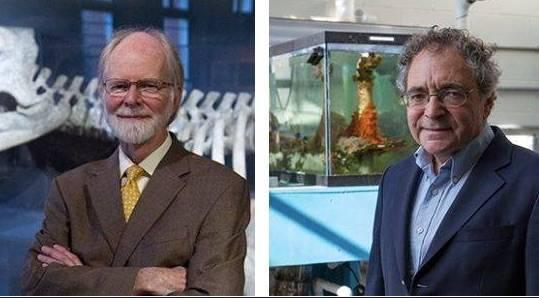

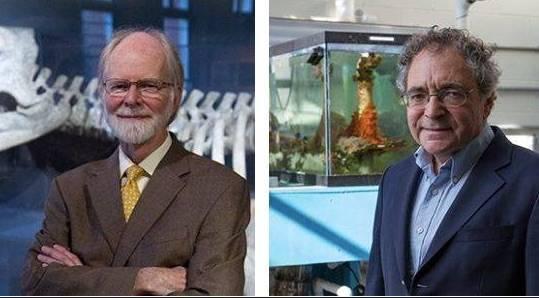

Two Scientists Studying the Biological Ocean-Climate Nexus Receive Tyler Prize

The Tyler Prize for Environmental Achievement, founded in 1973, is considered by many to be the Nobel Prize for the environment. This year’s prize was jointly awarded to two scientists that have spent their careers studying ocean life and the role it plays in shaping our climate. This is the first time the prize has recognized researchers who have focused their efforts on the oceans.

The two, Dr. Paul Falkowski, Distinguished Professor at Rutgers and Director of the Rutgers Energy Institute, and Dr. James J. McCarthy, the Alexander Agassiz Professor of Biological Oceanography at Harvard, have both focused their attention on the ocean biological systems and their relationship to the environment. These systems are comprised largely of tiny photosynthetic microorganisms called phytoplankton that are key drivers of the carbon cycle. While Falkowski studied this “engine of the ocean,” directly, McCarthy studied the nitrogen cycle, without which, the carbon cycle could not operate.

Falkowski founded the Environmental Biophysics and Molecular Ecology Laboratory, the only one of its kind, a cross-disciplinary program that bridges physical and biological sciences and focuses on measuring changes in the environment. Their goal is “to understand how biological systems function and evolve.”

When asked what he’d learned that he wanted everyone else to know, he said that “microbes are the stewards of the planet.” The “ocean’s invisible forest,” is what made the planet habitable in the first place, going back 450 million years. It’s their ability to produce organic matter from sunlight, absorbing carbon dioxide and giving off oxygen in the process, that makes it possible for us, and most other living things to exist here. If we fail to understand how these systems function, or inadvertently disrupt their operation, we could put ourselves and all life on the planet in jeopardy.

As to what he considered some of his most noteworthy contributions, he mentioned the algorithm that he wrote, with Chris Field, that enables visual satellite data to be used to determine the ocean’s productivity on a continual spatial and temporal basis. He also contributed to the development of fluorometer technology to enable the measurement of photosynthesis.

McCarthy also made significant contributions in basic research about the role that photosynthesis plays in the oceans, and by extension, on the planet. He also became involved in organizing scientific views from across disciplines and nations, in an effort to cooperatively improve understanding of the major forces and issues facing our planet.

McCarthy, who told Triple Pundit that “Many of my mentors and heroes are among the past recipients, that I never expected to join," served as co-chair of the IPCC, Working Group II, which had responsibilities for assessing impacts of and vulnerabilities to global climate change for the Third IPCC Assessment (2001). He was also one of the lead authors on the recently completed Arctic Climate Impact Assessment.

McCarthy’s key takeaway is that although kelps and seaweeds represent a tiny fraction of the planetary mass of photosynthetic organisms, they are responsible for fully 45% of all photosynthesis. McCarthy’s work has greatly improved our understanding of the ocean’s productivity, which is twice as great as originally thought. A full one-third of atmospheric CO2 is taken up by the oceans. This is converted by micro-organisms which form the basis of the ocean’s great food web. “A small fraction gets buried in the sediment, the source of most of today’s oil and gas which is found “in coastal margins or ancient inland seas.” At the heart of it all is the “biological pump.” The productivity of this pump is determined by two things: light, and the availability of nitrogen. McCarthy studied the ocean highly complex nitrogen cycle around the globe. Factors include deep water mixing, where much is recycled, as well as runoff from land, and even lihgtning strkes. He learned to read the history of a molecule through the use of isotopes. When he first started, people primarily thought of phytoplankton as fish food. He has come to understand its much larger role in the web of life.

On the policy side, starting in the mid-1980’s, he led an effort among Earth Scientists to outline a set of studies to answer large (International Geosphere-Biosphere program) scale questions about the climate system up to the early 2000s. In the reports that came out in 1990’s for the UN IPCC, they saw unusual changes. At that time they didn’t know how unusual it was or how much was caused by human activity. By 2000, “we could now see unprecedented changes that could only be explain by release of greenhouse gases. We could see the effects on every continent whether it was organism range, loss of ice, sea level rise, or extreme weather events.” He gave testimony at various levels of government from congress to cities. “Citizens have more impact at the city level.” He analyzed what the impact of new standards could be, and trumpeted, the need to invest in alternative systems.

Our entire civilization, our economy and every aspect of modern society rests on a bedrock of science. Yet, we find ourselves in a strange time when much of our best science is ignored and even ridiculed, because some of its findings are threatening to the profitability of some of the world’s most powerful corporations, who themselves owe virtually all of their success to the application of science. It is for this reason, that awards like this one, are more important than ever, to acknowledge the great work that scientists do every day, and how indebted we all should be to them.

Yet, as Dr. McCarthy says, “I think there is reason to be optimistic that we really have a very clear vision now of what the future could be, and its just a matter of getting the forces re-aligned and realize that the benefits of that for healthy working conditions for all people, for longevity, is an extremely important and reachable goal. And it’s something that I don’t think any of us who are convinced, as I am, of the science, will ever feel anything but impatience until we get this on the right track.”

Images by Katie Voss. Courtesy of the Tyler Prize

Green Champions: Five Takeaways from Conversations with Sustainability Leaders

By Renée Yardley

Rolland, a manufacturer of premium recycled post-consumer content paper, has published a series of conversations with sustainability leaders whose values aligned with the company's.

We wanted to engage with other organizations which share the same sustainability ethos, to learn about their practices: what it means to be environmentally responsible, and what it takes to operate sustainably.

In “Conversations with Green Champions,” Philip Rundle, Rolland president, talks to customers and partners from the business world, including Patagonia, Lush, Cirque du Soleil, and Air Canada; non-profit Canopy; and academia’s University of Colorado. Here are five key takeaways learned from these, and other, Green Champions.

1) Environmental leadership is shifting toward companies

Nicole Rycroft, executive director at Canopy, has seen a noticeable shift in environmental leadership – toward companies – since founding the Vancouver-based non-profit in 1999: “Most of the bold leadership that’s taking place globally around sustainability is at the intersection where conservation organizations work with the private sector.”

Rycroft said marketplace support from large corporate paper customers has translated into breakthroughs, like the Great Bear Rainforest agreement signed in 2016, which conserves a 6.5 million-hectare landscape (the size of Ireland) in British Columbia: “Fifteen years ago, 90 per cent was open for logging, and now 85 per cent is formally protected or off-limits from logging – and parallel to that is a vibrant sustainable forest products industry. Cause for hope!”

This hopefulness reflects her business-minded insight into the rising popularity of sustainable products like paper made with post-consumer fiber: “Large publishers, printers, and fashion brands are compelling players in the supply chain and do not want to contribute to the loss of the world’s remaining ancient and endangered forests.”

2) Practical environmental actions have significant symbolic value

Cirque du Soleil understands the universal appeal of the forest. Jean-François Michaud, Cirque du Soleil’s senior advisor – corporate social responsibility, said: “We decided to make an eco-responsible choice with office paper for copiers and printers years ago – we see paper as a strong symbol worldwide due to its roots in the forest.” (The company is a long-time user of Rolland Enviro Copy, a premium office paper made with 100 per cent post-consumer content fiber.)

Cirque du Soleil sees water as another important symbol, and takes water management to heart:

“Starting in 2007 we used innovative techniques that have become commonplace to reduce water usage. These include recovering rainwater from our headquarters and a main parking area – then using it in toilets and to water exterior grounds and gardens,” Michaud said.

The big top is a traditional symbol for circuses, and in 2017 the Cirque du Soleil transitioned to a lighter grey and white fabric which reflects sunlight. This reduces heat under the big top, lessening energy consumption. It also typifies the spirit of continuous improvement common to the Green Champions.

3) New research into low carbon aviation biofuel could be a game-changer

Aviation biofuel, which is refined from an existing feedstock such as used cooking oil or agricultural waste, has a low carbon footprint. That is because no hydrocarbons are extracted from the earth, and no net CO2 is added to the atmosphere.

Air Canada is helping the National Research Council of Canada test a theory: “Since biofuels have lower levels of particulate matter, jets using biofuels are less likely to produce contrails – the cloudy vapor that appears at high altitudes. This is important because research indicates that contrails have a global warming effect,” said Teresa Ehman, P.Eng., director, environmental affairs at Air Canada.

The airline’s research role was to fly five commercial flights using certified biofuel in May 2017, trailed by an NRC chase plane gathering emission data (it also gathered data from conventional flights). NRC’s report is expected by early 2018 – and could fuel progress on the global warming front.

4) Activists go to work in the corner office and in retail stores

Patagonia, the maker of outdoor wear, has a longstanding commitment to be an activist company. Paul Hendricks, its environmental responsibility manager, said that will not change: “We are evolving to become an even stronger activist company. In the United States, there is large policy vacuum in terms of environmental protection so businesses need to step up.”

“Our CEO is also our chief executive activist. Rose Marcario is leading the charge to push our business to become more active on the policy front, with advocacy, and working with non-profits. So we are doubling down – make that doubling up – by investing in teams and initiatives that are reducing our environmental footprint internally. And we are increasing our external efforts.”

These efforts are very tangible: Patagonia donates time, services and at least 1 per cent of sales to hundreds of grassroots environmental groups worldwide.

Another longstanding activist company is LUSH – the inventor, manufacturer and retailer of fresh, handmade cosmetics. LUSH uses its 900 retail stores worldwide, of which 250 are in North America, to stage ethical campaigns that promote change for the better.

LUSH North America’s Katrina Shum, sustainability officer, said: “We have been an ethical campaigning company from the beginning. We are not afraid to use our storefronts as a platform to have conversations that matter – about protecting people, animals and the planet.”

“These campaigns raise awareness about timely issues, like microbeads (non-biodegradable microbeads enter the food chain for marine life), or fossil fuels and climate change, or trophy hunting (against higher limits for hunting bears and wolves in B.C.). And the Refugees Welcome campaign raised funds to support Syrian refugees.”

5) Students can learn sustainable behavior without a lecture

Colorado State University’s sustainability tradition stems from its original classification as an agricultural college in the 1800s. And it has a mature approach to encouraging sustainable behavior.

“We focus on providing information so students learn on their own, and we try not to lecture or push out emails and posters saying, “do this, it’s sustainable,” said Bonnie Palmately, graphic designer and assistant director of creative communications in CSU’s Department of Housing and Dining.

One example is Eco Leaders, an innovative peer educator program, where students living on campus encourage environmentally responsible behavior – waste reduction, energy conservation, using sustainable transportation, recycling and composting. Palmatory says this personal approach promotes change through the grapevine. The Eco Leaders program also has an academic component with mandatory classes, course credits and a housing stipend. Incentives never hurt a good cause.

Shared tradition of environmental responsibility

By covering such a broad range of organizations, these conversations have provided multiple perspectives. Across the Green Champions, the common denominator is a deep and longstanding commitment to improve environmental performance and become more sustainable. A commitment Rolland shares.

Join Rolland’s Conversations with Green Champions here.

Renée Yardley is Rolland’s Vice President, North American Marketing and Commercial Sales

Photo: Rolland

Originally published on Corporate Knights.

Three Ways to Activate Your CSR Mission

By Steve Randazzo

Making the world a better place is not just for activists and billionaires. Now, brands are taking on this role after realizing just how much their customers care about social and environmental causes. Corporate social responsibility initiatives have become popular in business plans, where companies send portions of their profits over to charities that they and their customers care about. However, given the short attention span of today's consumers as well as their growing passion for social and environmental justice, it's time to take brands' giving missions to the next level. Here's the truth: For customers to really feel like they’re participating in social good, they need more than passive efforts. So don’t let your mission go unnoticed. You’re literally using your business to create good in the world — it’s time to act like it. How to Turn Passive CSR Into Active CSR Instead of merely ticking off the CSR box on your advertising checklist, treat your social or environmental mission as a business priority. Be active and creative in how you show — rather than tell — customers that you care. 1. Take up space with your mission Many brands will place their CSR initiatives in the corner of their website and social media as a subtle hint that they care. Sure, humility is attractive, but customers don’t have time to take in these quiet signals. Upon visiting your company’s website, customers should immediately know that you are serious about CSR. In fact, it should appear to them as if CSR is one of the biggest reasons why your brand even exists. To do this, fill your website with content devoted to your social endeavors. For example, Warby Parker is one company that presents its CSR mission beautifully. Visit the company's website and you’ll find an entire section devoted to its “Buy a Pair, Give a Pair” program. Full of thoughtful text, graphics, and images, it turns CSR into an exciting, ongoing project, like a scrapbook or a video diary. In total, these elements make the cause come to life for Warby Parker's consumers. Remember, whatever your cause may be, make sure to invest in the time and use creativity to put together engaging content that takes up meaningful space. 2. Help customers join in The best way to move beyond passive activism is to build interactive elements into your CSR initiatives. Don’t just present the facts — customers can’t do much with those other than read them and move on. Instead, inspire people to take action alongside you by creating opportunities for them to interact. Patagonia does just this in a super engaging, brand-building way. It created a program called Patagonia Action Works that matches customers to causes they care about. Website visitors provide their location details and specify causes they’re interested in, like “climate” or “communities.” Then, they are led right to local organizations that need support. This is all presented in a vibrant, visual way, with energizing calls to action, including buttons that prompt visitors to “Act Now!” By using interactive elements, your brand can create a two-way street of interaction, and customers will be thankful for the opportunity you’re providing them to give back. 3. Take a road trip Don’t get stuck within the confines of your website or office. By taking your CSR mission on the road, you can spread the word faster than any TV ad or promotional packaging ever could. KaBOOM!, a nonprofit we’ve worked with for several years, is a noteworthy example of an organization that transports its CSR campaign on the road. Its mission is to bring fun and play to underprivileged youth in America. The nonprofit created a model of giving to support this mission. Its team drives around the country to form connections with other companies and organizations, all while bringing change to one community at a time. For example, in 2016, KaBOOM! partnered up with Target to create 175 play areas across the United States. These efforts affected more than 72,000 kids. Now, those children and their families think about both KaBOOM! and Target as members of their community that actively care about their lives. When you compare all this goodwill and awareness to simply writing a check out to a charity, there's no contest. Active CSR campaigns take the prize. CSR should be the heart of what your brand does, not just the cherry on top. It’s only then that customers will see your brand as part of their social giving lives. Show that, like them, your brand has a vested interested in solving problems in the world, and that by sticking with you, they’ll also be actively helping people, too. In the end, that’s how one-off buyers become fierce brand fanatics who continue to support your brand's efforts for the long haul. Steve Randazzo is the founder and president of Pro Motion Inc., an experiential marketing agency located in Missouri. With more than 30 years of experience in the industry, Steve has longstanding relationships with big-name clients, including The Walt Disney Company, Hewlett-Packard, Duck Brand, Fiskars, CITGO, the NBA, and Tractor Supply Company. Photo: Warby ParkerEnlightened Farm Policies, Practices, and Sustainable Agriculture Standards Bear Fruit for Pollinators

By Lesley Sykes

Many of our most beloved fresh food crops – almonds, apples, avocados, mangoes, blueberries, and pumpkins, to name a few –depend on pollinators to bear fruit. In addition, pollinators contribute to crops used for livestock forage, biofuels, and fibers. Beyond agriculture, pollinators are essential to our natural ecosystems, responsible for the reproduction of over 85 percent of the world’s flowering plants. As such, pollination services are central to the conversation about global food production, nutritional security, and our overall wellbeing.

Yet, as vital as they are, pollinators like bees are under threat worldwide from habitat loss, pesticide use, and diseases. Without their vital pollination services, it is believed that ecosystem processes would suffer. It’s no wonder the decline of these tiny invertebrates has gained so much attention worldwide – as of 2017, they even have a day named after them: World Bee Day, which falls on May 20th. This Earth Day, we’d like to call attention to the very important issue of pollinator health in the context of sustainable agriculture, and highlight some of the organizations and companies working to protect these pollinators and our food supply.

What are pollinators? Technically speaking, pollinators refer not just to bees, but a variety of species– including beetles, butterflies, flies, moths, bats, and birds – that support the diversity of plant life by transfer of pollen from one plant to another. Native pollinators have a symbiotic relationship with flowering plants, and are essential for overall ecosystem health and biodiversity. These pollinator populations are vulnerable when the ecosystems within which they thrive are threatened.

In this article, we focus on bees – and in particular honey bees, Apis mellifera - because they are the world’s most important pollinator for commercial agriculture production. Their role is especially important for large-scale crops that rely on land devoted solely to one crop (i.e., monoculture systems). Bee populations, both wild and managed, are at risk due to a variety of factors.

What is going on? Land use change, pesticide use, large-scale monoculture and climate change are all threats to bee populations. As farm fields have become larger (and less diverse) and cities continue to grow, natural habitats and forage areas are shrinking, which pollinator populations need to survive. Additionally, the use of certain agricultural chemicals has increased since the 1990s, most notably neonicotinoids that have been shown to be toxic to beneficial insects. Following widespread use of neonicotinoids in agriculture, commercial beekeepers started reporting unusually high colony loss rates. This problem affected the number of hives available for crop pollination in the U.S., and prompted many supply chain actors and nonprofits to take a closer look at what was going on. A similar phenomenon was also happening in Europe.

Taking Action. Recognizing the multi-faceted issue, numerous organizations and companies have made the conservation, restoration, and sustainable use of pollinators a priority. It has become an important concern for international groups such as the Food and Agriculture Organization (FAO) of the United Nations (UN) through its Global Action on Pollination Services for Sustainable Agriculture, federal agencies like the Environmental Protection Agency (EPA) and the U.S. Department of Agriculture (USDA) (see their joint report here), and a growing number of state legislatures. These groups have mobilized resources and taken action around research, implementation of best practices, and enhancing awareness. This momentum led the FAO and some 52 countries to support the declaration of May 20th as the World Bee Day.

Non-profits like the U.S.-based Xerces Society and Pollinator Partnership have also played critical roles in publishing research, policy advocacy, and educating land managers to restore landscapes for the benefit of invertebrates. In addition, the private sector has taken a stance – for instance, by creating coalitions to work together, and developing voluntary standards (e.g., Bee Better Certified) and other tools to improve pollinator health. For example, the Kellogg Company serves on the Honey Bee Health Coalition and supports cost-share programs for farmers looking to implement conservation practices on their farms to facilitate healthy pollinator populations. Whole Foods Market donates to Xerces Society and has a pollinator friendly labeling program for almond products, which means that almonds are sourced from orchards that take extra measures to create biodiverse landscapes. As a third-party certifier and standards developer, SCS is also playing a role, described below.

What can land managers do? Much research has been conducted on the topic of protecting pollinators in agricultural landscapes. The good news is that such efforts are consistent with key sustainable agriculture tenets, offering an opportunity to not only benefit the environment, but to enhance crop yields, quality, and resilience of cropping systems. Management practices related to restoring and enhancing conservation areas to promote pollinator health have been identified and tested by agricultural producers. For example, increasing the amount of natural land cover in and surrounding fields – even small patches of natural habitat – can help to establish and maintain diverse pollinator communities. Other strategies include allowing some fields to go fallow, or reducing tillage so that flowers can reestablish. Reducing impacts of pesticides known to be toxic to invertebrates is paramount to pollinator protection. Best practices include avoiding application of pesticides toxic to pollinators during crop bloom, and mitigating pesticide drift. In addition, areas prone to contain pollinators and nesting sites should be identified and carefully protected from contamination.

The role of third-party certification. Third-party certification plays an important role in communicating producer efforts in environmental responsibility, including land conservation and pollinator protection. For example, SCS Global Services’ Sustainably Grown® certification for agricultural crops, and its Veriflora® certification for cut flowers and potted plants, address pollinator health through a holistic sustainable agriculture framework, validating best practices through annual audits, including mitigation of risks associated with pesticide drift and maintenance of suitable buffer areas to minimize impacts on pollinators and wildlife. Land managers must also demonstrate knowledge of endangered species and habitats in or surrounding farms, and consider the risks associated with pesticide use, including adherence to the program’s pesticide management requirements and prohibited pesticide lists.

Conclusion. Because of the essential role honey bees and other pollinators play in agriculture, and in the larger environment, protection of pollinators is a cause upon which stakeholders across the spectrum of opinion can agree. At a time when so many issues are divisive, it is reassuring to bear witness to this unity of purpose.

Lesley Sykes is Manager of Sustainable Agriculture, SCS Global Services.

Photo: SCS Global Services

Distributed by 3BL Media

Building Your Nonprofit Market: How to Combine Technology Volunteering with Product Donations

By Ava Kuhlen

Product donations to social change organizations are increasingly popular. These donations can include software, hardware, subscriptions, or platforms. For many companies however, their product donation programs aren’t meeting their goals. A company can’t achieve their citizenship, brand or market development goals if no one is requesting or using their donations. The corporate sector knows that paid clients need training, customer service, and product implementation support, yet this same set of services is rarely offered to nonprofit customers. Too often, nonprofits end up paying for these “free” products in staff time and consulting fees. Forcing nonprofits to spend unexpected and unbudgeted time and money to use a donation can actually end up negatively affecting a company’s brand or community reputation.

Taproot Foundation knows that coupling a product donation program with pro bono service – donated professional expertise from the business’s employees - can be a powerful combination that supports nonprofits’ use and adoption of your discounted or free product. When nonprofits receive the support they need, they become happy- and repeat- customers.

Below are five steps to determine if your company has the right resources, information, and structure in place to launch your own pro bono program for product donations.

Step 1: Do you have a clearly defined product donation offering?

This may sound basic, but pro bono service is more valuable when it is coupled with an existing, viable product donation strategy. A clearly defined product donation offering includes a market focus, market segmentation, and a specific product offering for nonprofit customers. It includes external research to validate how your product can be helpful to social change organizations.

Step 2: Does your product need pro bono support?

This is about understanding your nonprofit users and their product experience. Gathering this customer feedback can help you understand whether organizations are actually using, not just acquiring, the product. It also gives you insight into the types of organizations and primary users of your solution, as well as uncovers the barriers or pain points nonprofits are encountering.

Step 3: Have you defined success for your pro bono for product donation program?

Determining what your goals are from both a social impact and business benefit perspective can ensure that you create a program that meets all of your objectives. To create impact, you may target your donations at nonprofits working on one specific issue like food security or inclusive entrepreneurship. Or you may focus on increasing all organizations’ efficiency and effectiveness. For business benefit, you may use the program to increase cross-department collaboration or as a way for employees to practice delegation and team management. Defining your specific goals is the first step to achieving them.

Step 4: Do you have internal buy-in around pro bono for product donations?

Building advocates, champions, and advisors across your business will go a long way to building a pro bono for product donation program that lasts. Gauging the understanding of pro bono service among both the C-Suite and employees will give you a sense of how heavy your “lift” will be to build support and participation in the program. Connecting the program to existing HR business goals—like leadership development—can expedite the buy-in process.

Step 5: Are resources available for pro bono for product donation at your company?

Launching and managing a pro bono for product donations program takes both financial and personnel resources. Like anything at the business, you are going to need to continually invest in it to make it work. You’ll need dedicated personnel to run the program, employees with the bandwidth to participate, and sometimes financial resources to hire outside advisors who can help you design, launch, and manage the initiative.

Taking the time to understand and build this groundwork will ensure that your pro bono for product donations program best serves your nonprofit customers, employees, and your business. Once this groundwork is in place, here are three tenets to follow as you design and launch your program.

- Follow the Business: Maintain quality, ensure sustainability, and make your life easier by treating your program with the same amount of rigor and diligence that you would any other aspect of your company.

- Make the Investment: Design this program in the same way you’d launch a new business line or product. Conduct the research and analysis of the marketplace and clients, invest in the staffing and personnel at the business, and allocate a budget to run both the product donation and pro bono programs.

- Structure the Offering: This is the nuts and bolts of the actual pro bono program. Consider your desired size and scale, how your employees will get involved, and what kinds of pro bono projects they will deliver. Your company’s culture, employees’ preferences, and nonprofits clients’ needs will all affect the way your program is delivered.

Being free isn’t good enough. Investing in a pro bono program helps ensure that nonprofits actually adopt and use your solution. Combining pro bono service with your product donation program can help organizations all over the world use your product to increase their effectiveness, reach optimal efficiency, and be fully equipped to take on our biggest social challenges.

About the Author:

Ava Kuhlen is Director of External Relations at the Taproot Foundation, a nonprofit that engages design, marketing, IT, strategic management, and human resources professionals in pro bono service projects to build the infrastructure of other nonprofit organizations. Taproot Foundation’s Advisory Services team has partnered with over 85 leading companies to connect their world-class talent with social sector needs. Ava has more than 10 years of experience aligning networks of people and resources for social impact and specializes in nonprofits, philanthropic advising, and corporate social responsibility. She lives in Berkeley, California, and spends her free time playing outside.

$9 Trillion in Investments Flow into Green Economy

Ethical Markets has released its 2018 Green Transition Scoreboard® (GTS). The Scoreboard tracks cumulative private investment in green sectors worldwide, measuring the transition to renewable energy, green finance, and circular economies since 2007. This report’s total for such investment is set at $9,317,882, 308,406.

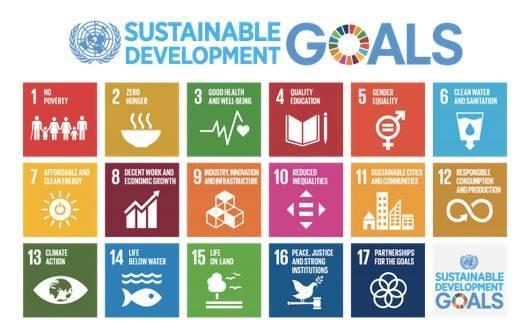

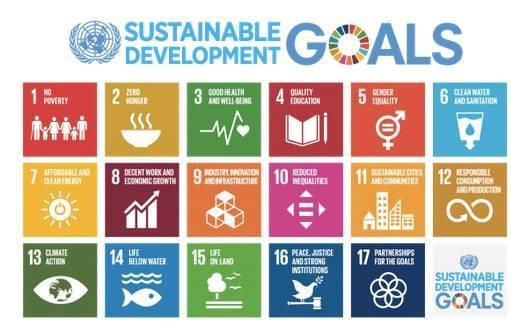

The report follows on Ethical Markets’ 2017 "Deepening Green Finance" and 2016 "Ending Externalities: Full Spectrum Accounting Clarifies Transition Management" studies. Companies tracked by the GTS are those avoiding negative externalities and focused on transition management in the context of the UN Sustainable Development Goals (SDGs) and the Climate Summits.

The GTS tracks renewable energy, energy efficiency, life systems, green construction and corporate green R&D, representing broad areas of investment in green technologies. Each sector covers an area of substantial capital investment in technologies which are contributing to the growing green economy.

The 2018 GTS continues these systemic explorations and how investments can be redirected to address all 17 Sustainable Development Goals (SDGs) ratified by the 195 member countries of the United Nations in 2015.

The upward trend in investments since 2007 aligns with a recommendation to invest at least 10% of institutional portfolios directly in companies driving the global Green Transition, updating strategic asset allocation models both as opportunities and as risk mitigation. Excluding government investments to the extent possible, the $9.37 trillion in private investments and commitments as of 2018 puts private investors on track to reach $10 trillion in green sectors investments globally by 2020.

Sources of financial data are screened by rigorous social, environment and ethical auditing standards, and also by tracking the evolution of these standards worldwide.

In its overview, the report follows global digitization trends, the future of the Internet and the politicization of social media. Full details here.

Community-owned Grocery Stores Fill Food Deserts

Community grocery stores are being revived to provide a local service in small Kansas towns, where, as in many rural areas, powerful box box retailers have opened up some distance away and scooped up their trade.

Business watchers report that the tide is turning in the Wheat State’s food deserts, the areas in which customers are at least ten miles from a grocery store. The inconvenience is greatest to the elderly and less mobile.

After 2007, when Kansas had 213 rural grocery shops, 45 communities lost their stores, so that about 800,000 people were left in food deserts.

“When a grocery store in a small town dies, the town dies,” said Yvonne Scott, healthy food access co-ordinator of AmeriCorps VISTA, a national program formulated to relieve poverty, based on a 1960s proposal from President Kennedy.

Some campaigners have pooled resources to establish community-owned stores; others have created co-operatives to start shops. In other towns local councils have joined residents to set up partnerships with some public money to run stores.

In Kiowa, Barber County, a co-operative manages the new store, and in Little River, Rice County, the city government and a community foundation have combined for the purpose. In Plains, Meade County, local activists intend to open a non-profit grocery business next year.

Loren Lance, who took over a closed community store in Mildred, Allen County, with his wife Regena, says he is thanked by at least one customer every day for keeping the service going.

“There are lots of innovative things that people are doing to try to either start or sustain their local stores,” said David Procter, director of Kansas State University’s Center for Engagement and Community Development, which tracks the closure of small town groceries and offers business advice to communities and shop owners.

The result of these local initiatives is that at the last count Kansas had 193 rural shops, almost the same number as in 2007.

There are no guarantees that all the stores will survive. However, the determination of the communities is encapsulated by Carole Hamilton, a cashier at a threatened shop in Moran, Allen County, due to become a food co-operative: “I believe people will fight to keep it open.”

The government estimates that 55 million Americans live in food deserts. Could Kansas be a model for other states?

Photo: Flickr Creative Commons 2.0

Jeff Bezos' Sustainability Catch-22

Jeff Bezos had an interesting tweet for Earth Day:

Dog sledding above the Arctic Circle in Norway. Jim Lovell says it’s not that you go to heaven when you die, but “you go to heaven when you’re born.” Earth is the best planet in our solar system. We go to space to save the Earth. @BlueOrigin #NoPlanB #GradatimFerociter #EarthDay

The text was followed with a short video showing Bezos enjoying dog sledding. However, not everyone enjoyed this tweet. Comedian Sarah Silverman responded to Bezos’ tweet saying:

Why do your employees need to be on food stamps & govt assistance? Be an example of fair payment & take the pressure off the taxpayers who are subsidizing ur lack of fair pay. I KNOW you can do it, Jeff! Don’t be like the Waltons of Walmart.

This exchange got me to rethink about Bezos. The conclusion I have reached lately that he is not only one of the richest persons in the world, but also the most important one when it comes to sustainability. In other words, he is the person with the most influence on the future of this planet, sustainability wise, which basically means he is the person with the most influence on our future—period.

Let me explain why I think this is the case and whether you should be super excited or very afraid.

First, I have to admit Bezos and his approach to sustainability have fascinated me ever since I started looking into Amazon’s sustainability issues back in 2011. In 2013, for example, I asked here if Bezos is really a long-term guy as he claims, given Amazon’s poor record on sustainability. While Amazon has improved its track record since then, I still don’t have an answer to this question.

One place to explore Bezos’ approach to sustainability is his annual letters to Amazon’s shareholders. In his most recent letter, which was published earlier this month there is a specific paragraph relating to sustainability:

Sustainability – We are committed to minimizing carbon emissions by optimizing our transportation network, improving product packaging, and enhancing energy efficiency in our operations, and we have a long-term goal to power our global infrastructure using 100% renewable energy. We recently launched Amazon Wind Farm Texas, our largest wind farm yet, which generates more than 1,000,000 megawatt hours of clean energy annually from over 100 turbines. We have plans to host solar energy systems at 50 fulfillment centers by 2020, and have launched 24 wind and solar projects across the U.S. with more than 29 additional projects to come. Together, Amazon’s renewable energy projects now produce enough clean energy to power over 330,000 homes annually. In 2017 we celebrated the 10-year anniversary of Frustration-Free Packaging, the first of a suite of sustainable packaging initiatives that have eliminated more than 244,000 tons of packaging materials over the past 10 years.

In addition, in 2017 alone our programs significantly reduced packaging waste, eliminating the equivalent of 305 million shipping boxes. And across the world, Amazon is contracting with our service providers to launch our first low-pollution last-mile fleet. Already today, a portion of our European delivery fleet is comprised of low-pollution electric and natural gas vans and cars, and we have over 40 electric scooters and e-cargo bikes that complete local urban deliveries.

This gets even more interesting when you go back to the 2016 letter, where Bezos writes:

One thing that’s exciting about our current scale is that we can put our inventive culture to work on moving the needle on sustainability and social issues.

These texts suggest that Bezos is aware of Amazon’s sustainability impacts and prioritizes initiatives focusing on energy consumption, packaging and transportation. We can also learn that Bezos is interested to utilize Amazon’s inventive culture to make a difference. So far, so good, but this story gets more complicated.

First, Amazon indeed takes steps to reduce its environmental footprint, but its general lack of transparency and somewhat vague goals (“have a long-term goal to power our global infrastructure using 100% renewable energy”) make it more difficult to assess how substantial these steps are. Amazon, for example, still doesn’t share its carbon emissions, or its carbon reduction goals. Even its Sustainability Question Bank or sustainability pages don’t provide much clarity about it.

Second, Amazon’s approach to sustainability is grounded in its famous customer obsession. This is important in particular when it comes to consider how Bezos may apply its “invention culture” to make a difference. We need to acknowledge that customer needs (or their job-to-be-done) guide Amazon’s innovations – you can see it very clearly in the only invention Bezos refers to in his letters - Frustration-Free Packaging, which came to the world after Amazon received growing negative feedback from customers who were frustrated by the need “to liberate products from hermetically sealed clamshell cases and plastic-coated steel-wire ties.”

This customer-centered approach to innovation, which could be noticed this week with the introduction of the new delivery service to the trunk of your car and Echo Dot Kids Edition, as well as the discussion on the company’s plans to build home robots, is a catch-22 when it comes to sustainability. The catch is that customers care more about the ease and convenience of their shopping experience than how sustainable it is, and as long as Bezos and Amazon follow customers’ lead, Amazon will continue to focus on making our shopping experience (and home environment) more delightful, not necessarily more sustainable. The more Amazon will do it, the less sustainable shopping will probably become.

Amazon has proved itself in the last couple of years as one of the most effective forces in shaping consumer behavior, at least in this part of the hemisphere. This is not just about moving consumers from brick and mortar retail to e-commerce, but also about shaping the culture of consumption overall. There are very few companies who have reached this level of influence on our minds, which creates an incredible opportunity for Bezos to move the needle, especially given Amazon’s expected continued growth. He can make Amazon a force for good that will help us embrace sustainability into our life at scale, using Amazon’s innovation capabilities to make this transition easier and faster.

Will he do it? Will Bezos become the powerful change agent the sustainability movement so desperately needs? I wish I could say ‘yes’ – it would at least help me feel better about being an Amazon customer. However, Amazon’s very slow journey into environmental sustainability, and what seems to be even a slower journey into social sustainability (see here and here about the company’s warehouse employees) suggest that even if Bezos will somehow transform ‘customer obsession’ into ‘sustainability obsession’ it’s not going to be anytime soon.

As Bezos wrote in his 2018 letter to Amazon’s shareholders: “Used well, our scale enables us to build services for customers that we could otherwise never even contemplate.” I agree with Bezos, but also want to ask him to consider Paul Ehrlich’s warning that “overpopulation and overconsumption are driving us over the edge.” Even if consumers do not see the edge, it is Bezos’ responsibility to do so, especially as someone who prides himself to be a leader who is solely focusing on long-term value creation.

Image credit: thierry ehrmann

SDGs Supported by New Service that Matches Sustainable Corporates and Socially Driven Startups

A new service bringing together corporates and businesses able to support their ethical policies is to be offered by fetch, a Dutch company formed this year to promote the UN Sustainable Development Goals.

Formed in the city of Nijmegen this year and a signatory of the Dutch SDG Charter, fetch will introduce a global digital platform providing what it calls “unique match-making” between companies and “sustainability and social-driven start-ups”.

The company, partnered with Agora Partnerships, an accelerator for entrepreneurs working to make social impact; Amsterdam-based Circle Economy, which encourages circularity; and the social-tech network TechForGood in Tel Aviv, goes live with its platform early in May.

The platform, says fetch, will enable start-ups to showcase their market-ready innovations to corporates and will allow corporates to pick the right businesses to help them.

Founder Alison Azaria says: “Fetch is born from years of research and understanding of what the market needs to make the world a more sustainable place.

“Through my experience in working with corporates and feedback from start-ups, I saw a gap and a channel missing in connecting the two.

“The idea for fetch is to create one global digital platform where members can search for innovations that align with their goals around all topics under the sustainability umbrella and the Sustainable Development Goals.

“The aim … is to become the world’s largest digital platform with a searchable database of sustainability and social innovations around the globe.”

The fetch objectives are in line with a wide-ranging report from the Business and Sustainable Development Commission, an international body dedicated to directing businesses towards the UN goals.

The report makes the case for businesses to concentrate on solving the world’s greatest challenges stated in the UN goals. It maintains that achieving the goals would have a monetary value of $12tn (£8.5tn, €9.8tn).

However, the report points out: “There is much more than $12tn of value at stake. There is the opportunity to shape a safer, more prosperous world with a more predictable future in which to invest and innovate.

“There is the chance to rebuild trust between business and wider society.”

The commission then reminds business bosses that that they must “lead the charge for sustainable growth” if a better world is to be realized.

Those leaders’ intentions, it says, must include marketing products and services inspiring consumers to make sustainable choices, and using the goals to guide leadership development, women’s empowerment, regulatory policy and spending.

One result envisaged is that the goals will create 380 million new jobs by 2030, but they must be decent jobs with a living wage.

Another is that fiscal systems may have to be reformed, reducing tax on employees’ incomes and increasing them on pollution and underpriced resources.

The spotlight is thrown too, on slave labor. The estimates are that worldwide between 20 million and 40 million people are working in modern slavery and more than 150 million children are working in fields, mines, workshops and on rubbish dumps without protection. This scene is “an unacceptable feature of 21st-century capitalism”.

Fetch’s last word is that it will continue to evolve, thus “enabling our generations and the generations to come to live a more sustainable and responsible life”.

The commission’s final word mixes a warning with a rallying call: “The world has 13 years before the deadline it has set itself for achieving the global goals.

“Company leaders will never have a better moment in which to align their business objectives with creating a better world.”

Photo: UN SDGs

HP Inc. Combats Unconscious Bias by Reinventing Mindsets

(L TO R) HP General Manager and Global Head of HPS Business Anneliese Olson, Labs research scientist Mithra Vankipuram, Chief Legal Officer Kim Rivera, Chief Diversity Officer Lesley Slaton Brown and Global Chief Marketing Officer Antonio Lucio celebrating International Women’s Day in 2017.

The cure for systemic unconscious cultural bias in business is a systemic overhaul of corporate values from the top down. Not many companies have managed to immerse themselves in this diversity and inclusion challenge more than HP Inc. In 2015, when the Hewlett Packard Company split into 2 separate companies (Hewlett Packard Enterprise and HP Inc.), HP intentionally created a diverse board of directors that today is made up of 40% women and 50% minorities.

From there, the company dove head-first into their D&I commitments by creating a supplier diversity & inclusion “holdback initiative,” setting standards for all in their supply chain to meet exacting requirements in their businesses, or risk no longer doing business with HP.

This past year, in an effort to continue to drive awareness around the importance of diversity and inclusion, HP launched a powerful project dedicated to identifying unconscious bias, entitled "Reinvent Mindsets." The multi-level initiative is an explicit call-to-action around “HP is hiring and talent is the only criteria,” to recruit, retain and promote diverse talent to HP.

“Building a diverse and inclusive workforce is central to our mission of delivering technology that makes life better for everyone, everywhere. Diversity and inclusion is a values issue and a business imperative,” says Lesley Slaton Brown, Chief Diversity Officer at HP. “As a company, we believe we have an obligation to take action by driving systemic change in our industry and ensuring our workforce reflects the communities we serve.”

Reinvent Mindsets supports this mission with a video series aimed at African Americans (“Let’s Get in Touch”), women (“Dads & Daughters”), the LGBTQ community (“Proud Portraits”), and the U.S. Hispanic community (“#LatinoJobs”). The series has been raising awareness of challenges faced by these groups and encouraging dialogue on bias and self-reflection about identity and our subconscious assumptions about others. And they are not finished— HP’s Reinvent Mindsets campaign will next explore engagement with US veterans.

With this series, and the dialogue it creates, HP hopes to be a part of not only the solution of creating a more diverse workforce in tech, but to be a part of the larger solution as well.

Photo: HP INC.