On the Trail of The B Team

This article is part of a series by students at Bard College’s MBA in Sustainability. Principles of Sustainable Management is a foundational class for all Bard MBA students. It delivers ecological and social literacy, the frameworks and tools used by sustainability professionals, the business case for more responsible treatment of people and planet, systems thinking and integrated bottom line accounting.

By Gwenyth Jones

Two years ago, 14 titans of industry came together and vowed to overcome the massive global challenges standing in the face of prosperity — theirs and everyone else’s. They called themselves the B Team. They were inspired by the work of Lester Brown and the B Corp movement, which takes as a self-evident truth that purpose, not profit, must form the foundation of any business that wants to stick around. B also stands for Plan B — a contingency plan for businesses operating on a planet in danger.

The B Team formed after a series of workshops with civil society leaders, systems experts, sustainability pioneers, economists and entrepreneurs. The founders included Richard Branson of Virgin Airlines, Jochen Zeitz of the Kering luxury goods group, Guilherme Leal of Brazil’s Natura, Ratan Tata of the Indian multinational behemoth that bears his name, Arianna Huffington of online journalism fame, Paul Polman of Unilever, Mo Ibrahim of Celtel Intl in Africa, and seven others.

Faced with the prospect of more than 9 billion people on planet Earth by 2050, and a diminishing supply of natural resources, these leaders saw a world that would too soon be unable to sustain human life, much less the businesses that connect the human population.

They understood that business had been a major driver of these increasingly catastrophic results — and that the current take-make-waste paradigm of business was irreparably damaging the planetary theater in which it operated. They believed that, since business screwed it up, business had to fix it.

Beyond damage control, however, they believed that effective social and environmental stewardship had become sine qua non to enduring financial success. When fully executed, the new paradigm would enable businesses to thrive, not just to survive. They developed a systemic approach to changing the nature of business -- setting an ambitious, impressive, even awesome, set of goals to be implemented throughout their companies:

Two years in, how are they doing? What impact have they had?

A year ago, Jo Confino, writing for the Guardian, called for more than press releases. He expressed concern about lack of funding. On their website, the B Team claims a phenomenal response to their challenges: Through 2014, over 1,200 Plan B kickoff events took place in more than 470 cities and 73 countries, giving shape to their plan. They have 14,500 Twitter followers and regularly provide a digest of news and events in the sector, a kind of Flipboard of the movement. In September 2015, the group staged a conference with passionate presentations by renowned scientists, CEOs, policy leaders and heads of global NGOs.

B Team members have received a great deal of attention in media and at key events. They’ve forged partnerships with organizations like the World Business Council for Sustainable Development and Ashoka, a leader in the social enterprise movement. They’ve joined the 2015 B20 Anti-Corruption Task Force. They’re good storytellers.

They formed partnerships with Transparency International, Global Witness, Global Financial Integrity and OpenCorporates, creating a working group to drive transparency. In January 2015, the B Team presented their Plan B for Business at Davos and committed to annual updates on its performance. They’ve sent an open letter to Christiana Figueres of the U.N. Framework Convention on Climate Change, calling for radical progress at COP21 in Paris, and now celebrate that.

Is this enough? Are they preaching only to their choir? Will they bring skeptical corporate peers into the fold?

The B Team is targeting its own cohort: mega-corporations arguably more capable of rapid, transformative change than the forces of governments, NGOs or social movements. Many of their executive peers, however, are highly incentivized to conduct business as usual. In their world, intentions are laudable, but results count.

Targets can be set and metrics defined differently — even radically differently — but to persuade the most recalcitrant, the targets must be hit. B Team leaders must provide hard evidence, both quantitative and qualitative, that their paradigm is working inside their own companies.

In the long run, that evidence will secure and hold the attention of their peers and make believers out of those from the religion of growth for growth’s sake, at any cost. They say on their site that they will do this, as part of their future plans. If it can deliver, the B Team will play a crucial role in the unfolding drama of our struggling planet. Let’s stay tuned.

Logo via the B Team

Gwenyth Jones is a student in the Bard MBA in Sustainability program, transitioning from a career in publishing and digital services.

The Bard MBA in Sustainability focuses on the business case for sustainability. We train students to see how firms can integrate economic, environmental, and social objectives, the triple Bottom Line, to create successful businesses that build a more sustainable world. Graduates of the Bard MBA Program will transform existing companies, start their own businesses, and pioneer new ways of operating that meet human needs, while protecting and restoring the earth’s natural systems. The Bard MBA is a low-residency program structured around “weekend intensives” with regular online instruction between these residencies. Five of these intensives are held each term: four in the heart of New York City and one in the Hudson Valley. Residencies take place over four days, beginning Friday morning, and ending Monday afternoon. Learn more today.

Tyson Foods: A Bigger Polluter Than ExxonMobil?

Just as Tyson Foods’ shareholders recently voted down a proposal to implement a water stewardship policy, a Boston-based environmental advocacy group has charged the chicken-processing giant of being one of the most polluting companies operating within the U.S.

Environment America has accused Tyson, its subsidiaries and contract chicken farms of releasing at least 104 million pounds of pollutants into surface waters across the continental U.S. from 2010 to 2014. Based on publicly-related data available from the U.S. Environmental Protection Agency, that amount of water pollution is far more than organizations such as Koch Industries, the U.S. Department of Defense, Cargill and International Paper — and more than seven times the amount that ExxonMobil released during the same period.

Most of the pollutants Tyson has discharged, according to Environment America, are nitrates from fertilizers, which find their way into rivers, lakes and groundwater. Manure from contract farms and waste from meat industry processing plants also contribute to what Environment America says are enlarging algae-infested “dead zones” that can be found from the Chesapeake Bay to the Gulf of Mexico. Furthermore, Environment America and its allies in the responsible investment community infer that the amount of pollution for which Tyson is responsible is even greater. Under U.S. law, however, Tyson is only required to report pollution from its food processing plants to the EPA’s Toxic Release Inventory.

As a result, a coalition led by the American Baptist Home Mission Society and the Sisters of St. Francis of Philadelphia urged shareholders to vote on a resolution pushing the $34 billion company to improve its performance on water issues. They called for Tyson to adopt new practices that would have limited the polluting effects of nitrates; develop more transparent measures reduce the number of water polluting incidents; draft a timeline of goals; and regularly disclose the company’s process on water management across its operations. That resolution went no where, and in fact, lost by an almost eight-to-one margin.

So far Tyson has ignored the allegations, choosing instead to report on efforts related to community hunger programs and new jobs at a North Carolina bakery plant. Nevertheless, the company has not been able to fly completely under the radar: Tyson was sued in 2014 for a massive wastewater discharge in Missouri. A decade earlier, it was among six poultry companies that paid the city of Tulsa, Oklahoma, a total of $7.3 million in order to settle charges that use of chicken fertilizer contributed to high amounts of phosphorous in the municipal water system.

Well connected and able to tout its role as a leading employer in the U.S. (although the company faces its share of litigation on this front, too), Tyson has been able to fend off many environmental allegations over the years. But these recent statistics, disclosed by the company itself, has now put the company in the crosshairs of many environmental groups and activist investors that insist the company can do much better.

Image credit: Tyson Foods

Local Food Cooperatives as a Cornerstone for Rural Community Development

By Leah Thibault

There is a trickle-down theory inherent in a lot of economic development activity – programs are primarily designed to help communities, particularly low income ones, attract and grow businesses. The thinking is that those new or expanded businesses will, in turn, improve the lives of community members by giving them employment or by providing additional goods and services, and further spur other business needs that can be answered locally.

But what if you could directly help a businesses and community members at the same time? You can, if that business is a co-op.

A co-operative, or co-op, is an entity owned and democratically controlled by its members, who often have a close association with the business, either as producers or consumers of its products (such as farmers or shoppers for a grocery store), or as its employees.

Co-ops have been around as long as people have found benefit in working together, but today’s modern co-ops generally work on the seven cooperative principles as outlined by The International Co-operative Alliance: voluntary and open membership; democratic member control; economic participation by members; autonomy and independence; education, training and information; cooperation among cooperatives; and concern for community.

While co-ops have a greater chance of surviving their first five years of business (80 percent versus 41 percent, according to 2015 report by Co-operatives UK), getting one off the ground is a tremendous effort of coordination, and finding financing for infrastructure and capital projects can be difficult.

Back in 1997, some community members in the western Massachusetts town of Northampton met at the local library and decided the area would benefit from a consumer-owned store. As the effort to acquire membership moved forward, the question of where to site said store persisted for years, until a site was selected in 2004. That ushered the next challenge – how to pay for the real estate and construction of the store when membership was about 1,500.

In a way the financing modeled the cooperative ideal – multiple sources contributed, from member fundraising to three different bank loans, several economic development grants and even federal New Markets Tax Credits, as the co-op was sited in a low income census track.

In 2008, the River Valley Co-Op opened its new LEED-certified facility with a mission to provide fresh, local and organically grown groceries to this Western Massachusetts community. Today, nearly 20 years since that first meeting in the library, the vision is even greater than the founders imagined. The business is thriving, with nearly 1,500 daily customers, $23 million in annual sales, and plans for a second store underway.

A true cornerstone of community development, the store employs almost 150 employees (over 89 percent of which are full time with benefits), and the average hourly wage for a non-supervisory position is $13.68, exceeding the local living wage of $13.18. River Valley Co-Op is also a significant buyer of local produce and goods, with $4.2 million going to local vendors, 30 percent of the store’s total purchases.

This kind of robust employment and economic activity is impressive and admirable, but the success and profits of River Valley Co-Op don’t just go to anonymous stockholders, or a few select owners, but flows directly to the 7,480 member-owners who shop at and work for and supply its store. In 2015, River Valley distributed its third annual Patronage Dividend Rebate, which totaled over $100,000. Of that amount, the owners donated $30,000 to the River Valley Co-op Community Fund and The Food Co-op Initiative—two nonprofits River Valley’s Board selected to support to fund other new food co-op start-ups and cooperative development.

Though not a formal co-op, Premium Peanut, a shelling and distribution facility under construction in Douglas, Georgia uses a cooperative-like arrangement that exchanges investment in Premium Peanut by local peanut growers with guaranteed multi-year contracts that include a pricing premium over the government standard, as well as a proportional distributions of Premium Peanut profits.

This structure helps the company achieve its goal of bringing greater stability to its 225 member farmers by helping them gain better access to the market, improve their profitability, and help smooth out the common boom or bust cycles through vertical integration.

Shelling at the $50 million, state-of-the-art facility will start with 110,000 tons for the 2015 peanut crop and is expected to grow to 140,000 tons within the first three years. Financing the effort was not simple for the startup. Because it preserves jobs in a region of Georgia that suffers from high unemployment and poverty rates, the construction qualified for federal New Markets Tax Credits in its overall capital stack of other loans and grants.

In addition to supporting 225 small to medium-sized farms, the shelling facility will create approximately 100 direct jobs, the majority of which will be unskilled positions available to low-income individuals and all will pay a living wage for single adult in the county and include benefits such as paid time off, a 401(k), and subsidized health insurance.

River Valley and Premium Peanut both show how the co-operative model can directly benefit its members and the rural communities that surround them, making investment in local farming and grocery co-ops a win-win for economic and community development.

Image courtesy of River Valley Co-op

Leah Thibault is Director of Executive Administration and Special Projects at CEI Capital Management, a leader in rural community development and the nation’s largest practitioner of the New Markets Tax Credit program. Contact Leah at [email protected]

Minimizing Unconscious Bias in Talent Management

Collectively, as companies work to balance the scale for the inclusion of more women, minorities and other diverse groups within their teams, a focus on raising awareness of unconscious bias in the talent recruitment and management lifecycle remains a top priority for leaders seeking to tackle what exactly diversity means for their companies.

A 2005 Harvard Law School paper on unconscious bias theory in employment discrimination litigation borrowed from social psychology to make its case. Our natural human reliance on stereotypes to categorize information can cause discrimination regardless of our intent. This 'unconscious' or 'implicit' bias, as evidenced in the disparaging data on the lack of diversity within major U.S. companies despite an increasingly diverse workforce, has manifested itself in the form of biased hiring practices over the last several decades.

We sat down with Elena Richards, talent management and minority initiatives leader in the office of diversity at PwC, to gain her insights on frameworks that power talent development as a “whole leadership” strategy to increasing diversity.

TriplePundit: PwC has committed to increasing diversity throughout the talent management lifecycle – from recruiting through leadership development. How do you stay focused on these goals?

Elena Richards: We are a people business, so our commitment to diversity and inclusion (D&I) is critical to our ability to serve our clients and our broader communities. Studies have shown that having diverse teams bring together different perspectives that can achieve better outcomes than if you have a group of people who think alike. So, diversity is really about more than one’s gender, skin color, sexual orientation or physical and cognitive ability.

As such, D&I - is embedded in every part of the talent management process – including in recruitment, learning and development, and even in our succession planning process. For example, we incorporate accountability by requiring each of our partners to select three diverse individuals for whom they are responsible for developing as part of the annual plans. We’ve also adopted a framework that requires partners who want to be considered for a new role that is a part of our US Leadership team to demonstrate how they have supported the firm’s D&I initiatives.

I would also add that all that we are doing is part of a bigger discussion within the firm about diversity and inclusiveness. Programs like the ones I've talked about are important, but it's also important to build a culture where differences can be discussed openly - person-to-person. PwC is part of a world in which issues like race, religious and cultural difference can be very divisive. We don't have all the answers, but we're encouraging everyone from our leaders to our staff to have respectful and brave conversations about differences. We believe getting this right is a source of competitive advantage for us, because the organizations we work with expect us to bring the best thinking -- and we can't do that without the ability to bring teams that are diverse on every dimension to solving important problems.

3p: When it comes to mitigating potential unconscious bias in the talent management lifecycle, what are some examples of trainings or learnings you share with your team to increase their understanding?

ER: Research shows we all have blindspots that are the result of our collective learned behavior and experiences. To address this, we are working with leading specialists in the field of unconscious bias to raise awareness about possible blindspots and teaching partners and staff ways they can help reduce any potential impact they may have. We started offering blindspots training to targeted groups throughout the firm and expanded to include our human capital professionals because of the important role they play in fostering an inclusive environment. We’ve also built unconscious bias awareness into the recruitment training that is mandatory for our interviewers.

Also, we’ve rethought our performance development process to create a model that can help us develop leaders at all levels. Our PwC Professional career progression framework sets expectations at each staff level for five dimensions we think are important, including global acumen and whole leadership. Questions designed to assess potential candidates against this framework are incorporated into the interview process; and once they join, all PwC professionals take part in mandatory training to prepare them for playing an active role in their career development.

3p: How can companies implement a diversity policy strategy in the recruitment process? What is PwC doing to reach traditionally underrepresented groups of candidates?

ER: The recruiting process is a great example of where many businesses are moving beyond what has “always worked” and looking for ways to proactively reach underrepresented groups of candidates who may not have considered them in the past. We have PwC professionals on the American Institute of Certified Public Accountants’ National Commission on Diversity, which is developing strategies to increase the retention and advancement of traditionally underrepresented minorities in the accounting profession.

3p: What are your thoughts on preparing candidates in advance for understanding the diversity and workplace culture of PwC? What methods are helpful to demonstrate that you offer an inclusive environment in which everyone can apply and grow their skills?

ER: D&I is incorporated throughout the talent management lifecycle – starting with the questions around global acumen and other dimensions of the PwC professional. At PwC we embrace our diversity and want people to be proud of their differences. We work hard to offer an inclusive environment in which everyone can feel comfortable being themselves and have the opportunity to succeed.

Our commitment to diversity starts at the top with Chief Diversity Officer, Maria Castañón Moats, who reports directly to U.S. Chairman and Senior Partner, Bob Moritz, and extends down through the Diversity partners and leaders who are responsible for executing our strategy in our lines of service and markets.

A key part of our diversity strategy is to appreciate differences and develop targeted initiatives. We offer development programs. For example, Diamond provides coaching and advocacy to high-potential minority senior managers and directors. And we’re making significant investments to develop cultural dexterity within all our staff—critical leadership skills that include investing in relationships, building trust, communicating with impact and developing a global business perspective.

Image credit: Pixabay

California Dominates Solar, With More Than 50 Percent of all U.S. Capacity

The Golden State is quickly becoming America’s solar state, with a huge lead on the rest of the country due to favorable policy frameworks and innovative new energy companies.

According to the United States Energy Information Administration (EIA), for both utility-scale solar photovoltaics and solar thermal, California has more capacity than the rest of the country combined, with 52 percent and 73 percent of the nation's total, respectively. We all knew that California was ahead on solar, but these figures are just astounding.

Though California has certain natural factors that give it an advantage over other states -- namely, many sunny cities and a large population base -- that, obviously, is not enough. The chief driver has been a strong policy framework that gives incentives to solar energy on a utility-scale and also, crucially, on rooftops.

#California has nearly half of the nation’s #solar #electricity generating capacity https://t.co/O5gMqJBJZP pic.twitter.com/Ogz9WOyIcJ

— EIA (@EIAgov) February 5, 2016

California will keep these advantages due to a decision last week by the state’s public utilities commission, the CPUC, to maintain net-metering -- which allows rooftop solar households to be compensated for putting clean energy on the grid -- until 2020. This is in stark contrast to California’s sunny neighbors, Nevada and Arizona, which restricted net-metering and rooftop solar in a blatant power-grab by big utilities.

California also benefits from its reputation as having a positive business climate for innovative companies. Silicon Valley is the most well known, but the rest of California is quickly becoming the base of choice for emerging solar companies as well. In fact, not surprisingly, several of the country’s fastest-growing solar companies call California home, whether it's Oakland-based Sungevity, Visalia-based CalCom Solar, San Jose-based Sunpower or San Mateo-based SolarCity.

California isn’t finished here. SB 350, passed late last year, mandates the state to get 50 percent of its electricity from renewable resources by 2030, one of the most ambitious targets in the country. Some California cities are trying even harder, including its second biggest city, San Diego, which announced plans to become a world leader and go 100 percent renewable by 2035. You can bet that solar will be a huge part of both state and local initiatives.

At the same time, let’s hope this is a wake-up call to the rest of the country. There’s no reason Texas, Florida or other sunny Southern states can't also become solar champions like California. If not solar, then another renewable, as studies show almost every part of the country has an untapped renewable energy resource, whether it be solar like California, wind like in the plains or geothermal in Hawaii. There really is no excuse.

Image credit: USA BUREAU OF LAND MANAGEMENT via Wikimedia Commons

Big Hawaii Accelerator Backs the Little Wind Turbine That Could

Wind is a critical renewable energy resource for Hawaii, so it's no surprise that the state's so-called 'Energy Excelerator' incubator has included a wind company in its newly announced 2016 list of clean tech startups to support. The surprise is that the company is SheerWind, a Minnesota-based company that has some wind industry observers scratching their heads over its unique approach to wind turbine design.

Hawaii and renewable energy

The great state of Hawaii recently cemented its role as the leader of the United States' energy revolution by pledging to achieve 100 percent renewable energy by 2045. One emerging driver for attaining that goal is the Energy Excelerator. The incubator has its roots in the 1983 Pacific International Center for High Technology Research. It was formed in 2013 with a $30 million grant from the U.S. Navy, tripling an earlier pledge of $9 million from the U.S. Department of Energy.

For those of you outside of the U.S., it's helpful to keep in mind that Hawaii has a strong economic interest in weaning itself off fossil fuels that predates global action on climate change. The aforementioned Pacific Center, for example, was created specifically to reduce the state's dependence on expensive oil imports.

The Navy comes into play because Hawaii is a key strategic port, and because the Navy has been a forceful advocate for transitioning to sustainable, renewable energy. As a branch of the armed services, the Navy is also keenly interested in the Department of Defense's pursuit of scalable and portable renewable energy solutions.

The SheerWind wind energy solution

Just last week, TriplePundit took note of an experimental wind turbine design under development that's meant to tap offshore wind resources on a colossal scale with enormous blades the length of two football fields.

Of course, such a scale would be virtually impossible to replicate on land, particularly in developed regions and states like Hawaii, where energy development issues are complicated by ethnic and historic concerns as well as tourism and other competing industries.

These same issues also limit site selection for the current crop of high-efficiency wind turbines, which are perched on taller towers to harvest stronger, steadier winds at high altitudes.

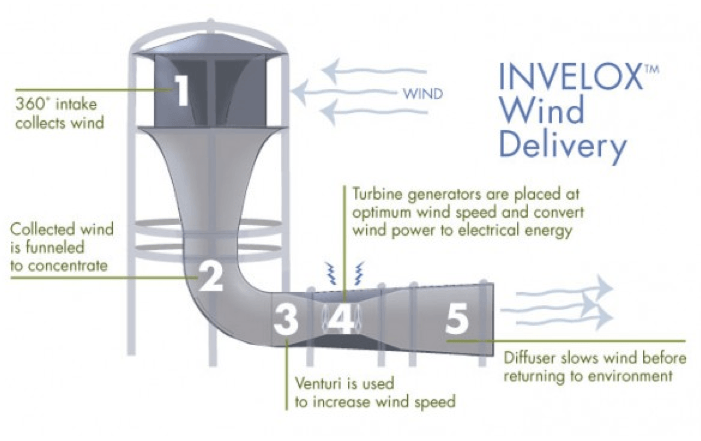

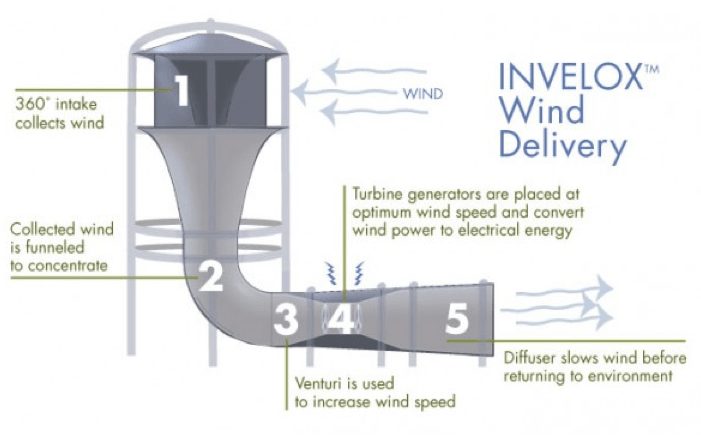

That's where SheerWind comes in. SheerWind's Invelox system deploys the Venturi effect, which describes how pressure increases when liquid (or air) flows from a larger pipe to a smaller one.

From the outside, the Invelox system resembles a stubby tower. It collects low-speed winds at low altitudes through large openings, and directs them down through a smaller funnel. The concentrated wind energy is then used to spin a series of turbines placed at ground level.

While not necessarily the most efficient setup for wind energy harvesting -- hence the aforementioned head-scratching among some industry watchers -- systems based on the Venturi effect are apparently beginning to finding acceptance. In certain locations, such systems could provide for low-cost wind energy harvesting in a way that can't be satisfied by conventional wind turbine designs.

That's partly because the enclosed, low-slung design provides a good canvas for aesthetic blending in a wide range of architectural styles. The close-to-the-ground design also enables greater ease -- and lower costs -- for transportation, installation and maintenance.

GE, for one, appears to have its eye on all angles of wind energy harvesting. The company is among the advisers to the research group working on the gigantic SUMR wind turbine project, and it is also an investor in the Energy Excelerator through its GE Ventures arm.

GE Ventures is keen on Hawaii as a global energy innovation hotspot:

"When it comes to energy innovation, all eyes are on Hawaii. Their residents pay the highest energy prices in the nation, three to four times the national average, while the state pays $6 billion per year to import fuel, mainly diesel, to power the grid."[snip]

"With these issues in focus, we are excited to announce our partnership with Energy Excelerator, a Hawaii-based program dedicated to solving the world’s energy issues."

[snip]

"We strive to partner with the most innovative organizations, and with Energy Excelerator, that trend continues."

Dawn Lippert, who co-founded the Energy Excelerator and serves as its director, emphasized these points in a recent press release, explaining: "We're betting on SheerWind because their bird-friendly, inexpensive, and easy-to-install technology has the potential to scale successfully in Hawaii and other markets."

It looks like the Netherlands is also interested. Last year SheerWind announced that it launched a licensing agreement with Reikon Beheer, a Dutch company with an interesting take on corporate social responsibility. Reikon Beheer appears ready to construct its first pilot project this year under the name NedPower SWH, so stay tuned.

Image (screenshot): via SheerWind

Updated Barbie Dolls Tackle Body Image with Diversity

For the first time in nearly 57 years, Barbie has realistically thick thighs, flat feet not doomed to a lifetime of stilettos and, finally, hips wide enough to conceivably birth a baby! By itself, the transformation in Mattel's new Curvy version of its iconic doll is enough to make headlines. However, this is just one of three new body types -- including Petite and Tall -- introduced as the toy company expands its Barbie lineup. Plus, the lineup includes a wider variety of skin colors and hair textures.

This new diversity in the Barbie doll community has attracted attention around the globe, landed her on the cover of Time magazine, and made her the darling of clever social media marketing with #TheDollEvolves hashtag. Bloggers and celebrities have been lavishing their praise, including the proudly curvaceous Queen Latifah:

I'm loving that @Barbie added 3 new body types to the line! Barbie baes let's celebrate! Tweet me pics of ya dolls. #TheDollEvolves

— Queen Latifah (@IAMQUEENLATIFAH) January 29, 2016

These new variations made history because of their daring divergence from the classic 1959 Barbie featured in the Smithsonian:

Today's Barbie might be changing, but here's a 1959 doll from our @amhistorymuseum https://t.co/8Y6rF9Viut pic.twitter.com/uzym73Hh4U— Smithsonian (@smithsonian) January 28, 2016

Barbie's pale, blonde and impossibly proportioned good looks have long drawn the admiration of young women and the ire of those concerned about Barbie's effect on healthy self-image. Barbie's creator, Ruth Handler said, per Mattel's own historians, that she created the doll because she was inspired by her young daughter, Barbara, who enjoyed playing with paper dolls. The first Barbie doll unveiled in 1959 at a toy fair was titled Barbie, the Teen-Age Fashion Model. Thus began the journey of a doll that looks like few of our daughters ever will, even in their teenaged years. While Barbie went on to offer role-play in various careers, she's never strayed from that teenie-tiny wisp of a waist and fashion runway look -- until now.

Barbie's global general manager and senior vice president, Evelyn Mazzoco, said upon Mattel's launch of the new Barbie variations that the company feels a responsibility to reflect a broader view of beauty. “Barbie has always given girls choices – from her 180 careers, to inspirational roles, to her countless fashions and accessories. We are excited to literally be changing the face of the brand – these new dolls represent a line that is more reflective of the world girls see around them – the variety in body type, skin tones and style allows girls to find a doll that speaks to them.”

The new Mattel lineup of Barbies is called its Barbie Fashionistas line, and promises to deliver seven different skin tones, 22 different eye colors and 14 different facial variations in all.

This expansion in choices can be empowering for children, said Dr. Robert Holloway, professor of psychiatry and pediatrics at the Children's Hospital Los Angeles and USC Keck School of Medicine. "I think it's great that kids will have more choices for their dolls. We express a lot with our choice of objects, especially such personal objects as dolls. I'm glad that kids will have more choices and hope their parents and peers will allow them to make their choices without too much pressure. Making a choice will always be met with scrutiny by others. Sometimes our choices are supported and sometimes they're discouraged. This is a part of life we all must navigate."

Chair of the gender studies program committee at Missouri State University, Shannon Wooden, agrees that the range of choices can be positive for children. Yet, she cautions parents to recognize dolls within the larger context of overall influence.

"Yes, it’s a good thing to broaden the range of physical types available for this kind of projection through play. Giving the child a range of bodies that she can see as beautiful and powerful and full of potential will certainly help to dismantle the rigidly-defined beauty ideal that has for so long prevailed. But to be culturally widespread, this dismantling has to go on everywhere — film, television, music — and to be consciously endorsed by parents and teachers."Parents need to be careful about how their own biases may trickle down to their kids’ consciousnesses, how their own compliments and criticisms define certain things as ideal and other things as inferior. (Why do we always say 'thank you' if told we look thin? Think about the implications just of that tiny thing.)

"Parents can ask different questions about (and pay different respect to) women’s bodies, besides how they look: What can they do? How do they feel? What have they accomplished, and what could they aspire to do? Parents can shift to more objective language about women’s bodies (rather than subjective): Whether or not she’s “beautiful,” for instance, traditional Barbie is undeniably tall, and that might be a positive trait in certain circumstances without being a beauty standard."

Mattel's updating of the Barbie line comes as the company announced its 2015 fourth-quarter profits were up considerably over the previous year. This follows years of declining Barbie sales during increasing competition from other doll makers. The Fashionistas line retails for just $9.99 per doll, widening its mass-marketing appeal and accessibility.

For all of the goodwill generated by what the diverse dolls represent, from a sustainability standpoint, they are, of course, still made of plastic. This detail is not lost on Executive Director Michael O'Heaney of the Story of Stuff organization that aims to reduce plastic pollution. O'Heaney commented on Barbie's messaging and materials:

"The introduction of Barbie dolls with different features and body types is a marketing scheme aimed at reversing skidding sales, not feminist leadership. At best, this is a lame attempt at updating a throwback, a trailing indicator of our changing society and culture. At worst, Mattel is offering a marginally less unhealthy beauty image to our children, our daughters in particular, but one that still centers on looks and accessories rather than brains and athleticism."They're also bad for the planet and the people who make them. Most of what I can find online indicates Barbies are made of various plastics, including PVC, which is exceptionally bad at all stages of its life cycle. Vinyl chloride is a known human carcinogen, particularly dangerous to the workers who produce it."

Despite a downturn in doll sales in recent years, Mattel boasts that Barbie is still responsible for more than $1 billion in sales worldwide. Barbie still has bragging rights as the single most popular doll sold in the United States.

Image courtesy o Mattel

Ecotourism Creates Livelihoods for Indigenous People in Cuyabeno, Ecuador

The motorist gained momentum to maneuver across a low area where tree branches block the Cuyabeno River in the Amazon rainforest of Ecuador. A loud hum from the two-stroke motor rang out through the air as it revs in preparation.

It is the dry season and Willian Toro, our nature guide, hasn't seen the river this low for a dozen years. It is normal to have a short dry season, but the season is lasting longer than usual this year. Some of the lakes in the reserve have dried out so much that only a few puddles remain, encrusted by dead fish and thirsty tree roots.

The 12 ecolodges of the Cuyabeno are closing until the rains return and the river level rises. The guides and cooks return to nearby towns for a break, and the canoe motorists return to their indigenous communities located within the reserve. Ecotourism is a main source of income for the roughly 2,500 indigenous people in five groups who reside here.

My husband, two young children and I spent five days exploring the Cuyabeno Wildlife Reserve in Northeast Ecuador, while staying at the Guacamayo Ecolodge. The lodge provides meals and daily guided excursions for groups of tourists to explore the jungle.

Located far from the power grid, solar panels charge batteries that provide a modest amount of power for lights and to charge electronics. The lodge is made of wood, with a thatched roof of toquilla. Biodigestors process human waste, while food and drinking water are brought in by canoes. River water is pumped to the showers, toilets and sinks, thus the water has a slightly tan color.

Only the indigenous communities are allowed to fish and hunt in the jungle for their own consumption. These communities rely on subsistence agriculture and income from the ecolodges.

A successful relationship with ecotourism has created economic opportunities within the reserve and the indigenous communities, helping to keep young people from seeking employment outside of the reserve. Several of the nature guides at other ecolodges are from indigenous communities, as are all of the canoe motorists.

The school teacher in the Siona community in the reserve is from the local community. This allows her to offer bilingual education in Spanish and the tribal language, Paicoca, one of the four indigenous languages spoken by the people of the Cuyabeno Wildlife Reserve.

Jairo Alvarez, nature guide for Guacamayo Ecolodge, however, believes that the educational opportunities of the indigenous people is quite limited and is an area ripe for improvement. He says the Ecuadorian government has helped successfully educate them in using ecotourism as a source of income, but he sees lack of awareness around waste disposal and recycling in particular as an issue. There is also an effort among some of the ecolodges to incorporate indigenous people in more staff positions.

Our group toured two communities and had the opportunity to help make bread from ground yuka root, toasted over a fire. A shaman from the Siona community explained how he studied for 15 years for his role and the importance of the use of Ayahuasca, a hallucinogenic tea used for spiritual purposes.

The motorized canoes used to transport visitors around the reserve are owned and operated by the indigenous communities. Trading in two-stroke for four-stroke motors seems like an obvious way to make the ecotourism industry more sustainable. The motorized canoes are the primary means of transportation, but some lodges also use some paddle canoes. Although more expensive, switching to four-stroke motors would be an improvement, but this is beyond the control of the ecolodges as the operation of the boats is controlled by the indigenous communities.

The Cuyabeno Wildlife Reserve is divided up into zones, with different indigenous communities having domain over various areas. For an ecolodge to be constructed in a given area, an agreement must be reached with the local tribe and approved by the federal government.

"You have to have an agreement with families in the community or the president," Alvarez says. "You then have to show this deal to the government, and they require that the whole project is involved in conservation to minimize the impact to the environment. Sometimes it is hard [to get approval for a proposed ecolodge] because there are always new measures required to protect the environment."

The nearest town is Lago Agrio, which is largely dependent on the petroleum industry. Now that both oil prices and extraction are in decline, many people are left unemployed. Working in the oil industry used to be highly regarded, says Alvarez, but is no longer since the decline.

The effects of the decline in the petroleum industry are felt throughout Ecuador and is largely blamed for the sluggish economy. It also creates budgetary problems for the government, which relies significantly on income from the oil industry.

Our guide, Willian Toro, used to work for the petroleum industry before finding employment as a cook in an ecolodge. He took advantage of every opportunity to learn about the local ecosystems until he was able to obtain his certification through the reserve as a guide. Now fluent in English, Toro was largely self-taught.

During every activity, Toro scoured the landscape for interesting flora and fauna to point out to us. Our group saw a river dolphin, several species of monkeys, an endangered Scarlet Macaw, a two-toed sloth and a scorpion, among other things.

"The Cuyabeno in Ecuador is much more beautiful than the Putumayo in Colombia and the tourism industry is much more developed," explains Jaime Amir Sotelo, a cook for Guacamayo Ecolodge and a Colombian national. Located several miles away as the crow flies, neighboring Colombia has not created reserves and protected these precious ecosystems to the same extent, and tourism has been developed primarily in other regions of the country.

On our trip out of the Cuyabeno, the water level in the river made navigation especially difficult. A large downed tree blocked our path up the river and there was a man with a chainsaw attempting to clear a path, but he was unable to make the cut deep enough to be successful.

Gradually, more and more canoes congregated due to the obstruction, filled either with indigenous people or tourists. Some of the men stood on the log, attempting use body weight to break the obstruction. Finally the men successfully used a motorized canoe to break the trunk, and the stretch of the Cuyabeno River was once again passable.

Few if any of the ecolodges in the reserve remain open due to the low water levels, and more have closed since our visit as they wait for the water levels to rise. The lack of rain puts strain on the indigenous communities which have difficulty traveling around and rely on the income from ecotourism. When the rains return, the ecotourism industry will soon greet new groups of tourists eager to view the marvels of the Amazon up close.

Image Credit: Sarah Lozanova

EasyJet is Developing Fuel Cell Hybrid Aircraft

British airline EasyJet is pushing the envelope on its quest to grow its ultra-low-fare flight service while keeping operating costs down. This includes things like using virtual reality for crew training, making airplane parts with 3-D printers, and employing drones to perform safety inspections.

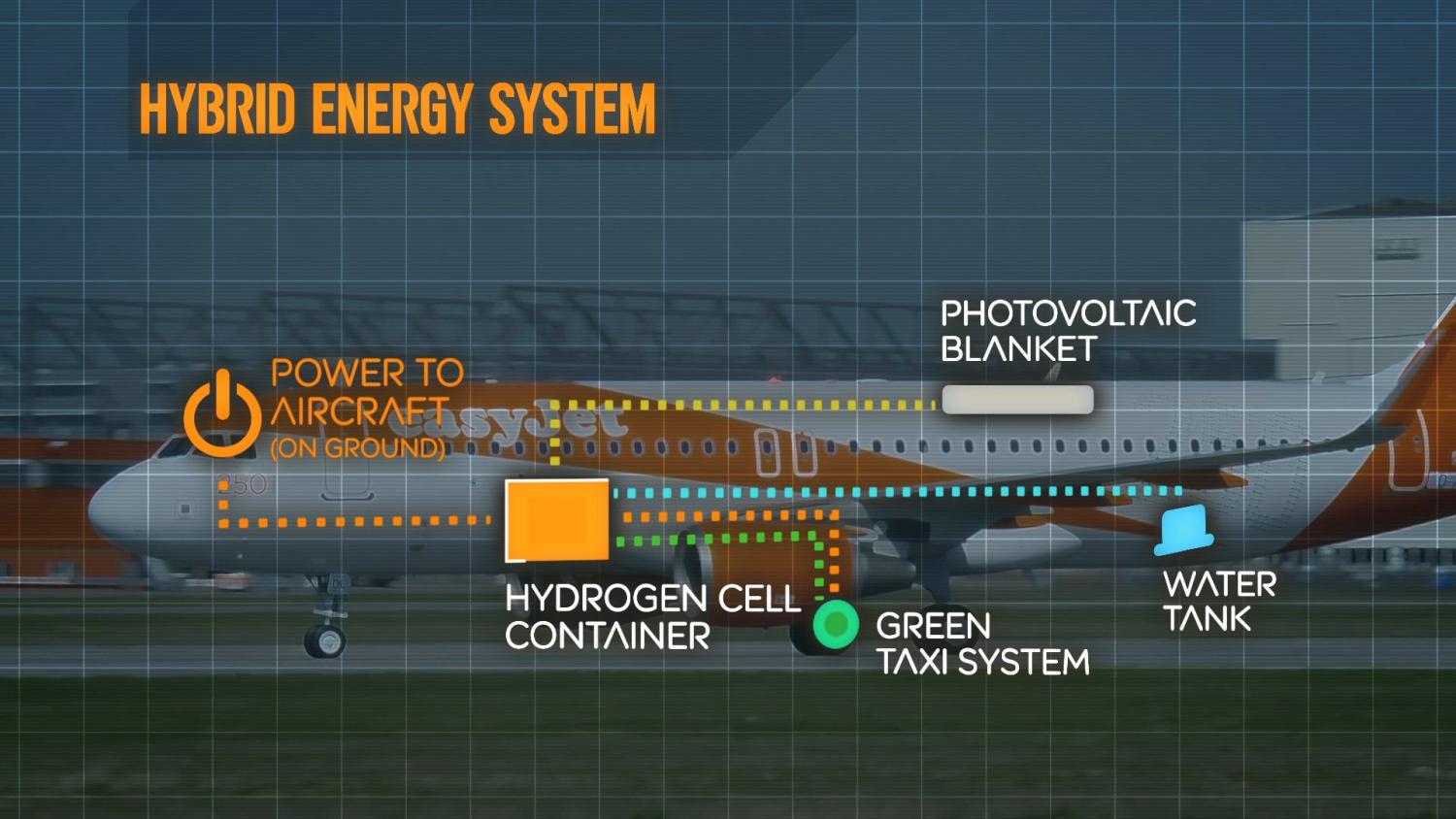

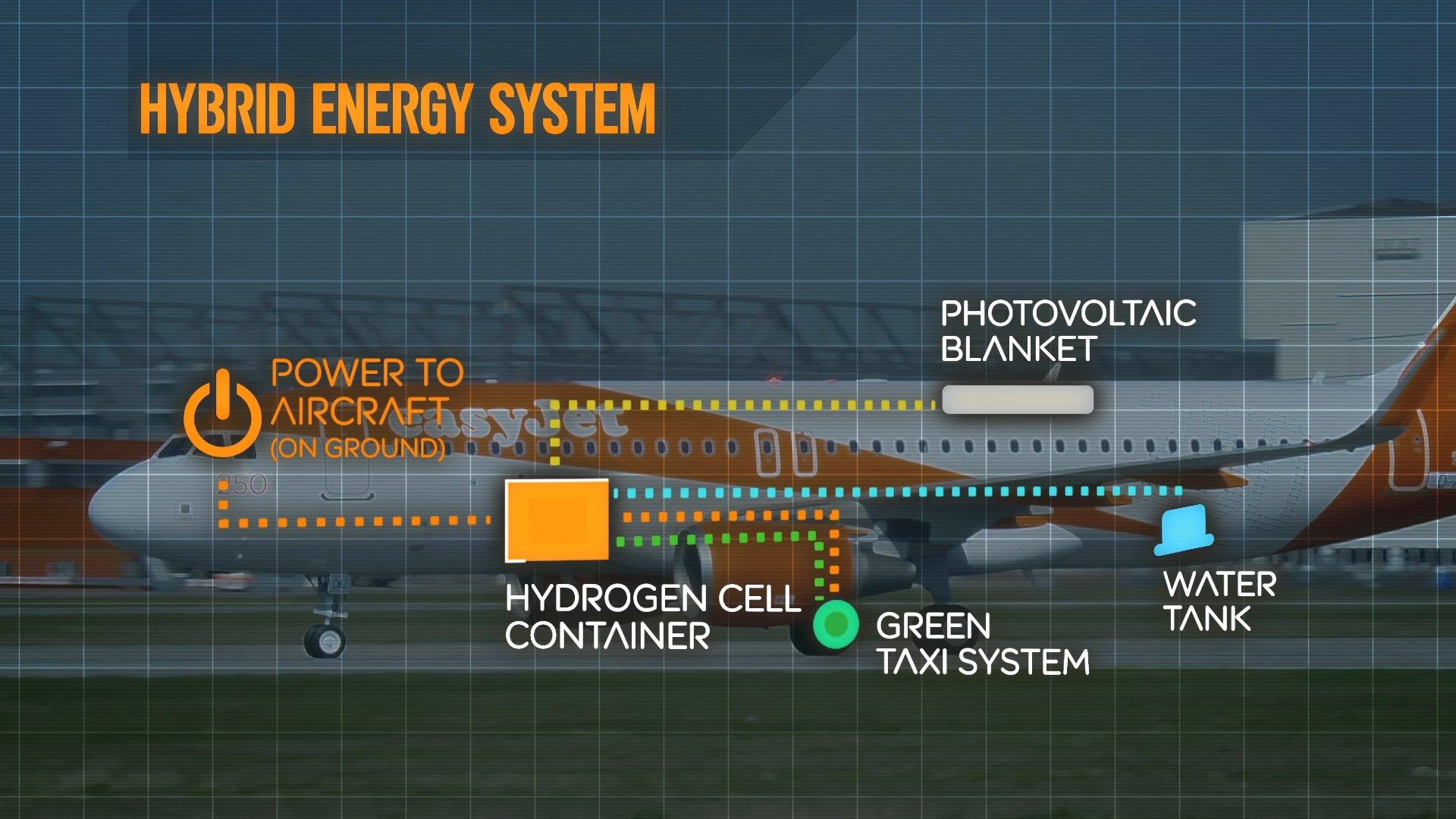

Now the airline is preparing to test out a new hybrid airplane later this year. Not only will this airplane utilize regenerative braking to reclaim energy during landings, but it will also utilize onboard fuel cells.

Electric motors, powered by the fuel cells, will power the planes while taxiing on the ground, a function that currently accounts for roughly 4 percent of an airline’s fuel bill. The company claims that this innovation could potentially save 50,000 tons of fuel annually. According to Ian Davies, EasyJet’s director of engineering, the airline's budget-oriented passengers help to make this work. "Because of the fact we're a low-cost carrier, most people take hand luggage and our hulls are empty, so we have the space to do it,” he told CNN.

Not only will this save money, but it will also reduce greenhouse gas emissions. It would also eliminate the need for tugs to tow the airplanes to the runway, which will provide additional energy savings. A further benefit is the fact that fuel cells produce clean water as their one and only waste product, which can be used to replenish the aircraft’s water supply.

The company claims that a three- to five-year proof-of-concept period will be required before the company can begin the commercialization process. This effort is aimed at the company’s goal to reduce fuel consumption by 7 percent by 2020. Other efforts include reducing the weight of everything from carpets to food carts, as well as a process to extract moisture from the cabin that can eliminate 330 pounds of unnecessary weight.

Innovations like this are going to be necessary to keep air travel viable in a world that needs to drastically reduce carbon emissions.

A little further along the boldness axis, Elon Musk has spoken about fully electric jets. He has a vision of a plane that will take off and land vertically. Once his Gigafactory is up and running, he will have plenty of batteries.

But, as cutting edge as this sounds, it’s worth noting that Airbus already flew an electric jet across the English Channel and has a roadmap that will lead it to a short-range regional jet in the years ahead. The single-seat, 1,300-pound prototype E-fan has now flown more than 100 missions powered fully by electricity.

The short-term goal is E-fan 2.0: a two-seat, short-range personal sport aircraft. The first step is a non-flight ground simulator model to be used to develop the robust control system that will be required. This will be followed by a four-seater. According to Detlef Müller-Wiesner, director of the Airbus Group electric aircraft program, the electric engines will be in the 1- to 2-megawatt range. This is part of a long-term effort by the European Union to reduce aircraft emissions by 75 percent.

Image courtesy of EasyJet

Sustainable Sourcing: The Myths, Risks and Opportunities to Private Brands

This is the first segment in a four-part series on undertaking a sustainable-sourcing business approach to innovate private store brands. Upcoming sections will explore the Crawl-Walk-Run approach to sustainable sourcing.

If you are just beginning the journey into sustainable sourcing or are considering if it makes sense for your private brand, there are some things you should know and contemplate as you explore the idea.

According to the 2014 U.S. Store Brands State of the Industry research study, retailer and wholesaler respondents selected ‘differentiation’ and ‘building loyalty to their stores’ as the most important roles that private brands play, the same as in 2013.

As U.S. national brands continue to struggle with lower growth year-to-year, private brands’ sales in all major retail channels continue their upward trend, setting new records across the board for annual revenue, according to the Private Label Manufacturers Association (PLMA). In 2014, U.S. store brands accounted for nearly $3 billion in incremental sales overall, an increase of 2.5 percent over the previous year and more than twice the percentage gain that was recorded by national brands.

In the U.S., consumer awareness, the demand for more transparency, and continued compression on margins are providing an opportunity for private brand owners and the industry to look at value and innovation through a different lens. Sustainable sourcing, generally defined as using a resource so that it is not depleted or permanently damaged, is one way to differentiate your private brand from the others and also bring additional value to the consumer.

When developing your brand strategy, it is crucial that it be approachable, believable and doable. It is important that your brand is communicated properly to the customers in a manner that consistently meets expectations.

Shattering the myths

First, let’s dispel some of the myths regarding the cost of adding a sustainable sourcing strategy to your private brand. Are you thinking, this is going to drive up costs significantly, or I need to hire a team to manage it, or I need to have a comprehensive approach to even start including sustainability into my business model?

The reality is that 1) sustainable sourcing may not drive down costs; 2) you will need CEO support; and 3) your existing team needs to have the same sustainable sourcing goals. There are, however, things you can do today to embrace sustainability within your private brand program that add little-to-no cost, utilize your current staff resources, and put you on the path towards working more efficiently with your trading partners. In addition, taking steps towards sustainable sourcing wins praise from NGO activists.

Sustainable sourcing will strengthen your brand and build a sustainably-savvy customer base which is highly loyal to its value equation. Your goal is to earn the loyalty of these customers as they discover the values inherent in your sustainably-sourced private brand. So, in addition to being viewed as socially responsible, loyalty of the sustainably-savvy customer is the best reason to integrate sustainable sourcing into your private brand strategy.

Risks

Let’s consider the risks of sustainable sourcing for private brands. It is likely that you have heard the term ‘greenwashing’. It is the term used for over-promising and under-delivering on the sustainability attributes of a product or service.

The overuse of the word ‘natural’ on labeling is a good example. We have all heard the problems with putting the word ‘natural’ on your packaging. The USDA and FDA definitions are ambiguous at best, and every natural private brand has a different definition. Due to the lack of a clear definition, lawyers have focused on packaging that is considered to be misleading to consumers due to the loose definition of ‘natural’ and, if challenged, you are put in the position of having to stop selling the product or of redesigning the packaging to remove the wording.

You may have a natural private brand program, and it is fine to refer to it that way internally. I caution you, however, about using the word ‘natural’ on your packaging and, instead, use measurable, fact-based words in order to avoid risk.

A newer but similar risk in product labeling is known as ‘humane-washing.' The word ‘humane’ can be interpreted in different ways, resulting in lawsuits challenging labels showing ‘happy cows,' ‘humanely raised pigs’ or pictures of idyllic farms.

Understand the risks and use fact-based words in marketing, but don't avoid sustainable sourcing. It is newer, less charted territory where rules and regulations are still being developed, but the business opportunities are tremendous.

In 1989, a U.K.-based publisher coined the new term ‘ethical consumer’. This was done by creating and publishing ‘ratings tables’ that award companies negative scores based on these sustainability categories. Today, in the U.S., Bloomberg and Reuters provide environmental, social, and governance ratings directly to the financial data screens of hundreds of thousands of stock market traders.

Consumer and social media are focusing on sustainable sourcing issues such as the humane treatment of animals, farming practices, packaging and recycling, and how the product arrives at the store. It is clear that actionable ideas are key to starting to incorporate sustainable sourcing into your private brand strategy.

Target markets

There are two primary segments of the sustainably-savvy U.S. customer base: millennials and the more mature LOHAS (lifestyle of health and sustainability) demographic. In 2012, Forbes said that the LOHAS market segment is a growing into a $300 billion+ business opportunity.

LOHAS is comprised of upscale, belief-driven consumers who are committed to ethical spending on products meeting its value equation and who don't switch brands to save money. Sustainably-sourced private brand products will attract LOHAS dollars.

Millennials are the new majority demographic classification and soon to be the largest dollar. This segment is very aware and supportive of a sustainable lifestyle. They are not specifically loyal to national brands, but are fiercely loyal to brands that meet their value equation. It should be the goal of a private brand to have millennials and LOHAS becoming its customers for life.

When taking on a project of this magnitude, I recommend taking the Crawl-Walk-Run approach, which is featured in the next three posts in the series.

Portions of this were originally published in Henry Stewart Publications 2045-855X Journal of Brand Strategy VOL. 4, NO. 2, 000–000 Summer, 2015

Image credit: Flickr/Andrew 鐘