Composting Offers a Simple But Effective Solution to Our Methane Problem

Ensuring more food waste is composted can make a major impact on methane pollution, researchers say. (Image: Sarah Chai/Pexels)

This story was originally published by Grist. Sign up for Grist’s weekly newsletter here.

The global food system is a climate mess, from the widespread use of greenhouse gas-emitting fertilizers to the methane-spewing livestock to all the food that gets tossed into the trash. In the United States, a staggering one-third of all food — something like 130 billion meals annually — gets thrown out. Each year, that discarded stuff represents an estimated 170 million metric tons of carbon emissions — the equivalent of 42 coal-fired power plants.

But there’s a simple solution, beyond simply reducing waste. According to a new study in the Nature journal Scientific Reports, composting food scraps results in 38 percent to 84 percent fewer greenhouse gas emissions than tossing them in landfills. Unlike trash in landfills, compost heaps are watered and turned, which aerates the decomposing waste and prevents bacteria from churning out as much methane, a powerful greenhouse gas.

“Composting still has some methane emissions, but it’s much, much lower because most landfills aren’t turned as frequently,” said Whendee Silver, an ecologist at the University of California Berkeley and a co-author on the study.

Landfills are a big climate culprit. Garbage dumps generate one-third of all methane emissions in the U.S., in part because the most common item in them is food. The organic matter in landfills breaks down through a process called anaerobic decomposition, in which bacteria feast on it and burp out methane. Food scraps often end up at the bottom of landfills, where it gets compacted and “creates the perfect storm for methane emissions,” Silver said.

Silver’s group measured emissions of three greenhouse gasses — carbon dioxide, nitrous oxide and methane — at a commercial compost facility in California. They continuously tracked emissions over the course of the composting process. Although other studies have done similar landfill-compost emissions comparisons, Silver said this one stands out because it used a new method that “allowed us to figure out exactly when and where and under what conditions the greenhouse gas emissions were occurring” and didn’t alter the conditions of the compost while taking measurements.

The big range in the findings — an emissions reduction of 38 percent to 84 percent — is a result of uncertainty around estimates of greenhouse gas pollution from landfills, which is “a really difficult thing to measure,” Silver said.

The researchers wrote that “fine tuning” the composting process, like turning the pile more and adding water more frequently but in lower quantities, could further lower emissions. Silver said that new tools like aeration tubes below compost heaps could also help slash methane emissions.

The study didn’t account for the climate benefits of applying compost as fertilizer. Other research has shown that laying compost on agricultural fields is key to storing carbon in soil. Some estimates suggest that adding compost to an acre of land can sequester enough carbon to offset 75 percent of a car’s annual emissions.

A handful of states and cities have passed laws to mandate curbside compost pickups and to prevent food scraps from entering landfills. Two years ago, U.S. President Joe Biden set a target of capturing 70 percent of methane emissions from landfills nationwide through a voluntary program. In 2015, the Department of Agriculture and the Environmental Protection Agency announced a goal of cutting food waste in half by 2030. But the country hasn’t tacked toward that target. Between 2016 and 2019, the amount generated in the U.S. actually increased by 6 percent, from 328 pounds to 349 pounds per person each year. And only about 5 percent of that waste gets composted.

This article originally appeared in Grist. Grist is a nonprofit, independent media organization dedicated to telling stories of climate solutions and a just future. Learn more at Grist.org.

Nixing PFAS is a Real Possibility: Here’s One Company That’s Doing It

PFAS are used as a coating on food packaging and are prevalent in other everyday items like personal care products and textiles.

Per- and polyfluorinated substances (PFAS) have been getting a lot of negative publicity. And with good reason. Classified as “forever chemicals,” they’ve been found in food, water, soil, animals and even our blood. Although the extent of their effects is not fully understood, they are known to negatively impact human health in a variety of ways. But while many are calling for an overall ban on the chemicals, pushback from the industry seeks to simply switch out the PFAS we already know are harmful with lesser-known ones that likely have the same — or possibly even worse — effects.

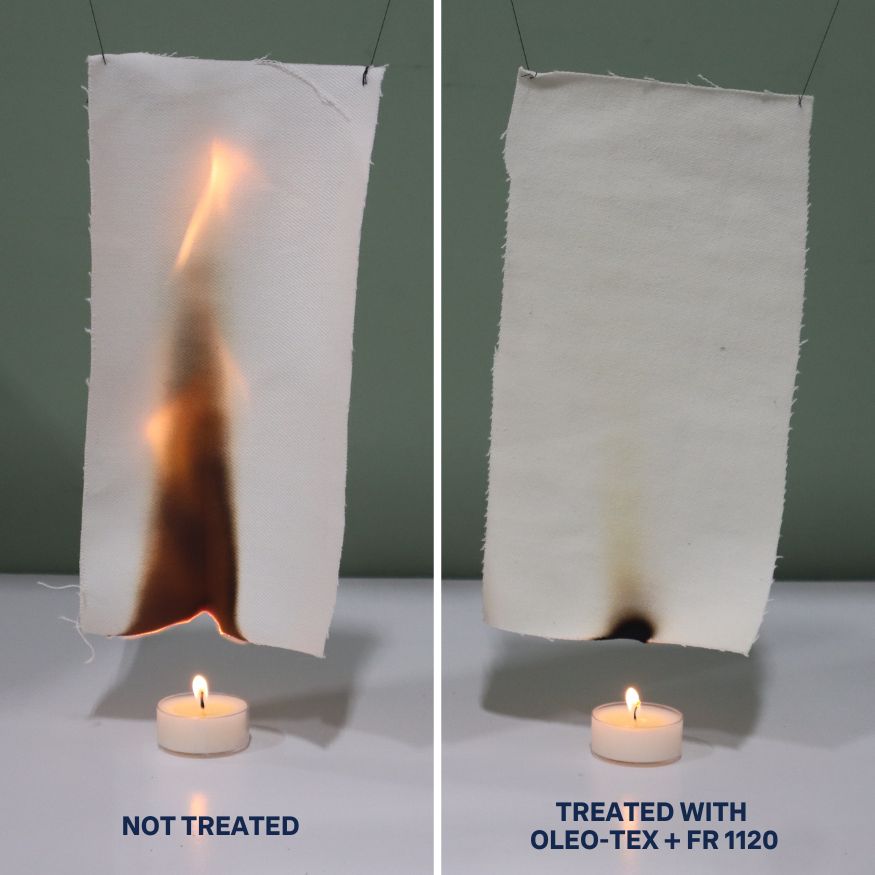

Although PFAS proponents argue that the chemicals are necessary for every aspect of modern life, innovators in chemistry are working hard to develop newer, safer compounds. Impermea Materials is one such company. Its water-based solutions can be used in place of PFAS in a variety of products — including packaging, apparel, upholstery, and technical textiles such as those worn by firefighters and military.

“We use different types of particles that are all inherently safe, they're amorphous,” David Zamarin, founder and CEO of Impermea Materials, told TriplePundit. “What we do is very different than the traditional chemical companies that are out there. We synthesize our own material and, by doing so, we can control a lot of the polymers and their functionality, which is very different because a lot of companies are just formulators.”

PFAS are everywhere

PFAS, or fluorinated chemicals, are ubiquitous in modern life. They are used in everyday items we all depend on, from cleaning and personal care products to non-stick cookware, touchscreens, batteries and fuel cells. They also appear in waterproof, flame-retardant and stain-resistant coatings on food packaging, upholsteries and textiles, among many more uses. As such, these chemicals have found their way into just about every part of our lives, down to the soil that grows our food, the water we drink, and sometimes even the air we breathe.

PFAS exposure is not equally distributed across the country. Those working in the industry’s manufacturing plants have the highest amounts of the forever chemicals in their blood, followed by people who live in areas with high levels of groundwater contamination, according to the U.S. Centers for Disease Control and Prevention (CDC). But that doesn’t mean anyone is free and clear of the stuff — it’s in just about everyone’s blood in the U.S.

But what does that mean for our health? While not enough is known about the consequences of PFAS — especially at low levels — we do know that some levels of exposure increase the risk of various cancers, reproductive problems, developmental delays, compromised immunity, hormonal issues, obesity and elevated cholesterol.

Can alternative materials replace PFAS?

Some manufacturers argue that the most dangerous PFAS — those with smaller molecules — can be replaced by safer, larger-molecule versions. But a study out of Canada found that is simply not the case, at least when it comes to food packaging.

“As some legacy PFAS are withdrawn from the market or regulated, alternative compounds are introduced as replacements. The idea behind this process, sometimes called ‘whack-a-mole,’ is that the alternative is safer than the compound it replaces,” one of the study’s authors, Marta Venier, a professor at Indiana University, told the industry publication PackagingInsights. “In reality, the result is a regretful substitution since the newly introduced compound has similar properties to the compound it replaces. The replacement is considered ‘safer’ because less is known about that specific chemical.”

Instead of just switching out one type of PFAS for another, Impermea Materials has developed its own molecule — dubbed siloalkoxyurylsilane. “The molecule that we believe we've invented is a combination of a variety of different types of chemistry,” Zamarin said. “A lot of it is bio-based. There are reactive chemistries, resin technology, urethane technology and, of course, silica and some silanes. So it's a combination of a few things. And we make it in a very unique way, which is what allows us to combine all of these chemistries together, which normally don't like to be together.”

Third-party testing is an important part of the process, especially with food packaging that has been approved by the U.S. Food and Drug Administration (FDA), as is consistent in-house quality assurance. “We regularly test for fluorine content in both our water and then our finished goods,” he said. “We test for a variety of other chemicals as well in the entire gambit of PFAS. From a third-party perspective, we try to get any of our claims that we make like non-toxicity or PFAS-free tested independently.”

Understanding how PFAS replacements work

Impermea Materials works with producers to provide coatings for a variety of products. But not all of them have a thorough understanding of how to properly cure the chemicals after application, which has led to some using the same process as they would with PFAS.

“We have a lot of clients that are used to applying the traditional C6 based fluorochemicals, and they're used to curing it at 170 degrees Celsius, for example,” Zamarin said. “Well, if you cure ours at 170 degrees Celsius for the same amount of time, you're actually going to burn the coating. If you put it under a microscope, you'll see literal blisters, so you want to avoid doing that.”

Other clients have tried to bypass the curing process and allow the coating to air-dry instead. “It does air dry, it dries within a minute,” he said. “But you do need to heat cure it because the chemistry specifically has what's called crosslinking mechanisms. Heat specifically activates certain molecules to bond together and get to that performance."

Unlike PFAS, which can take thousands of years to degrade, Impermea Materials' coatings are compostable. As such, they also offer potential to address packaging waste — if they're used on a compostable package, of course, which is by no means a given. Even then, it's often hard to tell if a piece of packaging can really break down in a home compost pile or if it's only suited for industrial-scale composting, which is not available in most of the U.S.

“As of now, they have not been tested for home composability. That's what we mean is they’re industrially compostable," Zamarin said. "But the caveat here is we're not saying that it isn't home compostable. We just haven't done the testing."

“Generally speaking, it's the substrate that matters more than the coating," he explained. "That's a general statement. It's not entirely true with all of our competitors, unfortunately, but with our coatings, we don't impact the sustainability metrics of the substrate. So, if the food packaging itself is home compostable, it hasn't been tested yet, but we would assume from a technical background that it would also be home compostable for the coating.”

Chemicals and protective coatings are an invaluable part of modern life. However, as we become more aware of the consequences surrounding a variety of chemicals, the hunt for safer alternatives cannot be underestimated. Impermea Materials is one company that is working hard to find a solution, with applications in food packaging and textiles already in use.

Image credits: Kampus Production/Pexels and Impermea Materials

This Blockchain-Powered System Tracks Ingredients from Field to Fork

Industries beyond the tech world are utilizing data and technology more and more these days to improve efficiency, find solutions to problems, and create new opportunities for greater transparency and innovation. The agricultural and food sectors utilize data and digitalization as a means for improvement, but few have used blockchain, the digital ledger technology that enables cryptocurrencies like Bitcoin to pass from hand to hand.

Enter Merge Impact, which bills itself as the first and only blockchain-powered agricultural measurement and data solution to help farmers, food manufacturers, and brands better understand the impact of their practices and purchases down to the field level.

From the ground up

Merge Impact co-founders Ben Adolph and Beth Robertson-Martin both come from agricultural backgrounds. But they have professional perspectives from different sides of the industry — Adolph in soil health and fertilizer sales and Robertson-Martin in commodity sourcing, most recently for General Mills.

Each realized the limitations of their respective fields and set out to solve them with their new agri-tech company powered by blockchain. "I had a thesis that there are lots of food companies that actually need regenerative supply chain problems solved," Robertson-Martin explained.

"We saw an opportunity to connect the climate impacts at the farm level and bring value to food companies," Adolph added. "She has the solutions from the brand side. I have them from the farm side.”

Blockchain for transparency

Using data as a means of analyzing and improving systems is commonplace in the modern digital age, but blockchain takes these processes one step further. “I think about blockchain as a tool in the toolbox, but it's one that makes things quicker and easier for us. Blockchain really helps prevent data corruption and data loss,” Robertston-Martin said.

Merge Impact’s use of blockchain allows it to serve as a software solution for transparent supply chains, as raw materials are digitally logged from the field to the customer and everywhere in between. This type of information is increasingly crucial as companies aim to provide their clients with transparent, accurate and easily accessible data.

Transparency for brands, consumers and farmers

Major food manufacturing companies have made public commitments to regenerative sourcing worth trillions of dollars. But many of these commitments have been based upon dubious data, resulting in shaky and unsubstantiated sustainability action plans.

As a company that operates on the integrity and security of data, Merge Impact remains a neutral party in the collection of information on its platform. Third-party partners like EarthOptics — which specializes in soil data measurement, including how much carbon is being stored by the soil — allow the company to provide more detailed information to clients while remaining impartial.

Merge Impact’s use of third-party data collection and blockchain technology allows food companies to understand the impact of their supply chains and make reliable claims about their products. In turn, customers can rely upon these claims to make better choices about the products they support.

From the farmer’s perspective, data platforms like Merge Impact’s make it easier for brands to find and connect with organic and regenerative farmers. It also helps farmers advocate for their services as a premium, as brands see how sustainable practices translate into improved soil health metrics like carbon storage and water retention.

Merge Impact also ensures that farmers can retain ownership of their data, which can be shared, transferred or monetized at their discretion.

“What blockchain allows us to do at the farm level is monetize data for farmers," Adolph said. "We never claim ownership of data. If you go into any other ag-tech platform, when data comes into that platform, that's the platform's data. But in our case, the producer creates the data, and that producer ultimately owns all the data. It is truly the only system where the producer has an account in the product."

More simply, Merge Impact serves to simply facilitate the movement of data, while giving the producers and brands total ownership of the data that the company and its partners help to collect and store.

"If it can be measured, we can measure it."

Merge Impact data has shown to be effective in helping companies to measure and manage their greenhouse gas emissions. It also serves to inform other key indicators of mission-based food systems, such as biodiversity and water usage.

“If it can be measured, we can measure it and we can track it," Robertson-Martin said. "Not only will you know where your oats came from, you'll know where your carbon, your biodiversity, your pollinator habitat metrics came from down to the field level, down to the subfield level. We make it really easy to get to that level of granularity."

With producer and brand ownership of their own data, coupled with the security and integrity of blockchain technology, Merge Impact’s platform serves as an end-to-end solution for traceable supply chains for regenerative, organic, and any other kind of mission-based food systems.

“Ultimately, Merge Impact uses blockchain to turn ag-tech into a solution for the industry and not just a product for the industry,” Adolph said.

Image credits: PHÚC LONG and Marc Kleen via Unsplash

The State of the American Workforce: Layoffs, Job-Switching and a Search for Balance

Job growth remains strong in the United States as the COVID-19 pandemic enters its fourth year. At the same time, higher interest rates have cooled the economy. American workers are worried about a potential recession, even as many continue to seek higher pay or are dissatisfied with their current roles or work environment, according to Morning Consult's annual State of Workers report.

Job search growth was flat from March to April but remains in a broad uptrend since the start of the year, the data intelligence firm found. The prospect of higher wages continues to pull people back into the job hunt, with elevated search activity suggesting quit rates could tick back up. So, what are workers really thinking out there? Let's take a closer look at the survey of more than 6,000 employed and unemployed Americans to find out.

Demand 'whiplash' rocks sectors like tech

Demand for workers has “whiplashed” since the start of the pandemic — first to tech, transportation and warehousing jobs, and then back to in-person services as consumers started dining out again and traveling more often, said Jesse Wheeler, senior economist for Morning Consult.

All of this represents a “huge reallocation of workers” from some sectors to others, he said. Meanwhile, economic and job growth are beginning to slow down. In an early warning sign, the share of U.S. adults reporting income losses increased considerably over recent weeks, according to Morning Consult.

“Overall, the U.S. economy is clearly slowing as the Federal Reserve’s rapid tightening of monetary policy takes its toll,” Wheeler explained. “We could really start to see the shedding of jobs potentially in the coming months and an increase in unemployment, but we’re not seeing it yet.”

Morning Consult’s Lost Pay and Income Tracker rose 1.2 percentage points from March to April, with the sharp rise driven primarily by adults from higher-income households, reflecting the sweeping layoffs announced by tech companies like Meta, Shopify, Dropbox, Lenovo, Lyft, Roku and others.

“This is really a potential warning sign for the U.S. economy,” Wheeler said. “These high-paying tech and financial service companies have really been prioritizing projects and shedding workers to prepare for a potential lower-growth environment.”

Where are laid off workers now?

Despite shakeups in the tech industry, there are some indications that laid-off workers are finding new jobs fairly quickly. About 75 percent of those laid off in December and January were rehired or had a job offer within two months, according to polling from the hiring company ZipRecruiter.

Laid-off workers in the advertising, auto and transportation industries were most likely to land a new job quickly, according to the study. Somewhat surprisingly, 80 percent of the workers who found new employment after getting laid off said they didn’t have to take a pay cut.

People are still job-switching, and many find it to pay off

A rising share of employed U.S. adults are being drawn into an active job search, with the prospect of higher pay as the prime motivator. Many are finding exactly that, with nominal wage growth higher among job-switchers than those who stay put.

“Morning Consult data shows that by far the largest reason for job-seekers going out there and looking for a new job is the potential for higher pay, with 60 percent of U.S. adults who had looked for work in the past four weeks citing more money as the primary reason,” Wheeler said. “This impetus really aligns with the data out there that shows that job-switchers are still being rewarded over job stayers.”

As the U.S. economy heated up in 2021 and 2022, workers enjoyed a high degree of bargaining power they had not experienced in decades, demanding workplace flexibility and other perks. But the tables have turned, and many workers are now less picky about what they need from employers, according to Morning Consult's research.

Although the upper hand seems to be shifting back to employers in many cases, they are still very much in need of workers, with nearly 10 million job openings according to the Bureau of Labor Statistics’ latest numbers.

Of those who are interested in leaving their jobs, Morning Consult found the top reason why is feeling underpaid, and that has not changed. It was also the top-ranked reason in 2022, followed by workers wanting a better work-life balance and feeling burnt out.

Add this to existing research from the job-search company Monster: 34 percent of job-switchers said there is no room for growth in their current role, and 26 percent are looking to escape a toxic work environment, compared to 40 percent in search of higher pay. This tells us that fewer demands around specific perks like childcare or remote work options doesn't mean employers should ignore company culture and employee morale.

“The broad takeaway here is that while we’re seeing people be more cautious about wanting to leave their jobs, the underlying motivations why they would do so remain the same,” said Amy He, industry analyst team lead for Morning Consult.

Image credit: Flow Clark/Unsplash

By the Community, For the Community: New Startup Accelerator Backs Locally-Led Climate Solutions

Young people rally in front of the California statehouse in support of climate justice at a Fridays for Future demonstration on April 21, 2023. (Image: Lynn Friedman/Flickr)

Investing in viable solutions to social and environmental problems can turn a profit — and the most lucrative ideas may not come from where you'd expect. That's the philosophy behind Village Capital. The nonprofit launched in 2009 under the tagline "democratizing entrepreneurship." Though it's based in Washington, D.C., its founding mission centers on identifying and supporting innovators outside the big coastal cities that receive the lion's share of venture funding.

Over the past 14 years, Village Capital has supported nearly 1,000 such startups through 45 U.S.-based accelerator programs — which provide funding and mentoring to entrepreneurs with smart ideas to solve big problems.

One of its most recent accelerators squares in on the crucial issue of climate justice, with a call for innovators on the front lines of climate change to submit locally-driven solutions for backing from Village Capital.

What is climate justice?

For the uninitiated, climate justice refers to the imbalanced nature of the real-world impacts caused by climate change: Those who fare the worst amidst natural disasters and sea-level rise tend to be poor and underserved, and as such have contributed least to the greenhouse gas emissions that cause climate change. For context, a billionaire will produce a million times more greenhouse gas emissions in their lifetime than the average person, according to research from Oxfam.

The related cause of environmental justice refers not only to the impacts of climate change, but also the sources of climate-inducing pollution — and where they're located. In the U.S. in particular, years of segregation has created a situation in which communities of color are far more likely to be in the direct vicinity of polluting sites like oil refineries and chemical plants. A bombshell 2021 study from the U.S. Environmental Protection Agency found that people of color are exposed to far higher levels of air pollution during their lifetimes than white people, regardless of income level.

Again, people living in communities that have faced chronic disinvestment for decades are more likely to be poor, and as such consume far fewer of the goods and services that these polluting industries provide. Yet they're still saddled with the impact, whether that's long-term air pollution exposure that can lead to preventable illness, or catastrophic events like leaks and explosions.

Impacted communities have sounded the alarm about environmental and climate justice for decades, but the issues are only more recently gaining attention on the global stage. A global loss and damage fund to help developing countries cope with the impacts of climate change was finally pushed across the finish line at the COP27 climate talks in 2022, although it will be years before it's up and running. U.S. President Joe Biden has also made justice a central pillar of his climate plan, with billions in new investments going toward efforts to reduce emissions and pollution in underserved communities.

Still, government investments have by no means reached the scale of the challenge — making private-sector interventions like Village Capital's accelerator essential to creating the widespread changes needed to cut the problem down to size.

Inside Village Capital's climate justice accelerator

Announced last month, Village Capital's accelerator is seeking early-stage startups that support immigrants, refugees and communities of color on the front lines of climate change in the U.S. In partnership with the WES Mariam Assefa Fund, Village Capital will provide grants and coaching to 10 to 12 startups with promising solutions that help their communities prepare for and adapt to climate impacts. The accelerator is fairly industry-agnostic, with startups across the climate tech, financial tech and property tech spaces encouraged to apply.

"We are looking for impact-driven startups that are solving critical challenges for people and communities who are disproportionately impacted by climate change," Elizabeth Nguyen, economic opportunity practice lead for Village Capital, told TriplePundit. "We’ve been very intentional about identifying the solution types, which thematically fall into: disaster preparedness, public action and civic response, resilient housing and cities, and overall support for immigrants and refugees. Each one of these solution types prioritizes supporting people and communities and enables them the ability to respond to the impact of climate change."

Along with grant funding, the selected entrepreneurs will receive invaluable training on how to further scale their businesses and attract investors, including help with a development plan to chart the course for growth. Through Village Capital's unique peer-selected investment model, the cohort of entrepreneurs will decide which two climate justice solutions will be eligible to receive an additional $100,000 in investments from WES Mariam Assefa, Nguyen said.

"This investment, especially at an early stage, has the potential to change the trajectory of a company, considering many immigrant and refugee founders often don’t have strong social networks or support systems that founders who may have been born in the U.S. have," she explained. "We also can’t stress enough how important social capital, mentorship, and connections are to early-stage companies. Village Capital provides not just training and financial support, but introductions to relevant mentors who are in the refugee and immigrant space and climate tech space. Our support enables our founders to walk away with tangible ways to speak to investors."

Championing locally-driven solutions to climate challenges

Importantly, Village Capital aims to support locally-led solutions driven by the people and organizations that experience climate impacts in their communities firsthand.

"We’ve seen time and again that top-down solutions will not be sustainable or effective because they don’t have a full understanding of the needs in a community," Nguyen said. "Locally-led startups also ensure that the solutions elevate the communities collectively so they are not left behind in the wave of innovation, a challenge that has unfortunately already been reflected in the history of climate tech solutions."

The company's accelerator model is proven to work, with over 150 accelerators supporting more than 1,400 startups globally. Entrepreneurs graduating from Village Capital accelerators raised three times more capital and earned 2.3 times more revenue compared to a control group, according to an impact study commissioned by the company.

The company's separate venture capital fund, VilCap Investments, has invested in over 100 peer-selected startups from across these accelerators — again, with a focus on founders who are often overlooked. Nearly half (46 percent) of startups in the fund are led by women, and 30 percent are led by people of color. A stunning 80 percent are based in states outside New York, California and Massachusetts, which together receive about half of all global VC funding, according to Village Capital.

"By catalyzing locally-led startups and strengthening the ecosystem for these entrepreneurs to succeed, we can create the biggest and most sustainable impact, one that improves and increases services and resources for the communities who need it the most," Nguyen said.

Applications for the accelerator close on May 25, 2023. Full details and eligibility criteria can be found here.

Beyond Trees: Using Blue-Green Algae for Natural Carbon Capture and Sequestration

Fun fact: Several species of flamingo get their pink color from a diet rich in cyanobacteria, but blue-green algae blooms aren't so fun for other wildlife. (Image: Elizabeth Gottwald/Unsplash)

Forestation is an important climate action strategy, but more sophisticated — and potentially more efficient — nature-based alternatives are emerging. One of them involves an environmental two-for-one: capturing carbon by preventing destructive blue-green algae blooms.

Cyanobacteria and algae blooms

Blue-green algae is the common name for cyanobacteria, a type of water-dwelling bacteria that has plant-like photosynthetic abilities.

An over-abundance or “bloom” of cyanobacteria can wreck ecosystems and harm other living things. “A combination of environmental factors such as the presence of nutrients, warm temperatures, and lots of light encourage the natural increase in the numbers of cyanobacteria,” according to the National Oceanic and Atmospheric Administration. In higher concentrations, the toxins produced by some cyanobacteria can damage the liver, nerves, and skin of humans and other creatures, including pets and livestock as well as wildlife.

The U.S. Environmental Protection Agency notes that warmer temperatures and other climate impacts affect the frequency and severity of algae blooms. Blue-green algae blooms in particular are a frequent occurrence in all 50 U.S. states and elsewhere in the world. They mainly occur on inland waters, but they can also happen in the open ocean.

Putting “bad” algae to good use

On the plus side, cyanobacteria are emerging as a clean technology jack-of-all-trades, partly because they are fast-growing, voracious consumers of carbon dioxide. Researchers have tweaked cyanobacteria to produce renewable hydrogen and other biofuels, for example.

Cyanobacteria are also attracting attention for their ability to convert airborne carbon to a solid substance. They have been linked to deposits of the mineral carbonate, a salt of carbonic acid. The “biomineralization” process carried out by cyanobacteria was formerly thought to occur as a result of outside factors. However, 2014 research concluded that some strains are capable of producing carbonate on their own.

In 2020, researchers at the University of Colorado in Boulder put the biomineralization concept to work. They demonstrated that, under the right growing conditions, certain types of cyanobacteria can produce calcium carbonate, which happens to be the main ingredient in cement. The research team tested their method on a growing medium of sand and gelatin. As the cyanobacteria produced calcium carbonate, they mineralized the gelatin and bound the sand into a bio-manufactured brick.

Algae remediation and carbon offsets

Regardless of the potential use cases for cyanobacteria-produced carbonate, algae blooms must be treated and prevented in order to protect aquatic habitats and human health.

BlueGreen Water Technologies is among those developing algaecides that specifically tackle cyanobacteria. Its patented, EPA-approved formula triggers a natural “suicide” response in cyanobacteria, clearing the way for beneficial algae and other aquatic species to take over.

The treatment effectively converts a body of water into a carbon sink, with the dead cyanobacteria locked into sediment for potentially millions of years, according to BlueGreen.

This carbon-sequestering feature could help offset the cost of remediating blue-green algae blooms, if stakeholders could claim carbon credits for the operation. The challenge is to develop a methodology that produces a science-based estimate of the captured carbon.

Scientific verification for cyanobacteria remediation

In March, BlueGreen received approval from the Social Carbon Foundation for its carbon quantification methodology, under the proprietary name Net Blue. Social Carbon manages the trademarked greenhouse gas standard by the same name.

“Net Blue is the first deep water, nature-based climate solution for atmospheric carbon removal that is regulatory approved, scientifically validated and, now, verifiable by industry standards,” BlueGreen asserted in a March announcement.

The company has been remediating cyanobacteria since 2019, for an estimated 3.3 million tons of carbon removal. With the Social Carbon standard in hand, BlueGreen can now market cyanobacteria remediation as a verifiable carbon offset.

According to BlueGreen CEO Eval Harel, the worldwide potential for cyanobacteria remediation offsets adds up to about 115 gigatons of carbon.

Natural vs. unnatural carbon capture

The emergence of verifiable cyanobacteria remediation credits should help meet the growing demand for carbon credits. The current demand for carbon credits already exceeds the supply, and BlueGreen projects a 15-fold increase in demand for carbon credits by 2030 and a 100-fold increase by 2050.

Cyanobacteria remediation could also help further undercut the case for carbon capture and storage (CCS). CCS has been promoted as an effective pathway for preventing greenhouse gas emissions from coal power plants and other industrial sources. However, the idea of capturing carbon and storing it in underground formations is rapidly losing currency.

BlueGreen offers a fast-acting, scalable carbon capture system that requires no infrastructure. The algaecide can be deployed swiftly to provide additional benefits for local businesses and recreational users, as well as restore biodiversity and protect public health.

In contrast, carbon capture and storage systems offer no such local add-on benefits, and their ability to scale up globally has yet to be proven. In particular, it is difficult to see how CCS infrastructure fits into the rapid decarbonization picture, due to its relatively high costs and long timeline for construction. Typically, CCS systems also require new pipelines to ship captured carbon from the source to a distant storage facility. That raises the threat of environmental impacts related to construction of the pipeline, as well as delays due to public opposition.

The U.S. already has one massive carbon capture failure under its belt, the FutureGen CCS project in Illinois. It kicked off in 2003 with support from the U.S. Department of Energy, intended to provide a showcase for technology to capture and store carbon from a coal power plant. The project was abandoned in 2015.

Since then, new alternatives have emerged in the field of carbon capture, utilization and storage systems (CCUS), which can convert captured carbon into new products that recycle or sequester it, at least temporarily. Recycled-carbon products also help reduce the need to draw virgin petrochemicals from underground.

Fuels, fabrics, perfumes and vodka are among the new recycled-carbon products coming to market, made from carbon collected at industrial sources or drawn from ambient air by CCUS facilities.

The International Energy Agency (IEA) expects CCUS activity to pick up considerably in the coming years, from just 35 systems in operation globally today to an estimated 200 in the pipeline by 2030.

What about the trees?

Despite all the forthcoming activity, IEA does not foresee CCUS playing a leading role in the effort to achieve a net-zero economy.

“Nevertheless… CCUS deployment would remain substantially below what is required" for a net-zero scenario, IEA concluded in a 2022 report. The need remains for a broad expansion of swift, effective decarbonization pathways across the board.

The Social Carbon Foundation is among those working to steer the decarbonization conversation into a more holistic framework that can achieve global progress on a larger scale. Through its Social Carbon standard, the organization advocates for nature-based decarbonization pathways that, like BlueGreen, provide local benefits. The localized nature of this approach requires the standard to be flexible and take political and social elements into account.

“Projects using our standard go beyond carbon, embedding meaningful social, environmental and economic benefits to the projects and their local stakeholders,” Social Carbon's website reads.

“The trademark communicates that emissions reductions result from efforts that benefit and improve living conditions for stakeholders involved in climate change projects, in ways that strengthen their welfare and civic consciousness without degrading their resources base,” it continues.

That reference to resources appears to be a cautionary note against tree-planting programs that focus on commercial timber plantations as a carbon sequestration tool, to the detriment of local habitat. Scientists have also raised concerns about the pace and efficiency of carbon capture through forestation.

Planting trees is likely to continue to hold a place in the carbon market, but companies seeking to burnish their reputation with forestation will need to ensure that their projects adopt a holistic approach that supports local communities.

This Insulation Take-Back Program Cuts Down on Waste in the Building Industry

The built environment has a direct impact on the daily lives of virtually every individual and community on the planet. The building industry itself, however, also has significant impacts on the environment. Owens Corning is among the companies in the sector that are looking to minimize their impact and push more sustainable practices forward.

As one of the world’s leading manufacturers of building materials, Owens Corning recognizes the impact its industry can have in the reduction, collection and reuse of waste through circular economy systems. The company’s European insulation brand Paroc, for example, has been running an insulation take-back program known as Rewool for nearly 20 years.

Paroc embraces insulation take-back to reduce waste

Paroc’s stone wool insulation is a natural product that serves as an energy-efficient and fire-safe insulation solution for both new and renovated buildings, as well as heating and air conditioning, marine, offshore, and other industrial applications.

First introduced in Sweden in 1996, the Rewool program allows for collection of Paroc stone wool offcuts to be recycled back into Paroc’s manufacturing operations in an effort to reduce waste and incorporate recycled material into the production cycle.

The program allows Paroc's Finland-based stone wool insulation manufacturing facility to implement circularity principles into its own operations, particularly as the collection of stone wool offcuts and scraps reduces the need for raw materials, turns customer waste into a valuable asset, and gives waste material a new life.

But the program also aids in the important task of helping Paroc customers reach their own sustainability goals, which is of particular importance for the brand’s European clients that are tasked with adhering to and adapting with the principles of the European Green Deal.

“Owens Corning and and its Paroc facilities set our own goal of zero waste to the landfill by 2030, but with the European Green Deal aiming for climate neutrality and a transition to a circular economy by 2050, there are a lot of incentives for our customers to move toward zero waste, as they have the same external pressures through the coming regulation,” said Beatrice Hallén, Owens Corning’s senior sustainability leader for insulation in Europe.

The business case for circularity

While the Rewool program serves as a key example of a sustainable business practice as a means of corporate responsibility, there is also a direct business case to be made for both Paroc and its customers.

Landfills around the world implement fees, known as tipping fees, for every ton of waste. By sending stone wool offcuts and scraps back to Paroc's stone wool plants, customers avoid these fees while also contributing to the beginnings of a more circular economy for insulation. Moreover, sending offcuts back to Paroc plants in lieu of sending them to the landfill increases a building’s score in environmental ratings such as the U.S. Green Building Council’s LEED certification and international BREEAM certification.

Expanding Rewool to more customers

The Rewool program now operates in Sweden and Finland, with plans to expand into new markets in the coming years. A takeback pilot is underway with select customers in Germany, but it is not without its challenges.

“With any new service, there are logistical considerations, and you have to roll out a huge development phase to make it successful,” said Thomas Kayser, Paroc’s European stone wool insulation circular economy lead.

Implementing circularity on a material level is also a tough task, particularly when it comes to ensuring cleanliness and integrity. “The challenge today is really to get the material sorted and clean, but that is a typical challenge in the transition to the circular economy,” Kayser said.

The circular economy as an asset

While there are reasonable logistical and material challenges in expanding the program across Europe, Kayser highlighted that what was once a barrier to expansion is now an impetus for the success of the program, particularly in conjunction with the European Green Deal.

“Originally, generating awareness of the Rewool program with our clients was a challenge. But now that installers are trying to avoid landfill fees, the Rewool recycling service is something they are inquiring about,” he said. “What once was a sell from Paroc is now a frequent request from clients.”

By providing insulation take-back for offcuts, Owens Corning’s stone wool business in Europe gives its customers a practical way to reduce waste, avoid fees and lessen their environmental impact. The Rewool program also fits into Owens Corning's broader strategy to be part of transitioning the building sector to a more circular economy.

“We are working to replace virgin materials in our products, and the Rewool program is a piece of that,” Hallén said. “We are also looking into other industries' waste fractions to see what is suitable for our production, and by doing so, we are able to increase the so-called recycled content, which currently serves as a main indicator of a circular economy [system], particularly in Europe.”

The bottom line: Consistent commitment can change hearts and minds on circularity

The Paroc Rewool program is a prime example of how reducing and reusing waste can support a company’s overall sustainability strategy. But more importantly, the program serves as a catalyst for the industrial and cultural shift toward a circularity mindset.

Programs like Rewool prove that incremental but consistent commitment to the circular economy and material innovation will get people engaged and, slowly but surely, make the lasting changes needed to shift the way the world thinks about waste.

This article series is sponsored by Owens Corning and produced by the TriplePundit editorial team.

Images courtesy of Owens Corning

Why ESG Still Matters During Economic Downturns

The global economic turndown is top-of-mind for business leaders. In the U.S., 59 percent of CEOs anticipate needing to pause or scale back their environmental, social and governance (ESG) efforts as a result, according to a recent survey by KPMG.

However, walking away from ESG right now could be disastrous for business, argues Geetanjli Dhanjal, senior director of business transformation for the consulting firm Yantra.

Scaling back environmental commitments would not only be detrimental to the planet, but it could also hurt the bottom line. “Companies should be committed to ESG and diversity, equity and inclusion (DEI) now more than ever,” Dhanjal told TriplePundit. Pausing these programs to bolster the budget could backfire by eroding consumer perceptions and damaging trust among employees, she warned.

Case in point: The retail sector proves ESG still matters

While certain sectors are more vulnerable to recession than others, retail is one of the highest-risk industries during economic downturns. Still, Dhanjal noted that many of her clients in retail, fashion and apparel are not turning away from ESG to save money. Rather, they are doubling down on their initiatives, from sourcing sustainable materials to ensuring fair pay for workers in their supply chains.

“These clients know that when in an economic downturn, one doesn't just stop investing in ESG," Dhanjal said. "ESG is a long-term strategy and roadmap. During economic downturns, businesses can invest in low-cost sustainability initiatives in order to maintain brand value and give back to the community.”

Further, many sustainability programs come with a cost savings. “When we enable green shipping methods, we reduce our costs, reduce our carbon footprint, and the customer benefits by paying less for shipping," Dhanjal noted as an example.

Investor trust is in jeopardy: Stronger ESG programs and reporting can help

While robust ESG programs can help grow consumer affinity and employee engagement, businesses now face a new problem: waning investor trust.

In KPMG's survey, 3 out of 4 institutional investors said they do not trust companies to meet their ESG and DEI commitments. Dhanjal believes their concerns are valid: Indeed, many companies are not meeting their commitments. But the trust gap also presents investment and growth opportunities for companies that are serious about implementing ESG, she said.

“There are many reasons for distrust," Dhanjal told us. "There are no consistent reporting frameworks. Enterprises may have more standardized reporting methods than small businesses, but they need to report transparently with the proof that they’re doing what they’re saying.”

Businesses and international agencies have also recognized the need for companies to demonstrate proof of their progress through standardized frameworks for sustainability reporting. At the COP26 climate talks in 2021, the United Nations and participating governments established the International Sustainability Standards Board (ISSB) in order to create a standard, global framework.

An evolving regulatory landscape calls for more ESG investment, not less

Dhanjal sees more changes on the horizon for corporate ESG programs. Regulatory changes will make compliance more challenging for companies that do not proactively measure, monitor and report on their sustainability efforts. Time is critical.

“Companies must invest in the tools they can use and the systems to provide them with the data they need to create their long-term strategy," Dhanjal said. "Companies also need the right consultants and partners to guide their programs and initiatives. Your specific company doesn’t need to be experts in ESG, but you can invest in the consultants and tools to guide you.”

Investment in tools to measure sustainability data is increasingly critical for companies that hope to to stay ahead of ESG regulations. The United States and European Union are moving toward making sustainability reporting mandatory for large businesses. That includes climate risk reporting in the near term, with mandatory disclosure of nature-related risk not far off.

The U.S. Securities and Exchange Commission (SEC) in particular is expected to release its long-awaited climate reporting rules this fall. But many businesses are not waiting for the final verdict. In fact, 70 percent of business leaders said they've already begun to disclose their climate-related data in alignment with expected changes from the SEC, according to 2023 polling from PwC and Workiva. Still, 85 percent of those respondents worry their teams don't have the right technology to accurately track and report their sustainability data.

Keeping up with the times requires consistent investment, and pulling back could mean falling behind. "It is not easy to implement systems, transform supply chains and invest in proper tools," Dhanjal said. "Things are changing rapidly while everyone is learning about sustainability at the same time, and that can be a challenge. Making sure we have appropriate tools and clear guidelines is a major challenge for ESG, but this is also our work [as ESG professionals]: to educate.”

Image credit: Miltiadis Fragkidis/Unsplash

Transforming Blight to Boon With Upcycled Sargassum Seaweed

Sargassum seaweed washed up on the beach at Playa del Carmen in Quintana Roo, Mexico. (Image: Thor Tryggvason/Unsplash)

Massive sargassum seaweed blooms have become par for the course in recent years. They’re the result of warming oceans and agricultural nitrogen runoff. As such, the problem is set to only get worse each season.

Fortunately, quite a few startups are working on solutions. One of them is Boston-based Carbonwave. The bio-material processor aims to collect 40,000 tons of sargassum seaweed in 2023. But it's not just about getting the rotting vegetation off of beaches. Once collected, the company is converting the brown algae into bio-stimulants and cosmetic emulsifiers while working to develop more fossil-fuel alternative products.

Sargassum seaweed: From scourge to resource

“We're on a mission to accelerate the circular economy and help with the climate problem,” Carbonwave CEO Geoff Chapin told TriplePundit. “To be able to do both of those things with a naturally occurring resource, it just seems that it's a no-brainer. It’s good for everyone.”

Sargassum seaweed is not only naturally occurring, but it is also integral to ocean health. It provides habitat for marine life, acting as a food source and breeding ground for numerous species. Birds, fish, turtles, shellfish and other sea life all benefit from the stuff, so long as it is in the ocean.

Sargassum, like algae in general, is also responsible for balancing oxygen and carbon dioxide in the world's oceans, Chapin explained. Once it hits reefs and shores, however, the brown algae creates a whole host of problems — including the release of methane emissions as seaweed decomposes in the sun. “The methane release is a huge problem obviously. And when it packs into those bays and rots, it releases arsenic into the water supply," Chapin said. "It kills the fish. And it can suffocate the coral."

Although the blooms become an environmental disaster as they make landfall, there is still value that can come out of it. “Why wouldn't we turn to this resource to help us course-correct on climate gases?” Chapin asked. “As we produce and consume more and more, we have to find alternatives that are aligned with nature, that help heal nature, and that can also be products we use. That's the ultimate goal here: to live sustainably from products that nature gives to us.”

Ultimately, the explosion of sargassum seaweed blooms is among the first tangible effects of the climate crisis, Chapin said. “It’s the ocean trying to heal itself really — from the warmth and the over-eutrophication," he said, referring to the prevalence of algae blooms and dead zones in oceans and waterways. "That's a good process. What we just can't do is let it hit the shores and rot and destroy the ecosystem locally, hurt tourism, jobs, human health and everything else.”

Sargassum-based products

Carbonwave’s products are designed in such a way as to play their own role in reducing climate change and its effects. The company’s biostimulants made from upcycled sargassum seaweed can act as an important part of regenerative agricultural practices, protecting crops from drought and heat. The product — which is sprayed directly on crops — results in sturdier plants and up to 10 percent higher yields by helping them grow more robustly, Chapin explained.

While cosmetics typically contain byproducts of fossil fuels, leading to a heavier carbon footprint and potential health drawbacks, Carbonwave produces cosmetic emulsifiers from sargassum instead. Additionally, the biomaterial maker is working on an alternative leather as well as bio-plastics to replace other traditionally fossil-fuel based products.

Keeping up with demand

One might expect the market uptake for such products to lag — however, that doesn’t appear to be the case. Instead, as far as the emulsifiers are concerned, the demand far outweighs what Carbonwave has the capacity to supply, Chapin said. “Right now, we can't keep up with the demand for emulsifiers in cosmetics,” he said.

Which is why the company is not only expanding its production capacity in Puerto Rico, but it’s also looking to license its proprietary processes that took years to develop. “We don't want to be the [only] one dealing with this massive global problem,” he explained.

Attempting to do so would be unwise, of course. Carbonwave currently collects its raw material on resort beaches in Quintana Roo, on Mexico's Caribbean coast, where Chapin said the bulk of the sargassum seaweed washes up. But, he noted, the smelly tangles of algae have been landing as far north as Ibiza, Spain.

Truly, there is no shortage of work to be done. A concerted effort by a multitude of players will be necessary to make a dent in the problem. Indeed, a variety of products can and are being made, including a seemingly magical compost out of Barbados. Likewise, there is the possibility of capturing sargassum seaweed before it reaches reefs and beaches, as well as plans to sink it into the ocean as a means of carbon capture and storage. All of these potential solutions should be considered and weighed, as diversification will be imperative to solving such a huge problem.

Overall, the key is clearly to treat sargassum as a resource to benefit humanity and not just more trash left to rot or, at best, disposed of. But in order to do so, partnerships as well as huge investments of capital will be necessary. “We would love to hear from any of your readers that are interested in the products at a corporate level,” Chapin said. “We're excited to talk to anyone who is interested.”

The World Has a Rice Problem, But Farmers Can Solve It

Jim Whitaker, a fifth-generation Arkansas rice farmer and proprietor of Whitaker Farms.

Rice is the most commonly eaten food in the world, but conventional rice production has a hefty environmental impact. Growing rice is incredibly water-intensive, and flooded fields are ideal growing conditions for methane-emitting bacteria.

For Jim Whitaker, proprietor of Whitaker Farms and a fifth-generation Arkansas rice farmer, the environmental challenges of conventional rice production were also economic concerns. “I grew up farming,” Whitaker said. “My dad struggled through a historic drought in the ‘80s. I remember coming home on my dad’s birthday, and he had gotten a foreclosure letter from the bank and was going to lose the farm. I was 16 years old, and I could not get that out of my brain.”

When Whitaker and his brother Sam started farming, they began again from scratch with a new plot of land and a loan from the U.S. Farm Service Agency. “We had a beginning farmer FSA loan and the worst piece of ground, but we knew that we had to adapt and change. Doing things the old way was not going to work,” he said.

The brothers decided to add irrigation to their land and level it off, which vastly improves water efficiency and reduces methane emissions. “We got lucky out of the gate,” Whitaker remembered. With a good crop and some income, they were able to further develop their land and rent another farm, which they also leveled.

“We went zero-grade and leveled the rice field completely flat. At the time, it is the gold standard for water conservation and greenhouse gas emissions reduction,” Whitaker explained. Over time, the brothers acquired more and more farmland and transitioned it to regenerative and water-smart practices — growing their operation from 90 acres in 1993 to as many as 9,000 acres today.

Scaling up sustainable rice production

In 2010, Whitaker attended the Rice Leadership Development Program, where he met a rice buyer for Mars, Incorporated. “We became great friends, and that started the journey of Whitaker Farms growing rice for the Ben’s Original brand,” Whitaker said. Today, Whitaker Farms produces over a third of the rice that Mars uses in Ben’s Original Ready-to-Heat pouches in the U.S. and Canada.

Whitaker Farms has also built up its sustainable rice practices over the years and now uses water sensors to monitor in field water levels. This allows them to conserve water through precision irrigation, providing water to fields at just the right times and in just the right amounts, and maximize yield at the same time.

Whitaker also uses a third-party verifier to track and monitor greenhouse gas emissions. The farm specializes in a technique called “alternate wetting and drying,” which means they allow rice fields to dry out before irrigating, a method which is making major waves in an industry that has long relied on perpetually flooded fields.

The wetting and drying method not only saves water and emissions, but it also has financial benefits: By adopting these methods, Whitaker Farms has been able to reduce their fertilizer input by 20 percent and irrigation by 50 percent. They have even been able to sell carbon credits to other companies for reducing emissions through regenerative practices.

A longstanding supplier relationship opens doors for sustainable rice practices

Whitaker said the relationship with Mars is critical to the farm’s sustainable rice success story. “Rice is a unique market,” he told us. “It is highly controlled globally, and there isn’t a mechanism that allows farmers to trade in the market in the U.S. Our contract with Mars is a good relationship, because it gives me the ability to plan. I know how many acres to work and the budget to work within.”

Mars is committed to sourcing 100 percent of its rice from farmers working toward more sustainable and climate-smart rice production practices, aimed at reducing GHG emissions, reducing unsustainable water use and increasing profitability for farmers. Mars is also a member of the Sustainable Rice Platform (SRP), a global alliance dedicated to helping small farmers grow rice sustainably and increase their resilience to climate change.

Mars is the first company in the consumer goods industry to commit to sourcing 100 percent of its rice from farmers working toward the SRP. It’s also helping other farmers learn about the environmental and economic benefits of wetting and drying rice production.

“We don’t have a lot of choice as farmers,” Whitaker said. “The equipment is getting bigger and more expensive every year. As the farms get bigger, underserved farmers are getting left behind. There is a huge opportunity for the government to provide tax incentives to retiring farmers to transition their farms to new, historically underserved farmers, through a transition period and an apprenticeship. Historically underserved farmers can’t get into regenerative agriculture if they can’t make ends meet. We need to meet them where they are.”

Kristen Campos, VP of corporate affairs at Mars Food North America, said the company is eager to keep this conversation going. “Ben’s Original mission to create opportunities that give everyone a seat at the table,” she said. “So we are looking at different ways and pursuing partnerships to support underserved farmers and bring more people into the farming profession.”

A slow but steady move toward sustainable rice production

Whitaker reflected on his early career, noting that the buzzwords he heard around sustainability planted a seed in his mind. “I could sense the industry was moving in this direction and there was a demand for it,” he said. “People want to do business with folks who are doing the right thing.”

He now realizes that doing the right thing was good for his land as well as his business. Whitaker Farms uses 50 percent less water than the mid-South average and emits 50 percent less methane through alternate wetting and drying, compared to farms of equivalent size using flooding methods. The farm also has 20 percent higher land use efficiency, with yields 20 percent higher than the average for the area.

But Whitaker doesn’t want to stop at the environmental and economic impacts. “From a social standpoint, we are trying to make farming halfway fun,” he said. “It wasn't fun when I grew up. Nobody aspired to be a farmer.” He now strives to make his farm a place where people want to work and foster a more creative and inviting agricultural industry that will attract “sharp young people” looking for a career.

“We hope to train other farmers, and we want to make a difference in their operations,” he concluded. “When it comes to regenerative or climate-smart practices, well, folks need to realize that farmers only get one chance a year to make a mistake. If we plant the wrong variety or put out the wrong fertilizer, we mess up the crop. So, these practices can be scary if they’ve never done it. If we can help people use less water and farm a few more acres economically, then perhaps there is a social benefit to that.”

This article series is sponsored by Mars and produced by the TriplePundit editorial team.

Image courtesy of Mars Incorporated