How Businesses Should Respond to a Shifting Consumer Mindset

By Doug Austin

While the discussion around millennials is often centered on tech trends and bootstrapped startups, that’s not all the generation is known for or where its influence ends.

In general, millennials — or those who reached adulthood around 2000 — value transparency, causes and sustainable business practices. As these influential consumers come of age, it naturally follows that organizations will need to rise up to meet them where they are — especially when it comes to green business practices.

How millennials are shaping the consumer mindset

American consumers have grown suspect of big corporations, and millennials are no different. It’s not surprising when you consider that many millennials entered the job market during the Great Recession and grew up at a time when concerns over global warming reached a boiling point.

As millennials mature, their strong opinions and values impact the global mindset in terms of green business practices.

Unlike previous generations, millennial consumers don’t just care about the products they buy; they care about where the products came from, who worked on them and how sustainable the production process was.

Surveys show that 40 percent of millennial consumers are willing to pay more for green products (compared to only 33 percent of consumers in other age groups). This is a powerful statistic when you consider that millennials’ spending power ranges anywhere from $200 billion to $1.3 trillion. And by 2020, the nearly 80 million millennials will constitute 30 percent of retail purchases. Baby boomers, on the other hand, are quickly aging and reducing their spending.

This emphasis on environmentalism will affect businesses across all industries that want to appeal to millennials. And don’t be mistaken: Consumers’ interest in process will only continue to increase, adding fuel to an already growing green-business flame.

How to adapt to changing consumer attitudes

As consumers’ values shape the global marketplace, your business must adapt to stay competitive. Luckily, every business can make changes to become more responsible, and even small changes can make a big impact when it comes to conserving resources.

1. Be transparent with your employees: Have an honest conversation with your employees about current green practices and what can be done to improve. Be willing to learn, share and try new things, and set up a process beforehand for reacting to and implementing feedback. If you let them, employees will be your biggest advocates. But this advocacy hinges upon their ability to be heard, so ensure their suggestions are acknowledged and implemented.

2. Strive to reduce wasted resources: Audit your current use of resources, and find ways to conserve or put them to better use. Make sure you’re cognizant of all resources used — from materials needed to make the finished product to the fuel used to transport it.

When you ask the right questions and take steps to ensure your business is as sustainable as it can be, you’re validating your company’s commitment to the environment, which your customers and employees will appreciate.

Reducing waste can benefit your company financially, as well. For example, you can actually earn tax credits for energy efficiency.

3. Encourage consumers to be Good stewards of resources: Whether your customers are everyday consumers or other businesses, you should encourage them to adopt similar habits to save energy and be kinder to the environment. Not only will this magnify your company’s impact, but it will also advance the discussion around sustainability and help you forge stronger customer relationships.

Consider Chipotle’s campaign, "The Scarecrow.” It focused on educating viewers about the benefits of sustainable farming and 'real food.' The campaign was shared and discussed widely online. The values-based advertisement advanced Chipotle’s message and solidified consumers’ perception of Chipotle as a responsible, sustainable brand.

--

Thanks to millennial influence, words like 'transparency' and 'accountability' dominate today’s headlines about brands. But by staying honest and engaged with your employees, collaborating with internal and external audiences, and being willing to make necessary changes, you can seamlessly adapt to the changing mindset of your most powerful customers.

Image credit: Flickr/francisco_osorio

For nearly 30 years, Doug Austin has been studying the “art of observation” and filtering out the human truths. Whether digging for key consumer insights or preparing the next national retail promotion, it’s all about the ability to “hear and see” what others may not and asking the hard questions. Austin is the SVP of growth and innovation and leads product and brand innovation sessions for Marlin Network.

Getting a Little Good Out of Everyday Choices

By Wendy Gordon

I went to the Museum of Modern Art on Sunday with a friend. I used my Bank of America credit card to buy the tickets. Not only did I get one free, but I also got us both in to see the sold-out Matisse exhibit.

Now that’s a reward. Got a total dopamine rush to boot. Pretty much made my day.

It doesn’t take much as it turns out. A few days earlier, I ordered some personal care products and cleaning supplies through PIPsRewards.com, a social good rewards site I co-founded. (PIPs stands for Positive Impact Points).

Along with the PIPs reward points I got for making responsible shopping choices, I was notified that a few of my newly-earned PIPs had been pledged to ioby.org, which supports neighborhood development projects. My face lit up. I had forgotten I’d set up the auto-pledge function a week or so earlier. And I’ll probably forget again until I get another notice that a few more PIPs are being passed forward to a favored cause.

Full disclosure, I founded the company that launched PIPs. But I’m also a healthy skeptic -- neither a wild rewards junky nor a rabid do-gooder. So, I was pleasantly bemused by my 'test mouse' reaction to the email and again in the museum. I was craving more.

As it turns out, the opportunity to goose a little good out of people is everywhere. I love this example from Beijing which installed reverse vending machines in subway stations so passersby can convert their empty plastic bottles into either transit credits or extra mobile phone minutes.

Wow, what’s not to love about a device that derives positive value for individuals who recycle those ridiculously overpriced, single-use, last-a-lifetime-in-landfills plastic beverage bottles?

The author of the article about the reverse vending machines suggests that it’s too bad it takes rewards to get people to care. I disagree. I happen to believe, like Matt Wallaert, a behavioral scientist at Microsoft, that “most of us are well-intentioned.” We do care. It’s just that to act on our intentions is "cognitively expensive" -- meaning it takes too much mental energy than we have to spare.

That is, until now. Technology, like this ingenious “recycle for rides” reverse vending machine, is making everyday behavior change significantly easier -- "cognitively easier" -- as well as more fun and more rewarding.

The many new personal tracking apps and connected home and car apps are further examples. Stores and restaurants everywhere use coupons, gift cards and discounts to build customer loyalty and drive sales. Why not reward behaviors like exercise, carpooling or saving energy that deliver not only economic returns but positive social benefit as well.

What about shopping? It’s the holiday season once again, a time often brimming with guilty pleasures and indulgences. Being a mindful gift giver can be a challenge -- ugh, just so much more stuff -- and ever so unrewarding. Until PIPs. Forgive the shameless plug, but PIPs’ online catalog is brimming with gift ideas -- everything from kitchen appliances, music downloads and games to responsibly made clothing and jewelry, local consumables and donation opportunities to worthy causes. There are even meditation apps you might just keep for yourself -- a chance to chill between the season’s crazier moments.

Sounds like every other catalog, no? What’s special is that every choice is carefully curated and comes with PIPs rewards points -- or can be made by redeeming or giving PIPs -- our guarantee that it has positive impact on personal and or planetary health.

Some day I hope you’ll be able to redeem your PIPs for entrance into museums, theatres and concerts -- experiences that would make an awesome holiday gift. Just thinking about it goosed my karma-meter.

Image courtesy of PIPs Rewards

Wendy Gordon is co-founder and CEO of PIPs Rewards. She and Meryl Streep co-founded Mothers & Others for a Livable Planet, an organization in the vanguard of the environmental consumer movement. M&Os' most successful strategy was the 'buycott,' by which consumers were guided to improved products in the marketplace. With 'Positive Impact Points' (PIPs) - 3P Partners' all new social good currency and the 'rewarding better' marketplace - Wendy hopes to significantly reduce "the friction" (a behavioral sciences term) and up the fun associated with making surprisingly simple yet powerfully positive choices everyday.

Acer U.S. Operation Goes 100 Percent Green Power

Acer Americas is joining the growing ranks of U.S. businesses meeting 100 percent of their electricity needs from renewable energy resources. The U.S. subsidiary of the Taiwanese multinational consumer electronics manufacturer on Oct. 28 announced it is joining the EPA Green Power Partnership and has purchased enough green power to offset all of its carbon emissions from electricity in the U.S.

To get there, Acer Americas recently purchased more than 27 million kilowatt-hours of green power in the form of renewable energy credits (RECs). That puts Acer among the ranks of U.S. businesses on the EPA's 100 Percent Green Power Users list, as well as the Top 30 Tech & Telecom partner rankings, Acer highlights in a company press release.

Acer also reported that it is ahead of schedule to meet its 2015 global carbon emissions reduction target. Reducing carbon emissions, environmental pollution and natural resource use, as well as reducing waste and promoting recycling, all factor into the strategic goals Acer has set out in its corporate social responsibility (CSR) program, company management points out.

Acer: CSR, GHGs and the Product Lifecycle

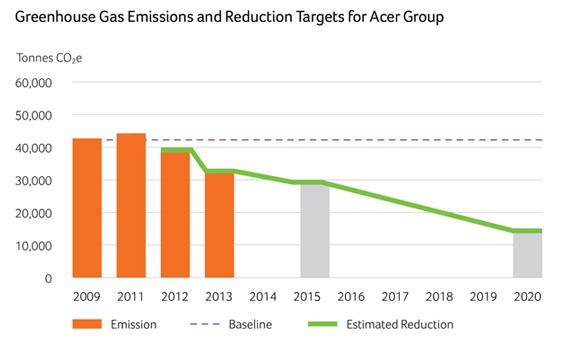

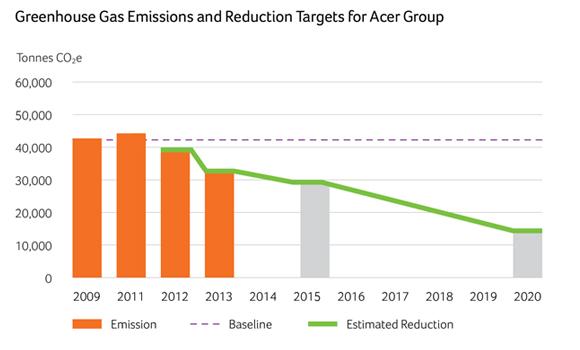

Listed on the Dow Jones Sustainability Index, Acer conducts annual greenhouse gas (GHG) emissions inventories and initiatives to improve efficiency in its products, operations and data centers. Aiming to meet, if not exceed, its CSR obligations as they relate to energy usage and GHG emissions, Acer “supports the two absolute GHG reduction targets proposed by the EU,” management explains: Firstly to use 100 percent renewable energy by 2050, and secondly to cut industrialized nation emissions by 30 percent by 2020 with 1990 as the baseline year.

For its part, Acer intends to reduce its GHG emissions 30 percent by 2015 as compared to 2009 baseline levels. It plans further reductions: to 60 percent below 2009 levels by 2020.

“Acer has steadily reduced its energy consumption since 2009 through investments in more energy efficient air conditioning and lighting equipment, among other efforts, in our offices around the world,” Acer Corporate President and CEO Jason Chen was quoted as saying.

The RECs purchased by Acer Americas are made up of a mix of electricity produced from renewable energy resources including wind energy and biomass. “The latest initiative by our U.S. operations to use 100 percent green energy demonstrates our commitment as a corporate citizen to work with our stakeholders to build a sustainable corporation and environment.”

Acer's sustainability strategy

Acer's sustainability strategy extend across the supply chain partners through its participation in the CDP (formerly known as the Carbon Disclosure Project) Supply Chain Program. Besides providing training and helping supply chain partners establish energy-saving and carbon reduction goals, Acer is working towards lowering the overall carbon emissions of its products’ entire life cycle through innovative product design.

According to Acer, “Our products embody the concepts of the precautionary principle and individual producer responsibility (IPR) as we endeavor to reduce our environmental impact throughout each stage of the product lifecycle and provide appropriate recycling channels to help consumers do their part for the environment.”

As management explains on Acer's website, “We understand that the opportunity to reduce greenhouse gas emissions is not limited to our own bases of operations, and there are an increasing number of carbon reduction projects worldwide with strict monitoring mechanisms that provide sound commitments to making substantial reductions. We are now planning to assess the feasibility of investing in projects to generate or purchase renewable energy and related certification to offset our emissions in the future.”

Acer's e-Enabling Data Center (eDC) in Taiwan was the first of its operations to install renewable energy generation assets. Operations in Germany and Italy followed in 2011 when they began to procure green power. Its U.S. operations followed in 2013, which management estimates will push the ratio of green power usage across its global footprint to over 30 percent by the end of 2014.

Images courtesy of Acer

How to Achieve Higher Productivity in Only 4 Days, Without Bosses

By Cristian Rennella

As a programming engineer, I started more than 15 years ago developing programming codes for prestigious software companies such as IBM, Intel and HP. Since the very early stages of my career, I could identify certain aspects of the operation with which I did not agree.

What were the problems?

Firstly, every highly-skilled software engineer I knew would eventually be promoted to a managerial position. This meant that the best programmers would, eventually, stop doing what they did best: programming. This system took place because it was the only way to get a high-rank post and, therefore, a better salary.

The problem lies in the fact that the best programmers will not necessarily be the best managers, or the so-called, “Project Managers,” since each job requires the mastering of very different skills. What's more, I strongly believe that programmers cannot perform well as managers. Finally, quoting Joel Spolsky, Trello’s designer/developer: “In the end, great human resources who did their jobs skillfully were lost."

On the other hand, there were managers who had never been programmers, but who did know how to deal with human resources efficiently, communicate their ideas and organize projects according to the company’s goals. The problem with working with this methodology is what Google’s founder, Larry Page, has expressed on several occasions: “Engineers should not be supervised by managers who lack technical knowledge."

Based on my personal experience, what really happened was that, as managers did not have the capacity of controlling the tasks developed by the programmers, they would reward those who performed their tasks faster, regardless of the quality of their work. And, as all programmers know, more is not necessarily better, since performance in software designing is governed by the premise 'less is more.' The less programming language we develop and the more efficient it is in its performance, the better. This is so because that programming language will eventually be cheaper in terms of maintenance costs and will also be much easier to run to run for anyone who wishes to use/modify such program.

What is the solution?

After 8 years of working in our project, OMT, there are currently 35 members in our working team, and the solution to the aforementioned problems is simply to work directly without managers (without bosses). In our company, we are all software engineers who work autonomously four days a week, for a total of 32 hours, as freelancers (without offices).

How did we come up with this solution?

1) The first thing we did was to create a SAAS (Software as a service) internal tool tailor-made to satisfy our needs. Any of our workers can, through this tool, consult the updated list of projects being developed at the moment.In this way, each of us can voluntarily join and work on any of the projects that we may feel most identified with by contributing hours of programming, research, design, etc. Programmers may even create their own project if necessary.

2) Despite the fact that each member of our company is a programmer, as in all enterprises, we all carry out marketing, sales and customer service tasks, etc. In order to bring about all of these aspects, we have implemented a rotation system in which each member shares 20 percent of their time to develop these activities.

Who could be in a better position to deal with and help a client with a problem than the person who actually developed the program? The benefits to be attained with this policy are priceless. To be in touch with clients is the key to success.

3) Our company has eliminated the hierarchical structure in which each of us does his or her own job with just one boss who assigns activities.

As stated in a recent research paper by the National Bureau of Economic Research, group decisions both foster commitment among team members and deliver better outcomes compared to those based on individual decisions.

Another example of this is DaVita, a health company with over $6 billion worth of annual income that did not go bankrupt thanks to the redesigning of its organization into one in which cooperation among all members was essential.

One final example is Morning Tomato, the world’s biggest tomato producer, where there is peer equality, autonomy and compensations defined by their coworkers.

4) Another key aspect of our company’s cultural approach is that we only incorporate proactive people. This means that no one is going to be controlled when performing his or her tasks, and also that employee promotion prospects depend on the employees themselves (how organized, hardworking and dedicated they are)

5) Finally, and according to research conducted by the American Journal of Epidemiology, individuals who work 55 hours a week perform much better and achieve better results than those who work 40 hours.

In accordance with our own experience over the last three years, those proactive programmers who worked four days a week outperformed by 35 percent the results achieved by those who worked five days.

However, results are not the only motivating factor that makes us work this way. Working this way is also an advantage for us when it comes to competing for the best talents in the labor market, and it helps us hire excellent professionals. Yet another advantage of working as our company does: It allows us to keep talented workers on our payroll, a better working environment and team work, as well as a long-term sustained growth.

As a conclusion, I am sure that there are many arguments in favor of continuing work practices in the traditional way, with a hierarchical and rigid structure made up of bosses, in a context where employees must work as much as possible (five days or even more). Nevertheless, I also believe that it is high time we grasp the idea that the industrial era is far gone, that less is always more, and where the current state of technology has the potential to allow and facilitate this transformation.

Image credit: Flickr/Matt Krawford

Cristian Rennella. Engineer. Professor of “Programming oriented to Objects” at the Catholic University of Córdoba. Cofounder of EMT. Now focused on the development of mobile technologies in developing countries.

Canadian Companies and Charities Discuss the Future of Cause Marketing

By Elizabeth Dove

Not that long ago cause marketing – leveraging a brand to encourage consumer participation in a cause effort – was the practice of just a few Canadian companies. Often it was a point-of-sale request to buy a leaf or shoe cut-out you sign and the store mounts, or give an extra toonie when you buy your java to help a kids' cause. Now cause marketing is considered an integral part of marketing for both business and charities. And, as evidenced at Toronto’s inaugural Companies and Causes Canada conference on Oct. 28, execution has become considerably more innovative, measured and refined based on evidence.

New data shows Canadian consumers open to new techniques

Ipsos Reid announced the results of its recent study, A Canadian View on Cause Marketing, at the conference. It showed that Canadians prefer and most often engage with a company-supported cause by 1) giving a donation at the cash register and 2) a cause-embedded purchase, which are arguably the two most used cause marketing methods. Interestingly, giving at-cash is the only area where those surveyed show less inclination in the future than current behavior. Buy one-get one is the greatest area of opportunity for companies as it shows the biggest gap between past consumer behavior and participation opportunities they “would consider."This is good news for at-cash employees, as evidence suggests they are uncomfortable with asking for donations: In the effort to win an external audience through at-cash requests for a cause, companies may be turning off their internal audience. Presenter Phil Haid of Public encourages companies who wish to respond to the evidence of at-cash engagement preference to create a campaign that makes it compelling for customers to ask to participate in-store versus being prompted by an employee.

Give where your customer lives

The Ipsos Reid survey also proves customers want specifics about the actual impact of their participation and prefer it to be close to home (e.g. will donate $2.50 which will pay for 22 meals at the local foodbank). Specific preference on geographic area of cause impact of those polled was 44 percent Canada, 38 percent local – (evenly split on province, city/town) and 18 percent global.

These findings support the efforts of companies such as conference presenter Telus whose multiple cause marketing campaigns, such as #givewherewelive and Go Pink, have employed innovative, sharable techniques (using selfies, social media) and locally-tailored campaigns with trusted charities like WWF and a focus on local impact. Telus gave more to cause charities in 2013 than all of the telecom companies combined and can quantify the payoffs of their techniques with metrics such as: decreased customer complaints, increased employee engagement and a larger share of Facebook followers than all other telecoms combined; additionally, 55 percent of customers say Telus' cause commitments influence their decision to stay.

Determine what social impact your consumer will pay for

Choosing the right cause depends on in-depth knowledge of your consumer. As presenter Sue Tobias of Mission Measurement put it, “It’s great to save the world, but if it doesn’t touch the consumer, it’s not going to move the needle on business.” The key is to determine the social impact your customer will pay for through attractive functional benefit (e.g. fuel savings), emotional benefit (e.g. "I feel good that my higher priced java means fairer wages for workers") and/or identity benefit (e.g. see my ethical TOMS shoes).

Your data-informed campaign has to employ the preferred techniques of your consumer. Millennials are far more likely to respond to a campaign that has tools built in to allow them to share their participation with their social media network than one where they simply pin on a button. Choice of charity partners also must be informed by alignment with cause, your consumer and your brand. But of course there is so much more that needs to go into creating the best partnership fit, which presents an opportunity for next year’s conference to explore.

Bigger, more focused investments by companies

With slick television and print ads, events, the contributions to partner charities, and often involvement of third parties – like sports teams – the financial layout for cause campaigns is considerable. As a result, companies are getting more focused, often down to a single cause they are behind. As Brian Collins of Purolator said at the event while discussing the company's award-winning Tackle Hunger program, “Purolator is not listening unless you can connect your cause to hunger.” It also means that charities are finding it harder to break in to cause marketing while others with high trust and desirable segment appeal (e.g. Free the Children’s hold on millennials) enjoy multiple corporate cause marketing partners.

Bold leadership on underexposed causes -- the next frontier?

One of the most impressive presentations showcased the multiple commitments of Unilever, including their leadership to recognize previously underexposed issues – like women’s self esteem (Dove’s ‘Self Esteem Project’) and preventable disease spread through poor hygiene (Lifebuoy’s ‘Help A Child Reach 5’ campaign) -- and bring them to light, leveraging the company's global reach. As part of the company's motivation for the ambitious Sustainable Living Plan, John Coyne of Unilever framed the business case as self-evident, “We know the economic cost of inaction is more than action.”

But short-term business interests often trump this. What will it take for more businesses to take this long view on sustainable change investment -- and step out from the safe issues multiple businesses rally behind -- to bring more of the root causes of inequity and eroding sustainability to light?

Image credits: 1) Elizabeth Dove 2) Telus

Elizabeth Dove is a specialist in strategically engaging the public, companies and government on sustainability and social change. She has worked as senior staff and consultant for initiatives that support the arts, child welfare, public health and particularly international development. Passionate about the power of collaboration, she seeks out projects that bring together actors from different sectors to create value for their organizations and the broader community. She is Senior Vice-President, Strategy at The Divinsky Group and an Associate at Open Spaces Learning, a Canadian change management firm helping companies realize business and social impact. Twitter: @EDove5

Chevron Lobbyists Lose Richmond Election Bid

For many organizations concerned about the environment and the impact of global warming on their communities, last week’s mid-term election results were a disappointment.

Organizations like NextGen Climate Action spent millions of dollars in an effort to combat candidates it felt wouldn’t take action on climate change. The League of Conservation Voters and Sierra Club also went to the mat and lost in a number of states, including Oklahoma, where victor Sen. James Inhofe has called climate change a hoax. In Florida, a state literally divided by climate change impact and an election that had Gov. Rick Scott in a tie with challenger Charlie Crist, environmentalists lost as well.

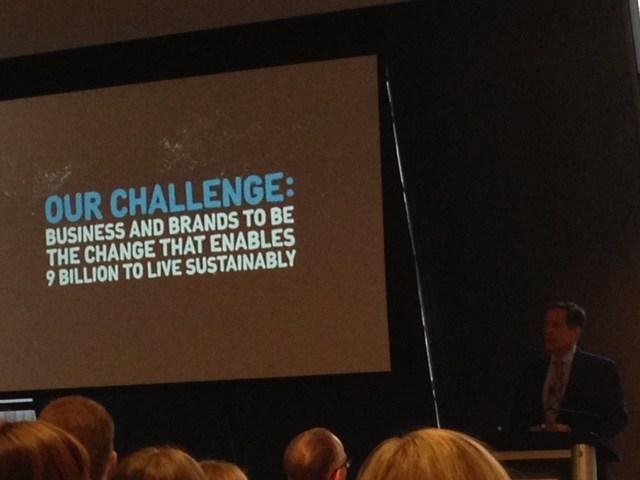

One surprising bright spot for environmentalists, however, was Richmond California, where voters turned down the heavily financed appeals of their neighbor Chevron Oil and elected the well-known Democrat Tom Butt as mayor. His overwhelming win over Republican Nat Bates is the result of a trend that has reshaped Richmond’s image in recent years. Initiatives like banning petroleum-based plastic bags and creating bike lanes and green city concepts were all part of a platform that spoke to Richmond voters.

Of course, Butt wasn’t the only pro-environmental candidate to win. Former Richmond Mayor Gayle McLaughlin, Eduardo Martinez and Jovanka Beckles also won seats on the council.

The Chevron refinery fire of 2012 helped turn voter momentum and bring national attention to Richmond, which has served as a refinery town for decades. Climate justice activists have long criticized conditions in neighborhoods in Contra Costa County, where there have been more than 30 industrial accidents in the past 25 years. Anyone who has driven through the area since the 1950s or so might remember it more for its dominating plumes of steam, smoke and pollution than its historic neighborhood communities. That ambiance is now changing as Richmond reconfigures its vision to become part of the dynamic Silicone Valley.

Still, Richmond’s new mayor is no stranger to controversy. In 2006 he made headlines by criticizing the city’s ongoing infrastructure problems, an issue that led to raw sewage overflowing onto the streets and a lawsuit filed by the environmental group San Francisco Baykeeper. The city was eventually forced to upgrade its sewage system. He was also the catalyst in an effort to link Richmond to San Francisco’s popular Bay Trail Link.

Butt won the election by more than 15 points, and cost Chevron more than $3 million in lobbying dollars. His campaign, like those of South Florida’s brash coastal communities, sent a clear message that climate change may be part of their future -- but it doesn’t mean their residents won’t try to stop its advance.

Whether Standard Oil, Chevron’s parent company, is ready to make that switch is another thing, of course. In March of this year, the Chevron plant released a report that stated it had been approved for a modernization project that would increase pollution at some periods of construction and “would allow the facility to process crude and gas oils containing higher concentrations of sulfur, which could result in increased emissions of sulfur-related compounds and TACs (toxic air contaminants)."

It is unknown at this time what this new city council shakeup will mean to Chevron’s future plans, but the fact that the company invested heavily in a small-city mayoral election (that it lost) might suggest discussions about increased production and potential pollution aren’t necessarily over. An ongoing court case being heard by the California Supreme Court could determine whether the Bay Area Air Quality Management District can set thresholds for greenhouse gases. That outcome could affect Chevron’s TAC output. Either way, Chevron’s plumes seem to be in the way of Richmond voters and their changing vision for the city.

Richmond refinery: Sharon Hahn Darlin

Xerox Provides New Tools to Reduce Printing Impact

Given the widespread popularity of digital communications, you might imagine that the use of paper should just about be dead by now.

Here’s a reality check: Although paper consumption is declining in North America, it is still on the rise worldwide. And before we get too carried away patting ourselves on the back, it’s worth noting that Americans still use far more paper per capita than any other people in the world, upwards of 500 pounds per year each. A full 40 percent of all industrial logging goes into paper production, and that number is expected to increase.

Xerox just announced a couple of new services that can help reduce paper consumption. That might be a little surprising for a company that, not long ago, made most of its revenue based on the number of pages customers printed. Now, in additional to copiers, the company also provides services like document management, which has reoriented Xerox towards helping its customers become more productive.

The Xerox Print Awareness Tool is a software application, developed at Xerox’ European Research Center, that can give you another reality check. It asks how many copies you think you print each month, and then gives you the actual numbers. This is done not to harass you, but to befriend you and win your trust -- with the promise that it will help you become more productive and less wasteful. At that point, it becomes a kind of game. Users are given a monthly allocation of points based on their nominal printing requirements. Feedback is provided to compare users to their peers, and suggestions are made with ways to improve productivity.

This might seem odd, but it is, in fact, part of a growing trend of workplace gamification, which has been touted as an effective way to increase employee engagement.

The other tool launched by the company is called Xerox Digital Alternatives. This is a pretty nifty set of tools that allow workers to move smoothly and easily between the paper and the digital world. Say you have a form you need to fill out and sign, and you only have it available in hard copy. After scanning the page and bringing it up on screen, you can fill it in using an annotate function, which is a kind of floating text box that automatically aligns itself to lines on the form. The application remembers where the text has been placed for printing or future edits. The sign feature works in a similar manner, though it inserts a color digital image of your signature. The read function brings e-reader capabilities to scanned or digital documents and encourages users to read the information onscreen, rather than printing it out (and thus winning the user points on the Print Awareness Tool). The application, which also contains share and save functions that are self-explanatory, will run on Windows platforms or iPads.

Xerox also announced partnerships with Hyland, makers of OnBase enterprise content management and workflow software, and Datawatch, data visualization software, to accelerate the migration from paper to digital.

Both of these tools can help to reduce paper consumption, which is a win for both the users and the planet.

Image courtesy of Xerox

RP Siegel, PE, is an author, inventor and consultant. He has written for numerous publications ranging from Huffington Post to Mechanical Engineering. He and Roger Saillant co-wrote the successful eco-thriller Vapor Trails. RP, who is a regular contributor to Triple Pundit and Justmeans, sees it as his mission to help articulate and clarify the problems and challenges confronting our planet at this time, as well as the steadily emerging list of proposed solutions. A former award-winning inventor at Xerox, Siegel's uniquely combined engineering and humanities background help to bring both global perspective and analytical detail to bear on the questions at hand.

Follow RP Siegel on Twitter.

Supercharge Your CSR Commitments Through Employee Engagement

By Leslie Bennett and Elizabeth Dove

According to early findings of the Conference Board of Canada’s second Canadian Corporate Community Investment Benchmarking report, employees are the drivers of reputation. Happy employees usually equal profitable companies. For these reasons, most companies are putting increased resources into improving their employee engagement metrics.

As demonstrated at the Conference Board of Canada’s CSR Summit in Toronto Oct. 29-30, a number of Canada’s most successful companies are leveraging their corporate social responsibility (CSR) commitments as opportunities to create fulfilling employee engagement opportunities.

From the successful Green Shield CSR strategy that helps employees to make a difference for their clients, to SaskEnergy employees installing weather stripping in low-income homes as a part of their Home Energy Legacy Program, tips and cautionary tales demonstrated a number of key elements for success.

- Start at the top: Interface, a modular carpet company that is consistently on a number of sustainability indexes, is able to point to the bold commitments and leadership around sustainability led by its founder. At the Co-operators, even senior leadership have sustainability objectives in their performance measures.

- Get employee buy-in on CSR commitments: Royal Bank of Canada's internal campaign for its Blue Water Project included both education on the importance of water conservation and fun. The employee 'What’s your water personality?' survey also sent educational messages to individuals based on their water 'personality type.'

- Tell awesome stories: Great videos like those shared from Canadian Tire on the success of its Olympic commitment and Ford Canada’s video starring employees celebrating the achievement of their zero waste to landfill commitment stoke the fires of pride and affiliation. An even deeper level of emotional connection can be achieved with internal stakeholders through videos that show the impact of CSR efforts, like the SaskEnergy video where low-income families share the importance of the energy retrofits they received through the Home Energy Legacy Program.

- Give employees opportunity to participate in community initiatives: It's best if, as with Cisco’s Connected North program that creates connectivity for remote communities and SaskEnergy’s Home Energy Legacy Program, you utilize employee’s core competencies where you can. SaskEnergy shared a caution on employee engagement that you must ensure employees maintain role productivity alongside community involvement. Also, as a crown corporation, SaskEnergy has to be able to answer to criticism that taxpayers’ money is paying for employees doing something other than their job.

- Assemble a Great Team: Jeff Goldman, of Step Forward Paper, hosted a session on the 10 Keys to Success in Eco-Entrepreneurship, highlighting for us that an authentic CSR program with meaningful employee participation has its roots in human resource decisions to prioritize values in the hiring process.

In fact, in our experience, wide commitment to a defined set of core values is essential for creating an organizational culture in which everyone pulls for the success of corporate strategies. Teams united around a purpose beyond profit are more productive and loyal. Whether delegated from the top down, like Interface, or built through employee pride of association with smart community impact projects, carefully crafted CSR programs have the power to be the galvanizing force that makes other corporate strategies succeed.

It would have been great to hear from presenters how their employee engagement metrics have moved as a result of CSR strategies. Better – what tactics do they use to create a culture where the level of employee engagement consistently pulls for an integrated corporate social responsibility strategy? Perhaps this is on the agenda for next year's summit.

Image credit: Flickr/thetaxhaven

Leslie Bennett designs and delivers powerful programs for corporate clients that shift cultures, improve results, and change the future. She specializes in creating and customizing programs that meet the needs of each client. She develops powerful partnerships and collaborates on projects that support Corporate Social Responsibility goals in Canada and the United States. Her executive coaching skills expand her clients' collaborative relationships with colleagues and their strategic success. She is passionate about mental health and supporting organizations to have workplace cultures that embrace diversity, inclusion and are mentally healthy. She is the founder of Open Spaces Learning, a Canadian change management firm helping companies realize business and social impact.

Elizabeth Dove is a specialist in strategically engaging the public, companies and government on sustainability and social change. She has worked as senior staff and consultant for initiatives that support the arts, child welfare, public health and particularly international development. Passionate about the power of collaboration, she seeks out projects that bring together actors from different sectors to create value for their organizations and the broader community. She is Senior Vice-President, Strategy at The Divinsky Group and an Associate at Open Spaces Learning, a Canadian change management firm helping companies realize business and social impact. Twitter: @EDove5

These Stores Refuse to Open On Thanksgiving Day

Nothing is more American than the Thanksgiving holiday. As a cherished time when families gather for good food and connection, many stores have traditionally remained closed to encourage employees to spend the day with their own families. However, in the past couple of years more and more store chains have opened earlier and earlier on Thanksgiving. Macy’s announced that it would open for Black Friday sales at 6 p.m. on Thanksgiving. Last year the department store chain opened at 8 p.m. Kohl’s and Sears are also opening at 6 p.m. this year, and JCPenney is opening at 5 p.m.

However, not all store chains are opening on Thanksgiving. There are about two dozen stores that will stay closed. The Facebook page Boycott Black Thursday compiled a list of stores, as did Mental Floss. Some of the stores refusing to open on Thanksgiving include Costco, Nordstrom, Patagonia, Dillard's, TJ Maxx and Marshall’s.

Some stores have respect for the Thanksgiving holiday

Why are these store chains going against the trend to open earlier and earlier on Thanksgiving? Some of them spoke to ThinkProgress, and it appears the stores have respect for their employees’ time off. Patagonia is one of them, and the store chain simply said, “It’s a holiday – we’re closed!”

Department store chains Nordstrom and Dillard’s also spoke to ThinkProgress. Dillard’s told the publication that it decided to stay closed on Thanksgiving “in longstanding tradition of honoring of our customers’ and associates’ time with family.” Nordstrom said that it is the company’s tradition to stay closed on Thanksgiving. “Over the years, our tradition has been to be closed on Thanksgiving and to unveil our holiday trim the following morning.”

TJX owns T.J. Maxx, Marshalls, HomeGoods and Sierra Trading Post. All of its stores will be closed on Thanksgiving Day. A spokesperson for TJX told ThinkProgress, “We consider ourselves an associate-friendly company, and, we are pleased to give our associates the time to enjoy the Thanksgiving holiday with family and friends.”

A mixed review from American consumers

Do the American people really want to shop on Thanksgiving? Polls show that while some do, some do not. A survey by Accenture found that 45 percent of those polled plan to shop on Thanksgiving, up from 38 percent in 2013. Almost half of those who said they plan to shop on Thanksgiving plan to visit a physical store between 6 p.m. on Thanksgiving and 5 a.m. on Black Friday.

A RichRelevance survey found that 6 in 10 polled said they “hate” or “dislike” stores opening on Thanksgiving. Only 12 percent said they “like” or “love” the retail practice.

Image credit: tsheln

McDonald’s Japan sales drop after problems with Chinese supplier

McDonald’s Japan expects a 2014 loss of US$157m owing to a scandal at a Chinese chicken supplier. The company says that, this year, it will lose money for the first time in 11 years due to lost sales and higher expenses after the supplier was found to be using expired chicken meat.

The company now expects a net loss of ¥17 bn for the current fiscal year ending in December. In 2013, McDonald’s Japan made a net profit of ¥5.14bn. It had previously forecast a net profit of ¥6bn for the current year.

The company withdrew its financial guidance for 2014 in late July, citing uncertainty about the cost of responding to food-safety issues related to the supplier. The fast-food company booked a one-off loss of ¥9.3bn, which includes an impairment charge and a write-off for unsold food.

“We take this forecast and this result very seriously,” said Sarah Casanova, McDonald’s Japan chief executive, at a press conference, adding that the Chinese supplier problem had an “immediate and significant impact” on McDonald’s business.

McDonald’s Japan said the meat supplier scandal is expected to cause a ¥45bn decline in sales, slicing ¥11.6bn from its current profit.

The problems also increased costs, including financial support to franchise owners and measures to reinforce quality management and improve information disclosure, subtracting a total of ¥10.4bn from the profit figure.

Despite the poor earnings outlook, McDonald’s Japan plans to keep its dividend and shareholder incentives unchanged. It previously said it expects a year-end dividend of ¥30.

The company halted sales of all chicken products made in China shortly after its supplier, Shanghai Husi Food Co., part of US-based OSI Group Inc, was accused in Chinese media of intentionally selling expired meat to restaurant companies.

That move, however, did not stop sales from falling. Same-store sales sank 25.1%in August, the largest year-over-year decline since the company went public in July 2001. Sales in September fell 16.6 %.

To help restore customer trust, McDonald’s Japan now discloses on its website a list of countries where its foods are processed, as well as countries that supply the main ingredients.

McDonald’s Japan currently depends on chicken from Thailand but plans to diversify sources. The quality of meat from Brazil has been tested and this will be imported next year.

There are no plans to resume using meat from China.