Can This Simple Shift Help Us Halve Food Waste?

Roughly a third of all food produced globally goes to waste. In the US, this figure is closer to 40 percent—at a cost of more than $160 billion annually. If food waste were a country, it would be the world’s third largest greenhouse gas emitter.

Figures like these are enough to put anyone off their lunch, especially when considering the 850 million people around the world who are chronically undernourished. Looking to stop the madness once and for all, the United Nations called for a worldwide 50 percent reduction in per-capita food waste between 2015 and 2030, as part of the Sustainable Development Goals (SDGs).

One country, Norway, is going even further. “Our goals are more ambitious than the UN because we are going to reduce food waste by half, all the way down the value chain,” Vidar Helgesen, Norway’s minister for climate and the environment, told the Guardian.

Last summer, the Norwegian government struck a deal with food purveyors and manufacturers aimed at driving solutions to help them reach their collective goal. “We are collaborating with all the actors in the food industry,” Helgesen told the paper. “We are setting targets, and how the industry gets there is up to them. We are unleashing innovation.”

The Scandinavian country is targeting a 15 percent cut in food waste by 2020 and incremental reductions leading up to the 2030 finish line. Fresh ideas to help them get there are already going live across the country—and they can serve as an example for other nations around the world.

Image: Norwegian startup grocer SNÅL frukt & grøn sells misshapen produce at a discount.

Norway drives innovation to cut food waste

In developing countries, where food is more expensive and thus culturally more valuable, most waste happens on the farm field or in transit. But in Western countries, where the vast majority of waste happens down the supply chain, changing consumer mindsets and improving food management at businesses is the key to cutting those figures down to size.

Norway’s public-private collaboration has sparked a host of simple yet impact-driven initiatives to do just that. The online platform Bestfør.no digitally tracks products’ sell-by dates and helps grocers identify food at risk of spoilage. The consumer-facing app Foodlist asks shoppers to photograph foods near the end of their shelf life and tells other shoppers where they can find at-risk food. Like a growing number of retailers in the US, startup grocer SNÅL frukt & grøn began selling misshapen produce and off-colored eggs at a 30 percent discount.

Additionally, a growing number of food manufacturers and grocers are changing the way they sell and label food. In January, Norway’s largest dairy cooperative, Tine, swapped the standard expiration date on its milk cartons to a label reading, “Best before, but not bad after.”

Companies like the dairy brand Q-Meieriene and egg producer Prior pioneered the practice last year. According to Q-Meieriene, nearly one-third of Norwegians have thrown away milk on the expiry date without checking to see if it’s still good, prompting the company to take action, the Daily Meal reported.

Tine credited its competitor for the idea, and Q-Meieriene’s CEO said the company is happy to see industry peers follow suit. “Food waste is a major societal challenge and we have a common interest in reducing food waste in Norway. Therefore, it is very positive that we can stand together on common labeling,” Q-Meieriene CEO Bent Myrdal told the Daily Meal. The new label now appears on perishable products like milk, eggs, juice and yogurt across Norway.

Best Før supermarket in Oslo is taking on food waste—it keeps foods on store shelves for weeks after their best-by date and sells them at discounted prices. The pop-up grocer is an offshoot of the mainstream Lentusgruppen chain, and it’s the first of its kind in the city.

“Most supermarkets won’t buy products that are within 10 days or so of their expiry date—it often has to be wasted,” Naeeh Ahmed, operations manager at Best Før, told the Guardian last year. “We thought, ‘Why don’t we make a place that has that kind of product, that will be beneficial to every party: the consumer, the supplier, and us. A win-win for everybody.”

The concept is already catching on elsewhere. The East of England Co-op, the largest independent retailer in the East Anglia region of the United Kingdom, began a similar program in December. It now sells canned and dried foods past their best-before date for a mere 10 pence (around US13 cents).

The U.S. looks to standardized food labels

On this side of the pond, grocers and manufacturers are looking to standardize food labeling in order to tackle food waste. In the U.S., food packages have more than 10 different date labels, ranging from “use by” to “expires on” to “best before,” causing understandable confusion among consumers, reports FoodTank.

The Harvard Law School Food Law and Policy Clinic and the Natural Resources Defense Council (NRDC) promoted standardized food labels in a 2017 policy paper. They suggested using only two date labels—“best by” for quality and “use by” for food safety—and pushed for better efforts to educate consumers about the meaning of each label. The change could save 398,000 tons of food annually and return $1.8 billion in economic value, the paper concluded. The U.S. Department of Agriculture (USDA) made a similar recommendation in December 2016.

In March of last year, two prominent food industry organizations—the Grocery Manufacturers Association (GMA) and the Food Marketing Institute (FMI)—put the suggestion into action, calling on their members to voluntarily adopt the two-label system.

“Eliminating confusion for consumers by using standard product date wording is a win-win because it means more products will be used instead of thrown away in error,” Jack Jeffers, vice president of quality at Dean Foods, which led GMA’s work on this issue, told FoodTank. “It’s much better that these products stay in the kitchen—and out of landfills.”

Last fall, the Consumer Goods Forum, a network of the world’s largest food and consumer goods companies—including Walmart, Kellogg, Nestle, Campbell Soup and Amazon—followed suit. In addition to streamlining labels, the Forum asked its members to partner with nonprofits and government agencies to educate consumers about how to interpret the dates on their food.

“This is an issue that can only truly be tackled by collaboration across the value chain,” Peter Freedman, managing director of the Consumer Goods Forum, said in a statement. “We believe simplified and consistent date labelling will help us get one step closer to meeting [the Forum’s] resolution to halve food waste by 2025 while also helping reduce confusion for consumers.”

The move is part of Champions 12.3, a coalition of governments, businesses, nonprofits and civil society leaders united around SDG 12.3—to halve global food waste by 2030.

"The Sustainable Development Goals have given us a historic opportunity and we must rise to the challenge," Hans Hoogeveen, ambassador and permanent representative of the Netherlands to the UN Organizations for Food and Agriculture, said in a statement. "Of all the SDGs, Target 12.3 is the only one to my knowledge that is being advocated by a coalition like Champions 12.3 with leaders from every sector mobilizing action to achieve success. We stand a great chance, but a lot of work remains."

The bottom line

Most of the solutions with the greatest potential to reduce food waste are simple tweaks that nudge consumers toward a different mindset about food. Despite our best efforts, changing cultural norms will take time, but we’ll need efforts like these and more if we hope to halve food waste by 2030.

"It is good to see clear signs of momentum building behind the movement to tackle food loss and waste,” Liz Goodwin, senior fellow and director of food loss and waste at World Resources Institute, said in a statement. "However, 2030 is only 13 years away, and more is needed. We now have a roadmap for how to cut in half the more than 1 billion tons of food that goes uneaten each year, and it's vital that governments and the private sector everywhere put it to use."

Image credits: Vishang Soni/Unsplash and SNÅL

A Behind-the-Scenes Look at How the Makers of M&M’s Source Renewable Energy

We recently heard from Mars, Incorporated’s chief procurement and sustainability officer, Barry Parkin, about the company’s plan to tackle its ambitious climate goals in an EDF+Business “Business of Sustainability” podcast. Their Sustainable in a Generation plan details Mars’ commitment to procure 100 percent renewable energy. Mars is plowing full speed ahead toward these goals and recently, Mars Australia signed 20-year power purchase agreements (PPA) to generate the equivalent of 100 percent of Mars’ electricity from renewable energy by 2020.

As a manager of EDF+Business’ carbon and energy supply chain initiatives, I wanted to learn more about Mars’ approach to meeting its renewable energy goals. What I like about Mars is that they are always willing to share their tips and best practices so that other companies can learn how to start mitigating their impact on the environment. So, I sat down with Mars’ renewable energy manager, Winston Chen – who has been with the company for 15 years – to learn more about their renewable energy strategy and what other companies can learn from being innovative when looking for ways to decarbonize the energy they need to make their products.

Here are the main takeaways from my discussion with Winston:

A comprehensive sustainability plan integrates energy efficiency with renewable energy strategies.

For a company that has been growing quickly over the last few years, it can be a challenge to achieve absolute reductions in its overall carbon footprint. As the sixth largest privately held company in the U.S., Mars has over 50 factories just in the U.S. and it is constantly expanding with manufacturing facilities, offices and retail locations in almost every country in the world. Strong growth, however, didn’t stop Mars from setting an ambitious target to eliminate fossil fuel energy use and greenhouse gas emissions from global operations by 2040.

Winston told me that in order to manage the company’s growth year after year while also meeting its sustainability goals, Mars has to invest significantly in both energy efficiency and renewable energy, which they do through a four-pronged strategy:

- Technology upgrades: Mars looks for ways to reduce energy demand through adoption of more energy-efficient technologies. This includes low-hanging fruit such as lighting upgrades, but also more capital-intensive upgrades to manufacturing equipment.

- Operational excellence: Ultimately, energy demand not only depends on the efficiency of the technology but how it is used on the factory floor; so Mars works with its employees to optimize the operation of energy-using equipment to minimize waste while improving productivity.

- Process design innovation: Reinventing how things are made can reduce energy demand. Mars invests in innovation to rethink its manufacturing processes – for instance, in its baking and drying processes to make pet food – to minimize energy use.

- Renewable energy: Mars also looks for solutions to decarbonize its energy supply, working with developers and utilities to procure renewable energy through PPAs.

While Winston says that renewable energy projects can be easier to implement, it doesn’t make sense for a company to only focus on renewables. He told me it is important to think about the whole picture of a company’s environmental footprint.

“It has to be a balance. We don’t want to take the easy way out. It’s easy to sign another PPA contract and not focus on our own facilities and processes to reduce our actual energy consumption,” Winston said. “That last part is the most critical component of the strategy.”

Mars’ goal is to reduce its energy intensity on an annualized basis by roughly 2 percent to mitigate the overall increase of its carbon footprint because of business growth.

Finding new ways to become more energy efficient is smart business for any company. With technologies widely available on the market to help companies innovate and save energy, solutions that benefit bottom lines and mitigate environmental impact abound. For example, an overwhelming majority of executives at top companies say they are using innovative technologies to drive profitability and environmental performance, according to a recent EDF survey. More than 70 percent of executives surveyed said their business and environmental goals are more closely aligned than they were just five years ago, primarily due to advances in technology.

Collaborating for scale leads to innovation and a more sustainable supply chain.

Companies have a number of options for procuring renewable power including investing capital to install onsite renewable energy projects. I asked Winston why Mars prefers using PPAs, which account for almost all of its renewable energy investments. One of my favorite moments from my conversation with Winston was when he stated, “Mars is good at making chocolate and pet food, but we’re not an expert in producing power.”

Leaving energy production to the pros, Mars is able to scale the renewable portion of its energy supply quickly by partnering with other investors in large projects – such as a 60-megawatt wind project in Scotland – that will produce enough power to cover all of Mars’ annual electricity demand in the United Kingdom.

Mars’s PPA strategy has been to focus on its biggest markets first – which it has done over the past five years. This included supporting projects in the United States first, followed by the United Kingdom, Mexico, Australia, France, Poland, Spain and Belgium.

Sustainable companies attract customers, please employees, aid recruiting and burnish reputations.

This insight is perhaps the best takeaway from my discussion with Winston. He explains it perfectly in this quote:

“In today’s world, more and more people are focusing on making a lot of money but they’re not doing the right thing in terms of minimizing their impact on the environment. This is a big risk to a company’s reputation. I truly believe our renewable energy investments have actually improved our company’s standing in the world in terms of being a sustainable and responsible company.That’s very important to us, not just from a customer standpoint, but also because our associates care about what we can do as a company to minimize our impact.”

From my talk with Winston, it is evident that Mars is a company that truly understands the correlation between a thriving businesses and a healthy environment. I’m excited to see what Mars will do next, and I sincerely hope Winston gets to enjoy several Peanut M&Ms – his favorite type of candy – for answering all my questions about Mars’ renewable energy efforts.

Have you been thinking about what you can do to improve your company’s environmental performance while boosting your bottom line?Join Victoria Mills, EDF+Business’ managing director and Lisa Manley, Mars’ senior director, sustainability engagement & partnerships for a webinar on September 5 to learn how businesses of any size can cut emissions and reduce risks related to climate change.

For more posts like this, follow Graziella Siciliano on Twitter.

Previously posted on the EDF+Business Blog and on 3BL Media news.

Image credits: Mars Inc.

Keeping the Dream of Education Alive Amid Conflict

The Avery Dennison Foundation focuses its giving in three core areas: Sustainability, Education, and Women’s Empowerment. In many cases, our giving is inspired by employees who recommend organizations for grants, which allows the Foundation to connect our employees’ charitable interests with the company’s philanthropy.

Last year, a group of employees in Europe reached out to the Foundation with a desire to support children disproportionately impacted by global conflicts. The Foundation recognized the United Nations Children’s Fund (UNICEF) for its efforts in providing ongoing, regular access to education for the millions of school-aged children in Syria whose education has been affected by the country’s eight-year civil war.

While Avery Dennison does not have a location in Syria, the Foundation has contributed $100,000 to UNICEF to support its Self-Learning Program in Syria. The Foundation was inspired by UNICEF’s commitment to education, innovative thinking, and community-based approach to delivering learning to Syria’s children.

A Unique Opportunity. An Exciting Partnership.

UNICEF reports that nearly 6 million school-age Syrian children and youth need education assistance. More than 7,000 schools in Syria – one in three – have been destroyed, damaged or are being used either as shelters for displaced families or for military purposes. In addition, UNICEF notes that a sense of fear and psychological distress has emerged among children, parents, teachers and community members, who are reluctant to send their children to school even when schools are operational. This climate of fear decreases the likelihood that children will return to, or stay in, school.

To address this multifaceted challenge, UNICEF developed an alternative approach to education called the “Self-Learning Program (SLP),” which enables children to learn at home, on location at NGO facilities, or in community learning centers. Using the accompanying “Self-Learning Materials” (a set of 50 modules with topics such as Arabic, English, mathematics, and science), the SLPs are positioned to give Syrian children access to a wide range of knowledge that will propel them towards brighter futures.

UNICEF is implementing the SLP in a way that is mindful of the complex environment in Syria (large populations of displaced people, widespread violence and poverty), with the goal of reaching 95,000 out-of-school children over three years, providing self-learning materials, supportive teachers, and safe and inviting learning spaces.

As always, the Foundation team is proud to partner with employees who bring such important global concerns to light, and honor their desire to help those in need. We look forward to sharing more about the impact of UNICEF’s Self-Learning Program in Syria.

Learn more about the Avery Dennison Foundation and its commitment to education, sustainability, and women’s empowerment.

Image credit: Avery Dennison

Previously published in Avery Dennison's newsroom and on 3BL Media news.

Small Businesses Can (and Should) Do More to Align with the SDGs

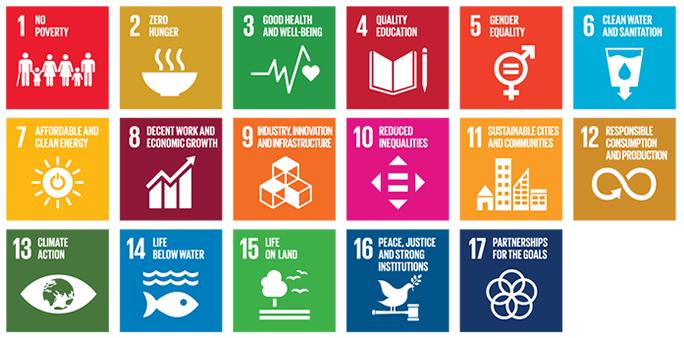

Launched by the United Nations in 2015, the Sustainable Development Goals (SDGs) are a roadmap for solving the world’s most pressing challenges by 2030. The 17 goals and 169 targets include lofty ambitions such as ending poverty, achieving universal access to energy, and eliminating inequality in education. Along with UN member states that will use the goals to frame their public policies, the SDGs explicitly call on businesses to play an active role—and many are already stepping up.

As of February, four in 10 of the world's largest firms referenced the SDGs in their corporate reporting, according to a study by KPMG, but many smaller companies remain unsure of how they fit in.

Small- to medium-sized enterprises (SMEs) represent roughly half of all private-sector employment in the United States, according to the US Small Business Administration. In developing markets, up to 90 percent of all workers are employed by small businesses, so it’s not hard to see how important it is for growing companies to get on board with the agenda.

“We’re not going to solve the SDGs unless we’re able to unlock the power of entrepreneurs,” Ben Powell of Agora Partnerships told Silicon Valley Community Foundation in its 2017 report on business SDG alignment, which includes tips for both large companies and SMEs. As founder of the nonprofit behind the lauded Agora Accelerator, Powell helped more than 150 impact entrepreneurs build their businesses—and he knows what it takes to grow a company with impact at its core.

Though Fortune 500 firms often have entire teams devoted to mapping their operations against the SDGs, Powell says the process will likely be much simpler for small businesses. “As a social entrepreneur, just ask yourself: ‘What is my purpose?’ You knew what your purpose as a company was before the agenda, and your purpose is probably expressed in one of the SDGs.”

Tracy Triggs-Matthews, associate director of UNC Kenan-Flagler's Center for Sustainable Enterprise, agrees. "I think many SMEs would be surprised to see how 'good' their company already is and how small tweaks can make them even better," she told Business.com this month. Even further, taking the time to see how they align with the SDGs can help growing companies stand out from the pack. "Consumers are looking for brands that are making a big difference, and being able to tell that story will only help differentiate an SME among competitors,” Triggs-Matthews said.

By now, most large firms are familiar with how their operations affect people and the planet—more than 80 percent of the S&P 500 published sustainability reports in 2016—but SMEs are often less familiar with assessing and improving their supply chains. Still, more than 5,300 SMEs have already partnered with the UN Global Compact to track their alignment with the goals, and a growing number of early adopters are proving that the SDGs can help small businesses thrive.

Two small businesses make SDG alignment work for them

Founded in 2010, Uncommon Cacao connects small farmers in Central America and the Caribbean with chocolate companies looking for traceable ingredients. By working closely with farming communities on transparency, efficiency and quality, the Berkeley-based startup is able to offer growers a highly competitive price for their cacao—outpacing even local fair trade collectives—and it provides premium product to cult-favorite labels like Videri Chocolate Factory and Dandelion Chocolate.With a core team of fewer than 10 people, Uncommon Cacao is an early mover on the SDGs. It was among the first group of 16 startups to participate in Unreasonable Goals, an SDG mentorship network spearheaded by the impact entrepreneurship accelerator Unreasonable Group. “SDG alignment was a natural decision for us,” Emily Stone, co-founder and CEO of Uncommon Cacao, told Silicon Valley Community Foundation. “We are a registered public benefit corporation and have a clear mission-driven focus to our business.”

To avoid overextending its lean team, Uncommon Cacao focused on two SDGS that are a clear and natural fit for the business: eliminating poverty (SDG 1) and decent work (SDG 8). The company committed to publish all pricing across its supply chain to further align with these goals and boost transparency. “We believe transparent pricing is a first, big step toward greater equity,” co-founder Maya Granit said in a statement last year.

Similarly, United Kingdom startup Globechain keeps its focus tight—targeting three of the 17 SDGs—in order to maximize impact. Founded in 2013, Globechain is a digital platform that helps large corporates, SMEs and nonprofits share reused items. Rather than send unwanted building materials, stock and other goods to landfills, larger firms can share them with charities, smaller businesses and other members of the Globechain network.

The platform helped nonprofits and small businesses save more than $500,000 in 2016 while diverting 700 tons of material from landfills. Connections made through the platform also furnished two hospitals and sent medical equipment to developing markets like Kenya, Ghana and Sierra Leone.

Globechain founder May Al-Karooni showcased the company’s SDG plan at the 2017 World Circular Economy Forum in Helsinki, Finland. The company hopes to further goals like building sustainable communities (SDG 11), ensuring responsible consumption and production (SDG 12), and acting on climate (SDG 13) by expanding its network that turns waste into resource, she explained.

“Globechain's vision was to prove a business can be commercial with a conscience,” Al-Karooni told the U.K. National Advisory Board on Impact Investing last year. “We created a model that has quickly become profitable, while also having a substantial social impact.”

The bottom line

Achieving the SDGs will unlock at least $12 trillion in new market opportunities and create 380 million new jobs by 2030, according to a 2017 report from the Business and Sustainable Development Commission. Both small and large businesses will reap the benefits, but we’ll never realize them unless we have all hands on deck. By aligning their core purpose with the shared SDG roadmap, small businesses can be a part of the solution and help forge a future of equality and economic opportunity.“With just 12 years left to the 2030 deadline, we must inject a sense of urgency,” António Guterres, Secretary-General of the United Nations, wrote in the 2018 SDGs progress report. “Achieving the 2030 agenda requires immediate and accelerated actions by countries, along with collaborative partnerships among governments and stakeholders at all levels. This ambitious agenda necessitates profound change that goes beyond business as usual.”

Image credit: UN Foundation

Elon Musk Still Has Much To Ensure Tesla's Future - Would You Bet Against Him?

Elon Musk is to Tesla what the late Steve Jobs was to Apple. Both have made their mark as chief executives inextricably linked to the companies over which they preside. As with Apple during the days of Jobs, news about Tesla - its past, its present and its future - is as much about the personality at the top, as it is about the product portfolios these visionaries sought to produce.

Of course, Jobs’ legacy is a company that has endured in spite of his passing, and in his absence, Apple just became the first ever company to achieve a market capitalization in excess of a trillion dollars. Those who thought Apple would flounder without Jobs have been proven wrong.

Elon Musk is not going away any time soon, of course, but the company seems to be at an inflection point where it can either go to scale profitably, or succumb to the weight of debt and cash flow problems. Back in the day of course, people bet against Jobs. He was forced out of Apple over internal disagreements, but the company eventually brought back again. Will people bet against Musk now?

It’s no secret that Musk has pinned the future success of the company on the Model 3, Tesla’s smallest and cheapest car that will either prove - or disprove - the company’s ability to become a true mass producer of automobiles.

Achieving that status comes with the imperative of manufacturing cars profitably, and Musk determined that building the gigafactory to control production of a reliable source of batteries - at the right price - would be an essential component of reaching profitability. Equally essential would be hitting a production level, of at minimum, 5,000 cars per month to generate necessary revenues.

And here we are. The Gigafactory now employs 3,000 people and is the biggest battery factory in the world, while at the end of the second quarter of this year, Tesla met those production goals, too, though the company was a few months late getting there.

Still, reaching the production target was an impressive feat, and involved the company going to remarkable and unprecedented lengths to pull it off: building an entire production line under a tent at their Fremont, California factory. It’s hard to imagine that anyone but Musk at the helm would have applied the necessary drive to make that happen. And as we now know from the New York Times interview, at his own personal sacrifice.

We don’t have to weep for Musk, but still, do we bet against him?

Certainly, not all in the garden is rosy. As this Bloomberg piece shows, while Q2 production has risen sharply as Model 3 production has ramped up, cash flow remains severely negative.

This week, the Wall Street Journal reported that in a recent survey of Tesla’s suppliers, 18 of 22 said that they are worried that Tesla provides a financial risk to their businesses. The WSJ says delays this year in the production of the Model 3 drained Tesla’s cash, which fell by $1.13 billion in the first six months of this year and as of August 12 leaves the company with cash and cash equivalents of $1.69 billion on hand. So, not a huge buffer considering the burn rate. Nonetheless, all suppliers surveyed said they wanted to sustain or grow their business with Tesla - so there’s still faith out there.

There’s no room for complacency though. In order to stem the cash flow problem, The San Francisco Chronicle reported this week that Tesla is slashing spending. The Chronicle details that in June the company announced it would lay off 3,500 employees, about 9 percent of its workforce, while Tesla also plans to cut capital expenditure by a quarter this year. Analysts quoted in the piece say that while this might help achieve profitability, it won’t help Tesla bring new models to market. Indeed Bloomberg’s article points out that the Model S sedan is already an aging model, (it launched in 2012) and that while it’s still a fancy car, it no longer excites.

To that point, how long does Tesla remain the most prestigious electric vehicle money can buy? Bloomberg points out Jaguar, Audi, Porsche and Mercedes are all expected to come out with electric cars, starting as early as next year. Competition is certainly coming from established luxury brands.

Remember though, Tesla isn’t just a car company - which isn’t altogether good news either. Back in 2016, Tesla acquired SolarCity, a solar panel installation company run by Musk’s cousin, for $2.6 billion. While enveloped in Tesla’s financials now, this Forbes article from June - which comes with part of the headline reading “SolarCity is dying” - details that SolarCity effectively cost Tesla $5 billion, because on top of acquisition costs came $2.9 billion in debt. Worse still, Forbes says that legacy debt starts coming due in November of this year.

Who knows, the negative cash flow exposure, debt obligations, as well as pressure from traders shorting the stock might have, in part, been the stimulus to prompt Musk to tweet out he was thinking of taking the company private at $420 a share. As we now know, this announcement was based on preliminary talks with Saudi Arabia’s sovereign fund, with the impromptu announcement attracting the attention of the SEC.

Yet despite all this, and despite some roller coaster antics of the share price over the last week, Tesla’s stock is still impressive. As of press time, the company’s market capitalization still remains more than $16 billion, or over 40 percent more valuable than Ford’s. Wall Street clearly doesn't think the lights are about to go out.

Perhaps this proves that despite Ariana Huffington suggesting Musk needs to get more sleep, like Steve Jobs before him, Elon Musk remains credited with being a visionary, and the stock price suggests the market still believes he can pull all of this off. It doesn't appear to be a slam dunk though. While Jobs’ legacy is the most valuable company the world has ever seen, Musk still has much work to do if Tesla is going to eventually bring it home. Some will bet against him to be sure, but it’s still all about the future it seems - as long as the company can keep pumping out those Model 3s.

Image credit: JD Lasica/Flickr

Why the U.S. Army Looks to Wind Energy for Veterans Jobs

The Department of Defense's push for renewable energy has taken a back seat during the Trump* Administration, but new programs are still getting under way. One development of interest to the business community is located at Fort Benning in Georgia. This summer, the post launched a new training course that qualifies graduates for entry-level positions in the wind power industry and related fields.

The program could become a model for other industries struggling to find skilled workers in a tight labor market, because it leverages training in the Army for a specific civilian employment sector.

Why is Fort Benning is pushing for wind energy jobs?

For bottom line and energy security reasons, the U.S. Department of Defense was a vigorous, early adopter of renewable energy during the Obama Administration. Climate change also factored in to DoD's interest in renewables. Much of the focus was on installing solar panels at its facilities, ranging from small rooftop arrays to massive ground-mounted solar farms.

Wind energy has been much slower to make a home at DoD facilities, partly due to air traffic and other operational concerns.

The Army's Fort Benning is a case in point. By 2016, Fort Benning had a massive 30-megawatt solar farm up and running, along with a number of rooftop arrays.

In contrast, wind energy is barely represented at the post, and their equipment doesn't look anything like the tall, long-bladed turbines that are becoming familiar fixtures around the US. Fort Benning's turbines are fully housed in low-rise structures and they are designed to run on the updraft from an AC system, not on ambient winds.

So, why is the U.S. Army introducing a wind energy employment program at Fort Benning, when they have no "real" turbines?

For that matter, ambient wind speeds in the state of Georgia are far less than optimal, and the American Wind Energy Association currently lists no significant wind installations in the entire state.

That's why!

The simple answer is that the U.S. wind industry is where the jobs are, if not in Georgia than elsewhere. The U.S. Army cites a forecast from the Bureau of Labor Statistics, indicating that job growth in the field of wind technician could climb as high as 108 percent over the next five years.

At a ceremony launching the new training program last month, U.S. Army Garrison Fort Benning deputy garrison commander George Steuber explained:

We started out transitioning civilians to Soldiers; now we want to transition these experienced Soldiers to be civilians again with good paying jobs. We're going to make sure that when you go on and you are done with your active-duty career that there is another career out there that is equally competitive and productive in the civilian economy.

This is all familiar territory for the wind power industry. When growth in the industry first began surging under the Obama administration, industry stakeholders quickly realized that military veterans come equipped with a skill set that matches their needs, including a familiarity with electronic and mechanical equipment, manual dexterity, physical fitness, and experience with discipline, teamwork and leadership.

The new course, called Renewable Energy and Communications Tower Technician Program, was designed in partnership with the company Airstreams Renewables, Inc.

The company already runs similar programs at four other Army bases. The idea is to set active military personnel up with specific, in-demand career skills before they leave the Army, rather than discharging them without any solid prospects.

Fort Benning loves solar, too

Meanwhile, Fort Benning is still has an interest in innovative new solar technology.

Last week, Fort Benning introduced its new "Smartflower," located at its Environmental Learning Center. The array produces enough electricity to run all of the electrical systems in Learning Center building, aside from its energy-sucking climate control.

The compact array tracks optimal sunlight during the day and folds up at night for safekeeping. The folding system also removes any dust and debris from the panels, so they're clean and ready for the next morning.

The Learning Center is another training resource for Army personnel, with a focus on energy management and compliance issues. It also provides a learning opportunity for students in the community.

Fort Benning's Director of Public Works Environmental Division, Kirk Ticknor, explains the reasoning behind installing the Sunflower at the Learning Center:

We're getting these energy managers, who are getting this training inside that building, to think outside the box. They can save energy in their building by calling in work orders or by increasing the awareness of people in the building to turn off their computers, the lights, and unplug things if they don't need them. In addition to the Smartflower providing power to our grid, it is also educational and inspirational.

As with wind energy, Georgia is not an optimal state for solar energy. Though it gets plenty of sunlight, its high heat and humidity interfere with solar cell efficiency. Nevertheless, Fort Benning is demonstrating that solar is still a worthwhile investment in Georgia.

In addition to the Learning Center and its wind and solar initiatives, Fort Benning also recently installed a centralized, data-driven energy management system that coordinates more than 200 buildings. The post is also replacing its conventional streetlights with energy-saving LEDs.

The U.S. Department of Defense and sustainability

This is all part of Fort Benning's sustainability strategy, which extends beyond the post to the surrounding civilian region. As with other branches of the Armed Forces, the Army has been quick to realize the bottom line and operational advantages of renewables, as well as the importance of sound environmental practices for the health of its Soldiers and the community at large.

Here's the explainer from the Fort Benning website:

Sustainability is a critical enabler in the performance of the Army's mission, as its importance and benefits cut across the entire Army enterprise...By implementing sustainability principles and practices, the Army is decreasing future mission constraints, increasing operational flexibility and resilience, safeguarding human health and the environment, and improving quality of life for Soldiers and local communities.

Hmmm...looks like the Commander-in-Chief didn't get the memo.

Photo (cropped): Visitors inspect a training installation at the Fort Benning Renewable Energy and Communications Tower Technician Program/U.S. Army.

Paper Company Gears Up to Recycle 500 Million Coffee Cups

A paper maker that claims to use the world’s first process for recycling disposable coffee cups has set itself the target of putting through 500 million a year.

The James Cropper company in Kendal in the Lake District, which employs the term upcycling to reflect the transformation of discarded material into useful goods, has processed 20 million cups since September 2017 but is geared up for the 500 million figure.

James Cropper receives the discards from waste management companies, which collect them from coffee shop chains, including Starbucks, McDonald’s and Costa—which started a scheme in January for recycling all its used takeaway cups—and various hubs such as airports and office blocks.

The target represents about a fifth of the 2.5 billion takeaway cups that are thrown away in Britain annually. At present most of them wind up in landfill sites.

The James Cropper process extracts the paper fiber from the cups and turns it into the high-quality packaging paper in which it specializes as an alternative to plastic. The packaging is recyclable, but it biodegrades without harming the environment if it is disposed of.

The remaining plastic content goes to waste management companies for recycling.

Phil Wild, chief executive of James Cropper, said: “We’ve developed these processes over a number of years because we recognise the need for brands to consider their packaging design and explore plastic-free alternatives.

“We believe a truly sustainable approach is not just about using renewable materials and committing them to responsible lower-impact manufacture, but is also about ensuring packaging is easy for consumers to recycle.”

The Business in the Community charity, which promotes responsible manufacturing and trading, is holding a summit in November as part of its commitment to a collaborative plan to tackle the UK’s growing waste problem.

As a member, James Cropper is likely to present its latest project at the meeting, said marketing director Richard Bracewell.

Gudrun Cartwright, environment director at Business in the Community, emphasized: “There needs to be a change in mindset in how we handle waste and source materials for our products and packaging, and we have a responsibility to do something different.

“To achieve this, government and business need to come together to lead by example.

“This includes showcasing businesses like James Cropper, bringing waste back into value chains and unpicking the challenges that lie in the way of creating change at scale.”

James Cropper attracted royal interest in March when Prince Charles visited the company’s plant and attended a Business in the Community roundtable on methods of creating value from waste.

Business Leaders Find New Ways to Help Wildfire Victims

As shifting climate conditions continue to impact communities across North America, a quiet movement is taking shape that could help reframe how we view the responsibilities tied to disaster response.

And this development is predicated on a basic philosophy that most of us already embrace in our daily lives: food nourishes, and nourishing food feeds a community spirit.

Last year, as Puerto Ricans were struggling to overcome the devastating impact of Hurricane Maria, Chef José Andrés and his nonprofit, World Central Kitchen, arrived on the scene. Andrés, best known at that point for his sustainability initiative and his success in introducing Spanish tapas cuisine to the American culinary scene, marshaled the help of local cooks, business, celebrities and politicians to feed residents "in every corner" of the island.

This month, Andrés' focus was California and specifically Mendocino County, where the Carr fire has cindered more than 225,000 acres and uprooted thousands of residents. World Central Kitchen's "Chefs for California" has taken steps to ensure that there is nourishing food for both wildfire victims and first responders -- and food that not only fills bellies, but that local residents can identify with.

Hence the signature approach of Andrés, who has made cooking in remote settings, often without local electricity, a simple art form. Just as in the small towns of Puerto Rico where local chefs cooked up thousands of plates of the local favorite pastelon, World Central Kitchen treated Redding fire victims to dishes they would most draw comfort from: favorites like jambalaya, chili, hand-made pizza and chicken tacos, "a meal that is like home, that's made with love."

And initiatives like World Central Kitchen -- backed by chefs that represent dozens of restaurants and businesses across country -- could become the signature stamp of disaster relief in the future.

Another nonprofit, Operation BBQ Relief, which grew out of the catastrophic effects of the Joplin, MO tornado in 2011, is also helping to ensure that displaced residents and first responders have access to quality meals. The nonprofit has taken a slightly different approach by engaging corporate sponsors like Butterball Turkeys, Yeti and Blue Rhino to provide the resources for on-site food preparation, often where there is minimal access to electricity or services.

And this is far from the first wildfire disaster scene that World Central Kitchen or Operation BBQ Relief have visited. Both have amassed a long history at this point of transforming devastated neighborhoods into community networks through volunteerism and hyper-local initiatives.

Last fall Andrés coordinated efforts with L.A. Kitchen, an innovative program whose tag line is "neither food nor people should ever go to waste," to provide emergency support for firefighters and victims of the California wildfires that hit Napa and other areas of Northern California. In doing so, he not only harnessed the expertise of accomplished chefs, but helped to teach L.A. Kitchen enrollees, many of whom were ex-convicts or former drug users who were learning how to restart their own lives, that there is value in giving to fellow people in need -- including those who may live hundreds of miles away.

As one L.A. Kitchen student succinctly put it, "I can look over to my left, look over to my right and at the end of the day, I know I am not the only one that needs a help up."

It's a message that carries particular importance as we wrestle with the impacts of climate change: Businesses and NGOs carry their own unique recipes for rebuilding resiliency and can transform a humanitarian effort to a community partnership for success.

Images: USFS Pacific Southwest Region 5 (Flickr); World Central Kitchen

The CEO of Girl Rising is Making the World a Better Place for Girls, One Story at a Time

By Abigail Libers

It's not unusual for a movie to win awards, get rave reviews and win big (or lose) at the box office. But it's not every day one helps to change the world. Girl Rising is a film that became a powerful movement and gave filmmaker Christina Lowery the role of a lifetime. Now the CEO of a globally recognized non-profit with connections to Michelle Obama and support from Meryl Streep, Alicia Keys, Priyanka Chopra and Freida Pinto, Lowery's work is to show communities the power of education, get girls in school and keep them there. The reason: educating girls is the single most powerful way to end global poverty.

The original film, which celebrates its fifth anniversary this year, aired in more than 170 countries to over 400 million viewers, and now the multi-faceted organization has programs around the world in some of the most difficult places to be a girl. Lowery and her staff developed a Girl Rising curriculum that is used by thousands of teachers, reaching tens of thousands of students, in the U.S., India, Nigeria and the DRC, with plans to expand later this year. It has also entered into partnerships like the Girl Rising Creative Challenge, powered by HP which calls for people all over the world to share stories, videos or art about how they or people in their communities are working towards gender equality and making the world a better place for girls.

Using storytelling to create change and make a difference is what Lowery has known she wanted to do since she was young. Here, she talks about how she’s helping make the world a better place, one story at a time.

What’s your background?

I was born in Canada and lived in Baltimore and Columbus, Ohio. When I was 12, my family moved to Austin. I have one older brother and my father was a surgeon, and my mother was an emergency room nurse. Their work in the field of medicine was built on helping people, and they ingrained that philosophy in me. I remember them both being very attuned to the needs of others, even outside of their work. So, the idea that life is about helping people was just a natural thing for me.

What was your first transformative experience of helping others?

As a kid, I helped build houses on a Native American reservation and helped paint a school in South Texas with my church group. When I was 17, I convinced my parents to let me to travel to Honduras to work in an orphanage. My father had an older patient from Honduras and her relatives lived in Tegucigalpa. With their help and connections, I was able to arrange a volunteer stint at the orphanage. I was studying Spanish at the time, so I was itching to go to a Spanish speaking country. I had my eyes opened to the unfairness of the world and realized it was a sheer stroke of good fortune that I was born into my family. I thought: Why did I get so lucky when so many children are born into situations that are really tough?

Why is storytelling such a powerful way to help people and change minds?

I have ping-ponged back and forth in my life between two main interests: storytelling and international development. In my late 20s, I went to Kenya and Tanzania with a group that was studying the communities around national parks and that experience led me to get a master’s degree in community and regional planning. I thought I would go into international development and work for a big NGO, but at the end of graduate school, I went to Mexico to research another documentary on women’s economic development, and I thought, "Oh! Why would I want to do anything but this? Telling stories from real people is so interesting."

I was working at a film production company when a funder approached us about making a project on how to end global poverty. We looked into the data around girls’ education and found a mountain of evidence showing that educating girls is the single best investment that can be made to break the cycles of poverty, improve health, improve families' resilience to disaster, improve prosperity and increase stability and peace. We wanted to grab the world's attention and shine a spotlight on this issue: to change minds, change lives, and change policy. That film became Girl Rising.

How does the work of educating girls globally impact you on a personal level?

I have two boys and a girl. My daughter is nine years old, and I look at her and think if I were a mom somewhere where it was normal in my community for her to be married off at this age, I would hope that somebody who could do something, would do something. My daughter and my friends' daughters have opportunities that many girls around the world don't and I’m blessed to be in a position to help make a change, and it feels like I have a responsibility to help. To me, equality for girls is the human rights struggle of our time, and that’s why I do what I do.

What has been your proudest moment?

One of the proudest moments I had was when I heard of a group of boys in Bihar, India, who, after being part of a Girl Rising program and watching the film, decided to form an End Child Marriage club in their community. If they heard about girl who was to be married, they went to her house and talked to her parents about why they thought she should stay in school. And another group of boys in rural India took a pledge to share housework with their sisters and they formed a club where they wore badges that announced to the community they were each a brother supporting his sister. Even when girls are in school, they bear the brunt of the housework which in turn keeps them from exceling in school because they have less or no time to study. When I hear these stories of people doing something concrete in their community to support girls and bring about a more gender equitable place, that’s when I’m most proud.

How have the past few years of new awareness around gender imbalance changed or affected the urgency of your work?

Our work seems to have new relevance and resonance with people in a way that it didn’t five years ago. People are aware of the spectrum of what happens when there are imbalances in power between genders, and what gender inequality can look like, and what the effects of that can be. And I think that has made people more interested in the work that we're doing and helped them connect with it in a different way.

Tell us about the Girl Rising curriculum for schools.

One of the ways we’re educating people about the important of gender equality is through our adaptable, free curriculum. Designed for upper elementary, middle and high school, it’s used to teach subjects ranging from English to social studies to math to art. Whether in the classroom or extracurricular programming, educators can teach directly from the materials, strengthen an existing lesson plan with select resources or build an energizing new unit. Using these compelling stories and an imaginative array of teaching resources, the program inspires young people to see beyond their borders, embrace their education and believe in their capacity to be agents of change. The aim is to instill them with a deeper sense of resilience, personal power, global citizenship and local responsibility.

We also have a Skype-in-class program that connects Girl Rising staff with classrooms around the world, teaching students about barriers to education for girls around the world and igniting discussions how to be active global citizens.

How is partnering with HP for the Girl Rising Creative Challenge moving the needle?

We’ve partnered with HP before and this latest round is really to bring attention the everyday stories of people who are making a difference for girls, and who are doing something in the realm of gender equality. We run across people who are doing amazing things all the time. I think HP and Girls Rising both believe in the power of stories to change mindsets and spark meaningful action. There are many submissions I’ve seen so far that have touched me, from a band that sings about what it means to be a woman in El Salvadoran society to Brown Girls Do Ballet, a photography project that shines a light on the lack of cultural diversity in local ballet schools in the U.S. [The winners will be announced on October 11, International Day of the Girl Child.]

What’s next for you and Girl Rising?

We’re expanding our programs and curriculum into Guatemala, Pakistan, Thailand and Kenya later this year, and over the next two years, we plan to make a series of short films that tackle the most urgent issues and draw the world’s attention to the most critical issues facing girls, along with promising solutions. The topics for our next series of films include girls displaced or living in refugee situations, the link between girls’ education and climate change and sports as a pathway to girls’ empowerment. The reality is that girls are twice as likely to never set foot in a classroom and girls who go to school are too often not learning the skills and mindsets they need to thrive. We want more people aware, caring and doing their part to take down the barriers holding girls back.

Originally posted on The Garage Blog and on 3BL Media news.

Image credit: HP

The Earliest Earth Overshoot Day. Ever.

In 2018, Earth Overshoot Day fell on August 1. The earliest ever.

This reminds us of the urgency of the climate crisis and pressure on natural ecosystems: despite the indisputable progress made over the last years, Overshoot Day is still moving forward. At Schneider Electric, our belief is that the situation is reversible: technologies and know-hows are readily available to push back the date of Overshoot Day towards December 31st . Economics are there as well, when you consider both short-term and long-term value, with immediate savings from resource efficiency and long-term increased value of future-proofed assets and business models.

To succeed we need to focus both on efficient newly built infrastructure and on retrofitting existing assets. Everything that is built new today has to be well designed with the future in mind, since initial design will largely determine the asset’s energy and resources use over its entire lifespan. At the same time, we should not forget about retrofitting existing infrastructure. For example, in OECD countries about 50% of buildings that will be in use in 2050 are already built. Together, Global Footprint Network and Schneider Electric researchers estimated that if 100% of existing building, industry and datacenters were equipped today with active energy management technologies that are readily available and the electric grid was upgraded with renewable capacities, the world could move the date back by at least 21 days.

We are reaching a turning point: an increasing share of businesses are thinking long-term, and have accepted they are operating in a world of finite resources. A recent poll of our customers in Europe revealed that 82% consider resource scarcity and sustainability as key elements in their decision-making processes. We invite all our partners to see Global Overshoot Day as an important milestone during the year: it is the opportunity to take a step back and assess targets against the ecological overshoot equation. It is a date at which we need to challenge ourselves and ask “is my business model One Planet compatible?”.

Moving out of ecological overshoot is core to Schneider Electric’s strategy. In addition to representing a massive business opportunity, ‘moving the date’ aligns with our vision and mission. The four key markets Schneider serves consume 70 percent of the world’s energy. Thanks to our EcoStruxure solution, we propose to our customers new type of business thinking to ensure sustained growth that balances productivity and financial profitability, on the one hand, with the planet fragile equilibrium preservation on the hand. For example, using PPAs (Power Purchase Agreements) has enabled world’s largest data center & colocation provider Equinix to boost its use of renewables to 100% for North America and 82% of its global needs, saving massive quantities of CO2 from being released into the atmosphere. This also resulted in a $23.2 million cost savings. To know more, you can read our recent white paper, Living with Finite Resources: Strategies for Sustainable Resource Utilization.

Finally, to succeed, CO2 must become a new currency. Many companies are already submitted to a carbon price, through a carbon tax or a quota scheme. Others are using an “internal price” of carbon, to factor the cost of CO2 externality into business decisions. At Schneider Electric, we fully embarked into this quantification journey, and we report externally and quarterly how much CO2 our solutions enable our customers to save (see Schneider Sustainability Impact). Our ambition is to prove that “More Schneider is a better Climate”.

See our full Earth Overshoot Day infographic here.

Reposted from the Schneider Electric Blog and 3BL Media news.

Image credit: Schneider Electric