Hydrogen Fuel Cells Get a Boost from Tesla's Elon Musk

Tesla Motors CEO and co-founder Elon Musk is famous for blowing off hydrogen fuel cell vehicles as "bull----," but it looks like he may have stirred a hornet's nest. Spurred in part by the success of Tesla's zero-emissions, battery-operated EVs, oil companies are helping to build out a fueling infrastructure for fuel cell vehicles.

That's not necessarily a clear win for the environment, because the primary source of hydrogen for fuel cells is natural gas. However, hydrogen from renewable sources is already inching into the market, and some oil companies -- Royal Dutch Shell being one notable example -- are beginning to transition into lower-carbon business models.

Where are all the hydrogen stations?

Hydrogen fuel cell vehicles run on electricity, just like Tesla's popular Model S. The difference is that the Model S stores an electrical charge in a battery. Fuel cell vehicles generate electricity through a chemical reaction between hydrogen and oxygen. The only emission is water.

Fuel cell EVs have one big advantage over battery EVs: They can be refueled in a few minutes just like a conventional car.

The problem is that very few hydrogen fuel stations are available.

On the bright side, several interesting collaborations have popped up to fix that problem.

The Shell-Toyota hydrogen collaboration

Shell is mapping a hydrogen transition. Back in 2015 the company announced big plans for a hydrogen fueling network in Germany, leveraging locations at existing gas stations.

In the latest development, Shell is banking on a $16.4 million grant from the California Energy Commission to help fund the construction of seven fuel stations. Shell and Toyota -- manufacturer of the Mirai fuel cell EV -- will chip in the remaining $11.4 million.

The eventual goal for California is 100 public fueling stations by 2024.

In consideration of the natural gas issue, Shell's interest in the California market is a step in the right direction. The Air Resources Board requires 33 percent renewable hydrogen to be dispensed in any fuel station that it funds.

Shell may shrug off oil, eventually

Shell also appears to recognize that, just as zero-emission vehicles are nudging out combustion engines, renewable hydrogen will eventually push fossil fuel aside. Here's a snippet from the company's website:

"When driven, the vehicle’s fuel cell converts compressed hydrogen from the fuel tank into electricity that powers the motor. FCEVs produce no emissions from the tailpipe, only water. When renewable electricity is used to make the hydrogen, the vehicle can effectively be driven without generating any carbon emissions."

Helping that initiative along, last year Shell created a division devoted to wind energy investments.

As cited by Bloomberg, the company's chief financial officer let word out that Shell foresees demand for oil peaking in about five years.

Toyota is also active in the renewable hydrogen field, and the company is confident that hydrogen will compete with batteries for the EV market. Bloomberg's Craig Trudell, Yaki Hagiwara and John Lippert explain why Elon Musk's success with Tesla spurred Shell and other companies to start looking at new technologies:

"Musk may be inadvertently helping Toyota’s cause. Early on, Big Oil wasn’t convinced cars could make the zero-emission switch in droves. Then Tesla took about 373,000 pre-orders for its Model 3 sedan last year. The oil industry was 'a bit scared' by the feverish reception, said Katsuhiko Hirose, a Toyota project general manager."

The hydrogen economy has many fans

Despite the environmental issues involving natural gas, the U.S. is forging ahead with plans for the hydrogen economy of the future, as is Japan.

Europe is another hotbed of fuel cell activity. Earlier this year, Shell partnered with a dozen other industry stakeholders to form the Hydrogen Council: a new organization with a mission to help guide policymakers toward best practices and encourage an efficient transition to fuel cells.

The new partnership leaves plenty of wiggle room for hydrogen sourced from natural gas, but it also emphasizes the role of renewable hydrogen in the decarbonized economy of the future:

"Efforts to decarbonize the energy system need to pull on four main levers: improving energy efficiency, developing renewable energy sources, switching to low/zero carbon energy carriers, and implementing carbon capture and storage (CCS) as well as utilization (CCU). This will radically change energy supply and demand."

As for Mr. Musk, about two years ago he had this to say about fuel cell EVs:

"I just think that they're extremely silly ... It's just very difficult to make hydrogen and store it and use it in a car," Musk said at the time. "If you, say, took a solar panel and use that ... to just charge a battery pack directly, compared to split water, take hydrogen, dump oxygen, compress hydrogen ... It is about half the efficiency."

It looks like hydrogen may get the last laugh after all.

Image (screenshot): 2017 Mirai fuel cell EV via Toyota.

House Resources Committee Seeks $50M to Transfer Public Land to States

The fight over U.S. public lands managed by agencies such as the Bureau of Land Management (BLM) continues -- and it’s a noisy one.

In the latest salvo fired, the chairman of the House Resources Committee asked congressional budget writers to reserve $50 million in order to transfer federally-managed lands to state and local governments.

Bob Bishop of Utah, who has long chaffed at the federal government’s land holdings in his home state, said that such land transfers are a boost for local control while helping to reduce the federal budget deficit.

Bishop further argued that “poorly managed federal lands create a burden for surrounding states and communities,” Timothy Cama of The Hill reported on Monday.

Environmental groups, however, are taking issue with Bishop’s assumption that these lands are anywhere near a burden. In fact, the BLM estimates that its stewardship of American lands generated $114 billion for local economies in 2014. The Wilderness Society presented an even larger figure, $646 billion, as well as millions of American jobs.

Utah’s congressional delegation, as well as the state’s legislature, has long opposed what they say is an excessive amount of federally-managed public lands and, therefore, relentless federal interference in their local affairs. Estimates suggest that over 60 percent of the state’s area is publicly owned – which in turn churns out several billion dollars a year in revenues and almost a billion dollars in tax receipts for the state’s coffers.

The Outdoor Industry Association (OIA) suggests that those public lands and the revenues they generate comprise 5 percent of Utah’s gross state product. When Utah Rep. Jason Chaffetz proposed a bill in January that would sell off “disposable” lands, the OIA hit back hard. So did some of the outdoor gear trade association’s members, including Patagonia, which said it would pull out of the OIA’s summer trade show this summer in Salt Lake City.

Chaffetz has since withdrawn his bill from the House floor, but the damage was already done: OIA said it will pull its events out of Utah after its contract ends in 2018.

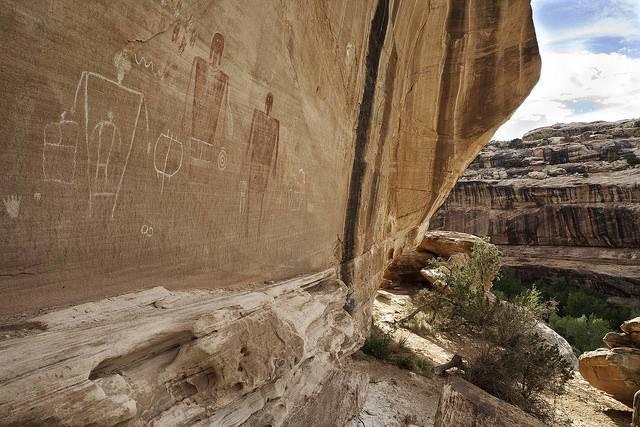

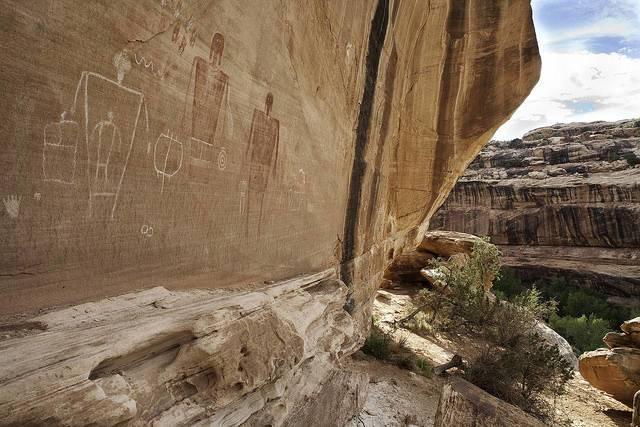

Much of this dispute centered around former President Barack Obama’s declaration of the Bears Ears National Monument last December, which cheered outdoor enthusiasts and Native Americans but left many Utah political leaders fuming. Bishop was one of several Utah Republicans who claimed Obama’s decision to use the federal Antiquities Act to preserve Bears Ears failed to take into account how those lands could best be used. For outdoor-lovers and Native Indian tribes, however, the Bears Ears landscape and history make the need for its preservation and protection obvious.

The fight is far from over. Recently the Donald Trump administration reversed a ban on lead-based ammunition and tackle on federally managed lands, which Bishop hailed as important in order to stop “a deliberate attack on Americans’ fundamental rights and privileges.”

But even the current White House seems to realize that any deficit reduction will require more than a few million dollars of discretionary spending here and there.

Cama of The Hill reports that Donald Trump and his new Interior Secretary Ryan Zinke are resisting any large-scale transfer of federal lands – and Bishop has yet to make clear which lands he plans to relinquish. Meanwhile, environmental groups are fired up: Matt Keller of the Wilderness Society dismissed Bishop as a “bully” and described the congressman’s tactic as a ploy that would only benefit energy and mining interests.

Image credit: BLM/Flickr

How Trump's Proposed Climate Science Budget Cuts Will Impact You

The National Oceanic and Atmospheric Administration (NOAA) operates satellites that collect weather data. It also funds research on sustainable fisheries and how to protect the jobs of 13.5 million people employed in coastal tourism from natural and technological hazards.

But the Donald Trump administration is proposing deep cuts to the NOAA’s budget.

Why cut a program that is collecting weather data and funding research that protects jobs? Many say it's because the NOAA also generates data that enables global warming research.

An obvious question is whether cutting $650 million in satellite data collection and science research will protect or harm your job and our economy.

Cutting climate science when Americans are focused on global warming

As of 2016, 70 percent of Americans agreed global warming is happening, according to the Yale Program on Climate Change Communication.

Global warming is also no longer a red state versus blue state issue.

Yale's interactive map identifies global warming opinions by individual counties. I picked Kentucky to examine. This state is identified as coal country. Its federal senators just voted for legislation to repeal EPA rules that protect streams from mine waste dumping. I was stunned by what I found: In Kentucky county after Kentucky county, at least half of residents believe global warming is real, according to Yale's data.

Pick any state, and you will see similar results. In almost every county in America, at least 50 percent of us believe global warming is real.

But Americans are still split over what is causing global warming. Yale found that 55 percent of us believe global warming is caused by human activities. A significant 30 percent of us think global warming is caused mostly by natural changes in the environment.

What could be causing this divide?

Yale found that only 1 out of 7 Americans understand that over 90 percent of climate scientists conclude that climate change is a result of human activity. This is a huge issue since 71 percent of us say we trust climate change scientists about global warming.

This maybe the key reason why the Trump administration is proposing to slash NOAA’s funding. Doing so would cut Americans off from the very scientific research that we claim to find most trustworthy and informative.

To some critics it appears the Trump administration is so focused on denying global warming that they are willing to violate their campaign job focus: Slashing NOAA’s budget will also cut the agency's research on how to protect jobs from environmental impacts.

What cutting NOAA’s funding does achieve is alignment with the 75 percent of Trump voters who believe climate change is either not real or not caused by human activities, according to data from the Pew Research Center.

Global warming is today's challenge

The most telling finding in the Yale study is how Americans respond to global warming. The research found that the more people think global warming can hurt them, the more likely they are to think global warming is real and created by human activity.

The issue of near-term impacts from global warming is what really divides Americans. Yale found that only 14 percent of us believe global warming will cause a great deal of personal harm. But almost all of us (over 70 percent) agree that global warming will create moderate harm, or a great deal of harm, to plants, animals and future generations. The challenge in gaining a consensus for global warming actions is that almost all of us see global warming as “tomorrow’s problem.”

This might be the ultimate motivate behind the Trump administration's decision to slash NOAA’s satellite data and research. This data and research is documenting how global warming is today’s challenge that is growing more severe.

How cutting climate science budgets will hurt you

Cutting Americans off from NOAA’s research will not stop global warming. It will only make us less informed.

When global warming drives food prices higher due to impacts on farming and fishing, or when it drives our electricity bills through the roof to pay for increased air conditioning, it will come as surprise. And it may be a surprise because the Trump administration did not want you to learn the facts.

Image credit: Flickr/NOAA Photo Library

When Workaholism Stops Working: Humanity’s Last Stand Is on the Job

By Patrick Riley

Where have all the humans gone?

It might sound like the plot of a sci-fi thriller, but it’s a legitimate question when you consider how much of the business world reflects robot-like qualities. Companies tend to reward employees who sacrifice their personal lives for work, staying tethered to their jobs around the clock.

Employers might prefer an army of machines, but workers are flesh and blood rather than gears and switches. Workers can’t run for unlimited hours — we need down time to recharge. Most of all, we crave encouragement from other human beings.

My company has tried to squash this bad habit by viewing team members as human beings first and foremost. We have a “no overtime” policy, and employees understand they have only 40 hours each week to get their work done. Instead of viewing work as a sprint, we’ve shifted to a marathon mentality. We sometimes put in 16-hour days, but they’re the exception rather than the expectation.

Regrettably, this isn’t the norm in the startup world. Our industry routinely pushes people to put in 60-plus-hour weeks, then we act surprised when people become too stressed out and exhausted to be productive. We must focus on the needs of the human body, mind, and spirit to avoid sending ourselves into crisis mode.

Stop treating yourself like a machine

It’s relatively easy to measure work needs. How many widgets were produced? How are key performance indicators trending? How much money is in the bank? They’re all fairly black-and-white metrics.

Measuring human needs isn’t quite as straightforward. They’re not tangible, and they’re not necessarily easy to track. It’s surprisingly difficult to know when you’re truly tired, stressed out, or anxious. It’s time to take action and reclaim your humanity:

1. Consistently inventory your needs: No lie: This can be a challenge if you feel driven to act like a machine, but you must know what you want in your heart of hearts. A major takeaway from Robert Glover’s “No More Mr. Nice Guy” is that few people actually recognize what they want in life. If we don’t even know what we need, Glover argues we’re doomed to remain unhappy.

A recent study found 52 percent of workers delayed basic bodily functions such as going to the bathroom to meet work deadlines. It’s completely absurd. We need to listen to our bodies. Do we need rest? Would hitting the gym make us more productive? Are we refreshed enough to get back to the grindstone? Our bodies have the answers.

2. Learn to listen to your body: Still confused about how to get in tune with your body? Go on a hike, or head to a quiet place for an hour. Spend about 30 minutes writing down everything that has been on your mind lately. Let your gut talk to you.

Jot down whether you’ve been feeling sad, tired, stressed, or anything else. For each emotion you note, add possible reasons behind that feeling. Have you been sleeping too little? Is a relationship hitting the skids? Write everything that comes to mind.

Once you’ve gotten it all out, spend 30 minutes going through your notes. Themes and patterns will start to emerge. To wrap things up, spend about 15 minutes making a game plan of no more than three things you’d like to change in the coming week.

3. Stop glorifying workaholic tendencies: Most workaholics would tell you they feel productive and successful — almost like they’re changing the world. People thump us on the back, and in Pavlovian fashion, we eagerly repeat this self-destructive cycle. Go for a run? Leave the office early to spend time with our family? Nah. We have work to do!

No one congratulates the person who works 38 hours a week and squeezes in time to address personal needs. But clock 65 hours in a week, and you’re heralded as a hero: “Whoa! Nice work getting all that stuff done.” The message is clear: You’re important because you work.

When a co-worker leaves at 4:30 p.m. to attend yoga class, we’re more likely to glare at him than give him a thumbs-up. Considering we’ve been knee-deep in the “more work equals better person” myth since birth, it’s not entirely our fault. But workers who take time to address their physical needs ultimately win. A recent study suggests exercise can improve memory function and effectiveness at work. Want to have a greater impact at the office? Take time to do something other than work.

4. Disconnect from technology: I’m embarrassed to admit it, but I recently found myself guilty of treating a business partner like a robot. He went to Hawaii on a family vacation, but we ended shooting messages back and forth throughout his week away. Neither of us prioritized his human needs for downtime and connecting with his family. We exchanged texts while he was on the beach because we could, never considering whether we should.

Technology is a wonderful thing, but it also taps into our cravings for instant gratification and connectivity. What if we miss something important? We decide it’s a good idea to check our email several times over the weekend to ensure nothing slips through the cracks. As scary as it might feel, we must remind ourselves that every device has a feature we should use more often: an off button.

Unless we want to create a world of exhausted employees shambling around like zombies, it’s time to re-establish a positive view of our innate humanity. Work needs often stem from a desire to care for others, but this can quickly spiral into self-neglect.

Ignore your body’s signs long enough, and you’ll wake up one day to find you have no energy and are completely ineffective at work and home. Treat yourself — and your colleagues — to a little kindness and compassion, which are two things the robots of the world will never understand.

Image credit: Pixabay

Pat Riley is the CEO of the Global Accelerator Network, a group of respected startups and the organizations that support them from around the world. More than 5,500 startups are in GAN, and many grew through one of its startup accelerator programs. Startups in GAN get access to its partner network and venture fund, which provides capital for startups to create and grow their businesses. For more information, visit gan.co.

Iowa Republican Mocked for Attending Business School at Sizzler University

A state senator representing a rural southeastern Iowa district found himself in the national news this week. It turns out the business degree he claimed on his official biography was actually a training course at the chain restaurant Sizzler. The predictable puns soon followed.

The offender, Mark Chelgren, made headlines in news outlets including the Associated Press and NBC News after he insisted that he did not mean to mislead anyone. He has since changed his biography on the Iowa State Senate website, which mentioned the business training.

So, is this academic snobbery? After all, former Vermont Gov. Howard Dean earned little more than scorn when he needled former Republican presidential candidate and Wisconsin Gov. Scott Walker for not having finished a university degree. Whatever one may think of Walker, he was hardly a slacker: He took a job at a local American Red Cross chapter during his early 20s, decided not to finish his senior year, got connected to the right people such as the Koch brothers, and worked his way up to winning his first statewide election in 2010. Education is hardly the same thing as intelligence.

On that point (ahem) some detractors of the current president will remind us that exit polls suggested he won a narrow, but decisive, victory in November’s election; assumptions that the white working class or “whitelash” paved the way to Donald Trump’s shocking victory are not the whole story.

And while Chelgren claimed to have an associate’s degree from an Inland Empire community college, he also noted that he took courses in some pretty complicated science courses at the University of California, Riverside. Even if he did not pass them or dropped out, he at least had the ambition to enroll – and again, ambition and intelligence are great qualities that do not have to go hand-in-hand with being “educated,” whatever that oft-overused word means.

So what’s the big deal? After all, I worked for a company where my replacement said she attended Harvard. Oh, she attended Harvard, all right – for a week-long seminar. Chelgren’s claim had more or less chutzpah, depending on your point of view, as his business degree or certificate was from Forbco Management School, which apparently was affiliated with a Sizzler’s franchise in Torrance, California. He was a college student at the time and, according to interviews, he did what many of us forgot to do: Update his resume. If he was proud of that degree, so be it.

But part of what landed Chelgren in this mess is that he recently submitted legislation to require Iowa’s universities to ask prospective faculty candidates about their political affiliation. The goal, Chelgren said last month, would be to ensure partisan balance so the divide between Republican- and Democrat-leaning faculty would be no more than a 10-point percentage gap on either side of the political divide.

Senate File 288 went over like a lead balloon. First of all, while no federal laws exist that prohibit privately-run companies, academic institutions or NGOs from asking questions about political leanings, most human resources experts agree that posing such a question risks sparking eventual claims of discrimination or workplace retaliation. Furthermore, Chelgren’s legislation would not apply to anyone who declares that he or she is an independent voter, so prospective academics could simply check the “no party” box – a loophole Chelgren admitted could be done easily, which makes the legislation all but pointless.

Many feel Chelgren’s legislation is insulting because it assumes that young minds are impressionable and can be easily swayed by someone spouting off ideology from behind the lectern. If that were true, the 40 percent of Americans with a college degree would vote in such overwhelming numbers that Donald Trump and George W. Bush would have been historical footnotes, not No. 43 and No. 45. Conservative firebrand Sens. Ted Cruz and Tom Cotton both completed degrees from that cauldron of northeastern U.S. liberalism, Harvard. The stubborn truth is that the vast majority of us develop our political ideology based on countless factors, including upbringing, biases, background and spirituality.

Nevertheless, legislators like Chelgren have an affinity for drafting such ridiculous legislation because it scores them press. Sadly for Chelgren, he won plenty of press – just not the kind that is great for building a career.

Image credit: Sizzler/Facebook

Veolia, BITC Responsible Business of the Year 2016, buys into the circular economy

By Tom Idle — Talking about the so-called circular economy and all the potential economic and environmental benefits it might bring is not to speak of a distant future, says the woman leading Veolia in the UK and Ireland. Estelle Brachlianoff (pictured) argues that it is something happening here and now, and that there is a huge mine of hidden value just waiting to be tapped for businesses of all shapes and sizes.

The resource management business, which is 2016’s Business in the Community Responsible Business of the Year, has been keenly putting some concrete figures to better define the size of the pie on offer. In its new 'Imagine 2050' report, Veolia looks at a number of new business models it says are needed in three sectors if the UK is to meet the ongoing resource and waste challenges between now and 2050.

The manufacturing, pharmaceutical and chemical, and food and drink industries generate 13 million tonnes of waste, which, if properly re-used, recycled or re-manufactured, could generate £4 billion of value to the economy. “Business models and operations can be re-engineered and redesigned by 2050 so that products and manufacturing processes are completed by closing the loop,” it says. “By generating energy from renewable sources and no longer treating water as a cheap commodity, but a valuable resource, businesses will become more self-sufficient”.

Exciting opportunity

As you might expect, Veolia is excited. Whenever Brachlianoff appears at an event or panel discussion, she almost always brings out of her pocket a casino chip-sized piece of bio-plastic material – made entirely from organic effluent – just to make the point. “We’re investing in R&D right now, developing solutions with our customers and building partnerships with like minded people,” she says, comparing the realisation of a circular economy to “a Galileo moment, when people realised the Earth was not flat, but round”. Businesses cannot go back to the Middle Ages, she adds.

Manufacturing businesses can benefit from £2.8 billion of hidden value in under-utilised waste streams by generating, using and recovering energy and water resources. Veolia predicts that by 2050, waste materials will be turned into tradable commodities, potentially enabling 100% recovery rates.

On top of this, there is a further £6 billion on offer just by being more efficient – using less water, energy and gas – according to Steve Evans, director of research at University of Cambridge. “Non-labour resources cost five times as much as labour in manufacturing and we need to improve skills and knowledge across the board,” he says.

In the pharma sector, there is £800 million of extra value to be had from designing efficiency into products at a concept stage and in creating new finance models that will enable medicines to be produced more efficiently.

Meanwhile, in food production, the prediction is that cost pressures will bring about major changes, with companies forced to reimagine the by-products currently thrown away. As Evans says, “We’re already growing enough to feed the future world. We just don’t feed people with it. We don’t need to grow more stuff; we just need to stop throwing away the edible stuff that we do grow”.

Easier said than done

But creating circular products, models and services is easier said than done. Brachlianoff is right: circular economy principles are being adopted right now. But examples of closed loop developments are still few and far between, despite an increase in awareness and knowledge.

For a company like BMW, asking the business to rethink the way it builds and sells cars is not something that will change overnight. “There’s no doubt, the circular economy is going to be hugely important to our business,” says Thomas Sherifi, BMW’s environmental programmes manager. “No longer are cars these beautiful, shiny things that sit on our driveways. We need to think more about what happens at the end of their life and the recyclability of all of the components – and we are doing that”.

But if building circularity into products and processes demands collaboration and partnerships between companies that might want to share waste streams and resources, as Brachlianoff suggests, the rulebook might need shredding and writing again, particularly in the car-making sector. “Innovation is what drives our business, and we are reluctant to share that,” says Sherifi. “To let that Pandora out of the box is a big decision for the big bosses”.

Collaboration is crucial

The need to find companies willing to find common ground and efficiencies together is crucial – “to find the right prince among frogs,” as Evans puts it. Without collaborating, companies will find their market share eroded entirely, warns Ravi Krishnamoorthi, Fujitsu’s senior VP and head of business applications services. “Uber exists because there was a reluctance to collaborate,” he says. “There must be a culture change from business leaders if we are to do business in a circular way.”

One thing that might help to focus the minds of CEOs is economics. “It was only when the environment lead at one of our customers started reporting to the chief finance officer that the true environmental costs of inaction were translated to the board,” says Brachlianoff. She disagrees that short-term activity translates into profits, while long-term thinking is purely about saving the planet. “Climate change impacts are taking a hold now and having an impact on quarterly performance. There’s no time to wait”.

Redefining ‘cool’

The other likely future trigger for more companies to re-engineer their offer with the environment in mind is consumer expectation and demand. The sales proposition of all car companies is that customers must have the latest, shiny new models straight off the forecourt. In a circular economy, a car-leasing model – where customers bypass ownership – will be the order of the day. That is a big shift for a company like BMW. “We need to redefine what ‘cool’ is,” says Sherifi. Companies like Riversimple and Tesla have already stolen a march on traditional companies in the sector.

Serious innovation in business models is a tough ask for companies with a legacy, with very few unwilling to challenge their own way of doing things. The pioneers are currently experimenting in silos that sit alongside their core business, so it is far from mainstream thinking. But within the next five years, we will see a shift, predicts Evans. “Increasingly we will see companies redefining what ‘winning’ means: winning at the expense of another company, as is the case now, or winning together”.

Business chooses long term planning for sustainability

Interest in Alberta Tar Sands Oil Wanes, But Keystone XL Pipeline Could Still Pay Off

The notorious Keystone XL tar sands oil pipeline is back in the news, now that the Donald Trump Administration has pledged to ensure the project moves forward. At first glance it may seem odd that Keystone's owner, TransCanada, is still pushing to get the job done. Several major oil companies are beginning to pull back on Canada's tar sands fields due to oil price slumps. And if that trend accelerates, TransCanada could find itself with a brand new pipeline and no oil to put in it.

However, there are some key reasons why tar sands oil production could survive despite the challenges it faces, and that's where TransCanada is placing its bet.

Keystone XL and Canadian tar sands oil

For those of you new to the topic, the Keystone XL pipeline surged into the media spotlight during the Barack Obama administration.

The pipeline is designed to bring tar sands oil from Canada through the midsection of the U.S. and on to refineries on the Gulf Coast.

Tar sands oil is a particularly controversial element in the fossil fuel category. Often described as a "carbon bomb" due to its heavy greenhouse gas emissions, tar sands development also bears a heavy load of local environmental impacts.

Here's an explainer from the U.S. Department of the Interior:

"Tar sands (also referred to as oil sands) are a combination of clay, sand, water, and bitumen, a heavy black viscous oil. Tar sands can be mined and processed to extract the oil-rich bitumen, which is then refined into oil. The bitumen in tar sands cannot be pumped from the ground in its natural state; instead tar sand deposits are mined, usually using strip mining or open pit techniques, or the oil is extracted by underground heating with additional upgrading."

The U.S. Department of Energy offers this rundown of the benefits of tar sands development for the U.S.:

"The United States is also endowed with approximately 50 billion barrels of tar sands resources, with the largest deposits in Utah. If these resources can be commercially developed, while protecting the environment, they could contribute up to three million barrels per day to domestic energy supply."

However, the agency also offers up some significant risks:

"Transforming unconventional resources into useable fuels consumes water and energy, impacts surface and subsurface environments, and produces emissions, effluents, and solid wastes that must be captured, managed, and disposed of."

If you caught that thing about U.S. tar sands development, you may be wondering why opponents of the Keystone XL pipeline targeted the Obama administration over the particular pipeline and not over tar sands development in the U.S.

The explanation is relatively simple: With the exception of one recently started tar sands field in eastern Utah, the U.S. has yet to tap into its tar sands resources.

In addition, oil pipelines typically do not require federal approval, so pipeline construction in the U.S. is usually treated as a local issue. The result is that opposition doesn't break into the national media spotlight. One notable exception is a section of the Dakota Access pipeline, where protests came to a head during the last months of Obama's term in office. That project is also moving forward under the Trump administration, and some analysts predict that it will eventually carry oil from Canadian tar sands fields.

The Keystone XL pipeline is different. It crosses the border between Canada and the U.S. As an international project, it requires review and approval by the U.S. Department of State.

That made the Keystone XL pipeline a prime target for protests in the U.S. during the Obama administration. Activists were able to contrast the administration's progress on reducing carbon pollution with its role in the Keystone approval process.

Ultimately, public pressure proved successful, and the Obama administration refused approval of the project.

New hope for Keystone XL

That was then. On Jan. 24, President Trump took action to remove the Obama-era obstacles from both the Dakota Access and the Keystone XL projects.

The Keystone project is still in the planning stages, so there is still a way to go before the shovels hit the ground.

However, things appear to be moving along smoothly. Last Friday, Bloomberg cited David MacNaughton, Canada's ambassador to Washington:

"Discussions on TransCanada’s crude-oil route are going 'extremely well' with U.S. federal authorities, Ambassador David MacNaughton said Friday in an interview at his office," as reported by Andrew Mayeda and Josh Wingrove of Bloomberg."'I don’t see any big hurdles in the way of Keystone from the administration’s point of view,' he said, referring to the government of President Donald Trump."

. . . Or not

Those of you familiar with the Keystone route will recognize that the project still faces at least one significant obstacle.

The state of Nebraska figured prominently in opposition to the pipeline during the Obama administration, and that hasn't changed.

Last month, TransCanada filed for a permit to build the Nebraska leg of the pipeline along a route previously approved by state regulators in 2013.

The New York Times reports:

"The founder of Bold Nebraska, which led the opposition to the pipeline, pledged to again use protests and lawsuits to halt the project, first proposed nine years ago.'Bold (Nebraska) continues to stand with farmers and ranchers to protect property rights from being infringed upon by a pipeline for their private gain,' said Jane Kleeb. 'Keystone XL is and always will be all risk and no reward.'”

Another sticky wicket could be the use of U.S. steel to fabricate the pipes.

Opponents of the pipeline argue that the project would only provide a few dozen permanent jobs in the U.S. Supporters counter that thousands of temporary jobs would be involved, including jobs for U.S. steel workers fabricating pipes.

Previously, Trump supported that argument by pledging that his administration would require the use of U.S. steel in infrastructure projects, including the Keystone XL and Dakota Access pipelines.

But last week the Trump administration said Keystone would be exempt from the U.S. steel requirement.

The outlook for Alberta tar sands oil

That brings us to the 800-pound gorilla in the room: Why is TransCanada still pushing the Keystone XL project?

Aside from public opposition related to environmental issues, the economics for Keystone are challenging because the tar sands sector is floundering.

Several years ago, oil prices were much higher and the financials looked good for tar sands oil, but much has changed since then.

Shell, ExxonMobil, Chevron and Statoil are among the companies that have changed their plans for Canadian tar sands development in recent years.

It would seem that the future looks gloomy, but there is some indication that Canada's carbon bomb will not be defused any time soon.

At least one major company -- a subsidiary of Koch Industries -- has expressed interest in a new tar sands lease. That's significant because Koch Industries is already among the largest tar sands lease holders in Canada.

Koch could be taking a page from the shale gas book. Several years ago when gas prices were in the doldrums, ExxonMobil began snapping up shale gas fields. That was a bit of a risk, but it could pay off as the global energy picture transitions out of coal and into gas and other alternatives.

Another factor is the baked-in costs of starting up a tar sands oil operation. Tar sands production typically involves a steam-assisted process that is difficult if not impossible to restart after it has been shut down. That's why some companies are locked into continuing production even they lose money on every barrel.

If oil prices continue to fall, some analysts predict a financial disaster for tar sands oil due to its high expense. But others are inclined to think oil prices will bounce back in the near future, and that increase could be dramatic. That would push the financials back in favor of tar sands oil.

U.S. refineries and tar sands oil

Last month, Forbes presented an optimistic outlook for tar sands oil under the title "Keystone Pipeline Is A Risky Bet On Higher Oil Prices."

The author, petroleum geologist Art Berman, makes it clear that there is some risk to betting on a rise in oil prices. However, he also makes a good case for continued interest in tar sands oil production.

One key to that line of thinking is how dependent U.S. refineries are on tar sands oil. This is a point that has not come into sharp focus in the debate over Keystone XL:

"U.S. tight oil plays produce ultra-light oil ["tight" oil refers to oil from shale or sand formations]. Almost all of it is too light for refinery specifications. That means that it must be blended with heavy oil in order to be refined and that is why there is demand for Canadian heavy oil," Berman wrote.

In other words, as long as the U.S. continues to produce a copious amount of ultra-light oil, tar sands oil will continue to flow into the U.S.

Under that scenario, Keystone XL will be relevant for many years. That means "several decades," Berman said.

In a recent development supporting that outlook, plans are in the works for a new 730-mile pipeline that will bring fresh supplies of ultra-light oil from oil fields in western Texas to Gulf Coast refineries.

Berman also brings up the interesting point that U.S. supplies of light oil play a crucial role in tar sands development:

"Similarly, Canadian viscous, heavy oil must be diluted with ultra-light oil to move through pipelines. Because of that, Canada is the biggest importer of U.S. light oil."

When Berman (and other analysts) look at the factors influencing oil price trends, they predict that oil prices will rise "dramatically" in the near future, with this result:

"That should lead to the next oil boom and the Keystone XL Pipeline will be there to provide heavy oil to U.S. tight oil plays," he wrote in Forbes.

And of course the project has a much better chance of success with a strong advocate for Keystone XL occupying the Oval Office.

Whether or not that happens will depend on the ability of groups like Bold Nebraska to take their case to court, to state legislators, and to the public.

Photo (cropped): Keystone pumping station in Nebraska by shannonpatrick17 via flickr.com, creative commons license.

Greenpeace: Brazil Could Soon Deforest Protected Land

Last year Brazil impeached its president, Dilma Rousseff. Since then new Brazilian President Michel Temer has repeatedly given strong signals that the country's powerful agriculture interests will have more say on everything from imports to land ownership. And with Latin America’s largest economy enduring its worst recession in over 100 years, its business community is eyeing lands the Brazilian government recently promised would be protected.

Greenpeace says such a policy reversal would leave around 1 million hectares of land, an area larger than Yellowstone National Park, at risk of deforestation. Aerial photographs taken by a Greenpeace team in Brazil indicate areas around these lands are already being primed for development.

After years of steady decline, Greenpeace claims deforestation in Brazil’s Amazon increased 75 percent between 2012 and 2015. Nevertheless, President Temer’s administration is considering a proposal from the country’s National Congress to cancel one designated conservation area and reduce the size of four others by about 40 percent.

“These forests are being cleared for global commodities such as animal feed, as well as cattle products such leather and meat – which end up exported to Europe and elsewhere all over the world,” Daniel Brindis, a campaigner for Greenpeace, told TriplePundit.

Some Brazilian politicians say these conservation units are an obstacle to economic development. But the photographs reveal that landowners, or business interests well connected to the federal government, already had designs on these lands even before a change in policy became official.

Greenpeace says that so far there is little evidence of development underway other than the construction of roads and mining operations. But some areas have already been burned or cleared of forests, suggesting signs of new farms or timber logging.

Local and indigenous communities depend on these lands, Greenpeace says. “The fact is that you have the people in traditional communities who rely on them to survive,” Brindis told us.

And that's only the start of why these forests should continue to be preserved. “In addition, these forests have critical roles that vary from pollinators to some of their plants’ untapped potential as pharmaceutical ingredients.”

Brindis also made the case that the amount of deforestation occurring in Brazil has pushed these lands to a tipping point. He described deforestation’s effects as a “beachhead factor,” at which once a formerly forested area is opened to industrialization and then, as more people move in, additional pressure is imposed on the remaining local forest.

“We don’t talk enough about these forests’ roles in regulating local temperatures, as they help absorb heat so that surrounding areas are much more tolerable in which to live,” Brindis explained. “There’s only so much forest that can be used until you reach a point where the forest starts to degrade on its own or even becomes vulnerable to fires.”

The Brazil’s insistence that it must develop more virgin forests comes despite the fact that other environmental NGOs, including Mighty Earth, say as much as 200 million hectares of land is degraded across South America that could instead be primed for use such as soy cultivation or cattle ranching.

Furthermore, Brazil’s meat industry, as is the case with much of the world’s beef sector, is highly inefficient: The average head of cattle needs one hectare. While feedlots for North American cattle operations have long drawn the ire of environmental groups, some analysts make the case that they are more effective for raising cattle. “Brazilian cattle ranchers could raise even more cattle on the pastures they have now by reforming how they currently treat those lands,” Brindis said.

Brazil’s beef supply chain is also much more nebulous than the livestock sectors in other countries. In the U.S. and Canada, for example, companies often own or can closely monitor heads of cattle from breeding to slaughter. But despite the efforts of large Brazilian meatpacking companies such as JBS, Minerva and Marfrig, cattle in Brazil are often bought and sold with no traceability. As a result, indirect suppliers are often responsible for actions such as land-grabbing and deforestation.

As Brindis explained, there is no simple solution to solving this problem. Wealthy countries like Norway and Germany fund forest conservation programs in Brazil and other nations and are doing their part. And the decades-long fight to “save the Amazon” has matured. More activists now realize that the locals who rely on forests for their livelihood are often the best stewards of these lands. They must be part of the solution and need a voice to ensure current and future sustainable development.

But consumers also bear much of the responsibility to ensure these lands are not developed just to enrich the already wealthy and well-connected.

“The framework to stop deforestation is there, and people are paying more attention,” Brindis told us. “But the big question is: Who is going to pay for this?”

If ranchers are willing pay more for better fencing and land management, and meat producers pay for better supply chain monitoring, then consumers must be willing to pay more at the checkout aisle.

Image credit: Greenpeace

Trump's Manufacturing Roundtable: What U.S. CEOs Want

President Donald Trump reached out to two dozen of America's largest companies last month in an unusual appeal: Help him come up with a workable plan to put American jobs back in the manufacturing sector. Suffice it to say, he got an earful.

Twenty-four CEOs, selected to represent four key focuses of the Trump reform agenda, turned up at the White House on Feb. 23 to “brainstorm” with the president and a panel of advisors about the biggest stumbling blocks to growth when comes to taxes and trade, infrastructure needs, federal regulations, and workforce potential.

The CEOs, including Mario Longhi of U.S. Steel, Phebe Novakovic of General Dynamics, Marillyn Hewson of Lockheed Martin and Inge Thulin of 3M, were assigned to working groups that later reported to the president.

Members of the press were invited to the first part of the meeting, but according several reporters, they were restricted from quoting CEOs by name during the meeting. Interestingly, much of what companies saw as key points was disclosed publicly after the meeting in press follow-ups. The following are some of the key points U.S. manufacturing companies felt the president should know.

Regulations

When it came to government oversight, CEOs assigned to reporting on the effects of regulations and trade pretty much agreed with Trump’s view that the Environmental Protection Agency’s “overreach” is hampering business potential. “The Clean Power Plan should be re-crafted to address concerns about EPA overreach infringing on state authority, while providing maximum flexibility for compliance,” the CEOs said, according to a press release from the National Economic Council.

The CEOs also called for the repeal of an Obama-era regulation to make 4 million more workers eligible for overtime pay. The regulation is currently on hold by the courts. Business leaders said it was unaffordable; the Department of Labor is appealing the court ruling that blocks the rule from taking effect.

Affordable Care Act (ACA) regulations also need to be revised, say the CEOs. The ACA requires employers to pay a 40 percent tax if the aggregate cost of the medical plan they offer is in excess of a set dollar amount. (These high-priced plans are often called “Cadillac plans.") That tax is meant to keep plan options affordable. According to the roundtable participants, however, the increased cost for employers is “staggering.” The CEOs advised eliminating the tax.

Tax and overseas manufacturing

Some of the CEOs supported the idea of a “border-adjusted tax” that Republicans in Congress want to see passed. The tax would essentially lend favor to products manufactured in the U.S. and would exclude exports.

Trump hasn’t said if he’ll back the strategy, but retailers (who weren’t included in this series of roundtables) have strongly opposed the tax. Companies such as Target and Walmart, whose market often relies on overseas manufacturers, said the retail market would suffer if the border tax were imposed.

Workforce of the future

When it comes to employing Americans in factories and tech industries, the CEOs said there were plenty of jobs to offer, but not enough qualified applicants.

The issue isn’t that the jobs are being “taken” out of the U.S., but that U.S. high school graduates often don’t have the math and language skills that overseas applicants are able to demonstrate, the CEOs said. Aligning educational curricula with what vocational jobs demand would help increase job opportunities for U.S. high school graduates, they insisted in the meeting with Trump.

And vocational training carries a stigma here in the U.S., some CEOs explained, unlike in Europe and the U.K. where blue-collar, industry-trained jobs are viewed as professional choices. Expanding opportunities for public-private partnerships such as those being pushed by some auto companies would help ensure more technical jobs, the execs said.

Many of the representatives were receptive to Trump’s pro-business strategies, which Michael Dell, founder, chairman and CEO of Dell Technologies, told Business Insider would “bring capital back onto the balance sheet of the United States.”

Trump’s immigration policies appear to have been diplomatically avoided, with some participants noting that members of the regulatory business roundtable “stand ready to help avoid unintended consequences that would inhibit the ability for U.S. companies to drive economic growth and be globally competitive.”

What wasn’t heard

The roundtable focused on large-scale manufacturing companies’ needs. It didn’t necessarily address Main Street small businesses that often have different concerns but are impacted by the supply-chain decisions of those larger companies.

The meeting also didn’t address how service-related industries would be impacted by these suggestions. How will ethnic restaurants, for example, deal with a border import tax that clearly benefits large manufacturers but could restrict those restaurants from offering affordable services and selling authentic imported goods?

Bringing “millions of jobs” back to the U.S. means ensuring those industries that depend on the resources and values already in place have a voice in the process as well.

Image credit: Flickr/Nicole Yeary