5 Signs the Agrivoltaics Revolution Has Only Just Begun

An upswell of opposition to large-scale solar power plants on farms took shape in the U.S. last spring, partly fueled by conspiracy theories about climate change. Nevertheless, farmland is attractive to solar developers. Now they have a new support system on their side, in the form of agrivoltaics.

Agrivoltaics is an emerging field that allies solar energy and agricultural stakeholders. Here are five signs that it is a force to be reckoned with.

Agrivoltaics can overcome the opposition

Solar developers are attracted to farmland because it is already developed, commercialized, leveled, treeless, and open to the sun. All of these factors can help minimize the cost of site preparation. Access to roads and transmission infrastructure is another plus. On the farmer’s side, leasing land to a solar developer provides the security of guaranteed revenue for the lifespan of the project, typically 25 years or so.

Critics have argued that solar power plants are an inappropriate use of farmland. However, that argument no longer carries the same force as in years past.

An agrivoltaic array deploys solar panels that are raised higher off the ground than usual, enabling livestock grazing and other types of farming to take place underneath.

The extra-high racking adds cost to the project, but the agrivoltaic factor can help overcome local opposition to solar projects.

In Colorado’s Delta County last March, for example, the county commissioner board rejected a proposal for an 80-megawatt solar array from the developer Guzman Energy. The board cited loss of agricultural land and opposition from neighboring property owners among the reasons.

Guzman came back with an offer to improve irrigation, establish an apiary, and graze more than 1,000 sheep on the site. The new proposal won approval last August.

Agrivoltaics makes farmland even more attractive for solar development

As noted by Colorado Sun reporter Mark Jaffe, local supporters of the Guzman proposal were in the majority by August, but critics continued to raise objections. Among other points, area residents “questioned whether it would be too hot for the sheep among the solar panels in summer,” Jaffe reported.

The question of harm to livestock stands the actual facts on their heads. Combined with the surrounding vegetation, shade from the solar panels creates a cooling microclimate, not a hot one.

In addition to providing livestock with access to shade and relief from heat, the reduced temperature also enhances the efficiency of the solar array, which benefits the solar developer.

Employing livestock to trim vegetation around a solar array can also reduce maintenance costs for the developer, compared to mowing machines.

Agrivoltaic arrays can enlist crop farmers, too

In addition to grazing and pollinator habitats, interest in other areas has been spurred by a growing body of evidence about the beneficial impact of agrivoltaic microclimates on fruit and vegetable crops.

“Agrivoltaics has been carried out for berries, grapes, and orchard crops like apples, and is well suited for shade-tolerant crops such as cauliflower or cabbage,” the Department of Energy noted in an August 2022 agrivoltaics market research study.

“Researchers from the University of Arizona determined that growing crops in the shade from solar panels can yield two or three times more fruit and vegetables than conventional agriculture setups,” the Energy Department also observed.

“For example, within the study cherry tomato production doubled in the agrivoltaics system and water-use efficiency for the crop was 65 percent greater than normal growing conditions,” they added.

Other benefits include protecting crops from hail, heavy rain and other extreme weather events. Agrivoltaic arrays could also provide farm workers with a cooler environment during hot weather.

Crop farmers and other stakeholders are also beginning to deploy agrivoltaics as an educational attraction, as illustrated by Jack’s Solar Farm in Boulder County, Colorado.

Solar manufacturers and innovators are paying attention

The solar supply chain is another factor stimulating the agrivoltaics field.

Earlier agrivoltaic arrays employed off-the-shelf solar panels and mounting racks. Now solar manufacturers are beginning to tailor their product lines for agrivoltaic projects, often with the assistance of remote, artificial intelligence systems that adjust solar panels in real time for maximum effect.

The Energy Department also takes note of manufacturers that offer solar products to replace the plain glass or plastic sheeting typically used in greenhouses and other crop shelters.

One company cited by the Energy Department is the French startup Sun’Agri, which describes its AI-assisted system as “dynamic agrivoltaics.”

“It involves constructing a system of solar louvres on top of the crops, which represents a real agronomic breakthrough that protects yields by combating water, heat and solar radiation stress,” the company explains.

The Energy Department describes a Sun’Agri test at a vineyard in France, in which water demand was reduced by 12-34 percent for grape vines sheltered by the solar panels.

The aromatic profile of the sheltered grapes also improved compared to a control group, the Energy Department added.

Precision farming is another area that has attracted more allies to agrivoltaics. A paper submitted to the IOP Conference Series earlier this year outlines a high tech “agricultural complex” that illustrates how agrivoltaics and precision farming can be combined in a remote-controlled system.

A whole array of solar solutions

Large, utility-scale arrays with thousands of solar panels are just one aspect of the solarization of farmland. Smaller arrays are also in play, and they can encounter less resistance while helping to build awareness of the benefits of solar power.

New allies in that area include the U.K. startup H2arvester, which has developed a mobile “solar car” comprised of only 168 photovoltaic (PV) panels.

The device is aimed at producing green hydrogen from electrolysis systems, powered by electricity from the solar panels. The device can wheel around a field one part at a time, to collect solar energy without taking land out of production. Farmers can sell the hydrogen or use it on site for fuel.

Green hydrogen can also be processed into green ammonia fertilizer, adding more benefits to the farmer.

At a smaller end of the scale, the Canadian company Worksport is collaborating with Hyundai and other partners to integrate solar panels with pickup truck tonneau covers, the flat coverings that fit over truck beds to protect against loss, theft and weather. The solarized tonneau covers are combined with an energy storage system.

Stepping down in size another notch, the U.S. startup Aigen is developing a fleet of PV-powered robots. Designed to pull weeds, the small, boxlike devices scurry around a field with solar panels on their backs.

Bonus sign: The solar farming alliance grows

As reported by Reuters last spring, opposition to solar arrays on farmland is likely to continue, and opponents will probably continue to register some successes.

However, more solar development on farmland is all but inevitable. In addition to advocacy by solar developers and individual farmers, solar farming advocates have White House policy on their side. That includes an assist from the Department of Agriculture’s Climate-Smart Commodities program along with support from the Energy Department.

Big Ag is also poised to become a powerful ally. Leading stakeholders in the global food supply sector have begun to organize support for regenerative agriculture practices that support carbon sequestration in soil, and that overlaps with the soil conservation and biodiversity benefits of agrivoltaics.

Fossil energy only began to transform the agricultural landscape of the U.S. about 100 years ago. Now its grip is loosening, and a new transformation is taking shape.

Image credit: Tobi Kellner via Wiki Commons

How Two Women in Bolivia Launched Microfinance in Latin America

In 1990, women in El Alto, Bolivia, asked teachers Lynne Patterson and Carmen Velasco for money to support their families and make progress in their education. They needed funding to become financially independent and grow their businesses. Patterson and Velasco decided to travel to Bangladesh to learn something new themselves: microfinance, or the idea that providing loans to poor microentrepreneurs will enable them to pull themselves out of poverty, from pioneer Muhammad Yunus. It was the start of the nonprofit social enterprise I lead today, Pro Mujer.

Thirty years later, women in Bolivia and across Latin America are still at the margins of the financial system. They are self-employed, work multiple informal jobs to make ends meet, and have no access to credit. According to CAF Latin America Development Bank, only 49 percent of women in the region have a bank account. Even when Latin-American women own half of the region’s small businesses, 70 percent of them have no access to financing at all.

It is hard to build financial systems for the world’s poor. The Consultative Group to Assist the Poor (CGAP), a global partnership of more than 30 leading development organizations that works to advance the lives of poor people, especially women, says that microfinance is a powerful instrument against poverty. This year, research organization 60 Decibels surveyed nearly 18,000 microfinance borrowers across 72 organizations worldwide and published the first index to track the impact of microfinance in people’s access, household, financial management and resilience, along with their business.

The new index is an important benchmark and provides a series of compelling insights about how microfinance is helping people escape poverty today. The first insight is that over half of people surveyed said they got their first loan ever from their microfinance institution, with women and lower income respondents more likely to be first-time borrowers. Even when venture capital investment in fintech companies broke all records in 2021, around the world 1.7 billion people are still excluded from the financial system, and for them microfinance remains a way in.

Another insight supports the positive impact of microfinance in expanding access to credit without fostering excessive debt, with seven in ten borrowers reporting that paying their loans is “not a problem.” Microfinance borrowers also say they are more resilient to economic shocks, with only one in three people surveyed in the index reporting they could not pay for an emergency expense as compared to one in two globally. Crucially, the survey confirms the core premise of microfinance, that investing in growing their own business will help people improve their overall quality of life.

The survey also shows the most important improvement opportunity is to increase microfinance’s household impact. There is a fundamental difference between providing loans and a more holistic approach that brings together credit with financial education, entrepreneurial training, and health services. This insight is consistent with our experience on the field at Pro Mujer. Starting from Patterson and Velasco’s vision, who saw providing loans as complementary to the education and health services they were already focused on, Pro Mujer pioneered a holistic approach to empowering women in Latin America.

For example, in Nicaragua, where all Pro Mujer’s clients have access to entrepreneurship training and health services and 96 percent of our clients benefit from the support of their communal banks, 93 percent of Pro Mujer’s borrowers surveyed said that microfinance has helped improve their quality of life, and 91 percent said their business income has in fact increased.

The case of Maria Antonia Centeno, a single mother of eight children in Nicaragua, helps understand why. Centeno first borrowed $86 to buy hair styling tools in 2012 using community lending, a best practice where a group of a dozen borrowers with no guarantees or access to credit back each other up when one of them cannot make a loan payment. A neighbor invited Centeno to join their group, and she worked hard to pay back her trust, growing her business in the process.

At the time Centeno lived with her family in a single room house with dirt floors, so the first thing she did with her new earnings was to wall off some rooms, and install ceilings, floor tiles and aluminum windows. Then she made sure to send her children to school, so that they could become professionals instead of informal workers like her. Ten years later, three of Centeno’s children are accountants, one is an ophthalmologist, two studied business management, one works in sales and one studies medicine.

By participating in Pro Mujer’s training programs, Centeno learned how to better manage and grow her business. She got additional loans, one of them over $1,200, and eventually opened her own salon. The loan she is repaying today is ten times larger than her first one, but she remains mindful of where she started, and has taken the place of the neighbor who trusted her at the head of their communal bank. Along the way, preventative health services like pap smears, vital sign checks and blood sugar analysis were key in her journey to break the cycle of poverty.

There you have it, microfinance with a clear household impact. Here I could tell you that Centeno’s case is emblematic of the work we do at Pro Mujer, but more than that, she is a fine example of what Latin American women can accomplish when given a fair shot. Next time you hear about the region, remember how hard women like Centeno work to earn your trust, how proud they are of their accomplishments no matter how small, and how fiercely they fight to give their children a better future. Just like Pro Mujer, you would also give them credit.

Interested in having your voice heard on 3p? Contact us at [email protected] and pitch your idea for a guest article to us.

Image credit: Pro Mujer

This New ESG Rating Helps Organizations Achieve DEI Goals

Organizations looking to advance and benchmark their diversity, equity, and inclusion (DEI) plans have a new set of ESG ratings to consider. Launched by the International WELL Building Institute (IWBI) and in collaboration with its Health Equity Advisory, the resulting WELL Equity Rating helps organizations accomplish DEI goals.

A more holistic approach to ESG

“The goal here is really to drive shifts within the organization, to drive real progress but also to give organizations the ability to speak about some of the things they are already doing that they may or may not know are contributing to more diverse and equitable outcomes," Rachel Hodgdon, president and CEO of IWBI, told TriplePundit.

The WELL Equity Rating is a culmination of two years of extensive research and feedback from target groups of stakeholders. Further, Hodgdon explained to 3p that in its development process, her team made notable observations. That is, global organizations have a commitment or desire to advance DEI efforts but lack tangible plans for achieving its goals. In addition, the organizations that do have a roadmap for achieving DEI goals, aren't focusing on the impactful processes, according to Hodgdon and her team’s research.

To date, over 30 global organizations, including Anderel, Empire State Realty Trust, JLL, Overbury and Shaw Industries have enrolled in this program. The rating is comprised of 40 features across six actions: user experience and feedback, responsible hiring and labor practices, inclusive design, health benefits and services, supportive programs and spaces and community engagement. These features are opportunities for participants to earn points towards the eligibility baseline of 21 points. Organizations can cross check these features with its processes and ascertain which goals it is on tracking for achieving.

While some ESG ratings may solely focus on specific aspects of DEI such as LGBTQ inclusion, according to Hodgdon, the WELL Equity rating differs because it is based on the location of organizations. Participants enroll their organization based on the location of their employees which may be multiple global offices or one autonomous location.

An emphasis on wellness and DEI fosters a productive and engaged workforce

Hodgdon explained to 3p that parental leave or restorative spaces “are the kind of things that maybe an organization already does but they are not necessarily thinking it relates directly to more diverse outcomes and that’s where our research comes in to affirm that yes if you provided enhanced ergonomics that meet certain conditions that’s something that’s contributing to creating a more equitable workplace.”

Workplace design that considers employees’ interaction with their environment is essential. While ergonomics is implemented to primarily reduce injuries and increase efficiency, there are additional benefits. Ergonomics improves productivity, quality, employee engagement and helps create a safe culture. And a diverse and inclusive workplace that considers employees’ wellbeing and interaction with their environment, fosters innovation and fulfillment among them. To this point, the WELL Equity Rating focuses on health and wellbeing and creates a balanced approach to ESG for organizations, according to Hodgdon. She explained to 3p that in the rating eligibility process, participants can distill their ESG goals especially in the social and governance factors of the framework.

Factoring employee wellbeing is a win for all team members. And frameworks that keep organizations accountable to commitments and provide an efficacy assessment are essential. By partaking in the assessment of organizational structure, leaders can build strong DEI plans and fulfill any gaps accordingly.

Image credit: Pavel Danilyuk via Pexels

The Best TriplePundit Interviews During 2022

We here at TriplePundit are proud of the breadth of sustainability and social impact news that we’ve been able to provide to our readers — with a very small staff — since 2005. We’re slight in staffing, but can boast of a mighty team; and our crew of writers this past year is no different. We’re highlighting a few of our more compelling interviews during 2022; discussions about race and the workplace have been a continued theme of late, and we don’t see ourselves veering away from this topic at any point soon.

In any event, it isn't possible to have great interviews without thoughtful, smart and outstanding interviewees — so we list some here.

Yes, small businesses can ensure a public commitment to DEI

Plenty of business leaders are fearful of being branded as “woke,” especially those who are at the helm of smaller companies. Entrepreneurs, however, can stay committed to social impact by weaving their values into the core of their businesses — that is, according to disability advocate, author and DEI (diversity, inclusion and equity) consultant Alison Tedford. What’s more, by being genuine and proactive, these entrepreneurs can avoid the trappings of scandal and “cancel culture.”

A public and up-front DEI plan may appear risky at first, but the dividends pay off, insisted Tedford as she took time for interviews with Riya Ann Polcastro for a two-part series published this past spring. From Tedford’s perspective, “[DEI] isn’t about repackaging anything,” she said. “It’s about honoring what exists and presenting opportunities for growth.”

Further, Tedford suggested that companies ensure they apply DEI to all aspects of business in a way that creates a culture of inclusion for customers and employees alike. When it comes to customer service, this won’t eliminate the inevitable entitled guest, client or customer who appears now and again, but in the end, everyone will be better off, as the company will have an easier time attracting clients and customers with shared values.

Yes, companies should take a stand, no matter how difficult the issue is

Over the past several months, Roya Sabri showcased the thoughts Illinois-based DEI consultant Kim Crowder. During their talks, Crowder made the case for corporate racial audits, called out companies for crass Juneteenth promotions and explained why highlighting “first” and “seconds” only reminds us that the system is failing when it comes to recognizing the achievements of Black women.

Crowder also made it clear that when it comes to the most volatile social issues of our time, it behooves companies to take a stand. Speaking to Sabri after mass murder of schoolchildren and teachers in Uvalde, Texas, she reminded our readers that companies don’t need to have employees who are personally affected in order to act. "[If] your team members are in some way impacted, then it should be a priority for you,” Crowder said.

And, while political movement can take some time, office safety policies can be enacted immediately. “You’d be surprised how many companies do not have these policies already in place,” she added.

A return to the office won’t work without a commitment to mental health

The majority of American workers are meeting the call to return to the office with less than resounding enthusiasm; Black women have been near-unanimous in their desire to remain remote or at least, switch to a hybrid model. This reality is thanks in part to the reprieve they’ve experienced from microaggressions and harassment while working from home. Of course, returning to the office shouldn’t require Black women to sacrifice their mental health. Instead, Tara Jaye Frank, equity strategist and author of The Waymakers (May 2022), sees an opportunity for company executives to address diversity, equity and inclusion (DEI) in their organizations and create environments that encourage everyone to reach their full potential, thus retaining talent and boosting their companies’ success.

Frank told Polcastro earlier this year that her book’s title describes her audience: “People who make a way for those that have been left behind.” Inspired by her work with high-level executives, she is confident that those in leadership positions want to do the right thing, and she is eager to show them how. “Leaders don’t show up looking to harm people,” she said. “This is about building the capacity to be more equitable.”

Frank further recommended that as company employees return to the office, executives must take their employees’ mental health seriously — especially when it comes to Black women. “Whenever there is toxicity in any environment, it always harms the marginalized the most,” she said.

Dismissing employees’ well-being and mental health results in a beleaguered workforce: Employees end up doubting their own abilities, and it becomes too painful for them to be so invested in their job. Instead of being able to fully contribute, they are forced to focus on self-preservation.

We need to listen to disabled employees instead of ‘performative allyship’

Although 90 percent of U.S.-based companies claim to prioritize DEI, only 4 percent consider disability as part of those initiatives. With more than 1 billion people globally living with a disability, that’s a costly disconnect, said Dannie Lynn Fountain, an author, DEI expert and human resources staffer at Google.

In her interview this fall with Gary E. Frank, Fountain said corporate announcements of diversity programs or internal resources for people with disabilities isn’t going far enough. That is merely “performative allyship,” Fountain told TriplePundit, as companies and individuals often say they support or seek to ally themselves with marginalized identities “purely for the way it appears, purely for the performance of it.”

Companies looking to attract people with disabilities can start by reexamining their outreach to potential job candidates, Fountain advised — and that is particularly important when it comes to vetting job candidates who are neurodiverse. “So many organizations, when they get an application in or even when they are cold sourcing for candidates, the first step is to jump on the phone with the recruiter, let's have a quick 15-minute chat,” she said. “First of all, even if you're not neurodiverse, if you're introverted, if you get nervous, if you get anxious, that phone call isn't going to be the best way to sell yourself.” There’s a simple yet better way, as Fountain explained to Frank.

Pet adoption has a structural problem, and companies can help

Americans love pets. And, Americans adopted cats and dogs at record rates during the pandemic. Nevertheless, at any given time nearly 48 million cats and dogs don’t have a home in the U.S. For years, workers and volunteers at animal shelters have faced an uphill battle as they struggle to find people willing to adopt these animals. It’s not that there’s an oversupply — the "neuter and spade" campaigns of yesteryear have worked. The problem starts with the fact that software systems used to monitor homeless cats and dogs are similar to what is used by prisons across the U.S.

“For every pet at an animal shelter, there’s an estimated eight people willing and ready to take them home,” Dr. Ellen Jefferson, an animal welfare advocate, longtime pet shelter veterinarian, and president and CEO of an animal shelter in Austin, Texas, told 3p during an interview in February. “But the problem is that the industry hasn’t been able to modernize in order to meet demand. There’s no longer an ‘infestation,’ but there are hundreds of barriers we face in finding these pets a new home.”

Companies can help — here’s how.

Image credit: Isabela Kronemberger via Unsplash

Happy Holidays! Our Editors’ Picks for the Best of 2022

We here at TriplePundit wish you a safe and wonderful holiday seasons with your loved ones. On that note, we’ll be doing the same, so we are planning to be on a part-time publishing and newsletter schedule for the rest of the year and will ramp up again on Tuesday, January 3. In the meantime, these stories from 2022 (and late 2021!) are what caught our eyes and scored plenty of comments from our readers.

Yes, a small business with a social justice mission can succeed in a red state

When Chelsia Rice and her spouse Charlie Crawford, both former educators, bought Montana Book Company in 2018, they knew they wanted to bring a social justice element to what is now downtown Helena’s 45-year-old bookstore. They also knew they wanted to do it in a way that knitted the community together, especially at a moment that was seeing increasing division: no easy feat in the capital city of Montana. Kate Zerrenner shared Montana Book Company’s story back in August.

It’s a new federal holiday with meaning, not an excuse to crassly market products

In only its second year of federal recognition, Juneteenth was once again subjected to a slew of exploitative and offensive marketing attempts from brands more interested in financial gain than respect and representation. Diane Primo, the CEO of Purpose Brand and an expert in DEI (diversity, equity and inclusion), spoke with 3p’s Riya Ann Polcastro about which brands managed to go against the tide and get it right, which one failed the worst of all — and what businesses should focus on for future Juneteenth commemorations.

Cite me, pay me

Protecting intellectual property on the web can be a dicey proposition. In the vast and bountiful wilderness that has become the internet, individuals can misappropriate or blatantly steal what someone else has created and profit from the material without the creator ever knowing. The damage to the economy is well-recorded for the creative industries. One reported estimated that digital piracy of videos displaces between $30 billion and $70 billion in annual revenue — and can lead to the losses of 230,000 to 560,000 jobs annually. And, race and gender are absolutely relevant to the issue of intellectual property theft.

To that end, this summer Roya Sabri caught up with qualitative researcher Dr. Carey Yazeed, who’s noticed that the individuals she’s seen benefiting from her work have been Black men and white women, a fact that may not seem relevant to some. Nevertheless, Dr. Yazeed said she recognizes that society doesn’t see IP theft as a specific problem for Black women. As she told Sabri, “I can say that, since I have spoken out, I have seen other Black women come forward and share how their intellectual property has been stolen.”

The U.S. highway system is finally confronting its racist past

South Bronx residents may soon be able to breathe again, and businesses that rely on them will have a shot, too. Nearly six decades after the first drivers entered the Cross Bronx Expressway, the city has received $2 million in funding to devise a plan to “cap” the highway with green spaces, pedestrian walkways and air filtration systems. The study should kick into motion federal funding of upwards of $1 billion with the hopes to depollute an area in South Bronx dubiously dubbed “Asthma Alley.”

As Grant Whittington shared just over a year ago, the Cross Bronx Expressway is likely to meet the same fate as its fellow dilapidating highways across the country: it’s getting capped. Capping consists of building parks and other structures on top of the thoroughfares to push these roads underground, transforming pollutant-generating, neighborhood-splitting highways into green spaces that reduce noise and reconnect communities. Major U.S. cities like Philadelphia, Denver and Dallas have jumped on this trend, capping or lidding their highways with “deck parks.” As a result, communities of color and the businesses that serve them could get a fresh start denied to them for decades.

COP27: It’s déjà vu all over again in 2022

The annual global COP meetings that focus on climate change negotiations may change hosts each year, but if you think the outcome and results (as in little accomplished) are the same year after year, you are in good company. “As a COP veteran, I see the difficulty of navigating these multi-stakeholder, inter-governmental processes where everyone has their own agenda and ideas on the best way to address climate change. It is frustrating to realize how long it has been since the Paris Agreement came into force and how far we still are from limiting global warming to 1.5 degrees Celsius,” wrote Sara Velander after attending last month’s COP27 in Egypt — her fifth such COP experience over the past seven years.

Image credit: Victoria Heath via Unsplash

Porsche Opens Pilot E-fuel Plant in Chile as Automakers Continue to Ignore Need to Scale Down

Porsche is taking a dual approach to a future with zero tailpipe emissions — announcing this month that its pilot e-fuel plant had gone online with commercial production. In addition to its growing electric vehicle (EV) product line, the automaker has been investing heavily in e-fuels — not just as an alternative to reduce emissions from ICE (internal combustion engine) vehicles already on the road, but as a part of its plan to continue at least some level of production after the company’s 2030 carbon-neutral goal.

But while this rush to EVs and sourcing e-fuel (also known as electrofuels or synthetic fuels) could be a practical way of reducing greenhouse gasses when combined with an overall scaling down of the auto industry, in its current manifestation, this is just another way for the purveyors of personal passenger vehicles to protect their profits.

Located in Punta Arenas, Chile, the Haru Oni plant produces synthetic fuel from water and carbon dioxide. The plant runs on wind energy, making it “nearly CO2-neutral,” according to the automotive brand’s announcement. Porsche chose the South American country due to its windy climate, noting that the breezes are flowing almost three-quarters of the year in southern Chile.

According to manufacturers, e-fuels are interchangeable with gasoline: They can be transported just the same and used in combustion engines the same as regular gasoline. Further, these fuels can even be dispensed using the same filling stations that are already in place for gasoline. This means that unlike the switch to EVs, no new infrastructure is needed.

Michael Steiner, who sits on Porsche’s Executive Board for Development and Research, said in the company’s announcement, “The potential of e-fuels is huge. There are currently more than 1.3 billion vehicles with combustion engines worldwide. Many of these will be on the roads for decades to come, and e-fuels offer the owners of existing cars a nearly carbon-neutral alternative.”

But expecting e-fuels to completely take the place of gasoline anytime soon is wishful thinking at best considering that the U.S. alone burned through 134.8 billion gallons of the fuel in 2021. Meanwhile, Porsche is planning to produce just over 34,000 gallons of the synthetic stuff in the plant’s pilot year with a mid-decade goal of 145.3 million gallons per year — a fraction of the overall demand for combustible fuel.

While there certainly are other companies making their own e-fuels, it’s not anywhere near the scale that is needed. Nor is it realistic to expect an immense ramp-up in production in the near future. In fact, according to a report by the environmental group Transport & Environment, as of 2035 European production is expected to be enough for just two percent of the vehicles in Europe. Yet, automakers may be pinning their hopes for circumventing the European Union’s ban on new ICE sales by the same timeframe on an unrealistic switch to e-fuels.

Porsche is aiming for more than 80 percent of the vehicles it manufactures to be all-electric by 2030, but it also plans to continue to sell the original gasoline versions of its sports cars presumably under the guise of e-fuel availability. However, even if e-fuel were widely available at that time – and even if the production of synthetic fuel was such that gasoline production could be completely discontinued by that time – the push for carbon-neutral alternatives is actually about saving the auto industry, not the planet.

The focus on tailpipe emissions misses the point altogether and has become more of a marketing slogan than an actual environmental strategy. Chevrolet demonstrates this perfectly with its “EVs for Everyone” campaign — an insane suggestion for a planet with eight billion people on it. Not only does prematurely replacing a regular car with an EV result in more environmental damage and CO2 output, but the ubiquity of the personal passenger vehicle is not an environmentally viable option even with the complete cessation of tailpipe emissions.

There are simply too many of us to continue this model, let alone spread it to the developing world. EVs and e-fuels are an encouraging direction for passenger vehicles, but the sheer number of those vehicles cannot continue, let alone increase without causing further environmental damage. Expanding highways take habitat away from wildlife, leach chemicals into the ground and increase noise pollution, among other consequences. Parking lots take up prime real estate and litter the landscape — with parking taking up more space than housing in cities like Los Angeles. Nothing is produced in a vacuum — there is a carbon footprint for every component of every car, regardless of whether it is emissions-free and no matter how many carbon sinks the manufacturer has purchased credits in.

Real reductions in greenhouse gasses requires changing how we think about transportation altogether.

Image credit: Greg Banek via Unsplash

Audi Rolls Out Its Flagship Carbon-Neutral Electric Vehicle

Audi Brussels CEO Volker Germann and a team in Brussels together present the first Audi Q8 e-tron

On December 14, Audi began production of its new flagship electric vehicle (EV), the Q8 e-tron at the company’s Brussels, Belgium factory. The first one to roll off the line was an SUV in a striking electric-blue color, the second, a Sportback variant in gray with a sloping roofline, followed shortly after.

Along with other members of print and broadcast media, TriplePundit was invited to see these first two cars come off the production line. But as important as the launch of the new premium EV undoubtedly is for Audi, the company was just as enthusiastic to showcase the carbon-neutral facility in which the vehicle will be produced, too. We’ll cover both here.

Let’s talk about the Q8 e-tron first.

The car: the all-electric Audi Q8 e-tron

The new vehicle improves upon the existing e-tron SUV which Audi has been producing at the Brussels factory since 2018. The original all-electric e-tron was very well regarded, with the usual plush interior associated with the company’s vehicles as well as its sprightly performance and premium ride quality.

But in the increasingly competitive EV market place, the range of the original e-tron, specified at just 226 miles (EPA assessed), has increasingly become less impressive compared with newer vehicles released by the competition. And not just in the premium sector, but increasingly for EVs at considerably lower price points too.

Appropriately then, the new Q8 e-tron handsomely addresses the market’s increasingly lofty range expectations.

With improvements to aerodynamics, coupled with revised gearing and associated “rolling parts,” efficiency improvements have been conferred upon the Q8 e-tron’s platform. And with decreased weight, and improved performance from Audi’s battery-packs (also assembled in the Brussels factory), substantially greater distances between charges are now possible for the new car.

Putting it all together, drivers of the new Q8 e-tron will be able to achieve up to 600 kilometers (375 miles) per charge from the Sportback version, featuring Audi’s 115 kWh battery pack. The SUV version, meanwhile, will achieve slightly less distance per charge at 582 kilometers (364 miles). It should be noted these distances are according to the Worldwide Harmonized Light Vehicle WLTP standard; the EPA typically assesses a somewhat shorter range, which has yet to be determined. Audi says the Q8 e-tron will have an approximately 30 percent improved range over the outgoing e-tron model.

The Q8 e-tron should be easy to live with too. With the vehicle's 170 kW charging capability, owners can expect to charge from 10 percent to 80 percent of full battery capacity in as few as 30 minutes from an appropriate fast charging station.

The rest of the package is familiar Audi, and we’d say, if it’s your brand, that’s exactly what you want it to be.

The factory in Brussels

And so onto the second part of the story, which Audi was keen to tell: the evolution of the Brussels factory in which the Q8 e-tron will be manufactured.

The factory dates back to the late 1940s, and was originally built by Volkswagen, Audi’s parent company, to produce the VW bug, (or Beetle, depending on where you’re from). Over the ensuing decades, numerous other VW models were produced there too.

Audi took over the plant in 2007 and began producing the sub-compact A1 model there, a popular small vehicle sold in many global markets but not in the U.S.

Then, after over 60 years of producing internal combustion engined vehicles, the Brussels factory began its transition to electrification in 2016 and in 2018, began production of the original e-tron SUV.

With the transition to producing electric vehicles, came the continuation of a transition to more sustainable production at the facility too. Audi says that investing in existing plants — rather than starting from scratch — is “sustainability in action - economically, ecologically and socially.”

Here are some of the notable developments at the factory.

The Brussels factory switched over to renewable energy in 2012 and embarked upon installing a 9,000 megawatt hours photovoltaic system — one of the regions’ largest — on the roof of the factory. Energy demands outside of this are met with solar and wind power, with carbon offsetting addressing any remaining shortfalls.

By the middle of next year, installation of a greywater system will be introduced to replace around 100,000 cubic meters of potable water used per year in the production process. Once in place, reuse of greywater will take place in a closed loop system.

Besides the factory itself, there is also focus on managing the supply chain to be as sustainable as possible too. Traction motors used in the new EVs are made in Hungary, and are transported to Brussels by sustainable rail freight, rather than by road, reducing the cars' carbon footprint.

As for the battery cells which go into the assembly of the vehicle battery-packs, these are purchased from third party suppliers, and Audi stipulates that its suppliers use only renewable energy in their production.

In combination, these efforts have led to the Brussels factory achieving certified carbon-neutral status since 2018, and lessons learned in the Brussels factory will contribute to the goal for all Audi plants to be carbon-neutral by 2025 under the company’s Mission-Zero program.

The Q8 e-tron consequently will be delivered to customers in Europe and the U.S. as a certified carbon-neutral car.

But with all of this said, we think one of the most important pillars of the transition of this car plant to electrification, is the human one.

Going from building traditional internal combustion engine vehicles for decades to EVs isn’t seamless. But Audi has invested over 1 million training hours in the facility’s 3,000 person workforce, to educate them in the transition to working on electrification.

So often with disruptive new technologies — which of course, electric vehicles are to the auto industry — legacy technologies are retired along with the workforces associated with them.

Audi’s focus on retraining workers proves instead that both facilities and staffing are adaptable as the industry shifts to EVs. Conversion to electrification is already proven at the Brussels factory, with 160,000 original e-trons already produced here since 2018.

Going forward, as well as the new Q8 e-tron, the Brussels factory will also produce an additional 40,000 of the smaller electric Q4 vehicles in the second half of 2023. For a factory that once produced the VW bug, it is already embracing an all-electric future that is coming at us fast.

Disclosure: Audi sponsored 3p's participation in a media trip to Brussels.

Image credits: Audi media relations

These Plant-Based Picks Are a Must For Last-Minute Holiday Meal Prep

(Image courtesy of Spero Foods)

The holidays are a time for gathering with loved ones and celebrating another year together. And while we all love hosting and toasting, every year it seems there's something we forget. As you grab those last-minute items for the weekend, consider choosing some that are plant-based. Even if you don't go fully vegan or vegetarian, studies show that eating less meat and dairy can have a significant positive impact on the environment — and serving your guests something they'd "never guess!" was vegan is a great way to start the conversation about how choosing plant-based sometimes can be tasty, sustainable and fun. Interested? Try adding a few of these seasonal plant-based favorites to your last-minute shopping list, all conveniently available at mainstream grocers.

Alt eggnog for toasting

If 'nog is your thing around the holidays, you'll find a growing number of vegan options to mix things up a bit. Chobani, Trader Joe's and Elmhurst offer varieties made from oat milk, while Danone-owned brand So Delicious opts for coconut milk for its holiday nog. Other seasonal plant-based nogs include almond milk varieties from Califia Farms and Almond Breeze.

Spreadable plant-based cheeses and more for your boards

Bring that holiday charcuterie to new heights with seasonal plant-based cheeses that can stand toe-to-toe with the real thing. Start with New York-based Treeline, which has been perfecting the art of vegan cheesemaking for over a decade using cashews and good ol' fermentation. Available at mainstream grocers like Ralphs, Giant and Whole Foods, the brand's impressive lineup includes cheese board favorites like goat cheese, and its newly released Reserve line features cashew-based varieties of blue cheese and brie.

Next up, try a seasonal treat like the limited-edition white cheddar and cranberry plant-based cheese wedges from Good Planet Foods, or go classic with the long-anticipated vegan take on The Laughing Cow wedges and Babybel mini-rounds from France-based Bel Group — all of which are available at major grocers. You can also find aged artisan cashew cheeses from woman-owned Miyoko's Creamery at retailers like Walmart, Target and Safeway.

Even 150-year-old brand Philadelphia, owned by Kraft Heinz, is getting into the plant-based cheese game — launching its first vegan cream cheese earlier this month at select retailers in the U.S. Southeast. Spero Foods, a favorite of celebs like Lizzo, is also rolling out its hit sunflower cream cheeses in California Ralphs stores just in time to meet your seasonal schmear needs (the brand is already available at natural retailers like Whole Foods and Fresh Market).

Sweet treats for dessert

With the ever-growing selection of dairy-free milks and plant-based egg substitutes, making vegan desserts from scratch has never been easier. But if you're looking for something ready-made to lend a hand this holiday season, your local grocer has plenty on offer. For starters, Black-owned brand Partake has your cookies covered, with its limited-edition vegan holiday sprinkle cookies bringing the cheer at major retailers like Walmart, Target and Kroger.

For a dairy-free topper for all your favorite pies, classic brand Reddi-wip now offers two vegan whipped cream options made from almond and coconut milk, and you can also find coconut milk varieties from brands like So Delicious and Truwhip. For ice cream, it's tough to get more festive than NadaMoo's seasonal plant-based peppermint bark.

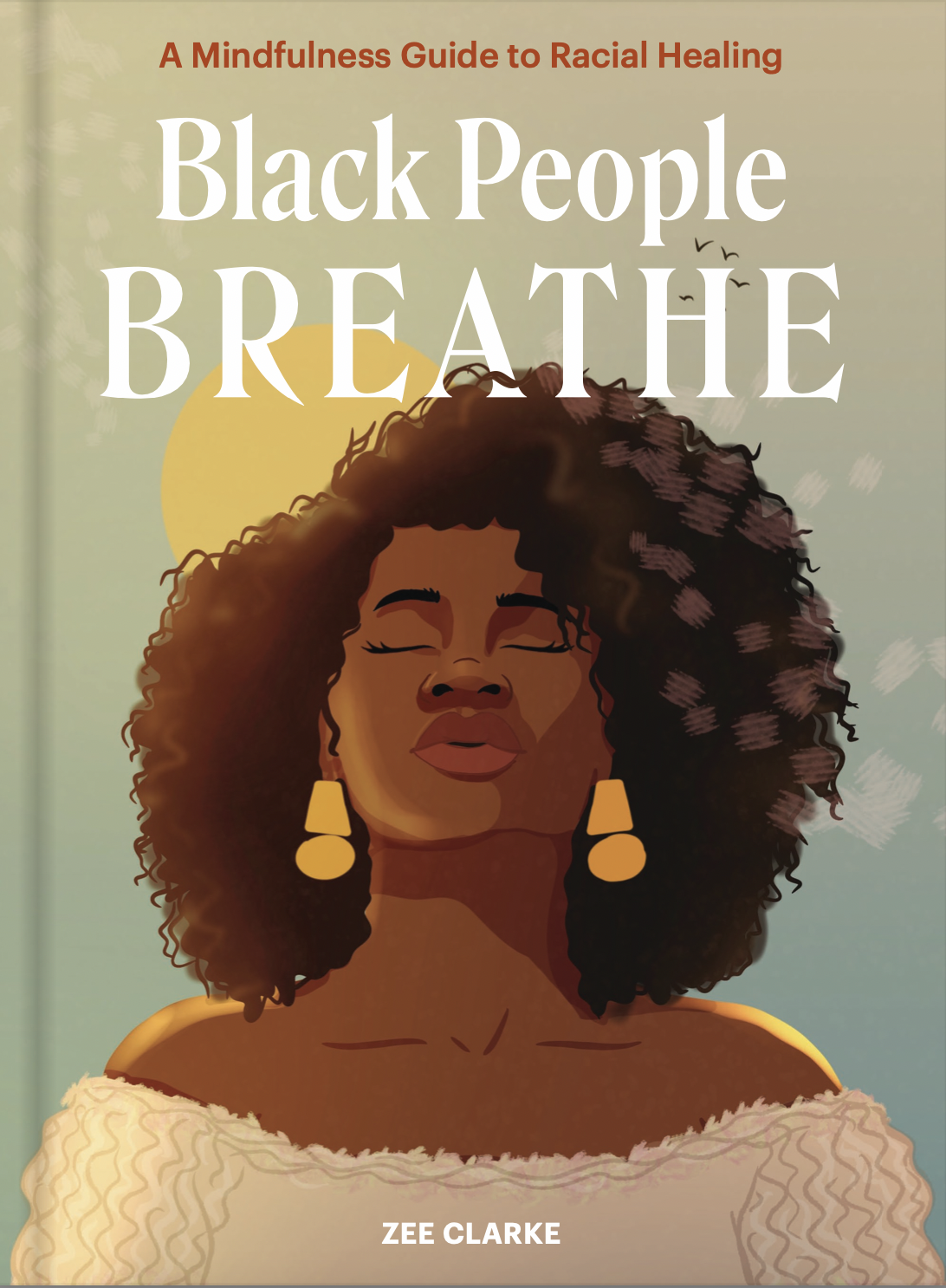

Author of 'Black People Breathe' Offers Insight Into Traveling While Black

While the headaches and hassles of travel increase across the board during the holidays, not everyone has to deal with the same stressors. For Black people specifically, traveling during any period presents an extra set of complications and dangers in the form of microaggressions and overt racism — and those experiences can be amplified when airports are packed with frazzled nerves and flaring tempers. TriplePundit spoke with Zee Clarke, a corporate diversity, equity and inclusion (DEI) consultant and the author of "Black People Breathe: A Mindfulness Guide to Racial Healing," about the additional pressures that come with traveling while Black and what Black people can do to protect their peace amidst the chaos.

“There are so many issues,” Clarke began. “Let’s start with airport security. Waiting in line for airport security is so stressful. Black people wonder, ‘Is today going to be another one of those days?’”

As demonstrated by a Freedom of Information Act request filed by the ACLU, the Transportation Security Administration’s own documents show how its behavior detection program is not only ineffective, but can actually be used as the basis from which to harass people of color and religious minorities. Some of the so-called behaviors used to excuse targeting include being late for a flight or yawning.

Black women are also more likely to be pulled to have their hair searched. “The TSA blamed thicker hair,” Clarke said, with the agency’s website indicating that styles such as hairpieces, buns and braids could trigger the alarms on full body scanners. Agents aren’t gentle either — she described how many Black women had their scalps roughed over in such searches.

And while it seems ludicrous that anyone would hide a weapon or explosive device in their hair, Clarke pointed out that disproportionate searches are not limited to thick hairstyles. She gave the example of a queer Black friend who, regardless of her super short hair, still gets pulled by TSA so often that “she’s just accepted that she is going to be targeted and stopped 75 percent of the time.”

These secondary searches and interrogations aren’t just minor inconveniences either. Not only can the stress of being targeted have physiological repercussions such as elevated heart rate and blood pressure as well as psychological effects, but the results of such interactions can also be even more dire. Clarke pointed to Britney Griner as an example of the dangers that Black people face, especially abroad where legal protections can be lacking even more. Griner was originally sentenced to nine years in a Russian prison for bringing in less than a gram of THC. But a white woman, Audrey Lorber, who smuggled almost 25 times as much marijuana into the same country in 2019 was given a mere two months and a small fine.

As such, Clarke encourages Black people to utilize breathing techniques to protect their peace while waiting in line for security. She offered the 4-7-8 technique for lowering anxiety and calming the nervous system, an invaluable trick when faced with the likelihood of being pulled for a secondary inspection.

She spelled out how interactions like those with the TSA can lead to individuals getting triggered, which stimulates a fight-or-flight response that will not be helpful in a situation where the person being targeted is expected to remain cool and collected for their own safety. Belly breathing calms the sympathetic nervous system and is ideal to use in these sorts of circumstances, Clarke suggested.

While the risk of being targeted by the TSA remains one of the top concerns for those traveling while Black, it by far is not the only one. Clarke gave numerous examples of how traveling while Black can go wrong, including microaggressions from fellow travelers and less-than-helpful customer service representatives. Being cut in front of while standing in line is a common occurrence. “Especially as a Black woman, I feel invisible,” she said of the regularity with which white people will do this to her. “Because we don’t fit the prototype we just aren’t seen.”

Bias against Black women’s hair isn’t limited to security checks either as the ubiquitous affinity that a lot of white people have for touching Black hair doesn’t appear to be going anywhere. Clarke related one story of a friend who, as a Black woman on a cruise, was asked by a white woman, “Can I pet it?”

As if such questions were not bad enough, unsolicited touching remains something that Black people still deal with not just in day-to-day life, but also as an aspect of travel that – like any microaggression — can really sour the experience.

When it comes to delayed and canceled flights, Clarke pointed to how often Black travelers notice that they are offered less than white travelers in the same circumstances. Of course, this isn’t limited to the transportation sector, as she explained, “Black people are five times more likely to be treated badly by customer service.”

When traveling, "the overall stress for a Black person is much higher than most," Clarke noted. “There is even a heightened state of stress while you are waiting at the gate.” Which is why she encourages belly breathing and long exhalations for dealing with customer service and microaggressions, as well as box breathing, body scans and stretching while waiting at the gate.

“You have to be ready for anything,” Clarke said of traveling while Black, while also cautioning against hypervigilance. “It’s a bad idea to expect bad things.” She encouraged Black people to be aware but not expect negative experiences. After all, “hypervigilance is a terrible place to be.” Instead, she encourages preparing ahead of time with a sound bath or guided meditation to go in feeling relaxed.

“During the holidays traveling spaces are crowded. And when spaces are crowded, stress levels are heightened. Regardless of race, everyone’s stress is heightened,” Clarke noted. “It’s a layer on top of that for Black people.”

Clarke's forthcoming book shares more specific examples of microaggressions and other racially inspired incidences that Black people deal with regularly and offers breathing techniques for managing the stress that comes from those experiences. Allies can also benefit, not just from the breathing exercises, but also because it can help them “become more educated about what happens to Black people in America,” Clarke said.

Image credits: TheVisualsYouNeed/Adobe Stock and Zee Clarke

Next Steps for the Bioeconomy: 5 Sustainable and Unusual Materials to Watch in 2023

In partnership with the U.S. Air Force Research Laboratory and tire company Goodyear, Ohio-based startup Farmed Materials is cultivating a particular species of dandelion that can replace natural rubber in tires.

The bioeconomy of the future is beginning to take shape, and it is emerging in many different directions. Replacing petrochemicals with plant-based material is still a leading concern. Researchers are also taking advantage of new tools and methodologies to deploy a wider range of renewable materials, and to use those materials in ways that create new efficiencies. Here are five to follow in 2023.

1. The look of linen, from squid

Squitex is a delicate looking, ivory colored fiber that can be spun into a twine-like yarn. However, it is not made from hemp, linen, cotton, jute or any other plant. Squitex is made from squid or, more precisely, from the proteins found in the circular “teeth” embedded in the suction cups of a squid’s tentacles.

Squid may seem like an odd place to look for inspiration in the bioeconomy, but their teeth have evolved over 350 million years to arrive at a state of highly durable, flexible and self-healing functionality, all of which are highly desirable traits in fabrics and other coverings.

Squitex was created in the laboratory of Penn State professor Melik Demirel, who specializes in leveraging biomimicry to develop sustainable materials. His team cultivated large samples of squid protein by piggybacking it onto E. coli bacteria.

As described by Penn State, Squitex fiber is strong enough to lift 3,000 times its own weight. It is biodegradable, and it can also be recycled if augmented with acrylic or cellulose.

Squitex was one of five materials to win the top prize in the 2021 Microfiber Innovation Challenge, hosted by the startup incubator Conservation X Labs.

2. The feel of leather, from plants

Petrochemicals have long been the go-to source for formulating synthetic suede and other alternatives to natural leather. Producing a high-quality leather alternative from non-petroleum resources within the bioeconomy has been a far greater challenge, but scientists from the company Modern Meadow have cracked the code. Their “Bio-Alloy” process incorporates proteins with natural plant-based polymers.

Earlier this year, Modern Meadow introduced Bio-Tex, the first material produced with Bio-Alloy technology. In partnership with Modern Meadow, the Italian firm Limonta is using Bio-Tex to produce BioFabbrica, described as a “vegan plant-based material family" that is "lightweight and delivers superior color vibrance and performance while reducing GHG emissions by over 90 percent compared to traditional, chrome-tanned leather.”

The partners say they are also working to incorporate more recycled and waste bio-materials into the process.

3. Sustainable tires, from dandelions

Electric vehicles are an important feature of the global energy transition, but they still contribute to the tire waste stream. That includes microplastic pollution from wear and tear on the streets, in addition to whole tires.

Automotive stakeholders have been searching for solutions. One seemingly obvious choice would be to use more natural rubber. However, that pathway is not available, at least not in terms of the current supply chain.

The rubber tree, Hevea brasiliensis, is the only supplier of natural rubber to the global economy. The entire species is now under threat from climate change and other issues, including a destructive blight. Demand for natural rubber is anticipated to outstrip supply in less than 10 years unless alternative sources emerge.

Dandelions could be it. Dandelion rubber already has a history dating back to the 1940s when researchers scouted for new sources after World War II disrupted supply chains.

More recently, the U.S. Air Force Research Laboratory has been working on a modern version with Goodyear for application to aircraft tires. Earlier this year, the lab upped the ante with a multi-year R&D commitment that pairs Goodyear with the Ohio company Farmed Materials, which is raising the dandelion species Kok-saghyz, or TK for short.

The roots of TK yield a natural rubber when crushed. The processing will be undertaken through the BioMADE program, a public-private bioeconomy partnership supported by the U.S. Department of Defense. Goodyear will incorporate the rubber into tires that meet Air Force specification. If the new tires meet performance expectations, Goodyear foresees applications throughout its product line.

4. Renewable “steel,” from trees

The global steel industry has been leaning on green hydrogen, electrification and recycling to decarbonize. A different kind of solution has emerged in the form of high-strength alternative materials. One example is MettleWood, a cellulose-based material described as “60 percent stronger than construction-grade steel but 80 percent lighter, much less expensive and far more sustainable.”

MettleWood was created in the laboratory of the startup InventWood. The company is a University of Maryland spinoff founded by Liangbing Hu, who is the Herbert Rabin distinguished professor in the school’s Department of Materials Science and Engineering and director of its Center for Materials Innovation.

MettleWood can be made from many different trees. The common denominator is a new process that removes the lignin “glue” that normally binds tree cells. The remaining wood can be compressed to a higher degree, resulting in an extremely dense but lightweight material.

The U.S. Department of Energy recently awarded InventWood with $20 million in funding to scale up MettleWood for widespread use. The InventWood research team has calculated that replacing steel structural beams, columns and connections with MettleWood would reduce greenhouse gas emissions in the construction industry by 37.2 gigatons in 30 years, which is roughly equivalent to the entirety of emissions from human activity for a year.

5. Recovering cobalt, with ostrich bones

For all the recent advances in materials science and the bioeconomy, researchers have barely begun to scratch the potential for bio-based alternatives to outperform their synthetic counterparts. New research from a team of scientists in the U.S. and Iran provides a glimpse into the possibilities.

The team modified ostrich bone waste with hydrogen peroxide to create a highly efficient process for recovering cobalt and other valuable substances from industrial wastewater.

The particular focus of attention is wastewater containing dyes, including cobalt-base dyes, produced by various leading industries including textiles, leather, paper, food, agriculture and pharmaceuticals, among others.

Among other uses, cobalt is a key material for manufacturing electric vehicles and for producing solar and wind energy. Manufacturers currently rely on a cobalt supply chain that is vulnerable to conflict issues and human rights violations. Wastewater recovery through the bioeconomy could provide an alternative route, while also helping to increase the supply of cobalt as demand rises.

Image courtesy of Goodyear