How to Move Sustainable Investing Into the Spotlight

By Kristen Kleiman

I am new to the world of sustainable investments. For the last 25 years, before joining the Climate Trust, my career was centered almost exclusively on timberland investing. The corollaries between sustainable and timberland investing may not be apparent at first, but U.S. timberland investing is based almost entirely on sustainable forestry. In fact, most U.S. timberland companies manage their assets under either the Sustainable Forestry Initiative (SFI) or Forest Stewardship Council (FSC) criteria.

Surprisingly, sustainability isn’t timberland investing’s greatest selling point. Instead, the industry does an excellent job of touting timberland’s positive role in a diversified portfolio. Timberland investment management organizations (TIMOs, as they are now called) rarely call out the environmental benefits of the asset class. Instead, they focus on investment fundamentals that portfolio managers focus on: preservation of capital, inflation hedging, and non-correlation with other asset classes.

There are lessons to be learned here: TIMOs grew from $1 billion to over $50 billion of assets under management from their beginnings in the 1980s to 2010, according to Timberland Investment Resource.

Labels matter...

Agreement on what our industry calls itself may seem inconsequential, but investors appreciate clear naming conventions for ease of performing asset allocation. Back in the late 1990s when I was marketing timberland, this was a real challenge. I had prospective investors ask me: Where does timber belong in my portfolio -- real estate, private equity, alternatives? Some even tried to lump timber in with oil and gas! Twenty years later, it is pretty easy to find timber as its own separate asset allocation (which was the industry’s ultimate goal).

Why does this matter? Like the old adage, “you can’t manage what you don’t measure,” one could argue, “you can’t market what you don’t label.” Sustainable investing (and I use that term tentatively) can’t seem to agree what it should be called: impact investing, socially responsible investing, conservation investing, green investing? And if the industry can’t even agree on its name, a message is sent that we are still too disorganized to warrant serious attention from institutional investors.

Like the TIMOs of the 1990s, the goal should be to convince institutional investors that sustainable investments belong in their portfolios — leading to the allocation of a small percentage to the asset class.

If the industry can achieve that, the numbers become big very quickly.

As of 2015, 96 American university endowments managed assets ranging from $35 billion to $1 billion each, according to the National Association of College and University Business Officers. And, according to the actuarial consultancy Milman, the top 100 U.S. pension funds had $3.4 trillion in assets in 2015. Even a small percentage of these institutional investors is a huge number. For example, a $25 billion pension fund allocation of 1 percent to sustainable investing would be $250 million.

So the industry has a label problem, which means it could have an asset allocation problem. To address this situation, we have to figure out what to call this new asset class.

The sector spans a wide range of issues, including climate change mitigation, poverty alleviation, renewable energy, access to finance, land and species conservation, and affordable housing. Perhaps we need to split them along different lines — lumping environmental-related investing into the broad 'sustainable investing' category, and poverty, education, and affordable housing into 'social finance.' Any way you slice it, this nagging problem requires a solution before we are able to progress.

... and so does risk

Portfolio managers have increasingly focused on risk management and mitigation since the Great Recession. TIMOs understood this early.

Timberland was initially marketed with 8 to 12 percent nominal projected returns (including inflation), with little track record to call on. Those projections were about the same return as a long-term investment in the S&P 500. Not terribly compelling.

But instead of trying to compete with heady projections of private equity and venture capital, TIMOs set themselves apart by showing that timberland investments reduce portfolio risk without reducing overall portfolio returns. Portfolio managers were convinced and started investing. And the icing on the cake was that many TIMOs beat those projected returns by a long shot during that first 20-year period.

Our industry should convince portfolio managers that investing in the sustainable asset class is less risky to their portfolio than not investing — but we have to prove it first.

Does sustainable investing actually de-risk a diversified portfolio of traditional assets? It certainly would seem so, given the work done by corporations to track their sustainability. But by focusing on the portfolio, and not just individual companies in the portfolio, sustainable investing could be seen as essential to portfolio risk management.

Use the right language

Timberland investing wisely uses traditional investment language to describe the asset class. This follows logically from addressing risk. Concepts like efficient frontier analysis, correlations between sustainable investing and traditional asset classes, and inflation hedging, need to be explored and explained.

Another component of right language is to keep the message positive and avoid speaking out against the competition. In the early years of timberland investing, there seemed to be an unwritten rule that you talk up the asset class -- and don’t talk down the competition.

All parties focused on educating investors about the benefits of timberland to their portfolios — it didn’t make any sense to belittle other timberland managers. As a whole, we wanted to build the asset class first and foremost. Competition heated up as the industry matured, but in the early days we were all in it together.

As Climate Trust Capital (an independent firm of the Climate Trust) launches its own funds, educating potential investors on these issues will take on a particular urgency. The required funding needed to support the low-carbon transition -- and arrest temperature changes -- is estimated to be $4.8 trillion according to the 2015 report Banks and Climate Change Impact. Our global wellbeing demands this maturing of sustainable investments — and given the particularly dire climate news of late, it must happen rapidly.

The lessons learned in bringing an asset class from infancy to maturity are many. But if 25 years have taught me anything, it’s that positioning is everything. We need to talk the right talk to move sustainable investments from the fringe to the forefront — where they belong.

Image credit: Flickr/NRCS Oregon

Kristen Kleiman is the Director of Investments for The Climate Trust.

Chipotle Rolls Out New Animal Welfare Standards for Chickens

Chipotle Mexican Grill has improved its animal welfare standards for chickens yet again. And for a company that buys about 140 million pounds of chicken a year, a commitment to better standards can improve the lives of many chickens in the U.S.

Chipotle worked with Compassion in World Farming USA and the Humane Society of the U.S. to develop the new standards. Those new standards deal with fast-growing chickens, the environments where chickens are housed, the space given to each chicken, and the way they are slaughtered.

Chipotle addressed each of these issues by aligning with the Global Animal Partnership’s (GAP) standards for broiler chickens. The company will make sure suppliers comply with the new standards through third-party auditors.

Chipotle's new commitment includes new goals for 2024, such as transitioning to strains of chickens that are bred for “measurably improved” welfare. Fast-growing chickens represent 98 percent of all chicken meat available in North America. Modern chicken breeds have been selected to grow quickly and efficiently and produce a higher yield of breast meat -- which has detrimental effects on the welfare of broiler chickens, such as immune and musculoskeletal problems that limit a chicken’s ability to express natural behaviors like flying and perching.

GAP’s plan requires slower-growing chickens that have a genetic potential growth rate that is equal to or less than 50 grams daily averaged over the growth cycle. That is about a 23 percent slower growth rate than that of conventional chickens.

Other goals include:

- Improving housing conditions by giving chickens more space and reducing the maximum stocking density to six pounds per square foot.

- Improving living conditions by including improved lighting, litter and floor enrichments that allow chickens to express natural behaviors.

- Improving the slaughter process by processing chickens in a way that uses a multi-step, controlled-atmosphere system.

“Chipotle has long been at the forefront of animal welfare issues and enlightened sourcing for our restaurants, and we’re proud of our commitment to the evolution of our already high standards for chicken,” Joshua Brau, Food with Integrity program manager at Chipotle, said in a statement.“This is one more step forward for Chipotle, and one giant leap for chickens,” added Matthew Prescott, senior food policy director for the Humane Society of the U.S.

Chipotle's goals represent a big improvement in the lives of broiler chickens, or chickens raised for meat. The lives of broiler chickens in the U.S. are bleak. They are housed in sheds that are typically bare and contain no natural light. Litter is on the floor so droppings are absorbed, and the floor is usually not cleaned until the chickens are taken to slaughter. Sitting in dirty litter can leave chickens with burns on their legs and feet, according to Compassion in World Farming. Their eyes and respiratory systems can also be damaged from the ammonia in the droppings.

Chipotle is not the only company looking to improve animal welfare standards. Shake Shack also announced new animal welfare standards this week. These also include goals for 2024 that align with GAP’s requirements. Shake Shack already sources hormone- and antibiotic-free beef, pork and chicken. It bans the housing of pigs in cruel gestation crates that limit the animal’s ability to turn around, and serves only dairy from cows raised without the growth hormone rBST/rBGH. It also only sources cage-free eggs as of last year, blowing past its goal for a cage-free egg supply by 2024.

A growing number of companies -- from fast-casual restaurants and their suppliers to consumer packaged goods giants -- are adopting better animal welfare standards. Confined housing systems for pigs and chickens are being phased out in the U.S. as a result. And that is a good thing for American farm animals.

Image credit: Flickr/U.S. Department of Agriculture

Entrepreneurial Innovation Is Driving Disruption in the Food Industry

By Robert Bikel

Last year a group of entrepreneurs debuted viable new meat alternatives: plant-based protein burgers that recreate the meat experience -- even smelling like beef, sizzling when cooked, and “bleeding” a fermented alternative to blood.

If, at first blush, this sounds like a marketing nightmare bound to offend vegetarians and carnivores alike rather than a triumph of innovation, consider this: Hour-long lines formed outside Traci Des Jardins’ iconic Jardiniere in San Francisco as patrons sought out the new meat-free Impossible Burger, forcing the restaurant to offer purchase vouchers. Likewise the Beyond Burger, a meatless burger that debuted at a Whole Foods Market in Colorado, first sold out in an hour.

Our society has reached a pivotal moment in its relationship with the food industry. After decades of passively accepting the food industry’s offerings without a high degree of public scrutiny -- regardless of whether those products were unhealthy and/or unethically sourced -- consumers are increasingly asking empowering, health-related questions in earnest. And even better: They're demanding change.

As often is the case in “consumer revolutions,” entrepreneurs -- not industry stakeholders -- are the ones meeting consumer demand and driving massive innovation and disruption in the food industry.

While large manufacturers continue to try to convince Americans that sugary breakfast cereals are good for kids, innovators are disrupting the industry and forcing food-conscious consumers to pay attention. If industry stakeholders continue to slowly trail entrepreneurs rather than expedite their own efforts, it will be at their own peril; those who fail to adapt will find that consumers are taking their business elsewhere.

In its defense, the food industry has implemented changes, albeit measured, from the point-of-origination to the point-of-sale. Many companies are embedding sustainable practices along their supply chains, reducing waste, and championing human rights and social causes.

Some mature, traditionally-structured companies -- including Whole Foods and General Mills -- have set up venture capital arms to explore innovation, allowing them to experiment at the margins of their core business to learn about and potentially uncover game-changing opportunities.

But many of these actions are reactive. High-profile documentaries such as "Food Inc.," "Super Size Me" and "Taste the Waste" have highlighted troubles in food sourcing and health impacts, as have social activism campaigns by food vigilantes. There is growing awareness of ethical problems with inefficiencies and food waste, estimated at about 40 percent of food supply in the United States. Even mass litigation has put food companies under a consumer microscope, continuing with the battle over GMOs.

Additionally, the food transparency movement has led to a growing awareness of where food originates, under what conditions it arrives on our plates, and what role the supply chain plays in those endeavors.

While these developments have accelerated responses in an industry dominated by large, publicly-traded corporations -- which are highly attuned to the public’s desire to balance accountability to shareholders with sensitivity to the public good -- those innovations are far outpaced by entrepreneurs who are actually re-imagining consumers’ relationship with food.

Startup ventures are pushing the envelope on food industry disruption. At New York-based Square Roots, an urban farming incubator program, entrepreneurs have developed vertical, soil-free farming techniques that use less water and space than traditional farming, and operate without seasonal restrictions.

In Germany, young innovators are opening the world’s first “packaging-free” supermarket to minimize waste, reduce transportation costs and improve the overall impact of food consumption on the environment.

And Back to the Roots, an Oakland, California-based company founded by two college students who gave up corporate jobs for lives of social entrepreneurism, offers numerous "ready-to-grow" (mushroom kits) and "ready-to-eat" (non GMO, minimal ingredient cereal) products which are now being sold in thousands of locations nationwide.

Even though food entrepreneurs often start small, their initiatives can lead to large-scale disruption. The once-small beverage company Honest Tea, now owned by Coca-Cola but acting as an independent business unit, recently struck a deal to sell its organic and Fair Trade certified beverages in Wendy’s restaurants—not a typical hot spot for diners interested in sustainable foods.

The noted entrepreneur Seth Goldman, Honest Tea’s co-founder and “TeaEO” emeritus, said the partnership allows Honest Tea to purchase more than 1 million additional pounds of organic ingredients. And Goldman is going beyond what he calls the “undoing,” or simplification, of food. In his role as executive chairman of the board for Beyond Meat, Goldman embraces the “redoing” of food, or “taking an existing category and redesigning it in a way that overcomes the perceived nutrition or health shortcomings of that product.”

There is no corporate safe haven from disruption, even in such a vital, basic product as food; there are no signs that the public longs for the “good old days” of junk food, minimal animal welfare safeguards and environmental exploitation.

Driven by entrepreneurial innovation, the food industry as a whole is wisely beginning to use that knowledge to re-imagine its core offerings. More companies, and even now, entire industries, need to look to cutting edge innovators and progressive entrepreneurs who are responding to societal demand and practices -- or risk being left behind.

Image credits: 1) Dan Gold via Unsplash; 2) Courtesy of the author

Robert Bikel is Director of the Socially, Environmentally, and Ethically Responsible (SEER) Program at Pepperdine Graziadio School of Business and Management. The 6th Annual SEER Symposium, “The Recipe for Innovation,” which explores next-generation business strategies focusing on entrepreneurship, values, and innovation, will be held February 3, 2017.

Ford Shows How Virtual Reality Will Change Our Lives

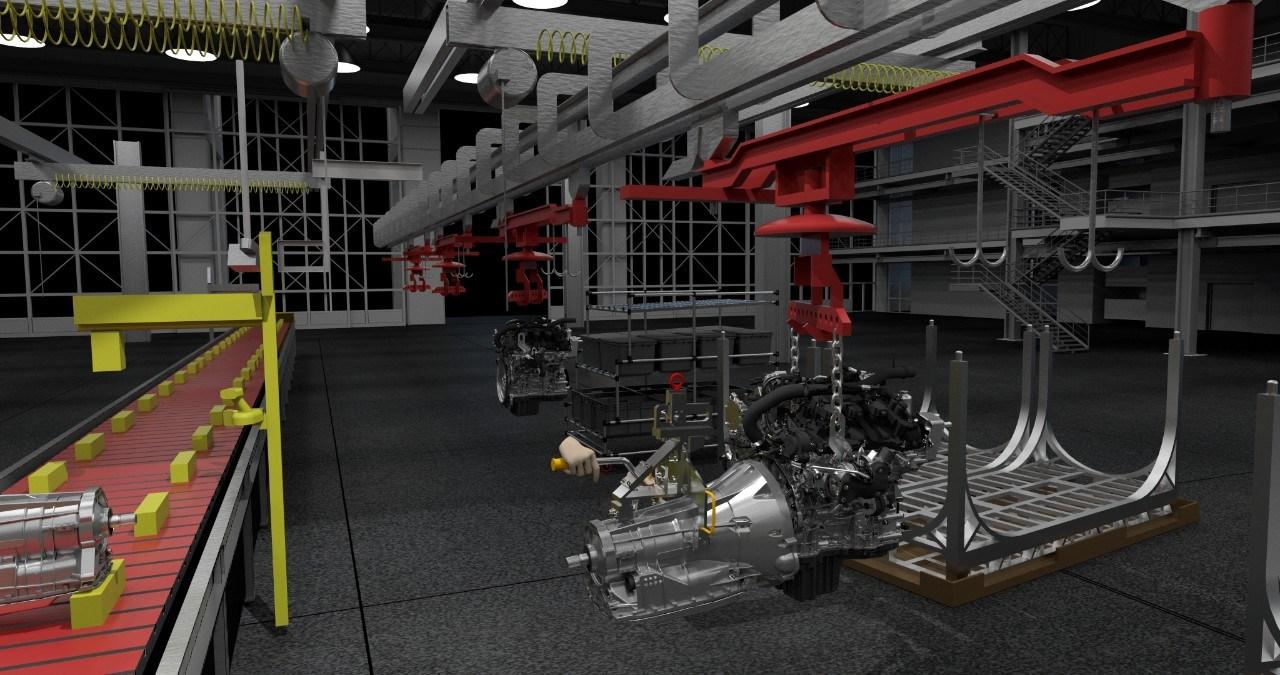

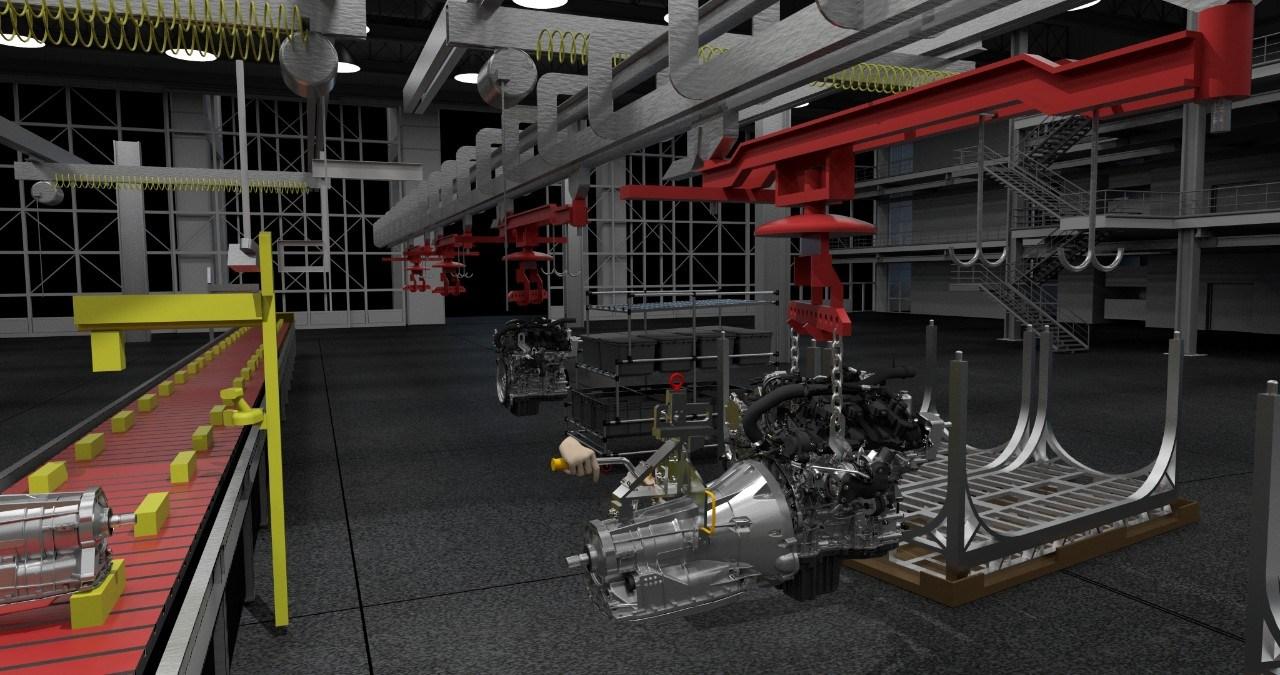

Virtual reality (VR) is poised to disruptively change our jobs and lives -- one of many things I learned after a demonstration on how Ford Motor Co. is using VR technology today and its vision for the future.

VR is a computer-generated, 3-D environment. The sensation of being inside a 3-D environment is truly weird. Your brain knows it is not real, but your senses are telling you it is. In one demonstration, the Ford team sat me in a chair connected to VR technology. I was shocked when I began experiencing motion sickness from the VR-generated sensation of soaring around 3-D office towers inside a futuristic urban vehicle. My brain kept saying: 'This is not real. I am sitting in a chair.' My senses were convinced otherwise.

That is where VR is today. For laypeople, VR is a cool amusement and not much else. Now imagine being able to actually drive a vehicle through VR. That is where we are heading in terms of our lives, economy and the environment.

How Ford uses VR to increase human productivity and safety

Ford demonstrated how its team uses VR manufacturing technology to increase human productivity and safety on the assembly line.The process begins with the accumulation of big data generated by placing full-body, motion-capture sensors on a manufacturing employee. When he or she executes an assembly line task, the body motion sensors covert the movement into digital data.

This digital representation of human motion is then inserted into algorithms of human ergonomics best practices -- which identify actions that come with increased risk for injury or can be re-engineered to increased productivity. For example, a human picking up an object and raising it above eye level creates injury risks. It is also inefficient. Ford uses VR tech to identify, and then engineer, alternative actions by humans and machines.

The results are impressive. Ford claims reducing employee injuries by 70 percent. This was achieved through a 90 percent reduction in overextended movements, difficult hand clearance and hard to install parts. Deployment of VR manufacturing technologies has also reduced days away from work due to injury by 75 percent.

VR now enables Ford’s decision-making

The auto giant is using VR to hold meetings to engage associates across regions and disciplines. For example, Ford's design team members are located around the world. They now conduct meetings in a VR-generated, 3-D environment. They collaborate using a 3-D car image that is as visually real and detailed as seeing it in person. Even better, the VR technology allows for each car part to be viewed in the same detail as if it were laying on a table in front of the team.

Ford is also using VR to accelerate executive decision-making. When a vehicle’s design is ready for senior officer examination, this can now happen in a virtual reality environment -- which speeds up approval time.

This VR communication and decision-making process is slashing Ford’s product design times while also increasing innovation. And the automaker has moved design and decision making from the speed of clay models to the speed of electrons.

The VR revolution will disruptively grow the triple bottom line

It is only a matter of time before VR’s declining costs and increasing capabilities reshape what humans do, how we make money and our impacts on the environment.

Here are just two examples:

Travel. VR will compete against the travel and hospitality industries for business travel. Today’s business travelers will be able to engage co-workers, suppliers or sales prospects through tomorrow’s VR environment without travel costs and time commitments. Product demonstrations in VR will be even better than in the physical world, because every component part will be available for 3-D examination without disassembly.

Office. Why go to the office if you have an office avatar you can use from your home’s VR-enabled chair? Imagine no more commuting. In fact, imagine working not in a urban city, but from your lakeside cottage.

Disruption in Earth 2017

Disruption defines Earth in 2017. Human consumption tied to 20th-century technologies has generated global warming and a national weight crises. These costs are constraining economic growth and causing illness, injury and death.21st-century technologies like VR are poised to solve the problems created from using 20th-century methods. VR can accelerate economic growth by lowering costs and increasing productivity. Learning, enabled by VR, can also make us safer. And integrated into our work processes and lifestyles, VR can reduce pollution.

But disruptive technologies like VR, artificial intelligence and the Internet of Things will also challenge our social system. Their destructive change impacts will both create and destroy jobs. Their destructive change impacts could end up further dividing us between those who benefit and those who are crushed.

Fundamentally, the challenge of Earth 2017 is not technology. The challenge is human behavior. The truly disruptive question is whether as humans we can use technology advances to the combined benefit of people, planet and profit.

Image credit: Ford (press use only)

Looking to the Future of Sustainable Cities

By Joel Oerter

The 2016 Net Impact Conference in Philadelphia passed as a marquis event of 2016, but the topics and insights are still fresh -- particularly as we think toward how to continue momentum on sustainability in 2017 and beyond.

While uncertainty remains regarding federal sustainability drivers, the role for cities will continue to be critical in framing environmental stewardship and social equity strategies.

Sustainability examined from buildings, to cities, to regions

With experts sharing perspectives on individual buildings, entire cities and beyond, the dialogue at NI16 highlighted the importance of thinking through interconnected systems when it comes to how we think about green cities. The discussion also explored the fundamental themes surrounding urban sustainability, how to communicate and advocate for change, and what meaningful progress actually looks like.

Making our buildings more livable

Broadening our understanding about how human beings interact with the immediate built environment was a deeply rooted theme for Scott Kelly of RE:Vision Architecture.

His criteria for a successful building are fourfold: environmentally restorative, culturally rich, socially appropriate and financially viable. To illustrate this concept, Kelly noted that the prevailing metric for green buildings is energy used per square foot. However, is it enough to create buildings which maximize efficiency, using little excess electricity? Instead, how about thinking about how much you are spending on your employees per square foot? This later metric not only captures electricity use, but also factors in healthcare costs due to sickness, missed working days, and potential productivity gains from employee collaboration in a well-designed space.

Such a small shift in thinking places the emphasis on human interaction and a livable environment for long-term quality of life, and it can be used to evaluate workplace, community, and personal buildings.

Making sustainability real for urban inhabitants

Based on her work for the city of Philadelphia, Sarah Wu acknowledged the challenges of moving an entire city toward sustainability, one in which a significant proportion of the population is at or below the poverty level.

Her key insight? Temper your language to make sustainability real for a person without jargon.

Instead of saying, "Global warming is raising the overall temperature of the earth and increasing environmental instability," one might ask: "Have you noticed more storms lately?"

Much of her work for the city of Philadelphia is about relationship management. Wu says she places a premium on meeting people where they are and having a key contact in every neighborhood in order to gauge priorities, source solutions and create support.

Making renewable materials a focus for urban regions

Laura Clise of Weyerhaeuser cited a recent U.N. FAO report on forests, wood products and climate change that challenged city-dwellers to think about the role working forests play in supporting a low-carbon economy.

Besides providing rural communities with immediate economic benefits and recreational opportunities, working forests act as a vast carbon sink. Engineered wood products, such as Parallam, come from these forests and offer advantages over traditional materials. After all, wood is a renewable resource, stores carbon, and substantially reduces emissions as compared to traditional building materials such as steel or concrete.

With such advantages, isn't it time to rethink wood tech?

A perfect example of the sustainability that wood can provide is embodied in this expert conversation starter — Penny Parallam (above), the wood duck (#PennyParallam). Made from a super-strong engineered wood product called Parallam, Penny the wood duck represents strength and sustainability benefits of engineered wood technology compared to non-renewable building materials.

Parallam was used in the construction of the University of British Columbia Brock Commons building that is being touted for its sustainability and speed of construction. Awareness of these type of building materials is growing.

If it were easy, a model sustainable city would already exist

The challenges of moving towards sustainability requires a long-term perspective and iterative gains, each of these experts acknowledged.

Moving one step forward and two steps back is sometimes a reality, they conceded, and success comes slowly with tenacious optimism. For instance, at the end of a building project, Scott Kelly considers success as moving a client up "the ladder of sustainability," even if it is only one rung.

Success is seldom absolute. When she started at the Philadelphia Mayor's office, Sarah Wu's outreach sustainability team set up 15 metrics for success. They covered broad operational areas such as waste diversion, energy management, access to local food and local transportation access. However, when the execution period had ended, only four of those 15 goals had been met, with six more headed in the right direction.

Wu acknowledged the extreme difficulty in hitting all sustainability goals, but she focuses on the "deep systems understanding" that the effort brought to light. Now in her second round of metrics-driven sustainability, Wu's team has grown from three to ten people, and the lessons learned from round one will inform action for future success.

What can I do for sustainability in my city?

"Be a student of yourself," Sarah Wu advised students at NI16. "Be aware of how your involvement in surrounding systems affect your decisions."

For instance, do you think of your carbon footprint in all circumstances, even when flying or driving to a conference such as Net Impact? How difficult is it to change your actions for the better, and what programs could help you most? This awareness can help generate ideas to improve the systems around you, especially with regards to urban infrastructure.

Optimism also fuels motivation for sustainability work. Scott Kelly cited the at-times contentious issue of independent, third-party certification as cause to remain optimistic. There are multiple sustainable forestry standards, but for many years forestry was the only industry who created such standards for building materials. While it’s important to remember that the majority of global forests are not third-party certified, and that the majority of non-certified private forests in the U.S. are owned by small family landowners, the progress made to date on third-party sustainable forest certification is substantial.

In closing, Laura Clise also offered some advice for those interested in working in sustainability: "Be passionate, but don’t forget to be humble."

The work of sustainability requires enthusiastic advocacy, but it also demands recognition that leading change demands a willingness to continue to learn from others in the process of identifying common ground. Smug certainty is simply not effective when enlisting the help of others, some of whom may have a career's worth of invaluable experience and perspective to offer when tackling intractable problems.

As we move towards the next generation of sustainability in cities, it's simply not a journey we afford to take alone.

Joel Oerter is an MBA Candidate at the University of Washington Foster School of Business.

Connecting Personal Values of CEOs to their Commitment to CSR: An Interview with Otgontsetseg Erhemjamts

Submitted by Kelly Eisenhardt

Understanding personal values of CEOs informs employees and investors about a company’s commitment to ethics and corporate social responsibility. In a paper titled “Relation between personal values of CEOs and their commitment to corporate social responsibility”, Professor Erhemjamts and her student Sarah Maher examined corporate social responsibility (CSR) ratings of S&P500 companies along with social capital of the states their CEOs grew up in. They found that firms with CEOs who grew up in high social capital states tend to exhibit greater commitment to community and employee relations, as well as higher overall CSR scores.

Otgontsetseg Erhemjamts is an Associate Professor of Finance at Bentley University. Her primary research interests are corporate social responsibility, corporate finance, and corporate governance topics. She has published in peer-reviewed academic journals including the Journal of Business Ethics; Journal of Banking and Finance; Journal of Money, Credit, and Banking; Journal of Financial Research; The Financial Review; and Journal of Risk & Insurance. She teaches graduate and undergraduate courses in investments, and equity research. Professor Erhemjamts holds a PhD in Finance from Georgia State University. Her student, Sarah Maher, graduated from Bentley University in May 2016, and works as a corporate debt origination analyst at BNP Paribas USA.

How do a CEO’s formative years affect their values and view on CSR?

In the beginning of our research, we thought about possible ways to capture one’s personal values and how those values might relate to executive-level decision making later on in life. We thought that the state-level social capital measure developed by Robert Putnam was a great way to proxy for the environment someone grew up in and the values this person developed during his formative years. Putnam defines social capital as how tight networks and norms of civic engagement is in a particular state. When people are active in their neighborhoods, clubs, and civic organizations, members of the community trust one another and they reciprocate in kind.

It is well accepted that during our formative years, our parents, teachers, and loved ones have a major influence on our outlook in life. To get to CEO’s personal values, we track down a CEO’s home town and home state. We then take the social capital of the home state of the CEO as a proxy for his/her personal values. Our conjecture is that growing up in a high social capital state should affect the values that a person carries throughout his/her life in a way that social networks and community engagement will be important for him/her. In the context of CEOs, their personal values can affect corporate policies, and changes they bring about in the organization.

A good example might be the link between personal values of CEOs and corporate social responsibility. CEOs that grew up in high social capital states are likely to emphasize the need for corporate social responsibility in their businesses. North and South Dakota, Vermont, Minnesota, Montana, New Hampshire, Wyoming, Wisconsin, Maine, Massachusetts, basically northern states closer to the Canadian border measure high on social capital.

For further information on social capital, check out www.bowlingalone.com. There are fascinating statistics about how social capital is correlated with social and economic outcomes such as educational performance, child welfare, crime, tax evasion, and economic inequality.

Is there an issue or a trend that prompted your research?

Yes, there has been a recent trend in many academic studies showing how the personal attributes of a CEO affect their firm’s CSR policies. Some studies found that female CEOs, younger CEOs, and CEOs that donate to both Republican and Democratic parties are significantly more likely to invest in CSR. Others found that Democratic founders, CEOs, and directors care more about CSR than their Republican counterparts. There was another article recently that connected CEOs’ religiosity and their CSR attitude. It was found that if a CEO is highly religious, it can lead to a negative impact on diversity, but a positive impact on charity.

One fascinating paper by Cronqvist and Yu, discussed in the Harvard Business Review, shared statistics regarding CEOs who have daughters as running more socially responsible firms. It appears that having a daughter shapes her father’s preferences in a way that it makes him want to be more ethical and leave a better world for her. This paper inspired us to think about how CEOs’ personal values shaped in their formative years may influence their decision-making related to CSR.

In sum, existing studies suggest that the CEO’s gender, family background, religion, age, and political leanings all affect the firm’s corporate social responsibility policies. We aim to contribute to this literature by examining the link between a CEO’s formative years and the values they carry forward into their professional life.

How can the values of senior management affect the priority of CSR within the organization?

As I mentioned earlier, we used social capital of the CEO’s home state as a measure of his/her personal values. In order to examine the effect of CEOs’ personal values on their firms’ CSR activity, we need some measure of firm-level CSR. To capture CSR activities at a firm level, we used the MSCI ESG STATS ratings, where MSCI compiles annual environmental, social, and governance (ESG) ratings of publicly traded companies. MSCI rates companies on over 60 different indicators, organized in seven categories (environment, community, human rights, employee relations, diversity, product, and governance). They also provide summary strength and concern counts for each of the seven ESG categories.

We first looked at an overall measure of CSR, by adding up all strengths across all categories, and subtracting all concerns across all categories, arriving at a net strength measure. We found that firms with CEOs that grew up in high social capital states have lower number of concerns, and higher number of net strengths compared to CEOs that grew up in low social capital states.

Next, by diving into the categories, we were able to discover further differences among companies run by various CEOs. For example, we found that firms with CEOs that grew up in high social capital states have lower number of concerns in community and employee relations categories. Concerns in community category rated by MSCI include indicators such as community impact, which measures severity of controversies related to firm’s interactions with communities in which it does business. Concerns in employee relations category include indicators such as controversies related to union relations, employee health and safety, supply chain, child labor, and labor management relations.

What is the correlation between CSR programming and SRI investing when there is C-level support?

While we didn’t look at the link between corporate social performance (CSP) and socially responsible investing (SRI) in this paper, there is a body of literature that examines the relation between CSP and the institutional ownership. Studies found a positive and significant relation between CSP and the number of institutions holding the shares of a company. There is also a finding that suggests firms with strong CSP attract long-term investors. If we link these existing studies with what we found, we can conjecture that firms with CEOs that grow up in high social capital states will pursue strategies to improve their CSP, and in turn, will attract more institutional ownership.

Has your research found connections between corporate risk and whether or not a company engages in CSR programming?

Yes, firm risk is definitely one of our control variables. Findings in the existing literature suggest that many firm characteristics affect the CSR policies at the firm level. For example, larger firms tend to draw a higher level of attention from the public, and have greater social impact, suggesting that larger firms are more likely to engage in CSR. Several studies also document a positive relation between R&D intensity and CSR. R&D intensity is often used as a proxy for the level of product differentiation.

One of my earlier papers (published in the Journal of Business Ethics) found that firm risk, proxied by standard deviation of monthly returns, is negatively related to the number of strengths, as well as net strengths scores, but positively related to the number of concerns that a firm has. We also found that firm’s financial health, proxied by Altman’s Z-score, was positively related to the number of strengths, as well as net strengths scores, but negatively related to the number of concerns that a firm has.

Can you share a few examples from your research that demonstrate CSR success championed by CEOs?

There are many S&P 500 firms that have CEOs who grew up in high social capital states. For example, Kimberly-Clark Corporation has a total number of 10 strengths and 0 concerns according to MSCI ESG STATS database, while median firm on our sample has 6 strengths and 1 concern. Kimberly-Clark strives to deliver on their value of caring for the communities where they live and work. Highlights in their 13th Sustainability Report include facts such as (i) socially-focused programs exist in 97% of their communities, (ii) 10-year partnership with the Forest Stewardship Council to end deforestation and safeguard forest ecosystems, (iii) 95.6% of manufacturing waste from landfill is diverted, (iv) awarded EPA climate leadership award for excellence in greenhouse gas management, and (v) exceeded the 25% water reduction goal with a 27% reduction rate. Its’ CEO is Tom J. Falk, who is a 33-year veteran of the company. He grew up in Iowa, which is ranked #7 out of 50 states in social capital according to Robert Putnam. He was educated at University of Wisconsin, and Wisconsin is ranked #11 in social capital. Interestingly, Kimberly-Clark is headquartered in Texas, which is a low social capital state.

State Street Corporation is another example of a firm with high corporate social performance, with 11 strengths and 0 concerns, according to MSCI ESG STATS. In their 2015 corporate responsibility report, State Street mentions their goal to reduce greenhouse gas emissions and water use by 20% per person by 2020, compared to a 2012 baseline. At the end of 2015, they had achieved 17% reduction in both categories. 56% of their global square footage of office space is certified to ISO 14001 standards. The State Street Foundation provided $22.7 million to non-profit organizations around the world in 2015, including matching employee contributions of $4.15 million to 2,222 charitable organizations. Its’ CEO is Joseph L. Hooley, who grew up and educated in the state of Massachusetts. Massachusetts is considered as a high social capital state (it is ranked #18 out of 50). State Street is headquartered in Massachusetts, as well.

How can readers engage more with senior management on CSR concerns and how can they learn more about your work?

Based on our findings, I’d say that when you’re thinking about joining a company, investing in a company, or, if you are in a process of hiring a new CEO, don’t just look at the CEO’s experience and education. It’s also important to understand their personal values and inclinations toward CSR. Those dimensions can make a world of difference to your experience as an employee run by them, improve your portfolio performance as an investor, or make implementing your CSR initiatives a breeze as a board. Instead of trying to incentivize a person without such values, it would be much easier to hire a person with such values already built in. An easy way to proxy for that seems to be finding out where he/she grew up.

You can learn more about our study a http://web.bentley.edu/oerhemjamts/Early_life_environments_of_CEOs_and_firm_CSR_Jan_2017.pdf

Forced Labor Is More Common In the U.S. Than You Might Think

In towns and cities across the richest nation on earth, people are forced to perform jobs against their will. They work in agriculture, manufacturing and many other industries, including the sex trade. Sometimes they are hidden in plain sight: in the fields picking fruits and vegetables or working on construction sites.

The State Department itself concedes the Unites States is a “source, transit, and destination country for men, women, and children subjected to forced labor, debt bondage, involuntary servitude, and sex trafficking.” Those subjected to this fate include both U.S. citizens and foreign nationals.

Human trafficking can be found in a variety of American industries and markets. While most of the scant media coverage around forced labor in America centers around the sex trade, human trafficking also occurs in industries such as hotel services, hospitality, agriculture, manufacturing, janitorial services, construction, health and elder care, and domestic service. Reports include people who worked temporary visa programs and filled labor needs in those industries who were later identified as human trafficking victims. As of 2012, the top countries of origin for foreign victims of human trafficking in America were Mexico, Thailand, the Philippines, Honduras, Indonesia and Guatemala.

Sex trafficking occurs in all 50 states

Most American media coverage around forced labor centers around the sex trade. The sad reality is that it occurs across the country and is a modern form of slavery. As has been well documented, traffickers lure victims and force them into sex work by using violence, threats, lies, and debt bondage.

This can occur “in a range of venues including fake massage businesses, via online ads or escort services, in residential brothels, on the street or at truck stops, or at hotels and motels,” according to the Polaris Project, a leader in the global fight to eradicate modern slavery.

The sex trade is a profitable one -- ranging from $39.9 million in Denver, Colorado, to $290 million in Atlanta, Georgia, according to a 2014 report by the Urban Institute. So, it should not come as a surprise that women, men, and children continue to be sold against their will for sex in towns and cities across all 50 states.

While some are foreign nationals, many are American citizens. Polaris identified almost 6,000 sex trafficking cases involving American citizens, through operating the National Human Trafficking Resource Center hotline and the BeFree Textline -- which provide services and case management to survivors of human trafficking in New Jersey and Washington, D.C.

The nonprofit says traffickers profit by finding and recruiting people they can exploit. Victims are made “elaborate promises” of a dream job, a place to live, or gifts of clothing and jewelry. Sometimes recruiters can even pose as being romantically interested in victims.

Awareness is growing on this issue, but it persists nonetheless -- and there's certainly much work to be done.

Labor trafficking preys on foreign nationals

While many victims of sex trafficking are Americans, more foreign victims of forced labor in the U.S. are found in other sectors, according to the anti-slavery nonprofit End Slavery Now. Some labor trafficking victims enter the country under either work- or student-based visa programs, while others are targeted once they arrive in the U.S.

The Polaris Project describes labor trafficking as a “form of modern slavery that exists throughout the United States.” Labor traffickers threaten victims and use violence, lies and debt bondage “to force people to work against their will in many different industries.” Labor traffickers lure victims to the U.S. with promises of good pay jobs, education or travel opportunities. When victims arrive in the U.S., they find they are trapped into awful working conditions. Their passports and money are often confiscated, so they believe they have no way out of their work situation.

Agriculture is an area where forced labor happens all too often. Anti-Slavery International describes farm workers as “some of the poorest paid and most exploited workers within the U.S. economy.” They only earn an average of $10,000 a year and lack some of the rights others American workers are guaranteed, including the right to overtime pay. They also often work without health insurance, sick leave, pensions or job security.

Those conditions are “the fertile ground that gives rise to forced labor in U.S. fields,” Anti-Slavery International says. Most of America's migrant farm workers come from Mexico, Guatemala and Haiti -- places with high poverty rates and political unrest that drive migration.

“Unfortunately, the agriculture industry seems to treat most living beings a mere commodities,” Lauren Ornelas, founder and executive director of the Food Empowerment Project, told Triple Pundit.The Coalition of Immokalee Workers assisted in the prosecution of a number of multi-state forced labor operations across the Southeastern U.S. and has helped liberate over 1,200 workers held against their will as a result. One of the cases the CIW helped in resulted in a federal grand jury indicting six people in Southwest Florida for making money off of farmworkers from Mexico and Guatemala by forging documents and committing identity theft.

Chief Assistant U.S. Attorney Doug Molloy labeled the case in Southwest Florida as “slavery, plain and simple.” For two years, over a dozen people were held as slaves on the property of those indicted. The workers were forced to sleep in shacks and box trucks. They were unpaid for picking produce and charged for food and showers. If they attempted to escape, they were beaten. The case was the seventh farm labor operation in Florida to be prosecuted in Florida.

The H-2 guest worker program is a breeding ground for forced labor

A federal program exists to temporarily bring foreign national workers to the U.S., called the H-2 guest worker program. But there's a serious problem: A 2013 report by the Southern Poverty Law Center (SPLC) characterizes the conditions allowed by the law as “rife with labor and human rights violations committed by employers who prey on a highly vulnerable workforce.” Guest workers who participate in the H-2 program are “systematically exploited and abused,” the report declared.One of the biggest problems with the program is that workers are bound to the employers who bring them to this country. They can’t change jobs if they are mistreated for that would jeopardize their immigration status. And that’s what makes them so vulnerable to abuse. “If guest workers complain about abuses, they face deportation, blacklisting or other retaliation,” the SPLC report stated. So, what results is that they can be victims of human trafficking and debt servitude.

“Forced labor exists within the H-2 programs because of their structure,” Naomi Tsu, deputy legal director of SPLC, told TriplePundit. “There is a huge power imbalance between employers and workers.”The U.S. offers two types of guest worker programs. The H-2A program is for agricultural work, while the H-2B program is for non-agricultural positions. Despite the distinctions in the programs, the nature stays the same. Both programs allow the guest worker to only work for the employer who petitioned the Department of Labor for their services. With both programs, workers have little recourse if they experience abuse or violations.

Most employers rely on either private individuals or agencies to both find and recruit guest workers in their home countries, which are generally in Mexico and Central America. The labor recruiters usually charge the workers fees to cover travel, visa and other costs. Sometimes the fees are thousands of dollars. Recruiters also require workers to leave them collateral like the deed to their house or car to ensure they fulfill the term of their labor contract.

Guest workers typically arrive in the U.S. with a debt of $500 to over $10,000, and sometimes they have to pay high interest rates on their debt. The majority of guest workers struggle to repay their debts, and interest continues to accrue -- leaving them vulnerable to debt servitude and human trafficking.

A report by Farmworker Justice on the H-2 guest worker program contains a case study on a man from Thailand named Chinnawat who ended up the victim of human trafficking. Brought to North Carolina to do farm work in 2005, he took out loans with his house as collateral to pay the $11,250 recruitment fee to work as an H-2A worker in vegetable fields. He ended up in poor conditions in a motel with six or seven in a room. At one point he was housed with other guest workers in a barn filled with insects and mice.

After several weeks, the work dried up, and only a few workers were allowed to work in the fields every day. The others who didn’t work received no pay, which meant they had no money to pay for their debt. They were told to not leave the farm and were afraid the police might arrest them if they did. The contractor often cleaned his gun in their presence to serve as a warning to not leave.

Chinnawat eventually fled and, with the help of a legal aid attorney, he obtained a visa reserved for victims of trafficking. Most workers in his situation do not have such good outcomes.

The problems of forced labor within the H-2 programs highlight the need for immigration reform. “We have to create an immigration policy that accords with our values, and part of that has to be creating a line that regular people can get into in order to enter the United States,” Tsu said.

The U.S. has long been a “beacon for many people in the world,” she pointed out. If more workers are needed in this country, “Then we should just do what we’ve always done which is to let people come in with freedom of movement in the community that they are part of building.”

Image credit: Flickr/CWMc

Rex Tillerson: Confirmation Overshadowed by Exxon Torture and Business Scandals

Recollections – or the lack thereof -- can say a lot about the way people look at things. That’s why when former Exxon CEO Rex Tillerson was questioned about his company’s alleged skirting of U.S. sanctions against financial dealings with Iran, Syria and Sudan, Sens. Jeff Merkely (D-Ore.) and Robert Menendez (D-N.J) found his recollections a bit odd. Or, that is, his lack of memory when it came to Exxon’s $55 million revenue from projects in these three countries from 2004 to 2006, a period that overlaps Tillerson’s tenure at Exxon.

The 64-year-old former head of the world’s largest oil and gas company was undergoing his confirmation hearings for the position of U.S. secretary of state at the time of the questioning. He was forthright, almost adamant, about the role and importance of sanctions as a tool for ensuring compliance (for example when it comes to human rights compliance). But when questioned about the fact that ExxonMobil had done business that gained direct financial benefit from countries on the U.S. sanctions list, he drew a blank.

“I do not recall the details of the circumstances around what you just described,” Tillerson told Merkely and Menendez when they asked why Exxon sold chemicals to the Iranian National Oil Co. The company was listed by the U.S. Treasury Department as an affiliate of the Iranian Revolutionary Guard Corps, an organization the U.S. said was a sponsor of terrorism.

“The question would have to go to ExxonMobil for them to be able to answer that,” Tillerson said.

The next day, Exxon did. The corporation’s spokesperson Alan Jeffers stated that the transactions were actually between a European company Infineum and Iran, and that Infineum was an “independently managed” company.

Independently managed, but owned in an even split by ExxonMobil and Royal Dutch Shell. Although Infineum did the financial bidding, ExxonMobil is estimated to have benefited in the millions from transactions the company did in Iran, Syria and Sudan.

Nor was the $55 million ever disclosed to shareholders. According to documents obtained by the Washington Post, in 2006 Exxon’s legal counsel told the Securities and Exchange Commission the firm wouldn’t inform shareholders of this new revenue – it was too small for investors of the world’s largest oil and gas company to worry about. It’s a position that Exxon maintained throughout much of its dealings with the SEC over this revenue. For its part, the SEC doggedly insisted that the investors should be informed of these undisclosed material transactions.

While Tillerson’s lack of memory and willingness to talk about these events have frustrated Democrats, the impasse likely isn’t enough to stand in the way of a confirmation. For Tillerson to lose the nomination, there would have to be a reason compelling enough to force one or two Republicans to vote against his confirmation.

And there just might be.

On Wednesday, Sen. Marco Rubio grilled Tillerson on his views about Russia, President Vladimir Putin, and the role the secretary of state would play when it comes to human rights in the global arena.

Rubio seemed less than convinced that Tillerson understood the weight his role would carry in representing the interests of the United States. He was almost prosaic in the summary he later gave Tillerson about why he asked him about the role that his office would play and his earnest decision to make sure those responsibilities were upheld.

“[The secretary of state] is the face of this country for billions of people, for hundreds of millions of people, as well, and particularly for people that are suffering and they’re hurting.

“For those people, those 1,400 people in jail in China, those dissidents in Cuba, the girls that want to drive and go to school, they look to the United States. They look to us and often to the secretary of state,” said Rubio, noting that these people expect the United States to take a decisive stand on issues of human rights.

When we don’t, he insisted: "It demoralizes these people all over the world. And it leads people to conclude this -- which is damaging, and it hurt us during the Cold War -- and that is this: America cares about democracy and freedom — as long as it’s not being violated by someone that they need for something else.

“That cannot be who we are in the 21st century,” Rubio concluded.

With new information surfacing about lawsuits ExxonMobil is facing for its alleged complicity in torture of Indonesian farmers in the late 1990s and early 2000s, new questions are emerging about what Tillerson would have known and handled as an executive vice president of ExxonMobil.

And with Rubio’s keen interest in ensuring that the country’s top diplomatic office is able and willing to interpret and address human rights issues fairly, Tillerson’s confirmation seems to be anything but a sure thing. The decision that determines whether Donald Trump’s top nominee is confirmed may not lie in the hands of Democrats after all, but under the purview of a Republican senator earnestly bent on reminding Trump of what really defines the country’s top leadership roles.

Image credit: The Office of the President-elect via Wikimedia Commons

How Companies Can Combat Public Skepticism of CSR

By Liz Bardetti

Although more businesses are seriously engaging with corporate social responsibility (CSR), the public is becoming more skeptical of their efforts. In a recent survey, 52 percent of consumers said they need to see proof of a company’s CSR initiatives in order to believe them. Why is this happening? Unfortunately, it’s largely a case of a few companies ruining it for the rest of them.

Rather than just making a profit, 90 percent of consumers expect companies to address social and environmental issues. CSR builds trust with employees and consumers, but are companies interested in that for the right reasons? Are they genuinely interested in making a better world, or are they interested in the profits that come from increased employee engagement and customer trust? That’s where public skepticism starts.

As you might expect, this creates a tough time for businesses that genuinely care about CSR and making a difference in the world. They now face the challenge of effecting real change and convincing the public that they’re actually doing what they say.

Top execs set the tone

It all starts with the CEO of a company: the big cheese, the main event. He or she is the face of the business, so they need to be behind the vision. Remember that social justice is no longer off limits to business like it once was. In 2014, 80 percent of the public said that corporations should take action to address important issues facing society, and that number is rising.In order to combat public skepticism, CEOs need to find a cause that they truly care about and commit to it on a personal level. Businesses often focus on differentiation through CSR efforts, which makes them stand out from others. What CSR should really affect is identification, which allows consumers to identify with a business and relate to its’ values. Perhaps that’s why Microsoft, so closely associated with CEO Bill Gates, is one of the highest ranked companies for CSR.

Vision is crucial, but it has to be realistic

Let’s look at Volkswagen as a great learning opportunity. Previously ranked one of the best companies in the world for CSR work, Volkswagen lost credibility when its emissions scandal came to light. All of the automaker's CSR work was swiftly forgotten.“It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently.” - Warren BuffettCSR visions fail when goals are in direct conflict with the company’s business practices. Corporations don’t need to practice precisely what they preach, but they also can’t be working against their own goals. This can be difficult for CEOs, because they must care about both CSR and their bottom line. What they need to realize is 90 percent of global consumers would switch brands to one that is associated with a good cause. Trust in a true vision for CSR and consumers are sure to follow.

Be transparent and address issues head on

No company wants to showcase their issues, but being picture perfect isn’t ideal either; If everything is too perfect, it becomes suspicious. Instead, what companies should do is be completely clear and open about their practices and their CSR initiatives. When all cards are on the table, businesses don’t have to worry about being called hypocritical or accused of being liars. When problems do pop up, companies should address them openly.One of the greatest examples of CSR transparency is the rags-to-riches transformation of Nike. Only 20 years ago, consumers were protesting outside their stores with accusations of child labor and sweatshop use. The company promised to change and followed through 100 percent. In fact, by 2020, they plan to eliminate all hazardous chemicals from their supply chain.

No company is perfect; issues will come up. What matters to the public is sincerity and how businesses choose to deal with those problems when they arise.

Don’t give up

Companies must pursue greatness with passion and commitment to doing the right thing, not just projecting a good image. In short, to truly convince the public that a company is out to do good, the company has to actually care about doing good. The public may be skeptical, but the best way to fight is to truly do great things. Regardless of public perception, the world would be a much bleaker place without CSR.Image credit: Pexels

Liz Bardetti is a seasoned advertising and marketing professional with 15+ years experience, including work for Gatorade, Welch’s and most recently, CyberGrants. CyberGrants is the preferred CSR software provider to the best philanthropic corporations around the globe. Our clients represent over 50% of the Fortune 100 and nearly one-third of all corporate giving. In the last twelve months alone, CyberGrants helped 250 customers give $6.5 billion plus more than 50 million volunteer hours to over 400,000 non-profit organizations.

It's Time to Accelerate Innovation and Action on Climate Change

By Seva Karpauskaite

As this year’s winner of Masdar’s Engage Global Competition, I am excited to have this unique opportunity to attend the largest gathering on sustainability in the Middle East as a guest blogger and social media influencer. During Abu Dhabi Sustainability Week (ADSW), I look forward to participating in and covering a series of exciting events, exhibitions and conferences, including the Global Action Day, the World Future Energy Summit, the International Water Summit and, of course, a visit to Masdar City.

I entered the contest because I am passionate about sustainability and climate. I come from a small country, Lithuania, that is vulnerable to climate change’s impacts. After I finish my master’s, my goal is to become an advocate for sustainable development and environmental protection by making the business case for clean technologies. Studying energy, resources and environment at SAIS, Johns Hopkins University, has enabled me to hone my theoretical knowledge on diverse energy and environmental issues. To that end, diving into ADSW will integrate me within the global community as attendees debate and address the most pressing issues related to climate change, at a time of uncertainty in the global energy landscape.

Here are the facts: There are two certainties regarding the phenomenon of climate change. First, the science makes clear that it has already started -- and, indeed, it is mind-boggling. One of my goals during ADSW is to highlight the borderless and multidimensional nature of this complex issue. I strongly believe that all of us need to reframe and broaden our understanding of climate change.

While we can clearly grasp the science behind global warming, I cannot emphasize enough that it is also a global security threat, exacerbates inequality and is detrimental to sustainable development.

So, let’s pursue a two-pronged approach: innovation and action. The development and deployment of the physical capital based on scientific research and technological innovation is crucial. So is the growth of social capital, catalyzed by reaching a global consensus that can be transformed into collective action.

We already see encouraging signs that community building is underway. For example, Masdar’s Gen Z sustainability survey revealed that young people see climate change as the biggest threat to the world over the next 10 years and that they seek to be proactive in ensuring a more sustainable future. The next step is engagement: channelling their passion for activism into opportunities to advance sustainable development. ADSW events like the Student Exclusive offer a platform for such youth-industry cooperation, so I am keen to meet youth from the UAE and worldwide who are also passionate about the issue.

Greater awareness is the crucial next step. The fact is that global leaders and institutions have historically focused their work on climate science and economics. Consequentially, we have significantly advanced in our technical ability to address sustainability issues. In some parts of the world, including the UAE, solar is price-competitive with electricity from conventional sources; cities are implementing smart and sustainable solutions to boost their infrastructure; clean technology R&D is creating new business opportunities for startups and corporates alike.

Nevertheless, the world must accelerate implementation of renewable and sustainable technologies. We must find new ways to narrow this chasm between ability and action to shape and spread knowledge of sustainability issues that engage and empower.

Women represent one of the key stakeholder groups that exemplify the need for a more nuanced understanding of global warming. We are greatly underrepresented in climate change science, negotiations, policy-making and adaptation efforts. Yet women, especially poor women, are also disproportionately affected by climate change. Strengthening our capacity to deal with climate change relies on grasping the intersection between gender and climate change. We must acknowledge the impact that global warming has on women, and strive to inspire them to become powerful agents whose knowledge, innovation and skills play a bigger role in the climate change crisis. That’s why I’m keen to attend and report from the Women in Sustainability, Environment and Renewable Energy (WiSER) event at ADSW.

I’m grateful to be included within this week-long conversation, which promotes cooperation and innovation as the next 10 years are crucial to harness climate change risks and transform them into opportunities. I am thrilled to be part of the dialogue and cooperation that sparks the development of the financial and social capital necessary as we shift toward a more sustainable world.

Follow me on Instagram and Snapchat for daily musings, happenings and snapshots from ADSW 2017! Also, track my journey with the hashtags #WorldIn2026 and #ADSW2017.

Seva is the winner of Masdar's 2017 Engage Social Media Contest. You can check out her winning video below:

https://www.youtube.com/watch?v=f7dEfsXLqB0

Seva Karpauskaite, of Kaunus, Lithuania, is the winner of Masdar's 2017 Engage Social Media Contest. She is a student at SAIS, Johns Hopkins University.