Video: Michelle Obama on Work-Life Balance

Apparently Michelle Obama brought a four-month-old Sasha with her to an interview for the Vice President of Community and External Affairs at University of Chicago Hospitals, and she was only willing to take the job if it came with tons of workplace flexibility.

I'm working from home today with my own four-month-old (who is thankfully going on 90 minutes in what is usually a 60-minute nap), so this video struck home for me.

http://youtu.be/9XGNDfm4gQM?t=4m44s

I'm very lucky that TriplePundit is a sustainable business and a very flexible place to work, but I have to admit that the addition of an infant to my life has created a ton of extra (miraculous, mostly enjoyable) work. Baby Frances is delightful, but my life was already pretty busy before she arrived. I can't shake the feeling that I'm not quite working up to my former potential, just because there are only so many hours in the day. Sheryl Sandberg argues in "Lean In" that it's possible to have a demanding executive-level job and leave at 6 p.m. if you just really focus while you're at work (and catch up on email after the kids go to sleep). The trouble is, my mind is now also full of issues like managing daycare schedules (How do they just close for two weeks in July but charge you for the full month?), when to start solids and how to do it, and the pros and cons of sleep training.

The brain of a sleep-deprived woman only has so much room for problem solving, and most of my job is problems solving of one sort or another -- truthfully, something must give and the infant is pretty effective at insisting that her needs get met first. Yes, she's still pretty young, but let's be honest, I wasn't really at peak performance for most of the pregnancy, so we're going on over a year now.

So what say you, working parents of the world? I'm all for flexible workplaces, especially now that I absolutely need one, but is the dark secret of all the work/life balance advocates out there that you don't actually accomplish quiiiite as much as you did before you became a parent? Or am I just in a rough spot? Inquiring minds want to know!

ExxonMobil to Comply with LGBT Executive Order

ExxonMobil said last week that it will comply with the protections for gay, lesbian and transgender employees required of federal contractors. But it’s unclear whether the oil major will formalize that by changing the language of its equal opportunity corporate policy.

A recent Associated Press story noted that President Barack Obama's signing of an executive order on July 21 expanded protections for federal workers and contractors from discrimination based on sexual orientation or gender identity. The Labor Department has 90 days to issue regulations for how employers must comply.

“Exxon, which according to government records won more than $480 million in federal contracts in 2013 and more than $8 billion since 2006, has long resisted pressure from civil rights groups and shareholders to enumerate such protections in its formal policy,” according to the AP account.

In a statement to the AP, ExxonMobil spokesman Alan Jeffers said the company will continue to “abide by the law,” adding that it prohibits “discrimination on any basis.” He wouldn't say if that meant changing the language in the company's formal equal employment opportunity policy.

For 15 straight years, most recently in May, ExxonMobil shareholders have overwhelmingly voted down proposals to create specific LGBT protections. The proposal this year won 20 percent of voters holding roughly $41.5 billion in Exxon stock. The company claims that it has a “zero-tolerance” policy for discrimination, but the Securities and Exchange Commission has pointed out that this does not offer the same legal force as the regularly-rejected protections would.

"They say they don't need to because it's not an issue, but we don't agree. Without clear written policies that are very specifically stated, employees aren't clearly entitled to equal benefits," New York State Comptroller Thomas P. DiNapoli said. The proposal to include specific non-discrimination LGBT language to ExxonMobil’s equal employment opportunity statement has been backed by DiNapoli since 2010 on behalf of the New York State Employees Retirement System.

Natasha Lamb of the private equity group Arjuna Capital, another Exxon Mobil shareholder, expressed confidence the company will comply with the executive order. "I can't imagine Exxon would compromise a federal contract over a couple of words," she said. "That would be juvenile. Once regulation is in place, they will follow suit and act in the best interest of shareholders."

The company began offering benefits to legally married same-sex couples in May 2013, a month before the U.S. Supreme Court struck down the Defense of Marriage Act, which previously allowed states to refuse to recognize same-sex marriages granted in other states.

Freedom to Work filed a complaint against ExxonMobil with the Illinois Department of Human Rights in May 2013, after resume testing found that the company would prefer a lesser-qualified candidate over one who identifies as LGBT. The case was dismissed in January on jurisdictional grounds, but this month the Illinois Human Rights Commission overturned the dismissal, allowing the complaint to advance.

After 15 long years, it is taking a presidential executive order to move ExxonMobil in the right direction, so heaping praise on the company for its “compliance” isn’t very impressive. It’s more like being dragged by the ear into the 21st century.

(Note: The company will discuss its second quarter earnings later this week. Will ExxonMobil or financial analysts address the LGBT issue?)

Image credit: Exxon Gas Station by T N Jones via Flickr

The North Face Sustainability Report: Environment and Efficiency

To enjoy much of the outdoors, one needs the proper clothing and equipment, but those very products have their own environmental impact — from petroleum-based polyester to the shipping required to move products from factories to stores. To that end, The North Face says it is making headway on its sustainability goals, according to its most recent corporate responsibility report.

The North Face is keeping up with outdoor gear companies such as its fellow VF Corp. brand, Timberland, and Patagonia in ensuring the messages it sends to its customers are reflected in how company operations perform.

So, following on its previous report, in which the company committed to more sustainable fabric and renewable energy, what exactly has The North Face accomplished and what are its future goals?

Clean energy is a large facet of The North Face’s commitment to reduce its environmental impact. Its new American headquarters in Alameda, California, which opened last year, generates more than enough electricity for the building’s requirements. The LEED Platinum-certified building also uses an evaporating cooling system that nixes any use of emissions-heavy coolants. Other regional headquarters and distribution centers also incorporate solar or water-saving features — and while leasing stores in malls limit the green building features a company can install, The North Face claims it will adopt as many LEED-Commercial features as possible. Those retrofits have helped the company continue its incremental drop in greenhouse gas emissions the past few years. While those efforts fell short of the 2013 target, The North Face is correct in focusing where most of a company’s impacts occur: within manufacturing.

And in manufacturing, the company is also making progress. It has a goal to use polyester from 100 percent recycled content by 2016. Considering the effects that will have throughout its supply chain, and that polyester comprises 80 percent of its total clothing line, two years is not much time. But the company is on its way with some of its popular Denali jackets, which use the equivalent of 51 plastic bottles. But the company is not just about recycling or using more sustainable and ethical materials. In an era where fast fashion has become the exasperating norm, the company’s lifetime warranty on its apparel and outdoors gear has led to more than 80,000 products being repaired and returned to customers annually; the rest are donated or downcycled.

Far too many clothes end up in landfill, the result of cheap manufacturing and the lack of systems to churn textiles into something other than garbage. But companies including The North Face are taking leadership on this enormous challenge. It’s an uphill fight, considering consumers’ preferences for quantity over the quality of clothes, but it is a fight other clothing companies, in the name of “responsibility,” are wise to follow.

Image credit: The North Face

Leon Kaye has lived in Abu Dhabi for the past year and is on his way back to California. Follow him on Instagramand Twitter.

New Jersey Turns to Distributed Resources to Enhance Energy Resilience

Superstorm Sandy caused tremendous damage, as well as hardship and loss of life, in communities across New Jersey – with a total of over $37 billion in physical damages alone, according to a Rutgers School of Public Affairs and Administration study released in October 2013.

Given current and rising levels of atmospheric CO2 and other greenhouse gases, New Jersey and states up and down the Eastern Seaboard, as well as across the U.S., can likely expect more in the way of extreme weather events and greater variability in weather patterns.

Aiming to strengthen New Jersey's resilience to power outages and energy shortages, the Christie administration on July 23 announced it has taken a big step forward in establishing the New Jersey Energy Resilience Bank (ERB). It will be the first state-sponsored fund of its kind dedicated specifically to enhancing the resilience of energy infrastructure and supplies to extreme and variable weather patterns and conditions.

With an initial $200 million from the mid-Atlantic state's Community Development Block Grant-Disaster Recovery (CDBG-DR), the ERB is to “support the development of distributed energy resources at critical facilities throughout the state,” according to a New Jersey Board of Public Utilities (NJ BPU) press release.

The legacy of Superstorm Sandy

Superstorm Sandy caused extensive damage to New Jersey's energy infrastructure, leaving some 5 million residents without electricity. Infrastructure and supplies of petroleum and natural gas were damaged or disrupted, as well as those for electricity.

Residents of coastal Monmouth and Ocean counties were among the hardest hit, though the monetary value of damages were nearly as large inland in Bergen county, N.J. Spotlight highlighted in March 2013. Residents of Toms River were not allowed to return to their homes for more than three months after Superstorm Sandy hit in late October 2012.

“More than 8,800 residences, nearly 90 percent of those individual houses, were damaged, 1,000 severely, according to the state Department of Community Affairs,” N.J. Spotlight reported.

Nearly 5,100 businesses were affected as well. A rollercoaster in neighboring Seaside Heights washed into the sea. All told, nearly 60 percent of Seaside Heights' residences (1,929 of them) were damaged, along with over 200 businesses, many along its famous boardwalk.

The benefits of distributed energy resources

Critical facilities, such as hospitals, wastewater treatment plants and universities, where distributed energy resources – combined heat and power (CHP) co-generation, fuel cells and off-grid solar inverters with battery storage – were able to weather Superstorm Sandy better than others. It's these sorts of distributed energy resources the ERB intends to finance.

According to state Board of Public Utilities (BPU) President Dianne Solomon: "The launch of the Energy Resilience Bank, the first of its kind in the nation to focus on resilience, is yet another effort of the Christie administration to increase energy resilience at critical facilities throughout New Jersey.

"Increasing energy resilience, whether through the Energy Resilience Bank, the BPU approved resiliency improvement measures implemented by utility companies or N.J.’s Clean Energy Program, will minimize the potential impacts of future widespread power outages due to major storms like Superstorm Sandy.”

In addition to enhancing the resilience of the state's energy infrastructure, spurring greater deployment of distributed energy resources will also benefit residents in terms of lower and more stable energy costs, a cleaner environment and improved energy efficiency. As state Economic Development Authority (NJ EDA) CEO Michele Brown elaborated:

“Distributed energy resources proved extremely resilient following Superstorm Sandy; unfortunately, due to high initial costs, many critical facilities do not have these energy resilience solutions in place. The ERB will help address this unmet need by providing technical and financial support to critical facilities across New Jersey to ensure they have a path for building energy resilience.”

The New Jersey Energy Resilience Bank

According to New Jersey's Action Plan amendment, ERB will focus on providing capital, primarily in the form of low-interest loans and grants, so that critical facilities, such as waste and wastewater treatment plants and hospitals, can deploy distributed energy resources. It's envisaged funding will expand to include other critical facilities, including police, fire and emergency services buildings, as well as schools that can function as emergency shelters.

In addition to the initial $200 million in CDBG-DR funds, the BPU approved a sub-recipient agreement with the state's Economic Development Authority to work jointly to establish and manage the ERB. This includes collaborating on the program's design, which in turn includes technical, operational and financial conditions that applicants will need to meet to qualify for ERB funding.

The BPU and EDA also announced the hiring of two individuals to fill two leadership positions with the Resilience Bank. Mitch Carpen was named ERB's executive director, and Thomas N. Walker was named deputy director. As director, Carpen will be responsible for managing ERB's project investment pipeline, which includes overseeing the selection and closing of individual deals as well as setting ERB's strategic direction. Walker, as ERB deputy director, will serve as head of policy and internal operations.

*Image credits: 1) NASA; 2) Fox News; 3) U.S. Coast Guard

WhiteWave Foods Issues Its First Sustainability Report

WhiteWave Foods met its 2015 goal to source Certified Sustainable Palm Oil for 100 percent of its liquid creamers in 2012, three years ahead of schedule. The company, whose brands include Silk, Horizon and Earthbound, set the target in 2010. Palm oil is an ingredient used in many of its liquid creamers, and the palm oil industry has a high impact on the environment due to deforestation.

WhiteWave Foods recently released its first corporate social responsibility (CSR) report, which goes on to detail other environmental achievements, including reducing packaging, waste and greenhouse gas (GHG) emissions.

Despite production volume increasing in both North America and Europe, WhiteWave has managed to reduce GHG emissions. It cut GHG emissions in North America by by 32 percent per gallon of product while production volume increased by 57 percent since 2006.

Meanwhile, the company also slashed carbon emissions by 39.5 percent per ton of product in Europe, where product volumes have grown by 22 percent since 2007. While cutting emissions, the company also increased onsite renewable energy production by 30 percent and reduced waste sent to landfill by 47 percent in its European operations.

Packaging

When it comes to packaging, WhiteWave Foods has three sustainability principles:

- Minimize the environmental impact by selecting the right materials.

- Optimize our packaging for both upstream and downstream impact.

- Engage and educate consumers and retail customers about packaging best practices.

Examples abound of how the company incorporates those three principles into its packaging. Its redesigned carbon packaging caps use 33 percent less material which resulted in 920,000 pounds of resin saved in 2013. It removed Polyvinylidene chloride (or PVDC, more commonly known as saran) material from its International Delight creamer singles, which eliminated 1.1 million pounds of material from the waste stream. Its Horizon Mac & Cheese and Snacks cartons contain a minimum of 35 percent post-consumer content and are made with 100 percent recycled paperboard. Alpro’s margarine bottle and Provamel’s margarine cup are packaged in polyethelyne terephthalate (PET), which helped reduce the amount of plastic used by 14 kilograms in the Alpro bottle and 8.48 kilogram in the Provamel cup.

Water conservation

Through training programs, WhiteWave is increasing awareness among its employees about water conservation. In 2012, WhiteWave required employees to participate in an online training module that provided background on important issues about water conservation, plus provided practical suggestions on how to use less water. Several of its North American plants have created teams that focus on water efficiency and ways to reduce use.

WhiteWave also works to preserve water systems: It is a charter sponsor of Change the Course, an initiative that works to preserve the Colorado River. The company buys Water Restoration Certificates (WRCs) to balance 100 percent of the water used to manufacture Silk products at its company-owned facilities. Its International Delight brand invested in a new water-flow restoration project in California in 2013, and bought WRCs to balance 100 percent of the water used to produce its iced coffee beverages. Its combined investments in WRCs have helped restore more than 485,000,000 gallons of water to ecosystems, according to the report.

Non-GMO soy

It's also worth noting that WhiteWave is one of the largest purchasers of organic soybeans in North America, and the majority of conventionally-grown soy in the U.S. is genetically modified (GMO).

The company is also making moves toward sustainability in this area: All of the company's Silk plant-based beverages, including soy beverages, are enrolled in the Non-GMO Project’s Product Verification Program (PVP) and display the verified seal.

Additionally, WhiteWave is vocal about its support of labeling GMO foods, stating in the report that it advocates “national mandatory GMO labeling in the U.S.” The company gave over $1 million to labeling efforts since 2012 through Just Label It and other initiatives.

Image credit: Earthbound Farms

Shrink the Solar Power Inverter and Google Will Pay You $1 Million

What's the size of a clunky ice cooler and essential to that off-grid lifestyle you’ve always dreamed of? If you guessed a solar power inverter, then you may be just the techie Google is hoping to hear from. At a time when computers can fit in the palm of your hand and miniaturized pacemakers can be less than 42 millimeters in size and less than 2 cubic centimeters in volume, it may seem surprising that we’re still dealing with solar inverters that can be as big as your grandmother’s knitting chest.

Google's Green Team has come up with an ingenious answer: Offer what every hobby industrialist has always wanted -- $1 million for the guy or gal that can come up with a way to shrink the technology.

For those who are unacquainted with power inverters, it’s that essential piece of equipment that allows us to actually utilize the power we gain through the solar panels or wind turbines. It converts the direct current (DC) that’s stored from say, a solar array, to the alternating current (AC) we use to power appliances.

Reducing the size of the power inverter would not only make it easier to install solar panels in isolated, undeveloped areas of the world, like Central America or India, but will also invariably open the door to better, smaller forms of renewable energy.

Google admits that the task won’t be easy. After all, if its techies haven’t come up with the know-how to shrink a small box down to the size of a tablet or IPad, chances are the task will take some ingenuity.

“There will be obstacles to overcome; like the conventional wisdom of engineering," admits Eric Raymond, from Google’s Green Team.

He explains in a blog post on EVNewsReport:

“We want to shrink it down to the size of a small laptop, roughly one-tenth of its current size. Put a little more technically, we’re looking for someone to build a kW-scale inverter with a power density greater than 50 watts per cubic inch.”

Interested candidates need to register their team by Sept. 30.

More deets:

- Once registered, teams will have until July 22, 2015 to submit their technical approach and testing application.

- Approximately 18 finalists will be notified in October 2015 to bring their tiny inverters to the testing facility by Oct. 21, 2015.

- The winning team will be announced in January 2016.

More helpful information can be found on Google Green’s Little Box page, including a list of wide bandgap semiconductor manufacturers and related information for candidates. There’s also a FAQ page with specifics about who owns the intellectual property, etc.

Grants are available to academic institutions that take up the challenge. “We’re expecting university teams and private companies,” says Google, “but we’d love anyone with a good idea to throw their hat in the ring.”

Image: Google - Little Box Challenge

Power inverter: Lauren Wellicome

A Proud Day To Be A Hockey Fan: NHL Releases First Sustainability Report

Growing up as a hockey-obsessed kid in a small New York suburb, there was no single event to which I looked forward more than The Day the Lake Froze Over.

For most of my hockey-playing years, I had the great fortune of living across the street from a large lake (Lake Mahopac), and a short drive from a smaller pond (Teakettle Spout), the latter of which attracted a disproportionate amount of pickup hockey talent. I still remember rushing out the front door on Saturday mornings to check the integrity of the ice -- “Solid enough to skate on?” -- or waiting for the inevitable phone call imploring me to get down to Teakettle because a game about to get underway. None of us who gathered on those lakes and ponds took for granted the free ice-time we were afforded, but I don't think any of us considered that these opportunities might, some day, disappear.

This same spirit -- that of the eager kid entertaining his or her professional hockey playing fantasies on the local lake or pond -- animates much of the National Hockey League's (NHL) first Sustainability Report, which was released last week. The NHL's report is the first of its kind in major professional sports, and its scope and ambition are impressive. Hopefully, the work the NHL did on its inaugural report will set the tone for the rest of professional sports and encourage the other major leagues -- the MLB, NBA and NFL -- to follow-suit.

Sweet Emotion: What the report does right

The future of hockey is directly threatened by global warming and the declining availability of frozen lakes and ponds. The NHL recognizes this and the report is at its most compelling when it makes the importance of environmental sustainability into an issue that is deeply personal to the league's past, present and future players. This emotional connection gives the report an added dimension, one that goes beyond the usual “Here’s how we’re impacting the environment, and here’s what we’re doing about it.”

Take, for example, the introductory statement by league Commissioner Gary Bettman:

The NHL represents the highest level of hockey in the world. But before many of our players ever took their first stride on NHL ice, they honed their skills on the frozen lakes and ponds of North America and Europe. Our sport can trace its roots to frozen freshwater ponds, to cold climates. Major environmental challenges, such as climate change and freshwater scarcity, affect opportunities for hockey players of all ages to learn and play the game outdoors.

That's a powerful statement, and it is supplemented throughout the report by quotes from some of hockey’s living legends -- Bobby Orr, Owen Nolan, Wayne Gretzky, Mike Richter. Each explains in personal terms the pivotal role access to lakes and ponds played in their development, both as players and individuals. Orr notes that, whether he was skating or fishing, his free-time as a child was spent on the water. Nolan points out how “[g]etting outside” has always helped his “peace of mind.” The Great One admits that, from the ages of 3 to 12, he spent “eight to 10 hours a day” on the ice. Richter calls “[t]he beauty of a frozen lake . . . more than free ice time; it is freedom itself.”

Yet, as Richter notes in the report’s afterword, a recent study published by the Institute of Physics' Environmental Research Letters: "Researchers found a 20 to 30 percent decrease in the length of Canadian skating seasons over the past 50 years.” The practical hockey-specific consequences of this are real. According to Richter, “The world's largest natural frozen skating rink had to close before March 1, making its skating season a much-abbreviated 28 days.”

The NHL and water use

While the future of the sport depends on access to (frozen) water, the NHL is contributing to the resource's depletion. According to the report, most of the water used in the league's hockey arenas is devoted to ice-making, landscaping, cooling, plumbing and food service operations; total annual water use by all NHL clubs is more than 321 million gallons, which translates to almost 250,000 gallons of water per game.

So, what are the NHL and its constituent teams doing about it? For one, the league is now, for the first time, tracking and analyzing water use. This will allow it to better understand the gravity of the problem and how best to solve it. Second, since the launch in 2011 of its “Gallons for Goals” initiative, for every goal scored during the regular season, the league has pledged to restore 1,000 gallons of water “to a critically dewatered river.” According to the report, by the end of the initiative’s inaugural season (2011), the Gallons for Goals program restored more than 6.7 million gallons of water. The league claims to have donated ~20 million gallons since the program's launch.

Individual teams and their arenas are also working to minimize their water usage, mostly by retrofitting or replacing bathroom fixtures -- sinks, urinals -- with more sustainable models. For instance, the report highlights the Florida Panthers’ BB&T Center, whose sink retrofitting program “decreased restroom-sink water consumption by close to 75 percent from baseline consumption,” and the Los Angeles Kings’ Staples Center, "where all 178 conventional urinals were replaced with waterless urinals, for total annual savings of more than 7 million gallons of water." On the more creative end of the spectrum is the Winnipeg Jets’ MTS Centre, which now uses “reverse osmosis to filter water instead of treating it chemically.” This system produces “demineralized water that is free of impurities and typically forms into a harder ice surface. Pure, hard ice requires less maintenance, flood water and refrigeration energy, and also saves on wear of the ice resurfacers.”

Tone deaf? Where the report comes up short

So what does the report do wrong? Well, I’m loathe to criticize a first effort that is so ambitious and, at least in appearance, so emotionally tied to its sustainability programs. I'm especially hesitant where said report is the first in its “industry.” Yet, while I admire the NHL’s focus on how warming and water scarcity impact the league’s own future and the future of its players, there’s literally nothing here about how these issues are threatening the lives of actual human beings, plants and animals.

One could certainly read the report as a bit tone deaf in this regard. Minimizing water usage, for instance, isn’t really about ensuring the development of star athletes -- it’s about human health. According to The Water Project, for example, “nearly 1 billion people in the developing world don't have access” to clean drinking water.

And should melting ice really be made into a sports issue? After all, global warming’s impact on ice sheets -- which, as they melt, lead to rising sea levels -- “could bring about disastrous effects for people and wildlife.” In places like the Arctic, this means that polar bears, whales and other species are being forced to alter their feeding and migration patterns, “making it harder for native people to hunt them,” according to the Natural Resources Defense Council (NRDC). Moreover, “along Arctic coastlines, entire villages will be uprooted because they're in danger of being swamped.”

Of course, these environmental problems are well-documented, analyzed and discussed by experts (like the NRDC) and other stakeholders, and nobody is looking to the NHL for new information on the effects of global warming. Yet, it would have been nice to see the league at least acknowledge that there are other consequences of global warming that don’t necessarily have anything to do with ice skating.

Image credit: Flickr/michaelrighi

Profitability, Customer Experience Not Correlated with CSR Performance

By Chi-Pong Wong

We have seen recent report cards on corporate social responsibility (CSR) with remarkable results from institutions like Tata, Morgan Stanley and Infosys. The question is: Have these and many other CSR maneuvers made notable global impacts?

Well, not quite. By examining the CSR scores of those multinational companies that are top rated in customer experience (CX) or annual profit respectively, one would find that their overall CSR achievements are far from ideal. And from a different angle, flag-waving CSR winners did not capture sizable market shares to make a difference.

This study demonstrates that institutions renowned in CX or net earnings are not necessarily rated highly on their CSR activities -- contrary to what many believe.

Businesses with highest customer satisfactions do not shine on their CSR operations

Marketingcharts.com recently published the leading CX global brands based on Foresee’s customer experience findings, but these brands are no CSR medalists according to CSRHUB’s database.

The following line chart is created to show how irrelevant those global brands’ CX ratings are to their CSR ranks. The case that the No. 1 CX ranked company, Amazon, had a much below average CSR score really hammer the point home loud and clear.

The evidence that companies' CX scores and CSR grades do not correlate indicates that customers do not really value CSR that highly when they engage with the brands. If CSR outcomes do not contribute to CX, which is a key driver of customer purchases, then there will not be any strong incentive for businesses to embrace or strengthen their CSR efforts.

World’s most profitable companies are also pretty dismal on their CSR achievements

If the CSR tally of the top CX score receivers are disturbing, then the CSR grades the world’s most profitable corporations earned should be outright perplexing. Yahoo Canada published a list of the world’s 25 most profitable companies last year on its finance page, and those institutions’ respective CSR marks dug up from CSRHub are utterly frustrating.

The chart below is created to show not only how bad they are on their CSR performances, but also how uninspired CSR must have been to their profitability.

There are plenty of reasons why these companies were most profitable, but the fact that they could get away with disappointing CSR results is frustrating. The message from this study is clear: The shoppers did not care too much about these firms’ CSR attainment status when they made their purchases. Warren Buffett’s Berkshire Hathaway is perhaps one most striking example among many to demonstrate this point. It was the world’s fifth most profitable team last year despite its disheartening CSR performance. This says a lot about the broken connection between consumer behavior and the conflicting message conveyed in CSR surveys.

Coda

Okay, the world has not been serious enough about CSR according to the data that have just been examined. How about CSR on a smaller scale? Has there been any particular country where its residents really walk the talk on CSR matters?

I know that it’s a daunting task to go through the same analysis on every country in the world, so I decided to sample a couple of countries with very active CSR evangelists just to validate. I triaged the CX data for USA and U.K. and charted them against their CSR values from CSRHub; sadly their results confirmed the worldwide phenomena uncovered in this inspection. Furthermore, I did a reverse inference exercise by looking up the CX scores and net proceeds for the top CSR performers. The findings were expected and equally dispirited.

From the aforementioned investigations, businesses highly praised or handsomely awarded with purchase orders by their patrons were no dignitaries, some were outright laggards, on CSR matters. This has revealed the reality that CSR is not among buyers’ primary considerations during their inquisitions and acquisitions. Although CSR sound bites have been gaining popularity online and in print, and clientele claim to have embraced this noble course, business transactions and consumer behaviors have demonstrated just the opposite. Overall, CSR still has a long way to go; its proponents need to enhance their games to better steer consumer behavior toward the desirable path.

Image credit: Flickr/itia4u

Charts courtesy of Chi-Pong Wong; Image

Chi-Pong Wong is a seasoned professional proficient in customer experience, vendor and partner relations, marketing and branding, supply-chain strategy, and program and project management. He has published articles on leading online magazines including Customer Think, UX Matters, Marketing Profs, CEO World, Service Director Business Review, Project Times, PM Hut, Project Management, Supply Chain Brain, Supply Chain Digital, and other popular journals. He earned a MA in Economics at SUNY @ Stony Brook and a MS in Computer Science at Duke University. He is currently with Hewlett-Packard, and has previously worked at Arrow Electronics, IBM, STMicroelectronics, and NEC Electronics. He can be reached at http://www.linkedin.com/in/chipong.

Alabama-Mississippi Waterway Upgrade Offers Clues to Energy Efficient Future

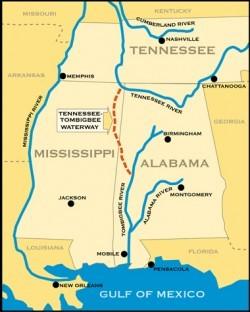

If you're not familiar with Tenn-Tom now, you're probably going to be hearing a lot more about it in the future. Tenn-Tom is the Tennessee-Tombigee Waterway, a huge public infrastructure project with a history that dates back to the earliest explorations of the North American continent in the 1500s. After literally centuries of dreaming, Tenn-Tom finally became a reality in 1984.

Built and managed by the U.S. Army Corps of Engineers (USACE), the 30-year-old Tenn-Tom is now due for an upgrade. USACE is using the opportunity to showcase a new, energy efficient approach to infrastructure improvements. If your business is contemplating an infrastructure upgrade, this is a good one to watch for best practices insights.

Tenn-Tom Waterway by the numbers

Tenn-Tom is a constructed waterway that links the Tennessee River to the Tombigbee and Black Warrior rivers. Stretching from the far northeastern corner of Mississippi to the middle of western Tennessee, it provides mid-continent states with an alternate shipping route to the Port of Mobile and the Gulf of Mexico.

At 111,000 acres, Tenn-Tom counts as a major U.S. civic infrastructure project. In addition to 10 locks and dams that enable barge traffic, the waterway accommodates recreation for an estimate 3 million visitors per year.

USACE also touts Tenn-Tom as a habitat enhancement for wildlife, although the Natural Resources Defense Council opposed the project in the 1970s. For those of you old enough to remember the snail darter, that would be the reason.

Energy efficiency upgrades For Tenn-Tom

USACE is using Tenn-Tom as a high-profile showcase for its third-party financing tool for energy efficiency upgrades, called the Energy Savings Performance Contract (ESPC).

Like the now-familiar power purchase agreements for solar power, ESPC is a contract that enables you to get energy efficiency upgrades with no up-front investment. You pay it off over a period of years based on the money you save from reduced utility bills.

In the private sector, the company Noesis provides a good example of how the energy market is expanding to embrace ESPC-style financing for energy efficiency upgrades.

Under the Tenn-Tom ESPC, the expected savings will be a little more than $5 million over the life of the contract, which is a hair under 22 years.

You can check out USACE's announcement of the new Tenn-Tom energy efficiency upgrades for a summary of the fail-safe mechanisms that are built into its ESPC's. The bottom line is that you want to make sure that the improvements really will produce enough savings to pay for the project within a reasonable amount of time. USACE caps that off at 25 years.

Low-Hanging Energy Efficiency Fruit

For Tenn-Tom, USACE is focusing on lighting at the locks and dams. Lighting is one of the most straightforward ways to produce energy efficiency savings across a wide variety of built environments.

The contract for the lighting upgrades comes to $2.8 million, which was awarded to Siemens Government Technologies earlier this year. While the length of the contract is almost 22 years, the actual construction work will start this October and is expected to be completed by spring 2015.

Here's John Coho, USACE energy coordinator and senior adviser for environmental compliance, on the topic:

This project award demonstrates that we can use ESPCs to leverage third-party funding at our civil works sites to help us reach our national sustainability goals and energy independence. It is going to be a model for others down the road, and I fully expect we will be able to use it at sites along other rivers as well.

Given its growing portfolio of renewable energy projects and energy efficiency projects, USACE is in a perfect position to use the anticipated success of the Tenn-Tom upgrades to leverage more ESPC's for other Defense Department projects.

Image courtesy of USACE

Harnessing the Benefits of Employee Volunteerism at Mid-Size Companies

By Jackie Norris and Nicole Trimble

Over the last decade we’ve seen a steady increase in corporate volunteer programs in the U.S. Since the global recession, in particular, companies of all sizes – from startups to the Fortune 500 ranks – have embraced employee volunteerism as a fiscally responsible way to supplement and expand on their existing community giving initiatives. But it appears mid-size businesses may not be harnessing the full potential of volunteer programs and are overlooking the wide range of benefits they can provide.

Volunteer service can be a powerful tool to help mid-size businesses like Outerwall Inc. – the automated retail company that brings consumers Redbox entertainment, Coinstar money services and ecoATM electronics recycling kiosks, which employs approximately 2,900 employees – recruit new talent, improve morale among current employees and build important relationships in local communities.

According to a 2013 Business4Better survey conducted among professionals at mid-size companies (ranging from 100 to 5,000 employees), only 20 percent reported that their employers are tying community involvement to successful business performance, and only 10 percent reported that their employers are leveraging these activities as a tool for employee engagement. While three-quarters of participants said the opportunity to impact communities underscores the need for corporate social responsibility (CSR) programs, only 12 percent said they’ve looked to community involvement to impact the bottom line.

When Outerwall first engaged with Points of Light, an organization dedicated to solving serious social problems through voluntary service, the company had far fewer employees than many organizations of similar revenue size, but goals that paralleled its much larger competitors. As a mid-size business, Outerwall had encountered unique barriers compared to its small and large company counterparts, but worked with Points of Light to discover an opportunity to engage its sizeable force of talented and interested employees.

In fact, representing roughly one-third of all American jobs, today mid-size businesses employ more than 40 million people in the U.S., and this number is climbing. Mid-size businesses have experienced more substantive and stable growth in recent years than any other business segment, as evidenced by their 2013 employment growth rate of 3.7 percent, compared to 2.1 percent for small firms and 2.6 percent for big businesses.

Given this growth, attracting talented employees will be more important than ever for mid-size companies. According to a recent Net Impact study, today employees are increasingly focused on mission-oriented businesses that enable them to bring their values to work and make a difference. In this way, workplace volunteerism programs have a direct impact on a company’s ability to attract new employees. This is particularly true of millennials, who expect the companies they work for to positively impact their communities.

In addition to supporting recruitment efforts, volunteer programs can help mid-size companies retain existing employees. By offering exposure to learning and leadership opportunities that may not be immediately available in mid-size firms, strategic volunteer programs can help employees grow both personally and professionally. According to Common Impact, participants in workplace volunteerism programs report that they feel more motivated and more invested in the long-term financial success of their employers. And a recent study from Net Impact and Rutgers University found that employees who believe they can make a direct social and environmental impact while on the job report greater satisfaction than those who cannot, by a two-to-one ratio.

Beyond recruitment and retention, volunteer programs allow mid-size companies to make valuable connections and build long-term relationships with important stakeholders. In 2012, A Billion + Change found the return on investment for such programs to be extremely high, generating a value of more than $170 billion to nonprofit organizations, enabling more than 75 percent of companies to develop stronger relationships with key stakeholders, and 61 percent to improve their brand value among target audiences.

At Outerwall, volunteer service is considered a valuable component of broader community-building and employee engagement efforts. Outerwall works closely with its corporate and field employees – who are dispersed in communities across the U.S. – to identify integrated volunteer service and charitable giving opportunities. In 2010 the company launched a new initiative that included skills-based opportunities and leadership roles for employees who are interested in the company’s community programs. Since that time, employee participation in workplace volunteerism has jumped from 3 percent to 28 percent and employee perception of Outerwall as a good corporate citizen has risen from 58 percent to 87 percent.

For mid-size companies that are trying to enhance their community involvement efforts, we recommend three key strategies: First, tie your volunteerism goals to business goals to gain executive support. Second, collaborate with many groups across your organization to implement and promote programs. And finally, involve employees in the selection of community partners so they feel more ownership and, as a result, will be more likely to take part in volunteer service activities.

We’re eager to see more mid-size companies leverage the full potential of their volunteer service programs and other CSR initiatives to do well by doing good. Finding untapped opportunities and turning them into assets may be easier – and more rewarding – than you think.

Image credit: Outerwall employees volunteering for Habitat for Humanity of Seattle-King County

Jackie Norris is the executive director of the Points of Light Corporate Institute, the go-to resource for community-minded companies looking to build and expand effective employee volunteer programs. Nicole Trimble is the senior director of corporate responsibility at Outerwall, the company behind brands including Redbox, Coinstar and ecoATM.