Gulf Flood Waters -- Breeding Grounds For Mosquitoes, Raising Zika Concerns

Hurricane Harvey's devastating floods, which inundated vast tracks of neighborhoods in August and brought with it the chance of toxic leaks has raised concern recently about another environmental risk: the rise in mosquito-borne illnesses such as Zika and West Nile. Southern U.S. locations are still dealing with lingering flooding and in an effort to be proactive, the Federal Environmental Management Agency says it plans to start spraying insecticide over the Houston area. It also has its eye on South Florida, which is already considered a natural breeding area for mosquitoes.

Many aerial sprays contain an organophosphate insecticide, which the Centers for Disease Control says is safe to use in populated areas. While FEMA and Texas Health and Human Services haven't published what insecticide it will be aerial spraying, organophosphates are often the treatment of choice because of their low toxicity to humans.

But they are a problem for bees and by extension, for honey producers, which Houston's surrounding countryside does support.

And widespread spraying for mosquitoes isn't necessarily a simple answer for eradicating diseases like Zika, West Nile and dengue, researchers point out. It doesn't stop the mosquito from breeding the next year or in the years following and the program costs millions of dollars to maintain (Many parts of Florida have maintained spray regimens for decades, unable to block the returning spread of West Nile and other diseases.)

In recent months, since taking scope of the toll of Zika's impact on places like South America and West Africa, some innovative scientists have determined that the real answer is targeting the mosquito's ability to spread the diseases themselves.

Two research teams -- one in California and one in Queensland, Australia -- have been working on distinct projects using a bacterial called wolbachia to control the mosquito's ability to transmit contagious diseases like Zika, dengue and West Nile.

Interestingly, both are working from the starting point of controlling the mosquito's ability to reproduce eggs that can carry disease, but with different targeted results when it comes to the viability of the mosquito species.

Wolbachia is a common bacteria found in the environment, so much so that it's often found in some species of mosquitoes. But it isn't common to the aedes aegypti (often called the yellow fever mosquito) and the aedes albopitus, (tiger mosquito), both known to carry diseases like dengue, West Nile and Zika.

What's attracted researchers' attention is that mosquitoes harboring the wolbachia bacteria seem to have a lower ability to spread these diseases, "suggesting that that viral transmission was blocked," wrote one group of researchers in Brazil.

Scientists have known since at least the 1960s that wolbachia may hold the key to stopping viral transmission in mosquitoes that carry disease ever since Dr. Hannes Laven, a German researcher experimented with breeding wolbachia-infected male mosquitoes with females that weren't carrying the bacteria. But figuring out why the bacteria actually blocked disease transmission has been the key to stopping disease transmission.

The two projects are both using wolbachia to curtail the two species' potential to spread these diseases, but with different economic and scientific objectives in mind.

In the city of Clovis, located at the northern edge of Fresno, California, researchers are "marrying" the two groups of mosquitoes (wolbachia-infected males and females without evidence of the bacteria) with the intent of eventually wiping out the aedes albopitus hold on the area.

It's a big job, with an even bigger goal: to find a way to ensure that the mosquito can't produce the larvae that carries these diseases.

It also carries a big budget because the release of wolbachia-carrying males must be flown in from outside the state twice weekly and released into the wild. The company, MosquitoMate, run by Dr. Stephen Dobson, already has a website up to explain to residents why millions of male non-biting mosquitoes can help control the potential for disease in their area. The company offers to provide an estimate based on the size of the homeowner's back yard.

MosquitoMate points out that unlike some treatment models, the company doesn't use genetically modified mosquitoes. That's been a plus in the eyes of some residents, such as in Florida, where residents on Key Haven turned down the option of hiring UK-based Oxitec to release its "GMO" mosquitoes into the area. Interestingly, the objective is pretty much the same: to nullify the ability of infection-carrying mosquitoes to survive.

On the other side of the world, though, another approach is taking shape, one that has garnered the attention of the Bill and Melinda Gates Foundation, a financial supporter of programs that work toward eliminating the impact of dengue.

Dengue gets relatively less attention in the U.S. than Zika or West Nile, but is considered by the World Health Organization to be one of the fastest-growing mosquito-borne diseases in the world. It has shown a 30-fold global increase in the past half-century, presenting increasing challenges for health care workers and researchers in tropical areas of South America, Africa and the Caribbean -- including those areas often most vulnerable to climate change impacts.

The World Mosquito Program (formerly called the Eliminate Dengue project), run with the backing of the foundation for the Institutes of Health, the Bill and Melinda Gates Foundation's Grand Challenges in Global Health Initiative, the Tahija Foundation in Indonesia and the Australian and New Zealand governments, aims to develop a non-profit model that can curb disease in the aedes aegypti mosquito, and do so without completely wiping out the species. The methods, similar to Dobson's was developed by a research team run by Dr. Scott O'Neill, at Monash University, Melbourne (Queensland) and has increasing backing from governments across the globe. The program, now taking root in more than 10 countries across the world, isn't just vital to curbing proliferation of the carrier, it has promise in stopping the spread of some of the world's most virulent diseases.

https://youtu.be/arijW2Aedds

Images: Flickr/Army Medicine;Flickr/Hermitianta Prasetya Putra

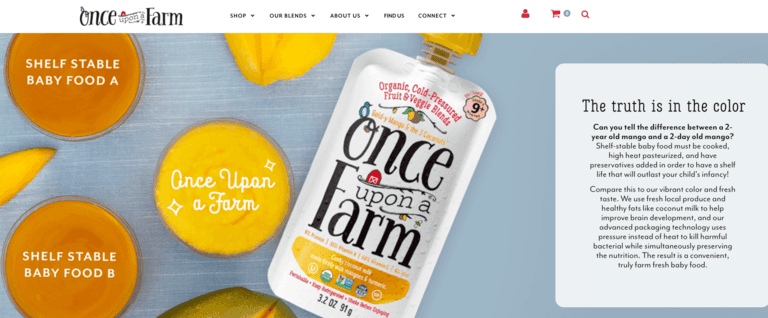

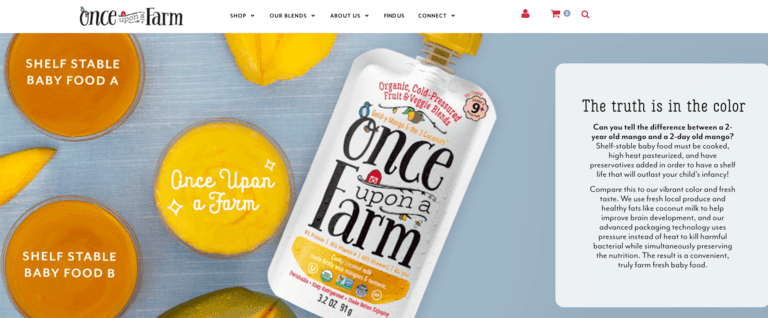

Baby Food for the 1%

It was really only a matter of time before the cold-pressed, cold-packed, hand-selected direct-to-your-door meal movement made its way to baby food. After all, parents of babies are universally-known to be exhausted balls of nervous energy. We've got a trigger finger for any "Buy Now" button that promises to make parenting even one iota easier.

Former CEO of Annie's Homegrown, John Foraker, teamed up with super-mom Jennifer Garner to lead Once Upon a Farm, an ultra premium baby food company. The elevator pitch is impressive: They combined the star power of Jessica Alba's Honest with the commitment to parents offered by Plum Organics and the convenience of Blue Apron. Indeed, Once Upon a Farm makes a compelling brand promise that is sure to captivate nervous parents:

- Premium Flavors Lovingly crafted blends of farm-fresh produce with the help of an expert pediatrician ensure the most nutritious, delicious food for your little ones.

- The Color Says it All Every product features a window to show the vibrant color and freshness of our blends. The truth is in the color!

- Healthy Fats Contains rich healthy fats proven to improve brain development and nutrient absorption, giving your little ones a nutritious start.

- Keep Refrigerated Each blend is prepared fresh and packaged under intense pressure, meaning no heat or preservatives.

Yup, these proprietary blends, like "Wild Rumpus Avocado" made of "organic pineapple, organic avocado, organic banana, and organic mint," are like manna from the heaven for a certain demographic – those moms (yes, it's always moms) who only want the best for their babies, but are too busy to blend farmers-market produce themselves. Never mind that you wouldn't be able to find pineapple, banana or avocado at most farmers markets in the U.S. And never mind that the kids in this demographic already have their nutritional needs satisfied. There will always be a market for the parents who want to go above and beyond.

The baby food purveyor suggests that we can find these pouches in the refrigerated section, but their website pushes the direct-mail option, with the overnighted freezer packs that entails. Customers can buy a trial 8-pack for $2.49 a pouch, after which one is automatically upgraded to a subscription of 24 pouches at a time for $59.76. (Still $2.49 a pouch for those too tired to do the math.) For readers who have not gazed confusingly at Target's entire aisle of baby food pouches, this is approximately twice the cost of the nearest premium brand – Plum Organics. Plum makes a similar healthful brand promise, but is – gasp! – shelf stable. Actually, to my mind, that's a feature not a bug, since I can leave them floating at the bottom of the diaper bag for any toddler emergencies I face. But cold-pressing preserves nutrients and flavor, or so they tell me. Never mind that young children are not known for their sophisticated palates. My three-year-old's ideal dinner is a pile of still-frozen peas and a slice of Kraft cheese.

Plum's pouches are still too rich for my blood at $1.25, since my baby will eat approximately 1/10 of a pouch before dive-bombing for my garlic bread. But at least Plum is a B-corp, which means they commit to better business practices in addition to better product offerings.

Now, yes, the cost of Once Upon a Farm pouches is relatively obscene. But I know there's a demographic out there who can afford it. That's not the point. Companies that make a sustainability brand promise must go beyond the sustainability of the product they produce and look at the larger community. Once Upon a Farm does make some vaguely-worded promises of a larger social mission on their website:

Once Upon a Farm aspires to be a leading organic family food company that will fight for and support efforts to drive positive social change and food justice for the benefit of parents, kids and families. It's with this mission that Once Upon a Farm strives to nurture our children, each other, and the earth to pass along a healthier and happier world to the next generation.

That's good, but not very actionable. Sustainability programs require tangible targets.

Here are some more specific numbers Once Upon a Farm might consider:

- 7.7 million mothers and children meet their monthly nutritional needs with WIC benefits. To qualify, families must meet income guidelines and be individually determined to be at "nutritional risk" by a health professional.

- 21% of American kids – 15 million children – live in poverty. The household income to qualify as "living in poverty" was $24,036 for a family of 4.

- Once they reach school age, 20 million+ kids in America receive free lunch at school

- 97 cents is the average cost of a public school lunch.

- 73 percent of the kids who eat school lunch get it for reduced or free prices, meaning those who eat school lunch mostly have no other choice.

President Trump's administration recently relaxed the already-weak nutrition standards for the public meal program. Additionally, it is well-documented that kids who get free breakfast at school have better behavior, attention, math scores, and are less likely to repeat a grade. You do the math: It's hard to concentrate when you are hungry. These kids weren't eating breakfast at home. Becoming a parent has made me much more sensitive to the plights of all children. There are kids out there who are not getting enough to eat to the point that they are malnourished and qualify for state benefits. When we feed them, we don't always offer healthful options. I'm not exaggerating when I say this is a national tragedy.

Given that Once Upon a Farm is just getting off the ground, I urge Foraker and Garner and the rest of the gang to take the tremendous opportunity they have in a nutritional food start-up to put that general interest in social justice into action sooner rather than later.

Sponsor a school garden program! Invest in a one-for-one model! Lead the charge on nutrition research and lobbying! I'm sure you have something in the works, but we all know that the best sustainability programs are built in from the ground up. You've done your nutrition research, now make a commitment to America's children who really need the help.

Update: Check out the response from Once Upon a Farm CEO in the comments below!

Image credit: Once Upon a Farm

Apparel Industry Stands by the Higg Index

COMMIT!Forum will convene hundreds of corporate social responsibility leaders and CEOs from CR Magazine’s annual 100 Best Corporate Citizens ranking. The event includes a pre-conference workshop on integrated CSR and sustainability reporting from BrownFlynn. Join MGM's Chief Diversity and CR Officer Phyllis James, Terracycle CEO Tom Szaky, Leidos CEO Roger Krone on the corporate response to the opioid epidemic at the 2017 Commit!Forum in Washington, D.C., this October. 3p readers get 20% off with discount code 3P2017CF

By Alexandra Rosas

It’s hard to imagine two brands more different than Walmart and Patagonia, yet in 2009 they aligned their unique strengths and issued a call to the industry. In an invitation to some of the world’s largest retailers, then Walmart chief merchandising officer, John Fleming, and Patagonia founder Yvon Chouinard proposed an industry collaboration unlike any attempted before. The idea was to join competitors together to develop an index to measure the environmental impact of their products. The benefits, if the idea was successful and didn’t implode before it even got off the ground, would not only be at the individual company level, but would transform the industry.

With some very determined leaders willing to prioritize progress over risk, the first meeting of the Sustainable Apparel Coalition (SAC) in 2010 included Patagonia, Walmart, Target, Gap, Kohl’s, Levi’s, Nike, JCPenney, Esquel, H&M, Hanes, Li & Fung, Marks & Spencer, The Otto Group, Timberland, Duke University, the EPA, the Environmental Defense Fund and nonprofit labor-rights group Verite. Now, nearly ten years later, the SAC is a multi-stakeholder initiative based in San Francisco and Amsterdam, comprised of more than 200 global brands, retailers, manufacturers, government organizations, non-profits and academic institutions. And the Higg Index – that pesky ambition to “create a single approach for measuring sustainability in the apparel sector” — is now the industry standard for assessing environmental and social sustainability throughout the value chain.

The Higg Index is developed solely by SAC members and offers a tool for each step along the value chain, from design and production to manufacturing to logistics. As a suite of tools, the Higg Index is a one-stop-shop tracking, measurement and analysis system for any apparel, footwear or textile company to organize its sustainability priorities — no matter the size or level of in-house sustainability expertise. Not only does the Higg Index help businesses reduce negative environmental impacts from the earliest phases of design, it also increases efficiency by creating an industry standard, helps improve positive social labor practices, and offers a roadmap for continuous improvement.

“Our members are pioneers in how they think about their brands,” said Jason Kibbey, SAC CEO. “They are constantly exploring about how to be more efficient for the bottom line, yes, but also how to be smarter for the planet, how to be kinder to the people who make their goods, and how to produce quality products that consumers want to buy and wear.”

Value of global collaboration

Through extensive year-round collaboration, SAC members develop the tools that comprise the Higg Index. Working together, members continuously create, test and enhance modules implemented in various parts of the value chain. From apparel or footwear design to material selection to chemical management to product distribution, the Higg Index empowers users with confidence in quality and credible data along every step of the supply chain. “We’re proud of the work of our suppliers to achieve efficiencies while reducing the environmental impact of our supply chain and improving their Higg performance,” Jeannette Ferran Astorga, Vice President of Corporate Responsibility at Ascena Retail Group, parent company of Ann Taylor and LOFT brands, said.

The way in which brands, in particular, participate in development of the Higg Index is most remarkable. It is not unusual for members to be fierce rivals in the marketplace, but when they come together within the SAC, their differences don’t get in the way of their support of the SAC mission to transform the industry. Instead, members focus on the SAC’s vision to collaboratively devise tools that help improve the entire value chain. “People are buying more clothes and throwing them away faster than ever before,” Kibbey said. “Through the hard work our members do, we are thinking about the lifecycle of clothing from the initial inputs to the end of life experience. That’s the kind of transformation our industry needs.“

Brands see the value in the membership as well. “The SAC is our most valuable partnership for pursuing a focused sustainability strategy,” Colleen Vien, sustainability director at Timberland, said. “Our collaboration on the Higg Index is a ‘one-stop-shop’ for tools, expertise and other resources.”

Transparency matters

As customers seek greater clarity from the brands they support, the SAC anticipates the Higg Index will continue to play an increased role in the value chain. “You can’t be halfway transparent,” Kibbey said. “Participation in the Higg Index creates an expectation that brands, retailers and manufacturers will align their processes with business goals and customer expectations. Everyone benefits.”

Adidas has used the Higg Index for all its strategic tier one suppliers since 2014 and has committed to roll out the tool to all its tier two suppliers in 2018, upon the launch of the updated Higg Facility Environmental Module (FEM), which is expected in November. Tracy Nilsson, Senior Director Social Environmental Affairs at adidas, sees the difference collective efforts can make in the push for increased sustainability across the supply chain. “We collaborate closely with our apparel supplier base,” Nilsson said. As part of its Manufacturing Excellence program, adidas aims to achieve 50 percent water savings at apparel material suppliers by 2020. By educating manufacturers about best available technologies and processes, adidas strengthens suppliers’ capabilities and improves water usage in the manufacturing of its products. “We know that we can only be successful if all of our partners throughout the supply chain contribute to our ambition," Nilsson said.

Companies have seen use of the Higg Index bolster their business ties, too. Starting in 2013, the team leading sustainability for Ann Taylor and LOFT asked its key strategic suppliers to complete the Higg FEM. As part of helping these suppliers apply the Higg Index, the company incentivized suppliers to perform energy audits and make savings pledges to reduce their energy use. Suppliers pledged to implement energy saving projects to collectively save more than $3 million by 2015. As a result, suppliers have implemented 250 energy savings programs that have saved them more than $3.5 million in energy costs.

“This program was a win-win for our suppliers and our business,” Ferran Astorga said. Ultimately, the program enabled suppliers to operate a better, more efficient business and strengthened the retailers’ partnerships with them.

Looking ahead to make positive change

On September 13, Patagonia again played a critical role in the evolution of the Sustainable Apparel Coalition when Rick Ridgeway, VP of Environmental Initiatives, helped kick off a campaign to sign up 10,000 new facilities in the Higg Index by the end of 2018.

“We’re working towards a future where trusted sustainability information from the Higg Index is available to all decision-makers up and down the value chain, including consumers,” Kibbey said. “It starts with brands that are willing to open their factory doors, share information with competitors and recognize that by prioritizing industry transformation, we all win.”

To learn more about the Higg Index, visit http://apparelcoalition.org/the-higg-index/

For a full list of SAC members, visit http://apparelcoalition.org/members/

Image credit: adidas

Alexandra Rosas is the manager of member services and communications for the Sustainable Apparel Coalition.

Pittsburgh’s Transformation Sparks Criticism About ‘Nonprofit Industrial Complex’

The growth of nonprofits including hospitals, universities, philanthropic foundations and environmental groups, has long garnered its share of criticism. Activists, according to one author, “Traded in grand visions of social change for salaries and stationery . . . and ceded control of their movements to business executives in boardrooms.”

One city in which this debate over the “nonprofit industrial complex” is currently raging is Pittsburgh, which has long been touted as an example of a Rust Belt city that has done just about everything right to become one of America’s leading twenty-first century “smart cities.” The city of 303,000 has become a leading green building hub; thanks to its leading universities, it is now a living next-gen laboratory for technologies such as self-driving cars; and its local leadership has long been proactive on issues such as climate change.

Much of Pittsburgh’s success and quality of life is due to local NGOs and foundations, which of course showcase names such as Mellon, Carnegie and Heinz.

Furthermore, in Pittsburgh (and in many cities), these nonprofits also dominate the local economy, especially as many are within healthcare and education – and in turn, they rank amongst the city’s and surrounding county’s largest employers. As a result, these nonprofit institutions, according to a Pittsburgh Post-Gazette investigation, employ roughly 20 percent of local workers, control 10 percent of real estate and own assets at a level that would have made the Gilded Age barons who once dominated Pittsburgh blush.

The result, says Post-Gazette reporter Rich Lord, is that these nonprofits dominate Western Pennsylvania’s government, economy and development. And because of tax regulations, they are also exempt from property tax – while they receive hundreds of millions of dollars in government grants and many are led by executives who receive salaries on par with those who head private or publicly-owned corporations.

But it is the property tax issue that riles up critics of these nonprofits’ influence across the greater Pittsburgh region. The Post-Gazette tallied up the revenues of the 64 largest non-profits within 50 miles of downtown Pittsburgh, and found their revenues are approximately $29 billion – not far behind Pennsylvania’s state government total revenues of $31 billion.

Allegheny County, however, forgoes about $48 million in taxes annually – funds that could be spent on schools, on infrastructure, or allow for a 12 percent reduction in every Pittsburgh resident's property taxes.

Nonprofits and their supporters, including Pittsburgh’s mayor Bill Peduto, counter that the economic benefits these nonprofits provide, from jobs to payroll taxes to research and development, far outweigh any breaks they may receive come tax season. “They’re the major employers in this town. They are the economic engine, and in some ways, within the city, the economic rudder as well,” Peduto explained to Lord in an interview.

The often-murky details that surround these nonprofits’ real estate transactions, however, brings up the argument that many of these organizations are not being transparent about the deals they arranged to build new university campus facilities, housing or research centers – even if they are being done in the name of sustainable development. Lord’s article covers several questionable case studies, including a private-public partnership that build affordable housing units at a questionable cost of $400,000 each. A charter school formed a non-profit for the space in which it rents, scoring subsidies it would not receive if it owned those buildings. And a coalition of nonprofits has taken 15 years to redevelop a former industrial site, when a private developer arguably could have done the work much more quickly.

Meanwhile, an understaffed IRS has done little to ensure nonprofits-at-large are actually holding these organizations accountable – and when they do investigate, as was the case in 2014, 31 percent of them have been penalized, lost their tax exemption or had their status revoked.

The result, says Steve Dubb of Nonprofit Quarterly, is that these organizations must be more forthcoming about their financials and dealings. “More fundamentally, though, it is critical that nonprofits show leadership in stepping up to use their increased economic power responsibly,” said Dubb in calling for these organizations to be clearer about their anchor mission – in other words, demonstrate to stakeholders how they will leverage their economic clout fairly and responsibly.

Pittsburgh is still struggling with a high poverty rate, almost 10 percent higher than the national average. The social good these nonprofits insist is part of their mission has still excluded many residents from the city’s renaissance. But with once-mighty U.S. Steel not even within the top 10 leading employers in Pittsburgh, these nonprofit medical and educational organizations (or “meds and eds”) have nonetheless filled in the gap left by the city’s declining manufacturing base.

“Although some parts of the nonprofit industrial complex may have room for improvement, on balance the collaboration has helped, and continues to assist, the Pittsburgh region with transitioning from an economy based on heavy manufacturing to a more diversified one in every sense of the term,” said a spokesperson for a green building nonprofit during an email exchange with TriplePundit.

Image credit: Brook Ward/Flickr

NYC as a Zero Waste City: Implications for Businesses

By Ushma Pandya Mehta

Across the globe, cities are taking aggressive action to support reduction in trash to landfill, with important implications for businesses and residents.

Since the term Zero Waste came into circulation a few decades ago, cities globally are adopting “zero waste goals.” Zero Waste is a philosophy that encourages the design of resources so that all products are reused and nothing is sent to landfill or incineration. New York City, for example, has announced a goal of 90 percent diversion from landfill by the year 2030 in its One New York or OneNYC plan. Other cities with zero waste goals include San Francisco, Los Angeles, Seattle and Dallas.

Spotlight on New York City

Historically, New York City sends approximately 3.6 million tons (7.2 billion pounds) to landfill and incineration each year from residential and commercial buildings. The OneNYC plan targets diverting more than 3 million tons from landfill by 2030.

Currently, New York City has no landfills or incinerators of its own, and either ships, rails, or drives its trash to surrounding states, costing more than $350 million a year and rising. There are economic and environmental costs to the disposal of the city’s trash, and Zero Waste goals ensure that the city can continue to support a vibrant residential and business environment.

As part of its Zero Waste goals, New York City is implementing eight specific initiatives. One initiative specifically focuses on the businesses that operate within the city, calling for a 90 percent diversion rate for commercial waste. To achieve this goal, the Department of Sanitation NY (DSNY) implemented two rules in 2016 that require businesses to:

- Recycle metal, glass, plastic, paper, cardboard, and beverage cartons

- Separate their organics (i.e. food waste and wet paper) for beneficial use (e.g., composting, anaerobic digestion).

While businesses have been recycling, the estimated commercial diversion rate in New York City is 22 percent (based on analysis conducted by the Transform Don’t Trash campaign), so there is significant room for improvement.

What businesses need to do to support Zero Waste goals

In order to achieve New York City's ambitious goals, businesses and commercial building owners / property managers will need to do the following:

- Determine the composition of their waste (i.e. conduct a waste audit) to determine what is in their trash, the volume of trash, what can be recycled and what is being recycled

- Establish shared goals so that everyone knows what the company is working towards achieving

- Re-engineer processes to reduce the generation of trash (e.g. determine if they can reduce packaging or use more easily recyclable materials)

- Review sourcing practices (e.g. move to reusables vs. single use products, work with suppliers to find new materials)

- Establish new waste management processes within the building to ensure compliance with new rules. Bins and signage are key!

- Train and support staff in behavior change with regards to their recyclables and trash. This is critical and will require a mindset shift by employees who were not required to think about what they were tossing into the trash.

- Train cleaning staff to support the new programs and be in compliance. Cleaning staff are on the front lines in getting these changes into the building’s DNA. They can help identify where there are gaps in employee knowledge or behavior and they maintain the integrity of the recycling program.

Cities are establishing the goals for waste diversion in their cities but each building and business will need to develop their own program to ensure that they are in compliance. If your business operates in a city with a zero waste commitment, are you ready to comply with the new rules and regulations?

Ushma Pandya Mehta is Partner, Think Zero. You can follow her on Instagram at ditchthewaste.

Major Cruise Lines Sail for Humanitarian Relief After Hurricane Irma

Florida may have dodged even worse destruction than what was feared only a week ago, but much of the Caribbean has been devastated and various news reports suggest damage from Hurricane Irma could cost $50 billion.

As the recovery and cleanup begin, three companies that have long been important to the Caribbean’s travel industry say they are helping the broader relief effort with their own cruise ships. Carnival, Norwegian Cruise Line and Royal Caribbean have announced that they are dispatching ships to ports including Key West, St. Thomas and St. Maarten.

According the the Miami Herald, Carnival Cruise Line has secured one ship to deliver supplies to St. Kitts and Grand Turk. The company has also promised to develop plans with local officials to deliver more supplies to more islands via future scheduled trips. Those pledges follow last month's announcement that Carnival and its chairman’s charity, the Micky and Madeleine Arison Family Foundation, pledged to contribute at least $2 million for disaster recovery after Hurricane Harvey.

Norwegian and Royal Caribbean are also contributing resources to offer direct assistance to some of the islands hardest hit by Irma. One of Norwegian's cruise liners departed over the weekend for St. Thomas to deliver supplies, as well as evacuate residents and visitors who were unable to evacuate before Irma hit. Meanwhile, another one of the company’s ships is reportedly at full capacity with travelers who were unable to make scheduled flights home after their travels.

Royal Caribbean has also dispatched ships to ports across the Caribbean in order to provide supplies and has offered space for those who need to evacuate their homes or hotels. The company has canceled several schedule cruises to destinations such as Cuba and the Bahamas in order to assist the broader humanitarian aid effort across the region.

Those supplies are desperately needed as news reports in recent days have shown the desperate conditions across the eastern Caribbean, long visited by vacation seekers worldwide. Food and water have been in short supply, and many hospitals and pharmacies have also been destroyed. Barbuda, one of the first islands to be hit by Irma, lost 95 percent of its buildings and currently half of its population is homeless. One-third of the buildings on the Dutch side of St. Maarten are in rubble, and its iconic beachfront airport suffered heavy damage.

The European Union, of which several of its members have sovereignty most of these islands, has promised a short-term emergency relief package of $2.4 million as of press time. But many of these islands' residents and visitors need assistance now, so the fact that these cruise lines are stepping up can make an immediate impact where help is needed most.

Image credit: OneCyclone/Wiki Commons

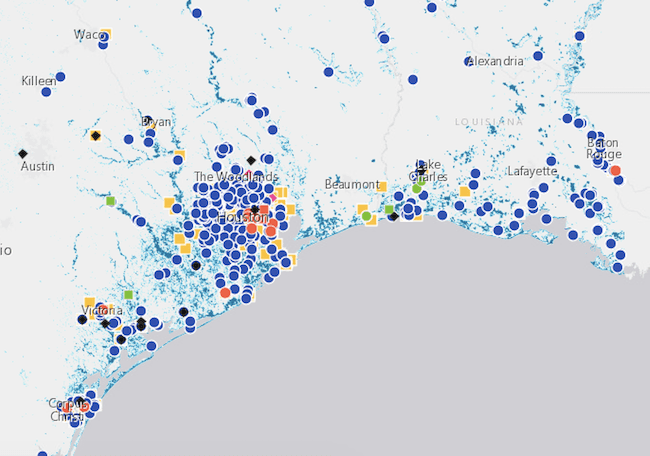

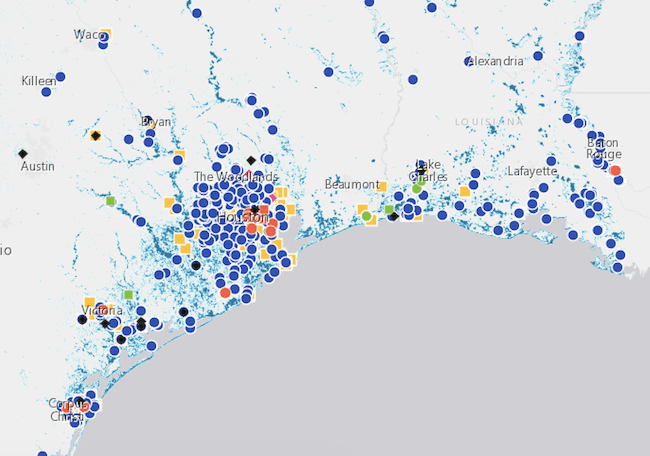

Harvey Flooding Potentially Spilled Chemicals at 400+ Water Treatment Plants

The Union of Concerned Scientists has assembled a list of facilities potentially impacted by flooding related to Hurricane Harvey, and the picture may surprise those who focus on Superfund sites. There are a lot of potential chemical stews brewing along the Gulf coast -- 650 of them.

The full extent of the environmental impact won't be known until the sites are assessed, but for now the UCS's list -- culled from satellite images of flooded areas -- provides more evidence of the need to invest in infrastructure that resists the impact of intensive weather events.

650 facilities flooded by Harvey (more or less)

The flooded areas have been delineated by the Dartmouth Flood Observatory, which uses satellite imagery that resolves to 10 meters, and the facilities list may contain some imprecise or inaccurate locations (the list was gleaned from data compiled by the US Energy Information Agency and EPA).

UCS cautions that its list is not a definitive one in terms of measuring environmental impacts, partly because some of the facilities (or hopefully, most of them) within the Harvey-flooded areas may have been sufficiently prepared, and partly because its data sources are not accurate with pinpoint precision.

On the other hand, although fewer than 650 facilities could be impacted, it is possible that the environmental impacts extend beyond the bounds of each facilities' walls.

The list only covers three types of plants for which data is available: energy infrastructure including refineries and power plants, wastewater treatment plants, and three types of chemical facilities including Superfund sites as well as sites covered by EPA's Toxic Release Inventory and Risk Management programs.

As a final note, the UCS list includes almost 430 wastewater treatment facilities. Regardless of whether they are municipal or industrial facilities, the impact of Harvey could potentially include environmentally harmful releases of untreated waste as well as treatment chemicals stored on site.

Rethinking flood preparation

One lesson learned from Harvey is the need to revise protocols for chemical facilities to prepare for hurricane and flood events.

According to UCS analysis, almost 200 facilities in the flooded areas are included in the three categories covered by EPA, including at least seven superfund sites.

The Superfund sites have been getting a lot of media attention, but those are inactive sites under remediation plans. The active facilities can cause just as much if not more harm. UCS explains:

Before the storm hit, many facilities shut down preemptively, releasing toxic chemicals in the process. In the wake of the storm, explosions at Arkema’s Crosby facility highlighted the risks that flooding and power failures pose to the region’s chemical facilities and, by extension, the health of the surrounding population.

That's an especially acute public health consideration for low income communities, which tend to be clustered near industrial sites.

A more environmentally-oriented approach to storm preparation is also a bottom line consideration. The Arkema disaster, for example, resulted in a $1 million lawsuit filed by first responders who were sickened by a chemical fire after Harvey flooded the facility. The Associated Press reports:

The suit in local court alleges Arkema failed to properly store the chemicals considering how prone the region is to floods. The chemicals became unstable and exploded in flames on Aug. 31 after refrigeration was lost to generator failures.

As of this writing, the responders are seeking a restraining order that would prevent Arkema from altering the site until an investigation takes place.

The case for biofuel

The high concentration of refineries and storage tanks along the Gulf coast is another area of concern. TriplePundit has been among the many to observe that the ripple effect on fuel prices reached far beyond the immediate area of Harvey's impact.

The Associated Press, for example, counted more than two dozen individual storage tanks that "ruptured or otherwise failed" during Harvey, resulting in the release of 145,000 gallons of fuel as well as airborne pollutants.

Harvey flooding also resulted in the shutdown of the troubled Colonial Pipeline, the major inland transportation route from Texas refineries to points east.

To be clear, biofuel production is not risk-free. However, the next-generation approach to biofuel is a regional one that draws from a wide variety of regional sources and sells to local markets. This more flexible model could help reduce the nation's reliance on centralized fuel hubs located in high risk coastal areas.

Texas refineries still in recovery mode

As for whether or not there will be any lessons learned, AP points out that the Harvey-related tank failures were predictable and preventable:

The tank failures follow years of warnings that the Houston area’s petrochemical industry was ill-prepared for a major storm, with about one-third of the 4,500 storage tanks along the Houston Ship Channel located in areas susceptible to flooding, according to researchers.

Two weeks after Harvey hit, the Texas refining industry is still suffering the impacts.

On Monday, CNN reported:

Five oil refineries remain shuttered as of Monday, according to S&P Global Platts, an energy research firm. Ten more are partially shut down as they attempt to recover from historic flooding.

All told, about 2.4 million barrels of daily refining capacity in Texas is offline because of Harvey, Platts estimates. That is about 13% of the country's total ability to turn oil into gasoline, jet fuel and other products.

CNN attributes the delays to flooding and other damages, power outages, and in some cases "challenges" related to the abrupt shutdowns.

If the environmental and public health issues aren't enough to hammer home the need for more attention to climate change resiliency, perhaps the bottom line concerns will motivate change.

Image (screenshot): Sites potentially affected by Harvey flooding via Union of Concerned Scientists.

Pizza Hut Manager’s Letter Threatening Employees Fleeing Irma Offers Painful Lesson for Brands

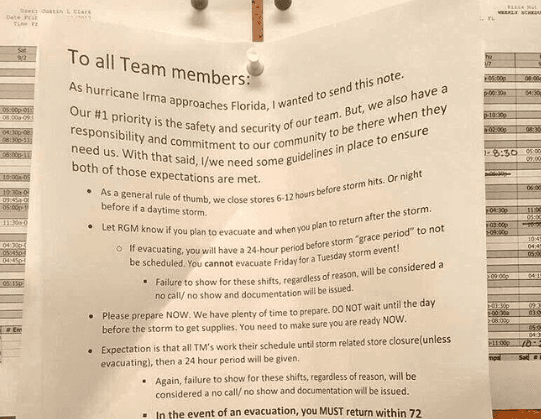

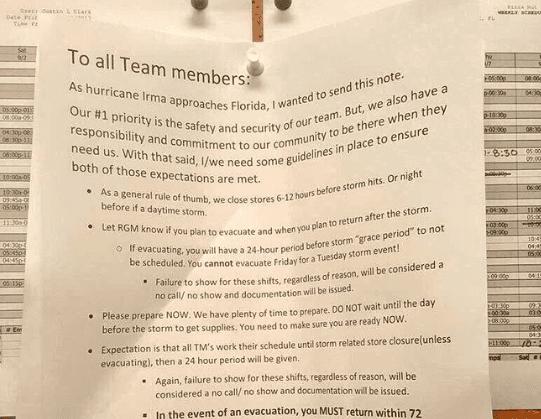

A letter posted on a Jacksonville, Florida Pizza Hut bulletin board warning employees that they risked punishment for fleeing Hurricane Irma caused plenty of buzz on social media earlier this week:

[embed]https://twitter.com/jacobinmag/status/907031322459344896[/embed]

Reaction, of course, ranged from snark to outrage at the brand. “You guys are closed on Christmas, but sending delivery drivers to their death for a hurricane? What's up with that?” asked one Twitter user on Sunday.

In fairness to Pizza Hut and its parent, Yum! Brands, fast food and casual dining companies have little control over the day-to-day actions of its franchisees. And to Pizza Hut’s credit, the company made it clear that there was no such policy dictating when team members can leave or return from a natural disaster such as Irma. Pizza Hut’s communications team also insisted the manager who wrote the letter was not following company guidelines and the local franchise operator “addressed” the situation with that store’s management in Jacksonville.

But the company did not apologize; perhaps Pizza Hut and Yum! Brands felt they did not have to, as this was a local snafu and in no way reflected the values of the Texas-based pizza giant.

Nevertheless, just as companies can no longer shirk responsibility for what occurs within even the furthest reaches of their supply chains, nor should companies for which franchising is core to their business refuse to own corporate actions in franchise locations. The risk that Jacksonville manager imposed on his company’s brand and reputation could negate the brave feats of other Pizza Hut employees, such as a pregnant store manager in Houston who found a way to deliver pies to Hurricane Harvey victims by kayaks.

The carelessness displayed at that Jacksonville Pizza Hut location also highlighted the difficulties many fast-food workers and their minimum-wage earning brethren face daily. As Maura Judkis of the Washington Post reminded us, whether they are single parents or students struggling to get by, many fast food workers could not evacuate in the first place. Few, if any, have any job protections. Leaving their homes and jobs could put these workers at risk of getting fired; staying meant a risk to their safety, and also the strong possibility they could lose their jobs if public transport options disappeared or they faced huge automobile repair bills due to flood damage.

Yum! Brands presents itself as running an ambitious employee engagement program; but it is clear that at a minimum, some employees in Florida have not been part of that conversation. And now Pizza Hut, to many, highlight the woes of working within the fast food industry.

The lessons Pizza Hut’s c-suite need to impart across the organization, as well as to franchises, include ensuring store owners are rigorously trained; that the company’s culture finds its way even to the most remote branded store; and values such as community service and sustainability are not just something posted on a web site, but are understood by everyone who is part of Pizza Hut’s extended family. After all, those typical 6 percent royalties that franchisees generally pay parent companies will do little to staunch the financial and reputational damage to a company’s brand.

Unfortunately for companies in this age of social media, it only takes one wayward employee, franchisee or ill-planned event to plunk a company into an embarrassing social media debacle. KitchenAid had more than batter on its face after an employee tweeted about former President Obama’s deceased grandmother on Twitter – from the company’s account. A Starbucks Christmastime social media campaign ended up with accusations the company dodged taxes in the United Kingdom. And embarrassments over pre-peeled citrus and $6 asparagus water contributed to Whole Foods’s woes before Amazon acquired the retailer.

More companies have taken ownership of their supply chains, as they realize one wayward supplier can cause an uproar that puts their reputation and long-term financial health at risk. Franchises need to be included in these initiatives and programs. After all, the evolving restaurant sector is already beset by several challenges, such as younger consumers’ changing dining habits and the effects they have exacted on the fast food industry. The last thing these companies need is to give consumers another reason to find other meal options.

The ill-timed Jacksonville bulletin board note should serve as a case study for how companies, and not just those in the food industry, need to engage everyone so that when companies say and act like responsible organizations, consumers will trust that they are genuinely authentic.

Image credit: Jacobin Magazine/Twitter

Reddit Case Study Proves Banning Hate Speech Works

It was not long ago that the social news aggregator and discussion site Reddit reached a point at which many doubted the long-term viability of the popular platform. “Hate speech is drowning Reddit and no one can stop it,” declared Mashable in 2014. Fat-shaming, racism and what The Economist described as a “bottomless cesspool” of hate speech prompted all kinds of suggestions on whether the site could secure its future. Petitions asked advertisers to flee the site to avoid creating the “next Dylann Roof;” others suggested a “super-quarantine” in the belief that banning hate speech would only cause other problems to fester.

Finally, in 2015, Reddit decided to ban two channels: one spouting white nationalist invective, the other body-shaming taunts.

Two years later, the results indicate that the “front page of the internet” has witnessed a dramatic drop in hate speech due directly to closing those channels. According to a study led by researchers from the Georgia Institute of Technology, Emory University and the University of Michigan, Reddit and its users reaped several benefits.

The group of researchers looked up Reddit’s “/r/coontown” and “/r/fatpeoplehate” users and evaluated their posts before and after those subreddits were banned. Participants in those groups departed Reddit at a more frequent rate than users in the "subreddit" control groups. Of course, some of these users may have changed their username, and others simply moved to forums such as “/r/The_Donald” or “/r/BlackCrimeMatters.” Others may have migrated to other toxic online communities. However, the study’s researchers found that many users stayed at Reddit but reduced the hate speech.

As a result, during the past two years since launching the ban, Reddit witnessed a 90.6 percent drop in the usage of manually filtered hate words associated with fat shaming, as well as an 81.1 percent decrease in manually filtered hate words associated with white nationalism. Furthermore, “communities that inherited the displaced activity of these users did not suffer from an increase in hate speech,” as observed by the study’s authors.

The study also noted “while the philosophical issues surrounding moderation (and banning specifically) are complex, the present work seeks to inform the discussion with results on the efficacy of banning deviant hate groups from internet platforms.”

In other words, banning despicable conversations helped Reddit’s business and salvaged its reputation.

Reddit’s approach was not simply to end racist or hateful data (a daunting exercise for a site approaching 1.3 billion monthly visitors) – the company just aimed to curb such talk within their topic forums. As Devin Coldeway of TechCrunch pointed out, “Make it difficult and many people may find it more trouble than it’s worth to harass, shame, and otherwise abuse online those different from themselves.”

Other sites and social media channels that have struggled with hate speech and the backlash from other users, such as Google, Facebook and Twitter, should consider scouring this study and find some clues as how they can discourage toxic content from proliferating accross their platforms.

Image credit: AJC1/Flickr

How Food Waste Reduction Can Save Wildlife

By Pete Pearson

Biodiversity is a crucial marker of Earth’s environmental health. The more diverse and abundant life is on this planet, the more resilient our landscapes and cities are to disease, drought, storms and other threats.

Human activity has numerous impacts on biodiversity, but none is more significant than food production. Everything we eat represents a sacrifice: a sacrifice of energy, water and often wildlife habitat to grow and produce our food. When food is wasted, everything that goes into growing and transporting food is wasted. That means reducing the amount of food we waste can save wildlife and their habitats.

To help ensure we make the best, most efficient use of our natural resources, World Wildlife Fund (WWF) has forged a diverse mix of alliances, including with The Rockefeller Foundation, which has embarked on its own $130 million global initiative to cut food waste and loss.

In our first brainstorming sessions, WWF and the foundation explored ways to reduce food waste across consumer facing businesses. Though we could have chosen to work with individual businesses across a mix of industries, we realized that honing our efforts on a specific sector could create a model for replicating in others. We set our sights on the hospitality industry, which serves approximately $35 billion worth of food and drinks annually and represents an incredible opportunity to gain insight—from chefs, servers, managers and customers (think of that last wedding you attended)—to how food is procured, prepared and served.

Next, we sought to find a champion that could help us establish trust within the industry and give us the freedom to experiment. The American Hotel and Lodging Association (AHLA) welcomed our proposed collaboration and opened the door. Sometimes organized groups are skeptical and unnerved by the introduction of new people and new ideas, but AHLA and its members took the risk and opened themselves to the unknown.

Finally, we needed innovators. AHLA arranged for us to pitch a group of U.S. hotel brands and independent operators on our idea to lead food waste pilot projects across the country. These pilots helped illuminate when, where and why food is wasted, and what interventions were most effective in reducing waste. Diverse group meetings can often be derailed by one loud voice fearing risk. Luckily, where many might have seen too big a risk, this group saw opportunity.

Over the next seven months, WWF worked with a dozen hotels across the country to explore how to solve food waste in the hospitality sector, both operationally and culturally. We collaborated with design firms, leadership consultants and industry experts to develop scalable solutions that the rest of the sector could adopt. This diversity of input was invaluable.

So what comes next? On November 13 in New York, we will deliver a toolkit and resources to the industry that will inspire other brands and properties to accept the food waste reduction challenge.

In much the same way that our planet relies on biodiversity, the success of a project to quickly solve an overwhelming problem relies on the diversity of partners working together to solve it. With this thriving diversity – including the vision of The Rockefeller Foundation, the breadth and depth of AHLA’s relationships, and most importantly the leadership at individual hotels – we can accelerate solutions to our most critical issues.

Let us go forth and embrace diversity in all its forms.

Pete Pearson is the Director of Food Waste at World Wildlife Fund.