Deforestation is Increasing During the Pandemic: What Can Business Do to Turn the Tide?

For the fourth consecutive year, World Rainforest Day (WRD) has come again, this time during the COVID-19 pandemic. WRD is a time to celebrate rainforests for all their beauty, diversity and richness of resources. It is also a day to recognize the challenges these ecosystems face, including deforestation, and to ask the question: What can we do to support these precious habitats?

Rainforests are some of the most biodiverse and productive ecosystems on the planet. Covering only 6 percent of the Earth’s surface, they support more than half of the world’s plant and animal species. Rainforest cover is valuable, producing about 20 percent of the world’s oxygen and regulating atmospheric temperatures.

But rainforests face increasing threats. Last year saw a loss of 14,500 square miles of global rainforest. The German branch of the World Wildlife Fund (WWF) estimates that 2,500 square miles were lost in March of this year alone. That's 150 percent higher than March averages from 2017 to 2019.

The WWF identified two factors influencing this troubling increase. Pandemic-prompted stay-at-home orders have reduced police presence in forests, allowing for a proliferation of illegal deforestation, and global job losses due to the pandemic have spurred people to act out of desperation.

Forests in Indonesia, the Democratic Republic of Congo and Brazil have seen the most significant losses, according to WWF's report.

Losing rainforests to clearcutting or monoculture has severe economic impacts. A study published in the journal Nature last year found that leaving the Amazon rainforest intact would have a positive $8.2 billion annual impact. Deforestation over a 30-year period could cost as much as $3.5 trillion in combined social and economic deficits.

Business solutions to deforestation during the pandemic

To diminish illegal deforestation, the WWF recommends that governments support their people with financial and technological resources. Expecting governments to do the heavy lifting to protect forests when they are still grappling with a pandemic may be impractical, though. Business solutions can help decrease deforestation from the ground up.

To start, from a business standpoint, much of the land already cleared by logging and fires is economically unproductive, even abandoned, Toby Gardner, senior research fellow at the Stockholm Environment Institute, told Al Jazeera in 2019. A McKinsey report from 2012 recommends improving the productivity of cultivated land by implementing agricultural best practices, rather than clearing more forests for agricultural use. The report claims that such improvements could symbolically free up more than 370 million acres of land.

Many corporations claim to support healthy rainforests. Now would be a good time for those companies to ensure they have the proper procedures and standards in place to fulfill the promises they’ve made to their stakeholders and customers.

A 2014 article in the Guardian identifies three essential elements to supporting sustainable rainforest management. First and foremost, any company that relies on commodities sourced from rainforests and their communities must know the ins and outs of its supply chain. That company can then develop relationships with these suppliers, part of which is providing the necessary financial resources for local industries to adhere to the highest standards. If the necessary standards don’t yet exist to maximize the productivity of land already cleared and to protect old-growth forests from further deforestation, corporations have a responsibility to work to develop them.

Now is the time for businesses to step up for rainforests

Last year, when fires were racing across the Amazon, 230 major investors called on businesses to step up their actions to protect rainforests.

“Deforestation and loss of biodiversity are not only environmental problems. There are significant negative economic effects associated with these issues and they represent a risk that we as investors cannot ignore,” Jan Erik Saugestad, CEO of Storebrand Asset Management, Norway’s largest private asset management firm and one of the signatories, told Reuters.

Investors called for businesses to forego any activity that leads to deforestation, but not to stop there. Actions must have a timetable and be quantifiable, transparent and reported.

Rainforests are a global resource — their protection requires coordinated global action, and that includes corporate action. Some of the world’s biggest brands and corporations have made no public commitment to decreasing deforestation — Tyson Foods, Ashley Furniture, Samsonite and Amazon among them, according to Global Canopy’s 2019 Forest 500 report. Of the 500 most influential forest-risk companies and financial institutions, 140 have no public commitment to end deforestation in their supply chains.

Knowing this, it’s no surprise rainforests are vulnerable to a 150 percent increase in deforestation within only a couple of months. This WRD should be a call-to-action for businesses to take up the responsibility they have to our global rainforests and to forego their long-held silence.

Image credit: Tobias Tullius/Unsplash

More Than Ever, Business Must Be an Ally for Refugees

Today, World Refugee Day comes at an ominous time as much of the world is under lockdown or has kept borders closed to outsiders. According to UNHCR, the U.N. Refugee Agency, more than 1 percent of all humanity is currently displaced. Even worse, less than 400,000 of the approximate 80 million refugees are able to return home each year. During the 1990s, that number hovered around 1.5 million a year.

More evidence suggests refugees and displaced people will contribute to society and the economy if given the opportunity. A 2017 report, for example, concluded that refugees who resettle in the United States end up with higher incomes and pay out far more in taxes than they receive in benefits in the long term. Nevertheless, the doors keep shutting. And in countries with a large population of refugees, including Colombia and Lebanon, their situation has become even more dire.

Within the business community, there are some bright spots. Here in the U.S., Chobani is one example of a company that has gone out of its way to hire refugees, and in part has thrived as a result. Starbucks and Volkswagen are among other brands that have made public commitments to hire or support refugees and displaced people. Amidst the COVID-19 pandemic, there are efforts worldwide to hire refugees, notably to manufacture face masks and other personal protective equipment (PPE). One UNHCR initiative, for example, has mobilized refugees in Turkey to make face masks as that country battles the novel coronavirus. In the Netherlands, Philips says it has been working with a partner foundation to make up to 100,000 masks a day.

As Reuters recently reported, two-thirds of the world’s displaced people are from five nations: Afghanistan, Myanmar, South Sudan, Syria and Venezuela. Most of these men, women and children seek safety and asylum in neighboring countries. For some lucky refugees, technology makes it possible to work, as in teaching their languages virtually, while they wait anxiously for a new home. For far too many, however, their skills are left untapped.

Gideon Maltz, executive director of the Tent Partnership for Refugees, has said that companies can go beyond government inaction not only by hiring, training and integrating refugees and displaced people into their workforces, but also by encouraging suppliers and vendors to follow their lead. Citing the insurer Generali as an example, Maltz added that business can also harness the entrepreneurial spirit many refugees exhibit by supporting them through offering loans, incubating their ideas, or helping guide their products or services to wider markets.

In a recent article in Quartz, Maltz urged state and local governments in the U.S. to be more supportive partners of the private sector on this effort by doing more to recognize refugees’ foreign education and credentials. The current pandemic is one example: Refugees and other new immigrants can join the fight against COVID-19, as “over 260,000 immigrants and refugees with undergraduate degrees in health-related fields are either out of work or underemployed in low-paying jobs that require significantly less education,” Maltz wrote.

While the business community has provided more leadership on this problem than policymakers, far more needs to be done, according to the UNHCR. “The gap between the number of refugees in need of resettlement and the places made available by governments around the world is worrisome,” the agency said in a public statement earlier this week. “We continue to call for more countries to join the program and find solutions for a greater number of refugees.”

Image credit: Ra Dragon/Unsplash

Revived 'Poor People's Campaign' Unites to Challenge Systemic Racism and Poverty

(Image: Demonstrators led by Rev. Dr. William J. Barber II (second from left) and Rev. Dr. Liz Theoharis (third from left) march on Washington in June 2018 in support of the Poor People's Campaign and its mission to end systemic racism and poverty.)

Today the nation observes Juneteenth, celebrated annually to commemorate the end of slavery in the United States, but the moral, economic and social stains of slavery never left us.

By the time of the Civil Rights Movement in the 1960s, Black Americans were still being held in bondage by Jim Crow laws, which enforced segregation and barred millions of people from social equality and economic prosperity. Along with his leadership in the movement, Rev. Dr. Martin Luther King, Jr. was adamant in his fight against systemic poverty and oppression in all forms. His rallying cry to unite poor and impacted communities across the country, shared with countless other grassroots organizers and religious leaders, took on the name the Poor People's Campaign.

Revived under the leadership of Rev. Dr. William J. Barber II and Rev. Dr. Liz Theoharis, the Poor People's Campaign is still fighting the good fight against systemic racism, poverty, and capitalist systems they say prioritize militarization and environmental destruction over people.

This week, the Poor People's Campaign will extend Juneteenth celebrations into the weekend, with a digital assembly and Moral March on Washington on Saturday, June 20.

The Poor People's Campaign unites a movement against systemic racism and poverty

On Saturday, low-income people from more than 40 states will unite under the Campaign's mission statement, "A National Call for Moral Revival." They'll hear stories from people protesting systemic racism and struggling through poverty during a digital assembly, and thousands will march on Washington to demand change.

Hundreds of organizations, including 14 national labor unions, 16 religious denominations and dozens of civil rights groups, will take part in the event, which will be live-streamed on MSNBC.

The day’s focus will be on "poor and low-income people who demand that their voices be heard," according to the Campaign. Those sharing their stories include Midwestern service workers who have worked through the coronavirus pandemic without protective equipment; families affected by police brutality; a coal miner from Appalachia; mothers who have lost children due to lack of health care; residents of the highly polluted region dubbed Cancer Alley in Louisiana; and an Apache elder who is petitioning the federal government to stop a corporation from destroying a sacred site in Arizona.

“The numbers of people suffering in this the richest nation in the world is already increasing and deepening as the effects of the pandemic, recession, and racist and anti-poor policies continue to hurt poor and low-income people the hardest,” Rev. Theoharis said in a statement. “On June 20, poor and impacted people will come together to tell the nation what it means to not have enough food to eat, to wonder how to keep a roof over your family’s head, and to have to choose between risking your life by going to work or staying at home and not getting paid."

A policy agenda for real change

Marchers will demand action on a specific policy agenda that brings the fight against poverty, racism and over-militarization together with campaigns to protect the environment and make it livable for all. Grounded in a 2020 report entitled The Souls of Poor Folk: Auditing America, the agenda focuses on five core justice issues: "systemic racism, systemic poverty, ecological devastation, the war economy and militarism, and a distorted moral narrative of religious nationalism."

"We will share the bold and visionary demands people are putting forth that can solve these grave injustices and the powerful and creative resistance of people organizing across the country," Rev. Theoharis said. "History shows that when those most impacted by injustice come together in a powerful movement, that this country can indeed change for the better. Those whose backs are against the wall are pushing this whole nation toward justice today."

This is the third annual march hosted by the revived Campaign, and the changes that have occurred since it first descended on the National Mall in 2018 played an integral role in the agenda.

"A pandemic hit and exposed the wounds of racism and poverty, and a lynching by police of a black man on camera poured salt in the wound, which makes our call for a moral fusion coalition of all people to address five interlocking injustices even the more relevant,” Rev. Barber said in a statement. “As we deal with the on-camera murder of George Floyd by racist policing, we must also recognize that many public policies have an ugly ‘DM’ — death measurement. When we look at their impact, they disproportionately kill black people and poor people. We must demand that these inequalities be addressed by policies, and we refuse to accept death anymore.”

The effects of these "high DM" policies can be felt in all corners of society — from the homes of working families, to the halls of public schools, to the board rooms of corporate America, as detailed in the Auditing America report.

The Poor People's Campaign has laid out a clear call-to-action and a policy agenda to back it up. The question is: Will decision-makers in Washington, on K Street and on Wall Street listen?

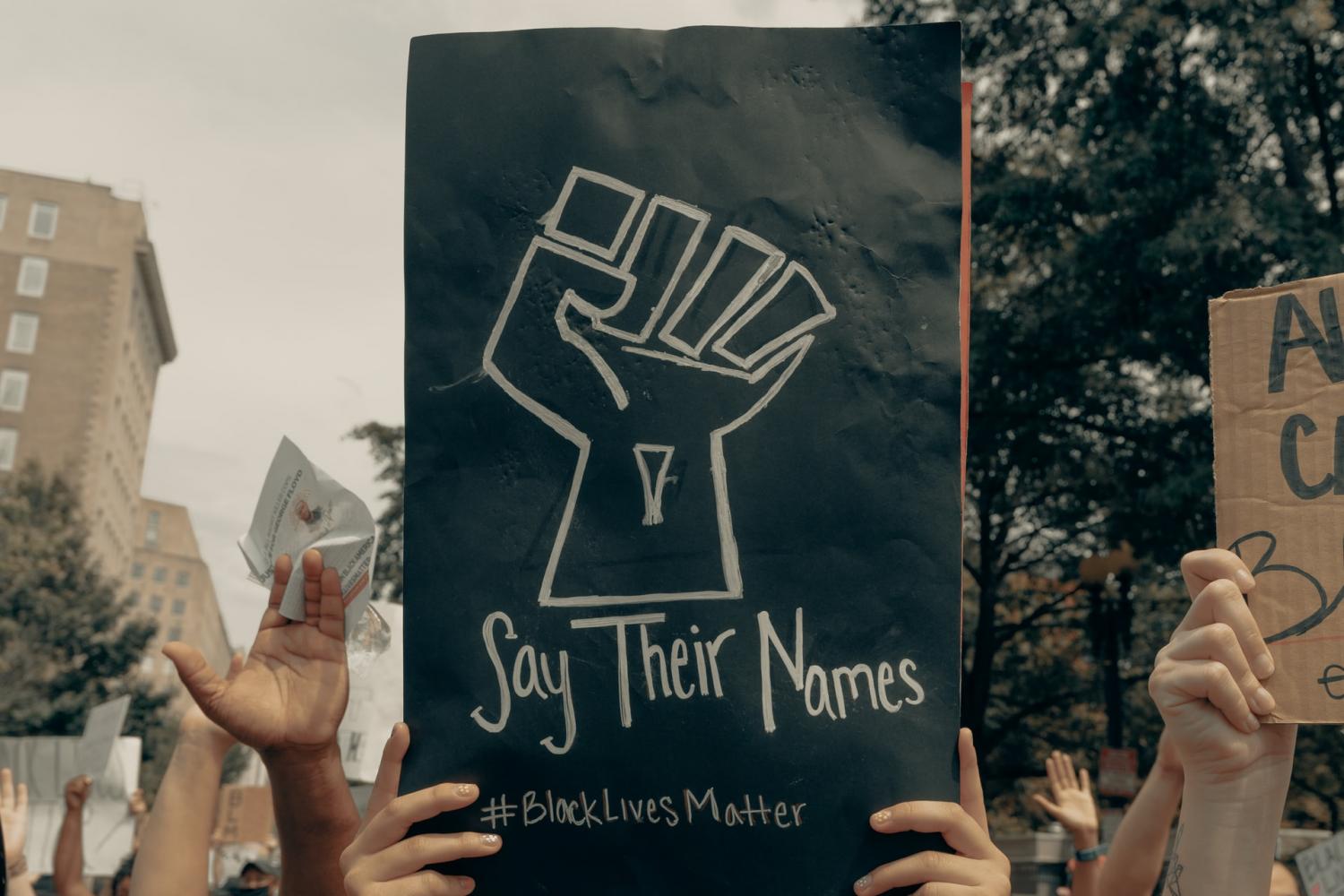

Businesses Must Step Up to Reform the U.S. Justice System

This op-ed on reforming the U.S. justice system was co-written with Ashish Prashar.

The past couple of weeks saw the movement to tear down the racist and ineffective American justice system grow exponentially. People from all walks of life felt compelled to speak out and stand up, so moved were they by the senseless killing of George Floyd. People are very angry, and rightly so.

But what happens next? Concrete and deliberate next steps need to be taken by the most powerful in our communities to change the fate of those for whom power has been consistently and systematically taken away. Ending racism in America requires a fundamental overhaul of the justice system, and we believe businesses must join us at the table if we are to see meaningful change.

This brutal murder shocked and outraged so many of us; but the relationship between racism and the administration of justice should come as no surprise. We were instantly reminded of Trayvon Martin, Rodney King, Michael Brown and countless others. It reminded us of what we already knew — that justice isn’t colorblind.

Why has it taken so long to drive this home for so many people? The racism that defines the U.S. justice system is world-renowned. In America, Black people are incarcerated at five times the rate of white people. One in four Black men will go to jail at some point in their lives. Despite the fact that Black people take drugs at exactly the same rate as white people, they are 10 times more likely to be arrested for drug offenses. We’re angry, but we should have been furious years ago, while the walls of this unequal system were built around us.

So, thousands took to the streets in an act of political protest. Businesses and brands quickly joined the fight, posting on social media and displaying the now ubiquitous “black square." But through the tear gas and the Twitter trolls, we’re compelled to ask: How can we make it count this time? How can we meaningfully fight prejudice in the hearts of those sworn to protect us equally, and banish racism from our justice system once and for all?

The most effective solutions are complex, unclear and hard to identify. The same cannot be said for the most influential actors.

Businesses have already shown how much influence they can have when they plant their flag in this debate. Nike’s defense of Colin Kaepernick was front-page news after he kneeled during the national anthem to protest racial inequality. True to their word, they have already joined the fight once again, adapting their world famous slogan to ask people: “For once, Don’t do it. Don't pretend there's not a problem in America. Don't turn your back on racism.” It is time for other companies to take heed.

Companies being instrumental in ending hate and suffering is not theoretical. Their activism is a proven path to understanding and tolerance. When Coca-Cola made the decision to withdraw from apartheid-era South Africa, they struck a major blow for racial equality in the region. They also served as an example to other businesses to do the same. As Timothy Smith from the Interfaith Center on Corporate Responsibility noted at the time: “The fact that Coke is an international symbol of American business means that this decision to withdraw will really accelerate the trickle of companies leaving into a flood.” Furthermore, it was demonstrative of consumer power to demand such action from their business leaders — the divestment was led by public outrage at home in the U.S.

Now that the black tiles have come down on social media, we ask businesses to start speaking up. Regularly and often. In America we’re making it a crime to be poor: Speak up about that. We’re incarcerating Black children: Speak up about that. We’re executing Black and Brown men for crimes their white peers do not get the death penalty for: Let’s talk about that. We’re making it almost impossible for people of color to escape previous convictions, get a job and start a new life: We need to change that. George Floyd moved to Minnesota to start a new life after a prison sentence and ended up dead because he allegedly had a counterfeit $20 bill. Hire formerly convicted people. Change the culture within your businesses. Take your employees, clients and partners on a journey of education with you.

For many years businesses have been afraid of the potential for negative fallout if they waded into political and tense issues. But just like the people of Atlanta did with Coca-Cola, now we see more consumers and employees voting with their feet and their dollars to push businesses to understand the risk lies in saying nothing. And, just like we saw in 1986, when these commercial juggernauts put their weight behind important issues, things change. If Coca-Cola can help end apartheid, corporations can and must help end racism in the U.S. justice system.

Businesses must also consider the tools available to them — and back up their voices with their leverage. The blow to apartheid was so devastating because a major corporation didn’t just speak out — it actually withdrew. It refused to do business with the perpetrators of racial oppression and refused to invest in regions defined by prejudice. We ask that companies and investors do the same today for the U.S. justice system and law enforcement. In doing so, they cripple discriminatory institutions while at the same time incentivizing progressive reform.

We are at a tipping point. We need companies to step up. As some of the loudest voices in society, staying silent is not an option. Brands need to do this for their employees and for their standing in society. Advocating for change in criminal justice systems, so that we can eliminate barriers to equality of opportunity, is a message we need corporations to shout out loud right now.

If we do this together, maybe we can master this moment and create real change. But we can’t do it without our leaders, and our business leaders are no exception. It’s time for them to be the champions of fairness and equality they claim to be.

About the authors:

Celia Ouellette has dedicated her legal career to fight for those most disadvantaged by broken systems of criminal justice. Prior to founding Responsible Business Initiative for Justice, she was a human rights lawyer for more than a decade, founding and directing The Powell Project, an organization dedicated to empowering and equipping capital defence teams with the knowledge and skills to level the playing field in death penalty cases.

Ashish Prashar is a justice reform campaigner, who sits on the Board of Exodus Transitional Community, Getting Out and Staying Out, Leap Confronting Conflict and on the Advisory Council for the Responsible Business Initiative for Justice.

Image credit: Clay Banks/Unsplash

UAW Workers Observe Juneteenth with 8 Minutes, 46 Seconds of Reflection

With recent tragic events involving the killing of unarmed Black Americans, including the deaths in Minneapolis, Atlanta and Louisville, the United Auto Workers (UAW) is one organization taking the lead in showing how to commemorate Juneteenth.

A quick refresher: Juneteenth is the holiday that memorializes the date when Union army General Gordon Granger entered Galveston, Texas, on June 19, 1865, and read federal orders that all slaves in Texas from that moment onward were finally freed. Despite President Lincoln’s Emancipation Proclamation of 1863, and the end of the Civil War in April 1865, the news had not reached Texas, the most remote state and one with relatively few Union troops. General Granger’s proclamation finally made it clear to as many as 250,000 people that they were free.

Despite the current White House occupant’s claim that “nobody had heard of” Juneteenth, it’s been a public holiday in Texas since 1980. Black Americans have celebrated this day for generations.

This year, the events leading up to the day have led to Juneteenth becoming a holiday for employees at companies including Nike, Target and Twitter. The UAW’s membership in particular is standing out for how its rank-and-file will remember this day.

Today, at 8:46 a.m. in each time zone, UAW members and their allies worldwide will pause and reflect for 8 minutes and 46 seconds, the amount of time George Floyd was pinned down by his neck by a white police officer while he cried out for help. There is one caveat – how members will remember this day at that moment will depend on where they are. “We know that our members work in different circumstances and industries,” the UAW said in a public statement. “Please do not stop work unless authorized.”

As of press time, none of the major automakers has declared Juneteenth as a company holiday. However, General Motors’ autonomous driving technology subsidiary, Cruise, said it will recognize Juneteenth. And the Detroit Free Press reports that GM has said it will allow employees to participate in the day’s commemoration. GM employees, depending when they are on the clock, will be able to take those 8 minutes and 46 seconds to reflect at 8:46 a.m. or p.m.

Ford Motor Co. and Fiat Chrysler have confirmed with CNBC that they will remember today with moments of silence.

While the UAW has had to deal with its share of troubling incidents over the years, by and large the union’s leadership has been at the forefront of the push for racial equality. Much of the UAW’s work on this front reflects the legacy of Walter Reuther, president of the union during the time of the U.S. auto industry’s spectacular growth from the post-World War II era until he died in a plane crash in 1970. Among his many efforts during the Civil Rights era, Reuther was instrumental in bailing out several hundred followers of Martin Luther King, Jr., after they were jailed during the 1965 civil rights marches in Alabama. King’s widow, Coretta Scott King, eulogized Reuther at his funeral.

With today being the 155th anniversary of Juneteenth, the UAW’s actions are an example of the many ways in which citizens can take action, reflect or celebrate. J’na Jefferson of The Root offers a list of virtual events people can attend today and throughout the weekend.

Image credit: Wynn Pointaux/Pixabay and Kateryna Babaieva/Pexels

Domestic Workers Say They Feel Unsafe As States Reopen

Domestic workers — most of whom are women of color and immigrants — have been especially hard hit by the novel coronavirus and related economic impacts, say advocacy groups such as the U.S.-based National Domestic Workers Alliance.

These workers, including nannies, house cleaners, and home carers for seniors and people with disabilities, were often the first to lose their income as families sheltered in place, needed fewer services, and grew wary of others entering their homes.

Domestic workers were also the last to receive financial assistance from the federal government, and many have yet to receive any aid at all, says Ai-jen Poo, executive director of the Alliance. "As everyone has been sheltering in place, domestic workers have lost the limited income they had and have been struggling to figure out how to put food on the table, pay for essential supplies and bills, and care for their own families," she said during a press briefing last month.

For the briefing, the Alliance invited domestic workers from across the U.S. to speak about their work and home lives as states begin to reopen. They described economic hardship, fear for their clients and their families, and frustration that state and federal governments aren't listening.

Domestic workers share their stories: "My anxiety is through the roof."

Those who shared their stories include Savvy Moore, a mother of three who has worked for more than 20 years as a home care worker and certified nursing assistant (CNA) in Charlotte, North Carolina. As a two-time cancer survivor, Moore is immunocompromised, but she could not afford to stop working when the pandemic struck.

Her daughter, who is also a CNA and is five months pregnant, is in the same situation. Moore says her daughter often cries when it's time to go to work, out of fear for her health and that of her unborn child, but without any savings or paid sick leave, she has no choice but to remain on the job. "We are at high risk, and it's almost like no one's hearing us," Moore told reporters. "We’re told, ‘Come to work, or lose your job.’ That's not right. That's no way to treat frontline workers."

Though they continued to work during the pandemic, Moore and her daughter saw their hours cut. "Our incomes have gone down significantly," Moore said. "I have debt collectors calling me all the time, threatening me as if they don't understand what's going on. My anxiety is through the roof."

Linda Walton, a CNA from Atlanta, Georgia, who cares for a man with a spinal injury through a domestic employment agency, is also worried for herself and her clients.

"Since Atlanta has reopened, it has been really stressful," Walton said. "I hear from our governor that things are getting better, but that does not match up with our reality. Our positive cases have almost doubled since the state has reopened."

Walton said she does not have health insurance or paid sick leave through her agency, nor does she receive hazard pay. It's up to her clients to provide protective and sanitary equipment, such as masks, gloves and hand sanitizer. "As a frontline worker performing an essential job and as a woman of color, I feel like I'm more at risk for contracting the virus," she said. "I am also concerned for the health of my clients, because they are medically fragile and have preexisting health conditions."

Her story is similar to that of Susie Rivera, a 63-year-old home care worker from New Braunfels, Texas, who said she does not have adequate protective equipment to ensure she, her clients and her family of five can stay safe.

"All the years that I've done this kind of work, I have never, ever, ever dreamt of having to work the way we have to work right now," Rivera said. "All we need is the equipment we should have to take care of the elderly we care for and make sure they're safe," she continued. "We need protective equipment to keep them alive."

The next federal stimulus is at a standstill in the Senate, leaving workers in limbo

"While the majority of states are now open or partially open, we are still in the middle of both a public health and economic crisis, and we need clear and concrete guidance from all levels of government so that everyone can be safe," said Poo of the Alliance. "Domestic workers should have protective gear. They should have hazard pay and clear, explicit agreements."

But response from government, specifically the White House and U.S. Senate, has so far been lacking.

The U.S. House of Representatives passed their version of the next coronavirus stimulus package on May 15. The $3 trillion proposal includes some elements of the so-called Essential Workers Bill of Rights introduced by Sen. Elizabeth Warren (D-Mass.) and Rep. Ro Khanna (D-Calif.) in April — including hazard pay, protective equipment, and healthcare and economic protections for essential workers regardless of immigration status. This is a significant departure from the last stimulus package, which barred families from receiving aid if anyone in their household did not have a Social Security number.

Senate Republicans, however, lambasted the idea of providing aid to immigrants without legal status. They also took issue with other provisions including mortgage relief, rental assistance and student loan forgiveness — which they claim are unrelated to the coronavirus — calling the House bill "dead on arrival."

More than four weeks later, the Senate has yet to schedule a vote on the House stimulus package or reveal their own version.

Advocates aren't waiting for government to act

Despite Senate opposition to the House bill, research indicates this type of legislation has broad support among the U.S. public. Nearly 70 percent of Americans agree "we need a major reform of the country’s response to the pandemic" and say the government should be "doing more to solve problems and help," according to a May survey conducted by Caring Across Generations and the National Domestic Workers Alliance.

"Working families still need economic support, access to testing and treatment, family care, and stronger health and safety standards in workplaces," said Haeyoung Yoon, senior director of policy at the Alliance. "We need the Senate to act swiftly to pass [the stimulus bill]."

But the Alliance isn't waiting for the federal government to act. In response to what they call a refusal of the White House and Senate to provide more aid for working families impacted by the coronavirus, Poo, Yoon and their colleagues put together their own set of guidelines for domestic workers returning to the job as states reopen.

One set of guidelines, created for domestic workers, includes advice and training resources to stay safe on the job, as well as places to turn for emotional and financial support. Another provides guidance for families who employ domestic workers, including how to ensure collective safety and how to come to fair agreements regarding pay and time off.

"There are very real power dynamics at play here. We really urge families and employers to bear in mind the incredible pressures on workers to have an income to care for their own families," Poo said. Still, "nothing could replace the impact of clear action and leadership at the national level," she said, and the Alliance and its allies continue to push for passage of a second round of federal stimulus.

"We should not have to be sacrificing our lives just to get through this crisis," said Moore, the CNA from Charlotte. "Take care of us because we take care of you. We do this work from our hearts."

Image credit: Anton/Unsplash and Karolina Grabowska/Pexels

COVID-19 Puts Migrant Children at Huge Risk

From urban locations to rural areas, the COVID-19 pandemic has dealt hardships to millions of citizens around the world. Many have realized that the pandemic discriminates against citizens with fewer resources, including impoverished families. What about the migrant children detained at the U.S. border?

There were nearly 70,000 unaccompanied minors who came into the United States last year. Here's how they've been affected by COVID-19; and the plight migrant children face are a reminder that nonprofits assisting however they can, including RAICES in Texas, need more individual and business support.

Ill-equipped environments can't handle a pandemic

When a migrant children arrive at the U.S. border, they're held by the Department of Homeland Security until they're transferred to the Office of Refugee Resettlement (ORR). This transition must happen within three days. It's up to the ORR to assign them a social worker, who determines whether or not they can stay legally. The child lives at a shelter throughout this process.

Unfortunately, these environments don't have the tools to handle a pandemic. A single shelter can be responsible for a thousand kids at one time. How are these group facilities supposed to follow the Center for Disease Control's guidelines? There isn't enough space to socially distance — some detention centers crowd up to 20 occupants inside a single cell.

If conditions are already unbearable for detained migrants without COVID-19, it's difficult to believe that these facilities can handle the coronavirus outbreak.

Current preventive measures to take on COVID-19 are failing

The U.S. government has a responsibility to protect these individuals from harm. Children don't have access to resources that can help them and their families deal with dire situations. Although the federal government took some measures to maintain detention centers over the past few months, it's also obvious it could have done much more.

Immigration and Customs Enforcement (ICE) continued to book individuals even when staff and detainees tested positively for the coronavirus. As a result, hundreds of them have contracted COVID-19. Many reports indicate that employees at shelters for migrant children are at risk, too. What happens when there aren't any caregivers to supervise, let alone watch over detained migrants with COVID-19? Add the inability to maintain social distancing, and the result is an ongoing human rights crisis.

“It’s impossible to socially distance in these ICE facilities,” said Efrén C. Olivares, Legal Director of the Racial and Economic Justice Program at Texas Civil Rights Project, in a public statement earlier this year. “So, by holding our clients at their discretion, ICE is asking for an outbreak that will endanger the lives of the entire community, in areas that are already starting out with fewer healthcare resources.”

There's also been a massive issue with personal protective equipment (PPE) and cleaning supplies. It's become known that detention centers don't have enough access to masks or soap, like many places throughout the country. If these locations don't have the proper procedures to combat the coronavirus, it's best to immediately release detained children to their U.S.-based family members.

The U.S. government hasn't taken that approach. Like migrant workers, it's apparent these children can't travel home safely — as a result, they become stranded.

The U.S. continues to deport kids unsafely

The standard immigration process for migrant children involves several steps. If a social worker finds that a child doesn't meet legal qualifications, it's up to U.S. agencies to organize a plan so they can return to their country. These procedures involve contact with the child's family, who determines whether or not there's a safe place to live back home.

At the moment, it's become increasingly tricky for organizations to do this. Many countries have closed their borders, so scheduling flights is a near impossible task. There's also no way to tell if a family can house their child, as many areas don't have access to proper COVID-19 tests. These obstacles haven't stopped the U.S. government from taking certain actions, though.

ICE continues to deport many migrant minors to their home countries. These children don't have an opportunity to seek asylum — and they can't communicate with their families properly. As a result, they show up without any security measures. It's common for their parents not even to know they're on their way until they arrive. These measures push kids back into unsafe environments.

Detained migrants' COVID-19 exposure has increased

As the coronavirus continues, it's clear that detained migrants face unique problems. The U.S. government must take the necessary steps to create a safe environment for these individuals. Otherwise, these children, through no fault of their own, will continue to encounter several life-threatening health risks.

"The administration is using coronavirus and the pandemic as a cover for doing what it has always wanted to do, which was to close the border to children," Jennifer Nagda, the policy director at the Young Center for Immigrant Children's Rights, said to CBS News last month. "There is no reason why unaccompanied children arriving at the border can't be safely screened and transferred to ORR custody, where capacity is at an all-time low."

Image credit: Samantha Sophia/Unsplash

Bias Training Beyond the Factory Gates in the Black Lives Matter Era

The Black Lives Matter protests have sparked a badly needed police reform movement, and now attention has broadened to the behavior of private citizens as well. In the latest demonstration of how corporations are reacting to such incidents, the firm Raymond James quickly took action after an employee and his wife confronted and insulted James Juanillo, a gay Filipino homeowner, who was stenciling “Black Lives Matter” onto a wall that is part of his own property.

Stenciling while non-white

The incident could have gone much worse for the property owner. When private citizens take it upon themselves to police Black people, the consequences can be lethal.

The Black Lives Matter movement was initially sparked in 2012 when 17-year-old Trayvon Martin was killed by a private citizen while walking in his own neighborhood. The more widespread and sustained wave of Black Lives Matter protests has brought renewed attention to the killing of Ahmaud Arbery earlier this spring, and then George Floyd late last month.

The consequences can also be deadly when private citizens call the police to allege criminal behavior by Black citizens. That seems to have happened in the stenciling case, as a police car eventually came by during the confrontation. Fortunately, the officers recognized the homeowner and left the scene without getting out of their car.

Raymond James, Black Lives Matter and brand reputation

Even though the incident occurred outside of the workplace, Raymond James took decisive action immediately. After firing the associate, the firm posted the following message on Twitter (emphasis added):

“An inclusive workplace is fundamental to our culture, one in which people are free to bring their whole selves to their careers,” the statement read in part, “And we expect our associates to conduct themselves appropriately inside and outside of the workplace.”

The firm could have fallen back on a more conventional, less final response, including a public apology, a donation to the Black Lives Matter movement, and a pledge to do better in the future.

However, Raymond James may be particularly sensitive to brand reputation and recruitment issues following a series of much-publicized sexual bias allegations within the company back in 2007.

Among other actions since then, the firm established formal Advisor Networks focusing on women, Black employees and those in the LGBTQ community.

“The Black Financial Advisors Network supports the recruitment and retention of the best and brightest black professionals in the financial services industry,” Raymond James explains in a recruiting pitch. “Our mission doesn’t end there; we also are dedicated to helping you develop your career and grow your business with the support of accomplished advisors just like you,” the company adds.

The fatal flaw in unconscious bias training

As one of the many firms invested in unconscious bias training for its employees, Raymond James may also be more sensitive to out-of-work incidents in which an employee has clearly not assimilated the training.

That may not necessarily be the fault of an employee. It could also indicate a serious shortcoming in the conventional approach to unconscious bias training.

Also called implicit bias training, the field has become quite popular among leading firms seeking to improve their diversity profiles. However, diversity professionals have begun to take note of a fatal flaw.

Writing for Forbes in December 2019, the diversity strategist Janice Gassam observed that unconscious bias training can be successful in helping employees learn how their individual behavior is influenced by their own “blind spots and stereotypes.” On the other hand, she argued that these training programs fail to address the "systemic and structural issues that allow biases to be perpetuated in the workplace.”

Among the issues Gassam listed is structural racism, defined as “the complex system by which racism is developed, maintained and protected.”

“As much as you try to create an equitable workplace, if employees do not understand white privilege and the many ways it manifests in the workplace, systemic oppression will continue,” Gassam wrote.

Bias training beyond the factory gates

Gassam makes the case for addressing white privilege as a system, not simply as a matter of personal bias.

“With an understanding of white privilege, organizational leaders should assess policies and procedures to evaluate whether any of them perpetuate racial inequities,” she wrote, citing the example of grooming and physical appearance policies that disproportionately impact Black hairstyles.

“Understanding how practices and policies that were once deemed as acceptable may be causing and continuing inequities can help spark the necessary shift to deconstruct these oppressive systems,” she wrote.

In addition to breaking down structural racism within corporate operations, training on white privilege may help employees recognize biased systems in society at large. Equipped with that knowledge, they may be more capable of policing their own behavior outside of the workplace.

In the meantime, the Raymond James firing may help put more people on notice that they need to think before they act, if only to preserve their income.

As for the employee’s wife, as of press time she has still retained her position as CEO of the San Francisco-based skin care firm LAFACE (not to be confused with the entirely different Los Angeles company LA Face).

She has issued a statement of apology, but in light of the wave of Black Lives Matter protests sweeping the country, the words ring hollow.

As of this writing LAFACE has taken no other action, but its social media accounts and website are down.

Image credit: Clay Banks/Unsplash

Proclaiming Allyship Isn’t Enough: The U.S. Workplace Needs a Reset

The Black Lives Matter protests have become an unstoppable movement. The ongoing demonstrations following the murder of George Floyd, and now Rayshard Brooks, continue to reverberate across U.S. cities and even abroad.

Meanwhile, there’s no shortage of companies proclaiming their alliance with Black Americans, and many have gone as far saying they are in allyship with the Black Lives Matter movement.

For Black employees, corporations’ deeds are far from matching words

But here’s the problem: Well-crafted public statements offer a start, but are the tiniest of baby steps. As more mainstream U.S. publications listen to Black voices, it’s clear that how we conduct ourselves in the workplace needs a complete reset, starting with the fact that we must do better to treat all colleagues as human.

Black Americans continue to make it known, however, that such change is still not their reality, as the truth is that in many cases, corporations’ human resources departments have not been up to the task.

Yesterday, Fortune magazine showcased the thoughts, feelings and observations of Black Americans not only in the corporate world, but within the nonprofit sector and academia as well. It’s difficult to summarize how Black employees feel in a few words, but a few themes emerge. Alone. Overlooked. Disrespected.

“There’s a major difference between diversity and inclusiveness. We want to not only be in the room, not only be at the table, but also contribute to the decision-making process.”

“I want you to know what it feels like to not be able to stand up for yourself or correct someone's assumption about you or your culture or community for fear of losing your job.”

“The top of nonprofits is predominantly white and male, as it is within the private sector and government; most worker bees are women (of color).”

Human resources departments are one cog in the systematic racism machine

These constant reminders show that despite public commitments to diversity and inclusion, what’s said on a company’s media relations site often does not match what Black employees feel on the job day-to-day. For many, when it came time to bring these problems to the attention of the power brokers tasked with finding a solution — as in, human resources (HR) professionals — these employees time and again confronted the fact that their experiences were more than something they felt. They were blatantly systematic.

“Senior leadership can be the worst perpetrators of discrimination and will be protected by HR.”

“Eventually, I myself resigned because I learned I was being paid less than half of what my white colleagues earned. When I confronted HR and my manager about it, they blatantly lied to me.”

“I want you to know what it's like to be effective in your role and have the same or more credentials as your peers, but be passed over for promotions because you're ‘too serious’ or because there's a lack of connection.’”

Public gestures of allyship are not helping — and are even distracting

Companies keep saying publicly that they get it and will be at the forefront of change. One of the most visible examples of "allyship" occurred last week when Jamie Dimon, CEO of JPMorgan Chase, took a knee with some employees while visiting one of the company’s retail locations.

Such public gestures make for good photo ops. “But many black employees find them confusing, at times even laughable, because such pronouncements and headline-garnering investments are so terribly inconsistent with their firsthand experiences in workplaces that have long devalued their lives and professional contributions,” wrote Shaun Harper in the Washington Post.

What corporate executives and employees need to understand is that day after day, the problem isn’t limited to overt discrimination and racism. It’s the daily stream of microaggressions — the subtle and not-so subtle behaviors and comments directed toward Black colleagues — that must be addressed.

When it’s evident that a company’s human resources team either cannot or will not act on the problem, the effects can be devastating for Black employees. Many employees report they have felt invalidated, insulted or even verbally assaulted. One 2019 report concluded that almost 60 percent of Black employees in the U.S. had such experiences in the workplace, with the outcome that, at any given moment, Black employees have indicated they are 30 percent more likely to leave their jobs than their white counterparts.

As one Forbes writer explained last month, a common outcome that occurs when Black employees are made to feel as the “only” or “other” is one of the worst feelings any human being could feel: a sense that they are alone.

No human should be made to feel that way, ever. But it’s clear too many Black employees feel they must endure such an environment in offices across America. If a company’s human resources department is still turning a blind eye, then it’s time to rethink the purpose of what these professionals do. It’s obvious too many U.S. workplaces are still an alienating, unwelcoming place. A company’s CEO may set the tone or vision, but it’s up to human resources to ensure all employees feel valued.

It’s just not enough for companies to “stand with Black Americans.” They need to take bolder action so that all employees can stand beside each other, as equals.

Image credit: Hunter Newton/Unsplash

Report Reveals Dire Consequences from Lack of Women in National COVID-19 Response Efforts

From increased levels of gender-based violence to greater economic impact from loss of employment, experts say the COVID-19 pandemic is disproportionately affecting women and girls globally. Now, a new report sheds light on what may be the systematic reasons behind the disparity and how similar impacts could be avoided in future pandemics.

The report, published earlier this month by the NGO Care International, examined the role of women in leadership and COVID-19 responses in 30 countries. It found that countries with more women in leadership roles — not just as heads of state but at every level, from national crisis committees to local communities — were more likely to deliver COVID-19 responses that considered the effects of the crisis on women and girls.

Women bear the burdens of COVID-19, but have little say in policy

Canada topped the list with women comprising more than 50 percent of its national COVID-19 response teams. It also was the only country that, according to Care's methodology, took gender fully into account in its response. This included funding and policy commitments for gender-based violence prevention, sexual and reproductive health funding, childcare support, and funding that specifically recognized the economic effect of the pandemic on women.

The report also held up France and Ethiopia, which involved high percentages of women in their response efforts, as leading examples of countries with more inclusive COVID-19 responses. Both countries have made funding or policy commitments toward gender-based violence prevention and sexual reproductive health services.

In contrast, the United States ranked near the bottom of the list, with less than 10 percent of its COVID-19 response teams comprised of women. In fact, a tweet shared in February by Vice President Mike Pence showed the glaring absence of women from the U.S. Coronavirus Taskforce. While the U.S. has announced childcare support, funding to address women effected economically, and grants for women-owned businesses and training, it has not provided national funding or policy commitments around gender-based violence or any funding for sexual and reproductive health.

The U.S. is not alone; bottoming out the list was Brazil, whose national-level committee had the lowest percentage of women at under 4 percent. To date, it has taken few steps to meet women’s needs during the pandemic, according to Care.

Global health community calls for greater gender diversity in decision making

Care is not the only organization calling for greater participation of women in pandemic response efforts. Last year, the Global Preparedness Monitoring Board – co-convened by the World Bank Group and the World Health Organization – called for more women leaders to be part of preparedness efforts. The report looked specifically at the health sector where women make up 70 percent of the workforce but only comprise 25 percent of senior leadership positions.

A recent opinion piece published by the Thomson Reuters Foundation by members of WomenLift Health’s Global Advisory Board, Geeta Rao Gupta and Jeremy Farrar, emphasized the need to build the systems to support women’s leadership in global health before the next disaster strikes. “We can do this by equipping women with the skills, training and opportunities to rise to the top, and advocating for systemic changes – like closing the pay gap – to change the face of global health leadership.”

Quotas may be one answer

Authors of the Care report call for similarly urgent action, namely for governments to promote women’s participation in decision making, from the local to the national level, by applying a gender equality quota to decision-making bodies and processes tasked with taking on the COVID-19 crisis.

While quotas may be a blunt instrument, this would not be the first time they have been used to accelerate a shift toward gender equality. In Germany, for example, the government has set a mandate requiring at least 30 percent of non-executive members at large companies to be female. Since the mandate took effect in 2016, the share of women on supervisory boards of listed companies has risen by 13 percentage points, to 34 percent.

Whatever the means, the Care report shines and important light on the critical need for gender diversity in decision-making bodies.

“Women are bearing a disproportionate burden in this pandemic, yet in far too many countries their voices are silenced,” said Care International’s Secretary General Sofia Sprechmann Sineiro in a press statement. “If world leaders are truly committed to fighting this pandemic they urgently need gender equity. Not just lip service, but real action.”

Image credit: SJ Objio/Unsplash