Businesses, NGOs Partner to Create New Supply Chains for Ocean Plastic

Ocean garbage is gaining global attention these days as businesses, researchers, filmmakers and sustainability experts marshal efforts to address the ocean’s biggest environmental threat.

Spanning some 600,000 square miles, the Great Garbage Patch, a collection of plastic and debris floating between California and Hawaii, is still growing. A recent study headed by the Ocean Cleanup Foundation reported that the island of fishing nets, plastic bottles, bags and other debris is now estimated to be twice the size of Texas, “four to sixteen times [the amount] previously reported” in earlier studies.

The news is inspiring action from an eclectic group of activists from around the world – including one all-female research team well known for its effort to highlight women’s professional contributions to marine science as well as their inspired if not gutsy explorations.

Led by British skipper Emily Penn, EXXpedition will journey through the world’s largest of four patches of ocean garbage, starting in Hawaii, and ending in Seattle. The 3,000 nautical mile journey, which will be accompanied by sustainability experts, scientists, business people and filmmakers is due to take them through some of the densest sections of the Pacific patch, with the aim of sampling some of the findings along the way.

Marine researcher Emily Duncan, from the University of Exeter in the U.K. will head up the scientific research. Her team will be looking at the impact of microplastics on marine fauna, including the sea turtle, whose numbers have been declining due to habitat destruction and pollution.

They are also aiming to highlight the need for increasing acceptance of women in the science, technology, engineering and math fields – and what they see as an “imbalance in research funding directed towards gender specific diseases” like breast cancer. This year's expedition also explores the impact that the ocean pollution has on human health.

While EXXpedition is the first female team to focus its trip and research on drawing attention to the Pacific gyre, it isn't the only organization these days trying to draw attention to the destructive impact of ocean pollution.

11th Hour Racing, a Newport, RI organization is well known for its strategic partnerships within the sailing and maritime communities. Emily Penn's EXXpedition, a grantee of 11th Hour Racing, is a benefactor of 11th Hour Racing's collaborative approach in promoting environmental sustainability.

Through a three-pillar system of engagement with partners, grantees and ambassadorships, 11th Hour Racing works to promote collaborative, systemic change that among other things, helps to curb ocean pollution.

One such partnership is with Vestas 11th Hour Racing, a team currently competing in the 2017-18 Volvo Ocean Race (due to finish at The Hague, Netherlands July 1), a nautical race known for its support of environmental sustainability.

11th Hour Racing also supports other environmental projects, such as recovering abandoned fishing nets and gear that can then be molded into eyewear by sunglass manufacturers like Karun. Nearly half of all of the ocean pollution is estimated to be due to discarded fishing gear.

With its current sponsors, Vestas and 11th Hour Racing, the racing team has also been active in educating small communities about the need to curb discarded plastic. The team has established the Vestas 11th Hour Racing Exploration Zone, a series of interactive displays that can be transported from village to village along the route of the Volvo Ocean Race to educate people about how they can help protect the ocean’s vitality.

Depending upon where you are this summer, it looks to be a good time to advocate ecological issues from a seat of your vessel. One Australian team of kayakers has turned a paddling trip from Alaska to Vancouver Island into a research trip that can ultimately help nonprofits clean up beaches. Mathilde Gordon’s and Lucy Graham’s paddling trip will help raise funds for organizations that do research on ocean plastic and pay for expensive fly-ins to areas where marine are being threatened by pollution. Projects have a local and global impact: They raise awareness and efforts at the local town level near the site, while increasing awareness in other parts of the world where the research is tabulated, analyzed and published.

Businesses are also stepping up to advocate for change, from clothing manufacturers to computer and credit card companies.

- Musto, a U.K. clothing company that makes gear for Vestas 11th Hour Racing, is working to reduce the virgin sources of plastic in packaging. The manufacturer is one of a growing list of companies that’s supporting Volvo Ocean Race's Clean Seas Campaign to reduce and reuse plastic in supply chains and in the environment.

- Dell, which last year developed a way to repurpose ocean plastic as packaging materials, is now planning to eliminate the use of plastic straws in its facilities. It timed the announcement to coincide with World Ocean Day this year (June 8). Although straws are made from type 5 plastic, many recycling systems aren’t equipped to process them, so they end up either in landfills or in the ocean.

- And just to prove that there are many, many ways to reuse that floating bottle or sunken net, American Express has partnered with Parley to come up with its own innovative fix: Yes, a credit card made from ocean plastic. The card is currently in prototype and is expected to be released in the coming year. The company says it's also phasing out the use of plastic straws in its facilities as well as moving toward powering its data centers with green power.

The efforts to reduce and reuse come at a good time politically as well: With the news that debris in the Pacific ocean gyre is increasing, not disappearing, several communities are considering laws to ban straws and other types of plastic. Seattle, Maui, New York and Victoria BC Canada already have plastic straws on their elimination lists as communities look for new ways to stop the ocean’s growing supply chain of plastic.

https://vimeo.com/130961711

Flickr image: NOAA Office of Response and Restoration

How Do We Make a ‘We’ That Is All of Us; How Do We Embrace Different?

By Sonali Sathpaty

Company is a microcosm of the world

I heard actor Asia Kate Dillon speak at the Bloomberg Gender Equality summit in New York recently. Dillon, who identifies as both transgender and gender non-binary made a powerful case for equality at the workplace: They said and I quote, “Your company is a microcosm of the world as you see it, the way you want it to be. Do you want to live in a more free and inclusive world because you have a desire to be included, to be truly equal, to be free? No one is free until we all are free. Until the most marginalized amongst us; black, indigenous, people of color especially trans, intersex and gender queer folks and differently abled folks are held up as essential assets for the survival of us all, no one will be free…When we work to make the world more safe and free for others, we are ultimately making the world more safe and free for ourselves”.

This is the spirit and sentiment that we are striving to achieve at Schneider Electric. We believe that “Access to energy is a basic human right” – our aspiration is to improve the lives of people everywhere in the world by developing sustainable energy solutions for our customers. This belief also extends to our Diversity & Inclusion philosophy. Our ambition is to offer equal opportunities to everyone everywhere, and we want our employees — no matter who they are, or where in the world they live — to feel uniquely valued, and safe to contribute their best. For us diversity of people and an environment of inclusion generate greater engagement, performance, and innovation.

Creating a bias free and inclusive culture

Diversity is challenging because it highlights our differences. Sometimes the differences are visible and sometimes not. This makes it even more important to create a culture which is bias free and inclusive. By signing the UN Free & Equal Standards of Conduct for Business on Tackling Discrimination against Lesbian, Gay, Bi, Trans & Intersex People we made a global commitment to go above and beyond the diversity challenge.

By adopting these Standards, we as a company pledge to:

- Respect the human rights of our LGBTI workers, customers and members of the public

- Eliminate workplace discrimination against LGBTI employees

- Support LGBTI employees at work

- Prevent discrimination and related abuses against LGBTI customers, suppliers and distributors – and insist that suppliers do the same

- Stand up for the human rights of LGBTI people in the communities where we do business

We know from experience that public commitments such as these are important signals both within the organization and in the larger eco-system within which we operate- our customers, partners, shareholders and future talent. We also know that to be truly effective, these commitments need to be hardwired through policies, practices and bias-free processes. Which is why we have set ourselves the task of creating an environment of safety and trust so that employees can bring their true selves to work.

Earlier this year, we announced our global anti-harassment policy to demonstrate our commitment to zero-tolerance on all kinds of harassment, including sexual harassment. As recent events have shown, harassment is still quite pervasive and often goes unreported. As a global organization we need clear and consistent expectations of work place conduct to ensure a work place free of harassment.

In 2017, when launching our Global Family Leave policy, we ensured that we had a very inclusive definition of family recognizing that family needs are different for each employee.

Being inclusive is not difficult, but it is a deliberate action

But what about the everyday inequities, the micro-aggressions that occur on a daily basis, that can have such a negative impact on people? Being inclusive is not difficult, but it is a deliberate action. Most of us think of ourselves as inclusive people but we know that bias exists in all of us and we all have triggers which make us sometimes act in ways that might not always be perceived as inclusive. So, it’s important that we are aware of those triggers. In 2017, hidden bias education was rolled out to our top leaders, role modeling the change we want to drive. That rollout will continue to all managers and employees in 2018. However, training alone will not result in a culture of inclusion, and deliberate practice of these behaviors will need to be reinforced, rewarded and recognized to create lasting impact.

Olivier Blum, CHRO Schneider Electric, in his blog on “ Building an Inclusive Company in a Diverse World” summarized it very well. He said, “Diversity may be visible through representation, but inclusion is characterized by acceptance within diverse teams that in turn creates room for mutual respect, and multiple perspectives. Simply put, diversity is meaningless without inclusion…. I am convinced that global corporations must become visible role models, and advocates of change within society. There is great value in contributing to the debate by sharing experiences, and learning from others.”

As we celebrate Pride month, I would like for us to pause and consider the question Asia Kate Dillon posed to the audience – “When you acknowledge that you yourself are ever evolving, ever changing, different every moment of everyday, you acknowledge the same is true for all people. We must embrace the difference…the things that make us different those are our super powers… the question then becomes; how do we make a “we” that is all of us?”

Sonali Sathpaty is Vice President Diversity and Inclusion

Photo: Schneider Electric

Originally published by Schneider Electric and distributed by 3BL Media.

US Army Pursues "Instant" Renewable Hydrogen With New Nanopowder

Scientists in the Army Research Laboratory have developed a formula for plucking renewable hydrogen fuel out of practically any water based liquid, from leftover coffee and energy drinks to, well, just about anything else. Use your imagination!

Under ordinary circumstances, research like this could wandering for years through the "Valley of Death" that separates laboratory proof from marketplace profitability. However, in this case the labwork looks so promising that the Army is already looking around for a licensee to kick the technology into commercial development.

Renewable Hydrogen From Just About Any Kind Of Liquid

So, why is the US Army interested in renewable hydrogen? As a matter of fact, the US Army is climate-aware and it has developed a triple bottom line perspective that includes sustainable energy, with renewable hydrogen being yet another manifestation.

For those of you new to the topic, hydrogen is a cheap, abundant, zero-emission fuel but it does not have a standalone existence in nature. Currently the main source of hydrogen is fossil natural gas, but there some renewable pathways, too, such as biogas.

Another promising, renewable option is electrolysis, the process of "splitting" water with an electrical current generated by renewable energy.

The Army Research Laboratory is on still another track. Instead of splitting water with electricity, ARL researchers have come up with a formula that uses an engineered, powder-like form of aluminum to trigger a reaction that releases hydrogen.

The ability of aluminum to spark a hydrogen-producing reaction in water is well known. However, under normal conditions aluminum quickly develops a protective layer that prevents the release of hydrogen.

Until now, the workaround has involved breaking up the protective layer by adding toxic or expensive substances to the mix, or by applying an additional energy source.

The new breakthrough involves engineering a new form of aluminum that ARL is calling a "nanogalvanic structured aluminum based material." It can touch off a reaction at room temperature, without the need for any kind of exterior power source or any other additive.

The reaction takes place in under three minutes at almost 100 percent efficiency, a vast improvement over other methods that can take hours and achieve only 50 percent efficiency (to see how robust the reaction is, check out the ARL video on YouTube).

As another advantage over previous methods, the byproducts of the reaction are only heat and an inert residue.

According to ARL the reaction can occur with "virtually any" water based liquid including "naturally scavenged water, coffee, energy drink, urine" and more.

As an additional bonus, the new powder can be 3-D printed on an as-needed basis, which could simplify storage and other supply chain logistics. With the printing equipment on site, the aluminum could even be scavenged from disabled vehicles or other derelict equipment.

But Is It Practical?

The renewable hydrogen breakthrough was one of those accidental discoveries that could have a significant impact:

During routine materials experimentation at the U.S. Army Research Laboratory, a team of researchers observed a bubbling reaction when adding water to a nano-galvanic aluminum-based powder.The reaction surprised the researchers, but they soon considered its potential implications for future power and energy applications.

The potential for practical applications looks promising. Last year, ARL calculated that 220 kilowatts of energy could be produced by one kilogram of the new aluminum powder, or double that if heat production is taken into account.

They also demonstrated that the renewable hydrogen from the reaction could be captured and used in a fuel cell to power small electronic equipment.

Why Renewable Hydrogen?

As for why the US Army is especially interested in renewable energy, that's become clear in recent years. The ability to scavenge energy from local sources provides for more secure and effective operations in the field, compared to the conventional, expensive and dangerous practice of shipping fuel to overseas bases.

Last year, the ARL research team found that the reaction is especially rapid and efficient when the liquid in question is urine. ARL research team leader Scott Grendahl explains one particular application, for reconnaissance teams:

These teams are out for a short number of days, three to five days, and a lot of that depends not only on their food supplies, but on how long their supplies last in terms of their equipment and right now that stems from lithium batteries. If we can recharge those batteries, they can stay out longer.

Space exploration provides the inspiration for recycling and reclaiming energy sources:In space, astronauts recycle waste water and urine because drinking water is a precious commodity. For Soldiers in austere environments, there are many precious commodities. Power and energy is becoming increasingly important to run communications and electronics gear for away teams, which can't be resupplied.

If all goes according to schedule the next steps will occur rapidly. This week the Army has planned to open the process of finding a vendor to license the patented powder, with the expectation that interested parties will submit their applications in September.

Photo (cropped): via US Army ResearchLaboratory.

U.S. Business Taking a Stand Against the Separation of Families at the U.S.-Mexico Border

By now, it is clear that the American public is split over what is going on along the United States’ southern border – either you are in the Corey Lewandowski “womp womp” camp, or your thoughts on the issue are aligned with Rachel Maddow, who broke down last night while announcing an Associated Press breaking story over young children being sent to “tender age” shelters.

Now, many business leaders are showing which side of the “empathy gap” they are on – and many are not waiting to write an official press statement. Instead, they are stepping over themselves on social media platforms such as Twitter to show where they stand on this human rights crisis.

Many business groups, such as the Business Roundtable, are not mincing words and have joined the #KeepFamiliesTogether hashtag bandwagon:

“Cruel” was the choice word used by AirBnb’s co-founder and CEO, Brian Chesky. “Gut-wrenching,” from the point of view of Google’s CEO Sundar Pichai.

Another Airbnb co-founder, Joe Gebbia, told the Financial Times that the company’s response to this controversy was in part driven by the reactions of the travel accommodation web site’s employees, hosts and users. While Gebbia explained to FT that Airbnb experienced some “blowback” to its stance on immigration during last year’s immigration ban saga, any negative impact on its business at the most left no “meaningful dent.”

Chobani’s founder Hamdi Ulukaya, who himself has received death threats due to his company’s open-arms policy of hiring refugees, weighed in as well.

Meanwhile, the U.S. Chamber of Commerce, hardly a bastion of left-leading economic and social policy, ripped into the Trump Administration’s policy of trying to leverage the separation of families to influence Congress to change federal immigration policy:

“Let that sink in for a second: our government is forcibly separating children – including toddlers – from their parents and sending them to detention facilities as a means of sending a message and influencing Congress.”

Other CEOs have gone beyond assailing the White House’s current stance on how families are being treated along the border, announcing the ways in which their companies taking action. For example, Lyft’s co-founder and CEO, Logan Green, said they are offering “relief rides” for organizations working to assist families affected what is happening in southern Texas.

The co-founder and CEO of Yelp, Jeremy Stoppelman, urged other technology companies to join him in a planned nationwide really activists have planned on June 30.

Some corporate leaders are opening their wallets. Facebook’s Mark Zuckerberg and Sheryl Sandberg have reportedly donated to a fundraiser that seeks to help reunite migrant children with their families.

As FT’s Andrew Edgecliffe-Johnson explained, these actions show that companies are evolving past the twentieth-century “singular focus” on producing profits to demonstrating current responsibilities to all stakeholders.

We expect even more companies and brands to take a stand on this polarizing issue, but at the same time, there are some business leaders who are taking a more nuanced stand on how they feel about families being separated at the U.S. border. Tesla’s Elon Musk, for one, has appeared to throw up his hands. When called out on Twitter for taking a lukewarm stance on the border crisis, Musk simply responded.

Others, such as Goldman Sachs’ CEO Lloyd Blankfein, tried to have it both ways. According to Fortune, Blankfein described the ongoing situation as “heart-rending” and “tragic.” But he also had this to say about the line in the sand that the Trump Administration has drawn:

“It’s easy to criticize. It’s easy to say what you would do if you didn’t have to bear the consequences for what you decided. But when you have to bear the consequences . . . that’s what’s tough. That why I have a lot of sympathy for the people making the decision making. So when something doesn’t quite work out I right, I don’t want to go out and kill the person who made the decision… I wouldn’t want to be in the position we find our government in now, in respect to the tragedy that’s going on at the border.”

Now we ask you: what stand is your company taking toward what is happening along the Texas-Mexico border?

Be sure to stay in touch on how companies are responding to this and other controversial social and political issues with our Brands Taking Stands newsletter.

Image credit: U.S. Customs and Border Protection/Wikipedia

This Florida Utility Has Become a Global Leader in Renewables Investment

Where's the world's largest manager of solar and wind power installations? Is it based in the Netherlands, Germany or renewables juggernaut China?

If you guessed none of the above, you are correct. The right answer is a company based in Juno, Florida - NextEra Energy, which has been operating for over 90 years.

While other companies have been agile at making a huge public relations push to scream loud and clear they are leaders in clean energy investment, NextEra has been largely silent and has stayed under the radar. The company, which says it employs over 14,000 people and does business in 30 U.S. states and four Canadian provinces, last reported over $16 billion in annual revenues and claims over $90 billion in assets.

The company, which the Wall Street Journal recently described as the "green Goliath," has built its portfolio methodically and silently. It does not boast a media superstar akin to Tesla's Elon Musk. NextEra also does not link renewables to its branding efforts in the way iconic companies such Google and Ikea have in recent years.

But what the company has accomplished is several years of nimbly chasing where the money is - as in federal tax credits and state-level environmental mandates. The company does not invest in wind or solar projects unless they have the commitment of customers and a solid business case - which has helped NextEra going no where near unsustainable mountains of debt, unlike former clean power titans such as Sun Edison.

NextEra's recent success also demolishes claims that the switch to renewables can lead to a cleaner environment at the cost of higher electric bills. The company says that its principal subsidiary, Florida Light & Power, bills its air conditioning-hungry customers 25 percent less than the national utility bill average - and has the lowest bills overall in the Sunshine State. Meanwhile, NextEra insists that all of its clean power installations have succeeded in lowering emissions at a rate equivalent to removing 12 million cars from the streets.

While NextEra's record is hardly spotless - some critics have accused the company of stifling the growth of rooftop solar in Florida - NextEra responds that its track record of investment in renewables speaks for itself. Furthermore, the company says its Florida Light & Power customers have bills that are lower on average than they were 10 years ago.

And NextEra keeps expanding its renewables business: this week, the company announced it had reached a 330 MW power purchase agreement with AT&T - just a few months after the companies signed a similar 520 MW deal earlier this year.

Image credit: NextEra Energy

Caesars Ups the Ante, Sets Scope 3 Science-Based Targets

Gaming giant Caesars Entertainment, which operates 40 properties with 60,000 employees, is turning to the vendors that supply its casino empire to help dramatically cut the company's greenhouse-gas emissions.

Among commitments made by the Las Vegas company is a 95 percent reduction in carbon emissions by 2050 from 2011, partially through the purchase of power from a nearby desert solar farm.

“Our big news is all about climate change. We’ve stood up and taken a serious stand and have set science-based carbon-reduction goals,” said Eric Dominguez, vice president of facilities engineering and sustainability for Caesars, during a recent interview at Sustainable Brands in Vancouver.

Caesars is one of over 400 global organizations that has committed to business leadership and policy alignment on climate through the Science-Based Target initiative (SBTi), and one of just over 100 companies to have their targets approved.

The SBTi is a collaboration among the Carbon Disclosure Project (CDP), the United Nations Global Compact, World Resources Institute, and World Wide Fund for Nature. Targets adopted by companies to reduce greenhouse gas emissions are considered “science-based” if they are in line with the level of decarbonization required to keep global temperature increase below 2 degrees Celsius compared to pre-industrial temperatures.

“I think we’re setting the bar on this one,” Dominguez said of the scope 3 emissions goal in the company’s verified science-based targets.

This level of commitment helps to further accelerate the momentum of reducing environmental impact as it relates to the operations a company doesn’t directly control, including supply chain and vendors. This indirect influence also makes it one of the most ambitious goals for a company. With thousands of suppliers, Caesars recognized the importance of engaging the full supply chain in order to create meaningful impact, Dominguez said.

Commitments include reducing absolute Scope 1 and 2 emissions by 30 percent by 2025, and 95 percent by 2050 from a 2011 base year. Caesars said 60 percent of its suppliers, calculated by spend, would institute science-based greenhouse-reduction targets for their operations by 2023.

Watch our interview with Dominguez here.

Image credit: Shutterstock

America's Leading Companies Have Always Understood the Need to Invest in Their Brands

By Suzanne C. Shelton and Gil Jenkins

What's becoming a more mainstream notion now is that any shrewd brand investment would do well to articulate a commitment to environmental stewardship.

Consumers are primed to reward companies for making proactive, public commitments to both overarching sustainability and related renewable energy initiatives, according to newly released data from Shelton Group.

The findings indicate that while a clear majority of Americans care significantly about the environment, they aren't necessarily willing to translate those concerns into lifestyle changes they deem inconvenient or uncomfortable. Put simply: What they are willing to do is adjust their buying habits to align with their professed values.

Shelton Group found that:

* 88 percent of Americans believe the average person should be taking concrete steps to reduce his or her environmental impact, and

* 78 percent of Americans feel some sense of personal responsibility to change daily purchase habits and practices to positively impact the environment.

But:

* Nearly two-thirds of Americans say they most often choose personal comfort or convenience over the environment.

That's where brands come in.

* Nearly 60 percent of millennials look to companies to solve social and environmental problems they feel they can't address - or would rather not have to.

* Approximately two-thirds of Americans say a company's environmental reputation impacts their purchase.

* 60 percent of Americans say corporate social responsibility activities positively impact their purchase decision.

* Nearly one-fifth of Americans can now name a brand they've purchased - or not purchased - because of the environmental record of the manufacturer, a number that has risen dramatically over the last two years.

Renewable Energy: A Winning Narrative

The above data builds on a long track record of research suggesting that companies on the forefront of sustainability are inherently making a smart investment in their brands to attract customer preference and/or loyalty.

Of course, consumers can't act on these partialities if they remain in the dark about corporations' sustainability efforts, such as efforts to power operations from emissions-free renewable energy in the form of wind and solar power - which is quickly becoming a central plank of any sound corporate sustainability strategy.

Yes, corporate renewable energy purchasing is having a moment. Today, more than 50 companies across numerous industries sectors have signed up for renewable energy purchase agreements in the past five years - an incredible figure considering that just a decade ago it was only four companies: Apple, Google, SC Johnson and Walmart. In 2017 alone, corporate renewable energy deals equaled nearly 2.8 gigawatts of renewable power, roughly equal to the capacity of all power plants in Iceland!

All the progress on corporate renewable power purchasing suggests we may be reaching a turning point for something that was primarily limited to technical and financial discussions in the B2B world toward a broader conversation in the consumer marketing arena - a point where "powered by renewable energy" is seen as the badge of honor that every brand must have in its toolkit.

The fact is, even for the Americans who aren't keenly aware of a company's sustainability efforts, renewable energy tests very well. And broadly, "use renewable energy" is the second most important action Americans think companies should take to demonstrate their commitment to the environment.

Americans want to see more renewable power, regardless of where they live or their political persuasion. Refreshingly, a recent Pew study found that "robust support for expanding solar and wind power represents a rare point of bipartisan consensus in how Americans view energy policies." More specifically, 89 percent of U.S. adults favor more solar panel farms and 85 percent favor more wind turbine farms - roughly double the preference for any other form of energy development.

As two veteran practitioners in sustainability communications and brand marketing, we know firsthand that despite our progress in building consumer awareness and preference, green initiatives can still be viewed negatively by some Americans, seen as esoteric, costly, partisan or just plain dull.

Now, what is beginning to be widely understood among top brand marketers is that renewable energy offers a stronger value proposition among consumers when compared to other planks of a company's sustainability strategy. But it doesn't take an expert to surmise - who wouldn't want to attach their brand to any issue with an approval rating is in the high 80s?

Household Brands Go Renewable

Given the size of its marketing budget, anytime Anheuser-Busch InBev rolls out a major campaign it's worth taking note. Given how precious space on brand packaging can be, it's especially notable when a sustainability initiative makes its way on to the hero product.

This spring, Anheuser-Busch InBev started selling its flagship Budweiser with a new symbol on each iconic bottle highlighting that the beer was brewed using 100% renewable electricity. AB InBev's bold move is part of larger initiative to encourage more companies to sign on to similar goals and adopt the new badge.

And to add a dash of viral marketing flair like only a brand like Budweiser can, the company commissioned a base jumper to leap off a wind turbine and unfurl the 100% symbol at its brewery in California.

AB InBev's big foray into renewable energy marketing stands out for its ambition and reach, but it’s not the only new renewables campaign in the last year from other leading corporations and their household brands.

In the fall, the world's biggest chocolate maker, Mars, launched the "Fans of Wind" campaign through its M&M's brand to spread the messages about its sustainable solutions to combat climate change. Connecting the dots between renewables and the greatest environmental challenge of all time in an approachable and easily understood manner, Mars deftly noted:

"PEOPLE SURE DO LOVE M&M's. THAT'S WHY WE MAKE A TON OF 'EM. BUT WE'RE NOT JUST ABOUT MAKING TREATS THAT EVERYONE LOVES - WE WANT TO MAKE THEM IN A WAY THAT IS SUSTAINABLE AND TREATS THE PLANET BETTER. GUESS THAT'S WHAT MAKES US SUCH BIG FANS OF RENEWABLE WIND ENERGY."

Not long before the Mars entered the game, the big dog in consumer brand marketing - Proctor & Gamble - launched a transformative new product under its Tide detergent label featuring prominent sustainability messaging on the bottle, which notes the plant-based formula is made with 100 percent renewable wind power electricity and is sold in a recyclable jug - thereby achieving a rare sustainability marketing trifecta.

All three of these big brand marketing campaigns are validating a trend to tell sustainability stories through the lens of renewable energy efforts, but we're only scratching the surface in terms of brands that could be embracing the opportunity.

Consider the RE100 companies - a collaborative, global initiative uniting more than 100 influential businesses committed to 100 percent renewable electricity. Taken together, they aim to deploy more than 87 gigawatts of renewable energy worldwide over the next decade.

While all these companies should be applauded for their efforts, many consumer-facing brands with ambitious renewable energy goals have not made their way from the sustainability department to the marketing department.

Brands are missing out when they set ambitious environmental goals and leave it at that - you must let consumers know about it. When that happens, it's easy for consumers to feel like they're making a difference simply by making a purchase.

And when, in turn, those companies are rewarded by increased brand loyalty, more and more companies will incorporate clean power into their operations. Everybody wins.

Here in America, despite the current administration's misguided attempts to return us to the expensive polluting power of the past, the renewable energy economy has arrived. And it's only going to get bigger.

All consumers (not just millennials or the environmentally conscious) stand ready to reward brands for leading the charge toward a clean energy future.

The companies setting ambitious sustainability goals and implementing renewable energy purchase programs are reaping the operational benefits that come from such commitments - but the brands that can also translate this story through product marketing will be the biggest winners at the end of the day.

Just look at your beer, candy or laundry detergent a little closer if you don't believe us.

Suzanne Shelton is president and CEO of Shelton Group, the nation's leading marketing communications agency focused exclusively on energy and the environment.

Gil Jenkins is Vice President of Communications at the American Council on Renewable Energy (ACORE), a national non-profit organization that unites finance, policy and technology to accelerate the transition to a renewable energy economy.

Photo: Shelton Group

The Next Big Corporate Outsourcing Trend? How To Do Good.

By Mark Horoszowski

The final corporate social responsibility(CSR) reports from 2017 have hit the printing presses and one thing is clear: despite notable efforts to create social good (and publicize it), consumers and employees think that companies should be doing more.

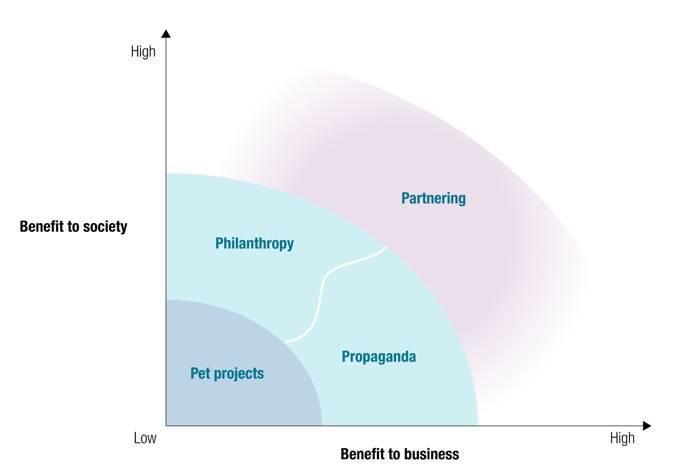

Research from McKinsey highlights that indeed, there is a growth in CSR Programs. The report also provides analysis showing that for CSR programs to be effective in creating an impact and bottom-line results, organizations must proactively create partnerships with external groups.

This shouldn’t really come as a surprise. Corporations are already increasingly outsourcing their core business processes, and now they are outsourcing critical aspects of their social impact projects, too.

Two weeks ago, 28 global brands - like Microsoft, PwC, and Timberland - took home Halo awards from the Engage for Good conference in Chicago. All were recognized for their leadership in developing and scaling social impact programs that created lasting change, while benefiting the business’ bottom line - but none of these companies did it alone. While the award-winning programs were vastly different, they all shared something in common: all received awards alongside external partners that were critical to delivering their for-good programs.

Microsoft’s MySkills4Afrika program is just one such example which received a Halo award for best employee engagement program through skills-based volunteering, which is modelled after and in collaboration with the MovingWorlds Experteering platform. Outsourcing is, of course, not new for Microsoft. In the same way that Microsoft is not an expert in end-user installs or device manufacturing, and hence relies on partners and outside electronic manufacturers to deliver its full value proposition, the MySkillsAfrika program relies on external support to share needed insights and best practices.

With the help of MovingWorlds, MySkills4Afrika invites Microsoft employees from all over the world to travel across Africa and volunteer their talent and deep expertise to support startups, universities, the public sector, and small-and-medium business working to build a promising future for Africans. The shared-value promise of MySkills4Afrika is fantastic: Transferring skills to the organizations that need them the most, contributing the professional development experience of a lifetime to the volunteer, and providing invaluable insights to Microsoft to learn more about some of its high-potential markets.

For corporations looking to engage in social impact programs, they can use these outsourcing lessons from the award-winning corporations featured at the Engage for Good conference:

#1: Identify the Business Objectives Your For-Good Program Is Seeking to Impact

For corporate social impact programs to take hold and be sustainable, they must address a critical business need and function. Outsourcing critical functions is an expensive and risky process and should be approached with clearly defined intentions. Before outsourcing, measurable goals should be identified for:

- Impact to people and/or planet

- Business bottom line measures

- Employee purpose achievement and professional development

Take MySkills4Afrika as an example. Before inviting employees to volunteer, Microsoft first had to build the business case for sponsoring its employees on one-to-two week volunteer projects across the African continent. It did that by highlighting some key objectives to its internal corporate funders: (1) develop technical proficiency across the African continent to increase usage of Microsoft, especially amongst startups to develop new solutions; (2) help human resources improve it recruitment and retention programs; (3) Appeal to growing employee demand to contribute to social good initiatives.

#2: Develop Clear Success Criteria with Clear Ownership

In partnership with your social good organization, make sure to document goals with clear lines of ownership. During the partner selection and project scoping process, it’s of paramount importance that both sides clearly understand these criteria, and that each organization can directly own key performance indicators. For this program to be sustainable, as the business, you should be able to connect each KPI directly to the business objectives outlined before, and that the achievement of those create direct social impact, too. Here is clear litmus test to know if you have achieved a match: Take away all your documents and pull out a scratch piece of paper. If you and your impact partner can both write down the same success metrics for the program and the partner, and who owns which, you’re at a good point of definition!

Let’s look at another recipient of Engage for Good recognition: Timberland. Timberland’s alliance with Smallholder Farmers Alliance (SFA) sets the gold standard for this, winning the best corporate environmental program. The Planting Seeds for Haiti's Futurecampaign smartly defined a goal that achieved a business objective for Timberland, while an impact goal for the SFA: Plant 5 million trees in 5 years, and develop a model along the way that would self-sustain the SFA, which was accomplished with a tree currency model. This aligned with the Smallholder Farmers Alliance’s mission of creating more economic opportunities for its farmers, while ensuring the long-term health and biodiversity of the land they worked, which included planting trees for environmental preservation. And here was the genius in this partnership: by aligning on creating a self-sustaining model alongside impact, the two parties remain engaged sharing insights back and forth. In doing so, SFA was able to share with Timberland the need to find purchasers of higher-margin products, like cotton, which would enable the farmers to earn higher incomes. SFA, which knew many of Timberland’s objectives, was able to build on the previous success to the Seeds campaign and collaborate with Timberland to integrate into its supply chain. In this case, not only did the success criteria enable the first Seeds projects to be higher impact, but it paved the way for future partnerships innovations, too.

#3: Integrate Processes, Workflows AND Data

In the same way that a manufacturing company is reliant on sharing and receiving timely data and updates to optimize its supply and distribution chains, social impact partners needs to be integrated, too. Integrations can differ dramatically based on the industries they reside, but for social impact outsourcing to be effective, integrations must be taken as seriously as any core business outsourcing.

These levels of integrations aren’t exactly easy, but at the Engage for Good conference workshop on “”, some best practices emerged from “: The Walt Disney Company & Girl Up’s award-winning #DreamBigPrincess Global Photography Campaignand Edward Jones & Alzheimer's AssociationInvesting in a Cure campaign.

- Processes should be co-designed so that both parties know where their works start and stop, and what triggers those starts and stops.

- Workflows, and automations of them, should have clear inputs and outputs so that the status of each workflow is easy to follow

- Data should flow along the entire integration so that all partners have the just-in-time insight to make decisions, adjust their ownership areas, and improve their operations

In Summary

As corporations continue to increase the breadth and depth of social impact programs, you can expect to see an increase in the number of partnerships with companies, and the number of partnerships that each company has. As partnerships are formed, keep these lessons in mind to ensure they are productive and deliver the triple-bottom line benefits: (1) Identify and communicate your business objectives, (2) Develop clear success criteria and ownership, (2) Integrate processes, workflows, and data.

Not only will these partnerships help create more sustainable change, but they might help your program set the new gold standard for developing the best corporate social impact programs.

Mark Horoszowski is co-founder and CEO, MovingWorlds.

Photo: MovingWorlds

Focus on Professional Farmer Organizations

By Agribusiness Market Ecosystem Alliance

Ask someone in agribusiness to define what a professional farmer organization is, and you will find a wide variation in definitions and understanding. While a professional small or medium sized enterprise is fairly well defined in any other sector by many books and research on entrepreneurship, for farmer organizations this is not yet the case.

Smallholder farmers are better off collaborating in cooperatives, unions or associations, and farming is a business just like SME’s in many other industries. Many sustainability issues in agriculture such as deforestation, child labor and water scarcity can only be addressed by farmers who are beyond subsistence level.

Agreement on what constitutes a professional farmer organization has great benefits; not only to the farmer organizations themselves, but also to other actors of the agricultural supply chains around the globe. With a global definition, farmer organizations will have more clarity on what professional core capacities are needed to close deals with buyers, financial institutions and other service providers. On the other hand, the definition will guide market actors and other stakeholders in finding and working with farmer groups that have the right business management and leadership skills to establish well-functioning business relationships. So many years of collective efforts have not brought the results that everyone hoped to see concerning improvement in livelihoods and stronger supply chains. The AMEA Partners understand this and believe that a focus on entrepreneurship is needed. A shared understanding and objective to achieve better market access and improved livelihoods of farmers and their communities can smoothen the communication between the leaders of farmer organizations and their partners.

This is why the Agribusiness Market Ecosystem Alliance (AMEA) has embarked on the journey of creating the global definition for professional farmer organizations. AMEA has asked the International Organization for Standardization (ISO) to develop the global definition through an International Workshop Agreement (IWA) to ensure an independent and open process, which is global, credible, multi-stakeholder and consensus-based.

As explained by Alan Johnson, Chair of the AMEA Board and Senior Operations Officer at the International Finance Corporation (IFC), “Reaching an IWA on what constitutes a professional farmer organization will be a huge step forward for all stakeholders working in agribusiness in emerging markets. The IWA helps create a common language for all of us supporting the transition of smallholder farming from semi-subsistence to farming as a business.”

Everyone who has a stake in the agribusiness sector is invited to participate in the co-creation of the definition. Participation is possible by commenting on the existing draft definition online and/or attending the in-person IWA meeting that will be held on 7-8 November 2018 in Delft, the Netherlands. If you wish to participate in the development of the global definition, register as a stakeholder in the process here before 6 July 2018 when registration closes.

Joanne Sonenshine, Independent Chair of the IWA process on defining professional farmer organizations, emphasizes that “Coming together as diverse stakeholders to support the future of farming by ensuring fair and equitable access to finance, markets and investment is critical now more than ever. Developing a mutually agreed-upon and internationally recognized definition for professionalization in the agricultural sector, as is the case in many other working environments, will allow for more efficient, collaborative and impactful engagement among the populations that need investment most.”

Now is the time to have your voice heard, register as an IWA participant, provide your comments to the draft, review comments from other participants and consider joining the consensus-based decision making workshop in November. The final version of the IWA global definition is aimed to be published in January 2019.

Photo: AMEA

About AMEA

The Agribusiness Market Ecosystem Alliance (AMEA) is a global multi-stakeholder alliance of diverse organizations sharing a belief in the collective and transformative power of increasing the professionalism of farmer organizations and farming as a business. The AMEA Framework is a collective and integrated methodology for realizing the shared benefits for all supply chain stakeholders. The Framework is developed by the alliance globally and promoted through local implementation partnerships. The alliance includes IFC, NCBA CLUSA, IDH, ACDI/VOCA, ICCO Cooperation, Rikolto, ICRA, Small Foundation, SCOPEinsight, Fairtrade Africa, Argidius, TechnoServe, Nuru International, Heifer International, CTA, CNFA, Self Help Africa and UTZ/Rainforest Alliance.

About the IWA

An IWA is an ISO document developed through a workshop meeting. Market players and other stakeholders directly participate in developing the agreement. During this one-year-long process, organizations from over 160 ISO-member countries are invited to comment on and inform the proposed global definition. The process is led by Joanne Sonenshine, Independent Chair of the process and facilitated by NEN, the Dutch Standardization Institute on behalf of ISO.

UN’s Faremo Eyes Artificial Intelligence Potential For SDGs At IPsoft ‘Digital Summit’

By Roger Aitken

Speaking at the Second Annual Digital Workforce Summit hosted by IPsoft in New York early this June, Grete Faremo, Under-Secretary-General and Executive Director of the United Nations Office for Project Services (UNOPS), said that the potential for Artificial Intelligence (AI) was “undeniable” and saw the possibility that AI has help “fulfill the UN’s sustainable development goals (SDGs).”

The event held at Cipriani’s in lower Manhattan, which saw around 600 delegates attend, witnessed a number of keynote addresses including being human in the age of AI from Professor Max Tegmark at MIT; AI for global good presented by Simon Moss, co-founder of Global Citizen; and, the impact of AI from Anthony Abattista, Global Cognitive Advantage Leader, Deloitte.

While the exact definition of Artificial Intelligence (AI) can be broad, one thing is certain in that there will be impacts on society. And, IPsoft’s Digital Workforce Summit sought to provide a range of speakers from industry, IT and academia to explore some of the hot issues around AI. Taking centre stage in the proceedings was ‘Amelia’, touted as the “world’s most human AI platform” by IPsoft, a recognized leader in Enterprise AI.

On the AI front some big numbers were being cited at the former Cunard Shipping booking office in New York’s financial district. Anurag Harsh, Chief Marketing Officer for IPsoft, referred in opening remarks to research by Gartner that has suggested AI will create more jobs than it eliminates by 2020 - 2.3 million (m) created versus 1.8m eliminated. And, in 2021, AI augmentation will generate $2.9 trillion in business value and recover 6.2 billion hours of worker productivity. Though the impact will vary by industry, Gartner sees AI as becoming a positive job motivator.

IPsoft’s Harsh said: “The business of AI is here despite all the noise and on the way to becoming the business of normal.

Given that UNOPS, a service provider, works with partners in both the public and private sector, such as other UN agencies, international financial institutions, national governments, foundations and private companies, the scope of their work is extensive in building a more sustainable future for people in countries outside the OECD.

For example, their activities include building roads and schools in places like Afghanistan and South Sudan, helping governments deliver healthcare to their populations, through national medical procurement in places like Honduras and Guatemala, and developing off-grid renewable energy projects covering nations in places like Sierra Leone.

The list spans around a thousand projects a year in 80-plus countries and last year UNOPS’ turnover equated c.$1.8 billion. And, with the demand for their services growing at a “significant pace’ and a need to manage being critical through efficient processes, Faremo, said: “This is why we are looking closely at the opportunities and challenges

As such the UN family are trying to see how “frontier technologies” can help deliver the Sustainable Development Goals (SDGs) with real and meaningful changes in the future work and societies, Faremo pointed out. Their agenda is ambitious too with the 17 global goals having 169 targets, which aim to create a world that is sustainable, environmentally secure, economically prosperous and inclusive.

The former Norwegian government minister for 10 years under three different Prime Ministers who worked also for Microsoft as Director of Law & Corporate Affairs (Northern/Western Europe), added: “It is clear. The SDGs will require a step change in how to deliver services to the citizens and the levels of both public and private investment in all countries. We know that traditional ways of financing development alone are insufficient.”

Referring specifically to areas where AI play a part in helping the UN’s work - on climate change, healthcare, energy and regions most in need - Faremo nevertheless cautioned that “we should not ignore those who perceive AI as an area in urgent need of regulation.”

That said, she added: “Standing here today from the UN, when I hear others talk, I immediately jump to the role AI could play to help accelerate the achievement of the Sustainable Development Goals. This is my focus. And it should be yours too.”

Her speech revealed that AI has reached into the agricultural sector of UN work too. The technology can also help predict the path of storms and track the spread of diseases, both of which hit poor communities especially hard. “But whatever AI tools governments, policymakers and humanitarian organizations use, it's important to use them where they'll do the most good,” Faremo concluded.

Concurrently with this event in New York, IPsoft launched Amelia City, an interactive, AI laboratory showcasing the evolution of AI together with off-the-shelf AI solutions for banking, telecom, hospitality, insurance and healthcare industries. For more information on Amelia City see: https://info.ipsoft.com/amelia-city