Video: EPA Honors Communities With Smart Growth Achievement Awards

Promoting and fostering sustainability in communities large and small, U.S. EPA Administrator Gina McCarthy recognized the winners of the agency's 2013 National Award for Smart Growth Achievement at a ceremony at EPA headquarters in Washington, D.C., on Feb. 5. Seven Smart Growth projects earned top honors, with the Atlanta BeltLine Eastside Trail and Historic Fourth Ward Park winning the award for Overall Excellence.

Whether it's enhancing water infrastructure, greening the urban landscape and improving residents' quality of life by building new parks; providing solar-powered, highly energy efficient mixed-income housing; lowering the risk of floods while building a riverfront park; or revitalizing inner-city neighborhoods through community-driven redevelopment, this year's EPA Smart Growth award winners demonstrate the compound effects and cross-cutting social, environmental and economic benefits that can result from well thought-out, inclusive and equitable sustainability initiatives.

"This year's winning projects show that smart growth approaches are having a visible impact on communities across the country— large and small, cities and suburbs, towns and rural places," McCarthy said in a pre-ceremony message. "They show that the choices communities make about how they develop can protect people's health and the environment while contributing to local economic growth. Most importantly, they show other communities that the path to a sustainable future is just around the corner."

Recognizing exceptional approaches in sustainable community development

The EPA National Award for Smart Growth Achievement was established in 2002 "to recognize exceptional approaches to development that respect the environment, foster economic vitality, enhance quality of life, and provide new opportunities for disadvantaged communities." This year's 77 entries brought the total number of award applications reviewed by the EPA over the past 12 years to 886.

The principles and aims of the award fall right in line with the country's first National Climate Change Action Plan, which President Obama launched last summer.

“Many places have found that smart growth strategies can help them both mitigate and adapt to climate change by providing transportation and housing options that use less energy, encouraging compact neighborhoods where daily needs are within easy reach, and using green infrastructure that mimics natural processes to capture, filter, and absorb stormwater runoff,” the EPA highlights.

“This year's National Award for Smart Growth Achievement winners illustrate some of the climate change mitigation and adaptation measures communities can implement that give multiple benefits for every dollar spent.”

2013 Smart Growth Achievement Award winners

Smart Growth Achievement awards are conferred across seven categories. Here, courtesy of the EPA, are this year's winners:

- Overall Excellence in Smart Growth: Atlanta BeltLine Eastside Trail and Historic Fourth Ward Park Atlanta, Ga.: The redevelopment of a formerly contaminated rail corridor into a multi-use trail and connected park system is sparking economic development, community engagement and new affordable housing options in 45 city neighborhoods.

- Corridor or Neighborhood Revitalization: Historic Millwork District and Washington Neighborhood, Dubuque, Iowa: The conversion of a mostly vacant former mill district into a lively mixed-use neighborhood reconnected the area to downtown and the adjacent residential community.

- Policies, Programs, and Plans: GO TO 2040, Metropolitan Chicago, Ill.: This seven-county regional plan for growth and economic development engages a wide variety of partners and links local planning efforts to a broad regional vision through tools and technical assistance.

- Honorable Mention: Lower Eastside Action Plan, Detroit, Mich.: This grassroots effort formed a plan for revitalization that engaged residents in creating a vision for a low-income, high-vacancy neighborhood and influenced citywide planning.

- Built Projects, La Valentina, Sacramento, Calif.: An energy-efficient, mixed-income, mixed-use apartment building on a former brownfield site next to a light-rail station is transforming an industrial neighborhood and giving residents transportation options.

- Honorable Mention, Via Verde, The Bronx, N.Y.: This affordable, transit-oriented, highly energy- efficient building features design that emphasizes health and wellness for residents.

- Plazas, Parks, and Public Places, Charles City Riverfront Park, Charles City, Iowa: This multi-facility park built on a flood plain connects to downtown and adjacent low-income housing, brings economic benefits, and has become the recreational heart of the city.

The EPA's Smart Growth Principles

- Mix land uses.

- Take advantage of compact building design.

- Create a range of housing opportunities and choices.

- Create walkable neighborhoods.

- Foster distinctive, attractive communities with a strong sense of place.

- Preserve open space, farmland, natural beauty, and critical environmental areas.

- Strengthen and direct development toward existing communities.

- Provide a variety of transportation choices.

- Make development decisions predictable, fair, and cost-effective.

- Encourage community and stakeholder collaboration in development decisions.

The EPA noted how each of these project developers strove to take a holistic, systems-wide view in realizing these initiatives, a sustainable development approach that incorporates and values indirect and intangible social and ecological benefits and returns as highly as purely financial ones.

"The strategies these places are using — including creating parks that can absorb flood waters, using renewable energy and energy efficiency to reduce fossil fuel consumption, and providing a variety of transportation options—make neighborhoods more attractive, draw activity that spurs further economic development, and help keep housing affordable for all income levels by reducing energy and transportation costs. Just as importantly, these strategies can help communities better weather the changes already evident in our climate, as well as changes projected for the future."

http://www.youtube.com/watch?v=A76FkCCo7xc

Image Credit: Atlanta Beltline

Google Chat with Susan McPherson

Every Wednesday, TriplePundit founder Nick Aster will take 30 minutes or so to chat with an interesting leader in the sustainable business movement. These chats are broadcast on our Google+ channel and embedded via YouTube right here on 3p.

On Wednesday, February 5th, an audience far and wide tuned in to a live chat with Susan McPherson - a serial connector, passionate cause marketer, angel investor and corporate responsibility expert. Recently, she launched McPherson Strategies, a communications consultancy focusing on the intersection between brands and social good, and continues to consult for Fenton as a strategic advisor.

If you missed the conversation you can watch it now on our YouTube stream (above).

About Susan

Susan is a regular contributor to the Harvard Business Review, TriplePundit and Forbes, and has 20+ years experience in marketing, public relations, and sustainability communications. She is a featured speaker at industry events including Net Impact, Center for Corporate Citizenship's Annual Summit, Sustainable Brands, and Committee to Encourage Corporate Philanthropy's Summit. McPherson founded and hosts the bi-weekly #CSRChat on Twitter.

Currently, McPherson invests in, and advises technology start-ups, including ZADY, TheLi.st, Posi

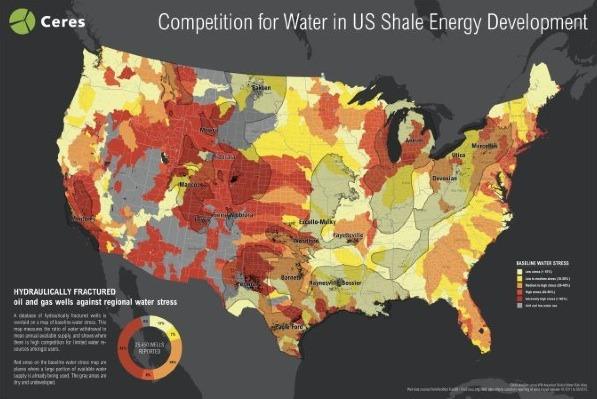

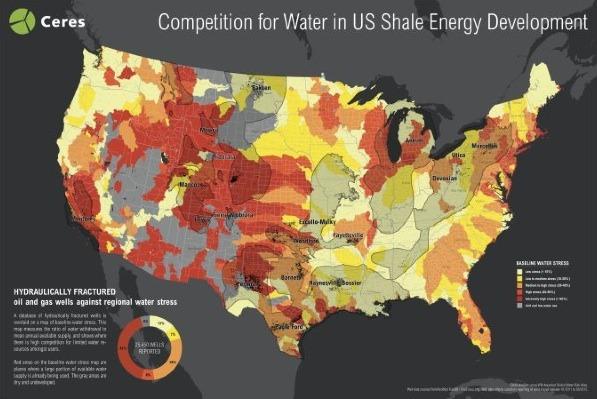

New Ceres Fracking Study Sounds Water Warning Signal

The green investment organization Ceres has just released a new report on oil and gas fracking in the U.S., and it adds to the red flags that have been popping up over the fracking industry for the last couple of years. The report, "Hydraulic Fracturing and Water Stress: Water Demand by the Numbers," underscores the urgency of addressing the risk that fossil fuel extraction poses to water resources - and to the investment community.

The report comes on the heels of the Ceres 2014 Investor Summit on Climate Risk in January. That event launched the organization's Clean Trillion Campaign, which aims to prod the investment community in a climate-ethical direction by exposing emerging risks and indicating the path to more financially sustainable strategies.

Fracking and water

For those of you new to the subject, fracking refers to a drilling method used to retrieve oil and gas deposits from shale formations. It consists of pumping a chemical brine into the formation at high pressure.

The emergence of horizontal drilling technology has added another new twist to the technology.

That can lead to a number of water resource issues that are not as apparent with conventional drilling. Modern fracking operations can involve enormous amounts of brine water, so the initial issue is competition for water with agriculture, livestock and other industries in addition to municipal needs.

Additional issues include potential contamination of existing groundwater supplies from fracking chemicals, geological disruptions, and the storage, treatment and disposal of fracking wastewater.

If you are wondering why these issues have only begun to be explored, that's because fracking was mainly confined to sparsely populated areas in the western U.S. until a few years ago, when improvements in the technology combined with a Clean Water Act loophole to open up drilling in much more populated areas. That includes the Marcellus Shale formation, which spans parts of New York, as well as Pennsylvania, New Jersey, West Virginia and other Northeast states.

The Ceres fracking report

Ceres produced a 2013 fracking report that recorded more than 24,000 fracking wells in areas that were already under water stress, indicating a potential risk to investors.

The new report (now available through the Ceres website) builds on the earlier work with a detailed analysis of water use data from more than 39,000 new fracking wells in eight different regions with intense shale development, from January 2011 through May 2013.

The executive summary is worth reading in full, but here is a brief recap identifying the main players:

...97 billion gallons of water were used, nearly half of it in Texas, followed by Pennsylvania, Oklahoma, Arkansas, Colorado and North Dakota. Among more than 250 operating companies reporting to FracFocus in the United States, Chesapeake (ticker:CHK) had the largest amount of water use reported, using nearly 12 billion gallons, followed by EOG Resources (EOG), XTO Energy (owned byExxon, XOM) and Anadarko Petroleum (APC).Halliburton (HAL), a service provider to many shale energy operators, handled the largest volume of hydraulic fracturing water overall, nearly 25 billion gallons, over a quarter of the water used for hydraulic fracturing nationally, followed by Schlumberger (SLB) and Baker Hughes (BHI).

And here is the situation in terms of competition for already-stressed water resources:

Nearly half of the wells hydraulically fractured since 2011 were in regions with high or extremely high water stress, and over 55 percent were in areas experiencing drought...Over 36 percent of the 39,294 hydraulically fractured wells in our study overlay regions experiencing ground water depletion.

Ceres fracking report: The way forward

Having identified a substantial risk to investors, the next step is an obvious one. Ceres follows up with a series of recommendations advocating greater risk transparency on the part of fracking operators and related companies. That includes disclosing the degree of water stress in their areas of operation, and disclosing the steps they take to protect and use water resources more efficiently.

Engaging employees and the supply chain in more sustainable practices is another obvious area of focus that Ceres recommends.

The organization also advocates for greater shareholder/stakeholder engagement, with recommendations to work on local communities and regulators to press fracking operators into more sustainable practices.

If these recommendations seem like a collective pipe dream, perhaps that is the point. The bottom line is that oil and gas fracking in the U.S. is a high-risk industry. As recently advocated by the new sustainable investment organization Divest-Invest Philanthropy, investors would be better served to take their money into more financially sustainable endeavors.

Image: Courtesy of Ceres

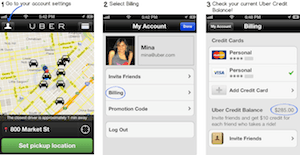

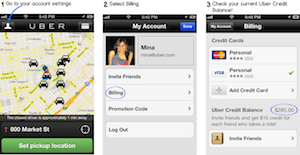

Who is Liable When Ridesharing Goes Wrong?

Popular ridesharing companies like Uber, Lyft and Sidecar have long-operated in a legal gray zone. While the California Public Utilities Commission’s (CPUC) unanimous approval of new regulations around ridesharing services last September helped to clear some of the ambiguity, scores of questions remain. Chief of these are liability issues -- just who is to blame when things go wrong with ridesharing?

Last Monday, Uber found itself slapped with the first wrongful death lawsuit ever brought against a Transportation Networking Company (TNC) after one of its drivers, Syed Muzzafar, hit and killed a 6-year-old girl on New Years Eve in San Francisco.

“This tragedy did not involve a vehicle or provider doing a trip on the Uber system,” the company said. Uber spokesman Andrew Noyes said the company had no comment on the lawsuit.

While at first it may seem that Uber has a point -- Muzzafar was not driving on the Uber clock at the time of the accident -- companies can be found responsible for causing wrongful death and emotional distress even if the party that committed the crime is a completely independent third party.

PandoDaily cites the case of Weirum et al. vs. RKO General, Inc., where a radio station sponsored a contest involving one of its DJs driving around town and having teenagers “find” him for a prize. This resulted in reckless teen driving that culminated in the death of an innocent man, and the radio station was held responsible.

The court said, “It is of no consequence that the harm to decedent was inflicted by third parties acting negligently…The issue here is civil accountability for the foreseeable results of a broadcast which created an undue risk of harm to decedent.”

It doesn’t seem fair that ridesharing companies like Uber should be liable for everything their drivers do all the time, but where do we draw the line?

To be clear, it would be tough for someone to win a case against Uber for "vicarious liability," which usually only applies when a company has full-time employees who represent the business itself. This relationship makes the company liable by proxy for employee actions.

But the fact that the Uber drivers are independent contractors only protects the company from some liability -- when it comes to hiring negligence, wrongful death or causing emotional distress, things are less certain.

A prosecutor could claim of hiring negligence if it proves Uber didn’t do its due diligence to vet Muzzafar, even though he is an independent contractor. Uber acts an awful lot like an employer -- it vets drivers, dictates their appearance and behavior, and takes a percentage cut of each ride. This makes it harder for Uber to claim it is simply and independent platform that connects users to drivers. Taxi companies employ independent contractors and have faced negligent hiring charges in the past.

"We’re in uncharted waters here with Uber," said Jordanna Thigpen, a trial lawyer in Los Angeles and the former executive director of the San Francisco Taxi Commission. "Society is evolving, these apps are evolving, and the court cases are catching up."

As a disruptive business, ridesharing will continue to face difficult legal questions until the law "catches up." The recent CPUC decision granting legitimacy to ridesharing companies, along with their mounting popularity with consumers, means that they likely are here to stay. Ridesharing also offers economic advantages, such as helping to cut down on traffic and saving some $429 million in opportunity cost lost every day to American commuters. While companies like Uber and Lyft continue to duke it out for ridesharing supremacy, consumers will be the ultimate winners.

Let’s just hope no one else gets hurt in the process.

Image Credit: Uber Blog

Based in San Francisco, Mike Hower is a writer, thinker and strategic communicator that revels in driving the conversation at the intersection of sustainability, social entrepreneurship, tech, politics and law. He has cultivated diverse experience working for the United States Congress in Washington, D.C., helping Silicon Valley startups with strategic communications and teaching in South America. Connect with him on LinkedIn or follow him on Twitter (@mikehower)

Want to Help Women Achieve Leadership Roles? Bring on the Men

By Kellie McElhaney, Haas School of Business

This past fall, I offered my Women in Business course at the MBA level, for the second year in a row. Again, the course filled, and again, males enrolled in the class as well as females. The fact that our male students see the value of investing in women globally exemplifies our culture of Beyond Yourself and Question the Status Quo.

This year, a male student applied and lobbied hard to be my graduate student instructor, so I gave him a shot. He was brilliant, not only in the structure, attention and small group discussions that he added to the class, but also in the perspectives he offered to me as the instructor. A theme that strongly emerged from the course readings, lectures and discussions this year was the critical need to bring men into this hard work, both to raise awareness of and to educate them on the data, value and opportunities of investing in women, but also to include them in solutions and efforts.

Warren Buffett says we can no longer afford to leave out women as part of the world of business, and my students agree: We can neither afford to leave out men as part of the solution. My male graduate student instructor’s novel idea - "Bring a man to class" night – resulted in 29 men in attendance. While most were students, spouses and partners, two Haas staff members also attended (sadly, though invited, no faculty showed up).

For the first hour, we listened to a leader from Facebook, a Haas alum, talk about her journey to authenticity and sincerity in leadership. For the second hour, the enrolled students summarized the data supporting the impact of investing and empowering women in leadership, and a rich though too brief discussion ensued. Challenges were raised. Solutions were discussed. A new idea on which we at Haas must work was born: How do we most effectively engage men in addressing this gender gap at work?

I am convinced that the men who have taken my course will go out into their respective professions and organizations and lead change, just as some corporate leaders, like John Chambers at Cisco, have done. For their final assignment, all students had to make a commitment to what they will do when they leave here to move the needle forward at the individual, company and system levels. One of my EWMBA students had already begun his work at his San Francisco tech firm. He had organized and was developing the strategy for a formal Women in Leadership group at his company. That’s the power of real-time education leading to real-world change!

We, too, at Berkeley-Haas are committed and strategizing. Under Laura Tyson, Laura Kray and my own leadership, the new Institute for Business and Social Impact has also committed to developing a center around women, the gender gap and business opportunities. As Hilary Clinton says, "Women represent the single biggest opportunity of this century." We here at Haas are on it… stay tuned for more information!

Kellie McElhaney is the faculty director of the Haas School of Business at the University of California, Berkeley.

A version of this piece was originally published on the Redefining Business blog, a Haas School of Business publication.

Even Corn Syrup Officials Call Attempted HFCS Rebranding "Dishonest and Sneaky"

Maybe you remember way back in 2010 when the Corn Refiners Association (CRA) put out silly commercials and tried to get the FDA to let them rebrand corn syrup as "corn sugar."

If that CRA bid to rebrand high fructose corn syrup as "corn sugar" and "natural" seemed a bit Orwellian to you, as Dr. Andrew Weil described it, you're in good company. New documents show the Corn Refiners Association thought it was a bit of a stretch, too, with David Weintraub - the spokesman for corn syrup producer Archer Daniels Midland - describing the name change as "dishonest and sneaky."

It's good to see there are voices of conscience and reason in these corporate entities, but distressing that their voices don't rise to the top.

The most public portion of this bid was a widely mocked ad blitz depicting corn syrup detractors as rude, snooty and uneducated in an attempt to convince Americans that corn syrup was "natural" and pretty much the same as sugar. And apparently that detractors are kind of judgemental jerks.

The attempted rebranding sparked a lawsuit between a group of sugar producers and the Corn Refiners Association, as the sugar producers claimed the CRA was misleading consumers. Then came a counter-suit from the CRA claiming the sugar companies had engaged in a nasty, decade-long smear campaign to make corn syrup seem particularly unhealthy. Like...more unhealthy than sugar.

The whole bizarre set of events and laughable commercials seem to have arisen because the Corn Refiners Association feared people were beginning to believe that high fructose corn syrup was to blame for the out-0f-control obesity epidemic. And they blamed sugar for promoting that perception. Whether one blames the obesity epidemic on the chemical makeup of HFCS or the subsidized affordability of corn syrup that mean it's put in everything, the CRA opted to address the perception problem by just renaming the product entirely in a pretty transparent attempt to fool the public.

From the lawsuits came documents showing communications between corn syrup producers that indicate their own misgivings about calling corn syrup "natural." In a Feb. 3, 2010 confidential memo with the words "Marketing Ploy" in the subject line, spokesman Weintraub said: "I think we're unnecessarily asking for trouble by using the ‘natural’ language....I don't think we really gain much in the mind of the audience or customers and I think it provides a point to ridicule the ads and the industry comes off as being disingenuous."

"Disingenuous" for sure.

When the FDA rejected the corn syrup bid, they appear to have done so largely based on the texture and nature of corn syrup versus sugar. Sugar is a solid, dry, crystallized substance. Not a runny, viscous fluid. They then go on with language that, to the average layperson, sure as heck makes corn syrup seem like the exact opposite of "natural."

"HFCS is an aqueous solution sweetener derived from corn after enzymatic hydrolysis of cornstarch, followed by enzymatic conversion of glucose (dextrose) to fructose."

Or, as the CRA may have said it in a commercial: "First we find the finest enzymatic hydrolysis tree and wait patiently until its dextrose fruit has reached the height of fructose before we harvest it from a stainless steel tap. Ahhhhh...from mother nature to your home. And your soda pop. And yougurt. And granola bars, and breakfast cereal, corn chips, children's cough medicine, bread, sausages, pickles, pasta and pizza sauce, ketchup, pickled herring..."

Image Credit: Flickr/** RCB **

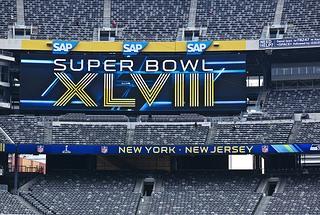

'Goodvertising' Trashed at Super Bowl XLVIII

At this year’s Super Bowl, "Goodvertising" fared as well as the Broncos – left out in the cold and wondering where it all went wrong. And while the clash on the field was more obvious, there’s a subtle power struggle happening in the world’s most expensive commercial break: Advertising as usual versus the world-bettering messages of Goodvertising.

For most companies, the Super Bowl is merely a way of imprinting their brand on your mind; like the branding of old: cowboys burning their name on their cattle, to show ownership. Or so the cattle wouldn’t end up stray or rounded up by a competing farm. These brands definitely won’t want you to stray from the consumerist dream of shop-till-you-drop – they own you.

Other brands seem to understand that people are growing increasingly tired of quick laughs and cartoon characters. They're tired of brands ruining their favorite movies, like Kia kidnapping The Matrix’s Morpheus, for an empty sales pitch about seat warmers. And they're tired of exploitative emotional porn from Budweiser, with its horse-on-dog (or is that dog-on-horse?) action.

Good at making you laugh or good at making a difference?

In terms of share of voice, there’s no doubt about it: standard advertising outmuscled the David-like attempts of Goodvertising to bring a different narrative forward -- one that advocates caring for each other and our planet. Advertising sacked Goodvertising much like Peyton Manning was pummeled into submission. The really good commercials, the Goodvertising, as in doing and saying good rather than good-at-making-you-laugh-and-buy-more, were few and far between.

This alternative narrative needs to be told if brands want to change their role in people’s lives from being part of the problem to being part of the solution. How much real trust are you building as a brand when you bombard consumers with calories and ridiculous scientifically formulated meals so far removed from real food as to be almost unrecognizable?

From sexist to conscious love

It was great to see Axe embracing a more thoughtful (and honestly, less sexist) approach... conscious love? This time we didn’t encounter a teenage boy’s sexually overloaded fantasy of hot supermodels idolizing him as a semi-naked David Beckham (H&M nicked that one this year), but rather love as the foundation for peace.

Somewhere in the back of my mind, I recall theater classes and the Greek comedy telling the story of Lysistrata, a woman with a mission to end the Peloponnesian War by persuading all the women of Greece to abstain from sex with their husbands and lovers until peace was reached. Axe hasn’t joined hands with Lysistrata, but rather actor Jeremy Gilles pie-in-the-sky project, Peace One Day, to make their dreams of peace come true and support a more peaceful world.

The banned commercial?

While both Coke and Pepsi rolled out their usual all-singing, all-dancing entertainment brass band, their tongue-in-cheek challenger reminded people how they could enjoy the bubbly sensation of soft drinks in a more sustainable way with the simple push of a button.

The original version of their Super Bowl ad was edited (or banned as Soda Stream’s PR people will desperately try make you believe) because of its remark to big soda, "Sorry to Pepsi and Coke." It’s sad to see that we’ve become so enamored of drama that unless something is "banned" or "the cut they didn’t want you to see," we don’t pay attention.

Makers of good

Microsoft also wants us to see them as a solution rather than just a provider of expensive word processors like the one I’m typing away on now. Their commercial celebrates how technology empowers people including a former NBA star, Steve Gleason, who speaks with a Stephen Hawking-like voice apparatus – powered by Microsoft?

The last stone from David’s sling is a humorous piece from Chobani that challenges the typical eco-conscious ads using the "mom-telling-you-off" approach with an added black-and-white filter for heightened drama. This is, instead, 30 adrenaline-filled seconds showing a bear rampaging through a small local grocery store, leaving only the cups of Chobani yogurt untouched, because they’re natural or because, as Chobani promises you after the bear’s roars quiet down, “A cup of yogurt won’t change the world. But how we make it might.”

I couldn’t agree more, so forgive me for applying their mantra to the business of advertising rather than fermented milk products. Brands pay a whopping $4 million each for their 30-second shot to entertain you and keep the consumerist dream alive, but we need commitment and cash behind promoting a different story. Honestly, we don’t even need that much cash to tell the story. We could use that money to do real good and have enough left over to share the amazing things we are doing.

If we want a healthy, fun, sustainable society, we need to change the way we craft these brands and their messages. It’s not about throwing away advertising budgets and watching the brands we care for fade into obscurity, but it’s about building a narrative or movement people can believe in. And let’s be honest – you don’t need bells and whistles when you’ve got a Good product that does Good things.

Image credit: Flickr/Anthony Quintano

Thomas Kolster is an author and speaker, as well as Director of The Goodvertising Agency and WhereGoodGrows.

Corruption costing European economy €120bn a year

Corruption continues to be a challenge for Europe, says the first ever EU Anti-Corruption Report from the European Commission.

Affecting all EU Member States, corruption costs the European economy around €120bn per year. Member States have taken many initiatives in recent years, but the results are uneven and more should be done to prevent and punish corruption, the report maintains.

“The Report shows that the level of corruption varies from one Member State to another. But it also shows that corruption affects all EU Member States. One thing is very clear: there is no "corruption-free" zone in Europe,” commented Cecilia Malmström, EU Commissioner for Home Affairs.

"Corruption undermines citizens' confidence in democratic institutions and the rule of law, it hurts the European economy and deprives States from much-needed tax revenue. Member States have done a lot in recent years to fight corruption, but today’s Report shows that it is far from enough. The Report suggests what can be done, and I look forward to working with Member States to follow it up."

National chapters in English and in national languages are available here

Pic caption: © Uschi Hering | Dreamstime Stock Photos

BITC calls for business to incentivise responsible behaviour

The charity Business in the Community (BITC) is calling on chief executives to reward responsible behaviour in the same way that they incentivise staff to meet financial targets and generate profit.

Speaking in London to an audience of over 400 chief executives, Stephen Howard, chief executive of BITC challenged leaders to incentivise and reward ‘doing the right thing’ at the charity’s Leadership Summit 2014.

A new survey of 215 senior business leaders conducted by the charity shows that individual employee objectives often do not align with the organisation’s corporate responsibility goals leading to behaviour which goes against those business values.

Howard suggests that responsible behaviour should form a central element of staff training and development and urges bosses to actively give staff experiences outside of the business to help nurture their values and decision-making.

“Business leaders are failing to properly reward responsible behaviour, meaning that despite good intentions, there is no incentive for new recruits to do the right thing. Changing incentive structures would send a powerful message that being a responsible business goes further than CSR reports and values statements,” he commented.

“Indeed, chief executives and investors must move beyond financial value as the only recognised metric of business success. By adopting an integrated approach, reporting on the added value of responsible practice business, and rewarding responsible behaviour, business can form a new and more powerful contract with society – and re-claim its rightful place as an engine for social change and innovation.”

Picture credit: © Atee83 | Dreamstime Stock Photos

17 Leading Philanthropies Pledge Fossil Fuel Divestment

A group of 17 leading foundations has announced a new initiative to encourage fossil fuel divestment by the philanthropic community. Called Divest-Invest Philanthropy, the new effort launched Jan. 30 in support of a growing movement among other nonprofit endowments, including academic, health, pension and religious foundations.

Divest-Invest comes at a time when climate-related events are shining a spotlight on the future risks that fossil fuel investors face, as highlighted by the Jan. 15 Ceres Investor Summit on Climate Risk.

Also of interest to investors is the long-awaited State Department Keystone XL pipeline report, which was finally released on Jan. 30.

The report identified a number of risks and impacts, including several related to environmental justice issues. The next step in the review process promises to be even more interesting, as it includes a public comment period and input from the Environmental Protection Agency and at least seven other federal agencies - the Departments of Defense, Justice, Interior, Commerce, Transportation, Energy and Homeland Security.

The Divest-Invest fossil fuel divestment initiative

Wallace Global Fund has taken the lead in Divest-Invest, joined by 16 other foundations: Ben & Jerry’s Foundation, The Chorus Foundation, Compton Foundation, The Educational Foundation of America, Granary Foundation, Jesse Smith Noyes Foundation, The John Merck Fund, The Joseph Rowntree Charitable Trust, KL Felicitas Foundation, Nia Community Fund, Park Foundation, The Russell Family Foundation, Schmidt Family Foundation, The Sierra Club Foundation, Singing Field Foundation, and Solidago Foundation.

The initiative was launched with an open letter to the philanthropic community, signed by all 17 foundations. The letter is worth a read in full, as it provides a clear, plain-language outline of the risk to investors from business-as-usual investment strategies, so following are just a few samples.

The group makes no bones about the fossil fuel divestment effort's roots in anti-Apartheid activism, writing that:

...today’s movement argues that mission-based institutions whose goals and constituencies are threatened by the extraction and combustion of fossil fuels should not also seek to profit from them. It exposes the fossil fuel industry’s efforts to block progress to a clean, renewable energy future, and argues for new investments that will advance climate solutions rather than drive the crisis.

The letter also brings up an area that emerged as a central concern of the Ceres Investor Summit on Climate Risk. With climate-related crises increasing to the point where urgent global action becomes imperative, fossil fuel companies and their investors will almost literally be left holding the bag in the form of "stranded assets."

The financial consequences will be devastating:

There is growing recognition that if we hope to maintain a livable climate, the majority of fossil fuel reserves now on the world’s books will become stranded, unusable assets...Fossil-fuel stocks, whose valuations are linked to reserves, are thus vastly over-valued, with conservative estimates pointing to a multi-trillion dollar 'Carbon Bubble,' many times the recent $2 trillion housing bust.

Anticipating pushback from political conservatives, particularly those who have been ginning up distrust of the UN Intergovernmental Panel on Climate Change, Divest-Invest cites similar warnings from economic conservatives such as Price Waterhouse Cooper, the London School of Economics, Financial Times and The Economist.

The way forward for climate-ethical investing by foundations

Outlining the urgent need for divestment is only half of Divest-Invest's mission, as its name implies. The organization also seeks to serve like-minded foundations as an information clearinghouse and best-practices model for climate-ethical investing.

As part of that mission, the Divest-Invest website (here's that link again) offers a variety of educational and informational resources, including white papers on divestment risk management, fiduciary responsibility issues, and investment opportunities and guidance.

Image (cropped) by doctor wonder