This Effort Aims to Help Diverse Small Businesses in the Shipping Sector Scale Up

Too often, the owners of small and medium-sized businesses struggle to find the financial and professional support they need to build their place in the mainstream. Business owners from underrepresented backgrounds — including women, people of color and military veterans — tend to face even more of an uphill climb.

Among other challenges, women entrepreneurs, entrepreneurs of color, and veteran entrepreneurs are less likely to connect with the mentorship and business networks that could help their businesses grow.

Access to large, dependable vendors with consistent business needs is critical to allow these entrepreneurs and their businesses to succeed. Committed to make that happen is Crowley, a supply chain logistics company committed to purchasing more goods from diverse small businesses.

Driving investments and opening new networks to diverse small businesses

Crowley partners with entrepreneurs through its small business program, which concentrates on forging connections between traditionally underserved entrepreneurs — such as veterans, women, people of color and those from marginalized communities —with new buyers to help them expand their businesses. It also provides one-on-one services to small businesses owned by traditionally underserved entrepreneurs.

The company reported it has invested $630 million with small businesses across the nation from mid-2018 to mid-February 2024, including over $206 million for veteran-owned businesses, over $197 million for women-owned businesses, and nearly $190 million for businesses owned by traditionally disadvantaged and underrepresented groups.

The Small Business Program is an example of the private sector’s broader goal of diversifying larger companies' supply chains and boosting emerging businesses.

Crowley’s assistance to underrepresented companies includes not just providing brokerage services, but also opening up a network of development support and recruiting to help build their resources, said Jessica Baczkowski, small business administrator for Crowley Solutions.

“The more diverse suppliers we have in our network, the more dependable our supply chain becomes,” Baczkowski said. “We exceed our contractually obligated goals for small and diverse usage by almost 40 percent. We also know that a database must be maintained of these suppliers so we can do more.”

The company named Baczkowski to be small business support administrator to increase its creation of these connections between Crowley and small businesses looking to grow. “This work also supports our overall corporate procurement goal of spending 27 percent on small businesses, which is a sustainability goal that the company has committed to seeking to support a more inclusive and diverse supplier pool,” she said.

Government contracts create new opportunities for some small business owners

Crowley utilizes several resources to connect with suppliers, including the National Veteran Small Business Coalition, the HUBZone Contractors National Council and the National Minority Supplier Development Council.

It also utilizes SAM.gov and the U.S. Small Business Administration, and it maintains a strong relationship with the U.S. government-backed APEX Accelerators program to source specific suppliers within a region. APEX Accelerators, formerly known as the Procurement Technical Assistance Program (PTAP), was authorized by the U.S. Congress in 1985 to expand the number of businesses capable of participating in government contracts, Baczkowski said.

In this mutually beneficial relationship, Crowley refers its suppliers to the appropriate APEX office for further education on growing their businesses with local, state and federal contracts. The company also provides guidance on certifying suppliers that did not know they could qualify as a small and/or diverse supplier.

Crowley’s efforts extend to its Defense Freight Transportation Services (DFTS) program under the largest freight transportation services contract for the U.S. federal government.

The DFTS program supports government customers from initial shipment requests to in-transit shipment management through final payment and delivery of freight of all kinds. The program provides the transportation of military, health and emergency relief cargo across the U.S.. The company also has contracts to provide disaster relief under other contracts.

Particularly, Crowley facilitates contracts for small businesses with the U.S. Department of Defense and other agencies. As the prime contractor, Crowley then brings in small business subcontractors to provide supporting logistics, transportation and tech services for federal agencies.

Crowley grew its DFTS network of suppliers by more than 500 percent between 2018 and 2023, more than three times the capacity needed to effectively service 300,000 movements annually across maritime shipping lanes.

Its network now includes more than 1,800 subcontractors. And in October 2023, Crowley received the Champions Award for surpassing its DFTS contract goals for service-disabled veteran owned and veteran-owned small businesses by the National Veteran Small Business Coalition.

Helping small businesses in the shipping sector scale up can build supply chain resilience and combat climate change

The payoff is big for participants. Crowley has seen multiple transportation suppliers expand warehouses, hire additional employees and purchase more equipment just to support the DFTS contract.

“As a large prime contract holder for the United States Transportation Command … it is our moral and ethical responsibility to mentor and guide underrepresented groups, especially those that are interested in government contracts of their own,” said David Touzinsky, general manager and director for DFTS services at Crowley. “And we can’t do it alone. It takes multiple suppliers to support any government contract, and we take our commitment to small and diverse suppliers seriously.”

One of those companies — Wright Xpress, a family-owned interstate freight carrier based in New Cumberland, Pennsylvania — has worked with Crowley in supporting the DFTS contract since 2019. Wright Xpress’ commitment started with one truck and quickly grew to 54 trucks with drivers, despite some downturns in the economy and rising fuel prices, Baczkowski said.

“We began conservatively, and then started adding more trucks and capacity,” Charlie Wright, who runs the company with his wife Pam, told Crowley for a recent blog. “As Crowley grew confident in me, they gave us more and more work,” he continued. “We have a true partnership. I helped them, and they helped me.”

Besides helping these smaller businesses succeed, Crowley’s involvement contributes to its decarbonization efforts. “Supporting diverse suppliers increases the resilience of the supply chain and decreases the risk of business interruption, while opening more avenues for innovation and ideas,” Baczkowski said. “As a leader in our industry, we are poised to assist diverse suppliers by providing tools, training and resources for taking climate action. This includes providing support to our suppliers in understanding and measuring their carbon footprint, setting emissions reduction goals, and providing incentives and/or recognition for climate performance.”

Shannon Sarkees, Crowley’s director of sustainability, agrees. “Engaging suppliers to take climate action is a critical component of supply chain decarbonization,” she said.

With so many mutual benefits, Touzinksy urges other companies to diversify their supply chains, too. “Do it. You have nothing to lose and everything to gain,” he said. “In a time when we are seeing a crunch in specific areas of the supply chain, we need everyone involved. Plus, you get to be a part of small and diverse companies’ growth. It is so rewarding.”

This article series is sponsored by Crowley and produced by the TriplePundit editorial team.

Image courtesy of Crowley

Schools and Shopping Malls Can Help Marginalized Communities Go Solar

(Image: Los Muertos Crew/Pexels)

This story was originally published by Grist. Sign up for Grist's weekly newsletter here.

Across the nation, strip malls, schools, factories, and other big, nonresidential buildings bask in the sun — a powerful, and too often wasted, source of electricity that could serve the neighborhoods that surround them.

Installing solar panels on these vast rooftops could provide one-fifth of the power that disadvantaged communities need, bringing renewable energy to people who can least afford it, according to a study by Stanford University. Although such power-sharing arrangements do exist, the research found that marginalized neighborhoods generate almost 40 percent less electricity than wealthy ones. “We were astonished to see there is still such a large difference,” said Moritz Wussow, a data and climate scientist and the study’s lead author.

This imbalance, often called the solar equity gap, is even more prevalent in the number of home installations. Placing solar arrays atop large commercial buildings could bring renewable energy to renters, while also helping homeowners who can’t afford the technology’s high upfront cost. Previous research by Wussow’s collaborators found that affluent households are more likely to benefit from tax credits and rebates designed to make solar more affordable. With Solar for All, a federal program funded by the Inflation Reduction Act, poised to give states $7 billion to create fairer access to clean energy, the study shows that harnessing commercial rooftops could be an effective way to reach two-thirds of the nation’s disadvantaged communities and begin to close that gap.

“The renewable energy transition is one of the big pillars of where the government is seeking to spend money,” said Wussow. “Our research is supposed to contribute to narrowing the equity gap, and to provide an idea of how this can be accomplished.”

Using DeepSolar, Stanford’s AI-powered database of satellite imagery, the study tallied the number of photovoltaic panels on large rooftops, at least 1,000 square feet in size, across the U.S. To help its research more readily inform policy, it examined the prevalence of these arrays in census tracts defined as disadvantaged by the federal Justice40 environmental justice initiative. These areas, which must be low income and have a second environmental burden, such as pollution, make up roughly a third of census tracts. The researchers then calculated the cost of generating solar on nonresidential buildings in those areas and found that even in states like Alaska, where the sun all but vanishes for two months each year, the costs per kilowatt would still be cheaper than the local utility rate. If businesses generate their own energy and share it, the results show residents of the surrounding neighborhoods can cash in savings and meet at least 20 percent of their annual power needs.

Despite prevailing equity gaps, community solar projects have been around for over a decade. “I like to think of it as a model, a billing mechanism, where people, regardless of whether they own or rent, can participate in the solar energy transition,” said Matthew Popkin, a U.S. programs manager at RMI, a non-profit dedicated to sustainability research. Most community solar systems rely on subscriptions, where homes connected to a local solar array pay for a share of the energy. Such programs are helping neighborhoods in cities from Denver to Washington, D.C., save money and ditch fossil fuels. “There is no one-size-fits-all approach, there is no model that will nail it for every single community, or a whole city,” Popkin said. “More creativity is probably going to help expand this further.”

Boston, a city short on open space but with plenty of rooftops, can expect to see community solar on commercial buildings expanding soon. The Boston Community Solar Cooperative, which launched this March, will begin its mission to bring clean energy to disadvantaged households with an 81-kilowatt solar array on top of a grocery store in Dorchester, one of the city’s lowest income neighborhoods. Gregory King, president of the cooperative, said the project is only possible because of solar tax credits provided by the Inflation Reduction Act. “The idea behind the model is really to create community empowerment,” he says. “And we have to create more and more, particularly rooftop solar, in an urban environment like Boston.”

Recent changes in how utilities buy back solar energy from homes, a process called net metering, has tipped residential installations into a decline. But with Solar for All funding about to pour into states as soon as July, experts like Popkin say these new resources could shape the next wave of community solar. “The biggest unknown we have right now is what some of those exact funding structures are going to look like,” he said, but inclusive planning will be key. As communities across the U.S. race to seize clean energy benefits, incentivizing businesses to go solar and share the bounty could give everyone a brighter future.

Homepage image: Los Muertos Crew/Pexels

This article originally appeared in Grist, a nonprofit, independent media organization dedicated to telling stories of climate solutions and a just future. Learn more at Grist.org.

Concentrated Products Reduce Packaging and Emissions: Can They Win Over Consumers?

Canary Clean Products founder Luke Wilson demonstrates the amount of plastic packaging consumers can eliminate by choosing concentrates. (Image courtesy of Canary Clean Products)

More options for concentrated products are hitting the market as a new generation of home and hygiene brands aim to win over consumers. From toothpaste tablets to shampoo bars and detergent sheets, these products save a whole lot of space and packaging, as well as fuel savings for distributors and crucial reductions in carbon emissions.

Concentrated products reduce packaging

Canary Clean Products is one of the upstart brands vying for a piece of the market with a lineup focused solely on concentrated hygiene products. “I wanted to build a brand that was highly concentrated, so we lower our environmental footprint throughout the whole process [and] the whole lifecycle of the product,” founder Luke Wilson told TriplePundit.

“A lot of products are shipped with a lot of water weight, which makes them heavier and more costly to ship,” Wilson explained. That extra weight and bulk means traditional products require more trucks — and more fuel — to get them from the point of manufacture to the point of sale. And that means higher emissions. Instead of adding unnecessary water and charging consumers for it, brands like Canary are in a position to win over environmentally-conscious shoppers by being a part of the solution.

Canary makes bar soap, hand soap refills, toothpaste tablets, and concentrated mouthwash and face masks. The year-old company is also looking to expand into shampoos and conditioners, shaving cream, and laundry products — all of which can benefit from less packaging and a lower shipping weight made possible by concentrated products.

Canary’s products are packaged as minimally as possible in glass bottles, cardboard and paper pouches. The cardboard and paper packaging are both recyclable and compostable. And unlike many products that carry misleading compostability claims, the packaging doesn’t have to be sent to a commercial facility — it can be composted at home so long as it is shredded first, Wilson explained.

While the brand hasn't calculated exactly how much plastic its customers have kept out of landfills by choosing concentrates so far, Wilson estimates that each four-month supply of toothpaste tablets eliminates between two and four toothpaste tubes, which are generally not recyclable. Meanwhile, the brand's concentrated hand soap refills replace up to 12 plastic pump bottles, also avoiding a considerable amount of waste. “We need to recap our results for 2023, which we're wrapping up,” he said. “But it is something that we plan on reporting out, [as far as] how much we've saved versus the traditional products.”

Concentrated formulas mean products last longer, saving money and emissions

Concentrated formulas don’t just save on packaging. They also cut down on how often consumers have to purchase products, often saving money in the process. For example, a single shampoo bar can deliver the same amount of washes as up to three bottles of shampoo. Since the bars are available at comparable (or even lower) price points, customers can enjoy substantial savings.

Canary also claims its bar soap lasts three to four times longer than most on the market, Wilson said. At 4.5 ounces, part of this is due to its size. But it’s also because of how the soap is milled and its particular ingredients.

Small specialty brands are in a unique position to bring change

Naturally, the planet would be better off if major brands immediately switched to concentrates as well. Instead of waiting for new, smaller brands to win the hearts and minds of consumers, these larger companies could make a big difference in packaging and emissions — and fast. However, consumers are also becoming increasingly disenfranchised with traditional brands, thanks to the perfect storm of greedflation-inspired price hikes and ever-shrinking contents. As a result, consumers are less likely to trust itty-bitty packages of concentrated products from the same companies that have already been subjecting them to shrinkflation.

Companies like Canary have another advantage: Their business models tend to be more in line with a public that is increasingly concerned with ingredients. The brand's lineup is cruelty-free, meaning it is not tested on animals, and its mouth care products are formulated without sodium laureth sulfate, a surfactant that can cause irritation for some people.

Like most emerging specialty brands, Canary is available for direct-to-consumer shipping. This may not be ideal as far as carbon footprints are concerned, but the mere availability of such products is a step in the right direction.

Fortunately, Canary products are also available in select refill shops — which are gaining popularity as more and more people aim to take responsibility for the amount of waste they produce. Such stores allow Canary to sell products in bulk, which eliminates even more packaging. Together, concentrates and refill shops represent a shift in thinking that could change how we shop for hygiene and home care products.

Meet the Clean Energy Company Bringing NASA’s Battery Technology to Earth

(Image credit: NASA/Unsplash)

Finding a sustainable, affordable, and consistent energy supply can be a roadblock to decarbonization as the world moves from burning fossil fuels to using renewable energy. In some cases, we've turned to batteries to store energy for the days when renewables like solar and wind aren't generating enough power to meet demand. Lithium-ion batteries, like those used for electric vehicles and storing backup solar power, are the clean energy storage of choice because they are lightweight and fast-charging. But lithium-ion technology also has a growing list of sustainability and safety concerns.

In 2020, Yi Cui, a Stanford professor of materials science and nanotechnology, took a cue from NASA and made an energy storage breakthrough. NASA has used sustainable batteries for the solar arrays that power the International Space Station and the Hubble Space Telescope for decades. The organization’s batteries are powerful and durable, even in the rugged environment of outer space. But they utilize platinum, making them too costly for most clean energy applications on Earth.

Cui discovered a way to recreate NASA’s battery technology using a far more affordable metal: nickel. That same year, he founded the clean energy company EnerVenue to commercialize his innovation.

“Because this was a cost reduction play on an existing technology, we have been able to move fast. We have found a way to reduce costs drastically through material substitution and redesign, and that makes it easier to manufacture,” said Jorg Heinemann, CEO of EnerVenue. “It has characteristics similar to lithium-ion. But unlike lithium-ion, our batteries effectively last forever.”

Demand for these batteries is growing, and the company recently announced a new 1 million-square-foot production factory in Kentucky.

EnerVenue’s batteries are nickel-hydrogen based. A chemical reaction inside the battery generates hydrogen to charge them. As the battery discharges, the hydrogen oxidizes and turns back into water.

The batteries look like long scuba tanks — about 6 feet long and 6 inches wide. That makes using them while one the move nearly impossible, but they are perfectly suited for use in power plants, businesses and homes, Heinemann said. “We can meet any energy storage need as long as it is not mobile,” he said.

Though EnerVenue’s batteries utilize a pressurized tank, they reach peak pressure at approximately 5 percent of what a typical hydrogen fuel cell would reach. If pressure continues to build, the hydrogen is forced to recombine into water, which can be released from the battery as steam.

Unlike lithium-ion batteries, nickel-hydrogen batteries do not carry the risk of overheating and do not require a temperature-controlled storage site with hired staff for constant monitoring. They can be stored together in large quantities for their entire lifespan.

“Storing energy in the form of hydrogen is highly efficient and very durable and works almost as well in the hottest places and coldest places in the world as it does at room temperature,” Heinemann said.

Plus, nickel-hydrogen batteries have a lifespan of 30 years, equal to solar arrays and wind turbines. “Other batteries tend to wear out for the same reason a paper clip wears out when you bend it: There is a flexing mechanism,” Heinemann said. “Think of your cell phone. It can get warmer and thicker when it is charging. That is because the material in the battery is flexing. When you do that enough, it starts to not hold its charge well enough anymore and degradation accelerates. That doesn’t happen with our battery.”

Regardless of the relatively long lifespan, the company designed the batteries to be “cradle-to-cradle,” Heinemann said. EnerVenue employs a circular manufacturing model where the batteries’ parts can be removed and re-used without the risks that lithium-ion recycling carries.

“Batteries have always been things that wear out or we throw away,” Heinemann said. “We have to replace them or baby them. Those constraints don’t exist for us. Energy storage can last forever and be incredibly cost-effective as a result.”

EnerVenue is scaling up quickly after the success of its pilot programs. “We have proven that systems work in the field, and we have half a billion dollars of firm orders from customers,” Heinemann said. “We are really excited. Our order book is in excess of what I imagined it would be at this stage.”

The company is also exploring new and innovative applications for clean energy storage. “Because our battery is fire safe and does not require maintenance, we want to launch a new category of energy storage that allows us to build our batteries into unused storage areas, like in the ceilings of parking garages or crawl spaces of buildings,” Heinemann said. “Where there is dead space, our batteries could go there.”

Homepage image: NASA/Unsplash

Raising the Bar: Alcohol Giant Diageo Aims to Increase Glass Recycling

(Image courtesy of Diageo)

When you crack open a beer on a Friday night, the bottle is the last thing on your mind. But once drained of its last sip, it has a bumpy road ahead. We’ve made glass for millennia, yet our approach to its reuse is less sophisticated.

Americans send the vast majority of their glass to landfills — about 7.6 million tons every year, according to the U.S. Environmental Protection Agency (EPA). With glass recycling rates of only around 31 percent, we lag far behind European countries that reuse an average of 74 percent. Unfortunately, glass breaks down extremely slowly in landfills.

However, while some see the glass pile as half empty, Diageo sees it as half full. As one of the world’s largest producers of spirits and beer, it's stepped up to tackle glass recycling in the U.S. Most recently, the company partnered with Don’t Trash Glass, a bottle collection program aiming to increase recycling in bars, restaurants and local businesses.

Glass recycling 101

Despite our propensity to trash it, glass is infinitely recyclable without losing quality, according to the Glass Packaging Institute, which is a part of Don't Trash Glass. Originally made from sand, soda ash and limestone, glass can be melted down at extremely high temperatures and formed into products like jars and bottles. In this production process, recycled glass can be substituted for up to 95 percent of the raw materials. Creating six tons of recycled glass saves a ton of carbon dioxide emissions.

“Glass has a very important role in our supply chain emissions,” said Jayant Kairam, vice president of society at Diageo North America. “In order for us to cut those emissions down, which represent 90 percent of our overall emissions, we need to really transform and invest in circularity … When we think about glass and packaging, it's really from a carbon reduction perspective.”

Glass recycling faces several roadblocks, though. “We have low recycling rates anyway, it's not just glass,” said Rose King, co-founder of GlassKing Recovery and Recycling, one of the companies involved with Don’t Trash Glass.

Only about 32 percent of the waste generated in the U.S. is recycled, according to the most recent data from the EPA.

“There's lots of reasons [for that],” King said. “One of them is a lack of education and the lack of awareness of what, why and how. Don't Trash Glass was designed specifically to explain what, why and how.”

Other factors hinder glass recycling rates, too. For example, numerous American communities have eliminated glass from their curbside recycling programs, citing high shipping and processing fees. Further, in single-stream recycling programs, glass can break and contaminate other recyclables, pose a hazard to workers, and damage machines at recycling facilities.

Diageo’s recycling partnership

But when life gives you lemons, make lemon vodka.

In 2023, Diageo joined the Don’t Trash Glass program, which expanded to the Chicago area from Arizona in 2021. It began as a partnership between the Glass Packaging Institute and GlassKing Recovery and Recycling, and it collected 2.2 million pounds of glass from over 50 businesses in Illinois last year.

To get glass into the recycling stream instead of landfills, the program first assesses a business’ recycling needs and provides both indoor and outdoor recycling containers. Then, it collects and transports the glass to be recycled into products like bottles, jars and even fiberglass.

“Don’t Trash Glass is a very exciting opportunity for us to really invest in tackling and building momentum on achieving some of our sustainable packaging objectives at Diageo,” Kairam said. “We also have a very ambitious sustainability agenda, which includes some bold commitments to increasing the sustainability of our packaging. And when we take a step back and think about our packaging, we always immediately go to glass. It is very much associated with our products. It's a wonderful material — infinitely reusable and chemical-free.”

Illinois was of particular interest to Diageo because its primary bottling and packaging facility is just outside of Chicago, Kairam said. In addition, a number of its glass suppliers are close by, and Chicago is a major commercial hub. The city is filled with bars, restaurants and chains generating lots of used glass.

“Chicago made a lot of sense in that first year,” Kairam said. “We had some very promising results, enough to build on and commit to expanding to another strategic location — which is northern Kentucky, Louisville, where we have our Bulleit [Frontier Whiskey] operations.”

Don’t Trash Glass is slated to start in the Bluegrass State this spring. Home to multiple Diageo facilities, Kentucky could use a little boost — its glass recycling rate is only 15 percent, according to a report by Eunomia Research and Consulting and the packaging company Ball Corporation.

“We're very committed to Kentucky,” Karaim said. “I want to see this program thrive and grow, and hopefully, bring more partners along to it because the rates are low.”

GlassKing shares that goal. “We have a passionate vision that if you're sipping bourbon in Kentucky on a Monday, and you fly to Arizona on a Wednesday and have a cold beer in the middle of the summer, it's [all] part of the Don't Trash the Glass program,” King said.

Other steps toward sustainability

This partnership is part of a larger vision for Diageo to reinvent its packaging by 2030. For instance, the company’s targets include sustainably sourcing all paper and board packaging materials and reducing overall packaging weight by 10 percent. Additional goals include using 60 percent recycled content in its packaging and making all packaging and plastics widely recyclable.

But that’s not all. “We're investing in hydrogen-powered furnaces to decarbonize the production of glass, particularly in Scotland,” Karaim said.

The company is also experimenting with alternative bottles — including a new Baileys Irish Cream line with aluminum bottles, which emits 44 percent less carbon than the glass bottles used today, Karaim said.

The company has made some notable progress so far. It’s transitioning into more lightweight bottles for certain types of scotch and reducing cardboard packaging by 600 tons. It also introduced compostable and biodegradable carrier rings instead of plastic ones for some beer brands.

Don’t Trash Glass isn’t Diageo’s first recycling rodeo. It also implemented glass and plastic recycling programs in Brazil and Ghana. And in Brazil, it set up a bottle return program for one of their cachaça brands, Ypióca, where glass from a 500-mile radius is brought to its facility for sanitation and reuse.

“It's pretty amazing to hear such a global company trying to do all these different things to make their impact,” King said. “This Don't Trash Glass relationship between Diageo and Glass King is really just the beginning of what we have to do as a collaboration in different areas.”

That’s good news for all the empty beer bottles out there, so raise your glass to a more sustainable future.

People Want Their 401(k) Plans to Align With Their Values, Survey Finds

(Image credit: Markus Spiske/Unsplash)

Most financial professionals likely assume a strong return is all everyday investors are looking for as they save for their retirement. But even in a tough economy, a growing segment of global investors are equally concerned about aligning their money with their personal values, according to new research.

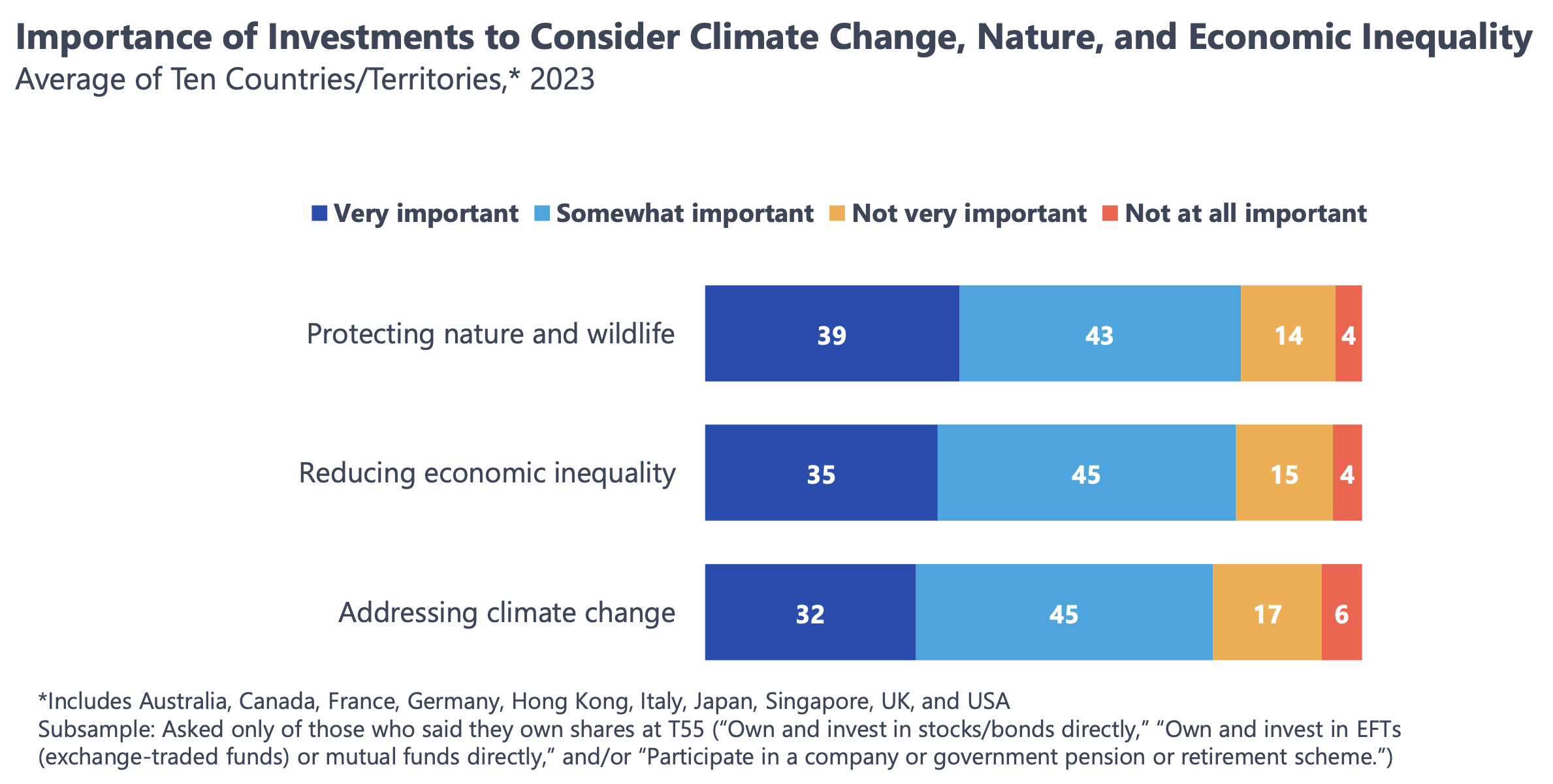

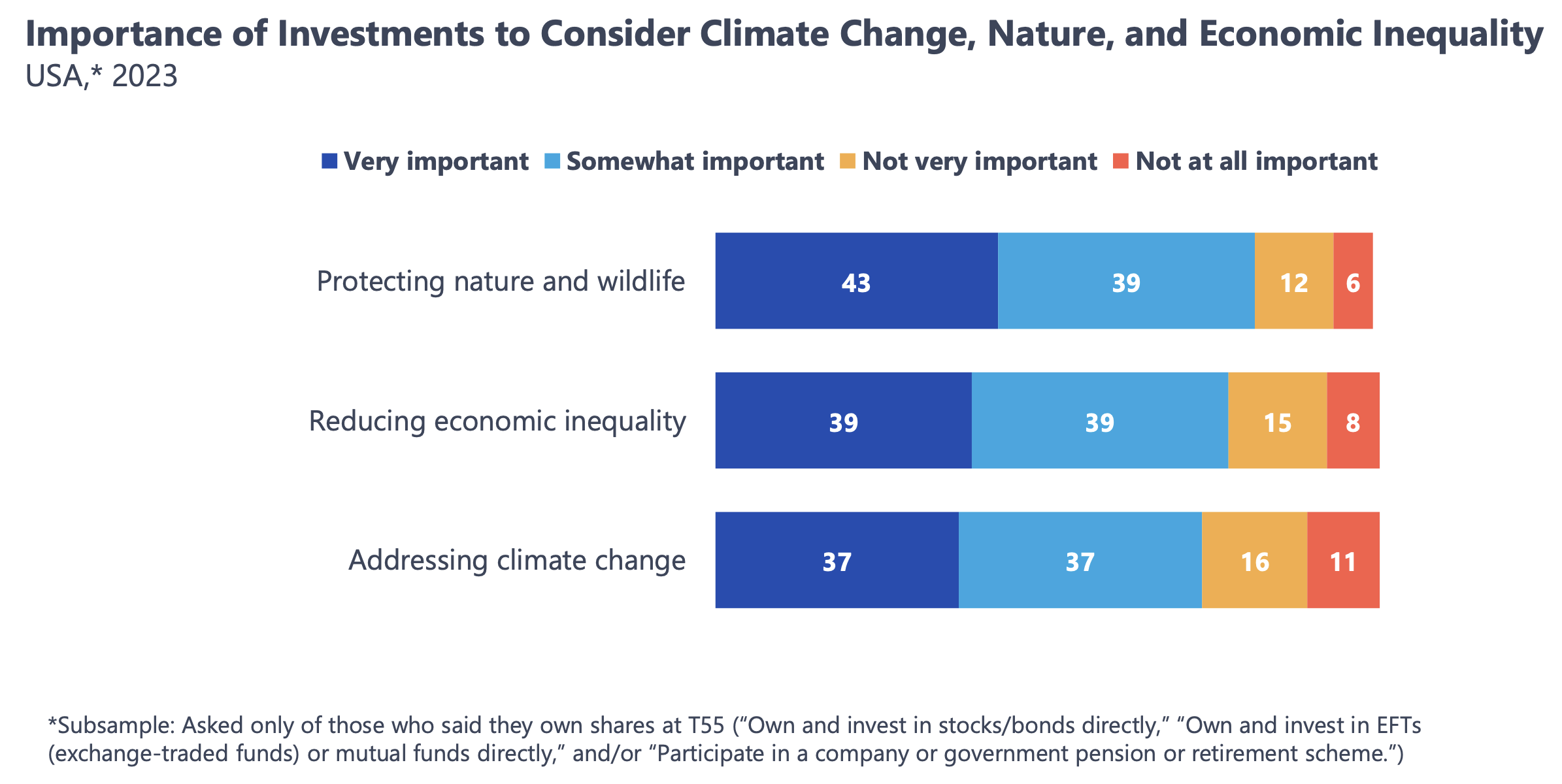

The global insights consultancy GlobeScan and the climate policy think tank InfluenceMap surveyed 5,000 retail investors — in other words, regular people who participate in 401(k) retirement plans and pension schemes or who dabble in purchasing individual stocks — to understand more about their preferences. Surveyed investors represent 10 countries and territories around the world, including the United States, Canada, Australia, France, Germany, Hong Kong and Japan.

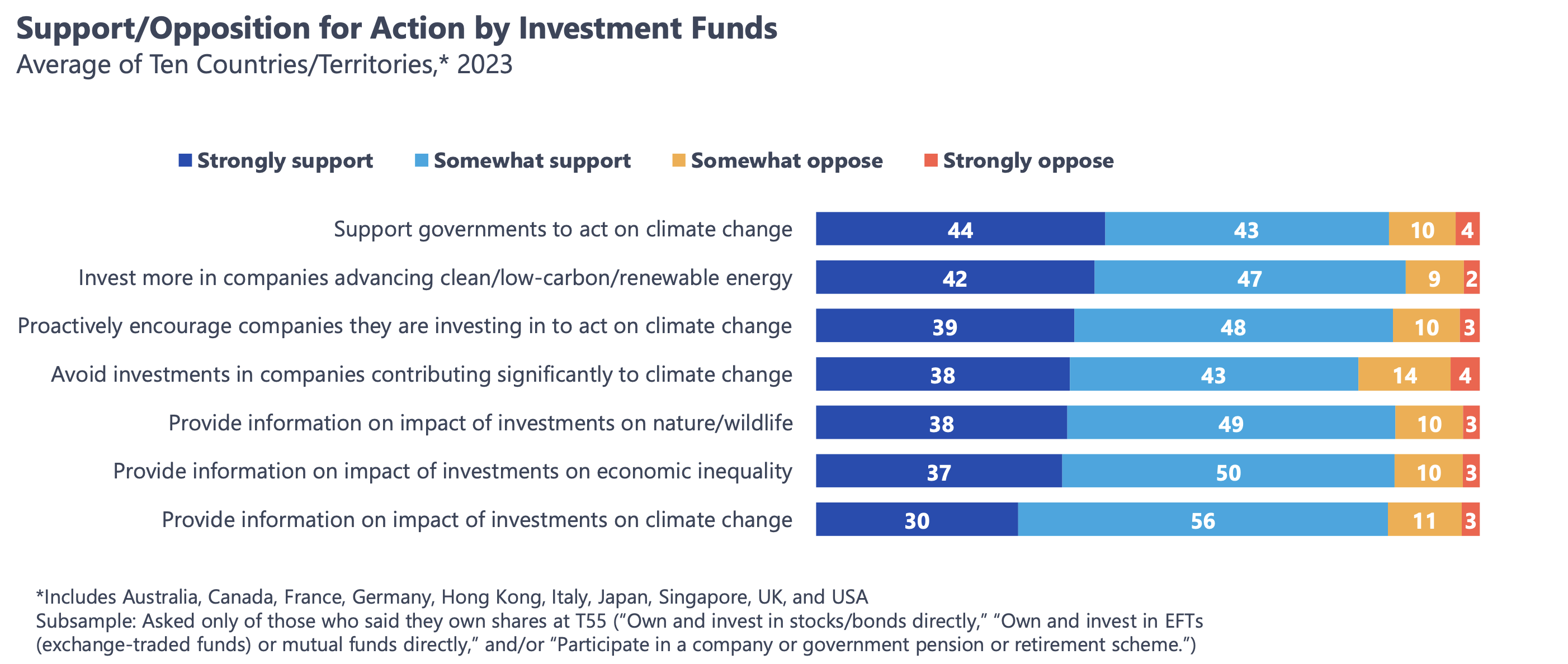

More than 8 in 10 of these investors (89 percent) either "strongly" or "somewhat" support investment funds putting money behind companies in the clean energy space, and 87 percent support funds actively encouraging the companies in their portfolios to act on climate change, according to the research. Further, over a third of surveyed investors strongly support funds excluding "companies that contribute significantly to climate change," and another 43 percent somewhat support it.

Many of these investors are also looking for the funds they do business with to provide information about how their investments impact nature and wildlife, economic inequality, and climate change, with more than 85 percent either strongly or somewhat supporting these disclosures.

"The financial system is all obviously predicated upon fiduciary responsibility and maximizing profits, but I don't think the industry is very good at engaging their passive investors," Chris Coulter, CEO of GlobeScan, told TriplePundit. "In this world of transparency and ability to reach people, we probably underestimate the innate, baseline sense of importance of sustainability issues for investment decisions among retail investors."

How can funds align with investor preferences?

Findings like these dovetail with recent research from TriplePundit, in which more than half of surveyed U.S. consumers agreed it is “important” or “very important” for financial service companies to act responsibly when it comes to society and the environment. Over 30 percent said they switched their retirement fund provider in 2023 for sustainability reasons, according to the study conducted in partnership with 3BL, the research technology company Glow and panel partner Cint.

But even as sustainability becomes a more influential purchase driver for everyday investors, fund managers have been slow to respond.

“GlobeScan’s research shows the extent of retail investors’ demand for ambitious climate action by their fund and pension managers," Daan Van Acker, program manager at InfluenceMap, said in a statement. "This stands in stark contrast to InfluenceMap’s findings that the world’s 45 largest asset managers are investing almost three times more assets in fossil fuel companies than green ones, while the proportion of managers with ambitious investee company stewardship has almost halved since 2021."

Given the ongoing disconnect, research like this is a powerful tool for financial professionals interested in aligning their firms' activities more closely with consumer preference.

"If I was in a fund and saw these metrics, I'd be intrigued, because you're looking at 80 to 90 percent of people saying this stuff is important," Coulter said. "There's depth and foundational elements that even if you eroded a little bit, you still have significant majorities that are into this, so there's an opportunity here."

Still, growing political backlash against the use of environmental, social and governance (ESG) principles in investment decisions poses real risk for funds, particularly in the U.S. Among the recent examples, Texas’s Permanent School Fund pulled $8.5 billion out of BlackRock last week, arguing the asset manager's focus on ESG hurts investors and runs counter to its fiduciary duties.

BlackRock stopped using the term ESG to describe its interactions with portfolio companies, citing increased weaponization of the term, CEO Larry Fink said last year. But the so-called "anti-ESG" backlash still cost the company an estimated $4 billion in assets in 2023.

Amidst this environment, fund managers would be wise to pay attention to the global interest in sustainability among investors, and perhaps test new offerings and policies in markets outside the U.S. first, Coulter advised.

"The context of the ESG politicization and the weaponization of these issues makes it much more challenging," he said. "It's only for the brave, probably, in the U.S. In most other markets, it's much less of an issue. Testing in other markets outside the U.S., where there's a bit of a stronger sense of interest and importance and also less risk around the anti-ESG backlash, would be a sensible thing to do."

Taking note of these global trends — with an eye toward a continued strong interest in the U.S., where more than 70 percent of investors say it's important for their investments to consider climate change, nature and economic inequality — can help fund managers maintain perspective in a difficult time.

"There's a lot of noise out there, a lot of politicization, but the underpinning reality once this fever breaks is that there's opportunity here to build something," Coulter said. "Listening, understanding, getting close to people, hearing their own words, language and needs, and then finding ways to develop value propositions on the back of that, is really important."

Messaging matters for funds, investors and the public

Even in the U.S., financial companies have an opportunity to connect with investors around issues that are less subject to political partisanship, with investments in nature, conservation and biodiversity being a clear example. Where the gravity of the climate crisis can easily overwhelm people to the point they tune out, the proactive, solutions-oriented tone of conversations around nature lend themselves to greater engagement among investors and the public, Coulter said.

"Winning on climate change means we avoid the apocalypse and we all don't die. That is sort of the extreme expression of success on climate change and net zero, so it's inherently negative or inherently focused on avoiding tragedy," he explained. "Winning or being resilient on nature is infinitely positive in consumers', retail investors' and other stakeholders' minds. You can always imagine a much more positive future for nature, and that means it's got more energy and more possibility than just the climate conversation and decarbonization."

Leaning into these areas with universal appeal can help fund managers to meet consumer preferences while providing much-needed funding to preserve natural resources, which also helps to fight climate change and promote economic equality.

Still, there is only so much that mainstream sustainable investing can do to drive progress. "With the trillions of dollars of assets under management that meet certain ESG criteria, it's extraordinary numbers, and yet we don't see any dramatic change in the impact that companies have on the environment or on people on the ground," Coulter said. "There are two potential reasons for that. One is that it's in the system now: There's a lag in the system, while this amazing hockey stick impact curve is taking shape, and things will start to change dramatically because capital has been allocated in certain ways. Or two, the bar has not been high enough to differentiate what good looks like versus what average or status quo looks like."

In particular, most sustainable funds apply negative screens to exclude entire sectors, such as oil and gas, or exclude companies with especially poor social and environmental records. But fewer have built funds around companies that have an especially positive impact on people and the environment, leaving investors with little information about how this approach would really perform. "Someone has to prove that the social impact approach actually delivers much more returns, and that's still to be done," Coulter said.

Research like this indicates the approach could be well received. "There's an underlying value set that people have: People love nature, they're worried about climate, and they care about inequality. And these are generally long-term investments, so it's not about next quarter. It does change the future discounting risk for people that in the next 30 years, this makes sense. It's very rational and it also fits with my values."

Graphics courtesy of GlobeScan and InfluenceMap

Homepage image: Markus Spiske/Unsplash

Beware the Silent Boycott, Lest It Get Loud

(Image: Charlie Deets/Unsplash)

The run-up to the 2016 presidential election cycle touched off a rash of boycotts organized through social media. Many slipped silently into the clutter of the Internet, but others broke through. Now, one of these silent boycotts is taking shape against the high-profile automaker Tesla — offering an opportunity to explore why automakers that promote their environmental profile also need to attend to the social aspect of ESG (environmental, social and governance) principles.

When boycotts work

Before a boycott is organized on social media, there needs to be a groundswell of consumer discontent. That's what happened in 2016 when then-candidate Donald Trump campaigned for president on a platform critics derided as based on bigotry and xenophobia. The well-known #GrabYourWallet boycott launched in October of that year, after months of public exposure to Trump’s inflammatory rhetoric. It was soon followed by the Sleeping Giants campaign, among others.

These boycotts took a strategic approach. Instead of simply urging consumers to stop buying certain products, they prevailed upon businesses and advertisers to stop engaging with the target of the boycott and his allies in right-wing media.

One red flag for Tesla: Consumer discontent

As regards to Tesla, two red flags crop up. First is consumer discontent. Tesla launched in 2003 with high marks for the environmental part of ESG. It was the first modern U.S. automaker to reach scale with an entirely zero-emission electric vehicle lineup, leading the way into the decarbonization movement.

However, in recent years the brand has suffered a well-documented series of reputational blows related to social and governance issues. The hits increased exponentially after Tesla CEO Elon Musk acquired the social media site Twitter in October of 2022, exposing his controversial views on social issues to constant, widespread attention.

Sure enough, earlier this week Reuters reported on several consumer surveys that indicate consumer discontent is contributing to the recent decline in Tesla sales in the U.S. and Europe. Among the sources cited by Reuters is the marketing research firm Caliber.

“It's very likely that Musk himself is contributing to the reputational downfall,” Caliber CEO Shahar Silbershatz told Reuters, partly because his name is so closely associated with the Tesla brand.

As reported by Reuters, Caliber found that 83 percent of Americans associate Tesla with its CEO by name. It would be difficult if not impossible for any other CEO in the entire automotive industry to match that level of recognition.

Another red flag for Tesla

The other shoe to drop involves the business-to-business element — which is also beginning to materialize, without any evidence of an organized boycott.

In November 2021, before Musk acquired Twitter, the rental car firm Hertz announced plans to buy 100,000 Tesla Model 3 cars over the next two years. Hertz cited “climate change benefits” among the reasons for the growing demand for electric vehicles.

By this year, the bloom was off the rose. Hertz did not come close to buying 100,000 Model 3s, which was just as well. In January, the company announced plans to sell its Tesla cars along with much, though not all, of its electric vehicle fleet — citing lack of interest from renters along with issues related to collision risks.

That same month, the Germany-based global rental firm SIXT also announced that it was phasing out its entire fleet of Teslas, to be replaced with a mixed fleet of electric vehicles, hybrids, and gas vehicles purchased from Stellantis for the North American and European rental markets. Among other reasons, SIXT noted that Tesla’s recent price cuts were undermining the resale value of rental fleets. Tesla’s recent labor and environmental controversies in Europe were not cited but may have also played a role.

The importance of leveraging social issues in a crowded electric vehicle market

In this day and age of heightened consumer engagement with social issues, these two red flags would normally spark some corporate damage control to ensure that the silent boycott does not build to an organized roar.

In terms of ESG, the social element is particularly important at this stage of the electric vehicle market. Because many more automakers are introducing environmentally-friendly cars of their own, the way they respond to social issues can help them stand out from the crowd.

Notably, Tesla has never had a public relations department or media representative, other than Musk himself. The company finally issued its first diversity, equity and inclusion (DEI) report in 2020, only to drop all references to DEI in its latest 10-K financial report to the U.S. Securities and Exchange Commission in January of this year.

How to avoid a silent boycott

In that regard, it’s instructive to take a look at three other automakers surveyed by Caliber. As cited by Reuters, Mercedes, BMW and Audi saw their consideration scores — which measure consumer preferences — climb slightly from January, even as Tesla’s score dropped by 8 percent.

Notably, all three of these rivals continue to sell gas vehicles, indicating that environmental issues are secondary to other reputational elements. None of the three are leaving anything to chance on ESG or DEI. They devote considerable space to these issues on their corporate websites.

“We foster a culture of appreciation and respect in which age, ethnic origin and nationality, gender and gender identity, physical and mental abilities, religion and belief, sexual orientation as well as social origin play no part,” Mercedes-Benz states forcefully “Alongside sustainability and integrity, diversity forms the foundation of Mercedes-Benz's sustainable business strategy,” the company adds, by way of introducing a detailed rundown of its engagement programs.

BMW also emphasizes, in great detail, the importance of integrating DEI principles holistically throughout its operations. “We find the topic of diversity so essential today that we offer diversity campaigns and events throughout the year that sensitize our employees and encourage them to exchange ideas with each other,” the company states.

Audi also takes nothing for granted. The company’s DEI statement starts off by acknowledging that the automotive industry as a whole needs to do better. “We recognize that people of diverse backgrounds — including women, people of color, LGBTQ+ individuals and beyond — are underrepresented within the automotive industry. At Audi of America, we are challenging the norms and challenging ourselves,” the company’s U.S. branch states.

It's not rocket science. It’s just plain common sense. All three brands have established a reputation for luxury and engineering excellence, and they are not about to risk it with an unforced error on DEI or ill-considered words on timely social issues. Building a strong DEI profile is part and parcel of today’s hotly competitive global automotive market, and top brands — well, most of them — are leveraging every angle to attract and keep their customers.

(Homepage image: Dmitry Novikov/Unsplash)

Ikea Sources Bright Sustainability Ideas From Stakeholders at the One Home, One Planet U.S. Event

Javier Quiñones, CEO and chief sustainability officer for Ikea U.S., speaks at the One Home, One Planet U.S. event in Washington, D.C. (Image courtesy of Ikea U.S.)

The projected global revenue from shifting to a circular economy is expected to increase from $339 billion in 2022 to $712 billion in 2026. The emphasis on regenerative resources, material circulation and eliminating waste at the core of this economic model requires changing the way products are consumed and, ultimately, the way businesses operate.

This isn’t a new observation for Ikea. The global home furnishing company aims to become a circular and climate-positive business by 2030. Building on its vision to improve everyday life for people and create a positive global impact, Ikea recently brought leaders together to envision a better and more sustainable future.

One Home, One Planet U.S. 2024: Developing collaborative solutions

Ikea U.S. hosted its second One Home, One Planet U.S. event at House of Sweden in Washington, D.C. last month. Nonprofit organizations, political leaders, entrepreneurs and corporate professionals in the sustainability field came together to discuss challenges and opportunities related to climate action, inequality and resource shortages. The goal of the two-day event was to inspire action, as it did for Ikea and guests of the last One Home, One Planet U.S. event in 2022.

"One Home, One Planet has created a lot of these movements,” Javier Quiñones, CEO and chief sustainability officer for Ikea U.S., said in his opening remarks at the event. “Many of the actions that were put in place are because of inspirations that we have had in the past. Our Buy Back and Resell program is something that came from One Home, One Planet in 2019, and now it's a service that we offer all over the world. So, imagine the power of these gatherings.”

Ikea brings ideas to execution at One Home, One Planet U.S.

The One Home, One Planet U.S. event was split into a series of town hall panels and co-lab sessions — where leaders shared their unique perspectives on public and private interventions that power a more sustainable future, and attendees broke into groups to discuss them.

One town hall, for example, focused on addressing public policy. Former Columbia, South Carolina, Mayor Stephen K. Benjamin, assistant to the president, senior advisor to the president and director of the White House Office of Public Engagement, filled the audience in on the Biden administration’s sustainability and environmental justice efforts, the impacts they have and how businesses and other stakeholders can get involved. "Every opportunity there is to potentially celebrate a huge success for Ikea [around sustainability and social impact], that also is a huge success for the administration,” Benjamin said.

During the co-lab sessions, attendees were divided into groups to discuss core topics related to the insights shared in the town halls, specifically around ideas and solutions for the circular economy, affordable housing and clean construction.

Throughout the second day of the event, attendees completed a series of strategy activities such as trend maps, identified challenges and opportunities close to their topics and created desired future statements to develop practical ideas that would turn their desired future into reality. The co-lab topics align with Ikea’s overall strategy and vision, with an eye toward what the company can learn from what’s discussed.

Next steps for the company following the event include gathering insights and ideas shared by attendees and translating them into plans for future action, both within Ikea and externally via continued cross-sectoral collaboration. "We don't know everything, but we all know a little bit, and when we come together, magic happens,” Quiñones said.

People and planet are ingrained in the Ikea ethos

This type of learning-and-doing model is just one way Ikea looks to embed sustainability across all areas of the business. In addition to the Buy Back and Resell program that gives used furniture a second life, the company has developed strategies to reduce emissions and implement renewable energy sources to achieve its goal of becoming a climate positive business by 2030 — specifically in its supply chain operations.

To date, 25 of the company’s global retail markets operate with 100 percent renewable electricity, and 408 additional factories and suppliers use 100 percent renewables. In its fiscal year 2023 (September 2022 – August 2023), Ikea U.S. collectively generated more renewable energy than its locations consumed. It also installed public electric vehicle chargers at several U.S. stores and plans to install an additional 500 public chargers and 300 fleet chargers within the decade across its U.S. locations.

In fiscal year 2023, Ikea U.S. also granted more than $2.5 million in donations to nonprofits that work toward social change. More specifically, it donated over $50,000 from sales of its Storstomma rainbow shopping bags to True Colors United, a nonprofit organization focused on the unique experiences of LGBTQ+ young people experiencing homelessness. Ikea U.S. also partners with the American Red Cross and has provided numerous financial donations including its most recent contribution of $150,000 in relief efforts for the Maui wildfires.

"We know that climate change does not affect everyone in the same way,” Quiñones told the audience at One Home, One Planet U.S. “And many of the people who are affected are actually the ones who have nothing to do with climate change.”

By hearing from those impacted and those with the vision for a brighter future, companies like Ikea can improve on what they already do and implement the new systems we need to realize a more regenerative, circular and climate resilient economy.

This article series is sponsored by Ikea U.S. and produced by the TriplePundit editorial team.

DEI Isn't the Enemy: It Helps Organizations Navigate Conflict and Change

(Image: PX Media/Adobe Stock)

This story is part of Let's Talk About It, a guest-contributed column exploring how to navigate hard conversations and complex challenges in the workplace. If you're interested in contributing your perspective on DEI, corporate culture and workplace issues to this column, please get in touch with us here.

Almost as soon as the news broke that a cargo ship lost power and hit a bridge in Baltimore, conspiracy theorists took to social media to blame the accident on diversity, equity and inclusion (DEI) initiatives. While some making the claim are merely internet trolls, the sentiment was also shared by a former member of Congress and a gubernatorial candidate. Before Baltimore’s Key Bridge collapsed, a critical safety incident on a Boeing plane was also blamed on DEI, a charge championed by billionaire Elon Musk, who has called DEI “another word for racism.” Perhaps this attitude explains why his electric vehicle company was recently ordered to pay a former employee $3.2 million in a racial discrimination lawsuit.

If the people with influence making these claims had a better understanding of the value of DEI, they would see it as an insurance policy against workplace discrimination claims and the strain they put on productivity and profitability. It’s a no-brainer to think that employees will be more engaged in a workplace where they feel valued and treated fairly.

The value of DEI to leaders was clearly demonstrated in the wake of the October 7, 2023, attack by Hamas on Israel. When Israel responded with force, the world reacted. U.S. college campuses, in particular, became a symbol for pro-Palestinian sentiment, and several university leaders were summoned to testify before Congress about campus protests. Under this scrutiny, DEI opponents cynically linked diversity programs to antisemitism and attacks on DEI proliferated, providing new fuel for those who had already mounted a concerted effort to sink these policies long before the Israel-Hamas conflict.

Many companies felt pressure from internal and external stakeholders to comment on the Hamas attack and its aftermath. Knowing what to say about complex and emotionally charged global events is uncomfortable territory, especially as sympathies toward both sides in the conflict shift — particularly among younger generations, hence the congressional focus on college campuses.

Navigating this uncharted territory creates a crucial test for leadership that requires a thoughtful and strategic approach.

Change is the only reliable constant, and smart leaders will invest in planning for change sooner rather than later. Effective leaders take necessary steps to control their destiny, and investing in DEI is one way to future-proof an organization.

Take, for instance, a small financial services firm we consult that initially struggled with how to respond to the conflict. Leaders recognized that office opinions about the situation were divided and that any statement they made was likely to disappoint some subset of their employees. But they also recognized they couldn’t ignore the situation.

Instead of issuing a statement, they facilitated a listening circle with carefully considered ground rules, providing employees with a safe place to express their feelings and perspectives. The session reinforced the company’s commitment to creating an inclusive work environment and allowed employees to feel heard, valued and engaged.

This private equity firm passed a critical leadership test because the executive team considered the needs and perspectives of the company's stakeholders. They took the time to understand why their employees cared about the conflict and how they are personally impacted by events halfway around the world. Company leaders also took the time to acknowledge their own points of view and why they hold those opinions. Checking your own bias can be difficult, but it’s important to be honest about why you feel one way versus another. Listening exercises like these demonstrate respect for differences of opinion and different perspectives.

In contrast, another mid-sized company in the healthcare space that our firm is familiar with took a different path and failed the leadership test in its response to the Hamas attack. The company’s CEO sent an all-staff email reflecting his personal beliefs without consulting anyone in the organization. Many people on staff were offended by the message and felt like they didn’t belong at the company. Months later, the company is still trying to manage the internal crisis, spending precious capacity on a problem that didn’t need to happen.

Making employees feel heard and valued is an important factor in improving employee engagement. Gallup research shows that only 32 percent of employees are fully engaged and thriving at work, a number that has continued an alarmingly steep decline since the pandemic. Interestingly, engagement is higher among employees who are either fully remote or in a hybrid work location, possibly reflecting the fact that people are less likely to experience microaggressions outside of the workplace. But since 61 percent of the U.S. workforce cannot work from home, investing in DEI remains critically important for most workplaces.

Although some news travels fast and is impossible to avoid, it is important for leaders to remember that not all events worth acknowledging make headlines. Whether it is the psychological trauma Black Americans face inside and outside the workplace, the targeted attacks against Asian Americans during the COVID-19 pandemic, or even the economic stress low-income Americans navigate daily, every employee carries their personal and community trauma to work each day. Leaders can make the workplace more welcoming, for example, to Black employees by recognizing the effects of injustices and violence that occur closer to home. What business leaders choose to react to, or not react to, sends a message about company values, whether it is intentional or not.

Today’s company leaders are so much more than bosses and managers, and leadership is more nuanced than giving orders and setting goals. Today’s leaders are responsible for setting the tone of an organization by reinforcing its culture and demonstrating its values. Leaders need to create workplaces where employees feel safe — both physically and psychologically — and want to do their best work and be fully engaged. While a leader may be responsible for a final decision on how to address a particular situation, they will be well-served to listen to diverse perspectives before making that final decision.

While billionaires may blame their large legal bills on DEI, the risk and liability were created by the absence of a DEI strategy. A workplace that tolerates racial abuse, pervasive stereotyping, and hostility — including epithets and slurs — does not respect the civil rights of its workers and leaves itself vulnerable to civil and criminal legal action.

Effective leadership means standing up for what is right by fostering a culture where everyone feels empowered and welcome to contribute their unique perspective and talents, ultimately leading to a more successful, strong, and resilient organization for the long term.

This App Helps Immigrants Reclaim Their Stolen Wages

A board of ideas by the team that created Reclamo, an app helping immigrants reclaim stolen wages, from their design meetings. (Image courtesy of Pro Bono Net)

In the United States, wage theft is the crime of the century. Every year, American workers lose approximately $50 billion in wages stolen by their employers, according to the most recent data available from the Economic Policy Institute.

Wage theft occurs when employees are not paid the wage they agreed to, are not paid for all the hours they worked, don’t receive overtime compensation, or receive illegal deductions to their pay.

This national epidemic is most prevalent in America’s biggest cities. Each year, an estimated 2.1 million New Yorkers lose a cumulative $3.2 billion to wage theft, according to a report by the Center For Popular Democracy. The bulk of those workers live in New York City. These numbers depict the ubiquity of the issue in America, and the risk is even higher for immigrant workers. In New York City, low-income laborers who were born in other countries are more than twice as likely to experience wage theft than those born in the U.S.

While wage theft is a universal problem, it is not universally felt. Immigrant workers are more vulnerable to wage theft for a multitude of reasons. The barriers for an average low-wage worker seeking to reclaim stolen wages include a lack of knowledge of state wage and hour rules, flawed complaint processes, and lack of access to legal counseling. Immigrants who had their wages stolen must navigate these obstacles while contending with potential language barriers, complicated paperwork, and the fear of employer retaliation. Even when stolen wages are reclaimed, workers only receive a small portion of what they are owed.

The app that’s helping reclaim stolen wages

Rodrigo Camarena first learned that wage theft was a big problem for immigrants in late 2019 while reading a Spanish-language newspaper. Camarena is the director of the Justicia Lab at Pro Bono Net, a nonprofit focused on expanding access to legal aid to vulnerable populations in America, including immigrants and people facing poverty. The Justicia Lab develops digital tools that help immigrants navigate citizenship, taxes, aid eligibility and more.

Camarena read the story of a low-wage immigrant worker who had his wages stolen, and the employer harassment he was subjected to when he sought to reclaim what he rightfully earned. Unlike with housing or employment, Camarena couldn’t think of any nonprofits dedicated to helping immigrants reclaim stolen wages.

So, the Justicia Lab partnered with policy work centers like Make The Road to develop a digital tool to provide a unique answer to this problem. The resulting app, Reclamo, launched in October 2022 and has already helped hundreds of immigrants reclaim their stolen wages. It guides legal and non-legal advocates at work centers as they navigate the process of reporting stolen wages with immigrant laborers.

“We’re trying to help the helpers here, who are doing amazing work in all of our communities,” Camarena said. “They’re very resource-strapped, and we believe that technology can be a force multiplier and can help.”

Similar apps were created in the past to help immigrants with issues like tallying labor hours, but Reclamo is the first digital tool created by a nonprofit advocacy group for the express purpose of screening and filing wage theft complaints from low-wage immigrant workers.

The tool is designed to address multiple barriers presented by stolen wages. A wage theft calculator helps determine just how much pay an employer has stolen. A legal center streamlines the complaint-filing process and advises advocates. And data collection and analysis help to identify larger-scale wage theft patterns to help influence labor organizing and systemic reform.

On top of that, the app is full of educational material relevant to both immigrant workers and their non-legal advocates. Many wage theft victims are not even aware that they are victims, and others are not aware of the extent to which they have been robbed, Camarena said. So, Reclamo doesn’t just help determine if wages were stolen, but it’s also fundamental in determining how much was stolen.

The current impact and future focus

Reclamo had a near-instant impact when it was rolled out in October 2022, and has grown ever since. When New York City’s immigrant population began to soar last summer, many immigration nonprofits were stretched thin trying to address their needs for things like shelter, food aid, employment, healthcare and schooling. Being an app, Reclamo didn’t experience that same stress when serving more people.

While reclaiming stolen wages may not initially seem as essential as finding food or housing, the app has helped hundreds of people file claims, collectively amounting to more than $1.5 million in stolen wages.

Besides the obvious demand for the app, the financial support of partner organizations has been fundamental for Reclamo, Camarena said.

“We’re always trying to grow the app’s popularity and awareness amongst work centers and workers themselves,” Camarena said.

Funding from the government isn’t easy to come by for Justicia Lab, but Camarena and his co-workers are optimistic about receiving more government assistance in the future.

For the moment, Reclamo is only available in New York state, but Pro Bono Net has greater aspirations for the app. “We are excited to bring powerful digital tools to people who are already doing really impactful work throughout the country,” Camarena said.