Shareholders to Chevron: Bar All Political Contributions

Times they are a-changin'. The unprecedented win by progressive candidate Tom Butt in the 2014 Richmond, California mayoral elections signaled a new, more determined outlook in the city that holds Chevron's largest oil refinery.

Environmental groups, accusing the oil company of soaking the 2014 city elections with some $3 million in funding, are calling for Chevron to stop committing its money to local, state and federal elections. And to drive home the point, Sierra Club, Green Century Funds, local politicians and activists are backing a shareholder resolution to prevent the corporation from making political contributions.

"Chevron flooded our democracy with millions of dollars in 2014, but Richmond voters saw through their attempt to buy our elections and the progressives candidates triumphed," said council member and former Richmond mayor Gayle Mclaughlin."

Chevron's political contributions to Richmond elections were only a small part of the money it spent on political contributions in 2014. According to its federal corporate political contributions filing for that year, it contributed almost $10 million to public and private organizations and political representatives (and another $9 million in lobbying expenses).

Those contributions include almost $3 million in contributions to the lobbying organization Californians for Energy Independence, which has been known to have its own paid lobbyists doing grassroots campaigning. While it refers to itself as a "coalition created to educate the public about proven oil extraction technologies," critics have associated it with a broader list of organizations that have been accused in the past of promoting the lobby interests of the oil industry .

Chevron also contributed $3,096,70 to Moving Forward: A Coalition of Labor Unions, Small Businesses, Public Safety and Firefighter Associations. In 2013 the organization was investigated by the Fair Political Practices Commission for failing "to clearly identify the corporation Chevron as its sponsor on numerous campaign statement filings required by the [Political Reform Act]." According to FPPC's letter to the organization, which had been redacted, Moving Forward was given a warning letter, but was not fined for the violation.

Whether shareholders and environmental organizations will be successful in changing the company's political contribution policies by convincing it to prohibit political spending is unlikely. Shareholders submitted a similar proposal in 2013 without success. The board's recommendation against adopting the proposal, which it said would "would undermine the board’s flexibility to exercise its business judgment in a manner that it reasonably believes is in Chevron’s best interests." The proposal was defeated, garnering only 26 percent of the vote.

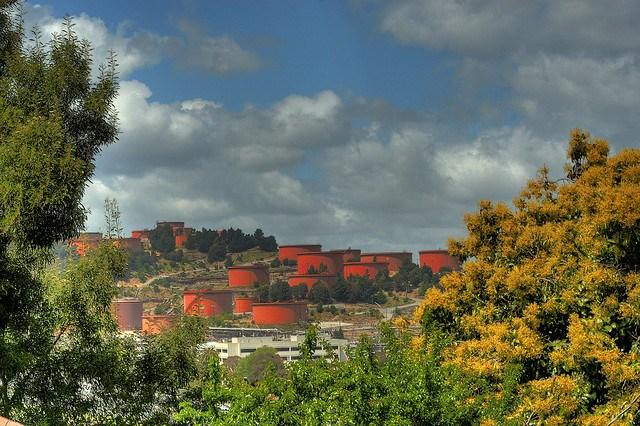

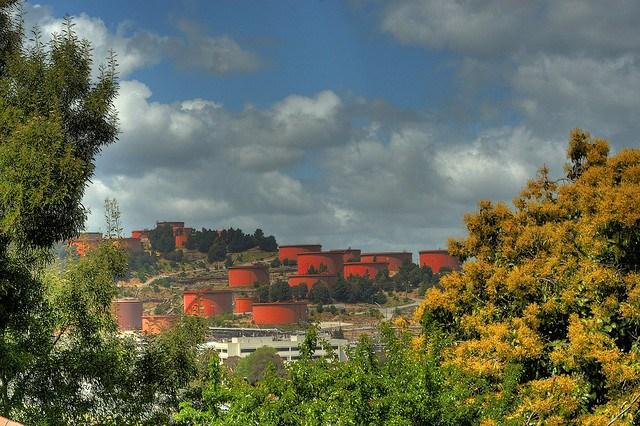

Nevertheless, environmentalists are focused on bringing attention to Chevron's corporate contribution spending, which is only one of several environmental issues related to the Chevron Corp. this year. Its Richmond refinery "modernization" plans are still on the table, having been approved by the city of Richmond only months before the mayoral elections. Those opposed are afraid it will add more pollution to the area, remembering Chevron's chemical accident in 2012.

Critics have also weighed in recently on allegations that it dumped 18 billion gallons of toxic waste into Amazon waterways in Ecuador. This issue garnered it the 2015 Public Eye Award at Davos Switzerland in January, for what the judges deemed were "irresponsible business practices." The issue, say environmentalists, has yet to be resolved.

Still, while it will be interesting to see how many percentage points this year's shareholder's resolution accrues, those calling for CEO John Watson to be "fired" are unlikely to change the company's policies when it comes to the benefits and risks of corporate contributions. As reporter Zachary Parks noted, the support that previous such proposals have claimed could be considered evidence to "the zeal of the activists behind them, not necessarily widespread and genuine shareholder interest and support." And given the fact that the oil industry is fighting to maintain its prominence against the increasing push for renewable energy and concerns about climate change, cutting off its political contribution account could be akin to cutting off its foot.

Image of earlier environmental protest in Richmond, Aug. 2009: planet a.

Image of Chevron's Richmond refinery: Shayan (USA)

Sustainable and Seductive Architecture in Fire Island: Horace Gifford’s Legacy

Fire Island has long been known as a summer getaway for New Yorkers, who flock to the 30-mile-long, quarter-mile-wide sand bar that protects Long Island from the Atlantic Ocean. But this string of villages and resorts 50 miles away from New York City also became a laboratory for modern and experimental architecture. Many of the homes included sustainable and passive design features before those terms became part of our vocabulary. One talented architect, whose work until recently was largely forgotten, not only has left a lasting impact for his ideas on how homes could be sustainable, but also had a leading role in gay culture during what now are often seen as the halcyon days bookended by Stonewall and the 1980s AIDS crisis.

Horace Gifford was born in 1932 and was raised in Florida, where his family had developed the town of Vero Beach. His time growing up on Florida’s beaches left a lasting impact on him as he trained as an architect in college. He never finished his education as an architect so he had to rely on his peers to sign off on his work, but Gifford began to earn a stellar reputation after he arrived at Fire Island in the late 1950s.

At that time, the section of the island now known as Fire Island Pines had little more than a collection of shacks that were cobbled in Long Island then floated across the water. But this village’s landscape changed as Gifford developed a clientele of well-off gay men who sought escape from the confines of Manhattan on the rustic dunes of Fire Island.

Gifford was determined to build the homes his way by rejecting the formal, tidy New England style of Cape Cod and Martha’s Vineyard. He also wanted nothing resembling the mansions of the posh Hamptons. Eschewing painted surfaces, fences, lawns or any other features that smacked of 1950s suburbia, Gifford’s designs relied mostly on cedar and glass so they would blend with the local landscape. Since Fire Island was free of cars, he wanted his homes to contrast with the boardwalk that was the main thoroughfare of Fire Island: When owners and visitors approached a home, he wanted them to feel reconnected with nature while they zigzagged among trees before they reached the house’s entrance.

Instead of sprawling homes with large and ostentatious rooms, Gifford cajoled his clients into accepting houses that, on average, were not much more than 1,000 square feet. Many houses showcased a breezeway that allowed air to flow into the living spaces, which often boasted an open floor plan. Gifford wanted minimal barriers between rooms, so the living room, dining room and kitchen would often be one large space. Closets often lacked doors so collections of possessions would be kept to a minimum. And at a time when being gay was still largely unaccepted, there was a metaphorical explanation to Gifford’s omission of closet doors as well. But like the larger-than-life personalities for whom he designed, there was still a sense of the dramatic and grand: Small spaces were balanced by tall, soaring ceilings, and interior spaces often jutted over sand dunes.

“Someday we will learn to live with nature instead of living on nature,” Gifford was often heard saying, a harbinger to what many within today’s sustainable architecture and design emphasize in their work. Gifford ended up designing about 40 homes in Fire Island Pines and another 20 elsewhere on Fire Island between 1961 and 1981.

Not all of Gifford’s architectural features were understated. To give his clients an escape from a world hostile to homosexuality, he would tuck in spaces for built-in “maxi-couches” adjacent to recessed spaces he called “conversation pits,” and a living room could have a “make-out loft" soaring above. Gifford included a sheepskin-lined pit in a residence he designed for himself on Fire Island Pines. Outdoor showers were common in his Fire Pines collection; or if they were inside, they were built from glass walls.

But while more of Gifford’s clients reveled in a world where they felt they did not have to hide behind walls, his own life and career started to crumble. On his birthday in 1965, he was arrested by police in a popular cruising area on Fire Island at a time when getting caught in such an act could cause one to lose any professional license. His professional reputation began to suffer, though he still refused to live as a closeted gay man. Gifford’s biggest fear, however, was that his struggles with manic-depressive disorder would become public. By the 1970s, as other architects made their marks on Fire Island, Gifford’s output declined, and at one point he moved to Houston, Texas so his sister could take care of him. His plans for a revolutionary beach house development in nearby Galveston scored plenty of praise with critics and the media, but that plan never came to fruition.

On April 6, 1992, Gifford died of complications from AIDS at the age of 59.

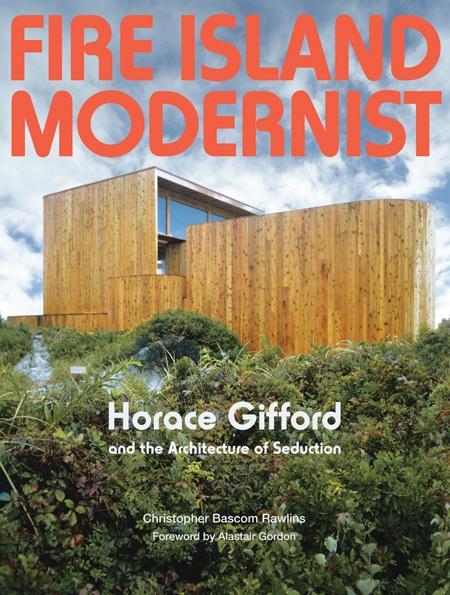

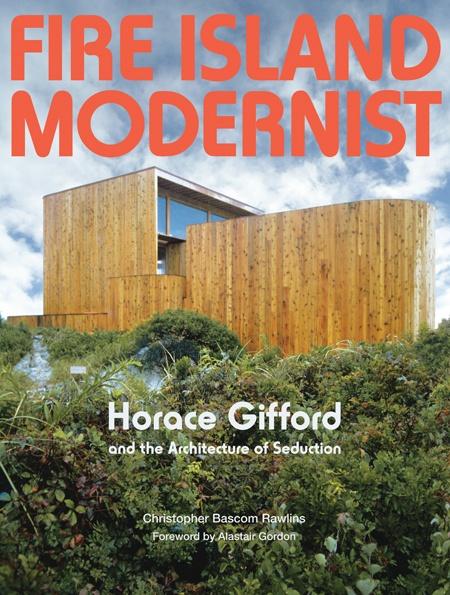

Gifford’s work has come to life again thanks to the scholarship of Christopher Rawlins, a New York-based architect. Rawlins discovered Gifford’s impact on Fire Island, largely due to archives that had been stored in a garage of one of Gifford’s friends. Rawlins’ 2013 book retraces Gifford’s career and Fire Island’s transformation. In addition to his own practice, he regularly lectures about Gifford’s legacy, including last weekend at Palm Springs’ Modernism Week.

Many of Gifford’s homes have been altered — some to the point where they are no longer recognizable. But Gifford’s lessons are ones from which current architects and designers can benefit: livings spaces that are in harmony with and do not harm nature; smarter, not overly spacious, floor plans; and blending with the local environment instead of bending it to an architect’s or homeowner's will.

Images of Horace Gifford’s Fire Island Pines houses are available for viewing here.

Based in California, Leon Kaye has also been featured in The Guardian, Clean Technica, Sustainable Brands, Earth911, Inhabitat, Architect Magazine and Wired.com. He shares his thoughts on his own site, GreenGoPost.com. Follow him on Twitter and Instagram.

Image Credits: Metropolis

Dark Horse May Outdo Lithium-Ion Battery Storage

Leading battery storage technology developers and emerging market players, including Elon Musk's SolarCity and Tesla, are investing billions of dollars to improve the performance and lower the costs of manufacturing lithium-ion (Li-ion) batteries. Along the way, they are promoting Li-ion battery storage as a cleaner, more efficient, sustainable and significantly less costly solution across a wide range of applications, from electric vehicles, homes and buildings on up to grid-scale energy storage and stabilization.

But Li-ion isn't the only game in town when it comes to emerging advanced battery and energy storage technologies. And there are those who believe proponents are stretching their case too far in touting the advantages of Li-ion battery storage across such a broad range of applications.

Developers of flow batteries, for instance, say utilities and other large end-users would be ill-served by acquiring Li-ion battery storage, except for comparatively narrow and strictly defined cases. A developer of vanadium-flow battery storage systems, Imergy Power Systems, is taking its case to the market.

Flow batteries for utilities and large-scale end users

On Feb. 17, Fremont, California-based Imergy announced the introduction of its largest line of vanadium-flow batteries to date: the ESP 250 series. Capable of operating 20 years or more without the need to replace electrolytes and with only a couple of moving parts, Imergy's ESP 250s are capable of delivering 250 kilowatts of electrical power for four or more hours.

That's at least 1 million kilowatt-hours of electrical energy housed in two 40-foot shipping containers. It's an amount that – when considered alongside other salient attributes – makes ESP 250s ideal for utilities, large commercial, industrial and government end-users, and developers of renewable energy projects, Imergy states in a news release. Its ESP 250s, Imergy says, are ideal for use across a wide range of large-scale applications.

ESP 250s, for instance, are more efficient and will soon prove more cost-effective than the conventional natural-gas and coal-fired “peaker” plants used by grid operators to meet peak electricity demand. They are also much better-suited than Li-ion batteries for applications such as utility and grid operator transmission and distribution investment deferral, renewables management, microgrid implementation, emergency back-up power system delivery, frequency regulation, and peak shaving, Imergy contends.

Broad spectrum energy storage applications

Imergy CEO Bill Watkins touted the broad spectrum use of its vanadium-flow batteries across the supply and demand sides of U.S. power markets. “With the introduction of the ESP 250, Imergy has broadened its product portfolio to include a product for every major energy storage market segment and application,” he was quoted as saying.

“From demand response for individual buildings, to frequency regulation for the grid, Imergy has a product designed to meet the market’s growing demand for low-cost, high performance energy storage.”

Those assertions were echoed by company president and COO Tim Hennessy in a 3p interview. A combination of unique characteristics and attributes make Imergy's vanadium-flow battery storage systems ideal, and much better suited than conventional alternatives and Li-ion battery storage systems, for a wide range of stationary energy storage applications – from utility-scale down to residential-scale energy storage applications, Hennessy explained.

The advantages of vanadium-flow batteries start and flow from their unique chemistry. Added to that is the combination of high-density energy storage, unlimited use, 100-percent charge-discharge capacity, fast ramp-up, ramp-down and response capabilities, and their long life.

Vanadium's unique chemistry means that end-users never have to replace the electrolytes used to charge and discharge Imergy's flow batteries. Stored in separate containers connected to the electrolytic cells that store and deliver electrical energy means that Imergy's vanadium-flow battery systems are modular and can be scaled up or down quickly as needs require.

Significantly, its vanadium-flow batteries are safer and more reliable than Li-ion battery storage systems. They are nontoxic and can operated in complete safety across a much wider range of temperatures than Li-ion batteries, Hennessy noted. That means avoiding the risk of battery systems erupting in flames, a big problem that has plagued Li-ion battery systems.

In addition, Imergy obtains the vanadium used in all of its batteries from secondary sources, such as mining operations and steel production. By recycling vanadium, Imergy is realizing value and beneficial use from what would otherwise be industrial waste. Furthermore, end-users can recover all the vanadium used in the system at the end of its useful life, generating revenue by selling it secondary markets.

Low levelized cost of energy

All this results in a low levelized cost of energy (LCOE), a measure of the overall costs of energy production and storage solutions over their lifecycles, Hennessy emphasized.

According to a recent market research from Navigant, worldwide revenue from energy storage for grid and ancillary services is forecast to grow rapidly and reach $68.5 billion from 2014 through 2024. “Around the world, utilities are also studying storage as an option to manage peak demand and increase grid resiliency,” Imergy points out.

“These same utilities are also focused on storage as a way to manage the impact to the grid presented by the increasing penetration of intermittent renewable energy sources such as wind and photovoltaic. Utilities now recognize that long-duration energy storage is the key to solving these issues. Imergy’s ESP 250 offers a solution which is typically financially and technically impractical for other battery and storage chemistries.”

The key to Imergy's ESP 250 and smaller-scale ESP5 and ESP30 vanadium-flow battery systems, Hennessy added, is “that it's a integrated, 'plug-and-play' platform."

“Our smaller platforms can be aggregated, but we've done that with the 250. That allows end-users, and our company, to realize the benefits of economies of scale – both in terms of customer applications and lowering the costs of manufacturing.”

This is unique to vanadium-flow batteries and what Imergy is doing as a company, Hennessy continued. “No one has the ability to move so easily and go from one end [of the market] to the other,” he told 3p.

*Image credits: 1) Goodpix.com; 2), 3) Imergy Power Systems

Coalition Files Lawsuit to Stay EPA Decision on New Herbicide Combo

A coalition of environmental groups and farmers is trying to stay the U.S. Environmental Protection Agency’s October 2014 decision to approve Enlist Duo, a powerful new herbicide.

Enlist Duo is a combination of 2,4-D and glyphosate, and it's approved to be used on genetically modified (GMO) crops in six Midwestern states. Enlist Duo approval is expected to expand to 10 other states.

The coalition argues that the EPA violated the Endangered Species Act (ESA) by not consulting with the U.S. Fish & Wildlife Service about the impact of Enlist Duo on two endangered species in those six Midwestern states, the whooping crane and the Indiana bat.

The whooping crane is one of the world’s most endangered animals. In 2006, there were only about 338 whooping cranes in the wild. The EPA admitted that during the whooping crane's migration the birds “will stop to eat and may consume arthropod prey” that may have been exposed to Enlist Duo and that exposure is toxic to them. The Indiana bat could suffer reproductive damage from Enlist Duo exposure. Scientists cite pesticide contamination of their food supply as one of the reasons for their decline.

The Natural Resources Defense Council filed a lawsuit to try and stop the approval of Enlist Duo back in October. NRDC claimed that the EPA ignored possible health and safety risks to humans and monarch butterflies. “This short-sighted move by the EPA opens the door for the ever increasing use of pesticides that will only further endanger both wildlife and people which is why NRDC will challenge the decision in court,” the NRDC wrote in its statement.

GMOs, superweeds and increased herbicide use

Back when the federal government first approved the use of GMO crops, supporters said that they would lead to less weeds which would mean less herbicides used. However, the reality is that now there are superweeds, or herbicide-resistant weeds. A Food and Water Watch analysis found that total herbicide use increased by 26 percent (81.2 million pounds) between 2001 and 2010. Glyphosate use applied to the three biggest GMO crops (corn, cotton and soybeans) increased ten-fold between 1996 and 2012. 2,4-D use increased by 90 percent between 2000 and 2012, and could increase by almost three-fifths within two years of 2,4-D tolerant corn’s introduction.

The Food and Water Watch analysis also found that superweeds are greatly increasing. In 2008, only five states reported having glyphosate-resistant waterhemp. But by 2012, 12 states reported having it. Other weeds have been found to be resistant to glyphosate. The International Survey of Herbicide Resistant Weeds found that the amount of multiple herbicide-resistant weed infestations were about one per year between 1997 and 2001, but became three times greater from 2007 to 2011. The cost of superweeds is high for farmers, ranging from $12 to $50 an acre, and as much as $12,000 for an average-sized corn or soybean farm and $28,000 for an average cotton farm.

Image credit: U.S. Air Force

New app helps businesses maximise value of recycling

A new web app promises to make recycling more financially rewarding for businesses according to its developers Element Green Recycling.

Called Green Alchemist, the app provides the latest material prices enabling businesses to find out how much their sorted recycling is worth on the waste stock market.

Businesses can input their postcode and the weight of their recyclable materials to find out how much they are worth and either auction this material to waste couriers nearby or receive quotes for it to be collected. In turn, waste couriers can access the app for free (for the first year) to find businesses with sorted recyclable waste in their area and bid to buy or collect this material.

The app’s auction facility can also be used to sell office furniture and electronic goods as well as recyclable materials.

Businesses have to subscribe to the service, £49.99 for a year (or from £9.99 for one month).

Element Green Recycling’s ceo Ayo Isinkaye commented: “Due to the high demand for uncontaminated recyclables from the reprocessing industry we have identified a market opportunity for businesses to make money from their sorted recyclable waste.

“We are confident the app will empower businesses to ensure they realise the best possible value for their waste.”

The Green Alchemist was developed with funding from Ordnance Survey’s GeoVation.

CR reporting becoming more widespread, finds Vigeo

CSR audit and consultancy firm Vigeo’s latest analysis shows a dramatic movement towards a more universal adoption by listed companies in publishing commitments and information about their corporate and environmental responsibility.

Vigeo says that leaders of big firms have recognized the need to address a transnational opinion and that an era has begun where markets and society will ask for information that goes beyond the dissemination of regulatory financial statements to include more or less accurate comments.

The firm’s review covered more than 1,300 companies based in Europe, North America, the Asia Pacific region and 15 emerging countries.

The study shows that corporate responsibility reports are becoming widespread and gaining in professionalism in all of the continents and countries analyzed. This compares to 2008, when it was still mainly a North American, British and French practice.

Vigeo highlights that information on human rights, social dialogue and the integration of social and environmental standards in international purchases and in the internal supply chain remains the weak link of reporting on corporate responsibility.

Fouad Benseddik, director of methodology and institutional relations at Vigeo commented: “This second study demonstrates a change to which we are proud to contribute every day as a new generation of rating agency; company reporting on their corporate responsibility is a serious component of their performance. Those that best respect the right to information of their stakeholders are those that best reflected their ability to create sustainable value.”

To receive the full study, email: Anita Legrand.

3 Simple Ways Entrepreneurs Can Change the World

By Kevin Xu

If you’re a successful entrepreneur, you’ve probably felt a pull toward philanthropy. According to a 2010 study, 89 percent of entrepreneurs donate money to charitable causes; 70 percent donate their time; and 61 percent believe they are more inclined to give to charity because they are entrepreneurs.

There’s no doubt philanthropy and entrepreneurship go hand in hand. An entrepreneur’s drive to pursue a dream is the same force that leads to giving back. By helping others, entrepreneurs generate good feelings that help them overcome daily struggles, and they get a sense of personal fulfillment.

But even if you feel compelled to give back, you might not know the best way to help. Or, if you currently donate your money or your time, you probably worry you’re not doing enough. After all, the world is a big place with a host of problems that need attention.

How to make an impact

If you want to make a difference but don’t know where to begin, consider giving to causes that fight chronic disease and hunger — two of the most pressing problems facing our nation and the world.

Chronic illnesses, such as diabetes and heart disease, are responsible for 7 out of 10 deaths in the United States, and 805 million people in the world aren’t getting the minimum amount of food required to lead a healthy, active life.

Contributing directly to help tackle these problems is one solution. But entrepreneurs are helping in other ways, too.

For one thing, entrepreneurs are accelerating the commercialization of new technologies that will help solve the world’s problems. For example, electric vehicle manufacturer Tesla recently announced it would open-source to encourage others to use its patents in an effort to combat the carbon crisis with zero-emissions vehicles.

In addition, the very spirit of entrepreneurship — determination, creativity and optimism — is instrumental in inspiring others to act. And entrepreneurs are prone to disrupting traditional industries, generating new ideas and unlocking innovations that will help the world.

These are all passive ways you’re probably already making an impact, but you can do more by taking an active approach. Donating food or money is admirable, but those efforts only provide temporary relief — not a long-term solution. The world needs cures for disease and programs to educate people on techniques for creating new food sources.

Here are three ways you can use your unique position to improve quality of life for others:

1. Invest in new technologies. Become a charitable investor for new technologies that benefit others. You can take an active role in investing in charities that support innovation and development by using ImpactAssets. For example, Seth Goldman of Honest Tea uses this method to generate funding for Beyond Meat, CSA Medical and Sweetgreen.

2. Share your story. Help others become entrepreneurial philanthropists by becoming a mentor and sharing your story via social networks. Your testimony can inspire others to launch their own ideas and create more opportunities to support social good. Seal-Bin Han, co-founder and president of the World Youth Initiative, helps students launch philanthropic projects by providing them with the tools to succeed.

3. Recruit others to your cause. If you run a successful business, you’ve probably developed ties to some powerful people. When looking to champion a cause, use your network connections to gain momentum. For instance, my family created the Brighten Award for Entrepreneurial Gerontology at the University of Southern California, Davis School of Gerontology. This award supports students who demonstrate entrepreneurship and aim to incorporate elder-friendly elements into their ideas.

In “Understanding Social Entrepreneurship: The Relentless Pursuit of Mission in an Ever Changing World,” authors Jill Kickul and Thomas Lyons write: “In business entrepreneurship, every investor in an enterprise expects a return on investment … The same should be true for social investments; they should ‘pay off’ by producing social gains that exceed the value of the initial investment.”

However, as Kickul and Lyons point out, social ROI cannot always be measured in dollars. Improving quality of life will certainly help others and give you a deeper perspective, but there are other significant benefits to philanthropic endeavors. You’ll gain positive feedback from society and access to new ideas you’d never have otherwise. But perhaps most importantly, you’ll provide hope and inspiration to other like-minded people who have the power to help.

How can you use your connections, resources, and entrepreneurial drive to make a difference in the world and improve quality of life for others?

Image credit: Flickr/Alex Barth

Kevin Xu is the CEO of MEBO International, a California- and Beijing-based intellectual property management company specializing in applied health systems. He also leads Skingenix, which specializes in skin organ regeneration and the research and development of botanical drug products. Skingenix is listed in the 2014 Empact100 Showcase.

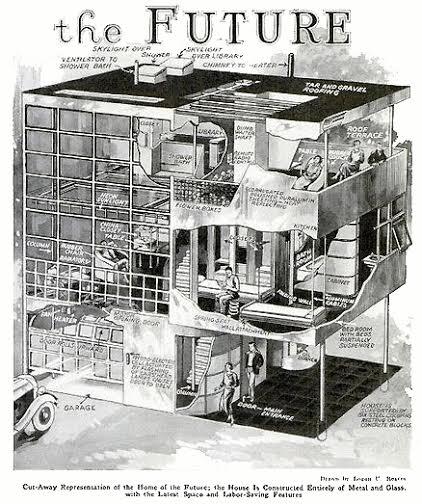

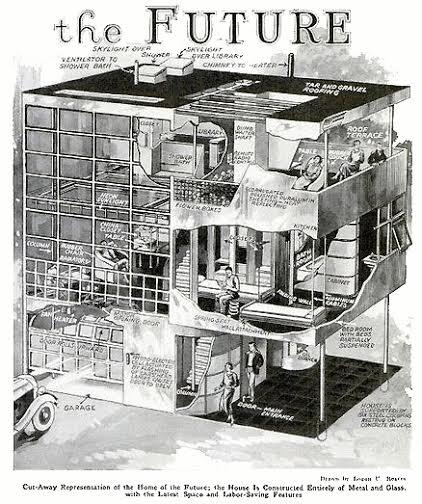

Forbearer of Modern and Sustainable Architecture Moving to Palm Springs

When the Aluminaire House went on display in 1931, it started a long path from case study into a phenomenon that helped launch a new architectural movement in the United States. For 10 days during the Architectural and Allied Arts Exposition in New York City, 100,000 people filed through the beaux-arts Grand Central Palace to view what was inside: a stark contrast, what critics saw as an unprecedented and innovative 22 x 28 feet aluminum-and-glass structure. Architecture historians have generally recognized this structure for being the first all-metal modular home built in the U.S. After eighty years, during which it has moved, fallen into disrepair and then almost demolished, the Aluminaire House will soon find a new home in Palm Springs, the epicenter of mid-century modern architecture and design.

For its fans in the architecture and design world, the Aluminaire House is vindication for the International School of architecture, a movement that reached its peak in the 1960s. During the following decades this school of building design largely fell out of favor--then ridicule and for many buildings, demolition--but in the last decade has become vaunted again for its historical impact, practicality and minimalist aesthetic. But this house is also important because it was ahead of its time for its use of prefabricated, sustainable and lightweight materials as well as its ease of construction—the norm within today's increased focus on green building and construction.

The house was designed by A. Lawrence Kocher and Albert Frey, the latter of whom was trained by famed architect Le Corbusier. Frey eventually ended up designing many houses and buildings in Palm Springs and lived the rest of his life there after moving to the desert in the 1930s. Both architects wanted to show they could build a home with “off the shelf” materials. After working for almost two years on the design and working with manufacturers to make the components, the house was assembled in only 10 days.

Three stories tall and with 1,100 square feet of space, the house was comprised mostly out of aluminum. Some steel was used for chairs, floor decking and windows, but the exterior panels and interior walls were unanodized aluminum. Pastel colored rayon was used as wallpaper because it was easily washable. The flooring was linoleum. Upon its completion, Frey chose the word “Aluminaire” as a play on the prevalent building material, which was just getting a start as the metal for choice in cars and jewelry, while designers favored it for its flexibility and hue.

During its conception, Frey and Kocher also published a study touting the future potential of mass production the house, which they believed could be easily replicated and sold for $3,200 (about $52,000 today). Like many architects in that era, Frey and Kocher were interested in developing modern cost-effective homes that could be built affordably for the working and middle classes.

Copies of the Aluminaire House for the masses never came to fruition, but after the 10-day exhibition in 1932, noted modernist architect Wallace K. Harrison bought the house for $1,000 and moved it to his property in Huntington, Long Island, New York. After six months reassembling the house, Harrison and his wife immediately enlarged it to accommodate their driver, nanny and cook so it could serve as a weekend home and summer office for the architect and his family. The house moved a few times on the massive lot, eventually becoming a guest house. Years later the property changed hands, and was largely forgotten until another owner applied for a demolition permit in 1986.

The house by then had caught the attention of Joseph Rosa, a young architect who was researching the work of Frey. Rosa rallied New York architects together to save the Aluminaire House, and his efforts captured the attention of the New York Times. The house was eventually disassembled and moved to the West Islip Campus of the New York Institute of Technology, where it became used for instruction within the school’s architecture and design program. But when the university closed down that campus, the house needed to find another home. Efforts to move the house to Queens failed when local residents complained the house would not fit in with the local brownstone and row house aesthetic.

Now architects and civic leaders in Palm Springs, including mayor Steve Pougnet, are busy raising funds to move the Aluminaire House from the east coast so that it can be near Albert Frey’s work in the Coachella Valley. A campaign, including a fundraising party last night during Palm Springs Modernism Week, is underway with a goal to raise about $600,000 to cover such costs.

As with the case of other modernist designs, the idealism and optimism that inspired the Aluminaire House never went from conception to completion. But this curious metal house that aroused so much curiosity during the Great Depression was a proud forbearer of what has become increased enthusiasm for streamlined, prefabricated and green building: the use of lightweight and sustainable materials, uniform components that also allow for custom floor plans and choosing materials that maximize air floor and minimize energy consumption. And this house, in turn, inspired, and can still generate, new ideas on how to build for comfort with limited resources and capital while providing modern and comfortable living spaces.

Based in California, Leon Kaye has also been featured in The Guardian, Clean Technica, Sustainable Brands, Earth911, Inhabitat, Architect Magazine and Wired.com. He shares his thoughts on his own site, GreenGoPost.com. Follow him on Twitter and Instagram.

Image Credits: Aluminaire House Facebook Page, Aluminaire.org, Aluminaire House Foundation

Divestment Works: From Apartheid to Climate Change

Editor’s Note: This article originally appeared in the Feb. 25 issue of Green Money Journal.

By Timothy Smith

The Episcopal Church made history in 1971 when it filed the first shareholder resolution by a religious organization. The company in question was General Motors, and the resolution called on the company to withdraw its business in South Africa. It was both church history and business history.

Religious organizations had publicly spoken out against South Africa’s repressive system of white supremacy before, but this was the first time that a religious organization had utilized the power of its stock portfolio to raise an issue for a vote by investors. While it was a front-page New York Times story, shareholder support was unenthusiastic, coming in at around 3 percent voting support. But in that moment, a new tool was created to present social and environmental issues to a company’s board and top management.

The Episcopal Church’s witness was quickly adopted by a number of other Protestant denominations including United Church of Christ, American Baptist Church, Presbyterian Church, United Methodist Church, Disciples of Christ and National Council of Churches, followed by Roman Catholic organizations. From a few dozen religious investors in the 1970s, today more than 300 religious organizations are part of the Interfaith Center on Corporate Responsibility (ICCR) with member assets of over $100 billion.

But that was still to come in the 1970s. At that time, a new era was emerging as businesses were engaged by investors who championed a concern for ethics and corporate responsibility along with a search for shareholder value.

As one might imagine, the earliest company responses countered that church representatives didn’t understand business, and that a bank couldn’t decide on a loan nor could a company make decisions on where to invest using social or ethical criteria. Within a few short years, however, major banks announced they were ending loans to the South African government because of apartheid. Chase Manhattan, led by David Rockefeller, announced it wouldn’t continue loans to the South African government since the bank didn’t want its funds supporting government-sanctioned racism.

The anti-apartheid campaigns had a number of notable and complementary component parts: The religious community, shareholder resolutions, universities, foundations, boycotts of company products and demonstrations, and Congress acted as well. The full article expands on each of these.

Are there lessons here for the vigorous debate occurring today on investments and climate change? Absolutely and here are a few of those...

Read the full article here.

Timothy Smith is Senior Vice President and Director of ESG Shareholder Engagement for Walden Asset Management.

Low carbon technologies could fuel 'cold economy' boom

The demand for cooling in everything from supermarkets and medicines to data centres could boom to create huge growth in the "cold economy" in the coming years, a new report from the Carbon Trust maintains.

David Sanders, director, innovation at the Carbon Trust, said: “Turning the Cold Economy from an idea into reality will depend on joined-up thinking and collaboration by industry, academia and government to develop, test and deploy novel solutions. With Britain’s rich history of innovation and engineering, we have a real opportunity to lead the way in low carbon cold technologies and drive innovative solutions from the lab to the market.”

According to the Trust's report, The Emerging Cold Economy, by 2030 global power demand for cooling could grow by the equivalent of three times the current electricity capacity of the UK. At the same time, it points out, vast amounts of cold are wasted. It cites the re-gasification of LNG at import terminals as an example. This could potentially be recycled to reduce the cost and environmental impact of cooling in both buildings and vehicles.

Access the full report here.

Picture credit: © Martinapplegate | Dreamstime.com - Girl Buying Cakes In Supermarket Photo