Breaking the Consumer Cycle: Netting Revenue Through Waste

By Giulio Bonazzi

After 25 years in the manufacturing industry, I have become a true believer in the social and economic power of the circular economy. With the world’s population expected to reach 9 billion by 2030, it has become clear that our disposable culture and one-time use model for consumer products is no longer viable.

It’s obvious that the key to meeting future demand will be to move beyond a traditional linear economy where we produce, consume and then simply dispose of products. However, with a population so engrained in the convenience of disposables, this could be easier said than done.

As the world’s population increases, so does demand – which is great for business but bad for the environment. There is not a never-ending supply of raw materials from which to draw, so the manufacturing industry will need to adapt to meet growing demand for synthetic consumer products.

Fortunately, there is a solution in the most unlikely of places – waste. Landfills and other waste streams are goldmines when it comes to creative materials sourcing, and with the appropriate reverse supply chain programs in place, end-use products never have to see a landfill again – they can instead be returned and upcycled into new raw materials.

As environmental consciousness becomes more widespread, consumers are voting with their dollars, further encouraging the sustainable manufacturing trend. And where the consumer dollar goes, the rest of the industry soon follows. In particular, within the carpet, textile and apparel industries, there has been an upswing toward the use of recycled materials in product manufacturing.

However, end-use companies are increasingly looking to move beyond minimal levels of post-consumer recycled content and are starting to shift toward suppliers that take a more forward-thinking approach to production.

As a supplier, Aquafil has proven that it’s possible to remain profitable while promoting environmental and social responsibility through the use of upcycled waste materials. It turns out that waste is an abundant and incredibly useful manufacturing material. Aquafil’s ECONYL Regeneration System was first developed as a sustainable nylon-6 material sourcing solution for carpet and apparel manufacturers and has since scaled into a worldwide operation. The process redirects post-consumer nylon waste from around the world that would otherwise end up in landfills, incinerators and oceans, and upcycles it back to the same quality of the original virgin raw material. The result is nylon-6 fibers made from 100 percent regenerated nylon, such as threadbare carpets and old fishing nets diverted from global waste streams.

An important step in creating a closed-loop manufacturing system is to identify avenues for waste collection and recovery. Reclaiming programs provide a virtually endless supply of waste materials and help to better optimize recovery and reuse by allowing companies in the carpet industry to return their end-of-life products to be regenerated into new virgin material. Several non-profit organizations also exist to aid in waste recovery – such as the Healthy Seas Initiative, a program aimed at recovering and recycling abandoned nylon fishing nets from oceans. Healthy Seas promotes marine protection and reduces ocean debris and is a prime example of how taking a circular approach to business practices and partnerships can yield new opportunities and further drive a company’s sustainability goals.

In order to sustain forward momentum toward a circular economy, there is a need to promote this emerging movement through discourse and collaboration. From a corporate reputation standpoint, it’s crucial for companies to demonstrate their commitment and efforts to promote a sustainable future, and to continue to drive sustainability strategy by adhering to the triple bottom line approach: investing in business practices that promote social, environmental and economic sustainability.

If implemented on a large scale, the waste diversion and reverse supply chain model will encourage a global closed-loop manufacturing economy, completely changing the way companies source manufacturing materials, and providing choices that empower consumers to finally move away from the tired linear one-time use model.

Image credit: Aquafil

Giulio Bonazzi is the chairman and CEO of Aquafil SpA and an expert in the circular economy. As an entrepreneur, Mr. Bonazzi is not afraid to take risks to see his company evolve and grow. Under his fierce dedication and leadership vision, Aquafil SpA has become an important sustainability leader and a key driver within the synthetic textile industry, with 15 plants in eight countries across three continents. Giulio has been President of CIRFS (European man-made Fibers Association) from 2011 to 2014.

Nespresso makes progress in improving lives of coffee farmers

Nestlé Nespresso says it has made significant progress towards improving the lives of thousands of coffee farmers in countries ranging from South Sudan to Colombia, as part of the company's AAA Sustainable Quality(TM) Program.

Speaking on the occasion of the one-year anniversary of The Positive Cup, Nespresso's 2020 sustainability strategy, Jean-Marc Duvoisin, ceo, commented: "Through our sustainability investments, the first steps have been taken to rebuild the coffee industry in South Sudan, and we are helping to initiate a better future for farmers in Colombia through a retirement savings plan.

"These are small steps given the scale of the challenges, but I am proud that we can do our part to help farmers, while securing the future supply of the highest quality coffees for our business and our Club Members."

Nespresso aims to source 100% of its coffee from its AAA Sustainable Quality(TM) Program by 2020. This depends heavily on the extension of the program into Kenya and Ethiopia, to support a more skilled, self-sufficient and sustainable farming community. In the last 12 months Nespresso, working with partnerTechnoServe, have provided training and technical assistance to over 10'000 farmers, and will reach 50,000 farmers by 2020.

In addition to the expansion of the AAA Program in Africa, Nespresso has made progress to implement welfare solutions to ensure that coffee farming remains attractive to younger generations too. Last year it launched a pilot retirement savings plan, together with the Colombian Ministry of Labour, Fairtrade International and local coffee cooperatives. So far 850 AAA Fairtrade certified farmers have entered the retirement savings plan.

Nespresso has also progressed with its agroforestry plan. The reintroduction of trees in coffee producing regions helps protect natural ecosystems, thereby strengthening coffee farms' resilience to climate change and ensuring sustainable coffee production for the future, says the company. Around 130,000 trees were planted in 2014 in Guatemala and Colombia as part of pilot programs.

In the first half of 2015, approximately 200,000 trees have been planted in Ethiopia and Guatemala, and another 300,000 will be planted by the end of 2015 in Mexico and Colombia.

Kendall Jackson Goes for Sustainability Gold

The most interesting wines come from grapes that had to struggle a little bit. As with people, in the world of wines interesting is almost always good. You might recognize Jackson Family Wines (JFW) as the seller of the popular restaurant chardonnay: Kendall Jackson Vintners Reserve. It's the best-selling restaurant chardonnay in the country. In the world of wine, small, unique and batch are selling points; many throw shade on K-J's popular entry-level chards. Wine snobs should note that JFW also makes a lot of interesting-and-delicious expensive wines under a number of labels at dozens of wineries. With $15 million in savings to date from sustainability initiatives, the company's wine also got a lot more interesting for TriplePundit.

JFW's founder, Jess Jackson, didn't set out to start a business. At the ripe old age of 55, he bought some vineyards intending to be a gentleman farmer. In his second year of production, Jackson faced a buyer's market and decided to make wine rather than sell his grapes at a loss. While his first batch didn't come out so well, he caught the vintner's bug and decided to become a winemaker.

Eighty-five percent of vineyards in Sonoma County, California, where JFW is located, are family owned, so it is no surprise that Jackson brought his extended family into the fold. His son-in-law is the CEO, his daughter Katie is VP of government relations and community outreach, and his second wife has served as chairman for over 25 years.

While he passed away several years ago, on a recent tour of several Jackson Family Wines properties, many employees shared fond memories of Jackson as if he was still at the helm. He built his company with a long-term view reminiscent of the Brundtland Commission's simple definition of sustainability: "development which meets the needs of current generations without compromising the ability of future generations to meet their own needs." With climate change and water constraints pushing all ag businesses to the brink in California, it is nice to see the Jackson Family Wines leadership carrying on a commitment to building a business that will last for generations.

It turns out conservation pays. JFW has saved $15 million through sustainability programs that include energy efficiency improvements. In addition to the financial savings, the firm has conserved an noteworthy 5300 megawatts of energy per year since 2008 by making energy efficiency a Key Performance Indicator (KPI). That's an impressive 51 percent reduction in greenhouse gas emissions organization-wide.

Not content to stop there, JFW plans to invest these savings in a Tesla energy storage battery and put solar panels on all of its wineries. The company installed its first fleet of batteries at La Crema winery. The batteries store energy produced by the solar panels so that it can be used when the sun isn't shining. The batteries also help manage costs by predicting usage patterns based on previous years and minimizing load spikes which keeps utility prices low and predictable.

By the end of 2015, JFW expects to be the largest solar producer in the wine industry with 6.5 megawatts providing about 30 percent of its current energy needs. The company has a goal to produce 50 percent of its energy needs from solar power by 2020. Over the 8 years since JFW began purchasing solar panels, the price has dropped by 80 percent, meanwhile utility costs have gone up 3 to 5 percent per year.

Of course, water consumption is a huge concern in any agricultural organization, and water conservation is at top of mind for the management of JFW. The industry as a whole uses and average 6 to 9 gallons of water to produce 1 gallon of wine. JFW is currently at 4.5 gallons for each gallon of wine, with a goal to get that number down to 3 gallons. "I look at the [California] drought as a tremendous opportunity to do things right," Julien Gervreau, senior sustainability manager for JFW, explained during a site tour last week.

To make water savings a priority, JFW has put a price on water of 3 cents per gallon so that it can measure savings, even though the company uses largely well water which is currently "free." The winemaker uses a variety of technical solutions to reduce water use like drip irrigation instead of sprinklers or flooding. It is also trialling buried drip tape which can water the roots directly eliminating evaporation.

Delivering the perfect amount of water is easier said than done in the world of wine. Good wine grapes come from a careful mix of soil, sun exposure and local climate conditions, called terrior. The correct mix takes years of experience to perfect. Grapes grow well on the slopes of hills, which means the terrior can be different from one hill to the next, and the proper water mix might differ as well. By using new technologies like drones to take close-up pictures of the vineyards, JFW can adjust the water volume in near real time. Careful water management becomes a key to growing the grapes that produce interesting-is-good wine, and it saves a bunch of water at the same time.

Other water-saving efforts include triple-reuse in the bottle washing line, wind inversion props to send warm air to the grapes during a cold snap to keep them from freezing (instead of coating all the grapes in water to create an igloo effect), and sending dirty water from the bottling process out to reservoirs where it can find a second life watering the grapes.

Through these efforts JFW has an average water savings of 11 million gallons per year. But all the high-tech stuff doesn't replace good old fashioned employee engagement.

As Mitch Davis, general manager at La Crema explained: "We're a winery; we make a lot of messes. Our first and most effective water savings tools were a broom and a squeegee." It's a good reminder that technology can bring us a long way, but education and common sense are often the right place to start.

Image credit: Jen Boynton

A Glimpse Into the Future of Driverless Automobiles

By Emma Bailey

In the Coronado National Forest, high above the saguaro cacti and desert yucca of southern Arizona, Forest Road 42 invites the intrepid motorist to cross creeks, dare winter snows and scale mountain peaks. Thousands of miles to the east, in Jacksonville, Florida, a state-of-the-art arterial highway system leads beach-goers and state senators through sprawling suburbs and across saltwater marshes.

Today, the same car, like a Ford F-150 or Buick Enclave, might see service in both areas. Tomorrow, at least if Google has its way, that may all change.

As of May 2015, Google's fleet of self-driving cars collectively logged more than 1 million miles. During the course of all that driving, they sustained only 12 minor accidents, though "not once was the self-driving car the cause," says program director Chris Urmson.

No one can ignore a car that's been driving itself for the human equivalent of 67 years. On June 25, Google announced the official arrival of its adorable, autonomous vehicles on the public roads of Mountain View, California. This summer the company plans to test its in-house built prototype, a two-seat, koala-bear-cute car equipped with a removable steering wheel, removable accelerator, removable brake and removable human.

Unlike its peers, who will incessantly gripe at its 25 mph maximum speed limit, the Google test car will not drive intoxicated. It will not respond to text messages. It will not fall asleep. It will not daydream about Chris Hemsworth. It will neither respond to raised fingers nor crush roving box turtles.

For that is the dream: a self-driving automobile with the reliability of a calculator. It has been estimated by the U.S. National Highway Traffic Safety Administration that 81 percent of car crashes are caused by human error. Could not those lives, that death lottery, be saved?

Other dreams fall in line. Some 45 percent of disabled American citizens still work. Autonomous cars could empower the other 55 percent. Costs of shipping would plummet as trucking companies lay off drivers. Valets and traffic jams would become as outdated as washboards and VCRs. If 20 percent of all cars were driverless, suggests one source, 724 million gallons of fuel would be saved, probably due to platooning and efficiency algorithms.

There are quagmires, to be sure. Casual automobile use may increase with access to technology, a variant of the traffic generation phenomenon. Expert Don MacKenzie, assistant professor of civil and environmental engineering at the University of Washington, said that automated driving pathways could lead to a 160 percent increase in automobile travel, bad news for the rapidly dwindling amount of available crude oil and natural gas.

And how would liability insurance be calculated? Who – or what – bears legal culpability in multi-vehicle collision? And all these dreams forget one thing: Forest Road 42 in the Coronado National Forest.

But first, the science:

A multitude of technologies work together to guide the Google driverless car. A GPS system informs the car of general routes and road regulations. A $70,000 LiDAR system, which uses a Velodyne 64-beam laser rotating 360 degrees and capturing 1.3 million readings per second, measures distances to surrounding objects. Stereo video cameras create overlapping fields of vision that record and follow road lines. Radar measures the speed of other cars. Altogether, approximately 1 gigabyte of data is gathered per second and fed into the car's brain to render a three-dimensional map.

Yet the system falters in heavy rains or snow. It flails on unimproved surfaces where road markings – sometimes even a road – do not exist. It cannot identify human hand signals.

Granted, most of the current obstacles to autonomous vehicle adoption can be surmounted. Vehicle-to-vehicle WiFi communication can prevent collisions. RFID chips in road signs can alert driverless cars to icy bridges and construction zones. Of course, these solutions present their own problems. You can hack a WiFi network, for instance. Unless you're a mega-powerful super-alien, you can't hack the human brain.

Where the road of autonomous automobiles will go, no one yet knows. But there will always be places, lost dirt roads and forgotten gravel pathways, where driverless cars will be unknown – because a human, unlike an intelligent automobile, can imagine what's around the next bend.

Image credit: Flickr/Roman Boed

Emma Bailey is a freelance writer and blogger from the Midwest. After going to college in Florida she relocated to Chicago, where she now lives with a roommate and two rabbits. She primarily covers entertainment topics and issues pertaining to the environment. Find her on Twitter @Emma_Bailey90

Managers: Help Your Charges See Your Vision

By Laura Morrissey

People can be difficult in any area of life. At work there has to be a certain way of dealing with people. In a leadership role, we all know that compassion is a necessity, and it would be good to see that being a compassionate leader and positive force pays off and that you have reason to be proud of your subordinates. Sometimes, though, we just don’t see this happen.

As a leader you’ve probably worked incredibly hard to get to where you are now. As someone with no fear of hard work, if your team isn’t do as well as they should, you’re probably the type to roll up your sleeves and work even harder to compensate. It’s in your nature, so that’s what you do.

By doing this, you are enabling this cycle to continue. You might make excuses for your staff or think that you need a different team of people to succeed. While one or two might be somewhat a 'lost cause,' you as a leader are the one that can do things differently and motivate your team so team cohesion and productivity are strong forces in its identity. Your overcompensating in order to set a high standard might be what you think is best for the team, but you are actually failing them by being a defeatist.

People end up in leadership for different reasons. Some aspire for a leadership role. Others fall into it after proving strong in their original job role. The transition from being a standout individual to a responsible manager is a challenging time due to the pressure to see results quickly. For some, there seems to be a knack for getting the best out of people whereas others are promoted into roles for which they aren’t prepared.

So, how do leaders who aren’t defeatists deal with a difficult team? They apply a mirror self image in order to improve behaviors and results within the team.

The mirror self image

The concept of the mirror self image is based on developing a vision in the people you work with, both as a team and individually. Michael Zwell, author of "Creating a Culture of Competence," has written extensively on the analytical shift required to move from story-based models to skills discussion of practical leaders.

Zwell believes that people tend to only do what they believe that they can do, or in some cases, less. We are all limited by our self-image and also derive beliefs about our capabilities based on past happenings. In short, your behavior and the results derived from the past mirror your beliefs. When the self believes in a wider range of possibility, the performance will also stand a chance of improving.

Nothing will change until leaders start to believe in themselves and their people

In most instances, nothing will change until an inspirational leader comes along. Even when this person comes along saying, "I believe in you," to each and every employee, the chances are that very little will change quickly.

It is likely that the workforce you are dealing with will all have different issues that are holding them back, all depending on their past experiences. For example, people that are low in assertiveness probably learned that they shouldn't take the lead or be assertive at a young age. The same principle applies for those who seem to be naturally low in initiative. Not just limited to childhood, negative traits that leave us limited in self-belief can develop at any age if we fall under the wrong guidance.

You, in your leadership role, have the potential to provide your people with a vision of where they are going and convince and inspire them there is a way of getting there together.

Connect the dots

A good manager of people will help every individual to connect the dots from corporate vision to the self and how each individual's behaviors and performance impact corporate success in terms of fulfilling the vision. This needs to be done in a way that suits each individual. Managers need to know what motivates every individual to create visions for individuals becoming bigger and better.

An organization's productivity is a direct result of the quality of the vision of its employees. Communicating the vision correctly and positively is the key. Restrictions can appear in the form of not wanting to correct or lecture individuals or not offering inducements or rewards because you feel the vision should be motivating enough in and of itself.

Invite the individuals that you lead to turn your visions into reality, and work with them to develop practical pathways for the investment of more effort and time into their personal and professional development. If they see you care about them, they will want to succeed in their jobs. Cohesive team coaching and regular encouragement of behavioral changes guide the individuals you work with toward their personal visions that will over time align with your own.

This is much more effective than showing displeasure and goading them whenever they fall short of your expectations or hopes.

What you do and don't do: The damage is equal

In your leadership role, what you do and don't do is equally as important an indicator as what is expected. When we only pick our errors, defects or omissions and demonstrate frustration, anger and disappointment toward the people we want to lead, then we direct their attention and energy in a negative direction. They will be much more likely to develop fears, anxieties and aversions. Failure to recognize effort and progress is also very discouraging.

By adopting the mirror self image approach, your management will no longer include ineffectual behaviors. Developing others is commonly the hardest part of a management or leadership role. Developing the ability to use vision to inspire people to become better versions of the self is not a job that we all intrinsically know how to do. It becomes even more difficult when development must intertwine with corporate vision that will ensure execution, as a vision without execution is hallucination. This matters even more so in the business world when results directly measure productivity.

Corporate results reflect the quality and size of the body of employee's self image. Inspire your employees by giving them reason to believe in themselves. Never doubt or withhold praise. We all have our own anxieties, and leadership needs to a guiding hand that will help each employee to overcome theirs.

Image credit: Flickr/Yahoo

Laura Morrissey is a writer for Everything Disc UK, a Team Cohesion tool for assessing human behavior in the corporate world. She loves to engage leaders and professionals globally through her motivational and leadership articles.

Funding Latin American Watershed Replenishment

By Margaret Uttke

Leaders often struggle to understand which choices are best when it comes to investing in sustainability. One way to improve is to enable stronger business case development and associated analyses of both tangible and intangible benefits connected to these investments.

In response to this challenge, FEMSA Foundation and Antea Group founded the Monetization Working Group (MWG) in March 2014. This cross-sectoral group of industry, NGO and private-sector leaders focuses on enabling better, more sustainable business decisions.

Group participants are collaborating on the development of a business case capability development curriculum. To test and refine this curriculum, FEMSA Foundation, Antea Group and the Nature Conservancy (TNC) have partnered on a series of pilot workshops delivered to select teams working on Water Funds – a series of water conservation initiatives involving local watersheds throughout Mexico, Central and South America, collectively known as the Latin American Water Funds Partnership.

These Water Fund initiatives not only impact the sustainability of the watershed itself; they also impact the local and global communities through impassioned and informed stakeholder engagement. By involving stakeholders and creating a clear understanding of the problem, the Water Fund teams are able to develop scientifically-based solutions that aim to benefit all those concerned with the local watershed. The teams’ ability to articulate the value of those solutions, however, is a key issue; and it represents part of the broader challenge the MWG is working to address on a global scale.

With that context in mind, I sat down with Carlos Hurtado, manager of sustainable development at FEMSA Foundation; Hugo Contreras, Latin American water security director for the Nature Conservancy; and Tod Christenson, senior consultant with Antea Group, to get their perspectives on this project and their ultimate goal of accelerating better, more sustainable business decisions.

Margaret Uttke: What are some of the challenges you face in communicating the benefits of these Water Fund initiatives?

Carlos Hurtado: First, they’re hard to convey because they are usually loosely defined – things like brand reputation and community involvement. We have to go out and dissect these vague ideas to quantify the value – to make what seems intangible easier to understand.

Hugo Contreras: To add to that, I work with the scientists on these teams, who are very interested in writing something a guy like me will understand … but not in terms that are simple or actionable for stakeholders. We need to bridge that gap; that means we need the science behind our solution to be easily understood.

Part of the problem is that our stakeholders have nothing to compare performance of these Water Funds to except information that is based on perceptions, not hard fact. There is also a gap between the time you start acting and the time you see the results from conservation efforts. Benefits to these longer cycles can be hard to see when you are faced with short term issues.

MU: Given these challenges your teams face, what are your goals for this pilot?

CH: We’re seeking to increase the skill and capacity of the Water Fund teams -- to better articulate the business case. But this project goes beyond our own organizations; we’re not alone in facing these challenges, and the workshop series is an opportunity for us to provide concrete examples and test broader concepts we’re developing through the Monetization Working Group.

Tod Christenson: As Carlos has indicated, leading into these workshops, we’ve developed a business curriculum to advance the business case development and delivery capabilities of these Water Fund teams as they work to engage various social, governmental and business stakeholders on specific watershed projects. Based on our discussions in the MWG, this includes several key components:

- Understanding the concept of shared business value

- Building and presenting an effective business case to targeted stakeholders

- Applying quantification and monetization principles to their existing investment

- Systematically monetizing benefit estimates and framing uncertainty

It’s really designed around the concept of creating change through collective action – and the way to ensure that is through the business case articulation.

HC: We think it’s important that participants will be able to apply content learning to their current Water Fund business case presentations utilized in stakeholder discussion today, better articulating how we may enrich these presentations for more effective engagement tomorrow; and practice the skill of monetizing the projects – in other words, deconstructing, quantifying and monetizing the business benefits to better communicate with stakeholders and spur effective collective action.

MU: What does success for this project look like five to 10 years down the road?

HC: First, we engage corporations and individuals – and by engage, I mean show them the reasons why it makes sense to act. Second, we will have convinced many cities that conservation is important and there is a cost and benefit they can internalize and communicate to their stakeholders.

TC: And we will have convinced those cities and other stakeholders of the tangible benefits to watershed conservation because TNC’s scientists and FEMSA’s sustainability leadership are able to clearly articulate the business case.

CH: For the Water Funds, I really want to see effective stakeholder engagement, meaning companies get involved not only because it’s good to do and they care about their city, but because it makes sense from a business perspective.

On a broader level, I would say sustainability is ingrained in the business conversation; we will start talking about sustainability and investments on every aspect -- supply chain, operations, etc.

MC: So let’s talk about the broader issue we’re grappling with: Why monetize sustainability investment decision-making?

TC: There are a number of reasons why. For example, the failure to monetize represents a clear obstacle to business progress. In a 2013 study done by the UN Global Compact and Accenture, thirty-seven percent of CEOs said the lack of a clear link to business value was a critical factor in deterring faster action on sustainability.

CH: That’s the common challenge we all face, isn’t it? Trouble translating common knowledge concepts or intricate solutions to hard and clear choices. It’s a lot easier for high level executives to make the right choice when the value is clear.

TC: Carlos nailed it. Today’s sustainability investment options are extensive, ranging from relatively straightforward energy conservation projects to complex multi-year supply-chain initiatives. While doing any or all of these could yield significant benefits, leaders often struggle to determine which will generate the greatest, most enduring value.

We need to enable stronger business case development and associated analyses of both the tangible and intangible benefits connected to these investments. That will lead to better investment choices and results.

CH: But I don’t want people to think it’s just about putting numbers to our projects – there’s a real opportunity to create a substantive, actionable model that bridges this gap between the practitioners and decision-makers. If we can compare, meaning monetize, these initiative benefits and speak clearly to both public and private sector outlets, that would be tremendous for companies and society. And that’s the whole premise behind our broader efforts with the Monetization Working Group.

MU: Beyond the pilot project, how is the Monetization Working Group tackling the issue of articulating value and enabling better decision-making?

TC: This curriculum we’re developing and testing is part of the answer. After extensive review and collaboration, the MWG has embarked on this initiative to build a Sustainability Investment Business Case Development and Monetization Curriculum geared toward sustainability professionals and business decision-makers.

CH: The idea is that we will enhance capacity in making intangibles tangible by providing tools and skills to better quantify the benefits, thereby strengthening overall investment business decisions.

HC: To put it another way, Carlos: complexity turned into simplicity. This curriculum project will allow us to grasp a complex concept and translate it into simple information that will enable us to better describe how sustainability initiatives like the Water Funds benefit the environment, local communities and our business investors – true examples of shared value.

MU: Why should other organizations get involved in this global effort?

CH: This is an issue that keeps me up at night, and I know FEMSA’s not alone in this problem. Monetizing sustainability can be hard to define, but this initiative promises to generate real knowledge and tools to advance not only FEMSA’s work, but the sustainability sector as a whole.

HC: As an NGO, the Nature Conservancy has always looked for alternative ways of communicating conservation and engaging people. We don’t believe in confrontation, we believe in convincing. For us, having this toolkit is a perfect fit, as it will help to translate our initiatives in clear terms that make economic sense and encourage collective action.

TC: We’re still at the beginning of this journey, and this is an opportunity for cross-sectoral companies to shape the conversation together, through both the MWG discussions and contributing to the ongoing curriculum-building efforts.

Want to become engaged in the conversation? Feel free to reach out to Tod ([email protected]) or Carlos ([email protected]) to learn more about the Monetization Working Group’s journey.

About Our Interviewees:

Tod Christenson, Senior Consultant, Antea Group

A consultant to private industry for more than 29 years, Tod partners with clients to develop and implement fit-for-purpose and innovative solutions to drive sustainability across the entire value chain. Tod is one of the principal innovators of Antea Group’s Accounting for Sustainability - AA4S solution, and the Director of the Beverage Industry Environmental Roundtable, as well as the Healthcare Plastics Recycling Council.

Hugo Contreras, Latin America Water Security Director, The Nature Conservancy

Before joining The Nature Conservancy in 2014, Hugo was a business development and institutional relations director for Bal-Ondeo, Mexico´s leading private water utility. In his more than 10 years with the company, he designed and implemented a new business model for private operators to provide services to local water utilities, as well as developed the first comparative study of the performance of water companies in Mexico. He has also led the environment and good government practice at Thesis Consultores, served as Chief of Staff for the Underministry for Planning, and Director for Natural Resource Economics at the Ministry of Environment, Natural Resources and Fisheries in Mexico.

Carlos Hurtado Aguilar, Manager of Sustainable Development of Water Resources, FEMSA Foundation

Carlos has directed FEMSA Foundation’s water related programs since its creation in 2008. From 2005 to 2008 he coordinated strategic projects for the Presidency of Mexico, municipal governments, and international organizations such as the United Nations while working as a Senior Consultant at the Graduate School for Public Management of Tecnológico de Monterrey. Before that he was Senior Analyst in structured finance for subnational governments at Banorte.

Image credit: Shutterstock

Margaret Uttke is the Solutions Marketing Manager for Antea Group, an international environmental engineering and consulting firm. She currently serves as the Communications Director for the Monetization Working Group, as well as the Beverage Industry Environmental Roundtable. Margaret works with clients to develop sustainable solutions with a business first approach.

Water and Corporate Culture at Golden State Foods

New emergency rules for water use are now in effect in California as government agencies and residents attempt to address long-term water needs as well as cope with immediate shortages.

Akin to its industry peers, Irvine, California-based Golden State Foods (GSF) requires lots in the way of water to produce and distribute food products for the likes of McDonald's and other restaurant chains and food retailers. Founded in 1947 and growing alongside California's burgeoning agricultural sector, GSF has been addressing the issue of water use and conservation directly since at least 2008 – not only in California, but across what's grown to be a multinational business.

Part and parcel of institutionalizing its overall sustainability strategy, GSF in 2014 set an organization-wide goal to reduce water consumption 20 percent by 2020.

“We recognize that water is a vital natural resource that is of utmost importance to our business, our associates, and the communities in which we operate,” Dimetria Jackson, GSF's director of sustainability and corporate social responsibility (CSR), told TriplePundit.

Doing its part to conserve water in California

Aiming to reduce water usage by 25 percent state-wide, the California State Water Resources Control Board in early May instituted the first mandatory water reductions in the state's history. The emergency water conservation measures went into effect this month. Since then, it has even gone to the extreme of curtailing diversions of water to senior rights-holders in the Delta, San Joaquin and Sacramento watersheds. Fiercely protected, some of these senior water rights, which are mostly owned by farmers, have been held since as far back as 1903.

Having developed and grown alongside water access and California agriculture, Golden State Foods is well aware of the history of water resources and use in the state – and it's intimately involved with water conservation efforts. Management takes the view that ingraining water conservation into its corporate culture will boost the company's economic performance and financial bottom line, as well raise consciousness and contribute to improving water management in California and beyond.

Its 2020, water conservation and broader sustainability goals, “will improve the overall efficiency of our operations; reduce the company’s environmental impact and its economic spend by reducing costs associated with wastewater, waste disposal, fuel and utility expenses; and engage our associates in corporate social responsibility and sustainability practices," Jackson continued.

GSF's distribution center in Chicago, for example, recently earned LEED Gold status. There, GSF harvests rainwater in a 40,000-gallon cistern. The harvested rainwater is used to irrigate the surrounding landscape. In addition, GSF Chicago makes use of ionized water, which is a by-product of the hydrogen fuel cells used to produce electricity, for cleaning warehouse floors.

GSF's water conservation and sustainability plans

More broadly, the GSF distribution centers dedicated to supplying food products for McDonald’s have collectively reduced their water usage by 2 percent compared to a 2012 baseline.

Across the organization, GSF uses reclaimed water for cleaning and landscaping, and it has installed high-efficiency plumbing fixtures in most of its facilities. Water and sprinkler audits, as well as leak checks, are conducted regularly. The company even has a hotline number posted in facility bathrooms and kitchens, so employees can call facility maintenance personnel to report leaks or water waste.

Company-wide, GSF's innovative water conservation policy encompasses:

- Using reclaimed water for washing vehicles, cleaning and irrigation

- High efficiency plumbing fixtures in most facilities

- Posting monthly water use at facilities to show progress toward water-saving goals

- Planting native, water efficient landscaping

- Conducting sprinkler and water audits

- Posting a hotline number in bathrooms and kitchens to report leaks or water waste to facility managers or maintenance personnel

Educating associates on water conservation and seeking their input.

The CSR and sustainability goals GSF instituted last year extend well beyond reducing water use, however:

- Reducing GSF’s carbon footprint by 20 percent

- Achieving zero waste-to-landfill at all facilities

- Implementing an EMS at 100 percent of its locations

- Incorporating renewable energy/alternative fuel in 100 percent of its fleet

- Active engagement of at least 75 percent of its associates in these programs

Furthermore, GSF is focused on improving wellness among its associates (employees), and responsible sourcing of the materials and other resources it needs to see to its day-to-day operations and long-term viability, Jackson added.

CSR-Sustainability Champions

GSF's efforts to ingrain CSR and sustainability into its corporate culture extends to the creation of its CSR-Sustainability Champions program. Led by a steering committee, CSR-Sustainability group members are drawn from across the organization's functional lines. Representatives from each of its domestic U.S. facilities, as well as IT, finance, and health and wellness, are actively involved in a range of activities, from setting CSR and sustainability goals to implementing associated initiatives.

GSF's commitment to assuring sustainable water use and, more broadly, the overall environmental sustainability of its operations is also evident in its Statement of Environmental Policy, Jackson noted. The policy, she pointed out, “recognizes environmental protection as one of our guiding principles and a key component of sound business practices.”

Looking ahead, “We recognize that there are many opportunities for improvement and through GSF’s top-down/bottom-up approach, management and associates continually seek to identify additional solutions to help achieve our goals and objectives,” Jackson told 3p.

*Image credits: Golden State Foods

Video: Jonathan Atwood, Unilever on "The ROI of Sustainability"

This article is part of a series on “The ROI of Sustainability,” written with the support of MeterHero. MeterHero helps companies and organizations offset their water and energy footprints through consumer engagement. To follow along with the rest of the series, click here.

At Sustainable Brands 2015, we asked thought leaders to define the ROI of Sustainability in their words. In this video, Jonathan Atwood of Unilever shares some thoughts:

https://www.youtube.com/watch?v=Rr7X230ZH6M

About Jonathan Atwood: Jonathan is Unilever’s Vice President of Sustainable Living and Corporate Communications, North America. He joined the company in May 2012 and is responsible for Communications, Unilever Brand, and the shape and implementation of the Unilever Sustainable Living Plan in North America.

In 2007, Jonathan founded Common Way Communications, a public affairs and ommunications consultancy based in Vermont. There he worked as a consultant to the Global Issues Group, a coalition of global chocolate and cocoa processing companies and trade associations working on responsible labor practices in the cocoa sectors of West Africa.

Carbon Pricing Spurs Economic Development in Oregon

By Sheldon Zakreski

When the Oregon legislature passed a law in 1997 requiring new power plants to reduce carbon emissions, it was seen as a significant step in combatting climate change. Looking back almost 20 years later, it’s also played a role in developing rural economies throughout Oregon.

The Oregon Carbon Dioxide Standard (the Oregon Standard) requires new power plants to reduce their net carbon dioxide emissions to 17 percent below the level of the best existing gas combustion-turbine plant anywhere in the United States. There are three ways to comply with the Oregon Standard, but the most popular option is to provide funding to the Climate Trust in exchange for carbon offset credits. To date, all facilities have chosen this option, entrusting the Climate Trust with approximately $30.8 million for projects that avoid, sequester or displace greenhouse gas emissions.

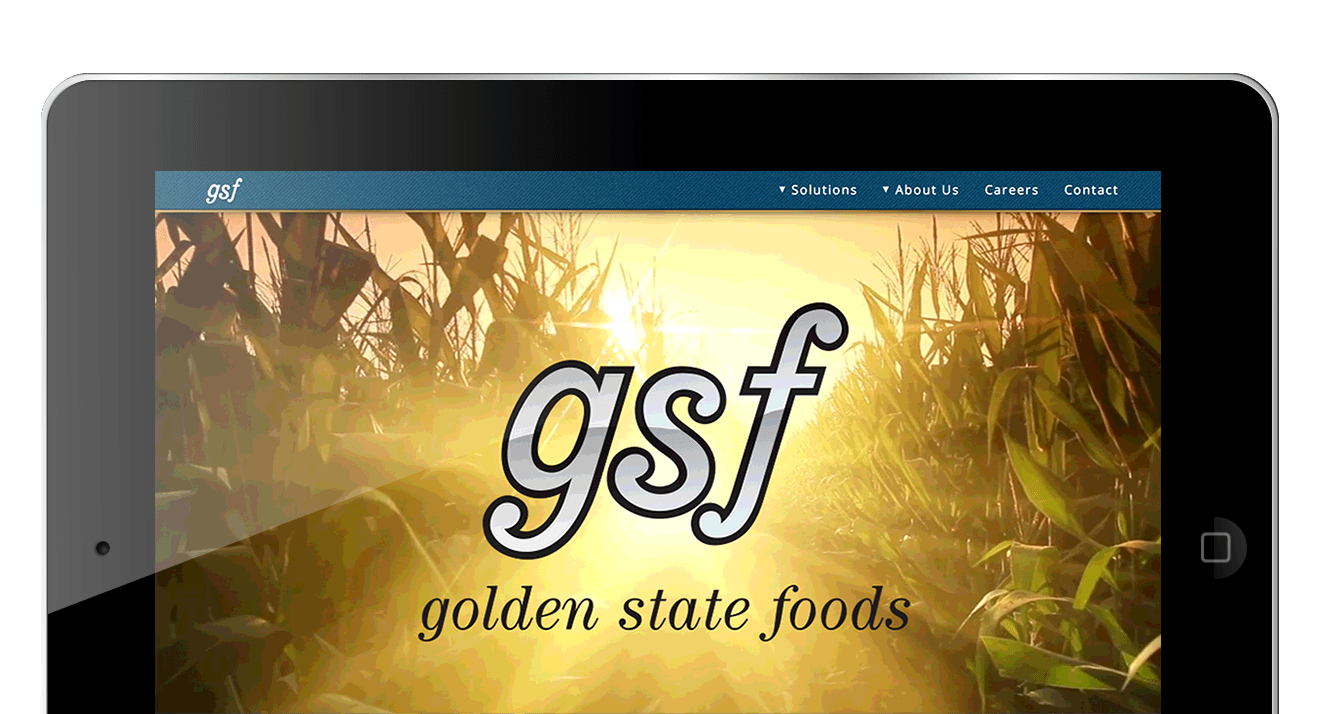

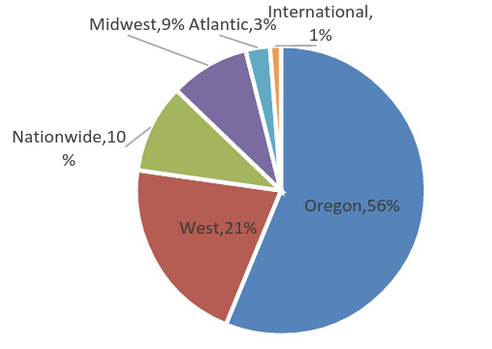

Although the climate effect of emission reductions projects is the same globally, decisions about where to spend carbon finance can have a huge localized impact. For this reason, the Trust has strived to support emission reduction projects in our home state of Oregon. For every $1 of Oregon Standard funding we’ve committed to offset projects, 56 cents goes to Oregon offset projects. This amounts to almost $8.6 million of the $15.3 million in contractual commitments the Trust has entered into with offset project owners using Oregon Standard funds.

The chart to the below shows where our funds go. With more than three quarters going to the West Coast and Alaska, it shows that thinking globally but acting locally is possible when it comes to addressing global climate change.

The evolution of the types of Oregon projects we’ve funded over the years is indicative of the shift toward rural projects. In our first several years, 2000 to 2005, funding was largely directed toward transportation and energy efficiency projects in the Portland area. These investments reflected the early days of the offset market and lack of funding options for these types of projects.

Although reducing energy and transportation emissions are still important, there are a number of clean energy organizations that have emerged in Oregon to fulfill this financial role. Additionally, over time, the offset market has evolved to focus on developing project standards that avoid methane emissions from organic waste and sequestration of carbon on forestland and farmland.

These trends prompted the Trust to work with the Oregon Legislature in 2011 to expand the Oregon Standard to include not just carbon dioxide, but also methane and nitrous oxide, as greenhouse gases eligible to receive project funding. It made little sense to miss out on opportunities in our home state to reduce emissions because these two potent greenhouse gases were not included in the initial legislation.

Not only did this change allow the Trust to spend more money in Oregon, but it also facilitated a shift to projects in rural parts of Oregon; methane destruction projects generally occur on dairy farms or near transfer stations that receive large volumes of food waste. As a result, the Trust’s offset funding has found its way to the Oregon towns of Boardman, Junction City, Roseburg and Tillamook. In addition to lowering emissions, offset funds have helped to stimulate economic development in these areas. For example, a typical biogas project creates roughly 10 construction jobs and three permanent jobs.

The increased offset market focus on forest carbon projects enabled the Trust to fund improved forest management practices at the city of Astoria’s watershed. This Forest Stewardship Council certified forest is already managed to a high environmental standard, but funding from the Trust has enabled the city to keep even more trees in the ground sequestering carbon.

The debate on who and what areas of the country will bear the costs of putting a price on carbon will continue, but as carbon markets continue to grow and evolve, so will opportunities. Going forward, opportunities to reduce emissions, while also realizing economic gains from doing so, will increasingly be found in rural areas. This is a win-win, as putting a price on carbon will not only combat climate change, but also fund the economic development of rural America.

Image credit: Flickr/Paul Nelson

Sheldon Zakreski is the Director of Risk Management for The Climate Trust

5 Reasons Companies Should Take Green Audits More Seriously

By Keith Tully

Green audits are an essential means of figuring out how large or small a company’s carbon footprint really is, but their usefulness is not yet fully appreciated by everyone.

Here’s a look at five reasons and some explanations of why green audits should be seen as positive actions by small, medium and large enterprises alike.

1. Efficiency gains

The process of carrying out a green audit does not deliver benefits in and of itself. However, the process of reporting the findings and opening up access to figures on energy consumption can be very impacting in terms of influencing behavior within even the largest of companies.

In many ways, a green audit gives a business a roadmap for finding efficiency gains. This can be very useful in any circumstance but particularly where a company is big enough that even subtle efficiency tweaks can bring very notable rewards.

2. Financial savings

Every business in the world wants to do more with less and save money in any way that is possible and does not impact on revenues or profits. Conducting green audits gives companies clear sight of where they might be able to make major cost savings.

Furthermore, the cost savings that green audits are able to highlight and bring to the attention of executives are often relatively straightforward to deliver and sustainable over extended periods of time. In short, the financial incentives for being more energy efficient are rendered very obvious through green audits, and they’re presented in the language of dollars and cents, which has a tendency to help turn strategy ideas into action points very quickly.

3. Competitive advantage

Being energy inefficient and contributing on a massive scale to carbon emissions on an annual basis is not something that is yet completely outlawed or an immediate or obvious problem for companies from a competitive standpoint. However, the impacts of corporate contributions to carbon emissions are high on political agendas around the world.

Increasingly, laws are being introduced with the aim of incentivizing companies away from the use of non-renewable energy, and that trend is only likely to continue. So, businesses can effectively secure a competitive advantage by using green audits as a means of preparing for future ‘green’ regulations and by equipping themselves with a full and robust understanding of how their own energy use stacks up.

4. Brand perception

Relatively few companies are in a position to be genuinely proud of their own record when it comes to carbon emissions, but those that are can enjoy benefits of an improved perception of their brand. So, for businesses whose contributions to climate change are relatively slight, there is potentially a lot that can be gained from conducting a green audit as a means of quantifying that good performance.

Consumer-facing brands are perhaps best placed to take commercial advantage of being a ‘green’ company because there’s every chance a proportion of their customers will be environmentally conscious and impressed by a low carbon emissions score. But business-to-business operators can also take advantage of their ‘green’ status when it comes to recruitment and establishing a brand with which potential employees have positive associations.

5. Audits result in real changes

Leaving aside the business case for conducting green audits for a moment and getting back to the bigger picture, we know that carbon reporting instigates changes that make a real difference. The end result of keeping a close eye on how efficient or otherwise a business is when it comes to their energy use is reduced emissions and more energy-conscious companies. And, given the scale of carbon emissions contributed by businesses worldwide each year, any means of making a positive impact should be given every possible backing and chance to succeed.

In the U.K., green audits are being made mandatory for businesses of all sizes, and signs are that all manner of operators are finding easy ways to save money and cut their carbon emissions as a result. There’s every reason to think that the more green audits there are being conducted around the world, the more money will be saved businesses and the lower corporate carbon emissions will become.

Image credit: Flickr/Tanya Hart

Keith Tully from Real Business Rescue is a leading corporate insolvency specialist. He knows what it takes to keep struggling businesses afloat and what qualities are required of company directors.