Breaking Through the Complexity: Transparency and COP21

Let's be real for a second. United Nations negotiations are complex. Here in Paris, there are continuous, simultaneous meetings with delegates from dozens of countries all contributing to a draft deal that is, by the minute, getting more complex and more difficult for us, regular people, to understand. It's tough for an experienced journalist to get a grasp on, much less a layperson.

“International negotiations are incredibly opaque, incredibly difficult to understand,” said Peter Wood with the International Institute for Sustainable Development (IISD), at the Global Landscapes Forum in Paris, taking place alongside COP21. "It is really incredible how these people have managed to make something very straightforward into a completely foreign language.”

That is definitely what we're seeing right here in Paris. A new draft text agreement was just released that elicited criticism from countries including the Philippines, India and many in the Climate Vulnerable Forum (CVF), a grouping of nations that are likely to face the worst impacts of climate change. But to regular citizens, it is hard to get worked up about the fact that human rights is only mentioned in this section, or that. What difference does it make if loss and damage is included within adaptation and not as a separate section? In the end, what's a few words in a thousand-plus-page document anyway?

“Because of the language used – acronyms, different issues – [it creates] a cloak of invisibility,” Wood said. “People don't want to look at what is happening.”

The solution, Wood continued, is transparency. IISD seeks to change this by providing detailed, easily-digestible information to the public about what happens at negotiations – not only high-profile ones like the Paris climate talks, where over 3,000 are media attending. But other ones, too, where, sometimes, IISD is one of just a few civil society representatives.

Transparency is the key to not only U.N. negotiations, but also to how we fight climate as a whole. We need information about emissions – to ascertain whether or not countries are meeting their agreements. This applies to the private sector, too: At TriplePundit we often write about companies making green commitments, but if those companies are not being transparent about their operations, those commitments will, in the end, mean little. Without transparency, there cannot be accountability.

One new, powerful tool is social media. It if forcing governments to be more responsive to their situation, and, through the million-plus tweets with the hashtag #COP21 (not to mention 3p's custom COP21 hashtag, #GoParis), allowing millions to participate in the discussions taking place right here in Paris.

“It’s never been so cheap to get your message out,” Wood said. The costs for transparency are going down due to social media and mobile communication.

This, more than anything else, gives me hope that Paris will help us achieve a real agreement that can produce real change. The accountability, though, will not be up to the negotiators. It will be up to us.

Photo credit: Le Centre d'information COP21

Ceres CEO: Forget Bleeding Hearts, Pursestrings Will Win Paris

Long gone is the narrative of climate change as a crisis manufactured by bleeding-heart liberals. Institutional investors are moving assets away from fossil fuels to the tune of $3.4 trillion. Stranded fossil fuel assets are pegged at $2.2 trillion. And regulatory bodies like the U.S. Securities and Exchange Commission have mandated that companies disclose climate change risks to their investors.

No, bleeding hearts won't solve the climate crisis -- or lead to a bold resolution coming out of Paris. It will be the pursestrings of big-money investors and multinational companies that will make the difference, as Ceres CEO Mindy Lubber underscored at a COP21 side-event focused on stranded assets.

"As we, as a community, take on the complex issue of climate change and its implications for humanity, for the environment, for public health, for national security, for our children, some people don't hear that message quite well enough," Lubber said on Thursday. "The issue with climate change is also one of the greatest financial risks facing us, which is why companies and investors are acting -- and acting now in greater ways than they have before."

Earlier Thursday afternoon, former U.S. Vice President Al Gore compared the financial risks associated with stranded assets to the sub-prime mortgage bubble -- a notion Lubber doubled-down on in her remarks.

"We saw sub-prime mortgages … nearly take down our economy internationally," Lubber said. " ... Whether you want to believe every scientist or not -- we may want to, other skeptics may not -- this is a financial issue of unknown proportions."After thinking a moment on that last bit, she rephrased: "Well, frankly, we now know it. But we've got to look at it, and we've got to act on it."

A reality check for the fossil fuel industry

The price of oil is plunging. At press time, prices sat at $39.98 a barrel, down from just under $100 a barrel this time two years ago. Late last month, Barclays released a white paper predicting prices would settle at around $60 a barrel by 2016, but even that puts a serious dent in oil company profits. But somehow the industry has yet to accept these realities.

"Right now, the fossil fuel industry somehow thinks that, in most cases, they can keep going on the track they're going. But oil is no longer $100 a barrel," Lubber continued. "It is a very high-priced industry. They can't succeed and be a good bet for the financial community if in fact the price of oil goes down to $60 as Barclays says, or it goes down to $40 or $50 as we're seeing [now], and survive as a profitable industry. They just can't."

Citing changes in the energy market, she added, "They also can't survive if demand keeps going down." She referenced two underlying factors driving down demand for fossil fuels:

Falling renewable prices and rising electrification: As oil prices continue in a free-fall, the cost of renewable energy technologies, much to the chagrin of the fossil fuel industry, continues to do the same. And investors are taking notice, moving their money away from risky fossil fuel assets and into promising new clean-technology solutions.

"As the vice president said, this is the first year in history we've seen more money invested in renewables than in fossil fuels -- and that's only going to grow," Lubber emphasized on Thursday. The continued electrification of the transport sector, a trend we're already seeing around the world, will only further the drop in fossil fuel demand, Lubber added.

Efficiency driven by big data: "The other reason demand is going down, well beyond just the obvious ... is the big-data world," Lubber continued. "We are seeing changes -- whether it is in the way railroads are run, how aviation is run, how technology is used -- that is changing the dynamic overnight." The aviation industry, Lubber explained, is already projecting a 10 to 20 percent decline in its fossil fuel needs due to efficiency improvements driven by big data. A similar drop is expected in the rail sector, Lubber said.

Investors respond

"The bottom line is: We have an industry that can function at $50 a barrel or at a lower demand, and that is changing the mix in the eyes of investors -- again, not because it's the right thing, the moral thing, the compelling thing, but because it is a financial risk that no longer makes sense," Lubber continued, with a forthright pragmatism that would make even Milton Friedman sit up and take notice.

In response, Lubber explained, investors are beginning to demand transparency about climate change risks -- a trend TriplePundit first noticed last year. The SEC guidance, issued in 2010, is also helpful. Lubber noted that it's not always executed properly, but that it's a step forward on the way to appropriate disclosure of risks. "There's more focus particularly because of the size of the stranded assets," she explained. "It is hard to deny that is a material risk that every fossil fuel company that files an SEC filing ought to be showing."

Additionally, led by Ceres, 70 global investors managing more than $3 trillion in collective assets petitioned 45 of the world’s largest fossil fuel companies in late 2013 to stress-test the financial implications of conducting business in a 2-degree world (i.e., a world in which we stay below a 2 degrees Celsius temperature rise, considered by scientists to be the climate tipping point).

"It can be done," Lubber insisted. "BHP Billiton did it, and other companies are starting to say they will -- Shell and BP committed to doing it. But those other 40 companies that the investors have sent letters to are part of negotiations and part of shareholder resolutions, and they will be in play this year."

A new messenger

So now, in this new scenario, rather than patchouli-wearing activists waving the climate action flag, it's the big-money stakeholders in their custom Brooks Brothers. And, predictably, that's changing the tide quickly.

"What makes this Paris set of discussions different than any before is that the financial leadership and corporate leadership are here in strength, saying we need to act on climate; we need a price on carbon; and we need to move sooner rather than later," Lubber said firmly. "That wasn't the case at Copenhagen; that wasn't the case at COPs before that.Image credit: Mary Mazzoni"The message has changed. The messengers have changed. The arguments are stronger; they're more compelling. And I think with the strength of the financial and corporate community coming together with the policy community, the NGO community, the city and state community, we've got a great shot at moving forward -- and I think we're going to see it this week."

The Bay Area's Transportation Potential and the Role Tech Companies Can Play

It's clear that the Bay Area needs a transportation revolution. You've probably experienced our challenges – whether it's crowded, standing-room-only BART and Caltrain, the worsening traffic jams across the region, or the lack of integration that makes it difficult, or prohibitively expensive, to move from one of the region's 27 transit systems to another.

There are a lot of current proposals regarding our regional transportation mess, but they're not enough. Tech companies can play a roll in helping enable progress toward a better, more mobile and, importantly, more sustainable Bay Area.

Limited proposals

Here's the bad news – current transportation iniatives are, suffice to say, lacking. While cities like Taipei, London and even Los Angeles are in the process of adding many miles and multiple lines of new mass-transit infrastructure, the Bay Area has in the pipeline two small spur Bay Area Rapid Transit (BART) expansions to the suburbs, and a billion-dollar plus, mile-long subway that will do little to alleviate the downtown transit crunch. The Transbay Terminal is currently being built – far over budget – in San Francisco, but it won't add any rail capacity to the city, as its much-awaited Caltrain extension to downtown San Francisco is now pegged to cost $3 billion and may not even start construction until sometime in the next decade.

There are some bright spots – Bay Area Bikshare is planning to expand tenfold in the coming year, from 700 bikes scattered across downtown San Francisco and near a couple of Peninsula Caltrain stations, to throughout San Francisco and the East Bay.

“The Bay Area is prime for us,” said Kansas Waugh with Motivate, who runs bikeshare systems across the United States, during a public seminar. “This is an area that bikeshare will work – it's dense, walkable and transit-connected.”

Moreover, transportation network companies, most notably Uber and Lyft, have begun expanding their carpool systems Uberpool and Lyft Line, with massive success. Both companies are also now realizing that their systems work in tandem, not in competition, with public transportation.

“We don't think we should be the mode choice for every trip,” said Tommy Hayes, Lyft's transportation policy manager. “We are stronger when we work with other transportation options.” Hayes added that 20 percent of Lyft rides in the Bay Area end near a Caltrain or BART stop.

Still, there is a major challenge that is being solved, so far, by piecemeal solutions, especially when you look at the Bay Area as a region. Bikes and Uber won't solve traffic, overcrowding and congestion. We need bigger, bolder solutions that reflect the new reality of how the region is integrated.

“Somebody will live in Mountain View and commute to San Francisco, and they're crossing city lines, county lines ... The reality is that we move across all these political boundaries and restrictions in our daily life – the planning and transport network is based on these little, discreet political entities,” said Gerry Tierney, an urban mobility expert at Perkins + Will’s San Francisco office.

Beyond tech shuttles

It is that lack of planning that has led to the infamous, controversial tech shuttles, which fill a gap in mass-transit options between the big tech campuses in Silicon Valley and residents living in San Francisco and more distant parts of the Bay Area

Companies are doing more. Facebook has said it will put in $1 million to fund a Caltrain extension to the Dumbarton bridge, which would put a station closer to its headquarters in Menlo Park. Google is working with Mountain View to build more housing, including low-income housing, around its Mountain View campus. And LinkedIn has said it will implement a plan to reduce single-occupancy vehicles at its headquarters, pushing more of its employees to either take transit or carpool to work.

The problem is that these plans are great in isolation, but they're focused on either employees or just the surrounding community. They are not yet integrated with wider Bay Area transit challenges, or wider communities that are feeling the impact of the region's rapid, tech-led growth.

What we need is more support for big plans. San Francisco's subway plan, a second transbay tube or Envision Silicon Valley. Companies should be working with Clipper as it designs version 2.0, which, SPUR, a Bay Area nonprofit pushing for better, more integrated transport, hopes will include regional transit passes like those which exists in cities all around the world. A million dollars from Facebook and some housing is not enough. Companies can play a far more active role.

A model could be what happened recently in Boston, when, as part of its new headquarters project, New Balance invested $15 million in building a new commuter rail station. This station provided benefits for the entire community and is helping Boston build a better transportation system -- and it's a model that could be replicated by Bay Area companies.

In fact, Rod Diridon Sr., with the Mineta Transportation Institute, sees hope in current action – and the potential for more a la New Balance.

“Most of the large companies are offering leadership through the community, and through the Silicon Valley Leadership Group, but they could invest a little bit of their own capital in transit,” Diridon said.

Uber and Lyft, if they truly believe that their future lies in working with mass transit, should also work with cities to develop better transportation systems. To do anything else would be, quite honestly, hypocritical.

The climate factor

There is another angle, of course: climate. Right now, global leaders are gathering in Paris for the UNFCCC COP21, which many hope will lead to a historic climate agreement. Sustainable transportation is a key facet of any carbon-neutral future, and the Bay Area, as a hub for global technologies, could – and should – be a leader for a country that has fallen far behind the rest of the world in this field.

“It is the crippling issue,” Diridon said. “We've been underfunding our transport infrastructure since '50s and '60s. There is not enough money to maintain current transport systems, and we're now No. 28 in the world on transport infrastructure.”

There a lot of people to blame for this – oil companies that shifted us to automobile-centric design, lack of integration, and years of unstable, unreliable national transportation investment. But as we aim to move forward toward a more sustainable world, we need a better way to move around that's not only more efficient economically, but more efficient for the environment as well.

“Climate change is a crisis – one way to solve it it is electric-powered transport. Cars, and mass transport, high-speed rail, light rail and a better BART,” Diridon concluded.

According to Alex Mackenzie Torres, CMO of SF-based public transit app Moovit, all of these systems need to work well together, through better, integrated technology.

“We believe that the future of transportation technology lies in a multimodal model: When users have access to more and more forms of transportation in a city, they’re able to get around their neighborhoods in more convenient ways, shorten their time spent waiting for a bus that’s delayed, and spend more time doing the things they love,” Torres said.

Image credit: Jim Maurer/Flickr

Island Nations Tackle Shipping Emissions

The island nations have it tough. Most people think of them as vacation destinations and nothing more. But countries like the Marshall Islands, Tuvalu, Maldives and many more are on the front lines of the battle against climate change. With sea levels on the rise, the very land they sit on could cease to be. And, as small nations with little in the way of industry, they didn't do very much to cause the problem.

These island nations have formed a voting bloc for U.N. climate change negotiations to lobby for the issues and points of view of greatest concern to these small-but-mighty nations. The group, called the Small Island Developing States (SIDS), shares common challenges including small but growing populations, limited resources, remoteness, susceptibility to natural disasters, vulnerability to external shocks, excessive dependence on international trade, and fragile environments. They also collectively understand that climate change is a huge threat.

Which is why they are lobbying hard at this week's Paris talks for strong, immediate action.

These islands are united by what surrounds them -- ocean water -- which is one of the reasons they've come together to call out the international shipping industry. The shipping industry was the recipient of the "fossil of the day" award (if you can call it that) on Wednesday due to the volume of international shipping and the lack of regulations for this industry.

The International Maritime Organization (IMO), the United Nations' specialized agency responsible for improving maritime safety and preventing pollution from ships, and the International Civil Aviation Organization (ICAO) have the same emissions as Japan and Germany combined! What's more, emissions are set to increase -- IMO estimates that they'll go up 50 to 250 percent by 2050. Right now, they're responsible for 2.2 percent of total global emissions.

Yet this international industry has continued to fly under the radar (no pun intended) when it comes to emissions regulations. That's why the Marshall Islands, with SIDS at its back, is calling for regulations for the global transportation provider:

"Parties [shall][should][other] pursue limitation or reduction of greenhouse gas emissions from international aviation and marine bunker fuels, working through the International Civil Aviation Organization and the International Maritime Organization, respectively, with a view to agreeing concrete measures addressing these emissions, including developing procedures for incorporating emissions from international aviation and marine bunker fuels into low-emission development strategies."

While this is an entirely modest request, and the EU claims emissions can be reduced with existing technology, one fears that this sector will continue to go unregulated due to its international nature.

Supply chain emissions are a key issue for every global conglomerate, and shipping disruptions due to climate change will cost corporations billions. One would think regulation would be a no-brainer, but we've left it to the good people of the Marshall Islands to sound the alarm. Let's not let them down.

Image credit: Flickr/Andrew

From Oil Patch to Renewable Energy King, Texas Shows COP21 How It's Done

While certain U.S. elected officials continue to tar renewable energy as a job-killing economic disaster, the state of Texas seems delighted to show that the opposite is true.

The state's long-term planning has included a healthy dose of wind energy, and it is also emerging as a solar leader in the U.S. Far from killing jobs, strong renewable energy policies in Texas appear to be one of the factors enabling this oil-producing state to weather the ongoing collapse of the global oil market.

A renewable energy surge, Texas style

The latest figures on Texas renewable energy come from the Electric Reliability Council of Texas (ERCOT), the agency that manages a grid supplying 24 million customers, or about 90 percent of the state's total electric load.

Earlier this week, ERCOT released its updated analysis of future renewable energy growth as Texas adapts to President Barack Obama's Clean Power Plan, which effectively prevents the state from relying on new coal power plants to increase its energy supply. Though state and federal policies enable natural gas as a replacement for coal, ERCOT projects that wind and solar will far outstrip natural gas over the next couple of years. Here's a summary from our friends over at FuelFix.com:

"Since May, the grid has added nearly 3,000 megawatts of power capacity — about two-thirds from new wind farms and the remainder from two new gas-fired power plants. In 2016, ERCOT anticipates adding more than 4,200 megawatts of new power capacity, including nearly 2,800 megawatts of wind power, more than 1,000 megawatts from solar farms and the rest from a new gas plant."

The American Wind Energy Association (AWEA) also paints a glowing picture of wind energy growth in Texas. According to the organization's latest figures:

"Texas is a national leader in the wind energy industry. Texas ranks first in the country for both installed and under-construction wind capacity, while supporting over 17,000 wind-related jobs. The wind energy industry in Texas has provided over $26 billion in capital investment and has thrived thanks to smart state policy, such as legislation that created Competitive Renewable Energy Zones (CREZ) for wind power transmission."

As a corollary to its renewable energy growth, Texas is also expanding its energy storage capacity, highlighted by a major new grid-scale solar energy storage project that is expected to provide relief for the state's notorious "electricity island."

For the record, TriplePundit is not surprised. Back in September 2012, we took note when the integrated energy company Direct Energy began marketing 100 percent wind-powered electricity for its Texas customers. Under the title, "For a Look at the Future of U.S. Energy, Go to Texas," we said:

"Texas is lagging a bit when it comes to solar power, but it is becoming a national centerpiece for algae biofuel research and its wind power industry is coming on strong."

Texas survives the petroleum roller coaster

So, here's where it gets interesting. With the global oil market in a state of permanent collapse, one would expect the economy of oil-producing states like Texas to head south, too. However, despite a rash of layoffs, facility closings and project cancellations, the state is doing pretty well so far. The Texas economy was surging throughout 2014 and though growth has tailed off this year, a recent article in the Houston Chronicle put a positive spin on things:

"Overall, though, we are doing much better than in similar oil price collapses, thanks to a more diversified economy and strong growth in other parts of the country. If the Houston economy catches a mild cold instead of the flu from the oil price collapse, we should consider ourselves very lucky."

Other observers also put the state's relative good health down to the growth of a more diversified economic field, including manufacturing. With that in mind, look at what the wind industry has contributed to growth in the Texas manufacturing sector, according to AWEA:

"The wind energy industry in Texas has provided over $26 billion in capital investment and has thrived thanks to smart state policy, such as legislation that created Competitive Renewable Energy Zones (CREZ) for wind power transmission. The state is home to at least 46 manufacturing facilities, including turbine manufacturer Alstom, tower manufacturer Trinity Structural Towers and numerous component suppliers."

Another interesting twist to the story is the role of Texas's fossil fuel industry in the growth of electricity demand, and by extension, the growth in renewable energy generation.

In its latest, update, ERCOT said it expects the peak demand for electricity to top out at more than 70,500 MW in summer 2016 and continue to increase after that, climbing to almost 78,000 MW by summer 2025. This is an increase from earlier forecasts, and it is partly based on anticipated demand from the a forthcoming liquefied natural gas facility, expected to be up and running by midyear 2019.

So there's that.

Texas and the COP21 Paris climate talks

According to a recent study of ERCOT's figures by the Environmental Defense Fund, Texas is already on track to meeting 88 percent of its Clean Power Plan goal even if it just follows current market trends rather than enacting new policies.

The water-energy nexus could also leverage adoption of renewable, water-sipping technologies over conventional electricity generation. EDF also points out that water resource issues in Texas could provide a non-controversial rationale for accelerating the adoption of renewable energy.

Add it all up, and it's clear that despite the state's long history in fossil fuels and the anti-environmental proclivities of its political leadership (we're talking about you, U.S. Senator and presidential candidate Ted Cruz), Texas makes a great case for a strong outcome at the COP21 Paris climate talks.

Image (screenshot): Online wind projects and manufacturing facilities via American Wind Energy Association.

Black Friday Post Mortem: Business as Usual or End of Capitalism?

Black Friday is over. Cyber Monday is over. Even Small Business Saturday is behind us. It’s time to take a deep breath and look at the numbers, starting with Black Friday, which wasn’t that successful this year: According to ShopperTalk, in-store sales decreased 10.4 percent over Black Friday weekend (Nov. 26-29) compared to last year.

If you’re not a fan of Black Friday this is good news, right? After all, Black Friday is probably the best reflection of an unsustainable culture of over-consumption, contributing to many of the problems we face. Therefore, weaker sales numbers on Black Friday could indicate that this unsustainable culture is losing steam, which is a step in the right direction.

But before you run to open a local, organic bottle of champagne, you need to ask yourself if there is a real reason for celebration. Have Americans really had enough of Black Friday madness? Well, it’s complicated.

While Black Friday sales were somewhat disappointing for retailers, Cyber Monday seemed to compensate for it: According to Adobe's Digital Index, total online sales on Cyber Monday rose 16 percent from last year to $3.07 billion. Overall, “sales for the five-day period starting on Thanksgiving totaled $11.11 billion, 2.4 percent more than the expected $10.85 billion and 17 percent more than last year,“ Adobe reported.

These figures apparently show a shift from shopping in brick-and-mortar stores to shopping online, especially on mobile phones, which reached a new record - $800 million in spending in the five-day period. In addition they might reflect changes not just in the way consumers shop, but also in their expectations – consumers “might be holding out for even better deals as the season progressed,” as Matthew Shay, the National Retail Federation’s president and chief executive, explains. Last not least, it could be that year-round deals cause consumers to feel that almost every day is a Black Friday, resulting in what the New York Times described as sales fatigue.

So, does it matter at all that Black Friday’s sales have gone down, if Cyber Monday’s sales have gone up and the overall retail sales this holiday season are expected to be up by about 3.5 percent compared to last year? Isn’t this, at the end of the day, nothing but business as usual?

The first answer that comes in mind is yes – this is business as usual. After all, the shopping frenzy of the holiday season hasn’t changed much, even with the demise of Black Friday. As Gerald Storch, CEO of the Hudson’s Bay Co., which owns Saks Fifth Avenue and Lord & Taylor, puts it: “Christmas always comes, and people have to shop. They will be back.” In addition, while a shift toward online shopping could actually reduce the carbon footprint of shopping, the fact that it takes off some of the friction involved in traditional shopping like the need to spend time in very crowded brick-and-mortar stores could end up in increasing consumption, and thus erode the somewhat positive impact online retailing could have on the environment.

Yet, on a second thought, Black Friday is a symbolic image of everything that is wrong about capitalism, and symbols do matter -- if Black Friday becomes weaker, maybe what it represents also becomes weaker. As sociologist Fred Polak wrote in his book “The Image of the Future”:

“The rise and fall of images of the future precedes or accompanies the rise and fall of cultures. As long as a society’s image is positive and flourishing, the flower of culture is in full bloom. Once the image begins to decay and lose its vitality, however, the culture does not long survive.”

In other words, the decay of Black Friday, the ultimate image of unsustainable capitalism, could possibly lead eventually to the decline of the same type of capitalism it represents. It’s true that this reasoning may not go hand-in-hand with more factual reasons other thinkers like Paul Mason or Jeremy Rifkin give for the decline of capitalism as we know it, not to mention that the holiday season shopping orgy itself isn’t going away, but perception matters as much as the facts.

This also has to do with the principle of social proof, which describes our tendency to conform to social norms, or in other words: We tend to do what everyone else does. As Dan Ariely and Wendy De La Rosa explain: “Black Friday has become the 'social norm.' Because so many people are spending, it becomes socially acceptable for one individual to spend. It’s the classic 'everyone is doing it' excuse.”

While Ariely and De La Rosa contextualize this idea that Black Friday has become a social norm in terms of having impact on people on that day only (“That day, for many American households, might be serving as a spending cheat day. Over the years it has becomes socially acceptable to spend a substantial amount on this day," they write), I would take it one step further and suggest that Black Friday may also help excessive consumption become an acceptable social norm in general. Therefore, if Black Friday is gone and we don’t see “herds of people throwing their dignity and morals away just for that last flatscreen TV on sale and in stock," people may see over-consumption differently and won’t accept it as an appropriate behavior. After all, as Robert Cialdini wrote: “Persuasion can be extremely effective when it comes from peers.”

While I doubt if any of the leaders debating our future in Paris has been paying attention to the decline in Black Friday sales, this trend could become an effective ally for policy makers in creating a more sustainable world, or at least in helping us imagining one.

Image credit: Flickr/Clotee Allochuku

Coal’s Double Jeopardy: The Overlooked Impact on Forests

Here in the U.S., coal has fallen out of favor the past several years due to cheap and cleaner-burning natural gas, but it is still one of the most popular sources of fuel on the planet. The International Energy Agency (IEA) estimates it provides 30 percent of the world’s energy, only second to oil. Coal is also the base of 40 percent of the world’s electricity generation. And why wouldn’t coal be used? It is easy to source and transport, is cheap and, unlike oil, it is not beholden to geopolitical conflict. No one ever sniffed at a wad of cash and dismissed it as “coal money.”

But coal is also a huge contributor to greenhouse gas emissions and air pollution worldwide, as photos from China, the world’s largest coal producer, have starkly reminded us in recent years. The coal industry has pointed to technologies such as “clean coal” plants and carbon capture and storage, but technology has not kept up with demand. And with global leaders currently in Paris trying to hammer out a climate deal during the COP21 talks, coal in many ways has become a fuel of the past.

To that end, a Dutch NGO, Fern, has issued a report that advocates turning away from coal -- not for the typically stated reasons, but because of the impact the loss of land, as in forests, has on the world’s climate when they are transformed into coal mines. According to Fern’s researchers, the loss of land to coal production, especially in Canada, India, Indonesia and Australia, lead to “double jeopardy.” Not only is that newly produced coal contributing to climate change and air pollution, but the loss of forests also poses an additional danger to the planet.

Fern's analysis suggests that almost 12 million hectares (about 46,000 square miles) of forest, a land mass larger than Portugal, are at risk of of being cleared to make way for coal mines. Much of that risk, insists Fern, is concentrated in a few countries:

- Over 5,000 square miles in Australia, the equivalent of 2.1 million football fields. Concerns over the impact of coal mining have led to protests and even the arrest of Australian rugby star David Pocock.

- In Canada, over 4,200 square miles of forest are threatened in British Columbia alone.

- Almost 3,300 square miles in Indonesia, or 9 percent of that country’s forest cover. The rush to mine coal, according to many sources, has led to “land grabs” and devastation for indigenous populations who have lived in central Borneo for generations.

Fern’s report goes on to cover the multiple effects that would result if all this forest were to be converted into land for coal production. In addition to the millions of tons of sequestered carbon that these forests would emit into the atmosphere, the roads, new mining camps and other developments necessary for coal mining would also create more air pollution and contribute more greenhouse gas emissions.

So, what is the solution? According to Fern, the evidence suggests that the best stewards of these forests are the people who live within and near them. With its estimate that 1.6 billion people, including 60 million indigenous people, worldwide are dependent on forests for their livelihoods, Fern suggests more local control and stronger protections of land tenure rights. And while Fern does not offer alternative sources of energy for this coal that would otherwise be kept below ground, readers of this report will be left thinking that a real solution derived in Paris, and continued investment in clean energy and technologies, are needed more than ever.

Image credit: Andrew Taylor/WDM (Flickr)

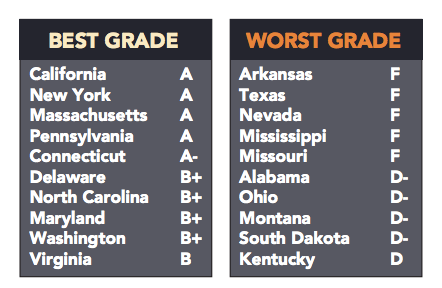

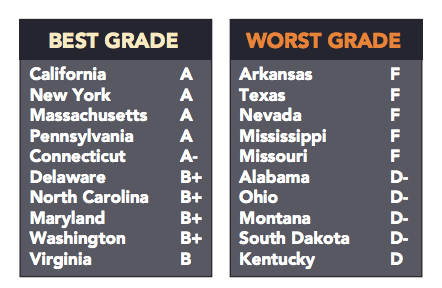

Report Reveals America’s Most Vulnerable States are Not Prepared for Climate Change

As the Paris climate talks continue on, a recently published report card is helping to bring the issue of climate change a bit closer to home. Released just prior to the U.N. climate summit, where world leaders converged to stave off climate change, the States at Risk report is the first national analysis of state-level preparedness for climate-driven threats.

States were scored on an A through F grading scale and assessed on their individual preparedness relative to other states across five distinct climate-related threats: extreme heat, drought, wildfires, inland flooding and coastal flooding. The study was conducted by research group Climate Central in collaboration with consulting firm ICF International.

See how your state scores on climate change preparedness

So, here’s the rundown: The most at-risk states include California and Florida (which face all five threats), as well as Texas (which faces four of the threats).

In regards to overall disaster-response preparedness, California is at the top of the list, earning an A across all five categories, indicating its national lead and example of best practices to combat climate change.

“Across the United States, extreme weather poses a significant risk to the U.S. economy, infrastructure and lives, and the costs of recovery are taking an increasingly large economic toll on federal, state and local coffers,” said Steve Ellis, vice president of Taxpayers for Common Sense.Devastatingly, more than half of all states assessed have taken no action to plan for future climate-related inland flooding risks or taken action to address them.“Since the 1980s, the annual number of disasters with a price-tag exceeding $1 billion has nearly tripled, from less than three to more than eight a year. Planning and taking steps to address these inevitable disasters cuts long-term costs, reduces impacts, and ensures states and communities can more quickly rebound from losses. Rather than continue to write big checks post-disaster, we as a nation must invest in ourselves to become less vulnerable.”

The lowest scores were doled to Texas, Nevada, Missouri, Mississippi and Arkansas, where little-to-no action has been taken to mitigate projected climate change challenges.

The report also lays out major issues that states must address on a policy level as it relates to citizen vulnerability. Impoverished populations (the majority of whom are elderly or under the age of 5) are the most vulnerable to the impact of climate change, which exacerbates hunger and availability of water, transportation and resources during times of extreme heat.

Though the report commissioned favorable opines from researchers at the University of Arizona, and former public officials, the request to meet climate change with serious policy and behavioral change has been an uphill battle both nationally and globally. President Barack Obama has been criticized and blocked harshly by the U.S. House of Representatives for his stance and efforts to put climate change on the agenda.

If world leaders can make a deal over the next few days of the summit to reduce greenhouse gas emissions on a global level, the data provided by this report gives an invaluable starting ground for state leaders to begin taking action to protect their economies and their constituents from the very real threat of climate change.

Images via States at Risk report

Dunkin’ Donuts Uses Bio-Digesters to Dunk Food Waste

Americans love their fast food, and it often shows in the litter strewn along highways and in overflowing trash cans in American cities. Part of the problem lies in packaging, which is a large portion of what the Natural Resources Defense Council (NRDC) estimates to make up as much $11.4 billion in wasted, non-recycled packaging annually. Then there is the food waste itself, of which estimates run anywhere from 30 to 40 percent of all food produced in the U.S. annually.

While some fast-food and other restaurant chains are showing some creativity when it comes to dealing with food waste, the reality is that too much food is still going into landfills. Tack on the resulting methane gas emitted into the atmosphere, and the fact that municipalities are running out of landfill space (forget new spaces as no one wants them in their backyard), and those half-eaten burgers, fries and donuts pose quite the problem.

Speaking of donuts, one chain, beloved on the East Coast and often craved for out West, says it is trying a new approach to solve the food waste problem. Dunkin’ Donuts announced this week that it installed a food waste disposal system at a second location in New Jersey.

The coffee and breakfast goodies giant has engaged the services of BioHighTech Global, an American subsidiary of a British clean technology firm. The company builds a bio-digester that appears to be a benign, boxy, stainless-steel contraption with wheels. Is it a trash can? Is it a dishwasher? Well, one could say it is a little bit of both. In go coffee grounds and those half-eaten muffins and donuts. And, thanks to a process called aerobic digestion, the end result is harmless greywater that can be discharged into a municipal sewer system.

Wait, but those grounds can be composted, you say! Fair enough — but few cities have reliable composting systems in place, especially in congested cities, which, if you have spent much time in urban areas, have a Dunkin’ Donuts on every corner whether you love them or not. And while some chains such as Starbucks are good about giving out those coffee grounds on a daily basis, there are not always takers. The best possible alternative, therefore, is to haul all that food waste, in some cases as far as 100 miles, to the nearest landfill. So, not only is that waste creating greenhouse gases and taking up depleted landfill space, but one must also consider all the fuel needed to transport that garbage to its final resting spot.

BioHiTech claims its aerobic digesters can process up to 2,500 pounds of food waste a day. Along with these digesters, BioHiTech also markets a cloud-based monitoring system so that users can gauge a system’s food disposal process and find ways to establish even better practices for waste diversion. This technology in part is behind what Dunkin’ claims is the goal to establish 100 “sustainable restaurants” by the end of 2016.

Considering how widespread Dunkin’ Donuts is, however, the company has a long way to go. If this bio-digestion process succeeds in the two locations in which it is installed so far, then the company has another estimated 10,998 shops to retrofit if it will sincerely tackle food waste in the U.S. and overseas.

Image credit: BioHiTech Global

Al Gore Calls for Bold Commitments at COP21

(Image: Al Gore addresses U.N. Secretary-General Ban Ki-moon.)

Former U.S. Vice President Al Gore took to the stage at COP21 on Thursday in a side-event focused on stranded fossil fuel assets. The crowd expected the longtime climate activist to come prepared with a compelling narrative that made the case for strong action coming out of the conference—and Gore did not disappoint.

In a 20-minute speech, he laid out the many forces at play in the climate crisis and the solutions being presented by scientists, activists and indeed by the market itself.

He pointed to catastrophic downpours, flooding and mudslides happening now in Chennai, India, which stalled the publication of The Hindu newspaper for the first time since the 19th century, along with ongoing and historic droughts in California, the Korean peninsula and much of southern Africa.

"Indeed, the television news every evening is like a nature hike through the book of Revelation," he punctuated, with flair befitting of a former presidential candidate.

And while Gore pulled no punches with regard to the severity of the climate crisis, he acknowledged the road ahead will not be an easy one—and seemed to almost call for patience from the environmental community, which is surely ironic considering he's been warning the world of these issues for over 15 years:

"For 150 to 200 years, we have relied on carbon-based fuels for the dramatic progress in global civilization, and to this day more than 80 percent of all the energy used in the world economy still comes from carbon-based fuels," Gore declared. "And all of us must acknowledge what a daunting task lies ahead in making the switch to a low-carbon economy. It's bound to be filled with challenges; it already is."

Bullish on Paris

Gore is no stranger to COP proceedings. He's attended a number of them in years past and is even known for "stalking" attending delegates in the corridors of power, as Nick Nuttall, head of communications and outreach for the United Nations Framework Convention on Climate Change (UNFCCC), fondly described in his introduction.

But, although Gore has witnessed the lead-up and disappointment surrounding former COP proceedings, he appeared bullish that Paris will end differently:

"One of the dramatic differences in the reality we are living in—in these days of the Paris conference, compared to previous conferences—is that the business community, investors, technology developers, researchers and others have brought the technologies of solar photovoltaics, wind power, efficiency in a variety of different forms, battery storage, sustainable forestry and sustainable agriculture to the point where these new approaches are extremely competitive with the legacy approaches that we are quite used to."

He pulled several examples from current events to illustrate his point:

Goldman Sachs reports big gains in solar and wind: Entitled The Low-Carbon Economy, this new report's name alone is enough to raise eyebrows coming from a source like Goldman Sachs, but the findings are even more surprising. The financial group predicts that, between 2015 and 2020, solar photovoltaics and onshore wind will add more to global energy supply than U.S. shale oil production did between 2010 and 2015. "Those of you who pay attention to the energy markets," Gore said, "know what an incredibly powerful development for energy markets was caused by that sudden addition of fractured gas."

Renewable energy shatters predictions: In 2000, the best predictions available for advances in wind energy forecast that the world would generate 30 gigawatts of wind power by 2010, Gore explained. We exceeded that prediction 12 times over. In 2002, analysts predicted we would add 1 gigawatt of solar energy per year by 2010. We exceeded that prediction 17 times over. Last year it was exceeded 48 times over, and this year it will be exceeded 62 times over. "That is an exponential curve," Gore said.

Utilities offer free power with renewables: "It's not only the exponential cost-down curve associated with renewable energy, which is having such a powerful impact that was unexpected for so many," Gore said, "it is also the nature of this resource -- it has zero marginal cost." That, he continued, is what led TXU—an investor-owned utility in Texas—to introduce a renewable-based rate plan that made electricity free for customers during non-peak hours (between 9 p.m. and 6 a.m.). Similar rate structures are also being used in south Australia, Gore said.

Two U.S. states hold open competition for energy generation: Two U.S. states, Minnesota and Colorado, recently ran a transparent, open competition for the provision of new electricity generation, Gore said. In both cases, it came down to competition between gas-fired generation and solar photovoltaics.

Solar sells for less than 4 cents per kilowatt-hour in Nevada: Warren Buffet recently signed a contract purchasing new electricity from photovoltaics for 3.87 cents per kilowatt hour. Gore called this "a figure that was just stunning to many who thought we might never get there."

A warning to investors

Gore then posed a question to the audience, "Will we change?"

"That's what Paris is all about. But the answer that will come here in Paris will come not only from the final text of an agreement that the national governments will sign, but from the business community, from the NGOs and from the investor community."Investors need to look at the pattern that is unfolding, lest they be trapped holding stranded assets."

Gore doubled-down on his warning to investors, comparing stranded fossil fuel assets—which a new report from the think-tank Carbon Tracker pegged at $2.2 trillion—to the catastrophe of sub-prime mortgages that caused the Great Recession, from which the world is still struggling to emerge.

"They decided in the banking community that the traditional reluctance to give mortgages to people who could not make a downpayment and had no ability to make monthly payments could be circumvented if you just got millions of them, lumped them together, securitized them with some illusory financial instrument, and then bundled them and sold them into the global market," Gore summarized, to knowing and somewhat cynical snickers from the audience. "It turned out that that illusion was punctured when reality intervened and a few, and then many, noticed that it was a complete scam. And suddenly those assets were stranded."There are now trillions of dollars of stranded carbon assets, and there are illusions which levitate the assertion that the value is much higher than it really is. There are active efforts to fool investors."

Gore then pointed to the recent announcement from New York Attorney General Eric Schneiderman that he will open a criminal investigation against ExxonMobil for actively misleading investors into believing that no one needs to worry about the climate crisis. "Well, they do," Gore said flatly.

A bold agreement coming out of Paris—as well as state, local and regional action undertaken in places like California, Quebec and the European Union—could lead to additional stranded fossil fuel assets, Gore pointed out. And as consumers continue to wise up to the gravity of the climate crisis, fossil fuel companies are faced with even greater risk.

"Many of the carbon companies are in danger of losing their public license to operate, as more and more people realize that we simply cannot continue putting 110 million tons of global warming pollution into the atmosphere, as if it is an open sewer, every single day."

Many large institutional investors are already coming to this realization, as fossil fuel divestment commitments reach $3.4 trillion. And Gore predicts this trend will continue, with investors divesting "first from the riskiest carbon assets, and over time from all [of the assets] that look as if they are in danger of being stranded" and then investing "in the fantastic new opportunities that are emerging in the low-carbon economy."

The proverbial mic-drop

To close his speech, Gore stared into the the camera lens only a few feet from his pulpit and took aim at laggard global politicians, with a line that likely left them shaking in their Gucci loafers.

"I would close by saying that for anyone who doubts that we have the political will to act, please remember that the will to act is itself a renewable resource."

Well said, Mr. Gore. Well said.

Image credit: Flickr/United Nations Photo