How Social Consciousness Can Drive Financial Success

By Milind Mehere

What do 29 unbanked borrowers, one small business owner, 22 investors, and an investment platform have in common? They are working to create a better world where their roles benefit not only themselves, but also one another.

Nearly 18 months ago, a company called Quest Livery Leasing asked my investment platform to back its business. Quest Livery wanted to lease its fleet of vehicles to drivers working with services such as Lyft and Uber. However, most of the drivers were unbanked and didn’t have credit histories, making it all but impossible for them to secure traditional financing.

Given our expertise in alternative investing, YieldStreet investors agreed to back the loans. The deal became a study in impact investment for us. Our investors were able to invest in a commercial loan to which they otherwise may not have had access; Quest Livery raised cheaper debt capital; and drivers were able to lease the cars and become entrepreneurs.

That’s the power of socially conscious investing. Contrary to traditional investment thinking, profit and positive impact aren’t mutually exclusive.

The power of social investments

Social justice investments help underserved communities by bringing new businesses and opportunities to their neighborhoods. Socially conscious initiatives also provide more sustainable, long-term strategies for making a difference than one-time donation campaigns can.

Litigation finance is another great example of this. Too often, the people who win lawsuits are those who can afford to stay in the fight the longest — not the people most entitled to compensation. Litigation finance enables plaintiffs to see their cases through by borrowing from third-party lenders.

A small British manufacturer used third-party funding to wage a lawsuit against Caterpillar Inc. In 2015, after five years of litigation, Miller UK Ltd. won $73.6 million in damages after a jury convicted Caterpillar of misappropriating trade secrets. Without litigation financing, Miller likely would have had to abandon the suit against the multibillion-dollar company.

Borrowers pay lenders only if they win their suits, so there’s no danger of going deeper into debt if they lose. Litigation financing promotes legal justice for people who were previously disadvantaged by the system, and it ensures that investors get paid if their borrowers do. Social investments make sense for everyone involved.

Make an impact without sacrificing profits

For-profit companies are judged primarily on their financial successes, but social responsibility is a key component in attracting consumers and recruiting talented workers. Here’s how you, as a leader, can marry financial success and social responsibility:

1. Connect the dots. Identify ways in which you can connect the business to social aspects. When Quest Livery pitched YieldStreet on investing in unbanked drivers, we saw a chance to make a real difference.

Ask yourself and your employees, when the going gets tough, what gets you going? Beyond doing your job, what does the company stand for? Who is using its products? What effects are you having on society or on consumers who use your products? How can you live those ideals more fully as an organization? What contributions are you already making, and how can you deepen that impact?

Connect your mission with every single person on your team to create a shared vision and purpose to define why you are coming to work every day. By inviting employees into this conversation, you build a socially conscious mentality that radiates from every level of the organization.

2. Empower employees. Passion is a key driver for success. How can you ensure your team is engaged and firing on all cylinders? That is how you create a competitive advantage for solving big problems.

Smaller companies may not have a corporate social responsibility (CSR) department, but you can still align your company’s social responsibility with employees’ everyday experiences. Solicit feedback, including criticism, about how you can improve possibilities for them to engage in efforts aimed at boosting employee social responsibility. Reward those who get involved in ESR campaigns and who help promote ethical, socially conscious behavior in the workplace.

Most importantly, hire people who are passionate about corporate social responsibility (CSR). Acumen, a nonprofit investment fund, recruits candidates who are aligned with the organization’s values and ideals by asking them for thoughts on CSR and how the company could do better. Applicants who come prepared with ideas are the ones you want on your team.

A toxic group of people can destroy morale, but an engaged group can build momentum around key company initiatives. If you empower employees to make decisions, solve problems, and work on projects that matter to them, they will build something amazing.

3. Engage in socially responsible team activities. Designate service days to take group action on an issue that someone on your team is passionate about. Clean-up projects stimulate environmental awareness and encourage teamwork and collaboration. Raising funds via marathons promotes health and wellness and helps people in need. Even simple things like energy saving or recycling programs at the office can get employees into the mindset.

In a U.K. study on volunteering, correlations were discovered between volunteering and overall better peer and family engagement, as well as greater confidence in social settings. Because a harmonious workforce is more productive, service projects make good business sense. They also offer great opportunities for natural leaders to emerge.

Use service days to showcase your team’s skills for a good cause. If you run a marketing agency, for example, you could offer to run a pro-bono campaign for a local nonprofit. Such efforts garner goodwill in the community and keep your services top of mind.

Social responsibility doesn’t have to happen at the expense of sound business decisions or smart investments. As a company leader, you should understand the how the work you do affects the areas around which your business is based. Business growth and social impact don’t need to be mutually exclusive.

Will you help create jobs? Positively affect the environment? Such outcomes aren’t just good for the community; they’re also good for business. So start thinking about how you can expand and fine-tune your operations to incorporate more meaningful initiatives.

Image credit: Pexels

Milind Mehere is a passionate serial entrepreneur currently at the helm of YieldStreet as CEO and founder. YieldStreet uses technology, data, and investment management to empower financial independence for all. Milind has been fortunate to work for industry-defining companies, and he has successfully built and scaled three businesses, one of which, Yodle, was acquired by Web.com for $342 million in 2016.

UK Millennials buy responsible brands this holiday

Authentic is the new black: Ex-CFO on finding yourself as the key to success and happiness

3p Weekend: The Biggest CSR Stories of 2016 -- Updated

As 2016 comes to a close, it's natural to reflect on the months that passed and how they will impact our future. And this year saw no shortage of headlines pertinent to the corporate social responsibility (CSR) discussion.

To make sure you're caught up before that holiday party, we're taking a look back at the year's biggest news items -- and what's happening with them now.

Armed standoff leaves America shocked

2016 was a crazy year for news. And the action started almost immediately. In the first few days of January, a group of self-styled patriots stormed the Malheur National Wildlife Refuge in eastern Oregon. After pointing weapons at refuge employees, the group essentially commandeered the area -- which they held in an armed standoff with federal officials that lasted over two months.

The occupiers were led by Ammon Bundy, son of the now-notorious Nevada cattle rancher Cliven Bundy. They claimed they sought to “educate” the local community about their rights, prevent two local ranchers from going to jail for arson, and turn the public preserve over to ranchers, loggers and miners. But members of the community were not quick to warm up to their goals -- as 3p's Tina Casey explains in her CSR analysis of the standoff.

What's happening now?: Although the refuge was left littered and damaged, all seven occupiers who faced federal charges over the incident were acquitted by a jury in Portland, Oregon, in October. One occupier tragically lost his life in an armed conflict with authorities, in what many said was an effort that was misguided from the start and benefited only a select few lobbying interests.

Supreme Court stays Clean Power Plan amidst court battle

In February, the U.S. Supreme Court issued a stay that temporarily halted progress on the Clean Power Plan. The decision came after a group of states, utilities and coal companies sued the EPA over the Obama administration's landmark climate change policy, saying it was unconstitutional and infringed on state's rights. (As a refresher, the Clean Power Plan — which was updated and strengthened in August of last year — seeks to limit greenhouse gas emissions from new and existing power plants.)

What's happening now? In September, with the stay still in place, the suit made its way to the U.S. Court of Appeals for the District of Columbia Circuit. Months after arguments were initially heard, the plan is still under court review -- and the stay remains in place. President-elect Donald Trump has vowed to kill the plan upon taking office. But only time will tell whether influence from companies and states in support of the plan could sway his decision.

AGs investigate ExxonMobil, Congress sparks climate science witch hunt

In November of last year, New York Attorney General Eric Schneiderman launched an investigation into ExxonMobil to determine if it lied to the public or investors about climate change risks. In January, California Attorney General Kamala D. Harris opened her own investigation into the company -- saying executives knew about climate change risks for decades, but failed to disclose them to investors. Before long, 17 state AGs and a group of NGOs also began looking into the company.

A few months later, the House Science Committee -- led by Texas Rep. Lamar Smith -- began issuing broad-sweeping subpoenas to the attorneys general and NGOs investigating Exxon. The committee's investigation, which many called a climate science witch hunt, continued with hearings and more requests for emails and records. But the efforts didn't stop the search for the truth: In September, the Securities and Exchange commission opened its own investigation into Exxon.

What's happening now? In December, Exxon filed suit against the AGs behind the investigation -- saying the company was being unfairly discriminated against. And with its CEO Rex Tillerson on tap to be our new Secretary of State, the company's influence in Washington is only set to grow.

Peabody declares bankruptcy, some point to the collapse of U.S. coal

In April, Peabody Energy -- America's largest private coal company, with a market cap of $20 billion in 2008 -- filed for Chapter 11 bankruptcy. Many said the company's demise further signaled the collapse of U.S. coal -- pointing to a sharp decline in coal production, which is now a third of what it was six years ago. The U.S. Energy Information Administration predicted 2016 would be the biggest year-on decline for coal in history.

What's happening now? President-elect Donald Trump has vowed to revive America's coal industry and bring mining jobs back to struggling communities. But experts are dubious on whether he can make good on these promises. For its part, Peabody is in the process of restructuring -- a move CEO Glenn Kellow says "paves the way for a sustainable future" for the company.

The rise of Black Lives Matter

The Black Lives Matter movement formed in 2013 in response to the high-profile killings of unarmed black men at the hands of police. It continued to grow in strength and influence in 2016, releasing a point-by-point platform in August.

TriplePundit partnered with Symantec for an editorial series on the BLM phenomenon and how companies should approach racial justice. And Alicia Garza, co-founder of the movement, was tapped for the opening keynote at the 2016 Net Impact Conference -- proving BLM isn't going away any time soon.

What's happening now? Earlier this week, the BLM movement announced its big project for 2017: an initiative to support and promote black-owned small businesses in partnership with New York ad agency J. Walter Thompson.

Tesla merges with SolarCity

This summer, Elon Musk -- cleantech visionary, Tesla CEO and SolarCity board chairman -- started hinting at the fact that Tesla may look to acquire SolarCity. The CEO made good on his promises, and put an offer before Tesla's board -- recusing himself from the final decision.

What's happening now? The $2.6 billion offer was finalized in August, and the merger officially took effect last month. Executives say the move creates the world's largest, vertically-integrated clean energy company. And they were quick to demonstrate why -- releasing plans for a low-cost solar roof and even powering a whole island with clean energy.

Paris agreement enters into force

At COP21 in Paris last year, world leaders inked the first global agreement aimed a curbing climate change. On Earth Day, leaders from 175 nations signed the agreement in "the largest one-day signing event in the history of the U.N.,” said U.S. President Barack Obama.

After signing the agreement, the next step was for countries to formalize their commitments -- and they did, in droves. The U.S. and China formally joined in September, sending up clear signals to the rest of the world. In order to come into force, at least 55 countries representing 55 percent of global emissions needed to come on board. The agreement crossed that milestone a few weeks later -- months ahead of schedule.

What's happening now? COP22 convened in Marrakesh, Morocco, in late November, where leaders discussed how to effectively implement the Paris agreement. And while President-elect Donald Trump has vowed to pull the U.S. out of the agreement, that may not be as easy as he expects. Nevertheless, other nations vowed to carry on regardless of American participation.

Dakota Access pipeline conflict mobilizes thousands

In 2014, the Standing Rock Sioux of North Dakota began mobilizing protests around the planned Dakota Access pipeline. The pipeline was set to carry crude oil 1,168 miles across North Dakota, South Dakota, Iowa and Illinois, at a cost of $3.8 billion. The tribe said the pipeline, which passed within a half mile of the reservation, would put sacred sites at risk. They also expressed concern about the crossing at the Missouri River, which supplies drinking water to 17 million Americans, including the Standing Rock Sioux.

The protests reached a fever pitch over the Labor Day weekend, when the tribe accused pipeline workers of desecrating sacred burial sites. Soon after, reports emerged of company security guards using pepper spray and attack dogs on protesters, and injuries were reported on both sides. In September, a U.S. appeals court halted progress on the pipeline and put it under review -- but the standoff continued.

By November, the pipeline was completed save for the Missouri River crossing, which protesters blocked with prayer camps and their own bodies. As temperatures dipped below 25 degrees Fahrenheit, authorities reportedly sprayed protesters with water cannons -- outraging both environmentalists and human rights advocates.

What's happening now? The Obama administration and the U.S. Army Corps of engineers denied the pipeline company's rights to drill under the Missouri River, and ordered them to find an alternative route. But with the incoming Trump administration, advocates insist the fight isn't over.

Many drew comparisons to January's Oregon occupation -- insisting authorities didn't even shut off power and water to the armed occupiers, but used aggressive force against peaceful Standing Rock protesters seeking to protect their cultural heritage and water resources. Petitions are circling across the Web seeking to hold authorities accountable for injuries sustained by protesters, including partial blindness and loss of limb.

Trump's election and the rise of localities and businesses in the climate fight

In the early hours of Nov. 9, progressive Americans were shocked to learn that Republican candidate Donald Trump achieved the 270 electoral votes necessary to win the White House. Much hemming and hawing ensued in the following days. But by late November, those resolved to tackle climate change had regrouped and assembled a plan.

On Nov. 21, a group of businesses sent an open letter to Trump telling him to take climate change seriously -- emphasizing that they would continue to cut emissions despite executive action. A few days later, a group of 37 mayors did the same.

What's happening now? While Trump continues to promote fossil fuels and stack his cabinet with climate deniers, businesses -- as well as local and state governments -- aren't budging. Business leaders gathered in -- gasp, Florida? -- earlier this month to discuss climate action in a Trump administration. Tech employees spoke out about their refusal to participate in plans to dismantle climate policy and create a "Muslim registry." And California Gov. Jerry Brown said his state will move forward on climate research, even if Trump defunds such efforts at NASA and elsewhere.

Image credits: 1) Flickr/Matt Johnson; 2) Flickr/USFWS-Pacific Region; 3) Flickr/Ryan J. Reilly; 4) @chriskendigphotography, courtesy of Net Impact (press use only); 5) Flickr/Joe Brusky

Silicon Valley Company Promotes "Made In America" Effort

As we wait to see if the incoming administration successfully brings jobs back to America, as promised, one Silicon Valley company has developed a business model that embeds production in the United States to offer a key competitive advantage to clients.

BriteLab, a 10-year-old company formerly known as E Systems, works with startup manufacturers to offer innovative companies the benefit of seasoned OEM experience in bringing products to market.

We spoke to CEO Robert De Neve, who told us BriteLab serves as an integrator of product lifecycle solutions, encompassing functions such as industrial design at the front end through advanced manufacturing in Silicon Valley, and global product support at the back end.

The expertise offered to startups grew from the experience BriteLab’s team gleaned over decades in the semiconductor industry -- an industry in which the U.S. still dominates today and one which, due to Moore's law, means “you have to remake yourself every 18 months,” De Neve said, adding: “We wanted to leverage that experience to help other OEMs.”

The perfect clients for BriteLab, are companies whose products can be described as “high mix/low volume,” De Neve explained. High mix means the products incorporate a lot of high-technology content, a lot of intellectual property (IP), and require a lot of configuration. In other words, they are highly complex and valuable products, typically in a business-to-business environment.

That said, the company also works with clients to build the inverse: “low mix/high volume” consumer products, which De Neve said “is to prove that this can be done in Silicon Valley.”

For example, One-Wheel -- manufacturer of a powered mono-wheeled skateboard-like device, which the company says "was inspired by the feeling of snowboarding on powder" -- worked with BriteLab to develop and build its product.

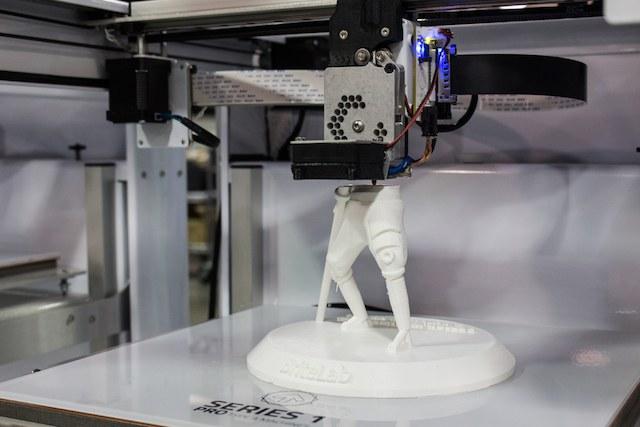

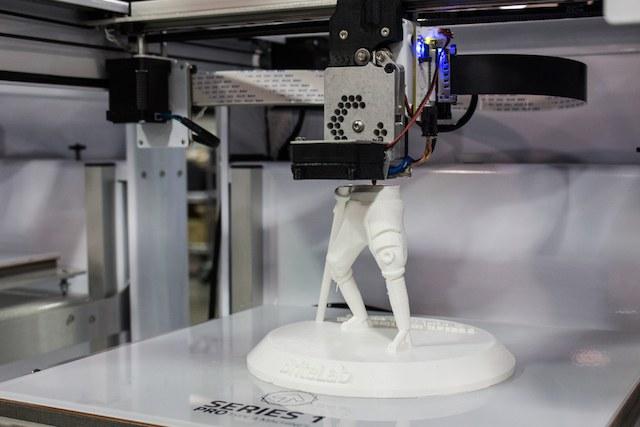

The end-to-end product lifecycle development process all happens in BriteLab’s 55,000-square-foot integrated design and manufacturing center in San Jose, California. There, the company offers six nodes of expertise to their clients: Industrial design, product engineering, rapid prototyping, new product introduction, advanced manufacturing, and global product support.

De Neve explained: “Customers can plug in at any one of these nodes, and we help assess where they are in the product lifecycle.” By way of analogy he added, “We are basically their Sherpa; you can’t climb Everest on your own.” During the relationship, BriteLab provides clients with accelerated product development and IP-safe manufacturing.

There’s a competitive advantage of doing all of this in Silicon Valley rather than offshoring, De Neve explained: “The fresher your IP is, the closer you keep it to your chest,” he said, explaining companies gain value from both having proximity to engineers as well as keeping the supply chain tight; these attributes are lost, or are at least harder to control, when you send manufacturing overseas.

Consequently, it is the business case that drives the value in making products in the U.S. rather than an expressed mission to bring manufacturing back -- though De Neve said, “Personally, as an American, we want to bring it all back.” Indeed, as automation engineers, he said, “Let’s keep it in the U.S. and automate.”

That said, when BriteLab talks to clients, De Neve asserts its team must be agnostic on this point, given their responsibility to do what’s best for their clients and their clients’ shareholders. If it makes sense to produce overseas, they have solutions for that too, with vetted partner factories.

Interestingly though, the founders of some of BriteLab’s clients, including One-Wheel and robot maker Anybots, engaged with the company on the basis that they specifically wanted to build their products in America. And the millennial executives running such companies are sometimes annoyed with their business counterparts from older generations who outsourced everything, De Neve explained.

Because of companies' desire to build in America, De Neve says it sometimes does “bias the problem-solving a little” and indeed it might cost a little more to produce goods in the U.S. But he goes on to say that when he leads tours through the factory and people see “One-Wheel boxes that say ‘designed and built in California’ -- you should see the reaction. They’re getting their money back. If they’re spending an extra dollar a unit, they are getting two or three dollars a unit back in extra sales and recognition from the public.”

De Neve says working with the new generation of business entrepreneurs offers BriteLab the ability to see the future, which indicates the built-in-America momentum has legs. In anticipation, BriteLab plans to build seven of these integration centers around the country where there are high-tech hubs.

Image credit: BriteLab

Trump Keeps Tweeting, Jobs Keep Marching to Mexico

In his efforts to stop U.S. jobs from moving to Mexico, President-elect Donald Trump seems to have come up against the brick wall of the Twitterverse. His tweet-fueled campaign to keep Carrier's Indiana factory running turned out to be a taxpayer bailout. The deal will also support a job-killing automation plan. Now it looks like another batch of 140-character declarations from @realDonaldTrump will not be enough to save 350 jobs at a nearby Rexnord manufacturing facility.

As with Carrier, the Rexnord case illustrates how automation and globalization are driving upheavals in the U.S. labor market of historic proportions.

Rexnord and automation

Rexnord Corp. is a global supplier of parts for transmissions and water systems, among other industrial fittings. Somewhat ironically, one of its main product families consists of parts for conveyor belts, rollers and related systems that boost factory throughput while trimming labor costs.The company began life as the Chain Belt Co. in Wisconsin in 1892. Rexnord is now a wholly-owned subsidiary of the global holding company BTR PLC with almost two dozen facilities all over the world, including the U.S. and Mexico.

For the past 10 years, Rexnord adopted a fast-paced, mergers-and-acquisitions business model. One of the four driving principles of that strategy is creating "an opportunity to innovate faster."

"Mergers and acquisitions (M&A) are a critical part of the Rexnord growth strategy," the company says. "We continually look to expand our portfolio through M&A activities. Our strategy is to build around multiple, global strategic platforms that participate in end-markets with sustainable growth characteristics where we are, or have the opportunity to become, the industry leader."

A growing focus on automation also became evident last year, when Rexnord tapped the senior vice president and chief financial officer of Rockwell Automation Inc., Theodore Crandall, for a seat on its board of directors.

In a press release announcing the new board member, Rexnord made it clear that Crandall will play a key role in the company's future:

Paul W. Jones, Rexnord’s non-executive chairman, stated: “Ted has extensive financial and management experience and possesses the skills and qualities that will make valuable contributions to Rexnord’s long-term growth plans and help drive shareholder value.”

Moving to Mexico

The future already looked dim for Rexnord's Indiana bearings factory about four years ago, when the company demanded -- and received -- wage concessions in return for keeping the doors open.

However, the reprieve was temporary. As reported by USA Today's IndyStar affiliate, last October the company installed security cameras in preparation for what was then a "tentative" move to Monterrey, Mexico.

Plans for the move to Mexico firmed up by November, when the Milwaukee Business Journal reported that the union representing Rexnord workers was unable to meet the company's demands for concessions:

In a Nov. 14 update to members, the United Steelworkers said: "The representatives of Rexnord have told your committee that the cost saving measures offered are not near enough to change the tentative decision to relocate the plant. They informed your committee that we cannot make enough concessions to keep the plant here. The decision to move the plant is now final."

In contrast to the Carrier case, in which Trump became personally involved, there was apparently no communication between Rexnord and the president-elect leading up to the decision.

That could be for any number of reasons, but the fact is that it would have been a lost cause.

As the Milwaukee Business Journal reported, back in May 2015 Rexnord was already firming up plans to trim its U.S. manufacturing footprint by 20 to 25 percent.

At the time, Rexnord President and CEO Todd Adams explained the move in terms of the company's broader business strategy, aimed at a savings of $30 million per year:

“Number one, it’s to enhance our competitive advantage and improve upon our industry-leading service levels, quality and customer satisfaction with no customer disruption.

“Second, it’s to position Rexnord to produce permanently higher returns in whatever economic environment exists and over cycles by reducing our fixed costs and enhancing our free cash flow and being more nimble.”

That emphasis on reducing fixed costs and being more nimble leaves the door open to automation. After all, machines and automated systems can be bought, sold, reconfigured, shipped, and reclaimed for other uses, to a degree that human labor cannot possibly match.

So, by the middle of next year, 300 Indiana factory jobs will evaporate from the U.S. According to Rexnord, the remaining 50 jobs will be relocated to Texas.

A tweet, then silence

President-elect Trump responded to the Nov. 14 announcement about two weeks later, with this widely reported comment on Twitter:

“Rexnord of Indiana is moving to Mexico and rather viciously firing all of its 300 workers. This is happening all over our country. No more!”

The tweet, sent on Dec. 3, provided Rexnord employees with some hope that Trump would cut a deal to save at least some jobs, as he did for Carrier.

While that could have provided at least some short-term relief, such a piecemeal approach is not nearly up to the task of retaining U.S manufacturing jobs, unless Trump intends to provide for significant taxpayer support.

Even with support from the public till, the incoming Trump administration can do little to preserve conventional factory floor jobs. The Carrier episode provided one clear demonstration of how easily a company can manipulate the president-elect to provide financial support for automation.

The Rexnord case also demonstrates that an infusion of public cash does not stem the underlying tide of globalization. The company's Indiana facility received $380,000 in tax abatements over five years to remain in Indianapolis, and local officials are now trying to figure out if they can claw at least some of that back.

Another related example is provided by Whirlpool. The company cut thousands of jobs several years ago and has begun to restore them -- though in much smaller numbers -- by leveraging automation, utility costs and other favorable factors.

As of this writing, President-elect Trump has apparently still not communicated directly with Rexnord or its workers, who are represented by United Steelworkers Local 1999. (The same local, headed up by Chuck Jones, represents Carrier workers.)

By mid-December, Rexnord negotiated a severance package with Local 1999, putting the official seal on the factory closure. Jones had this to say about Trump's involvement:

"I've reached out to him numerous times through the media and said if he's sincere about keeping the jobs here in this country, we'd be grateful to sit down and see if we could get it worked out," Jones said. "We haven't heard nothing. As far as we know, Rexnord and him haven't talked about anything."

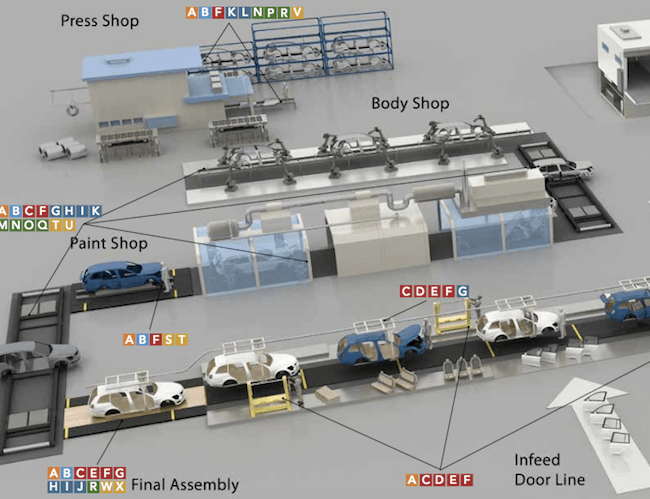

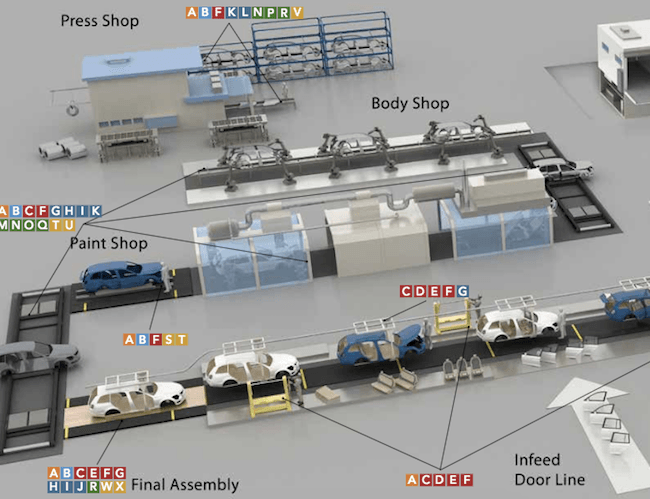

Meanwhile, the Obama administration has been addressing those trends through collaborative advanced manufacturing initiatives that aim to prepare U.S. workers and employers for the next level of manufacturing technology, including robotics as well as 3-D printing and other emerging systems.

Many of those programs are run through the Department of Energy, which Trump has declared should no longer exist.

Perhaps he has a plan to replace those programs. Or, perhaps not.

In the case of Rexnord, it appears the president-elect has decided to rest on his Carrier laurels, and let history run its course.

Image (screenshot, p. 4): via Rexnord Corporation.

Israel, the Detroit of E-Bikes & E-Scooters

Many electric bicycle and scooter companies have come and gone here in the U.S.. The reasons for their fitful success are many: Bicycling, with the exception of a few cities like Portland, Oregon, is often seen as a means of recreation and exercise, not transport; venture capitalists are more enamored of battery storage as it is key to help renewables and electric vehicles (EVs) scale; and, let’s face it, politicians view huge public transportation systems as the Holy Grail of infrastructure projects, not bicycle lanes for vehicles smaller than an automobile.

When many of us want something electric, we aspire for the Tesla; many of us would settle for a Nissan Leaf. Reality often means a Prius. Two-wheelers are not part of this picture.

But visit Tel Aviv and other cities across Israel, and e-bikes and e-scooters are almost as common of a sight as bicycles. At least 72 miles (120 km) of cycling paths stretch across Tel Aviv, both along its stunning beach promenade and within some of the most congested boulevards in the city. And they are used by cyclists and e-cyclists alike: Woe is the clueless visitor who dares to saunter within the dedicated bicycle lane, as a few choice words in Hebrew or English from an e-bike rider or cyclist may be the least of his or her problems.

One reason for these vehicles’ increased popularity is pure necessity. As is the case in any nation that grows by a million people a decade, traffic in any of Israel’s cities can be a nightmare at rush hour, and an accident at any time of day can lead to snarled roads for hours. Real estate is also at a premium in cities, and of course the Holy Land’s millennia of history means an ambitious project can be stalled for years upon an archeological find. With the high cost of living and limited space, a small vehicle can offer a speedy way to the office while avoiding the headaches involved with parking.

One example is RoadIX, a startup that works out of Capital Nature, a tech incubator located in Kibbutz Yotvata in the Arava Desert. This kibbutz was founded in the late 1950s as a dairy. But as with many of these communities, Kibbutz Yotvata diversified its holdings over the years. One of them now includes this hub that is home to a dozen companies, including the manufacturer of the MUV-e.

RoadIX’s MUV-e is a “three-wheel electric personal vehicle” that the company insists is a model for future transportation.

Resembling something halfway between a Segway and a skateboard, the sleek MUV-e can travel up to 25 miles (40 km) on a single charge; it's a light 33 pounds (15 kilos); and it can fold in as quickly as three seconds.

The company has ambitions to become the next bike-sharing program, as it views this option as the most sustainable way to move people around congested cities. (The MUV-e, however, would have stiff competition from Tel Aviv’s popular bicycle sharing program.) In an ideal world, this scooter is perfect for those who already take a bus or subway for much of their daily commute, but need an option for those last several blocks that take them to the office.

Testing the MUV-e, in one word, was a hoot. The trick is for the commuter to know his or her core well, as one needs to shift his weight slightly in order to turn left or right. But after a few fits and starts, the MUV-e was easy to use and could fly.

Whether or not it can succeed on the streets of Manhattan or the hills of San Francisco, however, is another story. The company now has a waiting list for those interested in purchasing a MUV-e, which is priced at approximately $2,000.

For now, the Israeli e-bike and e-scooter scene is akin to Detroit’s auto industry before World War II, as it is still relatively fragmented.

Companies such as EBMAX (a common sight in Tel Aviv), INU, Blitz Motors (really an e-motorcycle) and Zooz are just a few examples of the companies trying to win over Israel and the rest of the world. They face challenges, not the least of which is consumer acceptance. Nevertheless, Israel has become the leading test lab of this new form of transport, which can offer an efficient and cost-effective alternative.

But cities will have to sort out how to integrate and regulate these vehicles into their overall plan – recent backlash against accidents involving these vehicles spurred Tel Aviv authorities to fine e-cyclists $70 if they are caught on sidewalks instead of the city’s dedicated bicycle paths.

Image credit: Shani Sadicario

Editor’s note: Vibe Israel is funding Leon Kaye’s trip. Neither the author nor TriplePundit were required to write about the experience.

Capital One and Mayim Bialik Team Up to Teach Middle Schoolers to Code

Technology is changing how we raise our kids, how we operate in the workplace, and how we manage our social lives. And while it helps many of us to be more productive, it threatens to leave many behind.

A recent analysis of 26 million job postings found that nearly half of all American jobs in the top quartile in pay require some coding skills. Unfortunately, with gaps in STEM (science, technology, engineering and math) education across the country, opportunity is out of reach for many.

In response, Capital One has made it a corporate mission to give students from all backgrounds, in all corners of America, an opportunity to learn and “get ahead” in the digital world.

Collaborating with educational institutions nationwide, the Capital One C1 Coders Program, part of the company’s Future Edge initiative, is helping students form a greater interest in the STEM fields during a critical developmental period: in sixth, seventh and eighth grades. The Future Edge Initiative dedicated $150 million to help Americans gain the digital skills they need in the 21st century. And the C1 Coders Program in particular is a hands-on, employee volunteer-led approach to giving young people the ability to prepare for tomorrow today.

For the past 10 weeks, 1,000 students across the country learned about software engineering and developed their own unique apps using MIT University’s App 2 Inventor. In effort to help its latest Fairfax County Public School cohort develop an even greater interest in the STEM fields, Capital One hosted a final presentation at its headquarters in McLean, Virginia, last week -- featuring a surprise presentation from neuroscientist and actress Mayim Bialik, star of "Blossom" and "Big Bang Theory."

I had the opportunity to speak with Bialik and Jen Manry, VP of technology at Capital One, to learn why this age is critical to STEM immersion and why C1’s program is unique in this space.

Bialik is personally involved in the C1 Coders Program because, as she said: “I not only play a scientist on TV, I’m one in real life as well. I have a PhD in Neuroscience from UCLA and I actually learned to code in college, but I do wish I would’ve learned it earlier.”

Obviously, Capital One is onto something in teaching digital skills to middle-schoolers while they’re impressionable. Bialik confesses that she never appreciated science until the age of 15, when she connected with a female biology mentor on the set of "Blossom." “I came late to the science world. But part of what I do in my spare time when I’m not acting is to do STEM advocacy and put a positive face, particularly a female face, on the field.”

The C1 Coders Program is now active in 20 schools across the country. Manry says Capital One is passionate about giving back to the communities in which it operates, and where its employees live and work. “We’re giving [students] great tutors and mentors … and a way to develop not only their technical skills but how they problem-solve and think together."

By educating the middle-schoolers in group work, Capital One is also emphasizing the soft skills that future jobs will require of them. “They’re going to have to have not only the technical skills to fulfill these roles that are coming into the future, but they also have to be really adept at working as a team and problem solving as a unit,” Manry said.

Bialik and Manry are also both mothers who believe STEM education should start at home, at a very young age, rather than be a skillset which needs “immersion” in a classroom or formal setting. “Being a parent is such a gift because, whether you’re a scientist or not, you get a [child’s] brain and it’s full of questions and is really so receptive to anything you could teach them,” Bialik told us.

At the graduation, Fairfax County Public School students demonstrated the apps they created during the Capital One C1 Coders Program, and competed for prizes in four categories: Best Application, Most User Friendly, Most Creative and Most Technical Application. Since its inception in 2014, over 2,500 students have participated and created 500 different mobile apps.

Bialik is also an author on attachment parenting and an advocate for gender equality in education. She closed our conversation by saying: “The curiosity of how a bridge works or how an apple falls from a tree is the same whether you’re a boy or girl. There’s no difference in the brain and how to understand that or think that that’s amazing.”

Images: Capital One

6 Disruptive Changes That Rocked 2016 and Will Shape Your Future

Has there been a year during the 21st century where disruptive changes are so poised to define our future? Donald Trump’s election appears to be the year’s obvious mega disruptive change. But it is actually just the tip the iceberg.

During 2016, six disruptive changes achieved critical mass. Any one of them has the power to forever change our country. The synergy of all six will shape your future, our economy and the environment.

These six disruptive changes are:

1. America divided over its past and future

Research is emerging that points to Election 2016 as being a vote for the 20th century versus a vote for the 21st century. It appears that those who voted for Trump were seeking a restoration of the past. Those who did not vote for Trump were seeking to realize a future very different from that past.This research explains for me why “Make America Great Again” was such an engaging slogan. In this slogan, Heartland America found hope. It was a hope of restored jobs. It was hope for a renewal of their values and faith that they saw as core to what America stands for. This slogan captured a back to the future.

Equally important, this research points to half of America being perplexed by “Make America Great Again.” For these Americans, the future was the promise. This promise is built on smart and clean technologies creating an economy that delivered sustainable jobs and societal/environmental solutions. This future embraces diversity. The future for half of America was a world coming together to solve big problems in a way that enables economic progress, increased human health and environmental sustainability.

In Election 2016, the “past” won the electoral college but lost the popular vote. Whether this election is a lasting victory, or a last gasp, is the question 2016 leaves us.

2. Social media "fake news" goes mainstream

'Fake news' is the promotion of unsubstantiated claims to make an emotional connection. Fake news was not invented in 2016. But it could be argued that this year it gained critical mass.

A BuzzFeed News analysis found that “in the final three months of the U.S. presidential campaign, the top-performing fake election news stories on Facebook generated more engagement than the top stories from major news outlets such as the New York Times, Washington Post, Huffington Post, NBC News, and others.”

Placing this 2016 disruptive change in perspective, before there was fake news there was the early 20th century’s yellow press or jingoism. The 20th century’s age of yellow press was followed by a global trade war instigated by the U.S. that sparked the Great Depression. Within 10 years of the Great Depression, the world was at war.

3. Hacking warfare 3.0

Hacking warfare 1.0 was a pursuit by hackers seeking to steal money. Hacking warfare 2.0 was a pursuit by government agents to steal technological proprietary information. Hacking warfare 3.0 is a pursuit of regime change by an outside government.

It now appears Russia successfully implemented hacking warfare 3.0 by influencing Election 2016. The relevancy of Russian hacking is not only tied to who was elected president. That perspective fails to appreciate the cyber warfare precedent and the conflicted American reaction.

Hacking warfare 3.0 raises the question of whether hacking is now part of our culture, like advertising. Have the lessons learned this year on how to implement hacking warfare 3.0 opened the door to foreign companies who seek to undermine the legitimacy of an American business competitor?

4. Global warming is here

In 2016, global warming passed key milestones. 2016 is the hottest in recorded history. And this year the world permanently passed the 400 ppm CO2 concentration level.

Arctic ice is melting at an unprecedented level. The American Meteorological Society concluded that the major heat-related weather events of 2015 where all magnified from global warming. The 2016 evidence is conclusive, except among climate deniers, that global warming is here and our climate will never be the same.

5. Smart and clean tech wins on economics

The fundamental premise of the Green Economic Revolution is that the world will become smarter and cleaner because these solutions cost less. 2016 saw the emergence of an enabling technology called prediction that will accelerate the adoption of the Green Economic Revolution.

Prediction software uses mass accumulation and assimilation of data to create machine learning -- think: Iron Man’s J.A.R.I.S. (Just A Rather Very Intelligent System). The more data gathered, the smarter, cleaner and cheaper that technology can become.

The autonomous car was the poster child for prediction in 2016. All those millions of miles that Google and Uber autonomous cars accumulated in 2016 are the foundation for enabling a future trillion sensor Internet of Things. We will look back at 2016 to see the start of a new economy that uses artificial intelligence to do things cheaper, better and with less environmental impact.

6. Our weight is killing and bankrupting us

In 2016, the U.S. Centers for Disease Control and Prevention documented that we are in a national weight crisis. Our weight has created an obesity and diabetes epidemic. The cost of weight threatens to bankrupt our healthcare system.

2016 also saw incremental improvement in awareness and actions to address our weight crisis. But like in politics, America is divided in its response. 2016 raised the question of whether the boomer generation will embrace a healthier future or face a painful and costly death from a love of 20th century convenience food.

Image credit: Pexels

CSR in 2016: Who Was Naughty and Who Was Nice

By Dale Wannen

With the close of 2016 approaching, it’s that time again where we can sit back and think about what an “interesting” year it has been. In fact, just the news of Brexit and the rather surprising election results would have been plenty to sit and ponder over some spiked egg nog. But if you still have an appetite, check out our naughty and nice corporate scandals to bring lively conversation to the holiday party.

Naughty

1. We all can’t stand paying that $3 ATM fee. But imagine paying fees on an account you didn't even sign up for. Wells Fargo was caught opening over 1.5 million accounts that were not authorized. Wells also fired 5,300 employees related to the shady behavior. Since the scandal, CEO John Stumpf (who agreed to not receive the $41 million in unvested options — thanks!) has stepped down from both the CEO role and chairman of the board. New customer checking account openings plunged 41 percent in November compared with last year. Note that Wells has stated the CEO can no longer also be the chairman of the board, clearly a rule that could have helped the company avoid this mess.2. Increasing the price of a service or good by over 600 percent would generally cause the buyer to simply stop buying. But when the convoluted world of pharmaceuticals is involved, it seems to be the norm. Enter the Epipen and Mylan Pharmaceutical CEO Heather Bresch. As Bresch spiked the cost of the EpiPen, which is used to help children who experience allergic reactions, her own compensation increased 671 percent -- from about $2.5 million in 2007, to some $18.9 million in 2015. Mylan agreed to fork over $465 million to make up for years of underpaid Medicaid rebates on the product. The company is also in the midst of laying off about 10 percent of its workforce.

3. Got a friend at JPMorgan? JPMorgan Chase & Co. will pay $264 million to the U.S. government to settle allegations that it hired the children and relatives of influential Chinese policymakers in the hope of winning their business. The settlement follows a three-year investigation. The practice of giving the children of China's ruling class plum jobs was so common that the bank had a formal program known as "Sons and Daughters." The program included spreadsheets that tracked how often the hires turned into business deals. Somehow CEO Jamie Dimon still has a job and is now a member of President-elect Donald Trump’s economic advisory team.

4. The big pharmas sure know how to pay themselves. This final spot goes to Leonard Schleifer of Regeneron Pharmaceuticals. He netted about $47 million, up from $42 million last year. To put that in perspective: With a five-day, 40-hour work week, Schleifer would make more than $22,800 an hour; $182,000 a day; and $910,000 a week. As of Dec. 19, the stock’s year-to-date performance was negative 30 percent. Yes, that’s negative. Something tells me that Regeneron’s compensation package needs some tweaking.

Nice

1. We have all heard of the evil oil-congested Carbon Underground 200, but what about the good guys? Nonprofits As You Sow and Corporate Knights came up with the flipside version called the Clean 200. And the winner is Toyota! Companies eligible for the Clean 200 must have a market capitalization of at least $1 billion and derive at least 10 percent of their revenue from clean energy as defined by Bloomberg New Energy Finance (BNEF). Second to Toyota was Siemens, while Johnson Controls came in third.2. Patagonia donates all Black Friday profits to environmental charities. Can you top that!? The apparel company donated $10 million in Black Friday sales to charity. Instead of donating to just one charity, however, Patagonia will give money to "hundreds of grassroots environmental organizations." The activewear company only projected $2 million in sales and said it was "humbled" by the final figure. Patagonia is not a publicly-traded stock. Shucks.

3. Take that United States! At 648 megawatts, India and the Adani Group have opened the largest solar plant in the world. The plant will power 150,000 homes and is a step closer to making the country fully sustainable. Facing a growing population, India’s goal is to produce 40 percent of its energy through renewable resources by 2030. The world's second largest solar plant, the Topaz Solar Farm in San Luis Obispo County, California, has a capacity of 550 megawatts. Do I sense a little friendly alternative energy competition to build the first 1,000-megawatt station?

4. How about a positive note for the big pharmas? Fortune Magazine unveiled its 2016 “Change the World” roster of 50 companies which focused on social and environmental challenges. Topping the list is pharma firm GlaxoSmithKline, which bases drug prices on income levels in the countries where it operates and reinvests 20 percent of any profits it makes in the least developed countries into training health workers and building medical infrastructure. On top of this, its CEO made a fraction of what the aforementioned drug-pushing CEOs made.

Image credit: Flickr/Mobilus In Mobili

Dale Wannen is President of Sustainvest Asset Management, an investment advisory firm focused on sustainable and responsible investing (SRI).