A Brief History of Sustainable Fashion

Type the words ‘future’ and ‘fashion’ into any search engine, and you’ll get a stream of results on 3-D printing, wearable technology and e-commerce websites – sustainability is but a mere mention. Yet, the S-word has undeniably made its way into the modern apparel-making process and increasingly influences what lands on runways and store racks.

The fashion industry’s growing focus on sustainable practices has even prompted business publications such as Forbes to hail “Green is the New Black.”

Through innovative business practices, the fashion industry has come a long way in improving environmental and social conditions along complex global supply chains. Still, it has a way to go. A brief look into the industry’s storied past illuminates how corporate style setters have responded to shifting consumer demands, market trends and natural resource constraints over the years – signaling what the future of sustainable fashion might hold.

From industrialization to Earth Day

When the first department stores appeared in the United States in the late 19th century, amid the rise of the Industrial Revolution, sewing machines were relatively new and child labor was still legal. Most clothes were made to order domestically, and only a slice of the population owned enough garments to fill a small closet.

Fast-forward to the postwar consumer boom where strip malls became as common as tract housing, and shopping became as much of a national pastime as cruising around in a Chevrolet. The consumer culture cultivated in the 1950s established an economy based on mass production – at the time most consumer goods were made in America. That same ethos sparked a proliferation of malls, outlet stores and seasonal sales to encourage more consumption.

The postwar mentality of growth without limits was not met without dissent. As political and social movements developed in the late 1960s and 1970s – for civil rights and against the Vietnam War – a growing awareness of humans’ impact on the planet also gave rise: The first Earth Day was commemorated on April 22, 1970. While the modern environmental movement had its start well before that day, sustainable fashion sprouted from the seeds of the paisley patterns sewn onto patchwork bell-bottoms widespread during that period.

Opening the flood gates

As eco-consciousness, the “do it yourself” (DIY) movement and consumer awareness of clothes’ potential second life emerged in the later part of the 20th century, consumerism swelled to unprecedented limits. During this time, the apparel industry experienced major shifts in production logistics, timelines and scale – much of which increased output and helped fuel shoppers’ mounting desire to fill their ever-growing closets.

One important shift occurred in 1973, when the U.S. and other countries signed an agreement that set up a quota system to limit the amount of textile and apparel imports from specific countries – intended to protect U.S. business interests. Instead, the agreement drove up domestic manufacturing costs. When the quota system was eliminated in 2005 and replaced by a World Trade Organization agreement, the floodgates to outsource manufacturing abroad were opened, and all bets to guard one of America’s homegrown industries were off.

“Moving production off-shore was the impetus for fashion becoming more global,” said Connie Ulasewicz, co-editor of "Sustainable Fashion: Why Now?" and associate professor at San Francisco State University. “Companies moved their manufacturing to places like Cambodia, Vietnam and Mongolia, where there are no minimum wage or age requirements or regulations on maximum hours worked. When this happened, people also lost contact with how and where their clothes were made.”

The movement to manufacture clothes abroad also led to a slew of controversies that prompted consumers to begin to question the origin of their garments.

The rise of conscious consumerism

In 1991 Nike came under fire for the low wages and poor working conditions at one of its Indonesian factories; consumer protests and boycotts, as well as heavy media attention, drove the company to make some serious changes to its supply chain. This and other tragic incidents (most recently the collapse of the Rana Plaza factory in Bangladesh) forced the industry to take stock and shape up.

Twenty-four years later, that same multinational athletic-wear giant is one of the world’s most sustainable companies. And while Nike and other apparel companies still compete to drive down costs and increase margins, they also now compete to boost their reputation as good corporate citizens – and win conscious consumers’ hearts, minds and pocket books.

Patagonia’s Responsible Economy campaign is one example of a brand continually demonstrating to consumers how sustainability is sewn into its corporate DNA. Other companies have cleverly innovated to raise consumer awareness of their part in a garment’s life cycle, such as Levi’s Care Tag for Our Planet and Water<Less, Waste<Less, and Wellthread collections.

Even big names like Gucci and Calvin Klein want in on the sustainability game, and mainstream labels like Stella McCartney and Puma are re-imagining what style can stand for (faux fur and environmental profit and loss accounting, anyone?). The trend towards sustainability in the fashion industry is clear.

Back to the future

Even as apparel companies propel sustainability innovation forward – designing sustainable fibers, launching chemicals management programs, enhancing product traceability and supply chain transparency, decreasing product packaging, and promoting textile recycling – the specter of fast fashion and its related environmental and social problems cannot be ignored. While the slow fashion and Made in the USA movements offer glimmers of hope for the industry, tough questions about our modern apparel system remain.

“Globalization allows us to not pay very much for clothes,” said Linda Welters, fashion professor at the University of Rhode Island. “If people buy at a deeply reduced priced, they have a throwaway mentality about clothes, and that’s the one major factor that’s a problem."

As more e-commerce sites pop up and make it easier to purchase outfits with the click of a button – and perhaps someday deliver our goods in an instant via drones – that throwaway mentality is the fashion industry’s Achilles heel. To thrive, global apparel brands will need to reinvent their business models, embrace the circular economy and creatively invite consumers to do away with throwing away. Considering that as much as two-thirds of a garment’s total environmental impact occurs in the consumer use phase (washing and drying), fashion brands must engage consumers in sustainability to truly move the needle.

The future of sustainable fashion will not rise out of a lower-priced T-shirt, the next 3-D printed creation or cool-looking wearable tech gadgets, it will come alive in how our fashion finds are made, how they’re used, and how they’re disposed of or reused -- cradle to cradle, from seamstress’ fingertips to consumers’ hands.

Image credits: Genibee and Classic Film via Flickr

China Leads in Contributions to Pacific Garbage Patch

We’ve all heard a lot about plastic pollution, which has led to a movement away from plastic shopping bags and bottled water in the U.S. A principal driver of these actions has been a growing awareness of the so-called “Great Pacific Garbage Patch,” a floating island of plastic twice the size of Texas. This unplanned floating dump, also known as the Pacific Trash Vortex, comes about because of swirling ocean currents known as the North Pacific Subtropical Gyre. The full extent of the patch stretches from just off the U.S. West Coast to the East Coast of Japan.

A recent study in Science analyzed the contents of the patch. The study determined that in 2010 there were 275 million metric tons of trash found in the patch. The team, led by Jenna Jambeck from the University of Georgia, estimated that an additional 4.8 million to 12.7 million metric tons were being added to the patch each year. So, the question is: Where is all that trash coming from?

The first step was to establish that, based on geography, there were 192 different coastal countries that were potential contributors. Then, by carefully studying a great deal of data including each country’s per-capita waste generation, the number of people living within 50 kilometers of the ocean, the percentage of waste that is plastic, and the effectiveness of waste management in each country, the researchers were able to estimate the potential contribution each country could make to the ocean-borne trash heap. The final step was to estimate what percentage of this “mismanaged waste” was likely to end up in the ocean. By studying detailed records of trash movement in places ranging from South Africa to the San Francisco Bay area, they came up with an estimate of 15 to 40 percent.

The results were sufficiently accurate to establish the top 20 offenders. The list underscores the need for better management of plastic waste everywhere, though certain countries stand out as particularly egregious litterers.

China took the top spot, contributing close to 5 billion pounds of trash in the year studied. This was equivalent to the next four offenders combined. These were (in billions): Indonesia (1.9), Philippines (1.1), Vietnam (1.0), and Sri Lanka (0.80). All of the remaining countries contributed half a billion pounds or less. The U.S. took the twentieth spot with approximately 0.20 billion pounds. Even though the U.S. has significantly better waste management practices than most of the other Pacific coastal countries, the amount of waste we generate per capita is far higher than any other.

The team also projected the amount of plastic waste that is expected to be generated by 2025 based on current policies and projected population growth. Based on the chart, most countries -- barring significant changes in waste management -- can be expected to double their waste output over that time frame. A few countries, namely Indonesia, the Philippines and Vietnam, as well as India, appear to be on a path to increase their output even more than that.

Raising awareness of the problem is the first step in combating it. While plastic has been an easy and inexpensive answer, particularly for packaging, more and more alternatives are appearing on the market in response to consumer demand. As far as recycling goes, there is a great deal of informal recycling going on in developing countries, but only for those materials that have a fungible market value, which generally excludes plastic. Establishing plastic recycling operations in these countries could do a great deal of good.

Image credit: Flickr/Kevin Krejci

RP Siegel, PE, is an author, inventor and consultant. He has written for numerous publications ranging from Huffington Post to Mechanical Engineering. He and Roger Saillant co-wrote the critically acclaimed eco-thriller Vapor Trails. RP, who is a regular contributor to Triple Pundit and Justmeans, sees it as his mission to help articulate and clarify the problems and challenges confronting our planet at this time, as well as the steadily emerging list of proposed solutions. His uniquely combined engineering and humanities background help to bring both global perspective and analytical detail to bear on the questions at hand. RP recently returned from Abu Dhabi where he attended the World Future Energy Summit as the winner of the Abu Dhabi blogging competition.

Follow RP Siegel on Twitter.

4 Strategies for Building an Efficient Home

I'm visiting Ecuador at the moment, and I've been struck by the fact that most of the homes on the coast and in Quito have no heating or air conditioning systems. Straddling the equator, much of the country has a relatively mild climate, with a wet and dry season. This allows many people to have a small energy footprint. Relying on ventilation from windows and doors alone, homes are relatively comfortable throughout the year. This is not the case in the United States, where most people heat or cool their homes much of the year.

Back in Midcoast Maine, we live in a high performance house in Belfast Ecovillage, a 36-unit community built to the Passive House standard (but not certified). While neighbors in our cold climate pay thousands of dollars to heat their homes, we pay just a couple hundred. Our home has generous amounts of insulation, triple-pane windows and doors, and is air sealed, so little heated air escapes to the outside. Because the home is nearly airtight, we have a Zehnder heat recovery ventilation system to continuously bring fresh air into the home, while recycling the heat from the exhaust air. Numerous qualities set high performance homes apart from their code-built counterparts.

1. Lots of Insulation

Our home is super-insulated compared to typical construction, from the bottom up. Insulated rigid foam is added to the slab, while cellulose insulation fills the stud walls and the trusses under the roof. The walls also contain structural insulated panels (SIPs), which consist of a foam core surrounded by oriented strand board, resulting in continuous insulation. Most homes have thermal bridges, or a break in the insulation that creates a path for heat to exit the home, but the SIPs eliminate this issue.

2. Airtight construction

The air-tightness of a house is commonly determined by the air-change rate. This is the number of times that the air in the home exchanges with outside air each hour. If the volume of air that enters and leaves the house in an hour is equal to the heated air volume within the house, it has one air change per hour. Most homes have an air change rate of one, two or even four. In contrast, many of the homes in Belfast Ecovillage have rates below 0.40 (at 50 pascals of pressure).

“We’ve beat the Passive House standard [of 0.60 air changes per hour] by far in all the houses at Belfast Ecovillage,” explains Brian Hughs, a member of Belfast Ecovillage and carpenter for GO Logic, the design-build firm that served as the general contractor. “The triplex unit got less than 0.20; that’s three times [more airtight] than the Passive House standard, which is a high standard to hit.”

3. Ventilation

Most leaky homes still rely on an exhaust fan in the bathroom and a vented hood over the range for humidity and fumes to exit the home, but our home has neither. Such systems don't recycle the heat, resulting in hot air leaving the home. Heat recovery ventilation systems are up to 95 percent efficient, conserving the comfortable room temperature and dramatically decreasing heating loads in the winter and cooling loads in the summer.

4. Passive heating

Our home is heated primarily from the sun, its occupants and appliances. Sunlight streams in through our large south-facing door and windows. During cold sunny days, our heating system is off throughout the day, with the home remaining warmer than the thermostat setting. During an extended power outage with below freezing and some sub-zero temperatures last winter, our home lost a mere 2 degrees daily. Nearby homes were below freezing in less than a day.

A high-performance house offers many unique features that dramatically reduce dependence on fossil fuels, while providing exceptional comfort. Although many of these features have an upfront cost, they reduce the operating costs of the home throughout its lifespan.

Image credit: 1) Steve Chiasson of Belfast Ecovillage 2) Fairfax County

Sarah Lozanova is a regular contributor to environmental and energy publications and websites, including Mother Earth Living, Green Builder, Home Power, and Urban Farm. Her experience includes work with small-scale solar energy installations and utility-scale wind farms. She earned an MBA in sustainable management from the Presidio Graduate School and she resides in Belfast Cohousing & Ecovillage in Midcoast Maine with her husband and two children.

Agriculture Drones Help Farmers Reduce Resource Use

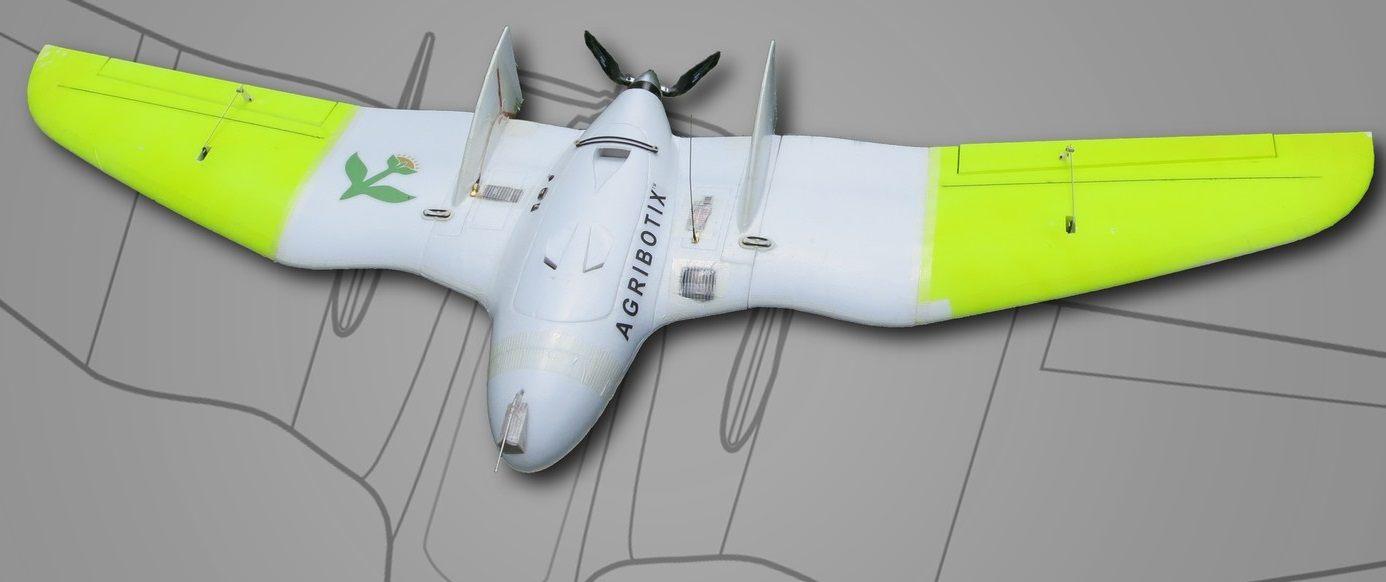

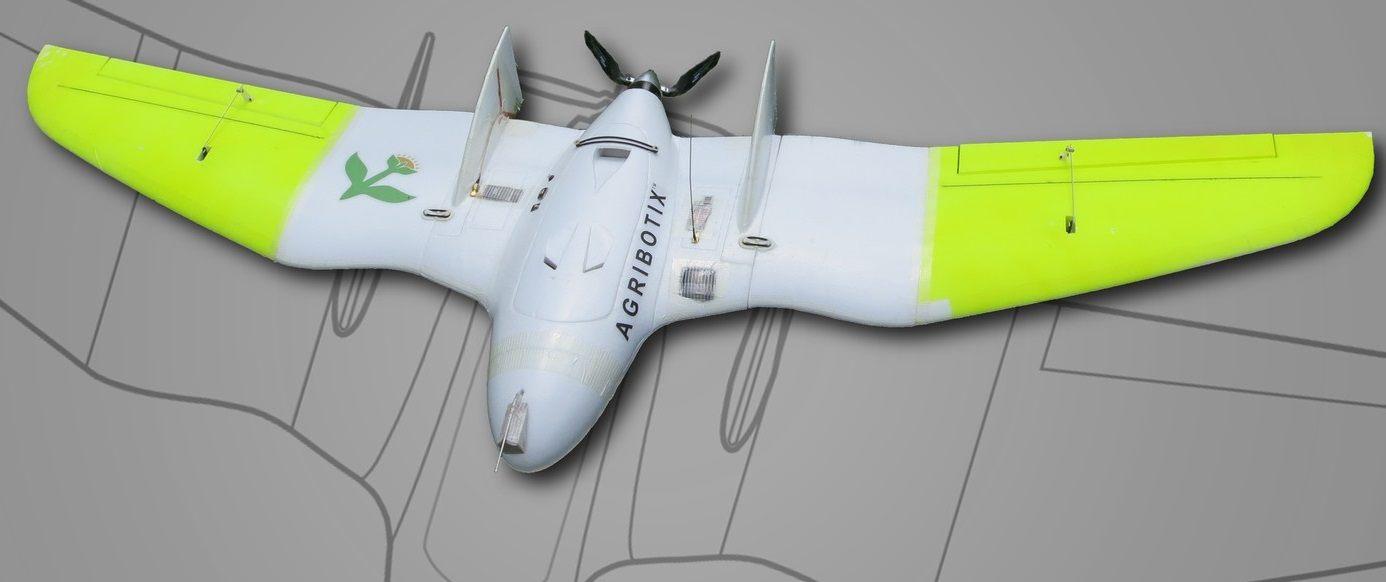

Boulder, Colorado-based Agribotix is helping farmers save money and conserve water and resources in a new way: by flying drones over their fields to measure crop density, growth and many other factors. Why does this work? Because drones are able to see things that are not as obvious from the traditional line-of-sight on the ground.

Agribotix, founded last year, works with farmers in Colorado like this: They send up drones over a field, fly over and capture photo, infrared and other data, and then land after about 20 minutes. The data is then transformed into maps showing where the crops are thriving and where they aren’t.

Speaking at the Innosphere, a northern Colorado incubator for clean tech, tech and life sciences, Agribotix CEO Paul Hoff explained that the company's drone solution would help save both money and conserve resources.

One case study: Agribotix was working with Munson Farms, a 4,000-acre corn farm in Missouri. By gathering the data from the drones, farmers were able to determine what parts of the field needed fertilizer and which didn’t. Simply looking from the side, the farmers couldn’t tell everything about growth. But after Agribotix developed a Management Zone map based on near-infrared imagery of plan density (!), they could see where the plants were chest-high, and which were waist-high.

For a farm that usually uses 50 tons of fertilizer per acre, they cut it down by 40 percent.

What data does in agriculture is allow for the prevention of waste. As you probably already know, American agriculture is incredibly resource-intensive, especially dependent on petroleum products that are manufactured into nitrogen-rich fertilizer. Water use as well is incredibly intensive: According to the USDA, more than 80 percent of water used in the U.S. goes to agriculture, with as much as 90 percent in Western states like Colorado. It is hopeful that simply getting more precise about irrigation and resources would ease demands on many fronts at once.

In other example, drone information helped a client avoid sacrificing their entire crop after a hailstorm. Assuming the whole field would have to be written off, the drones found that hail had really only damaged a section of the field, and the rest could keep growing.

Agribotix is going open-source with its "Bring Your Own Drone" project, which is open to the public and available at a discount. It’s a set of tools that make the critical link between the data collection and the production of maps that farmers can actually use for their planning.

To check it out, click here.

Images courtesy of Agribotix.

Sustainable Flower Growers Are a Few Roses Among Many Thorns

If you are irritated because Valentine’s Day flowers are already dying, take a step back and consider the journey they took to get from farm to vase. In the U.S., most of the flowers sold are grown in Colombia and Ecuador; regular reports estimate that 80 percent of cut flowers sold in the U.S. are imports. Across the pond in Europe, the Netherlands ranks as the largest exporter, thanks in part to its enormous flower auction house in Aalsmeer, where flowers from elsewhere in Europe, Africa and Asia are traded and sold.

The fact you got flowers at all is the result of their journey by airplane, underlying the massive carbon footprint of the industry. But there is also a massive effect on people — and that footprint is more like a boot on the neck. As many journalists have demonstrated, most recently in the Guardian, the hours floriculture workers endure are long, the conditions often terrible and the pay low. So, if you’re considering flowers for upcoming Easter, Passover, Mother’s Day, or for that birthday or milestone, you may want to take a look at some of the more responsible flower vendors that are on the market.

More retailers including Whole Foods and Trader Joe’s offer a decent assortment of sustainable and locally-grown flowers — something to keep in mind when considering all flowers imported into the U.S. must be fumigated. But if your local retailer does not carry sustainable flowers, or cannot prove their flowers are grown more responsibility, other options are available via delivery — which is how we usually prefer those bouquets to be delivered anyway.

One place to start is SlowFlowers.com, created by author Debra Prinzing. Prinzing, who has written two books on the subject of American flower farming, created this directory so consumers can see which florists in their area can verify the origins of the flowers they sell. Users can search by city or zip code and additional features include reviews and photo galleries.

And local flowers are becoming an available option as more farmers turn to the cultivation of flowers to make a living, from Nebraska to Ohio to California, where just about every farmers market features a local flower vendor. The Certified American Grown Program is also adding more growers to its directory as more consumers realize the best flowers are often the ones grown locally.

Certifications are also on the rise. Fair Trade USA, for example, has been working with flower growers on programs for workers including unionization, health care and education. The organization brags that it raised US$600,000 with consumers’ purchase of 20 million stems — you will have to do the math per flower to see if that is a fair deal for workers.

With an industry estimated to be worth as much as US$8 billion annually, there is plenty of room for a retailer or grower to offer flowers a cut above the ones shipped thousands of miles from dubious farms. And those options may end up being more creative, and therefore more appreciated, by the recipient, too.

Image credits: Leon Kaye

Based in California, Leon Kaye is a business writer and strategic communications specialist. He has also been featured in The Guardian, Clean Technica, Sustainable Brands, Earth911, Inhabitat, Architect Magazine and Wired.com. When he has time, he shares his thoughts on his own site, GreenGoPost.com. Follow him on Twitter and Instagram.

Seafood Distributor Makes Sustainability Policy Front and Center

It makes good business sense for a company that sells seafood to buy its products from sustainable sources. Sea Delight, a leading frozen fish distributor, recently made its sustainable seafood policy public -- and front and center -- on its website.

Sea Delight partnered with FishWise, a sustainable seafood consultancy, to develop the policy. Moving forward, FishWise will collect data on the seafood Sea Delight procures and use the data to assess, monitor and create an evaluation framework.

Sea Delight has set certain measurable goals for its supply chain, including:

- Increase the overall percentage of fishery improvement projects (FIPs) and/or Monterey Bay Aquarium Seafood Watch Green- and Yellow-rated products bought by the company every year.

- Work with one new supplier every year to directly implement FIP activities.

- Create a company traceability policy by the end of 2015.

Although Sea Delight does not require products to be eco-certified, but rather meet its criteria for food safety and quality, the company relies on eco-certifications from Marine Stewardship Council, Global Aquaculture Alliance–Best Aquaculture Practices and Aquaculture Stewardship Council. Sea Delight also relies on the sustainability ratings from Monterey Bay Aquarium Seafood Watch, Vancouver Aquarium Ocean Wise and SeaChoice.

“Sea Delight is one of the first seafood distributors in the U.S. to publicly set out clear and measurable sustainability goals,” FishWise Executive Director Tobias Aguirre said in a statement. “This includes increasing sourcing from fishery improvement projects — multi-stakeholder efforts to address environmental challenges in a fishery. It also directs Sea Delight’s suppliers to actively participate in these projects and implement procedures.”

Sea Delight created the Sea Delight Ocean Fund (SDOF) in 2012, a nonprofit organization that funds seafood sustainability projects. SDOF receives 1 cent per pound of seafood imported into North America by Sea Delight. The funds are then allocated to sustainability projects.

The dire situation of global fisheries

The world’s global seafood supply is in trouble unless something is done to stop overfishing. About 90 percent of the world’s fisheries are fully exploited, overexploited or have collapsed, according to Seafood Watch. The global fishing fleet is operating at 2.5 times the sustainable level. Or as World Wildlife Fund (WWF) put it, “People are taking far more fish out of the ocean than can be replaced by those remaining.” As a result, several important commercial fish populations have declined to the point where their very survival is threatened, and unless the situation improves, stocks of all species that are currently fished are predicted to collapse by 2048.

Given the situation of global fisheries, companies like Sea Delight that are striving to make their seafood supply chains sustainable are very important. And as one major company starts to make efforts others will be influenced to do the same. As Sea Delight stated, “Our Sustainable Seafood Policy is the foundation for Sea Delight’s future business and will send a ripple of positive change through the seafood industry.”

Image credit: Alpha

New Crop of OneEnergy Scholars Looks to Make a Net Impact

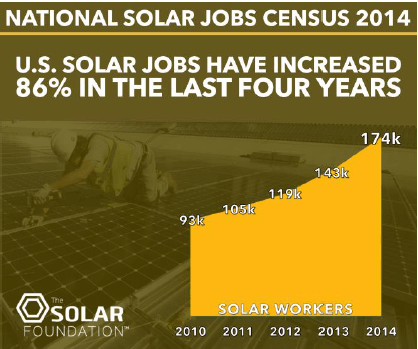

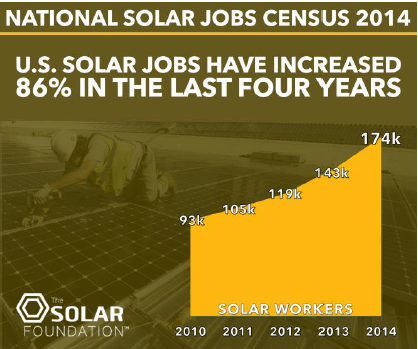

Job creation across the U.S. solar energy sector has been impressive. 2014 was the second year running in which solar energy sector job growth came in near or above 20 percent, according to the Solar Foundation's National Solar Jobs Census 2014.

Interest in working and building careers in the U.S. solar, renewable energy and clean tech fields is broad and deep, particularly among young adults and college students. Securing employment and forging a career path is hindered by obstacles, however, including a lack of specialized, up-to-date, accessible and affordable training.

That's a divide “mission-driven” solar and clean energy project developer OneEnergy Renewables, in partnership with Net Impact, aims to bridge with its OneEnergy Scholars program. Providing one-to-one mentorship to a small, chosen group of promising university students – primarily MBA candidates – over the course of one year, the OneEnergy Scholars program “is designed to accelerate the careers of high potential individuals that have demonstrated passion and commitment in the renewable energy field,” the company explains on its website.

Bridging the clean energy education divide

On Jan. 29, OneEnergy Renewables announced it had selected “six young leaders who promise to advance the clean energy sector in the coming years,” as its 2015 class of OneEnergy Scholars. Each of the six will receive one-to-one mentorship from OneEnergy executives as well as personalized career counseling, internship opportunities and professional networking prospects.

"The clean energy industry is growing at a remarkable rate, and we’re looking to the next generation of inspired professionals to shape and sustain the future expansion of this sector,” OneEnergy Renewables CEO Bryce Smith was quoted in a company press release.

"Just as today’s leaders were influenced by the guidance of their own mentors, it is our duty and our privilege to extend that same support to our 2015 OneEnergy Scholars. We can only imagine what this group of driven young people will achieve through hard work and ingenuity, and we look forward to watching their careers blossom.”

Partner Net Impact, which works to engage over 60,000 students and professionals in efforts to address critical social and environmental needs, plays a crucial role in the program, providing outreach, marketing and selection of OneEnergy Scholars' program applicants. “Many Net Impact students are eager to contribute to the clean energy economy through their professional pursuits,” Net Impact CEO Liz Maw said.

“The OneEnergy Scholars Program offers a unique avenue to enrich their understanding of renewable energy markets and build critical skills that will serve them well on their path to careers with sustainable impact.”

U.S. solar and job growth

Job growth in the U.S. solar energy sector has increased at nearly 20-times growth for the U.S. economy overall, Solar Foundation highlighted in the fifth of its groundbreaking series of annual reports. “Massive growth in demand for solar energy systems over the last decade” fuels green job creation in the renewable energy market segment, Solar Foundation points out. More than 7,200 megawatts of solar energy capacity was installed in the U.S. in 2014, contributing significantly to job creation across the industry value chain.

Totaling nearly 174,000 jobs across the U.S. states in 2014, the Solar Foundation found that over the past five years solar sector employment has grown 86 percent, employing more than 80,000 new workers. This type of performance offers strong testament of the economic, as well as environmental and broader social, benefits government support for solar and “green” economic development can bring about.

As impressive as job creation and growth in the U.S. solar sector has been, employment opportunities could be improved upon if U.S. students were afforded access to specialized, affordable and more accessible training. The OneEnergy Scholars program grew out of the “mission-driven” educational outreach the company's co-founders began while working for the Bonneville Environmental Foundation (BEF), CEO Bryce Smith told 3p in an interview.

While working for BEF, Smith and OneEnergy co-founder Bill Eddie created the “Solar 4R Schools” program. “We reached thousands of school kids through the program,” Smith explained. “With this [OneEnergy Scholars] we're striving to work with the most promising grad students we can find and work with them on a much more intimate level.”

Realizing job creation potential

Realizing the great job creation potential associated with renewable energy, clean tech and sustainable development hinges on young Americans acquiring the education and skills required. As Net Impact points out: “Seven of the 10 occupations projected to grow most rapidly over the next decade are in science, technology and engineering fields, and yet in 2013 the U.S. was ranked 49th out of 148 countries for quality of science and math education.

“Unfortunately, there is a conspicuous illiteracy around STEM (science, technology, engineering and mathematics) education and energy topics in our nation’s schools. As of 2010, less than one-third of U.S. eighth graders show proficiency in mathematics and science.”

Smith expanded on this topic during his interview with 3p. He related it directly to aims of the OneEnergy Scholar's program and its context within a U.S. energy market that's going through its first fundamental restructuring since the dawn of the Electrical Age.

“We have a very old traditional industry and then this emerging renewable energy sector. They are combining and colliding, and a new generation of students see opportunities to participate, particularly in the renewable energy sector. But they are going to need a whole set of specific, practical knowledge and skills in order to participate effectively.*Image credits: 1) OneEnergy; 2) Solar 4R Schools; 3) The Solar Foundation-SEIA“These subjects aren't dealt with effectively in business schools. We find that even in the utilities many folks aren't very knowledgeable, particularly when you add fixed price renewables into the discussion.

Renewables introduce many new variables to what has been a fossil fuel-driven U.S. energy mix. The fossil fuel industry hasn't thought about or dealt with them to any great degree, but there are a lot of students who should and need to acquire this knowledge in order to contribute positively and constructively to the conversation.”

4 Trailblazing Green Companies

By Lewis Robinson

Going green is a hot trend in the corporate world. This may be a result of consumer preference, the drive to be a good corporate citizen or simply as a means to improve profit by reducing costs. Whether or not the public continues to see value in green as a trend, the necessity of reducing costs by going green will continue to be an important business driver.

For the time being, customers are responding with their interest and wallets to green strategies, and these four companies are leading the charge.

1. General Electric

The most prominent example in recent years has been General Electric's Ecomagination campaign. It is an all-encompassing effort that combines a broad green marketing campaign, internal means to reduce emissions and energy costs as well as products that themselves are green. For example, General Electric got deep into the wind farming industry, producing transmissions, materials and finished goods for wind farming facilities. In addition, the company took steps to rent energy efficient offices and hardware as well as re-engineer manufacturing plants to reduce energy use and costs.

Consumers appear to respond positively to green marketing campaigns, as they make the company look more socially responsible. Even the government supports green marketing campaigns for businesses. As the customer is always right, these green marketing campaigns alone can help to boost the business.

2. Nest

Another recent example is Nest, which was purchased by Google for $3 billion last year. On the surface, that price seems excessive for a company that makes thermostats. However, Nest's Learning Thermostat is on the leading edge of green marketing and energy efficiency. The Nest is a beautifully designed, circular device that automatically adjusts temperature in the home to personalized settings. The device will adjust based on how rooms are being used and who is in the home. In addition, the Nest can be controlled by a smartphone app which makes it accessible from anywhere. These features can substantially reduce energy use and costs.

3. Walmart

The largest retailer and private employer on Earth, Walmart, has started its own green campaign. Despite its reputation as a conservative company, the firm has jumped onto the green trend. Not only is it good for customer appeal, but it also substantially reduces costs. Operating a huge nationwide delivery fleet, Walmart has pursued strategies to reduce fuel costs in its huge number of trucks. In addition, the firm must heat and cool a massive footprint of retail space around the country. It has invested in the most energy efficient systems to reduce costs as much as possible.

4. Tesla Motors

Tesla Motors may be the best example of a high-growth, high-impact company born with the express purpose to reduce global climate change. Tesla produces an all-electric fleet of luxury vehicles. The company's cars can be powered at home charging stations and increasingly at public facilities around the country and world.

Consumers respond positively to the firm's eco-consciousness. Despite the fact that these luxury cars are priced similarly or even more expensive than other luxury vehicles, Tesla's sales have skyrocketed to over $2 billion in 2014. Financial analysts predict continued rapid growth not only for Tesla, but also the entire electric car market as firms as varied as General Motors, BMW and Nissan jump into the fray. Either way, there is clearly consumer demand for this burgeoning market.

--

In all, using green marketing has proved an important part of the growth strategy of large companies. The Nest, Walmart's transportation strategy, GE's Ecomagination campaign and Tesla Motors have all proven the viability of this strategy. In addition, millions of small companies are taking their own steps to go green. Whether it is installing GPS in delivery trucks to reduce fuel costs or buying carbon offset credits, the returns in money and consumer appreciation can be enormous.

Lewis Robinson is a business consultant specializing in cause marketing and social media. He’s begun corporations and currently freelances as a writer and business consultant.

The Case of Insetting — Collaborating to Build Sustainable Supply Chains With Positive Impacts

Submitted by Thomas Camerata

This is the most recent article in our series on Supply Chain Sustainability. For more articles, go to

http://www.csrwire.com/blog/series/75-supply-chain-sustainability-special-focus/posts

Stakeholder collaboration can help management prepare for a better future: stakeholder expertise on operations on the ground can unveil areas in supply chains where there is high risk potential and unexplored opportunities.

Companies can improve the environmental, social and economic impact of their supply chains by working with, for instance, suppliers. The challenge that climate change poses on supply chains is becoming increasingly more complex. A collaborative approach provides a robust starting point for addressing issues in a comprehensive, systematic way. Businesses can ensure that their actions create long-lasting positive impacts by collaborating with strategic partners that possess specific competences. This enables them to positively affect the environment and communities they operate in, as well as their bottom line.

Every single year, the Swedish furniture giant IKEA uses nearly 1% of the world’s cotton production. The company partnered with Better Cotton to promote the sustainable use of resources within their supply chain for cotton. This allowed IKEA not only to improve the livelihoods of 43,000 farmers in South Asia, but also to significantly reduce the amounts of costly artificial fertilisers it used. Collaborating for more sustainable supply chains should be seen as a business imperative and significant source of shared value: healthy farmers who feel safe at work and outside of work will outperform unhealthy ones any day. For many days.

Corporate operations that include environmental and social impacts reflect a very attractive way of doing business: they foster the sustainable development of societies as such, while allowing companies to grow more dynamically. The outcome essentially reconnects environmental and community success with economic success - a factor duly noted by Swiss retail and wholesale giant COOP. By teaming up with south pole group and WWF, COOP Switzerland was able to offset the emissions of all goods imported by air. This was done by investing in a community-based project that distributes efficient cookstoves to local Maasai villages, among other activities. People from these Maasai villages currently represent the majority of the employees at Oserian Flower Farm, the Kenyan based producer of Fairtrade certified roses, who exports flowers to COOP Switzerland. This type of client-specific development of investing in emission reduction projects along a company’s supply chain is called Insetting.

Nearly everyone around the globe uses stoves to cook food. Nonetheless, a great proportion of the world’s population risk respiratory diseases, poor health, and premature death due to inadequate cooking stoves. Rudimentary stoves and open fires are the norm for nearly three billion human beings, including the Maasai people. By distributing energy-efficient cook stoves as part of the Insetting project carried out by COOP and WWF, this multi-stakeholder initiative combined carbon mitigation with sustainable development. It successfully reduced emissions and harmful illnesses and halved the demand for firewood. Burning less wood saves additional trees from being cut down and shortens the time for firewood collection. This in turn translates to reducing deforestation along COOP’s supply chain and maximising school attendance of Maasai children. The multiple positive impacts of this collaborative project helped it earn the coveted Gold Standard label. This prestigious label can only be awarded if a project consults with local stakeholders, continually reduces greenhouse gas emissions and improves both the environment and people’s lives.

In summary, multi-stakeholder partnerships along companies’ supply chains, such as Insetting unlock a series of positive impacts for the environment, business, and society as such. They provide a deeper understanding of a company’s stakeholder obligations and represent a genuine commitment to corporate social responsibility.

This is the most recent article in our series on Supply Chain Sustainability. For more articles, go to

http://www.csrwire.com/blog/series/75-supply-chain-sustainability-special-focus/posts

Your Seafood: Now Fair Trade Certified

Look out Whole Foods: Safeway is pulling ahead when it comes to seafood transparency.

Whole Foods met its match when Safeway was ranked slightly ahead for seafood sustainability by Greenpeace back in 2011. Both retailers had much to celebrate when they came out with the NGO's first ever seafood rating of "good."

Safeway hasn't taken its foot off the gas pedal in recent years, though. The company has continued to push ahead toward an audacious goal of 100 percent sustainable sourcing for all fresh and frozen seafood by the end of this year. The grocer's latest commitment brings it up to par with your local farmers market when it comes to worker transparency.

Sustainable seafood awareness and availability have moved in leaps and bounds thanks to the hard work of organizations like Marine Stewardship Council, Monterey Bay Aquarium and Future of Fish. These organizations work simultaneously on consumer education and seafood supply issues to ensure that when consumers set out to make a responsible purchase, they find good product availability on the shelves. But much of that seafood advocacy work has focused on environmental issues. Social issues -- from forced labor and child labor to a lack of workplace safety precautions -- remain a huge area of concern worldwide. Which is why the latest partnership between Fair Trade USA and Safeway is so exciting.

On Tuesday, Safeway and Fair Trade USA announced a new partnership to bring Fair Trade Certified seafood to North America.

Safeway shoppers in the American Northwest (including Northern California), can now find Fair Trade certified yellowfin tuna in their grocers' freezers. The yellowfin, sold under the Natural Blue line and imported by Anova, LLC, comes from a brand new group of fishermen in the Indonesian Maluku island chain. One hundred and twenty small-scale fishermen on these islands locate and catch yellowfin using single-hook handlines attached to handmade kites. The Monterey Bay Aquarium rates yellowfin tuna caught in this manner a Good Alternative.

Now that the group is organized and can earn a premium for their product, they plan to use part of their first Fair Trade Community Development Premiums to purchase compasses to make it easier to get home in the fog.

Why organize?

While the environmental impacts of seafood are well understood, few people know the details of how unregulated fishing can harm the 200 million people who work in the seafood industry worldwide. I asked Maya Spaull, director of new category innovation at Fair Trade USA, to explain why this industry even needs Fair Trade.

She told me about slavery at sea. If you've heard stories about enslaved sex workers, this will likely sound familiar: Cambodian men are offered better paying jobs in Thailand and join a shipping vessel, only to discover that there are no jobs on land. Rather, they'll be working on an IUU (illegal, unreported, unregulated) fishing vessel for 20 hours per day, facing beatings at the hands of an armed crew. "It's truly petrifying because you are at sea," Spaull said. "If you want to escape, your choice is to jump to death or wait until the ship eventually docks and try to escape."

These IUU vessels fish in unregulated waters -- trawling and grabbing all sorts of species to sell for whatever they can get -- and represent many of the harmful fishing practices that sustainable fishery efforts are trying to eradicate.

Beyond this dire story, many fisherman and seafood workers lack access to safety equipment, tools for environmentally preferred fishing techniques and even ice to keep their catch fresh, Spaull told me. Fair Trade USA focuses on empowering fisherman to improve their situation -- righting many of the environmental wrongs along with the social ones.

This new product will help Safeway reach its 2015 goal of 100 percent responsibly-caught fresh and frozen fish. “We are pleased to add the tuna products to the other Fair Trade Certified products offered by Safeway such as O Organics coffee and pineapples from Costa Rica,” said Chris Ratto, director of sustainability at Safeway.

As for what's next, Fair Trade USA is hard at work signing up more communities to get certified in the hopes that that a broader range of Fair Trade certified seafood will become available nationwide.

Image credit: Paul Hilton