VW Management Knew About Emissions Issue a Year Before Scandal Broke

Volkswagen's top brass was informed of illegal practices involved with its diesel car production almost a year before the emissions scandal went public.

In a March 2 statement, the automaker admitted that former CEO Martin Winterkorn was told of the "emissions cheating" software in a 2014 email. The issue became public in September 2015.

"On 23 May 2014, a memo about the [International Council on Clean Transportation-sponsored] study was prepared for Martin Winterkorn, then-chairman of the management board of Volkswagen AG. This memo was included in his extensive weekend mail. Whether and to which extent Mr. Winterkorn took notice of this memo at that time is not documented," the auto manufacturer said. The statement came in response to a suit by shareholders.

Another memo discussing defect issues was issued in November 2014, the company said, but neither of these memos would necessarily served as tip-offs for the looming emissions scandal. "According to current knowledge, the diesel matter ... was treated as one of many product issues facing the company," not as an indication of the scope of the issue at the time, the company said.

The statement further clarifies that Winterkorn and Volkswagen Chairman Herbert Deiss were both briefed of the problem before the news broke. In July 2015 that year, VW executives attended a company meeting that focused on "damage and product issues," in which the emissions software was discussed. It wasn't until August 2015, however, when they met with technicians, that the executives realized the installed software "constituted a prohibited defeat device under U.S. law" and took steps to inform the Environmental Protection Agency and the California Air Resources Board.

VW's public statements on who knew about and authorized the use of emissions-cheating software have expanded over the past year. In October 2015, VW America CEO Michael Horn said in a U.S. congressional hearing that the software was installed by "a couple of software engineers who put this in for whatever reasons," and that the company had not been able to identify the individuals. "This was not a corporate decision, from my point of view, and to my best knowledge today," Horn told representatives of the Congressional Energy and Commerce Committee.

According to the most recent release, the company has begun to narrow down who may have made the final decision to install the software in select models. It has not yet explained, however, how or why the a manufacturer with global oversight of its green policies and technology could have been unaware of an installed device that would dramatically change the performance of its most popular flagship models.

Image: Rocco Demas

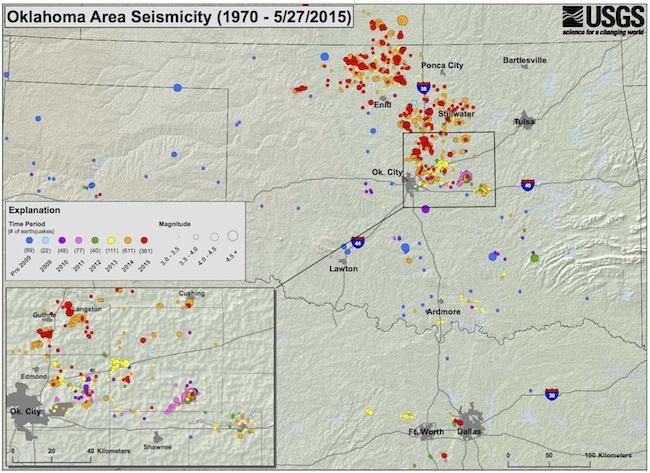

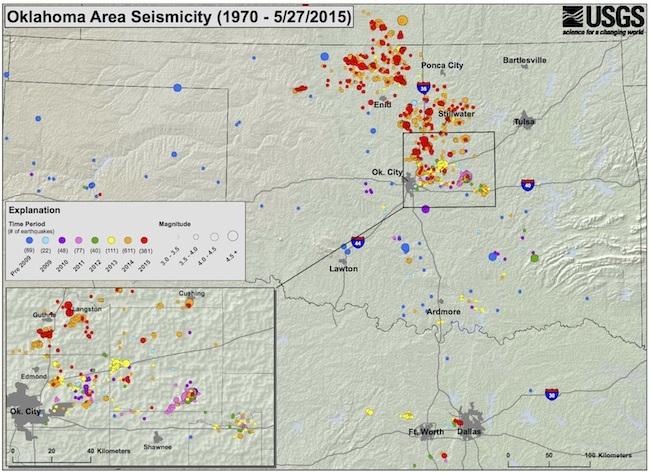

Oklahoma Earthquakes Continue To Haunt the Oil and Gas Industry

The fracking industry got another shot of bad news on March 4, when Oklahoma regulators leaked word that a clampdown on oil and gas wastewater disposal would begin soon.

The new actions are the latest attempt to quell a spate of earthquake activity in the state, which has been linked to the practice of injecting massive quantities of fracking wastewater deep underground, in addition to wastewater from conventional drilling sites.

Oklahoma earthquake response: Round one

The numbers that link oil and gas wastewater disposal rates to earthquakes in Oklahoma are fairly straightforward. Wastewater disposal volumes rose 81 percent over the past six years, while earthquakes increased from an average of twice yearly to the current rate of twice daily.

The problem consists of making a direct connection between specific disposal wells and earthquakes. However, the U.S. Geological Survey has collected enough data to assert confidently that there is "a strong connection in many locations between the deep injection of fluids and increased earthquake rates."

Apparently the pileup of evidence finally convinced the OCC (Oklahoma Corporation Commission) to act last spring and summer, when it began asking companies in some parts of the state to trim their wastewater injection rates and to shorten their disposal depths.

Most agreed, with the exception of Sandridge Energy.

Oklahoma earthquake response: Round two

With earthquake swarms still occurring at a record pace through last fall, the OCC took a series of actions culminating in January 2016, when Sandridge agreed to cut its disposal rate by 40 percent. That involved closing eight wells altogether and reducing operations at 36 others. The company also agreed to provide nine wells to researchers for study.

On Feb. 16, the OCC implemented a more ambitious, region-wide approach recommended by seismologists and to be conducted over the next two months. As a first step in the plan, the agency ordered a reduction in wastewater disposal for 245 additional wells in the Arbuckle formation, located in the south-central part of the state. The Arbuckle is the deepest geological formation in Oklahoma, and in a press release outlining the earthquake response plan, OCC noted:

"Researchers largely agree that wastewater injection into the Arbuckle formation poses the largest potential risk for earthquakes in Oklahoma."

That observation probably stems from a 2015 earthquake report from Stanford University:

"Stanford geophysicists have identified the triggering mechanism responsible for the recent spike of earthquakes in parts of Oklahoma – a crucial first step in eventually stopping them," wrote Ker Than for the Stanford Review."In a new study published in the June 19 issue of the journal Science Advances, Stanford Professor Mark Zoback and doctoral student Rall Walsh show that the state's rising number of earthquakes coincided with dramatic increases in the disposal of salty wastewater into the Arbuckle formation, a 7,000-foot-deep sedimentary formation under Oklahoma."

The researchers also noted that most of the wastewater now being disposed in the Arbuckle formation consists of wastewater re-injected from producing wells, not the fracking brine that is used to drill new wells. (Fracking is short for hydraulic fracturing, a drilling method that involves injecting chemical-laced brine into shale formations.)

Oklahoma earthquake response: Round three

In the latest action on March 5, Corey Jones of Oklahoma's Tulsa World paper reported that the OCC will extend its plans to take preemptive action in areas of the state where seismic activity has not yet accelerated.

The agency is not yet ready to publicize the next step, but the idea is to prevent earthquakes from "fanning out" into new areas, Jones reported.

Another report places the new area of earthquake response in central Oklahoma, encompassing 5,000 square miles. The area includes more than 400 injection wells, dotted around a number of cities including Edmond, Luther, Perry, Stillwater and Pawnee.

The Los Angeles Times followed up with an in-depth article on March 6 under the headline, "Oklahoma Takes Action On Fracking-Related Earthquakes — But It’s Too Late, Critics Say." LA Times reporter William Yardley anticipates that the state will continue to ramp up its earthquake response, particularly because the surge in seismic activity is intruding into new areas, where residents are wealthier, politically-connected or both.

New earthquake area on the map

It looks like regulators have some catching up to do. On March 3, John Green of the Hutchinson News, a Kansas newspaper, reported that a new swarm of seismic activity was recorded last week near the town of Waynoka, which previously had no record of quakes.

As described by Green, the Waynoka region is located north and west of an area that has seen seismic activity in recent months, and south of another active area.

Meanwhile, geologists are concerned that another fault under Edmond, about 100 miles south, could produce more damaging earthquakes. The potential for damage to Cushing, a key storage and transportation hub for the nation's oil and gas industry, is also concerning researchers and planners.

Fracking not off the hook

To be clear, Oklahoma's earthquake problem is linked to wastewater disposal from oil and gas production in general, not solely to fracking itself.

For impacts more specific to fracking, the picture looks increasingly gloomy. For example, one recent, limited study of 23 fracked wells in Ohio has apparently failed to turn up evidence that local water resources have been compromised. But the cumulative evidence from other studies indicates that fracking can pollute local wells and produce other impacts.

In the latest development on that score, in January a team of researchers from Harvard tracked a surge in methane emissions from the U.S. corresponding to the increase in fracking, suggesting a causal relationship between the two.

Mark Ruffalo, Van Jones Join Bus Tour to Highlight the Flint Water Crisis

TriplePundit is tracking the ongoing drinking water crisis in Flint, Michigan. Follow our coverage here.

You can’t watch the national news without hearing reports about the drinking water in Flint, Michigan. For the last two years, residents of the city have been drinking and using water that is contaminated with lead. (Review a full timeline here.)

In 2014, the city of Flint switched to the Flint River as source of water. The chemistry of Flint River’s water is very corrosive to lead plumbing. Residents complained about the smell and color of the water for quite some time before anyone took them seriously. It took until October 2015 before the city switched back to the Detroit Water and Sewerage Department as its water source, but the damage was done.

Some Americans want to bring even more attention to the problem. The Support For Flint’s Future Bus Tour will bring together a group of activists and artists who will travel to several places across Flint to call attention to the water crisis. Participants include actor and founder of Water Defense, Mark Ruffalo; author, activist and founder of Green For All, Van Jones; environmental justice activist and director of Green For All, Vien Truong; and businessman, philanthropist and founder of NextGen Climate, Tom Steyer. The tour will start this morning.

The Future Bus Tour will focus on three issues: children, environment, and jobs and economy. The participants will talk with individuals and organizations that are both affected by the water crisis and working to bring attention to it. The places they will visit will include Hurley Medical Center where they will talk with Dr. Mona Hanna-Attisha, the pediatrician who first sounded the alarm to dangerously high lead levels in local children and founded FlintKids.org.

Virginia Tech researchers are testing 252 water samples from Flint homes. The first 101 samples to be tested, what the researchers call “first draw samples,” have over 5 parts per billion (ppb) of lead, and Flint’s lead value is 25 ppb. That is over the 15 ppb that the U.S. Environmental Protection Agency (EPA) allows. Several samples were over 100 ppb and one sample that was collected after 45 seconds of flushing was over 1,000 ppb.

Lead contamination causes serious health problems, particularly for children and pregnant women. According to the EPA, even low levels of lead exposure in children can cause behavior and learning problems, lower IQ, hyperactivity, slowed growth, hearing problems and anemia. Lead exposure among pregnant women can cause reduced growth of the fetus and premature birth. Lead also causes problems for adults, including increased blood pressure, decreased kidney function, and reproductive problems in both men and women.

Lead contamination is a problem across the U.S.

Lead contamination isn’t limited to Flint, although the Michigan city’s problems are probably the worst found. In the Central California town of Fresno the area’s newspaper, the Fresno Bee, reported last month that traces of lead were found in water samples taken from about 20 homes in the city. The sources of the lead are not known, but weren’t traced back to the city’s wells. The problem likely lies within the homes, and pipe corrosion is thought to be the cause.Across the country in Sebring, Ohio, lab tests conducted in August found high levels of lead in the city’s drinking water, the New York Times reported. The culprit is pipe corrosion caused after workers stopped adding an anticorrosive chemical. It took five months before the city informed its residents of the problem.

It is unthinkable that in the U.S., the richest country in the world, people are exposed to lead from their drinking water. Residents of this country’s cities and towns pay their water bills and hope that when they turn the tap on, they will be drinking, cooking and bathing with safe water. In Flint and other cities, people turn on their tap and are exposed to lead, a substance that causes severe health problems. This simply should not happen in the land of plenty.

Image credit: Flickr/Paul Hudson

Packaging Industry Awards Grants for Polystyrene Recycling

Polystyrene has long been one of the more controversial materials in the nationwide and global recycling debate. Invented 75 years ago, it is lightweight and convenient, keeps food hot or cold, and helps ensure that shipped goods remain intact. But despite the packaging industry’s insistence that polystyrene can be recycled and that such a market is growing, many municipalities do not include it amongst other accepted recyclables such as glass, metal and plastic.

Some cities and towns have banned its use. New York City led the most prominent effort, only to have packaging companies let by Dart Container Corp. fight its law, a battle they eventually won in court. Meanwhile cities across the country struggle with the polystyrene recycling question, and often spend a lot of time educating their residents that nope, those clamshell to-go containers and Styrofoam cups are not recyclable and pose their fair share of environmental problems.

But the food packaging industry has realized that, in order to avoid more bans, it has to provide an alternative during an era when many cities and towns are confronting diminished landfill space — and no one wants a municipal dump in their backyard. One such trade group, the Food Service Packaging Institute (FPI), has launched another grant application cycle for organizations committed to launch or expand a post-consumer polystyrene recycling program.

The two-year-old Foam Recycling Coalition is accepting applications until April 10. In addition to the FPI, other organizations participating in this initiative include Chick-fil-A, the aforementioned Dart Container, Shell Chemical and TOTAL Petrochemicals.

Awards will range from $15,000 to $25,000, winners of the grant will have to commit to collecting polystyrene for at least three years and finally, they are required to report the total volume of polystyrene collected to the FPI. While the grant applications do not explicitly require a “densifier,” a machine that is necessary to compact polystyrene as the material is about 90 percent air, awardees are strongly encouraged to invest in such equipment.

While the polystyrene debate rages on, more companies have switched to different packaging materials to show that they are more environmentally responsible and proactive on waste-diversion efforts. Computer manufacturer Dell, for example, has experimented with a bevy of alternatives to polystyrene, including one that is a combination of agricultural waste and fungus. Ikea also claims it will transition away from polystyrene and instead incorporate a similar ag waste and mushroom-based material that is compostable.

Meanwhile more “green” and recycling experts tout alternatives to polystyrene and its cousin, plastic, but many of them are not scalable or present their own set of challenges. Polystyrene is lightweight yet is bulky and requires a huge amount of space — it is not as lucrative to collect, reprocess and sell as glass, aluminum, or even cardboard.

The problem food packaging companies face is that this supposed market for recycled polystyrene just is not there. Few companies tout that their product is using recycled polystyrene; it just does not resonate as well as “this shirt is made out of 15 recycled PET bottles” or “plant based plastic.” And recycling those massive Styrofoam inserts into “green” peanuts does not solve this riddle, as most likely they will end up in the local landfill. In the meantime, watch for companies to follow the sustainable packaging lead of Dell and Ikea as more consumers simply would prefer not to deal with polystyrene at all.

Image credit: David Gilford (Flickr)

Top 4 International CSR Insights for Fortune 500 Companies

By Pamela Hawley

For Fortune 500 companies wanting to make a difference in global corporate social responsibility (CSR), here are some tips on what to watch out for.

Congratulations on serving our global community. Your efforts will enhance your brand and employee commitment, while also serving nonprofits on the ground that deliver critical services in education, health, the environment and more. Best wishes as your company makes its unique, global impact.

1. Seamless, strategic community-relations planning

Seamless, strategic planning for your international corporate community-relations indicates that the domestic and international are tied to overall corporate strategic objectives. If your company doesn’t have a Strategic Plan and U.S.-based Community Relations Plan – those are the areas to start.

Make sure these two plans are wedded and practiced; lessons learned on the domestic scene can be applied to the international arena. Once these two areas are established, international community relations is a natural, albeit at times complex, expansion of planning.

2. The NGO nuance

Finding the right NGO nuance and NGO partner can take time – and it is not solely related to a common area of interest such as supporting education or the arts. Finding the NGO nuance takes it one step further, by identifying “on-the ground” partners and the right cultural synergy between the company and a particular NGO. These steps help ensure an effective working relationship.

Successful companies ensure that their community relations objectives incorporate the following areas: the greatest needs within the local community where the company is operating; how these needs fit their corporate objectives, both domestically and internationally; and the input of both U.S. and local, country-based employees.

In addition, identifying “on-the-ground” NGO partners provides community buy-in, and by working with an already established partner, more rapid and scaled results for the company. Alternatively, by not working with these partners, companies may cause damage in their efforts to establish long-term relationships. Finally, before agreeing to a partnership, the company spends time with the NGO – exploring the “NGO nuance” – to make sure there is a synergy and potential for a positive relationship.

Key areas to note are “hot spot” issues. Hot spot issues are issues critical to the community. Addressing these issues can win companies great favor and community standing. However, if these issues are volatile or cause community strife, they are often best times left for the local government to address. If your company is planning to stay in the community for decades, then such a commitment necessitates establishing long-term relationships with local governments and politicos. Through a multi-partner approach, these hot spot issues can be addressed.

3. Communication as a core principle

The companies which maintain effective community-relations practices and long-term relationships are the ones who commit to communications as a core principle of their efforts.

Communications must be frequent, multi-level and multi-partner inclusive. In addition, communications plans must take into account the following areas: international media outlets, cultural factors and perceptions which may arise. The type and tone of communications which are readily accepted within the United States are not always well-received outside of the U.S. Ensure that your communications team has the skills and experts to determine the right messaging and positioning applicable to each, unique local international effort.

4. Creative trust

Communication as a core principle allows you to set the groundwork for establishing long-term relationships. And that’s creative trust. Creative trust is built over time through frequent communications and actual execution with excellence. It’s in your company’s speaking and living: the message – what your company speaks – and in practice, how your company lives on the ground. A critical point in creative trust is it not only your company’s formal communications and events, but also the action of every person and employee who represents your company – and the company’s creative trust – in the day-to-day life of the community.

Image credit: Flickr/State Farm

Pamela Hawley is the Founder and CEO of UniversalGiving, an award-winning nonprofit that connects volunteers and donors with quality service opportunities all over the world. She is a winner of the Jefferson Award (the Nobel Prize in Community Service) and has been invited to three Social Innovation events at the White House. She also writes Living and Giving, a blog with the mission of “Inspiring Leaders to Live with Excellence and Love.” UniversalGiving Corporate helps companies manage and scale their Corporate Social Responsibility programs worldwide.

Connect with Pamela: Twitter

New report outlines how to identify weak corporate culture

Good governance is critical, but there should be a broader definition of what it means. Governance is not just a matter for boards of directors, but should be integrated into all areas of a company. Transparency matters.

Those are the key findings of a report on corporate culture produced by the International Corporate Governance Network, ICSA: The Governance Institute, and the Institute of Business Ethics.

The report is the product of a workshop of senior regulators, company directors and executives, and investors convened to study ways of identifying early warning signs of a weak culture. Measurable indicators of business culture were analyzed, including staff turnover, customer satisfaction, health and safety record, and public commitment to values by leadership. The warning signs extracted from this data include high levels of corporate stress, flawed remuneration policies, and lax financial discipline.

The study offers some solutions. It suggest that more attention should be paid to the role of HR departments in embedding culture, and to internal audit, which is well placed to notice when culture is slipping.

For more information:

• International Corporate Governance Network

• ICSA: The Governance Institute

• the Institute for Business Ethics

3p Weekend: Fruits and Veggies Turned Into Packaging

With a busy week behind you and the weekend within reach, there’s no shame in taking things a bit easy on Friday afternoon. With this in mind, every Friday TriplePundit will give you a fun, easy read on a topic you care about. So, take a break from those endless email threads and spend five minutes catching up on the latest trends in sustainability and business.

Containers and packaging account for 30 percent of the U.S. waste stream, according to the most recent EPA figures available. That amounts to 76 million tons annually, making packaging the single largest waste-item in America. The European Union also identifies packaging waste as a key area of concern, noting that its 28 member states generate around 79 million tons of packaging waste annually.

With a lifestyle that increasingly relies on convenience, we're unlikely to break off our love affair with packaging anytime soon. But some change-makers are taking a different approach by creating biodegradable alternatives made from fruit and vegetable waste. Check out these innovative ideas that cut down on both food waste and packaging -- talk about a win-win!

Mushrooms

When it comes to plant-based packaging, the mushroom is king -- at least for now. Dell introduced the concept of mushroom-based packaging to the world back in 2011 and began piloting the technology in its server shipments two years later. While the company admits it hit some roadblocks during the testing phase, it expects to be ready to reintroduce mushroom-based server cushioning this year.

Ikea is planning its own foray into mushroom-based packaging, and the material is now being produced by several packaging companies including Sealed Air and Ecovative Designs.

Potatoes

During processing, potatoes are blasted with water before being pushed through a tube fitted with a set of knives to cut wedges or chips. The byproduct is thousands of gallons of water laden with potato starch. Usually this water is processed and discharged, making waste of the potato leftovers, but a New Zealand-based firm devised another solution.

Appropriately named Potatopak, the company patented a technology that extracts potato starch from processing-plant wastewater for use in packaging. The water itself is also recovered and reused to make the company's namesake packaging, and all other waste from its manufacturing process is fed to livestock, fish or worms. The company plans to "expand to other countries and utilize their waste streams."

If the concept sounds familiar, you may be thinking of personal care brand Tom's of Maine and its own foray into potato-starch packaging. The company dappled with the idea of using a potato-based plastic resin in packaging such as mouthwash bottles, but it has since put the idea on the back burner.

Whey protein

Cartons can be tricky to recycle because paper is coated with layers of plastic film that must be separated before the materials can be recovered. A growing number of U.S. cities are beginning to accept cartons for recycling, but such technologies are often too pricey for recycling plants servicing smaller towns and rural areas. But a group of European researchers are out to make cartons easier to recycle through the use of bio-based materials.

Working in the EU-funded Bio-Board project, they developed a bio-based film that can be used to replace plastic in carton manufacturing. The film, made mostly from whey protein left over from cheese-making, is easier to separate from multilayer packaging, making the recycling of such packaging far more affordable.

“Bio-board responds to increasing demand from food packaging producers for biomaterials that can substitute synthetic coatings without compromising packaging properties for liquid and dry goods,” Elodie Bugnicourt, the project coordinator at IRIS in Spain, said in a statement. “Using extracts from whey and potato fruit juice we have developed materials that meet those requirements and evaluated their use in coated packaging production processes.”

Agricultural waste

Potato starch isn't the only agricultural byproduct being repurposed for packaging. Idaho-based BiologiQ, a longtime leader in biodegradable polylactic acid (PLA) plastic, is now making a resin it calls thermoplastic starch, or TPS.

Made from annually-renewable agricultural waste -- from crops like potatoes, corn and cassava, a woody shrub native to South America -- BiologiQ's TPS packaging is biodegradable and can be used in "a large range of consumer and industrial products," the company said.

The company, which has processing plants in Idaho, as well as Japan, Thailand and Indonesia, also launched another biodegradable product that's poised to revolutionize agriculture. Thin plastic films covering agricultural crops have been used for years to increase crop quality and yield, retain water, decrease harmful insects, and warm the soil for better seed germination and earlier planting. After use, this film is typically tossed in the trash, but BiologiQ developed a fully biodegradable alternative that can be returned to the earth after the growing season. How cool!

Edible food packaging

Would you chow down on food in edible packaging? Massachusetts-based Quantum Designs, the mastermind behind WikiFoods, is banking on it.

The company's innovative idea wraps foods and beverages in edible packages made of natural ingredients like fruit scraps, rendering the whole thing into a tasty treat.

The technology was first introduced to the open market in partnership with Stonyfield Organic in 2013, in the form of package-free frozen yogurt 'pearls.' Late last year, WikiFoods introduced non-allergenic, non-dairy frozen bits under the Incredible Innovations brand, now available in select New England locations.

Image credits: 1) and 2) Ecovative Designs 3) Bio-board 4) Stonyfield Organic

How Cotton Recovery is Changing the Game for Sustainable Fashion

How can we sustainably shape the world of the future? How can we consume with a clear conscience? What shape does effective recycling take? These are a few of the questions that we all have to ask ourselves in light of the fact that raw materials are finite and we’re using up this planet’s resources like we have another one to go to later.

I:CO believes it has found the answer to these questions, one proved by nature herself. Just as nature reuses everything that it produces, I:CO (short for I Collect) has created a closed-loop system in which textiles and shoes can be recycled and remade into new products.

The fashion industry is the second most polluting industry in the world, next to big oil. Every year, millions of tons of textiles and shoes are produced. And every stage in a garment’s life threatens our planet and its resources. It can take more than 20,000 liters of water to produce 1 kilogram (2.2 pounds) of cotton, which is basically equivalent to a T-shirt and pair of jeans. This is a tremendous waste of our natural resources especially since the vast majority of what is produced is simply tossed in the garbage.

As an international solutions provider for clothing reuse and recycling, I:CO is tackling this issue by creating a closed-loop production cycle in which these goods can be reprocessed and reused again and again. The company's mission is to reduce waste, preserve our natural resources and protect the environment.

Together with its partners, I:CO collected about 17,000 tons of clothing and shoes in 2015 (or 37 million pounds). About 40 percent of the clothing has been recycled (6.8 tons or almost 15 million pounds) -- with a good portion of that being cotton goods. This is attributed to I:CO's innovative process of sorting items for rewear and upcycling.

Rewear means that whatever is still wearable can be worn again, ensuring that the energy which once went into making the product is respected and optimally used. Upcycling means that a discarded textile or shoe is used to create a new product of equal or better quality. Things that can no longer be worn go into an upcycling process and kept in the loop so that a pair of jeans today can be turned into a new pair of jeans in the future.

“This system brings all returned clothing to its ecologically reasonable next best use,” explained I:CO's chief marketing officer, Jennifer Gilbert. “Thus, still wearable clothing will be kept in the closed loop in its original condition for as long as possible and marketed in secondhand goods markets. By giving these garments another life through the rewear concept, we assure the conservation of resources.”

Gilbert explained that an increasing part of the company’s recycling procedures involves the processing of unwearable garments back to fibers which are used to produce new products. “When it comes to the protection of resources, rewear enables us to save the most resources possible, and recycling saves the resources that otherwise would be lost because the garments cannot be worn any longer.”

The company partners with a bunch of big brands to bring its vision to fruition, including Levi’s, Puma, Forever 21, the North Face, and fashion powerhouse H&M. In an effort to reduce the environmental impact of the fashion industry, H&M launched a clothing-collection initiative in partnership with I:CO back in 2013, to limit the amount of textiles ending up in landfills. To date, H&M has collected more than 25,000 tons of unwanted garments in stores globally.

“As much as 95 percent of textiles and clothes that are thrown away globally can be used again, and we want to offer an easy solution for the customers that today throw their old clothes away,” an H&M spokesperson told TriplePundit. “Therefore, we collect clothes of any brand and any condition in our stores globally.”

In February 2014, H&M launched the first line of products made of recycled textile fibers from garments collected in the company’s Garment Collecting Initiative. The garments, which were made from recycled cotton, included five classic denim pieces, such as jeans and jackets, for men and women.

This serves as an example of how H&M is closing the loop in textiles, and the aim is to use more material from recycled post-consumer garments in the future. “Denim garments today can contain only 20 percent recycled cotton. To increase this share without losing quality, we need more technological innovation,” the company explained. “We are working hard to overcome the challenge, and we are investing in the innovation we need to create a closed loop.”

So, how does the process work? Once the customer’s clothing is collected by H&M, it is picked up from the store, consolidated, and then transported to a sorting plant where it is sorted by hand and categorized according to its next best possible use. The sorting process is based on the waste hierarchy criteria which states that all products fit for wear are to be sorted out to continue in their original form as long as possible.

A pair of jeans that has too many holes in it cannot be reworn so it is recycled according to its characteristics. The cotton denim jeans are shredded and pulled until only the fibers are left. A big portion of these fibers are used in insulation material, and some are mixed with virgin fibers to produce new fabrics, which in turn would be used to produce new clothes.

The recycling processes within the I:CO infrastructure do not involve the use of water, pesticides or any other chemicals. Additionally, following the company's intention to help retailers take on end-of-use product responsibility, the I:CO team is always furthering its knowledge of sustainable/ethical business practices by holding workshops which also involve sustainable matters and implementing solutions.

“We are grateful to collaborate with such an innovative, globally-conscious partner as H&M who is determined to take on their product responsibility and help create a more sustainable future for the industry and communities around the globe,” Gilbert told us. “Furthermore, we appreciate H&M’s commitment, in cooperation with us, to promote the closed loop worldwide.”

Image credit: I:CO

Tipping Point: Three More Grocery Chains to Source Only Cage-Free Eggs

It is a good week for America’s hens, many of whom live out their lives in tiny battery cages unable to even flap their wings. Three large grocery store chains made announcements that they will switch to cage-free eggs.

Kroger, the largest grocery store chain in the country, announced it will source 100 percent cage-free eggs by 2025. In 2015, only 15 percent of the eggs it sold were cage-free. Kroger has over 3,400 grocery stores and convenience stores nationwide under two dozen banners, including Kroger, Harris Teeter and Ralph's.

Albertsons, which has over 2,200 stores in 35 states and Washington, D.C. under different banners, including Albertsons, Safeway and Vons, will also go cage-free by 2025. Delhaize America is the third chain to make a similar announcement. Delhaize has over 1,200 stores on the East Coast and is part of Belgium-based Delhaize Group.

What is driving the move to cage-free eggs?

“In recent months, the movement to free hens from cages has reached its tipping point,” the Humane Society of the United States (HSUS) said in a statement. And recently, Safeway, Costco, Target, CVS, Trader Joe’s and BJ’s Wholesale have made similar announcements. Almost 100 other retailers, restaurants, food manufacturers and food-service companies in the past year have committed to going cage-free.What is driving the cage-free trend? A look at the press releases by each of the three large grocers that made announcements this week gives a glimpse:

- Albertsons' press release states that it is “making the move not only as part of its ongoing commitment to animal welfare but also in response to customer buying habits.”

- Krogers' press release states that as its “customer base has been moving to cage-free at an increasing rate, Kroger’s goal is to transition to a 100 percent cage-free egg supply chain by 2025.”

- Delhaize states that it “will continue to increase the number of cage-free shell options as quickly as possible based on available supply, customer demand and affordability.” And Delhaize told Triple Pundit that "customer preference is always an important factor in any of our decisions."

Do you notice the word that is used in all three statements and Delhaize's comments to Triple Pundit? The word is customer, and consumer pressure is a big driver of the move to cage-free eggs. “Every day, more and more consumers are showing that they do not support caging hens, and as a result, food companies are responding,” Aaron Ross, director of campaigns for the Humane League, told TriplePundit.

Recently, the Humane League led a campaign urging Kroger to go cage-free. A petition asked consumers to “tell Kroger to stop caging hens” and received over 30,000 signatures. In addition to the petition, the Humane League had a student initiative, a spoof video and a website devoted to the campaign.

The Humane League’s efforts are working. “Over the last year, the Humane League has won commitments from some of the largest food-purchasing companies in the world, in large part due to consumer support,” Ross told us.

Numerous studies have found that "consumers care deeply about animal welfare,” Josh Balk, director of food policy for HSUS, told TriplePundit. And companies are well aware of those studies. “With this in mind, there’s no way a grocery store wants to portray itself of being heartless toward animals,” he said. “And in this case, the cruel confinement of egg-laying hens in cages.

“Now, more than ever, consumers are concerned about animal welfare on factory farms, and the public strongly opposes cramming animals into cages so small they can barely move their limbs, walk around or engage in other natural behaviors,” Jaya Bhumitra, director of corporate outreach for Mercy for Animals, told 3p. “At a minimum, consumers demand that animals not be tortured in the process of meat, milk and egg production.”

“There is a growing recognition by North American food companies that animal welfare is important to consumers,” added Darren Vanstone, corporate engagement manager for North America at World Animal Protection. “Food companies risk doing damage to their brands if they ignore consumer expectations.”

Will battery cages in the U.S. go the way of tape cassettes and VCRs? Both Ross and Balk think so. Ross pointed out the significance of these latest commitments from Kroger and Albertsons. “When the two largest supermarket chains in the country make commitments to eliminate cages, it signals a future without cages,” he said. He added that the Humane League is “actively working with other major retailers and expect others to follow in the footsteps of Albertsons and Kroger.”

Balk said that by the end of this month the HSUS will “work with virtually all the top grocers to go 100 percent cage-free with a timeline.” He proclaims that “we’ve crossed the point of no return for the industry to abandon cages.”

Bhumitra pointed out that the numerous commitments to go cage-free “indicates that it’s only a matter of time before the archaic and cruel cages that severely confine hens are banned for good.” She adds that the announcements make it clear “that the days are numbered for egg factory farmers who pack birds in cages so small they can’t walk, fully spread their wings or engage in other natural behaviors.”

The end of battery cages will be great news for hens and for those who care about their welfare.

Image credit: Flickr/John Morgan

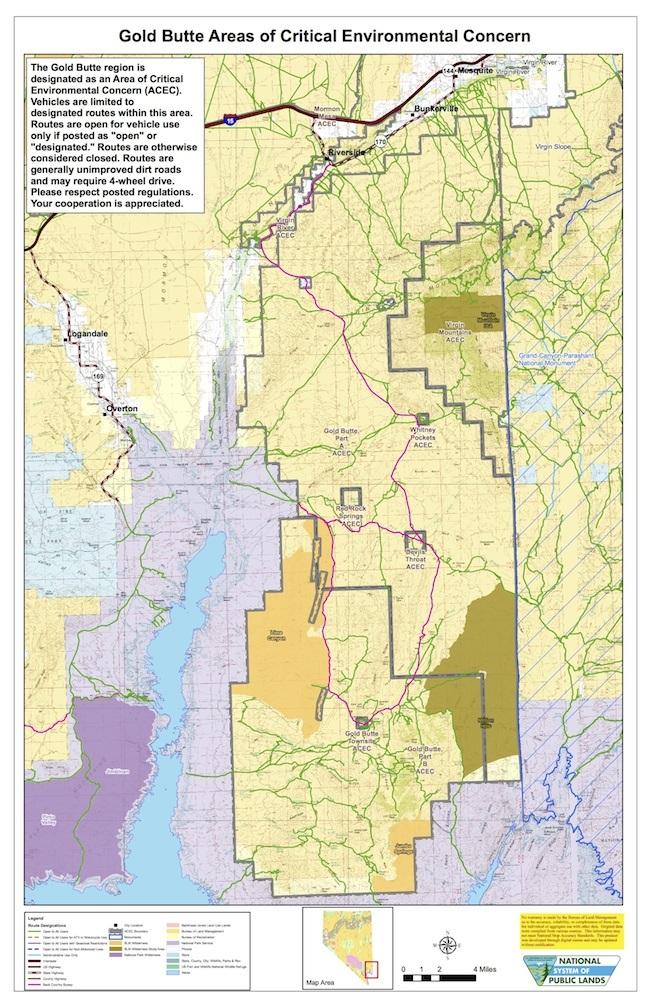

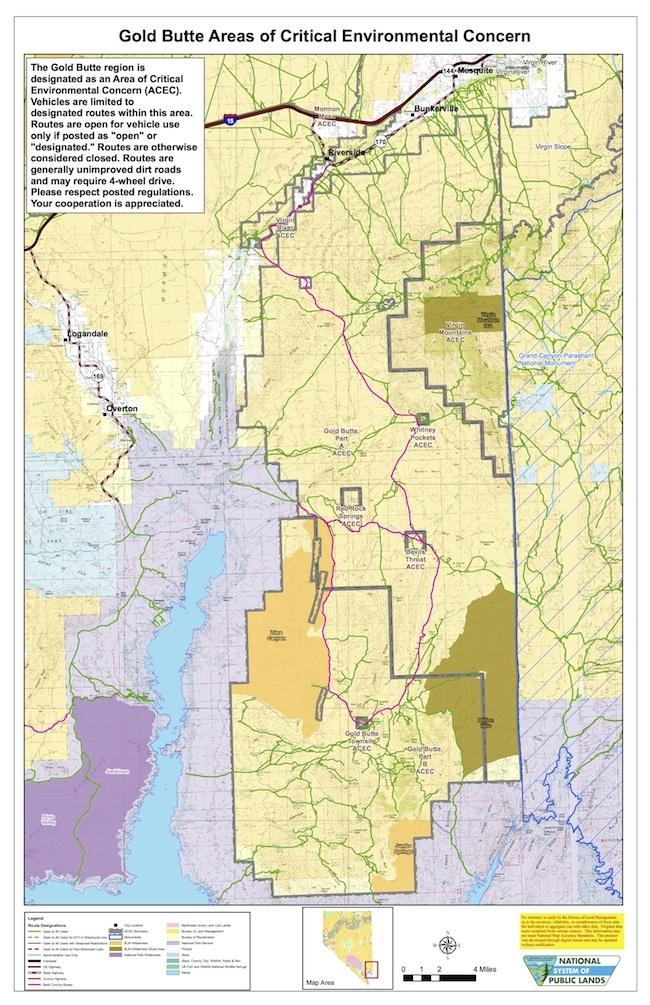

Fallout From the Oregon Takeover Continues

The public is finally getting a glimpse of the mess left behind at the Malheur National Wildlife Refuge in Harney County, Oregon, after the end of a six-week occupation by Arizona businessman Ammon Bundy and his gang of armed thugs. Bundy and two dozen of his supporters are now behind bars along with his father, Nevada rancher Cliven Bundy, who has finally been called to account for enlisting an armed gang of his own back in 2014, when federal agents tried to chase his cattle off the Gold Butte public lands in Nevada.

In the latest development, yesterday 14 additional people were arrested by the FBI and indicted by the U.S. Attorney's Office in Nevada for felony crimes related to the Cliven Bundy episode, some of whom were also involved in the Malheur takeover. Say, what kind of businessmen are these Bundys, anyway?

Hammer falls on Bundy supporters

On top of the two dozen arrests directly connected to the Malheur takeover, law enforcement has finally caught up with Cliven Bundy and his gang, referred to by one observer as the "parasites of the purple sage" (most likely a reference to the vintage Zane Grey novel set in Utah, "Riders of the Purple Sage").

Here are some snippets from the press release announcing the Bundy-related indictments from the U.S. Attorney's office:

The federal grand jury in Nevada has charged 14 more defendants in connection with the armed assault against federal law enforcement officers that occurred in the Bunkerville, Nev. area on April 12, 2014, over the removal of Cliven Bundy’s cows from public lands......The newly-added defendants are charged with one count of conspiracy to commit an offense against the United States and conspiracy to impede or injure a federal officer, and at least one count of using and carrying a firearm in relation to a crime of violence, assault on a federal officer, threatening a federal law enforcement officer, obstruction of the due administration of justice, interference with interstate commerce by extortion, and interstate travel in aid of extortion. The indictment also alleges five counts of criminal forfeiture which upon conviction would require forfeiture of property derived from the proceeds of the crimes totaling at least $3 million, as well as the firearms and ammunition possessed and used on April 12, 2014.

Ouch!

The U.S. Attorney's Office reminds us that "the defendants are presumed innocent and entitled to a fair trial at which the government has the burden of proving guilt beyond a reasonable doubt."

Stay tuned for more, because in the press release U.S. Attorney Daniel G. Bogden also had this to say:

"This investigation began the day after the assault against federal law enforcement officers and continues to this day. We will continue to work to identify the assaulters and their role in the assault and the aftermath, in order to ensure that justice is served."

From heroes to thugs

Cliven and Ammon Bundy have presented themselves as the authentic grassroots voice of a movement to transfer federal land out of federal control, ostensibly to create more jobs and foster economic activity in rural areas.

However, TriplePundit has been examining the Bundy's through a corporate social responsibility perspective -- after all, they are both business owners who claim to be acting on behalf of the community -- and from that angle their actions make no sense.

In particular, after Ammon Bundy and his thugs blundered into the Malheur refuge, it became abundantly clear that he lacked support from any local stakeholder group, even though he purported to act in the interests of local ranchers, miners and loggers.

Ammon also ignored the interests of the local Paiute tribe and enabled his supporters to run roughshod over sensitive archaeological areas in the refuge, where they built a new gravel road, enlarged a parking lot, and dug trenches for refuse and human feces during the six-week standoff.

Cliven Bundy's actions were different: He did not take over a federal facility, but he also displayed a similar pattern of ignoring local interests and professional responsibilities. For two decades, Cliven refused to pay the same fees that other ranchers pay for grazing on federal land, letting his cattle run wild on Gold Butte, which is listed among the "areas of critical environmental concern" in Nevada. Now that Cliven is behind bars, the destructive legacy of his actions are coming to light.

Fox News, which is hardly a champion of federal bureaucracy, reported on the situation earlier this week under the headline, "Bundy's million-dollar herd of ornery cattle giving feds a meaty problem:"

"... His 1,000 head of cattle are still roaming federal lands due, in part, to his absence and also to what officials call his 'unconventional, if not bizarre' ranching methods."'Rather than manage and control his cattle, he lets them run wild on the public lands with little, if any, human interaction until such time when he traps them and hauls them off to be sold or slaughtered,' said court documents filed by federal prosecutors last month. 'He does not vaccinate or treat his cattle for disease; does not employ cowboys to control and herd them; does not manage or control breeding; has no knowledge of where all the cattle are located at any given time; rarely brands them.'"

Fox also noted that the untended cattle have been trampling Pauite artifacts at Gold Butte in addition to damaging range lands through overgrazing.

A long article in ClimateWire provides many more details on the Gold Butte situation, noting that an atmosphere of intimidation after Cliven's 2014 action has continued to hang over the area, enabling vandalism and preventing conservation programs from being carried out:

"Agency trespass investigations show that cattle have 'trampled' and 'denuded' sensitive soils, increasing the risk of erosion and invasive and noxious weed infestations. Cows have also damaged Native American petroglyphs by 'bedding down and rubbing against these irreplaceable archaeological resources ...'"Restoration efforts have been stymied.

"BLM forfeited a $400,000 matching grant from the Walton Family Foundation for a $1 million restoration project in 2013 and 2014 that would have benefited the endangered southwest willow flycatcher. The presence of cattle thwarted the project ..."

As reported by ClimateWire, it's no surprise that Cliven Bundy is not a member of the Nevada Cattlemen's Association, though in a statement issued shortly after the 2014 episode, the organization expressed sympathy with Cliven's "dilemma" over federal land management.

On the other hand, in the same statement the Cattlemen's Association reiterated its support for the emerging collaborative land management model and distanced itself from the criminal acts of Cliven and his supporters.

The Oregon Cattlemen's Association has also issued public statements regarding the Malheur takeover that echoed the sentiments of its Nevada counterpart. In one such missive after the last holdouts at Malheur were arrested, Executive Director Jerome Rosa made this observation:

"... the Oregon Cattlemen’s Association has 'a positive history working with government agencies on both a state and federal level. These trusted relationships are what will allow positive and productive change to occur.'”

The ALEC angle

So, how to make sense of the Bundy's actions? From the beginning, TriplePundit has been among those noting the close connection between the Bundys and the powerful business lobbying group ALEC, which has made the privatization of federal land a legislative priority.

As a Koch-backed organization, ALEC's priorities directly serve the mining, ranching and logging interests of the family business, Koch Industries. Koch Industries is better known for its fossil fuel activities, but the company is also interested in uranium mining, it has dabbled in ranching, and it acquired U.S. forestry giant Georgia-Pacific in 2015.

The Georgia-Pacific acquisition highlights something else about the Malheur takover that doesn't make sense outside of the ALEC connection. The Malheur refuge has been cited as a national model for cooperation between the federal Bureau of Land Management, conservationists, and local ranchers and other business interests, so it would seem to be the least compelling choice to make a stand against government intervention. However, take into consideration the enormous reach of Koch Industries in the Oregon forestry sector through Georgia-Pacific, and you can see why the success of the cooperative model is not in the best interests of the family business.

We'll close with a shoutout to the Steens Mountain Brewery, another family-owned business. Located in the town of Burns near the Malheur refuge, the tiny "nanobrewery" was just getting under way when the presence of Ammon Bundy's armed thugs cut its operations down to a fraction.

Steens Mountain owner Rick Roy is also an employee of the Bureau of Land Management. As one of the many local residents who make a living on the government payroll, Roy's interests were pretty low on the Bundy family priority list, and you can read all about Roy's thoughts on the Bundy "idiot parade" in the Portland Mercury.

Meanwhile, keep an eye out for Roy's ambitious plans to expand his brewery (and create new jobs), along with a new brew commemorating true local stakeholders, called Harney County Strong American IPA, along with a new hopless LEO concoction, so named in appreciation for the law enforcement officers who removed Ammon Bundy and his out-of-state thugs from the Malheur refuge.

You can also check out the Go Home campaign, launched by two Oregon brothers opposed to the Malheur takeover, which has been raising funds for the Malheur refuge, the local Paiute tribe, gun control advocacy and the Southern Poverty Law Center, which tracks hate groups.

Image: via U.S. Bureau of Land Management.