How 'Hybrid Electric Buildings' Will Transform Commercial Real Estate

America’s commercial buildings are on the cusp of being radically redesigned into Prius-like hybrid energy centers. These buildings will create value by guaranteeing lower energy bills, plus increased worker productivity, while also delivering climate-changing environmental impacts.

Like hybrid electric cars, this is a global trend. The cost of enabling technologies is falling - driven by global economies of scale. In the U.S., the only question that impacts when "hybrid electric buildings" will be built in your town is tied to the pace of change in utility and regulatory policies that remove the legacy distinctions between energy solutions that sit "behind the meter" versus those supplied through the utility grid.

Hybrid electric building design

Today’s hybrid electric car uses more than 100 microprocessors to collect data that is feed into a smart operating system. These microprocessors integrate traditional gasoline engines with electric generators and regenerative brakes to achieve superior MPG results. The car's microprocessors also feed information into dashboards, designed to be productivity tools that coach a driver on how their behaviors can reduce costs and emissions.

Hybrid electric buildings will mirror this design. Like hybrid cars, they will have extensive sensor systems - collecting big data that smart systems will use to optimize integrated design components - like rooftop solar, onsite batteries and load-controlling technologies - to achieve occupant comfort, electrical reliability and lower cost.

Hybrid electric buildings are a quantum technology leap. The difference is similar to that between a landline phone and a mobile smartphone. Hybrid electric design is a bridge - linking the values of grid service and onsite electrical systems to deliver guaranteed lower electric bills. By linking utility service and onsite technologies, hybrid electric buildings create owner and tenant value while also offering a value to the utility in the form of stored electricity and/or solar generation accessible during local or system critical-voltage time periods.

Hybrid electric design: Drivers and an implementation barrier

The following are the three drivers and key barrier to adoption of hybrid-energy building designs by the commercial real estate industry:

Driver: Escalating electric bills drive adoption. Similar to the Prius customer, reducing pain at the meter is the No. 1 driver pushing the adoption of hybrid electric buildings. The hybrid electric building is a disruptive leap beyond utility-sponsored energy efficiency rebates. For example, utility rebate programs target a specific replacement of one technology for a more energy efficient technology. To the frustration of the commercial real estate industry, the utility does not financially guarantee a lower monthly electric bill as a result of a building owner investing in the purchase of a rebate-linked technology.

In comparison, a hybrid electric building is designed to achieve guaranteed energy bill reductions. Guaranteed results are achieved through a hybrid electric building's ability to assure a measured resulted that can be financially back-stopped with commercial performance insurance. An owner of a hybrid electric building will see a lower electric bill either through building operations or through a payment from the insurer. Unlike utility conservation programs, hybrid electric buildings are designed to achieve a guaranteed reduced energy bill.

Driver: Increasing utility service interruptions drive adoption. Disruption of utility service from weather volatility is now a business norm. Hybrid electric buildings are designed to continue operations during a utility's service interruption. The hybrid electric building has onsite renewable generation plus onsite battery systems that can bridge six or more hours of utility service interruptions. They also have predictive operating systems that can optimize building operations to enable continued operations of key activities during a disruption. A hybrid electric building can make the difference between a business making money after a storm or closing down operations.

Driver: Millennials drive hybrid electric building designs. The millennial generation's entry into the workforce is reshaping how commercial workspace is designed. The baby boomer generation’s office design legacy is the VP’s corner office with a view, interior cubes for work associates and lots of file cabinets. The millennial generation is pushing digital-centric open office designs that increase collaboration between work associates, accelerate learning, and provide a more humane and social experience.

The open office design preferred by the millennial generation also increases productivity-per-square-foot - which enables reduced office sizes, less energy consumption and fewer emissions. The open office design also enables hybrid electric building innovations by favoring daylight compared to electric light, plus increased deployment of sensor-based smart systems that can conserve electricity by operating electrical equipment in alignment with a building’s occupant needs and location.

Barrier: Utility and regulatory policies. The utility industry views a hybrid electric building as a micro-grid that combines onsite generation and onsite energy storage. Utilities often view a micro-grid as a threat to their revenues.

One path to align the interests of utilities and building owners is to re-position hybrid electric buildings as a capacity resource that utilities can aggregate like power plants. The aggregation of thousands of micro-grids will require a disruptive transformation in a utility’s system controls, the pricing of "behind-the-meter" capacity, and regulatory policy on how utilities should be compensated for their service. These issues of public and utility policy, rather than technology costs or capabilities, are the largest barrier to the adoption of hybrid electric buildings.

Susan Kennedy, founder of Advanced Microgrid Solutions, is pioneering a bridging solution. Kennedy is simultaneously approaching the California Energy Commission, the California Public Utility Commission and California’s utilities to develop a pilot project that will push for public and utility policy innovations that allow hybrid electric buildings to participate in utility's bid solicitations for new generating capacity or electric storage. If such a project can be implemented, it will offer new precedents for the utility industry on how a utility can make money integrating hybrid electric buildings into their operations while also aligning with their customer’s growing search for technology solutions to higher electric bills.

Image credit: Future Agenda

Insights referenced in this article were drawn from the recently held Verexhange in Los Angeles, California.

Bill Roth is an economist and the Founder of Earth 2017. He coaches business owners and leaders on proven best practices in pricing, marketing and operations that make money and create a positive difference. His book, The Secret Green Sauce, profiles business case studies of pioneering best practices that are proven to win customers and grow product revenues. Follow him on Twitter: @earth2017

7-Eleven, Avis, Walgreens Reduce Peak Power Demand For Big Energy Savings

Revenue growth and profits for U.S. power utilities have always been predicated on increasing demand, regulatory framework and relationships with regulators. Though still highly regulated, that business modus operandi is being turned on its head. Rapid growth in distributed solar, wind and other renewable energy resources and the development of smart grid and demand-response systems are two factors driving these changes. The movement to put a price on carbon emissions – based on the polluter pays principle – is another.

Also driving change are innovative new power industry participants, some of whom are now progressing from bleeding to leading edge, and from pilot stage to commercial scale. Leveraging its innovations in demand reduction/power efficiency software and the latest in battery storage systems, Santa Clara, Calif.-based Green Charge Networks (GCN) believes it has the ways and the means to generate very healthy returns by smoothing out customers' electricity load profiles and boosting power, as opposed to energy efficiency.

It's not only GCN's customers, but the U.S. power grid and society as a whole that stand to benefit. With critical federal and state government support, GCN is out to prove that it can not only lower consumers' electricity bills, but enhance U.S. power grid utilization, reliability and resiliency as well. That may well prove to be the missing link capable of driving U.S. renewable energy growth and adoption over the top.

From an even bigger-picture perspective, the energy conserved by making full use of integrated power storage systems that reduce peak demand, such as GCN's GreenStation, would help realize what is widely recognized as the best way to address an increasingly costly, threatening and global-scale problem: climate change.

GreenStation: Peak power-demand reduction with battery storage

Founded in 2009, GCN was formed in the wake of the housing crisis and financial industry debacle with a $12 million Department of Energy (DOE) grant that came courtesy of President Obama's American Recovery & Reinvestment Act (ARRA). Work on a $93 million DOE Smart Grid Demonstration Program project followed, enabling GCN, in collaboration with New York City and Westchester County utility Con Edison, to develop its flagship products: the GreenStation intelligent demand reduction system and GCN GridSynergy smart grid energy management system for utilities.

The first of its kind in the U.S., a pilot GreenStation system was installed by 7-Eleven in New York in July 2011. Its ability to reduce grid demand, boost power efficiency and deliver savings month after month has driven GCN's rapid transition from pilot stage to commercial scale, with a roster of customers that includes Avis and Walgreens.

On Feb. 4, GCN announced that it had reached a milestone, having signed 1 megawatt (MW) worth of 10-year Power Efficiency Agreements (PEA) with customers. That number is growing, and fast, to include municipalities and universities, as well as other commercial businesses across California as well as New York, GCN founder and CEO Vic Shao told 3p in an interview.

At GreenStation's core are its proprietary, patent-pending software algorithms and service-delivery features, which, Shao elaborated, "are akin to stock trading algorithms." On the energy storage side, GreenStation's Li-ion batteries – supplied by SAFT – discharge and recharge second-by-second based on instructions from the controller's real-time analytics and prediction engine, the main goal of which is to optimize power efficiency, flatten the load profile, and hence reduce customers' electricity bills. As Shao explained,

“Building loads change minute to minute. We employ stochastic decision-making based on imperfect information to charge or discharge the battery pack on a second-by-second basis to even out demand and flatten out the load profile.”

Changing U.S. power market dynamics

Accumulating and analyzing huge amounts of real-time data on energy consumption and other real-world operating conditions from customer sites, GCN has been able to realize drastic improvements on the ability of its system to predict power consumption and respond to changing supply-and-demand conditions.

The stochastic algorithms embedded in GreenStation's system controller, "essentially an industrial computer," are now predicting power usage with accuracy in the 80 to 90 percent range and making adjustments to minimize customers' peak energy use and maximize savings. That significantly enhanced predictive ability, combined with its service delivery capabilities, translates into a higher utilization rates, lower energy bills, shorter payback periods and higher returns on investment (ROIs) for GCN customers, Shao explained.

Though GCN's products and services would produce significant, long-lasting benefits for society as a whole, their businesses are often constrained, if not derailed, by a regulatory framework that has been built for centralized fossil-fuel energy systems and can be painfully slow to adapt to changing environmental and social, as well as economic, conditions.

On the other hand, GCN is benefiting from state and federal government support for energy efficiency, renewable energy, smart grid and, most recently, battery storage systems. California is on the leading edge of enacting an institutional framework that spurs development of a new energy infrastructure with programs such as the Self-Generation Incentive Program (SGIP), which "pays $2 per watt for an energy storage solution. That's typically about half the cost, which has really helped state of affairs in California,” Shao noted.

Taking the lead on energy storage, California last October enacted a state-wide mandate that requires investor-owned utilities to expand their energy storage capacity and acquire 1,325 MW of electricity and thermal storage by 2020. New York is expected to enact similar legistlation in the near future, Shao pointed out, a development that will spur a lot in the way of additional demand for systems like GCN's GreenStation.

Power vs. energy efficiency

GCN is finding that its intelligent demand response-battery storage platform can provide customers with attractive bottom-line and investment returns without tax credits or government mandates by taking advantage of the way electricity usage is priced, however.

As Shao explained, utilities typically charge customers – residential, commercial and others – by the kilowatt-hour (kWh) for the electrical energy they use. Commercial, industrial and other larger-scale customers, including municipalities, educational institutions and the like, are also charged at a rate priced by the kilowatt (kW) for electrical power during periods of peak demand.

Known as demand charges, these rates have been rising 7 to 10 percent annually, accounting for larger and larger portions of larger customers' electricity bills, as high as 70 percent, Shao related. In contrast, non-peak electrical energy prices, priced in kWh, have been declining. That growing differential is where GCN earns its daily bread.

GCN's business case is based on reducing electricity demand, more specifically, peak power demand. “It's really demand reduction – peak kilowatts,” Shao said.

In California, demand charges for peak rates during the summer are around $37/kW, he pointed out.

“New York, it so happens, has the highest demand charges in the U.S., at $43/kW in peak summer.” Hence, the electricity bill savings realized by customers in Con Ed territory in New York can pay back their investment in GCN's GreenStation in as little as 1.5 to 2.5 years. The story is similar in California.

Ninety percent of the proposals GCN is sending out to prospective customers in California have ROIs, or payback periods, of five years or less. The average is in the 3.5 to four year range. “The returns are absolutely incredible when you factor in all these rebates and tax credits and so forth. Some really super attractive situations have ROIs in the 1.5 to 2.5 year range, about 25 percent of our deal flow,” Shao elaborated.

Image credit: Green Charge Networks

Green Mountain Coffee Roasters: With Commitment to Fair Trade Comes Great Responsibility

By Lindsey Bolger

Looking back, 2013 was a rough year for coffee, but also a year of great opportunity. Coffee market prices saw one of the biggest price slumps in decades, and a severe outbreak of a coffee leaf-killing disease – called coffee rust or "la roya" – decimated crops and affected about 75 percent of Central American coffee farmers.

Despite these market challenges, some businesses were still able to celebrate profits, and consumers were still able to drink their daily cup of coffee. But it’s the unseen coffee farmers who continue to bear the burden. That’s why supporting Fair Trade for the health and sustainability of coffee-growing communities is more important than ever.

As the Vice President of Coffee Sourcing & Excellence for Green Mountain Coffee Roasters, Inc. (GMCR), it’s my job to delve into the intricacies and human faces behind one of the most popular beverages in the U.S. Watching the ups and downs in the coffee marketplace, I have seen firsthand how Fair Trade acts as a sourcing model that provides a great cup of coffee for consumers and a better quality of life for coffee farmers. By setting a minimum buying price for coffee beans, Fair Trade is able to deliver "premiums" or community development funds that provide opportunities to not only positively impact coffee quality and sustainability, but the people behind the coffee as well. GMCR began purchasing Fair Trade Certified coffee in 2000 and has since expanded its commitment to become the largest purchaser of Fair Trade Certified coffee.

Fair Trade levels the playing field by providing financial means to improve communities and create new opportunities for education, healthcare or advancing the way farmers run their businesses. Since 2000, GMCR has delivered more than $22 million in community development funds to coffee farmers around the world – helping fund schools, community centers and better access to healthcare. At the source, the beginning of our coffee supply chain, it is easy to see the impact of Fair Trade in empowering coffee-growing communities and why GMCR believes so strongly in this movement.

Fair trade and social justice

In Popayan, Colombia, several small coffee farmers have become firm believers in the importance of education as a way to stop cyclical poverty. While many of the farmers received limited formal education, they understand the importance of education for their children. Fair Trade has become essential for them in providing the resources necessary to advance their childrens' education. The community development funds generated from the Fair Trade Certified coffee that farmers sell to large buyers like GMCR allow farmers to purchase shared houses for their children in bigger neighboring cities where higher education opportunities are available. This is a huge advantage in a rural area where secondary schools are few and far between.

About 700 miles due south, where GMCR has been sourcing Fair Trade coffee since 2004, Fair Trade is impacting another South American community in a different way. A community bank, established by Fair Trade premium funds, is a pioneering entity in Agua Azul, Peru providing important financial services to the community. While you won’t find tellers and checking accounts here, the bank renders economic empowerment opportunities to the community.

Acting more as a local micro-financing cooperative than a bank, members contribute money on a weekly basis and then vote on micro-finance loans – requested by different bank members – to fund. The most surprising thing about this bank is that of the approximately 20 bank members, all but one are women. Through the bank, women gain financial literacy skills and are empowered to make important choices and decisions in their community. A community and bank member, Maria Sabina Hernandez Cueva, explains that the bank has provided a lot of opportunities for women and that, "Fair Trade doesn't discriminate against color, gender, race or religion."

A win-win for consumers

In addition to the social justice impacts Fair Trade has on the unseen players in the coffee supply chain, there are also many positive implications for consumers. Every Fair Trade Certified bean that arrives at a milling facility for example goes through a rigorous quality control process so we know that each bean in each bag of coffee we sell meets our high standards.

Additionally, because of transparency in the Fair Trade supply chain, GMCR can provide direct feedback to Fair Trade cooperatives and their members to ensure the quality of their coffee aligns with our expectations. In fact, we meet with most of our suppliers of Fair Trade coffee on an annual basis, either in their communities or at our headquarters in Vermont, to calibrate around quality standards and discuss plans for future business. These opportunities for direct engagement translate to stable relationships and a stable supply of excellent quality coffee, harvest after harvest.

While the positive benefits and implications of Fair Trade are far-reaching and complex, the first step toward making a difference is an easy one –and that’s to choose Fair Trade products. Simply choosing to replace items that you normally buy – such as coffee, chocolate, sugar, tea or even clothing – with those that are Fair Trade Certified helps to ensure that you’re getting a good quality product and that the people who made it are getting a fair price for their products.

I recently took a source trip to Peru with Kelly Clarkson to meet some farmers and see our coffee supply chain in action. You can go to www.facebook.com/GreenMountainCoffee to learn about how choosing Fair Trade helps create a better quality of life for farmers around the world.

Image credit: Flickr/Rainhead

Bacardi aims for zero waste to landfill by 2022

The world’s largest privately-held spirits company Bacardi has unveiled a new environmental initiative called Good Spirited: Building a Sustainable Future.

The campaign details specific goals in sourcing, packaging and operations to be achieved by 2022. In raw materials, the Bombay Sapphire maker has committed to obtain 40% of its sugarcane-derived products from certified, sustainable sources by 2017, rising to 100% by 2022.

In the field of packaging the company plans to reduce the weight of its packaging by 10% by 2017 and achieve 15% by 2022.

Bacardi will continue to focus on reducing water use and greenhouse gas (GHG) emissions too with a 2017 goal to cut water use by 55% and GHG emissions by 50%. In addition, the company aims to eliminate landfill waste at all of its production sites by 2022. Recently, at the world’s largest premium rum distillery in Puerto Rico, demolition crews recycled more than 150 truckloads of concrete without sending any debris to landfills. The concrete was reused in the construction of new blending facilities.

“Protecting the natural resources we use to create our brands, at every step along the value chain, is central to our corporate responsibility,” said Ed Shirley, president and ceo. “We’ve always set the bar high. Now, we’re taking our solid, sustainable foundation to the next level.”

Picture caption:

Since Bacardi began tracking its global impacts on the environment in 2006, it has reduced energy use by more than 25% and water use by 54%. Some sustainable projects to date include repurposing water used to clean barrels.

Why Corporate Legitimacy Matters

Submitted by Guest Contributor

By Dorothée Baumann-Pauly

This is the first post in the Managing Corporate Legitimacy series.

In response to the worldwide seven-month controversy over U.S. spying practices, President Obama recently announced his “proposal” to reform the National Security Agency.

In his January 17, 2014 speech at the Justice Department, he acknowledged the power and threats of new technologies, arguing that while there are fewer technical constraints on what can be done, the tough questions about what should be done are central to the U.S. government.

Lessons from the NSA Mass Surveillance Scandal

The NSA scandal has evoked a legitimacy crisis for the U.S. government. The general public does not perceive the spying practices as socially acceptable, particularly the collection and use of phone records. Legitimacy is based on public perceptions; and managing legitimacy matters to governments. In democratic societies, the social acceptance of government activities is fundamental for staying in power.

The immediate reactions to Obama’s speech were highly critical. Press commentaries, in the U.S. and abroad, found that the speech was calculated to reassure audiences rather than to introduce meaningful NSA reforms. With the continuous disclosures of NSA spying practices over the past months, the public has grown weary of announcements. To effectively restore trust in the US government, concrete actions  will have to follow promises.

will have to follow promises.

Corporate Legitimacy at Stake

Managing legitimacy is also a growing concern for corporations. In a joint statement that AOL, Apple, LinkedIn, Microsoft, Facebook, Google, Twitter and Yahoo issued after President Obama’s speech, the companies argue that the presidential proposal outlines positive progress on key issues, yet many crucial details remain to be addressed.

Over the course of the past months, these companies have moved from defensive legalistic statements to lobbying for surveillance reform in Washington to meet public expectations for privacy protection. The strategy change reflects the growing understanding that their corporate legitimacy is at stake and that it can only be restored through concrete steps in collaboration with the U.S. government.

As for governments, legitimacy is a vital resource for corporations. It ensures their social “license to operate.” For many corporations, CSR has become an essential tool for managing legitimacy.

Most large multinational corporations today are fluent in the CSR talk. They issue CSR reports and policies and participate in conferences on CSR and stakeholder dialogues. Yet, what matters for building legitimacy is substance that goes beyond glossy reports.

Lack of Consensus on CSR

Unfortunately, since CSR has emerged over a decade ago, scholars and practitioners have made many attempts to define what the concept actually entails and should entail. To this date, there is no consensus over what is expected from corporations that commit to CSR. CSR interpretations stretch from  philanthropy to expectations that CSR is good for profits.

philanthropy to expectations that CSR is good for profits.

This confusion on the conceptual level has impacted the implementation of CSR. Corporate activities that are labeled CSR are often not linked to the core business processes of corporations. In these cases, CSR does not alter the way business is done.

Instead, corporations use the CSR terminology to describe how they spend their money to address societal concerns without reflecting on how they make it. This type of green-washing, while pervasive, is a short-lived legitimacy strategy.

Why so?

CSR Movement Rooted in Core Business Operations

The reason why the idea of CSR became popular in the first place was the growing public concern over corporations’ core business operations. In a globalized economy, corporations are able to split up their value chains. They can move production to jurisdictions that are weakly regulated. In those places, states that should define and enforce basic rights for their citizens are either unable or unwilling to do so.

Resulting governance gaps led to corporate human rights violations and to an exploitation of natural resources. Branded goods were found in burnt down factories; environmental pollution was traced back to corporate activities.

The growing number of social and environmental scandals triggered a reflection about the role of the corporation in a global economy. Public opinion shifted towards making corporations, not states,  responsible for such societal disasters. Corporations are perceived to have the power and the resources to fill governance gaps.

responsible for such societal disasters. Corporations are perceived to have the power and the resources to fill governance gaps.

Today, respecting internationally recognized social and environmental standards through core business processes is what renders corporate activities socially acceptable. Particularly when corporations assume government responsibilities and move into a space that was originally exclusive to state actors, managing legitimacy matters.

Implementing the Guiding Principles

Managing corporate legitimacy is thus at the heart of CSR. The umbrella term CSR has not helped to clarify the role of business in a global economy. The legitimacy concept, however, is a reminder for why CSR emerged and what it should stand for: Core business activities that are aligned with what society perceives as just and fair.

The UN Declaration of Human Rights embodies a consensus on universal humanitarian values. As such, it serves as the ideal reference point for corporations that hope to manage the legitimacy of their core operation’s social impact.

The discourse on business and human rights has gained momentum since the United Nations Human Rights Council unanimously endorsed a set of Guiding Principles on business and human rights in June 2011. Yet again, it will be the actual implementation of the corporate commitment to human rights that will convince critics that corporations can operate responsibly and respect human rights.

Corporate Legitimacy and Privacy as a Human Right

Privacy is a fundamental human right (Article 12 in the UN Declaration of Human Rights) and in today’s digitalized world, ensuring privacy is part of tech companies’ core business. At the World Economic Forum (WEF) in Davos, key leaders from the IT industry, governments, and academic experts met to  discuss privacy issues in the context of the WEF’s Council for Human Rights.

discuss privacy issues in the context of the WEF’s Council for Human Rights.

On the agenda was how companies in this industry can work together most effectively to challenge excessive government interference and demands for data, as well as identifying best practices and responsible polices by governments to protect the privacy of users. These topics will be the subject for a two-year inquiry announced at Davos 2014. If such collective initiatives are able to develop substantial and transparent action plans, they will also help to restore legitimacy.

Managing Corporate Legitimacy – A Toolkit, released in January 2014, describes the organizational preconditions for managing corporate legitimacy through core business processes. It outlines the organizational elements that need to be in place for corporations to credibly show and tell that their commitment to contribute to the solution of pressing social issues is real.

About the Author:

Dr. Dorothée Baumann-Pauly is a business ethics scholar and human rights advocate. She received her PhD in Economics from the University of Zürich. In her scholarly work she links the interdisciplinary academic discourse on global governance with the practical implementation challenges of corporations as political actors. She currently teaches at HEC Lausanne and works with the Center for Business and Human Rights at Stern School of Business, New York University.

Sustainable Design in Masdar City: Photo Essay

For those interested in design, architecture and sustainability, Masdar City is something of a living museum: Everywhere the eye wanders, something new and intriguing makes it stop and look twice. I felt as if I could spend weeks poring over every crevice, examining each facade and gently running my fingers over whatever curious material sparked my interest.

Some have criticized Abu Dhabi's low-carbon eco-city for just this phenomenon - calling it everything from "a green Disneyland" to a playground for tourists and the rich. But the fact remains that the city is an experiment. Tailored specifically to Abu Dhabi's harsh desert climate, it is a testament to what's possible if sustainability is placed at the core of urban planning - rather than tossed in as an afterthought. Masdar is upfront about the fact that it's willing to entertain multiple approaches and technologies. As a general rule with such experimental projects, some methods work, and others don't.

It's also worth mentioning that, as one of the most oil rich nations in the world, Abu Dhabi doesn't have to do this. Its government didn't have to invest in Masdar, the nation's renewable energy company, or put its dollars behind the city in the first place. But the fact that it's doing so, and that the UAE has an integrated approach to sourcing 7 percent of its energy from renewables by 2020, speaks volumes about how proactively the emirate is addressing the reality that one day the oil will run out - a lesson large swaths of the Western world could stand to observe.

While Abu Dhabi is still flush with cash, why not invest in the infrastructure of tomorrow, rather than another standard skyscraper or posh landscaping element - of which the city has plenty? Some approaches may not be scalable, or simply don't work out at all, but those that succeed may have far-reaching impacts that stretch miles beyond this desert plot outside downtown Abu Dhabi.

Masdar expects the city to be completed by 2025, pushed back from a 2020 target set before the global economic downturn. At full build-out, the company hopes to draw 40,000 residents and 50,000 commuters to the city. For an up-close look at some of Masdar City's most impressive sustainable design elements, flip through the photo essay below - featuring images snapped on a recent tour of the city during Abu Dhabi Sustainability Week 2014.

[gallery ids="176833,176834,176835,176836,176837,176838,176839,176840,176841,176842,176843,176844,176845,176846"]

All images by Mary Mazzoni

Ed Note: Travel expenses for the Author and TriplePundit were provided by Masdar.

Based in Philadelphia, Mary Mazzoni is an editor at TriplePundit. She is also a freelance journalist who frequently writes about sustainability, corporate social responsibility and clean tech. Her work has appeared on the Huffington Post, Sustainable Brands, Earth911 and The Daily Meal. You can follow her on Twitter @mary_mazzoni.

Keystone XL Report: Is It Really About the Environment?

It’s here. The long-awaited report by the State Department on whether the proposed Keystone XL pipeline would have any detrimental impact to the environment arrived last Friday. As American households were buying up the beer, chips and last-minute preps for Super Bowl Sunday, arguably one of the country’s most popular annual holidays, the Bureau of Oceans and International Environmental and Scientific Affairs dropped their newly minted report onto the airwaves.

Environmental organizations that have been hoping that the project would be rejected were quick to highlight the finer details of the report, which pointed out that there would be environmental impact from Keystone – a reasonable assumption for an 875-mile pipeline that would become the expressway for heavy crude and an increasing dependence on carbon-emitting technology. During operation it would add the equivalent of 300,000 cars to the road, or 71,298 houses using electricity for one year. It would also have other potential effects that could ultimately contribute to climate change.

But anyone who read the fine details of the 44-page report realized within the first few pages that those points were extraneous and not relevant to the takeaway message of the report.

“For proposed petroleum pipelines that cross international borders of the United States, the President, through Executive Order (EO) 13337, directs the Secretary of State to decide whether a project serves the national interest before granting a Presidential Permit … If the proposed Project is determined to serve the national interest, it will be granted a Presidential Permit that authorizes the construction, connection, operation, and maintenance of the facilities at the border between the United States and Canada.”

The issue all along then, has not been whether implementing Keystone XL to ship bitumen contributes to climate change, but as President Obama said last year, whether it contributes significantly to climate change – the word “it” being the actual, tangible construction process and operation of the pipeline, not its intended use or how that much bitumen may affect the climate as it is used.

The authors of the report have taken pains to underline that difference, pointing out that whether the project is approved or not, climate change will still be occurring, as it has since the Industrial Revolution. The report gives a nod to the fact that human activity is considered the cause of much of the climate change, but doesn’t offer any concrete acknowledgement to whether the project is, in light of that cumulative result, a bad idea.

Taking those remarkable limitations into the picture, this is what the report did say:

- One endangered species and 10 threatened species will be at risk. The endangered species is the American burying beetle. Most of the threatened species weren’t mentioned. Whooping cranes are among the threatened species.

- 383 acres of wetlands would be impacted, with only 2 acres expected to be lost.

- The U.S. GDP is expected to benefit by $3.4 billion.

- While the project is expected to create 4,200 jobs during the construction phase, only 50 jobs, not all of them full-time, would remain during operation. “This small number would result in negligible impacts on population, housing, and public services in the proposed Project area,” the authors state. (Although the report didn’t highlight this, that also means that the 50 jobs would probably not contribute significantly to the economy in local areas, either.)

- 16 community groupings have been identified which would be at risk due to environmental justice issues. Interestingly, here the State Department steps out of the role of impartial risk evaluator, and explains how mitigation would be accomplished. The authors state that Keystone has agreed to “avoidance and mitigation measures” that include “ensuring that adequate communication in the form of public awareness materials regarding the construction schedule and construction activities is provided.”

- GHG emissions for the crude oil to be transported are estimated at 1.3 to 27.4 metric tons of CO2 equivalents (MMTCO2e) annually. The authors explain the wide spread saying that there are many variables, including which study is used to determine the output.

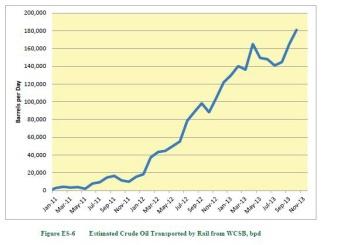

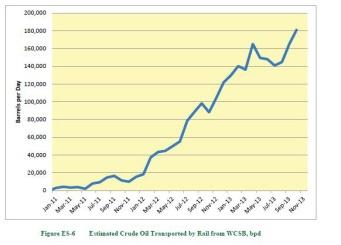

Perhaps the most important detail to consider in this report is that the transportation of bitumen from Canada’s tar sands is already underway by railway. And production is increasing (pg. 16). So President Obama’s determination of whether the Keystone XL pipeline would “significantly exacerbate the problem of carbon pollution” is really all about the pipes, the construction and the strategy that will be used to expedite the oil project. As this report highlights so well, the issue was never about whether the environmental risks of bitumen use and transport was a good idea.

Image courtesy of U.S. Government

US Algae Biofuel Company Wins French Beauty Award

The Marie Claire 2014 Prix d’Excellence de la Beauté award has gone to an algae oil company called Solazyme, making it one of only two U.S. brands to garner a prize against hundreds of entrants this year. The award indicates excellence in both innovation and performance. That's a pretty high mark for a company better known for algae biofuel, but Solazyme actually covers four markets with its unique algae oil extraction technology: fuels, chemicals, nutritionals and personal care.

Announced earlier this month, the award was given unanimously by a panel of judges for the company's Algenist® line of skin care products. That's great timing for Solazyme. The company has just announced the start of commercial algae oil operations at two integrated locations in Iowa, which together showcase the company's ability to hop nimbly from one market to another.

Solazyme and Biofuel

Solazyme's biofuel endeavors became big news back in 2011 when it began supplying algae biofuel to the U.S. Navy, including a biofuel-for-shipping project between Maersk and the U.S. Navy, so that accounts partly for its familiarity as a biofuel company.In 2012 the company also launched a unique retail biofuel station for vehicles in partnership with Propel Fuels, making it the first to offer algae biofuel to the general public.

The company also gained some additional fuel-related notoriety in 2012 when it opened an algae oil facility in Peoria, Ill., with the support of Department of Energy funding.

Solazyme Makes Its Mark In Beauty

Solazyme's earlier biofuel ventures occurred while certain members of Congress were engaged in an all-out war to stop the Department of Defense (the Navy, in particular) from buying algae biofuel, but now that the noise has died down, what's left is the fact that algae is becoming a commercially viable feedstock for sustainable fuel.

The company's growing reputation in personal care opens up a whole new level of public awareness about commercial algae farming. This is what Marie Claire Health and Beauty Editor Ariane Goldet had to say about Solzyme's award:

For the past 28 years, we have searched for trailblazing products and brands that couple the latest breakthroughs with the latest trends, and Algenist with their breakthrough, hero-ingredients, Alguronic Acid® and Microalgae Oil, do all of this and more. They are a pioneering brand and we are pleased to place them amongst the 2014 Maria Claire Prix d’ Excellence de la Beauté winners.

Solazyme and the Sustainable Supply Chain

Solazyme's ability to hop markets provides yet another new option for companies looking to ramp up the sustainability of their supply chains.

The global textile lubricant company Goulston, for example, has already publicized its relationship with Solazyme for a new class of sustainable products.

The key to Solazyme's market-hopping is a tailored approach to growing microalgae called TailoredTMoil.

Also helping things along is a high-efficiency, low cost process that uses microalgae that grow in the dark, feeding on waste material including corn stover, forestry waste and other renewable sources.

The algae "farm" consists of standard industrial fermentation equipment, so the use of off-the-shelf technology also plays a role in the cost-effectiveness of the system.

The new facilities are in partnership with Archer Daniels Midland Company in Clinton, Iowa, which takes care of the algae oil process, and American Natural Products in Galva, Iowa, which takes care of the downstream product end.

The two facilities have already produced three different products at commercial scale with applications that range from lubrication and metalworking to home care and personal care.

Image (cropped): Courtesy of Solazyme

Big Payoff for US EPA Climate Protection Partnerships

The Environmental Protection Agency has just released its annual Climate Protection Partnerships report, and it indicates that the U.S. is in a strong position to achieve economic growth - in other words, job growth - as it transitions to safer, healthier and more sustainable forms of energy. The report comes on top of great news for job growth in the solar industry, with as-yet untapped offshore wind energy and vast reserves of geothermal energy offering potential for even greater growth in the green jobs sector.

That's something to keep in mind as the battle over the proposed Keystone XL pipeline gathers a new head of steam. Now that the State Department has delivered a required environmental report, it has to move forward and consult with other U.S. agencies to consider a variety of potential impacts the project could have on the public, and that includes economic impacts.

The 2012 Climate Protection Partnerships Report

The latest year for which statistics are available is 2012, hence the formal title of the report, "EPA’s Office of Atmospheric Programs Climate Protection Partnerships 2012 Annual Report."

The report highlights the achievements of EPA partnerships with more than 21,000 organizations, impacting millions of individuals with new clean energy and energy efficiency programs, including the ENERGY STAR and Green Power Partnership programs.

Here's a taste of the results for 2012:

- Prevention of 365 million metric tons of U.S. greenhouse gas emissions (about the same emissions from electricity used by 50 million homes).

- A $26 billion savings on utility bills with and assist from ENERGY STAR.

- Emissions equal to the electricity used by more than 10 million homes prevented by methane and fluourinated greenhouse-gas-program partners, using tools and resources developed by EPA.

- The Green Power Partnership, a voluntary program launched back in 2001, included more than 1,400 organizations with a combined commitment of approximately 29 billion kilowatt-hours of green power annually.

- Another 2001 voluntary initiative, the Combined Heat and Power Partnership, included more than 450 partners with more than 5,700 megawatts of new combined heat and power installed.

Climate protection and economic growth

The Climate Protection Partnerships predate and support President Obama's Climate Action Plan, which was announced in June 2013. In fact, some elements of the program go back 20 years including at least two launched during the Bush administration.

As for the consistency of that timeline, in an introduction to the new report EPA Chief Gina McCarthy points out that compliance with the Clean Air Act has been an overall winner for the U.S. economy:

...Every dollar we've invested to comply with the Clean Air Act has returned $4 to $8 in economic benefits. A clean and healthy environment lays the foundation for a strong, sustainable economy."

You can see that reflected in the EPA's top-ranked Green Power Partners. Along with government agencies and academic institutions, the quarterly list of 100 percent green power users (including purchased offsets) boasts healthy representation from the private sector including Intel, Whole Foods, Staples, Herman Miller, and of course, the Empire State Building.

With winter sports upon us, let's also note that the National Hockey League was the first pro sports league to join the Green Power Partnership, with support from the National Resources Defense Council for its efforts to preserve a hockey-friendly climate in the U.S.

In that regard, McCarthy draws a stark picture of the devastating economic consequences of inaction:

Scientists have observed changes in precipitation, rising sea level, melting ice and altered weather patterns, including more frequent and intense storms...These changes come with devastating consequences and real economic costs to Americans. Last year alone, the second costliest year ever recorded in terms of disasters, the U.S. endured 11 different weather and climate events with estimated losses exceeding $1 billion each."

That's not even counting the economic fallout from recent fossil fuel-related disasters -- such as the Kalamazoo River diluted bitumen spill in Michigan, the long-term damage to Louisiana ecosystems from oil industry infrastructure, and the West Virgina chemical spill, which involved a compound used to prepare coal.

Add California's ongoing and devastating drought this year, and you have a compelling case for aggressive action.

CollectiveSun: Solar Power for Nonprofits

The boom in solar energy in the U.S. is due in large part to innovative financing, putting solar within reach of almost any business or homeowner with a roof, for little more than their signature. But for nonprofits it's a different story.

Traditional banks and financial institutions shy away from lending to 501c3 nonprofit organizations who are dependent upon charitable giving because they see it as an unreliable source of revenue. "We shouldn't penalize nonprofits for being nonprofits," says Lee Barken, founder and CCO (chief community officer) for CollectiveSun, a firm specializing in solar power financing for nonprofits, a deeply underserved market in need of a solar power financing solution.

With years of experience as a CPA and LEED-AP in renewable energy project finance, Barken saw day-in and day-out the gap that did, in fact, penalize nonprofits interested in going solar. With no tax liability, nonprofits are unable to reap the tax benefits of solar power projects available to homeowners and for-profit corporations. "Solar should be accessible by everybody trying to expand the market and include community participation," says Barken.

The problem with the self-service island

Unable to secure a traditional loan or 20-year Power Purchase Agreement (PPA) financing arrangement, Barken explains that too many nonprofits try to "roll their own" solution. Often this leads only to frustration.

"There are a lot of nonprofits struggling, that don't know about us and are trying to figure it out on their own" says Barken, "Instead of spending a lot of money on attorneys and accountants, we could probably help."

It isn't impossible for nonprofits to go solar on their own, devising their own methods and using their own limited resources. It's just prohibitively difficult, expensive and doesn't leverage community support and involvement, a key asset for any nonprofit.

CollectiveSun provides a much easier, lower-cost path to solar power, one that saves the nonprofit money while engaging community support.

"Part of the huge benefit we can offer," says Barken, "is that our structure offers a way to monetize tax benefits. But more importantly we can do it in a way that allows community participation as a promissory note. We use a simple debt arrangement."

Solar financing for nonprofits - how it works

"If you really want to serve the nonprofit, you give them a pathway to ownership."

The CollectiveSun approach involves two simultaneous transactions: First is the promissory note between CollectiveSun and investors to raise funds for the solar project. Second is the PPA between CollectiveSun and the nonprofit. After CollectiveSun raises project costs from investors, funds are then handed off to the solar installer chosen by the nonprofit. The PPA payments are used to make the annual principal and interest payments back to investors.

Using a community-based affinity investment platform, CollectiveSun offers nonprofits a low-cost, 10-year PPA, followed by a purchase option that is paid in equal monthly installments over four years. Tax benefits are passed through to the nonprofit in the form of lower cost power, and the short-term PPA with purchase option gives nonprofits a clear path to ownership.

As an investment, it isn't risk-free. Barken explains that CollectiveSun is very upfront with investors - if the nonprofit defaults on a PPA payment, no payment is made to investors. Generally speaking, investors interested in backing a particular nonprofit are already engaged in the community and much more risk-tolerant with the investment vehicle than "a typical risk committee at a bank."

Not just another brick in the wall

The challenge for nonprofits, apart from pursuing their particular mission, is fundraising. For any nonprofit wishing to go solar, this creates a conundrum: Do we just go out to our community and ask for another donation to finance solar power? Is it the best use of our community's good will, or is there a better option? CollectiveSun is that better option, drawing the best elements of solar financing for both investor and nonprofit.

By providing a return on their investment dollars, nonprofits aren't asking for a handout from their community as they go solar. It's real return on the dollar and not "just another donor's name on a brick." The nonprofit is able to share in the benefits of solar, with a clear path to ownership and reduced energy costs.

Nonprofits serve society in countless ways. They educate, heal, and comfort the vulnerable and less fortunate in our communities. Yet too often they struggle to share in the promise of the new energy economy. CollectiveSun's mission is to change that equation.

CollectiveSun currently operates only in California, but it is looking to expand as more nonprofits and local communities throughout the United States seek to share in this win-win community investment platform for low-cost solar power.

"This is an investment in my local community that hits all three P's: People, Planet, and Profits!" - Ellen K