Swaddle Baby's Bottom with Jellyfish!

I type here today to testify about the avalanche of diapers going into our landfills and the bizarre or ingenious solution to that plague. Based on research from Tel Aviv University on the super-absorbancy of jellyfish flesh, the Israeli nanotechnology company Cine’al Ltd. is developing a diaper that's more absorbent and decomposes in just 30 days. And by the way, this new green product is made of jellyfish.

Back in my college days I worked my way through school as a janitor at a large child care center, scrubbing tiny toilets, sanitizing doorknobs several times a day, sweeping wet rice off the lunchroom floor, and yes, I was that guy who brought in the sawdust when some poor kid got sick after eating rainbow-colored cereal. But most of all, I remember the diapers. Mounds of them. Thousands. Every three hours I'd sweep through the baby and toddler rooms, play peek-a-boo for a couple of minutes, then take out the diaper-stuffed bags and replace them with new bags: Four 55-gallon Hefties every three hours, each filled with scores of compact little white plastic-lined balls of ... you know ... let's just say diapers.

As a parent, I saw the same thing. Garbage overflowing with diapers.

Disposable diapers, as it turns out, are the third-largest category of landfill trash by volume accounting for 4 percent of the solid waste in U.S. landfills. And in households with a baby or toddler, disposable diapers make up about 50 percent of the family's trash. At the child care center, I'd wager about 75 percent of our trash was Huggies/Luvs/generic Target brand based -- all of which take hundreds of years to decompose.

We are overrun with diapers.

Enter the jellyfish.

Same problem: The oceans are becoming overrun with a jellyfish population explosion.

Waters are getting warmer, due to climate change, and opening new habitats for our gelatinous friends. Overfishing is taking out natural predators and creating new places for them to explode in numbers. Agricultural runoff is giving them an abundance of nutrients to spread their tentacled rubbery progeny far and wide. Offshore structures like oil rigs and wind turbines are creating perfect breeding grounds for them in new locations.

And this is a problem why?

Because they're overflowing pristine touristy beaches making the waters squishy and stingy, washing up en-masse on the beaches and rotting into a stench. They're clogging up water intakes for power plants and other industries ... They're causing potentially hazardous situations when they obstruct the cooling water intakes for nuclear plants. Ecosystems are getting disrupted as they compete with other species and suck up nutrients other aquatic critters need. And fishermen hate them because they can fill up a net with one of the most useless catches in the ocean.

So, here we are in a world with an overabundance of diapers that won't rot for hundreds of years, and a jellypocalypse threatening our oceans and our way of life.

It takes a spark of genius to draw a line between the two and find a way to solve both problems while hopefully making a tidy profit. Cine’al Ltd. is using the newly discovered super-absorbant properties of jellyfish flesh to create biodegradable diapers that decompose in 30 days rather than the usual hundreds of years. This technology could turn jellyfish from a nuisance species to an honest, useful commodity for many nations enduring the jelly problem.

Cine'al is also envisioning using this technology for tampons, medical sponges and paper towels. Now all we need to do is get over the notion of swaddling our babies' butts in jellyfish. Couldn't possibly be worse than what we find down there anyway.

Image credit : Jason Pratt : Source

Biomimicry Lessons for Business

How do we create a better future? How do we redesign our economic system to be more sustainable?

Exploring these and similar questions, a growing number of people look for inspiration from the greatest lab of all: Nature. This type of exploration already has a name (biomimicry), definition (“an innovation method that seeks sustainable solutions by emulating nature’s time-tested patterns and strategies”) and even an inspiring visionary leading the way (Janine Benyus).

It also has a growing number of followers, as I could see last week at an event titled “Biomimicry + the Regenerative Economy.” Organized by BiomimicryNYC, a network dedicated to fostering a community of nature-inspired practice in the New York City metro region, it took place at Impact Hub NYC with more than 100 attendees who came to learn more about aligning business with nature from two experts in this field: Amy Larkin and Katherine Collins.

I was curious to hear what Larkin and Collins had in mind when it comes to applying biomimicry to business and economy, because currently we have too many questions and perhaps too few propositions. My hope is that nature can help balance this out, but I’m still not sure how. Hence I was hoping to gain some insights at this event.

Amy Larkin, founder of Nature Means Business and author of “Environmental Debt: The Hidden Costs of a Changing Global Economy,” was the first to go on stage. One of the main topics she focused on was harmonizing the laws of business with the laws of nature.

“The financial and environmental world is as connected as your mind and body and until we make this connection we are in a course for collision with the laws of nature,” Larkin explained. “Today we are less and less connected to nature in how we think, spend money … conduct business, consume food, and consume products. All of these measurements are done wrong,” she added, referring among others to the issue of externalities.

Later I asked Larkin: If business is on a collision course with the laws of nature, how come currently only a small number of companies see it this way? “It's easier and more profitable to take the money and run,” she replied. “Everyone at a large (and small) business works terribly hard, and whether profiting greatly or scraping by, it's just easier to do things as they've been done before … Until the environmental problems get so bad, as many are becoming now, and more and more businesses are resigned to putting in the extra time and money to change course. But no doubt, it's hard and unless something is on the top of the pile, it just doesn't get attention.”

And this is where biomimicry can come to help. It is, Larkin suggested, “one of these great doors to go through to help discover new ways to both conduct business and how you measure, what you value in what you count.” To be more specific she mentioned three rules from her book that will help change the way we do business now:

- Pollution can no longer be free and can no longer be subsidized.

- All government and business policy must incorporate the long-term.

- Government has a vital role to play.

I asked Larkin why governments need to play an important role: Why isn't the marketplace capable enough to take care of itself without this sort of intervention? She replied that many companies have this state of mind of “I'm making money. I figured out my market and my product, now leave me alone. And don't tax me or regulate me.” However, she added, many products cause great damage, and since we don't show the cause and effect in our financial ledgers, government has to regulate the prevention of the damage or make the act of damaging too expensive to continue. “Unless government steps in, the biggest polluter makes the biggest profit and business is in the business of making money … at least that's how it sees itself now.”

Next came Katherine Collins, founder and CEO of Honeybee Capital and author of “The Nature of Investing: Resilient Investment Strategies Through Biomimicry." A long-time investor, Collins explained that for her biomimicry was at its core about the question ‘what would nature do’ or WWND.

“[The question] encourages you right from the very beginning to be clear about what exactly you’re trying to do,” she explained. “What is this essential function that you’re trying to perform? These are two elements that it is just so easy to skip over and biomimicry forces you right from the very beginning to get to that core. So instead of asking things like ‘what’ you end up asking ‘why’ and instead of asking ‘how much’ you end up asking ‘how’ and these are better, more important questions.”

I asked her afterwards how significant the role of biomimicry could be in leading the investment community towards a more sustainable future. And can it ever go mainstream? “To many fundamental investors, some elements of this practice are already mainstream, though they might be called by different names,” Collins told me. “As a young analyst I learned all about assessing competitive advantage, considering long term risks, and connecting the dots to understand interconnections between companies, suppliers, and communities. Biomimicry investing puts these analytical approaches in a larger context, the context of our natural world, which helps to illuminate additional wisdom that is not found in our spreadsheets.”

Another interesting point Collins made was about differentiating between liability, in a more legal sense, and responsibility, in a more ethical and moral sense. If you start with the responsibility part, she explained, the liability comes along quickly and you might not even need a number on it. Collins said that one thing that worries her with the conversation about reporting standards is that we’re diving very deeply into putting a number on something, and pretty often when you have a number on something people feel discharge of their responsibilities.

At the same time she was also encouraged that many approaches are taking a multi-dimensional view of valuing natural capital, she told me. “This view includes price, but also other measures of ecosystem services that are, quite literally, priceless. I am indeed wary of any approach that believes a single-point dollar amount can reflect true and complete value (of anything, not only nature).”

When leaving the event that evening I still had more questions than answers, but at the same time I was glad to see that biomimicry is evolving into a space where value and values become a sort of yin and yang in designing better solutions. After all, if nature can teach us something, it’s not just about better accounting, but also about being humble. Hopefully we’ll be willing to learn it.

Image credit: BiomimicryNYC

Raz Godelnik is an Assistant Professor of Strategic Design and Management at Parsons The New School of Design. You can follow Raz on Twitter.

Dr. Bronner’s Takes the Lead in Sourcing Sustainable Palm Oil

Palm oil production has surged across the world in recent years, and often with devastating results. More companies have pledged to source palm oil more responsibly, but the consequences to the environment, wildlife and people have been severe as more tropical rainforest has been razed to cope with global demand.

When it comes ensuring fairness for people who harvest palm oil, one company making a difference is Dr. Bronner’s Magic Soaps, the iconic manufacturer of castile soap and other natural personal care products. With palm oil in countless items eaten or applied — from cosmetics and toothpaste to packaged crackers and cookies — Dr. Bronner’s leadership on the development of more responsible sources of palm oil is a template for other companies pledging to do less harm.

Dr. Bronner’s efforts date back to 2007, when Serendipalm, a sister company located in eastern Ghana, opened up for business. By then palm oil production had long drawn the ire of environmentalists and human rights activists for a bevy of reasons —from the clear-cutting and slash-and-burn techniques that scarred the land to indigenous peoples being forcibly removed from their lands.

According to Dr. Bronner's, the palm oil operation in Asuom, Ghana nixes several of the problems associated with conventionally-grown palm oil. The factory, an employer of more than 200 people, sources the organically-certified reddish palm fruit from approximately 700 local farmers. Those growers in turn cultivate the palm fruit on over 4,000 acres using organic methods that replenish the soil and help boost local biodiversity. Unlike the sprawling palm oil plantations in Indonesia, Ghana is not a natural home of orangutans, the giant Asian apes that have lost much habitat to palm oil production.

The difference that Dr. Bronner’s takes towards sustainable palm oil, in contrast to RSPO (Roundtable on Sustainable Palm Oil), is the emphasis on both organic palm oil production and fair trade practices. While RSPO focuses on conventionally-grown palm oil and the large companies that source this raw material, Dr. Bronner’s sought palm oil production that emphasized both the socially and the environmentally responsible.

As this video shows, the palm oil production in Ghana has generated a better way of life for local farmers and their families. Proceeds from the fair trade premiums have paid for wells providing drinking water; a dormitory for nurses was built at a local hospital; and the rise in incomes have allowed many families to send their children to school. And with Dr. Bronner’s business continuing to grow, the company has pledged to buy even more than the 450 metric tons of palm oil that Serendipalm produces annually — generating even more economic opportunity, safely and fairly.

Image credit: Serendiworld

Leon Kaye has lived in Abu Dhabi for the past year and is on his way back to California. Follow him on Instagram and Twitter.

More Utilities Are Shifting to Renewable Energy

The “new reality” facing electricity consumers and their utility companies is that renewable energy is meeting an increasingly larger share of U.S. energy needs, according to a report released this month from Ceres and Clean Edge.

That translates into more and better choices and a clean energy future.

“Renewables — including wind, solar, biomass, geothermal, waste heat and small-scale hydroelectric — accounted for a whopping 49 percent of new U.S. electric generating capacity in 2012, with new wind development outpacing even natural gas,” writes Jon Wellinghoff, partner at Stoel Rives LLP and former chairman of the Federal Energy Regulatory Commission in the report.

"Benchmarking Utility Clean Energy Deployment: 2014," the first report from Ceres in partnership with Clean Edge on this subject, ranks the nation's 32 largest electric utilities and their local subsidiaries on their renewable energy sales and energy efficiency savings.

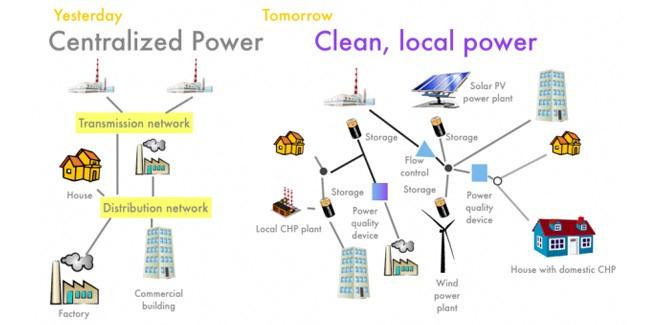

The report says the different components of clean energy — energy efficiency, demand response, renewable energy, distributed generation, and the “smart” infrastructure required to integrate and optimize them — are critical elements of the 21st century electricity market.

“Traditional utilities and third parties will compete to offer consumers a range of customized energy-related products and services that extends far beyond today’s electricity service — and probably sooner than we think,” Wellinghoff says.

Companies were benchmarked on three major indicators of clean energy deployment:

- Renewable energy sales, or the total amount of renewable electricity sold to retail customers

- Cumulative annual energy efficiency savings

- Incremental annual energy efficiency savings, or the energy savings from new programs or new participants in existing programs

The report, which will be released annually, focuses on renewable energy delivered by electric utilities; it does not cover independent power producers. The renewable energy sales data provided in this report is considered a “strong indicator of the utilities’ clean energy deployment.”

But “wide disparities” were found in the extent to which electric utilities currently deliver renewable energy and energy efficiency, the report says. For example, five of the 32 companies included in the report accounted for nearly 54 percent of renewable energy sales.

NV Energy, Xcel Energy, PG&E, Sempra Energy and Edison International ranked the highest for renewable energy sales; their renewable resources accounted for about 17 to 21 percent of their retail electricity sales in 2012.

Meanwhile, SCANA, Southern Company, Dominion Resources, AES and Entergy ranked at the bottom of the report’s rankings, with renewable energy sales accounting for less than 2 percent of each of their total retail electricity sales.

Energy efficiency top performers included PG&E, Edison International and Northeast Utilities, each of whose cumulative annual energy efficiency savings was equivalent to 16 to 17 percent of their annual retail electric sales in 2012. Pinnacle West, Sempra Energy, Portland General Electric, Puget Sound Energy and Northeast Utilities performed the best on incremental energy efficiency savings.

Other key findings from the report reveal:

- State policies are a key driver in utility clean energy investment.

- Two of the EPA’s Clean Power Plan’s building blocks, energy efficiency and renewable energy, are increasingly economically feasible options for electric utilities.

- Even among companies in similar market and regulatory environments, however, there is a range of performance, suggesting that strong state-level policies are not the only factor in utility investment in clean energy.

- Customers are increasingly in the driver’s seat in influencing clean energy policymaking.

In addition, the report finds that “better, more up-to-date data is paramount” and needed. This is because data on utility clean energy deployment is “is too scattered among numerous sources.”

Bottom line: Ignoring the clean energy shift “is dangerous, for both the traditional utility business and the environment.” The U.S. Department of Energy recently found that renewables could feasibly provide 80 percent of the nation’s energy by 2050.

“The main obstacle is not the price tag (which is comparable to a business-as-usual scenario) or the technical challenges, though both are considerable,” the report says. The basic issue “is largely a question of leadership, market structures and political will.”

Amen to that.

Image credit: Cover from Benchmarking Utility Clean Energy Deployment: 2014

Firms Raise $56 Million to Boost Smart Energy Storage

Making smart, efficient use of distributed clean energy resources is a key enabler in order for a more sustainable U.S. energy mix to fully mature.

Santa Clara, California's Green Charge Networks (GCN) has been carving out a niche for itself in the nascent, growing U.S. smart grid-energy efficiency market space. It sets itself apart by leveraging the latest in battery storage technologies, its own proprietary energy management algorithms and software, and zero-down, results-based customer Power Efficiency Agreements (PEAs).

On July 29, GCN and new firm K Road DG announced the closing of $56 million in funding that will help the company take the next step. GCN will use the funds to spur uptake of its GreenStation energy management and storage solution (pictured above) and associated PEAs. Through PEA agreements, investment returns are linked to customers' actual demand charge and utility bill savings.

To date, GCN has closed over 2 megawatts (MW) of these zero-down agreements with a variety of customers, including 7-Eleven, Walgreens and UPS, as well as school campuses and municipalities in California and New York.

Intelligent energy storage and a smarter grid

GCN was founded in 2009 with an American Recovery & Reinvestment Act of 2009 (ARRA) award, which was pivotal in enabling the company to develop its GreenStations.

According to a GCN press release, the $56 million capital infusion closed July 29 “is the largest amount of capital raised by any company in the intelligent energy storage space, thus securing Green Charge Network's leadership position in this evolving sector.”

K Road DG was founded in 2014 by former K Road Power executives William Kriegel, Gerrit Nicholas, Mark Friedland and technology investor George Coelho. The company “is launching a distributive generation and Smart Grid business and operations platform based on the conviction that renewable and distributive power generation will ultimately power much of the globe.”

Driving efficient, distributed power generation

Similar to solar energy leases and power purchase agreements (PPAs), through its PEAs, GCN owns and operates energy storage assets at customer sites, installing the system with zero-down and zero in the way of maintenance charges.

Customers, and society, benefit through reduced power usage and energy consumption. This also means shrinking carbon and greenhouse emissions, as well as other environmental pollution caused by conventional fossil fuel exploration, production and use. Economically, GreenStation customers realize savings on energy bills, more specifically the demand charges utilities charge large energy consumers.

“Power efficiency is the next frontier in energy savings,” GCN CEO Vic Shao was quoted in the company's press release. “We plan to leverage the alliance and financing from K Road DG to scale our company’s deployments and continue our customer-centric innovations.”

Added K Road DG CEO William Kriegel: “We are excited to enter into this strategic alliance and to provide growth capital that will drive deployment of Green Charge’s innovative technology to C&I customers on a commercial scale. K Road DG believes that Green Charge’s technology solutions respond directly to a global demand for intelligent energy storage.”

According to analysts at market research company IHS, energy storage installations will grow at a rate of over 40 gigawatts (GWs) annually by 2022 from just 0.34 GWs in 2012 and 2013, with the U.S. expected to be the largest market for grid-connected energy storage.

Image credits: 1) GreenCharge Networks; 2) Fresh Energy

Mars roars into overdrive with Tigers Alive programme

Whiskas maker, Mars Petcare, is expanding its support for the WWF Tigers Alive Initiative, a global conservation program to help protect tigers from extinction with a new target to double the number of the big cats in the wild by 2022.

The next phase of the partnership will also support two key projects: A “zero poaching” initiative to assist in the advancement of enforcement work, and a “landscape” initiative, which will help to identify safe spaces for tigers in the wild.

The original partnership recognized a shared philosophy between Whiskas and WWF, that together they would have more impact on the future of wild cats, and in particular tigers. The strength of the connection led to a successful campaign in the UK in 2013, maintains the company, where it will continue to be active. The partnership will also be rolled out in Germany, Switzerland and Belgium before the end of 2014, with the ultimate goal to create a global programme.

Mars, Incorporated board member, Frank Mars, commented: “We believe the expansion of our relationship will continue to be a catalyst for greater global public awareness around this critical issue. At Mars, we have many passionate Associates who are dedicated to looking after your cats, and it is our ambition to continue to harness this work for the good of their endangered cousins as well.”

Picture credit: © Kathleen Struckle | Dreamstime Stock Photos

Beware ‘changing of guard’ warns KPMG as fraudsters get younger

The profile of the typical fraudster has shifted from rogue senior executives to younger individuals funding extravagant lifestyles, finds KPMG’s latest Fraud Barometer.

Fraud cases totaled £317m in the first half of 2014, analysis of which shows that that frauds committed by those aged 26-35 were valued at just over £62m – an increase of 285% on the first half of 2013. At the same time, frauds committed by those aged 46 and over fell by 72% to £88m.

Hitesh Patel, UK Forensic Partner at KPMG, commented: “Where once it was the jaded executive who relied on unquestioned seniority and authority to get away with dipping their hands in the till, it seems we are witnessing a changing of the guard.

“Today's fraudster is younger and just at ease with using technology and data as selling promises. They rely on the assumption of the innocence of youth, whereas the reality is that many of these fraudsters are nothing more than a wolf in lamb's clothing. It is important for UK organisations to recognise that youth doesn't always equal innocence, as a confident and tech savvy generation comes through, adept at circumnavigating conventional controls and staying under the radar.”

While the value of fraud fell during the studied period, the number of cases remained constant. KPMG warns that while this sounds like good news, history shows that fraudsters tend to start with smaller schemes, to test the system, with fraud value then increasing as their confidence grows if they are not caught.

Pic credit: © Bizroug | Dreamstime.com

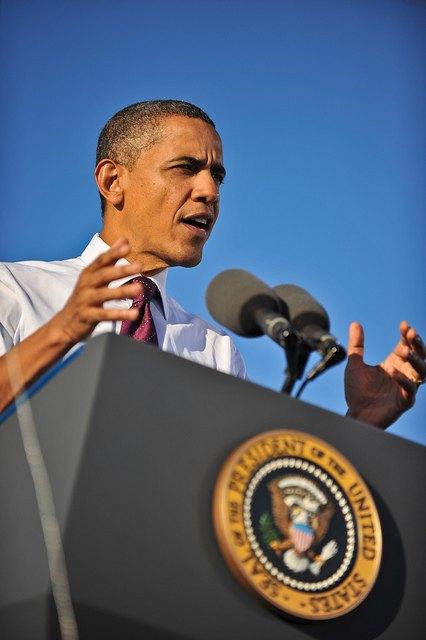

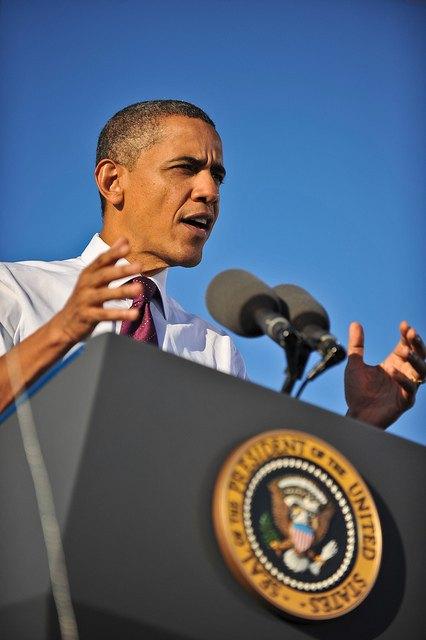

Obama's 'Economic Patriotism' Won't Win Until Firms Do

This week, President Barack Obama lashed out at corporations that have taken up the legal but questionably ethical practice of tax inversion.

For those who aren’t familiar with the expression, tax inversion occurs when companies purchase property in another country in order to change their tax base to another, more financially advantageous location. Northern Ireland is the latest geographic sector to benefit from burgeoning U.S. firms like Google and Facebook, which are said to be thriving under more generous tax provisions. Biopharmaceutical giant Pfizer, which earlier this month attempted to purchase U.K. pharmaceutical firm AstraZeneca, is also suspected of trying to change its physical address.

“My attitude is: I don't care if it's legal,” Obama said in a speech in Los Angeles this week. “It's wrong.”

What I often appreciate about Obama is his ability to come right to the core of the issue, which often doesn’t have to do with pragmatism, or partisanship (although, he’s been known to trump that card as well), but ethics. Few presidents have had the moxie to aim for the moral bull’s-eye as many times as Obama and hit it squarely on the mark.

And he’s particularly skilled in coming up with phrases that speak to the heart of the matter, but might never have found their way into the English lexicon if it hadn’t been for the latest debacle.

Pointing out the benefits of “economic patriotism” Obama called on Congress to “close wasteful tax loopholes and invest in education, and invest in job training that helps the economy for everybody.”

Critics have pointed out that there’s some value to international collaboration, and companies like Pfizer that invest in overseas companies help further technological and healthcare research, not just expand their businesses.

I think Obama knows that, because it wasn’t more than a few months ago that he openly rejected calls for the U.S. to become more “isolationist,” pointing out that “[The] values of our founding inspire leaders in parliaments and new movements in public squares around the globe.”

Of course, at the time he was speaking before the Military Academy in West Point, and the topic wasn’t company tax inversion or collective brainstorming with competitors you may wish to buy, but global security. Still, in the eyes of some, what’s good advice for global governments that handshake across the pond is great advice for small multi-billion-dollar companies that want to expand their markets.

And don’t look for this tax loophole to close any time soon. The federal government has actually been trying to facilitate a change since 2012, when the administration published a concise 25-page report on the President’s Framework for Business Tax Reform. It has plenty of interesting ideas like cutting the corporate tax rate so companies will actually want to stay in the U.S., and my favorite: simplifying and cutting taxes for small businesses. But so far, Congress hasn’t stepped up to the challenge.

In the meantime, as Treasury Secretary Jacob Lew points out, companies that benefit from U.S. resources currently have the ability to pick and choose their principal tax base.

“Many of these companies are for all intents and purposes still based in the United States, and they remain here to take advantage of everything that makes the United States the best place in the world to do business: our rule of law, our universities, our research-and-development capabilities, our innovative culture and our skilled workforce.”

What neither Obama nor Lew addressed is the question of whether companies like Google and Facebook would have been able to reach the pinnacle of success that they have reached if they had been forced to pay taxes under the current U.S. tax system. Would the many others that have changed their addresses succeeded as well, like Apple and General Electric?

Perhaps the answer is finding ways to incentivize collaboration by not only making it more worthwhile for companies to keep their tax bases in the U.S., but also by encouraging more global commerce that benefits commercial growth and exchange.

The Obama administration is correct, however: Economic patriotism has its value in every country. But in this global day and age, when it’s the aspiration of most business owners to expand their business beyond the borders of their homeland, nations have responsibilities as well. And those responsibilities, as Obama’s proposal points out, include keeping abreast with the rest of the world to ensure that tax laws benefit the business owners that must cover their bottom line, not just the financial needs of the country. In today’s global marketplace it seems, everybody is a competitor. Even Uncle Sam.

Image of President Obama: Nick Knupffer

Why Would the USDA Waste $34 Million on Soybeans in Afghanistan?

Many of us have already concluded the 13-year war and military involvement in Afghanistan has been a horrific waste of blood and treasure with no ideal resolution in sight. But among the many throttled programs the U.S. has tried to implement in this proud, landlocked country is one especially laughable if not absurd.

In 2010 the U.S. Department of Agriculture, in a partnership with the American Soybean Association and SALT International, launched SARAI, or the Soybeans in Agricultural Renewal of Afghanistan Initiative. The goal was to haul American soybean processing equipment, and of course soybeans, into northern Afghanistan to start a soy-farming industry under the guise of nutrition and economic development. Optimism was rampant even two years ago:

“It’s great to see the Afghan and U.S. partners get this soybean processing facility up and operating. It will help Afghanistan agriculture continue to develop.” -U.S. Foreign Agricultural Service Agriculture Minister Counselor Quintin Gray, in September 2012.

Then the stubborn reality hit.

John F. Sopko, an attorney from the Office of the Special Inspector General for Afghanistan Reconstruction, revealed concerns over the “viability” of the project. In fact, for several reasons that one would think common sense would have sorted out, the project has failed. Among the factors: the American Soybean Association did not bother to conduct any feasibility studies before the program’s launch; a United Kingdom study a few years earlier confirmed soybean cultivation were not feasible in northern Afghanistan; and well, Afghans like their naan made from wheat. According to the Center for Public Integrity, despite the fact there is no history of soy consumption in Afghanistan, an informal 20-person taste test led to the conclusion that soy products could catch on in this country of 30 million people.

The outcomes: the first crop failed; more soybeans in turn were imported from the U.S. Midwest to Afghanistan for a special factory built to process the beans into flour, oil and other soy products; and despite a pledge to spend over $1 million on marketing and training bakers to use soy products in their breads, locals simply did not like the results. The factory that had received the expensive equipment may end up selling it off soon to close its operations.

You could argue the program had noble goals, which is true for just about every anti-famine and economic development program undertaken in developing countries. True, Afghanistan ranks low on many human development indices, which is hardly a surprise since the country has been in turmoil since the 1970s.

But the failed SARAI project is an example in which business groups’ self-interest trumps local sensitivities. Despite the depictions often given to us by media accounts of the recent wars in Afghanistan, the country’s cuisine ranks with that of Iran in terms of variety and sophistication in the greater Central Asian and Middle Eastern region. Afghan craftsmanship also reigns supreme, from woodwork to ceramics. Visit a souq in the Gulf region and you will see countless Afghan antiques and crafts—a testament to the quality of the work coming from Afghanistan and how tragically the country has been looted in recent years.

The $34 million is a drop in the bucket considering that $7 billion of the $120 billion spent on reconstruction in Afghanistan have been wasted on dubious projects. There exists other methods of ensuring infrastructure in Afghanistan improves, like teaching farmers new tactics to improve yields on foods people want to eat, and boosting citizens’ skills so that could provide for their families and build stronger communities. But instead, the U.S. government once again opened its checkbook to U.S. business interests, which should have fronted the money themselves if they were so confident this boondoggle would have worked, for a program that benefited no one.

Image credit: SALT International Facebook Page

Leon Kaye has lived in Abu Dhabi for the past year and is on his way back to California. Follow him on Instagram and nd Twitter.

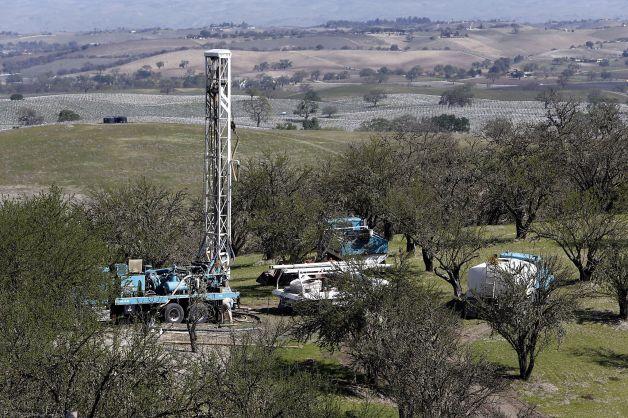

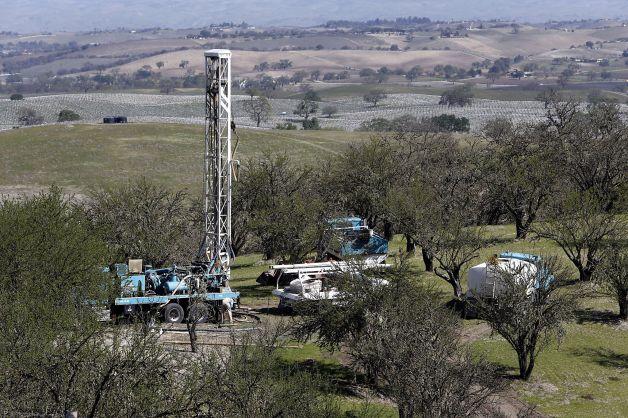

NASA: Groundwater Depletion Threatens Southwest Water Supplies

An analysis of data from NASA's Gravity Recovery and Climate Experiment (GRACE) Mission indicates the U.S. Southwest is more vulnerable to drought and water shortages than previously believed.

Studying 14 years of GRACE satellite data since late 2004 covering the parched Colorado River Basin, NASA and University of California, Irvine scientists found that groundwater loss accounts for more than 75 percent of total freshwater resource loss across the basin region.

Freshwater flowing through the Colorado River Basin is the lifeblood of cities and communities throughout the seven-state region and beyond into Mexico, supplying freshwater to 40 million people and irrigation for some 40 million acres of farmland in the southwestern U.S. However, the basin “has been suffering from prolonged, severe drought since 2000 and has experienced the driest 14-year period in the last 100 years,” NASA highlights in a news release.

Coping with drought

Results of NASA-UC Irvine's Colorado River Basin groundwater study – the first to quantify groundwater contributions to the basin's watershed – indicates “that groundwater loss may pose a greater threat to the water supply of the western United States than previously thought,” NASA states. That raises the stakes for farmers, factories and commercial businesses, as well as entire towns, cities and states throughout the region, as they try to conserve freshwater resources and identify and implement sustainable water resource management solutions.

Researchers at the University of California, Davis Center for Watershed Sciences peg the total economic cost of the ongoing drought in California's Central Valley – the state's agricultural heartland – at $1.7 billion.

Struggling to cope with severe or exceptional drought conditions, California farmers and ranchers have been drilling new water wells at a record pace, raising concerns about the sustainability of groundwater supplies.

Requests to drill new water wells “have soared, more than doubling over this time last year” in some counties, according to a Bakersfield Now online news report. The number of new requests for agricultural water-drilling permits in Kern County has more than quadrupled year over year.

The water lifeline of the western U.S.

Explaining the NASA-UC Irvine research team's motivation, report senior author Jay Famiglietti, a senior water cycle scientist at the U.S. Jet Propulsion Laboratory and a professor of Earth Sciences at UC Irvine, said:

"The Colorado River Basin is the water lifeline of the western United States. With Lake Mead at its lowest level ever, we wanted to explore whether the basin, like most other regions around the world, was relying on groundwater to make up for the limited surface-water supply. We found a surprisingly high and long-term reliance on groundwater to bridge the gap between supply and demand."

Changes in mass and gravity measured from space by the GRACE mission's twin satellites are related to changes in water on or below the surface, NASA explains. Studying monthly GRACE measurements from December 2004 through November 2013, the researchers found that the Colorado River Basin lost nearly 53 million acre feet (65 cubic kilometers) of freshwater over the period. That's nearly twice the volume of freshwater found in Nevada's Lake Mead, the largest freshwater reservoir in the U.S.

Groundwater loss represented more than 75 percent of the freshwater loss – some 41 million acre feet (50 cu km).

Shocking groundwater loss

Commenting on the surprisingly large amount of groundwater loss in the basin, Stephanie Castle, UC Irvine water resources specialist and study lead author, stated:

"We don't know exactly how much groundwater we have left, so we don't know when we're going to run out. This is a lot of water to lose. We thought that the picture could be pretty bad, but this was shocking."

The U.S. Bureau of Reclamation manages waters above ground in lakes and rivers throughout the Colorado River Basin and documents losses. Pumping from underground aquifers is regulated by states -- and often isn't, NASA notes.

"NASA's GRACE satellites provide researchers with a view of regional groundwater resources that otherwise would be unattainable," Famiglietti added. "There's only one way to put together a very large-area study like this, and that is with satellites. There's just not enough information available from well data to put together a consistent, basin-wide picture."

The researchers' findings compounds “the problem of short supply by leading to further declines in stream flow in the Colorado River,” NASA points out.

"Combined with declining snowpack and population growth, this will likely threaten the long-term ability of the basin to meet its water allocation commitments to the seven basin states and to Mexico," Famiglietti said.

*Image credits: 1), 3): NASA; 2) SFGate