Your 21st-Century Car Will Be Zero-Emissions and Smart

Silicon Valley and Detroit are now in a race to reinvent the automobile -- delivering zero tailpipe emissions, autonomous driving, and seamless voice-connectivity between the car, all your digital devices, your home and place of work. Think iPhone compared to landline in visualizing the scale of change.

We are on the cusp of the mass marketing of zero-emissions smart cars that will deliver fuel competitiveness against 75 cents per gallon gasoline, zero emissions, improved safety, seamless connectivity and a quantum leap in human productivity.

The two mega-trends creating demand for smart cars

The zero-emission smart car is not a technology solution looking for a market. It can already be applied in two key areas to drive its global commercialization.

Cities: Cities are one of the the 21st century’s demographic mega-trends and a key trend that will support the commercialization of zero-emissions smart cars. For the first time in human history, half of the world population now lives in cities. Cities have entered into a gargantuan growth stage. From just two mega-cities in 1950, the world now has 22 mega-cities with populations of 10 million or more. By 2030, the world is projected to have 30 mega cities, and by 2050 it is projected that 70 percent of the world’s population will live in urban areas. Traffic congestion is a universal challenge confronting all cities and, most especially, mega cities. City traffic congestion is choking urban productivity. Cities from Indianapolis to Beijing are in search a solution.

Deadly urban air pollution. Deadly urban air pollution is the second mega-trend driving the commercialization of zero-emissions smart cars. Urban air pollution is now so intense that it is destroying human health and worker productivity. Today, 7 million people around the world die prematurely from air pollution each year. This scale of urban air pollution is now retarding economic growth by reducing worker productivity due to sickness and lost work time. Urban air pollution is driving already high health costs to even higher levels. Finally, investment in pollution control further impedes economic growth by shifting capital from more productive investments and by increasing the per unit cost of fossil fuels.

Zero-emission smart cars' elegant economic solution

The smart, zero-emission car is posed to be an elegant economic solution to urban congestion and deadly urban pollution. It uses existing urban infrastructure. A smart car will use the Internet of Everything to deliver safer and more efficient traffic flow. Emissions-free smart cars will dramatically reduce urban pollution. The connectivity of the smart, zero-emissions car will be a productivity multiplier for humans who can repurpose ride time to connect with work associates, friends, home and business.

The CEO that successfully wins market leadership selling zero-emission smart cars will be hailed as the Steve Jobs of the 21st century. And it is my take that this is the global, disruptive mega-prize being pursued by CEOs from Silicon Valley to Detroit.

This article is sourced from my participation at the Looking Further With Ford event held at the 2016 North American Auto Show. Part two of this article series outlines the disruptive technologies that will deliver zero-emissions smart cars. The third article will detail how zero-emissions smart cars will change how we think about cars, how we drive and how we live.

Image credit: Flickr/Ed and Eddie

Benefit Corporations for a Sustainable Economy

By Melissa Schweyer

In 2015, we witnessed what is possible when large groups of people come together to change the world. But with the adoption of both the Sustainable Development Goals (SDGs) and the Paris Agreement, we have a lot of promises to keep and work to get done.

A sustainable economy is within our reach, but it will take the cooperation of multiple stakeholders, the investment of billions of funds and the dedication of the entire world.

Lobbyists, activists, scientists and politicians have already — quite successfully — mapped out some of the important policies that need to be adopted by governing bodies around the world in order to propel us into a sustainable economy by 2030.

Many of these policies relate to agriculture, deforestation, water, research and development, technology, renewable energy, and transportation. And they all have the capacity to create synergies that would — no doubt — encourage the private sector to invent, create, produce, and sell goods and services for a more sustainable future.

Any policy that can boost cooperation, facilitate multi-channel communications, incentivize information-sharing, strengthen scalable impact, create new sustainable capital, mitigate environmental degradation, motivate early adoption and provide long-term solutions are policies worth lobbying for.

Today, I’m lobbying for a policy that can do all of those things.

I strongly believe that governments should adopt policies that provide companies with the ability to register as purpose-driven corporations. Purpose-driven corporations are different from traditional for-profit companies and nonprofit organizations because they operate with a triple bottom line, equally valuing profits, people and the planet.

Legislative terminology refers to them as Benefit Corporations.

Benefit Corporations are for-profit entities that seek to create social and environmental benefits in addition to the traditional aim of generating profit. Only two countries in the world, Italy and the U.S., have adopted legislation that enables businesses to register as Benefit Corporations.

This policy gives for-profit businesses the opportunity to define themselves as for-purpose companies within their articles of incorporation, protecting directors who may make business decisions based on societal or environmental needs that run against traditional short-term, profit-generating norms.

If governments around the world want to encourage public-private partnerships that help us transition toward a sustainable economy, then they must also create new guidelines and frameworks that clearly enable companies to operate via a triple bottom line.

To be candid, I’m not trying to suggest that this lack of policy has stopped the world from embracing purpose-driven business.

But the void certainly hasn’t helped.

In my home country, the Canadian Bar Association is putting pressure on our government to act quickly. And B Lab, a nonprofit which serves a global movement of people using business as a force for good, also believes that Benefit Corporation policies could change our economy for the better.

Both groups argue that the introduction of such a policy would increase business transparency, protect for-purpose companies’ missions, provide more freedom to entrepreneurs, attract further investment and create economic development, all at no additional cost to the government.

Beyond this, experts also indicate that this policy shift would protect purpose-driven companies during capital injections, through leadership changes and help prepare businesses post-IPO.

Our next move is clear.

Benefit Corporation legislation has the potential to be our best next step forward on our journey toward a new sustainable economy.

Image courtesy of Liam Andrew via Unsplash

Melissa Schweyer is a writer, people-person and change-maker with nearly 5 years of progressive work experience in the not-for-profit sector. Most recently, she’s teamed up with Habitat for Humanity Hamilton, utilizing many of her past experiences to help break the cycle of poverty in Hamilton, Canada. A CSR enthusiast at heart, Melissa also manages a blog, www.csrtist.com, where she shares her thoughts, ideas and new ways of thinking about corporations and how they can make a positive impact on our world. In her spare time, you’ll most likely find her writing, practicing yoga, enjoying cheese or spending time with family and friends.

Follow Melissa Schweyer @CSRtist

Boosting Sustainability in the World's Priciest Sailing Race

The America’s Cup has come a long way since its inception in 1851. So has the financial cost of competing in what is arguably one of the highest-profile sailing races in the world. Some competitors reportedly spent as much as $200 million to compete in the the 34th America’s Cup, held in San Francisco in 2013.

With today’s eye on leaner, smarter and more sustainable approaches, Sir Ben Ainslie, skipper and team principal for Ben Ainsle Racing (BAR), and other competitors entering the 2017 competition are calling for a rewrite of some competition rules. They want smaller vessels that are more financially practical and can be matched by improved design and engineering.

"This will be a big change, but it is a necessary one if we are to create a sustainable America's Cup for the future,” Ainslie said last March when the group released news about their plans.

It's a change that fits right alongside Ainslie's other key focus these days: sustainability.

"Our vision is to establish a long-term sustainable business and sports team that inspires the next generation" said Dr. Susie Tomson, Land Rover-BAR's sustainability manager. In doing so, she said, the company is hoping to inspire a "rethinking [of] the way natural resources are used to deliver a winning team."

To this end, Land Rover-BAR has partnered with 11th Hour Racing, an organization that is well known for its support of sustainable practices in water sports. Initiated by the Schmidt Family Foundation, it strives "to promote collaborative, systemic change for the health of the marine environment" through sponsorship of local programs. In past years its projects have included a marine education program in Rhode Island, a workforce program in the Dominican Republic that upcycled old sails and kites and provided additional work to the local community, and the funding of critical research to support Long Island's clean water resources. 11th Hour is also a sponsor of the Atlantic Cup and the 55 South racing team.

"We share [11th Hour Racing's] objectives for a sustainable future, and we are able to support each other in working towards this goal, with a long-term vision that goes beyond the 2017 America’s Cup," Tomson said. "By embarking on this new model of sport sponsorship, 11th Hour Racing aims to demonstrate the advantage of embedding sustainability into operations and pilot innovations to achieve greater performance."

Early last year, BAR partnered with City College in Southampton, England, to build to two docking ribs for its headquarters in Portsmouth, 25 miles south of the college. Eighty apprentices from the college's Marine Skills Center were put to work to create the ribs that would help berth the team's huge multihulls. At the forefront of the project would be finding ways to reduce wastage, both in materials and in the hours put into the project. So, rather than building brand-new facilities, the team opted to work with materials used in the 34th America's Cup competition. They also opted for resins and other fibers with a smaller environmental footprint than conventional materials.

Other green accomplishments for the racing team include:

- The facility is built to BREEAM standards

- The team is using renewable electricity to run their facility. The energy source includes more than 400 solar panels

- 25 percent improved water efficiency

- Established goals of 60 percent waste diversion from landfills

- Use of 100 percent VOC compliant carpets and paints

- Use of recycled demolition concrete to support 100 percent of the facility's foundation

- Collection systems for waste and rain water collection for boat maintenance and other needs

- Introducing artificial reefs at its new base to support the revival of local species

- Implementation of a carbon management program for team operations

- Ongoing materials research to find ways to improve recycle potential for essential materials like carbon fiber reinforced plastic, epoxies and other traditionally environmentally challenging materials

Breaking this barrier is part of what will redefine the environmental and financial costs of the America's Cup and takes sailing yet another step away from the older, more toxic options of previous generations.

Tomson said that Land Rover-BAR and 11th Hour Racing hope that their efforts to develop, introduce and standardize sustainable sailing practices will teach future generations that thinking green pays off. "Sustainability isn't a handicap," said Tomson, "whether your business is winning the America's Cup or or manufacturing computers. This is the future, and it will drive innovation and technology so that we do things better -- more efficiently."

In 2016, the BAR team will continue its participation in the Louis Vuitton America's Cup World Series, held last summer in Portsmouth. The race moves around the world as a lead-up to the 35th America's Cup in 2017, in Bermuda's Great Sound.

Tomson said the team will continue its efforts to promote green technology by using renewable energy to power its temporary base in Bermuda. "[We] hope this will leave a legacy that others will follow," she said. "We are also working with 11th Hour Racing to help local environmental organizations, supporting them in the development of their own green event guidelines.

"We have an opportunity to push for all sports teams to become truly sustainable businesses, and we want to lead the way by educating and inspiring younger generations, who will then drive sustainability forward instinctively."

Images: Harry KH/Land Rover BAR

The Solar Investment Tax Credit Extension and Tax-Exempt Entities

By Adam Feldman

The recent federal legislative action extending the Investment Tax Credit (ITC) and bonus depreciation with clarity through 2021 is, as many of my colleagues in the industry have already pointed out, likely to result in outsized returns for tax-equity investors who are no longer pressurized to place such investment capital during this calendar year. It also opens up opportunities for investors who have been on the sidelines to develop investment programs based on this increased visibility. Less noted, however, is the ability of tax-exempt entities – such as universities and municipally-owned utilities – to benefit from this extension.

With no ability to monetize the tax benefits that accrue from owning a solar system, such entities have been effectively forced to engage in power-purchase agreements (PPAs) or leases in order for a third-party to monetize these benefits (presumably, they are shared with the tax-exempt entity in the form of lower PPA or lease pricing).

A modified version of the PPA, in which the energy buyer pre-pays for a significant portion of the electricity the system will produce over the contract period (the chart above shows approximately 50 percent over an assumed 20-year contract period), can allow tax-exempt energy buyers with strong credit to leverage their financial standing to further reduce the total cost of the energy produced. In some cases, this can reduce the cost of energy by as much as 25 percent. (Note: For entities without strong credit but with the cash capabilities to make such a prepayment, regardless of tax status, this structure can also serve as a credit enhancement mechanism).

However, certain complexities in this structure, including the energy buyer’s need for reasonable levels of security in the asset itself combined with the tax-equity investor’s requirements around such security, require structural and legal undertakings that are typically only advisable for larger systems sizes (greater than 5 megawatts) so that the costs of these efforts can be allocated such that they do not outweigh their benefits. (Note: The prepayment structure can be employed without security for the energy buyer, significantly decreasing the costs, though trade offs must be contemplated thoroughly).

Because of the time required both to negotiate such contracts and to develop larger systems, over the last year the looming ITC cliff prevented many tax-exempt entities from pursuing prepaid PPAs. Even if such a structure was completed, the ability to replicate the effort was also in jeopardy because of the potential end of the ITC … Would it even be worth doing if it could only be done once?

With the clarity provided by the recent ITC and bonus depreciation extension, many tax-exempt entities now can – and should – embark on programmatic procurement strategies that employ the prepaid PPA. Further, such entities that have a desire to eventually own these assets can ensure a path to ownership by including purchase option rights within the contract. The time afforded by this extension not only allows larger projects that might not achieve operational status until 2017 to remain viable, but also creates a five-year window in which to replicate successfully-deployed structures, presumably more efficiently on the subsequent transactions given the completion of the efforts on the first.

Finally, on the investor side, tax equity investors willing and able to deploy resources into solar assets that efficiently employ the prepayment structure will realize further optimized returns. This structural alignment between the energy buyer and a single investor – with the prepayment, there is no need for the tax investor to take on either debt or a cash-equity partner – creates an ideal programmatic opportunity for deployment through the end of 2021.

Image credit: Pixabay

Chart courtesy of the author

A life-long resident of the San Francisco Bay Area, Adam Feldman was a co-founder and served as a Director at GSSG Solar, LLC from 2013 through 2015. Previously, while with SunEdison, Adam and his team successfully deployed the prepayment structure on a 35MW project in San Antonio, TX. He holds a BA in Business Economics from UCLA and an MBA with a focus on sustainability from Presidio Graduate School.

Business needs to do more to build greener Scotland

Scottish businesses must be motivated by more than the financial bottom line if they are to help build a fairer and greener Scotland. That’s the conclusion of Better Business, a new study into responsible business practices in Scotland.

The study, the first of its kind in Scotland, was conducted by Social Value Lab and delivered in partnership with social enterprise development agency Firstport, CEIS, and the Scottish Business Awards. The project was supported by Scottish Enterprise, Highlands and Islands Enterprise, CGI and Caledonian MacBrayne.

Research included a nationwide survey of over 1,000 businesses of all shapes and sizes across Scotland, in-depth interviews with 34 business leaders and CEOs and detailed case studies illustrating good practice. Researchers also analysed the corporate social responsibility and reporting practices among Scotland’s 500 leading companies.

Over half (52%) of the business leaders that responded agreed there was a clear business case for investing in community, social and environmental issues yet almost a third (29%) felt the sole responsibilities of companies was to maximize profit.

While nine in 10 Scottish companies (89%) felt they were delivering on their social and environmental responsibilities, the study concludes there is still a long way to go in areas such as representation of women in senior positions and involving staff in decision-making, for example. Of Scotland’s top 500 companies, only 13% of all board posts are held by women and over half (56%) of the firms have none at all. Just 4% of CEOs are women.

The study also shows that the larger the business, the more likely it is to formalise its commitment to corporate responsibility. For example, 32% of small companies reported specific initiatives, rising to 62% of mid-sized companies and 90% of large ones. This confirms the view that corporate responsibility in small businesses is driven by the owner/leader’s values, largely unplanned and with no desire for recognition.

In contrast, some of Scotland’s largest companies are delivering well publicised and resourced CSR programmes and are more influenced by the interests of employees, public opinion and business image.

Social Value Lab director Jonathan Coburn commented: “The face of business in Scotland is changing. The traditional notion that business is simply about making money no longer holds true. There is growing influence from the emerging generation of business leaders whose personal values are reflected in how they do business, while the public is more ethically motivated and less tolerant of corporate negligence and corrupt practices.

“There is recognition by business leaders that people are more likely to admire, work for, buy from and support companies that they perceive to share their values. With social media, there is nowhere for businesses to hide – reputation is everything, as the Volkswagen emissions scandal showed.

“Many businesses are trying to do the right thing but face intense competition, tight profit margins and the costs of meeting existing responsibilities – they struggle to release the money or time to go further with their commitments. The aim of this study is to get a realistic picture of corporate responsibility and explode the myths.”

You can read the full report here.

Picture credit: Edinburgh skyline - © Karen Mcdonald | Dreamstime.com

62 People Own As Much As Half of the Global Population

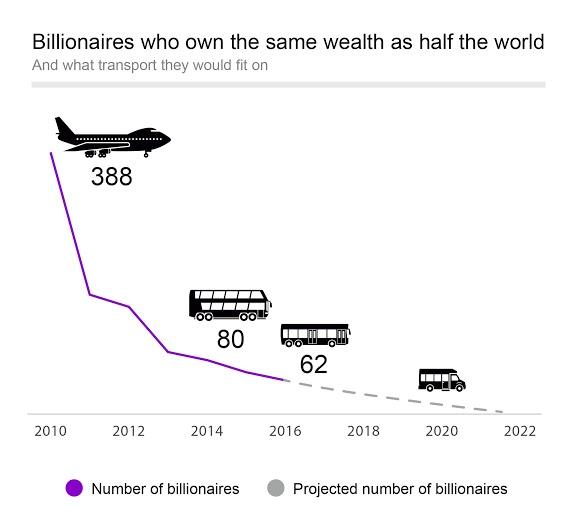

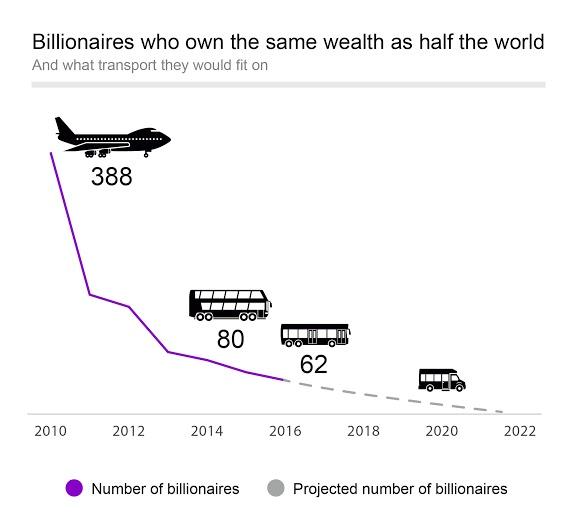

The rich get richer and the poor get poorer is an adage we’ve all heard countless times. Sadly, it is absolutely true. Just 62 people own as much as the poorest half of the global population, which is 3.6 billion people, an Oxfam report revealed on Monday.

The gap has been increasingly widening. Last year, it was 80 and in 2010 it was 388 -- a 44 percent increase. The report, published before the annual World Economic Forum in Davos, where the world’s political and financial powers that be gather, also found that the wealth of the global population’s poorest half has decreased by a trillion dollars since 2010 -- a 41 percent decrease. This decrease in the wealth of the world’s poorest occurred while the global population increased by about 400 million people since 2010. Last year before Davos, Oxfam predicted that the 1 percent would own more than everyone else by 2016. The prediction came true in 2015.

Since 2000, the global population’s poorest half received only 1 percent of the total increase in global wealth, but half of that increase went to the top 1 percent. The average annual income of the poorest 10 percent of the global population increased by less than $3 each year in nearly a quarter of a century. Their daily income increased by less than a single cent a year.

From 1990 to 2010 the inequality within countries has increased, despite the “fantastic progress” that has helped reduce the amount of people living below the extreme poverty line by half. If the inequality within countries had not increased, 200 million more people would have escaped poverty, the Oxfam report pointed out. That number “could have risen to 700 million had poor people benefited more than the rich from economic growth.”

While some argue that wealth trickles down to the poorest, Oxfam reveals the opposite. One big example is tax avoidance by the wealthiest. Consider that $7.6 trillion of individual wealth is held offshore. That is more than the combined gross domestic product (GDP) of the U.K. and Germany. Oxfam’s analysis of 200 companies, including the world’s biggest and the strategic partners of the World Economic Forum, found that 9 out of 10 companies have a presence in at least one tax haven. Corporate investment in tax havens in 2014 was nearly four times bigger than it was in 2001.

Tax avoidance by the wealthiest is harmful to both rich and poor countries. It is “sucking the life out of welfare states in the rich world,” as the report states. But it also prevents poor countries from having the funds they need to deal with poverty.

This is not sustainable

Oxfam gives recommendations to the world leaders who will meet at Davos. Those recommendations include:- Closing the gap with executive rewards through three ways: increasing minimum wages towards livings wages, having transparency on pay ratios, and protecting workers’ rights to unionize and strike.

- Promoting women’s economic equality and women’s rights by providing compensation for unpaid care, ending the gender pay gap, promoting equal inheritance and land rights for women, and improving data collection to assess how women are affected by economic policy.

- Keeping the influence of powerful elites in check. One way to do this is by building mandatory public lobby registries and stronger rules on conflict of interest.

- Agreeing to a global approach to end the era of tax havens.

A world in which only 62 people have as much as half of the global population is not a sustainable one. For one thing, the average carbon footprint of the richest 1 percent could be up to 175 times higher than that of the poorest 10 percent. In other words, the richest 1 percent are using resources at a pace that is vastly higher than the poorest 10 percent.

The world’s population deserves an economy that works for all and not just for the 1 percent. It is high time for world leaders to pay attention to Oxfam’s recommendations. Whether they will remains to be seen.

Image courtesy of Oxfam

Corporate Leadership Lessons from Malheur National Wildlife Refuge

When Arizona businessman Ammon Bundy orchestrated an armed invasion of the Malheur National Wildlife Refuge in eastern Oregon earlier this month, apparently he expected the same measure of support that his father got from prominent Republican leaders during a notorious 2014 standoff with federal agents over grazing rights in Nevada. However, Ammon Bundy has failed to rally prominent supporters, local residents or anyone else who could make a good impression on the national stage. If attracting a strong executive team and a cadre of effective collaborators are hallmarks of good corporate leadership -- and they are -- then clearly the younger Bundy has been bested by the elder.

Before we launch in to the details, it looks like Ammon Bundy has been bested by the Internet as well. Last weekend a pair of Oregon residents started an online fundraiser called G.O.H.O.M.E., in which donors add to the pot each day that the occupation continues. The funds have been dedicated to the Malheur refuge, the local Paiute community, a gun control reform group, and the Southern Poverty Law Center, a longstanding civil rights organization that tracks hate groups. After just a few days the page has already clocked in almost 600 donors for a total of more than $24,000.

The Malheur invasion: Be careful what you wish for ...

For those of you new to the topic, Cliven Bundy gained fame by calling in supporters for an armed standoff with federal agents over grazing rights in Nevada. Though he later fell out of favor with Republican leadership after making a series of bluntly racist remarks, those remarks also served to distract attention away from his relatively nuanced articulation for the right of states to appropriate federally owned land -- a policy favored by the powerful lobbying organization ALEC.

In contrast, Ammon Bundy has blundered into a weeks-long occupation of a popular public park, which he has punctuated with a steady stream of calls for turning over public, federal property to "local authorities" for use by miners and loggers as well as ranchers. He has continually put his foot in the bucket by ignoring native Paiute claims to the land, in addition to ignoring local residents' nearly universal pleas for him to go home.

Bundy describes himself as someone there to help the local community, but from the outset he has alienated all but a handful of residents and ranchers -- and even that handful, the six-member so called "Committee of Public Safety" -- has publicly disavowed Bundy for acting and speaking on their behalf without their knowledge or permission.

However, Bundy has remained steadfastly oblivious to the steady stream of negative reaction from the community. His message to a reporter after a full two weeks of occupation was:

"We came down here to take a county and give it back to its constitutional premise, to work with the people so that they can begin to claim their rights themselves and so that they can begin to use them."

In that context, it's no mystery why ALEC and other powerful allies have failed materialize for the younger Bundy. His "getting the miners back to mining" mantra has stripped away ALEC's loftily crafted states rights pretense, and reduced it to nothing more than a land grab to benefit private businesses.

The irony is that if ALEC accomplishes its privatization goal, then small scale local businesses -- ranchers, miners, and loggers alike -- could easily find themselves left out in the cold.

In reality, considerable globalization and consolidation have taken place over recent years in both the logging and the mining industries, so clearly ALEC is not particularly interested in promoting states rights as it applies to small scale, local business owners. In effect, Bundy is supporting ALEC's efforts to give away the store to large, national and multinational corporations.

As for the connection between ALEC's insistence on privatizing federal land despite consolidation in the mining and logging industries, take a look a 2012 article in USA Today about ALEC-funded U.S. Sen. Al Melvin (R-Arizona):

"... With the state in control, the backers say, loggers could return to forests where endangered species halted work decades ago and miners could regain access to ore outside the Grand Canyon.

"In the last 30 years, the radical environmental policies of these federal agencies have ground those industries to a halt — right into the ground — and almost killed them," said state Sen. Al Melvin, a Republican from Tucson, Ariz., and sponsor of the land-takeover measure."

That would be this Al Melvin, as reported by ProgressNow Arizona:

"... Melvin also attended the conference at the Grand Hyatt in Washington, disclosing that ALEC picked up a $2,300 tab for registration, hotel, airfare and meals. ALEC also paid $1,800 for Melvin to attend a 2011 conference in Salt Lake City. “Al Melvin ran for the Legislature as an iconoclastic Tea Party candidate, but it didn’t take him long to ‘go Hollywood,’ if you catch the drift,” [ProgressNow Executive Director Robbie] Sherwood said."

So there's that.

With friends like these ...

Without any significant measure of local leverage to fill in the radio silence from ALEC and its partner legislators, Ammon Bundy has been left to rely on his small core constituency. He has spent the past two weeks calling for others to join, bust so far the occupation still consists almost entirely of people from outside of the local community, and a good number of them have magnified Bundy's numerous blunders with their own misadventures.

Last week, for example, Bundy supporter Kenneth Medenbach was found at a local store in possession of a vehicle from the Fish & Wildlife service, and was promptly arrested. That was clearly an unforced error, as federal authorities have been allowing the invaders to come and go at will in their own vehicles.

As of this week, a second Bundy follower got into trouble when he flipped his own vehicle on an icy road and was cited for driving without a license, a third was revealed to be living on a six-figure income wholly derived from the State of Arizona, which had been paying him and his wife to provide temporary care for a series of foster children, and a fourth has gone online to claim that Child Protective services removed his children from his home.

To make matters worse, a quick search for Kenneth Medenbach on the Intertubes uncovers a very fervent disavowal of Bundy from a small-scale Oregon mine owner, the very kind of person who should be at the core of his intended constituency.

Reportedly, last spring Medenbach took part in an armed rally in support of the Sugar Pine Mine in southern Oregon after the owner requested help during a dispute with the Bureau of Land Management. Apparently, armaments were not what the owner had in mind. He requested the men to go away, and ended up reaching an agreement in court with BLM to stop work until he filed the proper papers.

The whole situation has also drawn attention to the messy details of Ammon Bundy's personal life, including property tax delinquency, an apparent foreclosure and a rather spotty record as a small businessman that makes his cowboy attire look more like a fashion statement than workwear. In addition, his acceptance of a federal small business loan of $530,000 in 2010 does no service to his anti-federal rhetoric, further contributing to the feeling that the whole Malheur episode is the played-out fantasy of a poseur.

The aforementioned Sugar Pine Mine owner now has this to say about the Malheur takeover, in full:

We here at the Sugar Pine Mine have been made aware of the situation unfolding in Harney County, Oregon.Although we fully support the Hammond family, we DO NOT support the splinter group currently occupying a Federal Government building to further their own agenda - whatever that may be.

Whatever the reason, whatever the motives of this group, this is not the way to deal with the traitors inside the rogue government agency called BLM.

The crimes of the BLM are so vast, so wide-ranging, that the Federal government will have to deal with the criminals who work for them.

We still believe in the LAW.

We still believe in JUSTICE.

We still believe in the CONSTITUTION of the UNITED STATES of AMERICA.

We still believe there are good people, righteous people, who work IN government and FOR the people.

We still believe that we can, and will, win in court.

We hold these values and beliefs dear and we shall never surrender them.

We DO NOT and WILL NOT support any action that has been designed to inflame emotions or incite violence. We DO NOT and WILL NOT support any action that will render a wife without a husband, nor children without a father.

Sincerely...

- The Sugar Pine Folks.

This latest disavowal leaves Bundy with virtually no support from any sector other than a small circle of extremists, leading one to conclude that he is in fact acting on behalf of ALEC, and only ALEC -- whether that organization likes it or not.

Image: An adult American Avocet with four chicks at Malheur National Wildlife Refuge, Oregon, USA via U.S. Fish & Wildlife Service by Barbara Wheeler, creative commons license.

Chipotle Moves To Put 'Healthy' and Safety Back in Fast Food

While its food safety issues have yet to be officially resolved, and may never be, Chipotle boldly asserts it will reboot its staff along with new safety protocols to win back customers after the recent outbreak of E. coli and a norovirus that sickened more than 500 customers and briefly closed 53 stores in nine states in late 2015.

While some of the measures -- at least on the scale that the burrito king says it is implementing -- may be unprecedented, one has to ask: Why wasn’t management doing this all along? Why did the inherent risks of sourcing ingredients and their marketing value outweigh food safety?

The answer to that, of course, is: Because they didn’t have to, until now.

Will it be enough?

We’ll get the answer to that question as Chiptole charts its hoped-for recovery, which it outlined for investors last week in Orlando, Florida. There, founder and co-chief executive, Steve Ells, pretty much admitted there’s been room for improvement on safety. He said the company wants to be seen as “in front of food safety as we are in sourcing our ingredients.”

At the center of their refreshed food safety practices are two distinct measures:

- “Very high resolution testing” in the company’s “central kitchens” before shipping ingredients to its 1,900+ stores; and

- A “kill step” to catch any pathogens that might have slipped through the revamped sourcing procedures via farms, ranches and other suppliers.

In addition, Mark Crumpackher, chief creative and development officer, asserted they are instituting “unprecedented changes” in their restaurants “to make sure our employees are observing all of the most up to date food safety practices.”

At one point during the investor conference, Ells declared “Chipotle is as safe as ever” in its efforts to reduce the risk of foodborne illnesses to “near-zero.” But later he acknowledged the ‘bar’ keeps rising.

“We’re continuing to roll things out,” Ells said. “I don’t think we’ll ever be finished. We’re always looking for opportunities to become safer.”

To help prove his point, Chipotle is briefly closing its stores on Monday, Feb. 8, for several hours to link up via satellite as many of its 60,000 employees as possible. There executives will spell out why customers should give it another chance.

“I’m sure that event will get covered (in the media),” Ells said. It will be a very public type of meeting.”

Enabling the media and perhaps the public to listen in would be a bold public relations tactic. But it’s not without some risk.

What happens if an employee asks a question executives would rather take privately? What happens if there is another outbreak? Coaching thousands of employees ahead of time can only prepare them to a certain degree.

Scientists and other experts at the Centers for Disease Control and Prevention (CDC) in Atlanta have been investigating the e.coli outbreak since its inception. While the norovirus incident was attributed to a sick employee, the causes of the e.coli outbreak are still proving difficult to pin down.

Company executives signaled in December it would wait for an “all-clear” from the probe. But with it still underway, any such green light may never come. That leaves the company with no choice than to forge ahead on its own, especially in light of how its stock price fell back from a record high and sales plummeted.

The last outbreak was reported Nov. 27.

Late Friday, the CDC responded to this writer’s request for any updates and stated: “Foodborne disease outbreak investigations can take varying amounts of time. There have not been any recently reported illnesses in either outbreak (e.coli or norovirus), and that gives us some information to indicate that the outbreak may be nearing an end, however the investigation is still ongoing.”

Matthew Wise, who leads the CDC response team, told the Wall Street Journal he was surprised to hear Chipotle say that it’s close to calling an end to the outbreak. “This is one of those outbreaks that has been a real challenge,” he told the Journal. “We can’t cross anything off the list.”

Will the source of the outbreak ever be identified? According to Dr. William Schaffner, an infectious-diseases specialist at Vanderbilt University Medical Center, probably not.

As TriplePundit reported on Jan. 5, a food industry blogger asserted that Chipotle might be the victim of a deliberate bid to tarnish the growing natural food movement. But no evidence has surfaced to substantiate the claim.

Guiding the management team along the way has been Dr. Mansour Samadpour, a Seattle-based food safety consultant. Ells and his colleagues tapped into Samadpour’s apparent high-standing during the investor presentation to buttress their safety overhaul. Whether that means anything to customers who aren’t eating at Chipotle now remains to be seen.

In early December, he told Food Safety News: “I was asked to design a more robust food safety program to ensure the highest level of safety and the best quality of all meals served at Chipotle.”

Some customers at Chipotle restaurants not affected by the outbreak may continue to eat there as if nothing happened. Several customers surveyed at a store in Leesburg, Virginia, last week (photo) and who said they were aware of the outbreaks opined that Chipotle now, probably, is safer than before because of the steps it is taking.

In the ever-expanding space more food retailers are striving to carve a niche in, Chipotle’s response could become a defining case study for how to transparently marry food safety with nutrition and corporate responsibility, all while enduring a significant crisis.

In addition to the satellite meeting, Chiptotle executives told investors they will execute marketing campaigns including traditional advertising and direct mail. Part of that campaign will be a “detailed story of what happened” and “what we’ve done about it to make sure it doesn’t happen again.”

There are at least two other challenges facing the company.

First, the U.S. Attorney’s Office for the Central District of California, in conjunction with the Food and Drug Administration’s (FDA) Office of Criminal Investigations, slapped the company a subpoena January 6 in a federal probe concerning the outbreak of norovirus cases at the firm’s restaurants in California. Chipotle was asked to produce a “broad range of documents.”

Neither the FDA nor the U.S. Attorney’s office have said anything since announcing the probe other than to explain “When foodborne illness outbreaks occur, the FDA works closely with other federal and state agencies and other health officials to identify the source, ensure that companies are removing foods from the marketplace, and communicate with the public.”

Second, a shareholder named Susie Ong filed a class-action civil lawsuit against the company in U.S. District Court in New York, according to Law360. It claims investors were not informed that Chipotle’s “quality controls were inadequate to safeguard consumer and employee health.”

Chipotle’s stock price has been as high as $758.61 per share over the past year. It dropped more than 40 percent in early January and recovered to $475.94 before the Martin Luther King holiday weekend.

Adding up all of these challenges, as Chief Financial Officer Jack Hartung acknowledged at the presentation, “We’re not going to the efficient business model that everyone has come to know … Our margins are going to suffer … The most important thing we can do to get our margins back is bring our customers back in.”

Co-CEO Ellis said: “I have confidence we are going to win our customers back and will emerge a much stronger company,” Ells said at the investor conference. Go here for a recording of the conference by Wall Street Webcasting.

Image credit: Jim Pierobon

Abu Dhabi Sustainability Week Keeps Momentum From COP21 Surging

Here in the Middle East, the sense of excitement one month after the COP21 climate talks has electrified the halls of the massive convention center where over 33,000 people are expected to attend the annual Abu Dhabi Sustainability Week (ADSW). This week’s agenda has already started with numerous side events building off COP21, including the annual assembly of the International Renewable Energy Agency (IRENA). But yesterday’s opening ceremony amplified COP21’s accomplishments, while reminding attendees that much work remains to be done if the world is really going address the risks posed by climate change.

It has been 10 years since Masdar, Abu Dhabi's renewable energy company and the main sponsor of ADSW, was founded, and its chairman, Dr. Sultan Al Jaber, summed up in his opening remarks what occurred in Paris succinctly:

“For the past two decades, we kept saying ‘we can,' ‘we should’ and ‘we must’ but last month at the Paris Conference of Parties (COP21), we did.”

Dr. Al Jaber also told the audience, “There has never been a greater opportunity to make real progress toward sustainable development and to create an economic potential that could drive sustained growth for future generations.” For Masdar -- which has endured its share of ups and downs building its sustainability city near Abu Dhabi's airport, as well as the challenges it faced working on renewable energy projects for the past decade -- the past several weeks have been cathartic.

Ban Ki-moon, who has centered his tenure as Director-General of the Union Nations around campaigning for a global agreement to address climate change, also spoke with optimism at this summit’s opening ceremony. “We are the first generation with an opportunity to end poverty,” said Mr. Ban, “but we are the last generation with a chance to combat climate change. Clean energy is the key to both of these tests.”

President Enrique Peña Nieto of Mexico also addressed the several thousand who were in attendance, and the morning’s events also included the ceremony for the Zayed Future Energy Prize (ZFEP). ZFEP, which is best described as a “Nobel Prize for clean energy deployment," awarded several clean-energy innovations within business, the nonprofit community and schools.

Clean energy indeed is the hot issue here in Abu Dhabi this week, and the exhibit halls in Abu Dhabi’s convention center are laden with booths showcasing countless products and services related to the sector. Dozens of industry groups from nations around the world have space devoted to their companies’ innovations, while companies ranging from startups to energy behemoths such as BP and Total also have a presence. What started several years ago as the World Future Energy Summit has morphed into a gathering that includes conferences on water and waste, as well as another that is devoted to finding ways to empower more women to enter the clean energy and sustainable development sectors.

With oil under $US30 a barrel and projected to drop even further in price, one would assume clean energy technologies to struggle in this business environment. But judging by the number of deals expected to be made in Abu Dhabi this week, and this event’s continued growth, watch for this sector to grow even more. Renewables have become more profitable even as they have become cheaper, and the optimism here signals that new sources of energy will have a banner year in 2016.

Image credit: Leon Kaye

Disclosure: Leon Kaye’s trip to Abu Dhabi was paid for by Masdar

Demand For Lithium-Ion Batteries Surges in Spite of Cheap Oil

Last week, the price of crude oil dipped to a 12-year low selling for under $30 a barrel -- a far cry the pre-recession peak of around $147. On Jan. 16 it was reported that a town in northern Michigan was the first place in the country to start selling gas at under a buck a gallon in a purported local price war. Meanwhile, the national average price for gasoline is running at just $1.89 a gallon.

This is the culmination of a protracted downward price trend due to a global oil-production glut, which according to the American Automobile Association saved Americans more than $115 billion during 2015, with drivers pocketing savings of more than $550 each.

Perhaps unsurprisingly, some American car buyers seem to have taken this as a signal to forgo the economical compact car, and start buying SUVs again. Ford said ahead of last year’s Los Angeles auto show that it predicts the market for SUVs will grow to 40 percent by 2020, up from around a third of the domestic U.S. market today.

But despite the return of cheap gas, all the major auto companies continue to take electrification seriously, including Ford, which recently announced they will invest another $4.5 billion to bring 13 new electrified cars to its lineup by 2020. And this week’s Economist ran a couple of articles reporting that demand for lithium-ion batteries is surging, with lithium itself being, “one of the world’s only hot commodities.” That’s remarkable with crude at today's rock-bottom prices.

For sure, robust demand for lithium and lithium-ion batteries does not depend on the transportation sector alone. The Economist details that utilities are installing “millions” of batteries as energy storage into power plants to regulate supply at times of peak of demand, as well as accommodating the "intermittency" of renewables.

The Economist cites a couple of examples in the United States alone: During 2016, a solar plant in Hawaii will be equipped with batteries, such that it will be able to supply energy after dark at a price that is cheaper than using diesel generators. Another example, AES Energy Storage won a contract in 2014 to provide a “peaker-plant” in Southern California with battery storage able to provide up to 100 Megawatts of power to the grid in times of maximum demand, which, as a company spokesman says is, “hybridizing the grid.”

But it’s not just utility grade storage that lithium-ion batteries will fulfill, but at the consumer level too. Next month, Tesla will start installing its $3,000 Powerwall to early adopters in both the United States and Australia, so that people can, at last, store the energy generated from their own solar panels.

As important as energy storage is, transportation is still a key driver of demand for batteries. Tesla, of course, plans to play in both arenas, and the completion of its so-called Gigafactory aims to supply vehicle batteries for 500,000 vehicles a year within five years.

Something else that cannot be overlooked as a driver of demand for lithium-ion batteries is China. In 2015, Chinese auto manufacturer BYD was the world’s largest seller of electric vehicles. Though China’s EV market is comprised of multitudes of electric bicycles, scooters and other “slow speed EVs,” BYD sold over 61,000 “highway capable” electric vehicles, almost all into its domestic marketplace. Furthermore demand for EVs is growing at a clip. The country as a whole, organized around the government’s “new energy” initiative, tripled the output of EVs in the first 10 months of 2015, compared with 2014 - to 171,000 units, many of which were electric buses.

Indeed, government regulation across the globe is likely to help keep the demand for batteries strong. The Economist notes emissions standards in both the EU and US markets are likely to boost demand for lithium from automakers on a long term basis.

This is all good news for the battery manufacturers - a market thus far dominated by a handful of players; South Korea’s Samsung and LG, and Japan’s Panasonic and Sony. But add to that China’s numerous battery makers, and Tesla’s entry into the picture - not to mention automakers like Toyota forging partnerships with suppliers to ensure uninterrupted supply - and the commodity price for lithium spiked in the last two months of 2015, to almost double what it was just a couple of months earlier - reaching around $13,000 a ton.

Still, the market for lithium itself is relatively small. Worldwide, sales of lithium salts according to The Economist add up to only about $1 billion a year. Which might sound surprisingly low, until you consider the amount of lithium in the average battery comprises only 5 percent of total materials used in their manufacture, and only 10 percent of total cost; a little of this important metal goes a long way.

That said, according to The Economist, Goldman Sachs, an investment bank, has described lithium as “the new gasoline.” But if it is to become that, the lithium-ion battery has to satisfy detractors, including the Argonne National Laboratory, who says the ability to provide hundreds of miles driving range, be rechargeable in minutes, and provide power at a cost comparable with natural gas is, “beyond reach” of lithium-ion technology.

Perhaps that’s changing, however. Chevrolet’s boss, Mary Barra, in unveiling the automaker's new Bolt EV asserts the new car’s battery has “cracked the code” in terms of combining long range with affordable price - and it would indeed appear poised to be a breakthrough product if production vehicles achieve the promised 200-mile range for around $30,000 after incentives.

In addition, Samsung announced at this year’s North American International Auto Show that they have developed a prototype “High-Density” battery that will offer a driving range of 600 kilometers (373 miles) on a single charge, with an energy-density 20 to 30 percent improved over today’s - and slated for production in 2020.

There is a saying that the stone age didn’t end because we ran out of stones. So perhaps it’s not premature to say the growth of lithium-ion battery technologies in the face of cheap fossil fuels might allow an analogous saying: the end of the oil age will not be because we run out of oil. Time will tell.

Image courtesy of the author