Women in CSR: Nikki Korn, Cause Consulting

Welcome to our series of interviews with leading female CSR practitioners where we are learning about what inspires these women and how they found their way to careers in sustainability. Read the rest of the series here.

TriplePundit: Name and title. Briefly describe your role and responsibilities, and how many years you have been in the business.

Nikki Korn: I am the Principal of Cause Consulting. I am lucky to be able to co-lead a strategy firm committed to helping companies and nonprofits simultaneously strengthen business and impact society. Every day I am inspired by my work coaching organizations on how to be intentional and strategic in their approach to CSR and sustainability. With some clients just beginning their CSR journeys, and others charting new territory, together, we get to cause change.

Over the past 20 years in this rapidly evolving field, I have sought out new ways to integrate my passion for social issues, communities, and marketing communications. From Washington, DC-based public affairs and foundation consulting, to product marketing, and then to cause and corporate responsibility, I am having a ball.

3p: How has the sustainability program evolved at your company?

NK: We launched our firm with the belief that it does not matter what a company calls it – sustainability, corporate responsibility, CSR – as long as it has a shared vision and common language to set goals, develop strategies, and cause change. Today, ten years later, in a CSR field that is increasingly sophisticated and diverse, this intentional approach is more important than ever. Thus, at our firm, we are looking for new ways to take action, communicate, and inspire. We are aligning around the power of shared purpose and values; enhancing brands to unify the diverse elements of CSR; and harnessing storytelling and visuals to mobilize stakeholders.

3p: Tell us about someone (mentor, sponsor, friend, hero) who affected your sustainability journey, and how.

NK: In the late 1990s, I had the pleasure of working closely with the team at Chevrolet to build a cause initiative called Chevy R.O.C.K. (Reaching Out to Communities and Kids). The person at the helm of Chevrolet was Kurt Ritter. He is one of the smartest, humblest, and most inspiring leaders I have ever worked with. He knew his people, his business and his role. He would listen, ask great questions, provide concrete direction, and trust we’d get there. At every meeting, I remember him asking each of us for our opinions, before offering his own. He was a great coach! Kurt helped me recognize the power of guiding and coaching other professionals on their CSR journeys, joining with them and bringing out their talents, knowledge and expertise to achieve success.

3p: What is the best advice you have ever received?

NK: “Stop, take a long, deep breath, and plan out where you want to go.” As an athlete, this has always stuck with me. Applied to the CSR field, it means be intentional! Make sure you build well-thought-out strategies that generate short-term, meaningful “wins,” allowing the long-term results to come.

3p: Can you share a recent accomplishment you are especially proud of?

NK: I am psyched that Cause Consulting is celebrating its tenth anniversary in 2014. Time flies. I am incredibly proud of my expanding team and how they continuously bring creative solutions and big ideas to the table. Moving into our new, larger office space took some patience and hard work on everyone’s part, but now it is home.

3p: If you had the power to make one major change at your company or in your industry, what would it be?

NK: I believe that great brands have a deeper purpose and DNA beyond being just a great product or service. I wish that more marketers, especially pure brand marketers, would seek out and embed a human and societal dimension into their brand’s promise and experience. I love working with marketing teams and it’s often these teams that have the most power and assets to truly cause positive societal and business change. So…why is it often so hard to get them on board? I’d love to change this, and I’ll keep trying…

3p: Describe your perfect day.

NK: My perfect day starts in Warren, Vermont where I am blessed to spend family time vacationing. After sleeping in and grabbing a three-shot latte, I head to the courts for a good two hours of tennis. Then, off to “my” quintessential, local country Warren Store for a sandwich on their fresh French bread. Eating outside by the Mad River, we catch some rays and relax. The irony is that I love sitting on the rocks by the river, but even on the hottest day will rarely be found jumping into that icy water. Up again for more tennis, a nap, and finally to Flatbread for the best pizza in the world at their amazing outdoor setting. The evening always ends with lots of snuggles with my kids and my husband. Shhh, don’t tell anyone, it is our special, happy place.

2014: The Year of Impact Investing

By: Beth Sirull, President, Pacific Community Ventures

This is shaping up to be the year of impact investing -- the year when impact investing ceases to be a buzzword or a niche play and when mainstream investors start to recognize the opportunity presented by this growing investment thesis.

Impact investing refers to investing capital with the intention of producing social benefits alongside financial returns. Take, for example, Pacific Community Ventures’ 2003 investment in the Evergreen Lodge, a historic Yosemite destination. Over the course of a decade, Evergreen's management team transformed the lodge from a mom-and-pop seasonal motel to a year-round, premier destination resort. Since PCV’s investment, Evergreen’s leadership not only increased revenues by 18 times and its number of employees five-fold, but also implemented an internship program for at-risk Bay Area youth as well as cutting-edge energy and environmental conservation practices. PCV exited this investment in 2013, with substantial returns — both financial and social.

Impact investing is here to stay.

A growing body of research illustrates that impact investing has not only arrived, it is growing exponentially. The Aspen Network of Development Entrepreneurs (ANDE) recently estimated that there are 199 impact investing funds; a survey by J.P. Morgan and the GIIN in late 2011 found that 19 percent of the impact investors surveyed believe the market is about to take off. J.P. Morgan also estimated that global impact investments exceeded $50 billion in 2010 and predicted that invested capital in the impact investing market could reach $400 billion to $1 trillion by 2020.

What makes impact investment funds successful?

The latest important research, issued late last year at the World Economic Forum by PCV in collaboration with the Center for the Advancement of Social Entrepreneurship (CASE) at Duke University and Impact Assets, paves the way for a new era of impact investing – one that brings the market closer to the mainstream.

The report, "Impact Investing 2.0: The Way Forward – Insight from 12 Outstanding Funds," represents the largest public release of data on the financial performance of 12 successful impact investing funds. The authors analyzed more than $1.3 billion in investments across more than 80 countries, and they reached exciting new conclusions about the factors and trends that lead to a fund’s success.

- Successful impact investing requires "policy symbiosis," a deep, cross-sector partnership with government. The successful funds studied received direct support from the government as an investor or as a co-creator; or they leveraged government policy initiatives -- like the Community Reinvestment Act -- to stimulate or accelerate investment. The funds were also active in the creation of more supportive public policy to encourage impact investing. This is true not only in the United States but also around the world. The Impact Investing Policy Collaborative has been chronicling and advancing these policies for the past several years.

- Next, the authors discovered across the board that funds had accessed “catalytic capital” in the form of grants, guarantees or seed investments from foundations, government or other sources of seed funding. The catalytic sources of capital served to unlock billions of dollars in non-catalytic investments. This initial capital served as the foundation of a "capital stack" that enabled different types of investors, with different requirements, to invest -- producing total investable dollars many times the amount of that initial catalyst.

- Third, the authors found that because impact investing straddles multiple sectors it requires “multi-lingual leadership” that goes far beyond money management. Successful fund managers and leaders had experience in multiple arenas, including finance, government, public policy and philanthropy.

- Finally, whereas previous analyses of the impact investing market differentiated between funds that were either "impact first" or "mission first," the authors described the successful funds studied as “mission first and last,” meaning that impact investing is in the fund’s DNA. The successful funds put financial and social objectives on equal footing, which enforces discipline, avoids mission drift and keeps funds on track.

Looking to the future

The scaffold has indeed fallen, and impact investing is here to stay. But there is still much more work to be done to activate capital and to grow the field in a meaningful way. First, more research is needed to pinpoint what makes investments successful in different asset classes. Second, industry (and educational institutions) will have to grapple with the new requirement for multilingual leaders who have experience across different sectors. How do we accelerate the development of these leaders? And third, public policy will have to keep up the pace to build a stronger framework and drive more capital to solve the environmental and social problems that are just too big for governments to address on their own.

Beth Sirull is president of Pacific Community Ventures, whose mission is to create jobs and economic opportunities in low income communities through the direct support of small business and entrepreneurship as well as by promoting policies that drive investment in underserved communities. PCV is an impact investor providing capital directly to small businesses. The organization also works to build the capacity of these small companies to accept and deploy impact capital effectively.

Impact investment helps companies attract higher calibre staff

Impact investment - sustainably supporting charities and social enterprises for the long term - can be used as key way to recruit and retain high quality staff says a new survey from SharedImpact.

The SharedImpact Corporate Purpose survey conducted by YouGov also shows that 95% of people would be encouraged to work for a company that acted socially responsibly, and 87% would prefer to work for a company if they were told that it placed importance on empowering its employees in its donation decisions.

But it is not enough to simply donate to charity, says the survey. Engaging employees and helping charities get access to loan finance is also highly desirable. In fact, 84% of people believe that charities should have the same access to finance as businesses, and the vast majority that employees should be involved in the donation decisions.

SharedImpact, the world's first global donor-advised impact investment fund, maintains the survey reveals that people are becoming increasingly socially conscious, and place a great deal of importance on companies behaving with a socially responsible corporate purpose.

Paul Cheng, chair of SharedImpact, commented: “Our research shows that the majority of people are looking to work for a company that embraces a socially responsible corporate purpose. With more and more people looking to become engaged in this process, it is vital for businesses to follow suit in order to win the war for talent.These findings reveal that customers and employees are encouraged to purchase from and work for a business if it is socially responsible. That message has never been stronger.”

You can view the entire report here.

Picture credit: Astellas employees volunteering at the White Lodge Centre, Surrey.

Thermodynamics: Why Technology Won't Save Us

Submitted by Guest Contributor

By William Ophuls

In a previous essay on complexity, I said that the anti-ecological Titanic created by industrial civilization will not achieve sustainability by recycling the deck chairs, feeding the boilers with biofuels, installing hybrid winches and windlasses or the like. In other words, technology cannot save us from having to make fundamental, even radical changes in our way of life.

Why is this?

Shadow Costs

In brief, the laws of thermodynamics, among the most basic known to science, forbid infinite technological improvement. This is due to shadow costs and diminishing returns.

Using technology, we humans turn matter and energy from one form into other forms that are more useful to us. But every such transformation incurs losses—that is, it has a shadow cost. There may be just as much energy in the system after the transformation as before, but the quality of that energy is poorer.

is poorer.

To put it another way, all technological transformations cause matter and energy to move inexorably downhill from a more useful or concentrated state to one that is less useful or concentrated. This movement is called entropy, and the overall effect of human civilization—especially an industrial civilization—is to expedite entropy by manufacturing various forms of depletion, decay, degradation and disorder along with the desired goods and services.

An example will illustrate the point concretely and also make clear why technology cannot forever overcome thermodynamic limits. When coal is burned to produce electricity, only about 35 to 40 percent of the energy in the coal is converted into electrical energy. The rest becomes waste heat, various gases (such as carbon dioxide), various chemicals (such as sulfuric acid), particulates and ash. Even the electricity dissipates into the environment as waste heat once it has done its work.

From the physicist’s point of view, the books are balanced – there is just as much matter and energy in the system as before – but what remains is significantly lower in quality. So for every unit of good that man creates using this particular technology, he manufactures two units of bad—and even the good is ephemeral.

Diminishing Returns

Could we improve on this? Yes, but not as much as we might like. Improvement in engineered systems soon encounters diminishing returns (which means that it takes a leap to an entirely new technology to make substantial progress). For instance, generating electricity from coal-fired plants is a mature technology, so any thermodynamic gains would likely be modest.

However, even a magic wand would be of little use in this case. Perfect efficiency is impossible, for that would be tantamount to perpetual motion, which the entropy law forbids. But even if we were able to raise useful output to the thermodynamic maximum of 77 percent, this only represents a doubling of efficiency.

Tech Innovations Increase Thermodynamic Costs

Moreover, ironically, technological innovations often increase thermodynamic costs. Take the substitution of the automobile for the horse. To make a horse requires a modest investment in pasture, water, and fodder for the two to three years it takes from conception until the horse can work.

But to make a car requires not only many direct inputs—steel, copper, fuel, water, chemicals and so forth—but also many indirect ones such as a factory and labor force as well as the matter and  energy needed to sustain them.

energy needed to sustain them.

To use a technical term, the “embodied energy” in the car is many times that in the horse. And the thermodynamic cost of operating the car is far greater. A horse needs only a modicum of hay, water, and oats procured locally without too much difficulty. But the auto requires oil wells, refineries, tankers, gasoline stations, mechanics’ shops, and so on—that is, a myriad of direct inputs that are difficult and expensive to procure, as well as a host of indirect costs.

So the substitution of auto for horse may have brought many advantages, but at a heavy thermodynamic price.

Technology Not a Source of Energy

The technological leap represented by the computer is no different. Its partisans may believe that it will be the instrument of humanity’s final liberation from the tyranny of nature, but a quick glance at the enormous quantity of embodied energy in each computer and in the systems that support it, plus the major energy requirements needed to operate networks and servers, testify otherwise.

The idea that technology will allow us to do ever more with ever less is a delusion.

It is vital to understand that technology is not a source of energy. That is, it is not a fuel in its own right, only a means for putting fuel to work or for transforming one resource into another.

Thus, for example, coal can be converted into gasoline—but at a high thermodynamic price, because much of the potential energy in the coal is lost in the process. Or technology can make the conversion of energy more efficient—but, as we have seen, only up to a point. Similarly, technology can make new energy resources available—but only by first expending energy to find and exploit them.

So technology does not make energy out of thin air. On the contrary, technology is always ultimately dependent on the supply of energy. If the quantity or quality of energy resources dwindles, the power of technology declines along with them.

Technology Depends on Energy Density

Above all, technology depends critically on energy density. The total amount of available energy is staggering, but very little of it is available in concentrated form.

That is the beauty of fossil fuels. They are the energy-dense residue of past solar energy in the form of buried organic matter that has been subjected to eons of geological heat and pressure. With such a concentrated source of energy, technology can perform wonders, because it is, in effect, traveling thermodynamically downhill from dense to diffuse—from coal to electricity and waste heat, instead of vice versa.

By contrast, dispersed energy can do much less work and therefore limits what technology can do. Solar rays will make hot water for a household but do not easily lend themselves to running a multi-megawatt power plant that supplies power on demand.

Energy Return on Investment

One of the best ways of understanding the relationship of energy, entropy and technology is by examining economic systems in terms of net energy—that is, how much energy remains after subtracting the cost of effecting the transformation. The technical term is energy return on investment or EROI.

For example, it used to be that it took the energetic equivalent of only one barrel of petroleum to obtain a hundred barrels—that is, an EROI of one hundred to one. But this ratio has now declined to roughly fifteen to one and is destined to fall even further, because the remaining resources are on the whole more difficult, dangerous and  expensive to extract and refine.

expensive to extract and refine.

Hence the mere quantity of a resource is not what is important. A billion barrels of oil in the ground may sound like a lot, but if it costs five hundred million barrels to extract and refine, then the net energy is only five hundred million barrels, and the EROI is just two to one.

Peak Quality Is the Problem…

Because quality, not quantity, is the critical issue, the debate over so-called peak oil is often incoherent. The real concern for a civilization critically dependent on fossil fuels is not really the moment in time when the maximum rate of petroleum extraction is reached, after which production enters terminal decline, but rather the inexorable trend toward lower net energy and higher costs, both monetary and environmental.

New discoveries and improved techniques may boost production in the short term, but to hail them as refutations of peak oil while ignoring the long-term trend toward lower net energy makes no sense.

Low net energy is why most of the schemes for replacing fossil fuels with one or another form of ambient solar energy on a scale that would satisfy current demand, much less future growth, will come to naught; the EROI will be marginal, and the capital costs exorbitant.

Thermodynamic Vicious Circle

To reiterate, unless it is a matter of simply scooping up found wealth, technology is not a panacea. It is dogged at every step by the laws of thermodynamics.

Civilization is trapped in a thermodynamic vicious circle from which escape is well nigh impossible. The greater a civilization becomes, the more the citizens produce and consume—but the more they produce and consume, the larger the increase in entropy.

The longer economic development continues, the more depletion, decay, degradation, and disorder accumulate in the system as a whole, even if it brings a host of short-term benefits.

Depending on a variety of factors – the quantity and quality of available resources, the degree of technological and managerial skill and so forth – the process can continue for some time but not indefinitely. At some point, a civilization exhausts its thermodynamic “credit” and begins to implode.

Adapted from the author’s Immoderate Greatness: Why Civilizations Fail, CreateSpace, 2012.

About the Author:

William Ophuls is the pen name of Patrick Ophuls. He served for eight years as a Foreign Service Officer in Washington, Abidjan and Tokyo before receiving a PhD in political science from Yale University in 1973. In addition to Immoderate Greatness, he has published three books on the ecological, social and political challenges confronting modern industrial civilization. www.ophuls.org

Hey Good Lookin’! You Should Be a CEO

They say that beauty is in the eye of the beholder, and it just might be that beauty is also in the eye of the shareholder.

Joseph Halford and Hung-Chia Hsu, two economists at the University of Wisconsin, say that one way to increase a company’s stock price is to hire a hot or hunky CEO.

Yes, just when you thought that our society could not get more superficial, it does.

While it has been shown that the good-lookers in the CEO crowd earn bigger paychecks, in "Beauty is Wealth: CEO Appearance and Shareholder Value" Halford and Hsu found a link between attractiveness and company profitability after examining the looks of 677 people who served as CEOs of S&P 500 companies between 2000 and 2012 and the performance of their companies' stocks at various points.

“Overall, our findings suggest that more attractive CEOs receive higher compensation for a reason: They create value for shareholders through better negotiating power and visibility,” Halford says.

Halford and Hsu used a Facial Attractiveness Index (FAI) that assesses aspects of facial geometry (something long linked to universal standards of beauty). They then compared these scores to various measures of stock performance and compensation, and came up with four main conclusions:

• Halford and Hsu confirm prior research, which shows that more attractive CEOs receive higher total compensation than their less attractive peers. This pay difference is called the "beauty premium."

• Stocks rise when attractive CEOs start their jobs. "We find that FAI has a positive and significant impact on stock returns surrounding the first day when the CEO is on the job, indicating that shareholders seem to perceive more attractive CEOs to be more valuable," the economists write.

• Attractive CEOs get larger surpluses from merger and acquisition deals. Halford and Hsu say this finding is linked to the idea that attractive CEOs are more persuasive negotiators. This allows them to negotiate greater surpluses during M&A transactions and see greater stock returns when the deals are announced.

• Stocks also rise if the company's attractive CEO appears on TV. “If visibility is an important determinant of stock prices, firms may hire more attractive CEOs…to help enhance firm image.”

They say their findings “shed light on how the appearance of corporate insiders affects corporate decisions and outcomes. It is well established in the asset pricing literature that investors’ decisions are likely based on initial, possibly unconscious, impressions and perceptions.”

It is also said that beauty is skin deep, so perhaps we should consider something deeper than the “facial geometry” of our CEOs.

Image credit: Flickr/johnparker2012

Non-GMO Cheerios: A Sign of the Future?

Environmentalists are calling it a victory. General Mills, however, says it's just a recipe change.

In a recent blog post, GMO Inside.org took credit for General Mills' statement last week that it was making its regular Cheerios out of non-genetically modified sources (GMOs) – a change from its other Cheerios products, which do contain GMOs.

“Cheerios’ principal ingredient has always been whole grain oats, and there are no GMO oats,” says General Mills.

That’s true. According to Quaker Oats, which is owned by Pepsico, it doesn’t use GMO oats, either. There are no GMO-friendly oats on the market.

But the sourcing change that has given environmental groups like GMO Inside reason to crow about isn’t the oats but those other, seemingly insignificant additives that make the Cheerios taste good: sugar and cornstarch.

“So we were able to change how we source and handle ingredients to ensure that the cornstarch for original Cheerios comes only from non-GMO corn, and our sugar is only non-GMO pure cane sugar,” admitted GM.

It’s a change that, however much GM wants to downplay, is significant. According to the website NonGMOProject.org, approximately 95 percent of all sugar made from beets (the main source for sugar in manufactured products) in 2010 came from GMO sources. Approximately 88 percent of corn and corn products were GMO in 2011.

So why wouldn’t GM want to make a big deal over this? As Mike Adams on NaturalNews.com points out, this is so not-an-issue to GM that it hasn’t even announced the change on its cereal boxes.

"For starters, there doesn't seem to be anything in the announcement about General Mills adding any sort of 'non-GMO' label to Cheerios boxes,” notes Adams. "It seems as if General Mills wants Cheerios to be secretly non-GMO while avoiding bringing any real attention to the issue."

Maybe. But it may also have to do with the less-than-savory press that GM recently received for its objections to state laws regulating GMOs. According to GM, its objections concerning states, such as Washington, regulating GMOs had nothing to do with its position on consumer choice and everything to do with the way the issue is handled.

Still, the recipe change is a sign that GM knows that this is a hot-button issue for consumers, and that an increasing number are pushing for state laws that will give the public the freedom to decide whether or not to buy products containing GMOs. With the increasing demand for non-GMO products both here in North America and in Europe, tweaking the Cheerios recipe is not only a smart way to see how the market responds, but also a savvy way to show support for consumer advocacy.

Image credit: TheImpulsiveBuy

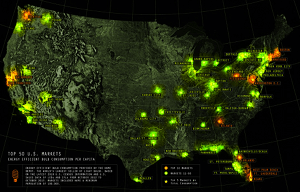

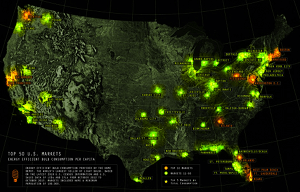

Home Depot Tracks Top Adopters of Energy Efficient Bulbs

The final year of the incandescent light bulb phase-out began on Jan. 1, meaning manufacturers have already stopped producing traditional 40- and 60-watt bulbs. In keeping with a law passed by Congress in 2007, the phase-out started with the 100-watt incandescent in 2012 and progressed last year to the 75-watt variety, but experts say this final stage is the most significant.

Noah Horowitz, a senior scientist at the Natural Resources Defense Council, told National Geographic's energy blog that 40- and 60-watt bulbs represent "more than 50 percent of the [consumer lighting] market." While the sale and purchase of incandescents will continue until supplies run out, many consumers who have been slow to jump onboard with energy efficient alternatives may face a rude awakening in the near future.

With the last leg of the gradual phase-out already in effect, Home Depot released a data-driven map that uses sales numbers to create a per capita look at U.S. adoption of energy efficient bulbs. By combining the latest 2010 Census data with U.S. sales from 2012 through 2013, the home improvement giant compiled a list of the top 50 cities for efficient bulb adoption - revealing the locales that are leading the charge and areas that are still lagging behind.

The top 10 cities for energy efficient bulbs range from areas known for sustainability, such as Seattle and San Francisco, to smaller markets like West Palm Beach and Fort Lauderdale, Fla., according to the study. Eight of the top 10 markets offer rebates for either LEDs or CFLs, and four of those provide rebates for both. Although the study was limited to markets of 100,000 or more, the Midwest is noticeably absent from the list, as is a large portion of the Southeast.

Obviously, consumers purchase their bulbs from stores other than Home Depot, but the Atlanta-based retailer is the world's largest seller of light bulbs and operates more than 2,200 stores in the U.S. alone. So, while it may not be a definitive list of energy efficient bulb adopters, the Home Depot heat map surely represents a large part of the picture.

The so-called light bulb "ban" has become a favorite target of conservative pundits in recent years, but Home Depot isn't the only top company to come out in support of it. Walmart recently opened its first 100 percent LED lit store and launched a budget-friendly line of Great Value LED bulbs. Another major light bulb manufacturer, Phillips, publicly defended the phase-out back in 2012, despite controversy surrounding a 60-watt LED bulb that received $10 million in funding from the Department of Energy.

For more information on which cities fared best in the Home Depot study, look at the full heat map here.

Image credit: Home Depot

How Entrepreneurs Are Helping the UN Solve Social Problems

By Geri Stengel

In a world in which social needs seem to be ever-increasing, we need to be more creative in the way we solve these problems. One approach is through public-private partnerships, which are transforming the way we problem-solve at local, national and international levels. The United Nations is entering into these partnerships, too.

Elizabeth Gore (no relation to Al Gore) is working to support the UN on these initiatives. She is the first-ever resident entrepreneur at the United Nations Foundation and chair of UN Foundation’s Global Entrepreneurs Council. Entrepreneurs think differently, Gore asserts. They’re not bound by doing things the same old way.

"Entrepreneurs don’t see barriers," she says. "To an entrepreneur, barriers are merely challenges that you climb over, slip under, go around or push through. Many entrepreneurs think globally and understand the importance of having a thriving community around them -- corporate social responsibility is part of their DNA. Working with entrepreneurs on solving world problems is a natural fit."

Every two years, Gore recruits a new group of 10 entrepreneurs to be part of the council and provide their innovative thinking to problems that, as a group, they decide to focus on. The latest council is focused on women and girls, among other issues. Research shows that when women are economically empowered, entire communities benefit. Women spend more of their income on food, shelter, healthcare, education and other family needs.

Entrepreneurship is a significant source of women’s economic opportunity – employment and income generation – for both urban and rural women in low-income countries, according to A Roadmap for Promoting Women’s Economic Empowerment, a report by UN Foundation and the ExxonMobil Foundation.

Whether they're running a big global company or a small local one, "entrepreneurs share a common mindset" and have an astonishing ability to persevere in the face of obstacles, Gore says. Angela Duckworth, a psychologist at the University of Pennsylvania, calls it grit. Of course, entrepreneurs also are passionate, resourceful and creative problem-solvers.

One of the people that fits the entrepreneurial profile to a tee is Ingrid Vanderveldt, entrepreneur-in-residence at Dell and a council member. Vanderveldt has founded and sold a couple of companies. She is on a mission to empower a billion women by 2020 through business, policy and media. Being on the council is a perfect fit for Vanderveldt and the company for which she works.

Dell has made entrepreneurship its cause. Entrepreneurship and technology have the ability to change the world and Dell is committed to making that happen. Between 1985 and 2005, when the PC model was proliferating, "the percent of people worldwide living in poverty was cut in half," said Michael Dell in his keynote at Dell World in December. "We're going to keep doing what Dell does: making technology more accessible and affordable; providing more value and making it easier to use. We're providing the infrastructure for the next billion people to rise out of poverty."

Dell is also deeply committed to supporting women entrepreneurs with Dell Women’s Entrepreneurs Network, Dell Pay It Forward and the world’s first gender-focused, global entrepreneurship index, based on the Entrepreneurship and Development Index (GEDI) it commissioned last year. The research identifies barriers that women face in starting and scaling high-growth companies in 17 countries. I will be fleshing out this research by developing lessons-learned and best practices by women who overcame barriers in the U.S.

One UN Foundation initiative that Vanderveldt is particularly passionate about is Girl Up, which helps American girls raise awareness and funds for UN programs that help some of the world’s hardest-to-reach adolescent girls.

Successful women entrepreneurs tend to be more socially responsible and philanthropic than their male counterparts. A fellow gal-pal entrepreneur of Vanderveldt’s is Heidi Messer, co-founder, president and COO of LinkShare and and now chairman and co-founder of Collective[i]. She offered to host a fundraiser for Girl Up early this year. Naturally, Gore will be at the event with several other council members. That’s girl power at its best.

When entrepreneurs are faced with an insurmountable obstacle, we recite that childhood mantra: “I think I can. I think I can. I think I can.” It’s time we apply that mantra to solving social problems.

Image credit: Flickr/Ashitakka

Geri Stengel is founder of Ventureneer, which connects values-driven small business owners with the knowledge they need to make the world a better place and to thrive as businesses.

McDonald’s makes sustainable beef move

Fast food chain McDonald’s has committed to a goal of purchasing verified sustainable beef by 2016.

Admitting it’s both ‘complex’ and ‘a big challenge’, the patty giant has been working on the initiative since 2011 when it developed the Global Roundtable for Sustainable Beef (GRSB) with partners WWF, Cargill and JBS.

The GRSB group has now drafted guiding principles and best practices for sustainable beef. Up until now, there hasn’t been a universal definition of sustainable beef. McDonald’s says that it aspires to support these criteria in 2014, develop targets and begin purchasing verified beef during 2016.

Over the years, the chain has made several efforts to improve its responsible purchasing. Currently it purchases varying quantities of whitefish certified by the Marine Stewardship Council, coffee certified by the Rainforest Alliance, and packaging certified by the Forest Stewardship Council.

Picture credit: © Alex Melnick | Dreamstime Stock Photos

Newlight Makes Plastic Out of Thin Air (Not Oil)

Imagine if you were given one wish to do anything you could about climate change, what would you do? Resetting the atmospheric carbon concentration back to pre-industrial levels would certainly be a big help. But at the rate we are currently generating CO2, adding 2.1 ppm per year and rising, if we didn’t do something else to slow down our emissions, we would be right back where we are today in a surprisingly short amount of time.

What if we could pull CO2 out of the air and convert it into something useful, something that requires the generation of CO2 to produce today? Wouldn’t a reversal like that be helpful?

That is exactly what a company called Newlight Technologies is doing. Its patented technology extracts carbon from the air and converts it into long-chain polymers that can be used as substitutes for oil-based plastics.

Every pound of conventionally produced plastic generates 6 pounds of CO2. Using Newlight’s method not only avoids this carbon production, but it also removes an additional pound of CO2 from the atmosphere. Considering that worldwide production of plastic is currently 77 pounds for every person on the planet, and increasing by 3 percent every year, shifting to this method of production represents an opportunity to reduce carbon emissions by close to 2 billion tons annually. That’s about 4.7 percent of the current global emission level. Of course a much larger portion of emissions are generated from transportation, electricity generation and the heating of buildings and water, but this is still a significant amount.

Newlight’s carbon capture technology is inspired by nature. It extracts carbon molecules from air containing greenhouse gases and rearranges those molecules into long-chain thermoplastic polymers that can match the performance of oil-based plastics. Their products can also outperform oil-based plastics on price. The impact of this approach is comparable to bioplastics, though the net footprint should be lower due to the absence of agricultural inputs such as land, water and chemicals.

The company was founded in 2003 by alumni of Princeton and Northwestern. They have been operating at commercial scale for several years, obtaining their inputs from such dirty sources as wastewater treatment facilities, landfills, digesters and energy facilities.

Their plastic resins are available in a variety of functional grades, providing green replacements for various grades of: polypropylene (homopolymer, glass-filled and impact co-polymer), polyethylene (HD, LD and LLD), ABS, high impact polystyrene, PMMA and TPU. Newlight’s AirCarbon resins can also be used in extrusion, blown film, cast film, thermoforming, fiber spinning and injection molding applications.

All the resulting end products can be both recyclable and biodegradable, depending on the formulations used and the requirement for durability.

According to the company, "by using greenhouse gases as a carbon input, AirCarbon resins, including AirCarbon-350, can be produced as a carbon-negative thermoplastic material, quantifiably reducing the amount of carbon released into the air in every pound of plastic made."

It’s innovations like this one that the doomsayers have overlooked in there pronouncement of “game over.” However, we need more of them, and we need them fast. Of course, there is the fact to consider that we use too much plastic and often don't dispose of it responsibly. And there are those who feel we'd be entirely better off without it. Though I feel there are places where plastic makes sense in applications where low-cost, lightweight material is needed.

How about a process to extract the CO2 from the air and turn it directly into energy? Green plants can do it, so why can’t we? Researchers in Minnesota are looking at using CO2 as a heat transfer fluid to vastly improve the performance of geothermal power generation. And if the EPA doesn't cave in to pressure from oil companies who would like to see them withdraw support for biofuels, we might just see third generation biofuels that convert carbon into energy more directly.

Image credit: Nemo’s Great Uncle: Flickr Creative Commons

RP Siegel, PE, is an inventor, consultant and author. He writes for numerous publications including Justmeans, ThomasNet, Huffington Post, and Energy Viewpoints. He co-wrote the eco-thriller Vapor Trails, the first in a series covering the human side of various sustainability issues including energy, food, and water in an exciting and entertaining romp that is currently being adapted for the big screen. Now available on Kindle.

Follow RP Siegel on Twitter.