Could Europe’s Car-Free Zones Become Long-Term Solutions? A Look at Three Cities’ Efforts

As post-lockdown reopening continues around the world, leaders are wondering how to maintain social distancing while also returning to life as (somewhat) normal. The timing of this discussion is especially prescient considering today is World Environment Day, the theme of which this year is #ForNature. While it’s clear the wildlife we’ve been seeing outside our windows won’t last forever once we emerge from this pandemic, the car-free zones we’re now seeing worldwide could help heal the planet in the long run.

Car free zones: A permanent change for cities worldwide?

Many European cities have introduced designated car-free zones to eliminate overcrowding during this time of transition. The areas, which promote walking and bicycling over public transportation and private vehicles, may also play a key role in creating more sustainable urban communities.

Here’s a look at three of these cities, and the potential benefits of more car-free zones in the short and long term.

London

In mid-May, London Mayor Sadiq Khan introduced the Streetspace plan, “one of the most ambitious walking and cycling schemes of any city in the world,” The Guardian reported.

In the plan, main streets surrounding the London Bridge and other select areas will be closed to the majority of automobile traffic, with the exception of emergency services and transportation for the disabled community. The hope is that by encouraging people to walk or cycle on these streets instead, public transportation and personal cars will be seen as last resorts, easing congestion.

Keeping public transportation numbers down is especially crucial. A release from the mayor’s office stated that even if Transport for London (London’s public transit system, also known as TfL) returns to pre-pandemic trip numbers, less than 15 percent of passengers would be able to ride, if social distancing is to be maintained.

“If we want to make transport in London safe, and keep London globally competitive, then we have no choice but to rapidly repurpose London’s streets for people,” Mayor Khan said in a press statement. “By ensuring our city’s recovery is green, we will also tackle our toxic air, which is vital to make sure we don’t replace one public health crisis with another.”

Milan

Milan has been hit exceptionally hard by both pollution and pandemic over the past year. In 2019, it was named one of Italy’s most polluted cities. Then this spring, Milan and its surrounding Lombardy province became the epicenter of Italy’s COVID-19 outbreak.

Before the pandemic, 55 percent of residents used Milan’s public transportation, resulting in an average of 1.4 million metro trips each day. To accommodate social distancing during reopening, the metro’s capacity will be reduced by more than two-thirds to a maximum daily ridership of 400,000.

It would be impossible to make up that difference with personal vehicles — there aren’t enough cars or parking spots, and traffic would be unmanageable. Instead, Milan is converting 22 miles of road space this summer into cycling and walking paths, as part of its Strade Aperte (Open Streets) plan. On streets where cars are still allowed, speed limits will be greatly decreased.

Janette Sadik-Khan, a transportation policy advisor with Bloomberg Associates, is working with Milan and other cities on their transportation plans, including ideas for car-free zones, during reopening and beyond.

“The pandemic challenges us, but it also offers a once-in-a-lifetime chance to change course and repair the damage from a century of car-focused streets,” Sadik-Khan told BBC Future. “Cities that seize this moment to reallocate space on their streets . . . will prosper after this pandemic and not simply recover from it.”

Budapest

In Hungary’s capital city, bike lanes were almost “nonexistent” prior to the pandemic, according to Mike Lydon, principal at the urban planning and design firm Street Plans.

Since April, however, more than 12 miles of bike lanes have been introduced throughout the city. “[Leaders in Budapest] were one of the first to really say, 'Okay, this is an opportunity that’s important beyond the worst of the pandemic. We can trial these things now and get them integrated. It’s easier to build these and then promote them as being potentially temporary,'” Lydon said in an interview with Fast Company.

Although the cycling lanes are currently scheduled to remain only until September, Budapest Mayor Gergely Karácsony’s office is monitoring traffic levels and may make the lanes a more permanent fixture if they are successful in lessening congestion.

“The pandemic has changed transport globally,” the mayor’s chief of staff, Samu Balogh, told BBC Future. “We have the opportunity to see what our cities look like when we are designing for people, not cars.”

Looking down the road at car-free zones

Researchers are still in the early stages of studying the exact relationship between air pollution and COVID-19. What is sure, however, is that pollution — including that from transportation — has been linked to more than 7 million premature deaths annually, according to the 40 million healthcare experts behind the #HealthyRecovery letter to G20 leaders. Significant reductions in personal automobile traffic — especially of combustion-engine vehicles — would result in healthier, more resilient communities.

“There exists a building momentum across the world that recognizes car-free streets as a critical way of tackling the urgent climate crisis, as well as a strategy to improve health and wellbeing,” BBC Future’s Francesca Perry wrote in late April. “This pandemic has resulted in countless forced changes to our lifestyles, economies and environments. Seeing what’s possible can lead to change — the question is how to ensure the change resulting from this global emergency improves health for people and planet.”

Image credit: Pixabay

UPS Ramps Up Carbon Neutral Shipment Offsets

Global logistics giant UPS has invested over $1 billion on alternative fuel and advanced technology vehicles over the past decade. In the company’s latest announcement, it is marking World Environment Day (WED) by matching carbon offsets of all parcels shipped via its carbon neutral program during June and using proceeds to continue buying “good quality” offsets.

UPS’ carbon neutral project was originally slated to commemorate Earth Day’s 50th anniversary on April 22 of this year, but by then the novel coronavirus pandemic struck.

“We didn’t want to give up on doing something good for the planet, so [we] moved and postponed this effort to World Environment Day rather than toss a positive endeavor aside," said Patrick Browne, director of global sustainability at UPS.

“The intent was still to raise more awareness about our carbon neutral shipping offering," Browne added. "And, we’re hoping to encourage additional customers to take advantage of it.” It's “too early,” though, to know if UPS will execute further initiatives similar to this in the second half of 2020, the executive said.

Through its UPS carbon neutral option, which as a service has been offered since 2010 and verified by inspection and testing company Société Générale de Surveillance, the estimated carbon impact of each shipment is counterbalanced by purchasing certified carbon offsets.

In order to participate, shippers pay a small fee, which Browne stressed has been set “as low as possible," to offset the carbon footprint of shipping parcels. UPS will then match these offsets throughout June, with all proceeds raised purchasing “good quality offsets," Browne indicated.

The result is a doubling of the shipper’s impact, thereby allowing the shipper to potentially net out “carbon negative” over the course of June.

In the U.S., the per-package flat rate price for the optional service is five cents for UPS’ ground services and 20 cents for faster services. Prices in the United Kingdom start at 13 cents (£0.10) for domestic shipments.

In terms of purchasing quality carbon offsets, “UPS has supported projects worldwide that include forestation, landfill gas destruction, and wastewater treatment," Browne pointed out.

The company’s current offset projects include the Wolf Creek Landfill in Georgia, where methane landfill emissions are captured to generate electricity, he explained. UPS says the annual emissions reductions at this facility add up to approximately 130,000 megatons, equal to the equivalent of taking more than 29,000 cars off the road annually or generating enough electricity to power over 1,600 homes. Another project at Chol Charoen in Thailand sees emissions captured and released from wastewater to produce electricity in the country.

UPS’ carbon neutral offering is touted as just one way the company is helping shippers reduce their impact on the environment. Customers can also choose more sustainable last-mile delivery options and solutions designed for more efficient returns. Further, they can participate in UPS’ Eco Responsible Packaging Program or UPS can conduct a carbon impact analysis on their shipping.

On the returns front, UPS is working with Optoro, using the company’s returns optimization platform that helps shippers in the U.S. maximize recovery value and reduce items going to landfills.

Highlighting UPS’ wider sustainability initiatives and credentials, last year the company reached an agreement with Clean Energy Fuels Corp. to purchase 170 million gallon equivalents of renewable natural gas (RNG), produced naturally from bio sources (e.g. landfills, dairy farms), over a seven-year period through 2026. It was at the time the largest commitment for RNG use by any company in the U.S., with a range of 22.5 million to 25 million gallon equivalents per year.

UPS has an “overarching sustainability” goal to reduce its own emissions by 12 percent across their global ground operations by 2025. “This means even as our business grows and package volume increase our emissions must decrease," Browne said. "We have targets to reach this 12 percent emissions reduction goal.” By 2025, for example, 25 percent of the company’s total electricity will come from renewables.

Image credit: UPS Pressroom

Responding to George Floyd Murder, Ben & Jerry’s Targets the Elephant in the Room

Among all the businesses responding to the murder of George Floyd, the ice cream purveyor Ben & Jerry’s is one of the few to face the truth. “Taking a stand” against racism is easy enough for CEOs who can command expert writers to articulate their thoughts, all the more so for those who can back their words with hefty donations to worthy organizations. That can only go so far, however, when one political party controls the White House, the Senate, the Supreme Court, and all the powerful machinery that goes along with them.

Ben & Jerry’s outlines the solution — and that’s the problem

Ben & Jerry’s has won widespread praise for its response to the George Floyd murder, and it’s easy to see why. In a brief statement, the company goes straight to the heart of the problem.

“First, we call upon President Trump, elected officials, and political parties to commit our nation to a formal process of healing and reconciliation,” the company states.

Insofar as President Donald Trump is the source of the problem, that is a rather big ask — and one that is obviously not going to be realized, considering Trump’s history both before and during his time in office.

As part of that demand, Ben & Jerry’s follows up with another equally impossible request. “The president must take the first step by disavowing white supremacists and nationalist groups that overtly support him,” the company states, while also calling upon the president to cease “using his Twitter feed to promote and normalize” white supremacists and nationalist groups.

None of this, of course, is even remotely possible considering how Trump and his supporters have behaved during his entire time in office.

And so on. Ben & Jerry’s lists three other demands that involve federal legislation and Department of Justice policy. Each of them is impossible to achieve without replacing the current occupant of the White House and changing the majority leadership of the Senate, while also retaining the current majority in the House of Representatives.

In short, Ben & Jerry’s has issued a call to political action aimed squarely at Election Day in November, without mentioning any political party by name.

Why are other businesses coming up short?

To be clear, the murder of George Floyd is a single flashpoint in a history of violent, often lethal oppression that predates the Trump presidency by almost 400 years. It is just as clear that the president is not responsible for events that took place before he was born.

However, Trump is the first president in modern history to use the power of his office to exacerbate racial inequality in the U.S., celebrate white supremacy, and all but cheerlead for armed insurrections of the kind not seen since the lynch mobs of the early 20th century.

Every point in the Ben & Jerry’s statement aims directly at Trump’s personal responsibility.

In contrast, almost every other CEO on record is treating the George Floyd murder and its aftermath as a civic problem alone.

Reporter Jessica Snouwaert of Business Insider surveyed leading companies from Netflix to GM and Glossier earlier this week. While she found some companies are more committed to concrete action than others, none has addressed the political elephant in the room.

On one end of the scale, GM expressed its intent to form an advisory board, McDonald’s pledged to hold a town hall, Disney released a statement on inclusion, Jeff Bezos of Amazon recommended reading an essay, and Starbucks is “having conversations with its partners.” None of these companies have articulated any particular action, let alone political action.

On a more concrete but similarly ineffectual level, Target has donated food, medical supplies, and other forms of assistance to its workers and community in Minnesota, where one of its stores was looted.

Glossier and several other companies have also taken the donation route in a more meaningful way by providing funds to leading nonprofit organizations in the civil rights field.

Finally, Facebook

Glossier’s approach is clearly one that will have a more significant and lasting impact than essays, letters, conversations and the like. However, donations can also serve to mask a company’s responsibility for enabling hate.

In particular, Snouwaert draws attention to the tens of millions donated annually through the Chan Zuckerberg Initiative. Established by Facebook’s Mark Zuckerberg and his wife Dr. Priscilla Chan in 2015, the CZI portfolio includes racial justice work. However, its efforts in that field have been rendered all but meaningless by Zuckerberg’s dogged insistence on a hands-off approach to the ideas expressed on Facebook.

In a report on Facebook released last month, the organization Tech Transparency Project (an offshoot of the Campaign for Accountability) criticized Facebook for failing to deal effectively with hate groups.

“What’s more, Facebook’s algorithms create an echo chamber that reinforces the views of white supremacists and helps them connect with each other,” TTP stated.

Earlier this week, the National Whistleblower Center cited the TTP report in a supplement to a 2019 report submitted to the Securities and Exchange Commission. The NWC stated: “Facebook was not engaged in meaningful efforts to remove content from hate and terrorist groups, but in fact was assisting such groups through its algorithms and its auto-generation of web pages for such groups, effectively assisting them with networking and recruiting.”

As of this writing, Zuckerberg has refused to change Facebook’s policy on hate groups.

Meanwhile, though, other social media platforms have begun to take action.

Twitter recently placed warning labels on misleading presidential tweets about elections and racial equity protests, and this week Snapchat announced that it will no longer promote the president’s posts through its Discover page.

Though Facebook is not likely to change its position in advance of Election Day in November, it is clear that Twitter and Snapchat have joined Ben & Jerry’s in singling out the president’s personal responsibility for fostering hate and violence. If other business leaders seek to accomplish something other than words in the aftermath of the George Floyd murder, they should follow suit.

Image credit: Maria Oswalt/Unsplash

The Winding Roadmap for Reopening Offices and Putting Workers First

Last Thursday, the number of deaths attributed to the novel coronavirus in the United States surpassed 100,000. Protective measures like statewide stay-at-home orders, though, likely saved many more lives. When it comes to work, these government restrictions have temporarily changed almost every American’s workday. Once reopening offices becomes the norm, the persistent desire to protect each other will likely have lasting effects on how Americans interact in the office.

Two and a half months after the nationwide shutdown, most states have lifted stay-at-home orders and are opening non-essential businesses, including dine-in restaurants and hair salons. As of May 28, New Jersey is the only state in the U.S. that is still largely closed due to the coronavirus pandemic.

Even with nationwide lifting of business restrictions, not all non-essential businesses have the green light to reopen, especially if employees can work remotely. To date, no government or individual has a clear idea of when life can return to “normal” — in the meantime, non-essential businesses are taking two basic approaches: embracing long-term remote work or reopening with caution.

Remote work has proven viable for many

The majority of American workers say their employer is offering flex time or remote options during the pandemic, an increase of almost 20 percent since February 2020, according to a recent Gallup poll. A majority also reported that they would prefer continuing to work remotely even after workplaces reopen.

In many cases, remote work has proven viable in the long run. After a two-month trial period, Twitter CEO Jack Dorsey told employees in May that the remote work option would be open to them indefinitely.

Google hasn’t taken as big of a leap, but the tech giant will allow its employees to work from home until the end of 2020.

Remote work is finally getting the attention it deserves. Going remote brings marked benefits to employees and businesses, including increased productivity by as much as 40 percent, improved work quality, better engagement and over 40 percent better attendance, a significant reduction in turnover, and even increased profits of over 20 percent. That’s not to mention the benefits to families, sleep schedules and the environment (fewer miles driven on the road).

Don’t take in-person work for granted

While remote work seems like the universal panacea to employee and business woes, the benefits of in-person collaboration can’t be dismissed. Coming together in person can have intangible benefits, including more effective communication and increased trust and camaraderie.

An April survey by software company Slack found that nearly half of knowledge workers who began working remotely during the coronavirus outbreak reported a diminished sense of belonging.

For some companies, a hybrid approach may be ideal, fostering independence and flexibility in some cases and community and collaboration when needed. That approach could also help companies take the necessary leisurely pace toward in-person work.

The Harvard Business Review (HBR) points to the information company Proquest as a model for this hybrid approach. Proquest’s research solutions division has three remote teams that come together every four months for a three-day summit to plan future work, innovate and socialize.

Outside of the summits, email, teleconferencing and face-to-face meetings have specific functions that play to their strengths. Email suffices for exchanging factual information, for example, but a phone call is best for making decisions.

The road to reopening offices is long and winding

No matter how companies decide to reconvene, one thing’s certain — offices will look very different in the coming months.

Obvious requirements in the near-term will be greater distances between desks, face coverings and increased cleaning. Some companies may even invest in technology like a sensor that can detect distances between individuals as well as apps that can track employee movement.

There’s a lot of pressure for companies to get office design right, given how grave the coronavirus pandemic has proven. And seeing how popular remote work has become, businesses will need to demonstrate that they have put care into workplace safety and comfort before employees will jump back into the rhythm of office work.

One silver lining for business leaders is that, to a certain extent, a one-size-fits-all approach can work. Commercial real estate firm Cushman & Wakefield has published an 6 Feet Office design that doesn’t require a complete building renovation and meets the needs of safe distancing, traffic and interactions between employees.

The firm has already helped 10,000 businesses in China get back into their spaces. The Chinese have an advantage over Americans, though — more of their office buildings are equipped with advanced air-filtration systems that adhere to high indoor air quality standards. Indoor ventilation in U.S. offices is already substandard, to say the least.

Without solving the underlying issue of office air quality, spacing and sanitation methods won’t carry much weight. Until those updates are made, companies should keep their workers at home and continue to reap the benefits of remote work, though managers should consider meaningful ways to build a sense of belonging.

If companies take necessary office improvement to heart, there could be other incidental benefits. For one, there’s the issue of the prevalence of open offices — a fad meant to improve collaboration and cross-pollination that often achieves exactly the opposite. A study published in the HBR in 2019 found that firms that transition to open offices see a 70 percent decrease in face-to-face interaction.

Additional adjustments like adding dividers between desks could help resolve the privacy issues rampant in open offices, thus aiding productivity. Ironically, creating barriers could improve company communication.

Slow and steady wins this race

Especially during a pandemic, business leaders have a responsibility for their employees’ wellness, safety and comfort. This responsibility extends past workplace morale. If employees are forced to return to subpar work conditions, executives are jeopardizing reputation and the company bottom line. If employees feel uncomfortable or become sick, companies aren’t simply risking liability, productivity and engagement — they are losing trust.

The business benefits of trust are quantifiable, and they have been measured. Trustworthy companies have stock market returns that are two to three times higher than the market average and claim 50 percent lower turnover rates than industry competitors. That’s not to mention greater customer satisfaction and employee engagement.

Responsible business owners and CEOs will listen to their employees, their needs and their timetables. No one individual has the right answer or schedule, but when it comes to this pandemic, the best answer errs on the side of caution.

How a company prepares its offices for returning employees will make a mark on its reputation — for better or worse.

Image credit: Pexels

Rights for States, Tribes Doused in Latest Assault on Clean Water Act

Environmental groups and several states are up in arms over the gutting of a key portion of the Clean Water Act earlier this week. The legislation limits states’ and Indigenous tribes’ authority to protect water within their own borders from projects such as pipelines and dams that can be detrimental to water supplies.

The new rule from the Environmental Protection Agency (EPA) targets Section 401 of the law, which gives states and tribes the right to certify that a federally licensed or permitted project meets state water quality standards. The new rule gives federal agencies the ability to overturn state decisions, and it significantly shrinks the scope of review the states and tribes can conduct. The rule also creates new deadlines that will effectively limit states’ and tribes’ ability to meaningfully analyze the impacts of these complex projects.

This section of the law has been a target of the Donald Trump administration, which last April ordered the EPA to accelerate and promote the construction of pipelines and other infrastructure. As TriplePundit has shared, this is part of an ongoing rollback of environmental regulations by the administration. EPA Administrator Andrew Wheeler, a former coal lobbyist, made as much clear when, as the New York Times reported, he said states would no longer be allowed to use the law to object to projects “under the auspices of climate change.”

Environmental groups including The Sierra Club, The Natural Resources Defense Council (NRDC) and the National Wildlife Federation have all issued statements denouncing the move. Officials from Washington and New York states, both of which have used Section 401 to sideline major infrastructure projects, have also voiced strong opposition. Both environmental groups and some states have vowed to fight the new rule in court.

Water rights are a matter of racial justice, too

At a time when the country is roiled in crisis, with thousands of protesters on the streets demonstrating for racial equality, some environmental leaders see this latest ruling by the EPA as much a matter of racial justice as the right to clean, safe water. A Section 401 review can be states’ and tribes’ only meaningful opportunity to protect their own water resources.

“It’s a fact that people of color and low-income communities are disproportionately impacted by the air pollution, water contamination and climate chaos produced by fossil fuel projects,” Wenonah Hauter, executive director of the NGO Food and Water Action, said in a statement.

“This is a targeted strike against environmental justice and racial justice," Hauter said. "The new EPA rule seeks to undermine a bedrock environmental law and hamstring the rights of states to protect communities from water contamination and climate change.”

For civil rights advocates, the weakening of water rights for states raises the specter of Flint, Michigan, which in 2014 suffered a health crisis after lead from city water pipes seeped into the untreated water flowing through them, a situation that advocates label environmental racism. As journalists including New York Times reporter John Eligon have discussed, the term refers to the disproportionate exposure of black people to polluted air, water and soil. It is considered the result of poverty and segregation that has relegated many black Americans and other racial minorities to some of the most industrialized or dilapidated environments.

Similarly, in central California, some consider the legacy of segregation as contributing to the reality that many residents can only rely on unsafe water systems, with as many as 350,000 people lacking access to potable water in the San Joaquin Valley alone.

Protecting the Clean Water Act should matter to business, too

Certain industries have wholeheartedly supported the new EPA rule, not least the fossil fuel industry, which clearly seeks an easier permitting process. They have some legislators in their corner. Sen. John Hoeven (R-North Dakota) said in a statement: “We’ve worked hard to advance regulatory relief to strengthen our nation’s economy, including for the development of critical energy infrastructure.” He is joined by Senate Environment and Public Works Chairman John Barrasso (R-Wyoming), who said the rule would curb abuse from states like Washington, which he argued has "hijacked" the permitting process and blocked Wyoming coal from being exported.

But there’s plenty of reasons why business should be concerned about protecting the rights of states and tribal leaders to ensure water quality and safety. Water is as important to the world’s economy as oil or data, argues a recent McKinsey report that called water “a business and human priority.” All industries rely on water in some way, in terms of raw materials, suppliers, direct operations and product use. Nearly two-thirds of freshwater consumption is associated with ingredient production for corporate supply chains alone, according to The Nature Conservancy, and in 2018, CDP reported that companies experienced a $36 billion negative financial impact as a result of water challenges.

But climate change, population growth and changing consumer habits are increasing water stress for many regions. By 2050, the U.N. estimates that 1 in 4 people may live in a country affected by chronic shortages of fresh water. Water stress is a risk multiplier, according to McKinsey: Alone, it is a powerful risk with the potential to upend socioeconomic and ecological systems. When compounded with other risks, such as those related to food and energy systems, politics, and infrastructure, it becomes detrimental.

As water stress grows, business will experience that risk in four forms: physical, regulatory, reputational, and stakeholder. And when key water sources are inaccessible or unfit for use, that can be a critical and costly risk.

Image credit: Nathan Dumlao/Unsplash

When Boycotts Work: Co-Opting a Brand for Bad Intentions

In the runup to the 2016 presidential election, it quickly became apparent that brand reputation was caught in the middle of the battle for the White House. Since then, a long string of brand boycotts has piled up, centering on hateful rhetoric and discriminatory policies of the Donald Trump administration. Now the reputational factor has taken a sudden turn that should alarm brand managers across the board.

When boycotts work: brand reputation at risk

Hate-inciting campaign rhetoric was the inspiration for two influential boycott campaigns that launched in 2016, Grab Your Wallet and Sleeping Giants.

Both campaigns aim at empowering individual consumers to pressure brands into taking a stand against hate and other offensive behavior, by leveraging the organizing power of social media.

Consumer boycotts are notoriously difficult to sustain, but both of these campaigns have succeeded in underscoring the reputational risk that brands assume by association, as advertisers and as retailers.

A new challenge for brand managers

Over and above organized efforts like Grab Your Wallet and Sleeping Giants, the Trump administration has touched off a minefield for brand managers, with high-profile corporate names from Under Armour to Tesla feeling the impact.

The COVID-19 crisis has also given rise to new complications as companies scramble to respond to public health guidance, despite conflicting signals from the Trump administration.

In one recent example, Ford suffered a stinging, high-profile setback on its worker safety efforts after President Trump removed his face mask during a visit to one of the automaker’s facilities in Michigan.

Brand reputation takes a sudden turn

The media blowback could have been worse for Ford, but it has been overshadowed by a week of protests triggered by the death — an apparent homicide — of George Floyd during an arrest in Minnesota after allegedly passing a counterfeit $20 bill.

Against this backdrop, on Monday President Trump staged a photo opportunity in front of St. John’s Church in Washington, D.C.

The White House forced peaceful demonstrators from the vicinity and did not seek permission from the church or provide a courtesy call beforehand.

Nevertheless, the photo depicts Trump on church property, holding a bible with the words “St. John’s Church Parish House” clearly visible on a sign in the background. Since then, the commentary has been seething, with the president's defense secretary offering an awkward excuse that he didn't know what was going on in the moments leading up to the photo op.

The Episcopalian brand takes a stand

Reaction to the photo op was swift and unequivocal, at least on the part of Bishop Mariann Edgar Budde of the Episcopal Diocese of Washington.

In widely circulated comments to CNN’s Anderson Cooper, Bishop Budde excoriated the president for his use of force against peaceful demonstrators, for his failure to use the church’s property for its intended purpose, and for his failure to “acknowledge the agony of our country.”

Budde drew particular attention to the president’s failure to address people of color, “who are rightfully demanding an end to 400 years of systemic racism and white supremacy in our country.”

More to the point, Budde washed her hands — and her brand — of association with the president.

“And I just want the world to know, that we in the diocese of Washington, following Jesus and his way of love ... we distance ourselves from the incendiary language of this president. We follow someone who lived a life of nonviolence and sacrificial love,” she said.

The social media connection

In the middle of all this, of course, is the impact on social media brand reputation.

Twitter has come in for its share of criticism for failing to moderate content, but the company did modify its position on oversight last November when it banned all political ads.

Another important move came last week, when Twitter put a warning label on misleading tweets from President Trump regarding elections.

Twitter founder Jack Dorsey followed up with a statement clearly affirming the company’s policy on elections information. “Fact check: there is someone ultimately accountable for our actions as a company, and that’s me,” Dorsey stated in a follow-up tweet on May 27. “We’ll continue to point out incorrect or disputed information about elections globally. And we will admit to and own any mistakes we make."

In contrast, last week Facebook’s Mark Zuckerberg reiterated his company’s hands-off policy in the context of the George Floyd protests, though insisting that he is personally offended by “divisive and inflammatory rhetoric” such as that deployed by the president.

In a 600-word post on Facebook, Zuckerberg’s argument basically boiled down to the idea that each statement should be examined individually. “…We should enable as much expression as possible unless it will cause imminent risk of specific harms or dangers spelled out in clear policies,” he explained.

However, rhetorical impacts are like environmental impacts. The harm may be difficult or impossible to measure individually, but it can easily add up to a clear, identifiable impact.

Employee activism and shareholder revolt in play

Perhaps the events surrounding the occupation of St. John’s Church by President Trump will motivate Zuckerberg to modify his position with Twitter-like warning labels.

After all, Facebook has previously joined Twitter and other social media companies to warn users about the dangers of anti-vaccination misinformation. More recently, the company has joined a coordinated social media effort to warn against COVID-19 misinformation as well.

This week’s episode has renewed calls for social media users to boycott Facebook. The common wisdom about consumer boycotts is that they are often ineffective, but they do have a chance of success when brands are already suffering reputational loss, and that is what appears to be at play.

In an ominous sign of that reputational loss, earlier this week Facebook employees put public pressure on the company’s hands-off policy on presidential posts, the first time in memory that employees have taken such an action.

A shareholder revolt has also gained renewed momentum, as part of a years-long effort to remove Trump supporter Peter Thiel from Facebook’s board.

Zuckerberg is notoriously stubborn, but the stakes are high and the pressure to take meaningful action is mounting.

A good start to repair the damage would be to take a cue from Bishop Budde and include her disclaimer on the White House’s Facebook account, which has posted video of the now-notorious photo op for all to see.

Image credit: Koshu Kunii/Unsplash

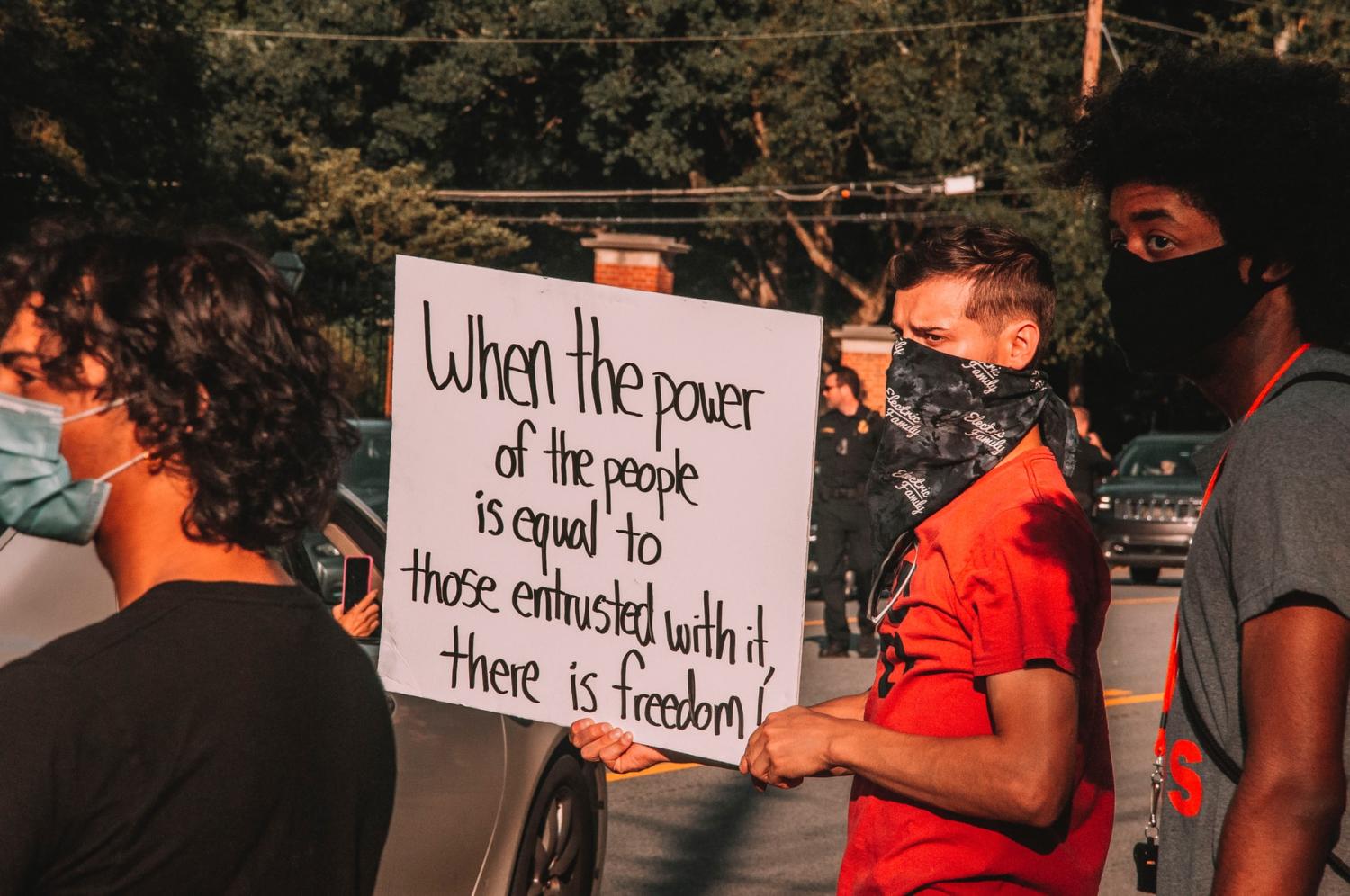

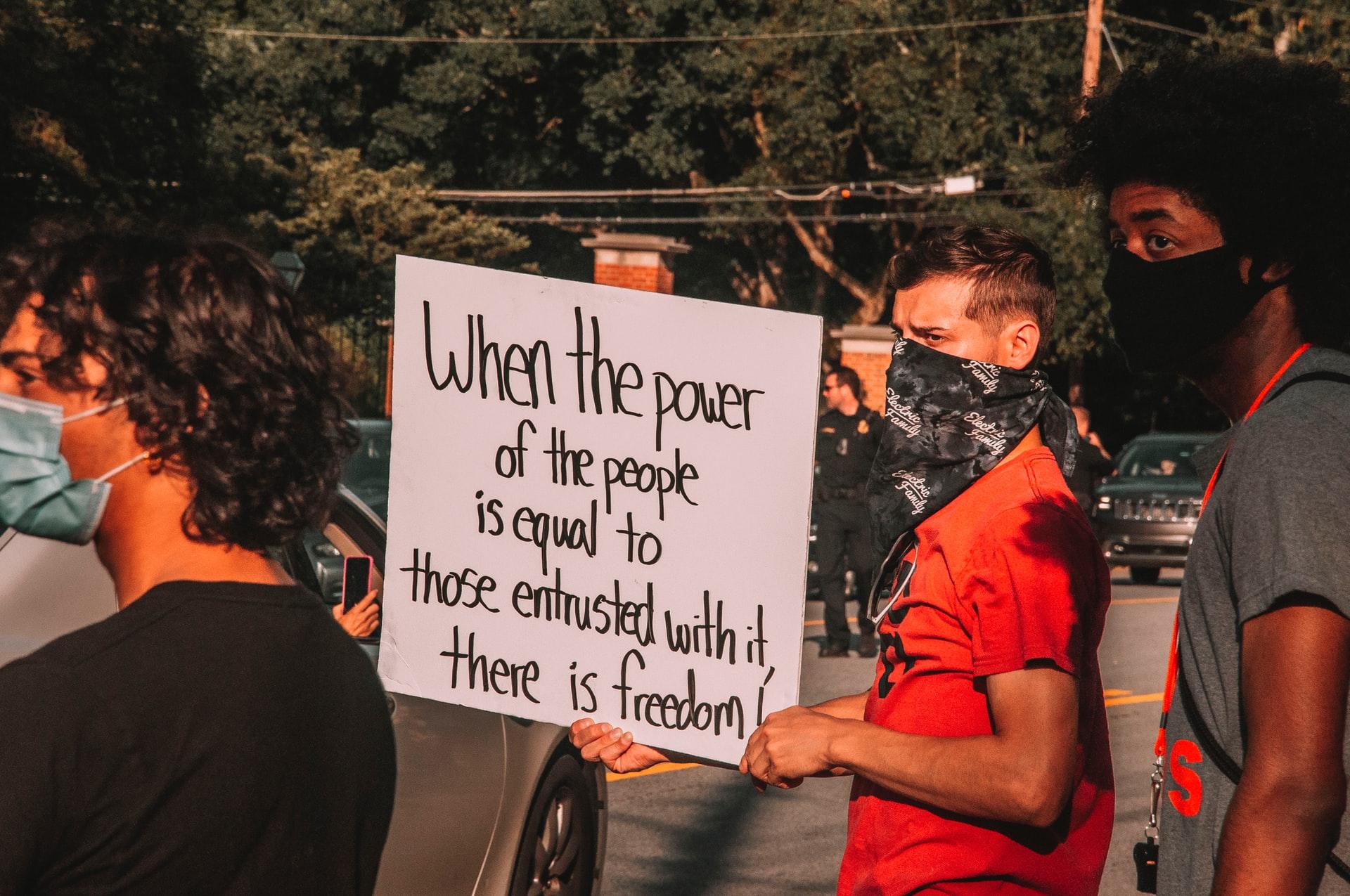

To Understand the Movement For Racial Justice, Listen to Black People

(Image: Protesters take a knee during a demonstration against systemic racism and police brutality in Charlotte, North Carolina, on Saturday.)

Over the past few days, I've struggled to understand how I can contribute to the dialogue around racial injustice and the fight for black lives. As writers, when we see stories we feel need to be told, we do our best to tell them. But what could I, a white woman, possibly say about these issues that hasn't already been said — better and from a place of deeper understanding — by black writers and creators?

I don't really want to try and would much rather do what we can with our little platform to amplify the voices of those who work tirelessly, day in and day out, to educate people about systemic racism, oppression and solutions for change, even though it shouldn't have to be their job to do so.

Read on for resources to help you understand what's happening, the pain and anger that's gripping black and brown people across the country and around the world, and the centuries-long history of systemic racism in America, of which the murders of Ahmaud Arbery, Breonna Taylor and George Floyd are only the latest examples. All of these resources were created by black people, which is who we should all be listening to right now.

U.S. Businesses Must Take Meaningful Action Against Racism (Read it here)

Resource type: Article

Authors: Laura Morgan Roberts and Ella F. Washington

What it is: Here at TriplePundit, our primary focus is how business can be a force for good and drive positive change in the way we interact with our environment and with one another. But too often when it comes to pervasive issues such as systemic racism, business responses are little more than lip service. Laura Morgan Roberts and Ella F. Washington call for change in an article in the Harvard Business Review, unpacking missteps to avoid and suggesting a framework for business action that goes beyond public relations and has the potential to truly make a difference.

Pull-out quote: "While conventional diversity, equity, and inclusion initiatives focus on employee engagement and belonging, today’s challenges reach far beyond marginalization in the workplace. We now see and hear Black people who are suffering from the weight of dehumanizing injustice and the open wound of racism that has been festering for centuries."

Understanding the Pain Fueling Nationwide Demonstrations (Listen here)

Resource type: Podcast

Authoring organization: The Takeaway podcast, featuring Aaron L. Morrison and Marc Lamont Hill

What it is: Aaron L. Morrison, national race and ethnicity writer for the AP, and Marc Lamont Hill, professor of media studies at Temple University and host of BET News, join The Takeaway podcast. In only 45 minutes, they go miles to educate people about what's happening on the ground during nationwide demonstrations and the legacy of systemic racism and oppression in America.

Pull-out quote: "There's a sense that for the last few months in the midst of COVID, there was very little intervention, very little support. And the moment people express their frustration against state violence, there's all kinds of federal intervention — but not the kind they were looking for," Hill says. "The response immediately looks like there's no room for protest. There's no room to express legitimate outrage, that the state is more interested in protecting property and protecting white fear than it is in making sure that black lives are safe or that justice prevails."

Your Black Colleagues May Look Like They’re Okay — Chances Are They’re Not (Read it here)

Resource type: Article

Author: Danielle Cadet

What it is: Danielle Cadet, managing editor for Refinery29, shares perspective on what it's like to continue to show up to work even as horrific, racist acts fill the news and a global pandemic continues to disproportionately impact black people.

Pull-out quote: "The likelihood that your Black colleague lost a family member to COVID-19 is painfully high. The chances that your Black colleague was triggered by the viral video of Amy Cooper because a white woman used her race and privilege and weaponized it against him is incredibly likely. The possibility that your Black colleague is afraid to go for a run, or terrified when her husband leaves the house, or just simply enraged by the incessant lies this country keeps telling us about equal liberties is so high you’ll need a ladder to get it down."

Don’t understand the protests? What you’re seeing is people pushed to the edge (Read it here)

Resource type: Article

Author: Kareem Abdul-Jabbar

What it is: Basketball legend Kareem Abdul-Jabbar raised his voice in an op/ed in the Los Angeles Times, laying out the pain, fear and anger that accompanies being black in America and calling on white onlookers to learn from protesters rather than judge them.

Pull-out quote: "I don’t want to see stores looted or even buildings burn. But African Americans have been living in a burning building for many years, choking on the smoke as the flames burn closer and closer. Racism in America is like dust in the air. It seems invisible — even if you’re choking on it — until you let the sun in. Then you see it’s everywhere."

Fortune's raceAhead (Subscribe here)

Resource type: Newsletter

Author: Ellen McGirt

What it is: Brilliantly authored by Fortune senior editor Ellen McGirt, the raceAhead newsletter is a regular update on all things race, equity, and inclusion in the business world and beyond. In the most recent issue published Monday, McGirt unpacks the early corporate response to the protests and provides resources on allyship that any non-black person should read and bookmark.

Pull-out quote: "What has become crystal clear in this moment is that if diversity work isn’t policy work, then it’s no work at all."

How to Be a Strong White Ally (View it here)

Resource type: Resource page

Author: Maxwell Boise

What it is: As author and activist Angela Davis famously said, "In a racist society, it is not enough to be non-racist, we must be antiracist.” One of many resources referenced in McGirt's newsletter above (again, I recommend clicking here for the full list), this guide from creator Maxwell Boise offers insight into what that means in practice, including things to read and watch to open your mind, check your own biases, and bust your own ignorance.

Pull-out quote: "I want to thank all of you who’ve taken advantage of these resources to begin the necessary process of critical introspection, meaningful communication, and intentional action," Boise wrote of the page, which has gone viral since he published it on Saturday, on Instagram.

A gift to white people who insist they know what Martin Luther King, Jr. would have said (View it here)

Resource type: Twitter thread

Author: Michael Harriot

What it is: "I’ll never stop being amazed by the number of white Americans confidently willing to tell you what Dr. King would think and feel about what black people do when it’s clear they’ve never read a single speech or book that King wrote," Pulitzer Prize-winning journalist Nikole Hannah-Jones (better known on Twitter as Ida Bae Wells) wrote on the platform on Friday.

In this thread published Sunday, Michael Harriot, senior writer for The Root, shares what King actually said about white privilege, police brutality and white people who disagree with black methods of protest.

Pull-out quote: "I have almost reached the regrettable conclusion that the Negro's great stumbling block in the stride toward freedom is not the White Citizen's Council-er or the Ku Klux Klanner, but the white moderate who is more devoted to 'order' than to justice; who prefers a negative peace which is the absence of tension to a positive peace which is the presence of justice." — Dr. Martin Luther King, Jr., Letter from a Birmingham Jail, 1963

Justice Now: A BET News Special (Learn more here)

Resource type: Television series

Authoring organization: BET News

What it is: On Tuesday, BET announced a series of programming to address systemic racism, violence against black Americans and ways to move the country forward. The first segment, featuring black voices in activism, politics and entertainment, aired last night. BET will also host a virtual Town Hall later in the week and a Presidential Forum on Juneteenth (June 19), to which both U.S. President Donald Trump and presumptive Democratic nominee Joe Biden have been invited to address the concerns of black Americans.

Pull-out quote: “We stand in steadfast solidarity with George Floyd’s family, the many victims of racist brutality, and those who are using their voices and platforms to challenge it. There are no easy solutions for these systemic issues of racism, injustice, and trauma. BET is leveraging every platform and resource at our disposal to support and inform our community and help identify strategies and viable solutions in this time of crisis," Scott Mills, president of BET, said in a press statement announcing the series.

People Can Only Bear So Much Injustice Before Lashing Out (Read it here)

Resource type: Article

Author: Elie Mystal

What it is: As people criticize tens of thousands of protesters for the actions of a small minority, it's worth remembering the courage and strength it takes to respond nonviolently in the face of murder and oppression, argues Elie Mystal, justice correspondent for The Nation.

Pull-out quote: "I choose to praise those who protest nonviolently, instead of decrying those who do not. The restraint shown by black people all across this country is admirable. We are being terrorized. We are being traumatized. We are being hunted by cops who can kill us out in the open, and when we gather to complain, those cops use violent tactics to scare us and hurt us and disperse us. And still, almost all of us use our words instead of our fists."

Statements Made By Top Tech Companies on Racial Justice, BLM and George Floyd (View it here)

Resource type: Google spreadsheet

Creator: Sherrell Dorsey

What it is: Created by Sherrell Dorsey, journalist and founder of The Plug, a newsletter and Web platform focused on black innovation in tech (I highly recommend you subscribe or become a pro member), this resource holds tech companies accountable. In it, Dorsey lists more than 100 companies that have responded to Floyd's death and voiced support for racial justice, and she includes information about how they walk the walk — including the percentage of black employees and whether they publish diversity and inclusion reports.

Pull-out quote: "It's a tad bit unreal that our spreadsheet has been viewed by almost 10k people!" Dorsey tweeted on Monday. "THANK YOU for making this work visible."

Speech by George Floyd's brother, Terrence Floyd, at the site of his death in Minneapolis (Watch it here)

Resource type: Video

Creator: Shared by Global News, words by Terrence Floyd

What it is: Last but certainly not least, this emotional speech from George Floyd's brother, Terrence, is required watching for anyone who thinks they know what these protests are or what they're about. He calls for peace in the demonstrations, while underscoring that the collective raising of black voices is the only way to create change.

Pull-out quote: "Let's do this another way. Let's stop thinking that our voice don't matter and vote — not just vote for the president, but vote in the preliminaries, vote for everybody. Educate yourself — don't wait for somebody else to tell you who's who. Educate yourself and know who you're voting for."

Image credit: Clay Banks/Unsplash

This Company Is Risking It All Because Black Lives Matter

You may not have heard of Simris, but here’s a quick primer – the company makes algae-based omega-3 supplements. But that’s not why we’re writing about it. Today, its founder and CEO, Fredrika Gullfot, announced that the company is ending its paid advertising on both Facebook and Instagram in a show of support for the Black Lives Matter movement.

Gullfot pulled no punches in describing why Simris stopped its advertising campaigns on these popular social media platforms.

“The current developments have now rendered it morally impossible for us to continue feeding the same hand that complacently offers its services as the major platform for hate-mongering, promotion of violence, and disinformation,” Gullfot wrote in a LinkedIn post. “The same hand that has also shown to be a major enabler of the racist movement. Through its active refusal to intervene, Facebook has made its stance clear.”

To Gullfot, black lives matter more than inbound sales leads.

Black lives matter, unless you're afraid of offending POTUS

Gullfot was referring to a tweet that U.S. President Donald Trump sent early Friday as a response to the protests that spread from Minneapolis to other cities across the country following George Floyd's death while in police custody. The president called the demonstrators "THUGS" and suggested that law enforcement launch deadly force against them. Invoking the words of a racist police chief from the 1960s, the president added, "When the looting starts, the shooting starts."

As many of us have read and observed by now, Twitter hid the tweet behind a disclaimer that the president’s message had "violated" the platform's rules about "glorifying violence." The company also prevented users from liking the tweet or sharing it without comment, and did the same the next day after the same message was reposted on the White House Twitter account.

When the president's staff shared the message on Facebook, however, the social network left it alone. "I know many people are upset that we've left the President's posts up," founder and CEO Mark Zuckerberg wrote last weekend, "but our position is that we should enable as much expression as possible unless it will cause imminent risk of specific harms or dangers spelled out in clear policies."

In the same post, Zuckerberg offered another eye-rolling excuse. “Although the post had a troubling historical reference, we decided to leave it up because the National Guard references meant we read it as a warning about state action, and we think people need to know if the government is planning to deploy force.”

How many bold companies like Simris are out there?

The drastic move Simris took shows far more boldness than what many of America’s largest and most well-known brands have shown so far. Companies that generate billions in revenues annually have the resources to write a check or make a pointed, well-crafted public statement about where they stand on racism. Sure, some stakeholders or customers will pitch a fit and resolve never to buy their products or services again. Nevertheless, the record shows that these companies will endure, whether it’s Starbucks taking on race (or stepping into it) or Sanofi mocking Roseanne Barr for her abhorrent behavior in 2018.

The stakes are much higher for a smaller company that relies on social media tools to break through and score customers. So on the gutsiness scale, the decision Simris made lifts the brands taking stands bar to further heights. “We understand this puts us at a major marketing disadvantage compared to other brands and products out there,” Gullfot concluded. “But we also trust that honesty and respect will win in the long run, and trust our friends and community to share our message.”

Image credit: Clay Banks/Unsplash

Could More Business Leaders Support Reparations as a Way to Heal?

What started as a trickle late last week turned into a wave as companies spoke out against the racist acts that triggered protests across the U.S. and even overseas. Some companies backed up their pledges with financial support. Nevertheless, the protests are showing no signs of dissipating. Meanwhile, many leaders of all stripes are skittish to speak out, including the U.S. president, who has reportedly spent time in a White House bunker while dimming the executive mansion’s lights. The images are enough to demonstrate that while communities burn, the leaders aren't home. Might it be time for the U.S. business community to stoke a conversation that for many white citizens is very uncomfortable — as in, discussing reparations?

So far, few business leaders have broached the subject of reparations. But that didn’t stop the CEO of Snap, Evan Spiegel, who in an email to company employees said that “people of color cannot visit a grocery store or go for a jog without fear of being murdered without consequence, and put simply, the American experiment is failing.”

In a public statement, Spiegel suggested it is now time to launch a non-partisan commission on reparations and reconciliation. Going beyond the moral argument, he added an economic case:

“I believe that one reason entrepreneurship in America has declined so substantially since the 1980s is the lack of a sufficient societal safety net. Entrepreneurship depends on people being able to take risks to start a business, which is nearly impossible to do without some sort of safety net like the one I had. Today’s would-be entrepreneurs are saddled with student debt and are subject to stagnant wage growth and rising expenses that make it hard to save the seed capital necessary to start a business.”

For anyone of any background who was interested in starting their own venture but were dissuaded by the confluence of student debt, the cost of healthcare, or the thought of being denied access to credit by banks, this economic argument could certainly hold sway.

The founder of BET, Robert Johnson, has gone beyond asking for a plan or commission:

“Is $14 trillion too much to ask for the atonement of 200 plus years of brutal slavery, de facto and de jure government-sponsored social and economic discrimination, and the permanent emotional trauma inflicted upon black Americans by being forced to believe in a hypocritical and unfulfilled pledge that all men are created equal?”

In a press statement, Johnson insisted that the only way for society to move forward and to atone for generations of systemic racism is to disperse cash payments to Black descendants of U.S. slaves over a period of 10 to 20 years. “The purpose of reparations, as presented here, is to acknowledge to 40 million Black Americans, the decedents of slaves, that you are owed damages for the evil that was visited on your ancestors,” Johnson wrote.

The CEO of Merck, Kenneth Frazier, also echoed the sentiments of other U.S. businesses leaders, and noted that the four days of inaction by Minneapolis officials was the trigger that transformed years of pent-up anger into taking to the streets. “What the African-American community sees in that videotape is that this African-American man, who could be me or any other African-American man, is being treated less than human,” Frazier said.

Frazier, however, stopped short of calling for any plans for reparations. “I don’t believe that we’ll be able to get anything like that through our political system,” he said during an interview with CNBC.

There is no shortage of corporate executives who believe that when it comes to ending systematic racism, we as a society need to “do more.” Defining what “do more” means, however, is an answer the business leaders are still struggling to find.

Image credit: Julian Wan/Unsplash

Facebook Employees Walk Off the Job in Support of Black Lives Matter Protesters

Even as most of the country shelters in their homes amid coronavirus lockdowns, the senseless violence against black Americans has continued.

In February, 25-year-old Ahmaud Arbery was chased down and shot to death by two white men while out for a jog in South Georgia. A month later, police stormed into 26-year-old Breonna Taylor's home in Louisville, Kentucky, as she slept, fatally shooting her eight times in what her family referred to as a botched drug raid. No drugs were found. Last week, 46-year-old George Floyd died after a white Minneapolis police officer knelt on his neck for over eight minutes while he repeatedly said, "I can't breathe."

As protests spread from Minneapolis to major cities across the country following Floyd's death, U.S. President Donald Trump sent a tweet at almost 1 a.m. on Friday, calling the demonstrators "THUGS" and seeming to suggest that law enforcement use deadly force against them. "When the looting starts, the shooting starts," Trump wrote.

In an unprecedented move, Twitter hid the tweet behind a notice that it had "violated" the platform's rules about "glorifying violence." It also prevented users from liking the tweet or sharing it without comment, and it did the same after the message was reposted on the White House Twitter account.

But when Trump shared the same post on Facebook, the company opted to leave it alone. "I know many people are upset that we've left the President's posts up," founder and CEO Mark Zuckerberg wrote on his Facebook page on Saturday, "but our position is that we should enable as much expression as possible unless it will cause imminent risk of specific harms or dangers spelled out in clear policies."

In another message, Zuckerberg pledged $10 million to "groups working on racial justice." But it did little to encourage disgruntled employees, a group of whom refused to work on Monday in protest of Zuckerberg's decision and in support of demonstrators across the country. The protest group labeled their move a "virtual walkout," as most Facebook employees are already working from home due to the coronavirus.

Facebook employees speak up, walk out

Over the weekend, Facebook employees circulated petitions and discussed their grievances in group chats, staff intranets and message boards. “The hateful rhetoric advocating violence against black demonstrators by the U.S. President does not warrant defense under the guise of freedom of expression,” one Facebook employee wrote in an internal message board, which was viewed by the New York Times.

Other senior staffers took to social media to express their concerns. "Censoring information that might help people see the complete picture *is* wrong. But giving a platform to incite violence and spread disinformation is unacceptable, regardless who you are or if it’s newsworthy," Andrew Crow, head of design for Facebook’s portal product, tweeted on Sunday. "I disagree with Mark’s position and will work to make change happen."

"I am not proud of how we’re showing up," added Jason Toff, Facebook director of product management. "The majority of coworkers I’ve spoken to feel the same way. We are making our voice heard."

Is change coming to Facebook's senior ranks?

Along with removing — or adding a warning to — Trump's posts, Facebook staffers are calling for increased diversity in leadership. Like many tech companies, most Facebook employees are white, particularly at the very top.

Facebook talks a big game in its latest diversity report: "Over the last six years, we have worked hard to make our commitment to diversity and inclusion more than just sound bites. Our company has grown a lot. So has our approach." But the numbers fail to back these statements up. As of last year, 3.8 percent of Facebook employees were black, compared to 2 percent in 2014.

"Although incremental changes are being made, the fact remains that the population of Facebook employees doesn’t reflect its most engaged user base," former Facebook employee Mark Luckie wrote in an online memo after quitting the company in 2018. "There is often more diversity in keynote presentations than the teams who present them. In some buildings, there are more 'Black Lives Matter' posters than there are actual black people."

And while Trump regularly accuses social media companies of censoring conservative voices, policymaking at Facebook is largely dominated by conservatives, particularly the three leaders of the company's powerful Washington, D.C. office, Joel Kaplan, Katie Harbath and Kevin Martin.

In private online chats, employees called for Kaplan, a former deputy chief of staff in the George W. Bush administration, to resign. His official position is vice president of global policy, but a former Facebook employee told journalist Judd Legum that, in reality, Kaplan "serves as an advocate for right-wing sites on Facebook."

"Any time there was an issue with Breitbart or Daily Caller, Joel made the decision, and he always acted to protect them," the employee said. Kaplan angered many employees by sitting in the front row during the confirmation hearings of Supreme Court Justice Brett Kavanaugh, a close friend.

A way forward, but is it the right one?

A Facebook spokesperson told Rolling Stone that the company is open to feedback from critics, including those within its own ranks. “We recognize the pain many of our people are feeling right now, especially our Black community. We encourage employees to speak openly when they disagree with leadership.”

Additionally, Zuckerberg and Sheryl Sandberg, Facebook’s chief operating officer, planned to host a call on Monday night with civil rights leaders who have publicly criticized the company's move to protect Trump's posts, the New York Times reported.

While some may consider it encouraging to see the company engage its critics directly, the two executives may be in for a rude awakening. In interviews with the Times, Rashad Robinson of Color of Change called Zuckerberg's $10 million donation “one of the most insulting things I’ve ever seen,” while Vanita Gupta of the National Leadership Conference said he is "prioritizing free expression while our democracy is literally burning."

If employee feedback thus far is any indication, it will take more than donations and conference calls to change minds at Facebook. Employees are looking for a firm policy regarding speech on the platform — and executives with the guts to enforce it. Per the Times report, several have already threatened to leave their jobs permanently if Zuckerberg does not reverse his decision on Trump's tweets.

“Mark is wrong, and I will endeavour in the loudest possible way to change his mind,” Ryan Freitas, the director of product design for Facebook’s News Feed, wrote on Twitter. He isn't the only one: On Monday, online therapy platform Talkspace dissolved a six-figure partnership with Facebook, with CEO Oren Frank saying, “We will not support a platform that incites violence, racism and lies."

Image credit: Shop Catalog via Flickr