 1994 Riegle Community Development and Regulatory Improvement Act established the Community Development Financial Institutions Fund, defining requirements for CDFI status and leveraging federal resources to increase the organizations’ access to capital. Instead of relying on singular sources, community-focused lenders combine private, philanthropic and public funding. By diversifying funds, these institutions can mitigate losses on the funders’ side while leveraging more capital toward community investments.

But to do so, CDFIs have to get on investors’ radars. Community finance professionals consistently highlight the need for greater visibility and access to capital, Berman told TriplePundit. Streamlining the investment process is a large factor.

“If I'm a value-aligned foundation, I don't want to spend hours opening up accounts that are administratively hard for me to manage,” Berman said. “If I'm a corporation, I don't want to call up 10 different organizations and gather impact reports to see if any of them are relevant to my investment.”

CNote’s model focuses on simplifying three areas: access, administration and reporting. First, the platform evaluates and selects top-performing CDFIs, low-income-designated credit unions, and minority deposit institutions. The impact evaluation team and automated reporting allow these financial organizations to take on new sources of capital without the heavy burden of reporting that usually comes with working with a diverse set of investors.

There are various investment options for both individual and institutional investors. CNote’s early adopters were often individuals seeking to support their values through not only purchasing decisions, but also where they store their money, Berman said.

Last summer, Baltimore-based investment management firm T. Rowe Price announced a $50 million investment in the platform, joining the likes of Apple, Paypal, Mastercard, and Netflix in partnering with CNote to leverage corporate balance sheets for impact.

Investors have the option for customized deployments, driving capital to specific causes or geographic regions. CNote sees a broad array of impact interests, including racial justice, regional investment, gender issues and climate-friendly banking, Berman said.

The impact stories that CNote shares are countless, from small business owners receiving critical funding, to community land trusts expanding affordable housing, to nonprofits surviving volatile federal funding. At the core of each story are CDFIs and mission-driven deposit platforms enabling opportunities that traditional financial institutions often don’t. Investing capital in these organizations, Berman said, means “supporting a future of finance that is representative and diverse.”

Do Your Investments Support the U.S. Prison System? It Will Soon Be Easier to Find Out

(Image credit: Tom Blackout/Unsplash)

When most people think about companies profiting from the U.S. criminal justice system, private prisons are likely the first thing that comes to mind, but that's only the tip of the iceberg. More than 1.2 million people are incarcerated across the United States. The vast majority of them — more than 90 percent — are housed in public prisons run by states and the federal government, at an average annual cost of more than $40,000 per person.

"It costs as much to send someone to prison as it does to send them to college," said Tanay Tatum-Edwards, CEO and founder of FreeCap Financial. "And that money is all going somewhere."

We know more about exactly where it's going thanks to new research from FreeCap Financial, and the data provider has more insights to come this spring. Armed with this information, asset managers can better understand how the companies in their portfolios interact with the criminal justice system and ensure their investments align with their clients' values.

"Capital markets aren't the solution to all problems," Tatum-Edwards said. But when it comes to the mass incarceration system that leaves around 1 in 3 U.S. adults with a criminal record that would appear on a routine background check for a job, "this is actually one problem where we can't fix it without fixing the profit incentives that drive it," she said.

More than $8.6 billion in profit from prisons

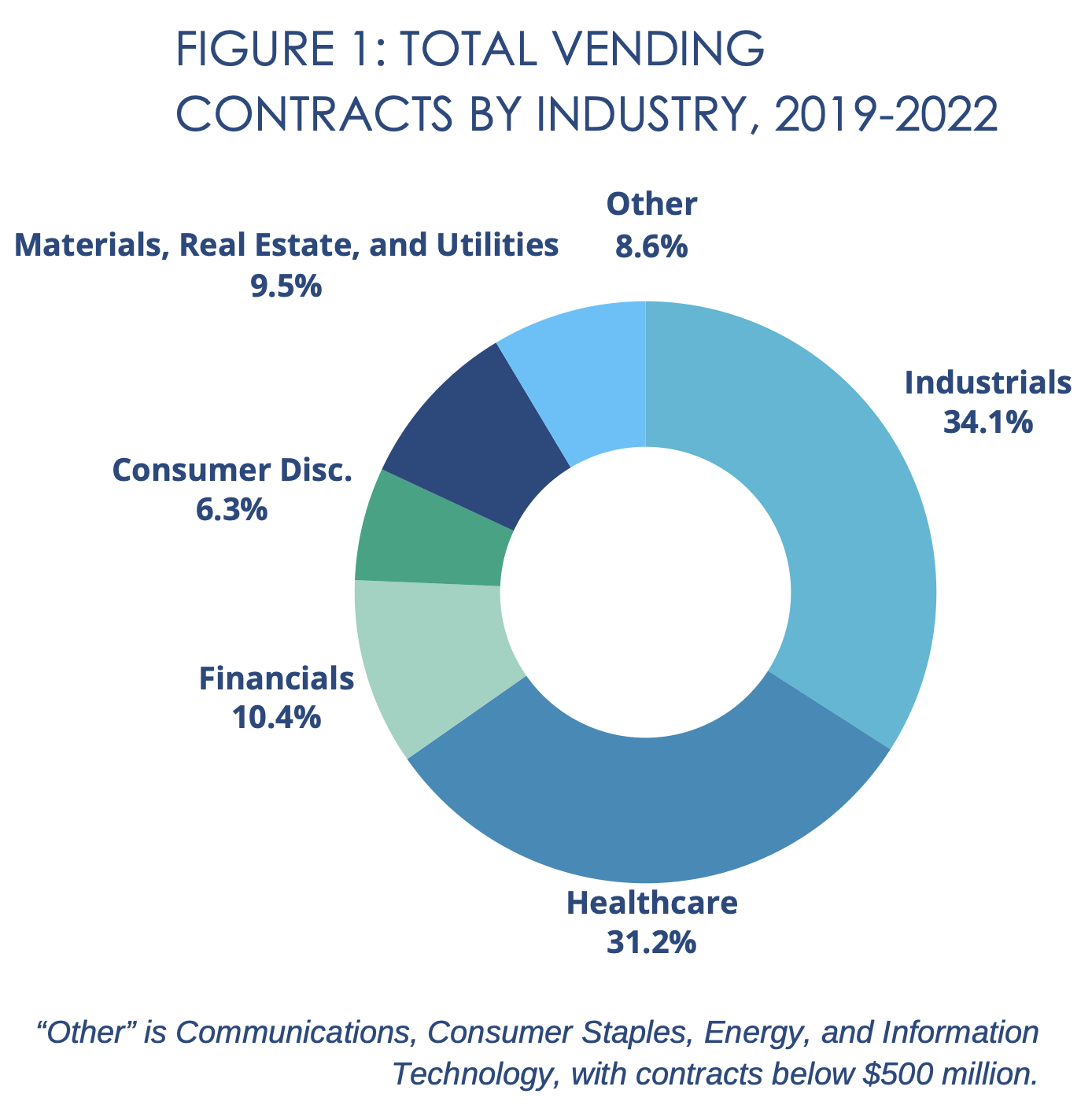

FreeCap‘s Prison Vending Relationship Dataset, released earlier this year, aggregates payments between the 3,000 largest publicly-traded U.S. companies and corrections departments across the country.

"Thanks to the Freedom of Information Act, states now publish which companies they have contracts with at a department level, so we started gathering state transactional data between corrections departments and companies in the entire Russell 3,000 to see how much money companies were making off of vending contracts with prisons," Tatum-Edwards said. "This is, to my knowledge, the only dataset that actually quantifies how much money companies make off of prisons."

The big total? The companies in the Russell 3,000 Index made more than $8.6 billion from state and federal prison contracts between 2019 and 2022, according to FreeCap's analysis of data from state comptrollers' offices, the Federal Bureau of Prison Comptrollers and the Federal Bureau of Prisons.

Contracts tracked in the dataset span industries including healthcare, financial services, real estate and consumer goods. The largest share of state and federal prison contracts went to the industrials sector, which includes logistics companies and utilities.

Beyond prison contracts: Other ways companies impact mass incarceration

The Prison Vending Relationship Dataset appears within FreeCap's 2023 Criminal Justice Report. Along with the findings on prison contract relationships, the report details other ways companies directly or indirectly fuel the system of mass incarceration.

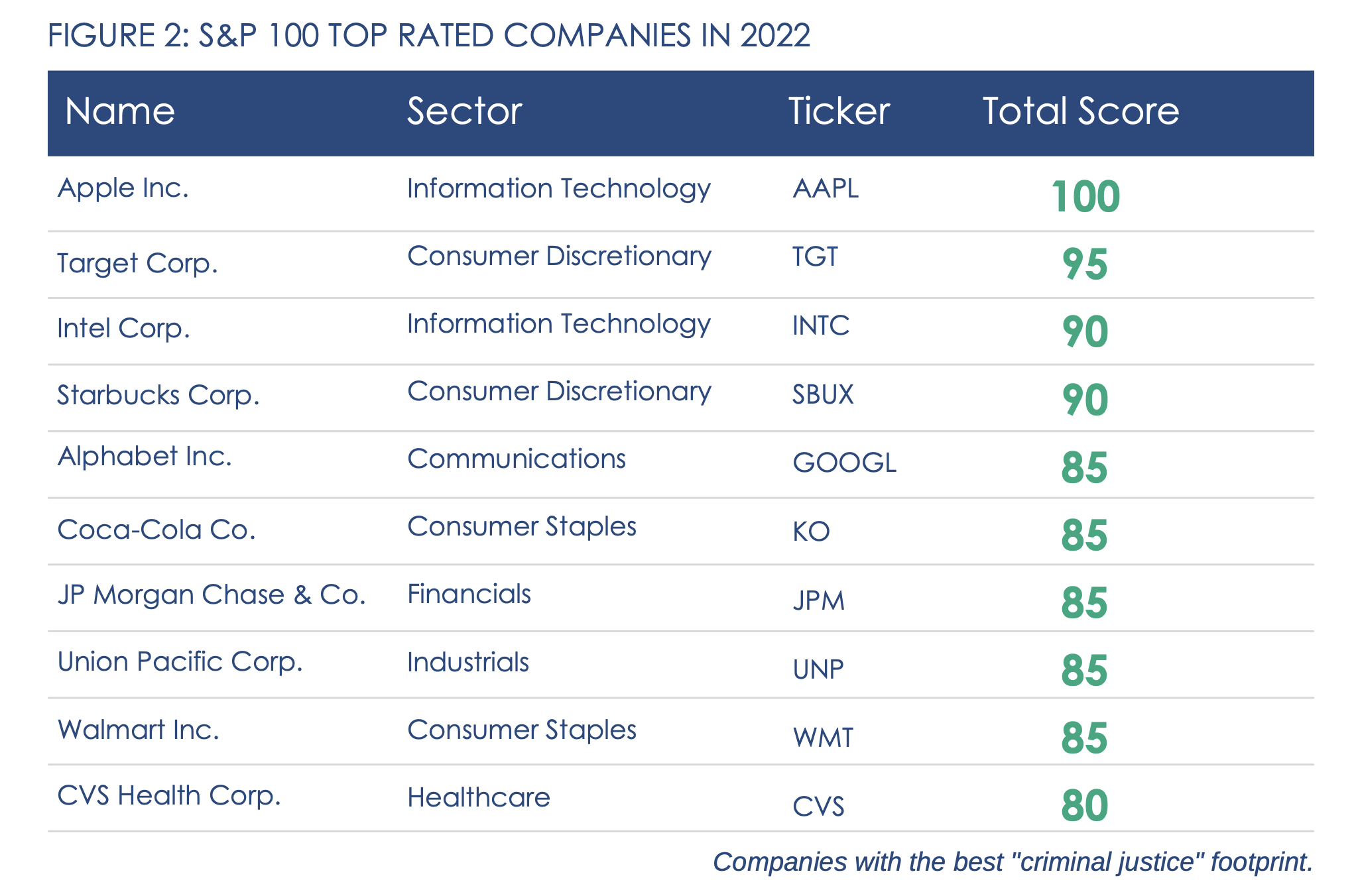

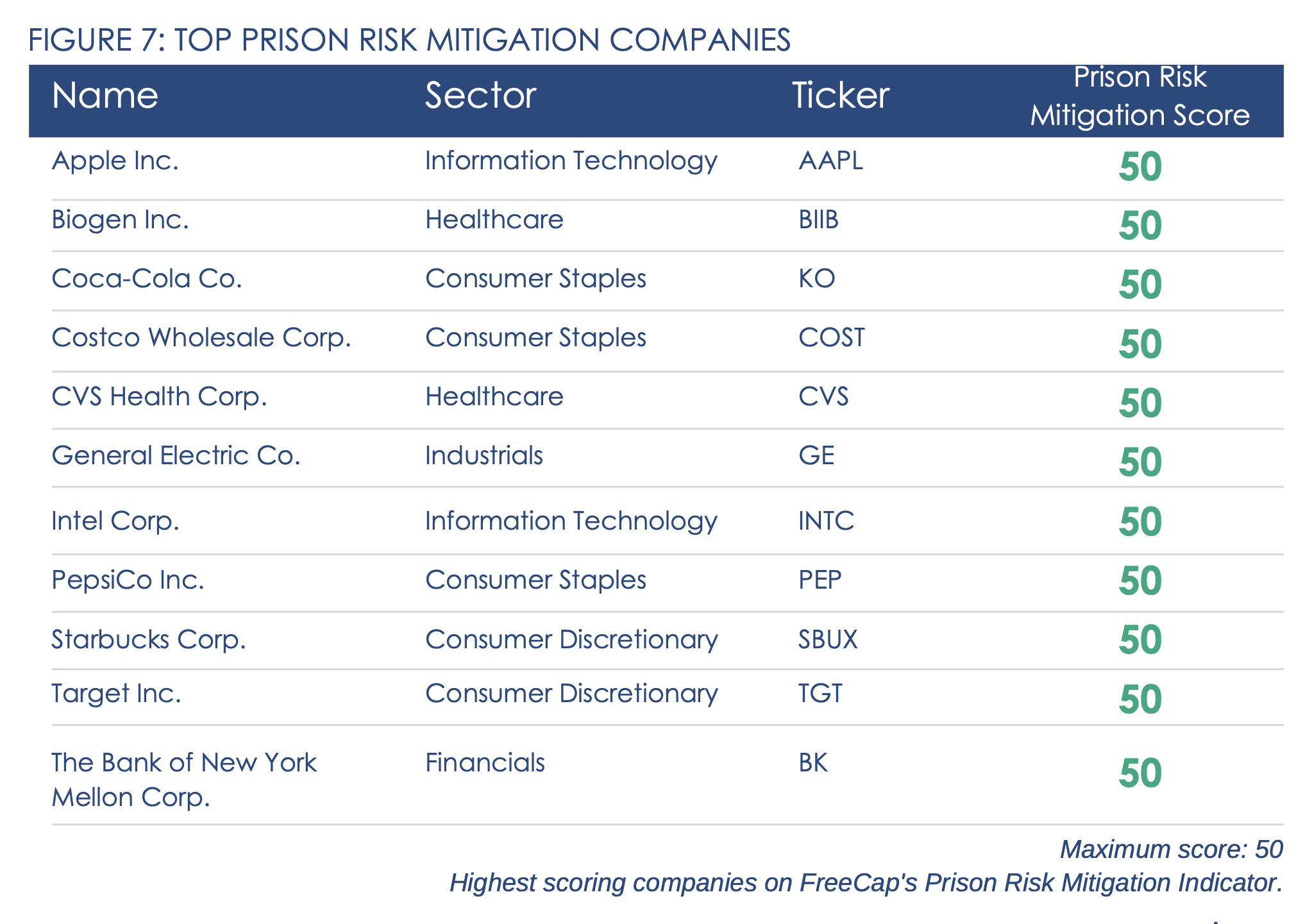

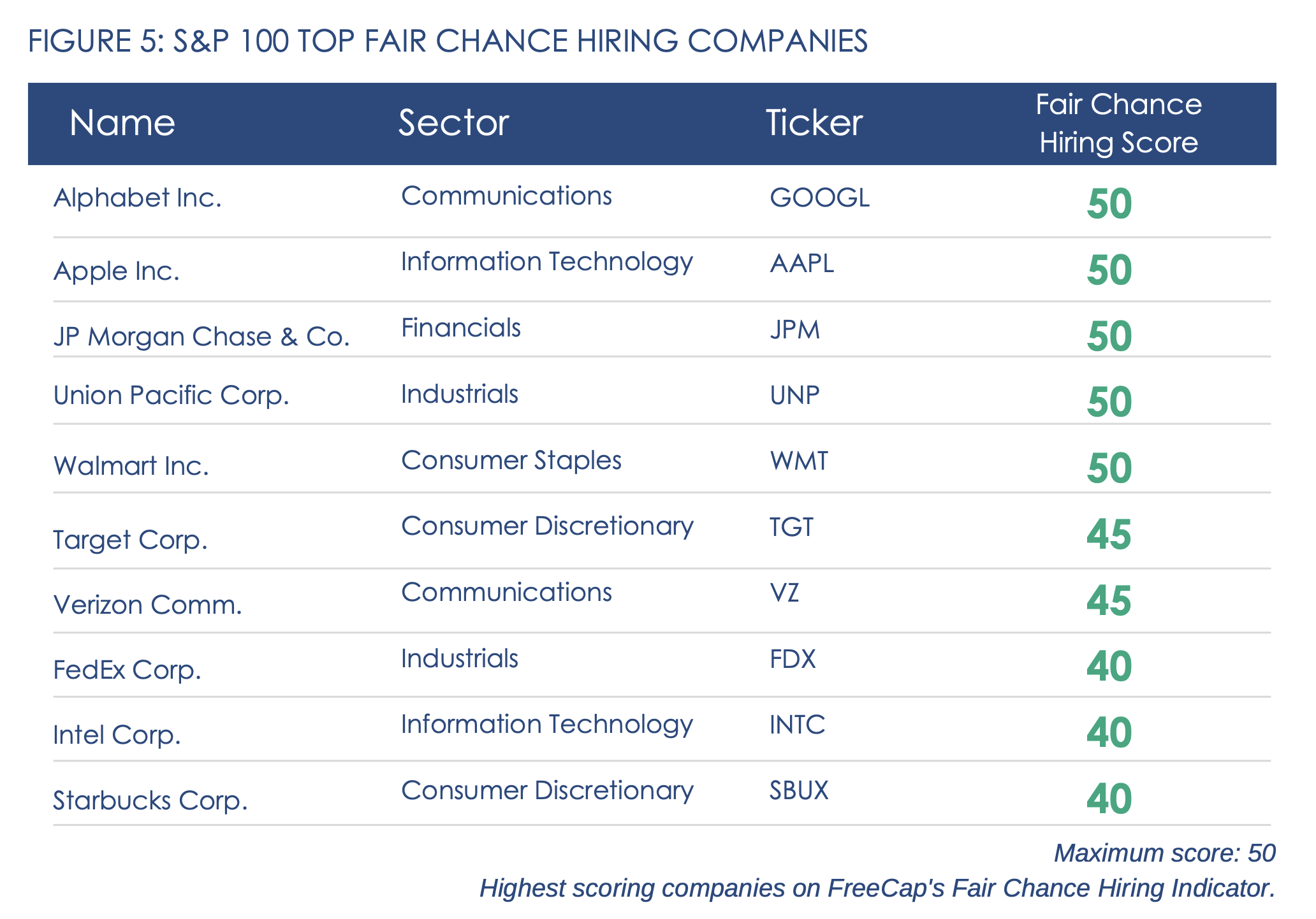

Specifically, FreeCap analyzes corporate supply chain policies around the use of prison labor, as well as hiring policies for people who are justice-impacted, to create a scorecard ranking for use by asset managers. The report covers the 105 largest U.S. companies in the S&P 100, and a follow-up that ranks the entire S&P 500 is expected in April.

Prison labor in U.S. supply chains presents major business risk

It may come as a surprise to consumers and investors that less than a fifth of companies in the S&P 100 explicitly ban the use of prison labor. Even fewer have policies in place to identify the potential risks of prison labor in their supply chains.

"The vast majority of companies will ban forced labor, but because prison labor is legal under the 13th Amendment in the U.S., in order for prison labor to be covered by company policy, they have to be explicit about it," Tatum-Edwards said. "The U.N. best practices around forced labor don't actually cover U.S. prison labor, [although] most folks in prison are making less than a dollar a day."

By not adding language about prison labor to their supply chain codes of conduct, companies leave themselves exposed to reputational risks that could follow them for decades. Some of the companies that score the highest on FreeCap's rankings are actually those that faced blowback from their shareholders and customers over links to prison labor in the past. Though they responded by enacting clear policies and audit procedures, landing them top ranks on FreeCap's list, many of these companies are still linked to prison labor in the media to this day.

"Starbucks is a great example of that," Tatum-Edwards said. After being alerted to prison labor in its supply chain, Starbucks explicitly banned it in 2006, but new articles linking the coffee chain to prison labor still pop up a few times a year, prompting the company to issue new statements and social media posts about its nearly two-decades-old ban.

"Because they had that exposure at one point, they have to spend a lot of resources convincing the public that they're not in that space," Tatum-Edwards said. "And because of that, we actually see them as having some of the more strict prison labor policies in our database."

Companies would be wise to learn from experiences like these and address their potential exposure to prison labor before they're subject to stakeholder backlash. "Something as easy as simply explicitly banning prison labor in all of its forms in your supplier code of conduct policy means that any subcontractor who is using prison labor is in violation of that," Tatum-Edwards said.

Fair chance hiring offers a labor opportunity

On the other end of the spectrum from prison labor risk, fair chance hiring policies for people with criminal justice histories present a major labor market opportunity.

More than 85 million jobs could go unfilled by 2030 due to a shortage of skilled workers, according to 2023 research from Korn Ferry. "But when you look at the number of people who have records, who are systematically discriminated against in the job market, that number is 70 million," Tatum-Edwards said. "Some of these companies have realized that in order for them to be able to remain competitive from a labor perspective, they have to figure out how they can actually hire people who have been involved with the Justice Department or else they are not going to have talent at all."

FreeCap measures corporate performance on fair chance hiring based on factors like whether background screenings are applied before or after the initial job offer, as well as whether a criminal record automatically disqualifies someone from employment without further consideration. It also looks at whether companies have programs in place to actively recruit or train people with criminal justice histories.

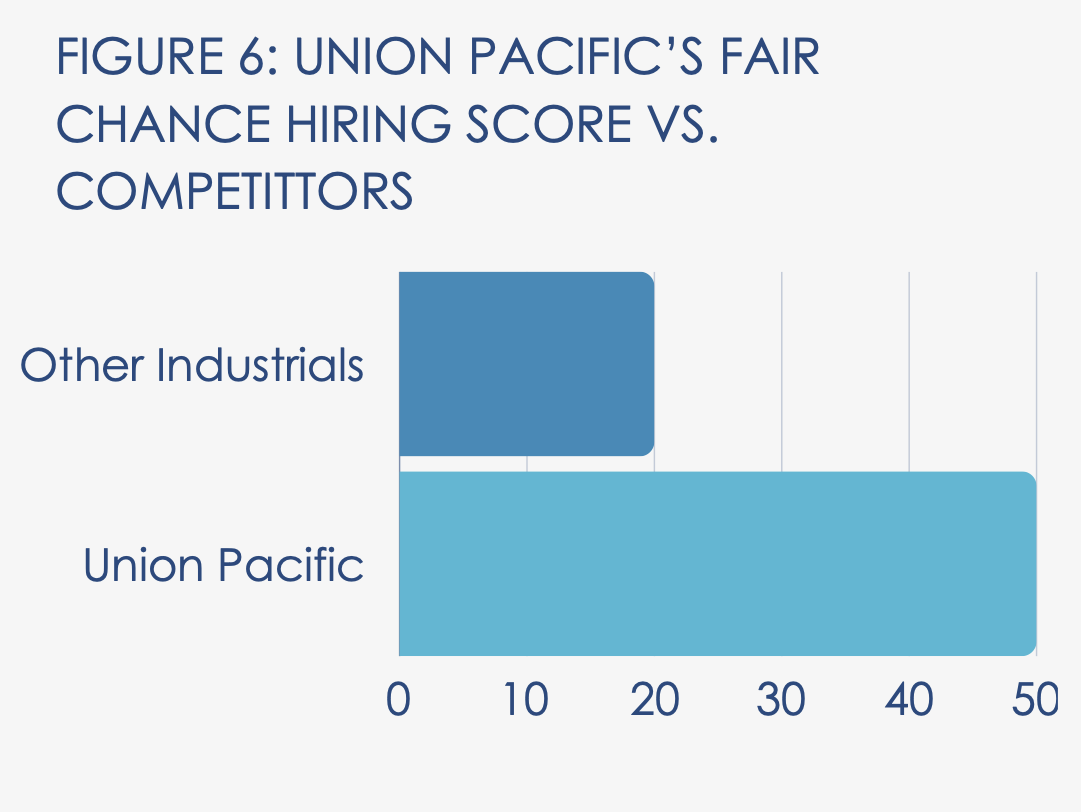

Five companies — Apple, JPMorgan Chase, Walmart, Union Pacific and Google parent company Alphabet — received perfect scores for their efforts to promote fair chance hiring. FreeCap highlighted the freight company Union Pacific in particular, which is part of the industrials sector that is most exposed to prison risk, for its leading programs to minimize that risk and recruit people with records.

"The fair chance hiring piece is huge," Tatum-Edwards said. "Companies need to do it for their bottom lines and it's also good for society, so it's one of those win-wins where everyone should be investing resources into it."

Still, progress is still slow, with less than a third of the S&P 100 making public commitments to support fair chance hiring, the same amount FairCap observed in 2021.

Why should investors care about this?

"There's these trends showing that companies who engage in fair chance hiring are going to remain competitive, and folks who are profiting off of prison are engaging in reputational risk," Tatum-Edwards said. "Decarceration is one of the only issue areas that's actually bipartisan. People love police, but people don't love prisons. And so if you are looking at those trends, companies whose business models are fixed around and rely upon profiting off of prisons are going to have trouble as incarceration decreases."

FreeCap's work aims to turn observations like these into objective datasets asset managers can use to reduce their exposure to prison risk and drive more values-based investment.

Due to be released next month, the FreeCap Index will rank the best performers in the S&P 500 across criminal justice factors, allowing asset managers — and everyday stockholders — to make evidence-based decisions about prison risk.

"We vote with our dollars every day," Tatum-Edwards said. "This will make it easier for people to see exactly how to invest based on this factor."

Some Companies Dig in for the Long Haul on Reproductive Rights, While Those on the Sidelines Face Risk

(Image: Gayatri Malhotra/Unsplash)

When Texas passed a strict new abortion law in 2021, some business leaders simply passed the buck. They said they'd pay to shuttle their Texas employees off to other states for medical care or permanent relocation, rather than taking any definitive stance for or against the legislation. Three years later, conservatives have tightened their grip on reproductive healthcare policies, potentially impacting women, girls and other pregnancy-capable people in every state, not just the “red” ones. Business leaders who were hoping to stay above the fray will soon have nowhere to go unless they realize that the buck stops right where they are.

Fill that communications gap

Despite the U.S. Supreme Court's Dobbs v. Jackson Women’s Health decision that ended federal protections for abortion in the U.S., some companies continue to protect equal access to health care through their employee health plans, as indicated by a survey of plan offerings related to abortion services in 2023 conducted by the firm KFF. The survey focused on large firms of 200 or more employees.

However, the survey strongly suggests that some large firms need to do a much better job of communicating about their abortion coverage. Or at least they need to clarify who is responsible for communicating about their abortion coverage.

KFF’s surveyors requested to speak with a person most familiar with the plans, generally meaning a human resources or benefits manager. Nevertheless, almost 40 percent of the persons who were designated to respond to the firm’s questions reported that they were not familiar with their firm’s abortion coverage.

Presumably, a prospective employee seeking information about abortion coverage would keep digging until they found the answer. Nevertheless, the survey indicates that some companies may be missing an opportunity to communicate about their support for gender equality as it relates to reproductive health care.

Opportunities for leadership on reproductive rights: Size and location

The 40 percent of firms without information represent a knowledge gap in the survey. But the top-line result is still somewhat reassuring to workers seeking plans that cover abortion services.

KFF found that 32 percent of firms with information about their plans reported that they still offer abortion coverage in “most or all circumstances.” Another 18 percent provide coverage but restrict it to cases of rape, incest, danger to health or life, or other limited circumstances. Only 10 percent reported that they provide no coverage at all.

The size of the company makes a difference. Forty-three percent of firms with 5,000 or more employees reported covering abortions in all or most circumstances, beating the average of 32 percent by a wide margin, according to the survey.

That finding suggests an opportunity for larger firms to collaborate with each other on support for reproductive rights and equal access to health care.

Firms headquartered in the Northeast also appear to have a stronger platform for collaboration. In the Northeast, 56 percent of firms reported covering abortions in all or most cases, presenting a sharp contrast with the national average of 32 percent.

The other region to beat the national average was the West, at 44 percent. In contrast, firms headquartered in the Midwest and South appear to be ignoring the impact that access to abortion services could have on employee attraction and retention. Only 20 percent of respondents in the Midwest and 18 percent in the South reported covering abortion in all or most cases.

“Although where a firm is headquartered is not necessarily where its largest plan is offered, these findings do largely mirror trends related to abortion rights and abortion coverage laws in states in these regions,” according to KFF.

The shrinking windows of opportunity

When Texas moved to dramatically restrict access to abortion in 2021, some businesses relied on other states to fill in the gaps of service for their employees. That window began to shrink just one year later when the conservative-led U.S. Supreme Court decided the Dobbs v. Jackson case. The majority argued that states should be empowered to restrict abortion if they choose. While many states did not take up the offer, others did.

As of last year, 13 states all but banned abortion services, according to information compiled by the nonprofit organization Guttmacher Institute.

“One year after the U.S. Supreme Court’s decision in Dobbs v. Jackson Women’s Health overturned Roe v. Wade, the status of abortion rights in many states is dismal and complex legal questions continue to create chaos and confusion,” according to the Institute.

Guttmacher also takes note of some “bright spots.” However, other red flags have emerged elsewhere in the reproductive health care field.

For example, in 2023 the Joe Biden administration permitted pharmacies to dispense the widely used abortion medication mifepristone. Last week CVS and Walgreens both announced they would begin dispensing it, though only in states where abortion is still permitted.

Limited as that window is, it may soon slam shut. Last year a federal judge ruled that mifepristone should be pulled from the market. On appeal, the case will be heard by the U.S. Supreme Court. Oral arguments are scheduled for March 26, and a decision is expected this summer.

Another red flag was raised on February 16 when the Supreme Court of Alabama ruled that embryos frozen through the course of in vitro fertilization (IVF) are people under the state’s Wrongful Death of a Minor Act, a law passed in 1872.

The ruling created an uproar across the political spectrum. Pregnancy clinics in Alabama almost immediately suspended operations, citing concerns over legal consequences. The Alabama legislature scrambled to control the damage, but legal experts have already raised concerns that the forthcoming legislative fix will not reassure IVF practitioners.

So far, Louisiana is the only other state to restrict the disposal of IVF embryos. Clinics there have continued to operate under a loophole that permits the transportation of embryos to other states, but those opportunities are now at risk. Reproductive rights advocates have raised concerns that “fetal personhood” bills threaten IVF services in 14 other states.

A solid step in the right direction

Against this backdrop, CVS and Walgreens took advantage of a new opportunity to stand up for reproductive rights. Both companies announced they will sell the daily contraceptive medication Opill under its new status as an over-the-counter product approved by the U.S. Food and Drug Administration.

CVS will begin stocking Opill in April, and it has already taken steps to ensure customer privacy. The company has posted information about Opill on its website. Customers can assess the contraceptive without the need for an in-store consultation, though CVS advises that its healthcare staff is also available to assist on request.

Out of additional privacy considerations — including the risk of confrontation with judgmental staff or customers — CVS also reportedly plans to implement same-day delivery service for Opill. Customers can also pay online and pick up their orders in person.

Walgreens’ approach is also notable. The company took an unapologetic, enthusiastic position on birth control. “When used as directed, Opill is 98 percent effective at preventing unplanned pregnancies,” Walgreens states on its website. “The best part? You don't need a doctor's appointment or a prescription before you begin using it, so it's a great option for those without health insurance or frequent access to medical services. No hassle, no worries.”

That remains to be seen. The sale of a new contraceptive is a matter of routine in many U.S. states, but Opill may kick up a firestorm of controversy in states where fetal personhood advocates have already politicized health and wellness decisions.

In addition, Republicans in Congress are already preparing federal legislation in support of fetal personhood, such as the proposed Life at Conception Act, which will bring down the curtain on access to birth control as well as abortion and IVF.

Business leaders who still think it’s possible to pass the buck on reproductive rights are only deluding themselves and their employees.

The Port of the Future: A Vision for Cleaner, Low-Carbon Seaports

Seaports in the United States are economic powerhouses: They employ 31 million people, account for 26-percent of the nation’s overall economy and generate $5.4 trillion in economic activity. For every billion dollars in exports shipped through U.S. seaports, 15,000 jobs are created.

But they are also part of communities, and they have an opportunity to play a major role in helping improve air quality through emissions reduction, especially at the largest ports in the U.S.

Understanding the environmental impact of seaports

When compared to aviation and trucking, ocean shipping remains the most environmentally efficient means of cargo transportation. However, on-shore environmental impacts remain a challenge, due to particulate and greenhouse gas (GHG) emissions from both vessels and related road traffic congestion. The local public health impacts from pollutants generated at seaports and other industrial areas disproportionately affect the typically lower-income communities which neighbor them. These communities suffer from elevated levels of cardiopulmonary and cardiovascular diseases, increased rates of asthma, and too frequently, developmental disorders in children.

Efforts are underway by companies and governments to lessen the environmental impact of seaports, led by the U.S. Environmental Protection Agency's Ports Initiative stated goal for U.S ports to be global leaders in clean, efficient freight and passenger transportation.

A vision for the “port of the future”

Port operators also have a vested interest in modernizing ports for a cleaner future. Crowley, a U.S. maritime, logistics and energy solutions company, is innovating in this space, envisioning a “port of the future” with a focus on decarbonizing its port operations.

Crowley has committed to achieving net-zero emissions across all areas of its business and operations by 2050, playing a leadership role as stewards of the environment as well as serving customers and communities.

“The reduction of both global greenhouse gas emissions and local community environmental impacts is at the core of our 2050 initiative,” said Matt Jackson, vice president of Crowley’s Advanced Energy division. “To achieve this requires the collaborative working efforts of many stakeholders such as ports, local community, regulators and our customers.”

So, what is Crowley’s vision for ports? Jackson described the broad outline like this:

The port of the future is an ecosystem of different net-zero solutions that provides and supports all the activities in the port — and works together with all port stakeholders.

To this end, Crowley is forging important industry partnerships at ports across the U.S. to find new ways to reduce carbon emissions.

In 2022, Senesco Marine — a major builder of barges, tugboats and other marine vessels in the U.S. Northeast — selected Crowley to undertake design verification and production packaging for a new hybrid-electric passenger ferry. Due to go into service this year, the new ferry will carry passengers and vehicles to the islands of Casco Bay from Portland, Maine. It will replace an existing diesel-powered ferry and is projected to avoid 800 tons of carbon emissions annually.

And later this year, Crowley will begin testing Class 8 long-haul trucks for Terraline, an autonomous-ready electric truck company. With an expected 500-plus mile range, the zero-emissions trucks are slated to service Crowley’s Florida facilities in Fort Lauderdale, Jacksonville and Miami.

Within their port operations, Crowley is making strides to reduce air pollution at the development phase of the Salem Offshore Wind Terminal, which will service offshore wind operations across New England. Through the process of cold ironing, which allows vessels to plug directly into port electricity, rather than idling on diesel while in port, Crowley will enable certain vessels pulling up to the terminal to significantly reduce air pollution and particulate emissions within the port and neighboring areas.

In addition, Crowley recently broke ground on a microgrid-based shoreside charging station at the Port of San Diego which will fast-charge the company’s forthcoming eWolf electric tugboat, the first vessel of its kind in the U.S. The charger’s design allows it to draw energy from solar and the traditional grid via the microgrid, reducing loads on the local energy grid at peak times.

These are just a few of the sustainable enhancements Crowley is making to their shoreside operations. “We are constantly evaluating technology by creating our own research and development team to evaluate and test [hybrid and alternative energy vessels],” Jackson said.

With net-zero goals top-of- mind, “we have established Crowley Advanced Energy to support the development of renewable energy solutions to bring ample power to the grid edge in support of maritime electrification efforts.”

Looking toward existing technology to work toward the port of the future, today

As Crowley works toward the port of the future, it's already taking steps with tried and tested technology that is already available in its existing ports.

The company’s work at the Port of Jacksonville, Florida (JAXPORT) offers a real-world proving ground. “Our initiatives to modernize JAXPORT are a part of the broader transition to low-emission ports — using the infrastructure we have to get where we need to go, and identifying gaps to meet the challenges of this technology transition,” Jackson said.

Among those efforts is an initiative dubbed JAXPORT EXPRESS (Exemplifying Potential to Reduce Emissions with Sustainable Solutions). “[The] project will enable us to procure zero-emission cargo handling equipment and install high-power DC fast-charging infrastructure to enable further adoption and utilization of that zero-emission handling equipment,” Jackson explained. And though it’s a stepping stone in the journey to net-zero, “it is a giant leap forward for our own operations and for ports in the South,” he said.

From microgrids to carbon sequestration

Crowley sees microgrids as an important component of its port operations. They can be utilized during peak grid demand hours and help balance the distribution of power between the microgrid and local grid — in effect dovetailing with grid demand-response efforts. Although some energy sources for the microgrid might be fossil fuel-based (such as LNG), for cost effectiveness and reliability reasons, they can also incorporate renewables such as solar, as well as wind and hydrogen. Fuels such as LNG can be transitionary sources while infrastructure, technology and supply chains mature, so later, renewable natural gas (RNG) can be used, such as in Crowley’s JAXPORT terminal.

The microgrids and charging stations can then power electrified port vessels, trucks, yard equipment, and cars while acting as local resilience hubs and even putting energy back into the grid.

Given that fossil fuels remain a necessary part of the vehicle fuel mix in the near term, Crowley is also actively working to capture emissions from vessels at the source.

“We are participating with our partner Carbon Ridge, a leading developer of maritime decarbonization technologies and solutions, in a pilot to test and validate the effectiveness of carbon capture on vessels,” Jackson said. “We hope to pilot carbon capture in 2024 and then determine how to roll it out to our fleet.”

Government support is needed to help port modernization scale up

Important to all these initiatives are not just Crowley’s efforts, but also partnerships, funding and in, large part, government support.

For example, JAXPORT EXPRESS received a grant from the Port Infrastructure Development Program, administered by the U.S. Maritime Administration. This program was established by Congress and former U.S. President Barack Obama in 2010, more recently received funding from the bipartisan infrastructure bill passed in 2022.

Efforts supported by the grant include the deployment of 160 refrigerated cargo charging stations (so-called reefer plugs), allowing temperature-controlled container cooling to be achieved without the use of diesel power.

Funding for specific projects like this “is incredibly important to continue to grow and scale sustainably,” Jackson said. "Not only will the funding allow Crowley to add zero-emissions equipment, but it also supports America’s zero-emissions manufacturing capabilities generally.”

And while regulations are often blamed for inhibiting industry objectives, in this case, Crowley identified where regulations would help the maritime sector compete with other modes of transportation, such as improving and expanding utilization of the nation’s 25,000-plus miles of inland waterways.

All hands-on deck

As Crowley continues to invest in new technology and updates vessels and operations to reduce emissions, Jackson stressed that "Crowley and our fellow port and maritime stakeholders cannot bear the entirety of the risk in advancing low- and zero-emission technologies. We will continue to look to our government partners to support these efforts and ensure the United States technological, environmental and innovation leadership.”

This article series is sponsored by Crowley and produced by the TriplePundit editorial team.

Image courtesy of Crowley

Why Corporate Sustainability Goals Fail (And What Leaders Can Do About It)

(Image: Markus Spiske/Unsplash)

A new report from GlobeScan and the software giant Salesforce pinpoints exactly what's keeping business leaders from reaching their sustainability goals.

Ninety-three percent of sustainability, finance, and technology leaders think sustainability is key to the financial success and longevity of their businesses, but only 37 percent say sustainability is well-integrated into company operations, according to the report based on a survey of over 200 professionals across North America, Europe and Asia.

While sustainability excellence is often linked with long-term business success, many corporate leaders are not giving sustainability the capital it needs to succeed, the report found.

TriplePundit spoke to Robert G. Eccles, founding chairman of the Sustainability Accounting Standards Board (SASB) and co-author of the report, about how companies can address the gaps that are stalling their progress.

“Our results sadly show that, despite all the happy talk about the importance of sustainability, senior management teams aren’t giving it the attention and resources it needs to really contribute to value creation,” Eccles said. “Companies either need to dial back their claims about the benefits of their sustainability initiatives, or face this challenge head-on with more senior management commitment and capital.”

How companies can close the gaps that stand in the way of their sustainability goals

While companies face significant barriers to implementing sustainability programs and realizing the value created by those programs, some solutions and strategies can close the gaps.

Access to high-quality sustainability performance data, for example, is critical to measure progress and achieve sustainability goals. Yet only 27 percent of companies have access to such data, even in the face of new regulatory frameworks like the European Union's Corporate Sustainability Reporting Directive, according to the report. Upcoming reporting requirements may leave companies that have not yet invested in data collection and management resources exposed to risk.

“Data builds resilience,” said Sunya Norman, senior vice president of environmental, social and governance (ESG) strategy and engagement at Salesforce. “There is so much coming at business executives all the time. We are in unprecedented times and the world is moving fast. Sustainability is a piece of the information puzzle that executives need in order to react to the big picture. It feeds into how we navigate multiple geopolitical crises, the talent wars, the polarization of issues. The CEOs of tomorrow need to have their head on a swivel and take in data from all parts of their business and society.”

Investing in data management tools and resources is imperative for sustainability progress, regulatory compliance and value creation. However, the data must be accessible and understandable to everyone within the organization. Finance and technology are widely recognized by company leaders as critical for advancing sustainability goals, but surveyed professionals reported insufficient collaboration between these teams and the sustainability teams at their companies.

“With [new reporting frameworks], companies need to upgrade their internal control and measurement systems,” Eccles said. ”This is a great opportunity for a CFO to also learn sustainability because the CSO and CFO will have joint responsibility for reports.”

Norman agreed, adding: “A huge part of the role of a CSO or sustainability leader is helping different parts of a business connect. Integration is the only path forward, and companies need someone who can see across the business, take the horizontal view and help connect the dots.”

Both Norman and Eccles emphasize the need for cross-functional collaboration, including comprehensive strategic planning processes that fully integrate sustainability.

“Whenever a company talks about their sustainability strategy, we should wonder how it is connected to their corporate strategy,” Eccles said. “Companies should not just have a sustainability strategy. They should have a sustainable corporate strategy. We should ask if sustainability is a part of their strategic planning process and if it is tied to capital allocation.”

Ultimately, no sustainability program can succeed without access to capital. Yet it is consistently underfunded. Only about a quarter of corporate leaders are allocating the necessary levels of capital to sustainability, according to the report.

“Companies say that they care about sustainability, but when push comes to shove, they have to invest the money,” Eccles said. “If the CSO sees that sustainability is not sufficiently resourced, they have to own it and go to their boss, even if their boss is the CEO. The company must understand themselves, find the gaps, accept those gaps, and stop greenwashing themselves … It’s a language problem. Until you can get a conversation on sustainability’s value creation over a period of time, companies won’t put capital into it.”

The future of sustainability reporting

For companies to reach their sustainability goals, they need to be proactive about establishing their narrative and ensuring that it is consistent with their existing strategy, Eccles said.

“Sustainability shouldn’t be a moral imperative,” he said. “If companies present themselves as though they are solving systemic problems when they are not, that is problematic. Don't make claims about sustainability unless you've attached that to your strategy.”

Companies should also do their best to ignore the political headwinds.

“There are ESG culture wars. The general response has been to lie low and keep doing what we are doing and hope it blows over. That is a fundamental mistake," Eccles said. "The goal isn’t to make critics happy. The goal is to say who we are, what we stand for, what we can and cannot do, and flip it around so the company is proactive and controlling their narrative rather than reacting to outside forces. The good news for sustainability professionals is that they are in the bullseye now. There is money to step up and shine, but they have to find the courage to do so.”