Common Roadblocks to Better E-Waste Recycling

By Kayla Matthews

As an individual, you’ve probably gone through your share of electronics. When a new phone model is announced, a tablet goes bad or it’s time to replace a desktop computer, you’re probably so excited about the new gadget that you overlook an important step: disposing of the old piece.

Because 25 states, covering 65 percent of the U.S. population, have passed e-waste recycling laws, it’s not as easy — or good for the environment — to simply throw the old electronic away. E-waste recycling is not only responsible, but it’s also likely mandatory.

But it’s not always so easy. In many cases, e-waste recycling requires time-consuming research on regulations and best practices. Find out more about e-waste recycling roadblocks and potential solutions below.

E-Waste facts and statistics

E-waste is no small problem. In fact, by 2016 the total global volume of e-waste generated by common consumerism is expected to be well over 93.5 million tons. This is an increase from 41.5 million tons in 2011 at a growth rate of 17.6 percent each year. It’s the fastest growing municipal waste stream in the United States.

In U.S. landfills, e-waste represents only 2 percent of the trash but accounts for over 70 percent of discarded toxic waste. Electronics that are considered the most hazardous include televisions, computer monitors and tablets with LCD monitors.

According to the Environmental Protection Agency, most of the e-waste in America is shipped to developing countries that may or may not have processing facilities. When handled incorrectly, because of the toxicity of the products, human health could be at stake. Harmful substances are released when e-waste is handled incorrectly, which exposes handlers to high levels of lead, mercury, arsenic and other contaminants.

Why has it come to this? What roadblocks prevent the proper recycling of e-waste domestically?

Cost is a critical factor

The cost of accepting e-waste for recycling is high. Because electronics must be disassembled, separated and categorized by material — glass, plastic, metals and hazardous chemicals — broken and cleaned, the process is less straightforward than it sounds from the outside.

While some private facilities can earn incentives for each pound of e-waste they turn in to larger facilities, it’s often not enough to cover expenses. Because of this, many facilities charge customers for e-waste that is to be recycled. In most cases, this makes them ineligible for the incentives. This creates a lose-lose situation that could be difficult to remedy.

Take-back programs present an alternative that allows consumers to recycle e-waste without burdening smaller, local recycling facilities. One well-known program is sponsored by Best Buy. In certain situations, the retailer takes back electronics in exchange for gift cards or, at the minimum, for free.

Toxicity of products

As mentioned above, electronics contain high concentrations of toxic materials. Employees at recycling centers, and the environment in general, can face major consequences when these materials are handled incorrectly.

This is not just a problem for developing countries. It’s also an issue at home. Last month, an electronics recycling company in Illinois received 26 health citations after failing to implement the proper controls and procedures, exposing employees to toxic materials.

While it’s a great initiative to aim to recycle one million laptops or to set another big goal, if the products are not recycled properly, major issues could arise. To combat this roadblock, the EPA has put together a set of guidelines for recycling e-waste and properly handling toxic materials. While implementation costs could be high, the benefits outweigh the risks.

Product designs create an overload

In the past, products were designed to be easily disassembled and repaired. If a screen or battery went awry, a consumer could simply replace the part instead of the entire electronic. This reduced the burden on landfills and kept e-waste to a minimum.

Today, however, products are designed to be more singular — when something goes wrong, the consumer is expected to replace the piece or upgrade to a newer version. The old piece becomes waste. This equates to 100 million cell phones, 41.1 million desktop and laptop computers and 20 million televisions that are replaced each year. Because only 13% of electronic waste is properly disposed of, the system becomes overloaded.

One possible solution? Creating products that are meant to be fixed, not replaced. Short of that, the problem will only continue to intensify.

While e-waste recycling is mandated by law, actually following the practice is not as easy as it sounds. Until the roadblocks above are remedied, the situation will become worse in the coming years.

Image by Tookapic

Kayla Matthews is a healthy living writer and blogger who writes for The Huffington Post and The Climate Group. Follow her on Facebook or at ProductivityTheory.com.

Clear-cut link found between ESG disclosure and business performance

New research has found a definitive link between ESG disclosure and business performance.

The analysis by responsible investment manager Alquity and Cass Business School of over 4,400 listed companies over the period 2011-2015, has revealed that companies with strong and improving ESG disclosure in emerging markets realised an annual return of 9.4%, against the benchmark performance of 5.4%.

The research also found a marked increase in disclosure of ESG information in emerging markets. Emerging market companies have increasingly disclosed more ESG information over the last five years, as a means of attracting foreign investment with the greatest improvements in the Energy and Financial Services sectors (25% and 10% respectively).

The research concludes that ESG analysis is an effective tool in identifying winning stocks because companies with high and improving ESG disclosure provide better risk-adjusted returns, especially in Emerging and Frontier markets where political and regulatory environments are less mature.

Alquity has called on the investment industry to understand the importance of ESG disclosure and noted that companies are reacting to higher levels of scrutiny from investors, regulators, commentators and the media following the global financial crisis.

Roberto Lampl, head of Latin American Investments at Alquity, said: “These results confirm Alquity’s view that greater transparency and disclosure of ESG criteria are vitally important in emerging and frontier markets where risks are greater due to less developed institutional oversight of businesses. Forward looking ESG provides investors with an indication of high quality businesses, especially when the disclosure is voluntary.

"High profile disasters like BP’s Macondo crisis in the Gulf of Mexico, the workforce crisis and shootings at Lonmin’s South African mines and more recently the problems experienced by Volkswagen all point towards an increasing scrutiny of corporate behaviour.”

3p Weekend: 60+ Companies Going All-In on Climate

With a busy week behind you and the weekend within reach, there’s no shame in taking things a bit easy on Friday afternoon. With this in mind, every Friday TriplePundit will give you a fun, easy read on a topic you care about. So, take a break from those endless email threads and spend five minutes catching up on the latest trends in sustainability and business.

“This year is such a big year on climate change,” Emily Farnworth of the Climate Group, who oversees the RE100 renewable energy program, told TriplePundit during Climate Week NYC 2015. “There are a lot of businesses that want to make bold commitments to demonstrate — ahead of the negotiations in Paris — that businesses are actually very serious about tackling climate change."

A lot of businesses, indeed. Over the past few months, we've seen dozens of multinational conglomerates and mid-sized companies roll out bold commitments to tackle climate change. And, as the historic COP21 climate talks in Paris approach, we're likely to see a whole lot more in the way of corporate action.

But this week we're tipping our hats to the climate trailblazers: the leaders of the pack who aren't waiting for government to mandate climate action, but are making moves now to mitigate risk in their supply chains and help ensure a stable planet today and into the future.

Want to stay up-to-date on all the latest climate news in the lead-up to COP21? Follow TriplePundit's custom COP21 hashtag, #GoParis, on Twitter to make sure you don't miss a beat. You can also use the hashtag to share your questions, concerns, comments, news and ideas surrounding COP21.

Additionally, we’ll pose a new question of the week (or QOTW in Twitter-speak) around COP21, with hashtag #GoParis. The conversation’s already begun!

Nine Fortune 500s pledge to go 100 percent renewable ...

During Climate Week, nine top firms — Goldman Sachs, Johnson & Johnson, Nike, Procter & Gamble, Salesforce, Starbucks, Steelcase, Voya Financial, and Walmart — joined the RE100 initiative, pledging to work toward 100 percent renewables.

RE100 is an ambitious global campaign led by the Climate Group, in partnership with CDP, to engage, support and showcase influential businesses committed to 100 percent renewable electricity. The program launched at Climate Week 2014 with 12 big-name corporate partners, including Ikea, H&M, Nestlé and Philips, as well as Mars — the first U.S. business on board.

... And nine more lend their voices to a changing energy system

Wednesday, Sept. 23, turned out to be a big day for Climate Week -- and for bold corporate commitments on renewables. A few hours after Fortune 500 companies signed on with RE100, pledging to work toward 100 percent renewable energy, nine more took their own action on the clean-tech front, in partnership with the World Resources Institute and WWF.

The firms — Amazon, DuPont, Equinix, Etsy, Intuit, Microsoft, Sealed Air, Starbucks and Starwood — signed on to the Corporate Renewable Energy Buyers’ Principles, developed by large energy buyers as a way to advance renewables and add their perspective to the future of the U.S. energy system.

Five multinationals pledge to go net zero by 2050

Adding to the growing momentum at Climate Week, five global companies pledged to achieve net zero emissions by 2050. For those unfamiliar with the term, net zero refers to limiting global carbon emissions to the point where they balance the world’s ability to absorb that CO2. In the context of business supply chains, this involves measuring emissions released against emissions saved through things like renewable energy projects, reforestation and offsets. It’s a goal they call bold but necessary if we are to limit temperature rise to 2 degrees Celsius.Western readers will likely recognize consumer company Unilever and international investment group Virgin, but the rest may be unfamiliar: Chinese construction company Broad Group; African telecom Econet; and Brazilian cosmetics manufacturer Natura (which some may know as the largest publicly-traded B Corp).

But these firms have one thing in common: They’re all associated with the B Team, a nonprofit launched in 2013 by Sir Richard Branson and Jochen Zeitz with the aim of doing better business for both people and planet.

Siemens pledges to go carbon neutral

Many companies linked up with NGOs and business coalitions to structure and announce their climate commitments. Others, like global industrial giant Siemens, set off on their own.

During Climate Week, the company announced plans to cut its carbon emissions in half by as early as 2020 and to be carbon neutral by 2030. And it’s willing to shell out more than $110 million over the next three years to make it happen.

General Mills cuts emissions from farm to fork (and beyond)

A big wave of corporate climate commitments rolled out during and after Climate Week, and continue to break as COP21 approaches. But General Mills kicked off the trend in late August, announcing a commitment to reduce absolute greenhouse gas emissions by 28 percent across its full value chain – from farm to fork to landfill – over the next 10 years.

The commitment was calculated using science-based methodologies in line with the Intergovernmental Panel on Climate Change (IPCC), CEO Kendall Powell said during a Climate Week media briefing in August.

“Companies deal with risk all the time, and we get paid basically to mitigate risks,” Powell said. “So, these are actually muscles that are very well-developed in organizations … We’re very good at piecing together action plans and mitigating risk.”

Mars' U.S. operations switch to wind power

Mars, best known for trick-or-treat-ready candies like M&Ms and Snickers, is also taking on some compelling projects it says will make the company much more “sustainable in a generation.” One example of Mars’ investments in sustainability is the Mesquite Creek Wind Farm in western Texas.

Announced last year, Mesquite Creek generates 200 megawatts of wind power, enough to electrify 61,000 American homes, or the equivalent of what Mars claims is sufficient to power its entire U.S. operation.

The company, also a RE100 trailblazer, has its ear to the ground when it comes to sustainability. In addition to bold moves in its supply chain, the company prepared a detailed roadmap for how it will approach the recently adopted U.N. Sustainable Development Goals. Ready as soon as the goals were passed, the roadmap includes responses to all 17 goals.

CEOs of 10 major food companies demand climate action

Early this month in Washington, D.C., 10 major food companies — coordinated by Ceres and led by Mars — released a letter to U.S. and global leaders calling for action on climate change.

The signatories are a mix of major food conglomerates and mid-sized companies with a known sustainability bent: Mars, General Mills, Nestle U.S., Unilever, Danone Dairy North America, Stonyfield Farm, Ben & Jerry’s, Kellogg Co., New Belgium Brewery and Clif Bar.

“Climate change is bad for farmers and for agriculture. Drought, flooding and hotter growing conditions threaten the world’s food supply and contribute to food insecurity,” the letter, which also ran in full-page ads in the Washington Post and Financial Times, stated.

21 companies pledge to clean up their transportation footprints

At the close of Climate Week, 21 major companies -- and two U.S. cities -- linked up with ForestEthics to clean up their transportation footprints.

Commitments range from Walgreens' decision to remove Canadian tar sands from its transportation footprint, to Coca-Cola and Pepsi's pledges to remove carbon-intensive oil -- like tar sands and Venezuelan and Nigerian crude -- from their supply chains while they develop cleaner, safer fueling solutions.

Other companies you may know from the list include eBay, Patagonia, Whole Foods, Trader Joe's and Seventh Generation. Burlington, Vermont, and Bellingham, Washington, -- both near the sites of proposed tar sands projects -- also pledged to nix their use of the fuel.

Kellogg steps up on deforestation

Kellogg made big moves during Climate Week this year. It was one of 10 signatories of a letter demanding climate action on the part of global officials. It joined the We Mean Business Coalition (WMB), launched at Climate Week NYC 2014 to help businesses and investors rally around climate action. And, in partnership with WMB, the company behind our favorite breakfast cereals is going hard against deforestation.

The company committed to remove commodity-driven deforestation from its supply chain by 2020 and is setting ambitious greenhouse gas emissions reduction targets that align with climate science. This includes doubling-down on climate-smart agriculture practices, as well as training and partnership with suppliers, NGOs and other stakeholders around climate, which will put the company on track to meet its target of supporting the livelihoods of more than 500,000 farmers worldwide over the next 15 years.

Global companies get real with science-based targets

We've already mentioned that a few companies on our list aligned their commitments with science-based targets. But they're far from the only firms that are realizing commitments are nothing unless they're based on climate science -- and unless they're truly enough to help us stay below a 2 degrees Celsius temperature rise.

Coca-Cola pledged to cut its emissions from operations by 50 percent from 2007 levels by 2020. Procter & Gamble said it would cut its emissions from operations by 30 percent from 2010 levels by 2020.

Autodesk, Colgate Palmolive, General Mills and NRG Energy also made noise about science-based targets at Climate Week, leading an event that centered around the importance of using climate science -- rather than random numbers -- to frame corporate climate action.

Image credits: 1) Flickr/Peter Bowden 2) Flickr/Peter Bowden 3) Flickr/Tony Webster

Sealed Air Proves a Packaging Company Can Make An Impact

If you've purchased anything from Amazon recently, Sealed Air probably kept it safe on its way to your home. The packaging company -- maker of those, you guessed it, sealed air products -- has a big reach. The company has approximately 24,000 employees globally and is present in 62 countries with a sales and distribution network in over 175 countries.

A company that large has a chance to make an impact when it comes to sustainability. And it does, as its 2014 Sustainability Report shows.

Last year, Sealed Air developed what the report describes as a “more strategic approach to sustainability.” In addition to traditional water conservation and greenhouse gas reductions, Sealed Air's products themselves reduce waste by extending shelf life and providing a low-impact way to protect products en route.

As the company's president and CEO, Jerome A. Peribere, wrote in report's opening letter:

"I believe we no longer sell packaging; we sell increased shelf life. And this shelf life provides access to healthy food and reduces waste, which in turn contributes to increased food security and environmental benefits. We no longer sell cleaning products; we sell hygiene ... We no longer sell packaging that simply delivers what consumers buy. We sell product security."To this end, many of the company's goals for 2020 reach far beyond its four walls: increasing food security, promoting resource conservation and health and wellness, and helping others in their supply chain reduce waste.

Of the company's broader conservation goals, Ron Cotterman, VP of sustainability, told 3p that targets relating to waste reduction, resource conservation and food security are not only the "most straightforward [route to sustainability]," but these goals also "directly relate to cost savings."

Sealed Air also goes “one step further,” as Cotterman put it. The company has set additional goals related to the benefits that its products and solutions have on society. Cotterman believes these additional goals “differentiate Sealed Air within our industry while illustrating tangible and real examples of how we realize our vision ‘to create a better way for life.’”

Every push for sustainability has some sort of impetus, because nothing happens in a vacuum. In Sealed Air’s case, the impetus for creating a more strategic approach started when Jerome Peribere began as the new CEO. He saw a need to rebrand the company and focus on its core values. Part of the rebranding included creating a new mission and vision.

As Cotterman said, “He quickly came to understand the value that we create for our customers to help them meet their sustainability goals.”

Strategic approach to supply chain emissions

Sealed Air’s approach to strategic sustainability began with a pilot study of its Scope 3 GHG emissions (those that come from the company's supply chain). The pilot examined the impact of the company’s GHG emissions, including its Scope 1 and 2 emissions (operational and energy emissions). The study revealed some surprises. The impacts of the company's Scope 3 emissions is significantly larger than its Scope 1 and Scope 2 emissions. In fact, the company's supply-chain emissions represent almost 98 percent of its total GHG emissions.The largest source of emissions within Scope 3 is customer use of the company's products. So, reducing energy and GHG emissions for its customers’ operations through innovative products “can have a significant influence on overall environmental impacts,” Cotterman explained.

The pilot study was “significant,” in Cotterman’s words; it showed the company where and how to prioritize its efforts to reduce environmental impact. It made the case for a focus on product innovations and environmental impact throughout the supply chain. The company is doing more work to refine its Scope 3 estimates and to quantify the sustainability benefits it delivers to its customers.

2020 sustainability goals and the SmartLife approach

Sealed Air's 2020 Sustainability goals include:- Reducing the energy intensity of its operations by 25 percent

- Reducing the GHG intensity of its operations by 25 percent

- Reducing the water intensity of its operations by 25 percent

- Diverting 100 percent of its product and process waste from landfills

The system centers around three main categories: driving growth, conserving more and improving lives. Cotterman cited hotel linens as an example. Hotels can “significantly” reduce energy use associated with washing linens by using lower temperatures. Using lower temperatures also increases the life of the linens, often up to 50 percent. In other words, energy use is decreased and money is saved.

Soap for Hope is a simple program that saves lives and reduces waste

Every year, over 7 million children die from diseases that are preventable with handwashing. Just simple hygiene and a bar of soap can save the lives of children. Enter Sealed Air’s Soap for Hope program, which operates in 11 countries and 17 cities.The objective of the program is to save lives while preventing waste, and it's one of several programs outlined in the company's sustainability report. The program is simple: Soap from area hotels is recovered and taken to a local site where it is reprocessed. Then, the reprocessed soap, which is completely hygienic thanks to being reprocessed, is taken and distributed to communities in need. Over 120 hotels participate in the program and there are over 160,000 people every year who benefit from it by obtaining free soap.

Stefan Phang, Sealed Air’s regional sustainability director, started the program. Phang initially thought the program would just consist of working with a few hotel partners in Asia to prevent their used soap from going to the landfill while helping meet hygiene needs in their respective communities. But it became apparent that the program could help many communities.

“Through an innovate approach to partnering with customers and local communities, [Phang's] program quickly has become a living example of creating a better way for life by creating shared value,” Cotterman said.

Sealed Air has received awards for the Soap of Hope program. Recently, the program, which first launched in Cambodia, was recognized by being named the winner of the CSR Impact category in the 2015 Asian CSR Awards held in September in Bangkok, Thailand. Soap for Hope was among 134 entries from 12 countries that competed for the CSR Impact Award.

By working throughout the supply chain, Sealed Air extends its positive impact where it is needed most.

Image credit: Sealed Air

Jet Blue Greens Up JFK Airport with Organic Potato Farm

It's likely the last thing that airline developers thought of when they mapped out the runways. But thanks to an inspired airline, the John F. Kennedy International Airport now comes complete with its own organic potato garden.

It's kind a reverse psychology to the advent of flying: Most airports grew up around farms and vast green spaces. But these days, those fertile green spots on the horizon are at a premium, particularly when they fill a unique next-door need, like, say, providing potatoes and herbs for an airport's restaurants and passengers.

And if Jet Blue Airways, the airline that came up with this idea, is successful, there will be plenty of potatoes to go around. Some 2,400 acres of rich, blue potatoes and herbs.

According to the airline's website, it's joined forces with the Terra chips brand to create this little spot of heaven, and has already figured out how to ensure the produce will be used efficiently.

"The blue potatoes produced are taken to Terra's nearby factory where they are processed into blue potato chips for research of new flavors and ideas. All other produce is either used by businesses within Terminal 5 or donated to local New York communities through GrowNYC." Food scraps from the airport's restaurants will be composted and used in the soil, thereby reducing the local footprint even further.

The airline says the garden is part of its master plan to improve its environmental impact, an endeavor that now includes a post-security terrace that's open to the public and their four-legged companions, natural lighting, improved natural ventilation, and cool-roof improvements to spruce up the ambiance of the 67-year-old airport.

"Though most of our greenhouse gas emissions and energy use is related to jet fuel and planes, we operate too many buildings to ignore their environmental impact," says the airline.

The Smithsonian points out that Jet Blue's brainstorm is also part of a growing trend to incorporate green spaces into commercial areas that, at one time, seemed like unlikely candidates for gardens. Tokyo train stations now rent out spots for would-be gardeners. In 2010, the city of Houston became inspired by the idea of creating a sustainable green space and made room on an adjacent city property. Developer Asakura Robinson and Urban Harvest worked together to create the public food garden, which now serves as a meeting place for a farmer's market and community events.

But undoubtedly, Jet Blue's runway acoutrement takes the cake (or should we say the potato) when it comes to ingenuity. Let's hope it becomes a scenic trend.

Images courtesy of Jet Blue Airways, used with permission

California Restricts Livestock Antibiotic Use with Little Resistance From Industry

California might be among the last places in American that the sun hits with the dawning of each day, but it’s consistently among the first to wake up and take action on issues that threaten the safety of people and the environment.

Right on the heels of last week’s landmark passage of the SB 350 climate bill, which commits the state to reducing carbon emissions by 50 percent by 2030, California passed SB 27, which limits the use of antibiotics in livestock.

The reason for this is that it has been shown that the use of antibiotics in livestock has led to increased prevalence of antibiotic-resistant strains of bacteria, such as MRSA.

This is an issue that people have been aware of for some time, but due to the fact that low doses of antibiotics have been shown to make livestock grow faster, an economic boon for the ag industry, there has been resistance to cut back, despite the risk.

The FDA was expected to take action, considering the fact that its own Center for Veterinary Medicine produced a nine-minute video warning of the dangers. But for reasons that we suspect were not scientific in nature, the agency rather abruptly changed course, opting instead to provide voluntary guidelines.

California, however, had no such reluctance. The new law prohibits the use of antibiotics in cows, chickens, pigs and any other animals raised for meat, unless specifically used to treat animals that are sick, or for preventative purposes in cases of “elevated risk,” requiring the guidance of a veterinarian.

It is estimated that at least 23,000 Americans die each year from superbug infections, though some estimates run two to three times that high, with worldwide estimates reaching as high as 700,000. One study, commissioned by the British government last year, predicted as many as 10 million deaths from superbugs by 2050, more than cancer, with most of those occurring in Africa and Asia. The impact of that on the world economy could be as high as $100 trillion by 2050 or 3.5 percent of global GDP.

Given that the reason given for the lack of effective action on this has been industry pressure, it might be surprising to learn that, at least in California, the industry did not come out against the bill, decrying government regulation as so often is done. Instead, California’s meat and poultry associations remained neutral on the bill. Only seven lawmakers voted against it.

Bill Mattos, president of the California Poultry Federation, was quoted in Bloomberg Business: “I think the bill is basically doing something that we in California have been doing all along, which is phasing out antibiotic use. It’s something that the industry is living with. We’re happy to get this bill the way it is, and I think we’re going to see more of this."

Indeed, before legislation, there was consumer demand. Back in March, McDonald’s said it would stop selling chicken raised with antibiotics. Tyson Foods fell in line soon after, followed by Foster Farms and Perdue. Now Walmart is asking suppliers to do the same.

"I think we’re seeing the marketplace change, and this legislation will continue to push it in that direction," said Jason Pfeifle, public health advocate at the California Public Interest Research Group.

It would appear that there has been a sea change on this issue, as farmers' fears have subsided, and have in essence given way to the apparently more legitimate fears on the part of public health officials.

As Nathanael Johnson wrote in Grist: “The industry support for — or at least lack of opposition to — the California law suggests that we really have turned a corner on agricultural use of antibiotics. It also suggests that the industry will thrive without too much upheaval as it puts the squeeze on antibiotic use.”

Image credit: Heribert Duling: Wikimedia Commons

Why Won't the Gates Foundation Divest?

Divestment is cool. Bill Gates, apparently, is not, and his foundation is behind the times by continuing to invest in risky fossil fuels.

In the environmental movement, few campaigns are doing as well as divestment, the move to get institutions to remove their investments from fossil fuels. Earlier this month, we reported on the big news that California's state pension fund – one of the largest public funds in the world – was going to divest entirely from dirty coal. This was followed shortly thereafter by news that the University of California and the California Academy of Sciences would divest as well.

These are big victories for the main reason that they are not obvious, low-hanging fruit targets. Government pension fund managers are not naturally inclined to care about climate change. It was active, tenacious organizing, youth pressure, and effective lobbying that allowed this to happen.

Unfortunately, Grist has found a laggard in a foundation that claims to have fighting climate change as one of its biggest priorities, but won't tie its investments to its rhetoric. Bill Gates' reasoning is quite astounding.

“If you think divestment alone is a solution,” Gates said in an interview with the Atlantic, “I worry you’re taking whatever desire people have to solve this problem and kind of using up their idealism and energy on something that won’t emit less carbon — because only a few people in society are the owners of the equity of coal or oil companies. As long as there’s no carbon tax and that stuff is legal, everybody should be able to drive around.”

If what he says is true, and only a few people in society are owners of fossil fuels, unfortunately, the Bill and Melinda Gates Foundation -- which, credit be given, does some amazing work to fight diseases and help spread technology around the world -- is one of them.

But this is beyond the point, which Gates misses completely. Firstly, divestment can have an impact. When large banks such as Barclay's say they won't invest in coal-fired power plants anymore, that is big. Gates is right that divestment isn't going to bankrupt any fossil fuel companies (cheaper renewables and clean-energy regulations will take care of that, as they are already doing to dirty coal). But it makes a real impact on their bottom line. Trust me, companies are taking notice.

Secondly, there is the moral factor. Divestment is about building a movement, and making it clear that fossil fuels are morally reprehensible. Any self-respecting institution that cares about climate can -- and should -- divest. In the end, this will give more space for real climate action, driven by both socially responsible companies and governments.

Bill Gates is, sadly, behind the times. That is why the divestment campaign is gearing up to target his foundation directly. Expect more news from Seattle. My bet's that Gates will come to his senses sooner than later.

Image source: Wikimedia Commons/World Economic Forum

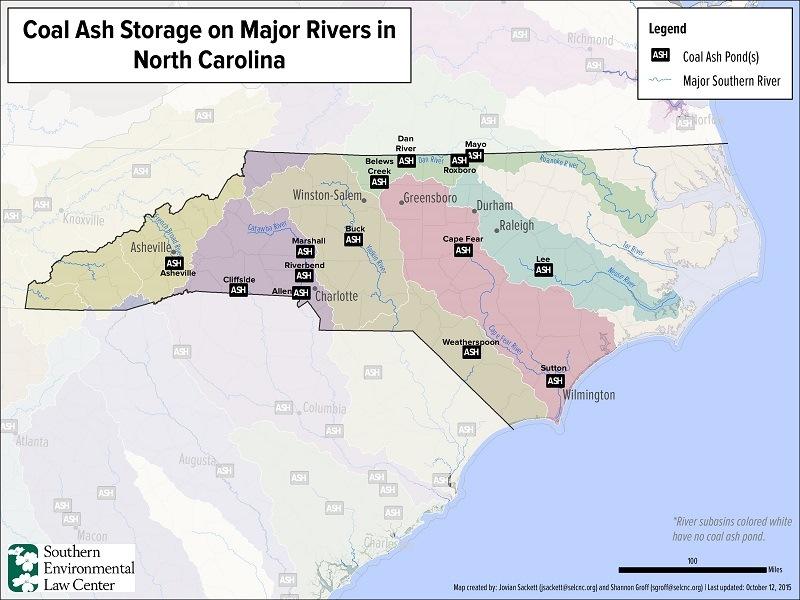

What to Do with Tons of Coal Ash? Vitrify Some of It, Sell the Rest

Anyone thinking that myriad new laws and activist campaigns trying to shut down coal-fired power plants will do away with the black scourge forever, think again.

Every large coal plant is leaving behind millions of tons of ash that needs to be safely contained lest it leach into nearby farmlands, rivers, lakes and other public water sources. It is the world’s second largest waste stream.

A partnership between eosMYCO, a Charlotte, North Carolina, startup, and Areva, the global nuclear and environmental services firm, sees an opportunity amid all that ash: extracting and re-purposing selected minerals for construction and manufacturing materials while entombing what’s left in glass.

EosMYCO and Areva are busy engineering a pilot-scale “waste-to-value” solution for the ash. It aims, for the first time, to physically transform all of North Carolina’s 140 millions of tons of coal ash in less than a decade into an inert, aggregate product. If the partnership succeeds, it could save utilities, and their ratepayers, billions of dollars while permanently eliminating the utilities’ liability.

Sound too good to be true? Perhaps. But with 3.5 billion tons of coal ash in the U.S. that by law now need to be managed, someone or something is bound to pounce on this opportunity. With a proven technology, some estimates put the opportunity at between $50 billion and $70 billion globally.

The plan is relatively straightforward. The partners' process will extract useful minerals such as alumina, titanium and other minerals, including “rare earth” metals. Then it will vitrify the silica which is left to create the aggregate for construction and other projects that use a lot of concrete. All this is supposed to happen in a mobile treatment facility that can go to where the ash is presently situated.

The rare earth metals left over can be ingredients in magnets, batteries, catalytic converters and other high-tech products. Because China is the world’s dominant supplier of rare earths, a U.S. supplier of even a small amount of rare earth metals could face a promising future, especially if the mining process is a byproduct of something else that makes money, as eosMYCO and Areva plan to do starting in 2017.

Because coal plants needed mined coal transported to them via rail lines and barges, those logistics can be reversed to help sell and ship the vitrified aggregates.

Ryan Rutledge is the first brain behind eosMYCO. After finishing his Master’s degree in environmental remediation at the University of North Carolina at Charlotte, he said he got the idea while researching mycologically-sourced (hence the name) bioremediation technologies.

Rutledge proceeded to win the 2013 Charlotte Venture Challenge Pitch Day and was awarded first place at 2014 Charlotte Venture Challenge. EosNANO, as his enterprise was called earlier, was recognized as a semi-finalist in the Charlotte Chamber of Commerce's “PowerUp” competition, and then selected to be a member of the local Ventureprise business incubator.

All this drew interest from two “innovation scouts” at Areva. Soon after the eosMYCO partnership – many details of which are subject to a non-disclosure agreement – was born.

The partnership is set to build a pilot-scale remediation vehicle to deploy the proprietary process in 2016. If negotiations with two investment funds go well, the technology and vehicles will scale up to meet the demands of North Carolina's coal ash. Other states and utilities, e.g. Georgia Power, Alabama Power and Dominion Virginia Power, may be next in line.

“We are actively working to have boots on the ground by 2017,” Rutledge said.

Image credits: 1) Southern Environmental Law Center 2) eosMYCO

From Boomers to Millennials: How to Design an Engaging Employee Giving Program

By Bryan de Lottinville

We’re approaching that time of year again, when charities start to make end-of-year fundraising asks, and employers launch what, for most, is their annual workplace giving campaign.

Before you take that dusty giving campaign playbook off the shelf, you should know that participation in conventional company-led efforts needs improvement. Between 2006 and 2012, America’s Charities reported that participation dropped from 41 percent to just 33 percent, and another 2015 report found that only 24 percent of people say they opened their wallets for workplace programs.

Many fundraising organizations note that giving levels have remained steady year over year, but their main challenge is a shrinking donor base. That means they’re trying to get more money from existing (typically older) donors, which means the demographics are not in their favor. And that “more from fewer” trend does not support one of the central goals of modern corporate giving programs: engaging employees.

The face of giving is changing rapidly, too. The conventional top-down directive to give to one or a handful of corporate-chosen charities no longer works. Today’s employees are empowered by technology in virtually all aspects of their lives, including wanting to choose which causes to which they donate their hard-earned money.

This change is driven by an emerging millennial workforce that demands the companies they work for provide them with a sense of pride and purpose, not just an income. Across generations, there are growing expectations for companies to help improve society (one country, India, has even made it mandatory, requiring that sizable businesses invest at least 2 percent of their pre-tax profit in doing good). These forces show that the same old ways of thinking won’t cut it anymore, and we must change the way we view corporate and workplace giving programs.

So, how do corporate giving managers and community investment professionals break through the status quo and make sure their “giving season” efforts achieve their goals? Looking at real data from our Fortune 1,000 clients, we’ve noted five practices that drive measurable results in workplace giving participation and engagement:

1. Empower broad employee choice

There is no one-size-fits-all cause for today’s diverse and multi-generational workforce. Employees are five times more likely to donate when they have options that fit their passions and resonate at a personal level. And while you’re at it, make it really easy and mobile-friendly. All the choice in the world doesn’t matter if the donor has to jump through hoops to give back.

2. Make giving easy through payroll deductions

Companies that offer donations via payroll see four times the rate of participation than programs that don’t. It’s the most convenient way for employees to give a donation of any amount to causes they care about regularly throughout the year. Plus, payroll deduction is an easy way to get a broader segment of your employee base to participate.

3. Make it a perfect match

When companies show an authentic commitment to helping their people give more to the causes that matter to them through matching, employees are twice as likely to donate. Companies with the most progressive workplace giving programs also use more advanced and creative strategies, where they match at a higher rate to strategic nonprofit partners, causes or pillars.

4. Kickstart giving with incentives

To boost participation, many companies offer incentives of “donation currency” that employees can direct to the nonprofits of their choice. Some companies pre-seed new employee giving accounts or give charitable gift cards as a reward. When they do this, they attract 117 percent more participants, while also reinforcing a prosocial corporate culture.

5. Volunteering boosts the likelihood of donating

Employees who volunteer donate on average 41 percent more money. The more engaged employees feel with a cause, the more likely they are to contribute. So, offering a variety of goodness opportunities can yield better results for your employee giving program. Keep in mind that adding rewards for volunteering creates even more impact.

--

Gone are the days of the top-down fundraising program using the same old tactics and tools. Any one of these simple strategies, when done in the right way, will deliver measurable outcomes for your workplace giving program. And better yet, when you apply several, you may just find yourself transforming a stagnant program into a pillar of your employee engagement strategy.

Read more of the results of the Benevity workplace giving analysis.

Image credit: Benevity

Bryan de Lottinville is the Founder and CEO of Benevity, Inc., the leading global supplier of workplace giving and volunteer management software solutions, boasting an impressive enterprise client roster, including Apple, Google, Microsoft, Oracle and SAP, among others.

A recovering lawyer, Bryan is an experienced growth company executive with a knack for innovating new approaches and a successful track record in “constructively disruptive” organizations that reinvent industry practices. Prior to founding Benevity, he was Chief Operating Officer and Director of iStockphoto Inc.

Clorox Goes Sustainable?

When I think of the Clorox Co., I think of bleach, a product I love for its disinfectant properties. The company also makes some of the most well-known household products, including Pine-Sol cleaners, Liquid Plumr clog removers and Glad bags.

But it turns out there's more to the multinational company that has 7,700 employees worldwide and sales of $5.7 billion this fiscal year.

Clorox is also a company that is serious about sustainability, as its 2015 Integrated Annual report shows. The report covers the company’s “good growth,” what it terms “profitable and responsible growth” during the fiscal year that ended June 30. The progress toward its 2020 Strategy is covered in the report.

One of the goals within the strategy is to reduce the company’s operational footprint 20 percent by 2020. That includes reducing greenhouse gas emissions, solid waste to landfill, energy and water. In one area, solid waste to landfill, Clorox has not only met its goal but exceeded it by achieving a 30 percent reduction.

The company also achieved reductions in the other areas, the have resulted in $116 million in cost savings in fiscal year 2015:

- Cumulative reductions in greenhouse gas emissions (11 percent)

- Energy consumption (6 percent)

- Water consumption (11 percent)

The goal for corporate responsibility is to “reduce the environmental impact of our operations and improve the sustainability of our upstream supply chain.” That means focusing on ways to reduce waste. The company emphasizes building “an even stronger agile enterprise that streamlines our work to focus on those activities consumers are willing to pay for.” In fiscal year 2015, Clorox has driven “significant productivity gains” in a number of its functions, including $116 million in cost savings, according to the report.

Clorox focuses on achieving 10 zero waste-to-landfill facilities

One way that Clorox is reducing waste is through its goal of 10 facilities achieving zero waste-to-landfill by 2020, a company spokesperson told TriplePundit in an email.Its plant in Fairfield, California, is now a zero waste-to-landfill site. Five other facilities are close to achieving the goal. Four others are “aggressively working hard to reduce their waste in order to be designated as low (90 percent plus solid waste diversion away from landfill) waste-to-landfill facilities."

There are several things that a facility must do to achieve zero waste-to-landfill designation, the company stated in its email:

- Reduce, reuse, recycle or compost at least 90 percent of the waste streams at the site.

- Send the remaining 10 percent or less of waste to a waste-to-energy facility.

- Ensure no commonly recycled items such as paper, plastic, corrugate or aluminum are in the remaining waste.

Focusing on redesigning and reducing product and packaging materials

Clorox estimates that only about 12 percent of its environmental impact comes from operating its 37 plants worldwide. Most of the environmental impact of the 1 billion products it sells annually occurs either before raw materials arrive at its sites for processing or after consumers buy products. So, the company is focusing on redesigning and reducing product and packaging materials.Part of the focus is increasing the amount of recycled content used in its packaging and enabling the packaging to be recycled. Between 2005 and 2011, Clorox made sustainability improvements to 50 percent of its portfolio. For 2020, it has set specific goals for packaging and product ingredients, including:

- Having only recycled or certified virgin fiber in packaging

- Having over 90 percent of all its products in recyclable primary packaging

- Including clear recycling instructions on all packaging

- Eliminating PVC in all packaging

Not bad for a company with such a global reach. Not bad at all.

Image credit: Mike Mozart