The Power of a Conservation Easement

By The Nature Conservancy, USDA's Natural Resources Conservation Service, and The Climate Trust

New Conservation Easement in Eastern Oregon Protects Zumwalt Prairie, Ranching Livelihoods

It is no secret there can be tension between conservation interests and cattle grazing, but the owners of the Lightning Creek Ranch in eastern Oregon have found some common ground.

Lightning Creek Ranch owners the Probert family, led by Dan and Suzy Probert, have teamed up with The Nature Conservancy, the Natural Resource Conservation Service (NRCS) and The Climate Trust to ensure their 12,225-acre ranch will be managed to benefit both ranching livelihoods and the native habitat and wildlife it supports. The Probert's have sold an agricultural conservation easement on the property that will prohibit tilling or energy development on the native grassland, while allowing the property to be used for livestock grazing that follows a grazing management plan.

“Wallowa County is a very special and unique place, and I believe it is absolutely critical that we protect our resources for future generations,” said Dan Probert. “Because of this agricultural conservation easement, Lightning Creek Ranch will always remain a working ranch while also protecting some of the most beautiful and ecologically important lands in the country.”

Conservation easements protect land for future generations while allowing owners to retain certain property rights. Through an easement, landowners willingly sell or donate only those rights necessary to protect specific conservation values, such as fish and wildlife habitat. Easements are individually tailored to meet a landowner's goals and the landscape’s needs. Because the land remains in private ownership, with the remainder of the rights intact, an agricultural easement property continues to provide economic benefits for the area in the form of jobs, economic production and property taxes.

“We know grazing is an important factor for grassland conservation,” said Jeff Fields, Zumwalt Project Manager for The Nature Conservancy in Oregon. “On large landscapes like Zumwalt Prairie, native species thrive with occasional disturbance, such as fire and grazing. Just like fire, it is critical that grazing happens under the right timing and intensity, which is what we guide with our grazing management plans on these easements.”

In addition to helping conserve North America's largest remaining grassland of its type and supporting the local ranching community, this agricultural conservation easement prevents the Lightning Creek Ranch from any conversion for residential or commercial energy development or crops. Preventing these changes and maintaining the native grassland will keep an estimated 55,000 tons of carbon in the ground, a benefit that secured funding for this transaction from The Climate Trust.

“Lightning Creek Ranch is the first grasslands project to join our Climate Trust Capital Fund I portfolio, and we are elated to be able to provide capital to this charismatic project in our own backyard,” said Mik McKee, Land Asset Manager for The Climate Trust. “The environmental benefits to be gained from preserving native grasslands are vast, with impacts ranging from improved water quality and soil erosion prevention to the safeguarding of carbon stored in the ground. This investment-grade project reflects our ongoing strategy of supporting quality projects in the early stages of development to elevate their impact.”

The match funding for this purchase—$1.3 million—was provided by the USDA Natural Resources Conservation Service through its Agricultural Conservation Easement Program – Agricultural Land Easements (ACEP-ALE). This program provides financial and technical assistance for long term conservation and protection of agricultural lands and their related benefits. Created in the 2014 Farm Bill, this is the first ACEP-ALE project to be completed in Oregon.

“The ACEP-ALE program is a critical tool in our toolbox to sustain pristine, working grasslands of special significance in the Zumwalt Prairie landscape while supporting the rural economy,” said NRCS Oregon State Conservationist Ron Alvarado. “The Lightning Creek Ranch ALE easement expands connectivity with other NRCS conservation programs in the Zumwalt Prairie, such as a multiyear, $3.1 million Regional Conservation Partnership Program (RCPP) project awarded this year, with The Nature Conservancy as the lead partner. The RCPP funding will help private landowners maintain and improve soil heath through innovative on-farm conservation practices and permanent ALEs, ensuring productive agricultural lands are never converted to other uses.”

After a generous gift of $700,000 from the Doris Duke Charitable Foundation, The Nature Conservancy is still privately fundraising $400,000 for the purchase of this land easement, which the Probert's sold to the Conservancy for $200,000 less than its appraised value.

“Ranch real estate values in Wallowa County and in other scenic areas are valued far above a fair market value for a ranching enterprise,” Probert said. “By granting the development rights to The Nature Conservancy, we were able to reduce the land cost to one that is manageable for our family. If we, as ranchers and farmers, want our children to be able to afford a farm or ranch and remain land owners rather than tenants on "legacy" ranches, then we need to find a way to reduce land costs to our heirs. Conservation easements are a great way to do this while ensuring the Zumwalt Prairie remains an intact grassland with the same characteristics that make us proud to call this beautiful place home.”Image credit: Flickr/J. Stephen Conn

Kasey Krifka is the Senior Marketing Communications Manager for The Climate Trust

Vitae London: the watch brand with heart

Rainforest Alliance and Europe’s UTZ Announce Merger

In the business world, they say mergers and acquisitions are necessary to eliminate redundancies and improve efficiencies. And considering the numerous environmental problems the world faces, from deforestation to ensuring the planet can sustainably and responsibly feed a rapidly growing population, M&A rules can certainly apply to the non-profit world.

To that end, New York City-based Rainforest Alliance and UTZ of Amsterdam have announced that they will merge later this this year.

Both organizations have a strong track record of promoting sustainable agriculture, while ensuring farmers receive a fair price for their crops akin to various fair trade programs underway worldwide. Rainforest Alliance has been successful in both holding companies accountable for their supply chain operations in countries where regulations and law enforcement are often lax. But the organization has also forged constructive partnerships with various companies, including its work with Procter & Gamble on the global paper trade. It has even landed fair trade coffee from Nicaragua at your local 7-Eleven.

UTZ is more familiar to our cousins across the pond, but can also boast about its work to ensure more responsibly-sourced food and beverage products are now featured in Europe’s supermarkets and cafes. The NGO claims a broad reach, with over 850,000 farmers registered within its agriculture programs; those landowners in turn employ an additional 424,000 workers who together raise UTZ-certified crops on 2.7 million acres of land. And in business-speak, UTZ can certainly claim several “wins,” from transforming tea production in Sri Lanka to improving cocoa farming and production in remote regions of Indonesia.

According to a press release, the new entity will keep the Rainforest Alliance name. Han de Groot, currently the executive director of UTZ, will serve as the CEO of the new and expanded Rainforest Alliance. Nigel Sizer, who is now president of Rainforest Alliance, will have a new role as of Chief Program Officer, Advocacy, Landscapes and Livelihoods – effectively becoming the organization’s chief operating officer. The new Rainforest Alliance will continue to be a member of the global Sustainable Action Network (SAN).

“Our missions are very similar, to work with farmers and communities in an effort to protect the natural environment and help mitigate the effects of climate change on a global scale,” said Sizer in an emailed statement to TriplePundit. “By uniting with UTZ, we will combine our strengths to expand our impact on improving the lives of farmers and forest communities, protecting biodiversity and championing companies that are on the path to sustainability.”

While the various sustainable agriculture certification standards have improved livelihoods and environmental stewardship worldwide, one complaint of both companies and consumers is that the various stamps, seals and logos displayed on packaging and marketing collateral often cause confusion. On that point, Rainforest Alliance has noted that at least 182,000 tea, coffee and cocoa farmers have been certified under both standards. Having one strong certification standard, and a globally recognized brand, will eliminate the doubling of administrative tasks in order to stay complaint with both programs. And the move could generate even more success, as it would convince more farmers and companies to either adopt this certification or, in the case of food and beverage companies, partner with Rainforest Alliance.

This new and expanded Rainforest Alliance will still face countless challenges with its sustainable development programs despite its boost in size and outreach. Political chaos in Brazil, for example, has led to accelerated deforestation after the work of NGOs succeeded in slowing that trend during the past decade. And as more food and personal care companies covet palm oil as a key ingredient, new lands are being harvested in Africa – often in countries in which weak legal and regulatory infrastructures make it difficult to ensure new development does not come at the harsh cost of human rights and wildlife destruction.

Image credit: Leon Kaye

Breaking: American Solar Direct Files for Bankruptcy

The growth of home solar has been unstoppable in recent years. According to the Solar Energy Industry Association (SEIA), solar sales nearly doubled in 2016, with more than 14 GW installed. For many, the projections for stellar growth in rooftop solar and other sectors of the industry seemed unshakable.

And nothing speaks more to that growth than the cost of home solar installations. In 2016, the cost related to those rooftop gems dropped 29 percent, says SEIA, which notes that a drop in hardware sticker prices helped lead the way to cheaper prices overall.

But while the cost of solar has been plummeting, there have been troubling indications for several years now that the home solar sector may not be as resilient as say, the community sector. Since 2011, more than 100 solar-related companies have shut their doors, either restructuring, selling or going out of business altogether.

Plus, a running list on GreenTechMedia from 2015 indicates that the turnover is by no means limited to solar installers. Parts manufacturers face their own challenges, with falling prices impacting the industry across the board and industry advances making it hard for others to keep up. Consumers however, notice it most when the installer they have contracted with doesn't turn up to finish the installation and won't answer the phone.

Still, it was the most recent spate of failed solar installers that made us ask: Is the problem a vast divide between what companies are promising consumers and what (they find later) it costs to run the business? Is it profit projections vs. profit reality? Or is it an indication that home solar is really unsustainable?

To get a sense of the problem, TriplePundit delved into the history of some of the most recent and largest installers that have called it quits. We bent an ear to what they said when they sent out their press announcements and took a look at what solar analysts feel is really the issue. Lastly, we took a speculative look at one company that earlier this year was struggling, but felt it had "positive momentum" to overcome until it went off the radar altogether.

Calling American Solar Direct

Most of the solar installers that have unfortunately landed on the list of company closures have been forthright, letting their customers know that there would be contract changes on the horizon, whether it meant an outright sale, a bankruptcy or a shifting of corporate priorities.

But according to Mel Burns, executive director of energy concierge services at MyDomino, that's not the case with American Solar Direct, which gained a great reputation after it burst on the scene in 2009 and disappeared earlier this year without a whisper. MyDomino, based in Oakland, networks with consumers to help them with their clean energy concerns.

"In 2014 they were like gangbusters. They were one of the fastest growing solar companies and now, poof! they're gone," said Burns. "They really [went] off of the radar very quickly and without notice."

And it was that lack of head's-up and follow-up that caught the attention of two solar customers, whose well-honed experience in research told them that something was amiss when their new solar installer not only didn't finish the job, but didn't file the paperwork to get paid by the loan company. Paul SanGiorgio is a physicist [his wife, Jen Boynton is the editor-in-chief of TriplePundit.]

"I totally understand if they are going out of business that they don’t really care about my side paneling or fixing the electrical panel," said SanGiorgio, but it just seems totally bizarre that they have shown zero interest in actually getting paid for the work that they did."

According to SanGiorgio, the couple reached out to MyDomino last September when they decided they wanted to install solar panels on their home. At their request, MyDomino sent a list of companies that had been screened and had been operating in the SanGiorgio's geographic area. The SanGiorgio's reviewed the choices and eventually settled on American Solar Direct.

"[American Solar Direct] sent some people out to look at our roof and make sure our roof was OK. They gave us the final OK sometime in October or November. So we signed the contract and they started doing the work."

But the couple soon found that the process wasn't going to be as straight-forward as it looked. SanGiorgio said the construction crew responsible for upgrading the electric box and installing the panels would turn up without the right contractor to do the work, with the wrong equipment, or with no equipment at all. In January, some three months after signing the contract, the installers announced the job was ready to be approved by a local inspector.

That's when the SanGiorgio's discovered that in order to install a new, higher grade electric panel, the installers had torn off some of the siding on their house presumably just before the record winter storms had set in, leaving the insulation exposed to rain and erratic temperatures. According to the city inspector, they had also failed to waterproof one of the electricity boxes, a requirement before the city would agree to OK the work.

SanGiorgio said the representative from American Solar Direct who was present at the inspection promised that if the inspector would sign off on the job, he would run over to Home Depot and buy a tube of calk and "come right back." The inspector accepted the promise and signed off on the new solar panel array.

"And that’s the last time I ever saw anyone from American Solar Direct," said SanGiorgio.

According to both SanGiorgio and Burns, it was also the last time either of them heard from the company.

Burns said her first solid indication that American Solar Direct may have gone under was a phone call from Sighten, a solar quoting platform that is an essential component to large-scale solar installations. Sighten had called to let her know that the company seemed to have disappeared from the network and was no longer using their services.

"That's a telling sign," said Burns. "They had been a large-volume player." Burns said it would have been virtually impossible for the company to operate without using the quoting platform.

Since our interviews with SanGiorgio and Burns, TriplePundit has learned that American Solar Direct has filed bankruptcy, adding its name more officially to those companies that couldn't compete with an aggressive market climate. According to its Chapter 7 filing, the company owed between $10 million and $50 million and by the time it called quits on June 2 had less than $60,000 in assets.

That kind of disparity between liabilities and assets is a familiar scene these days that has been played out repeatedly over the home solar landscape, where both new and seasoned solar companies, driven by the demand to corner the market and as Burns puts it, reach "the holy grail of grid parity" compete with unsustainably low prices and promises of record-speed installations.

Home solar: The list may not be finished

The names of failed home solar companies these days read like a who's who of solar fame: Sungevity, Solyndra, SunEdison, Verengo, HelioPower, One Roof and Vivint, some of which were forced into bankruptcy, and some of which had the better fortune to be acquired by hopeful companies, spell a troubling picture for an industry that has garnered the interest of investors and the excitement of homeowners who see affordable payments as a way to beat the increasing costs of the electricity grid.

Comments left on Glassdoor by Sungevity employees are as telling as the reasons that other companies have given for their downfall. According to Sungevity employees, cash management procedures and lack of foresight contributed to why a successful, name-brand solar company ended up being sold off for assets. The same story could be heard from its competitors like mega-giant SunEdison, which later found itself under investigation for overstating its worth.

But from Burns' point of view the issue is even simpler. It has to do with managing how much you charge against how much you really need to pay your overhead.

"Nine years ago, [the cost of solar] was roughly $8 or $9 a watt," explained Burns, who began made her career in clean energy working for Sungevity when if first launched. Today that cost is around $3 to $4 a watt. "That's a 60 percent drop. That's wonderful.That’s really triggered the solar explosion and made it possible for a lot of people to get solar [for whom] that was never possible before."

Except the overhead hasn't shrunk or kept pace, said Burns. That new, basement floor price must still pay for hard costs -- solar panels, inverters, etc. -- and soft costs -- labor, installation, design and a staggering list of in-house expenditures, government taxes and permits that now all must be met with lower revenue.

"Can a 60 percent drop in price still pay for all those things?," Burns asked.

As far as MyDomino is concerned, Burns said, the closure of American Solar Direct is a wake-up call for an industry that fervently believes in clean energy, but also relies on its partners to be transparent. She said she is taking the time to study and learn as much as she can about what caused American Solar Direct and others to become insolvent.

"I still believe in residential solar," Burns reassured adamantly. "It is still going to do well. It is still going to have great growth. But it is in a period of transition." And that transition may entail a few more years of growing pains.

As to the SanGiorgio's, they are still waiting for American Solar Direct -- or someone in its stead -- to bill their loan company. SanGiorgio said the loan company won't start the payments until they receive a bill from the installer, which so far has been unreachable.

"As far as I can tell, it has basically stopped functioning," said SanGiorgio, who echoed Burns observation that the company's bidding price and lack of operational management may have had a role to play in the company's fate, like so many before it.

"I don’t know why, but they [were] not bidding well and they [were] not organizing their projects well and this is the end result: They are going out of business."

Flickr images: brian kusler; Russell Neches; Wayne National Forest.

Can the Sun Pay for Trump’s Border Wall?

According to the business and political news site Axios, President Trump “floated” the idea that the wall he envisions along the U.S. border with Mexico could be festooned with solar panels, which would pay for itself with the electricity that it would generate.

While the Trump’s suggestion was just that, an idea for his “beautiful” wall, reactions, naturally, were all over the map. Although The Atlantic noted Trump’s disdain for the environmental movement, Robinson Meyer suggested that the notion could be viable and is “more than a troll.” Some GOP leaders were reportedly open to the idea. “I think it’s innovative,” House Majority Leader Kevin McCarthy told the Wall Street Journal. “To authorize it and to appropriate it wouldn’t cost as much.”

Trump’s preferred medium, Twitter, was quick to chime in with a wide range of responses:

[embed]https://twitter.com/SierraClubCO/status/872506945437093888[/embed]

Let’s step back a second and forget about the politics of why the president wants to support coal jobs in Appalachia but install solar along the border. Clearly, Mexico is not going to pay for this wall. The country’s former president, Vicente Fox, screams daily on Twitter that our neighbor to the south will never, ever pay for the “f---ing wall.” Congress is also dragging its feet on funding any wall. So far it has appropriated enough funds for only 74 miles along the 1,200-mile Texas-Mexico border. At face value, a wall that would generate clean power and pay for itself makes sense. And despite the White House’s exit from the Paris Agreement, there are nuggets of sustainability in Trump’s policies if one looks hard enough – his plan to privatize the U.S. aviation system, for example, could actually reduce emissions. Forget all the vitriol and the behavior of the president and his adversaries – in fairness, some of Trump’s policies appeal to both the left and right. The solar wall is one example.

But as with many of Trump’s policies, the devil is in those pesky details.

Trump supposedly envisions a 50-foot high wall covered with solar panels, and theoretically this structure could bond the U.S. and Mexico as it generates emissions-free electricity. But while not everyone agrees with the conventional wisdom on panel placement, in general, installations north of the Equator have panels facing south. With the exception of a stretch along Texas from Big Bend National Park in Brewster County, the vast majority of the panels would face Mexico. This stubborn question therefore has to be answered: who maintains, cleans and repairs the panels? Drones could be the answer, but as some opponents of the wall would retort, drones could serve as an effective tool for border security along the remote sections of the wall – and in any event, they are costly.

In addition, who would benefit from this energy? True, there are large and rapidly growing population centers along the wall, with San Diego-Tijuana, Tucson, El Paso-Juarez and Brownsville-Matamoros the obvious candidates to receive this cheap, limitless source of power. But those areas are not where new sections of this wall would be built.

The cost of transmitting this power to the population centers that could harness this power must be considered in enumerating the project’s total price tag. Improved battery storage would certainly help the case for building a solar wall. But considering the sensitive politics surrounding the wall, do not expect Elon Musk, who recently cut ties with the Trump Administration over the Paris Agreement exit, to enlist Tesla as a business partner with its PowerWall technology anytime soon.

Additional costs need to be considered, too, as in permitting and licensing. The bureaucratic nightmare of scoring permits from various federal, state and local municipal agencies would scare off most solar installation contractors while piling onto the installation’s mounting costs.

Finally, could this solar wall really pay for itself? Julie Pyper of GreenTechMedia has summarized various estimates of what this massive project would cost, and more importantly, assessed whether the return on investment would even be worth it. The total cost of installing this solar wall, assuming it runs about 1,000 miles long, could range anywhere from $10 to $20 billion dollars – but these estimates do not account for the additional cost of building this structure, and plunking solar panels atop it, in the more isolated areas.

One Oregon-based solar installer, Elemental Energy, at one point estimated that the payback time of such a project could be as short as four years – a solid ROI for the Negotiator-in-Chief. But then the company updated its figures; assuming this wall generated $106 million in revenues, the payback would be about 100 years if the wall costs $10 billion to build. (Trump has long suggested the wall would cost $12 billion; his political opponents say the final amount would be far more).

Of course, as the laws of government physics go, these projects often increase in price, so if the wall ends up costing over $20 billion, not including the costs of solar panels, then we are mulling a payback period of over 200 years. That is going to be a tough sell, even if this enormous solar installation could power as many as 220,000 homes. (And yes, we are including the cost of building the entire wall including the solar panels, since we assume in this scenario that no other political path for this structure exists in order for it to be built.)

The U.S. does have an impressive history of building world-class infrastructure projects: the transcontinental railroad and the interstate highway system come to mind. The completion of a 1,000-mile solar wall would be the crowning achievement for any world leader. But the president’s diminished political capital, pushback from the states and a Congress full of politicians concerned more about their careers than that of Trump’s together provide a reality check. The solar wall is a great conversation starter, but the truth is that such a construction project will not begin anytime soon.

Image credit: Pierre Marshall/Flickr

Interface: Now You Can Sequester Carbon in the Carpet

"We have a ton of parking lots. Why?" Erin Meezan, Chief Sustainability Officer at Interface, Inc. asked rhetorically in a recent interview, describing the iterative systems-based approach her company takes to sustainability at their Atlanta, GA headquarters, "We can park on grass." Grass is, of course, permeable and allows rainwater to soak in, creating a living ecosystem and carbon sink as opposed to storm drains which funnel water, and the trash and debris it picks up along the way, directly out to sea. But I digress. This is just one of dozens of examples Meezan shared with me as she described her company's efforts to treat the "factory like a forest."

Interface Inc. -- a public company with a $1B market cap -- was one of the first companies to take a bold, public stand on climate change. But that doesn't mean they put sustainability ahead of product. Instead, they use sustainability as a differentiator to push innovation. "There are hard-nosed business people on our board who understand the business value of sustainability," Meezan explains.

Its founder, Ray Anderson, had a personal epiphany that let him to use his carpet company company as a tool to make the world better. The company is sustainable through and through, and prior to Ray’s death in 2011, he was the perfect spokesperson for the movement. He sold plenty of carpet along the way.

Interface has carried on his mission and continued to innovate with research into new products. Their goal is to prove that business can be a climate positive actor. Meezan explains,"We make stuff. How can the stuff we make serve as a carbon sink?"

When the company took this design approach, they realized that they didn't just have one or two potential materials to choose from, they had 45 options like calcium carbonate to make "carbon a building block in our products." This way, the more carpet they produce, the more carbon is sunk -- business profitability and climate positivity go hand in hand.

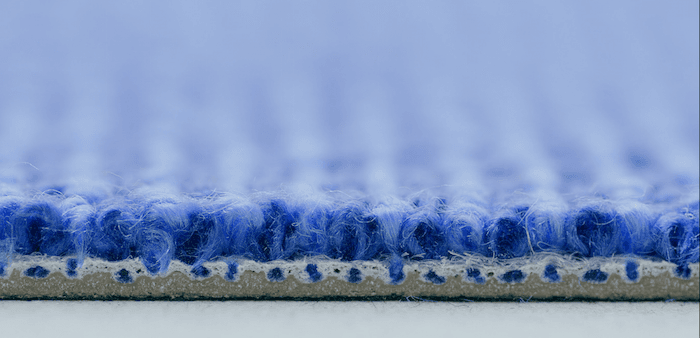

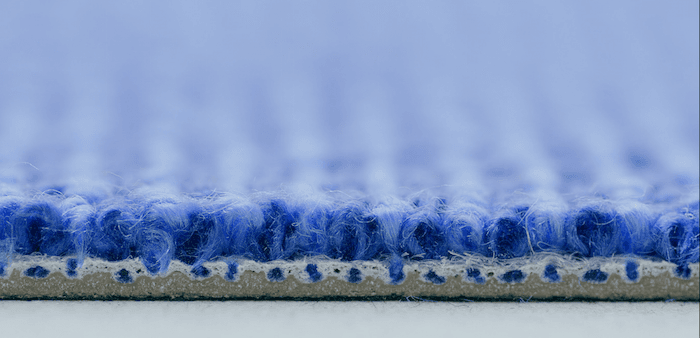

The most recent example is their Proof Positive carpet tile, a carpet tile that stores more carbon than is emitted during the production process.

The prototype tile has a negative carbon footprint, which the company achieved without purchasing carbon offsets. The materials that make up the tile are derived from plants and designed to store carbon for at least a generation. Since 1996, Interface has reduced the carbon footprint of its carpet tiles from 20 kilograms of carbon per square meter to just over 7 kilograms per square meter in 2016. The Proof Positive tile clocks in at an impressive -2 kilograms of carbon per square meter. At the end of its useful life, the carpet tile can be recycled into new carpet, making this a truly closed technical loop.

The company sees this product as a natural step in moving the design and architecture industries forward. These groups know that the built environment has a huge carbon impact and they have the power to have a positive impact through the choices they make. Designers make crucial product decisions before a product is even presented to a client, so influencing these decision makers is key to Interface's impact -- it hopes to pull the rest of the industry along by innovating better, more sustainable products.

23 years ago, Interface started the sustainability journey with the question, "What would a business look like in nature?" Using abundant atmospheric carbon as a building block in carpet tiles is certainly an exciting step.

Image credit: Interface Inc.

The Vegan, Saudi Prince Investor

HRH Prince Khaled bin Alwaleed is a hip, young vegan Saudi Prince who invests in clean energy and supports animal rights.

Earlier this year, his story was picked up by multiple outlets including One Green Planet. This Saudi Royal, now 38, is the son of the 26th wealthiest person in the world (billionaire investor and philanthropist HRH Prince Alwaleed bin Talal, often referred to as the “Saudi Arabian Warren Buffett”).

Part of the Prince’s journey started when he had a head injury in his teens while jet skiing in the south of France. He had to learn to walk again and witnessed his dad, a person he looked up to as strong and invincible, weep with worry in his hospital room. Somehow, when confronted with the fragility of life and the effect it can have on loved ones, it makes a person realize that being true to one’s own self is the only way to live. His social media feeds (Twitter and Instagram) are filled with animal welfare posts, vegan food posts, and in the case of Instagram, plenty of goofy comedy.

Several years ago, Prince Khaled was diagnosed with high cholesterol and started to change his diet. As he began exploring what it meant to adopt a plant-based diet, he became more and more knowledgeable about the challenges our current animal agriculture-based food systems place on personal and animal health and, especially, the environment.

An enthusiastic consumer of media exploring these topics, books such as How Not to Die by Dr. Michael Greger and documentaries such as An Inconvenient Truth and Before the Flood also shaped his interests. Born and university-educated in the U.S., he keeps a foot firmly planted in the Middle East. He started his business career with his father’s investment company, Kingdom Holding Company, and then branched out to start KBW Investments. KBW Investments has holdings on five continents in the areas of construction, property, engineering, automation, finance and hospitality. Following that, he founded KBW Ventures, which focuses exclusively on venture capital, value creation and growth equity.

He is a business leader, not only for the millions he has invested in emerging and established businesses, but for standing in contrast to his home country's biggest export: oil. He long ago divested any interests in dirty energy and oil, and owns one car, a Tesla.

The weekend that U.S. President Donald Trump visited Saudi Arabia, Khaled was speaking at a panel and meeting with other plant-based food leaders at the Reducetarian Summit in New York.

For our first meeting, I chose the DC vegan diner that I had mentioned in my article for Triple Pundit about plant-based dairy, Fare Well.

He showed up unaccompanied and actually Ubered to our brunch from the Four Seasons. Of course he's familiar with the famed hotel -- its management company is 45 percent owned by an investment company controlled by his father. For brunch Khaled wore baggy jeans, black Converse sneakers (he owns a number of pairs) and a hoodie. Doron, the owner of the diner and DC’s famed vegan bakery Sticky Fingers was there that day and we cracked jokes. Khaled took it all in, in good humor, and after our meeting, was off to CrossFit and a meeting with some documentary filmmakers.

A month later at the Reducetarian Summit, he was on a panel discussing conscious capitalism and the role business and investment have in moving the needle towards a more sustainable food system. He talked about his own journey to veganism and told stories like the time he took an omnivorous tennis pro to Cross Roads in LA and didn’t tell him it was plant-based until after the meal. He explained that he has taken on the role to “bridge the gap and create awareness for the benefits of a plant based lifestyle in the region.” He even convinced his father to go vegan.

Khaled greeted me warmly and with familiarity, like friends. Following his session, we stepped outside for an interview. I specifically wanted to explore his involvement in the plant-based food movement and his new involvement with documentary media. This interview has been edited lightly for clarity and length.

TriplePundit: How did the relationship with [vegan chef] Matthew Kenney start? What are your future expansion plans?

Khaled bin Alwaleed: We wanted to open a plant-based café in the Middle East. Originally, we were looking into a restaurant in Bali, Alchemy, that does plant-based and coincidentally at the same time we heard about Matthew Kenney. He seemed a much better fit. We looked into the licensing fees and I thought “Why am I paying him a fee, when I can just invest in the company?” We invested and decided to make [Bahrain’s] Plant Café a branch of Matthew Kenney’s restaurants. We’re going to have ten more in the region by 2019.

3p Last time we met, you mentioned backing a documentary about the plant-based food movement. Tell me about the name of the project and what are the plans for distribution?

KbA: That's “Eating Our Way to Extinction.” We’re working closely on an agreement with Ludo [Brockway] and his brother to make this film happen, but it’s early days on that one. They actually just got back from the Arctic where they were shooting some footage, but they haven’t shot much yet. It’s early days. [Ludo and his brother Otto are slated to start shooting in around September 2017 for a 2018 possible release.] Another film we're working on, which is further along in production, profiles former UFC fighter James Wilkes, and other elite vegan athletes. It's a documentary about athleticism and veganism. The filmmakers are close to finishing and we’re working with them to see how we can help with distribution.

For both, we’re looking at online distribution, and for the athleticism one, going through the proper channels of the festivals first as well.

3p: And so this has been in the last year or so that you’ve begun to get involved with media production?

KbA: The last year? No, this has only been the last two months.

3p: This is exciting, that you’re looking towards media because it’s a big influencer [in lifestyle decisions]?

KbA: Oh, it’s not just an influencer, it's what tipped the point for me. I was on and off being vegan, but it was films like Food, Inc., Food Matters Hungry for Change…

3p: It changed your life.

KbA: It really did. It opened up my eyes to what exactly is really happening.

3p: How do you think we can work to have a more sustainable food system? People are still starving and others eat far too much of the “wrong” things- what are your thoughts on how society can address these problems?

KbA: One of the main things, I think, is “How do you feed 9.7 billion people by 2050?” That’s the biggest issue that food innovators are addressing right now. Companies like Hampton Creek, companies like Memphis Meats are working to solve these problems. The main problem is that governments need to back these initiatives as much as they are backing the animal agriculture industry. There are gross inefficiencies within the animal industry, when you look at calories in versus calories out.

3p: Moving on to tech and innovation, we’ve talked previously about specifically sustainable hardware companies like iameco computers and Fairphone. As a connoisseur of all things “tech,” how do you think that the hardware business can become more sustainable? What are your thoughts on innovation toward sustainability in this area?

KbA: I think that companies like Fairphone and Apple each have their own markets and it lies with each company to work to make themselves more sustainable. For example, Apple just did this huge initiative where they took phones and recycled them to make other phones. I’d love to see this type of initiative with companies like Samsung and Huawei. Fairphone will continue to grow in its niche market, but you have to address these big companies…

3p: It’s like shopping- not everyone is going to shop at Whole Foods, you have to address WalMart.

KbA: Exactly, yes.

3p: You have many years left to work with numerous other positive innovators to do even more- what are the kinds of projects that catch your attention and interest?

Khaled bin Alwaleed: I’m a big believer in technology. I truly believe that technology is changing and will change the world even further. I’m not too big on brick and mortar, “analog” types of companies as opposed to digital companies. What gets me excited are new things that are changing the world, as clichéd as that sounds.

3p: So ideas you haven’t heard of before?

KbA: Yes, it’s ideas that make me open my eyes and say “Wow, this is actually happening in this world, where we say, 'we just have to get in there no matter what.'

For someone who is equally at home in traditional Saudi attire as he is in a hoodie and baseball cap, Prince Khaled’s outlook can be summed up by the quote that greets you when you open his personal website, “Never let anyone limit your aspirations.”

Photo credits: Lisa Dietrich, Green Product Placement

Another record-breaking year for renewable energy: more capacity for less money

Louisiana Oil and Gas, Environmental Orgs Unite in Opposition to Trump Budget

President Trump is beginning to see his polling slip even in counties where the vote swung to him by a wide margin. That's not surprising, as more voters come to understand that the Trump budget tears important benefits away from them. That pattern could hold firm in the coastal parishes of Louisiana. Louisiana is divided into 64 parishes, which resemble counties in terms of governmental structure and function. Support for Trump runs deep there, but the proposed Trump budget would eliminate a critical source of funding for wetlands projects aimed at buffering those very parishes from rising sea levels.

The Louisiana wetlands situation is just one area in which the Trump budget provides an opportunity to for business to support local environmental interests on issues that transcend political parties, rather than attempting to persuade voters to change their personal feelings about Trump or any other office holder.

Red state, rising seas

Once treated as mere swamps to be drained, wetlands are now recognized globally as regional economic engines and important buffers for inland communities, in addition to their value as natural habitat and their role in large scale carbon sequestration.

The Louisiana coast is particularly vulnerable to wetlands loss. As described by researchers with Tulane University, the state has suffered 80 percent of the wetlands loss in the U.S., though it is the site of only 40 percent of the nation's remaining wetlands.

According to Tulane, parts of the state are "on track to drown" due to sea level rise in addition to other factors including inland oil and gas activities, and issues related to Mississippi River management.

In 1980, the state won federal permission to establish the Louisiana Coastal Resources Program to address the problem, but over the next 20 years the region still experienced "unprecedented land and wetlands loss" attributed to erosion and subsidence as well as sea level rise.

In 1992 the U.S. Geological Service updated the situation. The state's three million acres of wetlands were vanishing at the rate of 75 kilometers annually, and USGS noted that reducing the rate of loss is "difficult and costly:"

"The swamps and marshes of coastal Louisiana are among the Nation's most fragile and valuable wetlands, vital not only to recreational and agricultural interests but also the State's more than $1 billion per year seafood industry. The staggering annual losses of wetlands in Louisiana are caused by human activity as well as natural processes..."

Hurricane Katrina added urgency to the situation. In 2007 the state legislature initiated a coastal master plan and in 2009 it ordered a "science-based study" to assess the Coastal Zone boundary, which includes part or all of 20 parishes.

As a result, in 2012 the state legislature added almost 1,900 miles to the Coastal Zone.

The law requires five-year updates and strategy assessments from participating states. The Louisiana Department of Natural Resources plan for 2016-2020 maintains wetlands and coastal hazards at high priority levels, and shifts the category of cumulative and secondary impacts from low to high.

Just last March, Tulane University published a new wetlands study highlighting the unusually rapid loss of wetlands in Louisiana. It positioned the state as a warning to the rest of the world:

With present-day relative sea-level rise (RSLR) rates among the highest in the world...coastal Louisiana may provide a window into the future for similar settings worldwide given global sea-level predictions with similar rates later in this century.

In sum, Louisiana has established a long track record of responding to wetlands loss for its impact on the economic well-being of the state and the very survival of its coastal communities, regardless of which party holds the White House.

The Trump budget proposal

Against this backdrop, consider that the state of Louisiana weighed in for Trump at a cumulative rate of 58 percent in the 2016 presidential election cycle. The New York Times provides a breakdown showing that some of the heaviest margins occurred in parishes along the coastline, including 88 percent in Cameron, 78 percent in Vermillion and 76.7 in Terrebonne.

Nevertheless, the Trump budget proposal would cut Louisiana off from an important source of additional wetlands protection funding. The funding derives from the 2006 Gulf of Mexico Energy Security Act (GOMESA). In the aftermath of Hurricane Katrina, GOMESA provides for enhanced revenue sharing from offshore drilling leases, for Louisiana and three other Gulf Coast states.

As described on NOLA.com, the state relies heavily on GOMESA royalties to fill the gaps in its long term coastal management plans:

Louisiana expects to collect $420 million from those royalties over the next three years, which amounts to nearly 17 percent of the $2.5 billion the state plans to spend on coastal efforts over that period.Another $36 million from the arrangement was expected to flow directly to coastal parishes each year.

These fund allocations disappear in the latest budget to emerge from the White House.

The Americas Wetland Foundation was among the organizations to react to the Trump budget proposal, and their response is interesting. Rather than highlighting the impact of sea level rise and the connection to climate change that would come from inaction, in a June 5 press release AWF underscored the role of wetlands in protection critical infrastructure and other assets that play a vital role in the national economy, including energy infrastructure:

States like Louisiana that host onshore the offshore energy production and distribution which supplies so much of the oil and gas consumed throughout the United States also incur the impacts of those activities.

Those impacts go beyond sea level rise:

As the BP oil spill demonstrated, as our working coast provides benefits to the entire nation, we bear the risk to our environment and communities associated with supporting America's energy security.

Ironically, AWF points out that the Trump Administration recently wrote a letter to Louisiana Governor John Bel Edwards underscoring the economic value of wetlands:

"We appreciate the significance of Louisiana's coastal area for energy production, fisheries, recreation, and other resources and we also recognize that ongoing land loss in Louisiana negatively impacts these valuable resources."

When news of the Trump budget proposal first surfaced last month, local officials also skirted the climate change issue to focus on economics. The Advocate cites Republican U.S. Representative Garret Graves, who pushed back strongly:

"If you care about offshore production, you need to do revenue sharing to help address some of the concerns that states have and some of the historic impacts" of the oil and gas industry, Graves said.Eliminating GOMESA revenue sharing, Graves said, is evidence of "a real policy inconsistency."

Republican U.S. Senator Bill Cassidy also weighed in:

U.S. Sen. Bill Cassidy called the proposal to end revenue sharing a "deal breaker.""Any cuts to coastal restoration efforts or GOMESA are short-sighted," he said. "I will not only oppose cuts to the revenue sharing program, but continue to work to expand it for the Gulf Coast."

The economic solution

And so, a wide range of Louisiana stakeholders, including the oil and gas industry, local communities and environmental organizations come to share common ground in opposing the Trump budget proposal.

In the wake of the Trump pullout from the Paris climate agreement, hundreds of U.S. cities and businesses have declared their determination to continue supporting the global accord, along with a growing number of states.

As of this writing Louisiana is not one of those states, but the GOMESA issue has provided it with a compelling economic reason to jump on board.

The loss of GOMESA funding would be painful, but Louisiana has the potential to find other sources, especially if U.S. states and cities are committed to reducing their carbon emissions.

In a carbon-saturated world, Louisiana could draw in revenues by selling carbon offsets, positioning its wetlands as a massive carbon sink -- and making a sound economic case for restoring and expanding this valuable natural resource.

Image: via lacoast.gov (Coastal Wetlands Planning, Protection and Restoration Act).

New York AG Accuses ExxonMobil of Climate Change Accounting 'Sham'

All eyes will be on James Comey’s testimony in front of Congress this week, yet the Trump Administration has additional headaches that could push the White House staff to gulp down more aspirin and seek more legal counsel. One other pain point is that new court filings allege Secretary of State Rex Tillerson may have links to a potential climate change accounting scandal that festered while he was CEO of ExxonMobil.

According to court documents filed by New York Attorney General Eric Schneiderman, ExxonMobil may have made “false and misleading statements” about potential risks to shareholders by future climate change regulations. Schneiderman and his staff have issued subpoenas for documents and other information that covered ExxonMobil’s risk management practices over the past several years.

The problem, according to Schneiderman, is that in past proxy statements the company distributed to its shareholders, ExxonMobil often cited potential carbon prices has high as $80 a ton in order to quantify the cost of future government regulations when discussing costs related to the company’s projects in region such as Alberta’s tar sands. But Schneiderman and his staff have accused the company of using a far lower figure for greenhouse gas (GHG) costs internally.

“Exxon’s use of the lower GHG taxes instead of its publicly-stated proxy costs is particularly telling,” says the memorandum about the company’s discussion of its Alberta investments, “because Exxon’s own documents suggest that if Exxon had applied the proxy cost it promised to shareholders, at least one substantial oil sands project may have projected a financial loss, rather than a profit, over the course of the project’s original timeline.”

Furthermore, Schneiderman alleges that this was not the work of a few rogue employees in the company’s finance or investor relations departments. Then-CEO Tillerson was “specifically informed of, and approved of, this inconsistency,” before the company supposedly ceased using the double-accounting trick in 2014.

In representing this data to shareholders, complains Schneiderman, ExxonMobil’s disclosures of climate change-related costs and risks “may be a sham.”

The latest request for documents filed in court by Schneiderman arrives as the Securities and Exchange Commission (SEC) has conducted investigations about the companies’ valuations of some of its oil and gas reserves worldwide. The SEC’s investigations have been unfolding as states’ attorneys general, including those of Massachusetts and California, launched their own legal inquiries over accusations that ExxonMobil suppressed its own climate change data years ago.

In turn, some congressional leaders have pushed back hard, including Texas representative Lamar Smith, who has subpoenaed the records of both government agencies and environmental groups in a move many say is a maneuver to shield ExxonMobil from years of investigations and litigation.

Do not expect this saga to end anytime soon. As David Hasemyer explains with great detail on Inside Climate News, ExxonMobil is determined to fight this litigation, and has the deep pockets to fund its quest to fight any and all climate policy seen as a threat to its business interests.

But while ExxonMobil has the heft to fund and win legal battles, it may be losing the optics war while dragging the White House down with it. Earlier this year, one of the company's key corporate responsibility advisors resigned, citing the “targeted attacks” on NGOs. While the company and Tillerson have claimed to support the Paris Agreement and some form of a carbon tax, critics say what is said publicly as opposed to what actually occurs on the ground demonstrates that ExxonMobil is doing little more than paying lip service to climate action. Furthermore, the specter of its former CEO and now U.S. Secretary of State embroiled in litigation is not a distraction the White House needs in the wake of last week's withdrawal from the global climate accords.

Shareholders have apparently had enough, including scions of the Rockefeller family, the founders of Standard Oil, which eventually morphed into many energy firms including ExxonMobil. Most family members have sold off their ExxonMobil shares. And Last week, owners of company stock were asked approve a shareholder resolution asking the company to be more transparent about how climate change will impose risks on the company – and in an upset, it passed overwhelmingly.

Image credit: Mike Mozart/Flickr