Tracking reward matters in interesting times

3p Weekend: Are Boycotts the New Normal?

The first weeks of the Donald Trump administration were tumultuous at best. But among the policy disputes, we're noticing another curious trend: boycotts galore.

Don't get your coffee at Starbuck's; they hate veterans. Don't shop at Nordstrom; they want to keep a working woman down. Don't drink Yuengling; those guys love Trump.

Meanwhile, the organized #GrabYourWallet campaign encourages shoppers to avoid purchasing an array of products with ties to Trump and his family members.

Boycotts, of course, are not a new phenomenon. They've been employed to great success over the years, such as the divestment movement partially credited with ending apartheid in South Africa. But the scope and pace with which we're seeing companies tossed to the side made us sit up and take notice.

In most cases, it's difficult to tell how effective these boycotts really are. TriplePundit hopes to speak to some of these companies over the next few weeks to learn more, but here's what we know right now: In the age of Trump, companies better watch where they step -- or risk squishing into a political dogpile.

Nordstrom

Last week, department chain Nordstrom did the unthinkable: It decided to stop selling first daughter Ivanka Trump's clothing and shoe collections. I know, this is really serious stuff you guys.

The chain said the decision was not political, instead citing the label's falling sales. But that didn't stop Trump from tweeting his displeasure, writing: "My daughter Ivanka has been treated so unfairly by @Nordstrom." Press secretary Sean Spicer quickly backed him up. For some reason, Trump counselor Kellyanne Conway also felt the need to get involved. And some questioned whether her call to "buy Ivanka's stuff" crossed legal and ethical boundaries.

But ethics aside, some Americans won't be seen with those metallic Nordstrom shopping bags any time soon. Calls for a boycott grew almost immediately, with some on social media tapping a favorite Trump buzzword and saying the chain is "failing." It turns out the opposite is true. In the two days following Trump's tweet, Nordstrom stock rose 7 percent and the company made $115 million, Forbes reports.

Starbucks

In the wake of Trump's controversial ban on travelers from seven majority-Muslim countries, Starbucks CEO Howard Schultz denounced the executive order and promised to hire 10,000 refugees over five years. 3p's Grant Whittington reports:

"It wasn’t long before the hashtag #BoycottStarbucks started trending on Twitter. The bulk of the tweets complained that Starbucks plans to favor hiring refugees when Americans remain out of work. Critics also questioned why Starbucks launched an initiative supporting refugees but not one supporting veterans."

It turns out that last claim is largely bogus, which Starbucks quickly reminded customers on Twitter:

"We the #veterans of Starbucks would like to set the record straight."

—A letter from Starbucks Armed Forces Network https://t.co/1UPs6Djz0b

— Starbucks Coffee (@Starbucks) February 2, 2017

Starbucks, of course, is no stranger to boycotts. They're basically a holiday tradition.

Budweiser

https://youtu.be/7ZmlRtpzwos

Budweiser's seemingly pro-immigration advertisement made a splash on Super Bowl Sunday. But the boycott backlash actually began days before the big game, after details about the ad were published online.

The ad depicts Budweiser’s German founder Adolphus Busch's immigration story. In most political climates, it would be fairly innocuous. But in the boycott bonanza, almost anything can land you on the hit list.

The hashtag #BoycottBudweiser quickly rose to 'trending' status on Twitter after the ad ran. And humorously, another hashtag containing a misspelling -- #BoycottBudwiser -- was also trending during the big game.

Airbnb

https://youtu.be/yetFk7QoSck

Airbnb was quick to respond to Trump's controversial travel ban. CEO Brian Chesky denounced the move on Twitter and pledged to offer free housing to those affected. Days later, the home-sharing service upped the ante with a pledge to provide short-term housing to 100,000 people over the next five years.

But it was the company's Super Bowl spot that landed it in hot water with the boycott crew. Some on social media perceived the #WeAccept ad as "un-American" and pledged to boycott Airbnb.

Kellogg

This week Kellogg announced it would shutter 39 distribution centers across the country and lay off around 1,100 people. Over a thousand Americans losing their jobs should, by almost all accounts, be sad news. But the controversial alt-right publication Breitbart News seemed to celebrate the announcement. Why? Because they claim their boycott caused it.

Okay, let's rewind for a second: Back in December, Kellogg was surprised to learn its ads were appearing on Breitbart through an automatic platform. The company made a public statement saying it would no longer advertise on the site. Breitbart publishers were furious and launched the #DumpKelloggs boycott campaign.

"Kellogg’s stock saw a decline and its brand perception online took a deep negative nosedive last year following the cereal maker’s politically-driven attack on Breitbart News," the site claimed this week when reporting the layoffs.

Whether Breitbart's boycott is to blame for Kellogg's financial woes remains uncertain. But it surely seems out of character for a publication with ties to a chief White House strategist to celebrate a loss of American jobs in any context.

Coca-Cola

https://youtu.be/LhP5sDUnF6c

Coca-Cola also found itself on the wrong side of the boycott bandwagon on Super Bowl Sunday with an ad featuring the lyrics to “America the Beautiful" in eight languages. 3p contributor Jo Piazza reports:

"What should have been a celebration of American diversity triggered a knee-jerk reaction from some of the very worst Internet trolls and a viral #BoycottCoke campaign which appeared seconds after the ad aired."

If the ad looks familiar, that's probably because it is. Coca-Cola first aired the spot back in 2014, and it faced boycotts then, too.

Uber

In the days after Trump's travel ban went into effect, chaos erupted at airports across the country. Refugees, green card holders and visa carriers were reportedly detained, and lawyers and protesters quickly showed up to call for their release.

The New York Taxi Workers Alliance suspended pick-ups from JFK Airport for an hour to protest the travel ban. And an ill-timed tweet from Uber quickly brought it into the fray.

Surge pricing has been turned off at #JFK Airport. This may result in longer wait times. Please be patient.

— Uber NYC (@Uber_NYC) January 29, 2017

The tweet was interpreted as being in defiance of the strike. And it wasn't long before #DeleteUber began trending on Twitter. Meanwhile the company's main competitor, Lyft, enjoyed some time in the spotlight for its speedy reaction to the ban. (The company quickly assailed the order in a blog post and pledged to donate $1 million to the American Civil Liberties Union.)

Uber denies it was ever trying to break the strike. CEO Travis Kalanick then vacated a position on one of Trump's advisory councils and implored customers to re-install the app. But for many, it was too late.

Netflix

https://youtu.be/1LzggK5DRBA

Netflix released a trailer for its new series "Dear White People" this week. And some were none too pleased.

A cross-section of social media commentators called the series "anti-white" and began tweeting with the hashtag #NoNetflix, encouraging others to cancel their video-streaming subscriptions.

Justin Simien, who created the Sundance film that inspired the show, was quick to respond to the kerfuffle -- but maybe not in a way boycotters would like.

"For me, it was really profound, encouraging in a weird way," Simien told ET on Thursday. "It just brought more attention to the series. Thanks, white supremacists, you really helped me promote my show."

Yuengling

Readers outside the American Northeast may have never heard of Yuengling. But the beer label, which claims the title of "America's oldest brewery," is beloved in the region for its flagship lager. The company's ads often proclaim that in Pennsylvania, "If you ask for a lager, you get a Yuengling." And it's true.

But some lager-lovers were left with a bad taste in their mouth in the days leading up to the presidential election. Richard “Dick” Yuengling Jr., the fifth-generation owner of the family business, publicly endorsed Donald Trump in October.

It wasn't long before customers took to social media in outrage. Some self-proclaimed "lifelong" Yuengling drinkers vowed to never touch the stuff again.

Since Yuengling is a private company, it's tough to tell how the incident affected its business. But the fire seems to have died down on social media. And if you trust anecdotal evidence: I've seen plenty of folks slugging 'lager' in and around Philadelphia, even amidst frequent anti-Trump protests.

Do you work for one of these companies? We want to hear from you! Send your boycott stories to [email protected].

Image credit: Flickr/Can Pac Swire

NRDC: Trump's 2-for-1 Regulation Order is an 'Abuse of Discretion'

On Jan. 30, President Donald Trump signed an executive order that would significantly change how regulations are passed. And some are calling it executive overreach.

In a new lawsuit, a group of nonprofits say President Trump’s "two-for-one" executive order is “arbitrary, capricious [and] an abuse of discretion.”

The suit was filed by the Natural Resources Defense Council, Public Citizen Litigation Group and Communication Workers of America. They argue the order actually jeopardizes public safety, rather than creating efficient, well thought-out laws.

“The executive order makes it harder to protect the public by erecting barriers to the issuance of new regulations and by creating incentives to repeal existing regulations, even if they are continuing to safeguard the public,” NRDC said in a written statement this week.

The plaintiffs also point out that the order requires agencies to maintain a net-zero cost ratio; in other words, they must guarantee the regulations they repeal result in a cost savings that would “cancel out” the cost of the new regulation put in place.

“President Trump’s order would deny Americans the basic protections they rightly expect,” NRDC President Rhea Suh said on Wednesday. “New efforts to stop pollution don’t automatically make old ones unnecessary. When you make policy by tweet, it yields irrational rules.”

Suh pointed to lingering questions around how the Environmental Protection Agency can effectively protect public safety under the new rule. “This order imposes a false choice between clean air, clean water, safe food and other environmental safeguards.”

After the rule was announced, the Office of Management and Budget attempted to add further guidance about how the executive order is supposed to work. The OMB pointed out that it is only meant to be temporary, like most directives the administration has implemented. The agency also outlined a Q&A for departments and agencies that may be confused as to how they can easily strike down two regs and enact a third with a net-zero cost.

The Regulatory Affairs Professional Society (RAPS) built upon this helpful bit of information by noting that the Food and Drug Administration has a list of regulations that may have attracted Trump's attention when he announced plans to cut federal regulations "by 75 percent." And, RAPS noted, the OMB guidance now offers some ways that agencies like the FDA can waive the requirements of the order.

Still, there's no guarantee the Trump administration will win this lawsuit, wrote C. Ryan Barber, a reporter for the National Law Journal.

“Judges do push back,” he insisted. The Obama administration, secure in its approach when it came to immigration, “was stopped in its tracks.” Obama’s Clean Power Plan and the Affordable Care Act both resulted in lengthy court cases, with different outcomes to date (the Clean Power Plan received an injunction, but is still in litigation).

“For Trump, pulling off his 2-for-1 Executive Order might require the wholesale repeal of legislation that drove regulations in the first place. Success on that front is not a certainty,” Barber wrote.

And then there is Trump’s increasingly fractious relationship with the judicial branch. He has repeatedly questioned the authority of judges overseeing cases he has a vested interest in. His most recent tweet criticizing the appeals court judges who are reviewing his travel ban for seven primarily Muslim countries has garnered top headlines -- again. But it has also elicited a rare comment from his own Supreme Court pick, Neil Gorsuch, who summed up Trump’s critiques as “demoralizing.”

Trump is obviously driven to break the mold when it comes to convention, both in business and politics. But will it yield the results he needs to meet his campaign promises and more importantly, to ensure government policies protect the resources that businesses and communities rely upon?

The outcome of this latest lawsuit may offer the clearest indication of whether the Trump administration’s strategy will truly “cut government” and improve support for small and large businesses in years to come. With more than 50 suits lodged against the White House in less than 30 days, reducing the cost of regulatory oversight may not be the only fiscal challenge that the federal government will now have to tackle.

Image credit: Flickr/Michael Vadon

Trump Administration Poised to Rescind SEC Conflict Minerals Rule

President Donald Trump may be poised to order the Securities and Exchange Commission to suspend a 2010 rule requiring companies to disclose whether they use conflict minerals. That's according to an apparent leaked draft of a presidential directive obtained earlier this week by The Intercept.

Publications including Reuters could not verify the authenticity of the document. But sources the news agency contacted said the Trump administration is prepared to instruct the SEC to suspend the rule for two years.

The rule, which is often known as Section 1502 of the 2010 Dodd-Frank Act, instructs companies that report to the SEC to share information about their procurement of metals and minerals including tantalum, tin, gold or tungsten. Such disclosure is mandatory if those materials are “necessary to the functionality or production” of a product contracted for, or manufactured by, a company.

The rule was designed to discourage companies from buying these materials from countries notorious for human rights violations, including the Democratic Republic of the Congo.

NGOs and human rights activists often hailed the rule as a way for companies to source raw materials more sustainably and responsibly. But the U.S. Chamber of Commerce and National Association of Manufacturers filed a lawsuit in federal court to stop the legislation.

Most of the regulations were upheld after a 2015 ruling, though companies no longer have to designate products as “not been found to be DRC conflict free” due to that federal court’s interpretation of the First Amendment. But according to Global Witness, an NGO that has long campaigned against corruption and human rights abuses in central Africa, the vast majority of the companies subjected to Dodd-Frank disclosures are not meeting the minimum requirements of the law.

The leaked document was released days before Trump met with Intel CEO Brian Krzanich, who later announced the company will build a $7 billion plant in Arizona that would employ as many as 3,000 workers. To some, such as Slate writer Jordan Weissmann points out, the meeting is part of a new corporate strategy to credit Trump with investment in jobs, whether or not the White House had anything to do with new plant openings or hiring.

Intel is one of many large technology companies that lobbied Congress while Dodd-Frank was debated before its 2010 passage. After Dodd-Frank become law, Intel pledged to ensure that its supply chain is “conflict free,” although investigations of Congo’s metal industry found that conditions in Congo have at the most only improved slightly.

Meanwhile, industry groups keep complaining that the cost of compliance is far too high.

The proposed suspension of Section 1502 should come as no surprise considering Trump’s rhetoric during the presidential campaign. While the legislation was passed as a response to the 2008-2009 global financial meltdown, Trump is on the record saying he wants to “do a big number” on Dodd-Frank -- claiming it makes it nearly impossible for small- and medium-sized businesses, including his “friends,” to access credit.

But other analysts say that while smaller banks have struggled due to the more restrictive rules on issuing mortgages and commercial loans, such legislation was necessary to prevent the excesses that led to the near collapse of the U.S. financial sector.

Finally, while the implementation of Section 1502 has been far from perfect, it at a minimum raised awareness of the corruption and environmental disaster resulting from the conflict minerals trade. And that ground gained may now be at risk.

Image credit: ENOUGH Project/Flickr

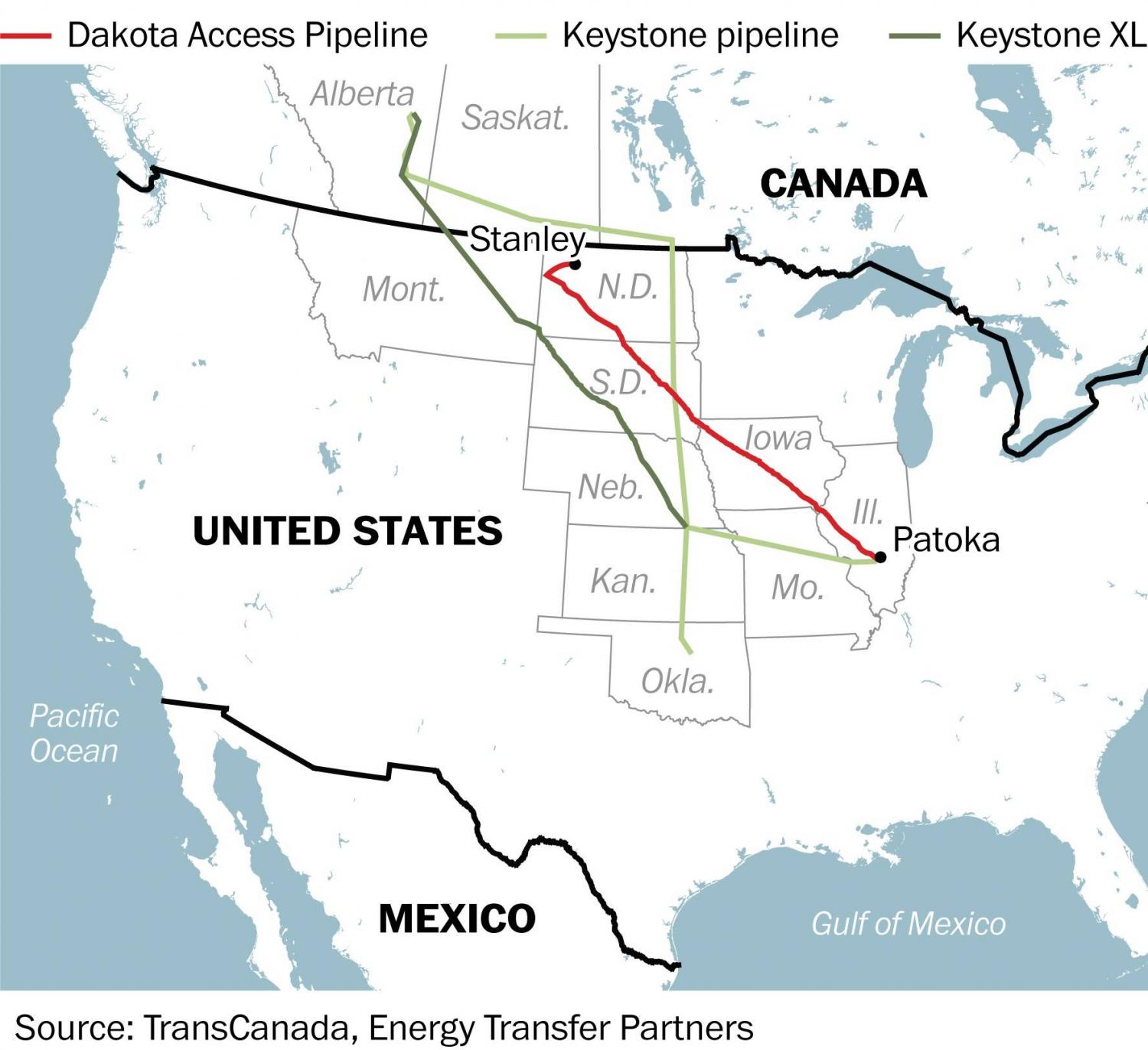

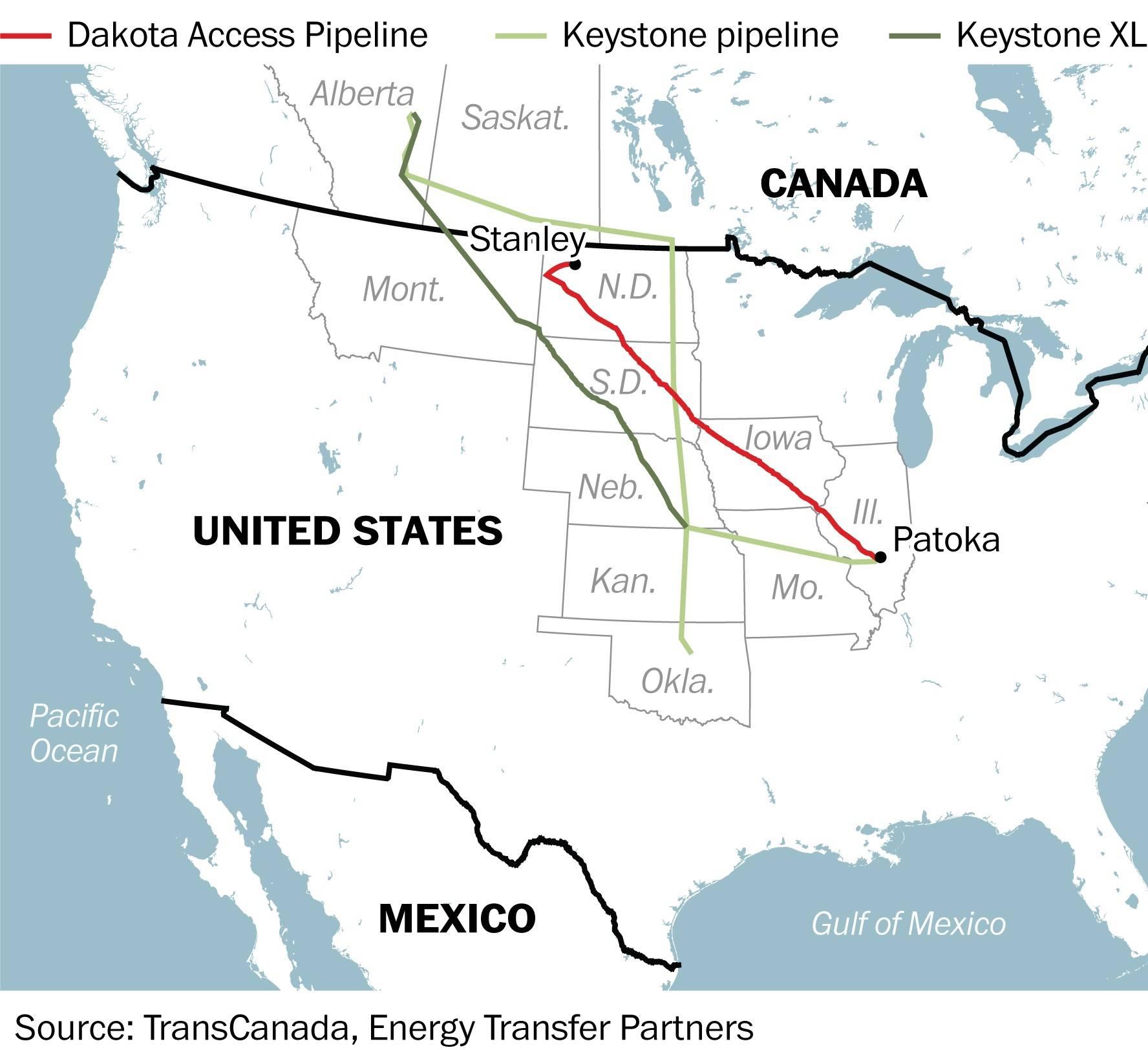

Dakota Access Pipeline Developers Linked to 69 Spills in Two Years

In the past two years, the companies responsible for heading the Dakota Access Pipeline reported 69 incidents accounting for nearly 550,000 gallons of oil spilled. Thirty-five of the incidents -- or 51 percent -- were pipeline related, according to a report from a Louisiana nonprofit.

The report, compiled by the Louisiana Bucket Brigade, a health organization promoting the safety and importance of the environment, used data filed with the National Response Center to complete the investigation. The 15-year-old nonprofit primarily serves 'fenceline communities' -- those near a dump, refinery or chemical plant.

The 69 incidents the Brigade cataloged spanned 14 states, though Texas stood out with a whopping 32 incidents.

The main company spearheading the $3.78 billion project that would connect crude oil transportation services from northwest North Dakota to Illinois is Energy Transfer Partners (ETP), along with some Sunoco subsidiaries. The construction of the Dakota Access Pipeline made headlines for months thanks to protests over environmental and wildlife concerns from environmentalists and Native Americans.

The Standing Rock Sioux Tribe, the most vocal and prominent group to protest construction, says the further development of the pipeline will jeopardize the safety of their drinking water. And the Louisiana Bucket Brigade suggests the tribe has a point.

According to their report, ETP’s oil spills polluted four rivers in four states -- Pennsylvania, New Jersey, Louisiana and Texas -- over the last 24 months. The water was a drinking source in 3 of the 4 rivers polluted, “Thereby confirming the concerns of the Standing Rock Sioux who fear the Dakota Access Pipeline would pollute the Missouri River,” the Brigade concluded.

President Donald Trump gave the U.S. Army Corps of Engineers the green light to resume construction of the pipeline on Jan. 24. ETP immediately started building, company spokeswoman Vicki Granado told the Hill. Of a total 1,134 miles, only 1.5 remain -- which involve drilling under Lake Oahe in North Dakota.

The project saw its fair share of challenges following mass protests over environmental concerns and the eventual hesitation of the Obama administration, which sought to investigate alternative routes so as not to affect the Standing Rock Sioux.

The U.S. Army Corps of Engineers said in early December it would undertake a comprehensive environmental review of the drilling under Lake Oahe. Trump, quick to reverse his predecessor's pause, asked for an expedited report and told the Corps it was okay for ETP to resume construction.

Following the start of construction underneath Lake Oahe, the pipeline could be operational in just 60 to 80 days, the Washington Post reported.

For the Native Americans in North Dakota, they just want to be assured their drinking water will remain pure and plentiful. The Standing Rock Sioux rely solely on Lake Oahe and the Missouri River for their water source and would have to find alternative means if the water is contaminated with oil leaking through the pipes.

ETP, a company guilty of a shocking number of incidents including oil, natural gas and gasoline spills, must build carefully.

Image credit: Flickr/Fibonacci Blue

UPS to Boost Onsite Solar By 500 Percent This Year

This week UPS announced it will invest $18 million in onsite solar installations, beginning with eight of its U.S. facilities.

The logistics giant plans to add 10 megawatts of solar capacity by the end of this year -- increasing its onsite production by 500 percent in mere months.

Should the price of solar power continue to decrease, UPS has even more opportunities to mitigate its carbon footprint. The company claims 2,600 facilities worldwide.

The company’s first investment in solar was a 110-kilowatt array in Palm Springs, California. But its growth in solar has been slow; to date the company can point to solar arrays at three New Jersey locations.

To be fair, so far UPS primarily focused its efforts on making facilities more energy efficient, with an emphasis on green building standards such LEED (and BREEM in Europe), Energy Star certification and an upgrading of light fixtures to LED technology.

Although UPS says this year's investment will result in the purchase of 26,00 solar panels, one FedEx solar installation in New Jersey alone has over 12,000 panels.

Over the past decade, UPS’ main sustainability push centered around making its fleet of cargo planes and vehicles more efficient. The data the company provided in its latest sustainability report suggests those efforts have been widely successful.

For shipments transported by its air fleet, UPS has seen energy intensity decline by over 9 percent. For small packages dispersed on the ground, that energy intensity decreased by over 15 percent. When including all of the freight that the company transported in 2015, its overall carbon intensity fell by 14.5 percent.

Meanwhile, UPS continues to add more vehicles running on alternative fuels to power its massive ground fleet. The company has increased its purchase of renewable diesel and renewable natural gas, and has also worked with partners to use more bio-methane for its natural gas-powered trucks.

And as anyone in a U.S. city can verify, more electric trucks, vans and even tricycles are used for UPS routes that are less than 60 miles. The company’s acquisition of Coyote Logistics in 2015 will further increase its overall efficiency as more of its vehicles will reduce their miles driven without hauling any freight.

Nevertheless, UPS’ huge presence on the ground across the U.S. gives the company an opportunity to burnish its energy-efficiency credentials with renewables, especially as online shipping continues to surge in popularity and as the company opens more hubs, distribution centers and warehouses. All of that rooftop space offers an incentive to find ways to drive electricity costs down through solar, a step long taken by retailers including Ikea and Walmart – the latter of which produces more power than at least 35 U.S. states.

Image credit: UPS

With Famine On the Horizon, U.N. Aims to Fund Yemen

The United Nations and its partners are seeking funds to mitigate the hunger and malnutrition in Yemen amidst one of the worst humanitarian crises in the world.

The U.N. World Food Program, the largest hunger-fighting agency in the world, reports that nearly 14.4 million people in Yemen are now food insecure. Of that number, more than 7 million people -- or about 1 in every 5 -- are in desperate need of food assistance.

The U.N. is trying to answer the call by issuing an appeal north of $2 billion -- which, if fulfilled, would mark the largest humanitarian contribution to Yemen. The U.N. has persistently warned that ignoring the crisis in Yemen could lead to famine and further exacerbate starvation and lack of resources.

The humanitarian appeal looks to provide 12 million Yemeni people with life-saving assistance this year.

Yemen’s rank as one of the poorest Arab countries has been exacerbated by civil war and strategic blockades limiting resources. The conflict erupted full-steam in March 2015 when Abdrabbuh Mansour Hadi was uprooted from his presidential palace by Houthi rebels.

The tensions began in 2011, when a political uprising forced Ali Abdullah Saleh, the country’s longtime authoritarian leader, to transfer power to Hadi. The Houthis, a Zaidi Shia-led group that formerly called for the resignation of Saleh, joined teams with the former president and is now using his military influence to fight Hadi and his expelled government.

The conflict, now nearing its second anniversary, has no end in sight. Al-Qaeda in the Arabian Peninsula (AQAP) maintains strong footing in the region and is considered one of the most dangerous branches of al-Qaeda because of its global reach and militaristic expertise, the BBC reports.

The U.N. estimates that 10.3 million people are acutely affected and need some form of humanitarian assistance in the vein of food, health and medical services, clean water and sanitation, and security. It remains challenging to deliver humanitarian aid to the war-torn country, as shipping ports are tightly monitored and airstrikes often threaten the security of agencies looking to donate resources to those in need.

The 2017 initiative, called the Yemen Humanitarian Response Plan, would target those facing acute needs or those likely to slip into what the U.N. calls “acute-need status.”

Although this appeal represents the largest requested sum to Yemen for international assistance, the international community provided a number of services to the country last year. In 2016, the U.N. reported that 120 partners worked in major Yemeni hubs to assist more than 5.6 million people with direct humanitarian aid.

The 2017 aim looks to nearly double that number. As the war intensifies and the food remains sparse, humanitarian aid in Yemen is more vital than ever.

“Two years of war have devastated Yemen, and millions of children, women and men desperately need our help,” said Stephen O’Brien, under-secretary-general for humanitarian affairs and emergency relief coordinator, in a UN news release. “Humanitarian partners are ready to respond, but they need timely, unimpeded access and adequate resources to meet the humanitarian needs wherever they arise.”

Image credit: Flickr/Julien Harneis

Australian Company Raises Money from Customers to Fund Clean Energy Projects

As tempers flare during another hot Australian summer -- and stakeholders bicker over whether renewables or the country’s energy administrator are to blame for rolling blackouts in South Australia -- one electricity retailer has given customers the opportunity to pay slightly higher rates in order to fund community solar projects.

Powershop was founded in New Zealand a decade ago and in recent years set up shop in Australia and the United Kingdom. The company allows customers to select various electricity providers on its website and choose whether they want lower prices, environmental benefits or to sponsor a cause.

Last year the company launched the Your Community Energy (YCE) initiative, which gives customers the option to pay a slightly higher rate in order to fund micro-hydro, small-scale solar or small-scale wind power projects.

As reported in the Guardian, Powershop aimed to raise AUD $20,000 (US$15,200) by the end of last year. But as of press time the company, has raised over $88,00. The result is “a chance to pay it forward” if consumers wish to fund renewables projects, reports the Guardian's Michael Slezak.

Powershop is now funding seven projects across the states of Victoria (where the largest city is Melbourne) and New South Wales (which surrounds the country’s capital, Canberra, and is anchored by its largest city, Sydney).

One beneficiary of this Powershop program is the Ceres sustainability center in East Brunswick, a suburb of Melbourne. Spread across 11 acres, the 35-year-old social enterprise runs environmental education programs, a green technology incubator and hosts urban agriculture projects. The organization is now closer to its goal of being a zero-emissions operation. Revenues dispersed from Powershop are funding the installation of solar panels on Ceres’ roof, which will help the organization procure 40 percent of its power from renewables by 2020.

Other YCE projects include community centers, a social enterprise that employs citizens with disabilities, and a retirement community. Most of the projects generate anywhere from 8 to 12 kilowatts of power -- allowing those organizations to save money on energy costs, funds that in turn can instead be used for various social programs.

This bottom-up approach to funding community energy projects comes at a time when the national debate over energy in Australia is becoming more toxic. While more countries are turning away from coal in favor of cleaner-burning sources of fuel, coal consumption is holding steady in Australia. The country of 23 million people is one of the few nations where the International Energy Agency expects coal consumption to grow, if even slowly, for the next 20 years.

The droughts and extreme weather that have ravaged Australia for several years prompted more interest and growth in renewables. But while some states backed by the country’s more liberal Labor Party support aggressive clean energy goals, the federal government, run by the center-right Liberals, have attacked those policies as causing widespread blackouts. Critics, however, respond that the blame lies with storms and other extreme weather rather than increasing reliance on technologies like solar.

Image credit: Powershop/Facebook

The Conservative Case for a Carbon Tax and 'Climate Dividends'

Insisting that “on-again-off-again regulation is a poor way to protect the environment,” eight veterans of previous Republican administrations met with White House officials on Tuesday to float the idea of a revenue-neutral carbon tax.

In an op-ed in the New York Times, three of the five Republican elder statesmen said a $40-a-ton carbon tax would “send a powerful signal to businesses and consumers to reduce their carbon footprints.”

The authors include James Baker, Secretary of the Treasury under Ronald Reagan and Secretary of State under George H.W. Bush; George Shultz, a senior economist during Dwight Eisenhower's administration, Secretary of the Treasury under Richard Nixon and Secretary of State under Reagan (and a huge proponent of solar power and electric cars); Henry Paulson, a former Goldman Sachs CEO and Secretary of Treasury under George W. Bush; N. Gregory Mankiw, chairman of the Council of Economic Advisors under the younger Bush; and Martin Feldstein, who chaired the same council during the Reagan administration.

Their report, The Conservative Case for Carbon Dividends, also included as co-authors Rob Walton, chairman of Walmart’s board of directors for over 20 years and now chairman of Conservation International’s executive council; Thomas Stephenson, an ambassador during the George W. Bush administration and a partner at Sequoia Capital; and Ted Halstead, CEO of the the Climate Leadership Council, the organization that supported and funded the survey.

The problem, say these GOP leaders, is that the Barack Obama administration was unable to push any significant environmental legislation through Congress, so the president enacted policy via executive orders.

The outcome, they say, is that the previous administration left a “grab bag” of regulations that may have some effectiveness in curbing carbon emissions, but infuriated Republicans – who are now, of course, hell-bent on overturning them.

They insist the result is uncertainty not only for businesses, but also for the environmental community, which will witness Obama-era programs and regulations disappear quickly.

The solution, according to messengers Baker, Schultz, et al., is a revenue-neutral carbon tax that would push businesses to reduce their carbon footprint, put money in Americans’ pockets and account for imports from countries that do not have a carbon tax in order to maintain U.S. companies’ competitiveness.

In exchange for this carbon tax, however, would be the rollback of regulations enacted during the Obama administration, including the Clean Power Plan.

This carbon tax proposal has four pillars:

1. An increasing carbon tax

The authors suggest that the carbon tax start at a “sensible” $40 a ton, which would be imposed at the first point where fossil fuels enter the economy -- as in mines, refineries and ports.

This tax would increase over time -- which would not only send a relentless signal to companies that they need to change their business practices, but would also nudge Americans to change their everyday habits. And the higher the tax becomes, the more American citizens would benefit.

This pillar speaks to the environmental community, who in theory would see their goals achieved as more companies ditch fossil fuels in favor of renewable sources of power such as wind and solar.

2. Redistribution of these funds to all citizens through 'climate dividends'

All of the carbon tax’s proceeds would be paid back to Americans equally on a quarterly basis via checks, direct deposits or into individual retirement accounts.

Under a $40 per ton tax, a family of four would receive about $2,000 annually. That $500 per quarter would become higher as the carbon tax increases -- motivating more Americans to move toward a low-carbon lifestyle, as more climate protection means higher checks.

The authors suggest that the Social Security Administration run the program, as dividend payments would be tied to social security numbers. This redistribution policy would undoubtedly appeal to the Bernie Sanders progressives who feel that too many in the working and middle classes are being left behind.

3. Border carbon adjustments

This pillar appeals to citizens who believe the U.S. has become a patsy on international trade – and helped to fuel Donald Trump’s narrow win in the November election.

Businesses that export to companies lacking a similar carbon tax system would receive rebates for any taxes paid, while imports from those same nations would be subjected to a surcharge based on the carbon content of their goods. The more imports from countries lacking any carbon pricing structures, the more dividends would be paid to Americans.

But the report’s authors claim such a policy could actually inspire more countries to adopt a similar carbon tax policy, which would result in a bigger win for the global environment.

4. A rollback in regulations

This is where the details of the plan become complicated. The report’s theory is that a higher carbon tax would negate any need for Obama-era energy and environmental regulations.

The Clean Power Plan would disappear, and the Environmental Protection Agency’s authority over carbon emissions would eventually be eliminated.

But in order to broaden the appeal of this carbon tax proposal, the authors suggest aiming high and setting emission reductions that are even more ambitious than what current regulations dictate.

Is it feasible?

The policy appears simple, but naturally there is the stubborn fact called reality.

Environmental organizations will fight any rollback of the Obama administration-era rules. In an emailed statement to TriplePundit, Rhea Suh, president of the Natural Resources Defense Council (NRDC), wrote:

“Putting a price on carbon could be an important part of a comprehensive program. It can’t do the job alone, though, and is not a replacement for carbon limits under our current laws.”

Many Republicans have also expressed hostility to any suggestion of a new tax, dating back to the “Contract for America” surge that allowed Republicans to sweep into control of Congress in 1994 after Democrats dominated both chambers for 40 years.

Trump’s Secretary of State, Rex Tillerson, has indicated that he favors a carbon tax. But critics say his statements are more lip service than advocacy for such a policy. Furthermore, Trump has made it clear that he is less interested in climate policy than he is in favor of harvesting America’s fossil fuel reserves.

Nevertheless, the Trump administration has an opportunity to extend a hand to some of his most strident opponents. His presidency’s first few weeks have been largely lampooned for arguments over inauguration crowds and whining over Nordstrom’s. And of course there has been the huge distraction of Trump’s immigration executive order, while opponents continue to speak out against other executive orders and his cabinet picks.

Embracing such a policy would show critics of all political persuasions the the president is serious about policy. Republicans would warm up to the elimination of regulations, struggling families would happily pocket the money, and environmental groups would see a reduction in emissions and pollution.

But this carbon tax plan means everyone would have to give up something sacrosanct and compromise, a word that is no longer in the vocabulary of many of our nation’s leaders.

Image credit: Climate Leadership Council

Inside the House Bill That Would Close Down the EPA

U.S. President Donald Trump has made no secret of his mission to slim down government oversight of business. Some supporters in Congress, however, don’t think that mission goes far enough.

Last week, a little-known junior representative from Florida dropped a bombshell when he submitted a bill to defund the Environmental Protection Agency. Rep. Matt Gaetz, a Republican, submitted the bill on Feb. 3 after circulating it among his peers and asking for co-sponsors.

Gaetz says small businesses are “drowning in regulations” and “cannot afford to cover the costs associated with [EPA] compliance.”

In a leaked email that was later published in the Huffington Post, Gaetz asserted that the burden of adhering to environmental regulations often led to more than just higher operating costs; it resulted in “closed doors and unemployed Americans.”

Gaetz’s bill, if passed, would abolish the EPA by 2018 and turn over environmental rule-making to state governments. Doing so, he proposed, would “create more effective and efficient regulation” of environmental protection polices.

His appeal has attracted the support of three other congressmen, all who have track records of opposing the EPA's regulatory oversight, particularly when it comes to controlling the impacts of climate change.

Rep. Steve Palazzo (R-Miss.) is best known for his support of an Americans for Prosperity pledge opposing a “climate tax” and his opposition to the EPA’s effort to regulate greenhouse gasses.

Rep. Barry Loudermilk (R-Ga.), who asserted his view against "federalism" in a recent tweet: “[The Georgia Environmental Protection Division] would do much better at protecting the environment than a big D.C. bureaucracy.”

Rep. Thomas Massie (R-Ky.) has voted on a number of recent efforts to strip the EPA of its environmental oversight, including votes to repeal key environmental rules put in place to protect water sources and air quality. He sits on the House Science, Space and Technology Committee, one of three committees currently reviewing Gaetz’s bill.

Pundits who weighed in over the past few days say it’s unlikely the bill will pass. Similar efforts last year failed to gain enough traction to even make it to a vote.

Still, the effort to dismantle the EPA speaks to a larger argument over who will protect local resources, and what “environmental protection” really means in agriculture-rich states like Mississippi, Florida and Georgia, as well as coal-producing areas like Kentucky.

But it may be a far stretch to say some states have done -- or could do -- a better job at regulating environmental adherence than the federal government, as Loudermilk suggests. It’s often the partnership between federal and state agencies that bring about the best results, such as in the 2001 case which found Dalton Utilities in violation of the Clean Water Act as well as Georgia’s own EPD regulations.

Collaboration is also needed when it comes to multi-state violations where broader federal laws allow states to show the much larger impact of damage, such as in the 2009 EPA case against Invista for violations in seven different states.

But then there are situations like what has played out in North Carolina over the past few years concerning Duke Energy’s coal ash spills, suggesting state regulation doesn’t always work when the regulating agency is reluctant to prosecute and enforce compliance.

And the environmental history of Gaetz's home state speaks to that fact as well. According to the Florida Center for Investigative Reporting, the state was home to seven different environmental polluters on the EPA’s watch list in 2011. It's also residence to more than 90 superfund sites, some 50 of which are still in the process of being closed down.

These statistics beg the question: If Florida’s Department of Environmental Protection is up to taking on this role, why hasn’t it before now?

Gaetz is right when he says there is cost associated with changing the way that businesses operate. Studies show that there is an initial price to implementing sustainable measures like curbing pollution, protecting water sources, and addressing leaks and spills. But he doesn’t go far enough on this topic. According to a brief by the nonprofit Sustainable Prosperity, the cost of regulatory adherence is often overestimated.

"Inaccurate cost estimates can lead to a number of problems, including a misinformed public, questionable integrity of the regulatory system, inability to secure public and political support for the policy,” said the authors, who point out that there can be a real downside to that overestimation. “Most importantly, inaccurate cost estimates can lead to sub-optimal design of environmental policy.”

The bill to close down the EPA has a ways to go before it can reach a House and Senate vote, if it ever does. But the implication that the nation’s most valued resources could do without federal oversight makes President Trump’s financial cuts for the EPA seem like a preferable second option. And for those businesses and cities that count on EPA input, that’s truly a scary thought.

Image credit: Flickr/I Love Mountains