Farm to Fashion: The California Cloth Foundry

The California Cloth Foundry is a small, sustainable textile company. It makes all-American products that are good for humans and good for the earth. The company's founder, Lydia Wendt, formed the Foundry after collaborating with North Face on the uber successful Backyard Hoodie Project. Wendt was a pillar of the project’s success, and has since launched her own line of American-grown-to-sewn sustainable soft goods.

The Backyard Hoodie Project

The North Face’s Backyard Hoodie Project was launched in 2014 as an effort to design and craft a unique apparel collection from seed to garment, all within a 150-mile radius of the company’s San Francisco Bay Area headquarters.

Although the company didn't meet its strict start-to-finish production goal, (the yarn was spun and knit on the East Coast), the Backyard Hoodie was declared the most sustainable product the North Face had ever produced. It became a shining example of how a successful collaboration with local farmers and craftsmen can produce a socially responsible and waste-reduced garment.

https://www.youtube.com/watch?v=vAXFcoy5TLA&feature=youtu.be

In the initial stages of the project, the North Face partnered with Fibershed, a local nonprofit which develops regenerative textile systems that are based on carbon farming, regional manufacturing, and public education. Fibershed in turn recruited Wendt to incorporate her textile expertise and sustainable production model into the design and commercial development of the Backyard Project Hoodie.

Cleaner Cotton

“I was tasked with managing the supply chain, designing textiles and putting the project together,” Wendt told TriplePundit. She sourced materials from domestic mills and designed yarn and textiles which incorporated high quality, California grown, Cleaner Cotton from the Sustainable Cotton Project.

California already produces some of the highest quality cotton in the world, characterized by its long and extra long staple fibers. Cleaner Cotton is not only cleaner than conventional cotton, it is stronger, softer and longer wearing than the majority of mass produced cotton due to its superior fiber attributes.

Cleaner Cotton not only supports farmers who are using sustainable cotton cultivation systems, it eliminates the use of the most toxic chemicals in cotton farming. This reduces the amount of toxicity from agricultural run off that pollutes our air, soil and local water sources. Cleaner Cotton is making measurable inroads into natural resources conservation and financial sustainability for growers.

A sustainable supply chain

From fiber to fashion, the California Cloth Foundry produces products and textiles that are grown and sewn in the U.S. The company boasts a completely sustainable all-American supply chain.

“Our production model is not very conventional,” Wendt explained. “Traditionally, you depend on the supplier for vetting the supply chain. But a lot of times you might be given incorrect information and brands are made to think that a product is more sustainable than it actually is. The best way to trust the supply chain is to really know it.”

“I go right to the source and work directly with the farmers. I go to the wool mills where the wool is produced and processed. You see your bail of cotton being tagged and bagged. I speak directly to the farmers about their crops. This way I can know exactly what the product is and can share it with clarity. Every single step of the supply chain I speak with the owners, suppliers and technicians. It’s all about building relationships. It’s an arduous process.”

Every step that Wendt takes is slow and purposeful. To her, sustainability starts with a transparent and well-documented local supply chain that considers the full ecological and social footprint of product development. This means that each aspect of production has been labeled, barcoded, registered, inspected, and thoughtfully designed to meet the highest ecological and ethical standards.

This not only includes environmentally sustainable fibers and non-toxic processes, but also a focus on fair wages and healthy working conditions from the agricultural workers on through to the mill and factory employees. In addition, there are no toxins added during yarn and cloth production or garment manufacturing. This means no harmful chemicals are released into the air or onto the skin of the company’s supply chain partners, its employees, or the consumer.

The future of sustainable fashion

Wendt believes that within the garment industry “sustainable” is a term in danger of losing currency. For many big fashion brands, it’s all about, “going off shore and dictating what they want to factories and not ensuring what is happening," Wendt said. "Sure, a product is using bamboo, but is it toxic bamboo? The worry is that every brand wants to say that it’s sustainable. They use one recycled plastic fiber or organic cotton just for marketing.”

She believes that we have to do more to educate consumers. “The consumer is the one who has to be impassioned to spend more on the product and will drive the brand to develop more sustainable products.” Although partnering with larger brands may be in the future for the California Cloth Foundry, for now Wendt enjoys working with smaller brands and designing products for the company’s dedicated customer base.

As for the future of sustainable fashion, she envisions large department stores and brands, restructuring themselves to be able to collaborate in a better way with slow makers, and designers. As labor becomes more important, we will see prices raise across the board. This will hopefully make consumers value products more, slow down and be less wasteful.

California Cloth Foundry is all about slow, transparent and thoughtfully collaborative design and production. “I’m not a leader and I’m not a follower,” Wendt told us. “I’m just a part of the movement to make solid beautiful quality products that are sustainable and nontoxic.”

Images courtesy of The California Cloth Foundry (used with permission)

Trump's Beef with Amazon Has Nothing to Do with Antitrust

Americans have a love-hate relationship with antitrust legislation that limits certain types of business ventures. It's like the wise, rich uncle we love to have in the family, but hate to invite to dinner parties because of his ability to spout that one piece of sage advice we really didn't want to hear.

Antitrust laws have blocked some of corporate America's largest and most influential marriages: Standard Oil, which was broken up in 1911 to create petroleum companies like Exxon and Mobil (later to become ExxonMobil); AT&T, whose protracted court battles resulted in many of today's largest telecommunications companies; and Nasdaq and the New York Stock Exchange, which were blocked from merging in 2011.

But antitrust violations weren't always that easy to prove or to define. The recent battle over the proposed merger of Office Depot and Staples was fraught with dispute. Although the U.S. District Court for the District of Columbia blocked the merger, attorneys representing Office Depot and Staples called the law "fatally flawed," and in protest, they refused to call any witnesses to their defense.

Yet for all the changes that U.S. antitrust laws have gone through in the past century, charges of unfair monopolies still get sizzling headlines.

Take for example Donald Trump's recent spat with Washington Post owner Jeff Bezos.

Earlier this month, the presumptive presidential candidate inferred that Bezos and the Washington Post have a "huge antitrust problem" after Trump took issue with some of the Washington Post's coverage of his campaign. Bezos also happens to own Amazon, which, among other things, features the Trump men's clothing label.

The Washington Post "is being used as a toy" by Bezos, Trump charged. "Amazon is getting away with murder, tax-wise. He's using the Washington Post for power so that the politicians in Washington don't tax Amazon like they should be taxed."

And if there is anyone who should know about antitrust laws, it's Trump. He's faced antitrust accusations three times in his business career, including allegations that he tried to monopolize casino gambling in a popular area of Atlantic City (the court later found he did not). He has years of experience with the invasive impact of antitrust investigations, particularly when it comes to large acquisitions. His purchase of Holiday Corp. and Bally Manufacturing Corp. in the 1980s launched Department of Justice and Federal Trade Commission investigations for failing to observe a waiting period required by the Hart-Scott-Rodino Antitrust Improvements Act. He later settled the case by paying a penalty of $750,000.

But do allegations that Amazon is benefiting "tax-wise" from the Washington Post mean Bezos is infringing on antitrust laws? U.S. companies benefit every day from sage investments. In fact, some of the biggest investors in media companies are -- yup, you guessed it -- banks. The very institutions that newspapers and online publications report on have a potential say over what readers think and do with their money. Yet our laws say very little about whether companies with a personal interest in what is reported can actually own majority stock in media companies.

And there have been a lot stranger bedfellows in U.S. corporate history than an online reseller and a well-known newspaper. Verizon's pick of AOL in 2015 aligned a telecommunications company with what used to be one of the country's biggest online media companies. It offered Verizon new possibilities and kept AOL from going under.

As Trump would probably admit, companies don't buy other companies because it's bad for business or for their tax status. They buy to make money and grow larger.

But as with so many other points in this landmark presidential campaign, Trump's inflammatory rhetoric had a resounding effect. It created media attention. It created controversy that draws the public's attention away from the key issues of this year's pivotal campaign and debates that can determine the future course of the country. And as Van Jones recently pointed out, that should be a warning to voters concerned about the outcome of the 2016 presidential election.

Image credit: Flickr/Gage Skidmore

North Dakota’s Economic Whiplash is Not Sustainable

The oil and gas industry’s story is one of boom and bust cycles: new discoveries and new players coming online, and economies rising and falling with energy demand following like a tail behind a dog.

The latest round was triggered by a new method of retrieving oil and gas deposits that were previously difficult to reach. Fracking (short for hydraulic fracturing) has its share of detractors, but there can be no question that it had a dramatic effect on production here in the U.S. Oil production hit a peak of 9,700 barrels per day in April 2015, just shy of the all-time high of 10,044 reached in January of 1970.

But then we saw a standoff between major producers, in which none of the oil and gas giants were willing to reduce production. Prices had nowhere to go but down, and soon the profits began to dry up, even as the oil kept flowing.

That leaves places like North Dakota, which saw unprecedented growth courtesy of the Bakken shale formation, with a case of economic whiplash that will take a long time to recover from. As another oil rig closed down in the state last week, the overall number of oil and gas rigs in the U.S. dropped to 406, an all-time low. A year ago that number was 888.

In 2014, North Dakota’s GDP hit $50 billion, more than double the 2002 level. Over 80,000 people came into the state to get in on the action. Then, the state’s economy dropped from the first to the last in the nation. Monthly oil revenues down to about a quarter of the $333.8 million they hit in 2014, and tax revenues are also down -- putting a strain on the state budget, as hastily constructed apartment complexes now sit vacant.

Of course, North Dakota isn't the only place hit by the bust. Around the world, remittances sent home by migrant oilfield workers fell dramatically, impacting local economies in places like Turkmenistan and Uzbekistan, where workers often send checks home from Russian oilfields. Even in oil-importing countries like India, the economic benefit of lower oil prices has been largely offset by the decline in remittances. This could have a significant impact on migration patterns.

So, what are some of the takeaways from this chain of events?

For one thing, in an increasingly global economy, coordination of supply in the face of rapidly increasing productivity is crucial if economic sustainability is to be maintained. At the same time, concerns over environmental sustainability have likely contributed to this behavior. Growing calls to “keep it in the ground,” raise the prospect of substantial oil and gas reserves becoming stranded assets. Many decision-makers have chosen to get whatever they can for the oil, viewing even those paltry returns as better than nothing.

But with high supply, along with reduced demand due to more efficient motor vehicles and the rise of alternative sources of energy, oil prices remain low. These are trends that will certainly continue, which should be enough to convince energy companies to rethink their business models and revise them into something more sustainable.

Image credit: SMU Central Library: Flickr Creative Commons

The Royal Society Launches GMO Guide for U.K. Consumers

While the global business sector and environmental groups wait to see if Bayer will acquires Monsanto, the world’s oldest scientific academy launched a guide it says can educate consumers in the United Kingdom about GMOs. The Royal Society, which for 356 years has covered everything from farming to ethics to climate change, explored what it says are the 18 common questions Britons ask about GMO technology.

According to the Royal Society, such a discussion is necessary in the wake of a recent Ipsos MORI poll, which concluded that half of the U.K.’s population does not feel well informed about GMOs, and at least 6 percent admitted that they had never heard of them. The study also comes at a time when the U.K. is close to voting on the controversial “Brexit” referendum, which coincides with the ongoing trend of more European countries exerting their sovereignty in part by banning the cultivation of GMO crops within their borders.

Claiming that the contentious debate over GMOs is largely due to the lack of informed scientific discussion, the Royal Society says it will complement its guide on GMOs with public panels that will be held across the U.K. this summer and fall. This road show will start almost a year after Scotland took advantage of its greater autonomy within the U.K. by banning GMO crops last August as a way to keep the country “clean and green.”

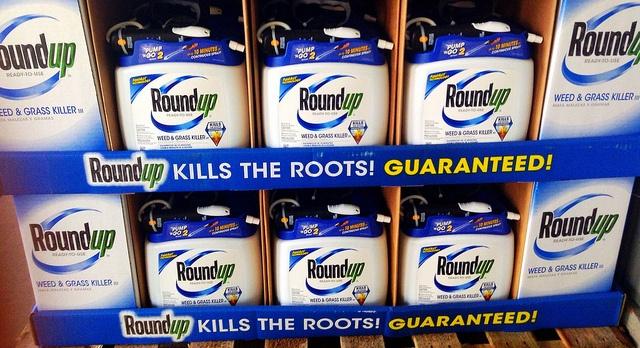

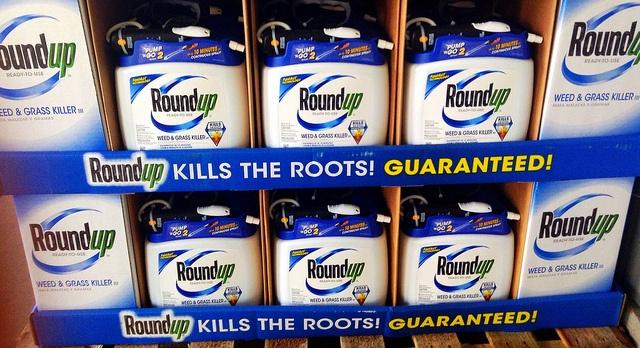

In making the case for a public discussion of GMOs, the Royal Society highlighted a recent study issued by the National Academies of Sciences, Engineering and Medicine in the U.S., which assessed over 900 published studies. That study concluded there is no evidence GMOs are harmful to human health, the environment or biodiversity on farms. The 400-plus page document, however, posited its analysis with some environmental concerns, including the finding that the use of some GMO crops developed to resist the insecticide glyphosate (which Monsanto markets as Roundup) caused some weeds to develop a resistance to that chemical.

The Royal Society also pointed to the World Bank’s suggestion that the world will have to produce at least 50 percent more food if it will be able to feed 9 billion people by 2050. Universities, such as the Massachusetts Institute of Technology (MIT), have also suggested that GMOs need to be part of the discussion over food security if an additional 3 billion people are to be fed by mid-century.

It is largely because of the arguments presented by intergovernmental organizations and academics alike that GMOs came on the Royal Society’s radar. Back in 2002, the organization recognized consumers' and activists' concerns about GMOs, and that issues related to the public debate had to go beyond the science. Nevertheless, the Royal Society also insisted that “the valuable potential and current impact of plant biotechnology on the quality of food and its importance in the development of new crops” also merited further research and development of GMOs.

Seven years later, in the wake of the global surge in commodities prices and concern over food security in much of the world, a 2009 study issued by the Royal Society suggested that among the various technologies needed to continue to feed the world, “the largest improvements stand to be gained where both the ‘seeds and breeds’ and management aspects of a system are optimized.”

Despite the Royal Society’s attempts to answer questions over GMOs in a science-based, straightforward matter, do not expect this guide to quell any fears or criticisms of biotechnology and GMOs anytime soon. The arguments over GMOs are akin to what has gone on with the climate change debate; many people reached their conclusions not by the facts over the science, but by ideology.

Witness the Scottish NGO Soil Association, which interpreted the National Academies’ analysis of GMOs as proof that GMOs are “an old and failing technology.” Never mind the discussion over yields, which the National Academies found “do not show a significant signature of genetic-engineering technology on the rate of yield increase.” Despite the National Academies’ analysis that the lack of sizable yield increases “does not mean that such increases will not be realized in the future or that current [GMO] traits are not beneficial to farmers,” the Soil Association has slammed the door on GMOs. Expect other organizations and activists to take the same approach, which is fear-mongering over reason, to any meaningful discussion on GMOs.

Image credit: Royal Society/Flickr

7 Steps to a Successful Corporate Philanthropy Program

By Andy Cummings

The benefits of a corporate donation program far outweigh the costs. Investment in your community allows your corporation to build customer and employee loyalty while reinforcing positive brand value. At Versaic, we have gathered insights and best practices from supporting hundreds of corporate donation programs with our CSR management solution.

Whether you’re launching a new program, revitalizing a stale one, or just want to make sure you’re following best practices here are seven key steps to maximizing your impact. For the full overview make sure to check out the infographic.

1. Establish mission and goals for your philanthropic initiative: What do you want to support and accomplish? Consider how key causes map to the interests of your employees and goals of your business. Authentic philanthropy programs support company values and aren’t just PR driven.

2. Plan your philanthropic initiative: Plan for a system that works the way you work and assemble your team. Eliminate inefficiencies so you can focus on your mission, not administrative tasks. Think about what you can provide, for instance, Wyndham Hotels donates hotel reward points, while Kohler donates plumbing fixtures. Be flexible and decide how to adapt as your giving program evolves.

3. Build your ideal system: Utilize an online system to streamline your program and automate responses. Jump in, learn and adapt as you go. Ask the right questions and set expectations with an initial eligibility quiz. Discover Financial is up front with its criteria for support and clearly communicates with submitters. Make sure to know the status of any request or donation and who is responsible!

4. Establish your online presence and build awareness: Enhance your overall brand message and tell your philanthropic story with a dedicated web page. Use this page to give examples of your work and share clear criteria for support. Promote this page on social media channels and include a link on your website. Educate your employees to encourage them to spread the word.

5. Go live!: Don’t worry if you don’t have everything in place. With the right system, you can make changes and additions as you learn and your program grows. The important thing is to get started, even if it’s small steps. With Versaic’s system you get free unlimited support and changes, a true partnership approach is the way to go!

6. Understand and communicate your results: A good report tells a powerful story about your programs and gives you insight into where you are having the most impact. Follow-up after each donation to collect data and send any stories to your communications/marketing team for promotion. The Safeway Foundation uses “story banking” to collect photos, videos and quotes from their community partners in an online system.

7. Incorporate what you learn to improve your program: Maximize the benefits of your philanthropic investment by incorporating what you learn along the way. Are you accomplishing your goals? Decide what other results you would like to collect and how these results can be communicated.

Image credit: Moyan Brenn

Andy Cummings has been with Versaic since 2003 and has been instrumental in building Versaic’s leadership position in the sponsorship and philanthropy markets. Over the years, through his extensive knowledge of Versaic’s product architecture and thousands of conversations with clients, Andy has built a solid understanding of how the Versaic platform can be adapted to create the most relevant applications and client solutions.You can reach out to Versaic via Twitter (@Versaic) and Instagram.Interested in learning more about. Interested in learning more about Versaic and our solutions for grants, donations and sponsorship? Call 877-712-9495.

It’s a Watershed Year for ExxonMobil and Chevron

It has been said that 2016 is a watershed year for fossil fuel companies, including ExxonMobil and Chevron. Both companies held their annual shareholder’s meetings on Wednesday, and both were called on to do more about climate change.

Climate activists have Exxon under the microscope. Media investigations revealed that the oil and gas giant knew about climate change since the late 1970s, yet funneled money into denial organizations while failing to report climate change risks to investors. The Los Angeles Times investigated Exxon earlier this year and found that the company’s failures to disclose climate change risks to investors could “amount to securities fraud and violations of environmental laws.”

Reports by both Inside Climate News and the Los Angeles Times reveal that Exxon incorporated climate change into both its plans and practices in the 1980s and 1990s. And it did so while publicly casting doubt on climate change. Investigations by Inside Climate News detail a company that researched climate change risks in the late 1970s and most of the 1980s, but did not inform investors or the public about those risks.

Exxon is under investigation by a number of state attorneys general as well, including California and New York, the first states to launch investigations into the company’s dodgy climate change dealings. In April, a group of attorneys general representing 17 states, Washington, D.C. and the U.S. Virgin Islands announced their plans to collaborate on climate change, including investigations into fossil fuel companies that misled investors and the public about climate change risks to their businesses.

A California law would give state prosecutors more authority to investigate fossil fuel companies. The Climate Science Truth and Accountability Act (SB 1161), introduced by California State Sen. Ben Allen (D-Santa Monica), would extend the statute of limitations under the state’s Unfair Competition Law from four years to 30 years. A summary of the bill states: “Given the environmental, health, and economic impacts that Californians are already paying for as a result of the fossil fuel industry's many years of public deception and their efforts to block action on climate change, it is important to hold the industry responsible.”

Exxon likely won't be the only fossil fuel company to face investigations. Back in November, the New York State Attorney General’s office launched an investigation into Exxon on its climate change record. That same month, the New York Times reported that Exxon and other fossil fuel companies, including Texaco which is now part of Chevron, were all members of a coalition “that started an advertising campaign in the 1990s opposing Washington’s involvement in strong international efforts like the Kyoto Protocol initiative to reduce greenhouse gas emissions.”

Proponents of climate-related shareholder proposals will make their cases at both meetings. And two days before the meetings, representatives from several organizations, including the Interfaith Center on Corporate Responsibility (ICCR) and the Union of Concerned Scientists (UCS), held a press conference. Kathy Mulvey from UCS moderated the press conference. She acknowledged that since the annual shareholders meetings at Exxon and Chevron last year, there have been “significant changes,” including the public revelations that fossil fuel companies knew about climate change risks for decades “yet choose to deceive the public.”

“Our groups are concerned that failure by Chevron and ExxonMobil to correct past abuses, make a clean break from climate denial, improve tracking and disclosure, insure consistency in lobbying and adapt to changing climate policies is systematic of larger problems of corporate governments and management,” Mulvey declared on Monday.

On May 25, Exxon and Chevron shareholders will vote on climate change resolutions. One shareholder resolution asks Chevron’s board to “institute a comprehensive review” of the company’s “positions, oversight and processes related to public policy advocacy on energy policy and climate change and share a summary of findings, omitting confidential information, with investors by September 2016.” A similar resolution asks Exxon to do the same.

Will Exxon's and Chevron's shareholders take climate change seriously by passing those and other resolutions on the issue that affects its assets? We will see! Check back to 3p for updates.

Image credit: Flickr/Quinn Dombrowski

New Platform Seeks To Improve the Relationship Between Buyers and Suppliers

We aren't the first ones to purchase the clothes we wear. Before they reach store shelves, these items are bought by brands and their buyers from suppliers, and most of those suppliers are located in developing countries.

Millions of people in developing nations are dependent on international buyers to make a living, as a 2006 report on purchasing practices points out. Many companies have codes of conduct in place for their suppliers. However, all too often the purchasing practices of buyers and brands can undermine the suppliers' attempts to meet these codes of conduct. And that can have “disastrous consequences for the poorest producers,” the report from U.K. fair trade organization Traidcraft found.

In short: Purchasing practices can significantly impact suppliers. Enter a new project called Better Buying, which describes itself as a dialogue and rating platform to highlight areas for improved purchasing practices.

The platform was founded last year by Marsha Dickson, a professor at the University of Delaware’s Human Services program in the Department of Fashion and Apparel Studies, and Doug Cahn, an expert in labor and compliance in global supply chains who leads the Cahn Group, which focuses on factory workplace conditions. It is funded by the C&A Foundation, partners with Fair Factories Clearinghouse and initially focuses on the apparel sector.

“We are excited to be able to provide this new tool which will provide information to suppliers and buyers,” Doug Cahn, co-founder of the Better Buying project, told TriplePundit.

The stated goal of Better Buying is to determine if it's feasible for a Web-based public forum to improve buying processes by allowing suppliers to anonymously provide input about how specific buyers make it difficult for them to comply with codes of conduct. “The notion is that there are purchasing practices that are taken by brands and retailers that make it difficult to adhere to codes of conduct,” Cahn explained.

How will the Better Buying platform work? It is still a work in progress. But the basic gist is that suppliers will register through the site and provide basic profile information, and they will be asked to rate the buyers they have worked with. The ratings by suppliers for an individual buyer will be averaged and, using a formula, the combined ratings will be used to create a Better Buying “score.” The aggregate ratings will be released to buyers, and eventually, the aggregate ratings and scores will also be released to the public.

Better Buying also opens up a dialogue between buyers and suppliers about potential solutions to the problems suppliers face that prevent them from meeting codes of conduct. How can they dialogue if it is anonymous? Both buyers and suppliers will share ideas and strategize about how to make improvements in online chat rooms. There is a reason why the Better Buying platform is anonymous: “Suppliers are reluctant to bite the hand that feeds them,” Cahn said. “The notion of having an anonymous rating system is to allow suppliers to rate buyers.”

Why aren't codes of conducts enough to solve the labor and working-conditions problems that exist? A report by the Clean Clothes Campaign provides answers: Even if companies adopt codes of conducts reflecting good standards, the overall impact on improving labor standards is “often fairly limited," the campaign found. The report goes on to identify one “underlying reason” why this happens: The purchasing practices commonly found in the athletic footwear and apparel sectors “have not been adequately amended to enable one to make the labor rights strategies effective.”

The Clean Clothes Campaign identifies structural characteristics that undermine compliance with codes of conduct, and one of them is an unstable relationship between buyers and suppliers. As You Sow, a nonprofit that promotes corporate responsibility through shareholder advocacy and legal strategy, confirmed these findings in another report: Many codes of conduct violations in the apparel industry can be traced back to corporate purchasing practices, the group found, also citing unstable relationships as having a big impact on compliance.

The fact that codes of conduct in and of themselves can’t prevent labor abuses highlights the importance of dialogue been buyers and suppliers to improve purchasing practices. Cahn describes the relationship between the two as a chain. “There’s a relationship between buyers and suppliers," he stated simply. And what Better Buying creates is a "more open dialogue despite the anonymity," he continued. "It opens the doors to buyers to think creatively with suppliers by having open dialogue in ways that can improve conditions for workers.”

Better Buying has the exhaustive research behind itself to actually improve relationships between suppliers and buyers. Last summer, Cahn and his partner did an “exhaustive study on knowledge that existed on sourcing practices,” he explained. They looked at the purchasing practices that harm workers and what makes a good rating system. Then, this fall and this January, they traveled to several countries including Cambodia, China, Hong Kong, Bangadesh and Vietnam to interview suppliers and workers. They used the information they gathered during their travels to measure what impacts both suppliers and workers.

The last step they took was talking to a wide variety of stakeholders to determine how the Better Buying system would work. Last week, they conducted a multi-stakeholder workshop in Geneva and received “good feedback,” Cahn said. “The next step this summer is to go through a beta test.” That beta test will test the methodology Better Buying will use to input and score data.

Image credit: Flickr/marc oh!

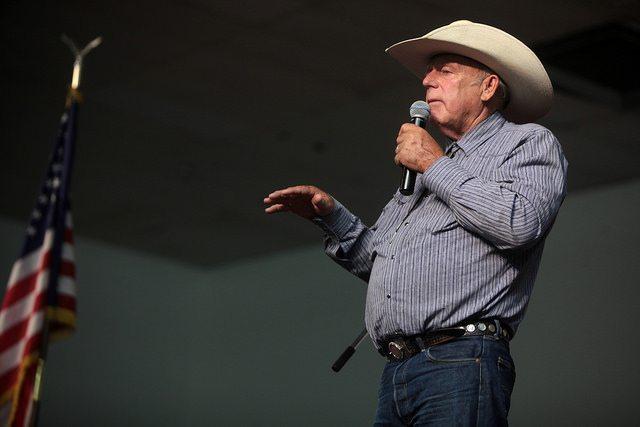

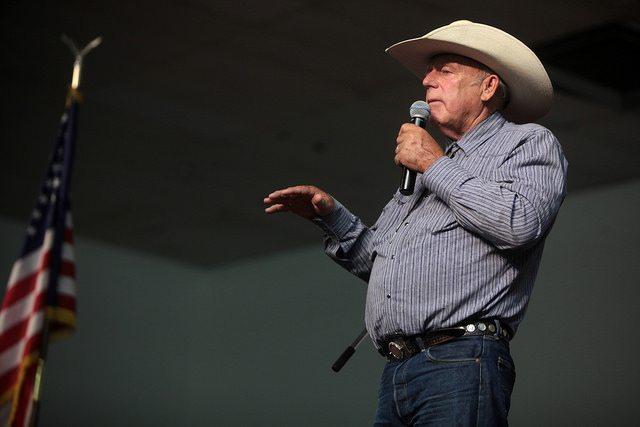

Cliven Bundy's Lawyer Hits Up Koch Brothers For Cash

Over the span of many years, the Koch brothers have carefully constructed and funded a network of lobbying groups and sympathetic legislators, one major aim being to open up more federal lands for private use. The effort largely escaped the attention of national media until 2014, when Nevada rancher and melon farmer Cliven Bundy, who is associated with the Koch network, orchestrated a gang of armed thugs to confront federal officers over that very issue.

Since then, the extra-legal exploits of Cliven Bundy and his son, Ammon, began to appear in the headlines with increasing regularity, drawing more and more unwanted attention to the influence the Koch brothers have over federal land policy.

Another day, another Koch connection

In the latest development, Cliven Bundy's lawyer, Nevada-based Joel Hansen, sent out feelers to see if the Koch brothers could help pay Bundy's legal bills. (For those of you new to the Bundy topic, scroll to the bottom for a quick recap.)

The news broke earlier this week when Ryan J. Haas, news content manager for Oregon Public Broadcasting, tweeted a copy of an email sent by Hansen to Utah State Rep. Ken Ivory. Ivory's connection to the Koch-funded lobbying group ALEC is no secret, Mother Jones reports:

"He sits on the federalism committee of the American Legislative Exchange Council. His nonprofit, the American Lands Council (ALC), is largely funded by local and county governments eager to gain control of land in their communities. It has also taken funding from utility companies and Americans for Prosperity, the dark-money group founded by the Koch brothers," Mother Jones correspondent Stephanie Mencimer wrote last year.

Hansen's email is a direct plea for financial assistance from the Koch brothers. It reads, in part:

"I understand from news articles that the Koch brothers are helping to fund Cliven's efforts to return our lands to the states."

Hansen also points out that he is representing Cliff Gardner, another Nevada rancher, among others, "in their fight against the BLM [Bureau of Land Management] and the Forest Service."

From Cliff Gardner to Cliven Bundy

Cliven and Ammon Bundy have both become high-profile advocates for the oddball constitutional theories advanced by ALEC and other "land rights" groups, and you can find roots of the argument in the Cliff Gardner land rights case.

To get the full picture, check out the Washington Post's timeline of BLM conservation efforts in Nevada after 1989. The initiative resulted in a restriction of grazing rights, touching off a series of bombing episodes in the 1990s.

Things appeared to calm down somewhat by 2001, when the Associated Press ran a story about a group of more than half a dozen Nevada ranchers accused of continuing to graze their cattle illegally after the new restrictions.

BLM enforced its authority by impounding the trespass cattle, an action that drew pickets and other protests by the ranchers and their supporters. Unlike Cliven's 2014 episode, though, there was no direct threat of violence.

The Department of Justice also got involved, issuing 12 lawsuits against the group. Among the targets was Cliff Gardner. He responded with a lawsuit of his own, deploying the same "states rights" argument advanced by ALEC:

"One Elko County rancher, Cliff Gardner, has decided to take his case to the 9th U.S. Circuit Court of Appeals, arguing that states' rights mean the federal government has no authority over the land where his cattle graze," Washington Post reporter Jaime Fuller wrote in the paper's timeline.

The argument flopped in court, and in 2002 Gardner was sentenced to one year of probation and a $5,000 fine.

But that was not the end of Gardner's activism. The Post notes that he "reappeared" in 2013 to argue against additional conservation initiatives in a series of letters to the editor.

After Cliven's 2014 episode, Gardner publicly pledged his support, stating: "I am determined to stand by the Bundy family in any fashion it takes regardless of the threat of life or limb."

Since then, Gardner remained active on the so-called 'patriot militia' speaker circuit. According to a Feb. 3 article in CounterPunch, Gardner continues to advocate for an ALEC-style interpretation of the U.S. Constitution, under which the federal government has no authority over land outside of Washington, D.C.

Gardner was a featured speaker at the 'Storm Over Rangelands' conference held in late January in Idaho. Hosted by Utah's Freedom Conference, the event was sponsored by some familiar Koch-backed names, including the American Lands Council and the John Birch Society.

CounterPunch reporter Katie Fite attended the conference and had this to say about Gardner's legal theories:

"Gardner spun through a history of 1800s land acquisitions. He segued into various laws that he believed led to federal overreach, where liberty and freedom took a turn for the worse. He swept through American history high and low points – from the 'Founding Fathers,' through the Civil War era, laws that persecuted the LDS [Church of Latter Day Saints] people, War Power, the interstate Highway system and the Frank Church Report ..."Gardner ... is stuck in a frontier-era mindset of disposal. He referred to a lawsuit he had brought in NV and seemed to say the Judge could never tell him which article his authority came."

This finally brings us back around to Hansen's email to Ken Ivory.

Considering Hansen's association with Gardner, and Gardner's history with the Koch-backed "land rights" network, it does not seem likely that Hansen is only aware of the Koch connection through "news articles."

Now that the email has gone public, expect Hansen to get the quick brush-off from Ivory. Virtually no mainstream legislators have gone out of their way to support Cliven or his son Ammon, the simple reason being that, due to their penchant for violence and crazy talk, both men threaten to undo all of the hard work undertaken by the Koch network.

After all, with friends like these, who needs enemies?

A quick recap of the Bundy exploits

For those of you new to the whole Bundy topic, TriplePundit is following the case from a corporate social responsibility perspective. Here is an extended excerpt from a previous TriplePundit article about Cliven and Ammon Bundy:

... Family patriarch and Nevada rancher/melon farmer Cliven Bundy has been active as the “grassroots” voice of a Koch-funded lobbying effort to transfer federal property to the states. The goal is to open up more public lands to extractive industries and other development.That goal is consistent with the Koch family business, Koch Industries. The company is concentrated in the fossil fuel and mining sectors, and the Koch brothers have also dabbled in cattle ranching. In recent years, they made a big mark in the logging industry through the acquisition of Georgia-Pacific.

In 2014, Cliven Bundy orchestrated an armed standoff with federal agents, who arrived at Bundy’s ranch because his cattle was trespassing on sensitive public lands in the Gold Butte area. Bundy let his herd run wild for years without paying the required grazing fees. After racking up roughly $1 million in fines and fees, it was finally time to call him to account.

Despite the obvious criminal behavior involved in the standoff, Cliven remained free to roam his Nevada safe zone until earlier this year, when his son Ammon, owner of an Arizona truck fleet repair business, masterminded his own armed takeover — setting his sights on the Malheur National Wildlife Refuge in Harney County, Oregon.

Ammon insisted that his mission was simply to “educate” the local community about its rights and to turn the Malheur refuge over to “ranchers, loggers and miners” — coincidentally or not, a complete overlap with the interests of Koch Industries.

The Malheur occupation ended with the apprehension of Ammon and two dozen of his supporters. Ammon and most of those arrested were determined to be flight risks and have remained behind bars in Portland, Oregon, pending trial.

Justice also finally caught up with Cliven Bundy. After Ammon issued a jailhouse plea for support, Cliven flew from Nevada to Oregon. He was promptly arrested at Portland International Airport, where federal agents could be assured that he was unarmed and harmless. He is now being held without bail pending trial in Nevada.

P&G Rolls Out New Plant-Based Tide Detergent

P&G first test-marketed Tide laundry detergent shortly after the end of World War II. Introduced in 1946, it soon became the top-selling laundry detergent in the U.S., surpassing iconic brands such as Rinso and Ivory Snow in popularity. Now Tide can be found in just about every overseas market. Arguably the product that transformed how laundry detergent is manufactured and marketed, Tide is even in a hall of fame of sorts: 10 years ago, the American Chemical Society designated the product a “National Historic Chemical Landmark.”

But Tide’s success is about more than marketing, as consumers obviously believe it works — and that explains why the brand survived from our grandparents’ generation while other household products disappeared from supermarket shelves. But now, P&G and its competitors in the consumer packaged goods (CPG) sector are forced to reinvent themselves as new products hit the market. And when compared to Tide’s list of unpronounceable ingredients, the reality now is that many believe products such as Seventh Generation, Mrs. Meyer’s, Method, and the plant-based, private-label products available in stores such as Whole Foods and Trader Joe’s are overall better for the environment.

So P&G responded with a new Tide product released last week. Tide purclean has the “trusted cleaning power” of its venerable detergent, P&G says, with the added bonus of a 65 percent bio-based formula.

Part of the struggle plant-based products come up against is that CPG companies have convinced us that we need their products in order to keep our homes, clothes ... and ourselves ... clean. At the same time, more consumers want their purchases to mitigate their effect on the environment. The result is a struggle for companies trying to pitch "eco-friendly" consumer goods.

Over the years, many consumers complained that plant-based products just do not work as well as those made with conventional ingredients. Of course, when it comes to detergent, old tricks such as adding citric acid, white vinegar or baking soda to a load of laundry can help make those clothes (and households at large) clean, but changing those habits is a tough sell.

P&G’s new detergent confronts both of those challenges. Many of the 17 ingredients in the Tide purclean product are plant-based. The company is ambiguous about the plants from which those components are sourced. But, in a recent Twitter chat with TriplePundit, a representative from the EPA's BioPreferred program said bio-based feedstocks often come from plant waste and algae.

For now, this new plant-based Tide detergent is a victory for one organization: the U.S. Department of Agriculture (USDA). In fact, P&G scored an endorsement from USDA secretary Tom Vilsack, who recently has often repeated his department’s claim that bio-based products contribute approximately $369 billion and 4 million jobs to the U.S. economy. The USDA launched a bio-based products program in 2011, which first, encourages the federal government to procure more bio-based products; in addition; a voluntary labeling initiative allows for a label to appear on products such as Tide purclean. The “USDA Certified Biobased Product” label has struggled to gain traction, however, in part because it has been promoted by agribusiness interests who wanted to have their say in the 2008 Farm Bill. Most environmental groups have responded to this initiative with silence. [Ed. note: we'll be taking a deeper look at the biobased certification next week].

Nevertheless, P&G's latest new product shows that the company is aware of consumers’ growing awareness and shift in buying habits. This new Tide detergent is another step, along with waste diversion and experimenting with plant based ingredients, in P&G’s quest to show that it is a more responsible and sustainable company.

Image credit: Tide.com

Monsanto Says ‘No’ to Bayer, But Still Faces Long-Term Struggles

Last week, German chemical and pharmaceutical giant Bayer said it would pay shareholders a 37 percent premium on the value of Monsanto’s stock in order to become the global leader in what it describes as “digital farming.”

Expounding on the need to feed the additional 3 billion people expected to live on the planet by 2050, Bayer’s executives described its potential acquisition of Monsanto as a global solution for farmers and businesses. This combined company, with an assumed value of $95 billion, would blend Bayer’s “best-in-class” agrochemicals strength with Monsanto’s innovation in seeds (as in GMOs).

When Bayer first expressed its interest in Monsanto earlier this month, the typical market reaction took place: Monsanto’s shares jumped in value while that of Bayer’s suffered a slight decline. Then the deal hit the newswires late last week, and Bayer’s stock price plunged even more. It was not just the fact that such a merger could drive down Bayer’s credit rating and that the company would possibly have to sell off some assets in order to acquire Monsanto. The specter of regulators nixing the deal rattled the markets, and while Monsanto’s stock price edged up as rumors of a Bayer takeover amplified, analysts noted that its stock price was nowhere near the $122 per share Bayer said it would pay to shareholders.

After mulling Bayer’s takeover bid, Monsanto announced yesterday that it rejected the offer as being “incomplete and financially inadequate,” but said it would leave the door open to future discussions with Bayer.

The spurning of Bayer’s offer, yet purported interest in further negotiations with the $51.6 billion company, caps a rough few years for Monsanto. Part of the St. Louis-based company’s challenge is due to the global collapse in commodity prices, which curbed demand for the company’s seeds and other products. But the company’s reputation also suffers because of its manufacture of glyphosate, the herbicide Monsanto has marketed as Roundup since the mid-1970s. Then, 20 years ago, Monsanto began to sell genetically modified soy seeds marketed as “Roundup Ready,” which resisted the herbicide. Monsanto developed a massive revenue stream with more farmers. But the company also became a bulls-eye for protesters who objected to the fact that these same farmers became dependent on Monsanto's seeds, as the seeds resulting from those harvested crops were sterile.

So, while no study has firmly concluded that GMOs are unsafe -- and many organizations including the National Academy of Science, European Commission, World Health Organization, American Medical Association and American Association for the Advancement of Science have found no evidence that GMOs pose any harm to human beings -- the anti-GMO movement is winning the war over the future of food, and Monsanto is its favorite bogeyman. Challenge just about anyone over the evidence of GMOs’ harm to human health, and the overwhelming response will be “Monsanto+Roundup.” Add the fact that Monsanto’s history was built upon saccharine, agent orange and PCPs, and the company, according to many activists and consumers, is guilty as charged.

But Monsanto also had a hand in creating its struggles, many of which should concern any investor who holds shares in Bayer stock. Monsanto’s joint venture in India, where the company’s GMO cotton enjoys longstanding popularity with farmers, has become the focus of a government antitrust probe. Monsanto also protested against government cuts to royalties paid by farmers to Monsanto.

The biotech giant claims its seeds are integral to India’s future food security and economic development for the country's agriculture sector. But considering India's success with genetically modified crops during its “green revolution” of the 1970s and 1980s, however, such pleas are falling on deaf ears within the country's bureaucracy.

Halfway across the world, Monsanto is mired in another long legal fight with the government of Argentina. After riding the wave of the past decade’s commodity boom, the country of 41.5 million has hit hard times. Its agriculture ministry, now run by the more business-friendly Mauricio Macri, asked Monsanto for more time to allow farmers to pay off royalties owed for sowing the company’s Intacta soybeans — but Monsanto has refused such an arrangement. The company also complained about many Argentinian farmers’ preference to reserve seeds for future harvests or purchase from seed sellers that do not pay royalties to Monsanto. Earlier this month, Monsanto said it would no longer introduce new soybean crops in Argentina.

The company has also fought accusations by activists, including the Mothers of Ituzaingó, who have long claimed that the use of Roundup in Argentina’s soybean farms cause high rates of birth defects and cancer. So, while Argentina could offer an even larger market for soy, Monsanto’s history in the world’s third largest soybean producer, with the potential for even more litigation in the near future, should also make Bayer shareholders nervous about its possible acquisition of the company.

These ongoing problems in some of Monsanto’s most important global markets, as well as regulatory scrutiny of an industry that is already undergoing consolidation, should make shareholders of both company’s stocks take a second look. "Bayer's shareholders will be less pleased as their shares have already fallen 10 percent and are falling further now the bid value is known,” said John Colley, a professor at the Warwick Business School in the United Kingdom, in an emailed statement to TriplePundit. “It is a classic transfer of value from the bidder’s shareholders to those of the target. Few megabids go well and research shows more than half destroy value, and only around a quarter deliver on their promises.”

In this case, Monsanto's past promises and deals might give Bayer's shareholders pause in pursuing such an acquisition, as the result has often been controversy and expensive legal fights with foreign governments.

Image credit: Mike Mozart/Flickr