UK's first-ever 'Social Mobility Employer Index'

How Coca-Cola and Boost Mobile Demonstrate Brand Authenticity

By Grady Lee

It wasn’t long ago that corporate leadership dismissed the concept of “doing good” as a distraction to business as usual. To do it well could be costly and, worse yet, consumers wouldn’t notice or care. So, the North Star was brand awareness.

Today, nearly 11,000 companies have filed reports with the Global Reporting Initiative’s Sustainability Disclosure Database, demonstrating that they not only care about the doing good, but also care enough to be held accountable.

Over this period of change, a lot has been written about the shift in consumer behavior that has incentivized this rush toward “doing good.” Unfortunately, less conversation has existed around how to get it right, and how to successfully move from brand awareness to brand authenticity.

A couple of years ago, I spoke with a former executive of Unilever, a shining example of a company whose CEO has infused social impact and corporate social responsibility successfully into the fabric of its business.

The executive relayed that Unilever had always maintained a CSR platform and set of principles, but they didn't really catch fire until their brand teams got involved. For instance, one of the product teams ran a taste test for fish sticks. One consumer group was told that the fish were sourced from specific fish farming families (which was true), and another group was told that the fish came from industrial fish farms. As you might expect, the product with the origin story from the family farmer tasted better than the one from the industrial farm. It was the exact same product! But now, the authenticity of how the food was sourced had an impact on customer perception of the product’s quality.

Boom. Authenticity was now a differentiator for Unilever products.

As companies seek ways to connect with the world around them, they are finding that their message needs to stem from the essence of the company — a true, authentic place. The reason this is so powerful is because, as Cone Communications has noted, “consumers believe it’s okay if a company is not perfect as long as it’s honest about its efforts.”

If your brand promise connects with your actions, you’ll enjoy consumer loyalty. Thus, authenticity has become the currency in the world of brands. But brand marketers need to look at the CSR side of the business to know what that means.

From our experience of producing brand promises through social impact, we have found it is important to get the big things right: Alignment, Connection, and Commitment

Alignment is always the first step. CSR can be critical or it can be fluff. If your CSR initiatives are non-critical, they don't get the funding or attention they need, and are quickly reduced to a press release. However, if these initiatives are working in tandem with issues that are core to the business and to the governance of the company, they will not be forgotten or under-invested.

For instance, we worked with Coca-Cola and their distributor in South Africa on a youth engagement program. We produced a concert where the only way to attend was to earn a ticket by volunteering. More than 4,500 high school students gave four hours each, refurbishing local daycare facilities in order to attend an exclusive concert with Ciara and Busta Rhymes. However, when we stepped in, Coca-Cola and its distributor had different objectives that needed to be aligned.

Coca-Cola's objective was to “Open Happiness.” The company wanted to celebrate and empower in and around Johannesburg. Its message was about joy, fun, and empowerment — and very brand driven. Coca-Cola needed to be seen as a supporter and friend of those communities. As executives explained it, this kind of effort “provided a social license for them to operate in these areas.” The distributor, ABI, was more concerned with the impact of the work in the townships around Johannesburg. They viewed the volunteer effort as critical in those areas because their trucks that drove through them daily.

The alignment was the most important part. If the brand message didn't connect or the work didn't ring true to the community, the project would not effectively "open happiness."

Connection between the brand message and the company means that the message comes from the inside out. If you want to present yourself as a company that cares about the community (as you should), then the people inside the company need to be invited walk that walk too.

When Orange in the UK wanted to exemplify their new tagline, “Together we can do more,” we worked with them on a campaign to mobilize tens of thousands of their customers to volunteer and help local non-profits throughout England. We also created thousands of opportunities for the marketing department, retail workers, and call center operators to do the same. The point was to show that together, we can do more. We then expanded in other Orange markets in the EU and Middle East with a similar effort. When evaluating the success of the initiative, the CMO was surprised by the impact the campaign had on his people. The success of the marketing initiative stemmed from the mobilization of the company itself.

Finally, commitment pays off when it comes to authentic brand efforts. Brand marketing departments have a reputation of loving and leaving in the social impact space. Connecting with community and driving social impact takes time and continued effort. If you get in and get out too quickly, your credibility will suffer.

Boost Mobile, a telecommunications company, chose to anchor itself to a message around helping customers ‘boost’ themselves to the next level. After we launched a program with the company in New York City, they doubled down and took the empowerment message to more than 30 cities over the next four years. The work we did in New York was impactful, but if it didn’t align with the brand it wouldn’t have mattered.

In the end, brand authenticity is real currency, and its value stems from aligning messaging to actions, leading with campaigns internally, and committing to change. It’s not easy, but it ultimately leads to more rewarding work and successful results.

Grady Lee is the CEO and Co-Founder of Give2Get, a production company that mobilizes volunteers through cultural experiences. He is also the Founder and chair of IMPACT 2030, a global collaboration between the United Nations and the business sector to help achieve the United Nation's Post 2015 Sustainable Development Goals by means of corporate volunteering.

Facebook's Menlo Park Facelift Will Help Community, Too

Finding affordable housing is a challenge in Silicon Valley, even for employees who work at Facebook's Menlo Park facility. Recent stories of Silicon Valley employees and families forced to live in a garage or out of the back of a renovated moving truck have galvanized attention on just how dire, though ironic, the housing situation has become in California's upper-end tech-savvy neighborhoods.

Facebook says it is attempting to address the problem. It argues that the challenge isn't just how to provide more living structures in an already impacted area but how Menlo Park, and the Silicon Valley area in general, can be better served by transforming its Science and Technology Park into a mixed-use area.

In its July 7 blog post Facebook VP of Global Facilities and Real Estate, John Tenanes, sketched a picture of what the new Willow Campus would look like.

- 1,500 living units will be constructed on site, with 15 percent of the units offered at below-market rates. Part of the idea said Tenanes, will be to reduce the traffic of commuters in the area and on connecting highways.

- 125,000 square feet will be dedicated to a mixed-retail area featuring a grocery store, pharmacy and "additional community-facing retail."

- The project will work in tandem with the goals of its Catalyst Housing Fund, which was established in 2016 to address challenges already being faced by tech employees in the area.

- The company hopes the project will also incentivize local and state governments to improve the area's transportation network, which Tenanes points out is insufficient to accommodate the region's growing needs. " Willow Campus will be an opportunity to catalyze regional transit investment by providing planned density sufficient to support new east-west connections and a future transit center. We’re investing tens of millions of dollars to improve US101," said Tenanes.

- The company is aiming to have the grocery, retail, housing and office portion completed by 2021.

Facebook's new project will dovetail nicely with efforts by Menlo Park to increase its affordable housing options. A 2012 lawsuit against the city by Peninsula Interfaith Action, Urban Habitat and Youth United for Community Action alleged that the city was violating state law by not updating its "housing element," and encouraged the city to increase its share of affordable housing.

But even the 800-some new housing permits that have been granted by the city has been insufficient to provide the adequate amount of living structures needed for its sector of the Silicon Valley community. Facebook's efforts therefore, will help.

Of course, the tech giant is right: Improving the state's antiquated transportation network is crucial to improving living conditions for millions of STEM workers. Time will tell whether the private investment of "tens of millions" by Facebook toward the this goal will convince the state and regional governments to to upgrade the highways and other infrastructure that are vital to its continuing growth.

Flickr image: Marcin Wichary

World's Largest Tuna Company Commits to Supply Chain and Labor Reforms

By Annie Leonard

For years, the seafood industry has operated out of sight and, for many people, out of mind. Companies have profited off of slave labor, human rights abuses, overfishing of our oceans and the needless slaughter of marine animals. Thai Union, the world’s largest tuna company and owner of Chicken of the Sea, has historically been one of the worst offenders. It has been implicated in human rights investigations by the Associated Press, the New York Times and Greenpeace. Its supply vessels have used the most destructive and indiscriminate fishing methods and the company has refused to take meaningful action to change. Until now.

Expedia Takes A Stand on "Entertainment" Wildlife Attractions

Elephants and other animals are wildlife, not entertainers, say many animal rights and wildlife conservation groups, including World Animal Protection.

Now more tour operators and online travel sites are eliminating, or at least reducing, bookings of such attractions. One of them is Expedia, which announced last week that in consultation with various NGOs, many wildlife-related activities soon will no longer be available for bookings on its site.

Expedia’s decision follows companies such as Intrepid Travel, which ceased any booking of elephant rides three years ago. Last autumn, TripAdvisor said it would phase out ticket sales to many animal-related attractions in a shift towards more responsible tourism.

One of the organizations with which Expedia said it will partner is the U.S. Wildlife Trafficking Alliance, which describes global wildlife trafficking as a crisis that is devastating some of the most magnificent animals on earth. The Association of Zoos and Aquariums, a wildlife and marine life attraction certification organization, will also consult with Expedia on determining which wildlife venues are focused on conservation as opposed to others that present animals as entertainers.

In addition, Expedia will also seek feedback from the Humane Society of the United States. One of the problems the Humane Society has confronted is the evaluation of zoos that are focused on conservation rather than those that are more tourist attractions with no concern for animal welfare. Even though U.S. law in general prohibits the possession of certain wild animals, loopholes exist – the results have included “roadside zoos,” such as privately-owned attractions in Maryland that the Humane Society profiled in a scathing report in 2013.

Expedia says it will soon launch a “Wildlife Tourism Education Portal,” which will aim to educate travelers on various animal-related activities while they plan their future trips.

"Our planet's wildlife is disappearing at a devastating rate as poachers meet consumer demand for exotic wildlife products," said Sara Walker, Executive Director of U.S. Wildlife Trafficking Alliance in a public statement. "With its significant global reach and influence, the travel and tourism industry can make an enormous impact in helping to end the scourge of wildlife trafficking.”

Image credit: Leon Kaye

The World’s Largest Hog Producer Talks Animal Welfare

To gain practical skills for sustainability management, join us at the COMMIT! Forum in DC October 11-12 2017

Our pork chop and bacon habits require a lot of pigs. Which means those in the pork business are in the pregnant sow business. Unfortunately, industry standard "gestation crates" are pretty miserable due to their tiny size.

Smithfield Foods, the world’s largest hog producer, is committed to transitioning all pregnant sows on company-owned farms to group housing systems by the end of 2017. The company is well on its way to meet the goal. As of the end of last year, 87 percent of its company-owned farms house pregnant sows in group systems.

Smithfield recommends that all of its contract sow grocers in the U.S. transition to group housing by the end of 2022. Although it is only a recommendation, the company states in its latest sustainability report that “if growers choose not to participate, their current contracts will remain unchanged, although extensions are less likely.”

Smithfield was first was the first in the industry to make the commitment to transition from gestation crates to group housing. And it is confident it can meet that commitment by the end of this year. “This year is our anniversary year and we believe we are right on track to meet the commitment,” Stewart Leeth, Vice President of Regulatory Affairs and Chief Sustainability Officer of Smithfield Foods told CR Magazine.

About 10 years ago, Smithfield made its commitment to transition to group housing “in large part because many of our customers were asking for this,” Leeth explains. He said that with the new system for the “majority of the time that the animal is pregnant, she's housed in a group setting.”

Leeth explained how the new housing system works. There are stalls used initially when the animal's pregnancy is confirmed. Once the sow is confirmed pregnant, she is put into a group housing system. When she is ready to give birth she goes to a separate farm with housing designed for the farrowing, or the birth of the piglets. It is a “stall system where she can lay down and the piglets can move into other areas of the stall so they don't get hurt or crushed as they sometimes do in the old-fashioned way of raising animals,” Leeth said.

All of the employees on its company-owned farms, its contract hog producers, and plant employees have to follow the Animal Care Management System. Part of that system is what Leeth terms “vigorous auditing.” The farms that the company owns and operates are audited at least once a year. The audits cover things like employee competency on animal handling and husbandry, the equipment, the facilities, management, animal health, veterinary practices, the conditions of the animal, and the outcomes of the farm. “We have third party auditors on our farms, as well,” Leeth added.

Smithfield's sustainability program is broader than most

Smithfield’s sustainability program is “broader than most,” Leeth said. It encompasses animal care management, worker safety, food safety and community involvement. “But the environment is where it all started,” he added. When Smithfield started its sustainability program it began with a “heavy focus on our environmental compliance issues,” according to Leeth. One of the first steps was to use an environmental management system (EMS) called ISO 14001. It is International Standards Organization's standard for environmental management.

“We set about and got every one of our farms plants at the time certified, and that's still the case today,” Leeth said. “We were the first in our industry to do that in terms of livestock and food production.”

Smithfield is "starting to focus more on our own supply chain," Leeth said. In December 2016, the company announced a new goal to reduce greenhouse gas (GHG) emissions 25 percent by 2025 throughout its supply chain. It is the first in its industry to set such a goal. Given the substantial environmental impact of livestock, this commitment represents over four million metric tons of emissions, equivalent to removing 900,000 cars from the road. The commitment is across the company’s supply chain, including on the farms it owns, its processing facilities and its transportation network.

“We're excited about that because we were the first in our industry to set a 25 percent reduction goal by 2025 over our entire value chain,” Leeth said. “It encompasses our farms, our plants, and our own supply chain."

Smithfield will achieve its GHG reduction goal through a variety of means, including through using technology that converts manure into energy. On one of its farms in Missouri, manure from two million pigs is being converted into renewable gas. The company is collaborating with a developer that is installing impermeable covers on the lagoons and flare systems on the Missouri farm so renewable natural gas can be collected. The project is expected to produce about 2.2 billion cubic feet of renewable natural gas. That is enough to produce electricity for about 53,000 homes for a year. It will keep also 850,000 tons of methane from entering the atmosphere. Methane is a GHG with a warming potential 23 times that of carbon dioxide.

Smithfield proves that the world’s largest hog producer can treat farm animals humanely and tackle climate change. In short, the company is an industry leader in sustainability.

Image credit: Smithfield Foods

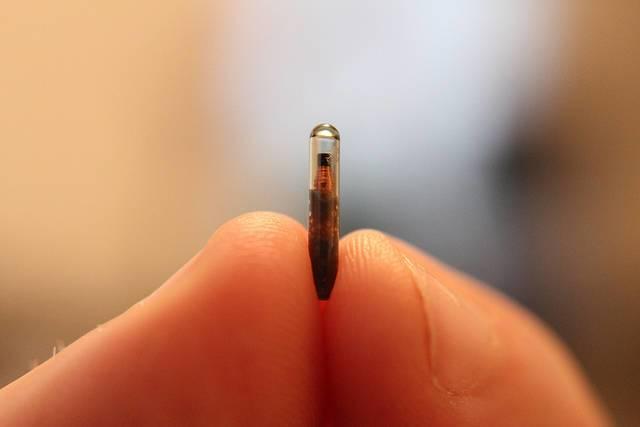

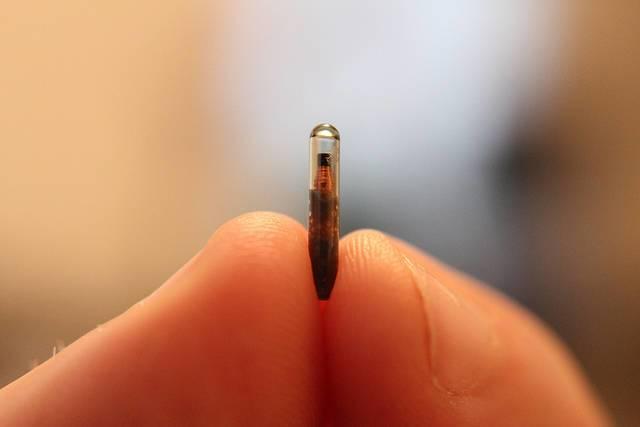

Wisconsin Vending Machine Company Offers Employees Free Microchip Implants

Is your Apple Pay or Android Pay still giving you fits at the checkout stand? Don't worry, you're not alone. Do you shudder at the thought of paying with your smartphone in the first place? If you are in the U.S., you are not alone on this front, either: mobile payments just have not scaled here as they have in many other countries across the world.

Well, if you're ready for the next best thing, a Midwestern vending machine operator is working on enabling its employees with a technology that reaches beyond mobile payments. This development is either brilliant and extremely convenient, or more-than-creepy, depending on your point of view.

Three Square Market, a next-gen vending machine company with 85 employees in River Falls, Wisconsin, believes microchipping humans is the future. According to several news reports, the company is partnering with BioHax International of Sweden to gauge whether radio-frequency identification (RFID) chips can have broader commercial applications beyond simply making supply chains more efficient. Three Square Market has made the implantation of these rice grain-sized chips an option for employees to test their applicability. So far the turnout has been impressive. As BBC deadpanned, "50 employees have signed up for the chance to become half-human, half-walking credit card."

Supporters of the technology tout a wide range of benefits. Forget scrounging for coins, smoothing out dollar bills or even swiping a credit card: consumers could just wave their hand to buy that soft drink or bag of Corn Nuts. The chip, which would be embedded between the thumb and forefinger, would also allow for company employees to use the photocopier, as well as enter buildings without looking like a Silicon Valley badge geek. RFID chips could also replace key fobs, so employees would have a seamless way to use that company's bike-sharing system or borrow a company car. Eventually, such technology could also become handy when buying groceries, taking public transit, or in a perfect world, function as our driver's license or passport.

Of course, opponents of such a scenario could envision all sorts of slippery slopes. Employers could monitor their workers' behavior, from spending too much time at the water cooler to sneaking out to play a little Pokémon Go. On the lighter side, if you have quite the night out and end up lost with amnesia at the local police precinct, they can figure out who you are, just like a lost dog or cat!

Companies like Three Square Market insist that this is voluntary. But as anyone knows, "voluntary" can lead to a grey area. Many workers feel obligated to play on the company's softball team, take part in an after-hours "team building activity" or donate part of their paychecks to fit in. Peer pressure, indeed, often continues after high school.

The idea of getting chipped is going to take a lot of getting used to; so are we getting ahead of ourselves in embracing this technology before we fully understand its potential?

Some politicians are already making moves to avoid what they feel is a squeamish brave new world. Nevada State Senator Becky Harris, for example, introduced a bill earlier this year that would make forcing employees to get microchipped a felony. The bill, however, did not make it out committee. In defending her bill, Harris said, "It wouldn’t prohibit the voluntary decision of a person to be microchipped," citing the example of a nightclub in Europe that offers such an option to its customers so the establishment can offer customized services.

Of course, considering the hassle of taking off those plastic bracelets the next morning after a night about town, microchipping may not be the worst option after all.

The reality is that microchipping foments a bevy of ethical issues. Who owns that information, and what happens if it that information is stolen, are only the start of questions that many employees and consumers will be asking. But supporters of the technology say that microchipping is about identification, not tracking, and in Three Square Market's case, the chips cannot be read at a distance of more than six inches.

Image credit: Dan Lane/Flickr

San Diego Study Finds Cheaper, Greener Energy from Utility Leapfrog

Utility companies are facing a tough environment with the advent of renewable energy, and things are about to get much tougher. A new study commissioned by the city of San Diego, California indicates that the city may have an opportunity to provide electricity consumers with lower rates, ramp up its use of renewable energy and meet its self-imposed greenhouse gas goals by forming a Community Choice Aggregation system.

A final decision on launching Community Choice in San Diego is a long way off, but the new study may force the local utility SDG&E to up its renewable energy game.

Community Choice Aggregation in California

California is among a handful of states that have established Community Choice Aggregation systems.Community Choice Aggregation basically enables local governments to control the power sources of their utility company.

Under CCA, the company still owns its infrastructure, billing systems and other operations, but local communities can determine where the electricity is coming from.

In particular, local communities can create new job opportunities and foster new economic activity by order their utility to purchase renewable energy from solar arrays within their jurisdiction, or from other locally available renewable sources.

California has eight CCA systems in place so far. Researchers have compiled that data into a solid argument (with some caveats) for more communities to adopt CCA, and San Diego could give the movement another powerful shove forward. It would be the largest jurisdiction in the state with CCA, by a significant margin.

The San Diego CCA Study

In 2015 San Diego approved a Climate Action Plan that calls for ending the city's reliance on fossil fuels for power generation by 2035, and now the pressure is on to accomplish that goal without raising electricity rates.San Diego's utility SDG&E currently provides power that is mainly sourced from natural gas. That makes matters more challenging because the shale gas boom has kept gas prices low.

Although natural gas emits less greenhouse gas pollution at the burn point than coal, it carries a significant degree of other environmental baggage. Green-branded cities like San Diego can strengthen their sustainability position by eliminating natural gas from their power supply chain.

The San Diego study was released last week under the title, "Feasibility Study for a Community Choice Aggregate," by the consultant group Wildan Financial Services. It is specifically aimed at assessing opportunities for the city to wean itself from natural gas.

Ry Rivard of the Voice of San Diego sums up one scenario described in the study, which would get the San Diego CCA to 50 percent renewables:

The city also has the potential to hit 80 percent renewables by 2026, though its initial rates would be more expensive than SDG&E for a longer period of time.Because of separate state mandates, 50 percent of SDG&E’s power needs to be renewable by 2030. The city said it can hit that 50 percent target faster and cheaper: The city’s rates would be 2 percent higher than SDG&E’s in the first year of its government-run program but then less and less expensive until 2026, when the city’s rates could be 11 percent lower.

According to Rivard, that would put the city in a good position to achieve 100 percent renewables by its 2035 target:

If the city can competitively get to 80 percent renewable energy by 2026, it still has nearly a decade to figure out how to get to 100 percent, a gap that by then may be easier to close thanks to falling renewable energy prices and rapidly advancing technologies.

A Good Bet On Renewables

San Diego officials are taking the new study under consideration, though with caution. Numbers and models can change, and the advent of distributed solar-plus-storage creates new complexities for CCAs, just as it has been disrupting utilities in the private sector.One thing that does seem relatively secure, though, is a further significant drop in the cost of solar power.

Despite the pro-coal rhetoric of President Trump, the Department of Energy is still committing new funds to help drive down the cost of solar and other renewables, partly by funding cutting edge research on solar technology and partly by taking steps to lower the cost of installation and other "soft" costs.

Much of the heavy lifting has been undertaken by an Obama-era initiative called SunShot solar, which aims to push the cost of unsubsidized solar power into parity with fossil fuels. Energy Secretary Rick Perry is known for public gaffes, and as a cabinet member he has dutifully supported the Trump Administration. However, his agency is still going full steam ahead with programs that foster the mission of SunShot and renewables in general.

The Energy Department's newly re-designed website makes it clear that the agency is determined to promote solar power over fossil fuels:

The U.S. Department of Energy SunShot Initiative is a national effort to drive down the cost of solar electricity and support solar adoption. SunShot aims to make solar energy a low-cost electricity source for all Americans through research and development efforts in collaboration with public and private partners.As for Community Choice Aggregation, one factor that tips the balance in its favor is local job creation. SDG&E already appears to be taking steps to turn public opinion against CCA in San Diego, but unless the company begins to get serious about finding local sources of renewable energy, that's going to be a tough sell.

Image (screenshot): via sandiego.gov.

Want a Big Boost in GDP? Bring in Immigrants

President Trump made an enduring campaign out of his views on immigration. From his proposal to build a 30-foot wide "border wall" at the boundary with Mexico, to his controversial and often chaotic legal battles over immigration bans, his administration has set a seemingly intractable line when it comes to welcoming visitors and immigrants to this country.

But what if immigrants are actually good for the economy? What if we could"make America great" by welcoming immigrants?

A new report published by ProPublica suggests that Trump's vision of a resilient economy that thrives on a 3-4 percent growth (a dream, some analysts say, that may be unrealistic according to the Congressional Budget Office's own projections) would only be possible with a clear-sighted plan that supports immigration.

The nonprofit journalism outlet had Moody's Analytics check the numbers and found that there is a correlation between increased immigration and a rise in the country's Gross Domestic Product (GDP). For every 1 percent increase in immigrants to the U.S., the country's GDP rises 1.25 percent.

"So a simple way to get to Trump’s 4 percent GDP bump?," suggest the writers, "Take in about eight million net immigrants per year."

To demonstrate that point, Propublica created an interactive tool that allows the reader to explore outcomes if, say, all immigration to the U.S. ceased -- and conversely, what would happen if the U.S. were to open its doors to three million immigrants per year. At the present time, the two percent growth rate is supported by the influx of one million immigrants. Based on that level of immigration, say analysts, by 2030 the U.S. should see a GDP growth of $24.6 trillion.

However, welcoming an additional two million immigrants would put the Trump administration more on track to reach its economic goals. We would see a 2.6 percent increase in GDP growth, or a cumulative growth of $15.2 trillion over the next 14 years.

Researchers also calculated what would happen if all 11 million unauthorized immigrants were deported. ProPublica estimates that GDP would drop $7.9 trillion cumulatively over the next 14 years. The economy would stagnate with GDP plummeting to 1.8 percent per year.

Of course, immigration is not a new topic for this country. There have been plenty of studies and stories done about the economic benefits of both legal and undocumented immigrants. Our story last February about the potential impact of an immigration ban highlighted several cities in which immigration has actually benefited the economy.

It's a story that is still being played out in fact, through towns across the U.S. In Storm Lake, IA, immigrants are what keep its businesses, and the town, alive. The old union jobs at a meat processing plant are long gone, replaced by open positions that immigrants from across the world willingly fill. More than half of the 11,000 residents that make up this lakeside town are from immigrant families; a dramatic contrast to the largely white demographics of Iowa.

And on the other side of the picture are the businesses that now worry they won't have the workers to harvest their crops. In Florida, famous for its low-paying tomato industry, workers calculate the risks of going to work with the increased risk of deportation. In California as well, where undocumented immigrants make up about 10 percent of the population and agricultural industries rely on immigrant workers, the claim that immigrants are robbing citizens of jobs doesn't seem to pan out, according to research done by PRI.

“Sometimes some people apply, but almost never do any of them stay.” said Ellen Brokaw, a ranch owner in Ventura County who said she's tried to hire U.S.-born workers, but finds they won't stay.

California state comptroller Betty Yee reported she found the same thing. "This is a workforce, a supply of labor from our undocumented workforce, that actually does provide just the basic foundations of these sectors and industries of being able to succeed and thrive."

And so has ProPublica, which also calculated what would happen if the federal government were to legalize all undocumented immigrants and allow them to stay. Could GDP grow?

Yes. slightly. Legalizing the country's undocumented immigrant population would bump the GDP up by a tenth of a percent. It obviously wouldn't be a magic bullet, but a $1.8 trillion cumulative gain over the next 14 years is nothing to sneeze at.

But it does point to the fact that the Trump administration's ongoing rhetoric that immigration is bad for the U.S. economy and bad for businesses is not only out of out of sync with recent studies but U.S. history. As growth in cities like New York demonstrated during the 1830s and later again in the 1990s, immigrants have always played a key role in America's ability to flourish. They continue to be the key to a resilient and growing economy.

Flickr images: Elvert Barnes; Elvert Barnes; Mike G

UK Banning Diesel and Gasoline Fueled Cars and Vans After 2040

Following the lead of France, the government of the United Kingdom has announced that it will ban the sales of diesel- and gasoline-powered passenger vehicles after 2040. The directive is part of the government’s updated clean air plan, which was updated after earlier versions were attacked as “weak” and “inadequate.” The government says up to £2.7 billion ($3.5 billion) in various investments are needed in order to improve human health.

Proponents of electric vehicles have long cited the need to scale adoption of electric vehicles in order to reduce greenhouse gas emissions. But other pollutants, including nitrogen dioxides (NOx), have had a detrimental impact on human health. Various environmental regulators, including the U.S. Environmental Protection Agency (EPA), have attributed high concentrations of NOx to respiratory diseases including asthma.

The directive acknowledges that at a macro level, there has been much improvement in air quality, thanks to improvements in automotive technologies. Since 1970, sulfur emissions by gone down 95 percent and NOx by 69 percent. Nevertheless, progress confronting NOx pollution in cities and towns has largely stalled, while the UK’s government has been routinely hammered as many environmental groups feel policies simply are not simply not bold enough to clean the air.

“Poor air quality persists in certain areas of the country as a direct result of the failure of the European regulatory system to deliver expected improvements in vehicle emissions,” summarized the report.

Diesel cars have become far more popular across the pond for decades, as they promised much better fuel efficiency and mileage. But according to UK policymakers, they did not deliver the anticipated reductions in NOx emissions. Furthermore, the Volkswagen emissions scandal of almost two years ago was a reminder that the European Union’s standards did not provide the air quality improvements UK leaders and citizens had coveted.

To that end, conventional car and van sales will have to end by 2040, and almost every automobile on the UK’s roads must be a zero emissions vehicle by 2050. In order to make this shift a reality, future investments will include £1 billion in electric vehicle charging infrastructure, as well as spending on bus retrofits along with expanding low- or zero emissions bus fleets in cities and towns.

But cleaning the air will not just be about switching the type of automobile engines. The lion’s share, or £1.2 billion of this clean air fund, will be spent on strategies and infrastructure to make bicycling and walking more attractive to Britons.

The government is optimistic such a transformation of the country’s transport system could occur. Changes are underway now, according to this report, as it claims that UK-manufactured Nissan LEAFs now account for 20 percent of electric car sales across Europe; the country also reportedly has the highest number of electric and plug-in electric vehicles in the region as well. Meanwhile, evidence suggests that automakers will change their business models. Volvo, for example, has said it will start selling only electric or hybrid vehicles after 2019.

Critics, however, say this new policy is not going far enough. One organization downplaying this announcement is Greenpeace. First of all, its campaigners have pointed out that the UK announced a similar future ban on internal combustion engine-powered cars in 2011. Greenpeace also says the 23-year transition is too long of a wait, and in any event, market forces could make conventional-fueled cars redundant by then. Finally, the NGO views the future ban as noise-only, masking the fact that the UK is losing its battle against air pollution. “Simply put, this announcement does little to deal with the vehicles polluting our streets right now,” Greenpeace’s India Thorogood concluded in a blog post dissecting the new policy yesterday.

Image credit: David Holt/Flickr