Operationalize Corporate Purpose to Realize Benefits for People and the Brand

Corporate purpose has made the leap from nice-to-have to materially important: Companies that enable employees to fulfill their personal purpose through their work reap a multitude of benefits in the form of improved loyalty and retention, higher levels of engagement and achievement, and improved health and personal resilience, according to a McKinsey study on the role of purpose in the employee experience.

But fewer than half of executives believe that purpose makes a difference, according to an earlier McKinsey survey. More recently, research from MIT Sloan Management Review found that half of the executives they surveyed believed that the role of purpose has been overlooked in driving business performance.

Where’s the disconnect?

To realize the benefits, connect people to purpose

Before we go any further, it’s worth noting the opportunity at hand for leaders to engage their employees more fully in their organizations’ purpose.

In the aforementioned McKinsey study, 70 percent of the employees surveyed said their sense of purpose is largely defined by work. However, a significant gap exists between executives and frontline employees when it comes to how people perceive the impact of their work on purpose: 85 percent of executives and upper management believe they are living their purpose at work, whereas only 15 percent percent of frontline employees agreed.

Worse, nearly half of these employees disagreed, compared with just a smattering of executives and upper management.

Keep these data in mind as we consider how purpose contributes to profit.

How corporate purpose contributes to profitability

Corporate purpose drives profitability from multiple angles. Research from Gallup gets even more granular, finding that improving employees’ connection to purpose by only 10 percent delivers an 8 percent decrease in turnover and a 4.4 percent increase in profitability.

The bottom-line savings a company would realize from improving employee retention are obvious. The influence of purpose on consumer behavior may be less visible, but the impact is potentially even more significant: According to research from PwC, a huge majority of consumers — 76 percent — would not hesitate to vote with their wallets and cease doing business with a company that treats its people, the environment or the communities in which it operates poorly.

Less visible to the naked eye is the profound impact purpose can have on providing clarity to the organization.

Guiding and motivating people

Claudia Gartenberg, a preeminent researcher on corporate strategy purpose, and her coauthors offered this definition of purpose — “ a set of common beliefs that are held by and guide the actions of employees” — in the paper titled, “Corporate Purpose and Financial Performance.”

Gartenberg and her fellow researchers surveyed approximately 500,000 at a sample of U.S. firms, and concluded that “high purpose” firms come in two forms:

- Firms that are characterized by high camaraderie between workers

- Firms that are characterized by high clarity from management

The researchers found that firms exhibiting both high purpose and clarity “have systematically higher future accounting and stock market performance, even after controlling for current performance, and that this relation is driven by the perceptions of middle management and professional staff rather than senior executives, hourly or commissioned workers. Taken together, these results suggest that firms with employees that maintain strong beliefs in the meaning of their work experience better performance.”

Operationalizing purpose

The opportunity to operationalize purpose is front and center at the upcoming 3BL Forum: Brands Taking Stands, taking place on October 25, 2022, at New York City’s iconic Pier Sixty.

Candid discussions about the role of corporate purpose within an organization, and the effect of the headwinds we’re experiencing today on brand commitments, are on tap. Learn from (and network with) senior leaders at top-tier brands as they address meeting stakeholder expectations for ESG, sustainability and diversity during this period of constant change.

TriplePundit readers can receive 35 percent off their in-person tickets using the code 35FORUM2022 when prompted.

Image credit: Czapp Árpád via Pexels

A Drop in the Bucket — Billionaire Philanthropy Pales in Comparison to Capacity for Change

Billionaire philanthropy has been big news as governments, corporations and individuals alike awake to the immensity of the dawning climate crisis. Michael R. Bloomberg and Bloomberg Philanthropies recently committed $85 million to combat pollution from petrochemical plants in the U.S. and $204 million to further marine preservation through the Bloomberg Ocean Initiative, as well as hundreds of millions more towards sustainable energy transitions across the globe. Likewise, the Bill and Melinda Gates Foundation pledged $1.27 billion toward the United Nation’s Sustainable Development Goals (SDGs). Overall, the 25 biggest philanthropists in the U.S. had donated a cumulative $149 billion as of January of last year, according to Forbes.

Giving it away hasn’t hurt them any, however, as together they were still worth just under $800 billion when their assets were tallied by the business magazine. With more wealth than the majority of the U.S. population combined, billionaires have the financial power to affect change in a way that no other group of people does. With this unique position comes not just the moral imperative to use billionaire philanthropy to repair the damage done by the unfettered consumerism upon which their fortunes have been built, but also a responsibility to their fellow inhabitants of planet Earth.

Humanity took giant strides and accomplished massive collective feats in order to arrive at the place we are today. Together, we have achieved what our ancestors would see as unfathomable technological advancement and an unimaginable accumulation of wealth. The very conditions that billionaires rely on to even exist were borne out of the sum total of human endeavors — not their individual contributions. But — while it has taken all of us to get us where we are — the environmental costs and financial benefits have been so unequally distributed that, overall, billionaire philanthropy appears paltry in comparison to the bulk of issues facing humankind.

Recent comments by Bill Gates seemingly peeled back the curtain — exposing his aversion to degrowth and motivation to maintain the status quo through yet-to-be-invented technologies. This willingness to sacrifice the Global South on the altar of profit and overconsumption in the Global North begs the question — are billionaires really donating toward the benefit of society, or are they just investing in their own future markets?

Considering the immense fortunes that they continue to amass regardless, it’s a fair inquiry. The U.N.’s predictions on the severity and immediacy of the climate crisis make it clear that life on Earth is at a crossroads. Humanity can choose sustainable and equitable resource distribution across the globe or we can continue on the path to disaster with our hopes pinned to those who seem to be seeing the impending crisis as an investment opportunity. For all of the tangible and financial help that the billionaire philanthropy class has given back, by shoring up the systems that keep their profits rolling in instead of supporting massive societal change, they’ve made it clear where their loyalties will always lie.

Although most billionaire philanthropists continue to get richer while giving away small percentages of their exorbitant wealth, there are a few ex-billionaires who stand out from the pack. Among them, Yu Pengnian and Andrew Carnegie — who gave away all of their wealth before they passed — and Charles “Chuck” Feeney. Now in his 90s, Feeney lives a modest, fortune-free lifestyle after donating all but $2 million in retirement.

Feeney is living proof that billionaires can give back to society without expecting a return on their investment. Unfortunately, while his de-fortuning may have moved Bill and Melinda Gates along with Warren Buffet to form the Giving Pledge, his fellow billionaires have failed miserably at following in his footsteps. If only more of them would take his advice: "I cannot think of a more personally rewarding and appropriate use of wealth than to give while one is living — to personally devote oneself to meaningful efforts to improve the human condition." We would stand a much better chance at fighting climate change if the wealthiest among us finally recognized their responsibility to the people and the planet that made them that way, after all.

Image credit: Adobe Stock

Oddly Enough, Plant-Based Protein Isn’t Tanking; In Fact, It’s Not Far from Taking Off

Plant-based protein is having a moment, and right now it’s not quite a good one. Sales are down in the U.S., punctuated by the meat giant JBS’ recent decision to shutter its Colorado-based Planterra Foods. The price of plant-based alternatives is still too pricey for many American consumers, especially after the cost of meat has largely flatlined, and even declined, after pandemic-induced supply chain problems sent the cost of beef and other meats soaring during 2020 and 2021. Then there was last month’s saga about Beyond Meat’s COO and his Mike Tyson moment: It was a allegedly a nose, not an ear, but that didn’t exactly spark a public relations lift for what analysts largely describe as a beleaguered segment within the global food industry.

But the plant-based protein industry, even here in the U.S., isn’t beleaguered, and investors should be confident in their current and future stakes in these companies if they’re seeking long-term returns. Sure, Beyond Meat’s recent struggles have taken up a lot of the oxygen in the room, and Impossible Foods did recently lay off about 6 percent of its workforce. On the latter point, the company responsible for reinventing Burger King’s Whopper claimed many of those roles were redundant or unnecessary under its reorganization plan, and says its retail sales have kept surging year after year.

The long-term fundamentals for the plant-based protein sector are sound

But not everyone is bemoaning the current trials and tribulations of plant-based protein companies. One of them is Bloomberg’s Amanda Little, who in a recent op-ed says investors should shake off what is now appearing as a bear market and be bullish on the future of these alternatives to meat. She points to a BCG report from 2021 that predicts plant-based alternatives to meat and dairy will comprise 11 percent of the global protein market — in the event she’s off by a few percentage points, that amount will still be sharply up from what is now about 2 percent today.

“Remember, too, that alternative meats are competing against a subsidized industry that has had more than a century to achieve good economics,” Little writes. “Even in the U.S., we can expect a price advantage for faux meats to arrive soon enough. The rising costs of water, feed and supply chain disruptions in the climate change era will increase the cost of livestock production and, eventually, consumers will be paying a green discount for alternative products rather than a green premium.”

Oddly enough, this vegan fast-food chain is ignoring all the polemics about meat alternatives

One company that is ignoring the current chatter over the state of the U.S. plant-based protein market is Toronto-based Odd Burger. Five years after opening Canada’s first vegan fast-food eatery, the company says it plans on launching franchises in 25 U.S. states, and no, California, New York, Oregon nor Washington are on the list: States currently in the company’s crosshairs include Alabama, Iowa and Wyoming.

While the company offers its own vegan takes on fast-food standbys such as the Big Mac, Egg McMuffin and Whopper, meat-free gyros, chicken sandwiches, tacos, milkshakes and even Nanaimo bars are on the menu. The company has operated its own manufacturing plant since 2018.

"We could not be more excited to initiate our U.S. expansion and extend our brand to millions of people in the U.S. market," says James McInnes, Co-Founder and CEO of Odd Burger, said in a public statement. "We have already received hundreds of inquiries from potential franchisees in the U.S. and now we will begin the process of finding the perfect franchise partners to work with."

McInnes joins Little in viewing the future of plant-based protein as on that is bright. Part of such optimism stems from two undeniable trends: The taste, texture and quality of these alternative to meats keeps improving, while the environment for the global meat industry will only become a more difficult one in which to operate. “The rising costs of water, feed and supply chain disruptions in the climate change era will increase the cost of livestock production and, eventually, consumers will be paying a green discount for alternative products rather than a green premium,” concludes Little. “For all the difficult headwinds plaguing the plant-based industry today, there are still more powerful tailwinds pushing it forward.”

Image credit: Odd Burger via Facebook

Levi Strauss Shows How to Lasso the Big Lie

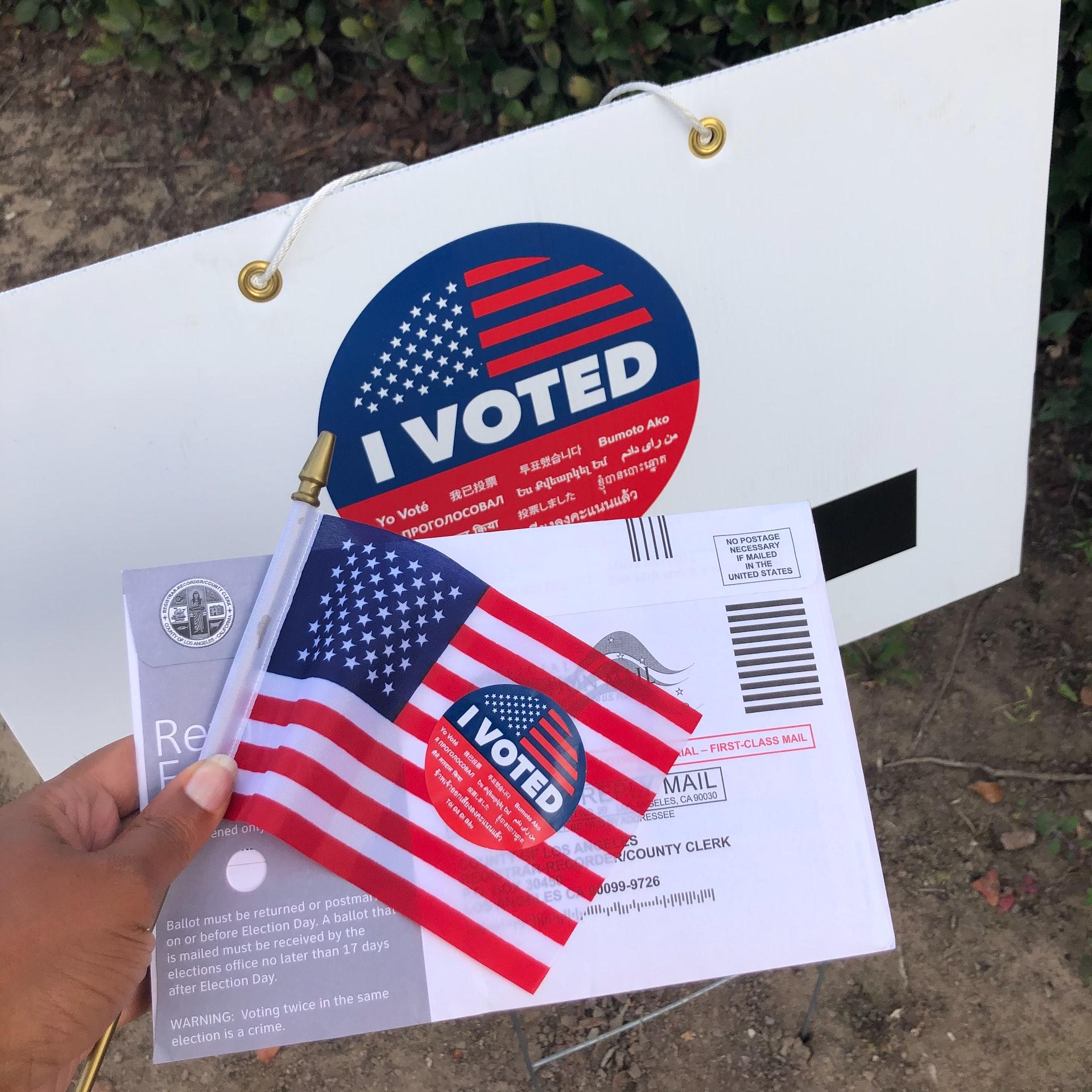

Former U.S. President Donald Trump began circulating false claims about voter fraud long before election day in 2020. Since then, millions of his followers, influencers and allies in elected office have worked to amplify the “Big Lie” about voter fraud through a constant barrage of repetition. Fact-based corporate get-out-the-vote efforts like those of Levi Strauss can help cut through the noise, and they are needed now more than ever before.

Levi Strauss understood the warning signs in 2020

Apparel maker Levi Strauss set a high bar for corporate get-out-the-vote (GOTV) activity during the 2020 election cycle. The company seemed to be aware, even back then, of warning signs that Trump would be the first president in U.S. history to refuse to participate in the peaceful transfer of power.

By 2020, the legalized suppression of Democratic-leaning voters had already been normalized in many states and local jurisdictions through onerous identification requirements, restrictions on voting by college students or inadequate provisions for polling locations.

Levi's may have also been alerted by the actions of newly confirmed Postmaster General Louis DeJoy. The election cycle of 2020 was already disrupted by the COVID-19 pandemic, and DeJoy added to the confusion shortly after taking office in June of 2020, partly by carrying out changes in service without first obtaining the required permission from the Postal Regulatory Commission.

Editor's note: Be sure to subscribe to our Brands Taking Stands newsletter, which comes out every Wednesday.

Context is important. The Postal Regulatory Commission is an independent federal agency, but DeJoy was nominated to his office by the Postal Service Board of Governors, which by then was dominated by appointees of the Trump administration.

Some of the changes ordered by DeJoy, such as the removal of mail boxes and sorting machines, had been previously scheduled before the pandemic. However, DeJoy also altered delivery rules on his own initiative without approval from the Postal Regulatory Commission.

Last week, federal judge Emmett Sullivan ruled that the changes did not violate federal voting laws. However, he did find that the changes caused harm to states and localities by obstructing their efforts to prevent the spread of COVID-19 and provide safe alternatives to in-person voting.

As reported by CNN, Judge Sullivan singled out the unapproved delivery rules as the primary factor impacting mail delivery after DeJoy took office, over and above the confusion caused by his other orders. “…the record evidence demonstrates that changes to and impacts on the USPS transportation schedule regarding late and extra trips were the primary factor in affecting service on a nationwide or substantially nationwide basis,” Sullivan determined.

Levi’s gets the message out

With watchful eyes on the Postal Service, DeJoy is less likely to impose new changes shy of Election Day 2022. But waves of new state-based election regulations have swept through the U.S. after the failed insurrection of 2021, with an outsized impact on Democratic-leaning voters.

Among those voters are college students. Although college students generally have the right to register to vote through their college address, the Brennan Center for Justice notes that state and local authorities have thrown up numerous obstacles in their path.

As a partial solution, this year Levi Strauss has focused its get-out-the-vote efforts on community colleges, where students are more likely to reside off campus at a permanent address. On Sept. 15, the company announced a new voter registration drive covering 150 community college campuses in 40 states.

“This initiative will complement our broader efforts to reduce obstacles to civic participation through public awareness campaigns, employee and corporate engagement, advocacy and nonprofit support focused on organizations led by people of color and leaders working to advance equity,” the company explained on its “Unzipped” blog.

“Community colleges account for just over 40 percent of U.S. undergraduates, but historically see lower voter registration and voting rates than four-year universities,” the company said.

Levi Strauss is partnering with the organizations Campus Takeover and Students Learn Students Vote coalition. The company also highlighted National Voter Registration Day at Miami Dade Community College in Florida and Austin Community College District in Texas, in partnership with the organizations Engage Miami, MOVE Texas and Pizza to the Polls.

Levi Strauss cited Clarissa Unger, co-founder and executive director of the Students Learn Students Vote coalition, who said that “community colleges are home to some of the most diverse and representative student populations.”

“When community college students mobilize around elections and engage with our democracy, they drive community-wide change and we all benefit from the more vibrant electorate they create,” she added.

Take a page from Levi’s playbook

Corporate leaders who have suddenly become aware of the role they can play in voting rights are too late for National Voter Registration Day 2022. That came and went on Sept. 24.

However, it is not too late to encourage eligible citizens to register to vote. Almost half of U.S. states allow registration less than 30 days before election day. Some allow same-day registration, including the District of Columbia. Businesses that want to get involved can check their state’s registration deadline at usvotefoundation.org.

Meanwhile, there is still plenty of time to help ensure that all registered voters have a free and fair opportunity to cast their ballots. Businesses can start by following the Levi Strauss playbook.

The company continues to provide employees with paid time off to vote, in support the Time to Vote movement, which it co-founded.

Employees of Levi Strauss are also encouraged to volunteer at voter registration drives through a partnership with the organization Headcount, and to sign up as poll workers on election day. The company also continues to reach out to its employees with registration and polling place information.

Other partners of Levi’s include the ACLU Voting Right Project, Campus Takeover, Civic Alliance, Citizens and Scholars, Hunger Free America, Houston Justice and National Voter Registration Day.

Prepare for the worst, expect the best on Election Day 2022

The Levi Strauss message to other companies is a simple one. Business leaders do not have to reinvent the wheel or fly solo. Nonprofit civic participation organizations with seasoned, experienced staff are readily available to help them support voting rights.

That help is needed now more than ever, as the Big Lie continues to seep into the nuts-and-bolts of the election process.

Voting rights observers have already raised the alarm over the spread of the Big Lie poison into polling places and elections offices, raising the possibility that ordinary poll workers — many of whom are seniors — will be intimidated and disrupted by Big Lie voters, by other poll workers recruited by Big Lie amplifiers, or by random citizens threatening violence.

Danielle Samaniego, the editor of Levi’s “Unzipped” blog editor, alerted voters that they may encounter roadblocks when casting their ballots. “Election Day will not go perfectly. You may be discouraged. Obstacles will abound,” she wrote. "Vote anyway.”

Samaniego wrote those words back in August of 2020. Two years later, corporate leaders should be on a mission to stand firmly with their employees, and all other voters, as they exercise their right to vote in 2022.

Image credit: Janine Robinson via Unsplash

Hispanic Workers: Still Overlooked and Undervalued

Hispanic Heritage Month is a time to reflect and remember the contributions this widely diverse group of people has made here in the U.S. But it’s also fair to note that this country has largely fallen short in valuing Hispanic workers, a reality that became even more glaring during the pandemic.

Hispanic workers suffered overwhelming job losses during the COVID-19 crisis. In the case of Hispanic women, their unemployment rate in the U.S. at one point soared to just over 20 percent.

Currently, the unemployment rate for both Hispanic men and women is low, retreating close to pre-pandemic levels. But that prior spike in unemployment reflects the fact that Hispanics have long been working disproportionately within the service industry. And many of these workers are still looking over their shoulders at the threats of economic insecurity while finding themselves too often working in low-wage jobs. Bottom line: If people who were let go during the pandemic are simply returning to the same jobs, that’s hardly progress — and they still lack opportunity to build the skills and wealth needed to stay afloat in this 21st-century economy.

The recent massive legislation packages passed in Washington, D.C. — including the Infrastructure Investment and Jobs Act, the Inflation Reduction Act, and the CHIPS and Science Act — all include provisions that could open the doors to more economic opportunities while taking on America’s stubborn ethic and racial wealth gaps, Rose Khattar and Jessica Vela of the nonprofit think tank Center for American Progress observed in a recent op-ed for MarketWatch. These bills include opportunities for STEM education, tax credits for employers who hire and train apprentices, and funds for minority-supporting universities and other institutions.

Editor's note: Be sure to subscribe to our Brands Taking Stands newsletter, which comes out every Wednesday.

To be clear, such an economic transformation could occur if these programs were deployed with a focus on equity. But such an approach would mean taking on an economic system that has long relegated certain groups of people to a limited set of jobs. In the case of Hispanic workers, most jobs available to them have overall been relatively low-paying, high-risk, and rife with violations that have left too many people vulnerable to problems such as wage theft and safety violations.

“Equitable implementation of all these new measures will mean that Hispanic and Latino people have access to these good jobs and that they are not merely returned to their pre-pandemic status quo,” Khattar and Vela wrote. “And, while it’s critical to expand opportunities in male-dominated fields to women, this must go hand in hand with improving the quality of work where Hispanic women are overrepresented today, such as investing in care and domestic work.”

In understanding the challenges many Hispanics keep confronting in the U.S. job market, it’s first important to acknowledge that this group is hardly monolithic. Within the wider Hispanic community, long-term economic security and job opportunities have long been marked by factors such as colorism. Further, as the Center for American Progress has pointed out, once one gets past lumping this group together as “Hispanic,” it’s apparent that some ethnic groups are doing relatively well when gleaning through the macroeconomic data. But within other ethnicities, including Mexicans and some Central Americans, many are working within a limited variety of jobs that pay low wages, a problem some analysts describe as “occupational segregation.”

The problem isn’t the ability to find a job or attain employment — across the board, all Hispanic ethnic groups have higher employment-per-population rates in the U.S. than that of white, non-Hispanic people. The challenge for many is finding jobs that are secure and pay a decent wage.

It’s clear that the recent actions of policymakers have unlocked new opportunities for underserved communities, including Hispanic workers and their families, with the new federal programs that have launched over the past 20 months. One challenge, however, is whether those opportunities will exist once such funds are distributed to state and local governments.

The private sector also has a role in addressing the opportunity and wealth gaps that Hispanic workers often face. Companies can start by responding to the growing pressure that shareholders and investors are putting on companies to diversify not only their workforces, but more importantly, corporate America’s C-suites and boards. And that focus on a more diverse and workforce means going beyond the proclamations and press releases that call for a “celebration” of Hispanic Heritage Month.

One executive who’s been speaking out on this issue is Jose Minaya, CEO of the asset management firm Nuveen, a subsidiary of the financial giant TIAA. In a recent interview with Insider, Minaya said: “Inclusion is a massive business opportunity. Even if you don't believe in research showing the importance of diversity and inclusion — if you don't do it well, you just ain't getting the money at the end of the day."

Image credit: Joel Muniz via Unsplash

When it Comes to Coal, Climate Action Delayed is Climate Action Denied

Last week, the German nonprofit Urgewald and 40 partner NGOs released the 2022 Global Coal Exit List (GCEL), which includes data on thousands of energy companies and their subsidiaries. The 2022 update shows that although the International Energy Agency (IEA) has recognized that no new coal mines or plants can be developed after 2021 in order to meet the Paris Agreement’s goal of limiting global warming to 1.5 degrees Celsius, almost 500 companies are developing new coal plants today. Coal is the world's highest-polluting fossil fuel, responsible for approximately a third of the planet’s total emissions.

Despite promises, coal production is surging

There are approximately 6,500 coal plants in the world, and humanity’s success in limiting global warming to 1.5 degrees Celsius this century will depend on how quickly this fuel can be phased out. However, energy companies are delaying phase-out plans. According to Urgewald, in order to meet the 1.5 degree Celsius goal, the U.S. will need to phase out 30 gigawatts worth of coal-fired energy capacity each year between now and 2030. Last year, the U.S. only phased out 8.4 GW. While some energy companies have announced phase-out plans, many of them plan to retire this source of power outside of the timeline necessary to limit warming to 1.5 degrees Celsius. Only five of the 1,064 companies listed in the GCEL have a phase-out plan that aligns with the Paris Agreement.

China and India are the world's two largest coal producers, and Coal India, the world’s largest mine developer, has a stated goal to double its production by 2025. Heffa Schuecking, director of Urgewald, said: “Pursuing new coal projects in the midst of a climate emergency is reckless, irresponsible behavior. Investors, banks, and insurers should ban these coal developers from their portfolios immediately.”

Investments in fossil fuels haven't stopped

The coal industry received more than $1.5 trillion in financing from 2019 to 2021, with 12 banks providing 39 percent of the global sector's underwriting. Eleven of the 12 underwriting banks are Chinese, and one is American: JPMorgan Chase. In fact, JPMorgan Chase, a member of the Net Zero Banking Alliance, is the world's seventh-largest coal industry lender, according to Urgewald's data. The only U.S. bank to lend more to the industry is Citigroup, which is also a member of the Net Zero Banking Alliance, a U.N.-convened group of banking companies that have pledged to align their portfolios with net zero.

“Many financial institutions justify their continued investments in the coal industry by claiming that they want to help these companies transition," Schuecking noted. "Our data, however, shows that the vast majority of companies with thermal coal related business are not transitioning. They are either developing new coal projects or dragging out the life of existing coal assets. Delaying has become a new form of climate denial.” Twelve banks issue almost half of the loans to this global industry.

A 2018 report from the Intergovernmental Panel on Climate Change (IPCC) found that coal-fired power needs to be reduced 78 percent by 2030 in order to limit global warming to 1.5 degrees Celsius above pre-industrial levels. However, 2021 saw an unusual jump in coal use of more than 8 percent, and emissions from the energy sector rose 7 percent as a result. The increase in this source of fuel was the result of an increase in electricity demand, a decrease in hydropower availability due to drought and high natural gas prices.

A shift has occurred in the U.S. as well

Though U.S. coal-fired power generation had been decreasing since 2017, the country saw a 14 percent jump in coal power in 2021. Half of the countries that pledged to phase out coal use at the U.N. COP26 climate talks in 2021 recorded an increase in such power generation last year, too. Some analysts are expecting another power spike in 2022 as Europe grapples with unprecedentedly high natural gas prices.

“Coal companies’ failure to transition mirrors the finance industry’s failure to adopt rigorous coal phase-out policies," said Lucie Pinson, director of Reclaim Finance, an NGO and think tank that monitors energy policy. "The majority of these companies won’t transition unless banks, investors, and insurers rapidly stop all support for the industry’s expansion and require the adoption of closure plans.”

Of the top 500 financial institutions worldwide, 190 lack any kind of coal policy, while 300 of such fossil fuel policies are considered weak or inefficient. The continued lending of capital to these energy producers is bearing this result: Coal was responsible for 35 percent of global power generation in 2021, more than any other power source.

Image credit: Albert Hyseni via Unsplash

Let Them Eat Meat — Bill Gates Doubles Down Against Degrowth

Bill Gates told on himself recently — and by extension the rest of the billionaire philanthropist club — as he waxed polemic over what he sees as humankind’s inability to lower greenhouse gas emissions through reduced consumption, i.e. degrowth. “I don’t think it’s realistic to say that people are utterly going to change their lifestyle because of concerns about climate,” he recently said on Bloomberg’s “Zero” podcast — as if the issue were simply a matter of a few inconvenient weather patterns.

But replace climate with the viability of Planet Earth, and it becomes painfully evident that this callous disregard for our one and only home reflects not on what humanity is capable of, but rather the degree to which the billionaire class is threatened by the undeniable need for immediate degrowth in the Global North.

Conveniently omitting that much of the world’s population is too poor to subsist on meat-heavy diets or live in oversized suburban homes, Gates blamed human desires and not rampant consumerism fomented by profit-centered growth for what he sees as our inability to scale back. “Anyone who says that we will tell people to stop eating meat, or stop wanting to have a nice house, and we’ll just basically change human desires, I think that that’s too difficult,” he said.

Instead, the billionaire is banking on technological solutions that he admits aren't even being developed today: "We're not even trying to make breakthroughs, such as inventing an economic way of making aviation fuel, cement or steel.” And while the U.N. sounds the alarm that it is now or never — emissions must be drastically reduced across all sectors in order to stop planet-wide catastrophe — Gates’ allegiance to the profit margin is not swayed even by his own observation: "The existing tools only apply to areas like electricity generation and don't apply to most of the emissions."

The climate crisis is already expected to cause at least 250,000 excess annual deaths between 2030 and 2050 while large swaths of land, including entire countries, are in danger of being swallowed up by rising seas this century. Humanity does not have time to wait on future technology. The most devastating effects of the climate crisis are and will continue to be inflicted on the parts of the world that release the fewest emissions.

Yet while those in the Global South stand to suffer the bulk of the consequences for overconsumption in the Global North, Gates’ statements suggest that he is unbothered as long as technology keeps the current economic system working in his favor. As he made clear, “I’m looking at what the world has to do to get to zero, not using climate as a moral crusade.” By denying moral culpability, the Global North can of course shirk responsibility for the most immediate effects of climate change while betting the future of our planet on technology that may or may not be invented in time to save us from ourselves — never mind what becomes of the southern hemisphere in the process.

It’s not just that the billionaire appears to be dismissing degrowth while projecting his own business motives as human nature, but he also admitted to shelling out $9 million annually to cover his own footprint while complaining about that very thing: “Just having a few rich countries, a few rich companies and a few rich individuals buy their way out so they can say they’re not part of the problem, that has nothing to do with solving the problem.”

That Gates and his fellow billionaires will continue to promote and profit from unsustainable lifestyles regardless of the environmental consequences — and all the while blaming the masses for their manufactured desires — should come as no surprise.

Billionaires are well aware of the threat that degrowth poses to their financial empires. For all the money they throw at the problem, and all of the accolades bestowed on them in kind, their interests remain in conflict with the planet and the majority of its inhabitants. We cannot rely on them to lead us out of a crisis created by the system that built their fortunes. There is a better way, and it doesn’t involve watching the rest of the planet flood and burn while billionaires declare, “Let them eat meat.”

Image credit: Nick Karvounis via Unsplash

Climate Finance Will Be a Key Directive at COP27, But Human Rights Controversies Linger

The 2022 United Nations Climate Change Conference, or COP27, will be held in Sharm El-Sheikh, Egypt, from Nov. 6 to 18. Egyptian organizers have dubbed this year’s talks the “Implementation COP” to encourage nations to take action on prior commitments and agreements.

At the heart of the talks is the fate of the 2009 Copenhagen Accord, in which wealthier nations promised to channel $100 billion per year to less wealthy countries in order to assist with climate change mitigation and adaptation no later than 2020. However, the $100 billion annual target has yet to be reached, and there is growing skepticism that the pledge will even be substantial enough to protect the world’s most vulnerable populations from the growing threat of climate change.

“Current commitments are a floor and not a ceiling," Mohamed Nasr, director general of climate, environment and sustainable development at Egypt’s Ministry of Foreign Affairs, said in a statement. "More is needed if we are to deliver an effective response to protect people from climate change.”

COP27: Controversy behind payments for loss and damage

Egyptian organizers have said for months that financial assistance for developing countries would be one of the top priorities of COP27. This year, Pakistan will lead one of the largest negotiations over financing for climate-related loss and damage, talks that could take center stage.

Pakistan’s delegation is expected to demand that wealthy countries meet their payment commitments as it reels from historically catastrophic flooding caused by climate change. Pakistan has historically emitted only 0.4 percent of global greenhouse gas emissions, but damage from its recent flooding catastrophe exceeds $10 billion. So-called “loss and damage” financing would create funding mechanisms for payments and assistance to help vulnerable countries recover from climate-related disasters.

However, the U.S. and many other wealthy nations are firmly opposed to any agreements that require financial obligations for loss and damage. (Scotland and Denmark are the two exceptions.)

“We cannot underplay the threat that humanity is facing due to climate change," Wael Aboulmagd, special representative of the COP27 president, said in a statement. "The cross-cutting issue is always going to be finance. How are we going to pay for this? We need all stakeholders on board.”

Meanwhile, U.N. Secretary General Antonio Guterres also called on wealthier nations to clarify their intentions to uphold the $100 billion climate finance pact.

With wealthy nations being firmly opposed to providing financial assistance for climate-related loss and damage, the U.N. is exploring other methods of funding. In September, Guterres called for a windfall tax on oil and gas companies to cover loss and damage, and some vulnerable countries are calling for a global carbon tax and a tax on air travel.

Beyond climate finance questions, accusations of human rights abuses linger

The lead-up to COP27 in Sharm El-Sheikh has been clouded by controversy as Egypt’s human rights record is coming under increased scrutiny. In September, a Human Rights Watch report accused the Egyptian government of undermining local environmental organizations’ abilities to conduct policy work and scientific field work.

In response to these accusations, Aboulmagd has publicly defended Egypt’s record, noting that Egypt is formally recognizing an increasing number of environmental groups. However, many Egyptian environmental activists have reported being unable to register to attend the conference.

"You will have activists from everywhere in the world coming to COP, but Egyptian activists are either blocked from going or they're in jail," one human rights campaigner in Cairo told the BBC. "Basically, nobody is safe in Egypt."

Egypt’s struggles with climate justice in part stems from the fact that with a per-capita GDP of just under $3,900, the country ranks worldwide between Tunisia and Sri Lanka; yet many environmental activists across Egypt who seek to address such inequalities say they are stifled and silenced by their country’s government.

Climate vulnerability is fueled by inequality

Countries responsible for the smallest share of historical greenhouse gas emissions are those that are most vulnerable to climate change. While the moral imperatives of this scenario are clear, wealthy nations with disproportionately high levels of carbon pollution are by and large refusing to participate in a due-diligence process that would allow for financial remediation for countries most significantly affected by climate change. Without a drastic change in climate finance, the loss of lives and livelihoods due to climate change will continue to be paid by the people least responsible for the disasters.

Image credit: Pavlo Rekun via Unsplash

Colombia’s Ciudad Perdida, a Gem for Local Indigenous Communities, Faces an Uncertain Future

Tourism to Colombia’s Ciudad Perdida is a case study of what can occur when local Indigenous communities are allowed to manage their land, on their terms. But along with successes, this archeological jewel is also a tale of lost opportunities and missed potential. Today, we'll discuss the backstory of this archaeological wonder.

As the crow flies, it’s only 17 miles, but what the lay of the land means for many visitors is a grueling 40-mile trek (65 kms) that starts immediately, uphill, in clay, after a one-hour drive in a four-wheel drive van that traverses a road mostly comprised of mud and potholes. “Trail” is a generous term to describe this network of paths in Colombia’s Sierra Nevada de Santa Marta mountains; most of this trek involved sharp climbs, up and down. Rocks alternated with mud and clay. Any spend on Gortex boots from the likes of The North Face or Columbia was a whiffed investment as hikers had to constantly cross rivers and streams. Wake-up calls were at 4:50 each morning, with breakfast at 5:20 so everyone could hit the trails again by 6:00 a.m. All trekkers had to hustle as the September rains came in by 2:00 p.m. — mind you, the alternative to rainy season was doing this in the summer sunshine and heat. While most travel sites said this trek could be done by almost anyone, the very word “anyone” is a technicality: This trip is not for any person who isn’t physically fit.

So why would anyone subject themselves to this adventure, or when rain relentlessly falls in the afternoon, a misadventure? After all, this is a different world from the idyllic beach resorts that line Colombia’s nearby Caribbean coast, as one’s hiking clothes never got dry, legs were a buffet for insects no matter how much bug repellent was used, and clothes and even backpacks became tan- or rouge-colored as they became caked with mud and clay. The answer was simple: This schlep was the only way to visit Ciudad Perdida ("Lost City"), the ruins of a city built by the Tayrona (or Tairona) people, now a spectacular archeological site older than Machu Picchu and offers visitors a singular, spiritual experience that makes the trek well worth the effort.

The backstory of Ciudad Perdida

To understand the meaning of Ciudad Perdida requires a deep dive into its background and the people who surround it and, now, even thrive because of it. For Indigenous Colombians, it's finally payback time. As typical of the case with the arrival of the Spanish to what is now Latin America, the Tayrona people’s experience with the appearance of the Europeans in the 16th century was followed by decades and centuries of violence, disease, enslavement and fierce resistance.

At first, the Spaniards’ emergence on the Caribbean shores was met by the Tayrona with some tolerance, and a network of trade developed: The Spanish had items such as tools, while the Tayrona could offer gold in return. But as our guides explained to us, any such tolerance dissipated when the Tayrona realized they were receiving items of poor quality. As confrontations between the two peoples increased, the Tayrona were largely able to resist Spain’s colonial conquests during the seventeenth and even eighteenth centuries. But such resistance involved moving into far more remote areas of the Sierra Nevada where they could farm, live their lives and nimbly avoid repression from the people who fancied themselves as their European masters.

We then must fast forward to the twentieth century, long after the powers behind Spain, Nueva Granada and eventually, a separate and independent Colombia coincided with the Europeans’ ability, finally, to squelch any resistance from the region’s Indigenous peoples.

By the middle of the twentieth century, events such as the riots following the assassination of the Liberal leader and presidential candidate Jorge Eliécer Gaitán in April 1948, along with a military coup in 1953, foreshadowed years of violence that accelerated across Colombia during the 1960s. For years, many rural Colombians fled for what they hoped would be the safe havens of cities such as Bogotá and Medellín; and to a certain extent, some of that growth occurred in Santa Marta, the Caribbean port mostly known for its exports of bananas and coal to the rest of the Americas and anchors the modern day department of Magdalena.

An economic lifeline grows in the form of weed

By the 1970s, farmers and laborers (or cachacos) who were struggling to make ends meet long after the “banana boom” of the 1920s in and around the Sierra Nevada and Santa Marta found their economic salvation: marijuana. In the U.S., they found a thriving market as weed become the recreational drug of choice for more and more Americans during the late 1960s and 1970s. But the Nixon administration, which launched the U.S. Drug Enforcement Agency (DEA) in 1973, did not take kindly to the fact that Colombia was providing as much as 70 percent of the country’s marijuana. The same could be said for the subsequent Ford and Carter presidencies, and by the late 1970s, U.S. DEA agency were corroborating with Colombian authorities to wipe out the local weed trade. They did so by deploying chemical agents such as paraquat, which was effective at killing off marijuana farms but also poisoned much of the landscape.

Those scars are still visible today, as the shades of green that slather the Sierra Nevada mountains that face Colombia’s northern coast don’t reflect the country’s nature and rich biodiversity but rather, the legacy of deforestation resulting from the chemical warfare inflicted on local people and their land: many Indigenous families who had lived in the region for centuries found themselves caught in the proxy war’s crossfire. In the years to come, they’d face waves of similar wars, ones that resulted with riches for some and ended with heartbreak for many.

A new source of wealth emerges… coca leaves

By the 1980s, many of the farmers and cachacos who remained in the region started cultivating another plant: coca, the leaves of which were long important to local Indigenous cultures, and for Westerners, coveted as the source of cocaine. The cycle of boom and wealth accumulation, as our trek’s guides explained, continued again — a saga shared by expats who happened to live in Colombia during the 1980s.

By then, Ronald Reagan had scored the keys to the White House, and while his wife led a “Just Say No” campaign against drugs, that administration embarked on yet another campaign with its Colombian allies to tamp down another thriving market, and the spiral of violence in Colombia, its cities and rural areas continued.

Ciudad Perdida is ‘found again’

While Colombia and its people were embroiled in this violent boom, bust — and within much of the Sierra Nevada, a fumigation cycle — the ancient city of mention became “lost,” or should we clarify, had long become hidden by vegetation and was largely forgotten.

But that would suddenly change after a turkey hunting expedition resulted in a dead bird landing on an exposed stone staircase. Two rival families realized there was gold artifacts and other treasures within the hills, stone-lined concentric rings, terraces and tiled roads known as Ciudad Perdida. The plundering of such remains continued until an archeological team arrived at the scene in 1976, and for the next several years the scientists on site were able to keep the Ciudad Perdida closed off while they continued to research and excavate the 80-acre site.

But Ciudad Perdida could no longer be kept under wraps after a French tourist — determined to take on the surrounding jungle’s dangers even though he was hardly equipped to hike through it — ran into an archeological team in 1981 while he was determined to find what he believed was a place known as the “Lost City.” It was then that local authorities realized that keeping the place closed to the public was a fool’s errand, and Ciudad Perdida has been “open” since then. But open is a relative term, as the local authorities made the decision to keep access to the archeological site difficult: A policy that nixes any cars or any form of motorized transport, a decision still intact to this day.

Found, but again not visited

Another factor continued to keep visitors away: after a relative boom in tourism between 1985 and 2000, violence between the Colombian government’s armed forces and paramilitary groups kept foreign tourists away until a ceasefire declared in 2007 convinced adventurers to make the trek once again; more tour operators responded in kind.

By then it was agreed that the local Indigenous population would determine who could visit, how many, and at what cost.

It's clear local communities are benefitting financially; after all, they are running Ciudad Perdida's entire "value chain." Currently, all supplies, from the food cooked for trekkers to the bottles of red Gatorade ubiquitous at the kiosks topped with palm fronds along the trails, can only brought in by mules; motorbikes can do some of the hauling, but only to a certain point. Garbage, including plastic bottles, is hauled out by mules as well Keeping casual visitors away from Ciudad Perdida has left the site intact and its surroundings, for the most part, pristine.

And while the local Indigenous communities are finally able to profit from a sacred site that has been theirs all along, the steady stream of visitors brings its own risks: and therein lies the next part of this series about Ciudad Perdida, coming next week. Money is certainly flowing in — but questions fester over where it's going.

Image credits: Leon Kaye

REI Makes Black Friday a Permanent Paid Holiday for Employees

Ask anyone who has ever worked retail on Black Friday, and they will tell you what an exhausting experience it can be. When those store doors open, it can often resemble a scene out of the TV reality series Survivor, complete with obstacles, races, strategizing, alliances and rewards.

REI Co-Op is once again encouraging employees and consumers alike to keep the post-Thanksgiving adventures in the great outdoors rather than in the department stores. Think more “rock climbing” and less “sprinting to get the last discounted toaster oven.”

Last week, the Seattle-based outdoors outfitter announced it would remain closed every Black Friday from now on to give its 16,000-plus employees a paid day off. The holiday applies not only to REI’s 178 store locations, but also its corporate headquarters, call centers, distribution facilities and activity centers.

This is the eighth consecutive year REI will not be open for business on what is commonly regarded as the busiest shopping day of the year. The paid holiday is a key component of REI’s Opt Outside initiative, which promotes meaningful, inclusive experiences in nature.

“Opt Outside has always been about prioritizing the experience of our employees—choosing the benefits of time outside over a day of consumption and sales,” said Eric Artz, REI Co-Op president and CEO, in a press release announcing the permanent change. “Making Opt Outside an annual observance will serve as a yearly reminder of this commitment to doing the right thing for the co-op community.”

REI: Standing out by staying closed

When REI first announced the company would stay closed the day after Thanksgiving in 2015, consumers and industry insiders immediately took notice.

Some experts said such a move was only possible because REI operates as a cooperative of like-minded stakeholders with similar values — customers pay a one-time membership fee for a share in the business as opposed to a publicly traded company with fiduciary responsibilities. (REI currently has more than 20 million members.)

“REI is taking direct aim at the frenzied consumerism that dominates the holidays with a message to do the exact opposite of what Black Friday demands,” USA Today’s Hadley Malcom wrote in a November 2015 article about the launch of Opt Outside.

Indeed, REI’s Opt Outside message was a refreshing change of pace from the “race to the bottom” mentality of retailers on Black Friday in the mid-to-late 2010s. Starting in the 1990s and early aughts, stores began opening earlier and earlier the day after Thanksgiving, responding to the introduction of “Cyber Monday” competition. Soon it was common for stores to be open Thanksgiving, too, as brick-and-mortar retailers fought for every possible advantage over online shopping.

Is Black Friday still relevant?

Since the pandemic, some stores – including Target, Walmart and Kohl’s – have returned to remaining closed on Thanksgiving.

There is also an industry-wide shift away from the laser-focused attention on Black Friday as the best day for deals, as retailers continue to create their own discount “holidays” to start the shopping season in October or earlier, competing with Amazon Prime Day (which is now not only multiple days, but several times a year).

So is Black Friday even still relevant in today’s retail climate? Different projections show different answers.

The National Retail Federation (NRF) points out that for many people, shopping after Thanksgiving is a chance to bond with family and friends, and after the past two years of COVID restrictions, people are eager to return to pre-pandemic traditions with loved ones. Indeed, 45 percent of respondents said they are likely to shop on Black Friday this year, according to a poll conducted last month by the NRF in conjunction with Prosper Insights & Analytics.

In PwC’s Holiday 2022 Outlook, meanwhile, only 20 percent of participants polled said they would shop on Black Friday, compared with three times that amount in 2015.

It is interesting to note that regardless of these findings, REI remains one of the only large retailers to keep doors shut on Black Friday, however.

Now, according to PR Daily, “there is a growing backlash by younger Millennial and Gen Z consumers against Black Friday, but REI was a trendsetter in the movement by closing stores on the day after Thanksgiving.”

And by the sound of last week’s announcement by REI, that trend will continue for years to come.

Image credit: Dusty Barnes via Unsplash