Urbanity: A Look at Urban Evolution in 2050

As a lead-up to Abu Dhabi Sustainability Week, Jan. 18-25, Masdar sponsored a blogging contest called “Engage: Cities and Sustainable Development.” The following post, a fictional piece set in 2050, was the winner.

By Tyler Caine

Associated Press – October 17th, 2050 – New York, NY

Yesterday afternoon, New York City’s administrators reported that the city has reached its goal of resource neutrality. This is a culmination of a multi-decade effort marred by numerous setbacks, including the Hurricane Katie in 2017 and Superstorm Heather in 2032. With less than two months before the end-of-the-year deadline, New York joins several international urban centers in completing the challenge set forth during the 2016 Sochi Accord. The Accord countered the once widely accepted practice of structuring cities as dense sinks of resources, requiring outlying rural and suburban land to survive.

The Big Apple was not the first city to achieve its dynamic equilibrium with the biosphere, but it is the largest in the United States. Contrary to early 21st century beliefs, post-industrial cities provided the flexibility necessary to become resource neutral. Several cities have already surpassed the goals of the Sochi Accord and achieved the coveted “Net Positive” rating from the USGBC’s LEED "Mid-Millennium" rating system.

New York’s Mayor, Sasha Rodriguez, commented on the city’s long road. "The beginnings of success came from acknowledging the city as a system of systems. There was no silver bullet, but the exponential leaps in efficiency came from helping multiple systems evolve together and letting them benefit from each other’s progress."

Several technological advances also spurned advancement. The city migrated from exporting food waste to using it to produce energy that now powers hundreds of thousands of homes in the five boroughs. Additionally, the growth of 3-D printing now allows massive amounts of “resources” to never leave the island, with old products and packaging easily broken down and printed into new ones.

The mayor was quick to point out, "Hanging our hat on technology alone would never have gotten us here." From the beginning of the century, the city has returned 35 percent of its vehicular street grid (which once comprised 25 percent of the city’s acreage) back to its citizens in the form of pedestrian plazas, alternative transit and green space. "[That] alone helped reduce heat island temperatures, deplete stormwater runoff and reduce emissions – all of which had positive energy repercussions."

City Council Speaker Richard Kennedy was quick to admit that regulation played a subdued role. "We never wanted regulation to act as a ceiling, but rather as a foundation supporting innovation. Whether it was LED lighting, next-gen appliances, recycling, or standards of building envelopes, I think the times we used the regulatory path were more empowering than restrictive."

So when asked whether laws or technology was the most important to the city’s progress, Mayor Rodriguez smiled and shook her head. “Neither actually. The biggest challenge was a cultural understanding of what we were trying to achieve and deciding to do it. Recycling laws don’t make people recycle. Bike lanes don’t make people ride. This administration, and previous administrations, merely facilitated options for urban evolution and the citizens of New York responded. Realizing that 'sustainability' was not a technological fix for a wasteful lifestyle was a conscious cultural choice. The results, well, they speak for themselves."

Leaving with some encouraging words towards the prospects of future progress, Deputy Mayor Wesley Chang said, “Oh, we’re not at the end. The smaller cities started with a leg up, but there is still a lot out there to accomplish.” According to the administration, future efforts include more space for urban farming, completing the “Street CONNECT” renovation of the subway system and adding to the city’s coastline resiliency storm measures.

Tyler Caine is a LEED-accredited architect practicing in New York City as part of COOKFOX Architects. In addition to his own blog, InterconGreen.com, Caine’s writings have been featured on ArchDaily, Green Economy Post and the Sustainable Cities Collective.

Ford F-150 Pickup Truck Trail Blazes New Green Technologies

Ford is taking another huge leap toward filling the void created by our lack of a national energy policy with the launch of its new F-150 pickup truck. Ford is stealing the spotlight at the North American International Auto Show by engineering a full-size pickup truck with an aluminum body. This is a bet-the-company move by Ford. The F-150 is both America's and Ford's vehicle sales leader. It has been the U.S. truck sales leader for 37 consecutive years. Losing this bet will rank with the Edsel. Winning it will be comparable to the success of the iconic Mustang.

Easing America's heartland into sustainability

The new F-150 delivers everything America's heartland loves about pickup trucks. This is a full-size truck. It screams tough. Ford's technology innovations underpin this visual impression. Its use of aluminum delivers "military grade" metal toughness. They claim their truck beds are now more dent-resistant than past steel trucks.

What an aluminum-alloy body also delivers is lighter weight. Ford claims cutting 700 pounds from last year's F-150 without sacrificing size. Reduced vehicle weight means increased carrying and towing capacity. It also means higher fuel economy.

Ford's new Eco-boost 2.7 liter V6 will further push up fuel savings. This engine has the horsepower and torque of a mid-sized V-8. While MPG performance has not been released, the combination of less weight and a more efficient engine should catapult the F-150 into fuel efficiency levels that previously could only be achieved by small pickups.

And the new F-150 delivers American jobs. The F-150 will be manufactured in Ford's Dearborn Truck Plant and its Kansas City Assembly Plant.

Can the F-150 bring America together?

America's pickup trucks are one of our cultural icons that embody the "don't trend on me" American spirit. The top three selling vehicles in the U.S. were pickup trucks last year. It has become the American technology path for making a personal statement, raising a family, and enjoying our love for hunting, fishing and boating. If the U.S. is going to embrace any form of a national energy policy to achieve energy independence and craft climate change solutions, it will require a solution to America's love of full-size pickup trucks. Ford has opened the door to this potential with the F-150.

The F-150 delivers on consumers' expectation of wanting it all. They want big trucks. They want fuel economy. They demand strong performance. Ford promotes the F-150 as their toughest, smartest and most capable truck. It also might become a symbol that we can come together on sustainability through technology innovation and vision, as demonstrated by Ford's big bet on the new F-150.

Image credit: Bill Roth

Bill Roth is an economist and the founder of Earth 2017 He coaches business owners and leaders on proven best practices in pricing, marketing and operations that make money and create a positive difference. His book, The Secret Green Sauce, profiles business case studies of pioneering best practices that are proven to win customers and grow product revenues. Follow him on Twitter: @earth2017.

Interview: Carry Somers of Pachacuti on the Fashion Revolution

In the second of our series Can Beauty be Benign, writer Holly Dawson talks to Carry Somers, founder and M.D. of Pachacuti, about what it means to run a truly ethical business.

There’s ethical fashion – and then there’s Pachacuti. The Derby, England-based label was one of the original Fair Trade trailblazers back in 1992 and remains the only ethical producer of genuine Panama hats. Since then, it has continued, as its name translates, to turn the "world upside down." It was the first company globally to have its entire supply chain audited and approved by the World Fair Trade Organization's SFTMS certification.

This is all due to founder and M.D., Carry Somers, whose determination and vision has seen the company thrive through recessions, death threats, armed robbery and Ecuador’s changing socioeconomic landscape.

Somers’ next groundbreaking project is Fashion Revolution Day, launched to mark the anniversary of the Rana Plaza disaster on April 14. To find out more, visit Fashion Revolution or follow @Fash_Rev on Twitter - where you can ask the question, "Who made my clothes?"

We caught up with her at Estethica at London Fashion Week, where Pachacuti was showcasing its new collection, including Panamas influenced by utilitarian servicewear and a new line of ethical fascinators.

Holly Dawson: Carry, you have been in the industry for so long. What advice do you have for upcoming ethical businesses and fashion companies?

Carry Somers: Firstly, I think it’s really important to show other designers that it is economically viable to have an ethical business. We have been going for 21 years, and we have always been profitable. Secondly, when it comes to Fair Trade or similar approaches, you must remember it is not a destination – it’s a process. We are constantly working to make our process more robust, beyond criteria or ticking boxes.

HD: Do you have an example of that?

CS: We recently plotted the GPS coordinates of every weaver, so you can actually see on the map where each hat was made. This was no mean feat, especially considering only 45 percent of the homes are accessible by boat. People talk about traceability – that’s what it meant to us.

HD: What’s most critical for your ethos – people or planet?

CS: People or planet? You can’t separate them! Although there is a common perception that Fair Trade is just social, not environmental. It has been stigmatized through some of the more well-known examples of Fair Trade, such as Fair Price coffee. There’s a real lack of understanding that Fair Trade actually covers 10 principles, of which environment is one.

HD: How does that influence the design process, compared with mainstream fashion companies?

CS: We have to be very much producer- and production-led, whereas other designers can be more fashion-focused. We have long lead times and can’t be so responsive to trends. It’s an advantage that we specialize in a classic item, but there are things we want to try sometimes, like the new fascinator collection, where we just have to be more patient than other designers.

HD: So how much of what you do is decided by the producers themselves?

CS: Almost everything. We do regular surveys with all our weavers to find out their time and expertise level, and that influences what we can make. For instance, we know from speaking to the women that they can weave coloured hats faster than plain ones, because of their poor eyesight and because they are often working at night. This also means it is easier for them to produce lower-grade hats. We are led by their capacity.

HD: Does this ever cause difficulties?

CS: The women are getting older – the average age of our weavers is now 56. Volume is also limited by the number of people in the association – an increasing issue, because fewer people have, or want to use, these traditional skills.

HD: How do you deal with that?

CS: We need to bring in more young people to keep the industry alive, but young people dream of migrating to America. They pay extortionate loans to coyotes believing they will get to the U.S. We are working with communities to create more incentives to stay, especially now [that] UNESCO has designated the craft of Panama hat-making an Intangible Cultural Heritage.

HD: What are your other main challenges?

CS: The challenge of Fair Trade is really the management aspect of our producers. The women's organizations are democratic, which results in a lot of change of management, meaning we lose all our orders and have to start from scratch. You know it’ll happen every year, sometimes less. It’s hard to put plans in place.

HD: How do you tackle that?

CS: We are trying to teach about the importance of continuity. We know a new administration is starting in January, so we have developed a manual with pictures, which shows you where to go for everything. For example, new hat blocks, this is the taxi driver that will take you to this place, etc.

HD: How do you handle the 'profit' part of the triple bottom line?

CS: I am just very careful about how to spend money. Starting in a recession [in 1992] makes you very conscious of money. I do all the accounting myself. I keep our costs to a minimum – we use public transport, for instance – but all our employees are paid really well and are happy in their work. Ultimately, all the money goes back into production.

Holly Dawson is editorial director of Ethical SEO, a digital communications consultancy based in the heart of the English countryside. She spends her days supporting good people to do interesting things online and thrive in the connection economy.

New BlackRock fund screens out tobacco stocks

Global investment manager BlackRock has launched the BlackRock Developed World ex Tobacco Index Fund to meet demand from organisations in the healthcare sector, charities, medical foundations and pension schemes.

The fund assists investors seeking to tailor their socially responsible investment strategies by providing a low cost exposure to global equity markets whilst also excluding stocks in the tobacco and controversial weapons sectors from their portfolios.

Doug Shaw, head of BlackRock’s Charities Business, said: “Many investors, not least UK charities, want to invest in a way which is consistent with their own ethos and values. BlackRock’s indexing expertise and long history of working with charities, health and life insurers have come together to provide this new low-cost fund designed to meet the demands of investors to gain global equity market exposure whilst screening out certain sectors".

The fund’s benchmark is the MSCI World ex Tobacco ex Controversial Weapons Index. The exclusion of tobacco and controversial weapons sectors in the fund will lead to small changes in country allocations, performance and dividend yield compared to the MSCI World Index.

The fund is part of BlackRock’s range of index solutions, which has £1.1 trillion of assets under management globally. BlackRock’s charities business is one of the largest investors of ethical active and passive funds in the UK and has over 5,000 clients. It offers a range of investment funds which follow socially responsible strategies and an individual portfolio management service for larger charities.

Picture credit: © Royen0822 | Dreamstime Stock Photos

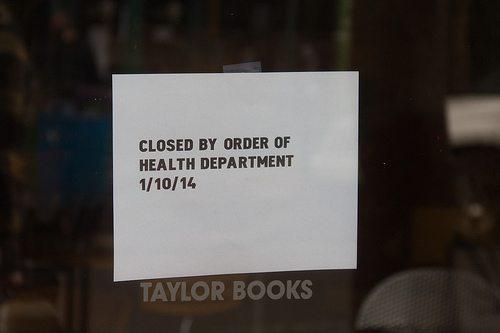

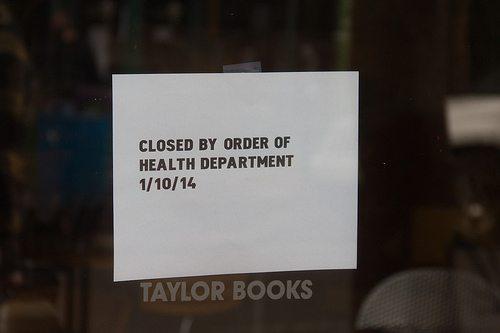

Cambodia in fashion supply chain spotlight after violent protests

Lawsuits are piling up against the Cambodian trade unions that called garment workers out on strike over low wages.

Tens of thousands of union members had downed tools on 24 December 2013. When they returned to work on 10 January 2014, demonstrations of support were staged at embassies and other locations worldwide.

The employers have reacted with lawsuits accusing the unions of inciting strikes, damaging property and assets and coercing and threatening employees who wished to work. More than 150 factories are already taking action and more cases are being prepared, said Khieu Sambo, a lawyer for the employers.

Cambodia’s garment industry employs more than 500,000 and is worth €3.38bn ($4.62bn, £2.8bn) a year, representing about 95% of the country’s exports. One reason for the legal action is that the Garment Manufacturers’ Association calculates the strike cost the industry $200m (£121m, €146m) and fears it could lose Western customers, including Adidas, Gap, H&M Hennes & Mauritz, Nike and Puma, through lack of competitiveness.

Chea Mony, president of one of the defendant unions, insisted the cases would be contested. He said: “They sued us because they want to intimidate us so that we won’t strike any more and we won’t help the workers. We are not afraid.”

The unions’ demonstrations backing demands for a doubling of the $80 monthly minimum wage had been crushed violently by the police and the military. Estimates of the number killed ranged from three to five, and up to 40 were hurt. At least 23 demonstrators were reported detained in an isolated prison.

This month the minimum wage was raised to $100 – and the government has banned workers’ demonstrations.

The regime’s crackdown on the demonstrations has been met with protest from labour rights groups, unions and the fashion industry worldwide.

Sam Rainsy, the opposition leader in Cambodia’s parliament, urged Western clothing companies to be responsible when buying. He said: “Check if there is any drop of blood in the garment they intend to buy.”

Gap responded: “We strongly oppose any form of violence and urge the government of Cambodia to drive negotiations among stakeholders to peacefully resolve this dispute.”

Jeroen Merk, an official of the Clean Clothes Campaign, the Netherlands-based alliance working for responsible conduct in the garment sector, said: “Whilst our primary concern is the safety and well-being of those workers who have been detained, we are also calling on brands to look at the long-term implications of their purchasing practices.

“Until brands recognise that these practices contribute to the poverty wages received by workers in Cambodia, and in turn the demonstrations we are witnessing, then no brand sourcing from Cambodia can claim to be acting fairly or decently.”

Seven Western companies have voiced their condemnation of the violence in an open letter to the Cambodian government, but the Clean Clothes Campaign has urged them to add demands for the detainees’ release, the restoration of workers’ rights and substantial wage rises, and to pay fair prices for goods.

However, Douglas Clayton, founder and chief executive of Leopard Capital, a private equity company that invests in frontier markets, said pessimistically: “There will always be another low-cost labour source somewhere.

“Western brands will do the minimum response required to avoid negative publicity. They know that most Western shoppers care more about value than values.”

Picture credit: © Maxsaf | Dreamstime.com

Intel takes affirmative acton on conflict minerals

Intel, the world’s largest electronic chip maker, is now excluding all minerals mined in conflict zones from its products.

Much of the gold, tin, tungsten and tantalum used in electronic devices is mined in the Democratic Republic of the Congo and neighbouring sub-Saharan countries where production and trading are controlled by armed groups and human rights are abused.

Intel’s decision comes ahead of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which becomes effective in May and compels companies to confirm in their filings to the US Securities and Exchange Commission that their supply chains are free of conflict minerals.

The new policy was announced at the Consumer Electronics Show in Las Vegas last month by Intel chief executive Brian Krzanich. “We felt an obligation to implement changes in our supply chain to ensure that our business and our products were not inadvertently funding human atrocities,” said Krzanich.

The decision is in line with Intel’s membership of the Conflict-Free Sourcing Initiative run by the Electronic Industry Citizenship Coalition, which encourages environmental and ethical responsibility.

Mark Morley, director of industry marketing for manufacturing at the GXS global supply chain consultancy, said: “Intel’s pledge … to make chips free of conflict minerals serves as an inspiration to the industry.

“An effective community management platform will be vital to ensure that companies can adhere to government legislation like the Dodd-Frank law.”

At the same time Intel has decided to replace the McAfee anti-virus brand name with Intel Security, thus severing the connection with the software founder John McAfee, who is having legal problems and has admitted extensive drug use.

McAfee’s response: “I am now everlastingly grateful to Intel for freeing me from this terrible association with the worst software on the planet.”

Chemical Spill in Tap Water Shuts Down Business in Charleston, West Virginia

Think of it as another practice run for local and federal crisis management. The chemical spill into the Elk River that breached the containment walls of one of Charleston, W.Va’s largest industries last week has closed schools, stopped commercial flights and converted the state capitol’s downtown core to a “ghost town.” It’s also painted an unnervingly clear picture of what can happen to a city’s infrastructure when a chemical spill shuts down its main commercial facilities.

After evidence of 4-Methylcyclohexane Methanol (MCHM), a foaming agent that is used to clean coal of impurities, was picked up by local water distribution plant West Virginia American Water last Thursday, state and county officials went into high drive to alert some 300,0000 residents of the pollution and to close access to drinking water. Hotels shut off water and warned residents not to use tap water to drink, bathe or wash their clothes until the alert was lifted. Restaurants closed, unable to wash dishes or supply coffee. WiFi-equipped facilities, stores and commercial services lost business.

A state of emergency was declared Thursday by Gov. Earl Ray Tomlin, and the National Guard was called in immediately to assist with distributing bottled water. Following assessment by state and county authorities, President Obama issued an emergency declaration on Friday. The declaration will free up a variety of federal programs and resources to help with local needs.

But what neither the state nor federal authorities have been able to do is to return business to Charleston’s otherwise active commercial core. Dining is at the heart of Charleston’s tourism business, with more than a dozen restaurants centered in and around the affected area. The spill has also cut short much of the travel opportunities to the city, with hotels and bed and breakfast inns unable to provide any safe washing facilities. After the tap water ban went into effect, commercial flights were suspended temporarily due to an agreement between airlines and a flight crew union that requires certain levels of service to be available at travel destinations. Some flights have not been reinstated.

According to Charleston’s Convention and Visitor Bureau, approximately 66 percent of the state’s population lies within 500 miles of the city, which is a tourism destination due to its year-round outdoor activities. It is also near popular fly-fishing locations on the Elk River.

The tap water ban affects nine counties in a widespread area west of the spill. Authorities aren’t saying how long the water ban will last, but while daily measurements show the chemical is decreasing in the water source, there is still a concern of toxic leaching from the shoreline. Readings must be consistently below one part-per-million. State officials haven’t released the current levels, but said as of this weekend that they may still have a ways to go before the ban could be lifted.

MCHM is toxic if inhaled, ingested or exposed to the skin. According to information released to the public by Eastman, which manufactures and sells the product, no information was available about acute symptoms of ingestion. However, information supplied by the National Institutes of Health website Toxnet contradicts this. According to federal law, Freedom Industries was required to file a report with the state’s Department of Homeland Security and Emergency Management on the status of the toxic chemical. At the present time, there has been no official comment issued on the status of that report, but the MCHM was found to be leaking from a container. The company did not have a permit to discharge the chemical into the river.

Local agencies and media outlets have been publishing a number of advisories to help residents cope with the water ban, including facilities outside the nine counties that have laundromats, restaurants and other facilities to use. The average drive is about 35 miles. Television station WOWK-TV has been publishing a list of places to obtain drinking water both in the state capitol and other municipalities in the nine counties, and businesses outside the affected area have opened their doors to assist with showers and water access.

While authorities are confident that levels of MCHM will decrease in the drinking source and the water ban will be lifted, there has been no statement yet on the environmental effects of the leak, which officials estimate at more than 7,000 gallons.

Photo credits: With gratitude to Foo Conner, Charleston, W.Va.

New York State Seeks Path to Energy Independence

Energy independence is a tricky concept, but New York Governor Andrew Cuomo shed some light on the subject in his State of the State address on January 8. He made it clear that the next few years are going to be boom times for the New York solar industry. You won't find it in the speech as delivered live, but turn to page 70 of the printed text and you will see the outlines of a big, fat, juicy package of initiatives to stimulate the community solar market.

Together, the programs are called Community Solar NY. That's an important step forward in New York State's progress toward a more diversified fuel mix, especially in its vast upstate region where the development of more local, distributed solar generating capacity would help to relieve the expense of building new transmission lines.

Speaking of transmission, though Hurricane Sandy's impact on the downstate New York City area is well documented, the Governor also noted the increased frequency of intense storms battering the upstate region. The development of more distributed solar generating capacity would help to harden the upstate grid against weather related distruptions.

That increased reliability dovetails with another goal outlined in the State of the State address, which is to focus on economic development upstate, where economic indicators have lagged behind national figures. In order to attract new manufacturers and other businesses, a more reliable energy infrastructure is a critical need.

With all that in mind, let's take a look at the Community Solar NY.

Community Solar NY

In the printed text of the speech, Governor Cuomo points out that so far the state has done a good job of promoting solar growth through NY SUN, which he initiated during his first year in office.

That's a good start. The original goal was to double the state's solar capacity, and the state's energy development office NYSERDA has estimated that developed capacity in 2013 was actually quadruple that of 2011.

However, there is still a huge untapped market for solar, consisting of individual property owners, schools, and communities, which don't have the resources to navigate the "soft costs" of solar installations -- basically, everything left over once you know the cost of the solar panels themselves.

Taking a hard look at soft costs

Aside from labor and other installation costs, those "soft costs" include critical factors from site assessment and financing to selecting a reliable vendor and obtaining the necessary permits for installation and grid connection.

Together, soft costs can easily total up to half the cost of a typical rooftop solar installation.

Soft costs are such an important factor in solar energy affordability that President Obama has made reducing them a priority under the Department of Energy's SunShot Initiative, through programs such as the Rooftop Challenge.

This is where the Community Solar NY will play a key role. It involves leveraging the state's solar experience and financing capabilities, so that small groups and communities don't have to reinvent the wheel for every solar installation.

Governor Cuomo noted that the state's solar initiatives have already qualified it for a Department of Energy Rooftop Solar grant, and now it's on to the next phase:

The next phase of this work is to lower the costs of project initiation by encouraging the aggregation of customers, helping more people to deploy solar through consumer awareness and lowering the total cost of solar photovoltaic systems.

The state will focus on tapping into its 5,000 public schools with a program called K-Solar, which will offer support to school districts through incentives, financing, and technical assistance.

The schools will also function as demonstration platforms and incentivizers for local communities to develop community-based models for aggregating their solar demand, with the aim of "solarizing" entire neighborhoods.

Let's also note for the record that New York State is a pioneer in the development of livestock biogas for its upstate dairy industry, and it is also pushing ahead with the development of shrub willow and other non-food biofuiel crops that can thrive in marginal lands upstate, so solar is just one element in a broader push for energy independence.

Energy independence, redefined

Not too long ago, energy independence referred to extracting more fossil fuels from U.S. sources, in order to reduce dependence on global supplies.

That necessarily involves more risk to American communities that host fossil fuel extraction, transportation, and waste disposal infrastructure, sometimes at the cost of existing economic activity, notably tourism and agriculture.

Last week's devastating West Virginia chemical spill, involving a substance used to wash coal, also illustrates the ripple effect that fossil fuel use has in terms of related high-risk industrial activity.

For energy independence to have any real and lasting meaning on the local level, the concept needs to evolve from a narrow focus on fossil fuels to embrace a more diversified fuel mix that places a priority on safety, reliability, and sustainability.

[Image (cropped): Bes Z]

Can the US Navy Turn the Tide with Biofuels?

At the beginning of the 20th century, 16 U.S. battleships -- all painted white with gilded bows -- set off on an unprecedented two-year voyage around the world. Dispatched by President Theodore Roosevelt as a show of America’s newfound naval might, the “Great White Fleet” ushered in a new era of U.S. involvement in global affairs.

More than a century later in 2009, Secretary of the Navy Ray Mabus announced that the Navy would demonstrate and then deploy a “Great Green Fleet,” a carrier strike group fueled by alternative energy sources. Developing the Great Green Fleet was one of five energy goals set by Mabus to reduce the Department of the Navy’s consumption of energy, decrease its reliance on foreign sources of oil and significantly increase its use of alternative energy. Mabus has also committed to obtaining at least 50 percent of the energy used by the Navy and Marine Corps from alternative sources by 2020.

Ambitious? Yes. Feasible? Definitely.

In 2012, the Navy demonstrated the Great Green Fleet’s potential in the Rim of the Pacific (RIMPAC), the world’s largest international maritime exercise. During these maneuvers, the Navy powered its ships, fighter jets and helicopters with biofuels.

What was the performance cost of running off renewables? Zero. Less than zero, actually, as engines saw a slight performance boost from the cleaner-burning biofuel.

Though the Great Green Fleet’s critics argued the biofuels used during the 2012 RIMPAC were significantly more expensive than petroleum-based fuels, this was only because the Navy ordered a small batch of the specialized fuel. As the Navy has scaled up production of biofuels by investing in specialized refineries, costs have plummeted.

A cornerstone of this effort is the “Farm-to-Fleet” program, part of the USDA-Navy partnership started in 2010, when President Barack Obama challenged his secretaries of Agriculture, Energy and Navy to investigate how they could work together to speed the development of domestic "drop-in" diesel and jet fuel substitutes.

“It's going to be very competitive with fossil fuels,” Mabus said last week during a discussion at the Commonwealth Club of San Francisco. “In fact, we're not going to do it unless it is competitive with fossil fuels.”

Mabus explained that going green was not only an environmental sustainability move, but also an economic and military imperative.

As anyone who has ever owned a car knows, the cost of fuel fluctuates every time there is so much as a hint of unrest in the oil-producing regions, such as the Middle East. With a petroleum-dependent fleet, the Navy is often forced to pay millions more than it budgeted when the cost of fuel shoot ups. This means it has less money to spend on operations, training troops and building new ships.

With the federal sequester and other austerity measures strangling military budgets, finding cheaper, more efficient energy sources is more important than ever.

“Now is exactly the time that we have to do this,” Mabus said. “A tightening budget situation makes it even more urgent, even more critical that we do this.

According to Mabus, the Navy has always been on the forefront of new energy technologies, switching from sail to coal, coal to oil, and pioneering nuclear. “Every single time, there were naysayers,” he said. “It’s one of our core competencies: changing energy.”

Investing in green technologies has also helped to save American lives, Mabus said. In Afghanistan, for example, for every 50 convoys sent to the front lines, one marine dies. Since oil is one of the main things these convoys haul, reducing the need for it will decrease the number of convoys needed, which will save lives.

Mabus said climate change and rising sea levels will make it increasingly difficult for the Navy to do its job. With a significant percentage of the world’s population living near oceans, sea level rise can trigger instability.

“Our responsibilities, our jobs, become bigger because of sea level rise,” Mabus said. There is serious concern for island-nations like the Maldives, which could disappear from the face of the Earth if sea levels rise much further.

The Navy often looks to its enlisted men for sustainability ideas, such as how to increase energy efficiency on its ships and land-based facilities. “People who join the Navy or Marine Corps have this willingness to change, and it’s part of the spirit of innovation,” Mabus said.

The Department of Defense is the biggest user of fossil fuels in the world, and the Navy uses about a third of it. With the U.S. having spent around $716 billion on defense in 2013, this isn’t chump change.

“What we do is we bring a market,” Mabus said.

Image credit: Commonwealth Club of California

South America's Largest Solar Thermal Power Plant to Be Built in Chile

Spain's Abengoa has landed the contract to design, build and operate South America's largest solar thermal power plant. Also known as concentrated solar power (CSP), Chile's Ministry of Energy and public sector development agency Coporacion de Fomento de la Produccion (Corfo) awarded Abengoa the contract to build a 110 megawatt (MW) CSP plant in Chile's northern Antofagasta region, where precipitation is lower, and solar insolation higher, than any other region in the world.

Following through on a recently enacted law that requires Chile's electric utilities to source 20 percent of their electricity from clean energy sources by 2025, the 110 MW plant is to be built with 17.5 hours of power storage capacity, which will enable it to generate and distribute clean, renewable electricity night and day.

CSP to spur clean, sustainable socioeconomic development

Construction of the CSP plant in the Antofagasta commune of Santa Elena, which is slated to begin in this year's second half, will entail placing highly reflective parabolic mirrors (heliostats) that track the sun's movement along two axes on ground mounts.

Built in a circular formation, the mirrors will reflect and concentrate sunlight to a receiver in the upper portion of a central tower. The receiver will transfer the heat to molten salts, which in turn will store and transfer it via a heat exchanger to a current of water -- generating superheated and reheated steam. The flow of steam feeds a turbine capable of generating some 100 MW of electrical power.

The project will stimulate social and economic development across the Antofagasta region, as well as cut carbon and greenhouse gas emissions by reducing reliance on coal and natural gas for power generation, thereby avoiding an estimated 643,000 tons of CO2 emissions per year.

Construction, operation and maintenance of the CSP plant, according to an Abengoa press release, will create "a large number of direct and indirect jobs for construction, development, commissioning and operation of the plant, as well as a network of services that will promote economic growth in the country."

Last October, Chilean President Sebastian Pinera signed into law a bill that requires electric utilities to source 20 percent of power generation from "non-conventional" renewable sources, including solar photovoltaic (PV) and CSP. An associated law shortens the time required for the permitting process from 700 to 150 days.

As per the new legislation, the government has begun holding annual auctions and accepting renewable energy project proposals and bids from developers. Abengoa won the international tender launched by the Chilean Ministry of Energy and Corfo to construct Latin America's first CSP plant.

The Chilean and European Union (EU) governments are providing subsidies to help finance the CSP project, financial terms of which were not disclosed. The Inter-American Development Bank (IADB), Germany's KFW Kreditanstalt für Wiederaufbau, the Clean Technology Fund and Canadian Fund are providing direct financing.

Image credit: Abengoa