Charmin and Bounty Manufacturing Now Powered by Biomass

Founded in 1837, Procter & Gamble holds some of the most well-recognized brands in the world. The company has remained a family favorite for everyday necessities like Charmin, Pampers, Tide, and Pantene, among many others products, since that time. Now, nearly 180 years later, P&G is moving full speed ahead into their current reality of business where sustainability is a major focus. On September 26, P&G and Constellation, a subsidiary of Exelon Corporation, opened a new biomass plant in Albany, Ga, a plant that will move the consumer goods giant closer to their goal of using 30 percent renewable energy in their U.S. operations by 2020.

Biomass energy is energy created using renewable materials such as wood chips, pecan shells, and peanuts hulls as feedstock for fires that produce steam. In an effort to move away from natural gas and petroleum-powered plants, the new biomass plant will create 100 percent of the steam used to run the P&G Albany Charmin and Bounty plant.

In preparation for the grand opening TriplePundit spoke with James McCall, P&G’s Global Product Supply Sustainability Leader, who shared an in-depth look at the company’s long-term sustainability goals and strategy:

“P&G is committed to using 30 percent renewable energy by 2020. So when we look at that, we need to look at a wide range of sources. To meet this goal we need the combination of both large projects and small projects, and for us, this is one of our large onsite projects.”

McCall continued, “Biomass is the right fit for Albany, but that doesn't mean that it’s the right fit everywhere. The way that we look at it, the type of renewable energy we use varies by region and location. We really want to take advantage of what makes sense for the area. We currently have a wide range of solar, wind, biomass, and geothermal energy projects globally, all helping to drive us toward our 30 percent renewable energy goal.”

Not only is the new biomass plant good for business, it’s also proving to be good for the community. P&G has maintained a presence in Georgia for over 40 years and has partnered with a number of businesses and organizations in the area to complete this project -- in turn strengthening the local economy. The new biomass plant was created in partnership with Constellation, a leading energy company which built the facility and is responsible for the day-to-day operations. The new plant will create about 35 permanent, full-time jobs along with a number of secondary jobs in the surrounding area collecting scrap biomass.

Georgia Power is the next major player in this partnership. Purchasing more than 385,000 megawatts of electricity per year, the plant will be a new source of power coming online and will continue to help Georgia Power add additional distribution in the area. The new plant will also supply the Marine Corps Logistics Base Albany (MCLB - Albany), physically located behind the P&G plant, with steam to power an electric generator. The partnership will help MCLB - Albany to become the first Navy base in the U.S. to reach net zero status.

The new biomass plant started as a vision nearly three years ago with the company's sustainability team -- a version of their “PVPs” or purpose, values, and principles, come to life.

Recognizing that the natural resources available to make many P&G products such as Charmin and Bounty are finite, P&G has a dual goal of doing what’s good for the environment and what’s good for business.

“P&G has been around for nearly180 years. Within our guiding principles, or PVP’s, we have specifically called out that we want to serve our consumers ‘now, and for generations to come’. The PVP’s came about a few years ago by senior leadership as a way to really say, we understand that we serve nearly 5 billion consumers around the world; it’s important that we do so in a smart and sustainable way,” McCall shared.

As important as the new biomass plant is to P&G, it is really all about their consumers. They want those who use P&G brands to feel good about the products that they are putting into their carts, and to understand that these products come from a responsible company. P&G wants to empower every shopper to make more sustainable choices and this new plant is a big step forward in their ability to do this. McCall expands on the natural role of biomass in creating a renewable system:

“People have been burning wood to create heat since the early days, so we’re going back to a lot of those naturally renewable sources and asking, what’s available? How do I partner with the community to work sustainably and responsibly? We are getting the leftovers, the residuals. We are not harvesting virgin sources. We are taking the leftover tree tops, tree limbs, pecan shells, peanut hulls, things that would otherwise go to waste. We are turning these things into a renewable source of energy.

P&G’s new biomass plant is quite an accomplishment for the company, yet it’s important to celebrate their leadership within the business community as well. It’s not always easy or economically viable to take on sustainability, especially at the scale in which P&G is currently operating. After nearly two centuries in business, the company continues to think holistically about the present and the future. With only three years until 2020, and to their goal of 30 percent renewable energy, the opening of this plant along with the windfarm in Texas will double their current usage from 10 percent to 20 percent, getting them two-thirds of the way to their 2020 goal. This investment will hopefully perpetuate their legacy throughout the next 180 years.

How to Respond Strategically to CSR-Related Protests: Lessons From 3M, Mattel and PepsiCo

By Nancy Himmelfarb

CSR-related boycotts and protests are intimidating, especially when advocacy groups are aggressive. What should you do if your business is a target?

Let’s look at three heated activist campaigns related to deforestation – three different companies and protestors, all addressing the same issue.

Paper company 3M was under fire by ForestEthics for more than six years, including a heated three-day campaign at the 2014 Sustainable Brands conference with 600-foot banners, pirate radio broadcasts and a marine flotilla. A full year after this public protest, 3M responded in ways that ForestEthics approved, and the conflict ended.

Toy manufacturer Mattel faced Greenpeace on deforestation in a drama that lasted only a few months. Greenpeace activists were very effective in garnering online and offline support with their "breaking up with Barbie" campaign. The protests ended quickly, when Mattel issued a new global sourcing policy that excluded suppliers involved with deforestation.

PepsiCo’s conflict is still ongoing. Rainforest Action Network (“RAN”) slammed PepsiCo last month upon release of its annual Palm Oil Policy Progress Report. RAN's complaint? The food and beverage giant condemned the company for allegedly partnering with irresponsible palm oil suppliers.

Think about what you would do if your company were in the shoes of any of these three companies, publicly (or even privately) criticized for CSR-related policies. You might have developed a roadmap to prepare for potential protests, as I described in an earlier TriplePundit article. But, now your company is faced with an actual challenge. To determine the appropriate response, be strategic and consider these factors:

1. Relative importance of the protester

Expect that your stakeholders: employees, investors, consumer advocacy groups, regulators, and NGOs will disagree with one another. Some will support specific policies and business decisions made by your company, and others will not. You cannot please all of them, and you don’t need to. Listen and acknowledge all of the viewpoints, but know that not all stakeholders are created equal. How important is the protesting stakeholder (and the stakeholder’s viewpoint) to your business?

Consider the examples above. Many NGOs and consumer advocacy groups care about the environmental and social impacts of corporate forestry policies. ForestEthics, Greenpeace, and RAN are three. Others include World Wildlife Fund (WWF), the Roundtable on Sustainable Palm Oil (RSPO) and SumOfUs (the 2015 catalyzing campaign against Doritos). With 3M and Mattel, the protesters were very vocal, and no other group came out in defense of the companies’ forestry policies. PepsiCo’s case is different. RAN’s opinion of PepsiCo seems to be an outlier. WWF gave PepsiCo the highest possible score among CPG companies in 2016 for leading the way on progress towards sustainable palm oil, and RSPO praised PepsiCo for its progress and transparent reporting.

In your case, determine whether the complaining stakeholder is a priority voice for your business. Pleasing key retail customers or investors obviously takes precedence over pleasing a small consumer segment or a non-influential blogger or NGO. Though you should identify and understand the viewpoints of all of your stakeholders, prioritize them in advance to help you respond to their demands appropriately.

2. Importance of the issue raised

Just as some stakeholders are more important to your business than others, some of their needs and interests are more important than others. Regardless of whether you have conducted a detailed materiality assessment, you should know which CSR issues are “hot button” issues, or risks, for your business. As an example, you know that deforestation is important, if you work for a paper company like 3M, or you are a big palm oil buyer like PepsiCo. Pay close attention to the important, priority CSR issues, so that you are not caught off-guard by a protest.

3. Relationships with supportive stakeholders

You will be in the best position to respond to objections if you have cultivated relationships with influential and well-respected stakeholders that support what your business is doing. You can leverage these positive relationships when faced with protests from others. Think of PepsiCo. The company would be in a very different position, if RAN were the only third party speaking out on the company’s palm oil policies and efforts, or if WWF and RSPO also objected to the supply chain efforts described in PepsiCo’s progress report. PepsiCo should weigh the opinions and support of WWF and RSPO heavily when deciding how to respond to RAN’s protest in the coming months. Having the support of well-respected and influential stakeholders should make a difference here.

Start early. Even if your business has never been the target of a protest or you think your business is too small to be targeted (wrong!), you should seek to cultivate positive relationships with NGOs, investor groups, and other public influencers. The positive relationships could be effective in reducing the reputational damage associated with a protest, or even avoiding a protest altogether.

4. Implications of accommodating stakeholder viewpoint

Assuming that a protest comes from a key stakeholder and relates to an important issue, you still need to determine whether it makes business sense to accommodate the demands. Ask yourself whether the stakeholder’s demands fit with with your company’s mission and business objectives, and whether it is feasible to change business policies or efforts in the ways asked. Do the benefits of adapting to the stakeholder’s protest outweigh the reputational and other business risks of sticking with your current business strategies and management approach? If the answer is “no,” then do nothing and explain your position to the protesting stakeholder.

Some protests catalyze significant changes by a business and rightfully so. Other protests do not warrant any change in business strategies or operations. If the decision is made strategically, then it is the correct one.

Nancy Himmelfarb is Principal of NJH Sustainability Consulting. Based in Chicago, Himmelfarb helps companies create and leverage sustainable business strategies based on her unique combination of business, legal and sustainability expertise.

These Companies Step Up After Hurricane Maria Devastates Puerto Rico

Yes, Puerto Rico is part of the U.S., but after three hurricanes that have disrupted thousands of lives and generated billions of dollars in damage over the past month, many Puerto Ricans and their brethren on the mainland feel ignored. And their anger is justified, as a fatigued media, cluelessness about the island’s relationship to the U.S. (Puerto Ricans are U.S. citizens) and a White House more focused on NFL players has contributed to a feeling that Puerto Rico’s 3.4 million citizens have fallen under the radar.

Nevertheless, there are companies that have been stepping up in their quest to assist Puerto Rico, so 3p is highlighting a few. And we welcome you to link to any NGOs or relief organizations in the comments section, as this is no way an exhaustive list.

Bacardi: The venerable rum distiller has promised $3 million for hurricane disaster relief assistance, with $2 million of that amount dedicated to Puerto Rico. Funds, according to the company, will provide relief and support rebuilding efforts in partnership with NGOs and local governments in affected communities.

Bristol-Myers Squibb: The pharmaceutical company’s foundation says its donations total $400,000 to support relief efforts related to Maria, Irma and Harvey. In Puerto Rico, the foundation says it is donating $250,000 to NGOs working on the ground.

Google: Yesterday, the Silicon Valley titan said it would donate $1 million in total to the Puerto Rico relief effort, an amount that includes funds contributed by individual employees. According to CNet, Google, its employees and through their efforts, “the public,” have together raised $7 million in total for hurricane relief efforts.

Humana: The health insurer has so far donated $250,000 for Red Cross efforts related to Hurricanes Irma and Maria. Humana has also said it has suspended its referral system and prescription authorization for its customers across Puerto Rico.

JetBlue: The airline has had to reduce the number of daily flights into Puerto Rico because of limited air traffic control systems and airport facilities, but many of those JetBlue flights have delivered much needed supplies to the island.

Lowe’s: So far, the home improvement retailer has donated $2.5 million for disaster relief efforts this year. That amount includes another $500,000 recently added for relief efforts due to Hurricane Maria and the earthquake in Mexico.

Starbucks: The coffee retailer, which employs hundreds of Puerto Ricans, has pledged $250,000 for disaster recovery efforts for the island. The company has also allowed customers to make donations through its smartphone app to benefit the Center for Disaster Philanthropy.

UPS: As of press time, the logistics and delivery company has sent two of its air freighters to Puerto Rico, both of which delivered ready-to-eat meals (MREs).

Verizon: Multiple press reports have confirmed that the telecommunications company has pledged $1 million for disaster recovery efforts related to this year’s hurricane season. In an effort to raise more funds for Puerto Ricans, Verizon has also said it will match employees’ contributions to hurricane relief-focused NGOs.

Walmart: The retail giant recently committed $5 million in support of Hurricane Maria relief efforts. This builds on the commitments previously announced by Walmart and the Walmart Foundation totaling $35 million to support 2017 hurricane assistance in response to Hurricane Harvey and Hurricane Irma.

Finally, many organizations are requesting cash donations so they can direct assistance to those who need supplies most desperately. PBS has listed a group with campaigns dedicated to the Puerto Rico relief effort here.

Image credit: U.S. Customs and Border Protection/Flickr

Wild Salmon or Farmed: Our Choice Makes Us Human

The following excerpt is from the upcoming book Being Salmon, Being Human: Encountering the Wild in Us, and Us in the Wild, available Oct. 18.

By Martin Lee Mueller

When studying salmon and their awe-inspiring, ancient journey, one sooner or later recognizes that many journeys have more than one beginning. So, too, does my relationship to salmon. One beginning was in August 2010, when the Norwegian business newspaper Dagens Næringsliv published a brief opinion piece on the future of salmon in Norway. The piece was signed by Rögnvaldur Hannesson, a professor of fishery economics at the Norwegian School for Economics and Business Administration. In it, Hannesson publicly raised the question of whether or not it is time to sacrifice all of Norway’s wild salmon in favor of their domesticated cousins. The paper described Hannesson as one of the country’s leading experts on fishery economics, and so his contention held a certain authority. “We should perhaps ask ourselves what we want wild salmon for?” writes Hannesson. “If wild salmon get in the way of the fish farming industry, then I must say we must be ready to sacrifice wild salmon. The industry creates great values and jobs along the entire coast. It is an important business branch, one that is important to keep. We need not feel pity for the upper class that will miss a playroom; surely they’ll find some corresponding amusement.”

Here I was, living in the land of Arne Næss, founder of deep ecology; Gro Harlem Brundtland, a pioneer of sustainable development; Fritjof Nansen, Nobel peace laureate and Arctic explorer; Roald Amundsen, first man on the South Pole; or Adolf Tidemand, the painter whose work celebrates Norway’s extraordinary richness in natural beauty and grandeur, its waterfalls, its cascading rivers, its fjords, its high plateaus. Caring for, loving, and taking pleasure in nature’s commons are ideals deeply rooted in the people here; forging kinship ties with these commons might in fact be the quintessence of what it means to make a home in this astonishingly beautiful northern land. And then, from within, this voice that openly and earnestly suggested letting a species go extinct! What are the implications of this suggestion? What worldview is being advocated here? What values resonate within it? What would that mean, to give up on the salmon? And how does this relate to the perfect storm of ecological collapse already well underway?

Meanwhile, another beginning was materializing on a different shore, on the Pacific Rim in the American Northwest. There, in a small community along the Elwha River, a short but mighty stream that gushes from the Olympic Mountains and spills into the Salish Sea, an extraordinary story was playing out: Almost exactly a hundred years after the salmon there had been deemed superfluous and in the way of industry, the human community was beginning to help their salmon leap back from the razor-sharp edge of extinction and recolonize the river. The return of the Elwha salmon became the motivating force behind the largest dam removal ever to be undertaken, anywhere in the world.

Early in the twentieth century, when white settlers first envisioned the two dams in Elwha River, these dams were to yield “peace, power, and civilization,” according to the pioneer and businessman Thomas Aldwell, who was the chief visionary behind the dams. It was Aldwell’s intention to convert the Elwha River “from its waste and loss into a magnificent source of energy and strength.” The building of the two dams was widely recognized to be a significant step toward modernizing the American west. In the hands of ingenious humanity, this “mighty power for good” was constructed without fish ladders that would permit the salmon to climb past the Elwha Dam and past the Glines Canyon Dam, and soon the fish, once renowned as the mightiest salmon in the Olympics, began to decline. Meanwhile, the watershed indigenous community, the Lower Elwha Klallam, also found themselves cast into a desperate struggle for survival. Once known throughout the region as the Strong People, they found that the rapid decline of their totem animal, the salmon, went hand in hand with an unraveling of community ties.

But by the year 2013 both dams had been completely dismantled, and the Elwha was running again, free of obstructions. Slowly, the salmon began moving upriver again. And as they did, the human community throughout the watershed engaged in a re-evaluation of the cultural narratives that have structured thought and guided action.

In some ways, the events in the Elwha watershed were the antithesis to Hannesson’s suggestion. The chronological symmetry between the two cases, combined with their stark contrast, intrigued me. I began reading about the Elwha, and eventually I decided to visit the Olympic Peninsula in the summers of 2012 and 2013, to learn more about the Elwha salmon and about the people who make up the watershed community, both indigenous and others.

Photo credit: Flickr / Richard Probst

Book cover image credit: Chelsea Green Publishing

Twitter Chat Recap: #WhyPurpose with Pearson & Partners

Pearson, SAP, ASU WSSI, UN PRME, and TriplePundit came together at #WhyPurpose today to discuss why young people want to work for businesses with a social purpose, how they’re preparing to join the workforce, and what this means for businesses.

Did you know that 47 percent of Millennials expect their CEOs to take a stance on important political issues, as compared to just 28 percent of Americans in the workforce in general? And, Millennials "are twice as likely as the overall pool to invest in companies or funds that target social or environmental outcomes."

As the world’s learning company, Pearson is engaging with learners, teachers, researchers and thought-leaders to understand the issues they care about -- for example expanding access to education, promoting education for sustainable development, preparing learners for good jobs or having a positive impact on the environment. Addressing these topics is part of their 2020 Sustainability Plan - a five-year vision to integrate environmental and social issues into every aspect of the company to drive long-term growth and help implement the UN Sustainable Development Goals (SDGs).

In the Twitter Chat, Pearson and guest panelists from SAP, ASU’s Walton Sustainability Solutions Initiatives, and the UN Principles for Responsible Management Education group shared examples of how companies, educational institutions, and governmental organizations are linking sustainability to their core business models and employee engagement - particularly focused on young people!

During #WhyPurpose, discussed the following and much more:

- Where and how are young people being taught about sustainable development? How can universities work with businesses to teach young people about sustainable development issues?

- How do companies align with expectations from Millennials, employees and other potential employees - and should businesses take a stand on important issues?

- How can companies ensure they’re recruiting effectively, engaging, and listening to their younger employees, while working together to achieve the UN Sustainable Development Goals (SDGs)?

FEATURED GUESTS:

- Amanda Gardiner (@Amanda_Gardiner & @Pearson) - VP - Sustainability and Social Innovation at Pearson

- Glenda Whetten (@WSSIatASU) - Walton Initiatives’ Director of Higher Education Programs

- Lourdes Rosales (@RosalesLuly & @LifeatSAP) - Global Strategic Partnerships at SAP SE

- Jonas Haertle (@JonasPRME & @PRMEsecretariat) - Head, Principles for Responsible Management Education, UN Global Compact

MODERATORS:

- The TriplePundit Team

About Pearson

We’re the world’s learning company, with expertise in educational courseware and assessment, and a range of teaching and learning services powered by technology. Our products and services are used by millions of teachers and learners around the world every day. Our mission to help people make progress in their lives through learning — because we believe that learning opens up opportunities, creating fulfilling careers and better lives.

For us, sustainability means using our core strengths as a learning company to help spread the benefits of quality education far and wide, while strengthening our business and upholding the highest standards of responsible business conduct.

Launched in 2016, our 2020 Sustainability Plan is a five-year vision to integrate environmental and social issues into every aspect of our company to drive long-term growth and help implement the UN Sustainable Development Goals (SDGs). Our Sustainability Plan is closely aligned with our corporate strategy and is driven by a set of issues that are relevant to our business and stakeholders. These issues include access to education, 21st century skills, economic empowerment, data privacy, and learners’ safety and security.

Join this chat to learn more about our 2020 Sustainability Plan, and be sure to read our latest sustainability report on pearson.com/sustainability.

Swedish food company Oumph! launches in UK, bringing environmental and sustainable values

The NFL Has a Paid Patriotism Problem

Despite several exciting finishes to football games over the weekend, the big news about the NFL focused on political statements. A coordinated response was repeated across the league in response to President Trump's rampage against players kneeling during the national anthem when he led a campaign rally Friday night in Alabama. The reaction has been well-coordinated and effective. Even Dallas Cowboys owner Jerry Jones took a knee last night with his team, though that was done in unison before the national anthem was played. The message, however, was loud and clear.

Never mind the fact that the U.S. has been coping with four hurricanes, "Rocket Man" in North Korea and stalled legislation in Congress. The president crossed a line, and one of the most enduring brands in the U.S. was not having it. For the NFL, the largely astonished and favorable response to the kneeling and locked arms was a welcome respite from a few years of bad headlines that were tarnishing the league's image: chronic traumatic encephalopathy (CTE) along with the alleged suppression of evidence and an eventual settlement; ties to domestic violence; allegations of dubious charitable work; and of course, the supposed blackballing of Colin Kaepernick, the notorious quarterback and kneeling symbol, who for a while had the top-selling jersey amongst NFL players last year.

While Kaepernick has largely been silent, and for a while was almost forgotten, President Trump's behavior has launched him as yet again a top story, and to some as a martyr. But to the president's supporters, including many NFL fans, Kaepernick's behavior, and now those of many players and personnel, is about disrespecting the flag and the U.S. military.

The truth about the NFL, and its relationship with the U.S. flag and the military, however, is a bit more nuanced.

First, standing on the field for the national anthem was not even a standard practice until 2009. Around that time, the Department of Defense (DoD), during the Obama Administration, mind you, had decided that it would be a good idea to pay teams to have soldiers appear on the field as an effective recruitment tool for the armed forces. The actual amount of money paid varies based on the source. CBS Sports concluded it was $5.4 million to several NFL teams between 2011 and 2015. A report authored by Arizona Republican senators John McCain and Jeff Flake claimed $6.8 million to various teams across the 5 major North American sports leagues from 2012 until last year. The DoD has since ended the practice of paying sports teams for military displays, but both McCain and Flake have inferred that more transparency is needed, and their assessment sounds like a statement that many assume would come from Bernie Sanders's or Nancy Pelosi's offices:

"Despite our success curbing this inappropriate use of taxpayer funds, DOD still cannot fully account for the nature and extent of paid patriotism activities. In fact, more than a third of the contracts highlighted in this report were not included in DOD’s list; instead, our offices discovered the additional contracts through our own investigative work. In the end, two-thirds of the contracts found by our offices or reported by DOD contained some form of paid patriotism."

Senator Flake in particular has harshly criticized the DoD for such spending. In 2015, Flake highlighted what he described as "egregious and unnecessary waste" of taxpayer funds used at New York Jets games to "honor" members of the New Jersey Army National Guard (NJANG).

“This will probably stand as the biggest Draft Day bust for the Jets until 8 p.m.,” sniffed Flake at the time, needling the perennial underachieving Jets as the revelations of the $100,000 the NJANG paid the team occurred during the NFL's annual college athlete draft ritual.

What is true is that even before the DoD and state national guards launched marketing campaigns with the NFL, players always had the option of appearing on the field during the playing of the national anthem. No evidence makes it clear that any pay-for-patriotism programs required players to stand during the anthem. But the optics of the league paying in order to appear patriotic gives notice to these players' harshest critics that they need to take a step back and look this entire controversy in context.

Indeed, the NFL did eventually refund the DoD some of the funds it had taken: Most estimates suggest that the amount was about $724,000. But considering the league has already harvested a reputation as one that fleeces desperate cities in order to retain or lure football teams - $750 million in the case of the Oakland Raiders franchise moving to Las Vegas - the league's willingness to indulge in "paid patriotism" showcases, of course, owners' greed. But this saga also exposes the hypocrisy of those who charge that players who decide to lock arms or take a knee are some how disrespecting the flag or the armed forces - especially since those displays have not been one of tradition, but out of lucrative business contracts.

Image credit: Keith Allison/Flickr

How Renewable Energy Can Accelerate the Microgrid Revolution

Hurricane Harvey made landfall in Texas on the night of August 25, and in the weeks since then the U.S. Energy Department has been flooding the media with news about its work on grid resiliency. It's a timely topic, considering the destructive path carved by Harvey, Jose and Maria. The Energy Department is now focusing more attention on the relationship between microgrids and resiliency. In particular, that includes microgrids that integrate distributed renewable energy resources, aka DERs.

We're probably going to hear much more about microgrids, DERs and "black start" recovery in the coming months. To provide a leg up on the issues, last week TriplePundit gathered some insights from microgrid expert Jared Smith of the global technology and innovation firm PA Consulting.

The following notes from our conversation are edited for flow and readability.

The conventional approach to grid resiliency is not working

Until recently, grid resiliency has focused on hardening utility poles and other conventional infrastructure against extreme weather and other emergencies.

The destruction unleashed by hurricanes Harvey, Irma and Maria has already demonstrated the shortcomings of that strategy, and there are still two months to go in this year's hurricane season.

The ongoing flood of news about cyber attacks -- real and threatened -- has also exposed vulnerabilities in traditional grid design.

Smith outlines the need for making resiliency a top priority, and the need to make radical changes in the way the electrical power industry approaches resiliency:

These events are making us aware of the vulnerability of the grid.We know that certain grid events are likely to happen, but we need to be more aware of the threat of events, including our vulnerability to cyber attack.

The security of the grid affects everything: the economy, national defense, and our day to day lives.

We also need to be aware that the grid is vulnerable even to relatively minor intrusions. There is a ripple effect because of the interconnectedness of the grid. That vulnerability is layered on to other disruptions from accidents and weather events.

The microgrid solution

Microgrids function like miniature electricity grids, and they can draw power from on-site or local sources.

One of the advantages is that microgrids can be insulated against disruptions in the wider grid. They can also potentially "black start," or come back online, quickly even if a widespread power outage continues to affect other parts of the grid.

On site or local renewable energy can potentially provide microgrids with a quick-recovery advantage, too.

Resiliency is just one aspect of microgrid technology, and Smith emphasizes that the that industry stakeholders are becoming more attuned to other bottom line advantages:

The resiliency aspects and capability arguments for microgrids are both wakeup calls for the industry. Microgrids offer a solution set that has peoples' attention.Microgrids are a link between the monopoly model of conventional utilities and a more interactive, consumer driven platform.

They are a stepping stone, with viable technology that fills the gap. We are living in the Energy Age, and microgrids provide opportunities for consumer choice and consumption options, including pricing options.

There are also opportunities to network microgrids with other microgrids, and network microgrids with utilities.

There is at least one major challenge, though. Microgrids that are connected to each other and the larger gird need to be capable of going into "island" mode seamlessly, in order to insulate themselves in case of widespread disruptions including cyber attacks.

That sounds easy enough on a small scale, but on a national level with tens of thousands of microgrid connections the complications add up.

Where the microgrid rubber meets the Silicon Valley road

Another bottom line aspect of microgrids is their connection with "smart grid" technology. The microgrid itself is composed of hardware, of course, but emerging microgrid design is closely integrated with advanced IT capabilities.

Some of those capabilities relate to boosting the efficiency of daily operations, such as accessing cloud data. Smith also notes the potential for microgrids to enable "more dynamic conversations" between energy consumers and producers, which can foster the use of new IT developments like crypto-currency.

This software-driven aspect also includes elements that could aid in resiliency, including artificial intelligence and machine learning.

"It's a logical progression toward a self-healing system," says Smith.

The role of renewable energy

Smith cautions that utilities have legitimate reasons to be skittish about encouraging distributed renewable energy generation. Independently owned microgrids can compete with utilities for sales of kilowatt-hours, and the growing patchwork of small scale solar arrays and wind turbines can pose safety issues for utility crews. Safety is an especially acute issue where do-it-yourself, jury-rigged systems are involved.

Assuming that the regulatory ecosystem will adjust -- as it has for automobiles, buildings, and other major aspects of civic infrastructure -- Smith sees advantages for grid resilience in microgrids with DERs:

Renewables provide "black start" capabilities. When you have a solar panel on a house with storage, you can get back up and running.In the chaos of post-Irma Florida, restoring order involves identifying live wires and tracking assets. Microgrids could help make it easier to understand where these assets are on a granular level.

The concept of grid service is also huge. Renewables have the ability to interact with consumers and their neighbors in the microgrid. That means they have the ability to provide services, and utilities are trying to valuate these services and make them accessible to more consumers.

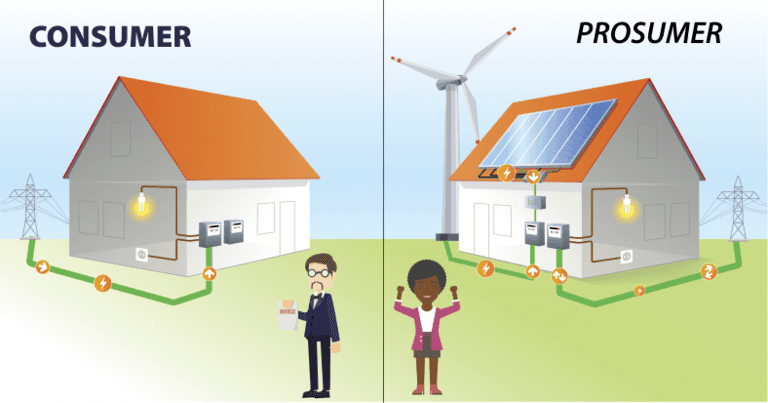

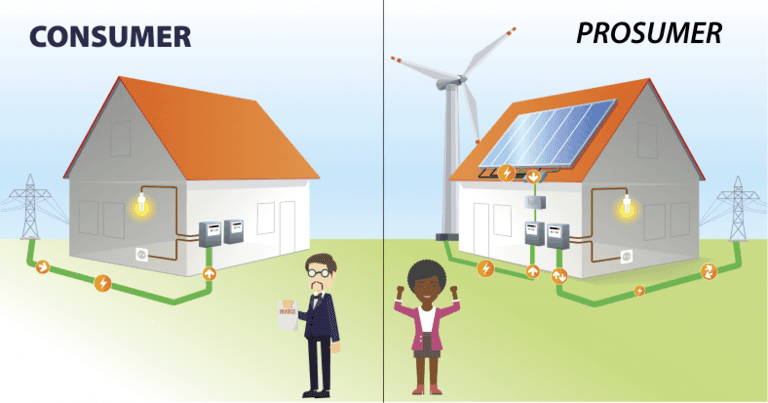

Interestingly, the U.S. Energy Department has been pitching the idea of a DERs enabled, consumer-oriented grid. The agency calls it the "prosumer" concept, in contrast to the conventional consumer model:

Simply put, a prosumer is someone who both produces and consumes energy – a shift made possible, in part, due to the rise of new connected technologies and the steady increase of more renewable power like solar and wind onto our electric grid.Think of it like a Facebook feed or YouTube page. Most users don’t just read or watch content – they also create their own and actively add to the conversation on social media.

The full value of DERs-enabled microgrids in disaster recovery has yet to be realized, but anecdotal evidence from Florida's hurricane recovery indicates that mini-microgrids -- aka homes with rooftop solar panels and energy storage -- can come back online within minutes even before the sun comes out again.

The Department of Defense is already testing the value of microgrids in providing energy security for domestic bases and overseas operations. Military veterans are beginning to re-enter civilian life with first-hand experience with renewables and are eager to promote them -- and work with them.

Emergency responders are also beginning to use electric emergency generators with portable DERs arrays instead of relying on diesel generators, which create local noise and pollution hazards and are encumbered by fuel supply issues.

The toll taken by Hurricanes Harvey, Irma and Maria on the conventional approach to electricity supply has been a cascade of worsening proportions, with Puerto Rico suffering an absolute calamity. As of this writing, the entire island is fully without power, and consequently water supplies are running thin.

Officials estimate that it will take six months to bring the grid back to life.

Image: US Department of Energy.

Leveraging Technology to Build a Successful Public-Private Partnership

By Laura Quintana, VP of Corporate Affairs at Cisco

This is the final article in a five-part series on how a company or organization can develop, implement, and sustain successful public-private partnerships (PPP) that achieve large-scale impact. Click to read part one on determining who to work with, part two on determining when and how long to engage, part three on determining how to execute, and part four on ensuring long-term sustainability.

Leveraging technology and innovation is essential to build capacity, streamline programs, and further impact in successful public-private partnerships (PPPs). Technology can be leveraged in two ways: first through the use of technical tools and platforms, and second through the use of technical knowledge to ensure expertise and innovative practices are applied uniformly and consistently to community investment strategies.

At Cisco, we’ve developed our own robust learning platform for Cisco Networking Academy, a world-leading IT skills and career building program. Accessed from netacad.com, the platform delivers learning experiences to students through video and collaboration technologies, the use of simulation tools that closely proximate hands-on experience with network equipment, and the use of big data and assessment technology to provide continuous student feedback.

Cisco’s 16-year partnership with the United Nations Volunteers (UNV) programme is a great example of leveraging technological knowledge. Networking Academy students and recent grads help fill technology gaps at UN agencies, leveraging their digital skills to support development projects. Since 2016, seven graduates trained in IT have been building websites and mobile applications, designing programs using big data, and integrating online and offline activities at UN agencies.

Through this partnership, UN agencies receive technical products that help streamline their programs, as well as much-needed insights from the students on how to better use technology to increase efficiencies and scale solutions. At the same time, the students gain experience in a real work environment and are able to use their skills to contribute to societal and environmental progress.

Mohammad Ilham Akbar Junior is a Networking Academy alumnus and one of the UN Youth Volunteers serving in the UNICEF Indonesia Country Office. Mohammad is serving UNICEF by supporting ICT incubators and labs, undertaking institutional audits of networking and technology needs, and training others to develop their ICT and networking skills.

Mohammad highlighted the uniqueness of his experiences, commenting, “I learned that volunteering is the purest way to understand society because I can be part of it in a positive way and can approach challenges from different angles. Volunteerism is about making your vision of the future real. It is about the journey to become an innovator for an even better future.”

Public-private partnerships play a critical role in achieving global scale and local impact, and technology plays a critical role in helping PPPs streamline efficiencies and further impact. We have an opportunity to close the digital skills gap and promote equitable education – all by leveraging the strengths of the public, private, and nonprofit sectors and using technology to create value for everyone involved.

Image credit: UNICEF, 2017

The Netherlands Teaches the Planet How to Grow Food in Changing Climates

There was a time when Latin America's temperate climate seemed like the perfect environment to champion the world's demand for food production. South America with its expansive land, warm environment that, on the whole, suffered less from rapid extremes and snowfall than say, Europe, was ideal for raising beef and growing soy, wheat rice, corn and of course, coffee.

But as we know now, climate expectations aren't always a predictable gauge for success. Micro climates change and so does technology.

Take Brazil for example, a country known for its coffee, grain and beef production. In the recent decade, Brazil's, grain production has been hit hard by droughts and sustained temperature increases. Recent studies that suggest that many those crops thought of as warm-weather products are incapable of being grown in temperatures that exceed 40 C/ 104 F. Declining revenues from crops like soy have highlighted the need for innovation when it comes to global warming, a challenge that may be harder to meet in warm, temperate zones that swelter during the summertime.

That's where the Netherlands come in.

We often think of the Dutch homeland as a brisk and chilly place that would be less accommodating to an expansive agricultural industry than say, Brazil. But while the Netherlands is experiencing its own problems with rising temperatures, many of its industries have learned that technology and adaptability are key to weathering climate change.

Agriculture and food represent a large part of the country's GDP -- about 10 percent. And despite the country's size (it's about a third the size of New York State), it's second only to the United States in agricultural production.

Part of that is due to the large focus on research and development. Both public and private funding ave a large say in agricultural innovation, which is nurtured by R&D facilities at Wageningen University, Top Institute Food and Nutrition and public-private partnerships.

Some of its most productive soil comes from reclaimed polders -- areas where the North Sea has been literally "pushed back" with the help of dykes, pumps and canals that drained the soil dry enough to cultivate. That process of taking arable land from the North Sea actually started many centuries ago, as early at the 1200s. But in recent years, the country known for giant windmills that helped strain water from land has used those rich, fertile lands to increase its arable production of barley, potatoes, sugar beets and wheat.

And tomatoes: The Netherlands' most surprising crop. In the past three decades the tiny country has literally championed global tomato production by using vast greenhouses and cutting-edge technology to step up production. Some 80 different species are seeded using technology invented by Incotec that ensures that the seeds aren't damaged as they are being planted. Geothermal energy and innovative approaches when it comes to resource management and land use have helped to make the Netherlands to excel in in the ag and horticulture markets.

Of course, it's also championed one other concept in recent years: Cross-border innovation. The Netherlands openly courts input from companies and expertise across the globe, which is why it is home to at least 12 of the world's largest agrifood companies. More than 4,000 companies, including Unilever, Starbucks, Cargill, Mars and Danone participate in and benefit from agrifood research in the Netherlands.

That isn't to say that the tiny Nordic country has figured out how to overcome climate change. With most of its polders below sea level, and with flat topography that has faced historic floods over the centuries, the Netherlands' ongoing challenge is to find a way to buttress its billion-dollar industries from floods and rising sea levels. And given its ingenuity so far, it's fair bet that the country is already addressing that challenge.