Most Companies Act Like Fresh Water is Limitless

It takes water to produce food. The global food sector uses 70 percent of the world’s freshwater during a time when a number of areas, including California, are experiencing extreme drought. A recent report by Ceres, entitled Feeding Ourselves Thirsty, looks at how the food sector is managing water risk.

The report looks at 37 major food-sector companies in four industries: packaged food, beverage, meat and agricultural products. Companies were scored on a zero to 100 scale in four different categories. The results are not exactly inspiring. What the report found is that, although many of the companies identify water risk as a priority, board oversight of water is not translating into strong overall performance. Sixty percent of the 16 companies with board oversight received less than 35 total points.

Here are some other results, equally uninspiring:

- Only 30 percent of companies considered water risks to be a part of major business planning activities and investment decisions.

- Only two companies, Nestlé and Unilever, use a shadow price for water to analyze the return on investment (ROI) of water-efficiency investments.

- While most companies have started evaluating water risks in their direct operations, two-thirds are not evaluating water issues in their agricultural supply chains.

Why don’t most companies understand the importance of managing water risk? The problem is that water is cheap, and as a result “it’s seen as limitless,” Eliza Roberts, manager of the water program at Ceres, told me. “When something is cheap and seen as limitless, it's just not going to be valued,” she added.

The California drought is starting to change perceptions of water. As Roberts explained: “It's becoming clear to all with the drought in California, that water is not limitless and that water scarcity can have a real impact on business operations and bottom line. So, additionally, as supply goes down and demand increases, it's becoming clear that water may be cheap for now, but this is likely to change."

What can companies, both higher-scoring and lower-scoring, take away from the report? They need to understand that the global freshwater supply is facing “extraordinary risks from the twin challenges of water scarcity and water pollution,” Roberts pointed out. “These risks are posing a material and financial impacts.” In other words, while water may be cheap for now, it is certainly not limitless.

How General Mills and Kellogg value water

A handful of companies stand out as leaders in managing water risk. General Mills is one of only four companies that have developed collaborative watershed protection plans linked to regions of high water risk. General Mills and Kellogg Co. are 2 of 4 companies (16 percent) that have time-bound goals to source the majority of their agricultural inputs from farmers with responsible water practices. General Mills is also one of a handful companies that offer financial support to help farmers practice sustainability in their operations.

Wanting to know more about water management at the companies that scored higher, I spoke with Ellen Silva, senior manager of applied sustainability at General Mills, and Diane Holdorf, chief sustainability officer for Kellogg Co. It’s clear that both companies understand that their business operations depend on access to freshwater.

As Holdorf said: “We use water as an ingredient in our foods, for heating, for cooling, for cleaning and, in some locations, irrigation. We’re determined to do our part to reduce our water use and use water more efficiently.”

Or, as Silva put it, “We do acknowledge publicly that water for safe drinking and hygiene is a human right.” She added that the drought in California highlights how important it is to manage water risk. For General Mills, that means helping growers farm more sustainably because most of the company’s water use “happens in agriculture.”

Image credit: Flickr/davebloggs007

Biodegradable Computer Chip: E-Waste No More?

Slimmer, faster and better-designed electronics are the default expectation of our generation. As our devices get smarter, our predisposition as a society to swell landfills with harmful wastes -- in the form of old computers, laptops and phones -- breeds inept environmental destruction that remains irreversible. Luckily, there are some very smart people who are seeking to find better solutions to curb the problem.

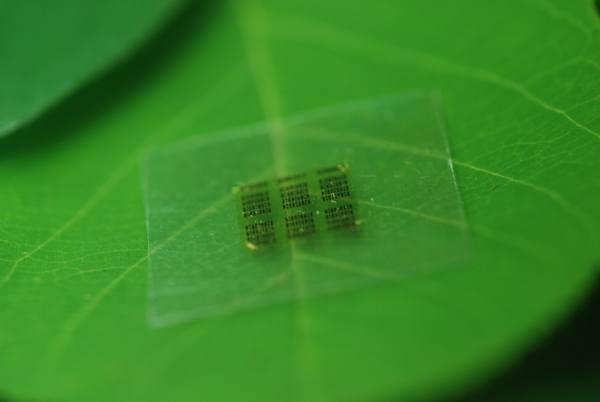

Recently, researchers at the University of Wisconsin, in partnership with the U.S. Department of Agriculture Forest Laboratory, released a study on the development of a wood-derived semi-conductor chip. According to the study, the biodegradable chip is made of from a translucent, cellulose-containing material (resembling plastic) called nanofibrillated cellulose.

"If you take a big tree and cut it down to the individual fiber, the most common product is paper. The dimension of the fiber is in the micron stage," study co-author Zhiyong Cai details."But what if we could break it down further to the nano scale? At that scale you can make this material, very strong and transparent CNF paper."

By using bio-based materials (traditional chips are made from unsustainable petroleum-polymers), reliance on environmentally toxic chips could wane. The performance of the chips is also noted to be comparable to what exists in our electronics today.

Certainly, the market for lifecycle innovation in how our electronics are produced and disposed is ripe. Imagine if the smartphones we purchase on average every 18 months contained environmentally friendly materials or contributed to the world economy by reuse of the silver, lead and gold components lost in the landfill?

Presently, top e-waste producing countries have exported these products to less-developed and regulated countries. In the U.S., it is not illegal, unlike the European Union, to ship out these harmful products to less developed areas like China and Vietnam.

China, also referred to by a 2013 United Nations study as “the e-waste basket of the world," is managing its own host of e-waste issues marked by legal loop holes that have yet to slow the importing of waste.

Consumer voices on this issue have pressured brands to step up to the plate to encourage more responsible practices. Top electronics-producing brands such as Apple, HP and Samsung have come under fire for both their popularity in the market and the growing impact of irresponsible consumer recycling. Each year, 20 to 50 million metric tons of e-waste are disposed worldwide — only 12.5 percent of which is recycled.

Since heightened awareness of the issue has sprung up amongst consumers and brands alike, e-waste recycling programs have become integral in a brand’s corporate responsibility plan.

Sony’s online search engine allows consumers to recycle their products for free through a nearby recycling center. Office supply retail chain Staples partnered with Electronic Recyclers International (ERI) in 2012 to help businesses recycle old technology by ordering recycling boxes online and shipping back to Staples.

Apple’s reuse and recycle program allows consumers to turn in eligible devices for immediate credit toward the purchase of a new device.

These programs help to solve short-term challenges by incentivizing responsible behavior and removing the dreaded and often expensive haul to recycling centers. But they are only one part of the equation.

If wood-derived, inexpensive microchips are our first step in widely adopting environmentally friendly electronic materials, we could be on the road to removing the burden of e-waste.

"Mass-producing current semiconductor chips is so cheap, and it may take time for the industry to adapt to our design," says Yei Hwan Jung, co-author of the study and graduate electrical and computer-engineering student. "But flexible electronics are the future, and we think we're going to be well ahead of the curve."

Image credit: University of Wisconsin

Scrub it out! anti microplastics campaign extends to luxury brands

With many personal care brands ditching the use of microplastics in their formulations, the Scrub it out! campaign is now turning its attention to the luxury beauty sector.

The campaign, a joint initiative between the Marine Conservation Society (MCS) and Fauna & Flora International (FFI), has seen major high street retailers including Waitrose, Boots, Asda, Marks & Spencer, Superdrug, Tesco, Sainsbury’s, Cooperative, Lush, Morrisons, and L’Occitane all pledge to get rid of plastics from their own brand personal care products. Discussions are still underway with Aldi and Lidl but MCS hopes they too will set a date for plastic free own-brand products.

Tanya Cox, projects manager for Marine Plastics at FFI says they’ve been working with cosmetics manufacturers on microplastic pollution for several years and launched the Good Scrub Guide to harness consumer power and dissuade companies from using these ingredients. “Through this, we and our partners, including MCS, have been able to secure a number of high-profile commitments from multi-national corporations to phase out plastic microbeads.”

MCS says the Scrub it Out! Campaign will now move on to luxury personal care products. Dr Laura Foster, pollution programme manager at MCS commented: “It’s possible that consumers assume the more expensive the product the better is for you, and the more natural the ingredients it contains. But we don’t believe this is always the case."

MCS and Fauna & Flora International are also asking the public to look for certain plastic ingredients - such as Polyethylene, Polypropylene and Nylon - in high end products and upload mobile phone images of labels to its website so it can highlight the issue with companies.

Picture credit: © Yekophotostudio | Dreamstime.com - Scrub Squeezed Out From Tube Photo

Mars to expand coral reef rehabilitation programme

Food giant Mars is embarking on a new phase of its Indonesian coral reef restoration project, one of the largest single coral reef rehabilitation projects anywhere in the world.

As part of the company's volunteering initiative, the rebuilding of the reef and creation of a marine protected area is driving significant increases in fish stocks, providing food and commercial opportunities for islanders for generations to come.

As well as repairing the marine eco-system and providing job opportunities within the community, Mars maintains that the project aims to provide a blueprint for best practice coral rejuvenation, which could help transform sustainable fishing practices.

The installation of the coral will be carried out over four days starting on 9 June by ten Mars Associates taking part in the Mars Ambassador Program – a volunteer initiative, which sees Associates from across the globe come together with local workers and interns to get involved with Mars sustainability projects first hand.

As part of the project, local fishing communities will receive training in how to both nurture and improve their livelihoods through the reef in a sustainable way.

Rana Plaza victims to receive full compensation as fund reaches $30m

Victims of the Rana Plaza factory collapse are finally to receive full compensation following the Rana Plaza Donors Trust Fund reaching its $30m target.

According to the Clean Clothes Campaign (CCC) the Trust Fund has met its target of $30m, following a large anonymous donation.

"This day has been long in coming. Now that all the families impacted by this disaster will finally receive all the money they are owed, they can finally focus on rebuilding their lives. This is a remarkable moment for justice,” said CCC"s Ineke Zeldenrust. “This would not have been possible without the support of citizens and consumers across Europe who stuck with the campaign over the past two years. Together we have proved once again that European consumers do care about the workers who make their clothes – and that their actions really can make a difference.”

The CCC has been campaigning since immediately after the disaster in April 2013 to demand that brands and retailers provided compensation to its victims. Since then over one million consumers from across Europe and around the world have joined actions against many of the major high street companies whose products were being made in one of the five factories housed in the structurally compromised building.

3p Weekend: Six Oddest Corporate Mission Statements

With a busy week behind you and the weekend within reach, there’s no shame in taking things a bit easy on Friday afternoon. With this in mind, every Friday TriplePundit will give you a fun, easy read on a topic you care about. So, take a break from those endless email threads and spend five minutes catching up on the latest trends in sustainability and business.

Even the most nefarious corporation thinks highly of itself. After all, it is adding value for someone, somewhere -- even if its operations have negative impacts as well. That's why most mission statements make the company's work sound truly important. However these corporate mission statements have us scratching our heads...

American Standard Company: Be the best in the eyes of our customers, employees and shareholders.

Isn't that every company's goal? American Standard Company makes air conditioning, plumbing and braking products -- all legitimately useful. Why not talk about the valuable air they keep cool, water they keep flowing, and cars they keep stopped when they should be stopped?

Barnes & Noble: Our mission is to operate the best specialty retail business in America, regardless of the product we sell. Because the product we sell is books, our aspirations must be consistent with the promise and the ideals of the volumes which line our shelves. To say that our mission exists independent of the product we sell is to demean the importance and the distinction of being booksellers.

That's just the first of a three paragraph mission statement, and yet sentence one manages to contradict sentence 3.

Chevron: At the heart of The Chevron Way is our Vision to be the global energy company most admired for its people, partnership and performance.

Chevron is an oil and gas company, which is all well and good. There is tremendous demand for their products. Why is admiration so important? And admiration of the people and partnerships?

Cooper Tire & Rubber Company: The purpose of the Cooper Tire & Rubber Company is to earn money for its shareholders and increase the value of their investment. We will do that through growing the company, controlling assets and properly structuring the balance sheet, thereby increasing EPS, cash flow, and return on invested capital.

Way to call it like it is, Cooper Tire and Rubber! But don't you want to make quality tires just a little bit?

Microsoft At Microsoft, our mission is to enable people and businesses throughout the world to realize their full potential.

That's lofty Microsoft! That's what we thought parents were for.

The Walt Disney Company to be one of the world's leading producers and providers of entertainment and information. Using our portfolio of brands to differentiate our content, services and consumer products, we seek to develop the most creative, innovative and profitable entertainment experiences and related products in the world."

Entertainment, we buy, but we think Disney should leave providing information to the internet.

How does your company's mission statement stack up?

Image credit: theriantravels

Fashion Brands Tackle Community Development

There are reams written about how far your food has traveled. And if you run in sustainability circles, you might have felt some guilt sneaking Chilean pears into your grocery cart this past winter. But have you ever thought about how far your clothing traveled to reach you? Some innovators in the space are trying to bring the locavore movement to your closet.

Local fashion is a whole different ball of wax, The North Face discovered when it set out to produce a hoodie made entirely within a 150-mile radius of its Bay Area headquarters. They were immediately stymied when they discovered that cotton mills had disappeared entirely from California. Despite this roadblock, the team carried on with the project and did their best to meet the challenge. They were able to get their Capay Valley Cotton milled and knitted in a North Carolina facility.

The project is one of many experiments in local engagement and market-building being undertaken by VF Corp. as a part of its sweeping sustainability program. You might not recognize the name VF Corp., but you certainly know its family of brands: The North Face, Lee, 7 For All Mankind, Reef, Timberland, Jansport and Wrangler, just to name a few.

Letitia Webster, global director of corporate sustainability for VF Corp., spoke about her role overseeing the sustainability programs for all these disparate organizations during this year's Sustainable Brands conference. VFC has managed to cut its carbon footprint by 5 percent despite the fact that revenue has grown 40 percent across the board.

Despite the clear environmental benefits of investing in sustainability, the higher-ups will always ask about the financials, "'Letitia, what have you done for me lately?'" Webster intones onstage, jokingly invoking her CFO.

Despite the challenges of tracking the financial return on sustainability projects, VFC brands are charging ahead with some of the most innovative capsule projects around, creating markets as they go.

The Local Hoodie project might have been small potatoes for the international retailer, but it made a massive difference in the work of local fiber craftspeople. Rebecca Burgess of Fibershed, a group dedicated to building regional textile communities, said that the economic development of the Bay Area fibershed in a typical year is around $47,000, a modest sum based mostly on farmers market sales. When The North Face got involved, the number grew to almost 50 times that amount.

Sally Fox of Fox Fibre provided the cotton, an heirloom ‘Buffalo’ brown. When asked how it felt to work with a big retailer, she said: “I was just happy. This was the first time my cotton had been used in a commercial product in 20 years.” This engagement in the local community reaps rewards far beyond those of a few carbon miles saved.

It worked for The North Face, too. While Adam Mott, director of sustainability for The North Face, admits that the Local Hoodie, "was certainly more expensive to make than a typical hoodie. But there was margin built in." The company didn't have to subsidize the production or pay for it out of foundation funds.

Another VF brand is taking local engagement in a whole different direction. Timberland, (yes, the work boot company), supported the Smallholder Farmers Alliance (SFA) with a $1 million grant over five years to work on reforestation, with the understanding that SFA would take the five years to figure out how to develop a program and make it self-sustaining. And develop one they did. Smallholder farmers (with 2 hectares of land or less), commit to plant and tend a network of trees on their land. In return, they receive training, seeds and tools to increase crop yields.

The project also works with farmers to build a market for the products made from the trees they tend. Moringa, in particular, has been successful due to the fact that the moringa tree is fast-growing (to an adult height of 13 feet in one year), and thrives with little water and in poor soil conditions. Demand for the superfood is growing in developed countries due to its high antioxidant content. The fact that these trees are more valuable in the ground than cut and turned into charcoal means that the trees "become a component of bio currency," said SFA co-founder, Hugh Locke.

When questioned about the value of the program for Timberland, Margaret Morey-Reuner, director of strategic partnerships and business development for the company, explained that it spent $1 million to make the business case for working with farmers. "Now that we know it's a success, we have support from VFC in terms of advocacy for the project."

Next up, Timberland hopes to engage the farmers in growing cotton, which could be used in the manufacture of Timberland's shoes in its Dominican Republic factory. By supporting the growth of a whole value chain in a single area, Timberland and VFC can help the region become self-supporting.

It's impressive to see such small, innovative projects completed under the umbrella of a multinational like VFC. With its breadth and buying power, the parent company has the potential to help pull hundreds of communities out of poverty. While these initiatives require a sustained effort, they don't require a handout.

Image credit: The North Face

To Smoke or Not to Smoke? That is the Environmental Question

By Thomas (T.J.) Franklin

For a minute, consider the environmental impacts of worldwide tobacco usage instead of the health risks that are associated with it. As a former smoker, the thought never crossed my mind to explore the cumulative effects of my choice to light up. When I became aware that over 5 trillion cigarettes per year are manufactured for human consumption, I felt this was worth exploring.

For years, deglamorization ads about the dangers of smoking have blanketed U.S. media. As a fourth grader, I still remember real human lungs from cadavers that were brought into class, demonstrating a stunning difference between a healthy non-smoker, and one who had chosen to smoke for years.

Today, society continues to be inundated via radio and television through the CDC’s current ad campaign, just to make sure we still understand the health impacts. To both the CDC and nation’s credit, the U.S. has enjoyed a significant reduction in smokers over the past 50 years. But as the global population is set to hit an estimated 9 billion by 2050, will the drop of tobacco users be sufficient to curb worldwide resource demands, especially factoring in the potential resource strains on water, food, and arable land?

Regardless if you’re a user or not, many likely overlook the detrimental impacts of tobacco from the lens of “environment” and “sustainability.” But if you were aware that tobacco production was linked to deforestation, impacts of pesticide use, environmental degradation, fires and litter/pollution, would that change how you personally view it?

For example, if you were aware that 60 million trees were cut or burnt down each year to support “big tobacco,” would that surprise you? What if lands that were used for tobacco farming were repurposed, and could subsequently feed 10 to 20 million people yearly, would that spark your interest?

Thankfully, we largely understand the detrimental effects of throwing cigarette butts on our beaches and roads (again, ad campaigns), but I think we remain blind to the rest of the story.

The tobacco industry has traditionally been a deeply rooted American narrative. But today, China and India are the two largest consumers and producers of the plant in the world. In fact, the Chinese consume 38 percent of the world’s cigarettes! The World Bank and other NGOs are pushing initiatives to educate governments on the negative social and economic impacts of smoking. One study reveals that smoking prevention and cessation efforts must be a primary focus, especially in countries like China. But government-owned companies like China National Tobacco Corp. that have such a considerable economic stronghold will be hard to convince.

Tobacco myths

Many myths exist about tobacco that should be set straight. One of the most intriguing is that tobacco is mostly an issue that relates to affluent people in affluent countries. The fact is that the true victims (either those who use or support production) are those that live in the lowest income categories. Another myth is that tobacco is the only way for low-income farmers to make a living. The truth is that sugar cane, bananas, coconut, pineapples and cotton are all suitable replacements that could be planted in the same locations to support an equivalent lifestyle. Whether it is by choice or by feelings of no other alternative, many stay the course and grow tobacco. Unfortunately, they become by-products of affluent societies and industry.

The issues revolving around worldwide tobacco production will continue to be complicated. What should be hoped for is that less people will become addicted to this dangerous drug. It is difficult to ignore the health risks, but it would be foolish to further turn a blind eye to what the tobacco industry is doing to the environment.

“Wood” you consider the following about tobacco production?

Tobacco production, especially in developing countries, uses tremendous amounts of wood, thereby becoming a silent partner in worldwide deforestation.

Have you ever seen the sobering Rain Forest landscape transformations through time-lapse satellite imagery? I think it’s human nature to overlook changes on monthly or even yearly scales, especially if the change is small. But when evaluated over a larger span of time, the changes can be staggering, almost jaw-dropping. There has been serious discussion lately about highly demanded commodities such as palm oil and soybeans and their associated contribution to deforestation. But for some reason, worldwide tobacco demand does not share that same detrimental linkage. The tobacco industry’s contribution might not be as compelling, but surely this change will be significant if left unchecked for many decades. Remember the time lapse example!

Here are the facts. Depending on what resource you find online, roughly 200,000 hectares of forests are cut-down each year from tobacco producing activities. Farmers, mostly in developing countries, clear lands for planting-with little to no regulation. Wood from nearby forests are then burned for the production of tobacco through the process of curing (or drying).

Additionally, these curing facilities (barns) are made of wood, and the process of flue-cured tobacco requires consistent amounts of heat (about 10 days worth) necessary to transform to properties of the tobacco plant. Since Virginia Tobacco is many times flue-cured and the plant of choice, global demands are typically high because of its high sugar content and nicotine levels. Because of this demand, farmers turn to wood for burning, regardless if the land is needed to be cleared for planting or not. So as you can see, there is a wicked multiplicative process at work here.

Global market demands (mostly from the Chinese) continues to be the crux of the issue. Demand drives supply, which then trickles down to farmers living in developing countries. In their defense, they are simply trying to put food on the table for their families and make an honest living. In places like Tanzania, this scenario is reality. Other locations around the world where deforestation seems to be targeted are the following: southern Africa, southeast Asia, South America, and the Caribbean.

Tobacco’s strategic dichotomy: One goal, two different directions

In order to meet worldwide goals for reduction in tobacco consumption, and in turn halt deforestation, regulation and education must occur simultaneously.

The more I’ve attempted to understand the various strategies to limit tobacco use, the more opaque solutions become. I previously noted that many programs simply focus on social and economic components of the problem; largely ignoring the environmental issues that tobacco creates. The more literature I read about two entirely different problems (socioeconomic versus environmental), the more interconnectedness there is. I’ve thus come to the conclusion that it will take both educational investments and environmental regulation in developing countries to battle this worldwide problem.

Since 2010, the Obama administration has looked at this topic and is urging other countries to follow suit. The Bill and Melinda Gates Foundation, as well as other NGOs are working to combat the tobacco industry’s increased advertising campaigns in developing countries, because they know that is where tobacco’s biggest customer base is located. Studies show that low income, low educated, rural persons are most likely to use tobacco. Therefore, the following policies are recommended:

- Introduce and inject mass media campaigns into developing countries. Help them understand the dangers of smoking. Use strategies to De-glamorize or urge people to think before they use. Start this process when they are young!

- Smoke-free laws. This will be more useful in cities or places of business where smoking is allowed indoors. 680,000 of the 6 million die annually of secondhand smoke.

- Tobacco cessation options. Offer outlets to help people quit. Nicotine is an addicting drug, so this resource is crucial.

- Restrict advertising and promotions for tobacco. This must be done fairly since tobacco industry is a business, but reductions could be made.

Because of the lack of international regulation, and the temptation from developing countries to over-exploit their natural resources for economic gain, the conundrum of deforestation must be addressed as a collaborative effort (government, NGO, industry leaders, etc.). Leaders from each of these sectors must develop a set of strategies that continue to meet each other’s goals.

For instance, if demand for tobacco can be somehow curbed, the law of supply and demand would tell us that there would be little-to-no incentive to chop down forestland. If taxes were raised or the price of cigarettes became more valuable, a larger percent of people would quit, while tobacco companies would continue to generate revenues from sales. If governments can educate farmers to shift from tobacco to tea or cotton, there will still be economic viability for these people. To be effective, these and many other policies must be executed at all levels and with multiple participating parties.

If previously mentioned policies are too difficult to embrace, there must be robust forest conservation programs within targeted countries where tobacco growing is most prevalent. In lands that have been cut down, there must also be afforestation programs aimed at recovering the land. Even at the local or community level, there could be incentives to better manage forest lands that are still standing.

Image credits: myclimate, NASA, Centers for Disease Control and Prevention

Trapped by Success: Thoughts on Sustainability in Business Following SB'15 San Diego

Few weeks ago “Mad Men” ended with Don Draper’s “om” moment followed by a 1971 Coca Cola jingle, “I’d Like to Buy the World a Coke.” While the “Mad Men” series is sadly no longer with us, the Mad Men era is still very much here.

No, not the '60s, but the era of consumerism that started back then, where a call for “new day, new ideas, new you” (as prayed for by the guru running a meditation in the last scene of “Mad Men”) inspires new ads rather than ways to make life better.

I thought about the last scene while watching some of the live-streamed panels and presentations at the Sustainable Brands 2015 conference that ended yesterday. The annual conference in San Diego is an inspiring event with great speakers and an audience that is part of and leads the sustainability in business movement.

Sustainable Brands founder and CEO, KoAnn Skrzyniarz, kicked off the conference, and among the issues she addressed was the pace of change. She told the audience how she’s still surprised to hear in some circles that nothing is been done when it comes to sustainability in business and that things are going too slow. She said that the expansion of the audience and its activities indicate that “we’re definitely accelerating our momentum.”

She also mentioned the following points to make a stronger case for acceleration in the activities of the sustainable business community (copied from her presentation):

- We are becoming better at seeing the problem/solution set differently, looking at whole systems

- You continue to be willing to experiment, risk, share

- More and more new data sets/tools available enabling innovation, consumers choice

- More data shows this is good for business

I think KoAnn is partially right. Companies indeed move forward at an accelerated pace when it comes to sustainability, but the problem is that the challenges they face seem to be moving forward even faster. The result therefore is that, while it may seem as if companies make progress when it comes to sustainability, they actually move backward or stand still at best.

To figure out how to change this state, we need to understand the problem, and the problem I believe is that business is “trapped by success.”

At the keynote he gave at the DMI conference last year, Prof. Richard Buchanan explained that ‘trapped by success’ means that when you succeed in something, you tend to do more of it. Buchanan went on to explain that it also applies to business with lines of products and services that work very well. Then when circumstances change, he continued, companies find themselves unprepared, as they are trapped by their own success.

This is the situation I see with most companies when it comes to sustainability. They are aware of the sustainability challenges they face, have some idea about the necessary solutions and are even open to collaborating with other companies, including competitors, to truly address these challenges. However, they are also successful enough in what they’re doing so they continue to do it. I’m not talking about a specific product or service, but about the business model. When it comes to the way companies operate, it is still very much business as usual.

I wouldn’t like to ignore the progress and innovation we see in business when it comes to sustainability (as presented at SB'15), but I believe that the changes most companies make are at the edge, not at the core. I know that change takes time, but the problem is that we don’t have much time because the challenges we face don’t stand still. Not at all.

Unfortunately most companies don’t see it yet. The tragedy is that, for most companies, climate change is still a vague threat, and the change in consumer perception about social and environmental issues doesn’t translate yet into action, at least not on scale. What we’re left with is a business model that seems to be working quite well and sustainability challenges that are believed to be adequately addressed with measures that don’t get the organizations out of their comfort zone.

This is good, but not good enough. Companies need to find a way out of this trap and do it not tomorrow but now.

Andrew Zolli, the author of “Resilience: Why Things Bounce Back,” likes to use the analogy of a car approaching a cliff, “a climatological point of no return,” when talking about the major challenges we face.

“Imagine a car speeding toward a cliff. The brakes are gone. For the people in the car, the top priority is finding some way to stop the vehicle before it reaches the precipice. At some point, however, the car will reach a point where — even with the best braking efforts imaginable — inertia will still carry it to its doom. Once the car has crossed that point, the passengers probably shouldn’t still consider how they’re going to slow the car down. Instead, they must start thinking — and fast -- about how to survive.”

We’re in this car. Companies are in this car. They need to understand that the Mad Men era -- when the cliff was nowhere to be seen -- is over. So is the short period of time when we actually believed we could somehow make a U-turn.

Now it’s time for companies to face the reality and understand that the framework has changed, as well as the expectations from them when it comes to sustainability: Either they get out of their ‘success trap’ and search for radical innovations that will smooth our way down, or else it’s going to be a much more bumpy and unpleasant journey.

Image credit: Sustainable Brands

Tata Power, Honeywell Roll Out First-of-its-Kind Smart Grid System

Commercial and industrial companies, as well as power utilities, are increasingly embedding intelligence in electrical networks. Comprising a wide range of connected equipment and devices, smart-grid technologies enable utilities and their customers to enhance energy efficiency, increase the reliability and resilience of power supplies, and reduce greenhouse gas emissions at the same time.

Smart-grid technology and systems are being deployed in developing, as well as industrially developed, countries. As has occurred with wireless telecoms, this affords developing nations the opportunity to “leapfrog” developed nations technologically, in the process charting a course toward genuinely sustainable development.

A just completed project illustrates the potential of smart-grid systems to help achieve sustainable energy and development goals set by the United Nations and other prominent multilateral organizations. On May 27, Honeywell and Tata Power Delhi Distribution (TPDDL) announced they completed installation of India's first automated demand response (ADR) system for commercial and industrial companies. The ADR system embeds "smarts" in an electricity distribution system that spans more than 160 buildings, enabling energy consumption to be reduced during times when grid supply is low or strained.

Smart grid tech, sustainable energy and development

Automated demand response and smart-grid systems can play a large role in addressing longstanding sustainable energy and development challenges in nations such as India. Some 400 million Indians lack access to electricity. While generation and grid infrastructure investment has been sorely lacking, India relies on coal for nearly 70 percent of supply. That makes cities such as New Delhi among the worst polluted in the world, endangering human and environmental health and safety.

Led by Prime Minister Narendra Modi, the Indian government intends to double the country's coal production, even as Modi has launched ambitious plans to greatly expand India's use of solar and other renewable energy resources. Smart-grid technology and systems, along with locally appropriate mixes of distributed renewable power generation, can reduce the need to mine and burn more coal and import oil while greatly expanding energy access and security.

Electricity demand in New Delhi has nearly doubled over the past decade, Tata Power and Honeywell note. Putting Honeywell smart-grid technology and services to work, the ADR system will help avoid brownouts and blackouts that periodically affect residents and businesses across Tata Power's New Delhi service area.

Commercial and industrial facilities account for nearly 50 percent of peak electricity demand in India. That puts great value on technology that can improve energy efficiency and intelligently adjust to grid supply-and-demand conditions.

"This is a significant initiative — one that supports our mission to build a resource-efficient, environmentally friendly electrical grid," said Praveer Sinha, Tata Power Delhi Distribution CEO and executive director.

"We are committed to making this deployment a success, and finding new opportunities to extend ADR to other customers, thus playing a role in helping to meet Delhi's energy needs. We believe our steps in this direction will also encourage other Indian utilities to adopt smart grid technology for efficient operations"

Automated demand-response and reducing peak power demand

By employing Honeywell's ADR technology and services, Indian electric utilities could reduce peak electricity load at any given commercial or industrial facility by an average 15 percent, the project partners highlight. In the case of Tata Power's ADR project in its New Delhi service area, that means the electric utility will be able to reduce peak power demand by around 11.5 megawatts.

Reducing peak and overall power demand -- what's come to be known as "negawatts" -- reduces the need for costly power infrastructure, reduces emissions and helps avoid potential tragedies. Dubbed “virtual power plants,” electricity consumption across the country could be reduced an estimated 10.5 gigawatts – nearly 7 percent of nationwide peak power demand – if ADR systems such as this one were to be deployed across all buildings in India, the companies go on to highlight.

Honeywell explains how Tata Power's ADR system works in this video posted on YouTube:

*Image credits: 1) Flickr, BDphoto1; 2) NRDC Switchboard