Individual Investors Can Now Divest From Fossil Fuels with One ETF

The array of sustainable investing choices is taking another step toward the mainstream as a San Francisco investment firm today launched on the New York Stock Exchange what it touted as the world’s first diversified, socially responsible and fossil-free, exchange-traded fund (ETF) based on a climate leadership index.

That may seem like a mouthful. But it’s worth noting how such products are standing up taller to pass any giggle test. At the same time, the increasing number of these and other investor tools should tell corporations, their directors and shareholders around the world that sustainable investing is growing and being taken more seriously faster than perhaps anybody envisioned even a year ago.

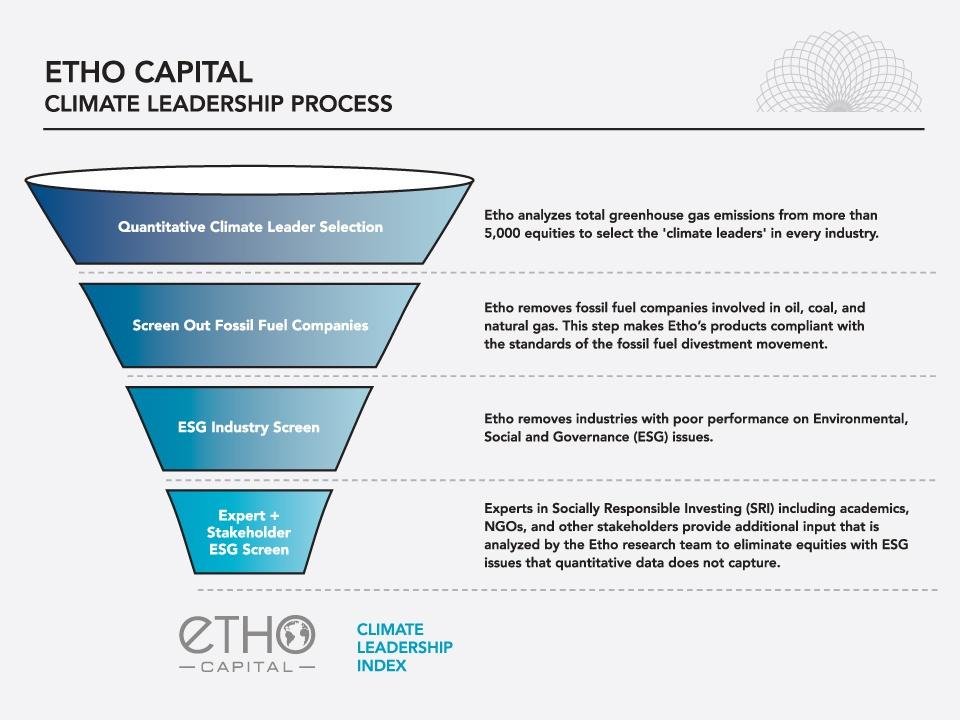

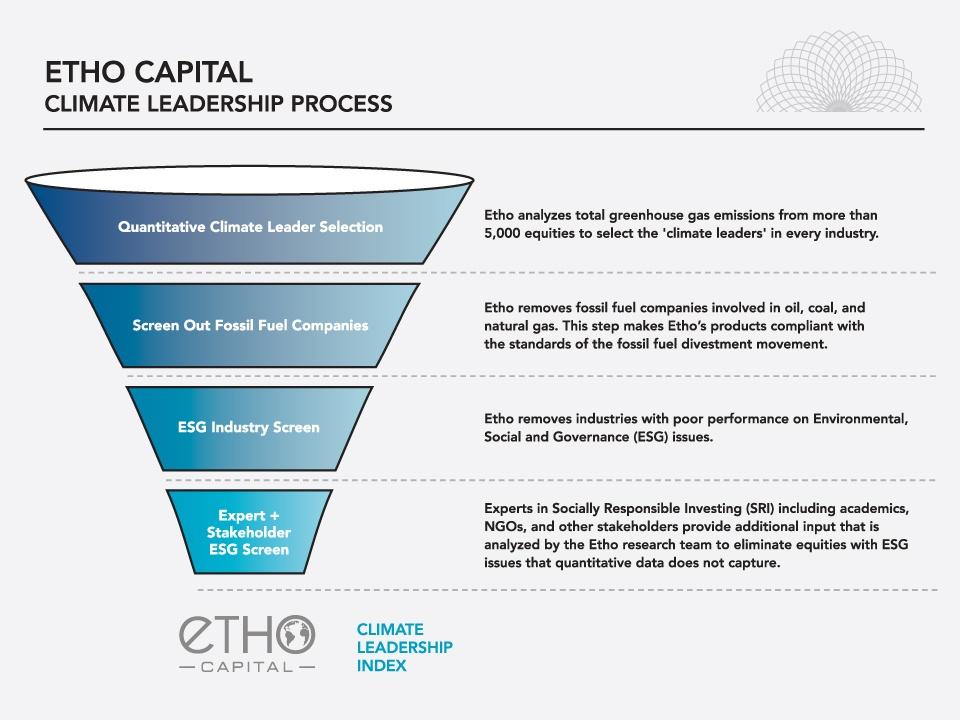

Among the newest tools is an ETF from Etho Capital in partnership with Factor Advisors, a subsidiary of ETF Managers Group. The Etho ETF is comprised of U.S. public equities in the climate leadership index which, company CEO and co-founder Conor Platt said, “combines quantitative climate performance data with qualitative environmental, social and governance criteria and feedback from non-governmental and academic sustainability experts.”

Platt said the index “has been closely studied to understand how it would have performed historically compared to major relevant indices.” In 10-year back tests, he said the index outperformed the S&P 500 on a risk-adjusted basis while reducing greenhouse gas emissions per dollar invested by at least 50 percent.

Etho Capital first screens out all fossil fuel companies, along with those in the tobacco, weapons and gambling industries. (See funnel graphic above.)

Ian Monroe, the other co-founder and the Fund’s sustainability scientist who lectures at Stanford University, listed 10 of the companies in the Fund. It shouldn’t surprise anyone that companies such ash Apple, First Solar, Google, Intel, Nordstom and Tesla are among them. It might surprise some that Chipotle, Disney, Harley Davidson and T-Mobile are also in the Fund.

One of the companies bounced from the Index is Monsanto. Monroe said it was removed for a “variety of reasons, including the carcinogenic effects of their herbicide, their treatment of smallholder farmers in disputes and their aggressive lobbying against GMO (genetically modified organisms) labeling law and regulatory oversight of GMO products.”

The Divest-Invest coalition announced in September that the global divestment movement now includes commitments from 430 institutions and more than 2,000 wealthy individuals; collectively they represent $2.6 trillion in assets under management.

The Divest-Invest tally is based on a report from Arabella Advisors and reportedly represents a 50-fold increase in just one year. If that assertion holds up, the fossil-free investment movement could be considered the fastest investor movement / shift ever.

The tally is likely to grow as a Morgan Stanley survey of millennials indicated they are taking environment, social and governance (ESG) investing more seriously every day.

“Investors of all ages are increasingly concerned about climate change,” Monroe said. “Younger investors are especially focused on aligning their portfolios with long-term sustainability because they have the most to lose form the ripple effects of a rapidly warming world.”

Now whether that generation actually acts on their beliefs is going to take some, maybe a lot of time. They be faced with a choice: Morgan Stanley projects that $41 trillion will pass to millennials from baby boomers during the next 35 years.

Conor and Monroe first connected about what became the Etho ETF when Monroe was experimenting with how to track the climate footprint of personal investment portfolios a few years back. Monroe founded Oroeco.com to help track the climate impact of various lifestyles.

“We quickly realized that we could take the data that Oroeco was using to track the carbon footprints of equity investments and use it to build investment products that are optimized for both climate and financial performance.

“And as we looked more closely into investing in climate efficiency,” Monroe continued, “we realized that climate-efficient investments can generate better returns and lower risks alongside superior sustainability. It’s a realization that neither Conor nor I would’ve come to on our own.”

Asked if the upcoming climate talks in Paris will play much of a role to speed up the divest/invest movement, Monroe is keeping his expectations in check.

“I’m hopeful that a strong international climate agreement will come out of Paris,” he said. “But even the vest possible deal will only get us about halfway to solve climate change. We’re still going to need to see a shift in climate culture for both individuals and investors where consumer and investor dollars are consistently directed to the cleanest options.”

Image credit: Etho Capital

Yes, EVs are Cleaner than Gasoline-Powered Cars

It’s the trick question that has left many of us stumped: from the earliest stages of manufacture to the years driving on the road until they are sent to the junkyard, are conventional automobiles or electric cars cleaner for the environment? While acknowledging that electric vehicles (EVs) emit no emissions when running on our streets and highways, many have assumed that those pesky rare earth metals in their massive batteries and the emissions associated with producing the power canceled out any environmental benefits that their drivers enjoyed.

According to the Union of Concerned Scientists (UCS), a two-year study has provided the answer. The EV is the cleaner option, hands down.

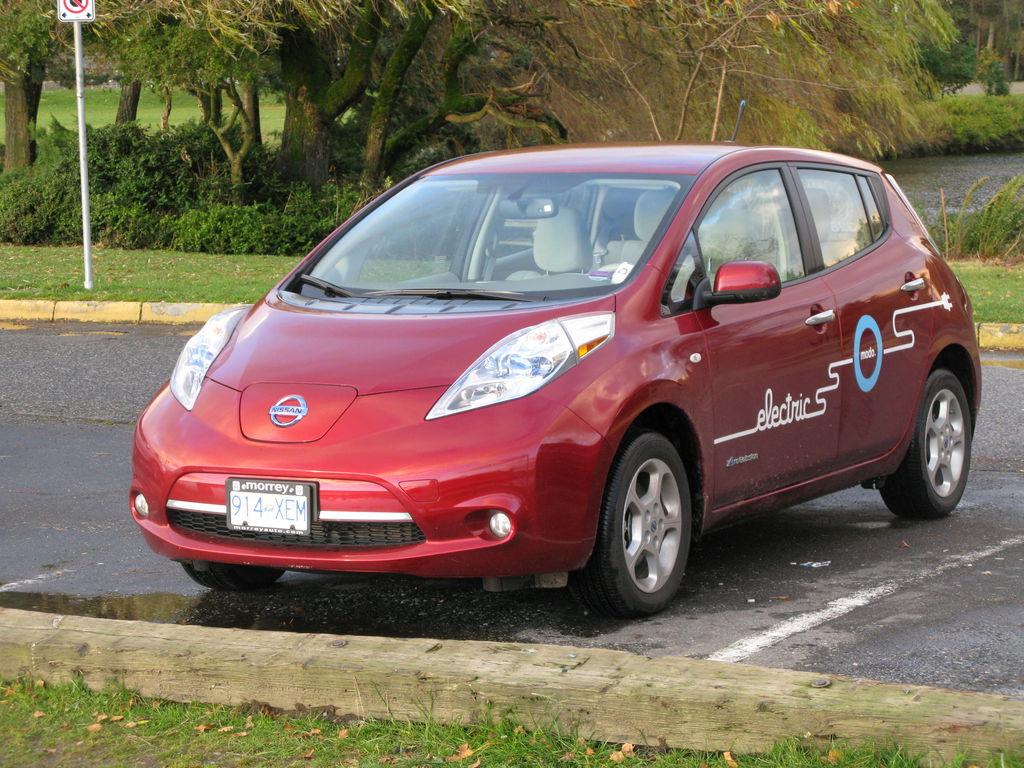

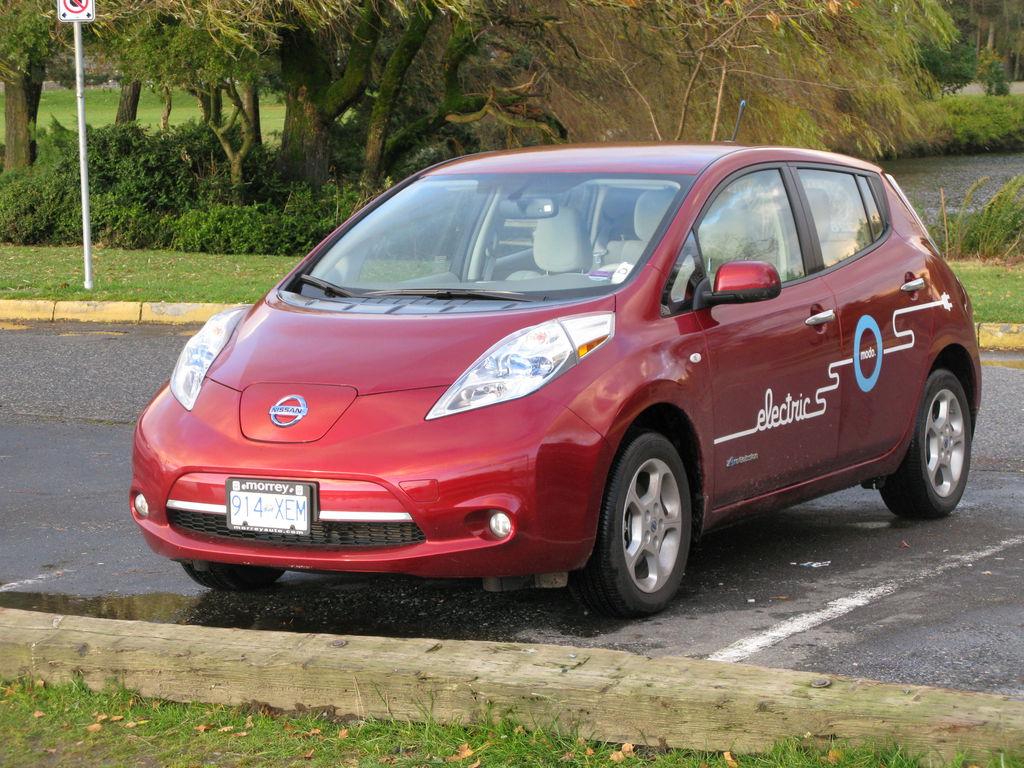

In order to reach that conclusion, UCS researchers evaluated the entire life cycle of an EV based on the two most popular models sold in the United States—the Nissan Leaf and Tesla Model S. Looking at the raw materials needed to make a car, the assembly and manufacturing processes, driving, disposal and recycling, the UCS team compared the emissions of EVs to a similarly sized gasoline-powered automobile, with examples including the Ford Focus, Mitsubishi Lancer Sportback, Kia Forte5 and Volkswagen Golf.

When emissions are measured during the early manufacturing phases, UCS found that the manufacture of EVs at first were less clean than that of conventionally fueled cars. But within anywhere from six to 16 months after both cars have been driven, those early emissions are quickly offset by their cleaner driving. So when comparing these cars’ respective environmental performance over their lifetime, UCS' researchers concluded that an EV will generate less than half of the greenhouse gas emissions compared to those of a gasoline-powered car. For a smaller EV, only 4,900 miles of driving will offset those higher emissions from that vehicle’s manufacture; in the case of a full-sized, long-range EV, those earlier emissions are canceled out after approximately 19,000 miles of driving.

UCS based its assumptions on the fact that both cars would have a 15-year life cycle, with 135,000 miles driven and a weight of approximately 3,000 pounds. The researchers also assumed that in comparison for this study, the average gasoline-powered car would have an average fuel economy of 29 miles to the gallon.

UCS insists that EVs will become even more efficient and therefore, cleaner in the coming years. These cars' environmental benefits will increase as additional sources of cleaner energy fuel the national grid. In regions of the U.S. where much of the grid is still reliant on coal energy, driving an electric car is currently about as efficient as a gasoline-powered automobile that scores 35 to 40 miles per gallon. And in areas where the electricity grid uses cleaner sources of energy (as on both the Pacific and Atlantic coasts), EVs' equivalent miles per gallon rates spike even higher. Overall, according to UCS, driving an EV in the U.S. on average produces greenhouse gas emissions equal to driving a gasoline-powered car with a mileage of 68 miles per gallon. To put all these statistics into context, UCS has an online tool that allows users to see how an EV's environmental performance would measure within their zip code.

More needs to be done, however, before EVs can truly make a difference in reducing the U.S.’s carbon emissions. EVs have got to contribute a larger share of vehicle sales than they do now—at the moment they account for less than one percent of sales nationwide. The grid has got to become cleaner and greener as well, though UCS does point out that even in a region dominated by coal-fired power plants, an EV reliant on such power at worst offers a fuel economy of 29 miles per gallon.

Overall UCS is sanguine about the future of EVs, consumer doubt and low oil prices notwithstanding. The convergence of better EV performance, cleaner electricity generation, optimized battery technology and improved battery recycling can help EVs reduce American oil consumption significantly in the coming decades--and of course, less time at the pump.

Image credit: Markus Mayer, Wikipedia

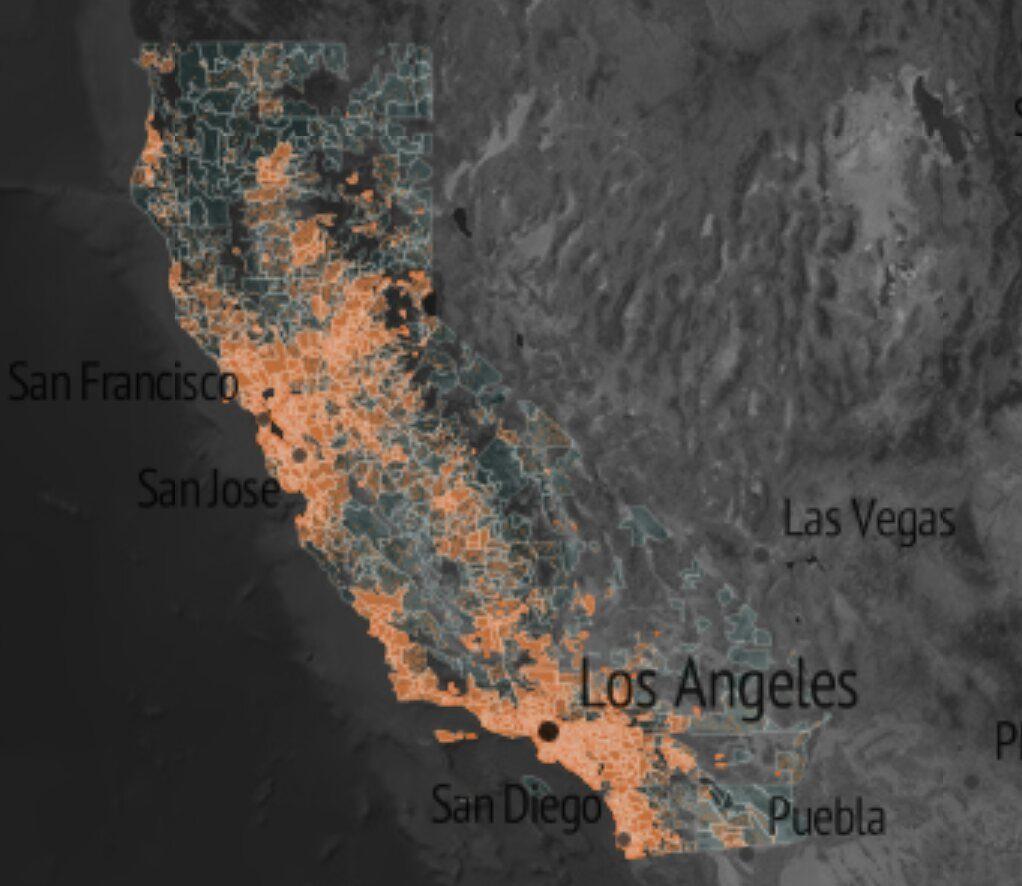

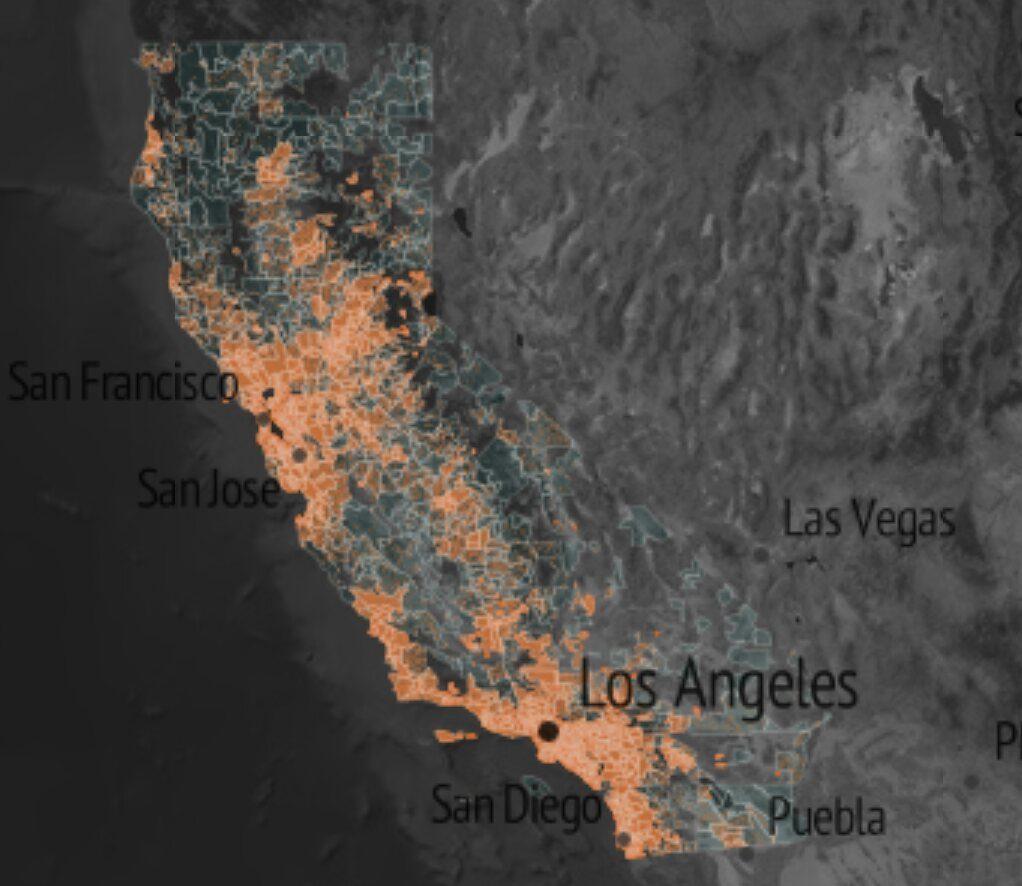

Interactive Map Shows Volkswagen Scandal’s Impact in California

Two months after Volkswagen admitted its clean diesel cars were rigged with software to falsify nitrogen oxide levels, the company continues to endure the fallout from the emissions scandal. Volkswagen’s overall financial performance, while hardly stellar, is reflective of the overall global stagnation in automobile sales, but clearly there are signs of worry as the company is losing market share.

The optics continue to look bad. Buyers of VW’s cars in the United Kingdom are now required to sign a disclaimer that warns drivers that the fuel economy ratings on their purchases may not be as good as originally claimed—a decision that hardly builds confidence a brand significantly tarnished by the “defeat device” fiasco. Across the pond in California, one of VW’s largest markets, a new interactive map offers a visualization of the effects stemming from the company’s shenanigans, just days before the automaker is set to present a plan to the California Air Resources Board (CARB) to compensate consumers who over the past several years purchased the models under question.

Developed by the data analytics firm Kevala, this map, released by the clean energy advocacy group California Clean Energy Fund, or CalCEF, attempts to show how air pollution generated by the VW cars in question has had a detrimental impact on poor and minority neighborhoods in metropolitan areas. By pinpointing the location of all diesel cars, typical commuting patterns, poverty rates, pollution data and the location of electric charging vehicle stations, CalCEF says it wishes to go beyond showing the effects of Volkswagen’s alleged malfeasance. According to Danny Kennedy, CalCEF’s managing director, the automaker actually has an opportunity to amend its past behavior by working to expand access to cleaner forms of transportation in poorer communities.

There is precedent for such action. During the winter of 2000-2001 in California, electricity rates skyrocketed without rhyme or reason across the state. Firms such as Enron and Dynegy were later accused of manipulating electricity prices, and eventually an offshoot of Dynegy, NRG Energy, settled with Gov. Jerry Brown in 2012. In addition to offering utility ratepayer financial relief, NRG has promised to install hundreds of electric charging stations across the state.

But as CalCEF points out, the vast majority of these charging stations are in affluent neighborhoods and business centers, not in the communities that suffer the most from higher air pollution rates. The solution offered by CalCEF, therefore, is for VW to go beyond cash settlements and new infrastructure for next-generation vehicles. Tax incentives, financing and charging stations should also be offered in such neighborhoods in order to improve air quality and mobility, insists CalCEF and its allies.

What is not clear, however, is whether such programs can make a difference in these areas—and if electric vehicles or cleaner forms of transport will still be affordable, or even wanted, no matter how generous Volkswagen will be once terms of any such settlement are announced. Offering charging stations in poor neighborhoods may sound enlightening until it becomes evident that they are rarely, if ever, used. And whether Volkswagen would be willing to pay for improved and cleaner public transportation infrastructure is another question that has got to be answered.

Image credit: Kevala

Honeywell’s “Smart Building Score” Uncovers New Ways to Generate Value

When I think of energy consumption in the U.S., I picture highways clogged with cars or factories pumping heat from tall smokestacks. But, according to the non-profit think tank Architecture 2030, it’s actually the buildings in which we live and work that consume nearly half of all the energy and CO2 emissions produced in the U.S.

At the same time, advances in the so-called “Internet of Things” (IoT) – the connection and interconnection of sensors to machines and other objects – have generated an explosion in “smart building” technologies that can, among other things, save building owners as much as 15 percent (or more, by some estimates) on energy bills. Spending on such technology is expected to grow from $7 billion in 2015 to more than $17 billion in 2019, according to a recent IDC report.

This poses interesting questions for building managers and owners: What strategic opportunities do smart building technologies represent for you now? And what should you do about it?

What is your building’s I.Q.?

Honeywell has released a new global index, Smart Building Score, which allows building owners and managers to assess how green, safe, and productive their buildings are. Along with this new self-assessment tool, Honeywell has also made available a new white paper, Put Your Buildings to Work: A Smart Approach to Better Business Outcomes. The paper contextualizes the global future of smart buildings with data from a new survey of building owners and facility managers across eight verticals, seven key cities, and 487 buildings. One key finding according to Honeywell's press release: Half of buildings surveyed said they were not equipped to capture energy efficiency and sustainability benefits.

I sat down with Frank Pennisi, VP and GM of Honeywell Connected Buildings at VERGE 2015 in San Jose (October 26-29), to talk about the significance their new findings for building owners and managers. “Everyone wants to cut costs and reduce risk, but that doesn’t go far enough in realizing the full potential of what your building can do,” said Pennisi.

Putting your building to work

According to Honeywell's report, 51 percent of U.S. building managers surveyed considered safety and security to be the most critical indicator of a smart building, compared to 27 percent who thought greenness was most important and 22 percent who felt increasing occupants’ productivity was the most critical factor.

Knowing that building owners are focused primarily on safety and security allows Honeywell to engage stakeholders in a conversation about how to achieve efficiency in the whole building network. Internal locating devices called “beacons” can detect when authorized personnel are approaching and open the door for them – that’s the security piece. But that same technology can tell the system when rooms are occupied or not, so that lighting, heating, and cooling can be optimized in the building. The same infrastructure can also be used to help with scheduling conference rooms and hot desking. Once the “smart” infrastructure is in, building owners and managers can layer in additional functionalities in the future without a big retrofit.

According to Pennisi, smart building technology can help building owners achieve their strategic goals, whether that’s generating revenue through reduced energy costs, improving student test scores through better classroom comfort, or improving patient outcomes through reduced time spent in waiting rooms.

“Buildings should not be left as a dead asset to rot on the balance sheet,” Pennisi told me. “There are so many things you can do to allow you to put your building to work and allow you to fulfill your mission, no matter what that is, and the Smart Building Score will help you to do that.”

You can see Pennisi's VERGE Launchpad talk by forwarding to 3:12:45 on the VERGE 2015 Virtual recording.

Image credits: 1.Becky Wetherington, Flickr; 2, 3 used with permission of Honeywell.

Toilets for 2.4 Billion – the Business Opportunity of the Decade

By Cheryl Hicks, Executive Director, Toilet Board Coalition

It is unacceptable that, in 2015, 1 in 3 people globally do not have access to a safe and hygienic toilet. Today is World Toilet Day, celebrated by the UN since 2013. World Toilet Day offers an important opportunity to shine a spotlight on the crimes against humanity caused by the global sanitation crisis – mass violations of the right to human dignity, health and a resilient environment in which to grow and prosper - all consequences endured by those living without access to a safe and hygienic toilet.

The issue is urgent. In the past two and a half decades since 1990, 2.1 billion people gained access to sanitation, but an even greater number – 2.4 billion – still have nowhere safe to go to the toilet. We can’t wait another two decades – we need speed and scale of delivery now. At the Toilet Board Coalition (TBC), we believe that there is an important role for business to play – as experts in delivering complex systems at quickly and to a lot of people. The TBC is accelerating existing sanitation business models and investing in co-innovation to fill gaps, with the goal of catalyzing a robust business sector to deliver sustainable, resilient access to sanitation for all.

The coalition is a business led public-private partnership. Its members are multinational corporations, development expert NGOs / IGOs and social investors. Founding corporate members include Unilever, Kimberley-Clark, Firmenich, and LIXIL Corporation who are bringing their commercial acumen, combined with the sanitation expertise of the WSSCC, UNICEF, WaterAid, WSUP, BRAC, and the social investment expertise of DFID, AFD, GCC, USAID, the World Bank and the Stone Family Foundation. These organizations, leaders in their respective sectors, share a joint vision and mission to support and accelerate commercially sustainable business models dedicated to building resilient sanitation systems. They are demonstrating their commitment by investing capital and by deploying experts from across their organizations to work directly with small and medium sized sanitation businesses in the countries and communities most affected. We call it The Toilet Accelerator – the first business accelerator and corporate mentoring program dedicated to growing robust sanitation sectors in emerging and frontier markets.

We are at a decisive time for the global development agenda. September saw the launch of the Sustainable Development Goals (SDGs), which follow on from the Millennium Development Goals (MDGs), laying out the roadmap for development for the next 15 years. The world missed the MDG for sanitation by a huge margin; we can’t let the same happen with the SDGs. The latest report from the WHO/UNICEF JMP for Water Supply and Sanitation, states that to achieve SDG 6, universal access to sanitation and water by 2030, current rates of reduction for open defecation must be doubled. New approaches to delivering sanitation to low income consumers at affordable prices will be integral to achieving this. We have all of the tools, we now need to accelerate solutions.

The Toilet Board Coalition seeks to prove that sanitation can be delivered profitably to underserved communities. Building a coordinated sanitation ecosystem aligns businesses, utilities, governments and civil society, will catalyse the impact we all want to see. For some, the word ‘profitable’ might seem incongruous with addressing the world’s most important social issue. I found exactly the opposite. Over the past months I have had the opportunity to consult with the global sanitation community, who have been resounding in their optimism for increased private sector engagement on this important issue. For me this is very encouraging: as a whole we are a much greater force for change than the sum of our parts. The potential gains of closer interaction between businesses, NGOs, academia, investors and governments, shaping a strategic agenda for the delivery of sanitation across Asia, Africa and Latin America cannot be underestimated. We are already working to better harness the depth of expertise that exists within the leading organizations of our membership, to expand our pipeline, and increase our investments. If you are interested in being involved, please get in touch. www.toiletboard.org / [email protected].

Finally, on World Toilet Day, today, add your voice to the global debate about improved sanitation by joining a Twitter debate at 3PM GMT / 10AM EST, using the hashtag #SanitationIs.

Cheryl Hicks is the Inaugural Executive Director of the Toilet Board Coalition - A business led coalition, working in partnership with NGOs and governments, dialing up innovation and investment in business models aiming to deliver universal access to sanitation.

American Financial Services Giant Attacked for Role in Brazilian Land Grab

Its long acronym, TIAA-CREF, stands for what sounds like a lofty purpose: Teachers Insurance and Annuity Association – College Retirement Equities Fund. Based in New York with origins dating back to the time of Andrew Carnegie, the 97-year-old company boasts that it is the United States’ largest retirement fund manager for professionals who work in the education, research, medical and cultural fields. And this is a “different” organization, according to TIAA-CREF, as it has worked on corporate social responsibility issues for over 40 years, has been named as one of the world’s most ethical companies and takes a “client-conscious approach” towards building revenue.

But this financial services firm, which manages over half a trillion dollars in pension funds, is known far differently in South America as for what some say has amounted to a massive “land grab” in Brazil. According to Grain, a small NGO that supports small farmers and social equality movements, TIAA-CREF has had a central role in a scheme that has acquired vast amounts of farmland across Brazil—even though the country has strict laws covering foreign investments in farmland.

According to an investigation led by Grain and a coalition of several other NGOs, TIAA-CREF has used a complex investment vehicle to ramp up its land holdings in Brazil. This separate fund, which TIAA-CREF operates in tandem with pension fund managers from Sweden and Canada, has purchased farmland throughout the Brazilian cerrado, a massive savannah-like region of 770,000 square miles. Over the past 30 years, the cerrado has largely evolved into industry-scale farms that now grow coveted crops such as soy, corn and cotton. Investment in the cerrado is one reason why Brazil, a net food importer in 1980, has become one of the world’s largest food exporters.

The rise in Brazilian agriculture, however, has also resulted in what critics call a massive “land grab,” during which many small farmers have been subjected to shady business practices and in turn lost their title and access to their land. Labor conflicts, environmental degradation and social ills have festered across the cerrado as political connections, falsified documents claiming title over land and forest and in the worst cases, death threats and even murder, have forced many families to leave land they had held for generations. The report issued by Grain accuses TIAA-CREF and one of its partners, the Brazilian sugar producer Cosan, of benefiting from this trend, and says their allegations are backed up by public documents and interviews with farmers who had been forced off their land.

TIAA-CREF and its investment partners have refused to disclose any information related these land purchases, but figures disclosed in its sustainability reports are aligned with the company’s growing interest in Brazilian agriculture. From just over 250,000 acres of farmland in 2012, its holdings have surged to over 630,000 acres by the beginning of this year. Meanwhile both Cosan and TIAA-CREF have declined to discuss the circumstances surrounding these transactions, and also refused to cooperate with a New York Times investigation. The researchers at Grain do not implicate TIAA-CREF or Cosan in the actual coercion of land titles. Instead, much of the land purchased was already cleared, some of it by Euclides de Carli, a businessman who has the reputation of being one of the most notorious land grabbers in all of Brazil.

The report issued by Grain shows how the lack of transparency is threatening TIAA-CREF’s reputation. Claims of being a responsible company have been undermined by business dealings that may have violated the spirit of the law in Brazil while causing many people to leave their homes and lose their only source of income. “Small farmers and indigenous people in Brazil,” Grain’s report concludes, “are paying much too high a price to support the pension funds of workers in the US, Canada and Sweden.”

Image credit: Grain

Why a Chinese Pizza Chain is Hot for Sustainability

By Smita Chandra Thomas

Gung Ho! Pizza (GHP) is a successful pizza chain founded in Beijing in 2010 by New Zealand natives and co-owners, Jade Gray and John O’Loghlen. It is an SME (small-to-medium enterprise) that has recently graduated from start-up to growth mode. GHP has three retail stores open in Beijing and more on the way, as well as the first franchise store expected by the end of 2015.

GHP was already on the path of sustainability when they hired me as Sustainability Advisor in 2013 to focus on Energy Efficiency in their retail stores. In fact, GHP has incorporated Sustainability as one of the core tenets of its approach to business since inception and executed on it in collaboration with a local sustainability consulting firm We Impact and designer Coro Urdaneta, enterprising people that I had the pleasure of working with. GHP is committed to the ‘three pillars of sustainability’ or the ‘triple bottom-line’ that consists of the 3P’s: People, Planet, and Profit (a term the readers of 3P would be familiar with). The founders were inspired by Yvon Chouinard, the founder of Patagonia, an outdoor clothing and gear company that is a global leader in environmental responsibility. When outlining their business plan in 2009, they decided to be the “Patagonia of Pizza”.

Why did GHP choose to embrace sustainability? And what makes them stay the course?

(Hint: It's good for business!)

Environmental Context

The simple act of living and breathing in Beijing is a constant reminder of the impacts that air pollution has on the eastern seaboard of China, with worldwide effects. But it is not easy to find reliable data on the sources of the pollution or ways to mitigate it. Here are some lesser known facts: The sources of pollution include electricity generation, use of petroleum in transportation, water pollution from overuse and from disposal of hazardous materials, and pollution from waste. For example, 70 percent of China’s electricity came from coal in 2011. By comparison, coal accounts for less than 40 percent of electricity production in the U.S.; while natural gas, which burns much cleaner, accounts for close to 30 percent of U.S. electricity. In China, the use of natural gas for electricity generation was only four percent in 2011. Hydro-electricity and nuclear electricity – the other relatively clean sources of electricity strictly speaking in terms of air pollution – currently play a relatively minor role in China. Given this current mix of sources for electricity generation in China, it is important to pay attention to reducing electricity usage. But given the inevitable rise in demand for resources in the rapidly developing nation of China, the best place to focus currently is on reducing the energy intensity per unit of GDP

Economic impetus

Energy intensity of businesses can be reduced by “greening” the energy-consuming operating systems (mostly invisible to customers), such as the water heating systems, ventilation, air conditioning, plugged-in equipment and lighting systems; the choices made in water-consumption; transportation of personnel and delivery services; and minimizing the production of waste. These back-of-the-house systems incur the highest operating expenses as well as cause the long-term environmental impacts. Operational Efficiency has been a requirement of China’s Three Star building standards first published in 2006, and most recently updated in 2013. (The LEED program (Leadership in Energy and Environmental Design) of the US Green Building Council added this requirement in 2009).

Operational efficiency results in direct economic benefits in China, because energy is a large variable cost for most businesses in China. Unlike the U.S., where operational energy expenses tend to be lower than the fixed costs of labor, operational energy expenses can be the dominating financial factor for a business in China while labor costs are relatively economical. For example, the hourly cost of labor is roughly four times cheaper in Beijing compared to the U.S. average. On the other hand, commercial electricity is roughly twice as expensive in Beijing compared to the U.S. average. Commercial electricity at GHP’s Sanlitun location in Beijing costs about 20 US cents per kWh (1.2 RMB per kWh). In contrast, the average cost of electricity to commercial customers in the U.S. is about 10 cents per kWh, which equates to about 0.6 RMB per kWh. This high variable business cost of electricity in Beijing provides a prime opportunity and makes a compelling business case to invest in energy efficiency.

GHP therefore embarked on a path of sustainability for both environmental and business reasons. In a relatively immature market for efficiency products and services in China, GHP faced a lack of local resources and standardized commissioning services geared towards small and medium businesses. On the other hand, opportunities existed in finding local, and even handcrafted solutions which might be unfeasible in a more developed country.

‘Soft’ benefits

When the first store renovation project was complete, I requested an interview with Jade Gray, the owner in charge of store operations and my lead client on the project. Among other things, I wanted to understand how GHP valued the costs versus benefits of the project, and their sustainability efforts in general.

Gray says of the efficiency upgrades:

I completely believe it’s not a waste of money. Although it is difficult to measure exact benefits, because there are so many parts to it, we have had both direct benefits and what I would call ‘soft’ benefits. First, speaking of direct benefits, the most obvious benefit is where we were wasting resources earlier. Laura [Xiao, the in-house environmental manager] helped identify potential areas for savings in utilities – energy, water, waste. For example, we discovered that 20-30 percent of the power in one retail store was being used by an extraction fan. We realized we didn’t need that on all day but only during rush hour. We cut that off, and saw savings of thousands of RMBs. Then by blocking draft at our doors and windows, we saved 10-20 percent on heating costs. Not running the tap while washing hands, not using paper towels… As we built this green culture of no-waste that Laura was really driving, we saved a lot on utilities. This was the direct response from the green initiative.An indirect benefit has been savings on employee retention. They [the employees] have really taken the green initiative to heart. It has become everybody’s passion, as long as we are driving it of course. Employees have said on numerous occasions that they really believe in what they are doing. They feel good about their company, they feel good about their job. We are absolutely saving on retention.

Another big impact on P&L [profit and loss] would be marketing impact. It was never our intention to use our green initiative as a marketing tool; but our social programs generated PR [Public Relations (media interest)]. We have created a media profile that we wouldn’t normally be able to afford. We are trying to spread the word about our business, so we welcome that attention. As a small company in China, we have to find ways to make noise in a very large market; you really have to create a buzz. We take the media attention responsibly, but it’s been great for business. Now more and more people are coming to us to learn about our green initiative.

Gung Ho! Pizza illustrates an example of a business that has purposefully integrated sustainability into its business in China and reaped tangible rewards not only in terms of environmental benefits, but also economic returns, improved employee retention, and public relations.

Do you have any stories of opportunities and barriers you may have seen for small businesses in developing countries?

Smita Chandra Thomas is a U.S.-based sustainability consultant and a LEED AP. She spent the last two years in Beijing where she did freelance consulting, learned Mandarin, and blogged. Ms. Thomas has been focused on enabling energy efficiency in buildings through building science for lesser waste, greater economy, better health, and a sustainable environment for future generations. Ms. Thomas currently runs her private consulting practice Energy Shrink in Washington DC. She can be reached at [email protected].

Report urges business to go beyond compliance on paying tax

There are many steps multinationals can take towards more responsible tax practices, three charities say in a new report.

Rather than highlighting what companies should stop doing, ActionAid, Christian Aid and Oxfam draw attention to how firms can act more responsibly in areas including transfer pricing, use of tax incentives and lobbying.

The charities' new report Getting To Good gives detailed examples of what more responsible tax decisions would look like, in order to bring about positive impacts for developing countries and the realisation of human rights.

For example, it suggests companies could publish country-by-country reports before being legally required to do so as well as audit their use of tax incentives and reliefs on a regular basis, to ensure they are delivering investment, employment or other benefits.

In addition, the report suggests the need for a change of culture within multinationals, towards an acceptance that they can go above and beyond being legally compliant on tax.

Penny Fowler, head of private sector at Oxfam, commented: “Companies and investors need to recognise that paying their fair share of tax is a human rights issue for which corporations must take responsibility, alongside such issues as labour and land rights.

"Until businesses adopt a more responsible approach to paying tax that goes beyond a focus on compliance and instead ensures they contribute fairly to the societies that their operations rely on, millions of vulnerable people in developing countries will continue to be deprived of the jobs, hospitals and schools which that tax revenue could help fund.”

Reactive: G20 Missed Major Opportunity to Change Game on Climate

By Mark Raven

Civil society and climate groups from across Turkey and the world have responded to Tuesday's G20 Leaders Communiqué with a mix of shock and disappointment.

“Coming right before the Paris Climate Summit, this was an opportunity for Heads of State from a range of countries to show their commitment to scaling up climate action both inside and outside of the UN,” said Mustafa Özgür Berke, from WWF-Turkey and İklim Ağı (Climate Network).

“Heads of State could have provided a clear and powerful signal ahead of the Climate Summit by putting a date the end of fossil fuel subsidies, and agreeing to stop funding fossil fuel projects around the world,” Ümit Şahin from İklim için (For The Climate) said.

Instead they have rehashed previous positions and in doing so risk being on the wrong side of history as citizens, cities and businesses increasingly take the lead in scaling up the just transition away from fossil fuels to a world powered by 100% renewable energy.

‘The G20 leaders failed to grapple their chance to show to the world community that they can be united to deal with the challenges we are confronted with,’ said Wendel Trio, director of Climate Action Network Europe. ‘Now was the time to be strong on tackling climate change and fossil fuel pollution. And we are disappointed our leaders failed to do so.’

“A broad and diverse range of civil society, non-profits and advocacy groups from across Turkey and the wider international climate and development movement all worked co-operatively to develop a set of four clear asks for G20 Leaders to meaningfully address the great climate challenge facing us,” Barış Karapınar, General Manager of TEMA Foundation said.

There was no significant progress made on any of these core asks:

- A complete and total end to ALL fossil fuel subsidies.

- Stop our financial risk from climate impacts and action; demanding the G20 set a clear plan by 2018 to stress test all spending against its compatibility with global climate commitments.

- An immediate end to all investment plans for the expansion of existing and all new coal fired powered plants and mines in Turkey.

- G20 leaders to unequivocally state their support for a long-term goal and ambition mechanism in Paris.

The climate movement stands for peace and solidarity - our members around the world have been deeply affected by the dreadful events that have taken place in Paris and Beirut and stand in solidarity with the victims. These events have pushed the G20 agenda in the direction of a strong and necessary focus on security.

“Climate change will only increase conflict, increase violence and play a role in even greater geopolitical conflicts and mass migration of desperate refugees,” Efe Baysal from Yuva Association said.

Groups as diverse as The Pentagon, the US Department of Defence, The Atlantic Council, NATO, the Global Military Advisory Council On Climate Change (GMACC), the Council for Security Cooperation in the Asia Pacific (CSCAP) and the Australian Defence Force have all concluded that climate change is one of the most serious security threats to the globe and that serious and immediate action is required. “The G20 leaders have failed to grasp this most basic of facts that the science illustrates so compellingly,” added Mustafa Özgür Berke.

“G20 members are currently spending 789 times more on fossil fuel subsidies than they are on the Green Climate Fund, and yet they say in the communiqué how critical this Fund is and climate finance is - this is patently obscene,” Ethemcan Turhan from the Ecology Collective added.

“Heads of State completely missed the point: as long as hundreds of billion of public dollars in fossil fuel subsidies are fueling climate change and its devastating consequences, we won't be able to build the world of solidarity, with a stable climate and 100% renewable energy we need." said Celia Gautier from Climate Action Network France.

“Now they have two more weeks to demonstrate the leadership needed to secure a successful deal at the Climate Summit in Paris. They must provide more money to help poor countries adapt, and commit to revisit and ratchet up their current inadequate national emissions reduction targets.” said Steve Price-Thomas, Oxfam’s Deputy Advocacy and Campaigns Director

“We must hope that these Leaders display the leadership in Paris that they failed to deliver here in Turkey on all matters to do with climate change, the most pressing of our global problems. The world is depending on it and the world is most certainly watching,” Ümit Şahin from İklim İçin (For the Climate Campaign) said.

About CAN: The Climate Action Network (CAN) is a worldwide network of over 950 Non-Governmental Organizations (NGOs) from over 110 countries working to promote government and individual action to limit human-induced climate change to ecologically sustainable levels. www.climatenetwork.org

Image credit: Turkey G20 Summit

This piece was originally published on Climate Network

Is the Gig Economy Good for Workers?

Unless you’re a part of the increasingly exclusive one percent, if you live in the San Francisco-Bay Area you most likely could use a little extra cash. There’s no surprise, then, that the city by the bay has given birth to a slew of startups that connect people with ‘gigs,’ on-demand, flexible, freelance employment, that are redefining what it means to work.

For some, living in one of the most expensive cities in the United States means occasionally taking on gigs – whether it’s running an errand, renting one’s car, or giving a lift to a total stranger and getting paid for it – while for others gigging is a way of life and welcome way to generate income.

This new ‘gig economy,’ comprised of companies such as Uber, Lyft, Airbnb, TaskRabbit and Handy, isn’t unique to the Bay Area; the gig economy is alive and well and counts on workers across the country who desire flexible part-time hours, are in between jobs, or have full-time jobs and are looking for ways to make extra cash on the side.

With all the upside that gigs seem to offer, it’s easy to overlook the impact this is having on local economies and worker well-being.

Long-Term Growth

Between 2010 and 2014, the gig economy accounted for 30 percent of new jobs and created new income sources for 2.1 million people in the United States, according to an American Action Forum report published this year.

Even more, according to business and financial management solutions provider Intuit, 7.6 million people will be part of the gig, or “on-demand economy,” by 2020 – and that slice of the labor market will grow by 18.5 percent per year over the next five years.

In other words, the gig economy is poised to grow and isn’t going anywhere.

Indeed, the rise of the gig economy is part of a broader trend in the U.S. within the “contingent” workforce (i.e. independent contractors), which has grown “from 17 percent of the U.S. workforce 25 years ago, to 36 percent today, and is expected to reach 43 percent by 2020,” according to the Intuit report.

Is this gig growth good for American workers? The jury is still out.

The Gig Economy’s Grey Area

While gig jobs offer flexible work schedules and work-life balance (not to mention, not having to report to a boss), gig workers lose out on important benefits offered by traditional full-time employers, such as guaranteed minimum wages, overtime compensation, and unemployment insurance.

“It’s a trade off between flexibility and stability in income,” Maya Tobias, co-founder of Bay Area-based local job board site Localwise, told 3p. “Our support system for workers seems to be eroding. It’s great if you’re a student making extra cash, but if you’re trying to support a family on one of these jobs, and you’re not getting health insurance and you don’t have certainty that you’re going to get paid next week, that’s a big problem.”

Localwise connects local businesses with local talent for one-time gigs, part-time and full-time opportunities and is rooted in strengthening connections between local businesses and local communities – something that well-known gig employers (think Uber) aren’t so well-known for.

Gig economy employers have also come under scrutiny for their lack of concrete policies that ensure worker security. Organizations such as the National Employment Law Project (NELP), which advocates for rights on the job, social insurance protections and equitable access to technology for “on-demand economy” participants, and New York Communities for Change, a social and economic justice coalition that drives awareness of “uber shady” gig employer business practices, are giving a voice to gig employees who are often the last heard in this national conversation.

Making It Count

Many of these gig workers (5.3 million) are full-time independent millennial workers (aged 21-35), according to management service provider MBO Partners. That same organization puts the number of independent works at 30 million. The growth of freelance, contract, consulting and gig workers in recent years has caused policy makers to re-evaluate how workers and wages are counted in state and national employment figures.

“The 'gig economy' has really become a convenient cover for the 21st Century robber barons,” one frequent Lyft driver and Airbnb renter, who chose to remain anonymous, told 3p. “They can keep a good public facade by eschewing the wonderous merits of the "sharing economy," but in reality the 'worker bees' they rely on are working around the clock just to scrape by, without any legal protections or benefits by the company or state.They also keep a relatively good morale…by dividing their workforce into a two-tier system. The top tier – those who keep the platform running – receive the staggeringly high tech income and plush benefits that befit a successful startup. The lower tier, though – those who drive the platform – earn a fraction of the income at (often) double the hours, far below the standard of living required to make it in the same city."

Next month, the U.S. Labor Department will host a summit on the future of work with the aim of figuring out how they can better tally up “on-demand” gig workers. This may signal a shift towards more protective policies for gig employees (and independent workers overall), who currently exist as ghosts in national economy head counts – ghosts who are fueling an ever-growing and ever-complex industry.

Image credit: Dan Gold and Humphrey Muleba via Unsplash