Can a Universal Basic Income Inspire Innovation? Mark Zuckerberg Thinks So

The surge in automation is driving a decline in the U.S. manufacturing sector. Jobs in sectors like ridesharing are only temporary for workers, as companies like Uber have big plans to develop fleets of self-driving cars. And white-collar jobs are hardly immune; artificial intelligence has started to replace some white-collar workers in Japan. Despite the good macroeconomic statistics, finding and keeping a job is what keeps millions of Americans awake night after night.

Can a universal basic income help solve future problems as jobs become scarcer? One minor party candidate for California’s governorship has suggested such a policy; and pilot programs are underway in Canada, Finland and Kenya as more citizens have become receptive of the idea. But the concept is still in its nascent stages, as not everyone is convinced a UBI can provide enough answers. Last summer, Switzerland’s citizens rejected a referendum that would have paid every national a $2,500 monthly supplement.

But could a UBI be about more than just letting citizens get by? The pilot in Finland suggests such a policy can help decrease stress and have a positive effect on citizens’ mental health. Other supporters of a UBI insist it could actually inspire innovation by reducing people’s aversion to risk. The more vocal supporters of a UBI represent a diverse group of business leaders: Elon Musk, Pierre Omidyar, financiers Bill Gross and Albert Wenger, and business publisher Tim O’Reilly have all promoted or even financed various iterations of a universal income.

On that point, Facebook co-founder and CEO Mark Zuckerberg touted the potential benefits of a UBI during a commencement address he gave at Harvard University last week. “We don’t do nearly enough to make sure that everyone can take lots of different shots,” said Zuckerberg, whose graduation speech had more of a campaign rally tone than a plea for graduates to move out and change the world.

The problem is that things really are not changing much on the business front in the U.S. Fewer citizens are taking a “shot” at striking out on their own. Despite the constant calls we hear from businesses about “innovation,” entrepreneurship in the U.S. has been on a long, downward trend. The nation once noted for startups is not cranking them out at the pace of even a generation ago, when the Internet boom created a new wave of business and job creation.

Several factors can explain this shift: increased business consolidation in many sectors, the hangover from the 2008-2009 financial crisis, and the fact that younger citizens are often more risk adverse – or, more importantly, they just do not have the resources to run with a new idea. The reality of starting a family or taking care of a sick family member can result in the tabling of one’s ambitions, including a delay in implementing that business plan.

The U.S. also has a culture of punishing failure, whether it is in the arts, athletics, business or politics. Such an attitude is quite the opposite of countries like Israel, arguably the world’s “startup nation,” where failure is actually celebrated and viewed as the fuel behind many of its new businesses.

So, does Silicon Valley have the answer to our uncertain economic future? The Bay Area’s business culture, which has long sported a libertarian streak, is actually one of the more vocal proponents of a UBI.

To some observers, including Jathan Sadowski of the Guardian, the technology sector's motives are dubious: After all, if people receive a monthly stipend, they can continue to drive for Lyft and Uber or find house-cleaning gigs via apps like TaskRabbit. “Thinking of UBI as a financial innovation represents the ‘businessification’ of government,” Sadowski wrote last year.

But Zuckerberg argued that a UBI could give potential entrepreneurs and innovators the peace of mind to start a new venture and pursue their creative ambitions, which, if successful, could actually become profitable.

“We should explore ideas like a universal income to make sure that everyone has a cushion to try new ideas,” he told Harvard’s graduates. “When you don’t have the freedom to take your idea and turn it into a historic enterprise, we all lose.”

Image credit: Alessio Jacona/Flickr

Duke Energy-Backed Bill Takes Aim at Solar in North Carolina

Duke Energy, America's largest utility company, made a surprising announcement earlier this year. In its February filing to the North Carolina Utilities Commission, the company declared the cost of solar unaffordable in the state.

The argument went like this: Federal law requires electric utility companies to buy back the power generated by renewable energy at a price set by the local utilities commission (called the “avoided” costs). In North Carolina, that rate is set every two years.

But with natural gas prices dropping, Duke claimed the cost of solar became too high to justify. The company estimated the cost discrepancy amounted to as much as $80 million a year or $1 billion over the course of completed contracts.

For the residential customer, that equates to about $20 more a year in utility bills, Duke further claimed.

Not surprisingly, local solar developers, such as Strata Solar, disagreed and challenged Duke's computations.

Now, a handful of North Carolina state representatives have come up with an answer, and it has the enthusiastic support of Duke Energy.

North Carolina House Bill 909, otherwise known as the Sound Energy and Renewables Policy Act, would force independent clean-energy startups into a cumbersome bidding process controlled by the state's utility company. The bill would set an artificial ceiling of 400 megawatts for each of the next five years.

The renewables sector in North Carolina estimates it would have access to more than 1,500 megawatts of renewable energy projects each year without the legislation.

The North Carolina Clean Energy Business Alliance is opposing the bill. Chris Carmody, executive director of the trade association, said the bill would make it unaffordable for small solar providers to compete with Duke, which does offer solar energy to its customers.

“[It] would allow Duke to eliminate all competition," Carmody told Southeast Energy News.

Rep. Dean Arp (R-Union) said he sponsored the bill because of what he calls “stagnation” in communications between stakeholders in the state's clean-energy industry, big and small.

But a number of critics see Duke Energy as the winner – and the instigator of the bill.

Although Duke Energy doesn't agree, it has a history of objecting to the large number of solar farms in North Carolina, which it reportedly attributes to North Carolina's adherence to the federal Public Utilities Regulatory Policies Act (PURPA). Carmody says the concept of a privately-established bidding process was supported (and some say proposed) by Duke until last February when the company suddenly backed out.

Duke Energy isn't the only large utility company to take issue with PURPA, which requires companies to “pay back” homeowners that can generate electricity on their own property, such as with a wind or solar installation. In Montana, Colorado and even California, utility companies, solar installers and often consumers are locked in debates over a federal law that makes small solar installations possible. To the large-scale utility company, that “avoided” cost is lost revenue. To the solar installer, it means a foot in the door in a utility industry once only operated by large companies like PG&E and Duke Energy.

Solar installers call Duke's efforts to limit new projects under PURPA illegal. Last year the company got into hot water with state regulators when it stopped hooking up small solar projects to its grid. Installers accused the company of preventing the construction of new projects and blocking consumers from having solar energy.

Duke denied the charges, saying that it would “do what we need to maintain the reliability and resiliency and the quality of the power on our grid.”

Bill 909 would not only reduce the number of solar installation companies in North Carolina, but it would also shrink avoided costs for utility companies. Current revisions of the House bill also cut the size of projects that could qualify under PURPA in North Carolina, a step that some clean-energy advocates like John Wilson of the Southern Alliance for Clean Energy say would “reconstruct [PURPA} as a barrier to participation in energy generation by independent companies.”

And this may not be the end of arguments over PURPA, a law that was created in the 1970s in recognition of a budding renewables industry.

Oregon, Utah, Montana and other state utility commissions face pressure from utility companies that want new rates, contract lengths and other considerations when it comes to utility markets that they don't necessarily control.

As consumers have become more educated about PURPA, what is often called an obscure federal law with big clout, utility companies like Duke Energy are looking for ways to protect profits in an industry that once had few regional competitors.

Wikimedia image: Alexisrael

On Eve of Shareholders Meeting, Critics Call out ExxonMobil for Climate Denial

UPDATE, May 31, 10:01 PDT: Exxon's shareholders approved a resolution that urges the company to report on the risks global climate change policies and technologies pose to its current business model. In response to this development, Greenpeace's Naomi Ages of Greenpeace sent out a written statement:

“Exxon’s shareholders are finally acknowledging what the company still refuses to - that the age of oil of nearly over. People and communities in this country deserve and want lives powered by renewable energy and we cannot let Exxon and the oil industry’s greed get in the way. The vote from shareholders this week that forces Exxon to face the music of its own record is not perfection, but it is certainly progress.”

Original article:

ExxonMobil convenes its shareholder meeting on Wednesday in Dallas. As the largest energy company in the U.S. and the largest worldwide outside of China, Exxon faces an uncertain future. Its former CEO’s departure for the State Department, a three-year slump in oil prices and the specter of investigations into the suppression of climate change research are amongst the challenges it faces.

But some shareholders, in addition to NGOs, are nowhere close to letting up on Exxon.

Activist investors put matters up to a vote on the company’s annual proxy statement. On the proposals related to corporate governance, equal pay and climate change, the company’s board recommended a “no” vote – though, in fairness, it also opposed two proposals aimed at muffling shareholders’ attempts to call meetings or submit resolutions.

One organization adopting shareholder resolutions as a tactic to nudge Exxon to take more action on climate change is the shareholder activist group As You Sow. The organization submitted a proposal that, if passed, would require Exxon to prepare annual disclosure statements on methane leaks across its operations. As You Sow's resolution also asks the company to reveal the methodologies used to detect such leaks as well as how they are stopped.

Environmental activists say such moves are necessary as methane is a greenhouse gas much more potent than carbon dioxide. And the Environmental Protection Agency’s recent decision to rescind its recent methane disclosure rule makes such reporting by energy companies even more crucial.

The resolution is expected to fail. But as with similar proposals, a significant number of “yes” votes could score the attention of Exxon’s board members and executives.

“We can no longer trust mere assurances that Exxon has this problem handled. The consequences are too great,” Danielle Fugere, president of As You Sow, told TriplePundit in a emailed statement.

Greenpeace is also calling out Exxon for its alleged track record of climate denial. The group attacked the oil company for its release of an energy outlook report that is in stark contrast to the global climate change goals upon which countries agreed at the 2015 Paris climate talks. Greenpeace suggests that Exxon is misleading investors through its reluctance to disclose how much global temperatures will increase under such a scenario.

“Investors should recognize that Exxon is relying on an outdated business model that contributes to an unsafe climate that will impact us all, and demand that Exxon explain how they will adapt to a carbon-constrained world,” said Naomi Ages, a senior campaigner with Greenpeace. "Exxon is content to hypocritically profit from catastrophic climate change that could destroy people’s lives, and is already impacting people living in the company’s home state of Texas."

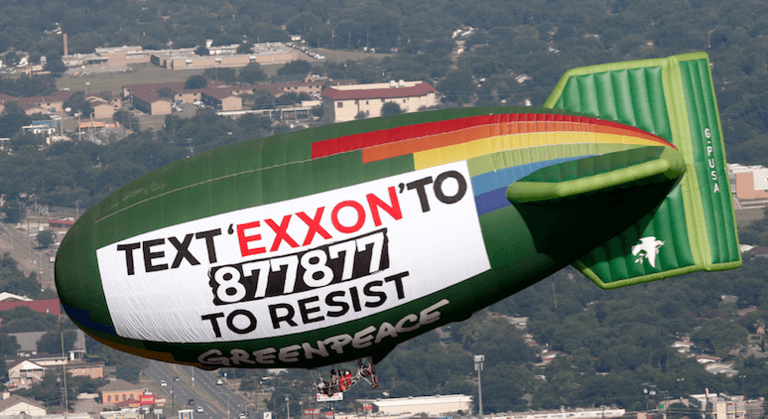

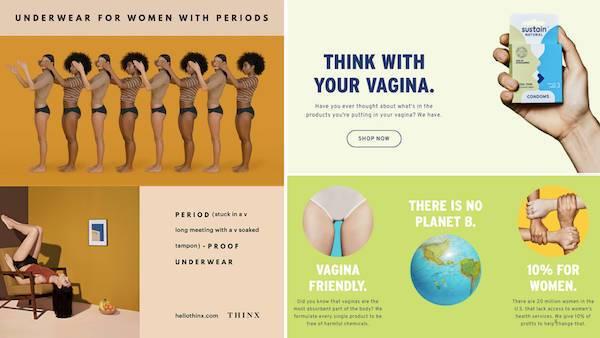

Greenpeace posted advertisements on billboard space, planted stickers at Exxon service stations, and launched its thermal airship in the Houston area to highlight what the group says is years of climate denial and information suppression.

Meanwhile, in California, environmental groups, politicians and the Los Angeles Times are insisting that Attorney General Xavier Becerra ramp up the state’s investigation into Exxon’s alleged suppression of climate change research.

Bercera replaced Kamala Harris, who launched the investigation last year. Unlike AGs in Massachusetts and New York who are also investigating Exxon, Harris reportedly made little progress on California’s investigation while she ran for the state’s U.S. Senate seat.

Moreover, not much has changed with the investigation since Bercera’s appointment in January. The the Times' editorial board urged the attorney general to move forward. “Holding ExxonMobil – and any other energy company – accountable for past misdirections would help incentivize corporations to be more transparent,” they wrote in Tuesday’s edition.

Image credit: Greenpeace

Investors and NGOs Pressure Chevron on Climate Change Risks, Transparency

As Chevron’s annual shareholder meeting convenes on Wednesday in Midland, Texas, investors and environmental groups continue to pressure America's second largest energy company to acknowledge the risks that climate change poses to its future business.

To that end, shareholders will be asked to vote on several controversial proposals on the company’s annual proxy statement. The resolutions cover issues related to lobbying and the company's links to governments accused of human rights violations, as well as corporate governance.

Chevron’s critics, including the Union of Concerned Scientists (UCS) and the activist investor network As You Sow, are taking the company to task for several reasons -- ranging from its membership in the American Legislative Exchange Council (ALEC) to the risk of its oil and gas holdings becoming stranded assets.

Stockholders managed to put at least seven proposals related to these issues up for a vote this year. Chevron’s board of directors urged investors to vote “no” on each one.

But there is some indication that Chevron is listening to more of its shareholders’ concerns about the long-term viability of the company in the event that a low-carbon economy becomes reality.

Executives and board members say a recent Chevron report proves that the company is taking climate change seriously. But some investors and environmental activists said the 17-page summary lacked any substantial discussion of climate action strategies.

Nevertheless, Wespath Investment Management withdrew its shareholder resolution earlier this month as a result, saying Chevron’s report was at least a “first step” in nudging the company to consider climate change impacts in its future scenario planning.

Other groups, however, pledged to stay focused on convincing Chevron to change its business practices and reveal the resources it spends on lobbying activities. From their point of view, momentum is on their side; after all, a shareholder resolution on climate resilience that Wespath submitted last year to Chevron’s stockholders scored a 41 percent “yes” vote, which is a practical landslide in the world of proxy statements.

“Investors see climate change as a material financial risk, which underscores the ongoing momentum post-Paris and urgency to prepare for a low-carbon transition,” said Andrew Logan of the investor group Ceres in a written statement.

Other NGOs were far more pointed in their criticism. From UCS’ perspective, the company is far from matching its words with action. In its October 2016 scorecard of Chevron’s climate action agenda, the group described the company’s actions overall as “egregious” for its affiliation with groups including ALEC and the American Petroleum Institute.

UCS also accused Chevron of blocking prior climate resolutions and described the company as slow to distance itself from public relations campaigns that disseminate climate misinformation. “Shareholders should not tolerate Chevron’s efforts to dismiss and deny the very real risks posed by climate change to our planet, to the company’s business model, and to their investments,” UCS’ Kathy Mulvey wrote last year.

Public Citizen, a Washington, D.C. group that views itself as a counterweight against corporate lobbying in the nation’s capital, also urged Chevron to become more transparent about the impacts climate change could have on its business. The organization sent Stephanie Thomas, a former Chevron geologist, to the Midland shareholders’ meeting this morning to call out the company for its current business practices.

Chevron’s milquetoast language in its voting recommendations to shareholders did not help its cause, as both investors and environmentalists show no sign of backing away from the differences they have with the $257 billion company. One proposal was spurred by Chevron’s business ties to a region in Burma, where human rights activists accuse the government of committing atrocities against the Rohingya, an ethnic minority group. Investors asked the company to draft a report later in the year to address the feasibility of a policy that prohibits conducting business with such governments.

But in requesting shareholders to vote “no,” Chevron’s board responded by concluding: “We believe the framework of management systems, policies and processes that we use to guide our business decisions wherever we operate provides clear and consistent guidance and expectations for our investments and operational decisions.”

Chevron will need to do more than keep repeating that it “is committed to operating responsibly” if it hopes to ever gain some measure of trust from its critics.

Image credit: Jonathan McIntosh/Flickr

This Big Energy Company Is Helping Small Business Kick The Coal Habit

Many major American companies grabbed the green branding spotlight by installing solar panels and wind turbines at their headquarters or operating in areas where there is ample access to renewables. Those opportunities are beyond the reach of most smaller companies and neighborhood businesses, but a good chance at green branding can still arise when local utilities transition out of coal.

The Michigan company DTE Energy is a good example of the benefits -- and shortcomings -- of that trend. DTE recently announced a new plan to wean its electricity customers off coal, but that doesn't necessarily mean an instant plunge into wind and solar for your neighborhood shop.

The renewable energy good news

With 2.2 million customers in Detroit and southeastern Michigan, DTE Energy is one of the largest electric utilities in the U.S. That makes it a good indicator of the direction for energy companies nationwide.

DTE has already established a low emissions profile that predates the current renewable energy trend, primarily through its hydropower contracts and the Fermi 2 nuclear power plant.

The company kept the option of expanding its nuclear capacity open, but its new plan for reducing carbon emissions makes it less likely that a Fermi 3 will be needed. (DTE's Fermi 1 nuclear plant suffered a permanent breakdown just a few years after it went online in the 1960s.)

The new targets, announced earlier this month, are designed to reduce DTE's carbon emissions by more than 80 percent by 2050.

DTE Chairman and CEO Gerry Anderson made it clear that the old jobs-versus-environment debate is no longer operational:

"We have concluded that not only is the 80 percent reduction goal achievable – it is achievable in a way that keeps Michigan's power affordable and reliable. There doesn't have to be a choice between the health of our environment or the health of our economy; we can achieve both."

The 80 percent goal will be reached in a series of steps. DTE expects to hit the 30 percent mark by the middle of the next decade. It hopes to hit 45 percent by 2030 and 75 percent 10 years later.

Renewable energy will not entirely drive the transition, but it does plays a key role.

DTE plans to add more than 6,000 megawatts of renewables under the new initiative. Going by the 2050 timeline, that's consistent with the company's past rate of adoption. DTE added 1,000 megawatts of wind and solar between 2009 and 2016.

As for coal, DTE previously shut down three coal-fired power facilities in the Michigan cities of Marysville, Harbor Beach and Conners Creek. And three more coal-fired units were retired at DTE power plants last year.

Within the next five years or so, the company expects to shut down its plants in River Rouge, Trenton Channel and St. Clair.

Grid modernization and 100 percent renewables

The new DTE initiative appears to be based on a relatively conservative outlook for the ability of wind and solar to compete on price with natural gas, at least in the near term. Wind and solar costs are dropping rapidly, but the shale gas boom is still alive. That means low-cost natural gas will continue to flood the market for the foreseeable future.

With that in mind, the new DTE initiative calls for the addition of 3,500 megawatts of natural gas capacity to replace coal power plants.

Aside from cost competitiveness, DTE's continued reliance on natural gas and nuclear also derives from the need to ensure 24/7 reliability. Intermittent sources -- namely, solar and wind -- were once assumed to fall short on the reliability score.

However, with the emerging combination of energy storage and smart grid technology, wind and solar are beginning to prove they can stand in for conventional power generation without a loss of reliability.

The reliability factor makes grid modernization a vital driver of renewable energy adoption. Accordingly, the new DTE initiative calls for a five-year, $5 billion upgrade that includes its natural gas infrastructure as well as its electric grid. (In addition to its electricity business, DTE has 1.1 million gas customers in Michigan.) In sum, the grid upgrades could put DTE in a good position to outperform its goals on renewables for electricity generation while easing back on its commitment to natural gas.

So, what about small business?

For the foreseeable future, DTE business customers do not have collective bragging rights to 100 percent renewables. However, that goal is in reach individually. Any DTE customer can take a shortcut to bona fide 100 percent renewables by opting into the company's MIGreenPower solar and wind buying plan, which launched in April.

As is typical of such plans, though, customers who opt in can expect to pay slightly higher electricity bills. That can be a deal breaker for small businesses and neighborhood stores that are struggling to get by, but DTE's 2050 initiative offers a hint of a solution.

The new initiative includes a line item for "continued heavy investment in energy efficiency and energy waste reduction." DTE already offers a slate of energy-efficiency resources for small business, and the next step would be to link those savings with a renewable energy plan.

DTE laid the groundwork for such a linkage earlier this year, with the launch of the new SBAM Energy Solutions partnership between DTE, the Small Business Association of Michigan and Consumers Energy. Rather than dedicate their own time to researching energy resources, small businesses can cut straight to the mustard and connect with SBAM specialists on a one-to-one basis.

The specialists are tasked with creating an individualized energy plan in areas that include renewable energy as well as energy efficiency.

In another recent development that dovetails with renewable energy adoption, DTE is now distributing free mobile technology that enables customers to track energy usage, identify weak points and set goals.

Like many other utilities, DTE has a long way to go before it can simply hand a 100 percent renewables brand to every business in its customer base. But in the meantime, it is creating more opportunities for small business to reach out and attain that goal.

Image: via DTE Energy.

Startup Teaches Coding Skills to Refugees in the Netherlands

Having to flee a war-torn country is agonizing. Learning how to adapt to a new country can be even harder, but learning new skills that can lead to a good job often helps to ease the transition.

Europe has experienced a refugee crisis since 2015 as millions arrived from Africa and the Middle East. In the Netherlands, asylum-seekers often lingered in refugee camps for up to 18 months awaiting a decision on their applications. Refugees “basically have nothing to do” while they wait, Gijs Corstens, the founder of HackYourFuture, a refugee coding school in the Netherlands and Denmark, wrote on Medium this month.

Corstens saw this waiting time as “an enormous wasted opportunity” because refugees need to learn the language of their adopted country and prepare themselves to gain employment. Only one in three 15- to 64-year-old refugees living in the Netherlands with residence permits have a paid job. Many are permanently dependent on welfare, according to a recent report from the Netherlands Scientific Council for Government Policy. And as the council put it, “This represents a waste of human capital and places an unnecessary strain on the country’s welfare system.”

HackYourFuture is Corstens' vision to help refugees learn a valuable skill. In the beginning, “five highly-motivated refugees from refugee camps camps across the country” were selected and invited to attend classes on Sundays in Amsterdam. Volunteer teachers were used to teach the classes with freeCodeCamp used as the curriculum. After six months, HackYourFuture’s first group of students graduated and “we used our network to help them find internships and jobs at various companies,” Corstens wrote.

Since January 2016, HackYourFuture has accepted more than 100 students. Half of them are still studying with the program, and 28 graduates found jobs or internships at companies all over the Netherlands. The company now runs a HackYourFuture program in Copenhagen and one in London called CodeYourFuture. And many of the students have “stopped identifying themselves as refugees and started to see themselves as developers,” Corstens said.

Corstens cites the example of a Syrian student named Sarea who lived in refugee camps since October 2015. Sarea left “everything behind,” including his job and his wife. His English skills were “very poor” when he started HackYourFuture, but he kept up with the program “by just working incredibly hard.” After he finished the program, he got an internship at De Bijenkorf, which Corstens describes as a front-end developer. Sarea also developed a web app that gives poor people in Amsterdam information about support organizations. His app was featured in two major newspapers, and thousands of people use it every month.

Here in the U.S., Cotopaxi, Adobe and the Utah Refugee Services Office developed aa similar program in Utah. The volunteer initiative provides weekly code trainings in partnership with the Bhutanese community in Salt Lake City. In 2016, the Refugee Coding Project was expanded to include the Sudanese, Burmese, Congolese and Burundian communities. Every week, computer science courses are provided to around 50 refugee students who are guided through a 20-week accelerated course by Code.org.

The Refugee Coding Project is not the only program that teaches refugees in the U.S. how to code. The Pi515 program is housed in Zion Lutheran Church in Des Moines, Iowa, where refugees take courses in computer programming. Short for Pursuit of Innovation and the local area code, the program launched in 2014.

Teaching refugees how to code is a great way to give them skills that will lead to good paying jobs. Or as Corstens says, “I believe teaching someone to program is one of the most valuable gifts you can give, because you enable someone to help themselves and become independent of other people.”

Perhaps HackYourFuture and other projects like it can serve as a new model for helping refugees transition to life in their adopted countries.

Image credit: HackYourFuture

Brand Advocacy vs. Aspiration in the Trump Era

By Liz Schroeter Courtney and Briana Quindazzi

Like few times in our history, brands and businesses are facing a profound moment of challenge and change. Trust has never been lower. Expectations have never been higher. And in our new political and cultural reality, there’s no middle ground and there’s no place to hide.

At BBMG, we believe the only way for brands to remain relevant and resilient is to put humanity first. Based on our global research into Aspirational and Advocate consumers, we’ve identified two paths for using the power of brand to fight injustice and create the good life.

If you’re ready to authentically inspire fans, mobilize champions and win in this new era, it’s no time for fear. It’s time to be brave.

The truth is, people believe brands can make a difference. Sixty percent of consumers globally say brands have a significant impact on creating “the good life.”* Brands give us something to rally around. Brands can be a badge for the values we hold dear. Because they combine business systems and cultural stories, brands can be a powerful tool to attract positive attention where it’s needed most.

If you work for a brand, you have an amazing weapon for fighting injustice and creating a more just, sustainable and healthy world for humanity. But like any weapon, we must be mindful how we wield it. It’s all too easy to get swept up in the zeitgeist and speak out in a way that does more harm than good, or that comes off as inauthentic and opportunistic.

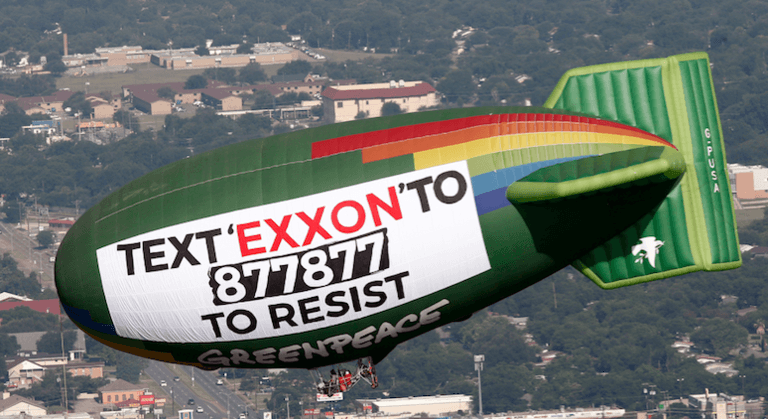

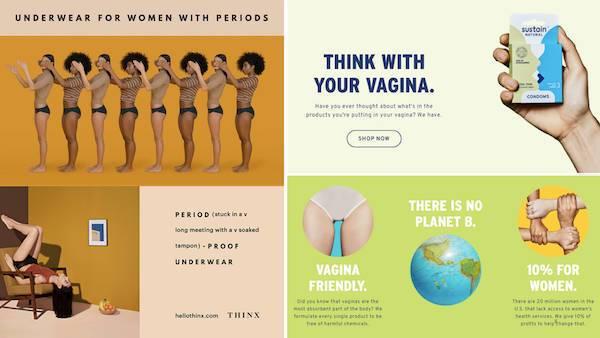

Every brand must find its own path if it wants to connect with humanity in an authentic and meaningful way. It starts with considering whether your brand is an aspirational brand -- one that unites style, social status and sustainable values to create a seamless brand experience -- or an advocate brand -- one that uses its megaphone to fight loud and proud against social, economic and environmental injustices.

So, which approach is right for your brand? BBMG has been tracking the Aspirational and Advocate psychographics for several years, and through that and our work with purpose-driven brands, we’ve identified five principles for each brand pathway.

The Ask: Buy our brand vs. Join the fight

What are we asking people to do? For aspirational brands, the positive impact is built right into the product or service. The brand creates good jobs without harming people or planet, it produces more experience with less waste, it gives back to society every time you buy a bag or a pair of shoes. When you buy an aspirational brand, you do some good.

For advocate brands, the ask goes beyond the brand or the product. Advocate brands are asking citizens to join them in a fight to impact positive change through activism and support of a cause that’s true to the brand’s mission.

The Stand: Stand for something vs. Stand against something

A strong brand can be a badge that reflects the shared values of the company and its customers and fans. The company’s values will inform what cause the brand supports, but the tone of that stance will depend on which audience the brand wants to engage.

Aspirationals are more likely to respond to an invitation to stand for something positive, to embody the change they want to see in the world. Advocates are going to identify with brands that are fighting against the problems, injustices, inequalities -- issues that motivate them and inform their purchase decisions.

The Goal: Better future vs. Change now

An aspirational brand will use its influence to champion ideals for a brighter future. A world where humanity shares equal rights, where all children thrive, where kindness rules.

Advocate brands choose to take a tougher, more urgent stance, speaking out against the ills and injustices happening in the here and now.

Advocating for immediate action might be the right move if there’s a societal or environmental threat that relates to the brand’s business interest, like members of Google’s workforce being threatened by the immigrant ban or Patagonia fighting to protect the natural places where its customers like to hike and play.

The Path: Lifestyle impact vs. Policy impact

Not every path to positive social change has to include a march through the streets. Sometimes it’s those every day actions -- mindful purchases, small acts of kindness -- that add up to massive cultural shifts towards the good life. Aspirational brands invite consumers to vote with their wallets and impact change through conscious consumption and thoughtful living.

Other times there may be a policy change that aligns with the brand’s mission but for which purchasing a product has no immediate connection. In those times an advocate brand may use its megaphone and its incredible reach to rally fans to sign petitions, call legislators, and spread important information that impacts public policy.

The Lead: Style is the story vs. Sustainability is the story

Finally, even if a brand is good for people and planet, that might not be the best opening line to attract customers. Imagine if you went on a first date and immediately started bragging about what a great companion you are, how you are awesome in bed and a great cook too! That may all be true, but a subtler approach may be more attractive. Aspirational brands lead with the style and desirability of their brand and their products and let their sustainability and social substance be the factors that create loyalty.

For some brands, however, sustainability may be the headline that sets the brand apart from the rest of the pack and shines like a beacon to advocate consumers desperate for a do-good alternative to the mainstream competitors.

Brands, the time is now for you to step up and create positive change in the world. Those who don’t, risk being left behind. But, before you go rogue, carefully consider whether aspiration or advocacy is the path for your brand to authentically honor and advance our collective humanity. Our global challenges are complex and in need of diverse movements to create sustainable change and build a more equitable world.

To read more about BBMG and GlobeScan’s research on Aspirationals and Advocates, download our report here.

*Data from GlobeScan’s 2017 Radar Research Program

Image credits: The Honest Company, Seventh Generation, REI, Patagonia, Airbnb, KIND Snacks, Ben and Jerry’s, Thinx, Sustain and Google images from Moriah Maranitch on Instagram and KnowStartup.

Liz Schroeter Courtney and Briana Quindazzi do business development and brand strategy at BBMG, a NYC and San Francisco-based studio that builds brands for humans. Learn more at BBMG.com.

Being bold at IKEA: Steve Howard on six years leading from the front

By Adam Woodhall — The man who last year brought us the concept of “peak stuff”, and is a self-proclaimed ‘professional optimist’, Steve Howard of IKEA, joined The Crowd for a TED talk-style presentation to give us a lesson in leading from the front.

Howard’s other TED talk has been viewed by over one million people. This time he did it in front of a couple hundred, and your correspondent was lucky enough to have a front row seat. In this parting public presentation before his exit from his role as Chief Sustainability Officer, he treated us to a talk which was at turns provocative, challenging and frustrated, at others inspiring, involving and full of hope.

His speech started on the front foot, by challenging the notion that 20% less bad might be good enough, stating “If you want incremental, I'm not your man. If you want transformative, I'm all in”. It didn’t appear that Howard was looking for a revolution though, but he certainly appears to believe that we need a very rapid evolution of our society and economy, saying “we need to repurpose capitalism”.

Howard believes we should go all in. He was instrumental in IKEA setting aspirational targets for areas such as sourcing renewable energy and certified wood, promoting “the power of 100% driving true transformational change... and brings a company with you” as reported on Twitter by @MrJonKhoo of Interface, another company that believes in such goals.

Thinking about how you present yourself in your organisation was something Howard mused, on stating “I’d rather be fired for doing too much than disappointed at myself for doing too little”. One of the intriguing lessons that he chose to share was how to approach your first 100 days in an organisation, maybe thinking of his own next move. He shared the truism that we all have two ears and one mouth and to use them in that order to “understand what drives the business and makes it tick”. This was something he suggested a certain Mr. Trump could learn from.

You don’t get to be one of the planet’s most influential corporate sustainability execs by being timid. Before joining IKEA, Howard insisted on being on the executive board, stating that “you're either at the table, or you’re part of the menu”. On joining he knew change was required, and as he dryly observed, “The only person that likes change is a wet baby”, which means that “you have difficult conversations and to be present in those is difficult for most of us”. He feels sustainability professionals are obligated to; “drive changes, to take a stand”, and wisely observed, “you need to do it with charm and persuasion and in a language that business understands, but if you don’t take a stand with the role you have, you give everybody else permission to opt out.”

However, Howard doesn’t think it is only the sustainability team’s responsibility—in fact, just the opposite, declaring a year into his role that “I introduced myself as co-responsible for sustainability with everybody else” and went on to state that “change is a team sport”.

Something the viewers on TED.com didn’t get was being treated to another hour with Howard, facilitated by the ever-urbane Axel Threlfall. Our host promised to probe his guest, and this wasn’t a cuddly fire-side chat. Threlfall’s questions, and the ones fielded from the audience, however, did produce an even deeper understanding of the journey Howard has been on. Sample highlights were that he was both “mighty pissed off by the state of the world” and that he also believed we “soon will have ubiquitous affordable energy and water”.

As well as saying goodbye to Howard in his role at IKEA, we also said hello to the new ‘Chief Catalyst’ at The Crowd, Daniel McMurray, who was given advice by Howard to be his own man. Howard was coy over his next move, but he indicated it would be with a smaller business. This isn’t necessarily surprising, as he said he was “encouraged by the innovation pipeline, but we need more big companies to get serious”, indicating a frustration with the slow pace of many large corporates.

As his parting message, Howard urged us all to be “be bold” in our future adventures in sustainability. This final excerpt from his talk gave a rallying call to the gathered crowd to do just that: “It really, really, really is the one hour past midnight in the day of sustainability. We’ve got all our working lives to throw at this. The younger you are, the more you’ve got to throw at this. The opportunities will be rich, but go for it, bring your best selves to it, and I think we’ll be remarkable in what we achieve together.”

Say hello to the Global Good Awards!

For 2018, the National CSR Awards is rebranding as the Global Good Awards.

Karen Sutton, CEO and Founder of the Awards (pictured above), explains: “These awards were originally born out of an ideal that everyone should be changing their actions in work – and in their personal lives – in order to make the world a better place. After three highly successful years, I wanted the Awards’ name to reflect that ideal more dynamically.”

The new name was sealed by a visit to Good Hotel London, one of this year’s award sponsors.

“Good Hotel hosted a reception following our judging day at the Crystal back in March,” says Karen. “It was a brilliant evening where we got a great insight into its profit-for-non-profit business model. Its multi-pronged approach to sustainability and community certainly got me thinking!”

Marten Dresen, founder and CEO of Good Hotel, commented “I’m excited to see that Good Hotel is able to inspire other successful organisations and companies with its profit for non-profit business model. That’s what it is all about, leading by example, inspiring others and eventually changing the way business is done. We believe all businesses should be social businesses and it’s great to see that the Global Good Awards is joining that mission too.”

Similarly the Global Good Awards takes a multi-faceted approach, reflected in its logo: ‘For People, Planet & Profit with Purpose’

As a result of the name change, the Awards will become more inclusive, rewarding businesses, NGOs, charities and social enterprises actively achieving #GlobalGood and will include a whole host of new categories.

“It’s an exciting new phase for the Awards,” adds Karen. “We are driven by a cause to celebrate all those who are making strides towards a better world for people, the planet and the global economy.”

The name change was first announced at the gala dinner for this year’s National CSR Awards by Sutton.

Report: Carbon Markets Contribute to Global Climate Action Efforts, But Need a Boost

The voluntary carbon offset market is helping governments and companies around the world reach their climate action goals for this decade, according to a recent report.

Nevertheless, challenges remain: The volume of carbon offsets sold last year actually declined from 2015. And we could soon see a more dispersed market, as half of those offsets were purchased in Asia -- a substantial increase from prior years.

The carbon offset market has its share of supporters and critics. For businesses that are scrambling to find ways to meet their climate change mediation goals, however, this study could spark interest: It is now a buyer’s market for carbon offsets.

As detailed in its study, the NGO Forest Trends found voluntary offsets to be highly affordable, with an average cost of $3 to offset the equivalent of a metric ton of carbon dioxide (MtCO2e). But those prices also had a wide variance, from wind power projects costing as low 70 cents per MtCO2e, to forestation projects in Africa costing 10 times that amount. And it was forestry management projects that generally garnered the highest prices, costing on average $8 to $9 per MtCO2e depending on the type of project. Grassland management also came at a high price of almost a $7 per MtCO2e on average. Clean cookstove distribution projects also trended higher than average, netting just over $5 per MtCO2e.

But those aforementioned projects had a far lower purchased volume combined than offsets that were designed for REDD+ (reduced emissions from deforestation and forest degradation), wind power or landfill methane projects. REDD+ projects could score competitive prices, topping off at over $4 per MtCO2e. But wind power and landfill methane programs, which during 2016 earned $1.50 and $2.1 per MtCO2e, respectively.

REDD+, wind and landfill methane carbon offsets prevented the emissions of about 23 million MtCO2e. Contrast that with reforestation, improved forest management, grassland projects and the distribution of clean cookstoves, which accounted for approximately 5 million MtCO2e – hence the low overall price.

Overall, $191.3 million in offsets was spent to offset 63.4 million MtCO2e last year, a 24 percent drop from 2015. And there is a huge glut of carbon offsets on the market, with 56.2 MtCO2e unsold as of the beginning of 2017.

Part of the challenge surrounding carbon offsets is the discussion of whether they are really effective or not. Some NGOs, including the Nature Conservancy, insist that their offset programs are verified by third parties to ensure those offsets actually prevent carbon emissions. One huge problem is “leakage,” as in an agriculture firm buying land for development next to a plot purchased or protected through an offset program.

The future of these markets shows both promise and concern, in the view of Forest Trends’ analysts.

The political situation in the U.S. could push carbon offsets in either direction; the U.S. could simply abandon its climate change goals, or the private sector could ramp up investment in low-carbon technologies even if the federal government completely backs away from such efforts.

The International Civil Aviation Organization (ICAO) says it will accelerate its own carbon offset program, as renewable jet fuel technologies are not ready to scale any time soon while air travel continues to increase worldwide. And countries that signed onto the global climate agreement in Paris will have to disclose how exactly they will accomplish those goals, which could also give the carbon offsets market a lift.

But despite ongoing criticism, Forest Trends is still bullish on carbon offsets. “As countries shift from debating climate change to implementing their proposed solutions,” its CEO wrote in the report, “voluntary offsetting can help tackle climate change now and explore new avenues of emissions reductions that may be included in compliance programs in the future.”

Image credit: DFID/Flickr