After the Thrift Store: What Happens to Your Donated Clothes?

This past weekend, thousands of fans crowded Levi’s Stadium in Santa Clara, California, to watch the San Francisco 49ers play the St. Louis Rams. Many of these attendees showed up to the game with old jeans and other unwanted articles of clothing, donating them in exchange for a special Levi’s discount coupon, as part of a used clothing drive sponsored by Levi Strauss & Co. (LS&Co) and Goodwill.

Since Levi Strauss announced the collection event in late October, the iconic jeans maker has received 15,500 unwanted pairs of jeans – 10 tons of denim – dropped off at Goodwill stores for this campaign and at this weekend’s game. Goodwill will sell those jeans and other donations to fund its job training program.

Later this month, LS&Co will cover the field of its stadium with the donated denim, creating a “Field of Jeans" to visually express the enormity of the country’s textile waste – 26 billion pounds sent to the landfill every year, according to the denim giant – as well as to demonstrate an example of how we can find a new use for that material. LS&Co’s partner Goodwill will be responsible for sorting and reselling all jeans and clothes collected through the “Field of Jeans” event.

But what happens to used clothing that can’t be resold – not just from this “Field of Jeans” clothes drive, but from other nonprofit charities, for-profit thrift stores and collection events?

Both for-profit and nonprofit secondhand stores, including Goodwill, have a strong financial incentive to sell as much of the used clothing as they can. Goodwill operates 3,000 stores in the U.S. and Canada where it attempts to do just that, raising revenue to fund its job training and other community-based programs, such as financial education and youth mentoring, according to Michael Meyer, Goodwill’s vice president of donated retail goods and marketing.

When an old T-shirt or blazer sits on the shelf for too long, it is sent to a nearby Goodwill clearance center or outlet store, where clothing is sold by the pound.

“Not all of the 165 local Goodwill organizations have such centers,” Meyer said, “but where present, this is a good way to squeeze more value from donations to fund our mission of helping people find jobs.”

Any leftover clothing items are sold to textile recycling companies – again, raising money for Goodwill’s work, as well as keeping this material out of the landfill. About 30 percent of used clothing that end up with textile recyclers is cut into rags or cloths used for wiping or polishing in commercial and industrial settings, according to SMART (Secondary Materials and Recycled Textiles), a nonprofit trade group of used clothing and fiber industry companies.

Approximately 20 percent of unwanted clothing and textiles is processed back into basic fiber, which is then remanufactured to make furniture stuffing, upholstery, residential insulation and more, SMART reported. Only 5 percent is completely unusable and discarded – because the material is wet, moldy or contaminated with solvents or chemicals.

But the largest percentage of unwanted clothes and textiles handled by textile recyclers – 45 percent – is packaged into large bales and sold to the secondhand clothing market, either here in the U.S. or in developing countries, where demand for quality used clothes is high, according to SMART.

In fact, the global trade of secondhand clothing is a multi-billion dollar industry: Used clothing exports from OECD countries were worth about $1.9 billion in 2009, according to the United Nations Commodity Trade Statistics Database, CNN reported. But Andrew Brooks, lecturer at King’s College London and co-author of the report Unraveling the Relationships between Used Clothing Imports and the Decline of African Clothing Industries, told CNN that the figure should actually be much higher – closer to $3 billion, when you account for smuggling and trans-shipments that aren’t documented in official records. And once you factor in the retail price these items fetch, Brooks said, that amount could double.

The export of secondhand clothing from North America and Europe to emerging economies, particularly nations in West Africa, has become controversial in recent years, with critics charging that the influx of cheap clothes quashes local textile industries.

"The long-term effect is that countries such as Malawi or Mozambique or Zambia can't really establish or protect their own clothing industries if they are importing secondhand goods," Brooks told CNN. "Your T-shirt may be quite cheap for someone to buy, but it would be better if that person could buy a locally manufactured T-shirt, so the money stays within the economy and that helps generate jobs.”

Local textile industries can provide substantial economic growth, creating jobs and generating tax revenue, detractors of secondhand clothing exports say; this sector could potentially lift millions of people out of poverty.

It’s a fair criticism, but used clothes from the West are hardly the only competitor to local clothing industries in West Africa: New clothes made in China are even cheaper than both imported secondhand clothing and clothing made locally, CNN reported.

It’s also unclear just how much individual Africans would benefit from a local textile industry, given the garment sector’s poor record on human rights, fair wages and environmental health.

The secondhand clothing market, on the other hand, does have advantages: employing thousands of people (24,000 in Senegal alone, according to an Oxfam report), as well as furnishing impoverished individuals with quality, inexpensive clothing.

The root of the problem is not selling your unwanted clothes to a local thrift shop or donating them to a nonprofit charity or a collection event like Levi’s and Goodwill’s "Field of Jeans"; the problem is 'fast fashion' – clothes that are cheap, low-quality and designed to be in style for a season or two. These disposable clothes are the reason why so many secondhand clothes from the West end up in Africa and why cheap Chinese imports displace African-made goods.

Whether or not you think the global trade of secondhand clothes is positive or negative, your best bet for making more eco-friendly choices when you purchase and donate clothes is to look for high-quality, classic styles you will wear for years, and, when you decide to finally retire clothing from your closet, take it to a well-respected secondhand store or charity that will do its best to make sure your old clothes will have a second life here in the states.

Image credit: Goodwill Industries International

California Readies for Cap-and-Trade Next Steps

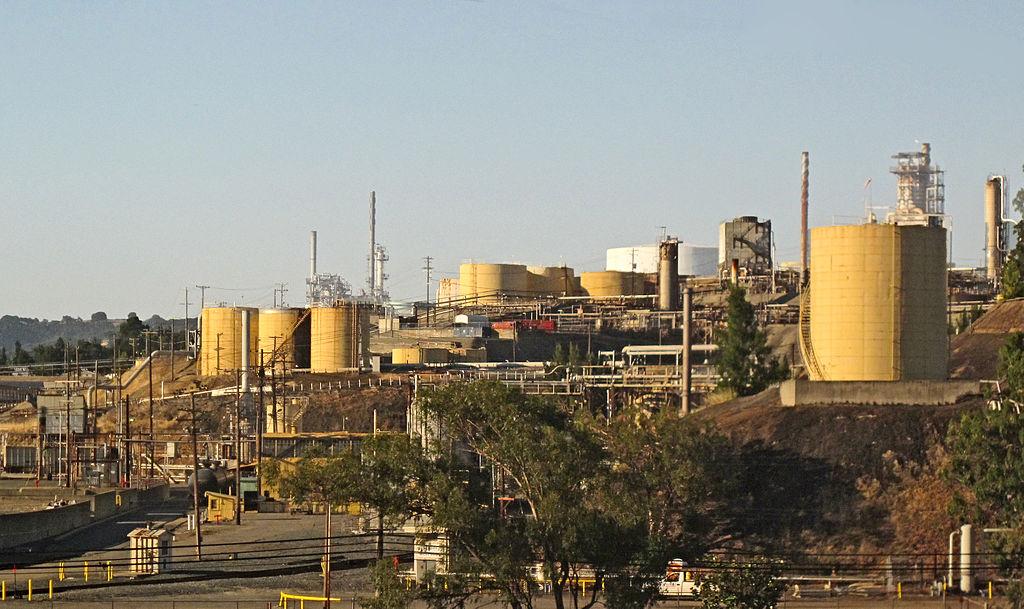

In November 2012, California launched its cap-and-trade program, the second largest in the world after the European Union’s. The state’s largest carbon producers -- businesses that emit over 25,000 metric tons of emissions annually -- buy carbon allowances from the California Air Resources Board's (CARB) quarterly auctions. Depending on who you ask, California’s carbon market is either a success or a drag on the state’s economy. The Environmental Defense Fund, for example, has touted California’s cap-and-trade as a global model for reducing emissions while creating new business opportunities. The Western States Petroleum Association (WSPA), on the other hand, regularly criticizes the program for what it says drives up the costs of business and could wreak havoc within the fuel markets.

The way California’s cap-and-trade program works is relatively simple. Large polluters, such as utilities, buy certificates for each ton of carbon they produce. Polluters who are successful in reducing their emissions can sell their allowances to other companies who are unable to do so, in sum creating a market-based price for carbon. The allowances will slowly decline in numbers over the years, so think of cap-and-trade as a form of musical chairs, with companies bidding on fewer certificates over time — motivating them to find ways to reduce their greenhouse gas emissions.

One of the first successful cap-and-trade programs was launched during the George H.W. Bush administration in 1990. Under the 1990 Clean Air Act, major polluters who were responsible for “acid rain” traded certificates in a move to reduce the emissions of such pollutants as sulphur dioxide. A generation later, California’s cap-and-trade program continues to grow: For example, the state has linked with Quebec’s cap-and-trade program, allowing the two to trade each other's carbon allowances. And as of January 2015, petroleum refineries will also be required to participate within California’s cap-and-trade system. The energy companies are clearly unhappy about it, sharing scenarios of the state’s economy headed for a “fuels cliff.” But will California, the economy of which has been oft-described as careening over a cliff, really experience a disruption to its slowly recovering economy?

Fears of California sinking under the weight of a cap-and-trade program appear to be premature. The WSPA, for example, often cites a report issued by the Boston Consulting Group (BCG) on AB 32, the legislative act that launched a bevy of environmental programs including California’s cap-and-trade program. The report estimated the cost of gas would rise 14 to 69 cents a gallon due to cap-and-trade, and also predicted volatility in the energy markets that could lead to electricity price volatility similar to what roiled throughout California in 2000. BCG also suggested a new wave of price volatility, from rapid price fluctuations on future carbon markets. Coupled with the state’s low-carbon fuel standard, the BCS report suggested as many as four to six refineries could close in California by the end of this decade.

But a University of California, Davis report written last year, of which the WSPA was a sponsor, has shown such fears are overblown. Part of BCG’s scenario assumes expensive sugarcane ethanol from Brazil would be the primary biofuel available to refineries to allow them to be compliant with California’s air pollution laws. But the UC Davis study points out that several alternatives to sugarcane ethanol are on the market. Furthermore, the scenarios of refineries closing for good depend on a variety of factors: The continued demand for gasoline in California isn't going away any time soon, and closing a refinery is a long, expensive process. It is doubtful energy companies will be quick to pull the plug.

Many organizations, taking a more holistic view, are making the case that cap-and-trade, along with the other programs under the umbrella of AB 32, are making a positive impact on the economy. The Environmental Defense Fund, for example, cites potential savings of $21 billion for the state by 2025 due to reduced health care expenses, a reduction in work days lost and a boost in energy security — and the cap-and-trade program, by creating a market for investment in energy efficiency programs and less carbon-intensive fuels, could account for 20 percent of the pollution cuts should all of AB 32’s programs continue as planned. And with transportation creating more pollution in California than utilities (in most states the reverse is true), the oil companies and their refineries have to be a part of this process.

Consumers are already seeing a difference. Walter Wang, an adviser with ZSA and Adjunct Professor at the University of San Diego School of Law, pointed out that many utility ratepayers have seen a "climate credit" on their bills this year. “There is real value in these programs going forward,” Wang said, “and while ‘energy efficiency’ isn't sexy, there is immediate value and a short payback period.”

The Union of Concerned Scientists (UCS) also points out auction revenues from cap-and-trade can benefit the public good by providing revenues for investment in clean energy technologies and job training programs for workers disrupted by new programs; for now the plan in California is to fund the high-speed rail, fund other public transport programs, contribute to home weatherization projects for low-income families and offer new automobile buyers lower emission vehicle rebates.

And speaking of automobiles, during an interview I had with Adrienne Alvord, California and Western States Director at UCS, she explained that looking at only prices at the pump does not give the full story. “Our gasoline prices are higher per pump, but people are spending less on gasoline,” Alvord said. Despite California’s reputation as the land of the car, California ranks 15th from the bottom in gasoline consumption per capita; and despite prices higher than most of the country, per capita spending on gasoline is 13th lowest in the Golden State. As a result of cap-and-trade and other energy efficiency programs in California, a driver who buys a new vehicle now can expect to save $3,000 if he or she drives the vehicle over 15 years.

Consumers across all income levels are seeing the results, insisted Alvord. “We’re taking the revenue that we are raising from these auctions, and we’re using it to lower emissions,” she continued, “and 10 percent of those revenues from the cap-and-trade auctions are being directly invested in low income communities. We’re not just cleaning up the air, but are investing in those who can benefit the most, as in home weatherization programs that directly benefit those who live in some of the most polluted areas of the state.”

Taking a long-term approach is important if California’s cap-and-trade program will succeed. “We have no control over oil prices now,” said Alvord. “We can drill domestically for oil all we want, but it is still a worldwide commodity subject to global pressures. To the extent we can provide ourselves with different forms of energy and make vehicles more fuel efficient, and the more we are able to plan our transport system in a way to reduce our dependence, then we are less vulnerable to our problems.”

If we are ever going to stabilize the price of oil and prevent the shocks that have often roiled our economy over the years, the best way is to reduce our dependence on it. Requiring that oil companies pay for the pollution they create within a cap-and-trade system, and using those monies to diversify our energy portfolio, is a way forward — and another reason why the U.S., and much of the world, looks to California for new ideas.

Image credit: Wikipedia (Downtowngal)

Latest IPCC Report Comes with Grim Warnings

Last week, the Intergovernmental Panel on Climate Change (IPCC) released its fourth and final report on climate change. The report contained no big surprises, since it essentially summarized the findings of the three reports issued over the past year. But the panel, having reviewed all the data, was now in a position to take a broad view of the issue.

Said U.N. Secretary-General Ban Ki-Moon, “Science has spoken. There is no ambiguity in their message. Leaders must act. Time is not on our side."

The panel has been reviewing the issue since 1988. All told, they have reviewed some 30,000 scientific studies, which led to the conclusion that most of the warming that has occurred since 1950 was due to emissions generated by human activity. They reached this conclusion with 95 percent confidence. What they found is that we have set in motion a process that has disrupted the natural balance of our climate. And we have done it with all of the carbon-based fuels that we collectively burn every day. If you want to get a sense of how much carbon that is, you should take a look here.

Despite the fact that the National Climate Assessment showed that climate change is already impacting every American, the American public is lagging far behind the science on this issue. A Pew Research poll taken last year shows that while 69 percent of Americans believe that climate change is occurring, only 40 percent see it as a threat. A similar poll, taken in 39 countries around the world, found that Americans have the lowest level of concern about the issue, despite the fact that we have emitted more cumulative CO2 than any other country in the world.

Why are Americans so blasé about this? Well, first all of all, the world doesn’t seem that much different yet. Yes, there are unusual rainfall patterns, the droughts and floods, the melting ice, the release of methane from Arctic permafrost, the unusually severe storms, the fact that plants are blooming earlier, birds and insects arriving sooner from migration or winter dormancy, the arrival of tropical diseases into temperate zones, and so on. But most people don’t notice these things because most of them are invisible most of the time.

Three or four degrees don’t seem like such a big deal when the temperature changes more than that during the course of a typical day. Also, Americans, despite our prosperity and our widespread use of technology, are not particularly savvy when it comes to science. In fact, in an international comparison of science education, American students ranked 27th out of 35 countries, well below most Asian and European countries. That’s something we need to fix.

Climate science is, in fact, quite complex. It is much more like rocket science than you might think. It involves turbulent flow, heat and mass transfer, and radiation. How many of you have used triple integration to compute the radiative shape factor of an emitting body? (That was the only test I flunked in engineering school, and I was an A student). Most people, even those that love to debate it, aren’t fully qualified to assess, for example, the viability of the computer models. The physics is difficult and complex, and sometimes even the experts get it wrong. There is a learning curve involved.

So, for many, perhaps most, it becomes a matter of faith. Who do we believe? Is it the soft-spoken geeky guy with the lab coat and beard, or the excitable guy on talk radio who sounds more like one of us? Each of us has our own proclivities and leanings (and social circles) that might predetermine our view of the matter, regardless of what the science says.

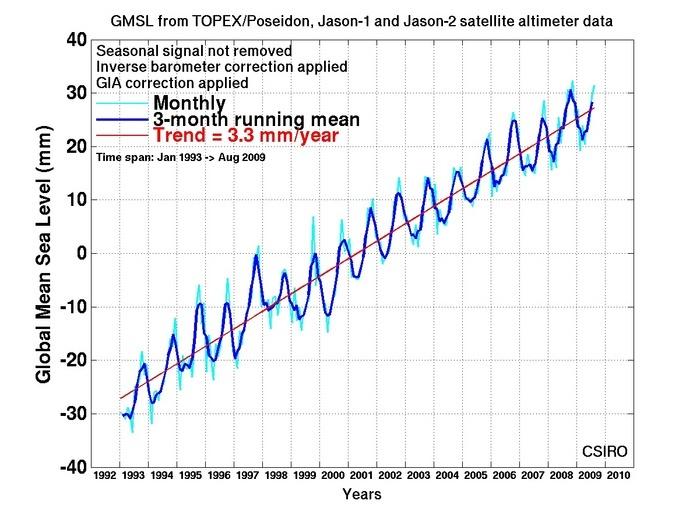

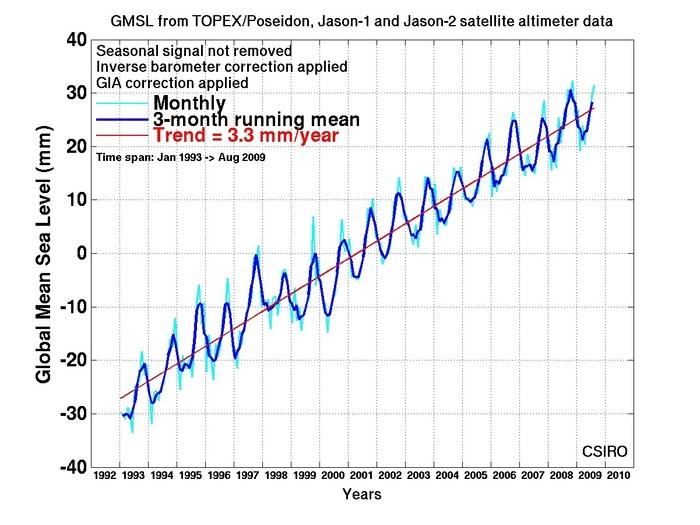

To be fair, the scientists are not getting enough credit. They are using the sophisticated tools, and instruments, sometimes inventing new ones to detect these rather small changes in sea level, atmospheric carbon concentration and overall global temperature. But those small amounts could be the difference between our survival as a species and the alternative. Think about the early detection of cancer, when there are only a few irregular cells that are just beginning to form a tumor. The chance of successfully treating that cancer will be far better than if it wasn’t discovered until months later when the symptoms became obvious.

If your doctor told you that you had early-stage cancer, even though you felt fine, would you have a hard time believing him? Of course you would. And if a different doctor told you he was wrong, which doctor would you want to believe?

There is a lot at stake here. Fossil fuels are what took us to this dance. There is no question about that. We all owe a debt of gratitude to those hard-working people who, in some cases, risk their lives every day to get that oil out of the ground so we can drive our cars and heat our homes. Yes, they make billions, but only because billions of us can’t live without what they are selling. Big changes are being proposed, and big change always means there will be winners and losers.

Some of today’s winners don’t want to become losers -- which is why we have a very active, well-funded and vociferous denial movement that will show up at every opportunity (no doubt they'll be accumulating at the bottom of this page soon enough) to proclaim with complete confidence that all of this is just a bunch of hokum. The U.S. is, after all, home to a number of the world’s largest fossil fuel companies, and, as they have learned from the tobacco companies before them, creating an atmosphere of doubt around an issue like this can forestall meaningful action, which would cost them money if not delayed.

Most oil companies are now publicly acknowledging climate change and taking action to reduce emissions. Some are even distancing themselves publicly from the most flagrant deniers like the Koch brothers and ALEC. Many of these companies are also facing shareholder resolutions that question how they intend to deal with the excess coal and oil that will likely be left underground in a low-carbon future.

Clearly, to those in these long-dominant industries that have been such a force in the development of this country as a super power, these are, as Al Gore said, “inconvenient truths."

But as the IPCC report clearly shows, here they are.

- Humans truly are responsible for altering the climate.

- It’s already happening.

- It’s going to get far worse.

- Much of the warming, so far, has been in the ocean.

- The ocean is getting more acidic.

- Developing nations will be hit the hardest, but everyone will be affected.

- Plants and animals are more vulnerable than we are.

- We need to switch to renewables by 2050 and eliminate fossil fuels by 2100.

- We already have the technology we need to tackle this.

- Most of the things that “might also happen” will make it worse.

For me, personally, I believe the scientists, which is why I spend almost every day trying to find new ways to explain to people why action is needed urgently on this issue. When all is said and done, if I’m wrong and we took action unnecessarily, that means we end up with a clean energy economy and some people will lose money on their oil stocks.

On the other hand, if the deniers prevail and we do nothing, and they turn out to be wrong, the consequences could be devastating beyond our ability to imagine, which is what the vast majority of scientists are saying.

That might already be the case. But we still have the opportunity to take action to minimize the impact to whatever level we can. As Naomi Klein says, it’s already too late to stop climate change, but it’s not too late to save our civilization. It's certainly not too late to try.

Image credit: Neil White, CSIRO : Wikimedia

RP Siegel, PE, is an author, inventor and consultant. He has written for numerous publications ranging from Huffington Post to Mechanical Engineering. He and Roger Saillant co-wrote the successful eco-thriller Vapor Trails. RP, who is a regular contributor to Triple Pundit and Justmeans, sees it as his mission to help articulate and clarify the problems and challenges confronting our planet at this time, as well as the steadily emerging list of proposed solutions. His uniquely combined engineering and humanities background help to bring both global perspective and analytical detail to bear on the questions at hand.

Follow RP Siegel on Twitter.

A Brief History of the Plastic Bag

California made headlines this fall when it became the first U.S. state to place a ban on single-use plastic shopping bags. But how did we get here: from just a few grocery stores offering customers plastic bags in the late ‘70s to today, with Americans using 100 billion plastic bags each year? Just how did the plastic bag become both so popular in our society and so problematic to the environment?

In 1965, Swedish company Celloplast came up with the design on which all modern plastic shopping bags are based: a tube of plastic sealed at the bottom to allow for the packaging of goods, an open top to insert such items into the bag and handles for convenient carrying. This model bag, which later became known as the “T-shirt plastic bag,” was made from high-density polyethylene, or No. 2-type plastic – the same used to produce plastic bottles and plastic lumber.

ExxonMobile was responsible for introducing the plastic shopping bag to the U.S., and the bag debuted in American grocery store checkout lines by the late 1970s. But the T-shirt plastic bag didn’t really start encroaching on the paper grocery bag’s territory until 1982, when two of country’s largest supermarket chains, Safeway and Kroger, made the switch from paper to plastic.

The bags caused controversy immediately after they hit grocery stores – and not just for their environmental impacts. Suburban shoppers preferred paper grocery bags, which could stand upright in the trunks of their cars, while city-dwellers found the plastic bags with handles were easier to carry on their walk home from the store, the Los Angeles Times reported in 1986 (paper bags didn’t boast handles until the 1990s).

"Some customers become real irate and start shouting if they can't get the kind of bag they want," a clerk at a Los Angeles Vons told the paper back then. "It's amazing how they let such a little thing get them so upset. Years ago, they didn't even have a choice."

But, as the war over customer bag preferences raged on, the plastic bag was winning the hearts and minds of businesses – by appealing to their bottom line. Plastic bags are simply much cheaper for stores to purchase than paper bags, which can cost up to four times what a plastic bag does. They’re also waterproof and stronger than paper bags – they can carry 1,000 times their own weight.

By the end of 1985, 75 percent of U.S. grocery stores carried plastic bags in addition to paper ones, and today, plastic bags have secured more than 80 percent of the grocery and convenience store market.

Soon after plastic bags appeared in grocery stores, environmental advocates raised concerns about their effect on the planet. Like other plastic products, plastic bags are made from oil and natural gas – resources that have significant environmental, political and social impacts during extraction and production.

And because the bags are so lightweight and aerodynamic, they can easily fly out of garbage and recycling trucks or bins -- and litter our streets, communities and waterways. Plastic bags also pose a particularly serious threat to marine life once they end up in bodies of water. Marine animals often mistake the plastic bags for food and ingest them (bags look just like jellyfish, a favorite treat for sea turtles), leading to starvation, suffocation or drowning.

But what really drew the public’s attention to the environmental impact of plastic bags was the 1997 discovery of the Great Pacific Garbage Patch, a giant gyre of plastic litter that has collected in the North Pacific Ocean.

By the early 2000s, governments across the world were placing restrictions on plastic bags: from Bangladesh’s ban of the bags, which clogged the city’s storm drains and caused severe floods, to Ireland’s 15-cent fee on plastic bags – which reduced plastic bag use by 90 percent in just three months.

San Francisco became the first city in the U.S. to ban plastic bags and place a 10-cent fee on paper bags, and now the City by the Bay’s state government has adopted a very similar law, prohibiting grocery stores, pharmacies and convenience stores from distributing plastic bags and charging customers 10 cents for a paper bag.

But right after California Gov. Jerry Brown signed the bag ban into law, plastics industry group American Progressive Bag Alliance began its efforts to overturn the legislation, launching a campaign to collect enough signatures to place a referendum on the law on the 2016 ballot.

While the plastics industry was successful in convincing Seattle voters to reject a plastic bag fee in 2008, “Big Plastic” may be facing an uphill battle against current California voters, who, according to a new poll from the LA Times and the University of Southern California, strongly support the plastic bag ban. Sixty percent of eligible voters who responded to the survey supported the new law, while only 35 percent were opposed.

With a third of Californians living in cities that already place restrictions on plastic bags, many residents of the Golden State are now simply used to plastic bag bans and fees on paper bags. And now that Californians see that the devastating predictions the plastics industry promised haven’t come true (job losses, fewer consumer choices, etc.), it’s going to be more difficult to sway voters to its side. The war over plastic bags carries on, but this time, the plastic industry may be fighting a losing battle.

Image credit: Alexis Petru

Passionate about both writing and sustainability, Alexis Petru is freelance journalist based in the San Francisco Bay Area whose work has appeared on Earth911, Huffington Post and Patch.com. Prior to working as a writer, she coordinated environmental programs for Bay Area cities and counties. Connect with Alexis on Twitter at @alexispetru

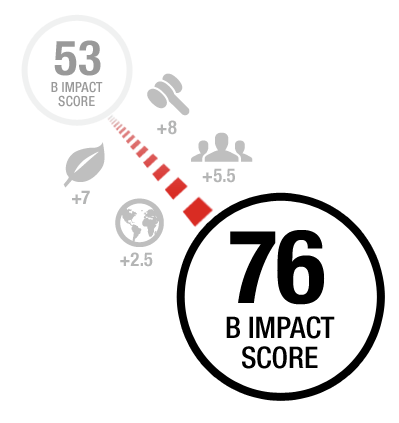

How to Raise Your B Corp Assessment Score

This is a weekly series of excerpts from the new book “The B Corp Handbook: How to Use Business as a Force for Good“ (Berrett-Koehler Publishers, October 13, 2014). Click here to read the rest of the excerpts.

By Ryan Honeyman

Our series continues with the next installment of a six-week, turbocharged Quick Start Guide to becoming a Certified B Corporation.

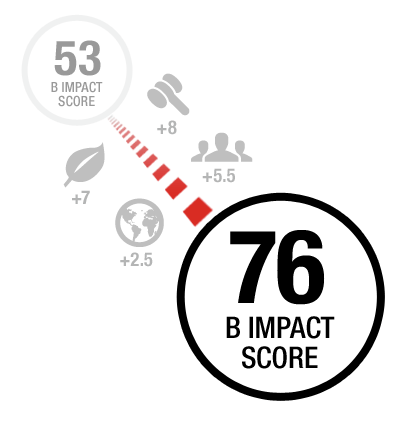

Week one focused on getting a baseline assessment of your social and environmental performance, week two focused on motivating and engaging your team, and week three was about creating an action plan for B Corp certification.

Week Four: Implement your improvements

Time estimate: One to five hoursOBJECTIVE: The objective during week four is for you and your team to dig in and start completing the items on your action plan.

END RESULT: An increase in your B Impact Assessment score.

1. Gather data and research

Depending on your action plan, this is where you start identifying the financial, worker, supplier, community, and environmental data required to update your B Impact Assessment responses. If necessary, contact the people responsible for the data you need.

2. Create policies and procedures

One of the best ways to earn points on the B Impact Assessment is to formalize your policies and procedures in writing. For example, your company can earn points by creating an environmental purchasing policy, a local purchasing policy, a community service policy, an employee handbook, a whistle-blowing policy, a code of ethics, a supplier code of conduct, or an external annual report that details your mission-related performance.

3. Download Free Templates

I created a free collection of 20+ policies, procedures, and templates that you can use to earn points on the B Impact Assessment. Feel free to modify these documents to fit your company's needs.

Ryan's Tip: If you are seeking B Corp certification, a good practice is to ask yourself, “If I were audited, what written documentation do I have that could prove that my answer is correct?” In almost every case you’ll need physical proof, not just informal practices, to qualify for points during the assessment review process.

Coming next week: Week Five: Fine-Tune Your Performance

Image credit: B Lab

Ryan Honeyman is a sustainability consultant, executive coach, keynote speaker, and author of The B Corp Handbook: How to Use Business as a Force for Good. Ryan helps businesses save money, improve employee satisfaction, and increase brand value by helping them maximize the value of their sustainability efforts, including helping companies certify and thrive as B Corps. His clients include Ben & Jerry’s, Klean Kanteen, Nutiva, McEvoy Ranch, Opticos Design, CleanWell, Exygy, and the Filene Research Institute.

To get exclusive updates and free resources about the B Corp movement, sign up for Ryan’s monthly newsletter. You can also visit honeymanconsulting.com or follow Ryan on Twitter:@honeymanconsult.

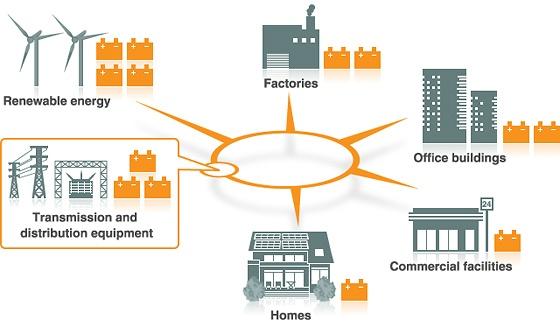

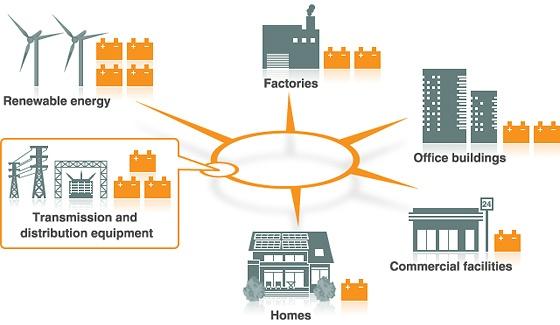

DOE Invests $15 Million in Solar PV-Energy Storage Grid Integration

Energy flows all around us, but it's not very beneficial unless it's harnessed, concentrated and distributed in a form useful to those who need it. That's one of the factors that has made distributed solar energy generation increasingly attractive. More powerful and cheaper than ever, photovoltaic (PV) panels are producing ever-greater amounts of pollution-free energy on-site for homes, businesses, government and public facilities in developing and developed countries the world over.

Utility-scale generation accounts for the bulk of installed solar power capacity in the U.S. The lack of transmission and distribution lines has constrained growth. Building those power lines also adds significantly to the time and cost of bringing new utility-scale solar power assets online. The converse is also true. Connecting rapidly growing residential and commercial solar energy systems to the power grid can yield substantial benefits all around – to power distribution companies as well as consumers and “prosumers.”

Yet, for a variety of reasons – including strong opposition on the part of well-entrenched power utilities – connecting distributed, on-site solar energy systems to the grid has proven to be a significant hurdle to wider-scale deployment and use.

Aiming to speed things up, the Department of Energy on Oct. 29 announced it is making $15 million available to promote integration of distributed, on-site solar energy systems into the U.S. electricity grid. Solar energy growth continues to shatter records, DOE notes in a press release, “with more solar power installed in the U.S. in the last 18 months than in 30 years prior.”

Distributed PV plus energy storage

Combined with solar power electricity production, a new generation of energy storage solutions holds out the prospect of resolving the issue of solar energy's variable nature. The $15 million in new DOE funding opportunities “is specifically aimed at supporting projects that enable low-cost, flexible and reliable solutions that successfully integrate solar PV power plants and energy storage,” DOE explains in its news release. The new funding also falls right in line with the goals set out in President Barack Obama's Climate Action Plan, which include mitigating the effects of climate change, as well as helping the U.S. take on a leading role in global solar and renewable energy industries, markets and adoption.

U.S. solar power generation capacity has grown thirteen-fold since President Barack Obama first took office, increasing from 1.2 gigawatts in 2008 to an estimated 15.9 GW today, DOE highlights, “enough to power the equivalent of 3.2 million average American homes.” Combining the fast-growing amount of solar power being generated around the country with new energy storage solutions can help strengthen the reliability and resiliency of the national electricity grid, which, in turn, helps lower operating costs and costs to consumers.

According to DOE, projects eligible to garner a share of the $15 million in new distributed PV-energy storage-for-grid-integration funding include:

- Advanced operation in conjunction with smart loads and demand response;

- Incorporation of solar and load forecasting;

- Innovative uses of smart components and functionalities, and

- Easily interoperable hardware, software and firmware technologies.

More information, including application requirements, is available on a DOE website.

Image credits: 1) DOE; 2) NEC Energy Storage

SB London: The Brewer, the Banker and the Sustainable Shoemaker

By Felicity Carus

Today was not so much the march of the change-makers, but the march of the brewer, the banker and the sustainable shoemaker at Sustainable Brands London 2014.

The brewer

Michael Dickstein, director of global sustainable development at Heineken International, showed the power of music in the company's 'Dance More, Drink Less' responsible drinking campaign. But not all brands have access to Armin Van Buuren to encourage customers to "drink slow."

He then showed a teaser for next year's campaign that seemed to set a target of 100 percent sustainably sourced barley and hops by 2020. That's a long time to wait for a green beer.

The banker

Financial service companies are thin on the ground at Sustainable Brands London. But all the financial wrongdoing of the banking sector was left to be represented by David Wheldon of Barclays, who surely has the most interesting job title in the corporate social responsibility (CSR) space: head of brand, reputation and citizenship.

Jo Confino, executive editor at the Guardian, gave Wheldon a tough welcome: "Let's be honest about this, the Bank of England produced a new report saying that wrongdoing in the banking industry was still embedded in the culture. Barclays has put aside another £500 million for its rigging and wrongdoing and generally appalling behaviour being one of the institutions that has driven us a society to the point of bankruptcy."

"Jo's introduction, let's face it, is absolutely right. For around 30 years, the financial services industry has made a woeful mistake of not putting the people that it serves at the center of what it does. The consequence of that is a lot of things that need fixing," said Wheldon in reply.

"I don't like 'corporate social responsibility' as a term because it implies there is another thing -- that there is 'corporate irresponsibility.'"

In 2013, 150 senior managers at Barclays had an element of their compensation linked to the "five Cs" – customers, colleagues, citizenship, conduct and company. This year, these five Cs will be taken into account when evaluating the performance of all 140,000 employees globally.

But is business-as-usual in the banking system? It would take a lot to shift it, and most people in the rogue poll in the room said bankers still get paid too much.

"It's a market economy where bankers earn a particular amount of money, and it has to be changed over time," said Wheldon. "I agree there is too much money paid to people who have not done the right thing and we have to change that. It's a difficult thing to do."

Progress on sustainability does not happen without two key ingredients in addition to the "illumination of the mind": inspiration backed by perspiration.

KoAnn Vikoren Skrzyniarz, founder and CEO of Sustainable Brands, spoke about the need to make "meaningful change." "It's not just a head issue; it's a heart issue and creative issue. 'Less bad' is not necessarily sustainable. It's certainly not inspiring."

The sustainable shoemaker

Aly Khalifa showed both vision and the action to make it as real as the Lyf Shoes he designs in a modular design that uses no glue and can be assembled in about 90 seconds.

"If you look at the footwear industry, it's ugly. As a young designer, designing for some big brands, I would have a headache within minutes in a shoe factory because of the toxic glues.

"One of the things I was inspired by was the Shinto architecture in Japan: If the lake gets too high, they disassemble it and move it further up the mountain without using any glue, screws or nails. It's really an exciting set of joinery that makes this whole thing happen.

"In addition, we have all the labor issues with giant centralized factories, and the shipping of these largely unpopulated boxes has a huge carbon footprint. In the United States, 90 to 96 percent of footwear is made at least 10,000 miles away. We have enough shoes to encircle the globe four times."

Khalifa's solution goes beyond upcycling, on demand or localized manufacturing.

"Landfills are a cop out -- we're not creative enough to think about what to do with your product after its useful life," he said.

Lyf customers get a 15 percent discount on their next pair of shoes. But that's not all. They also get a neat little heel sensor that records data to make the next "generation" of Lyf shoe even better for that customer.

"If I can monitor the way you walk for the lifetime of the shoe, I can tell you how you really walk and then modify your next pair so they're even better whether they're for high heel strike or foot issues. We're closing the loop on the customer. That's where the business is, that's where the sustainability is."

His 5-year-old son, he said, loves to watch Krispy Kreme donuts getting made even if he doesn't like to eat them. In Raleigh, North Carolina, the former textile center of the U.S., Lyf is making shoes in-store with a 3-D printer.

"Making is cultural we love to watch things get made," he said.

So, what is this telling us about the convergence of technology and sustainability? Khalifa compares the stage we are at now with an adolescent struggling to adapt to the responsibilities of adulthood. And where better to contemplate that analogy than London, the birthplace of the industrial revolution.

"Are we embarrassed by what we're doing? Do we know better than what we're doing now? If you can imagine a digital cobbler and how we can re-integrate that with the oldest way of doing things. We built cities because manufacturing was in them and the trades were in them. They need to come back to make cities vital. When you put all those things together there's nothing new at all."

Top 5 Reasons Why Online Petitions are Crucial to Your Advocacy Success

By Randy Paynter

With the news saturated with the crisis in West Africa, increasingly dire warnings about our warming planet and attacks on women's rights, I often worry about the world I'm leaving behind for my children. It makes me want to do something about it.

I'm not the only one. Over the years, I've seen millions of people step up and take action about these issues and more. Hundreds of thousands have demanded a crackdown on the illegal ivory trade. Thousands more appealed better access to health care. This year, more than 22,000 people came together to save a front yard lending library started by a 9-year-old boy in Kansas.

So, why haven't you heard stories about marches on the Capitol steps or protests at state houses? Because these campaigns raised awareness in a modern way: online. By organizing through the Web, activists sign petitions sent directly to the powers that be, from legislators and regulators to business people. Hundreds of thousands have created their own petitions to fight for issues in their communities.

Others have realized the power online petitions have to reach decision-makers and facilitate change. Even President Barack Obama gets it: His administration created "We the People," a government owned and sponsored petition platform, in 2011.

Here are five reasons online petitions are crucial to sharing your message and creating advocacy impact:

1. They're easy

Petitions are one of the oldest forms of grassroots activism. Thomas Clarkson, the workhorse behind Great Britain's abolition movement in the 18th and 19th centuries, traveled on horseback collecting petition signatures to oppose slavery. Clarkson's in-person methods required time and manpower. It's long, hard work.

With the advent of the Internet, things changed. Today, it's easy to create a petition in minutes and plug your petition directly into a network of activists, sharing it with like-minded people who want to help. There is even online coaching about how to make your petition successful, from persuasive writing tips to direct support with signature delivery and working with the media.

2. They reach people where they are

There's a reason traditional signature gathering happened on street corners and people's front steps: you have to meet people where they are. Everyone is busy, and while many take time to support causes they believe in, many more would act if the opportunity arose in the course of their daily life.

The internet is the modern-day meeting place, where people go to get informed and exchange ideas. Unfortunately, even if you create one, people won't necessarily come to your website automatically. That's why online petitions are integrated with Facebook and partnered with hundreds of media sites to connect the latent activists on their sites to opportunities to make a difference.

3. They help you find new audiences

You hear a lot about apathy among the Internet generation, but our engaged community of more than 26 million shows me that activists are out there - you just won't always find them using the traditional organizing methods. In June 2014, we celebrated the milestone of more than 200 million petition signatures.

According to a Pew Research Center study in 2013, more than half of Americans have participated in some kind of civic action, and two-thirds of all adults were politically active online. One in five active users on social networks said information they learned online inspired them to take further action. Pew also found in 2014 that people's online networks are deep. Even baby boomers have an average of nearly 100 Facebook friends. That means getting even one person to share your story can multiply, and pay huge dividends.

4. They make change

Just because online petitions are easy to start and sign doesn't mean that they don't make a big impact. Online petitions give people a powerful collective voice and access to decision makers.

In a substantial win for the environment and food security, an online petition helped the Chesapeake Bay Foundation, Pew Environment Group and Center for Biological Diversity flood decision makers with comments about a new rule to protect menhaden from overfishing. Dubbed the "most important fish in the sea" for the critical role they play as a food source for whales, dolphins, eagles and osprey and more, the petition efforts helped convince the Atlantic States Marine Fisheries Commission to provide historic protections.

Big wins make a big difference, but often, it's more exciting to see how online petitions started by everyday citizens can make local change. Earlier this year, the Taos Farmers' Market faced strong opposition to its move to the New Mexico city's historic town square from a handful of merchants. When it seemed the City Council would give in to this small minority's demands and close the market mid-season, Nyna Matysiak, a Taos area resident, took action. Though the Council refused to hear citizen comments on the issue, Matysiak submitted the 500 online signatures from her pro-farmers' market petition, which convinced the Council to keep the market open through this season.

5. They cultivate engaged citizens and informed democracy

Often a small step, like an online petition signature, is all people need to become engaged in other ways. Studies show that more informed citizens are more likely to vote in elections. Recent work looked at the protests in Wisconsin against Gov. Scott Walker's attack on collective bargaining rights and found that young people who expressed their views online were more likely to protest offline, too.

The world may face a lot of challenges, but it's heartening to see so many people are willing to take action to make it better. Online petitions are a critical part of any strategy to make change.

Image credit: Shutterstock

Randy Paynter is the Founder, President and CEO of Care2 and The Petition Site. He is a pioneer in the online advocacy field that is dedicated to helping empower others to collective action in support of their social and environmental causes. Randy's innovation of the "Engine for Good" model, whereby good actions generate revenue that fuels more good actions, is the basis for how Care2 and The Petition Site are run. He is a frequent speaker at conferences including Bioneers, Social Venture Network, Silicon Valley Boomer Venture Summit, SoCap, Aging in America, LOHAS, AARP and Green Festivals. Randy hold an undergraduate degree from Harvard University and an MBA from Standford's Graduate School of Business.

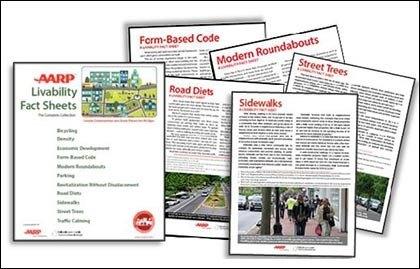

AARP: Baby Boomers Want Liveable Communities, Too

If we are to believe much of what we see in the press, millennials will have to make a more sustainable world to get us out of the mess that the baby boomers are leaving behind. But such generalities may not be necessarily true. Even AARP, which has paid plenty of attention to the baby boomer vs. millennials conflict, has made the case that its membership is concerned about the same issues with which the younger generation is often preoccupied. For example, one may not intuitively think of AARP as a locus of information on smart cities and better urban planning. This powerful lobbying group, however, has an impressive archive that inspires its members to advocate for more “liveable communities.”

AARP’s Walkable and Liveable Cities Institute should not be much of a surprise. As one approaches retirement age, the idea of living in an isolated exurb, where walking, cycling and public transports are the exception and not the rule, is less appealing. And with kids out of the house, denser communities and compact homes close to shops and services are becoming more desirable. Pedestrian-friendly streets and bicycle lanes are not only safer, but also allow citizens of all ages to save money and, of course, live sustainably.

To that end, AARP is arming its membership with a bevy of fact sheets, just as it has over the years when rallying its members over issues including health insurance and Social Security. Together they read like a syllabus for a Smart Cities 101 course. Succinct and full of information, the fact sheets can help citizens make the case for anything from tree planting to traffic roundabouts. For example, the dossier on bicycling not only presents numerous data points, but also does a solid job disputing arguments against the expansion of bicycle lanes and infrastructure in any city. Another section devoted to form-based code arms citizens with information on why conventional zoning in communities needs to go the way of the horse and buggy. In addition, AARP advocates members to work with local policymakers on the following:

- An increase in denser and mixed-use developments across the country, in urban and rural regions alike. “If increasing density in the town core becomes a priority of the community’s growth plan,” says AARP, “it can decrease some of the negative effects of the kind of population loss common in many rural regions.”

- Policies for revitalization without total gentrification, to which everyone from artists, minorities and yes, senior citizens, can relate. AARP points out successful community revitalization projects in Denver and Portland, Oregon, that did not completely change those neighborhoods’ demographics.

- Calling for a curb on “Road diets,” by pointing out the fact that wider streets often have higher accident rates, while redesigning a street to include bicycle lanes and pedestrian islands can actually be a boon for local businesses.

So if the over-55 crowd in the U.S. can muster their strength and have more cities embrace what AARP calls the “Age-Friendly Communities Tool Kit,” everyone within a community can benefit. Safer streets for elderly also benefit kids who bike to school; denser communities where residents can walk a short distance to the café and dry cleaners are a magnet for folks of all ages; and less cars on the road mean the air is cleaner for everyone. The millennial-boomer divide, in reality, is more cliché than reality after all.

Image credit: AARP

After a year in the Middle East and Latin America, Leon Kaye is based in California again. Follow him on Instagram and Twitter. Other thoughts of his are on his site, greengopost.com.

Series RE-Launch: Sustainable Apparel Part II Debuts Tomorrow!

Loyal readers will remember the tremendously successful series Sustainably Attired we ran this summer to explore the lifecycle of fashion. We're thrilled to announce that Levi Strauss & Co., a longtime proponent of sustainability in the supply chain, has returned for another round. Of course, the company's environmental programs aren't limited to supporting our editorial efforts. In fact, just today the denim giant announced a new partnership with the World Bank Group’s International Finance Corp. to provide financial incentives for garment suppliers in developing countries to upgrade environmental, health, safety and labor standards.

We'll launch part II of this series tomorrow with a focus on consumers: We'll examine how purchasing and clothing care choices affect the overall environmental impact of our clothes. Since we're heading into the holiday season, we'll also dedicate plenty of attention to purchases you can feel good about gifting. You'll hear about Levi's initiatives, as well as those from other leaders in the space.

Tomorrow we'll kick off with a piece that examines what happens at the end of a consumer's time with a garment. If it's donated, what happens next? What happens to the clothes too worn to wear? Are our hand-me-downs finding a second life in our communities, or are they shipped to a far-away country? You can check out the rest of the series here.

Image credit: Orangeadnan, Flickr