Indigenous Communities May Hold the Key to Wildfire Prevention, but Government Policies Leave Them Choking on Smoke Instead

The skies over Oregon during the state's 2020 wildfires

Take a hike through the forests of the Pacific Northwest and it soon becomes apparent how centuries of mismanagement and poor wildfire prevention created a landscape littered with tinderboxes begging to ignite. Fire-starved land stretches for acres on end. Meadows are choked out by brush and encroaching pine trees. Replanted clear-cuts stand in dead row after dead row — a testament to both the ignorance and arrogance inherent in centuries of shoddy forest management. As a result, Indigenous communities are grappling with inordinately higher than average concentrations of smoke-filled air as wildfire seasons across the U.S. and Canada become more extreme.

While low-income communities of color tend to bear the brunt of air pollution in urban centers, wildfire smoke collects at higher concentrations in rural areas where it disproportionately affects Native and First Nations people. Compounding the problem: Many communities don’t have access to air filtration systems or the ability to upgrade homes and buildings. As a result, air quality improvements over the past couple of decades have largely passed by these rural communities.

It’s hard to know exactly how bad the smoke problem is in Indigenous communities due to a lack of sensors. Most monitoring is done in cities, after all. The Environmental Protection Agency (EPA) has a grant program to fund monitoring but its budget is the same as it was 20 years ago — before fire seasons hit current levels. Tribes have begun taking matters into their own hands and are installing their own low-cost sensors. “Because of that disparity in the funding, tribes are really doing what they can with the minimal support that they have,” Chris Lee, co-director of the Tribal Air Monitoring Support Center at Northern Arizona University, explained in Grist. As for the dangers to Indigenous communities, he insisted that it “is not going to be ‘if,’ it’s going to be ‘when’.”

Indeed, tribal communities are already suffering the effects of extreme levels of fine particulate matter in the air from wildfire smoke. As further explained on Grist, the Mille Lacs Band of Ojibwe in Minnesota usually gets an average of four air quality alerts per summer but last year they got 29. These alerts are only issued when the air quality index (AQI) is over 100 (for reference, “good” is below 50). On one of these days, a sensor on the reservation came back with a reading comparable to 667.2 AQI. Worse yet — the Karuk Tribe of California saw the AQI reach almost 1600 from fires in the West. For all of the data that we do have, there are many more communities who know they are being choked out by smoke but lack the information they need to protect themselves.

Even with that data, rural communities are limited as far as what they can do to safeguard their health. A lack of air conditioning means people often have to choose between sweltering indoor temperatures and smoke blowing in through open windows. High rates of asthma and other chronic illnesses are only compounded by this, likely causing a cyclical effect, and leading to high rates of hospitalization and potentially premature death.

And it’s only going to get worse. Extreme fires are expected to increase by 14 percent as of 2030 – thanks to man-made climate change and land degradation – 30 percent a decade later and by half as of 2100.

The cruel irony is that these mega-fires might not even be possible if Indigenous people were allowed to practice the traditional forest and land management that previously offered wildfire prevention to what we now call the U.S. and Canada (and much of the world) from such devastation. Prior to the European invasion, tribes used controlled burns to clear brush which can act as tinder, return nutrients to the soil, prevent crowding and over competition for nutrients and water, sustain healthy forests, maintain meadows and open grasslands for wildlife such as buffalo, and prevent wildfires.

The European American approach to wildfire prevention, on the other hand, has been an unmitigated disaster. Fire has historically been seen as a menace. Instead of adapting to the land and learning to live with good fire, settlers sought to extinguish it from the landscape entirely while drastically upending both the climate and the environment via clear-cuts and single-crop agriculture. The good news is that more scientists and politicians are finally starting to come around and see the value — nay, the necessity — of these cultural burns.

Still, as the 90-day ban on prescribed fires that was implemented back in May demonstrates, officials are skittish after the wildfires in New Mexico. But their inaction on wildfire prevention is only exacerbating the problem and allowing the acreage of fire-starved forests to grow. In the meantime, tribes are once again forced to pay the consequences of the government’s failure.

Image credits: Mark Divier via Unsplash; Riya Ann Polcastro

America’s Racial Disparity Reveals Itself in Traffic Deaths: Can the Private Sector Do Anything?

At last count, the U.S. lost almost 39,000 people to traffic deaths in 2020, the highest number since 2007. The reasons are all over the map. Predictably, the usual suspects caused many of these deaths: speeding, the consumption of alcohol and the failure to wear a seat belt.

Despite what our assumptions may have told us during the pandemic, traffic deaths still increased during that time, and poorer citizens and people of color shouldered the brunt of these tragedies. Quiet streets notwithstanding, the disruptions during pandemic life led to more drivers behaving badly, whether they engaged in impulsive behaviors such as speeding through headlights or driving while impaired by drugs and alcohol.

The result has been a spike in traffic-related deaths for poor and Black Americans. Compared to whites, Blacks in recent years have died at four times the rate while cycling, and twice as much while walking when compared to whites — activities any reasonable person would expect could be done leaving one’s home without risking ending up dead. Overall, even before the pandemic started, it turned out Black Americans were killed in traffic-related incidents at a much higher rate than that of whites.

The most effective solutions at hand for reducing such deaths, however, are the most expensive ones. So, could the private sector do anything?

Editor's note: Be sure to subscribe to our Brands Taking Stands newsletter, which comes out every Wednesday.

According to the New York Times, the most impactful solutions to curbing traffic deaths are relatively simple. To start, law enforcement can bolster support for laws already on the books that are related to drunk driving, speed limits and seatbelt laws. But considering the mood in this country, doubts arise whether various police departments can tackle these problems when it’s long been documented that communities of color too often witness their neighbors experience getting pulled over for a broken tail light or expired registration tags. A culture of trust between communities and law enforcement would have to occur first. Blanket announcements of "we're going to increase the number of speed tickets!" won't fly.

Other tactics are more expensive: Cities and towns would need to improve their designs of streets, bike lanes and sidewalks — and not only bright green bike lanes in wealthier neighborhoods — as well as ramp up investments in public transit. Further answers are up to the automakers, such as adding features like sensors or automated breaking that can improve vehicles’ safety.

The U.S. Department of Transportation (DOT) says it has a plan to take on these mounting traffic deaths, but so far, they involve a few pilot programs: brighter lighting at a mass transit center here, newer sidewalks there, or an elevated walking paths in a busy city neighborhood.

Here’s where industries such as engineering and construction can step up. More leaders within these sectors are interested in showcasing their environmental and social sustainability chops; the challenge, however, lies in where to begin.

Federal legislation such as Build Back Better and the Inflation Reduction Act offer a start to transforming our cities and towns, but resources will still be scarce. Plus, there’s the added problem of municipalities’ project review timelines — nothing gets built overnight. Public-private partnerships could help on this front, and in fact, last fall’s Infrastructure Investment and Jobs Act (IIJA) tucked in some provisions that would allow community projects to attractive private capital.

Therein lies a gateway to do community good: Investments in pedestrian bridges near schools, better lighting at bus stops and spend on all-way crossings at busy intersections are among the ways companies and communities can work together to decrease traffic deaths. If a company provides the funds, let it put a logo on the project for all we care: Any increase in lives saved will be worth it.

Image credit: Mark Boss via Unsplash

Remote Work: Benefits for Employees, Employers and the Economy

The back-and-forth over remote work versus going to the office, and versus a hybrid system, isn’t going anyway anytime soon, but this ongoing debate’s noise is definitely getting louder. More companies are using more sophisticated technologies to gauge whether their employees are being productive or not. Meanwhile, companies that have gone 100 percent virtual report that they are doing just fine; other companies are drawing a line in the sand, and that line isn’t including the option to work from home. For many companies that are based or have a presence in America’s mid-sized or small cities, the discussion is largely over.

Remote work vs the office: What’s better depends on who’s asked

Part of the confusion is over the ongoing research about the benefits of working from home in contrast to a complete return from the office: The data is all over the place. Long before the pandemic, the human resources group SHRM had reiterated to what many appears obvious about the advantages of remote work. To start, employees were less stressed out from not having to commute, they faced fewer distractions from interruptions and banter in the office, and often had worked more hours, the latter data point a bonus for companies wishing to boast about their productivity.

Among the arguments against remote work, one of them is that isolated workers aren’t working and collaborating together, which can weaken a company’s overall efficiency, can prevent a strong work culture and curb innovation.

But, for any employees who often face microaggressions on the job, or simply don’t “fit in,” the jibber jabber over “collaboration” often doesn’t resonate with them — it’s difficult to be part of any team if one’s contributions are not valued or overlooked. Plus, the pandemic’s effects are still lingering, which means that for many employees, the best possible mental health program that allows them to both heal and focus on the job at hand is a relatively simple solution: to continue working from home.

Nevertheless, the tug-of-war between remote and physical workspaces continue — and in the spirit of fairness, another pre-pandemic survey found quite different results related to remote work when compared to SHRM’s study. In researching the habits of European workers, this 2019 study found that the gap in productivity of employees working remotely versus those in the office was close to 80 percent.

The most visible brands are generating the most remote-vs-office headlines

The headlines over remote work continue, in part due to the divisions shown within the workforces at America’s most notable brands. Take the conflict brewing at Apple, where staffers are balking at coming back to the tech giant’s Cupertino, CA headquarters (shown above) three times a week. But of course, they have their objections: To start, the definition of what is “Silicon Valley,” has long been extended from the Santa Clara Valley to the Peninsula, San Francisco and the East Bay, not to mention far flung exurbs such as Tracy and even Los Banos. The results are far longer trips to the office, as the median home price in Cupertino is currently about $2.65 million, and that’s after a recent dip in prices.

If you’ve suffered in Bay Area traffic, you’d get it. In the event Apple were hypothetically based in a smaller, far more navigable city of 100,000, perhaps the pushback wouldn’t be so vivid. If you’ve worked in the office where many colleagues drive, or commute and transfer long distances, that stress from the morning routine is not only water cooler conversation, but can affect one’s mood for the rest of the day and week. Add the pandemic’s induced stresses such as kids in school, worries about elderly parents, stubborn virus variants and of course, today’s toxic politics here in the U.S.

Therein comes another angle to the remote work debate. The reality is that we’re seeing two types of workers emerge: Those who thrive on being in the office and the banter and collaboration with colleagues, and those who do best from the office in their home's spare room. Of course there is the benefit for the occasional visit to the office; at the same time, major construction on a bridge or highway overpass, or a spike in fuel prices, should give companies’ management more than a nudge to send the memo, “it’s okay to be working from home for the next few days.”

There’s far more to this debate than ‘efficiency’ and ‘collaboration’

One of the most important benefits a company can offer employees is to treat them as adults and offer the option of where to work, or at least a compromise in the form of a hybrid schedule.

“Some employees I know prefer going into the office every day. Others not at all. The choice is theirs, as long as they meet the company’s minimum requirements and their managers are satisfied,” Gene Marks recently wrote for Guardian. “Will we still be debating work from home a year from now? I don’t think so. Because, unlike some of the other issues created by the pandemic, a hybrid work environment is already putting this one to rest. I just hope that my older clients recognize this. Because if they continue to resist, they’ll lose out on great talent.”

Earlier this summer, Nicholas Bloom, a Stanford University professor, pointed out to Bloomberg additional complexities to the home-vs-office debate. Some issues go beyond arguments over "work culture" and are about the greater good. One example: For large cities under financial strain — including their public transit systems, which are suffering as many workers fled to the suburbs or even farther away — a compromise on work schedules is absolutely needed if our cities can still thrive or even survive in the long term.

Bloom added that companies who seek out workers that need to work remotely, or at minimum a hybrid schedule, can add to the labor supply, which in turn can generate economic growth for companies and the wider economy alike. “There are a number of groups that are more able to work because of working from home. A lot of people – think folks with young kids, people that are disabled, people that are close to retirement age, students – may be happy to work three days a week for six hours a day without the commute, but wouldn’t be prepared to do that for five days a week, including commuting,” Bloom explained to Bloomberg’s Justin Fox. “I think that could push up labor supply by 2 percent, 3 percent, 4 percent, which would be a very large impact on growth.”

Bottom line, Bloom found a correlation between generous work-life-balance programs at companies with strong management and overall positive business performance. Scale that up, and one can tally up the economic gains — and the human benefits, too.

Image credit: Carles Rabada via Unsplash

The $11 Billion Plant-Based Protein Market Sees a Future in Fake Steak

How’s the plant-based protein sector been doing lately? Depending on who you ask, it’s a mixed bag. Privately-held Impossible Foods insists it’s going gangbusters, and further success with restaurant chains here and across the pond in the U.K. underscores the company’s performance. But elsewhere, some doubts have been sowed. A test marketing run of a plant-based sandwich at McDonald’s ended quietly earlier this month, and Beyond Meat, which had partnered with the Golden Arches on that pilot, has struggled as of late.

The challenges that some plant-based food brands are confronting have nudged analysts to tamp down their forecasts about the growth of what was once a small market niche. Generally, projections had seen growth for the plant-based protein market to reach about $50 billion by the end of this decade; previous analyses were far more buoyant, including one concluding a value of $150 billion by 2030 and another even predicting a $290 billion market by 2035. Now, such expectations are overall much lower. A more recent crunching of the numbers expects a $34.5 billion market by 2032, and this same report suggests that plant-based protein will wrap up sales this year with a value of almost $11 billion by the end of this year.

Plant-based protein is now facing a bumpy road

That $11 billion sum is still quite a number that didn’t seem possible a decade ago, but players within the plant-based market will need to rollout new products that can dazzle and impress consumers if they expect further growth. Even Impossible Foods, arguably the most successful and recognized plant-based protein brand by far, is gravitating more toward the word “beef” instead of “burger” on some of its products to nudge and remind customers that the company’s products is far more versatile than something that needs to be tucked between a brioche bun or lettuce leaves.

To that end, watch for the next plant-based protein trend to take on the Mercedes, the Ducati, the Bulgari, the iPhone 14 of the meat world: steak, especially the more popular and pricier cuts.

One such company is Nasoya, which sells strips that resemble Korean galbi or bulgogi. Nasoya boasts that its faux steak product only includes four “core” ingredients: water, soy, oil and a basic sauce for flavoring.

But what about folks who don’t want strips or nuggets to sauté in a pan, but want something sizable, even realistic, to show off their grilling skills?

Three plant-based ‘steaks’ to watch

First, there’s Juicy Marbles, which offers a plant-based filet mignon that the Slovenia-based company says closely mimics the texture and marbling of a cut of beef. The company has a tenderloin alternative in the works, and Juicy Marbles executive team says its technology will at some point soon allow it to produce these plant-based “steaks” at scale. Reviews so far have been mixed: admiration at the audacity to try to pull off a fake steak, though reviews on news sites such as The Verge says the texture could use some improvement.

Another emerging player in the plant-based steak race is British Columbia-based Urbani. A third-generation family-owned company that has long sold salami and other Italian-inspired foods, the company is pivoting toward plant-based protein, specifically its “Misteak,” which it expects to roll out later this year. The company’s first fake meat venture was an imitation jerky launched a few years ago.

For those seeking a middle ground on plant-based steak — maybe they seek the texture but don’t want to be disappointed with an analogue that doesn’t meet expectations on the grill, Meati has an option. The protein-rich, mushroom-based steak alternative sears quickly and has scored solid reviews for those craving foods like cheesesteaks but without the guilt or environmental impact. The company has won over investors, too, with an impressive fundraising round earlier this year. Consumers are buying in: As of press time, all of Meati’s options were sold out.

Image credit via Pixabay

The Artemis 1 Launch is a Huge Boost for Technology and Environmental Awareness

The Artemis 1 launch has been postponed till at least on Friday, but the excitement over a new venture to space won't abate anytime soon.

The return of U.S. spacecraft to the moon for the first time in 50 years is generating all kinds of buzz, including talk about the long-term possibility of eventually launching a mission to Mars.

And while the 32-story-tall Space Launch System rocket and its 8.8 million pounds of thrust will do much of the initial heavy lifting after takeoff, the unmanned Orion spacecraft will be conducting must of the critical work for NASA’s scientists during its 42-day journey as it orbits the moon and hightails another 40,000 miles beyond it.

While it’s clear NASA as a brand won’t become dull anytime soon — one superficial reason being the number of NASA tee shirts and swag we see as we go around town — the U.S. space program has always garnered its share of critics, largely over the cost. Artemis 1 is no different.

The rocket that is hugely important to the Artemis 1 mission is one such target of critics — the first three launches during the entire Artemis project alone will each cost approximately $4 billion, an amount that would make plenty squawk especially if you consider what the U.S. spends, or skimps on, various social programs. Critics of the Artemis 1 launch also say this project’s total price tag, an estimated $93 billion, is the outcome of a combination of powerful allies in Congress, stubborn bureaucracy and problems with government contractors.

So, why not just let private companies like SpaceX carry on with 21st-century space exploration and take that off the U.S. federal government’s plate? Well, to start, for all of its fits and starts, the U.S. space program has been about furthering knowledge — not generating publicity by letting a few chosen billionaires and celebrities score some pricey thrills in the outer reaches of the Earth’s atmosphere. Sure, the launches and missions over the years have spawned copious media coverage and iconic images, but much of the hard work and innovation that occurs behind the scenes largely goes on, for the most part unheralded.

NASA’s Jet Propulsion Laboratory is one stakeholder in the U.S. space program that’s pleased to remind you of the various technologies that have emerged from the decades-old quest to explore the moon and beyond. The list is long: smartphone cameras, LED lighting, scratch-resistant lenses, CAT scan technology, athletic shoes, landmine removal, foil blankets, water purification systems, memory foam, laptops and, for Trader Joe’s fans and hard-core backpackers, freeze dried foods such as fruit, curry entrees and buffalo-spiced chicken-and-mac-and-cheese meals.

But, there are additional reasons why space exploration presents society with long-term benefits. National security is among them. Related jobs and careers in STEM that result from this Artemis 1 project won’t necessarily be limited to working for NASA or the U.S. military comprise another benefit. (Fun fact: Artemis 1 has this first for NASA — it will have a launch director who is a woman.) Finally, environmental awareness is another reason to consider.

Remember that no human laid actual eyes on Earth — as in seeing the planet it its entirety — until the Apollo 8 mission in December 1968. “It can be argued, cogently, that lunar travel – humanity’s first venture into deep space – transformed our understanding of our place in the universe,” wrote the U.K’s Observer editorial board yesterday.

The astronaut Bill Anders photographs of the Earth in 1968 gave the public a perspective of the world not as oceans and continents, but as an entire entity. "We came all this way to explore the moon, and the most important thing is that we discovered the Earth," Anders said after that mission.

Seven months later, Neil Armstrong took his historic first steps on the moon. He later remarked, “It suddenly struck me that that tiny pea, pretty and blue, was the Earth. I put up my thumb and shut one eye, and my thumb blotted out the planet Earth. I didn’t feel like a giant. I felt very, very small.”

It was those images that helped spark growing environmental awareness within and beyond the U.S., which helped lead to the first Earth Day a year later.

As the Observer summed up:

“Anders, Armstrong and the other Apollo astronauts had a profound impact in changing our perspectives of our world. Their observations and experiences underlined the fragility of the Earth and played a key role in the birth of the environment movement in the late 1960s. From that perspective, lunar travel can be seen to have provided value for money and suggests there is still something to be gained from continuing to put men and women into space. Working out the exact price tag is more problematic but the placing of human beings on the surface of another world should be looked at as an act that is generally beneficial to our species.”

If you missed the live coverage of the launch, sites such as Space.com will host a replay of the countdown, launch and liftoff into space.

Image credit: Pedro Lastra via Unsplash

So, What’s Your Purpose? Your Brand’s Stakeholders Need to ‘Get It’

Consumers determine where they spend their dollars based on a variety of values, and a recent study revealed the advantages of brands' involvement in social activism. The 2022 Purpose Power Index is a study conducted by the consultancy StrawberryFrog, in partnership with Dynata, a research firm; the organizations say that their research is the first of its kind. StrawberryFrog describes it as the world’s largest first-party data platform for insights, activation and measurement. In sum, the study suggested that there are significant indications that consumers not only value a company’s involvement in social activism, but are beginning to expect it.

A new way to measure and evaluate purpose

StrawberryFrog aims to help clients achieve business outcomes through a human-centered approach called “movement thinking.” As Chip Walker, Head of Strategy at StrawberryFrog, explained to TriplePundit, “[movement thinking] reframes your company or organizational purpose in a way that people can understand and want to participate in.” This approach is said to connect people emotionally to a common cause and lead to action. To that end, StrawberryFrog created the Purpose Power Index to rank leading brands based on the power of their purpose.

In addition, StrawberryFrog calls its approach both “movement strategy” and “movement marketing.” The company suggests that any movement begins with a grievance that needs to be made right. The next steps are distinguishing what needs to change in the future and what stance will be taken to overcome the adversary. From there, a company may design marketing activities that activate the organization. This purpose-driven action is expected to inspire employees and customers alike. As time has evolved, marketing experts have shifted away from the idea that brands ought not take a side in social and political issues. Walker outlined for 3p a few reasons why this idea is outdated.

Three reasons why brands can take a stand

First, according to Walker, there's “a growing consumer demand that companies play a bigger role in society. Companies are increasingly seen as citizens just like everyone else who have a responsibility in society and are expected to weigh in on issues important to their employees and consumers. Increasingly, it is considered a cop out for companies to have no POV [point of view] on these issues.”

Further, Walker explained to 3p that due to the rise of social media, “The average citizen now knows more about company POVs on important issues in real time and can talk back and either approve or disapprove of their stances.”

Finally, we have to acknowledge the rise of a new generation. As Walker noted, “Multiple research studies have shown that younger people in particular want to buy from companies that share their values, and taking a stand on issues is a way companies are doing that.”

Yes, brands can have a purpose

With these points in mind, it is increasingly clear that consumers are looking for brands that share their values. People want to give business to companies that go beyond a public statement and take real action to back up their word. Walker provided some tangible tips for brands wondering how to navigate taking a meaningful stance on social and political causes.

To start, Walker emphasizes the "why." Rather than politicizing company involvement in a cause, it’s better to speak about and take action on issues that could be relevant to the company, employees and its customers.

There are clear advantages and disadvantages for brand involvement in social issues. Part of any brand identity includes core values, and a brand can reinforce its identity and increase customer loyalty through taking a stance on a social issue that relates to its core values. Even if it becomes controversial, the fact that people are talking about the brand at all can drive more awareness about that company or brand. The downside could be potentially offending a portion of customers and employees, so it’s important to ensure that the brand’s involvement within any social issue is intentional and well thought out.

The Purpose Power Index study aims to demonstrate to brands how powerful gaining clarity on their purpose can be. The study concludes that with a clear and common purpose, organization members are inspired to participate in meaningful action. Purpose provides the framework for movement, laying the foundation from which all decisions can originate.

Image credit: Jamie Street via Unsplash

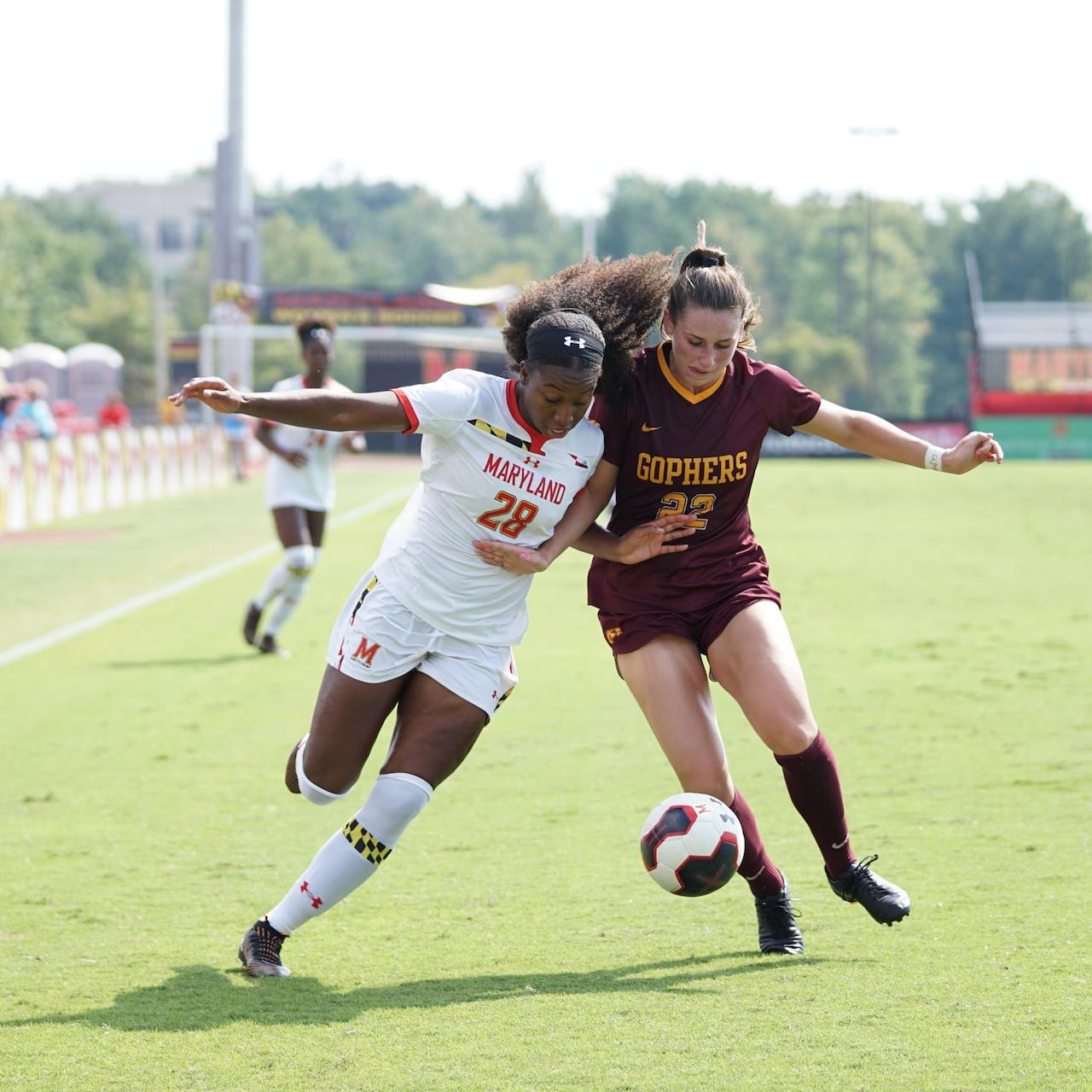

Pixstory and Women in Soccer Partner to Provide Safe Spaces for Sports Talk

Pixstory — the social media platform that puts the spotlight on evidence, not opinion — is partnering with Women in Soccer (WIS) starting today, Women’s Equality Day. The aim of this teaming up is to chip away at harmful or hateful speech online. Individually, each organization is already building a safe space through its own platform. Together, the groups expect to amplify their impact.

On its social app, Pixstory incentivizes integrity and fosters debate, instead of rigidity and friction. Each member is given an integrity score based on the validity of their posts, which affects the level of visibility their future posts are given. Women in Soccer manages an online hub of resources that aims to connect and uplift women and historically marginalized groups that are working in and around the sport — from team members on the field to fans in the stands to those making sports businesses run.

Women in soccer ‘deserve to be heard’

The partnership will lead to more inclusive conversations around soccer and amplify the voices of WIS members. Women is Soccer will use its Pixstory account to pass the microphone to groups that have been marginalized in sports, including women, trans and non-binary individuals and more. The group will also moderate discussions on equity in the world of soccer, allyship and the importance of safe spaces. The aim is to spur productive and respectful conversations, which can be quite rare in sports!

Consider a study conducted by humanitarian organization Plan International from 2019 that looked at posts from major sports news broadcasters in Australia. The organization found that about one-quarter of negative comments made towards female athletes were sexist, and 20 percent belittled women’s sports, athletic abilities and skills. Additionally, female athletes were receiving three times more negative comments on these posts than male counterparts.

“We deserve to be heard. We need more visibility, and we need more opportunity to tell our stories with confidence and in a safe environment,” Rachel LaSala, WIS managing director, told TriplePundit in an email interview. “The Pixstory team is malleable and open to feedback as they continue to develop their platform, and they are trying to help course correct the pitfalls of social platforms. That is important to us.”

Making Pixstory synonymous with women’s sports

LaSala noted that Pixstory already proved to be a committed partner at this year’s Equality Summit in London around the time of the recent Women’s Euros. “They entrusted ownership of the activation — a polaroid photography experience that involved creating 6-word stories — to us so as to ensure it best met the needs of our community. It made for a powerful impact on the members and individuals who joined us at the event. That was an early sign that WIS was teaming up with the right crew.” Pixstory will support additional WIS events, which LaSala wrote, help members form meaningful bonds and encourage “deliberate storytelling and conversation.”

But the benefits won’t flow one way. LaSala said, “We know Pixstory is just getting started – we hope to help them grow their impact and support of identities that need it most.” And that’s the type of partnership Pixstory is looking for. Appu Esthose Suresh, founder of Pixstory, wrote to 3P, “We want to make the platform synonymous with women’s sports.”

Athletics are already part of Pixstory’s DNA. After all, it was last year that the Paris Saint-Germain Féminine soccer club became a partner. In a press statement, NBA All-Star player Dwight Howard, who was also an early backer of Pixstory, said, “It was a natural step to join forces with the Paris Saint-Germain women’s team. The team embodies diversity and defends the same values as Pixstory.” When speaking of this new partnership with WIS, it was also the sharing of values that Suresh emphasized.

The economy finds a boost in greater inclusion

While Pixstory and WIS are pursuing greater inclusivity for the value it brings those who have been marginalized, there is also an economic case to be made for the work these organizations are undertaking. A brief from the Organization for Economic Co-operation and Development (OECD) puts part of the economic case for equal opportunity this way: Disadvantaged groups become more engaged in the economy, while those that were previously given greater privilege are forced to take their work more seriously. That reasoning certainly applies to sports, giving just one more reason to get behind the initiatives, ambitions and values of WIS and Pixstory.

Image credit: Jeffrey F Lin via Unsplash

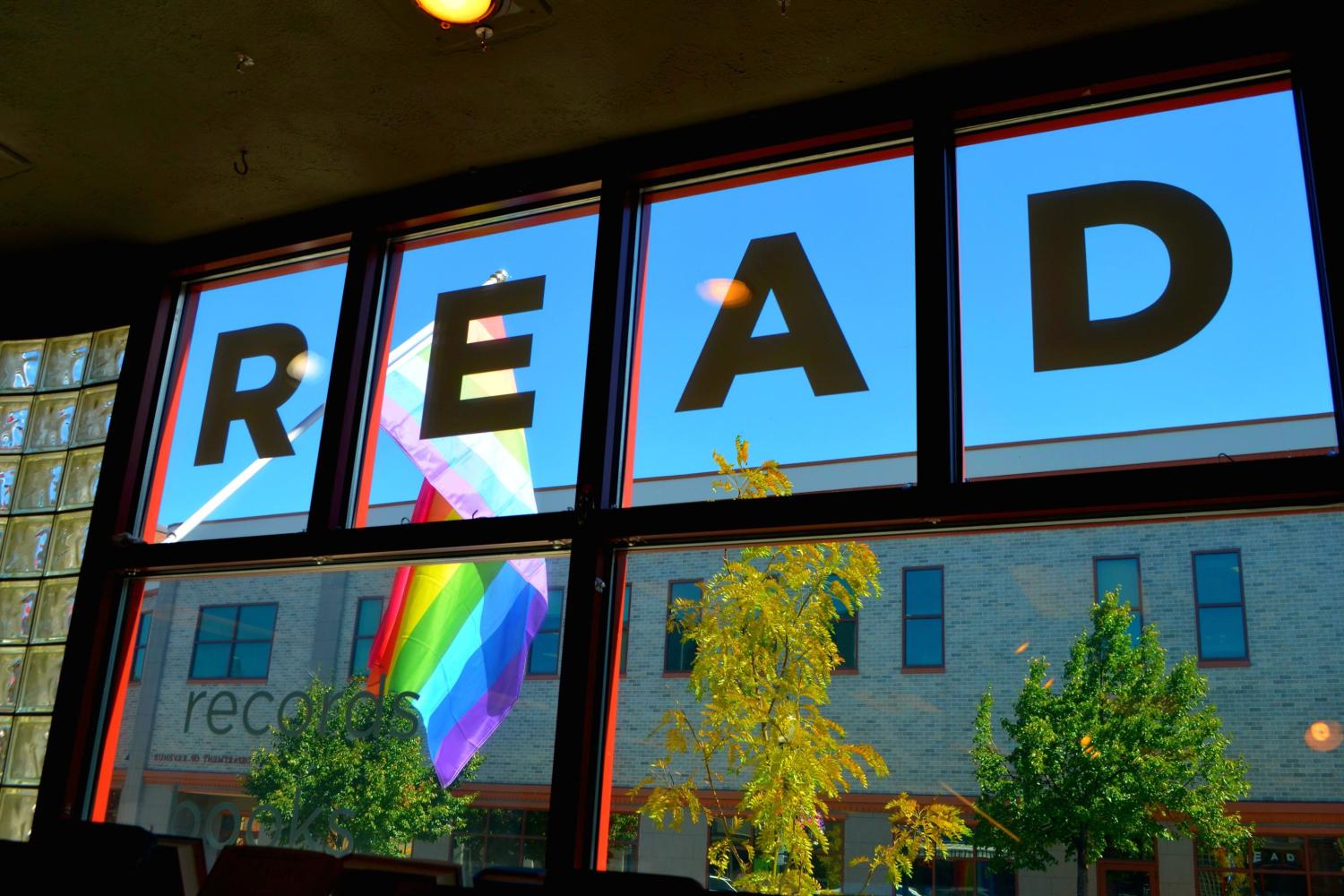

Of Course, a Bookstore with a Social Justice Mission Can Succeed In a Red State: Just Ask Montana Book Company

Montana Book Company has been a fixture in downtown Helena since the late 1970s.

When Chelsia Rice and her spouse Charlie Crawford, both former educators, bought Montana Book Company in 2018, they knew they wanted to bring a social justice element to what is now downtown Helena’s 45-year-old bookstore. They also knew they wanted to do it in a way that knitted the community together, especially at a moment that was seeing increasing division: no easy feat in the capital city of Montana.

Don’t assume you can define Montana, or any state

To an outsider, Montana is solidly a red state, but the reality is more complex. Montanans’ mentality generally lies more in the live and let live realm, but like everywhere else in the U.S. the past few years, divisions have grown. Not long after Rice and Crawford bought the bookstore, the murder of George Floyd occurred, and as tensions rose across the country, they decided that Montana Book Company would focus more on social justice.

Despite the divisions, the educator within Rice wanted the bookstore not only to be a place that stood for inclusion and social justice, but also a safe place for the community. One thing she didn’t want was for their LGBTQ-owned business to be the center of conflict. “People might assume we’re fishing for conflict [putting justice at the center of their business],” she told TriplePundit, “but we’re educators and interested in conversations with boundaries.”

Challenges to welcoming everyone in a community

That doesn’t mean they haven’t faced challenges—both on their doorstep and at the state house, which sits just a few blocks away from the store. Not long after they took ownership, Rice had an encounter with a customer that she still recalls with clarity. She was wearing a Black Lives Matter shirt under her cardigan when an older man in a camouflage cap came in the store. After collecting a stack of books to buy, he noticed the overt nature of the social justice stance of the store and put his books down, laying into Rice, saying she was liberal and biased.

Using her teacher training, Rice let him air his grievances and remained calm until he wore himself out. “I asked him, ‘listen, are you a vet?’” she recounted to 3p. When he answered that he was, she replied by telling him that her spouse was a vet in the 1990s (at the height of Don’t Ask, Don’t Tell). She explained her shirt was a message to honor the people who have died, not an attack. They continued to talk, and he began to tear up recounting his experiences. He came back later and bought the books he set aside, giving Rice a hug. “He left us a three-star review, but in it he said that the store was liberal but the owners were good people,” Rice said with a smile.

Unfortunately, a more recent incident led them to put up a sign prohibiting guns in their store, but by and large, Rice said the community has been loving and supportive of them. In response to anti-trans bills in the state legislature, Montana Book Company put out a call to raise funds for a billboard on the highway. In a short span of time, they had raised $10,000—enough to fund the sign through July 2023.

They have also had support from other local businesses, including one whose owners helped them develop a business plan, learn about payroll and generally gave them the confidence to become the success that they are.

Books, social justice and community

Community has been at the center of the store’s owners’ business model from the beginning. They found initial support through the Montana Human Rights Network, and continue to give back. “People come to us for conversation and comfort,” Rice said. “We are an activist bookstore, here to help people process what’s going on the world.” She and Crawford view their role as a hub of the community, with books and education at the center, which also means emphasizing the local aspect of their business. “Books are evergreen,” Rice told 3p. “There will always be a need for books. When someone says they can get something cheaper from [a national chain], I tell them when you buy a book here, you enable us to give someone in Helena a living wage and benefits.”

And that, in the end, is what anchors them. “This business is not just transactional, it’s building relationships,” Rice said. She recalled a time where she watched an eclipse on the Capitol ground and happened to sit on the grass next to one of Montana’s U.S. senators. “We talked about our families and just watched the sky.” For a business that wears its pride in the bold colors of the flag it flies outside, justice and community in Big Sky Country never seemed like a more natural fit.

Image credits via Kate Zerrenner

Big Food Boasts Pricing Power While Gouging Consumers

Rising food prices got you down? Turns out it's not a very exclusive club...

Consumers continue to face skyrocketing prices at the grocery store even as food companies boast about ballooning profits. And while CEOs claim to be merely passing on increased costs, an explosion of dividends and buybacks within Big Food companies suggests otherwise. As “Greedflation” keeps sweeping the nation, consumers appear to have accepted their plight with little pushback beyond grumbled complaints. Such passivity — perhaps fueled by an acceptance of market factors as the sole cause — may be emboldening runaway price gouging. However, buyers have little recourse when it comes to necessities like food.

Sysco is a prime example of how Big Food took advantage of rising supply costs as an opportunity to increase profits. The restaurant and commercial food distributor passed a 13.4 percent increase onto its clients and yet came out ahead to the tune of a 159 percent increase in annual earnings. Kevin Hourican, the company’s CEO, is quoted in Restaurant Business as describing how raising prices on customers while increasing profit was an “efficient pass-through of inflation”.

Likewise, in a news release the company’s CFO, Aaron Alt, described how profitability had increased in spite of inflation — “strengthening our balance sheet and returning $1.5 billion to our shareholders.” To put that in perspective, Sysco’s net capital expenditures for the year were less than half of that amount at just over $600 million. Of the $1.5 billion in shareholder giveaways, $500 million went towards stock buybacks while the remainder was distributed as dividends. Furthermore, Alt expects the 2023 fiscal year to bring an increase in earnings per share of 25 to 35 percent — all while no doubt continuing to pass on any cost increases.

At 12.2 percent, food prices (as in food bought to prepare and consume at home) rose at a higher rate than the average increase across all items, which was 9.1 percent over the course of the fiscal year ending in June 2022. But according to the Bureau of Labor Statistics (BLS), “food away from home” prices (as in restaurants and food service) rose at a slower rate, only 7.7 percent — suggesting that while there might not have been pushback when the largest food wholesaler in the country passed on double-digit increases, restaurants and institutions were likely absorbing much of it in the form of losses. Long-term, this trend could affect the landscape of the restaurant industry as chain restaurants are better equipped to withstand such pressures. Meanwhile, many mom and pops that barely made it through the worst of the pandemic are struggling to keep their doors open.

Sticker shock at the checkout counter has many families feeling the same pressure. Kraft Heinz — the maker of numerous American kitchen staples such as Philadelphia cream cheese, Oscar Meyer and Miracle Whip — has raised prices by 13.9 percent since 2019. The Kellogg Company has also been raising prices since the middle of 2020. Like Sysco, both food conglomerates blame inflation for cost increases while watching their net revenue rise. Kraft Heinz saw its net income increase by over 1,000 percent for the second quarter of 2022 while simultaneously paying out $980 million in dividends to shareholders in just the first half of the year. Likewise, The Kellogg Company paid out $394 million in dividends and bought back $300 million worth of stock during those same six months.

The Wall Street Journal credited Kraft Heinz's CEO Miguel Patricio with explaining that the lack of consumer pushback is the result of how universal price hikes have been. Leadership from Starbucks and Chipotle were a bit bolder, as they referred to their companies’ pricing power. Starbucks handed out $1.7 billion in dividends and bought back $4 billion in stocks over the first nine months of the 2022 fiscal year — last October, its previous CEO announced it would spend $20 billion in stock buybacks and dividends over a three-year period, though interim CEO Howard Schultz rolled back that commitment on his first day back at the company. Chipotle recently bought back over $260 million in shares after experiencing a double-digit increase in revenue in the second quarter. The fast-casual restaurant chain still plans to buy back an additional $300 million worth of stock — and customers can expect higher prices.

The insatiable appetite Big Food companies have for profits isn’t only threatening families and small businesses. Regarding runaway prices, Morgan Stanley recently warned, “In addition to taking a bite out of discretionary spending, increasing food costs have pushed inflation higher and pose a serious risk to global economic recovery.” (Though the investment bank doesn’t appear to recognize the effect of increasing profit via “pass-through inflation” and instead, only blames market factors.) There is good news, however: Researchers with the firm are hopeful that food prices will begin to drop at the start of next year.

Image credit: Karolina Grabowska via Pexels

Disaster Preparedness Hub in Caribbean Will Save Lives and Tons of Money

The United Nations (U.N.) announced its plans to establish a disaster preparedness hub in the Caribbean earlier this month. Located at the international airport in Bridgetown, Barbados, the hub will support air and sea operations to accelerate responses to natural disasters in the region.

“The Caribbean islands are right on the frontlines of climate change. As hurricanes become more frequent and severe, we need to be fully prepared so that lives are saved, livelihoods are defended and hard-won development gains are protected,” said World Food Programme Chief David Beasley when announcing plans for the hub.

It’s something that’s desperately needed in a region that is notoriously hard hit by natural disasters. Hurricanes, floods, earthquakes, and volcanic eruptions regularly have an impact on the Caribbean, making the need for a preparedness hub long overdue.

Storms in the Caribbean

According to the National Oceanic and Atmospheric Administration (NOAA), the average Atlantic hurricane season has fourteen named storms (winds > 39mph), seven hurricanes (winds > 73mph), and three major hurricanes (winds > 110 mph).

Of all weather disasters, hurricanes cause the largest loss of life and have the greatest financial impacts. The average financial cost for a hurricane response is $20.5 billion.

When small islands with fragile economies are hit by multiple hurricanes in a year, the economic impact can be overwhelming. Many of the Caribbean islands rely on tourism as a large part of their economy. Hurricanes not only cause immediate damage but also deter tourism until cleanup and restoration is complete.

Further exacerbating the situation is climate change and global warming. It’s projected that in the coming century, if we are unable to mitigate the effects of climate change, Atlantic hurricanes will have higher rainfalls and greater peak wind speeds.

A supplied logistics hub in the Caribbean will reduce response and coordination times when disaster strikes.

Disaster preparedness vs. disaster response

When there is proper preparation for a disaster, the effects of that disaster are reduced substantially. It might sound like common sense, but even still it has been difficult to get funding to prepare for disasters.

U.N. data shows that between 2010-2019, of the $133 billion in disaster funds, only $5.5 billion went towards disaster preparation.

The Federal Emergency Management Agency (FEMA) stated in a 2018 report that for every $1 spent on disaster preparedness and mitigation, it saved $6 in emergency disaster response.

The total economic cost of Hurricane Katrina is estimated to be around $180 billion. Research from Washington University in St. Louis suggests that if more were invested in disaster preparedness instead of relief, the financial cost of the disaster could have been as low as $7 billion.

Having the supplies ready to go, staff trained, and transport vehicles available to dispatch when a disaster strikes, such as is being constructed in Barbados, will save money and lives.

Why the struggle to get preparation funds?

If it’s so economical and lifesaving to be adequately prepared for a disaster rather than scrambling to coordinate help when that unfortunate moment comes, why has it been so hard to get funding for disaster preparation?

To put it bluntly, disaster prep isn’t sexy. It’s hard to justify spending money in the event that something might happen — and where you won’t see immediate results. It’ll pay off eventually, perhaps, but governments, private organizations, and individual donors want to see how their money is being put to work. They want to know they provided shelter for fifteen people or that they fed twenty hungry children.

Think about the disaster-related donations you might’ve made in the past — maybe it was for Hurricane Katrina in 2005, or the Haiti earthquake in 2010, or the Indian Ocean tsunami in 2004. Whatever it was, it was likely made in response to a disaster.

It’s difficult to send money when there is no dire need, no images of suffering on our screens, and no call for help. It’s in these prior moments, however, that our dollars are most effective.

Not to mention, the massive influx of donation funds that arrive immediately after a disaster create a ton of logistical issues. Which organization should receive what amount? What should we use the money for? Which company should we buy the supplies from? All things that would be much better sorted out pre-disaster, so that the focus can be on delivering help to those that need it most.

The planned hub in Barbados is a step in the right direction to alleviating the effects of natural disasters in one of the world’s most disaster-prone regions.

Image credit via Pixabay